Attached files

| file | filename |

|---|---|

| EX-99.1 - CLEANSPARK, INC. | ex99_1.htm |

| 8-K - CLEANSPARK, INC. | mainbody.htm |

O TC : C L S K C O N F ID E N T I A L INVESTOR PRESENTATION TICKER: CLSK December 2018

| 1 |

SAFE HARBOR S T A T EME N T Statements in this presentation relating to plans, strategies, testing and operational performance, OTC:CLSK CONFIDENTIAL projections of results of specific activities and other statements that are not descriptions of historical facts may be forward - looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 , Section 27 A of the Securities Act of 1933 , as amended, and Section 21 E of the Securities Exchange Act of 1934 , as amended . This release contains "forward - looking statements" that include information relating to future events and future financial and operating performance . The words "may," "would," "will," "expect," "estimate," "can," "believe," "potential" and similar expressions and variations thereof are intended to identify forward looking statements . Forward - looking statements should not be read as a guarantee of future performance or results, and will not necessarily be accurate indications of the times at, or by, which that performance or those results will be achieved . Forward - looking statements are based on information available at the time they are made and/or management's good faith belief as of that time with respect to future events, and are subject to risks and uncertainties that could cause actual performance or results to differ materially from those expressed in or suggested by the forward - looking statements . Important factors that could cause these differences include, but are not limited to : fluctuations in demand for the Company's products, the introduction of new products, the Company's ability to maintain customer and strategic business relationships, the impact of competitive products and pricing, growth in targeted markets, the adequacy of the Company's liquidity and financial strength to support its growth, and other information that may be detailed from time - to - time in the Company's filings with the United States Securities and Exchange Commission (the "SEC") . For a more detailed description of the risk factors and uncertainties affecting the Company, please refer to the Company's recent SEC filings, which are available at http : //www . sec . gov . The Company undertakes no obligation to publicly update or revise any forward - looking statements, whether as a result of new information, future events or otherwise .

| 2 |

INVESTOR HIGHLIGHTS RAPIDLY EXPANDING MARKET The electric grid is getting more distributed, with the distributed energy resource (DER) market expected to grow at a compound rate of 21% (Source: Transparency Market Research; July 2016 ) Distributed energy resources (DER) pose the biggest disruption to the centralized utility business model as sales of DER products are expected to grow 3 to 5 times faster than central grid products (Source: Navigant Research; 3Q 2016 ) TECHNOLOGY LEADERSHIP Engineering, design and software company focused on turnkey microgrid energy solutions at the center of which is our proprietary software platform that enables the integration and optimization of a variety of power generation sources (e.g., solar, batteries, fuel cells, diesel generators) Generation and energy storage agnostic, providing complete flexibility in working with customers on power solutions Offer proprietary electric switchgear products necessary to connect power generation equipment to the grid Switch gear used in our installations and sold to a variety of third parties as standalone or as a complete power package SALES Established sales channels include distributors, developers, EPCs as well as self - development Transitioning from sales development to execution and growth Switchgear product business provides ~$10 million dollars of annual baseline, profitable revenue Sizable and growing backlog under contract of ~$4.5 million for manufacturing in December 2018 and early 2019 Reoccurring customer orders are expected to result in an additional $5+ million in 2019 orders Microgrid backlog stands at ~$18 million OTC:CLSK CONFIDENTIAL

| 3 |

1 2 3 Software and Controls Project Development and Engineering Services Hardware Sales OUR BUSINESS SEGMENTS Avg. Margin: 80 - 95% Avg. Margin: 9 - 25% Avg. Margin: 10 - 40% CleanSpark’s Distributed Energy Resource (DER) Solutions Manage Power Flow to Create the Benefits our Customers Care About: BUSINESS SEGMENTS: OTC:CLSK CONFIDENTIAL

| 4 |

Patented Intelligent Controls and Analytics SOFTWARE Critical Infrastructure Equipment Transmission & Distribution OUR TECHNOLOGY IS CRITICAL TO THE INTEGRATION OF POWER GENERATION& STORAGE ASSETS CLEANSPARK BRANDS Switch gear Customer Building Software Controller MicroTurbines Fuel Cell Solar Panels OTC:CLSK CONFIDENTIAL

| 5 |

Energy Cost avoidance Energy Resiliency CUSTOMER VALUE PROPOSITIONS – WE PROVIDE SOLUTIONS TO MEET OUR CUSTOMERS EXPANDING NEEDS OUR BUSINESS Standardized Plug - and - Play Ecosystem Flexibility for the Future ENABLED BY OUR SOFTWARE Advanced optimization of power systems Enabling Distribution and Isolation Hardware Distributed Generation and Microgrid Equipment INCORPORATED WITH OUR HARDWARE Integrated Power Centers & Custom Switchgear CleanSpark’s Distributed Energy Resource (DER) Software and Control Platform Manages Power Flow to Create the Benefits our Customers Care About 2 Control of Distributed energy assets Critical power protection Revenue Generation Sustainability Power quality 1 OTC:CLSK CONFIDENTIAL

| 6 |

OPPORTUNITY THROUGH INTEGRATION SOFTWARE PARALLELING SWITCHGEAR Integrated strategy Pioneer Custom Electric Products (PCEP) was recently awarded a contract to build a $2.3 million parallel switchgear project with integrated energy monitoring software for a foreign embassy. CleanSpark can now provide this software on future switchgear projects turning costs into REVENUE resulting in a boost to gross margin on equipment sales from approximately 7 - 12% to 20 - 25%. OTC:CLSK CONFIDENTIAL

| 7 |

O TC : C L S K C O N F ID E N T I A L A GROWING ECOSYSTEM OF PARTNERS CREATING REVENUE GROWTH CHANNELS TO MARKET DEVELOPERS& ENGINEERING,PROCUREMENT,ANDCONSTRUCTION DISTRIBUTORS ENERGYSTORAGEVENDORS Strong foundation of trusted relationships cultivating an ecosystem of deal - flow SELF - DEVELOPMENT Supported by direct engagement with Customers with repeat business opportunities REITSANDPORTFOLIOPROPERTYOWNERS MILITARYANDGOVERNMENT

| 8 |

EQUIPMENT CUSTOMER SEGMENTS BACKUP GENERATION PARALLELING SWITCHGEAR INTEGRATED POWER CENTER Multi - year relationship First order 6/2016 $5mm annualized sales Systems provided power through Hurricane Harvey Deployed on Multiple US Embassies Expected 10 year deal flow Most recent project $2.3mm in revenue Fully contained power centers engineering for users specific needs High - dollar value orders with repeat customers OTC:CLSK CONFIDENTIAL

| 9 |

SOFTWARE AND MICROGRID CUSTOMER SEGMENTS TURNKEY MICROGRID DESIGN, ENGINEERING AND DEVELOPMENT SERVICES Portfolio strategy – full property portfolio was analyzed and ranked for ability to economically optimize power Cost avoidance is key driver Economically optimized solutions designed by CleanSpark under an engineering services agreement Software paired with DER assets allows REITs to turn power from an expense to revenue Military contractor since 2014 Currently executing on $900,000 turn - key microgrid at USMC base Camp Pendleton System supports mission critical data - center Designed remote deployment microgrid solution for USMC (pending implementation) OTC:CLSK CONFIDENTIAL

| 10 |

SOFTWARE AND MICROGRID PRODUCTS CLEANSPARK OFFERS A FULL SUITE OF POWER MANAGEMENT SOFTWARE FROM MODELING TO ACTIVE CONTROLS mVSO delivers the answers needed to make confident energy investment decisions mPulse™ intelligently manages and optimizes energy assets to maximize benefits through machine learning mPulse ™ orchestrates the operation of energy assets in coordination with electric loads and the utility to maximize energy savings, revenue, reduce CO 2 and secure critical loads mVSO™ Microgrid Value Stream Optimizer Modeling and Design Software mVSO™ supports strategic decision making in energy projects, pinpoints opportunities throughout diverse energy markets, tests business models and performance under various regulatory constraints mPULSE™ Enterprise Control and Monitoring software OTC:CLSK CONFIDENTIAL

| 11 |

MICROGRID VALUE STREAM OPTIMIZER Delivering the answers needed to make confident energy investment decisions. OTC:CLSK CONFIDENTIAL

| 12 |

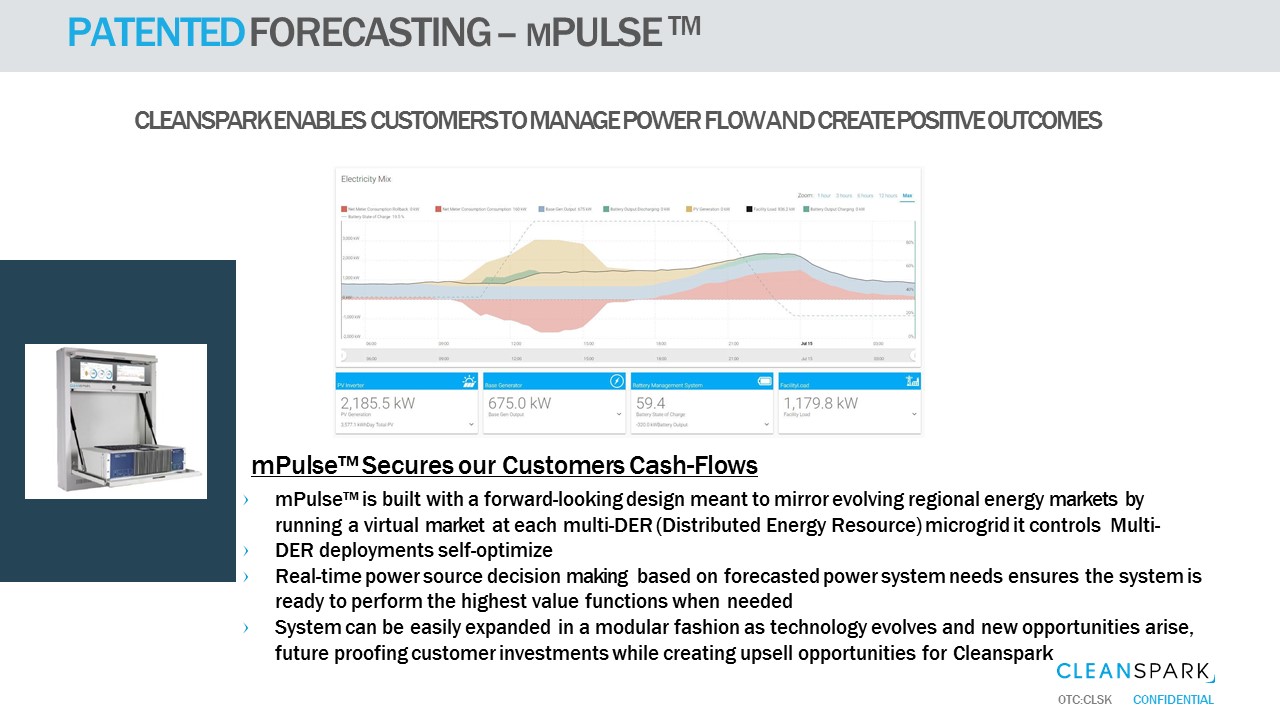

PATENTED FORECASTING – M PULSE TM CLEANSPARK ENABLES CUSTOMERS TO MANAGE POWER FLOW AND CREATE POSITIVE OUTCOMES mPulse™ Secures our Customers Cash - Flows mPulse™ is built with a forward - looking design meant to mirror evolving regional energy markets by running a virtual market at each multi - DER (Distributed Energy Resource) microgrid it controls Multi - DER deployments self - optimize Real - time power source decision making based on forecasted power system needs ensures the system is ready to perform the highest value functions when needed System can be easily expanded in a modular fashion as technology evolves and new opportunities arise, future proofing customer investments while creating upsell opportunities for Cleanspark OTC:CLSK CONFIDENTIAL

| 13 |

_ $1 _ $.3 million dollar rvlicrogrid . . Optimized in fl7V?O . c 1 _ n 9 Poweret j b Y CleanSpar k 1 s mPulse Platfqrm, . Ex p ecte d _ . . .. Comp .. letioh Augqst _ 2019 CONFIDENTIAL Powered by SPAr<K www.cleanspalk.com

| 14 |

Cost reductions in Solar Modules and energy storage is changing the energy market COST REDUCTION TECHNOLOGY IMPROVEMENTS OPPORTUNITY COST REDUCTIONS AND TECHNOLOGY SUPPORT MICROGRIDS OTC:CLSK CONFIDENTIAL

| 15 |

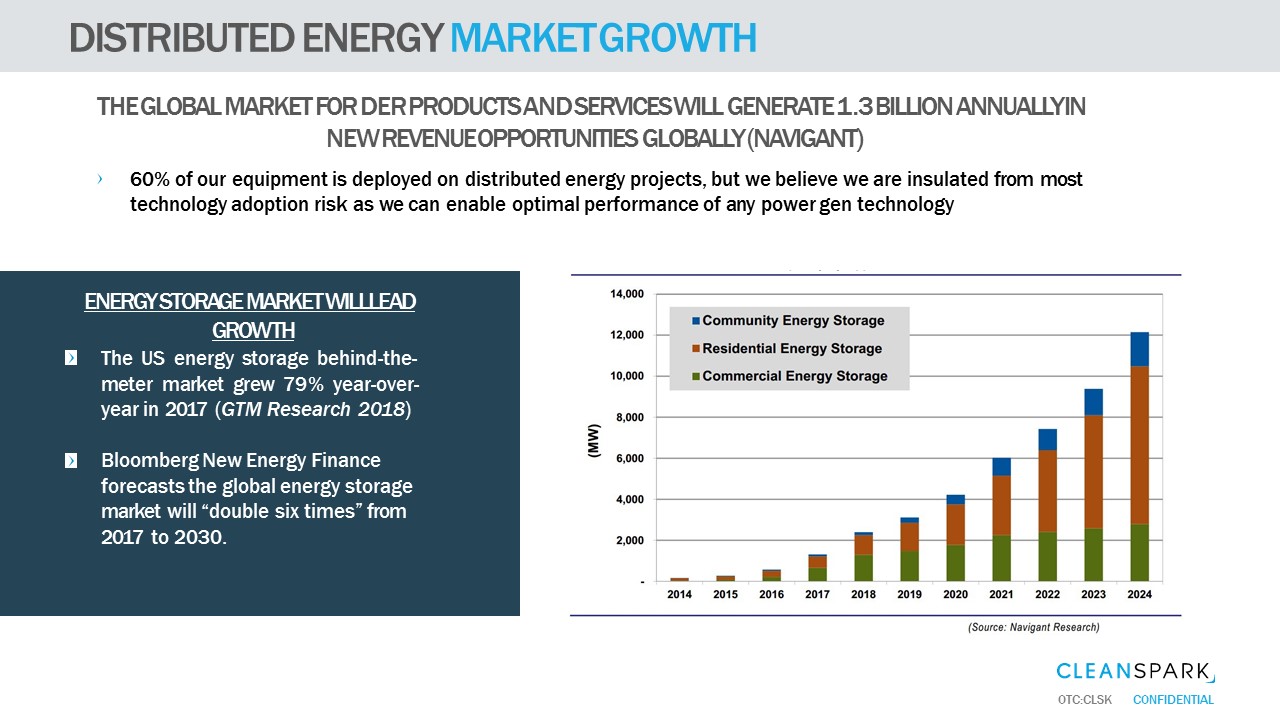

DISTRIBUTED ENERGY MARKET GROWTH ENERGY STORAGE MARKET WILLLEAD GROWTH The US energy storage behind - the - meter market grew 79 % year - over - year in 2017 ( GTM Research 2018 ) Bloomberg New Energy Finance forecasts the global energy storage market will “double six times” from 2017 to 2030. THE GLOBAL MARKET FOR DER PRODUCTS AND SERVICES WILL GENERATE 1.3 BILLION ANNUALLY IN NEW REVENUE OPPORTUNITIES GLOBALLY (NAVIGANT) 60% of our equipment is deployed on distributed energy projects, but we believe we are insulated from most technology adoption risk as we can enable optimal performance of any power gen technology OTC:CLSK CONFIDENTIAL

| 16 |

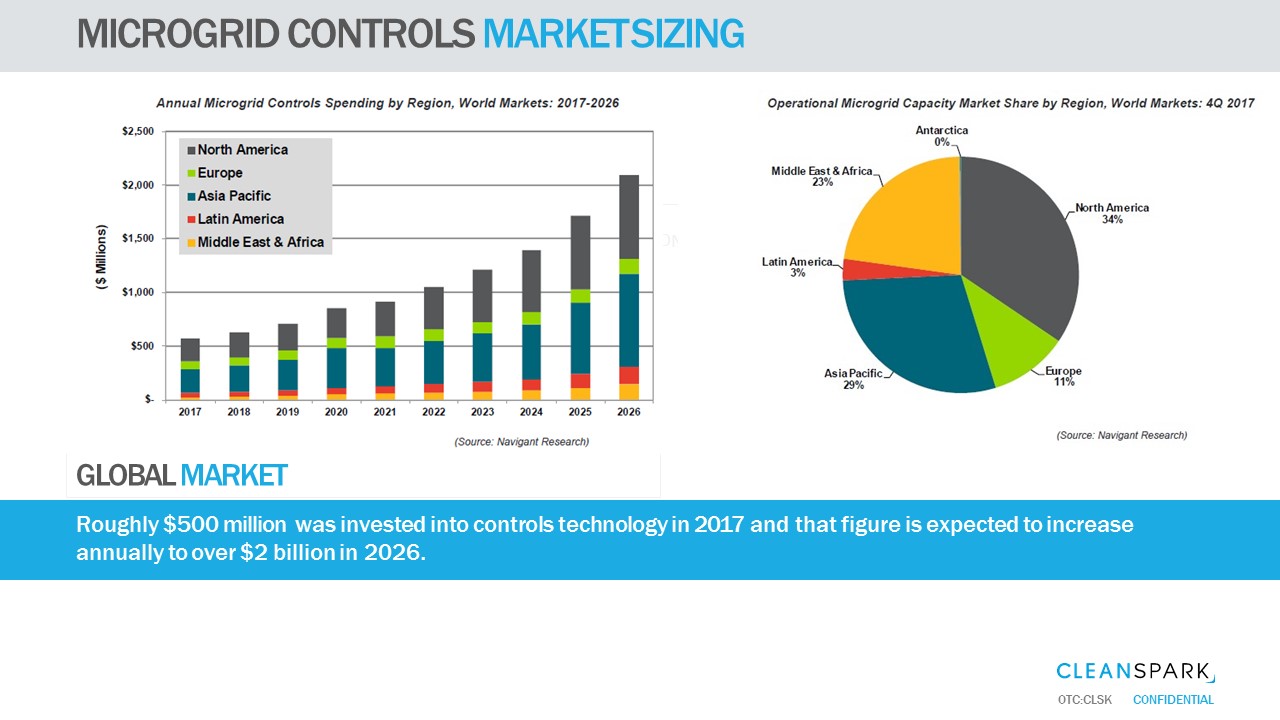

MICROGRID CONTROLS MARKET SIZING O BUSINESS PRESENTTAI N DESIGN GLOBAL MARKET Roughly $500 million was invested into controls technology in 2017 and that figure is expected to increase annually to over $2 billion in 2026. OTC:CLSK CONFIDENTIAL

| 17 |

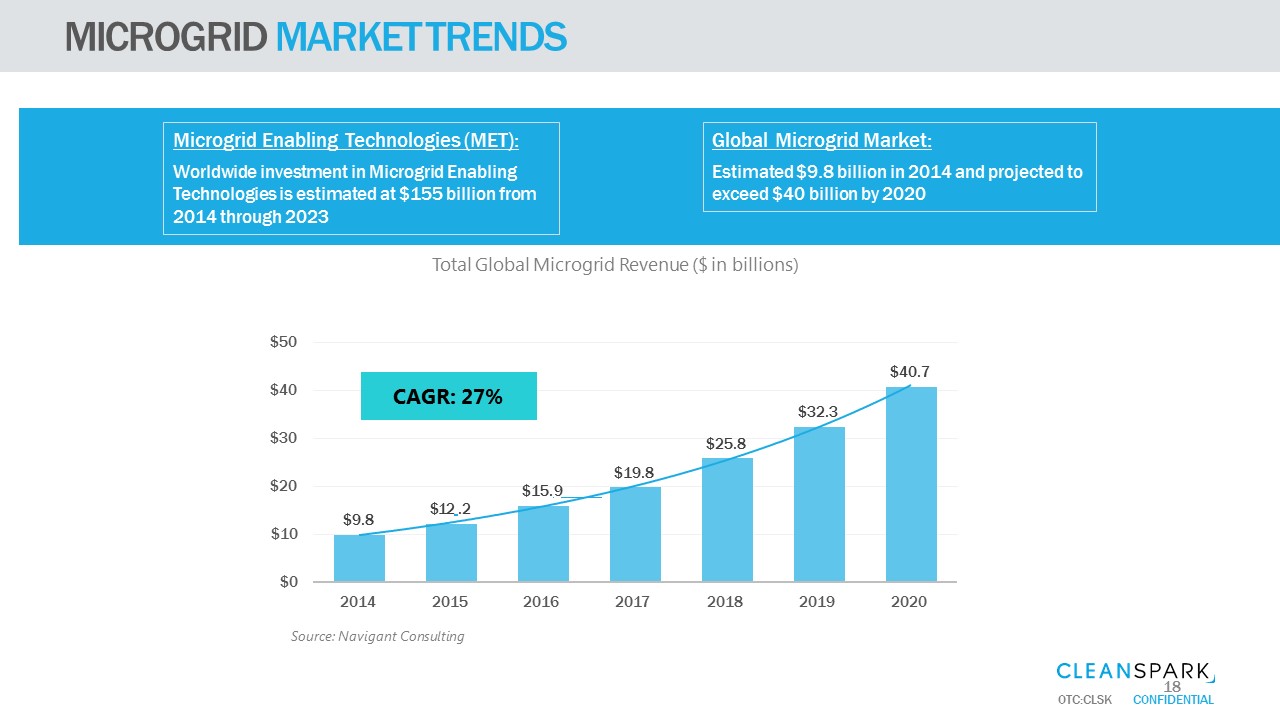

MICROGRID MARKET TRENDS 18 $9 . 8 $12 .2 $15 . 9 $19.8 $25 . 8 $32 . 3 $40 . 7 $10 $0 $20 $30 $40 $50 2016 2017 2018 2019 2020 Total Global Microgrid Revenue ($ in billions) 201 4 2015 Source: Navigant Consulting CAGR: 27% Global Microgrid Market: Estimated $9.8 billion in 2014 and projected to exceed $40 billion by 2020 OTC:CLSK CONFIDENTIAL Microgrid Enabling Technologies (MET): Worldwide investment in Microgrid Enabling Technologies is estimated at $155 billion from 2014 through 2023

| 18 |

SWITCH GEAR MARKET SIZING GLOBAL MARKET It is projected that $1.17 billion will be invested into parallel switchgear in 2018, and by 2023, the market should exceed $1.5 billion. Source: Researchandmarkets.com 2 0 18 2 0 19 2 0 20 2 0 21 2 0 22 2 0 23 $ 1. 55 $ 1 . 20 $ 1 . 00 $ 0 . 80 $ 0 . 60 $ 0 . 40 $ 0 . 20 $ - $ 1 . 80 $ 1 . 60 $ 1 . 40 Switch Gear Global Market Trends (Based on historical growth rates) $1.17 $1.24 Parallel switch gear OTC:CLSK CONFIDENTIAL $ 1. 3 1 $ 1. 3 9 $ 1. 47 Linear (Parallel switch gear) Parallel switch gear ($ in Billions) • Historical Global compound growth rate of 5.82% expected over the next 5 years • We expect the increase in distributed energy resource deployments to lead to an increase in this growth rate significantly over the next 10 years

| 19 |

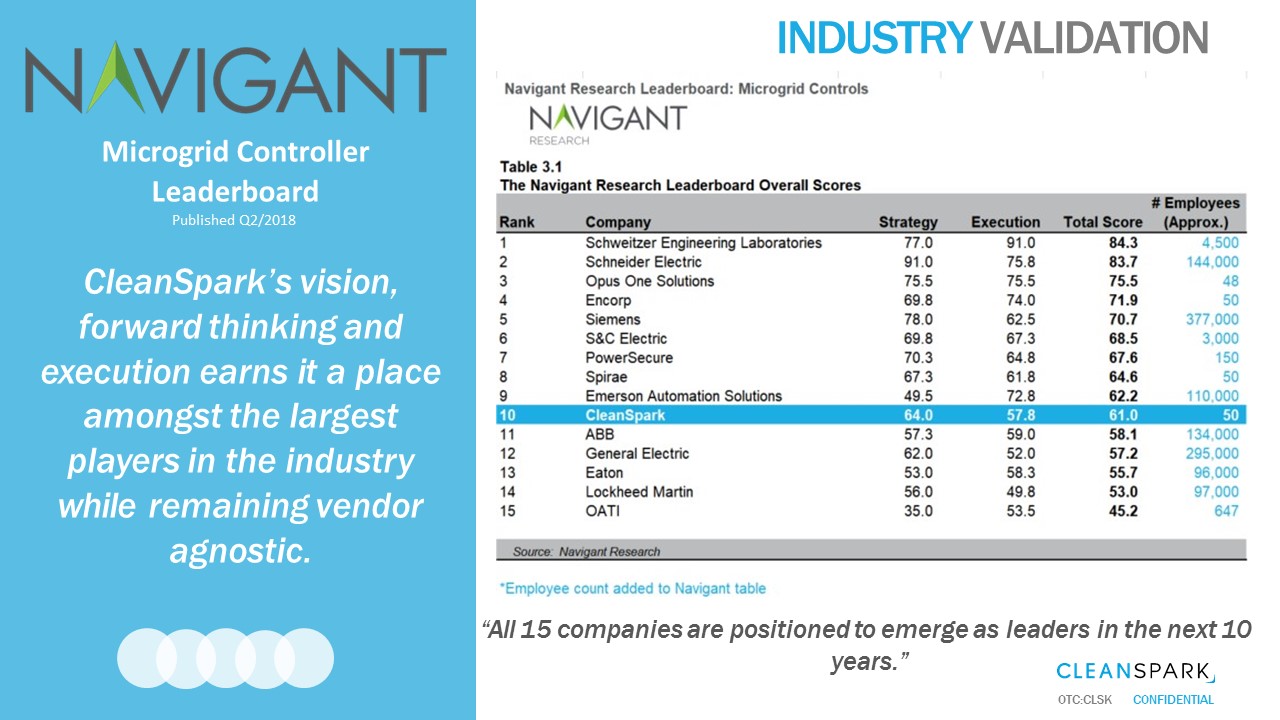

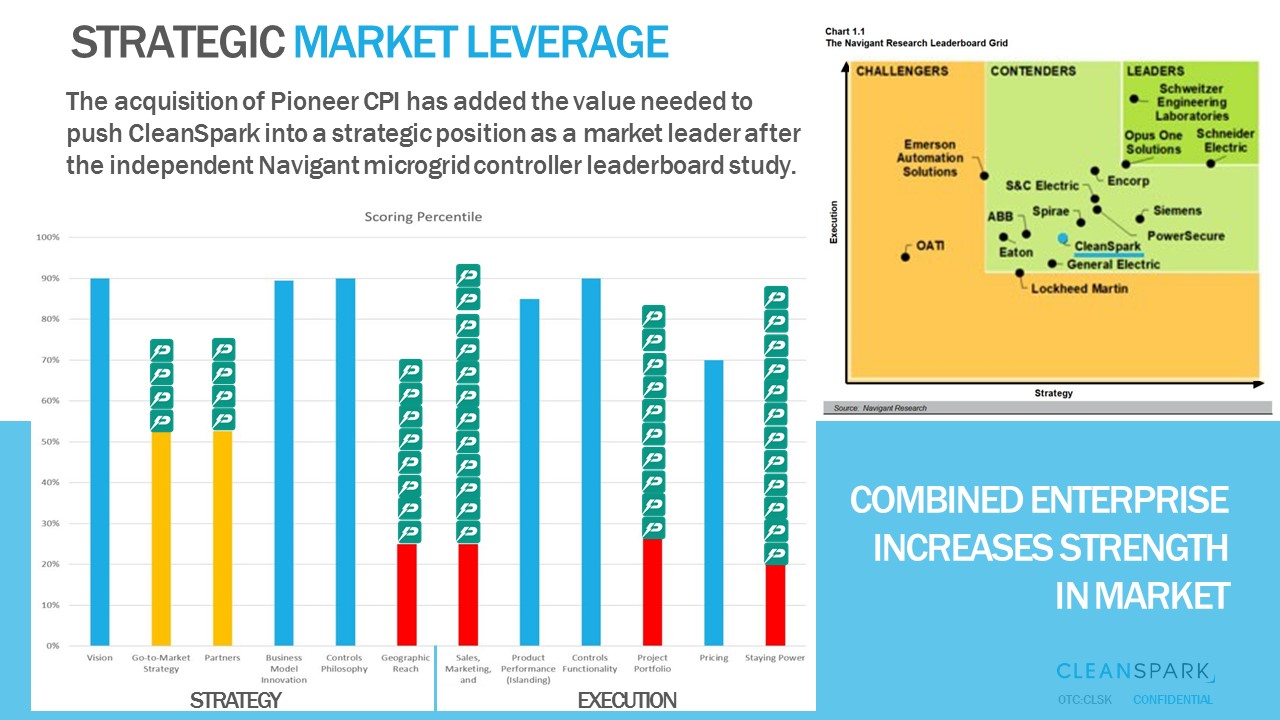

Microgrid Controller Leaderboard Published Q2/2018 CleanSpark’s vision, forward thinking and execution earns it a place amongst the largest players in the industry while remaining vendor agnostic. “All 15 companies are positioned to emerge as leaders in the next 10 years.” OTC:CLSK CONFIDENTIAL INDUSTRY VALIDATION

| 20 |

O TC : C L S K C O N F ID E N T I A L We’re thankful to be of service. OUR CUSTOMERS ARE OUR MEGAPHONE

| 21 |

A PP EN D I X OTC:CLSK CONFIDENTIAL

| 22 |

EXPERIENCED MANAGEMENT TEAM 23 Chief Executive Officer S. Matthew Schultz Mr. Schultz, Chief Executive Officer, has been involved in many capacities with several publicly traded companies. Most recently, he served as the President and CEO of Amerigo Energy, Inc., creating multiple syndicated offerings of developmental oil production programs, as well as overseeing the operations from permitting through production. Since 1999, he has assisted numerous development and early stage companies to secure financing and experience significant growth. As the President of Wexford Capital Ventures, Inc., he was instrumental in funding companies both domestically and abroad. He was a founding member and the Vice President of the Utah Consumer Lending Association. A native of Lander, WY, he studied management and finance at Weber State University. President, Chief Financial Officer Zachary K. Bradford Mr. Bradford, President and Chief Financial Officer, is a licensed Certified Public Accountant, Certified Global Management Accountant and a member of the American Institute of Certified Public Accountants. He has served as the managing partner of a public accounting and consulting firm in Henderson, Nevada since 2013 and has acted as a CFO, member of the board of directors and as an advisor for several high growth companies in both the public and private sectors. Mr. Bradford holds a B.S. in Accounting and a Masters of Accountancy from Southern Utah University. Chief Operating Officer Bryan Huber Bryan has over 13 years of experience in the design - build construction and energy industries. He has extensive experience and specialization with sustainable energy design and implementation, project management, quality assurance, and project commissioning. In addition, Mr. Huber brings with him a core competency within renewable energy Independent Power Producer deal structuring, design, forecasting, financial modeling, incentive monetization, and deployment. As a Co - Founder of CleanSpark, he continues to be integrally involved in technology development, and operation of CleanSpark’s Energy Operating Platform. Mr. Huber holds a B.S. in Construction Engineering & Management from Purdue University and has completed Master’s coursework in Architecture focusing on integration of Distributed Energy Resource Systems into the built environment, and is a LEED Accredited Professional through the United States Green Building Council. OTC:CLSK CONFIDENTIAL

| 23 |

O TC : C L S K C O N F ID E N T I A L COMBINED ENTERPRISE INCREASES STRENGTH IN MARKET STRATEGIC MARKET LEVERAGE The acquisition of Pioneer CPI has added the value needed to push CleanSpark into a strategic position as a market leader after the independent Navigant microgrid controller leaderboard study. STRATEGY EXECUTION

| 24 |

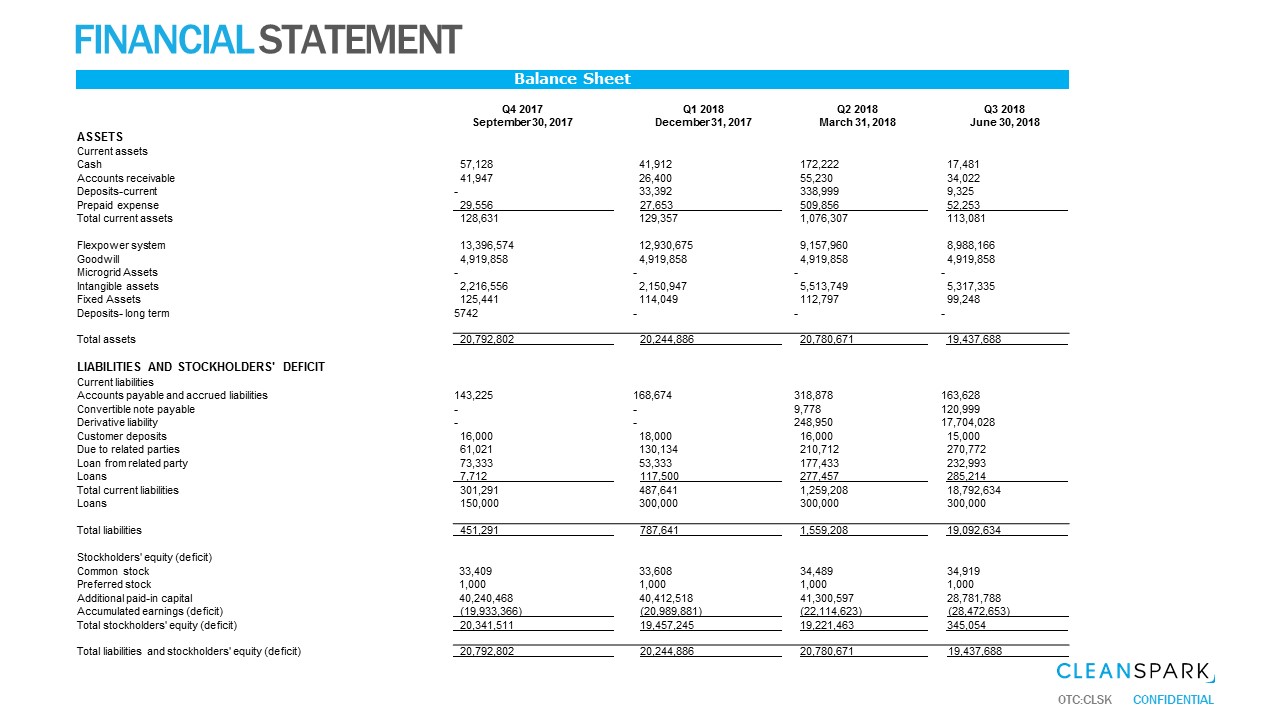

FINANCIAL STATEMENT OTC:CLSK CONFIDENTIAL Balance Sheet Q4 2017 Q1 2018 Q2 2018 Q3 2018 September 30, 2017 December 31, 2017 March 31, 2018 June 30, 2018 ASSETS Current assets Cash 57,128 41,912 172,222 17,481 Accounts receivable 41,947 26,400 55,230 34,022 Deposits - current - 33,392 338,999 9,325 Prepaid expense 29,556 27 , 65 3 509 , 85 6 52 , 25 3 Total current assets 128,631 129,357 1,076,307 113,081 Flexpower system 13,396,574 12,930,675 9,157,960 8,988,166 Goodwill 4,919,858 4,919,858 4,919,858 4,919,858 Microgrid Assets - - - - Intangible assets 2,216,556 2,150,947 5,513,749 5,317,335 Fixed Assets 125,441 114,049 112,797 99,248 Deposits - long term 5742 - - - Total assets 20,792,802 20 , 244 , 88 6 20 , 780 , 67 1 19 , 437 , 68 8 LIABILITIES AND STOCKHOLDERS' DEFICIT Current liabilities Accounts payable and accrued liabilities 143,225 168,674 318,878 163,628 Convertible note payable - - 9,778 120,999 Derivative liability - - 248,950 17,704,028 Customer deposits 16,000 18,000 16,000 15,000 Due to related parties 61,021 130,134 210,712 270,772 Loan from related party 73,333 53,333 177,433 232,993 Loans 7,712 117 , 50 0 277 , 45 7 285 , 21 4 Total current liabilities 301,291 487,641 1,259,208 18,792,634 Loans 150,000 300,000 300,000 300,000 Total liabilities 451,291 787 , 64 1 1 , 559 , 20 8 19 , 092 , 63 4 Stockholders' equity (deficit) Common stock 33,409 33,608 34,489 34,919 Preferred stock 1,000 1,000 1,000 1,000 Additional paid - in capital 40,240,468 40,412,518 41,300,597 28,781,788 Accumulated earnings (deficit) (19,933,366) (20 , 989 , 881 ) (22 , 114 , 623 ) (28 , 472 , 653 ) Total stockholders' equity (deficit) 20,341,511 19 , 457 , 24 5 19 , 221 , 46 3 345 , 05 4 Total liabilities and stockholders' equity (deficit) 20,792,802 20 , 244 , 88 6 20 , 780 , 67 1 19 , 437 , 68 8

| 25 |

FINANCIAL STATEMENT OTC:CLSK CONFIDENTIAL Income Statement For the Three Months Ended Q4 2017 Q1 2018 Q2 2018 Q3 2018 September 30, 2017 December 31, 2017 March 31, 2018 June 30, 2018 Revenues 447,963 18,080 120,265 328,586 Cost of revenues 296,295 6,468 77,277 288,400 Gross profit 151,668 11,612 42,988 40,186 Operating expenses Professional fees 1,016,934 155,001 331,891 364,863 Payroll expenses 264,063 258,198 107,775 128,604 Product development - 357,345 329,274 Research and development 591 2,315 646 3,880 General and administrative expenses 365,819 75,942 64,566 58,541 Depreciation and amortization 3,318,340 560,540 207,519 209,963 Total operating expenses 4,965,747 1,051,996 1,069,742 1,095,125 Loss from operations (4,814,079) (1,040,384) (1,026,754) (1,054,939) Other income (expense) Loss on settlement of debt (117,414) - - (41,092) Impairment expense (8,551,321) Interest expense (2,895) (16,131) (64,700) (4,689,126) Loss on derivative liability - - (33,288) (368,690) Gain (Loss) on disposal of assets (12,817) - - - Total other income (expense) (8,684,447) (16,131) (97,988) (5,098,908) Net income (loss) (13,498,526) (1,056,515) (1,124,742) (6,153,847) Basic income (loss) per common share (0.42) (0.03) (0.04) (0.18) Basic weighted average common shares outstanding 32,182,107 33,500,391 33,766,781 34,864,997

| 26 |