Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - Atkore Inc. | atkr4q18exhibit991.htm |

| 8-K - 8-K - Atkore Inc. | atkr4q18form8-k.htm |

Fourth Quarter and FY 2018 Earnings Presentation November 28, 2018

Cautionary statements This presentation contains forward-looking statements that are subject to known and unknown risks and uncertainties, many of which are beyond our control. All statements other than statements of historical fact included in this presentation are forward-looking statements. Forward-looking statements appearing throughout this presentation include, without limitation, statements regarding our intentions, beliefs, assumptions or current expectations concerning, among other things, financial position; results of operations; cash flows; prospects; growth strategies or expectations; customer retention; the outcome (by judgment or settlement) and costs of legal, administrative or regulatory proceedings, investigations or inspections, including, without limitation, collective, representative or any other litigation; and the impact of prevailing economic conditions. You can identify forward-looking statements by the fact that they do not relate strictly to historical or current facts. These statements may include words such as “believes,” “expects,” “may,” “will,” “shall,” “should,” “would,” “could,” “seeks,” “aims,” “projects,” “is optimistic,” “intends,” “plans,” “estimates,” “anticipates” and other comparable terms. We caution you that forward-looking statements are not guarantees of future performance or outcomes and that actual performance and outcomes, including, without limitation, our actual results of operations, financial condition and liquidity, and the development of the market in which we operate, may differ materially from those made in or suggested by the forward-looking statements contained in this presentation. In addition, even if our results of operations, financial condition and cash flows, and the development of the market in which we operate, are consistent with the forward-looking statements contained in this presentation, those results or developments may not be indicative of results or developments in subsequent periods. A number of important factors, including, without limitation, the risks and uncertainties discussed under the captions “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in the Annual Report on Form 10-K for the fiscal year ended September 30, 2018, filed with the U.S. Securities and Exchange Commission on November 28, 2018 (File No. 001-37793), could cause actual results and outcomes to differ materially from those reflected in the forward-looking statements. Because of these risks, we caution that you should not place undue reliance on any of our forward-looking statements. New risks and uncertainties arise from time to time, and it is impossible for us to predict those events or how they may affect us. Further, any forward-looking statement speaks only as of the date on which it is made. We undertake no obligation to revise the forward-looking statements in this presentation after the date of this presentation. Market data and industry information used throughout this presentation are based on management’s knowledge of the industry and the good faith estimates of management. We also relied, to the extent available, upon management’s review of independent industry surveys, forecasts and publications and other publicly available information prepared by a number of third party sources. All of the market data and industry information used in this presentation involves a number of assumptions and limitations which we believe to be reasonable, and you are cautioned not to give undue weight to such estimates. Although we believe that these sources are reliable, we cannot guarantee the accuracy or completeness of this information, and we have not independently verified this information. While we believe the estimated market position, market opportunity and market size information included in this presentation are generally reliable, such information, which is derived in part from management’s estimates and beliefs, is inherently uncertain and imprecise. Projections, assumptions and estimates of our future performance and the future performance of the industry in which we operate are subject to a high degree of uncertainty and risk due to a variety of factors, including those described above. These and other factors could cause results to differ materially from those expressed in our estimates and beliefs and in the estimates prepared by independent parties. We present Adjusted EBITDA, Adjusted EBITDA margin, Adjusted net income, Adjusted earnings per share, Net debt (total debt less cash and cash equivalents), and Leverage ratio (net debt or total debt less cash and cash equivalents, over Adjusted EBITDA on trailing twelve month basis) to help us describe our operating and financial performance. Adjusted EBITDA, Adjusted EBITDA margin, Adjusted net income, Adjusted earnings per share, and Leverage ratio are non-GAAP financial measures commonly used in our industry and have certain limitations and should not be construed as alternatives to net income, net sales and other income data measures (as determined in accordance with generally accepted accounting principles in the United States, or GAAP), or as better indicators of operating performance. Adjusted EBITDA, Adjusted EBITDA margin, Adjusted net income, Adjusted earnings per share, Net debt (total debt less cash and cash equivalents), and Leverage ratio (net debt or total debt less cash and cash equivalents over Adjusted EBITDA on a trailing twelve month basis), as defined by us may not be comparable to similar non-GAAP measures presented by other issuers. Our presentation of such measures should not be construed as an inference that our future results will be unaffected by unusual or non-recurring items. See the appendix to this presentation for a reconciliation of Adjusted EBITDA to net income, Adjusted net income to adjusted net income per share, and net debt over Adjusted EBITDA. Fiscal Periods - The Company has a fiscal year that ends on September 30th. It is the Company's practice to establish quarterly closings using a 4-5-4 calendar. The Company's fiscal quarters end on the last Friday in December, March and June. 2

FY 2018 Highlights Year ended September 30 Net Income of $136.6M and Diluted 2018 2017 Y/Y Earnings per share of $2.48 were up 61% ($’s in millions) Change and 95% year over year, respectively Net Sales $1,835.1 $1,503.9 +22.0% Repurchased ~19 million shares for ~$412 million Net Income $136.6 $84.6 +61.4% Adjusted EBITDA(1) $271.5 $227.6 +19.3% Constituted a fully independent Board of Directors Net Income Margin 7.4% 5.6% +180 bps Price and mix management actions more than Adjusted EBITDA offset inflation drivers 14.8% 15.1% (30 bps) Margin(1) Net Income per $2.48 $1.27 +95.3% Acquisition strategy is working; over-delivered Share Adjusted EBITDA expectations and driving Adjusted Net accretive margins $2.78 $1.65 +68.5% Income per Share(1) Operating cash flow of $146 million (1) See non-GAAP reconciliation in appendix 3

Consolidated Atkore Q4 2018 Financial Summary Q4 Q4 Y/Y Net Sales Growth Change Organic Growth +15.6% ($’s in millions) 2018 2017 Acquisitions/Divestitures +5.6% Net Sales $477.6 $395.8 +20.7% FX (0.5%) Net Income $32.7 $20.9 +56.5% Total +20.7% Adjusted EBITDA(1) $71.1 $59.6 19.3% Net Income Margin 6.8% 5.3% +150 bps Adjusted EBITDA 14.9% 15.0% (10 bps) Margin(2) Net Income per $0.66 $0.31 +112.9% Share (Diluted) Adjusted Net Income $0.79 $0.40 +97.5% per Share(1) (Diluted) (1) See non-GAAP reconciliation in appendix (2) Adjusted EBITDA Margin is Adjusted EBITDA as a percentage of Net sales 4

Consolidated Atkore Q4 2018 Highlights Q4 Net Sales Bridge Delivered double digit growth in Net $22 $2 $478M sales, Adjusted EBITDA, and EPS $63 $1 $396M Organic net sales up 16%; Industrial volumes continued to be strong with some short-term Electrical channel destocking 2017 Volume Price / Mix M&A FX 2018 Pricing & mix management actions continued to more than offset inflation headwinds from input Q4 Adjusted EBITDA Bridge $5 $2 $11 $71M cost and freight $17 $60M Growth $1 Investments, Variable Comp, Delivered Adjusted EBITDA at high-end of & Other Inflation Price & Mix offset by guidance range Commodities, Freight & Other COGS 2017 Volume Price vs. Cost M&A Productivity Investment / 2018 Inflation / FX 5

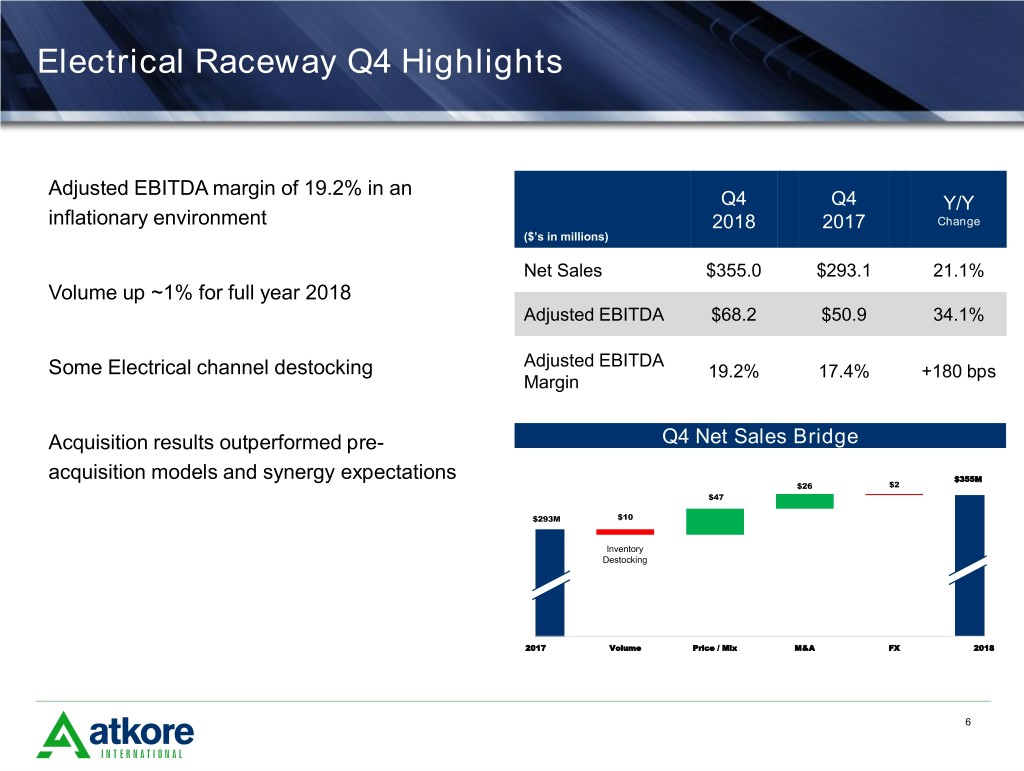

Electrical Raceway Q4 Highlights Adjusted EBITDA margin of 19.2% in an Q4 Q4 Y/Y inflationary environment 2018 2017 Change ($’s in millions) Net Sales $355.0 $293.1 21.1% Volume up ~1% for full year 2018 Adjusted EBITDA $68.2 $50.9 34.1% Adjusted EBITDA Some Electrical channel destocking 19.2% 17.4% +180 bps Margin Acquisition results outperformed pre- Q4 Net Sales Bridge acquisition models and synergy expectations $355M $26 $2 $47 $293M $10 Inventory Destocking 2017 Volume Price / Mix M&A FX 2018 6

Mechanical Products & Solutions Q4 Highlights Q4 Q4 Y/Y 2018 2017 Change Continued volume growth in Industrial verticals ($’s in millions) and pricing actions gaining traction vs. inflation Net Sales $123.0 $103.0 19.5% Significant increase in price realization; ~70% of Adjusted EBITDA $11.8 $15.1 (21.8%) 2018 price delivered in Q4 Adjusted EBITDA 9.6% 14.6% (500 bps) Margin Impact of Flexhead divestiture ($1M) Adjusted Q4 Net Sales Bridge EBITDA $4 $16 $123M $8 $103M 2017 Volume Price / Mix Divestitures 2018 7

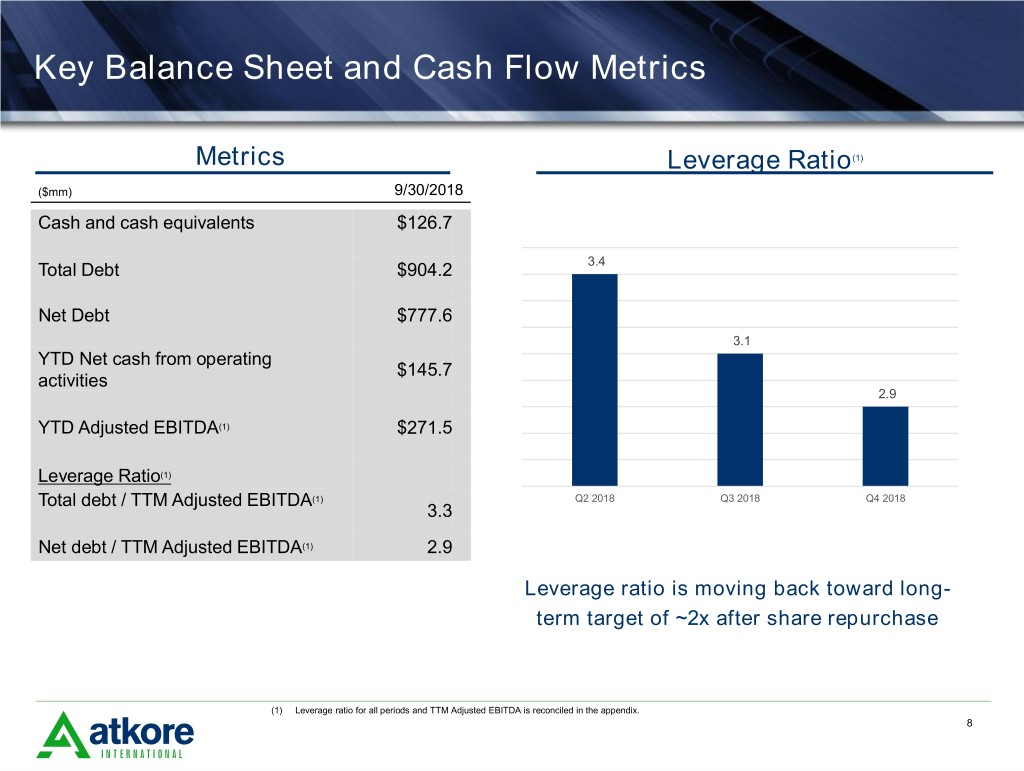

Key Balance Sheet and Cash Flow Metrics Metrics Leverage Ratio(1) ($mm) 9/30/2018 Cash and cash equivalents $126.7 Total Debt $904.2 3.4 Net Debt $777.6 3.1 YTD Net cash from operating $145.7 activities 2.9 YTD Adjusted EBITDA(1) $271.5 Leverage Ratio(1) Total debt / TTM Adjusted EBITDA(1) Q2 2018 Q3 2018 Q4 2018 3.3 Net debt / TTM Adjusted EBITDA(1) 2.9 Leverage ratio is moving back toward long- term target of ~2x after share repurchase (1) Leverage ratio for all periods and TTM Adjusted EBITDA is reconciled in the appendix. 8

What We Expect from the Market Key Market Influences by Segment Market Growth Mechanical Products 2019 Expectations Electrical Raceway & Solutions Non - Residential +2 to 4% Construction Industrial +4 to 5% Residential flat to +3% Construction Modest Volume Growth Expected in 2019 = Atkore Product Density 9

2019 Financial Outlook Summary Q1 2019 FY 2019 Electrical Raceway Volume Flat +2 to 4% Segment Adjusted EBITDA* $67 - $72M $265 - $285M Volume +2% +4 to 5% Mechanical Products & Solutions Segment Adjusted EBITDA* $8 - $10M $55 - $58M Adjusted EBITDA* $67 - $72M $285 - $305M Adjusted EPS* $0.65 - $0.75 $3.00 - $3.30 Consolidated Atkore Capital Expenditures $9M $35-40M Interest Expense $12M $50M Tax Rate 25% 25% Diluted Shares** 50 50 * Reconciliation of the forward-looking full-year 2019 outlook for Adjusted EBITDA and Adjusted EPS is not being provided as the Company does not currently have sufficient data to accurately estimate the variables and individual adjustments for such reconciliation. ** Represents weighted-average shares outstanding in millions used in calculation of Adjusted EPS guidance. 10

Appendix

2018 Bridges Year ended September 30 FY 2018 Net Sales Bridge Sales Growth $1,835M $109 $5 Organic Growth +14.4% $166 Acquisitions +7.9% Acquisitions less Divestures (0.7%) Flexhead Sale $52 FX +0.4% $1,504M Inflation Strong Pass Industrial Through Total +22.0% Markets 2017 Volume Price / Mix M&A FX 2018 FY 2018 Adjusted EBITDA(1) Bridge $24 $30 $8 $30 $272M Growth Investments, Variable Comp, $12 & Other Inflation $228M Price & Mix offset by Commodities, Freight & Other COGS 2017 Volume Price vs. Cost Productivity M&A Investment / 2018 Inflation / FX (1) See non-GAAP reconciliation 12

Segment Information Fiscal year ended September 30, 2018 September 30, 2017 Adjusted Adjusted Adjusted EBITDA Adjusted EBITDA (in thousands) Net sales EBITDA Margin Net sales EBITDA Margin Electrical Raceway $ 1,366,611 $ 255,260 18.7 % $ 1,094,783 $ 189,351 17.3 % MP&S 470,153 $ 51,339 10.9 % 410,532 $ 63,687 15.5 % Eliminations (1,625) (1,381) Consolidated operations $ 1,835,139 $ 1,503,934 Three Months Ended September 30, 2018 September 30, 2017 Adjusted Adjusted Adjusted EBITDA Adjusted EBITDA (in thousands) Net sales EBITDA Margin Net sales EBITDA Margin Electrical Raceway $ 354,968 $ 68,235 19.2 % $ 293,126 $ 50,886 17.4 % MP&S 123,030 $ 11,795 9.6 % 103,007 $ 15,086 14.6 % Eliminations (431) (326) Consolidated operations $ 477,567 $ 395,807 13

Adjusted earnings per share reconciliation Consolidated Atkore International Group Inc. Three Months Ended Fiscal Year Ended September 30, September 30, September 30, September 30, (in thousands, except per share data) 2018 2017 2018 2017 Net income $ 32,699 $ 20,857 $ 136,645 $ 84,639 Stock-based compensation 4,836 3,420 14,664 12,788 Intangible asset amortization 7,958 5,779 32,104 22,407 Gain on sale of a business — — (27,575) — Loss (gain) on extinguishment of debt — — — 9,805 Gain on sale of joint venture — — — (5,774) Certain legal matters (a) (7,119) 50 (4,833) 7,551 Other (b) 1,944 60 4,194 (10,247) Pre-tax adjustments to net income 7,619 9,309 18,554 36,530 Tax effect (1,981) (3,333) (4,824) (11,470) Adjusted net income (c) $ 38,337 $ 26,833 $ 150,375 $ 109,699 Weighted-Average Diluted Common Shares Outstanding 48,308 66,468 54,089 66,554 Net income per diluted share (d) $ 0.66 $ 0.31 $ 2.48 $ 1.27 Adjusted net income per diluted share (e) $ 0.79 $ 0.40 $ 2.78 $ 1.65 (a) Represents certain legal matters of an unusual or non-recurring nature. (b) Represents other items, such as inventory reserves and adjustments, release of indemnified uncertain tax positions and the impact of foreign exchange gains or losses. (c) Beginning in March 2018, the Company has excluded the impact of intangible asset amortization from the calculation of Adjusted net income. Adjusted net income prepared for periods prior to March 2018 have also been adjusted to reflect this change. (d) The Company calculates basic and diluted earnings per common share using the two-class method. Under the two-class method, net earnings are allocated to each class of common stock and participating securities as if all of the net earnings for the period had been distributed. The Company's participating securities consist of share-based payment awards that contain a non-forfeitable right to receive dividends and therefore are considered to participate in undistributed earnings with common stockholders. Included within the calculation of net income per diluted share is 2,456 and 3,134 of undistributed earnings allocated to participating securities for fiscal years ended 2018 and 2017. Included within the calculation of net income per diluted share is See Note 9, ''Earnings Per Share'' in our Annual Report on Form 10-K. (e) Adjusted net income per diluted share is calculated by taking adjusted net income and divided by the weighted-average diluted common shares outstanding. 14

Net Income to Adjusted EBITDA reconciliation Consolidated Atkore International Group Inc. Three Months Ended Fiscal Year Ended (in thousands) September 30, 2018 September 30, 2017 September 30, 2018 September 30, 2017 Net income $ 32,699 $ 20,857 $ 136,645 $ 84,639 Income tax expense 1,447 12,173 29,707 41,486 Depreciation and amortization 17,637 14,485 66,890 54,727 Interest expense, net 12,372 5,726 40,694 26,598 Loss (gain) on extinguishment of debt — — — 9,805 Restructuring & impairments 604 556 1,849 1,256 Stock-based compensation 4,836 3,420 14,664 12,788 Gain on sale of a business — — (27,575) — Gain on sale of joint venture — — — (5,774) Certain legal matters (a) (7,119) 50 (4,833) 7,551 Transaction costs 6,638 2,235 9,314 4,779 Other (b) 1,944 60 4,194 (10,247) Adjusted EBITDA $ 71,058 $ 59,562 $ 271,549 $ 227,608 (a) Represents certain legal matters of an unusual or non-recurring nature. (b) Represents other items, such as inventory reserves and adjustments, release of indemnified uncertain tax positions and the impact of foreign exchange gains or losses. 15

Net Debt to Total Debt and Leverage Ratio Consolidated Atkore International Group Inc. (in thousands) September 30, 2018 June 29, 2018 March 30, 2018 December 29, 2017 Short-term debt and current maturities of long- 26,561 7,630 7,653 4,215 term debt Long-term debt 877,686 898,509 900,556 527,802 Total Debt 904,247 906,139 908,209 532,017 Less cash and cash equivalents 126,662 109,519 76,892 39,761 Net Debt 777,585 796,620 831,317 492,256 TTM Adjusted EBITDA 271,549 260,054 245,423 236,204 Total debt/TTM Adjusted EBITDA 3.3 x 3.5 x 3.7 x 2.3 x Net debt/TTM Adjusted EBITDA 2.9 x 3.1 x 3.4 x 2.1 x 16