Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - Ingevity Corp | tv508728_ex99-1.htm |

| EX-2.1 - EXHIBIT 2.1 - Ingevity Corp | tv508728_ex2-1.htm |

| 8-K - 8-K - Ingevity Corp | tv508728_8k.htm |

Exhibit 99.2

Ingevity Announces Agreement to Acquire Perstorp’s Capa TM Caprolactone Division December 10, 2018

Disclaimer This presentation contains “forward - looking statements” within the meaning of the Private Securities Litigation Reform Act of 19 95. Such forward looking statements generally include the words “may,” “could,” “should,” “believes,” “plans,” “intends,” “targets,” “will,” “ exp ects,” “suggests,” “anticipates,” “outlook,” “continues,” “forecast,” “prospect,” “potential” or similar expressions. Forward - looking statements ma y include, without limitation, expected financial positions, results of operations and cash flows; financing plans; business strategies and expe cta tions; operating plans; synergies and the potential benefits of the acquisition of Perstorp Holding AB’s (“ Perstorp ”) Capa ™ caprolactone business (the “acquisition”); the anticipated timing of the closing of the acquisition; capital and other expenditures; competitive positions; growth opportuni tie s for existing products; benefits from new technology and cost - reduction initiatives, plans and objectives; and markets for securities. Like ot her businesses, Ingevity is subject to risks and uncertainties that could cause its actual results to differ materially from its expectations or that co uld cause other forward - looking statements to prove incorrect. Factors that could cause actual results to materially differ from those contained in the forward - looking statements, or that could cause other forward - looking statements to prove incorrect, include, without limitation, risks related to the satisfaction of the conditions to closing the acquisition (including the failure to obtain necessary regulatory approvals) in th e anticipated timeframe or at all; risks that the expected benefits from the proposed acquisition will not be realized or will not be realized within th e expected time period; the risk that the businesses will not be integrated successfully; significant transaction costs; unknown or understated liabi lit ies; general economic and financial conditions; international sales and operations; currency exchange rates and currency devaluation; compliance wi th U.S. and foreign regulations; attracting and retaining key personnel; conditions in the automotive market or adoption of alternative technolog ies ; worldwide air quality standards; government infrastructure spending; declining volumes in the printing inks market; the limited supply of c rud e tall oil (“CTO”); lack of access to sufficient CTO; access to and pricing of raw materials; competition from producers of substitute products a nd new technologies; and new or emerging technologies; a prolonged period of low energy prices; the provision of services by third parties at seve ral facilities; natural disasters, such as hurricanes, winter or tropical storms, earthquakes, floods, fires; other unanticipated problems such as la bor difficulties including renewal of collective bargaining agreements, equipment failure or unscheduled maintenance and repair; protection of intellect ual property and proprietary information; information technology security risks; government policies and regulations, including, but not limit ed to, those affecting the environment, climate change, tax policies and the chemicals industry; and lawsuits arising out of environmental damage or per son al injuries associated with chemical or other manufacturing processes. These and other important factors that could cause actual results or events to differ materially from those expressed in forward - looking statements that may have been made in this document are and will be more part icularly described in our filings with the U.S. Securities and Exchange Commission, including our Form 10 - K for the year ended December 3 1, 2017 and our other periodic filings. Readers are cautioned not to place undue reliance on Ingevity’s projections and forward - looking statements, which speak only as the date thereof. Ingevity undertakes no obligation to publicly release any revision to the projections and forward - looking statements contained in this presentation, or to update them to reflect events or circumstances occurring after the date of this present ati on. The financial results for Perstorp’s Capa ™ caprolactone business in this presentation have been derived from unaudited financial records prepared by Perstorp , without adjustment to conform to the accounting policies and methodologies used by Ingevity. Neither Perstorp’s , nor Ingevity’s auditors, have audited, reviewed, compiled or performed any procedures with respect to the financial results of Perstorp’s Capa ™ caprolactone business . The accounting policies and methodologies used by Perstorp’s Capa ™ caprolactone business differ in certain respects from those used by Ingevity. The audited financial statements of Perstorp’s Capa ™ caprolactone business will be delivered to Ingevity prior to closing. The actual audited results of Perstorp’s Capa ™ caprolactone business therefore may differ from those provided herein due to the completion of the financial closing and au dit ing procedures under U.S. GAAP, application of financial adjustments, and other developments. Non - GAAP Financial Measures This presentation includes certain non-GAAP financial measures intended to supplement, not substitute for, comparable GAAP me asu res. Investors are urged to consider carefully the comparable GAAP measures and the reconciliations to those measures provided. 2

Transaction Overview Transaction Value ▪ Cash purchase price of €590 million (~$675 million 1 ) ▪ ~11x 2018E adjusted EBITDA 2 ▪ Assumes no synergies or tax benefits ▪ Expected EPS accretive in year one ▪ To be financed under existing credit facilities and cash ▪ Pro forma 2018E net leverage: ~3.5x ▪ Expected to deleverage to below 3.0x by end of 2019 ▪ Ingevity has reached an agreement to acquire the Capa TM caprolactone division of Perstorp Holding AB ▪ Anticipated closing late in the first quarter of 2019, subject to regulatory approvals and other customary conditions ▪ To be integrated into Performance Chemicals segment as “Engineered Polymers” Financing Summary (1) EUR / USD exchange rate: 1.15; purchase price subject to customary closing adjustments (2) Earnings before interest, taxes, depreciation and amortization. 3

Capa TM Caprolactone Business Overview 4 ▪ Capa holds the #1 market position in caprolactone technologies, with only two other major competitors worldwide ▪ Caprolactone is a critical input to many high - growth end - use applications ▪ Note: Caprolactone is not caprolactam ▪ Highly profitable and scalable business ▪ Expected 2018 sales of ~$175 million (1) ▪ Adj. EBITDA of ~$60 million ▪ Adj. EBITDA margins of mid - 30s percent ▪ Single plant operation in Warrington, U.K. ▪ Experienced management team with approximately 90 employees globally Revenue by Product and Geography (2018E) Source: Company information Polyols 47% Thermoplastics 25% HDO 3% Caprolactone 25% Americas 31% EMEA 44% APAC 25% (1) EUR / USD exchange rate: 1.15

Market Use Benefits End - Products Coatings Capa Polycaprolactones for High - Performance Polyurethane Coatings • High gloss • Weathering resistance • Flexibility • Toughness • Self - healing • Aerospace coatings • Automotive coatings • Specialty flooring coatings • Windmill coatings Resins Capa - based Polyurethane dispersions and UV - curable resins • Wear resistance • Anti - weathering • Cracking resistance • Automotive and aerospace coatings • Wood flooring coatings • Leather coatings Elastomers Capa Polyols for thermoplastic polyurethane or cast elastomers • Durability • Resistance to wear and tear • Thermal stability • Ease of processing • Tires for forklifts • Skateboard wheels • Roller coaster wheels • Running shoe soles • Gaskets and O - rings Adhesives Capa Thermoplastics for hot melt adhesives and Capa Polyols for liquid polyurethane adhesives • Strong adhesion and bonding • Various substrates • Durability and heat resistance • Flexibility • Food packaging • Textiles • Laminates • Tapes • Shoes and consumer products Bioplastics Capa - based biodegradable thermoplastics • Durability • Tear resistance • Printability • Biopolymer bags and films • Food packaging • Plasticware • Paper coatings Capa TM Caprolactone End - Uses and Benefits 5 Source: Company information

Value - creating Acquisition Consistent with Our Strategy Strategic Rationale ▪ Strong, m arket - leading business focused on high - growth end - use applications ▪ Complementary fit with Ingevity business model and capabilities ▪ Technology - focused relationships drive customer intimacy ▪ Similar manufacturing process and approach ▪ Provides new avenues for strategic growth and value creation ▪ Top - tier financial profile, immediately accretive 6

Strong, Market - leading Business Focused on High - growth End - use Applications 125 Projected Market Growth and Share by Product Segment Monomer Polyols Thermoplastic 46% ▪ Polyols synthesis ▪ Reactive modifier ▪ Coating additives ~4 – 5% ~6 – 7% ~4 – 5% 38% ▪ Coatings ▪ Elastomers ▪ Adhesives ~7% ▪ Additives for adhesives ▪ Shoe components ▪ Materials for medical devices ▪ Components in biodegradables ~8% 16% ~3% ~8% ~>15% Weighted average growth ~6% 35% 39% 22% x Revenue split is favorably skewed towards higher market growth applications and higher margin derivatives (polyols and thermoplastics) x Significant growth potential arising from emerging applications, notably biodegradable polymers and 3D printing 2017 market split by volume Applications Market growth (FY17A – 22E) Market 2017 volumes by product “ Capa ” business Commentary ▪ Global market leader with unique technology and state - of - the - art manufacturing capabilities ▪ Capacity is ~3x vs. the closest competitor (~60% of available capacity); only two other producers globally ▪ Strategically targeted to high - value end - markets ▪ Target markets have a weighted average annual growth of ~6% Source: Company information 7 Strategic Rationale

Technology - focused Relationships Drive Customer Intimacy 8 Resins & Coatings 31% Adhesives 8% Elastomers 27% Bioplastics 5% Caprolactone and Other 29% Ingevity overlap Revenue by End - use Applications (2018E) Source: Company information ▪ Deep customer knowledge backed by 40 years of technical expertise and process know - how ▪ Long - standing, loyal customer base with no customer representing more than 10% of sales ▪ Proven expertise to develop tailored applications and technology solutions depending on customer needs ▪ Potential for channel synergies over time in end - use applications where Ingevity participates, particularly coatings and adhesives ▪ Leverage Ingevity corporate and functional resources Strategic Rationale

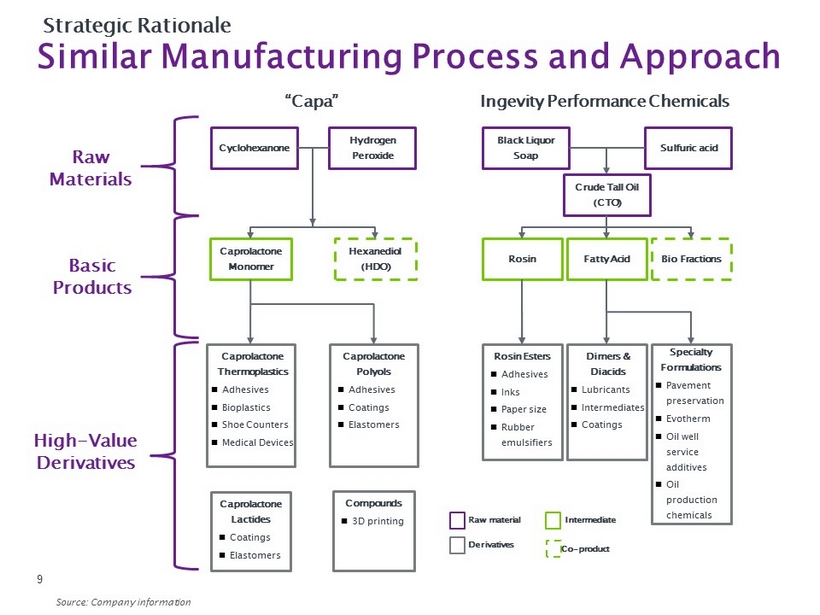

Similar Manufacturing Process and Approach “ Capa ” Cyclohexanone Caprolactone Thermoplastics Adhesives Bioplastics Shoe Counters Medical Devices Caprolactone Polyols Adhesives Coatings Elastomers Hydrogen Peroxide Hexanediol (HDO) Caprolactone Lactides Coatings Elastomers Compounds 3D printing Black Liquor Soap Sulfuric acid Rosin Fatty Acid Rosin Esters Adhesives Inks Paper size Rubber emulsifiers Dimers & Diacids Lubricants Intermediates Coatings Raw material Intermediate Derivatives Co - product Bio Fractions Crude Tall Oil (CTO) Specialty Formulations Pavement preservation Evotherm Oil well service additives Oil production chemicals Caprolactone Monomer Source: Company information Basic Products High - Value Derivatives 9 Ingevity Performance Chemicals Strategic Rationale Raw Materials

Provides New Avenues for Strategic Growth and Value Creation 10 ▪ Continued growth supported by end - market macro trends in core and emerging applications ▪ Biodegradable polymers, medical devices, 3D printing, etc. ▪ Untapped potential for caprolactone to increase penetration via technology substitution within existing key market segments ▪ Strong track record of innovation and new business development ▪ Platform for further bolt on M&A opportunities in strategically - targeted, value - added thermoplastics, resins and bioplastics Strategic Rationale

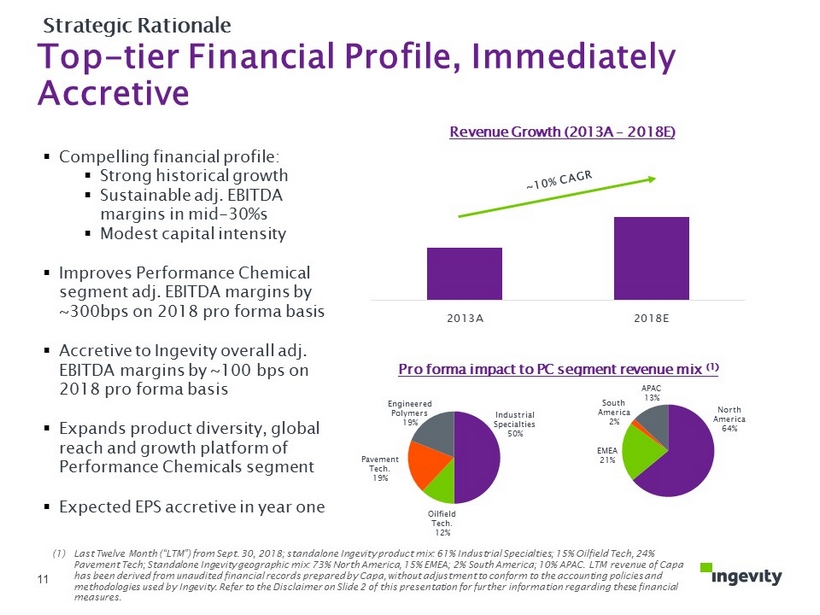

Top - tier Financial Profile, Immediately Accretive 11 2013A 2018E Revenue Growth (2013A – 2018E) ▪ Compelling financial profile: ▪ Strong historical growth ▪ Sustainable adj. EBITDA margins in mid - 30%s ▪ Modest capital intensity ▪ Improves Performance Chemical segment adj. EBITDA margins by ~300bps on 2018 pro forma basis ▪ Accretive to Ingevity overall adj. EBITDA margins by ~100 bps on 2018 pro forma basis ▪ Expands product diversity, global reach and growth platform of Performance Chemicals segment ▪ Expected EPS accretive in year one Pro forma impact to PC segment revenue mix (1) Engineered Polymers 19% Industrial Specialties 50% Oilfield Tech. 12% Pavement Tech. 19% APAC 13% North America 64% EMEA 21% (1) Last Twelve Month (“LTM”) from Sept. 30, 2018; standalone Ingevity product mix: 61% Industrial Specialties; 15% Oilfield Tech , 2 4% Pavement Tech; Standalone Ingevity geographic mix: 73% North America, 15% EMEA; 2% South America; 10% APAC. LTM revenue of Capa has been derived from unaudited financial records prepared by Capa , without adjustment to conform to the accounting policies and methodologies used by Ingevity. Refer to the Disclaimer on Slide 2 of this presentation for further information regarding the se financial measures. Strategic Rationale South America 2%

Value - creating Acquisition Consistent with Our Strategy ▪ Furthers our purpose of purifying, protecting and enhancing the world around us ▪ Provides a complementary, growth platform in new and existing end - use applications ▪ Business aligned with Ingevity strengths: ▪ Technology - based customer partnerships ▪ Reaction / purification process and derivative product approach ▪ Top - tier financial metrics and pro forma impacts translate into compelling value creation opportunity ▪ Financed under existing facilities at comfortable leverage levels; rapid deleveraging given excellent cash generation profile of combined business ▪ Ingevity welcomes the Capa organization and looks forward to building an even stronger Ingevity together! 12