Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - People's United Financial, Inc. | d661908dex991.htm |

| 8-K - 8-K - People's United Financial, Inc. | d661908d8k.htm |

Acquisition of BSB Bancorp, Inc. November 27, 2018 Exhibit 99.2

Forward-Looking Statement This communication contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 including, but not limited to, People’s United Financial, Inc. (“People’s United”) and BSB Bancorp, Inc. (“BSB Bancorp”) expectations or predictions of future financial or business performance or conditions. Forward-looking statements are typically identified by words such as “believe,” “expect,” “anticipate,” “intend,” “target,” “estimate,” “continue,” “positions,” “plan,” “predict,” “project,” “forecast,” “guidance,” “goal,” “objective,” “prospects,” “possible” or “potential,” by future conditional verbs such as “assume,” “will,” “would,” “should,” “could” or “may”, or by variations of such words or by similar expressions. These forward-looking statements are subject to numerous assumptions, risks and uncertainties, which change over time, are difficult to predict and are generally beyond the control of either company. Forward-looking statements speak only as of the date they are made and we assume no duty to update forward-looking statements. Actual results may differ materially from current projections. In addition to factors previously disclosed in People’s United’s and BSB Bancorp’s reports filed with the SEC and those identified elsewhere in this communication, the following factors, among others, could cause actual results to differ materially from forward-looking statements or historical performance: ability to obtain regulatory approvals and meet other closing conditions to the merger, including approval by BSB Bancorp shareholders on the expected terms and schedule, and including the risk that regulatory approvals required for the merger are not obtained or are obtained subject to conditions that are not anticipated; delay in closing the merger; difficulties and delays in integrating the BSB Bancorp business or fully realizing cost savings and other benefits; business disruption following the merger; changes in asset quality and credit risk; the inability to sustain revenue and earnings growth; changes in interest rates and capital markets; inflation; customer acceptance of People’s United’s products and services; customer borrowing, repayment, investment and deposit practices; customer disintermediation; the introduction, withdrawal, success and timing of business initiatives; competitive conditions; the inability to realize cost savings or revenues or to implement integration plans and other consequences associated with mergers, acquisitions and divestitures; economic conditions; the impact, extent and timing of technological changes and capital management activities; litigation; increased capital requirements, other regulatory requirements or enhanced regulatory supervision; and other actions of the Federal Reserve Board and legislative and regulatory actions and reforms. Annualized, pro forma, projected and estimated numbers are used for illustrative purpose only, are not forecasts and may not reflect actual results.

The Acquisition of BSB Bancorp, Inc. In-Market Acquisition Strengthening Our Greater Boston Franchise Attractive Financial Returns Bolstered By Achievable Cost Saves Low Execution Risk

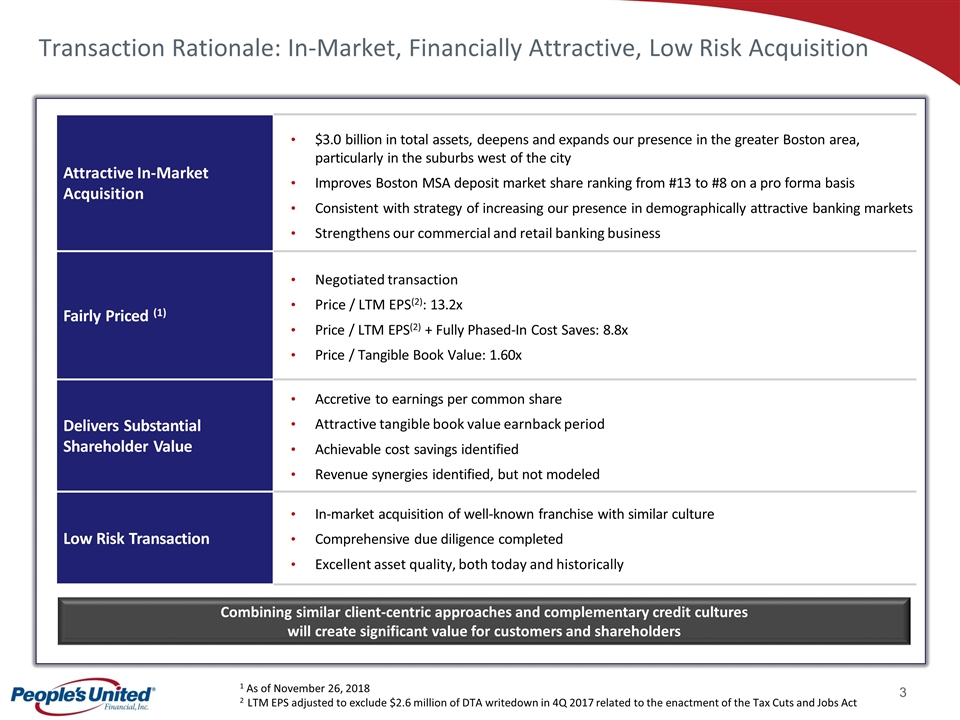

Attractive In-Market Acquisition $3.0 billion in total assets, deepens and expands our presence in the greater Boston area, particularly in the suburbs west of the city Improves Boston MSA deposit market share ranking from #13 to #8 on a pro forma basis Consistent with strategy of increasing our presence in demographically attractive banking markets Strengthens our commercial and retail banking business Fairly Priced (1) Negotiated transaction Price / LTM EPS(2): 13.2x Price / LTM EPS(2) + Fully Phased-In Cost Saves: 8.8x Price / Tangible Book Value: 1.60x Delivers Substantial Shareholder Value Accretive to earnings per common share Attractive tangible book value earnback period Achievable cost savings identified Revenue synergies identified, but not modeled Low Risk Transaction In-market acquisition of well-known franchise with similar culture Comprehensive due diligence completed Excellent asset quality, both today and historically Transaction Rationale: In-Market, Financially Attractive, Low Risk Acquisition 1 As of November 26, 2018 2 LTM EPS adjusted to exclude $2.6 million of DTA writedown in 4Q 2017 related to the enactment of the Tax Cuts and Jobs Act Combining similar client-centric approaches and complementary credit cultures will create significant value for customers and shareholders

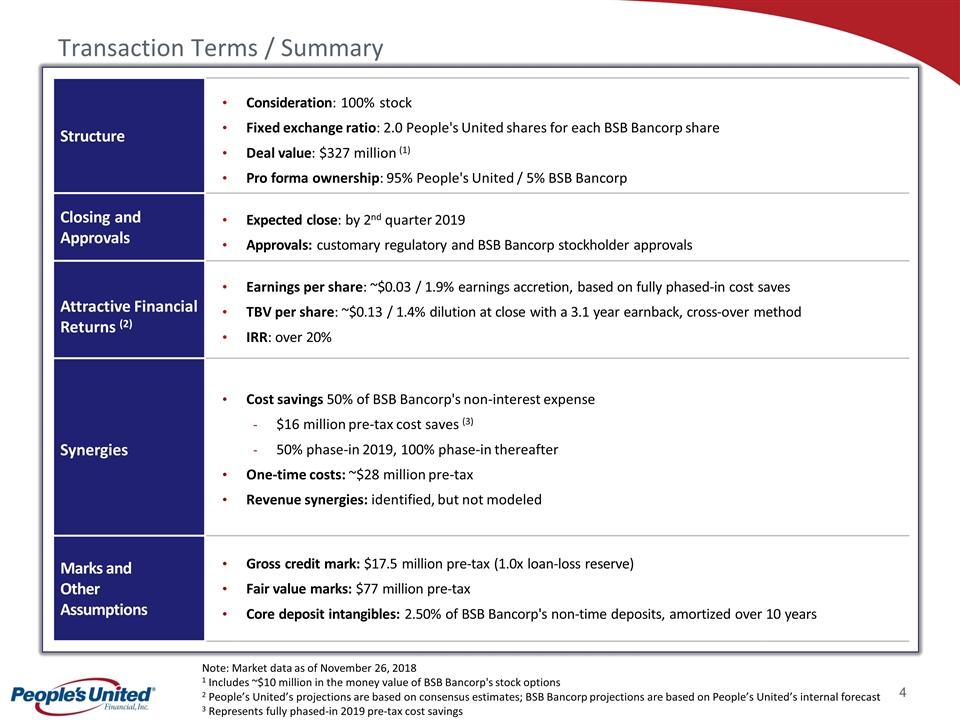

Transaction Terms / Summary Structure Consideration: 100% stock Fixed exchange ratio: 2.0 People's United shares for each BSB Bancorp share Deal value: $327 million (1) Pro forma ownership: 95% People's United / 5% BSB Bancorp Closing and Approvals Expected close: by 2nd quarter 2019 Approvals: customary regulatory and BSB Bancorp stockholder approvals Attractive Financial Returns (2) Earnings per share: ~$0.03 / 1.9% earnings accretion, based on fully phased-in cost saves TBV per share: ~$0.13 / 1.4% dilution at close with a 3.1 year earnback, cross-over method IRR: over 20% Synergies Cost savings 50% of BSB Bancorp's non-interest expense $16 million pre-tax cost saves (3) 50% phase-in 2019, 100% phase-in thereafter One-time costs: ~$28 million pre-tax Revenue synergies: identified, but not modeled Marks and Other Assumptions Gross credit mark: $17.5 million pre-tax (1.0x loan-loss reserve) Fair value marks: $77 million pre-tax Core deposit intangibles: 2.50% of BSB Bancorp's non-time deposits, amortized over 10 years Note: Market data as of November 26, 2018 1 Includes ~$10 million in the money value of BSB Bancorp's stock options 2 People’s United’s projections are based on consensus estimates; BSB Bancorp projections are based on People’s United’s internal forecast 3 Represents fully phased-in 2019 pre-tax cost savings

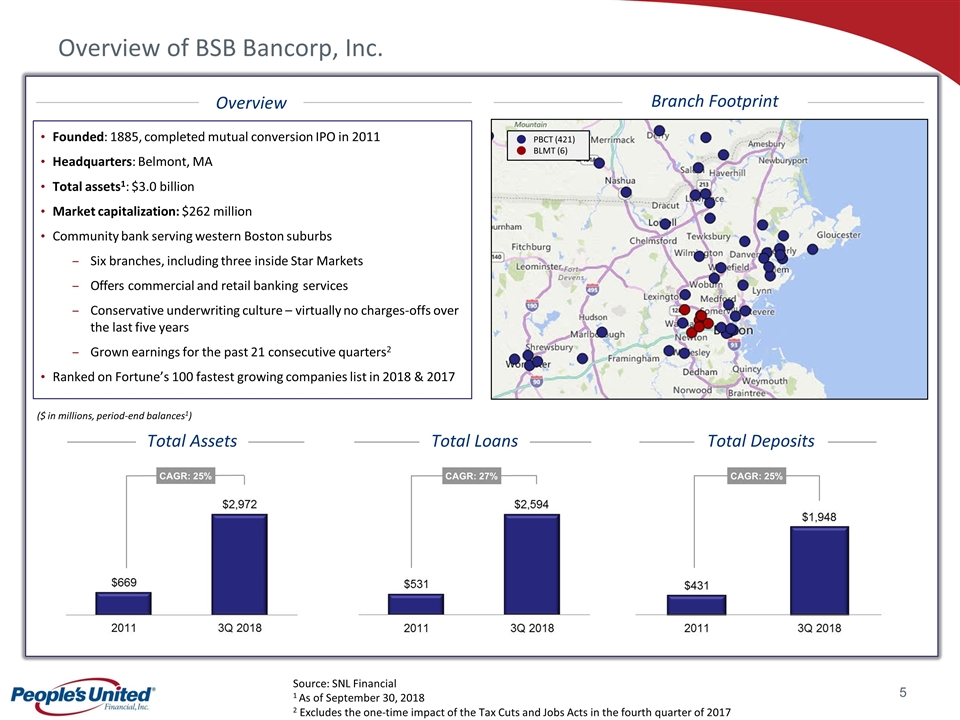

Overview of BSB Bancorp, Inc. Overview Branch Footprint Total Assets Total Loans Total Deposits Founded: 1885, completed mutual conversion IPO in 2011 Headquarters: Belmont, MA Total assets1: $3.0 billion Market capitalization: $262 million Community bank serving western Boston suburbs Six branches, including three inside Star Markets Offers commercial and retail banking services Conservative underwriting culture – virtually no charges-offs over the last five years Grown earnings for the past 21 consecutive quarters2 Ranked on Fortune’s 100 fastest growing companies list in 2018 & 2017 Source: SNL Financial 1 As of September 30, 2018 2 Excludes the one-time impact of the Tax Cuts and Jobs Acts in the fourth quarter of 2017 CAGR: 25% CAGR: 27% CAGR: 25% PBCT (421) BLMT (6) ($ in millions, period-end balances1)

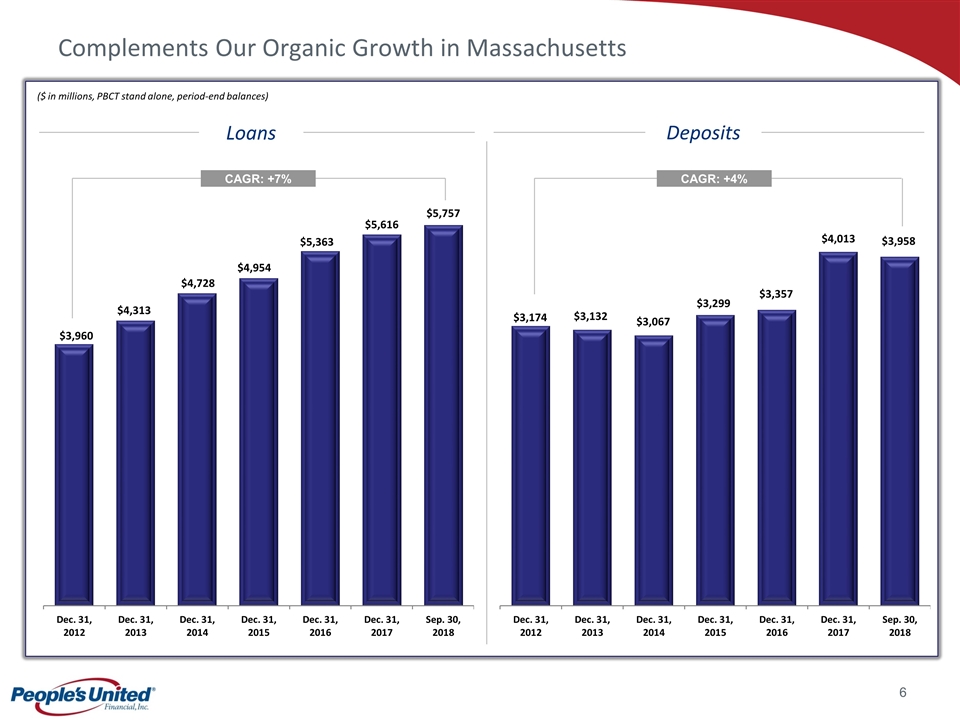

Complements Our Organic Growth in Massachusetts Loans Deposits ($ in millions, PBCT stand alone, period-end balances) CAGR: +7% CAGR: +4%

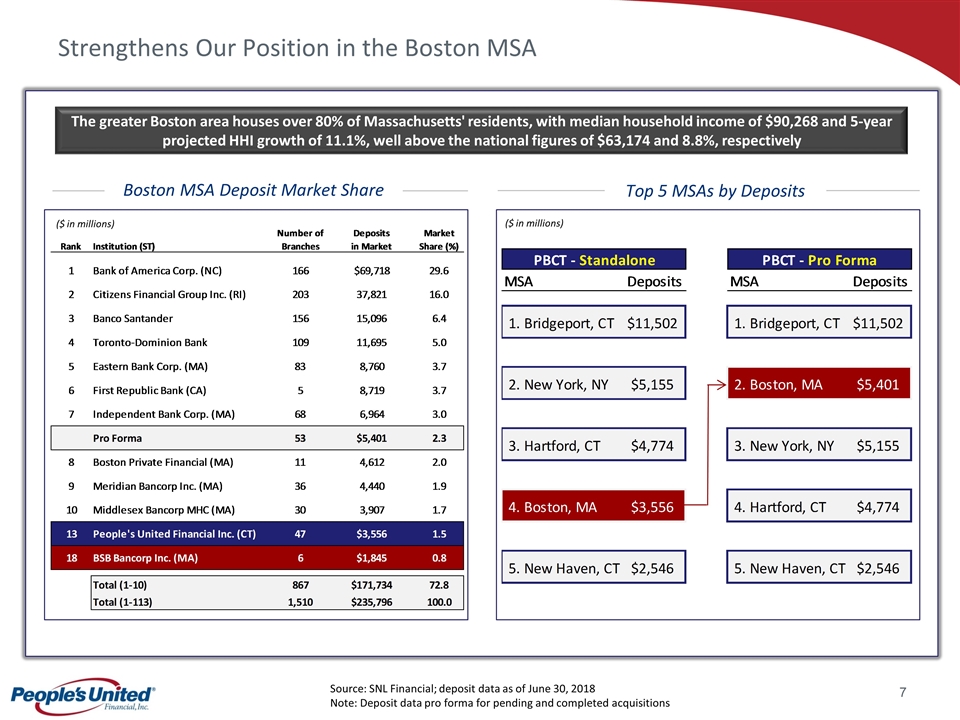

Strengthens Our Position in the Boston MSA Source: SNL Financial; deposit data as of June 30, 2018 Note: Deposit data pro forma for pending and completed acquisitions Boston MSA Deposit Market Share Top 5 MSAs by Deposits The greater Boston area houses over 80% of Massachusetts' residents, with median household income of $90,268 and 5-year projected HHI growth of 11.1%, well above the national figures of $63,174 and 8.8%, respectively ($ in millions) ($ in millions)

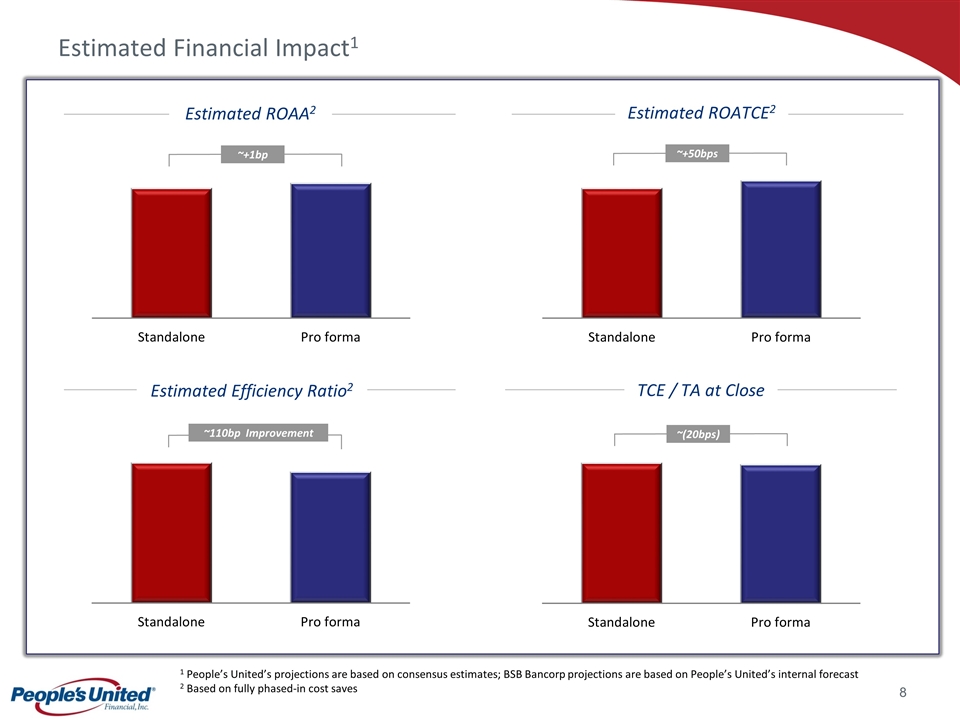

Estimated Financial Impact1 Estimated ROAA2 Estimated ROATCE2 TCE / TA at Close Estimated Efficiency Ratio2 ~110bp Improvement ~(20bps) ~+1bp 1 People’s United’s projections are based on consensus estimates; BSB Bancorp projections are based on People’s United’s internal forecast 2 Based on fully phased-in cost saves ~+50bps

Summary In-Market Acquisition Strengthening Our Greater Boston Franchise Attractive Financial Returns Bolstered By Achievable Cost Saves Low Execution Risk

Important Additional Information and Where to Find It This communication is being made in respect of the proposed merger transaction involving People’s United and BSB Bancorp. People’s United will file a registration statement on Form S-4 with the SEC, which will include a proxy statement of BSB Bancorp and a prospectus of People’s United, and each party will file other relevant documents regarding the proposed transaction with the SEC. A definitive proxy statement/prospectus will also be sent to the BSB Bancorp shareholders seeking any required shareholder approval. This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. Before making any voting or investment decision, investors and shareholders of BSB Bancorp are urged to carefully read the entire registration statement and proxy statement/prospectus, when they become available, and any other relevant documents filed with the SEC, as well as any amendments or supplements to these documents, because they will contain important information about the proposed transaction. The documents filed by People’s United and BSB Bancorp with the SEC may be obtained free of charge at the SEC’s website at www.sec.gov. In addition, the documents filed by People’s United may be obtained free of charge from People’s United at www.peoples.com under the tab “Investor Relations” and then under the heading “Financial Information”, and the documents filed by BSB Bancorp may be obtained free of charge from BSB Bancorp at www.belmontsavings.com under the heading “Investor Relations” and then under the tab “SEC Filings.” Alternatively, these documents, when available, can be obtained free of charge from People’s United upon written request to People’s United Financial, Inc., 850 Main Street, Bridgeport, Connecticut 06604, Attn: Investor Relations, by calling (203) 338-4581, or by sending an email to Andrew.Hersom@peoples.com or from BSB Bancorp upon written request to BSB Bancorp, 2 Leonard Street, Belmont, MA 02478, Attn: Investor Relations, by calling (617) 484-0613, or by sending an email to John.Citrano@belmontsavings.com. People’s United and BSB Bancorp and certain of their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from the shareholders of BSB Bancorp in favor of the approval of the merger. Information regarding People’s United’s directors and executive officers is contained in People’s United’s Annual Report on Form 10-K for the year ended December 31, 2017 and its Proxy Statement on Schedule 14A, dated March 7, 2018, which are filed with the SEC. Information regarding BSB Bancorp’s directors and executive officers is contained in BSB Bancorp’s Annual Report on Form 10-K for the year ended December 31, 2017 and its Proxy Statement on Schedule 14A, dated April 12, 2018, which are filed with the SEC. Additional information regarding the interests of those participants and other persons who may be deemed participants in the transaction may be obtained by reading the registration statement and the proxy statement/prospectus when they become available. Free copies of these documents may be obtained as described in the preceding paragraph. paragraph.

For more information, investors may contact: Andrew S. Hersom (203) 338-4581 andrew.hersom@peoples.com