Attached files

| file | filename |

|---|---|

| 8-K - 8-K - W. P. Carey Inc. | wpc2018q48-kfurnishingirde.htm |

W. P. Carey Inc. Investor Presentation 3Q18

Table of Contents I. Overview II. Real Estate Portfolio III. Balance Sheet IV. Investment Management Unless otherwise noted, all data in this presentation is as of September 30, 2018. Amounts may not sum to totals due to rounding.

I. Overview

Company Highlights W. P. Carey (NYSE: WPC) is a publicly-traded REIT that specializes in investing in net lease commercial real estate primarily in the U.S. and Northern and Western Europe One of the largest owners of net lease assets and among the Size top 25 REITs in the MSCI US REIT Index Highly diversified portfolio by geography, tenant, asset type Diversification and tenant industry Successful track record of investing and operating through Track Record multiple economic cycles since 1973 led by an experienced management team Proactive Asset U.S. and Europe-based asset management teams Management Investment grade balance sheet with access to multiple Balance Sheet forms of capital State of Andalucia Office Cordoba, Spain Strategic $5.9 billion merger improves earnings quality, CPA:17 Merger enhances diversification and increases size and scale Investing for the Long Run® | 4

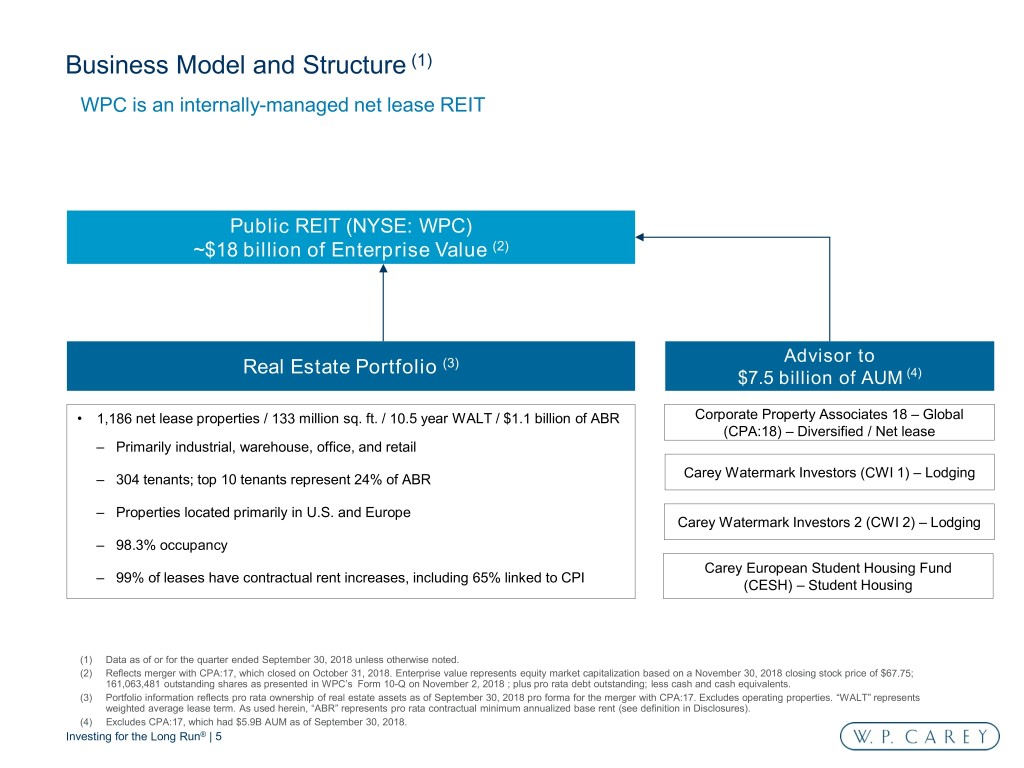

(1) Business Model and Structure WPC is an internally-managed net lease REIT Public REIT (NYSE: WPC) ~$18 billion of Enterprise Value (2) (3) Advisor to Real Estate Portfolio (4) $7.5 billion of AUM Corporate Property Associates 18 – Global • 1,186 net lease properties / 133 million sq. ft. / 10.5 year WALT / $1.1 billion of ABR (CPA:18) – Diversified / Net lease – Primarily industrial, warehouse, office, and retail Carey Watermark Investors (CWI 1) – Lodging – 304 tenants; top 10 tenants represent 24% of ABR – Properties located primarily in U.S. and Europe Carey Watermark Investors 2 (CWI 2) – Lodging – 98.3% occupancy Carey European Student Housing Fund – 99% of leases have contractual rent increases, including 65% linked to CPI (CESH) – Student Housing (1) Data as of or for the quarter ended September 30, 2018 unless otherwise noted. (2) Reflects merger with CPA:17, which closed on October 31, 2018. Enterprise value represents equity market capitalization based on a November 30, 2018 closing stock price of $67.75; 161,063,481 outstanding shares as presented in WPC’s Form 10-Q on November 2, 2018 ; plus pro rata debt outstanding; less cash and cash equivalents. (3) Portfolio information reflects pro rata ownership of real estate assets as of September 30, 2018 pro forma for the merger with CPA:17. Excludes operating properties. “WALT” represents weighted average lease term. As used herein, “ABR” represents pro rata contractual minimum annualized base rent (see definition in Disclosures). (4) Excludes CPA:17, which had $5.9B AUM as of September 30, 2018. Investing for the Long Run® | 5

(1) Advancements Since REIT Conversion Acquisitions Balance Sheet & Capitalization • Completed $16 billion in investments on our • $3.7 billion of USD and Euro-denominated (3) bond balance sheet consisting of: issuance ̶ $12.9 billion through acquisition of CPA • Established $1.85 billion credit facility providing (2) (4) REITs ample liquidity ̶ $3.3 billion through single-asset or portfolio • Issued approximately $400 million of total equity purchases through inaugural offering and ATM isssuance • Received investment grade ratings from Moody’s and S&P • Unsecured debt strategy initiated in 2014 Strategic Operational Efficiency • Exited non-traded retail fundraising, ultimately • G&A expenses reduced more than 30% since 2015 leading to: • Continued emphasis on streamlining cost structure ̶ More valuable company based on stable and going forward predictable earnings ̶ Simplified business / disclosure (1) All data on this page is as of November 2, 2018 unless otherwise noted. FX rate as of September 30, 2018. (2) Includes acquisition of Corporate Property Associates 15 Incorporated (CPA:15), which closed concurrently with our REIT conversion in 2012, our acquisition of Corporate Property Associates 16 – Global Incorporated (CPA:16) in 2014, and our acquisition of Corporate Property Associates 17 – Global Incorporated (CPA:17) in 2018. (3) Includes €500 million of senior unsecured notes issued on October 9, 2018. (4) After repaying term loans, our unsecured revolving credit facility capacity was $1.5 billion as of September 30, 2018. The aggregate principal amount available may be increased up to $2.35 billion, subject to certain conditions in our credit agreement. Investing for the Long Run® | 6

Investment Strategy Transactions Evaluated on Four Key Factors • Generate attractive risk-adjusted returns by identifying • Industry drivers and trends and investing in net-lease commercial real estate, • Competitor analysis primarily in the U.S. and Northern & Western Europe Creditworthiness of Tenant • Company history • Protect downside by combining credit and real estate underwriting with sophisticated structuring and direct • Financial wherewithal origination • Corporate headquarters • Acquire “mission-critical” assets essential to a tenant’s operations • Key distribution facility or profitable manufacturing plant Criticality of Asset • Create upside through lease escalations, credit • Critical R&D or data-center improvements and real estate appreciation • Top performing retail stores • Capitalize on existing tenant relationships through accretive expansions, renovations and follow-on deals • Local market analysis • Hallmarks of our approach: Fundamental Value • Property condition of the Underlying – Diversification by tenant, industry, property type • 3rd party valuation / replacement cost and geography Real Estate • Downside analysis / cost to re-lease – Disciplined – Opportunistic – Proactive asset management • Lease terms – rent growth and maturity – Conservative capital structure Transaction Structure and • Financial covenants Pricing • Security deposits / letters of credit Investing for the Long Run® | 7

Proactive Asset Management Domestic and international asset management capabilities to address lease expirations, changing tenant credit profiles and asset repositioning or dispositions • Asset management offices in New York and Amsterdam • W. P. Carey has proven experience repositioning assets through re-leasing, restructuring and strategic disposition • Properties are continually evaluated quarterly for credit quality, asset quality and asset criticality • Generates value creation opportunities within our existing portfolio Asset Management Expertise Asset Management Risk Analysis Transaction Operational • Leasing • Lease compliance Tenant Bankruptcy Watch List Stable Implied IG Investment Grade • Dispositions • Insurance Credit • Lease modifications • Property inspections • Credit and real estate risk • Non-triple net lease analysis administration Asset Obsolete Residual Risk Stable Class B Class A • Building expansions and • Real estate tax redevelopment Quality • Tenant distress and • Projections and portfolio restructuring valuation Critical- Asset Non- Possible Not Critical Renewal Highly Renewal Renewal Criticality Likely Critical Investing for the Long Run® | 8

II. Real Estate Portfolio

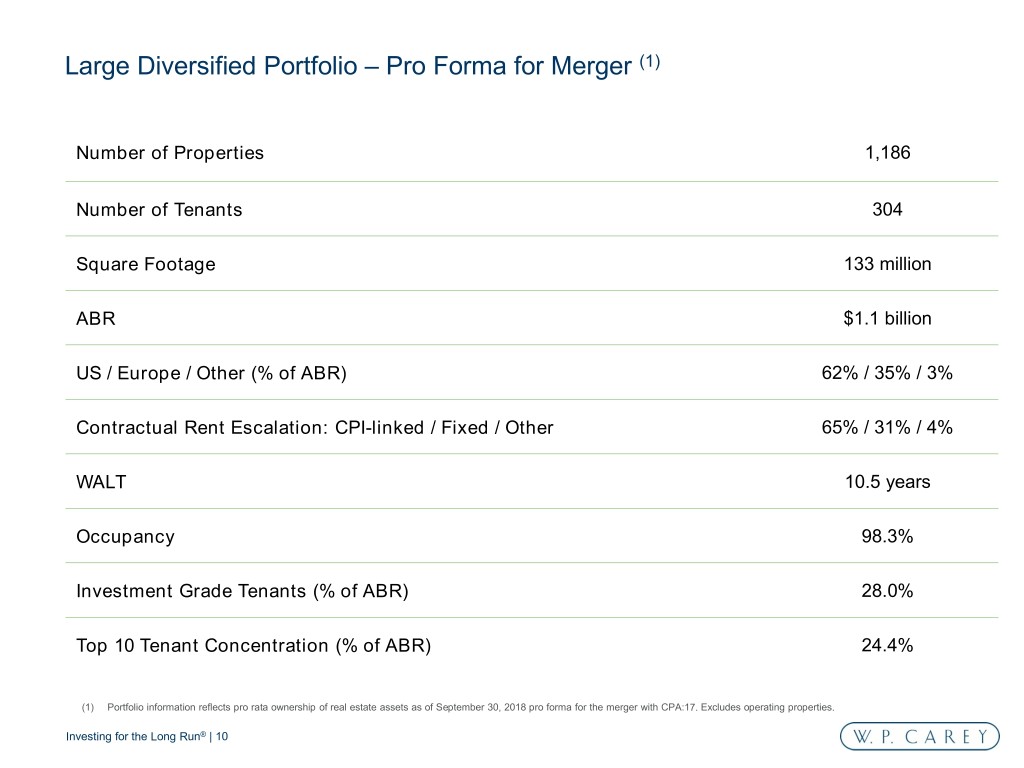

(1) Large Diversified Portfolio – Pro Forma for Merger Number of Properties 1,186 Number of Tenants 304 133 million Square Footage ABR $1.1 billion US / Europe / Other (% of ABR) 62% / 35% / 3% Contractual Rent Escalation: CPI-linked / Fixed / Other 65% / 31% / 4% WALT 10.5 years Occupancy 98.3% 28.0% Investment Grade Tenants (% of ABR) Top 10 Tenant Concentration (% of ABR) 24.4% (1) Portfolio information reflects pro rata ownership of real estate assets as of September 30, 2018 pro forma for the merger with CPA:17. Excludes operating properties. Investing for the Long Run® | 10

(1) Property and Industry Diversification – Pro Forma for Merger By Property Type (% of ABR) Top 10 Tenants Number of ABR WALT % of 9% Properties ($ millions) (years) Total 24% 3% Industrial 24% Warehouse 20% 53 $47 18.4 4.4% Office 25% 19% (2) Retail 19% 78 36 5.6 3.3% 20% 3% Self-storage (Net Lease) 25% Other (3) 9% 70 29 16.2 2.7% State of Andalucia 20 28 8.5 2.6% 44% Industrial / Warehouse (5) 1 28 5.5 2.6% By Tenant Industry (% of ABR) 70 21 11.6 2.0% Retail Stores (2) 22% Consumer Services 8% 6% Automotive 18 20 5.1 1.9% Business Services 5% Cargo Transportation 5% 16% 3% Grocery 5% 22% 30 18 14.3 1.7% 3% Healthcare and Pharmaceuticals 4% Hotel, Gaming and Leisure 4% 3% 27 18 24.7 1.7% 8% Media: Advertising, Printing and Publishing 4% 4% Sovereign and Public Finance 4% 4% 6% Construction and Building 4% 19 17 5.9 1.6% Beverage, Food and Tobacco 4% 4% 3% 5% Capital Equipment 4% Containers, Packaging and Glass 3% 4% 5% 4% 5% Top 10 386 $263 11.8 yrs 24.4% High Tech Industries 3% Other (4) 16% (1) Portfolio information reflects pro rata ownership of real estate assets as of September 30, 2018 pro forma for the merger with CPA:17. Excludes operating properties. (2) Includes automotive dealerships. (3) Includes education facilities, hotels, movie theaters, fitness facilities, laboratories and student housing, which are all net-lease properties. (4) Includes ABR from tenants in the following industries: durable consumer goods; aerospace and defense; banking; wholesale; chemicals, plastics and rubber; metals and mining; oil and gas; non-durable consumer goods; telecommunications; insurance; electricity; media: broadcasting and subscription; forest products and paper; consumer transportation; finance; real estate; and environmental industries. (5) In January 2018, The New York Times exercised its option to repurchase the property in 4Q19. Investing for the Long Run® | 11

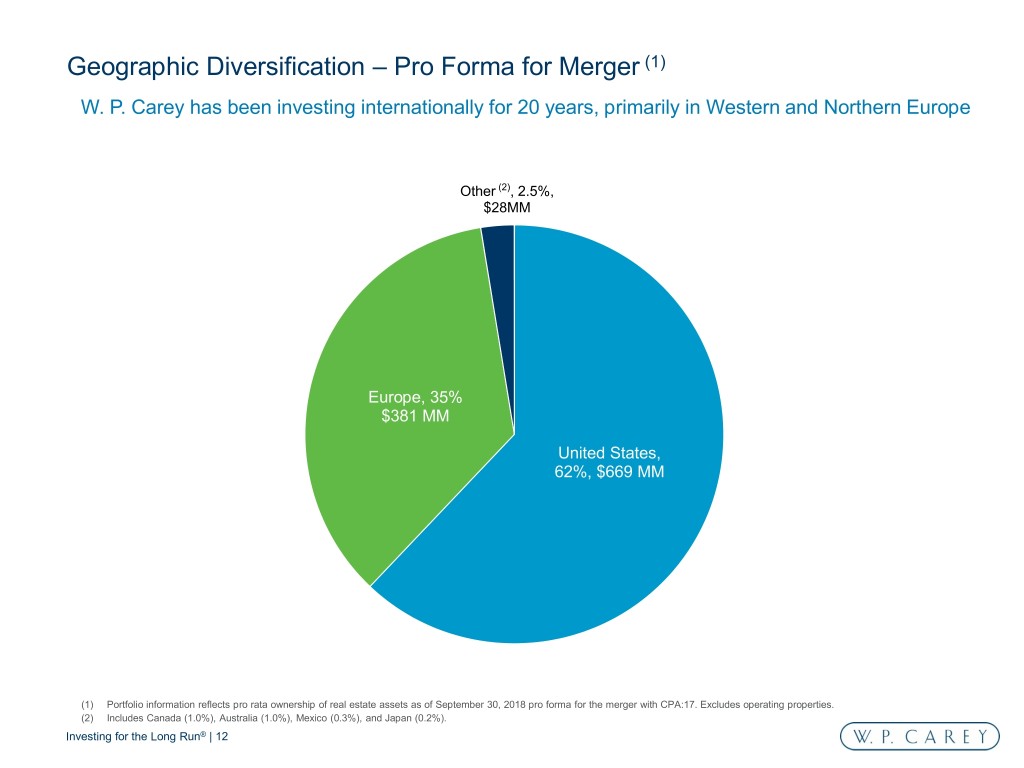

(1) Geographic Diversification – Pro Forma for Merger W. P. Carey has been investing internationally for 20 years, primarily in Western and Northern Europe Other (2), 2.5%, $28MM Europe, 35% $381 MM United States, 62%, $669 MM (1) Portfolio information reflects pro rata ownership of real estate assets as of September 30, 2018 pro forma for the merger with CPA:17. Excludes operating properties. (2) Includes Canada (1.0%), Australia (1.0%), Mexico (0.3%), and Japan (0.2%). Investing for the Long Run® | 12

(1) Internal Growth from Contractual Rent Increases – Pro Forma for Merger Approximately 99% of leases have contractual rent increases, including 65% linked to CPI None, 0.7% (2) Other, 3% Uncapped CPI, 41% Fixed, 31% 65% CPI-linked CPI-based, 24% (1) Portfolio information reflects pro rata ownership of real estate assets as of September 30, 2018 pro forma for the merger with CPA:17. Excludes operating properties. (2) Represents leases with percentage rent. Investing for the Long Run® | 13

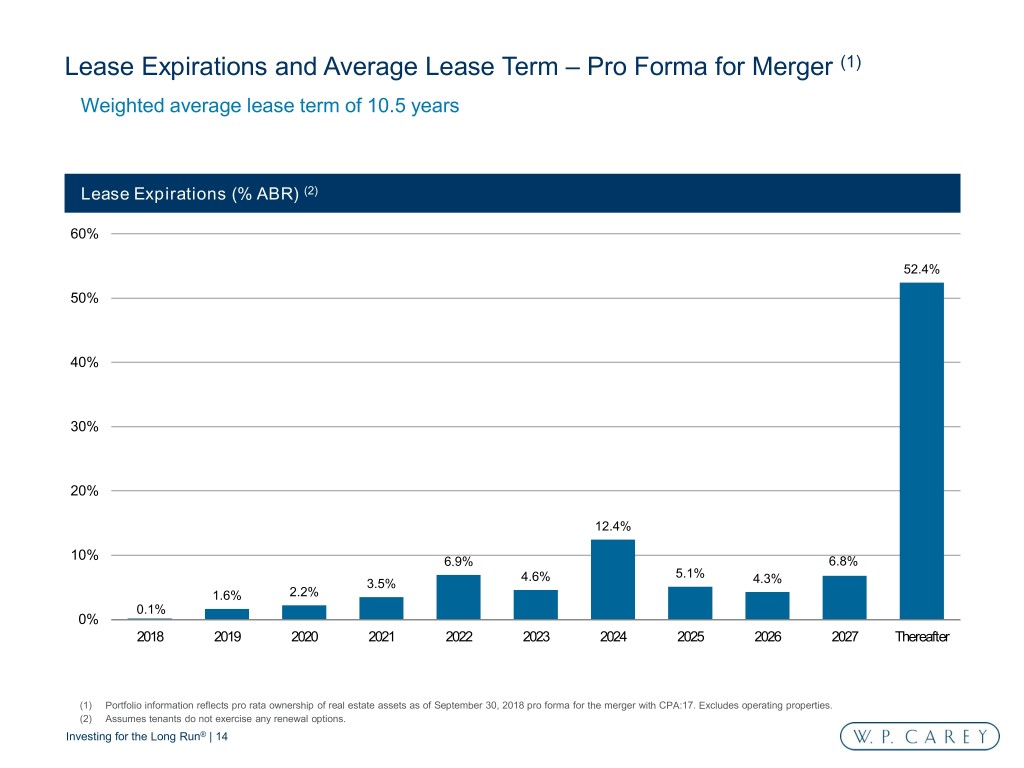

(1) Lease Expirations and Average Lease Term – Pro Forma for Merger Weighted average lease term of 10.5 years Lease Expirations (% ABR) (2) 60% 52.4% 50% 40% 30% 20% 12.4% 10% 6.9% 6.8% 4.6% 5.1% 3.5% 4.3% 2.2% 1.6% 0.1% 0% 2018 2019 2020 2021 2022 2023 2024 2025 2026 2027 Thereafter (1) Portfolio information reflects pro rata ownership of real estate assets as of September 30, 2018 pro forma for the merger with CPA:17. Excludes operating properties. (2) Assumes tenants do not exercise any renewal options. Investing for the Long Run® | 14

(1) Historical Occupancy Stable occupancy maintained during the credit crisis and economic downturn Occupancy (% Square Feet) 100% 99.1% 99.0% 99.8% 98.5% 97.1% 97.3% 98.4% 98.8% 99.2% 99.3% 98.3% 96.6% 80% 60% 40% 20% 0% 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 (2) (1) Includes W. P. Carey and the following CPA REITs: Corporate Property Associates 12 Incorporated, Corporate Property Associates 14 Incorporated, CPC:15, CPA:16, CPA:17 and CPA:18, as applicable. Portfolio information excludes operating properties. (2) As of September 30, 2018. Investing for the Long Run® | 15

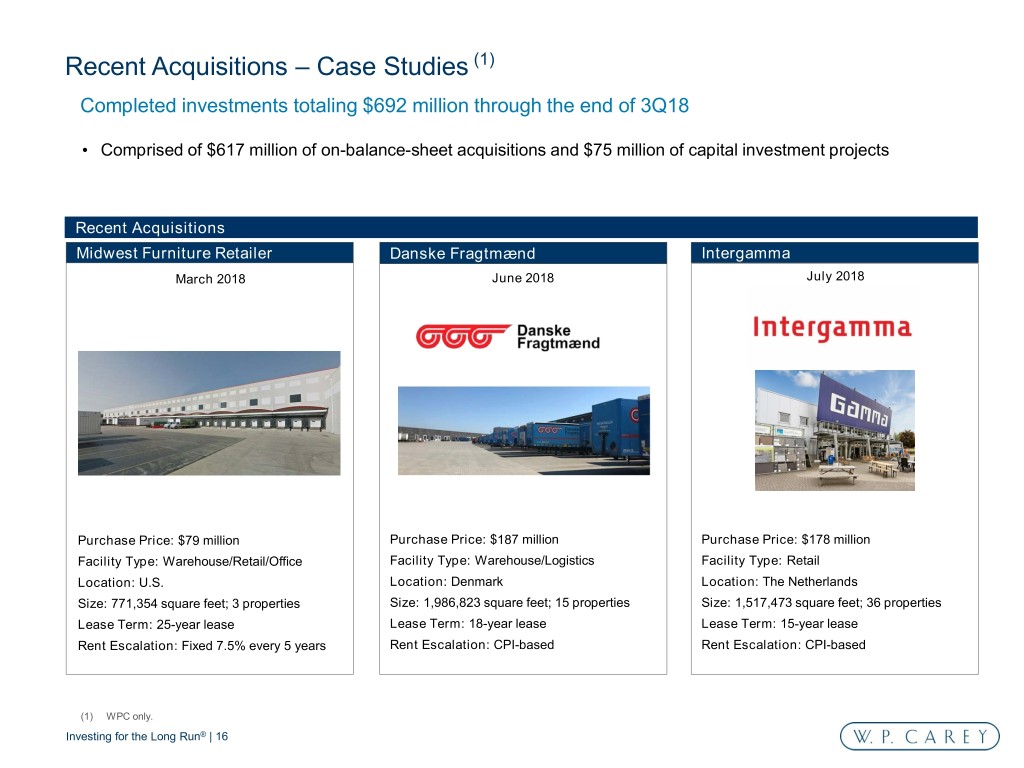

(1) Recent Acquisitions – Case Studies Completed investments totaling $692 million through the end of 3Q18 • Comprised of $617 million of on-balance-sheet acquisitions and $75 million of capital investment projects Recent Acquisitions Midwest Furniture Retailer Danske Fragtmænd Intergamma March 2018 June 2018 July 2018 Purchase Price: $79 million Purchase Price: $187 million Purchase Price: $178 million Facility Type: Warehouse/Retail/Office Facility Type: Warehouse/Logistics Facility Type: Retail Location: U.S. Location: Denmark Location: The Netherlands Size: 771,354 square feet; 3 properties Size: 1,986,823 square feet; 15 properties Size: 1,517,473 square feet; 36 properties 25-year lease Lease Term: 18-year lease Lease Term: 15-year lease Lease Term: Rent Escalation: Fixed 7.5% every 5 years Rent Escalation: CPI-based Rent Escalation: CPI-based (1) WPC only. Investing for the Long Run® | 16

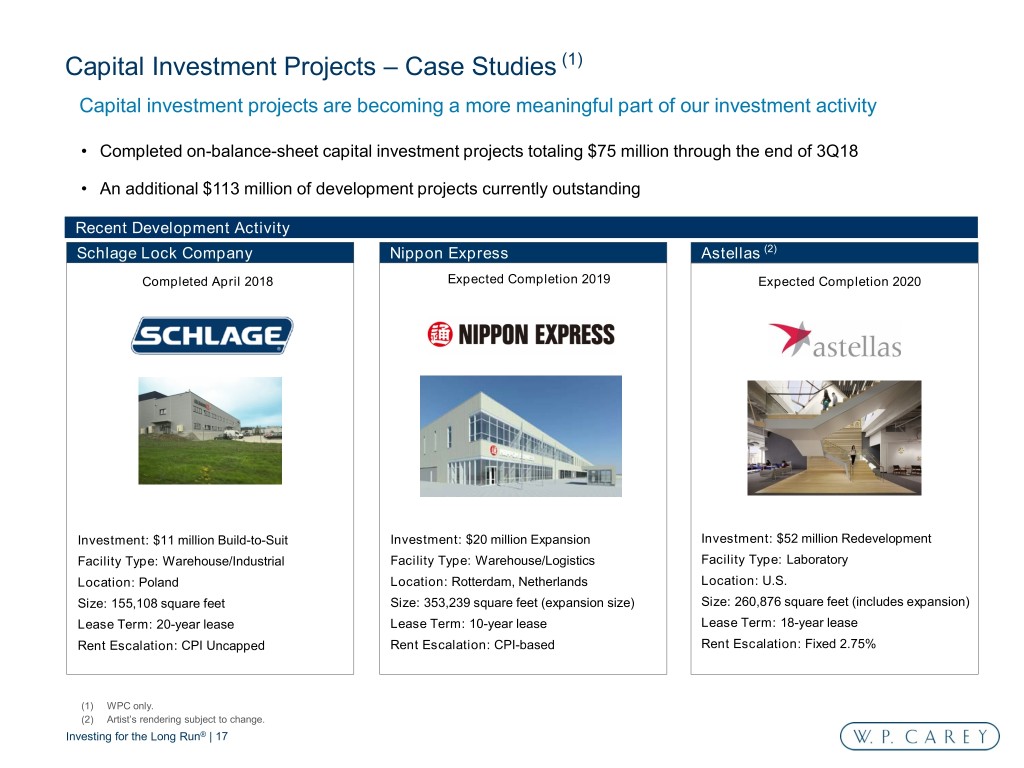

(1) Capital Investment Projects – Case Studies Capital investment projects are becoming a more meaningful part of our investment activity • Completed on-balance-sheet capital investment projects totaling $75 million through the end of 3Q18 • An additional $113 million of development projects currently outstanding Recent Development Activity Schlage Lock Company Nippon Express Astellas (2) Completed April 2018 Expected Completion 2019 Expected Completion 2020 Investment: $11 million Build-to-Suit Investment: $20 million Expansion Investment: $52 million Redevelopment Laboratory Facility Type: Warehouse/Industrial Facility Type: Warehouse/Logistics Facility Type: Location: Poland Location: Rotterdam, Netherlands Location: U.S. Size: 155,108 square feet Size: 353,239 square feet (expansion size) Size: 260,876 square feet (includes expansion) Lease Term: 20-year lease Lease Term: 10-year lease Lease Term: 18-year lease Rent Escalation: CPI Uncapped Rent Escalation: CPI-based Rent Escalation: Fixed 2.75% (1) WPC only. (2) Artist’s rendering subject to change. Investing for the Long Run® | 17

III. Balance Sheet

Balance Sheet Overview – Pro Forma for Merger CPA:17 Merger Impact on Balance Sheet Capitalization ($MM) 9/30/18 (1) • Moderate and temporary increase in net debt / EBITDA with Total Equity $10,912 projected path to reduce post-transaction to below 6.0x Pro Rata Net Debt • Debt / gross assets lowered to 44.7% (2) (from 50.5% at Senior Unsecured Notes USD 1,300 9/30/18) (3) Senior Unsecured Notes EUR 2,315 • Net debt / enterprise value lowered to 37.9% (1)(4) (from 39.7% Mortgage Debt, pro rata 3,052 at 9/30/18) Unsecured Revolving Credit Facility (5) 248 (6) • Temporary increase in secured debt to 20.5% (compared Total Pro Rata Debt $6,915 to 10.6% at 9/30/18) as a result of mortgages on acquired Less: Cash and Cash Equivalents 259 CPA:17 properties Total Pro Rata Net Debt $6,656 - Clear path to reducing secured debt with minimal frictional costs by repaying maturing mortgages Enterprise Value $17,568 Total Capitalization $17,827 • Higher quality cash flow coverage for interest expense and dividend by replacing finite Investment Management fees Capitalization (%) with long-term, recurring Real Estate rental revenues 1% • Substantial credit facility capacity to fund ongoing needs Equity (1) 61% 17% Senior Unsecured Notes • Increased balance sheet size – the largest diversified net 20% 61% lease REIT 20% Mortgage Debt (pro rata) 17% • Enhanced liquidity and access to capital Unsecured Revolving 1% Credit Facility (1) Based on a November 30, 2018 closing stock price of $67.75 and 161,063,481 outstanding shares as presented in WPC’s Form 10-Q on November 2, 2018. (2) Gross assets represent consolidated total assets before accumulated depreciation on real estate. Gross assets are net of accumulated amortization on in-place lease and other intangible assets and above-market rent intangible assets. (3) Includes €500 million of senior unsecured notes issued on October 9, 2018. (4) Pro rata net debt to enterprise value is based on pro rata debt less consolidated cash and cash equivalents. (5) Pro forma for the merger with CPA:17, as presented in WPC’s Form 8-K on November 16, 2018, less €500 million of senior unsecured notes issued on October 9, 2018. For illustrative purposes only. (6) Represents pro rata mortgage debt as a percentage of gross assets, as of September 30, 2018 pro forma for the merger with CPA:17, and as presented in WPC”s Form 8-K /A on November 19, 2018. Investing for the Long Run® | 19

Debt Maturity Schedule – Pro Forma for Merger (1) Principal at Maturity (3) (3) Mortgage Debt Unsecured Revolver Unsecured Bonds (EUR) Unsecured Bonds (USD) 1,500 1,200 500 $MM 900 350 (2) 248 579 600 579 450 (4) 300 635 600 579 579 540 380 81 188 53 140 32 21 0 2018 2019 2020 2021 2022 2023 2024 2025 2026 2027 % of Total 0.8% 1.2% 9.7% 12.9% 8.3% 14.7% 19.4% 9.0% 14.7% 9.2% (1) Reflects pro rata balloon payments due at maturity. Unless otherwise noted, data as of September 30, 2018 pro forma for the CPA:17 merger, which closed on October 31, 2018. (2) Pro forma adjusted balance reflects the paydown of CPA:17’s outstanding borrowings and new borrowings under the WPC facility, as presented in WPC”s Form 8-K/A on November 19, 2018, less net proceeds from €500 million of senior unsecured notes issued on October 9, 2018. The revolver has an initial maturity in 2021 with two six-month extension options. For illustrative purposes only. (3) Reflects amount due at maturity, excluding unamortized discount and deferred financing costs. (4) Reflects €500 million of senior unsecured notes issued on October 9, 2018, after quarter end. Investing for the Long Run® | 20

(1) Unsecured Bond Covenants – W. P. Carey Pre-Merger Investment grade balance sheet with Baa2/stable rating from Moody’s and BBB/stable rating from S&P (2) Senior Unsecured Notes Metric Covenant September 30, 2018 Total Debt / Total Leverage ≤ 60% 46.0% Total Assets Secured Debt / ≤ 40% 9.4% Secured Debt Leverage Total Assets Consolidated EBITDA / ≥ 1.5x 4.8x Fixed Charge Coverage Annual Debt Service Charge Maintenance of Unencumbered Asset Unencumbered Assets / ≥ 150% 187.0% Value Total Unsecured Debt (1) This is a summary of the key financial covenants for our Senior Unsecured Notes, along with estimated calculations of our compliance with those covenants at the end of the period presented. These ratios are not measures of our liquidity or performance and serve only to demonstrate our ability to incur additional debt, as permitted by the covenants governing the Senior Unsecured Notes. (2) As of September 30, 2018 our Senior Unsecured Notes consisted of the following note issuances: (i) $500 million 4.6% senior unsecured notes due 2024, (ii) €500 million 2.0% senior unsecured notes due 2023, (iii) $450 million 4.0% senior unsecured notes due 2025, (iv) $350 million 4.250% senior unsecured notes due 2026 (v) €500 million 2.25% senior unsecured notes due 2024 and (vi) €500 million 2.125% senior unsecured notes due 2027. Investing for the Long Run® | 21

History of Consistent Dividend Growth W. P. Carey has increased its dividend every year since going public in 1998 (1) • Current annualized dividend of $4.10 with a yield of 6.1% • Conservative and stable payout ratio since conversion to a REIT in September 2012 Dividends per Share & Payout Ratio (2) $6.00 100% 90% $5.00 80% 77% 77% 77% 76% 75% 80% $3.93 $4.01 $4.10 70% $4.00 $3.69 $3.83 Payout Ratio $3.39 60% $3.00 50% $2.44 $2.19 40% $1.96 $2.00 $2.03 $1.79 $1.82 $1.88 Dividend per Share $2.00 $1.65 $1.67 $1.69 $1.70 $1.72 $1.73 $1.76 30% 20% $1.00 10% $0.00 0% (3) 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 Note: Past performance does not guarantee future results. (1) Based on a stock price of $67.75 as of November 30, 2018. (2) Full year distributions declared per share, excluding special dividends, divided by full year AFFO per diluted share. (3) Dividend per share reflects 3Q18 dividend annualized. Payout ratio is calculated using year-to-date dividend declared over year-to-date AFFO per share. Investing for the Long Run® | 22

IV. Investment Management

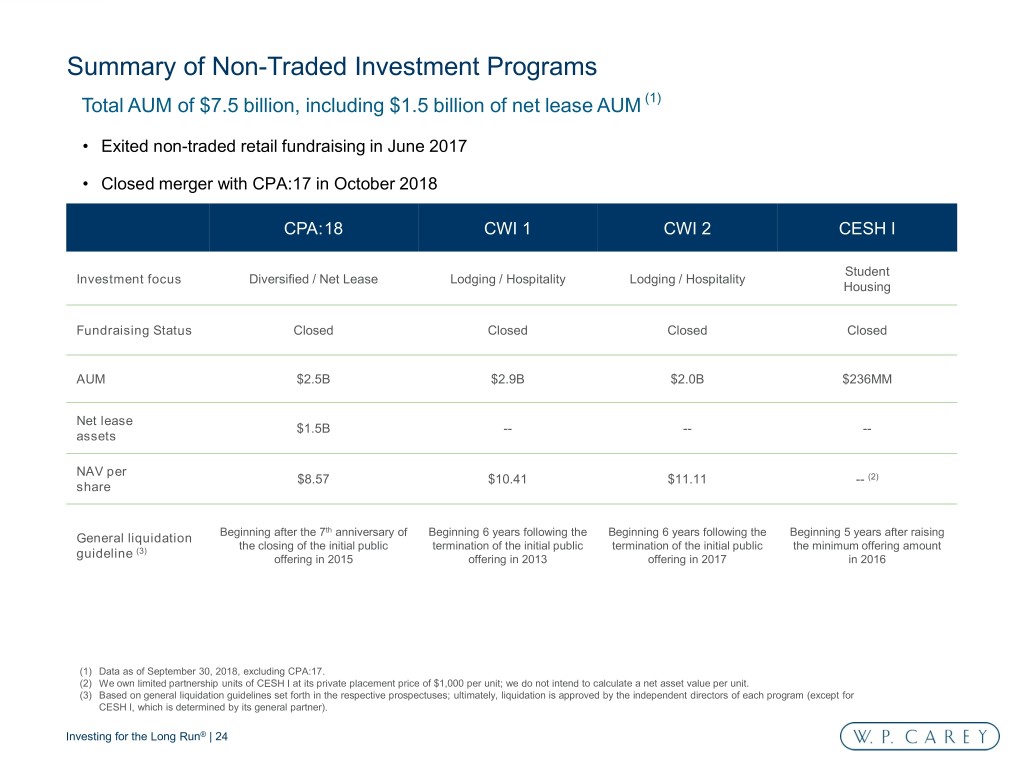

Summary of Non-Traded Investment Programs (1) Total AUM of $7.5 billion, including $1.5 billion of net lease AUM • Exited non-traded retail fundraising in June 2017 • Closed merger with CPA:17 in October 2018 CPA:18 CWI 1 CWI 2 CESH I Student Investment focus Diversified / Net Lease Lodging / Hospitality Lodging / Hospitality Housing Fundraising Status Closed Closed Closed Closed AUM $2.5B $2.9B $2.0B $236MM Net lease $1.5B -- -- -- assets NAV per $8.57 $10.41 $11.11 -- (2) share Beginning after the 7th anniversary of Beginning 6 years following the Beginning 6 years following the Beginning 5 years after raising General liquidation the closing of the initial public termination of the initial public termination of the initial public the minimum offering amount (3) guideline offering in 2015 offering in 2013 offering in 2017 in 2016 (1) Data as of September 30, 2018, excluding CPA:17. (2) We own limited partnership units of CESH I at its private placement price of $1,000 per unit; we do not intend to calculate a net asset value per unit. (3) Based on general liquidation guidelines set forth in the respective prospectuses; ultimately, liquidation is approved by the independent directors of each program (except for CESH I, which is determined by its general partner). Investing for the Long Run® | 24

Cautionary Statement Concerning Forward-Looking Statements Certain of the matters discussed in this communication constitute forward-looking statements within the meaning of the Securities Act of 1933 and the Securities Exchange Act of 1934, both as amended by the Private Securities Litigation Reform Act of 1995. The forward-looking statements include, among other things, statements regarding the intent, belief or expectations of W. P. Carey Inc. (“WPC”) and can be identified by the use of words such as “may,” “will,” “should,” “would,” “will be,” “will continue,” “will likely result,” “believe,” “project,” “expect,” “anticipate,” “intend,” “estimate” and other comparable terms. These forward-looking statements may include, but are not limited to, statements regarding: the impact of the merger with Corporate Property Associates 17 – Global Incorporated (“CPA:17”); our corporate strategy, including our continuing ability to qualify as a real estate investment trust (“REIT”); our annualized dividends, including the amount and timing of any future dividends; our estimated or future economic performance and results, including our underlying assumptions regarding occupancy rates, tenant credit quality and portfolio lease terms; our future growth prospects and possible new acquisitions and dispositions, including our international exposure; our capital structure and expenditure levels, leverage and debt service obligations, credit ratings, financing transactions and plans to fund our liquidity needs; our capital markets programs, including our ability to sell shares under our at-the-market (“ATM”) program and the use of any proceeds from that program; and the outlook for the investment management programs that we manage, including possible liquidity events for those programs. These statements are based on the current expectations of our management. It is important to note that our actual results could be materially different from those projected in such forward-looking statements. There are a number of risks and uncertainties that could cause actual results to differ materially from these forward-looking statements. Other unknown or unpredictable factors could also have material adverse effects on our business, financial condition, liquidity, results of operations, AFFO and prospects. You should exercise caution in relying on forward-looking statements as they involve known and unknown risks, uncertainties and other factors that may materially affect our future results, performance, achievements or transactions. Discussions of some of these other important factors and assumptions are contained in our filings with the Securities and Exchange Commission (the “SEC”) and are available on the SEC’s website at http://www.sec.gov, including “Item 1A. Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2017, and in our Quarterly Report on Form 10-Q for the quarter ended June 30, 2018, as filed with SEC on August 3, 2018, as well as other filings we make with the SEC from time to time. Moreover, because we operate in a very competitive and rapidly changing environment, new risks are likely to emerge from time to time. Given these risks and uncertainties, potential investors are cautioned not to place undue reliance on these forward-looking statements as a prediction of future results, which speak only as of the date of this presentation, unless noted otherwise. Except as required by federal securities laws and the rules and regulations of the SEC, we do not undertake to revise or update any forward-looking statements. All data presented herein is as of September 30, 2018 unless otherwise noted. Amounts may not sum to totals due to rounding. Past performance does not guarantee future results. Investing for the Long Run® | 25

Disclosures The following non-GAAP financial measures are used in this presentation FFO and AFFO Due to certain unique operating characteristics of real estate companies, as discussed below, the National Association of Real Estate Investment Trusts, Inc., or NAREIT, an industry trade group, has promulgated a non-GAAP measure known as FFO, which we believe to be an appropriate supplemental measure, when used in addition to and in conjunction with results presented in accordance with GAAP, to reflect the operating performance of a REIT. The use of FFO is recommended by the REIT industry as a supplemental non-GAAP measure. FFO is not equivalent to nor a substitute for net income or loss as determined under GAAP. We define FFO, a non-GAAP measure, consistent with the standards established by the White Paper on FFO approved by the Board of Governors of NAREIT, as revised in February 2004. The White Paper defines FFO as net income or loss computed in accordance with GAAP, excluding gains or losses from sales of property, impairment charges on real estate, and depreciation and amortization from real estate assets; and after adjustments for unconsolidated partnerships and jointly owned investments. Adjustments for unconsolidated partnerships and jointly owned investments are calculated to reflect FFO. Our FFO calculation complies with NAREIT’s policy described above. We modify the NAREIT computation of FFO to include other adjustments to GAAP net income to adjust for certain non-cash charges such as amortization of real estate-related intangibles, deferred income tax benefits and expenses, straight-line rents, stock-based compensation, non-cash environmental accretion expense, and amortization of deferred financing costs. Our assessment of our operations is focused on long-term sustainability and not on such non-cash items, which may cause shortterm fluctuations in net income but have no impact on cash flows. Additionally, we exclude non-core income and expenses such as certain lease termination income, gains or losses from extinguishment of debt, restructuring and related compensation expenses, and merger and acquisition expenses. We also exclude realized and unrealized gains/losses on foreign exchange transactions (other than those realized on the settlement of foreign currency derivatives), which are not considered fundamental attributes of our business plan and do not affect our overall long-term operating performance. We refer to our modified definition of FFO as AFFO. We exclude these items from GAAP net income to arrive at AFFO as they are not the primary drivers in our decision-making process and excluding these items provides investors a view of our portfolio performance over time and makes it more comparable to other REITs which are currently not engaged in acquisitions, mergers, and restructuring which are not part of our normal business operations. AFFO also reflects adjustments for unconsolidated partnerships and jointly owned investments. We use AFFO as one measure of our operating performance when we formulate corporate goals, evaluate the effectiveness of our strategies, and determine executive compensation. We believe that AFFO is a useful supplemental measure for investors to consider as we believe it will help them to better assess the sustainability of our operating performance without the potentially distorting impact of these short-term fluctuations. However, there are limits on the usefulness of AFFO to investors. For example, impairment charges and unrealized foreign currency losses that we exclude may become actual realized losses upon the ultimate disposition of the properties in the form of lower cash proceeds or other considerations. We use our FFO and AFFO measures as supplemental financial measures of operating performance. We do not use our FFO and AFFO measures as, nor should they be considered to be, alternatives to net income computed under GAAP or as alternatives to net cash provided by operating activities computed under GAAP or as indicators of our ability to fund our cash needs. Investing for the Long Run® | 26

Disclosures (cont’d) The following non-GAAP financial measures are used in this presentation (cont’d) EBITDA and Adjusted EBITDA We believe that EBITDA is a useful supplemental measure to investors and analysts for assessing the performance of our business segments because (i) it removes the impact of our capital structure from our operating results and (ii) because it is helpful when comparing our operating performance to that of companies in our industry without regard to such items, which can vary substantially from company to company. Adjusted EBITDA as disclosed represents EBITDA, modified to include other adjustments to GAAP net income for certain non-cash charges, such as impairments, non-cash rent adjustments and unrealized gains and losses from our hedging activity. Additionally, we exclude gains and losses on sale of real estate, which are not considered fundamental attributes of our business plans and do not affect our overall long-term operating performance. We exclude these items from adjusted EBITDA as they are not the primary drivers in our decision-making process. Adjusted EBITDA reflects adjustments for unconsolidated partnerships and jointly owned investments. Our assessment of our operations is focused on long-term sustainability and not on such non-cash and noncore items, which may cause short-term fluctuations in net income but have no impact on cash flows. We believe that adjusted EBITDA is a useful supplemental measure to investors and analysts, although it does not represent net income that is computed in accordance with GAAP. Accordingly, adjusted EBITDA should not be considered as an alternative to net income or as an indicator of our financial performance. EBITDA and adjusted EBITDA as calculated by us may not be comparable to similarly titled measures of other companies. Pro Rata Metrics This supplemental package contains certain metrics prepared under the pro rata consolidation method. We refer to these metrics as pro rata metrics. We have a number of investments, usually with our affiliates, in which our economic ownership is less than 100%. Under the full consolidation method, we report 100% of the assets, liabilities, revenues and expenses of those investments that are deemed to be under our control or for which we are deemed to be the primary beneficiary, even if our ownership is less than 100%. Also, for all other jointly owned investments, which we do not control, we report our net investment and our net income or loss from that investment. Under the pro rata consolidation method, we present our proportionate share, based on our economic ownership of these jointly owned investments, of the assets, liabilities, revenues and expenses of those investments. Multiplying each of our jointly owned investments’ financial statement line items by our percentage ownership and adding or subtracting those amounts from our totals, as applicable, may not accurately depict the legal and economic implications of holding an ownership interest of less than 100% in our jointly owned investments. ABR ABR represents contractual minimum annualized base rent for our net-leased properties, net of receivable reserves as determined by GAAP, and reflects exchange rates as of September 30, 2018. If there is a rent abatement, we annualize the first monthly contractual base rent following the free rent period. ABR is not applicable to operating properties and is presented on a pro rata basis. Investing for the Long Run® | 27