Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - Creatd, Inc. | f8k120418b_jerrickmedia.htm |

Exhibit 99.1

Jerrick Media Holdings, Inc.

JMDA $0.15

OTCQB Capital Market Market Cap $17M

Description: Jerrick is a multi-faceted technology company poised to achieve rapid growth. Jerrick’s flagship product is Vocal, a long-form digital publishing platform that provides an immersive ecosystem for creators. The company launched Vocal in 2016 after several years of extensive technology development and has spent the last two years growing its communities, which now include over 380,000 content creators and over 7 million unique monthly visitors. At its core, Vocal’s purpose is to provide content creators (e.g., writers, video creators, bloggers, musicians) with a comprehensive digital publishing destination – complete with best-in-class editing tools, monetization opportunities, and engaged communities – to help them get discovered and fund their creativity.

In our view, Vocal’s tools for creators are far easier, and cheaper to use, than those of WordPress, the go-to platform for many creators. See page 2

As Vocal now moves to the commercialization phase, we see two main market opportunity drivers in its revenue model:

| 1. | Subscription based revenues - by providing premium tools for creators that are easier to use and less expensive than other options such as WordPress (similar to the Vimeo and LinkedIn models). |

| 2. | Branded content - the Vocal for Brands content studio provides brands with highly targeted recurring campaigns that are fee based (similar to Buzzfeed and Vice Media, but without their heavy operational costs). A subscription model for brands may also be launched. |

Vocal aims to give a voice to a diverse network of creators, including both influential creators and those who are not widely known (yet). Some of these creators may be freelance writers or simply individuals who seek an efficient and effective way to tell their story and build an audience. Other examples might be a video creator who aspires to tell their story beyond their video or individuals who want to raise awareness for their Kickstarter campaign. In general, the characteristics of creators on Vocal are decidedly different from those of the already established thought leaders who appear on the Medium digital publishing site (see page 6).

In simple terms, Vocal provides compelling tools to help creators fund their creativity, which in turn encourages them to produce more high-quality content. As a consequence, brands will likely seek to increase their marketing dollars on the platform in order to reach a growing audience. Marketing campaigns for the brands, in the form of branded content, are published on one or more of Vocal’s 34 topic-specific communities, which can attract the appropriate audience for a given product.

1 |  Tormont Group Inc. | 15 Prince Arthur Avenue, Toronto, ON MSR, 1B2 | Main: 416-473-9133 Fax: 647-351-9133 |

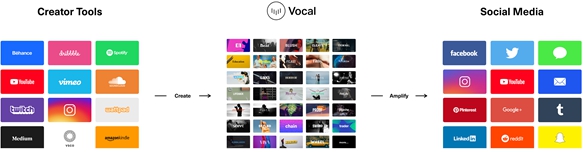

How Vocal Works: Vocal is positioned between platforms for content creators - such as Soundcloud for musicians, Vimeo for video creators, and iTunes for podcasters - and the mammoth social networks like Instagram, LinkedIn and Twitter. (See Figure 1 on page 2.) The process works as follows: Vocal attracts original content from creators who have, for example, made a video or podcast by using one of several platforms listed above. In turn, Vocal allows the content to be published on a specific community within its network, attracting a loyal audience to the content. The platform is agnostic to the origin of the third-party resources or tools that creators utilize. Appreciative readers can send a tip to a creator on Vocal’s platform, in the same way a rider may tip a driver through Uber’s platform. A recurring payment option is planned to be available to creators in late 2019. Finally, the unique architecture of Vocal’s technology provides creators with search engine optimization (SEO) that aids in the discovery of their content and increases its lifetime value.

Figure 1.

Vocal – An Essential Link Between Creator Tools and Social Platforms

Comparison of Vocal Creator Subscription Fees to WordPress Costs: To determine whether creators may in time potentially opt to pay a monthly fee to Vocal for a premium subscription (see pages 3-4), we examine the total cost of creating and maintaining a personal website or blog via WordPress. To do so, we note the following:

| ● | An individual can run a website for free on WordPress and receive a basic level of shared hosting for free. However, the domain name for the free site would be “yourwebsite.wordpress.com.” In order to get a “regular” domain name, an individual must subscribe to at least WordPress’ Premium plan for $4 per month. |

| ● | If the entrepreneur wants to host the site themselves, rather than on WordPress.com, the minimum monthly fee payable to a generic hosting provider (such as HostGator) is around $3. However, that low price will almost certainly mean the website will function on a massive shared server, causing slow performance. |

2 |  Tormont Group Inc. | 15 Prince Arthur Avenue, Toronto, ON MSR, 1B2 | Main: 416-473-9133 Fax: 647-351-9133 |

| ● | The lowest cost for securing a website (e.g., making sure it is not hacked) is around $200 per year, or about $17 per month (based on the cost of a “Basic” package from the security firm Sucuri). |

| ● | As a result, the lowest total cost of ownership of a site on WordPress is about $4 + $3 + $17, or about $24 per month, making a potential Vocal subscription fee a very attractive alternative. In addition, we believe the Vocal is a platform that can and may begin to offer more specialized services designed for creators. (As a side note, the research firm Digital Marketing Ramblings reports that there are 76.5 million WordPress.com blogs worldwide. If even a slight percentage of these bloggers were to decide use Vocal instead, the implications for Jerrick are obvious). |

Branded Content: Branded digital content represents non-interruption based advertising, and refers to content created by brands that does not involve traditional advertising such as pop-ups, banner ads and other types of intrusive programmatic advertisements. Instead, branded content, which can include articles, videos podcasts and more, brings relevant value to the consumer in a format native to the platform on which it is hosted. In Vocal’s case, creation of specific branded campaigns on one of the 34 communities appeals to an already-interested audience that is more likely to have higher conversion rates.

Rather than interrupting consumers with branded messages, as traditional online ads do, branded content seeks to educate and entertain audiences, resulting in better brand engagement returns. In fact, Demand Metrics reports that branded stories generate over 3x as many leads as outbound marketing, and cost 62% less. Numerous studies have shown that a large majority of Americans ignore online ads; this powerful trend explains the movement of advertising dollars toward branded content. Even more important, consumers like branded content because they believe it to be more consumer-focused. The McCarthy Group reports that 84% of millennials don’t trust traditional ads. The message isn’t a sales pitch; it builds brand affinity and creates consumer trust.

While there are other online entities, such as Buzzfeed, which focus on branded content and content generation, many of these companies do so while also incurring heavy operational costs. Vocal campaigns, created and optimized by an internal content studio, are extremely cost effective: they have delivered conversion rates equivalent to multiples of industry-average click-through rates of 0.24% for branded content. We do note that Buzzfeed recently cautioned that it expects lower profits because of these content creation costs.

Vocal for Brands: Jerrick’s in-house content marketing studio, Vocal for Brands, should be one of a number of key drivers for the company’s growth: namely by working with brands to create branded content on the Vocal platform that executes on specific campaign goals. Brands have different objectives – some want to increase awareness; others seek conversions, while still others are more interested in becoming an educational authority in their industry. Vocal tailors the campaigns to any of these objectives. Furthermore, unlike legacy advertising, such as display ad campaigns that have definitive end points, branded content created on Vocal is predominately evergreen in nature and provides an increase in the lifetime value of content.

Jerrick continues to build up a substantial data library of both its reading audience and creator community (currently 7 million unique monthly visitors and around 380,000 registered creators). Through its first party data, Vocal allows brands to target both readers of its genre-specific communities with branded content as well as the consumers of outside networks like Facebook and Instagram.

3 |  Tormont Group Inc. | 15 Prince Arthur Avenue, Toronto, ON MSR, 1B2 | Main: 416-473-9133 Fax: 647-351-9133 |

“Freemium” to Premium Business Model Transition: Jerrick seems likely to progress from a start-up company with a unique strategy and great technology (although burdened with a significant cash burn as it built out its Vocal platform) to a fast growing, cash-generating business over the next six to nine months. To do so, the company is exploring plans to transition from essentially a free service to one which additionally offers premium add-on services and features to creators and brands. Some aspects – and the likely positive financial implications – of such a transition are described below:

| ● | Creator subscription fees: Many online content providers, including the online publishing platform Medium (see page 6) and the New York Times charge their readers a fee to read all premium content. In contrast, Vocal should at some point in 2019 begin to charge creators on its platform a monthly fee to use premium features. We believe that a Vocal creator subscription model could be similar to that of Vimeo, an online video-sharing platform that was launched in 2004 and which is used by more than 80 million artists worldwide to share and promote their work (see page 4). |

Under this potential model, a creator would pay additional fees for access to premium tools. Examples of such tools could include the ability for a creator to customize their author page and the capacity to accept recurring monthly patronages. To illustrate the potential of a successful patronage framework: Patreon, an online platform that provides business tools allowing its creators to run a subscription content service, has 2 million monthly active patrons which will pay around $300 million to 100,000 active creators in 2018. Patreon retains 10% of the total as a processing fee. See page 6. As mentioned earlier, a recurring payment option is planned to be launched on the Vocal platform and available to creators in late 2019.

Vocal expects to have about 800,000 creators on its platform by around mid-year 2019. Based on the experiences of other similarly-situated companies, we think a substantial percentage of creators would reasonably decide that a modest monthly fee represents a good value proposition and convert. For example, if a potential monthly fee were set at around $10 and if 10% of creators were to convert, that implies Jerrick’s monthly revenue run rate could possibly be boosted by 800,000 x 10% x $10, or $800,000, equivalent to $9.6 million on an annual basis. (Note that Jerrick’s revenues totaled just $25,000 in the third quarter of 2018.)

The company’s creator acquisition costs have averaged $0.70 - $1.20 per registered creator. So, even if the company were to incur $400,000 in costs to boost its creator base to the 800,000 level, those costs would be quite small in comparison to potential incremental creator subscription fees in 2019.

| ● | Brand subscription fees: Jerrick is also exploring whether to introduce a monthly subscription option for brands. Additional resources could include increased insights and analytics and premium distribution. In our view, the LinkedIn Premium model represents a similar opportunity. In both cases, brands should be willing to pay additional fees for an increase in value. |

We also note that Vocal currently offers brands a premium content marketing option, which would become only more lucrative as the company expands and becomes even more established. Vocal for Brands currently offers packages starting at three thousand dollars per month to create and publish branded content on Vocal. Other popular online platforms such as Buzzfeed charge upwards of twenty times that amount for a comparable service.

WatchMojo Partnership: In November 2018, Jerrick and WatchMojo, a content producer with more than 19 million subscribers on YouTube, agreed to create editorial stories based on WatchMojo’s new and existing video content in order to reach Vocal’s growing audience. Three key implications of this agreement include:

| 1. | It illustrates Vocal’s ability to provide a unique alternative to distribution of existing content. For example, the narrative in a WatchMojo video on YouTube may be transcribed and included in a long-form Vocal story, along with links to other related videos and consumer products. (Jerrick’s founders envisioned such transactions as core to the platform’s success when it was originally conceived.) |

4 |  Tormont Group Inc. | 15 Prince Arthur Avenue, Toronto, ON MSR, 1B2 | Main: 416-473-9133 Fax: 647-351-9133 |

| 2. | Vocal’s partnership with WatchMojo is evidence of the platform’s growing recognition and could reasonably lead to the companies’ working together in the future with co-sponsors, yielding incremental advertising revenue. |

| 3. | It further demonstrates Vocal’s ability to leverage B2B partnerships, in addition to platform (P2P) relationships established earlier in the year between Vocal and Stripe, as well as the integration of Unsplash, the premiere platform for beautiful license-free photos. |

Capturing Advertising Dollars in the Digital Publishing Industry: Digital advertising spending continues to rise at a double-figure pace which, of course, creates a generally positive backdrop for digital publishers, but not all publishers stand to benefit uniformly. We believe that Vocal is uniquely well-positioned in the industry. Note the following key points:

| ● | Google and Facebook each command huge shares of all digital advertising spending. According to eMarketer, these two giants accounted for 63% of all digital advertising in 2017. |

| ● | To combat widespread concerns about fake news on its platform, Facebook has this year made substantial changes to its news feed algorithm such that its users now see more posts from friends and family and less public content. The net effect has hurt digital publishers on the whole and particularly those that rely more heavily on traffic from Facebook, such as Mic, Odyssey and Creators.co, all of whom shut down business operations over the last two years. |

| ● | On the other hand, digital platforms whose active audiences drive more of their own engagement and support a greater diversity of revenue are much less affected by the change. In our opinion, Jerrick and its Vocal platform fall into this category. |

| ● | We do note that the recent dislocation in public equity markets, particularly with respect to high-valuation tech stocks, has caused the private market valuations of digital publishing stocks to decline. For example, Vice Media had a valuation of $5.7 billion in mid-2017 based on a funding round done at that time. Its current value, however, is substantially lower. |

It is important to note that companies such as BuzzFeed or Vice Media pay for content, unlike Vocal (unlike Patreon or Vimeo as well – see page 6). Indeed, BuzzFeed incurs substantial costs to create its own content. This fundamental operating difference may protect the valuation of a crowd-sourced digital publisher like Vocal even during turbulent times in the stock market.

Deleveraging Actions: In October 2018, Jerrick converted $13.9 million of its debt and preferred stock (representing nearly 100% of its total debt and preferred stock) to common stock and warrants, essentially eliminating the company’s debt service burden. In turn, Jerrick will not need to raise expensive equity capital to satisfy debt obligations – unlike many fast-growing but thinly capitalized micro-caps stocks. Jerrick is well positioned to access lower cost capital while future revenue generation can be utilized to scale technology.

Many of Jerrick’s online competitors are funded by venture capitalists (VCs). Given the recent stock market difficulties and the historic lack of patience by VCs during turbulent times, accessing VC capital and long-term support is becoming more challenging. Jerrick, on the other hand, seems well-positioned – it currently has no VC funding and a clean balance sheet.

5 |  Tormont Group Inc. | 15 Prince Arthur Avenue, Toronto, ON MSR, 1B2 | Main: 416-473-9133 Fax: 647-351-9133 |

Time Well Spent Movement – A Plus for Jerrick: The burgeoning “Time Well Spent” movement creates a positive backdrop for Vocal. The social movement (which bears some parallels to nutritionists’ championing organic foods) essentially preaches against the excessive commercialization of the Internet and cautions against the adverse health effects for consumers. The movement is most clearly illustrated by the pushback against giant online platforms like Facebook and Google, which are based almost solely on display advertising. Many contend these companies are, at their core, simply advertising models designed to keep users on their platforms.

Vocal, on the other hand, places emphasis on quality and safety and does not employ any display advertising. Vocal does not treat its users as the product, rather as its partners. Equally important, the platform provides a safe and high-quality environment for creators and brands through its human-led moderation. As the Time Well Spent movement grows, Vocal’s positioning within this ecosystem is favorable.

Risk – Increasing Industry Regulation: A generic risk to Jerrick is the ongoing efforts to regulate the handling of online data. A few examples are noted below:

| ● | In May 2018, the European Union (EU) passed rules on General Data Protection Regulation (GDPR). Under GDPR, any company offering goods or services to customers in the EU is obligated to protect the personal data it gathers from misuse and exploitation, and to ensure its privacy. Failure to comply could result in a fine ranging from 10 million euros to 4% of annual worldwide revenues. |

| ● | California has passed the Consumer Privacy Act, its digital privacy law version of the GDPR; it takes effect in 2020. Among other things, consumers in that state can force tech companies not to sell or share their personal data. If a company fails to follow that dictate, a consumer and the state’s attorney general can sue for up to $750 and $7,500, respectively, for each violation. |

| ● | The European Parliament is currently working to pass a copyright directive called Article 13. In summary, the legislation states that any websites that host significant amounts of user-generated content, like YouTube, Twitter, Facebook, and, by implication, Vocal, are responsible for removing that content if it infringes on copyright. The EU has not yet determined how these identifications are expected to be made. |

Vocal Comps: We believe that Vimeo, Patreon, and, to a lesser degree, Medium have business plans which are reasonably similar to Vocal. As a result, we believe it is instructive to examine certain operational and valuation parameters of these companies. First, we provide brief descriptions of Vimeo, Patreon and Medium. Then, in Table 1 on pages 7-8 we compare the key operating and valuation data of these companies to those of Vocal.

| ● | Vimeo is a video-sharing website in which users can upload, share and view videos. The company has a premium subscription model for creators. |

| ● | Patreon provides tools for a creator to run a subscription content service whereby their subscribers, or patrons, make monthly contributions, or donations, to the creator. Patreon retains up to 10% of the donations. |

| ● | Medium is an online publishing platform which maintains an editorial department staffed by professional editors and writers. In March 2017, Medium imposed a $5 monthly subscription fee on its readers. |

6 |  Tormont Group Inc. | 15 Prince Arthur Avenue, Toronto, ON MSR, 1B2 | Main: 416-473-9133 Fax: 647-351-9133 |

Table 1

Key Comparative Statistics

| VOCAL | VIMEO | PATREON | MEDIUM | |||||

| Year Founded | 2012 | 2004 | 2013 | 2012 | ||||

| Company Status | Public | Owned by IAC Interactive (A) |

Private | Private | ||||

| Total Value of Company ($ millions) | $15 | $1,000 (based on three analysts’ views as of February 2018) |

$450 (based on Sept. 2017 funding round) |

$600 (based on Spring 2016 funding round) | ||||

| Approximate Annual Revenue ($ millions) | Small now, but poised for rapid growth (see page 4) |

$100 (based on parent company’s Feb.2018 estimate) |

$30 (based on Patreon’s retaining 10% of $300 million patronages paid to creators in 2018) |

N/A | ||||

| Profitable? | Not now, but paid subscription plan could change that as soon as late 2019 | Operated at net loss in 2017 | N/A | No. Medium spent $2 million on content in first seven months of 2018. | ||||

| Total Number of Creators Using Platform (in 000’s) | 380 | 80,000 | N/A | N/A | ||||

| Active Monthly Creators Using Platform (in 000’s) | 38 | N/A | 100 | N/A | ||||

| Number of Creators Who Are Paid Premium Subscribers (in 000’s) | Potentially 80 (could be achieved in 2019) |

873 (as of Dec. 31, 2017) |

Not Applicable | Not Applicable | ||||

| Creator Subscriber Growth Rate | Not Applicable | 14% growth in 2017 | N/A | N/A |

7 |  Tormont Group Inc. | 15 Prince Arthur Avenue, Toronto, ON MSR, 1B2 | Main: 416-473-9133 Fax: 647-351-9133 |

| Average Creator Subscriber Lifetime | Not Applicable | 5 years | N/A | N/A | ||||

| Monthly Active Patrons - from Reading Audience (in 000’s) | Not Applicable | N/A | 2,000 | (B) | ||||

| Consuming Audience - Unique Monthly Visitors to Website (in 000’s) | 7,000 | 170,000 | 2,000 | 13,000 | ||||

| Patreon Subscriber Growth | Not Applicable | Not Applicable | 100% (over the last year) |

Not Applicable | ||||

| Ratio of Total Value of Company Divided By Number of Creator Paid Subscribers (D) | 188 | 1,145 | Not Applicable | Not Applicable | ||||

| Ratio of Total Value of Company Divided By Revenue (D) | 3 | 10 | 15 | Not Applicable | ||||

Ratio of Total Value of Company Divided By Unique Monthly Visitors to Website (D) |

2.1 | 5.9 | 225 | 46.2 |

| (A) | Purchased in 2006 by IAC Interactive as part of Connected Ventures acquisition. |

| (B) | Audience subscribers pay $5 per month. Subscribers increased 160% between February 2018 and August 2018. |

| (D) | Vocal figures reflect our estimates for the company after it introduces its premium creator subscription plans. |

NOTE: Data in the above table is based on disseminations by the companies or news articles. Not all data is available on Patreon and Medium because they are private companies. Also, IAC Interactive does not disclose all information on its Vimeo subsidiary. As a result, we entered “N/A” in the above table for data which could not be found.

8 |  Tormont Group Inc. | 15 Prince Arthur Avenue, Toronto, ON MSR, 1B2 | Main: 416-473-9133 Fax: 647-351-9133 |

As shown in Table 1, Jerrick trades at sharp discounts to its comps based on a number of key parameters. In particular, we note the following:

| ● | If one factors in the likely response from Vocal’s creators to the paid subscription model that Vocal plans to introduce in 2019, the ratio of Jerrick’s total value to its number of paid creator subscribers is only about one-sixth that of Vimeo. |

| ● | Again, if one factors in Vocal’s subscription plan changes noted just above, Jerrick trades at about a 70% discount to Vimeo in terms of the ratio of total company value to revenue. Jerrick’s discount when compared with Patreon or Medium is even larger. |

| ● | Finally, as a ratio of total company value to unique monthly website visitors, Jerrick trades at only about one-third of Vimeo’s level and at just 5% that of Medium. |

Valuation: We assume that Vocal will introduce subscription fees to both creators and brands at some point in 2019. If so, Jerrick’s revenues are poised to gap dramatically higher in the second half of next year. Moreover, given that the Vocal platform is essentially built out, the company’s operating expenses should grow at a far slower rate, with increased revenues dropping to the bottom line. Based on these assumptions, Jerrick shares have extremely constructive risk-reward characteristics.

On a quantitative basis, if we assume that 10% of Vocal’s creators will in time opt to pay the premium subscription fee, the company’s annual revenue run rate could reach $5 million or more (see page 4) at some point in late 2019 (and continue to grow very rapidly in 2020 and beyond). Importantly, Jerrick has virtually no debt and its annual operating costs should be around $4-5 million in 2019, so Jerrick could turn earnings and cash flow positive on a run rate basis at some point late next year. The prospect of such a scenario should begin trigger a gradual reevaluation of the shares over the next few months from the current $0.15 level to perhaps the $0.30 range.

Total digital advertising industry spend should exceed $100 billion in just a year or two. In a multi-billion dollar market, a small increase in penetration can translate into substantial revenues and profits. Since Jerrick seems likely to continue to show rapid usage and creator growth for the foreseeable future, we believe that a company with its operating and balance sheet characteristics could, over the longer term, achieve a revenue multiple of around 10x, approximately in line with Vimeo (see pages 6 and 8). This in turn implies that Jerrick could command a market valuation of between $50-$60 million, equivalent to approximately $0.40-$0.60 per share, later in 2019, more than three times its current share price of $0.15 per share. In addition, we note that this valuation does not factor in any incremental revenues from Jerrick’s potential increase in brand subscription fees or from partnerships with premium content providers like WatchMojo.

In conclusion, Jerrick is creating a platform which mirrors the business models of a number of successful and established digital platforms, such as Spotify, Netflix and Uber. Jerrick plans to derive substantial revenues and profits from each of three key groups – creators, brands and Vocal’s consuming audience.

One final side note: In 2015, PriceWaterhouse Coopers estimated that car and room sharing, crowd-funding, personal services, and audio video streaming would comprise a cumulative $335 billion in global revenue by 2025, up from just $15 billion in 2014. Vocal’s key objective – allowing creators to easily share their thoughts and talents with engaged audiences – fits very well into the rapidly growing sharing economy.

9 |  Tormont Group Inc. | 15 Prince Arthur Avenue, Toronto, ON MSR, 1B2 | Main: 416-473-9133 Fax: 647-351-9133 |

Jim McFadden

Tormont50 Research

12/04/2018

Tormont50

is a venue for highlighting timely ideas and trends in individual stocks and the market. Tormont50 is not an advisory service,

and does not offer buy, sell, or any other rating on the securities we discuss. The stocks we select for commentary are derived

from our own research or via suggestions from Tormont50 members. We encourage participants to submit stocks or topics for discussion.

Our goal for this project is to create an exclusive, “concierge” research platform that will serve both management

teams and portfolio managers within the Tormont50 universe.

Tormont50

is a venue for highlighting timely ideas and trends in individual stocks and the market. Tormont50 is not an advisory service,

and does not offer buy, sell, or any other rating on the securities we discuss. The stocks we select for commentary are derived

from our own research or via suggestions from Tormont50 members. We encourage participants to submit stocks or topics for discussion.

Our goal for this project is to create an exclusive, “concierge” research platform that will serve both management

teams and portfolio managers within the Tormont50 universe.

This message is intended only for the personal and confidential use of the designated recipient(s) members of the Tormont50. If you are not the intended recipient of this message you are hereby notified that any review, dissemination, distribution or copying of this message is strictly prohibited. This communication is for information purposes only and should not be regarded as an offer to sell or as a solicitation. This material is based upon information which we consider reliable, but we do not represent that such information is accurate or complete, and it should not be relied upon as such. This information is current and is subject to change. Past performance is not an indicator of future results and the value of the holdings and the income derived from them can go down as well as up.

10 |  Tormont Group Inc. | 15 Prince Arthur Avenue, Toronto, ON MSR, 1B2 | Main: 416-473-9133 Fax: 647-351-9133 |