Attached files

| file | filename |

|---|---|

| 8-K - KAI FORM 8-K 12-10-2018ACQ - KADANT INC | kaiform8k12102018acq.htm |

| EX-99.1 - KAI FORM 8-K EXHIBIT 99.1 12-10-2018ACQ - KADANT INC | kaiform8kexhibit9911210201.htm |

Exhibit 99.2 Kadant to Acquire Syntron Material Handling Investor Presentation December 10, 2018

Forward-Looking Statements The following constitutes a “Safe Harbor” statement under the Private Securities Litigation Reform Act of 1995: This presentation and the accompanying remarks contain forward-looking statements that involve a number of risks and uncertainties, including forward-looking statements about the financial and operating performance of Syntron Material Handling Group, LLC and certain of its affiliates (collectively, “Syntron”), the benefits of the proposed acquisition of Syntron (the “Acquisition”), the probable timing and financing of the completion of the Acquisition, and the expected future business and financial performance of Syntron following the transaction. These forward-looking statements represent Kadant Inc.’s (“Kadant” or the “Company”) expectations as of the date of this presentation. Kadant undertakes no obligation to publicly update any forward-looking statement, whether as a result of new information, future events, or otherwise. These forward-looking statements are subject to known and unknown risks and uncertainties that may cause the Company’s actual results to differ materially from these forward-looking statements as a result of various important factors, including those set forth under the heading "Risk Factors" in Kadant’s annual report on Form 10-K for the year ended December 30, 2017 and subsequent filings with the Securities and Exchange Commission. These include risks and uncertainties relating to the ability to consummate the Acquisition; the ability to obtain financing to complete the Acquisition; Kadant’s ability to successfully integrate Syntron and its operations and employees and realize anticipated benefits from the transaction; unanticipated disruptions to the business, general and regional economic conditions, and the future performance of Syntron; the risk that regulatory approvals required for the Acquisition are not obtained or are obtained subject to conditions that are not anticipated; the risk that the other conditions to the closing of the Acquisition are not satisfied; potential adverse reactions or changes to business or employee relationships, including those resulting from the announcement or completion of the Acquisition; uncertainties as to the timing of the Acquisition; competitive and/or investor responses to the Acquisition; uncertainty of the expected financial performance of the combined operations following completion of the Acquisition; the ability to realize anticipated synergies and cost savings; unexpected costs, charges or expenses resulting from the Acquisition; adverse changes in global and local economic conditions; the variability and difficulty in accurately predicting revenues from large capital equipment and systems projects; the variability and uncertainties in sales of capital equipment in China; currency fluctuations; Kadant’s customers’ ability to obtain financing for capital equipment projects; changes in government regulations and policies; the oriented strand board market and levels of residential construction activity; development and use of digital media; price increases or shortages of raw materials; dependence on certain suppliers; international sales and operations; economic conditions and regulatory changes caused by the United Kingdom’s likely exit from the European Union; disruption in production; Kadant’s acquisition strategy; Kadant’s internal growth strategy; competition; soundness of suppliers and customers; Kadant’s effective tax rate; future restructurings; soundness of financial institutions; Kadant’s debt obligations; restrictions in Kadant’s credit agreement; loss of key personnel; reliance on third-party research; protection of patents and proprietary rights; failure of Kadant’s information systems or breaches of data security; fluctuations in Kadant’s share price; and anti-takeover provisions. 2 © 2018 Kadant Inc. All rights reserved.

Acquisition Overview Syntron Material Handling • Leading manufacturer of vibratory and conveying equipment • Trailing twelve month revenue of approximately $89 million1 • Purchase price: approximately $179 million in cash2 • Favorable tax profile • Financing through borrowing • Main facility in Mississippi, ancillary facility in China, approximately 250 employees • Purchase agreement signed, expected to close in January 2019, subject to customary closing conditions 1 Through October 2018 2 Subject to customary adjustments 3 © 2018 Kadant Inc. All rights reserved.

Full Suite of Industry Leading Products Breadth and depth of product lines provide a unique competitive advantage and a true “one-stop shop” for customers Recognized Product Line(1) Segment Brands (% of 2017 revenue) Representative Product Offering Description ▪ Light Industry Application: Feeding, mixing and blending (15%) ▪ End Markets: Food & Packaging Vibratory FEEDERS CONTROLS Equipment ▪ Application: Rugged materials feeding and screening Heavy Products ▪ (20%) End Markets: Mining, Minerals, Met Coal, Thermal Coal and Aggregates, Cement & Asphalt SCREENING FEEDERS SYNTRO-FLO FEEDERS ▪ Application: Above-ground bulk materials conveying Above Ground ▪ (24%) End Markets: Mining, Minerals, Met Coal (Steel), Thermal Coal and Aggregates, Cement & Asphalt CONVEYOR IDLERS COMPOSITE IDLERS ▪ Application: Under-ground bulk materials conveying Under Ground ▪ (29%) End Markets: Mining, Minerals, Met Coal (Steel) and Thermal Coal Conveying Equipment IDLERS AND STRUCTURES POWERED TERMINAL UNITS ▪ Application: Conveying, mixing, blending and batching ▪ End Markets: Mining, Minerals, Met Coal (Steel), Thermal Coal and Aggregates, Cement & Asphalt Bucket Elevators & Screw Conveyors (11%) BUCKETS COMPLETE SYSTEMS ▪ Application: Conveying, mixing, blending and batching ▪ End Markets: Industrial Processing, Food & Packaging and Pulp & Paper (1) Based on Syntron estimates of revenue by product line. CONVEYORS SCREWS / FLIGHTS Does not include freight and other revenue. 4 © 2018 Kadant Inc. All rights reserved.

Syntron Products are a Low % of Overall Cost with a High Cost of Failure High Cost of Failure $100M+ Surface Facilities 1%-10% Illustrative Example (2) Potash Mine Mine Tunneling and Preparation Unit Throughput Per 20%-30% 750 Hour (Tons) x $ Per Unit Revenue $225 Mining Equipment 20%-30% Revenue Per Hour $168,750 x Estimated Profit Margin 40% Opportunity Cost Other Material Handling $67,500 Systems (1) (EBITDA per hour) 25%-35% Conveyor and Feeding Equipment 1 Hour of Downtime is ~2x the Upfront 1%-15% Site Investment Cost of Syntron Equipment (Illustrative Breakdown of a Greenfield Expansion) (1) Examples include belting and drag chain (2) Illustrative, based on management analysis 5 © 2018 Kadant Inc. All rights reserved.

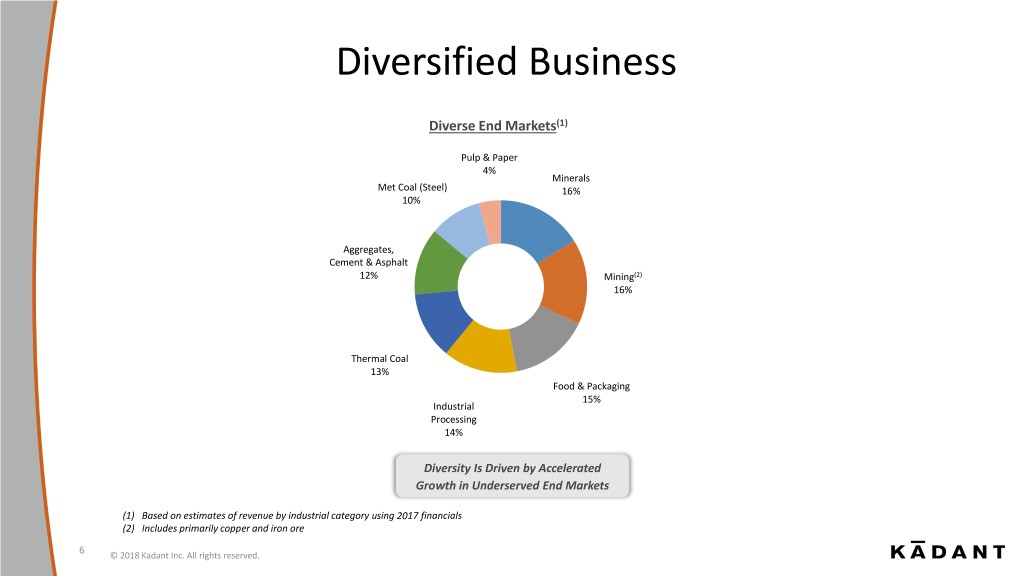

Diversified Business Diverse End Markets(1) Pulp & Paper 4% Minerals Met Coal (Steel) 16% 10% Aggregates, Cement & Asphalt 12% Mining(2) 16% Thermal Coal 13% Food & Packaging 15% Industrial Processing 14% Diversity Is Driven by Accelerated Growth in Underserved End Markets (1) Based on estimates of revenue by industrial category using 2017 financials (2) Includes primarily copper and iron ore 6 © 2018 Kadant Inc. All rights reserved.

Market Drivers ✓ Overall demand for material handling equipment in the U.S. is expected to grow 3-4%+ per annum (2) Key Sub-Markets % Revenue (1) ‘17-’20 CAGR (2) End Market ✓ Key submarkets (e.g., packaging) are growing 3-4%+ per annum Momentum Global GDP growth and globalization benefitting the broader Mining & Minerals 32% ~3% economy and industrial production Food & Packaging 15% ~5% Aggregates 13% ~4% Thermal Coal 13% ~0-1% ✓ Underinvestment in metal mining likely to spur additional capex projects Met Coal (Steel) 10% ~1-2% ✓ Rising labor costs are compelling companies to invest in new Pulp & Paper 4% ~2-3% Investment and technologies and automated solutions that Syntron products Automation support ✓ Public spending on infrastructure will benefit Syntron’s end markets such as aggregates (1) Based on estimates of revenue by industrial category using 2017 financials (2) Source: IGS Market Report 7 © 2018 Kadant Inc. All rights reserved.

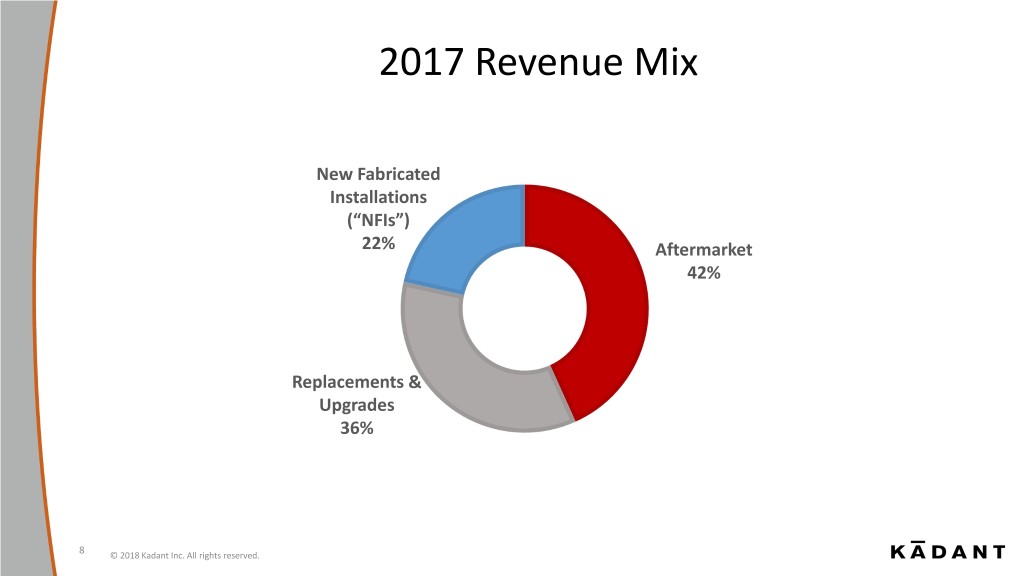

2017 Revenue Mix New Fabricated Installations (“NFIs”) 22% Aftermarket 42% Replacements & Upgrades 36% 8 © 2018 Kadant Inc. All rights reserved.

What We Like about Syntron • Leading market positions for vibratory equipment and conveying equipment through Syntron® and Link-Belt® brands. • High impact products on large capital investments • Strong organic growth and profitability over last 4 years • Stable earnings through recurring revenue • Aftermarket is 42% of revenue (1) • Replacements/upgrades on installed base is 36% (1) • Entrenched relationships with blue chip customers across a range of different industries • High cost of failure if product does not perform • Excellent platform to grow by acquisition in a fragmented market • Strong management team (1) Based on 2017 financials 9 © 2018 Kadant Inc. All rights reserved.

Integration Plan • Syntron’s management team will continue to operate the business within Kadant’s decentralized structure • Potential Synergies: • Expand current Kadant product portfolio into new markets through Syntron • Strengthen Syntron’s relationships in Pulp & Paper • Low cost sourcing 10 © 2018 Kadant Inc. All rights reserved.

Questions & Answers To ask a question, please call 888-326-8410 within the U.S. or +1 704-385-4884 outside the U.S. and reference 2824727. Please mute the audio on your computer. 11 © 2018 Kadant Inc. All rights reserved.