Attached files

| file | filename |

|---|---|

| EX-99.2 - EXHIBIT 99.2 - Avaya Holdings Corp. | ex992avayaq4fy18cfocomment.htm |

| EX-99.1 - EXHIBIT 99.1 - Avaya Holdings Corp. | ex991avayaq4fy18er.htm |

| 8-K - 8-K - Avaya Holdings Corp. | form8-kq4fy18earnings.htm |

TEXT 0 – 0 – 0 204-0-0 127-127-127 17-114-210 80-200-74 86-183-242 247-150-70 Exhibit 99.3 Q4 FISCAL YEAR 2018 FINANCIAL RESULTS December 4, 2018 © 2018 Avaya Inc. All rights reserved

TEXT 0 – 0 – 0 204-0-0 127-127-127 17-114-210 80-200-74 86-183-242 247-150-70 Forward Looking Statements Cautionary Note Regarding Forward-Looking Statements This document contains certain “forward-looking statements.” All statements other than statements of historical fact are “forward-looking” statements for purposes of the U.S. federal and state securities laws. These statements may be identified by the use of forward looking terminology such as "anticipate," "believe," "continue," "could," "estimate," "expect," "intend," "may," "might," “our vision,” "plan," "potential," "preliminary," "predict," "should," "will," or “would” or the negative thereof or other variations thereof or comparable terminology and include, but are not limited to, the outlook for the first quarter of fiscal 2019 and fiscal year 2019, including the expected impact of ASC 606. The company has based these forward-looking statements on its current expectations, assumptions, estimates and projections. While the company believes these expectations, assumptions, estimates and projections are reasonable, such forward-looking statements are only predictions and involve known and unknown risks and uncertainties, many of which are beyond its control. These factors are discussed in Amendment No. 3 to the company’s Registration Statement on Form 10 and subsequent Quarterly Reports on Form 10-Q filed with the Securities and Exchange Commission (the “SEC”), and may cause its actual results, performance or achievements to differ materially from any future results, performance or achievements expressed or implied by these forward-looking statements. For a further list and description of such risks and uncertainties, please refer to the company’s filings with the SEC that are available at www.sec.gov. The company cautions you that the list of important factors included in the company’s SEC filings may not contain all of the material factors that are important to you. In addition, in light of these risks and uncertainties, the matters referred to in the forward-looking statements contained in this report may not in fact occur. The company undertakes no obligation to publicly update or revise any forward-looking statement as a result of new information, future events or otherwise, except as otherwise required by law. These slides, as well as current and historical financial data are available on our web site at investors.avaya.com None of the information included on the website is incorporated by reference in this presentation. 2 © 2018 Avaya Inc. All rights reserved

TEXT 0 – 0 – 0 204-0-0 127-127-127 17-114-210 80-200-74 86-183-242 247-150-70 Use of non-GAAP (Adjusted) Financial Measures This presentation should be read in conjunction with our fourth quarter fiscal 2018 earnings press release issued on December 4, 2018. Within this presentation, we refer to certain non-GAAP financial measures, such as non-GAAP revenue, non-GAAP operating income and adjusted EBITDA, that involve adjustments to GAAP measures. Reconciliations between our non-GAAP financial measures and the most closely comparable GAAP financial measures are included on the last four slides of this presentation. EBITDA is defined as net income (loss) before income taxes, interest expense, interest income and depreciation and amortization. Adjusted EBITDA is EBITDA further adjusted to exclude certain charges and other adjustments described in our SEC filings and the tables below. We believe that including supplementary information concerning adjusted EBITDA is appropriate because it serves as a basis for determining management and employee compensation and it is used as a basis for calculating covenants in our credit agreements. In addition, we believe adjusted EBITDA provides more comparability between our historical results and results that reflect purchase accounting and our current capital structure. We also present EBITDA and adjusted EBITDA because we believe analysts and investors utilize these measures in analyzing our results. Accordingly, adjusted EBITDA measures our financial performance based on operational factors that management can impact in the short-term, such as our pricing strategies, volume, costs and expenses of the organization and it presents our financial performance in a way that can be more easily compared to prior quarters or fiscal years. EBITDA and adjusted EBITDA have limitations as analytical tools. EBITDA measures do not represent net income (loss) or cash flow from operations as those terms are defined by GAAP and do not necessarily indicate whether cash flows will be sufficient to fund cash needs. However, these terms are not necessarily comparable to other similarly titled captions of other companies due to the potential inconsistencies in the method of calculation. Adjusted EBITDA excludes the impact of earnings or charges resulting from matters that we consider not to be indicative of our ongoing operations. In particular, our formulation of adjusted EBITDA allows adjustment for certain amounts that are included in calculating net income (loss), however, these are expenses that may recur, may vary and are difficult to predict. We do not provide a forward-looking reconciliation of expected first quarter of fiscal 2019 and fiscal 2019 adjusted EBITDA, non-GAAP operating income or non- GAAP revenue guidance as the amount of significance of special items required to develop meaningful comparable GAAP financial measures cannot be estimated at this time without unreasonable efforts. These special items could be meaningful. 3 © 2018 Avaya Inc. All rights reserved

TEXT 0 – 0 – 0 204-0-0 127-127-127 17-114-210 80-200-74 86-183-242 247-150-70 Fiscal Q4 2018 Financial Highlights (Amounts are non-GAAP)* • Non-GAAP revenue of $770 million – Increased 2% sequentially and lower 3% from Q4 FY’17 – Excluding the impact of the sale of the Networking business, non-GAAP revenue increased 2% sequentially and decreased 2% compared to Q4 FY’17 – Software and Services achieved a fourth quarter record 83% of total non-GAAP revenue, up year-over-year from 79% – Recurring revenue was 56% of total non-GAAP revenue, down year-over-year from 57% – Avaya Enterprise Cloud and Managed Services and Professional Services each accounted for 10% of total non-GAAP revenue • Non-GAAP product revenue of $336 million increased 4% from the prior quarter and decreased 2% year-over-year. Excluding the impact of the sale of the Networking business, non-GAAP product revenue increased 4% sequentially and decreased 2% year-over-year • Non-GAAP service revenue of $434 million increased slightly sequentially and decreased 3% year-over-year. Excluding the impact of the sale of the Networking business, non-GAAP service revenue increased slightly sequentially and decreased 2% year-over-year • Total bookings for the fourth fiscal quarter increased 6% from the prior quarter and decreased 2% year-over-year. Excluding the impact of the sale of the Networking business, total bookings increased 6% sequentially and decreased 1% year-over- year. *For a reconciliation of non-GAAP to GAAP financial information, please see the last 5 slides of this presentation. 4 © 2018 Avaya Inc. All rights reserved

TEXT 0 – 0 – 0 204-0-0 127-127-127 17-114-210 80-200-74 86-183-242 247-150-70 Fiscal Q4 2018 Financial Highlights (Amounts are non-GAAP)* Continued…XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX • Non-GAAP gross margin was 63.4%, a quarterly record, compared to 61.9% for the prior quarter and 63.3% for the fourth quarter of fiscal 2017 • Non-GAAP operating income was $157 million, or 20.4% of non-GAAP revenue, compared to $151 million, or 20.0% of non-GAAP revenue, for the prior quarter and $183 million, or 23.2% of non-GAAP revenue, for the third quarter of fiscal 2017 • Adjusted EBITDA was $178 million, or 23.1% of revenue, compared to $175 million, or 23.2% of revenue, for the prior quarter and $225 million, or 28.5% of revenue, for the fourth quarter of fiscal 2017 • Cash balance of $700 million at quarter end. The sequential increase in cash and cash equivalents is primarily due to positive cash flows from operating activities and the proceeds from the sale of assets, partially offset by capital expenditures. • Signed 12 deals with a Total Contract Value ("TCV") over $5 million, and 117 deals with a TCV over $1 million • Added over 1,600 new logos *For a reconciliation of non-GAAP to GAAP financial information, please see last 5 slides of this presentation. 5 © 2018 Avaya Inc. All rights reserved

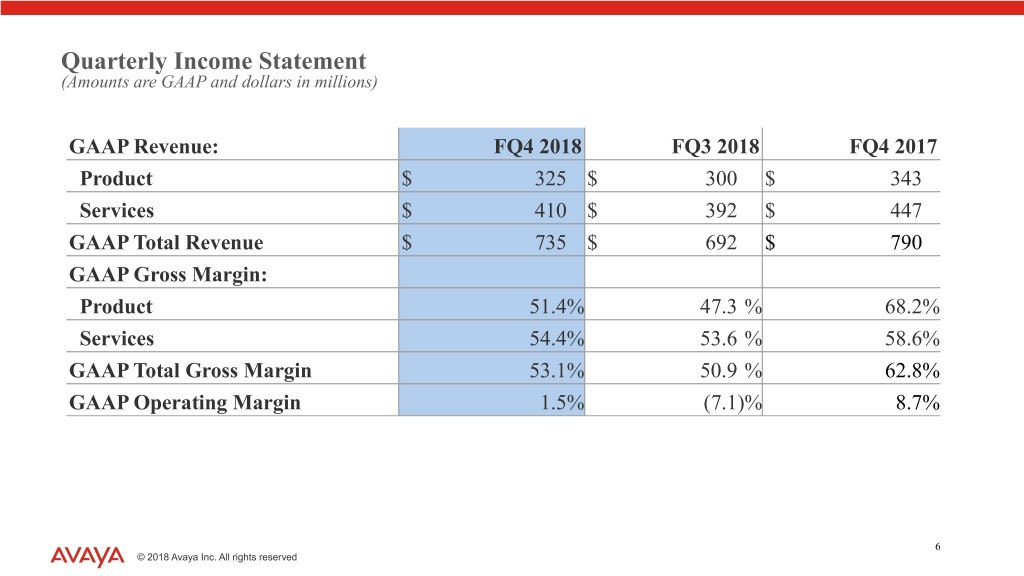

TEXT 0 – 0 – 0 204-0-0 127-127-127 17-114-210 80-200-74 86-183-242 247-150-70 Quarterly Income Statement (Amounts are GAAP and dollars in millions) GAAP Revenue: FQ4 2018 FQ3 2018 FQ4 2017 Product $ 325 $ 300 $ 343 Services $ 410 $ 392 $ 447 GAAP Total Revenue $ 735 $ 692 $ 790 GAAP Gross Margin: Product 51.4% 47.3 % 68.2% Services 54.4% 53.6 % 58.6% GAAP Total Gross Margin 53.1% 50.9 % 62.8% GAAP Operating Margin 1.5% (7.1)% 8.7% 6 © 2018 Avaya Inc. All rights reserved

TEXT 0 – 0 – 0 204-0-0 127-127-127 17-114-210 80-200-74 86-183-242 247-150-70 Quarterly Income Statement (Amounts are non-GAAP and dollars in millions)* Non-GAAP Revenue: FQ4 2018 FQ3 2018 FQ4 2017 Product $ 336 $ 322 $ 343 Services $ 434 $ 433 $ 447 Non-GAAP Total Revenue $ 770 $ 755 $ 790 Non-GAAP Gross Margin: Product 67.3% 65.5% 69.4% Services 60.4% 59.1% 58.6% Non-GAAP Total Gross Margin 63.4% 61.9% 63.3% Non-GAAP Operating Margin 20.4% 20.0% 23.2% Adjusted EBITDA $ 178 $ 175 $ 225 Adjusted EBITDA % (1) 23.1% 23.2% 28.5% (1) Q4'18 and Q3’18 Adjusted EBITDA % is based on non-GAAP Revenue *For a reconciliation of non-GAAP to GAAP financial information, please see the last 5 slides of this presentation. 7 © 2018 Avaya Inc. All rights. reserved

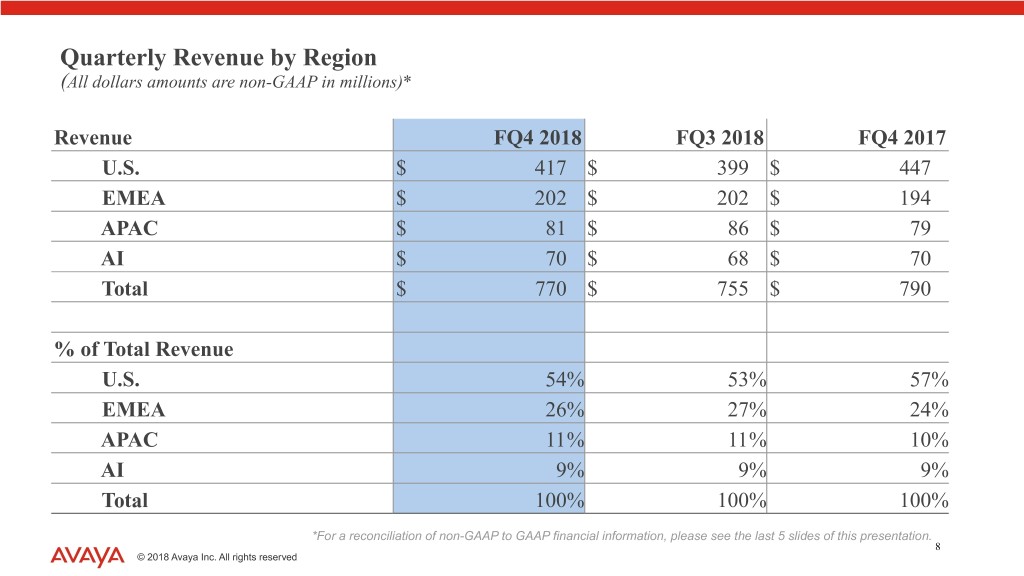

TEXT 0 – 0 – 0 204-0-0 127-127-127 17-114-210 80-200-74 86-183-242 247-150-70 Quarterly Revenue by Region (All dollars amounts are non-GAAP in millions)* Revenue FQ4 2018 FQ3 2018 FQ4 2017 U.S. $ 417 $ 399 $ 447 EMEA $ 202 $ 202 $ 194 APAC $ 81 $ 86 $ 79 AI $ 70 $ 68 $ 70 Total $ 770 $ 755 $ 790 % of Total Revenue U.S. 54% 53% 57% EMEA 26% 27% 24% APAC 11% 11% 10% AI 9% 9% 9% Total 100% 100% 100% *For a reconciliation of non-GAAP to GAAP financial information, please see the last 5 slides of this presentation. 8 © 2018 Avaya Inc. All rights reserved

TEXT 0 – 0 – 0 204-0-0 127-127-127 17-114-210 80-200-74 86-183-242 247-150-70 Annual Revenue by Region (All dollars amounts are non-GAAP in millions)* Revenue FY '18 FY '17 U.S. $ 1,650 $ 1,798 EMEA $ 808 $ 834 APAC $ 326 $ 334 AI $ 273 $ 306 Total $ 3,057 $ 3,272 % of Total Revenue U.S. 54% 55% EMEA 26% 26% APAC 11% 10% AI 9% 9% Total 100% 100% *For a reconciliation of non-GAAP to GAAP financial information, please see the last 5 slides of this presentation. 9 © 2018 Avaya Inc. All rights reserved

TEXT 0 – 0 – 0 204-0-0 127-127-127 17-114-210 80-200-74 86-183-242 247-150-70 Q4 FY’18 Financial Highlights Notable Q4’18 Stats (non-GAAP): • Software and services accounted for a 4th qtr. record 83% ($M, as reported) of non-GAAP revenue, up YoY from 79% Non-GAAP FQ4 2018 FQ3 2018 FQ4 2017 • Bookings grew 6% QoQ (excluding networking) Non-GAAP Revenue $770 $755 $790 • Signed 12 deals with Total Contract Value ("TCV") over Non-GAAP Gross Margin % 63.4% 61.9% 63.3% $5 million, 117 deals with a TCV over $1 million Non-GAAP Oper. Expense % 43.0% 41.9% 40.1% • Record revenue per employee of $379 thousand Non-GAAP Oper. Income % 20.4% 20.0% 23.2% • Cash flow from operating activities of $25 million Adj. EBITDA $ $178 $175 $225 • $700 million cash at September 30, 2018 Adj. EBITDA % 23.1% 23.2% 28.5% • Adjusted EBITDA of 23.1% of non-GAAP revenue Performance Highlights • Avaya unified communications solutions named Customers’ Choice in 2018 Non-GAAP Revenue per employee* (TTM) Gartner Peer Insights $400 TM • Avaya Vantage awarded Best Endpoint Solution of 2018 at UC Today $390 $379 awards. $380 $376 $370 $366 • Received 2018 Competitive Strategy Innovation and Leadership Award by ) 0 0 0 $360 $ Frost & Sullivan. ( $347 $350 • Winner in three categories of the 2018 Conarec Awards $340 $335 • Added over 1,600 new logos $330 $320 FY'18 Adjusted EBITDA % is based on non-GAAP Revenue FY14 FY15 FY16 FY17 FY18 *Headcount as of the end of the period indicated For a reconciliation of non-GAAP to GAAP financial information, please see the last four TTM-Trailing Twelve Months 10 © 2018 Avaya Inc. All rights reserved slides of this presentation.

TEXT 0 – 0 – 0 204-0-0 127-127-127 17-114-210 80-200-74 86-183-242 247-150-70 Balance Sheet and Operating Metrics (Dollars in millions, Balance sheet items as of the end of the period indicated) FQ4 2018 FQ3 2018 FQ4 2017 Total Cash and Cash Equivalents $ 700 $ 685 $ 876 Cash Flow from Operations $ 25 $ 83 $ 166 Capital Expenditures and Capitalized Software $ 25 $ 18 $ 17 Days Sales Outstanding (DSO)* 60 60 60 Inventory Turns 13.0 12.3 12.3 Headcount (as of the end of the period indicated) 8,061 8,134 8,712 Trailing Twelve Month Revenue ($K) / Employee** (Headcount as of the end of the period indicated) $ 379 $ 378 $ 376 *FQ4 3018 & FQ3 2018 includes $113M and $119M AR/deferred revenue netting impact when calculating DSOs **FQ4 2018, FQ3 2018 & FQ4 2017 TTM Revenue ($K) / Employee based on non-GAAP Revenue 11 © 2018 Avaya Inc. All rights reserved

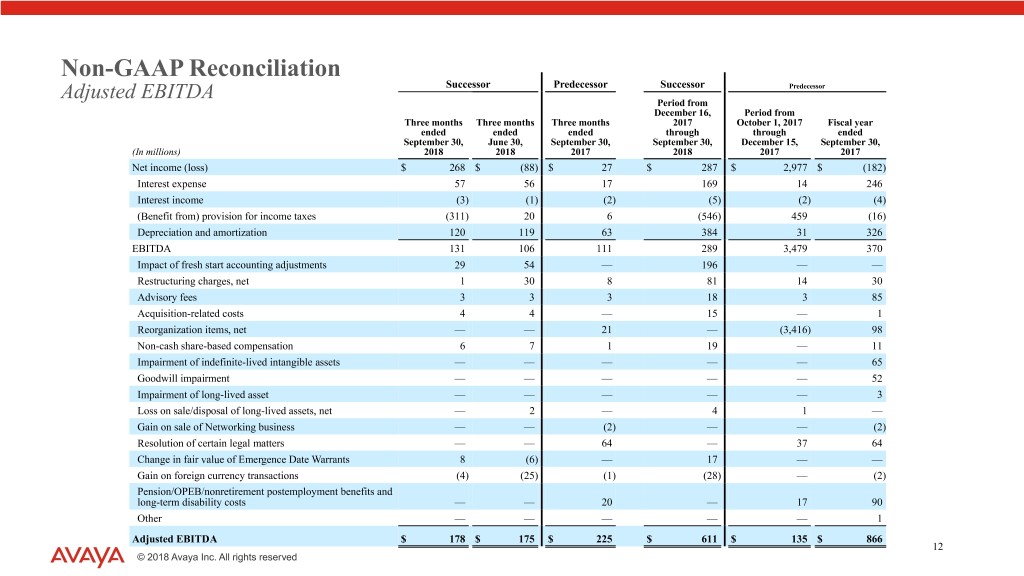

TEXT 0 – 0 – 0 204-0-0 127-127-127 17-114-210 80-200-74 86-183-242 247-150-70 Non-GAAP Reconciliation Adjusted EBITDA Successor Predecessor Successor Predecessor Period from December 16, Period from Three months Three months Three months 2017 October 1, 2017 Fiscal year ended ended ended through through ended September 30, June 30, September 30, September 30, December 15, September 30, (In millions) 2018 2018 2017 2018 2017 2017 Net income (loss) $ 268 $ (88) $ 27 $ 287 $ 2,977 $ (182) Interest expense 57 56 17 169 14 246 Interest income (3) (1) (2) (5) (2) (4) (Benefit from) provision for income taxes (311) 20 6 (546) 459 (16) Depreciation and amortization 120 119 63 384 31 326 EBITDA 131 106 111 289 3,479 370 Impact of fresh start accounting adjustments 29 54 — 196 — — Restructuring charges, net 1 30 8 81 14 30 Advisory fees 3 3 3 18 3 85 Acquisition-related costs 4 4 — 15 — 1 Reorganization items, net — — 21 — (3,416) 98 Non-cash share-based compensation 6 7 1 19 — 11 Impairment of indefinite-lived intangible assets — — — — — 65 Goodwill impairment — — — — — 52 Impairment of long-lived asset — — — — — 3 Loss on sale/disposal of long-lived assets, net — 2 — 4 1 — Gain on sale of Networking business — — (2) — — (2) Resolution of certain legal matters — — 64 — 37 64 Change in fair value of Emergence Date Warrants 8 (6) — 17 — — Gain on foreign currency transactions (4) (25) (1) (28) — (2) Pension/OPEB/nonretirement postemployment benefits and long-term disability costs — — 20 — 17 90 Other — — — — — 1 Adjusted EBITDA $ 178 $ 175 $ 225 $ 611 $ 135 $ 866 12 © 2018 Avaya Inc. All rights reserved

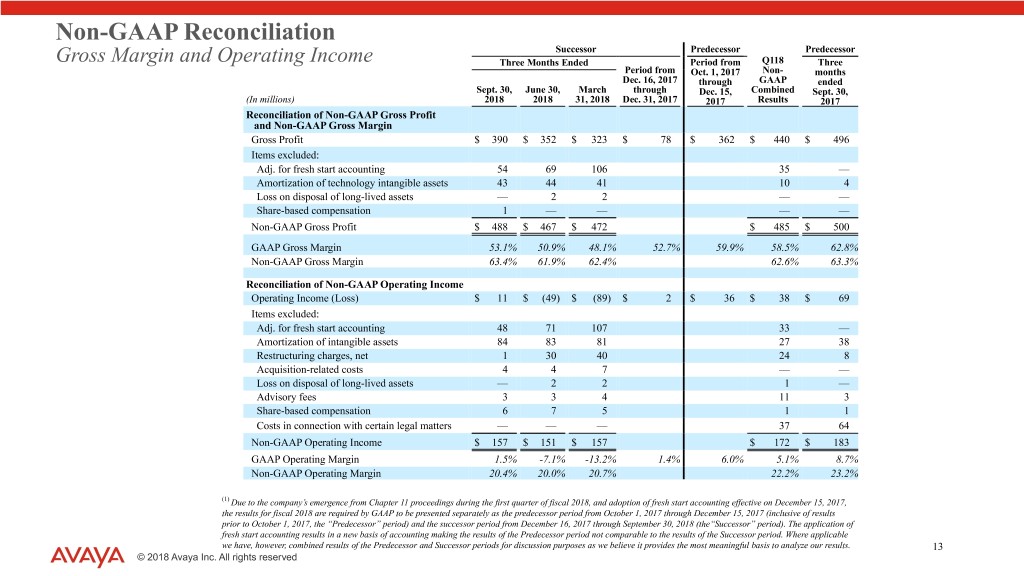

TEXT 0 – 0 – 0 204-0-0 127-127-127 17-114-210 80-200-74 86-183-242 247-150-70 Non-GAAP Reconciliation Successor Predecessor Predecessor Gross Margin and Operating Income Three Months Ended Period from Q118 Three Period from Oct. 1, 2017 Non- months Dec. 16, 2017 through GAAP ended Sept. 30, June 30, March through Dec. 15, Combined Sept. 30, (In millions) 2018 2018 31, 2018 Dec. 31, 2017 2017 Results 2017 Reconciliation of Non-GAAP Gross Profit and Non-GAAP Gross Margin Gross Profit $ 390 $ 352 $ 323 $ 78 $ 362 $ 440 $ 496 Items excluded: Adj. for fresh start accounting 54 69 106 35 — Amortization of technology intangible assets 43 44 41 10 4 Loss on disposal of long-lived assets — 2 2 — — Share-based compensation 1 — — — — Non-GAAP Gross Profit $ 488 $ 467 $ 472 $ 485 $ 500 GAAP Gross Margin 53.1% 50.9% 48.1% 52.7% 59.9% 58.5% 62.8% Non-GAAP Gross Margin 63.4% 61.9% 62.4% 62.6% 63.3% Reconciliation of Non-GAAP Operating Income Operating Income (Loss) $ 11 $ (49) $ (89) $ 2 $ 36 $ 38 $ 69 Items excluded: Adj. for fresh start accounting 48 71 107 33 — Amortization of intangible assets 84 83 81 27 38 Restructuring charges, net 1 30 40 24 8 Acquisition-related costs 4 4 7 — — Loss on disposal of long-lived assets — 2 2 1 — Advisory fees 3 3 4 11 3 Share-based compensation 6 7 5 1 1 Costs in connection with certain legal matters — — — 37 64 Non-GAAP Operating Income $ 157 $ 151 $ 157 $ 172 $ 183 GAAP Operating Margin 1.5% -7.1% -13.2% 1.4% 6.0% 5.1% 8.7% Non-GAAP Operating Margin 20.4% 20.0% 20.7% 22.2% 23.2% (1) Due to the company’s emergence from Chapter 11 proceedings during the first quarter of fiscal 2018, and adoption of fresh start accounting effective on December 15, 2017, the results for fiscal 2018 are required by GAAP to be presented separately as the predecessor period from October 1, 2017 through December 15, 2017 (inclusive of results prior to October 1, 2017, the “Predecessor” period) and the successor period from December 16, 2017 through September 30, 2018 (the“Successor” period). The application of fresh start accounting results in a new basis of accounting making the results of the Predecessor period not comparable to the results of the Successor period. Where applicable we have, however, combined results of the Predecessor and Successor periods for discussion purposes as we believe it provides the most meaningful basis to analyze our results. 13 © 2018 Avaya Inc. All rights reserved

TEXT 0 – 0 – 0 204-0-0 127-127-127 17-114-210 80-200-74 86-183-242 247-150-70 Non-GAAP Reconciliation Product and Services Gross Margins Successor Predecessor Predecessor Three months ended Period from Period from December October 1, Q118 Three 16, 2017 2017 Non- months through through GAAP ended Sept. 30, June 30, March 31, December December Combined Sept. 30, 2018 2018 2018 31, 2017 15, 2017 Results 2017 Reconciliation of Non-GAAP Gross Profit and Non-GAAP Gross Margin - Products Revenue $ 325 $ 300 $ 293 71 $ 253 $ 324 $ 343 Costs 115 114 110 33 84 117 105 Amortization of technology intangible assets 43 44 41 7 3 10 4 GAAP Gross Profit 167 142 142 31 166 197 234 Items excluded: Adj. for fresh start accounting 16 24 33 11 — Amortization of technology intangible assets 43 44 41 10 4 Loss on disposal of long-lived assets — 1 1 — — Non-GAAP Gross Profit $ 226 $ 211 217 $ 218 $ 238 GAAP Gross Margin 51.4% 47.3% 48.5% 43.7% 65.6% 60.8% 68.2% Non-GAAP Gross Margin 67.3% 65.5% 68.5% 66.1% 69.4% Reconciliation of Non-GAAP Gross Profit and Non-GAAP Gross Margin - Services Revenue $ 410 $ 392 $ 379 77 $ 351 $ 428 $ 447 Costs 187 182 198 30 155 185 185 GAAP Gross Profit 223 210 181 47 196 243 262 Items excluded: Adj. for fresh start accounting 38 45 73 24 — Loss on disposal of long-lived assets — 1 1 — — Share-based compensation 1 — — — — Non-GAAP Gross Profit $ 262 $ 256 255 $ 267 $ 262 GAAP Gross Margin 54.4% 53.6% 47.8% 61.0% 55.8% 56.8% 58.6% Non-GAAP Gross Margin 60.4% 59.1% 58.0% 60.0% 58.6% 14 © 2018 Avaya Inc. All rights reserved

TEXT 0 – 0 – 0 204-0-0 127-127-127 17-114-210 80-200-74 86-183-242 247-150-70 Non-GAAP Reconciliation GAAP to Non-GAAP Results Q418 Q417 Adj. for Amortization Other Non- Non- GAAP Fresh Start of Intangible Restructuring Acquisition Share-based Advisory Costs, GAAP GAAP GAAP Results Accounting Assets Charges, net Costs Compensation Fees net Results Results Results Revenue Products $ 325 $ 11 $ — $ — $ — $ — $ — $ — $ 336 $ 343 $ 343 Services 410 24 — — — — — — 434 447 447 735 35 — — — — — — 770 790 790 Costs Products: Costs 115 (5) — — — — — — 110 105 105 Amortization of technology intangible assets 43 — (43) — — — — — — 4 — Services 187 (14) — — — (1) — — 172 185 185 345 (19) (43) — — (1) — — 282 294 290 GROSS PROFIT 390 54 43 — — 1 — — 488 496 500 OPERATING EXPENSES Selling, general and administrative 275 17 — — (4) (5) (3) — 280 338 270 Research and development 62 (11) — — — — — — 51 47 47 Amortization of intangible assets 41 — (41) — — — — — — 34 — Restructuring charges, net 1 — — (1) — — — — — 8 — 379 6 (41) (1) (4) (5) (3) — 331 427 317 OPERATING INCOME 11 48 84 1 4 6 3 — 157 69 183 Interest expense (57) — — — — — — — (57) (17) (17) Other income (expense), net 3 — — — — — — 1 4 2 (1) Reorganization items, net — — — — — — — — — (21) — (LOSS) INCOME BEFORE INCOME TAXES $ (43) $ 48 $ 84 $ 1 $ 4 $ 6 $ 3 $ 1 $ 104 $ 33 $ 165 15 © 2018 Avaya Inc. All rights reserved

TEXT 0 – 0 – 0 204-0-0 127-127-127 17-114-210 80-200-74 86-183-242 247-150-70 Non-GAAP Reconciliation GAAP to Non-GAAP Results Successor Predecessor FY17 Period from Period from Loss on Dec. 16, 2017 Oct. 1, 2017 Disposal Costs in through through Adj. for Amortization of of Long- Connection Non- Non- Sept. 30, Dec. 15, Combined Fresh Start Intangible Restructuring Acquisition lived Reorganization Share-based with Certain Advisory Other GAAP GAAP GAAP 2018 2017 Results Accounting Assets Charges, net Costs Assets items, net Comp Legal Matters Fees Costs, net Results Results Results Revenue Products $ 989 $ 253 $ 1,242 $ 63 $ — $ — $ — $ — $ — $ — $ — $ — $ — $ 1,305 $ 1,437 $ 1,437 Services 1,258 351 1,609 143 — — — — — — — — — 1,752 1,835 1,835 2,247 604 2,851 206 — — — — — — — — — 3,057 3,272 3,272 Costs Products: Costs 372 84 456 (21) — — — (2) — — — — — 433 499 499 Amortization of technology intangible assets 135 3 138 — (138) — — — — — — — — — 20 — Services 597 155 752 (37) — — — (2) — (1) — — — 712 745 745 1,104 242 1,346 (58) (138) — — (4) — (1) — — — 1,145 1,264 1,244 GROSS PROFIT 1,143 362 1,505 264 138 — — 4 — 1 — — — 1,912 2,008 2,028 OPERATING EXPENSES Selling, general and administrative 888 264 1,152 16 — — (15) (1) — (17) (37) (21) — 1,077 1,261 1,100 Research and development 172 38 210 (11) — — — — — (1) — — — 198 225 225 Amortization of intangible assets 127 10 137 — (137) — — — — — — — — — 204 — Impairment of indefinite-lived intangible assets — — — — — — — — — — — — — — 65 — Goodwill impairment — — — — — — — — — — — — — — 52 — Restructuring charges, net 81 14 95 — — (95) — — — — — — — — 30 — 1,268 326 1,594 5 (137) (95) (15) (1) — (18) (37) (21) — 1,275 1,837 1,325 OPERATING (LOSS) INCOME (125) 36 (89) 259 275 95 15 5 — 19 37 21 — 637 171 703 Interest expense (169) (14) (183) — — — — — — — — — — (183) (246) (246) Other income (expense), net 35 (2) 33 — — — — — — — — — (18) 15 (25) (31) Reorganization items, net — 3,416 3,416 — — — — — (3,416) — — — — — (98) — (LOSS) INCOME BEFORE INCOME TAXES $ (259) $ 3,436 $ 3,177 $ 259 $ 275 $ 95 $ 15 $ 5 $ (3,416) $ 19 $ 37 $ 21 $ (18) $ 469 $ (198) $ 426 16 © 2018 Avaya Inc. All rights reserved

TEXT 0 – 0 – 0 204-0-0 127-127-127 17-114-210 80-200-74 86-183-242 247-150-70