Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Apptio Inc | d648574d8k.htm |

Exhibit 99.1

IN THE UNITED STATES DISTRICT COURT

FOR THE DISTRICT OF DELAWARE

| LOUIS SCARANTINO, Individually and On | ) | |||

| Behalf of All Others Similarly Situated, | ) | |||

| ) | ||||

| Plaintiff, | ) | Case No. | ||

| ) | ||||

| v. |

) | CLASS ACTION | ||

| ) | ||||

| APPTIO, INC., SUNNY GUPTA, TOM | ) | JURY TRIAL DEMANDED | ||

| BOGAN, PETER KLEIN, JOHN MCADAM, | ) | |||

| MATT MCILWAIN, REBECCA JACOBY, | ) | |||

| RAJEEV SINGH, and KATHLEEN PHILIPS, | ) | |||

| ) | ||||

| Defendants. | ) |

COMPLAINT FOR VIOLATION OF THE SECURITIES EXCHANGE ACT OF 1934

Plaintiff, by his undersigned attorneys, for this complaint against defendants, alleges upon personal knowledge with respect to himself, and upon information and belief based upon, inter alia, the investigation of counsel as to all other allegations herein, as follows:

NATURE OF THE ACTION

1. This action stems from a proposed transaction announced on November 11, 2018 (the “Proposed Transaction”), pursuant to which Apptio, Inc. (“Apptio” or the “Company”) will be acquired by affiliates of Vista Equity Partners.

2. On November 9, 2018, Apptio’s Board of Directors (the “Board” or “Individual Defendants”) caused the Company to enter into an agreement and plan of merger (the “Merger Agreement”) with Bellevue Parent, LLC and Bellevue Merger Sub, Inc. Pursuant to the terms of the Merger Agreement, Apptio’s stockholders will receive $38.00 in cash for each share of Apptio common stock they hold.

3. On November 21, 2018, defendants filed a proxy statement (the “Proxy Statement”) with the United States Securities and Exchange Commission (the “SEC”) in connection with the Proposed Transaction.

4. The Proxy Statement omits material information with respect to the Proposed Transaction, which renders the Proxy Statement false and misleading. Accordingly, plaintiff alleges herein that defendants violated Sections 14(a) and 20(a) of the Securities Exchange Act of 1934 (the “1934 Act”) in connection with the Proxy Statement.

JURISDICTION AND VENUE

5. This Court has jurisdiction over all claims asserted herein pursuant to Section 27 of the 1934 Act because the claims asserted herein arise under Sections 14(a) and 20(a) of the 1934 Act and Rule 14a-9.

6. This Court has jurisdiction over defendants because each defendant is either a corporation that conducts business in and maintains operations within this District, or is an individual with sufficient minimum contacts with this District so as to make the exercise of jurisdiction by this Court permissible under traditional notions of fair play and substantial justice.

7. Venue is proper under 28 U.S.C. § 1391 because a substantial portion of the transactions and wrongs complained of herein occurred in this District.

PARTIES

8. Plaintiff is, and has been continuously throughout all times relevant hereto, the owner of Apptio common stock.

9. Defendant Apptio is a Delaware corporation and maintains its principal executive offices at 11100 NE 8th Street, Suite 600, Bellevue, Washington 98004. Apptio’s common stock is traded on the NasdaqGM under the ticker symbol “APTI.” Apptio is a party to the Merger Agreement.

2

10. Defendant Sunny Gupta is Chief Executive Officer and a director of the company.

11. Defendant Tom Bogan is Chairman of the Board of the company.

12. Defendant Peter Klein is a director of the company.

13. Defendant John McAdam is a director of the company.

14. Defendant Matt McIlwain is a director of the company.

15. Defendant Rebecca Jacoby is a director of the company.

16. Defendant Rajeev Singh is a director of the company.

17. Defendant Kathleen Philips is a director of the company.

18. The defendants identified in paragraphs 10 through 17 are collectively referred to herein as the “Individual Defendants.”

CLASS ACTION ALLEGATIONS

19. Plaintiff brings this action as a class action on behalf of himself and the other public stockholders of Apptio (the “Class”). Excluded from the Class are defendants herein and any person, firm, trust, corporation, or other entity related to or affiliated with any defendant.

20. This action is properly maintainable as a class action.

21. The Class is so numerous that joinder of all members is impracticable. As of November 6, 2018, there were approximately 45,110,117 shares of Apptio common stock outstanding, held by hundreds, if not thousands, of individuals and entities scattered throughout the country.

22. Questions of law and fact are common to the Class, including, among others, whether defendants violated the 1934 Act and whether defendants will irreparably harm plaintiff and the other members of the Class if defendants’ conduct complained of herein continues.

3

23. Plaintiff is committed to prosecuting this action and has retained competent counsel experienced in litigation of this nature. Plaintiff’s claims are typical of the claims of the other members of the Class and plaintiff has the same interests as the other members of the Class. Accordingly, plaintiff is an adequate representative of the Class and will fairly and adequately protect the interests of the Class.

24. The prosecution of separate actions by individual members of the Class would create the risk of inconsistent or varying adjudications that would establish incompatible standards of conduct for defendants, or adjudications that would, as a practical matter, be dispositive of the interests of individual members of the Class who are not parties to the adjudications or would substantially impair or impede those non-party Class members’ ability to protect their interests.

25. Defendants have acted, or refused to act, on grounds generally applicable to the Class as a whole, and are causing injury to the entire Class. Therefore, final injunctive relief on behalf of the Class is appropriate.

SUBSTANTIVE ALLEGATIONS

Background of the Company and the Proposed Transaction

26. Apptio is the business management system of record for hybrid IT.

27. With the Company’s cloud-based applications, IT leaders manage, plan, and optimize their technology investments across on-premises and cloud.

28. On November 9, 2018, Apptio’s Board caused the Company to enter into the Merger Agreement.

29. Pursuant to the terms of the Merger Agreement, Apptio’s stockholders will receive $38.00 in cash for each share of Apptio common stock they hold.

4

30. According to the press release announcing the Proposed Transaction:

Apptio, Inc. (NASDAQ: APTI), the business management system of record for hybrid IT, today announced that it has entered into a definitive agreement to be acquired by an affiliate of Vista Equity Partners (“Vista”), a leading investment firm focused on software, data and technology-enabled businesses.

Under the terms of the agreement, Vista will acquire all outstanding shares of Apptio common stock for a total value of approximately $1.94 billion. Apptio shareholders will receive $38.00 in cash per share, representing a 53% premium to the unaffected closing price as of November 9, 2018.

Apptio’s Board of Directors unanimously approved the deal and recommended that stockholders vote their shares in favor of the transaction. Apptio’s headquarters will remain in Bellevue, with regional offices across the US, EMEA and APAC. Closing of the deal is subject to customary closing conditions, including the approval of Apptio shareholders and antitrust approval in the United States. The transaction is expected to close in Q1 2019 and is not subject to a financing condition.

The Proxy Statement Omits Material Information, Rendering It False and Misleading

31. Defendants filed the Proxy Statement with the SEC in connection with the Proposed Transaction.

32. As set forth below, the Proxy Statement omits material information with respect to the Proposed Transaction.

33. The Proxy Statement omits material information regarding the Company’s financial projections and the analyses performed by the Company’s financial advisor in connection with the Proposed Transaction, Qatalyst Partners LP (“Qatalyst”).

34. With respect to the Company’s financial projections, the Proxy Statement fails to disclose: (i) all line items used to calculate non-GAAP gross profit; (ii) all line items used to calculate non-GAAP operating income; (iii) all line items used to calculate unlevered free cash flow; and (iv) a reconciliation of all non-GAAP to GAAP metrics.

35. With respect to Qatalyst’s Discounted Cash Flow Analysis, the Proxy Statement fails to disclose: (i) the terminal value of Apptio; (ii) the inputs and assumptions underlying the range of discount rates of 10.0% to 13.0%; (iii) Apptio’s forecasted tax attributes outstanding; and (iv) the number of fully-diluted shares of Apptio common stock.

5

36. The disclosure of projected financial information is material because it provides stockholders with a basis to project the future financial performance of a company, and allows stockholders to better understand the financial analyses performed by the company’s financial advisor in support of its fairness opinion. Moreover, when a banker’s endorsement of the fairness of a transaction is touted to shareholders, the valuation methods used to arrive at that opinion as well as the key inputs and range of ultimate values generated by those analyses must also be fairly disclosed.

37. The Proxy Statement also fails to disclose whether the Company entered into any non-disclosure agreements that contained “don’t ask, don’t waive” provisions that are or were preventing the counterparties from requesting waivers of standstill provisions to submit superior offers to acquire the Company, including the non-disclosure agreements executed by Party A, Party C, and Party F.

38. Without this information, stockholders may have the mistaken belief that, if these potentially interested parties wished to come forward with a superior offer, they are or were permitted to do so, when in fact they are or were contractually prohibited from doing so.

39. The omission of the above-referenced material information renders the Proxy Statement false and misleading, including, inter alia, the following sections of the Proxy Statement: (i) Background of the Merger; (ii) Recommendation of the Board of Directors and Reasons for the Merger; (iii) Fairness Opinion of Qatalyst Partners; and (iv) Management Projections.

6

40. The omitted information, if disclosed, would significantly alter the total mix of information available to the Company’s stockholders.

COUNT I

Claim for Violation of Section 14(a) of the 1934 Act and Rule 14a-9 Promulgated

Thereunder Against the Individual Defendants and Apptio

41. Plaintiff repeats and realleges the preceding allegations as if fully set forth herein.

42. The Individual Defendants disseminated the false and misleading Proxy Statement, which contained statements that, in violation of Section 14(a) of the 1934 Act and Rule 14a-9, in light of the circumstances under which they were made, omitted to state material facts necessary to make the statements therein not materially false or misleading. Apptio is liable as the issuer of these statements.

43. The Proxy Statement was prepared, reviewed, and/or disseminated by the Individual Defendants. By virtue of their positions within the Company, the Individual Defendants were aware of this information and their duty to disclose this information in the Proxy Statement.

44. The Individual Defendants were at least negligent in filing the Proxy Statement with these materially false and misleading statements.

45. The omissions and false and misleading statements in the Proxy Statement are material in that a reasonable stockholder will consider them important in deciding how to vote on the Proposed Transaction. In addition, a reasonable investor will view a full and accurate disclosure as significantly altering the total mix of information made available in the Proxy Statement and in other information reasonably available to stockholders.

46. The Proxy Statement is an essential link in causing plaintiff and the Company’s stockholders to approve the Proposed Transaction.

7

47. By reason of the foregoing, defendants violated Section 14(a) of the 1934 Act and Rule 14a-9 promulgated thereunder.

48. Because of the false and misleading statements in the Proxy Statement, plaintiff and the Class are threatened with irreparable harm.

COUNT II

Claim for Violation of Section 20(a) of the 1934 Act

Against the Individual Defendants

49. Plaintiff repeats and realleges the preceding allegations as if fully set forth herein.

50. The Individual Defendants acted as controlling persons of Apptio within the meaning of Section 20(a) of the 1934 Act as alleged herein. By virtue of their positions as officers and/or directors of Apptio and participation in and/or awareness of the Company’s operations and/or intimate knowledge of the false statements contained in the Proxy Statement, they had the power to influence and control and did influence and control, directly or indirectly, the decision making of the Company, including the content and dissemination of the various statements that plaintiff contends are false and misleading.

51. Each of the Individual Defendants was provided with or had unlimited access to copies of the Proxy Statement alleged by plaintiff to be misleading prior to and/or shortly after these statements were issued and had the ability to prevent the issuance of the statements or cause them to be corrected.

52. In particular, each of the Individual Defendants had direct and supervisory involvement in the day-to-day operations of the Company, and, therefore, is presumed to have had the power to control and influence the particular transactions giving rise to the violations as alleged herein, and exercised the same. The Proxy Statement contains the unanimous recommendation of the Individual Defendants to approve the Proposed Transaction. They were thus directly involved in the making of the Proxy Statement.

8

53. By virtue of the foregoing, the Individual Defendants violated Section 20(a) of the 1934 Act.

54. As set forth above, the Individual Defendants had the ability to exercise control over and did control a person or persons who have each violated Section 14(a) of the 1934 Act and Rule 14a-9, by their acts and omissions as alleged herein. By virtue of their positions as controlling persons, these defendants are liable pursuant to Section 20(a) of the 1934 Act. As a direct and proximate result of defendants’ conduct, plaintiff and the Class are threatened with irreparable harm.

PRAYER FOR RELIEF

WHEREFORE, plaintiff prays for judgment and relief as follows:

A. Enjoining defendants and all persons acting in concert with them from proceeding with, consummating, or closing the Proposed Transaction;

B. In the event defendants consummate the Proposed Transaction, rescinding it and setting it aside or awarding rescissory damages;

C. Directing the Individual Defendants to file a Proxy Statement that does not contain any untrue statements of material fact and that states all material facts required in it or necessary to make the statements contained therein not misleading;

D. Declaring that defendants violated Sections 14(a) and/or 20(a) of the 1934 Act, as well as Rule 14a-9 promulgated thereunder;

E. Awarding plaintiff the costs of this action, including reasonable allowance for plaintiff’s attorneys’ and experts’ fees; and

F. Granting such other and further relief as this Court may deem just and proper.

9

JURY TRIAL DEMAND

Plaintiff hereby demands a trial by jury on all issues so triable.

| Dated: December 6, 2018 | RIGRODSKY & LONG, P.A. | |||||

| By: | /s/ Gina M. Serra | |||||

| Seth D. Rigrodsky (#3147) | ||||||

| Brian D. Long (#4347) | ||||||

| Gina M. Serra (#5387) | ||||||

| OF COUNSEL: | 300 Delaware Avenue, Suite 1220 | |||||

| Wilmington, DE 19801 | ||||||

| RM LAW, P.C. | Telephone: (302) 295-5310 | |||||

| Richard A. Maniskas | Facsimile: (302) 654-7530 | |||||

| 1055 Westlakes Drive, Suite 300 | Email: sdr@rl-legal.com | |||||

| Berwyn, PA 19312 | Email: bdl@rl-legal.com | |||||

| Telephone: (484) 324-6800 | Email: gms@rl-legal.com | |||||

| Facsimile: (484) 631-1305 | ||||||

| Email: rm@maniskas.com | Attorneys for Plaintiff | |||||

10

CERTIFICATION OF PLAINTIFF

I, Louis Scarantino (“Plaintiff”), hereby declare as to the claims asserted under the federal securities laws that:

1. Plaintiff has reviewed the complaint and authorizes its filing.

2. Plaintiff did not purchase the security that is the subject of this action at the direction of Plaintiff’s counsel or in order to participate in any private action.

3. Plaintiff is willing to serve as a representative party on behalf of the class, either individually or as part of a group, and I will testify at deposition or trial, if necessary. I understand that this is not a claim form and that I do not need to execute this Certification to share in any recovery as a member of the class.

4. Plaintiff’s purchase and sale transactions in the Apptio, Inc. (NasdaqGM: APTI) security that is the subject of this action during the class period is/are as follows:

| PURCHASES | SALES | |||||||||||||||||

| Buy Date |

Shares |

Price per Share |

Sell Date |

Shares | Price per Share | |||||||||||||

| 10/30/18 |

20 | $22.31 | ||||||||||||||||

Please list additional transactions on separate sheet of paper, if necessary.

5. Plaintiff has complete authority to bring a suit to recover for investment losses on behalf of purchasers of the subject securities described herein (including Plaintiff, any co-owners, any corporations or other entities, and/or any beneficial owners).

6. During the three years prior to the date of this Certification, Plaintiff has not moved to serve as a representative party for a class in an action filed under the federal securities laws.

7. Plaintiff will not accept any payment for serving as a representative party on behalf of the class beyond Plaintiff’s pro rata share of any recovery, except such reasonable costs and expenses (including lost wages) directly relating to the representation of the class as ordered or approved by the Court.

I declare under penalty of perjury that the foregoing is true and correct.

Executed this 5 day of December, 2018.

| /s/ Louis Scarantino |

| Louis Scarantino |

2

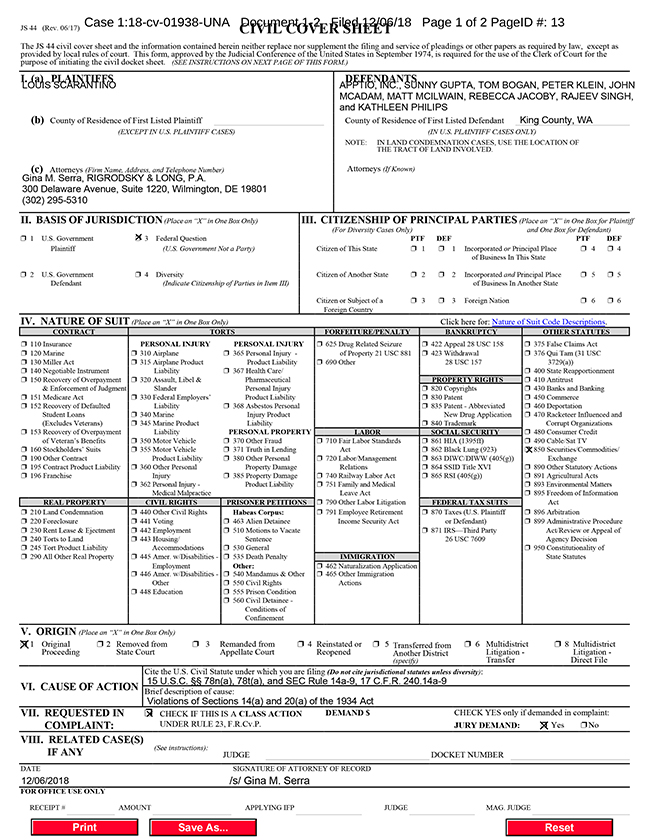

JS 44 (Rev. 06/17) CIVIL COVER SHEET The JS 44 civil cover sheet and the information contained herein neither replace nor supplement the filing and service of pleadings or other papers as required by law, except as provided by local rules of court. This form, approved by the Judicial Conference of the United States in September 1974, is required for the use of the Clerk of Court for the purpose of initiating the civil docket sheet. (SEE INSTRUCTIONS ON NEXT PAGE OF THIS FORM.) I. (a)PLAINTIFFSDEFENDANTS (b) County of Residence of First Listed Plaintiff County of Residence of First Listed Defendant (EXCEPT IN U.S. PLAINTIFF CASES) (IN U.S. PLAINTIFF CASES ONLY) NOTE: IN LAND CONDEMNATION CASES, USE THE LOCATION OF THE TRACT OF LAND INVOLVED. (c) Attorneys (Firm Name, Address, and Telephone Number) Attorneys (If Known) II. BASIS OF JURISDICTION (Place an “X” in One Box Only) III. CITIZENSHIP OF PRINCIPAL PARTIES (Place an “X” in One Box for Plaintiff (For Diversity Cases Only) and One Box for Defendant) ‘ 1 U.S. Government ‘ 3 Federal Question PTF DEF PTF DEF Plaintiff (U.S. Government Not a Party) Citizen of This State ‘ 1 ‘ 1 Incorporated or Principal Place ‘ 4 ‘ 4 of Business In This State ‘ 2 U.S. Government ‘ 4 DiversityCitizen of Another State ‘ 2 ‘ 2 Incorporated and Principal Place ‘ 5 ‘ 5 Defendant (Indicate Citizenship of Parties in Item III) of Business In Another State Citizen or Subject of a ‘ 3 ‘ 3 Foreign Nation ‘ 6 ‘ 6 Foreign Country IV. NATURE OF SUIT (Place an “X” in One Box Only) Click here for: Nature of Suit Code Descriptions. CONTRACTTORTSFORFEITURE/PENALTYBANKRUPTCYOTHER STATUTES ‘ 110 Insurance PERSONAL INJURY PERSONAL INJURY ‘ 625 Drug Related Seizure ‘ 422 Appeal 28 USC 158 ‘ 375 False Claims Act ‘ 120 Marine ‘ 310 Airplane ‘ 365 Personal Injury - of Property 21 USC 881 ‘ 423 Withdrawal ‘ 376 Qui Tam (31 USC ‘ 130 Miller Act ‘ 315 Airplane Product Product Liability ‘ 690 Other 28 USC 157 3729(a)) ‘ 140 Negotiable Instrument Liability ‘ 367 Health Care/ ‘ 400 State Reapportionment ‘ 150 Recovery of Overpayment ‘ 320 Assault, Libel & Pharmaceutical PROPERTY RIGHTS ‘ 410 Antitrust & Enforcement of Judgment Slander Personal Injury ‘ 820 Copyrights ‘ 430 Banks and Banking ‘ 151 Medicare Act ‘ 330 Federal Employers’ Product Liability ‘ 830 Patent ‘ 450 Commerce ‘ 152 Recovery of Defaulted Liability ‘ 368 Asbestos Personal ‘ 835 Patent - Abbreviated ‘ 460 Deportation Student Loans ‘ 340 Marine Injury Product New Drug Application ‘ 470 Racketeer Influenced and (Excludes Veterans) ‘ 345 Marine Product Liability ‘ 840 Trademark Corrupt Organizations ‘ 153 Recovery of Overpayment Liability PERSONAL PROPERTY LABORSOCIAL SECURITY ‘ 480 Consumer Credit of Veteran’s Benefits ‘ 350 Motor Vehicle ‘ 370 Other Fraud ‘ 710 Fair Labor Standards ‘ 861 HIA (1395ff) ‘ 490 Cable/Sat TV ‘ 160 Stockholders’ Suits ‘ 355 Motor Vehicle ‘ 371 Truth in Lending Act ‘ 862 Black Lung (923) ‘ 850 Securities/Commodities/ ‘ 190 Other Contract Product Liability ‘ 380 Other Personal ‘ 720 Labor/Management ‘ 863 DIWC/DIWW (405(g)) Exchange ‘ 195 Contract Product Liability ‘ 360 Other Personal Property Damage Relations ‘ 864 SSID Title XVI ‘ 890 Other Statutory Actions ‘ 196 Franchise Injury ‘ 385 Property Damage ‘ 740 Railway Labor Act ‘ 865 RSI (405(g)) ‘ 891 Agricultural Acts ‘ 362 Personal Injury - Product Liability ‘ 751 Family and Medical ‘ 893 Environmental Matters Medical Malpractice Leave Act ‘ 895 Freedom of Information REAL PROPERTY CIVIL RIGHTS PRISONER PETITIONS ‘ 790 Other Labor Litigation FEDERAL TAX SUITS Act ‘ 210 Land Condemnation ‘ 440 Other Civil Rights Habeas Corpus: ‘ 791 Employee Retirement ‘ 870 Taxes (U.S. Plaintiff ‘ 896 Arbitration ‘ 220 Foreclosure ‘ 441 Voting ‘ 463 Alien Detainee Income Security Act or Defendant) ‘ 899 Administrative Procedure ‘ 230 Rent Lease & Ejectment ‘ 442 Employment ‘ 510 Motions to Vacate ‘ 871 IRS—Third Party Act/Review or Appeal of ‘ 240 Torts to Land ‘ 443 Housing/ Sentence 26 USC 7609 Agency Decision ‘ 245 Tort Product Liability Accommodations ‘ 530 General ‘ 950 Constitutionality of ‘ 290 All Other Real Property ‘ 445 Amer. w/Disabilities - ‘ 535 Death Penalty IMMIGRATION State Statutes Employment Other: ‘ 462 Naturalization Application ‘ 446 Amer. w/Disabilities - ‘ 540 Mandamus & Other ‘ 465 Other Immigration Other ‘ 550 Civil Rights Actions ‘ 448 Education ‘ 555 Prison Condition ‘ 560 Civil Detainee - Conditions of Confinement V. ORIGIN (Place an “X” in One Box Only) ‘ 1 Original Proceeding ‘ 2 Removed from State Court ‘ 3 Remanded from Appellate Court ‘ 4 Reinstated or Reopened ‘ 5 Transferred from Another District (specify) ‘ 6 Multidistrict Litigation - Transfer ‘ 8 Multidistrict Litigation - Direct File VI. CAUSE OF ACTION Cite the U.S. Civil Statute under which you are filing (Do not cite jurisdictional statutes unless diversity): Brief description of cause: VII. REQUESTED IN COMPLAINT: ‘ CHECK IF THIS IS A CLASS ACTION UNDER RULE 23, F.R.Cv.P. DEMAND $ CHECK YES only if demanded in complaint: JURY DEMAND: ‘ Yes ‘ No VIII. RELATED CASE(S) IF ANY (See instructions): JUDGE DOCKET NUMBER DATE SIGNATURE OF ATTORNEY OF RECORD FOR OFFICE USE ONLY RECEIPT #AMOUNTAPPLYING IFPJUDGEMAG. JUDGE Case 1:18-cv-01938-UNA Document 1-2 Filed 12/06/18 Page 1 of 2 PageID #: 13

INSTRUCTIONS FOR ATTORNEYS COMPLETING CIVIL COVER SHEET FORM JS 44

Authority For Civil Cover Sheet

The JS 44 civil cover sheet and the information contained herein neither replaces nor supplements the filings and service of pleading or other papers as required by law, except as provided by local rules of court. This form, approved by the Judicial Conference of the United States in September 1974, is required for the use of the Clerk of Court for the purpose of initiating the civil docket sheet. Consequently, a civil cover sheet is submitted to the Clerk of Court for each civil complaint filed. The attorney filing a case should complete the form as follows:

| I.(a) | Plaintiffs-Defendants. Enter names (last, first, middle initial) of plaintiff and defendant. If the plaintiff or defendant is a government agency, use only the full name or standard abbreviations. If the plaintiff or defendant is an official within a government agency, identify first the agency and then the official, giving both name and title. |

| (b) | County of Residence. For each civil case filed, except U.S. plaintiff cases, enter the name of the county where the first listed plaintiff resides at the time of filing. In U.S. plaintiff cases, enter the name of the county in which the first listed defendant resides at the time of filing. (NOTE: In land condemnation cases, the county of residence of the “defendant” is the location of the tract of land involved.) |

| (c) | Attorneys. Enter the firm name, address, telephone number, and attorney of record. If there are several attorneys, list them on an attachment, noting in this section “(see attachment)”. |

| II. | Jurisdiction. The basis of jurisdiction is set forth under Rule 8(a), F.R.Cv.P., which requires that jurisdictions be shown in pleadings. Place an “X” in one of the boxes. If there is more than one basis of jurisdiction, precedence is given in the order shown below. |

United States plaintiff. (1) Jurisdiction based on 28 U.S.C. 1345 and 1348. Suits by agencies and officers of the United States are included here.

United States defendant. (2) When the plaintiff is suing the United States, its officers or agencies, place an “X” in this box.

Federal question. (3) This refers to suits under 28 U.S.C. 1331, where jurisdiction arises under the Constitution of the United States, an amendment to the Constitution, an act of Congress or a treaty of the United States. In cases where the U.S. is a party, the U.S. plaintiff or defendant code takes precedence, and box 1 or 2 should be marked.

Diversity of citizenship. (4) This refers to suits under 28 U.S.C. 1332, where parties are citizens of different states. When Box 4 is checked, the citizenship of the different parties must be checked. (See Section III below; NOTE: federal question actions take precedence over diversity cases.)

| III. | Residence (citizenship) of Principal Parties. This section of the JS 44 is to be completed if diversity of citizenship was indicated above. Mark this section for each principal party. |

| IV. | Nature of Suit. Place an “X” in the appropriate box. If there are multiple nature of suit codes associated with the case, pick the nature of suit code that is most applicable. Click here for: Nature of Suit Code Descriptions. |

| V. | Origin. Place an “X” in one of the seven boxes. |

Original Proceedings. (1) Cases which originate in the United States district courts.

Removed from State Court. (2) Proceedings initiated in state courts may be removed to the district courts under Title 28 U.S.C., Section 1441. When the petition for removal is granted, check this box.

Remanded from Appellate Court. (3) Check this box for cases remanded to the district court for further action. Use the date of remand as the filing date.

Reinstated or Reopened. (4) Check this box for cases reinstated or reopened in the district court. Use the reopening date as the filing date.

Transferred from Another District. (5) For cases transferred under Title 28 U.S.C. Section 1404(a). Do not use this for within district transfers or multidistrict litigation transfers.

Multidistrict Litigation – Transfer. (6) Check this box when a multidistrict case is transferred into the district under authority of Title 28 U.S.C. Section 1407.

Multidistrict Litigation – Direct File. (8) Check this box when a multidistrict case is filed in the same district as the Master MDL docket.

PLEASE NOTE THAT THERE IS NOT AN ORIGIN CODE 7. Origin Code 7 was used for historical records and is no longer relevant due to changes in statue.

| VI. | Cause of Action. Report the civil statute directly related to the cause of action and give a brief description of the cause. Do not cite jurisdictional statutes unless diversity. Example: U.S. Civil Statute: 47 USC 553 Brief Description: Unauthorized reception of cable service |

| VII. | Requested in Complaint. Class Action. Place an “X” in this box if you are filing a class action under Rule 23, F.R.Cv.P. Demand. In this space enter the actual dollar amount being demanded or indicate other demand, such as a preliminary injunction. Jury Demand. Check the appropriate box to indicate whether or not a jury is being demanded. |

| VIII. | Related Cases. This section of the JS 44 is used to reference related pending cases, if any. If there are related pending cases, insert the docket numbers and the corresponding judge names for such cases. |

Date and Attorney Signature. Date and sign the civil cover sheet.