Attached files

| file | filename |

|---|---|

| EX-31.2 - EXHIBIT 31.2 - LUBYS INC | lub_82918xex31-2.htm |

| EX-32.2 - EXHIBIT 32.2 - LUBYS INC | lub_82918xex32-2.htm |

| EX-32.1 - EXHIBIT 32.1 - LUBYS INC | lub_82918xex32-1.htm |

| EX-31.1 - EXHIBIT 31.1 - LUBYS INC | lub_82918xex31-1.htm |

| EX-23.1 - EXHIBIT 23.1 - LUBYS INC | lub_82918xex23-1.htm |

| EX-21 - EXHIBIT 21 - LUBYS INC | lub_82918xex21.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

____________________________________

FORM 10-K

x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Fiscal Year Ended August 29, 2018

☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Transition Period From to

____________________________________

Commission file number 001-08308

Luby's, Inc.

(Exact name of registrant as specified in its charter)

Delaware | 74-1335253 |

(State or other jurisdiction of incorporation or organization) | (IRS Employer Identification Number) |

13111 Northwest Freeway, Suite 600

Houston, Texas 77040

(Address of principal executive offices, including zip code)

(713) 329-6800

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

Title of Each Class | Name of Each Exchange on which registered | |

Common Stock ($0.32 par value per share) | New York Stock Exchange | |

Common Stock Purchase Rights | New York Stock Exchange | |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yes x No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer ☐ | Accelerated filer x |

Non-accelerated filer ☐ | Smaller reporting company x |

Emerging growth company ☐ | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐ | |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No x

The aggregate market value of the shares of common stock of the registrant held by nonaffiliates of the registrant as of March 15, 2017, was approximately $53,432,298 (based upon the assumption that directors and executive officers are the only affiliates).

As of November 7, 2018, there were 29,550,002 shares of the registrant’s common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the following document are incorporated by reference into the designated parts of this Form 10-K:

Definitive Proxy Statement relating to 2019 annual meeting of shareholders (in Part III)

1

Luby’s, Inc.

Form 10-K

Year ended August 29, 2018

Table of Contents

Page | ||

2

Additional Information

We file reports with the Securities and Exchange Commission (“SEC”), including annual reports on Form 10-K, quarterly reports on Form 10-Q, and current reports on Form 8-K. The SEC maintains an Internet site at http://www.sec.gov that contains the reports, proxy and information statements, and other information that we file electronically. Our website address is www.lubysinc.com. Please note that our website address is provided as an inactive textual reference only. We make available free of charge through our website the annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and all amendments to those reports as soon as reasonably practicable after such material is electronically filed with or furnished to the SEC. The information provided on our website is not part of this report, and is therefore not incorporated by reference unless such information is specifically referenced elsewhere in this report.

Compliance with New York Stock Exchange Requirements

We submitted to the New York Stock Exchange (“NYSE”) the CEO certification required by Section 303A.12(a) of the NYSE’s Listed Company Manual with respect to our fiscal year ended August 30, 2017. We expect to submit the CEO certification with respect to our fiscal year ended August 29, 2018 to the NYSE within 30 days after our annual meeting of shareholders. We are filing as an exhibit to this Form 10-K the certifications required by Section 302 of the Sarbanes-Oxley Act of 2002.

3

FORWARD-LOOKING STATEMENTS

This Annual Report on (this "Form 10-K”) contains statements that are “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements contained in this Form 10-K, other than statements of historical facts, are “forward-looking statements” for purposes of these provisions, including any statements regarding:

• | future operating results; |

• | future capital expenditures, including expected reductions in capital expenditures; |

• | future debt, including liquidity and the sources and availability of funds related to debt; |

• | plans for our new prototype restaurants; |

• | plans for expansion of our business; |

• | scheduled openings of new units; |

• | closing existing units; |

• | effectiveness of management’s disposal plans; |

• | future sales of assets and the gains or losses that may be recognized as a result of any such sales; and |

• | continued compliance with the terms of our 2016 Credit Agreement. |

In some cases, investors can identify these statements by forward-looking words such as “anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,” “outlook,” “may” “should,” “will,” and “would” or similar words. Forward-looking statements are based on certain assumptions and analyses made by management in light of their experience and perception of historical trends, current conditions, expected future developments and other factors we believe are relevant. Although management believes that our assumptions are reasonable based on information currently available, those assumptions are subject to significant risks and uncertainties, many of which are outside of our control. The following factors, as well as the factors set forth in Item 1A of this Form 10-K and any other cautionary language in this Form 10-K, provide examples of risks, uncertainties, and events that may cause our financial and operational results to differ materially from the expectations described in our forward-looking statements:

• | general business and economic conditions; |

• | the impact of competition; |

• | our operating initiatives, changes in promotional, couponing and advertising strategies, and the success of management’s business plans; |

• | fluctuations in the costs of commodities, including beef, poultry, seafood, dairy, cheese, oils and produce; |

• | ability to raise menu prices and customers acceptance of changes in menu items; |

• | increases in utility costs, including the costs of natural gas and other energy supplies; |

• | changes in the availability and cost of labor, including the ability to attract qualified managers and team members; |

• | the seasonality of the business; |

• | collectability of accounts receivable; |

• | changes in governmental regulations, including changes in minimum wages and healthcare benefit regulation; |

• | the effects of inflation and changes in our customers’ disposable income, spending trends and habits; |

• | the ability to realize property values; |

• | the availability and cost of credit; |

• | weather conditions in the regions in which our restaurants operate; |

• | costs relating to legal proceedings; |

• | impact of adoption of new accounting standards; |

• | effects of actual or threatened future terrorist attacks in the United States; |

• | unfavorable publicity relating to operations, including publicity concerning food quality, illness or other health concerns or labor relations; and |

• | the continued service of key management personnel. |

Each forward-looking statement speaks only as of the date of this Form 10-K, and we undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. Investors should be aware that the occurrence of the events described above and elsewhere in this Form 10-K could have material adverse effect on our business, results of operations, cash flows, and financial condition.

4

PART I

Item 1. Business

Overview

Luby’s, Inc. is a multi-branded company operating in the restaurant industry and in the contract food services industry. Our primary brands include Luby’s Cafeteria, Fuddruckers - World’s Greatest Hamburgers® and Luby’s Culinary Contract Services. We also operate another brand named Cheeseburger in Paradise.

In this Form 10-K, unless otherwise specified, “Luby’s,” “we,” “our,” “us” and “Company” refer to Luby’s, Inc., Luby's Fuddruckers Restaurants, LLC, a Texas Limited Liability Company ("LFR") and the consolidated subsidiaries of Luby’s, Inc. References to “Luby’s Cafeteria” refer specifically to the Luby’s Cafeteria brand restaurant.

Our Company’s vision is that our guests, employees and shareholders stay loyal to our restaurant brands and value them as a significant part of their lives. We want our company’s performance to make it a leader in our industry.

We are headquartered in Houston, Texas. Our corporate headquarters is located at 13111 Northwest Freeway, Suite 600, Houston, Texas 77040, and our telephone number at that address is (713) 329-6800. Our website is www.lubysinc.com. The information on our website is not, and shall not be deemed to be, a part of this annual report on Form 10-K or incorporated into any of our other filings with the SEC.

As of November 7, 2018, we operated 142 restaurants located throughout the United States, as set forth in the table below. These establishments are located in close proximity to retail centers, business developments and residential areas. Of the 142 restaurants, 77 are located on property that we own and 65 are located on property that we lease. Six locations consist of a side-by-side Luby’s Cafeteria and Fuddruckers restaurant, to which we refer herein as a “Combo location”.

Total | ||

Texas: | ||

Houston Metro | 47 | |

San Antonio Metro | 16 | |

Rio Grande Valley | 12 | |

Dallas/Fort Worth Metro | 12 | |

Austin | 9 | |

Other Texas Markets | 16 | |

California | 10 | |

Arizona | 4 | |

Illinois | 3 | |

Georgia | 3 | |

Mississippi | 2 | |

Other States | 8 | |

Total | 142 | |

As of November 7, 2018, we operated 30 locations through our Culinary Contract Services (“CCS”).

Total | ||

Texas: | ||

Houston Metro | 22 | |

San Antonio Metro | 2 | |

Rio Grande Valley | 3 | |

Dallas/Fort Worth Metro | 2 | |

Greensboro, NC | 1 | |

Total | 30 | |

5

As of November 7, 2018, we had 41 franchisees operating 104 Fuddruckers restaurants in locations as set forth in the table below. Our largest six franchisees own five to 12 restaurants each. Fourteen franchise owners each own two to four restaurants. The twenty-one remaining franchise owners each own one restaurant.

Fuddruckers Franchises | ||

Texas: | ||

Dallas/Fort Worth Metro | 8 | |

Other Texas Markets | 10 | |

California | 7 | |

Connecticut | 1 | |

Delaware | 1 | |

Florida | 10 | |

Georgia | 3 | |

Iowa | 1 | |

Louisiana | 3 | |

Maryland | 1 | |

Massachusetts | 4 | |

Michigan | 4 | |

Missouri | 3 | |

Montana | 4 | |

Nebraska | 1 | |

Nevada | 3 | |

New Jersey | 2 | |

New Mexico | 4 | |

North Carolina | 1 | |

North Dakota | 1 | |

Oklahoma | 1 | |

Oregon | 1 | |

Pennsylvania | 5 | |

South Carolina | 8 | |

South Dakota | 1 | |

Tennessee | 2 | |

Virginia | 3 | |

International: | ||

Canada | 2 | |

Colombia | 2 | |

Mexico | 3 | |

Panama | 3 | |

Puerto Rico | 1 | |

Total | 104 | |

In November 1997, a prior owner of the Fuddruckers - World’s Greatest Hamburgers® brand granted to a licensee the exclusive right to use the Fuddruckers proprietary marks, trade dress, and system to develop Fuddruckers restaurants in a territory consisting of certain countries in Africa, the Middle East, and parts of Asia. As of November 7, 2018, this licensee operates 33 restaurants that are licensed to use the Fuddruckers proprietary marks in Saudi Arabia, Egypt, United Arab Emirates, Qatar, Jordan, Bahrain, and Kuwait. The Company does not receive revenue or royalties from these restaurants.

For additional information regarding our restaurant locations, please read “Properties” in Item 2 of Part I of this report.

6

Luby’s, Inc. (formerly, Luby’s Cafeterias, Inc.) was founded in 1947 in San Antonio, Texas. The Company was originally incorporated in Texas in 1959, with nine cafeterias in various locations, under the name Cafeterias, Inc. It became a publicly held corporation in 1973, and became listed on the NYSE in 1982.

Luby’s, Inc. was reincorporated in Delaware on December 31, 1991 and was restructured into a holding company on February 1, 1997, at which time all of the operating assets were transferred to Luby’s Restaurants Limited Partnership, a Texas limited partnership composed of two wholly owned, indirect subsidiaries. On July 9, 2010, Luby’s Restaurants Limited Partnership was converted into LFR. All restaurant operations are conducted by LFR.

On July 26, 2010, we, through our subsidiary, LFR, completed the acquisition of substantially all of the assets of Fuddruckers, Inc., Magic Brands, LLC and certain of their affiliates (collectively, “Fuddruckers”) for approximately $63.1 million in cash. LFR also assumed certain of Fuddruckers’ obligations, real estate leases and contracts. Upon the completion of the acquisition, LFR became the owner and operator of 56 Fuddruckers locations and three Koo Koo Roo Chicken Bistro locations with franchisees operating an additional 130 Fuddruckers locations.

On December 6, 2012, we completed the acquisition of all of the Membership Units of Paradise Restaurant Group, LLC and certain of their affiliates, collectively known as Cheeseburger in Paradise, for approximately $10.3 million in cash plus customary working capital adjustments. We assumed certain of Cheeseburger in Paradise obligations, real estate leases and contracts and became the owners of 23 full service Cheeseburger in Paradise restaurants located in 14 states.

On August 27, 2014, the Company completed an internal restructuring of certain affiliates of the Luby’s Cafeteria business, whereby these companies were merged with and into LFR, as the successor. The principal purpose of these events was to simplify the Luby’s corporate structure. Following these events, the Company’s restaurant operations continue to be conducted by LFR and Paradise Cheeseburger, LLC. Our operating restaurant locations remain unchanged by these events.

Luby’s Cafeteria Operations

At Luby’s Cafeterias, our mission is to serve our guests convenient, great tasting meals in a friendly environment that makes everyone feel welcome and at home. We do things The Luby’s Way, which means we cook in small batches from scratch using real food, real ingredients prepared fresh daily, and our employees and our company get involved and support the fabric of our local communities. We buy local produce as much as possible. We promise to breathe life into the experience of dining out and make every meal meaningful. We were founded in San Antonio, Texas in 1947.

Our cafeteria food delivery model allows customers to select freshly-prepared items from our serving line including entrées, vegetables, salads, desserts, breads and beverages before transporting their selected items on serving trays to a table or booth of their choice in the dining area. Each restaurant offers 15 to 22 entrées, 12 to 14 vegetable dishes, 8 to 10 salads, and 10 to 12 varieties of desserts daily.

Luby’s Cafeteria’s product offerings are home-style made-from-scratch favorites priced to appeal to a broad range of customers, including those customers that focus on fast wholesome choices, quality, variety, and affordability. We have had particular success among families with children, shoppers, travelers, seniors, and business people looking for a quick, freshly prepared meal at a fair price. All of our restaurants sell food-to-go orders which comprise approximately 13% of our Luby's Cafeteria restaurant sales.

Menus are reviewed periodically and new offerings and seasonal food preferences are regularly incorporated. Each restaurant is operated as a separate unit under the control of a general manager who has responsibility for day-to-day operations, including food production and personnel employment and supervision. Restaurants generally have a staff led by a general manager, an associate manager and assistant managers. We grant authority to our restaurant managers to direct the daily operations of their stores and, in turn, we compensate them on the basis of their performance. Each general manager is supervised by an area leader. Each area leader is responsible for approximately 7 to 10 units, depending on the area supervised.

In fiscal 2018, we closed four Luby's Cafeterias. The number of Luby’s Cafeterias was 84 at fiscal year-end 2018.

7

Fuddruckers

At Fuddruckers, our mission is to serve the World’s Greatest Hamburgers® using only 100% fresh, never frozen, all American premium beef, buns baked daily in our kitchens, and the freshest, highest quality ingredients on our “you top it” produce bar. With a focus on excellent food, attentive guest service and an inviting atmosphere, we are committed to making every guest happy, one burger at a time! Fuddruckers restaurants feature casual, welcoming dining areas where Americana-themed décor is featured. Fuddruckers was founded in San Antonio, Texas in 1980.

While Fuddruckers’ signature burgers and fries account for the majority of its restaurant sales, its menu also includes exotic burgers, such as buffalo and elk, chicken breast sandwiches, hot dogs, a variety of salads, chicken tenders, hand breaded onion rings, soft drinks, handmade milkshakes, and bakery items. A variety of over 100 carbonated soft drinks including our own unique Sweet Cherry Cream Soda, which is exclusively offered at Fuddruckers restaurants, along with other varieties such as Powerade®, and flavored waters are offered through Coke Freestyle® self-service dispensers. Additionally, beer and wine are served and, generally, account for less than 2% of restaurant sales. Food-to-go sales comprise approximately 8% of Fuddruckers restaurant sales.

Restaurants generally have one general manager with two or three assistant managers and a number of full-time and part-time associates working in overlapping shifts. Since Fuddruckers generally utilizes a self-service concept, similar to fast casual, it typically does not employ waiters or waitresses. Fuddruckers restaurant operations are currently divided into a total of ten geographic areas, each supervised by an area leader. On average, each area leader supervises five to nine restaurants.

In fiscal 2018, we closed 11 Company-owned Fuddruckers restaurants. The number of Fuddruckers restaurants was 60 at fiscal year-end 2018.

Cheeseburger in Paradise

Cheeseburger in Paradise is known for its inviting beach-party atmosphere, its big, juicy burgers, salads, coastal fare, and other tasty and unique items. Cheeseburger in Paradise is a full-service island-themed restaurant and bar developed in collaboration with legendary entertainer Jimmy Buffet based on one of his most popular songs. The restaurants also feature a unique tropical-themed island bar with many televisions and tasty “boat drinks.” As of our fiscal year-end 2018, we operated two of the original Cheeseburger in Paradise locations.

Culinary Contract Services

Our CCS segment consists of a business line servicing long-term acute care hospitals, acute care medical centers, ambulatory surgical centers, retail grocery stores, behavioral hospitals, sports stadiums, senior living facilities, government, and business and industry clients. The healthcare accounts are full service and typically include in-room delivery, catering, vending, coffee service, and retail dining. Our mission is to re-define the contract food industry by providing tasty and healthy menus with customized solutions for healthcare, senior living, business and industry and higher education facilities. We seek to provide the quality of a restaurant dining experience in an institutional setting. At fiscal year-end 2018, we had contracts with 11 long-term acute care hospitals, seven acute care hospitals, three business and industry clients, three sport stadiums, one governmental facility, one medical office building, one senior living facility, and one freestanding coffee venue located inside an office building. We have the unique ability to deliver quality services that include facility design and procurement as well as nutrition and branded food services to our clients.

Franchising

Fuddruckers offers franchises in markets where it deems expansion to be advantageous to the development of the Fuddruckers concept and system of restaurants. A standard franchise agreement generally has an initial term of 20 years. Franchise agreements typically grant franchisees an exclusive territorial license to operate a single restaurant within a specified area, usually a four-mile radius surrounding the franchised restaurant. Luby’s management will continue developing its relationships with our franchisees over the coming years and beyond.

Franchisees bear all direct costs involved in the development, construction and operation of their restaurants. In exchange for a franchise fee, we provide franchise assistance in the following areas: site selection, prototypical architectural plans, interior and exterior design and layout, training, marketing and sales techniques, assistance by a Fuddruckers “opening team” at the time a franchised restaurant opens, and operations and accounting guidelines set forth in various policies and procedures manuals.

8

All franchisees are required to operate their restaurants in accordance with Fuddruckers standards and specifications, including controls over menu items, food quality and preparation. We require the successful completion of our training program by a minimum of three managers for each franchised restaurant. In addition, franchised restaurants are evaluated regularly for compliance with franchise agreements, including standards and specifications through the use of periodic, unannounced on-site inspections, and standards evaluation reports.

The number of franchised restaurants was 105 at fiscal year-end 2018 and 113 at fiscal year-end 2017.

For additional information regarding our business segments, please read Notes 1 and 4 to the consolidated financial statements included in Part II, Item 8 of this Form 10-K.

Strategic Focus

Our strategic focus is to generate consistent and sustainable same-store sales growth and improved store level profit. We want our company’s performance to make it a leader wherever it operates and in its sector of our industry. We strive to provide attractive returns on shareholder capital. From an operating standpoint, we support this strategic focus through the following:

1. | Consistently successful execution: Every day, with every guest, at every restaurant we operate. |

2. | Growing our human capital: Our team members are the most critical factor in ensuring our Company’s success. Our relentless focus as a company must be inspiring and developing our team members to delight our guests. |

3. | Raising awareness of our brand: Our restaurants provide guests in our local communities with memories of family, friends, childhood, a great date, a memorable birthday, or a significant accomplishment. The most reliable ways to grow and sustain our business is to perpetuate word of mouth and remain involved in the community. We must share our story with our guests in our restaurants. This allows new guests to learn our brand story and also reaffirms it with legacy and loyal guests. Loyal guests spread and preach the word about our brand. Our most loyal guests typically agree to be in our E-club so we can communicate with them and reward them. |

4. | Improving restaurant appearances: We recognize the importance of remodeling our legacy restaurants to remain relevant and appealing to keep loyal guests coming back and draw in new guests. |

5. | Effective cost management: We evaluate each area of our business to assess that we are spending and investing at appropriate levels. This includes restaurant operating costs and corporate overhead costs. Within our restaurants, we seek opportunities with our food and supplies purchasing, menu offerings, labor productivity, and contracts with restaurant service providers to maintain an appropriate restaurant level cost structure. Within our corporate overhead, we seek opportunities to leverage technology and efficient work processes to maintain a stream-lined corporate overhead. |

We remain focused on the key drivers of our businesses to achieve operational excellence of our brands and to efficiently manage costs to grow profitability and enhance shareholder value.

Intellectual Property

Luby’s, Inc. owns or is licensed to use valuable intellectual property including trademarks, service marks, patents, copyrights, trade secrets and other proprietary information, including the Luby’s and Fuddruckers logos, trade names and trademarks, which are of material importance to our business. Depending on the jurisdiction, trademarks, and service marks generally are valid as long as they are used and/or registered. Patents, copyrights, and licenses are of varying durations. The success of our business depends on the continued ability to use existing trademarks, service marks, and other components of our brands in order to increase brand awareness and further develop branded products. We take prudent actions to protect our intellectual property.

Employees

As of November 7, 2018, we had an active workforce of 6,589 employees consisting of restaurant management employees, non-management restaurant employees, CCS management employees, CCS non-management employees, and office and facility service employees. Employee relations are considered to be good. We have never had a strike or work stoppage, and we are not subject to collective bargaining agreements.

9

Item 1A. Risk Factors

An investment in our common stock involves a high degree of risk. Investors should consider carefully the risks and uncertainties described below, and all other information included in this Form 10-K, before deciding whether to invest in our common stock. Additional risks and uncertainties not currently known to us or that we currently deem immaterial may also become important factors that may harm our business, financial condition or results of operations. The occurrence of any of the following risks could harm our business, financial condition, and results of operations. The trading price of our common stock could decline due to any of these risks and uncertainties, and investors may lose part or all of their investment.

Our operating losses and working capital and liquidity deficiency raise substantial doubt about our ability to continue as a going concern.

The Company sustained a net loss of approximately $33.6 million in fiscal 2018. Cash flow from operations has declined to a use of cash of approximately $8.5 million in fiscal 2018. The Company’s continuation as a going concern is dependent on its ability to generate sufficient cash flows from operations to meet its obligations and its ability to obtain alternative financing to refund and repay the current debt owed under it's Credit Agreement. The above conditions raise substantial doubt about the Company’s ability to continue as a going concern.

Our ability to service our debt obligations is primarily dependent upon our future financial performance.

As of August 29, 2018, we had shareholders’ equity of approximately $113 million compared to approximately:

• | $39.5 million of short-term debt comprised of $19.5 million Term Loan and $20.0 million Revolver; |

• | $53.0 million of minimum operating and capital lease commitments; and |

• | $1.3 million of standby letters of credit. |

Our ability to meet our debt service obligations depends on our ability to generate positive cash flows from operations and proceeds from assets held for sale.

If we are unable to service our debt obligations, we may have to:

• | delay spending on maintenance projects and other capital projects, including new restaurant development; |

• | sell assets; |

• | restructure or refinance our debt; or |

• | sell equity securities. |

Our debt, and the covenants contained in the instruments governing our debt, could:

• | result in a reduction of our credit rating, which would make it more difficult for us to obtain additional financing on acceptable terms; |

• | require us to dedicate a substantial portion of our cash flows from operating activities to the repayment of our debt and the interest associated with our debt; |

• | limit our operating flexibility due to financial and other restrictive covenants, including restrictions on capital investments, debt levels, incurring additional debt and creating liens on our properties; |

• | place us at a competitive disadvantage compared with our competitors that have relatively less debt; |

• | expose us to interest rate risk because certain of our borrowings are at variable rates of interest; and |

• | make us more vulnerable to downturns in our business. |

If we are unable to service our debt obligations, we may not be able to sell equity securities, sell additional assets, or restructure or refinance our debt. Our ability to generate sufficient cash flow from operating activities to pay the principal of and interest on our indebtedness is subject to market conditions and other factors which are beyond our control.

Non-performance under the debt covenants in our revolving credit facility could adversely affect our ability to respond to changes in our business.

As of June 6, 2018, the Company was not in compliance with certain of its Credit Agreement financial covenants. The Company’s continuation as a going concern is dependent on its ability to generate sufficient cash flows from operations to meet its obligations and obtain alternative financing to refinance or otherwise repay our current Credit Agreement. While the

10

Company has obtained a Waiver of the default from the lenders under the Credit Agreement until December 31, 2018, announced a limited asset sales plan intended to help reduce the Company’s outstanding debt and engaged a third-party financial adviser to assist with refinancing such outstanding debt, there is no guarantee that we will be able to comply with the terms of the Waiver or with the financial covenants under the Credit Agreement once the Waiver expires. Our failure to comply with the financial covenants under the Credit Agreement once the Waiver has expired or to receive a new waiver from the lenders under the Credit Agreement could result in an event of default, which would have a material adverse effect on our financial condition and could cause us to seek bankruptcy protection, be unable to pay our debts when they become due or otherwise become insolvent because, among other things, our lenders: may declare any outstanding principal and the interest accrued thereon under the Credit Agreement to be due and payable, and we may not have sufficient cash to repay that indebtedness; may foreclose against the assets securing our borrowings; and will be under no obligation to extend further credit to us. For a more detailed discussion of our credit agreement please review the footnotes to our financial statements located in Part II, Item 8 of this Form 10-K.

The impact of inflation may adversely affect our results of operations.

The impact of inflation on food, labor and other aspects of our business can adversely affect our results of operations. Commodity inflation in food, beverages, and utilities can also impact our financial performance. Although we attempt to offset the effects of inflation through periodic menu price increases, cost controls, and incremental improvement in operating margins, we may not be able to completely eliminate such effects, which could adversely affect our results of operations.

We face the risk of adverse publicity and litigation, which could have a material adverse effect on our business and financial performance.

We may from, time to time, be the subject of complaints or litigation from customers alleging illness, injury or other food quality, health or operational concerns. Unfavorable publicity relating to one or more of our restaurants or to the restaurant industry in general may taint public perception of the Luby’s Cafeteria and Fuddruckers brands. Multi-unit restaurant businesses can be adversely affected by publicity resulting from poor food quality, illness, or other health concerns or operating issues stemming from one or a limited number of restaurants. Publicity resulting from these allegations may materially adversely affect our business and financial performance, regardless of whether the allegations are valid or whether we are liable. In addition, we are subject to employee claims alleging injuries, wage and hour violations, discrimination, harassment or wrongful termination. In recent years, a number of restaurant companies have been subject to lawsuits, including class action lawsuits, alleging violations of federal and state law regarding workplace, employment, and similar matters. A number of these lawsuits have resulted in the payment of substantial damages by the defendants. Regardless of whether any claims against us are valid or whether we are ultimately determined to be liable, claims may be expensive to defend, and may divert time and money away from our operations and hurt our financial performance. A judgment significantly in excess of our insurance coverage, if any, for any claims could materially adversely affect our financial condition or results of operations.

We are subject to risks related to the provision of employee healthcare benefits, worker’s compensation and employee injury claims.

Effective January 1, 2018, we maintain a self-insured health benefit plan which provides medical and prescription drug benefits to certain of our employees electing coverage under the plan. Our exposure is limited by individual and aggregate stop-loss limits. We record expenses under the plan based on estimates of the costs of expected claims, administrative costs and stop-loss insurance premiums. Self-insurance costs are accrued based upon the aggregate of the expected liability for reported claims and the estimated liability for claims incurred but not reported, based on information on historical claims experience provided by our third party insurance advisors, adjusted as necessary based upon management’s reasoned judgment. Actual employee medical claims expense may differ from estimated loss provisions based on historical experience. In the event our cost estimates differ from actual costs, we could incur additional unplanned costs, which could adversely impact our financial condition.

Workers’ compensation coverage is provided through “self-insurance” by LFR. We record expenses under the plan based on estimates of the costs of expected claims, administrative costs, stop-loss insurance premiums, and expected trends. These estimates are then adjusted each year to reflect actual costs incurred. Actual costs under these plans are subject to variability that is dependent upon demographics and the actual costs of claims made. In the event our cost estimates differ from actual costs, we could incur additional unplanned costs, which could adversely impact our financial condition.

11

In March 2010, comprehensive healthcare reform legislation under the Patient Protection and Affordable Care Act (the "Affordable Care Act") and Healthcare Education and Affordability Reconciliation Act was passed and signed into law. Among other things, the healthcare reform legislation includes mandated coverage requirements, eliminates pre-existing condition exclusions and annual and lifetime maximum limits, restricts the extent to which policies can be rescinded, and imposes new and significant taxes on health insurers and healthcare benefits. Although requirements were phased in over a period of time, the most impactful provisions began in the third quarter of fiscal 2015.

Due to the breadth and complexity of the healthcare reform legislation, the lack of implementing regulations in some cases, and interpretive guidance, and the phased-in nature of the implementation, it is difficult to predict the overall impact of the healthcare reform legislation on our business and the businesses of our franchisees over the coming years. Possible adverse effects of the healthcare reform legislation include reduced revenues, increased costs and exposure to expanded liability and requirements for us to revise the ways in which we conduct business or risk of loss of business. It is also possible that healthcare plans offered by other companies with which we compete for employees will make us less attractive to our current or potential employees. And in any event, implementing the requirements of the Affordable Care Act has imposed some additional administrative costs on us, and those costs may increase over time. In addition, our results of operations, financial position and cash flows could be materially adversely affected. Our franchisees face the potential of similar adverse effects, and many of them are small business owners who may have significant difficulty absorbing the increased costs.

We face intense competition, and if we are unable to compete effectively or if customer preferences change, our business, financial condition and results of operations may be adversely affected.

The restaurant industry is intensely competitive and is affected by changes in customer tastes and dietary habits and by national, regional and local economic conditions and demographic trends. New menu items, concepts, and trends are constantly emerging. Our Luby’s Cafeteria brand offer a large variety of entrées, side dishes and desserts and our continued success depends, in part, on the popularity of our cuisine and cafeteria-style dining. A change away from this cuisine or dining style could have a material adverse effect on our results of operations. Our Fuddruckers brand offers grilled-to-order burgers that feature always fresh and never frozen, 100% premium-cut beef with no fillers or additives and sesame-topped buns baked from scratch on-site throughout the day. While burgers are the signature, the engaging menu offers variety for many tastes with an array of sandwiches, and salads. Changing customer preferences, tastes and dietary habits can adversely affect our business and financial performance. We compete on quality, variety, value, service, concept, price, and location with well-established national and regional chains, as well as with locally owned and operated restaurants. We face significant competition from family-style restaurants, fast-casual restaurants, and buffets as well as fast food restaurants. In addition, we also face growing competition as a result of the trend toward convergence in grocery, delicatessen, and restaurant services, particularly in the supermarket industry, which offers “convenient meals” in the form of improved entrées and side dishes from the delicatessen section. Many of our competitors have significantly greater financial resources than we do. We also compete with other restaurants and retail establishments for restaurant sites and personnel. We anticipate that intense competition will continue. If we are unable to compete effectively, our business, financial condition, and results of operations may be adversely affected.

Our growth plan may not be successful.

Depending on future economic conditions, we may not be able to open new restaurants in current or future fiscal years. Our ability to open and profitably operate new restaurants is subject to various risks such as the identification and availability of suitable and economically viable locations, the negotiation of acceptable terms for the purchase or lease of new locations, the need to obtain all required governmental permits (including zoning approvals) on a timely basis, the need to comply with other regulatory requirements, the availability of necessary contractors and subcontractors, the availability of construction materials and labor, the ability to meet construction schedules and budgets, the ability to manage union activities such as picketing or hand billing which could delay construction, increases in labor and building materials costs, the availability of financing at acceptable rates and terms, changes in weather or other acts of God that could result in construction delays and adversely affect the results of one or more restaurants for an indeterminate amount of time, our ability to hire and train qualified management personnel and general economic and business conditions. At each potential location, we compete with other restaurants and retail businesses for desirable development sites, construction contractors, management personnel, hourly employees and other resources.

12

If we are unable to successfully manage these risks, we could face increased costs and lower than anticipated revenues and earnings in future periods. We may be evaluating acquisitions or engaging in acquisition negotiations at any given time. We cannot be sure that we will be able to continue to identify acquisition candidates on commercially reasonable terms or at all. If we make additional acquisitions, we also cannot be sure that any benefits anticipated from the acquisition will actually be realized. Likewise, we cannot be sure that we will be able to obtain necessary financing for acquisitions. Such financing could be restricted by the terms of our debt agreements or it could be more expensive than our current debt. The amount of such debt financing for acquisitions could be significant and the terms of such debt instruments could be more restrictive than our current covenants. In addition, a prolonged economic downturn would adversely affect our ability to open new stores or upgrade existing units and we may not be able to maintain the existing number of restaurants in future fiscal years. We may not be able to renew existing leases and various other risks could cause a decline in the number of restaurants in future fiscal years, which could adversely affect our results of operations.

Regional events can adversely affect our financial performance.

Many of our restaurants and franchises are located in Texas, California and in the northern United States. Our results of operations may be adversely affected by economic conditions in Texas, California or the northern United States or the occurrence of an event of terrorism or natural disaster in any of the communities in which we operate. Also, given our geographic concentration, negative publicity relating to our restaurants could have a pronounced adverse effect on our overall revenues. Although we generally maintain property and casualty insurance to protect against property damage caused by casualties and natural disasters, inclement weather, flooding, hurricanes, and other acts of God, these events can adversely impact our sales by discouraging potential customers from going out to eat or by rendering a restaurant or CCS location inoperable for a significant amount of time.

An increase in the minimum wage and regulatory mandates could adversely affect our financial performance.

From time to time, the U.S. Congress and state legislatures have increased and will consider increases in the minimum wage. The restaurant industry is intensely competitive, and if the minimum wage is increased, we may not be able to transfer all of the resulting increases in operating costs to our customers in the form of price increases. In addition, because our business is labor intensive, shortages in the labor pool or other inflationary pressure could increase labor costs that could adversely affect our results of operations.

We may be required to recognize additional impairment charges.

We assess our long-lived assets in accordance with generally accepted accounting principles in the United States (“GAAP”) and determine when they are impaired. Based on market conditions and operating results, we may be required to record additional impairment charges, which would reduce expected earnings for the periods in which they are recorded.

We may be harmed by security risks we face in connection with our electronic processing and transmission of confidential customer and employee information.

We accept electronic payment cards for payment in our restaurants. During fiscal 2018, approximately 73% of our restaurant sales were attributable to credit and debit card transactions, and credit and debit card usage could continue to increase. A number of retailers have experienced actual or potential security breaches in which credit and debit card information may have been stolen, including a number of highly publicized incidents with well-known retailers in recent years. In addition, we have previously been the victim of a cyber attack by hackers who deployed a version of the SamSam ransomware that encrypted electronic files, locking us out of many of our point-of-sale and other systems. These hackers requested a “ransom” payment in exchange for restoring access to these encrypted files. Such attacks, while they did not provide the hackers with access to confidential customer and employee information, did adversely affect our profits due to our temporary inability to operate our restaurants and increased costs associated further protecting and restoring our computer systems. While we have taken preventative measures, no assurances can be provided that we will not be the subject of cyber attacks again in the future.

We may in the future become subject to additional claims for purportedly fraudulent transactions arising out of the actual or alleged theft of credit or debit card information, and we may also be subject to lawsuits or other proceedings in the future relating to these types of incidents. Proceedings related to theft of credit or debit card information may be brought by payment card providers, banks and credit unions that issue cards, cardholders (either individually or as part of a class action lawsuit) and federal and state regulators. Any such proceedings could distract our management from running our business and cause us to incur significant unplanned losses and expenses. Consumer perception of our brand could also be negatively affected by these events, which could further adversely affect our results and prospects.

13

We also are required to collect and maintain personal information about our employees, and we collect information about customers as part of some of our marketing programs as well. The collection and use of such information is regulated at the federal and state levels, and the regulatory environment related to information security and privacy is increasingly demanding. At the same time, we are relying increasingly on cloud computing and other technologies that result in third parties holding significant amounts of customer or employee information on our behalf. If the security and information systems of ours or of outsourced third party providers we use to store or process such information are compromised or if we, or such third parties, otherwise fail to comply with these laws and regulations, we could face litigation and the imposition of penalties that could adversely affect our financial performance. Our reputation as a brand or as an employer could also be adversely affected from these types of security breaches or regulatory violations, which could impair our sales or ability to attract and keep qualified employees.

Labor shortages or increases in labor costs could adversely affect our business and results of operations and the pace of new restaurant openings.

Our success depends in part upon our ability to attract, motivate and retain a sufficient number of qualified employees, including regional managers, restaurant general managers and chefs, in a manner consistent with our standards and expectations. Qualified individuals that we need to fill these positions are in short supply and competition for these employees is intense. If we are unable to recruit and retain sufficient qualified individuals, our operations and reputation could be adversely affected. Additionally, competition for qualified employees could require us to pay higher wages, which could result in higher labor costs. Any increase in labor costs could adversely affect our results of operations.

If we are unable to anticipate and react to changes in food, utility and other costs, our results of operations could be materially adversely affected.

Many of the food and beverage products we purchase are affected by commodity pricing, and as such, are subject to price volatility caused by production problems, shortages, weather or other factors outside of our control. Our profitability depends, in part, on our successfully anticipating and reacting to changes in the prices of commodities. Therefore, we enter into purchase commitments with suppliers when we believe that it is advantageous for us to do so. If commodity prices were to increase, we may be forced to absorb the additional costs rather than transfer these increases to our customers in the form of menu price increases. Our success also depends, in part, on our ability to absorb increases in utility costs. Our operating results are affected by fluctuations in the price of utilities. Our inability to anticipate and respond effectively to an adverse change in any of these factors could have a material adverse effect on our results of operations.

Our business is subject to extensive federal, state and local laws and regulations.

The restaurant industry is subject to extensive federal, state and local laws and regulations. We are also subject to licensing and regulation by state and local authorities relating to health, healthcare, employee medical plans, sanitation, safety and fire standards, building codes and liquor licenses, federal and state laws governing our relationships with employees (including the Fair Labor Standards Act and applicable minimum wage requirements, overtime, unemployment tax rates, family leave, tip credits, working conditions, safety standards, healthcare and citizenship requirements), federal and state laws which prohibit discrimination, potential healthcare benefits legislative mandates, and other laws regulating the design and operation of facilities, such as the Americans With Disabilities Act of 1990.

As a publicly traded corporation, we are subject to various rules and regulations as mandated by the SEC and the NYSE. Failure to timely comply with these rules and regulations could result in penalties and negative publicity.

We are subject to federal regulation and certain state laws which govern the offer and sale of franchises. Many state franchise laws contain provisions that supersede the terms of franchise agreements, including provisions concerning the termination or non-renewal of a franchise. Some state franchise laws require that certain materials be registered before franchises can be offered or sold in that state. The failure to obtain or retain licenses or approvals to sell franchises could adversely affect us and the franchisees.

14

Termination of franchise agreements may disrupt restaurant performance.

Our franchise agreements are subject to termination by us in the event of default by the franchisee after applicable cure periods. Upon the expiration of the initial term of a franchise agreement, the franchisee generally has an option to renew the franchise agreement for an additional term. There is no assurance that franchisees will meet the criteria for renewal or will desire or be able to renew their franchise agreements. If not renewed, a franchise agreement, and payments required there under, will terminate. We may be unable to find a new franchisee to replace a non-renewing franchisee. Furthermore, while we will be entitled to terminate franchise agreements following a default that is not cured within the applicable grace period, if any, the disruption to the performance of the restaurants could adversely affect our business and revenues.

Franchisees may breach the terms of their franchise agreements in a manner that adversely affects the reputation of our brands.

Franchisees are required to conform to specified product quality standards and other requirements pursuant to their franchise agreements in order to protect our brands and to optimize restaurant performance. However, franchisees may receive through the supply chain or produce sub-standard food or beverage products, which may adversely impact the reputation of our brands. Franchisees may also breach the standards set forth in their respective franchise agreements. Any negative actions could have a corresponding material adverse effect on our business and revenues.

Our planned CCS expansion may not be successful.

Successful expansion of our CCS operations depends on our ability to obtain new clients as well as retain and renew our existing client contracts. Our ability to do so generally depends on a variety of factors, including the quality, price and responsiveness of our services, as well as our ability to market these services effectively and differentiate ourselves from our competitors. We may not be able to renew existing client contracts at the same or higher rates or our current clients may turn to competitors, cease operations, or elect to self-operate or terminate contracts with us. The failure to renew a significant number of our existing contracts could have a material adverse effect on our business and results of operations.

Failure to collect account receivables could adversely affect our results of operations.

A portion of our accounts receivable is concentrated in our CCS operations among several customers. In addition, our franchises generate significant accounts receivables. Failure to collect from several of these accounts receivable could adversely affect our results of operations.

If we lose the services of any of our key management personnel, our business could suffer.

The success of our business is highly dependent upon our key management personnel, particularly Christopher J. Pappas, our President and Chief Executive Officer, and Benjamin T. Coutee, our Chief Operating Officer. The loss of the services of any key management personnel could have a material adverse effect upon our business.

Our business is subject to seasonal fluctuations, and, as a result, our results of operations for any given quarter may not be indicative of the results that may be achieved for the full fiscal year.

Our business is subject to seasonal fluctuations. Historically, our highest earnings have occurred in the third quarter of the fiscal year, as our revenues in most of our restaurants have typically been higher during the third quarter of the fiscal year. Similarly, our results of operations for any single quarter will not necessarily be indicative of the results that may be achieved for a full fiscal year.

Economic factors affecting financial institutions could affect our access to capital.

We refinanced our 2013 Credit Facility on November 8, 2016 to a new senior secured credit agreement. The 2016 Credit Agreement, as amended, matures May 1, 2019. We may not be able to amend or renew the new facility with terms and conditions favorable to our operating needs.

15

We may not be able to adequately protect our intellectual property, which could harm the value of our brands and adversely affect our business.

Our ability to successfully implement our business plan depends in part on our ability to further build brand recognition using our trademarks, service marks, trade dress and other proprietary intellectual property, including our name and logos, and the unique ambience of our restaurants. If our efforts to protect our intellectual property are inadequate, or if any third party misappropriates or infringes on our intellectual property, either in print or on the internet, the value of our brands may be harmed, which could have a material adverse effect on our business and might prevent our brands from achieving or maintaining market acceptance. We may also encounter claims from prior users of similar intellectual property in areas where we operate or intend to conduct operations. This could harm our image, brand or competitive position and cause us to incur significant penalties and costs.

Item 1B. Unresolved Staff Comments

None.

Item 2. Properties

As of November 7, 2018, we operated 142 restaurants at 136 property locations. Six of the operating locations are Combo locations and are considered two restaurants. Luby’s Cafeterias have seating capacity for 250 to 300 customers at each location while Fuddruckers locations generally seat 125 to 200 customers and Cheeseburger in Paradise locations generally seat 180 to 220.

We own the underlying land and buildings on which 59 of our Luby’s Cafeteria and 18 of our Fuddruckers restaurants are located. Two of these restaurant properties contain excess building space or an extra building on the property which have 7 tenants unaffiliated with Luby’s, Inc.

In addition to the owned locations, 23 Luby’s Cafeteria restaurants, 41 Fuddruckers restaurants, and 1 Cheeseburger in Paradise restaurants are held under 64 leases. One of the 64 leases includes two restaurants at one Combo location: one Luby's Cafeteria and one Fuddruckers restaurant. The majority of the leases are fixed-dollar rentals, which require us to pay additional amounts related to property taxes, hazard insurance, and maintenance of common areas. Of the 64 restaurant leases, the current terms of thirteen expire in less than one year, 35 expire between one and five years, and 16 expire thereafter. Additionally, 47 leases can be extended beyond their current terms at our option.

As of November 7, 2018, we had four owned non-operating properties with a carrying value of approximately $3.9 million and 11 operating properties with a carrying value of approximately $15.6 million related to continuing operations recorded in property held for sale. In addition, we had one owned property with a carrying value of approximately $1.8 million included in assets related to discontinued operations.

We currently have one owned other-use property which is used as a central bakery supporting our operating restaurants.

We also have four leased locations that have three third party tenants and three Fuddruckers franchisees.

Our corporate office lease of approximately 26,000 square feet of office space runs through December 2021.

We also lease approximately 60,000 square feet of warehouse space for in-house repair, fabrication and storage in Houston, Texas. In addition, we lease approximately 630 square feet of office space in Farmers Branch, Texas and an executive suite in North Andover, MA where we have additional legal personnel.

We maintain general liability insurance and property damage insurance on all properties in amounts which management believes provide adequate coverage.

16

Item 3. Legal Proceedings

From time to time, we are subject to various private lawsuits, administrative proceedings and claims that arise in the ordinary course of our business. A number of these lawsuits, proceedings and claims may exist at any given time. These matters typically involve claims from guests, employees and others related to issues common to the restaurant industry. We currently believe that the final disposition of these types of lawsuits, proceedings, and claims will not have a material adverse effect on our financial position, results of operations, or liquidity. It is possible, however, that our future results of operations for a particular fiscal quarter or fiscal year could be impacted by changes in circumstances relating to lawsuits, proceedings, or claims.

Item 4. Mine Safety Disclosures

Not applicable.

17

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

Stock Prices

Our common stock is traded on the NYSE under the symbol “LUB.” The following table sets forth, for the last two fiscal years, the high and low sales prices on the NYSE as reported in the consolidated transaction reporting system.

Fiscal Quarter Ended | High | Low | ||||

December 21, 2016 | 4.50 | 4.03 | ||||

March 15, 2017 | 4.33 | 3.30 | ||||

June 7, 2017 | 3.41 | 2.46 | ||||

August 30, 2017 | 3.12 | 2.63 | ||||

December 20, 2017 | 2.87 | 2.36 | ||||

March 14, 2018 | 3.20 | 2.60 | ||||

June 6, 2018 | 3.06 | 2.35 | ||||

August 29, 2018 | 2.89 | 2.00 | ||||

As of November 7, 2018, there were 1,975 holders of record of our common stock. On November 7, 2018, the closing price of our common stock on the NYSE was $1.41.

18

Equity Compensation Plans

Securities authorized under our equity compensation plans as of August 29, 2018, were as follows:

(a) | (b) | (c) | ||||||||

Plan Category | Number of Securities to be Issued Upon Exercise of Outstanding Options, Warrants and Rights | Weighted- Average Exercise Price of Outstanding Options, Warrants and Rights | Number of Securities Remaining Available for Future Issuance Under Equity Compensation Plans Excluding Securities Reflected in Column (a) | |||||||

Equity compensation plans previously approved by security holders | 1,066,103 | $ | 4.53 | 1,612,652 | ||||||

Equity compensation plans not previously approved by security holders (1) | 17,801 | 0 | 0 | |||||||

Total | 1,083,904 | $ | 4.47 | 1,612,652 | ||||||

(1) Represents the Luby’s, Inc. Nonemployee Director Phantom Stock Plan.

See Note 16, “Share-Based Compensation,” to our Consolidated Financial Statements included in Item 8 of Part II of this report.

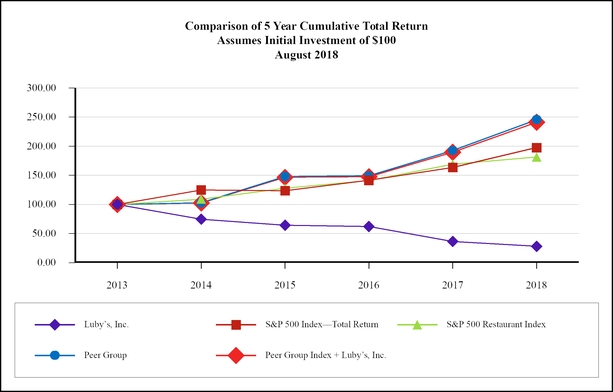

The following graph compares the cumulative total stockholder return on our common stock for the five fiscal years ended August 29, 2018, with the cumulative total return on the S&P SmallCap 600 Index and an industry peer group index. The peer group index consists of Bob Evans Farms, Inc., CBRL Group, Inc., Darden Restaurants, Inc., Denny’s Corporation, Diversified Restaurant Holdings, Inc., and Red Robin Gourmet Burgers. These companies are multi-unit family and casual dining restaurant operators in the mid-price range.

The cumulative total shareholder return computations set forth in the performance graph assume an investment of $100 on August 29, 2013, and the reinvestment of all dividends. The returns of each company in the peer group index have been weighed according to that company’s stock market capitalization.

19

2013 | 2014 | 2015 | 2016 | 2017 | 2018 | |||||||||||||

Luby’s, Inc. | 100.00 | 74.76 | 64.28 | 62.07 | 36.41 | 28.14 | ||||||||||||

S&P 500 Index—Total Return | 100.00 | 124.89 | 123.66 | 141.50 | 163.53 | 197.61 | ||||||||||||

S&P 500 Restaurant Index | 100.00 | 109.12 | 127.67 | 141.05 | 169.16 | 181.31 | ||||||||||||

Peer Group Index Only | 100.00 | 102.87 | 148.01 | 149.08 | 192.47 | 245.57 | ||||||||||||

Peer Group Index + Luby’s, Inc. | 100.00 | 102.39 | 146.51 | 147.52 | 189.49 | 241.33 | ||||||||||||

20

Item 6. Selected Financial Data

FIVE-YEAR SUMMARY OF OPERATIONS

Fiscal Year Ended | ||||||||||||||||||||

August 29, 2018 | August 30, 2017 | August 31, 2016 | August 26, 2015 | August 27, 2014 | ||||||||||||||||

(364 days) | (364 days) | (371 days) | (364 days) | (364 days) | ||||||||||||||||

(In thousands, except per share data) | ||||||||||||||||||||

Sales | ||||||||||||||||||||

Restaurant sales | $ | 332,518 | $ | 350,818 | $ | 378,111 | $ | 370,192 | $ | 369,808 | ||||||||||

Culinary contract services | 25,782 | 17,943 | 16,695 | 16,401 | 18,555 | |||||||||||||||

Franchise revenue | 6,365 | 6,723 | 7,250 | 6,961 | 7,027 | |||||||||||||||

Vending revenue | 531 | 547 | 583 | 531 | 532 | |||||||||||||||

Total sales | 365,196 | 376,031 | 402,639 | 394,085 | 395,922 | |||||||||||||||

Provision for asset impairments and restaurant closings | 8,917 | 10,567 | 1,442 | 636 | 2,717 | |||||||||||||||

Loss from continuing operations | (32,954 | ) | (22,796 | ) | (10,256 | ) | (1,616 | ) | (2,011 | ) | ||||||||||

Loss from discontinued operations | (614 | ) | (466 | ) | (90 | ) | (458 | ) | (1,436 | ) | ||||||||||

Net Loss | $ | (33,568 | ) | $ | (23,262 | ) | $ | (10,346 | ) | $ | (2,074 | ) | $ | (3,447 | ) | |||||

Loss per share from continuing operations: | ||||||||||||||||||||

Basic | $ | (1.10 | ) | $ | (0.77 | ) | $ | (0.35 | ) | $ | (0.05 | ) | $ | (0.06 | ) | |||||

Assuming dilution | $ | (1.10 | ) | $ | (0.77 | ) | $ | (0.35 | ) | $ | (0.05 | ) | $ | (0.06 | ) | |||||

Loss per share from discontinued operation: | ||||||||||||||||||||

Basic | $ | (0.02 | ) | $ | (0.02 | ) | $ | (0.00 | ) | $ | (0.02 | ) | $ | (0.06 | ) | |||||

Assuming dilution | $ | (0.02 | ) | $ | (0.02 | ) | $ | (0.00 | ) | $ | (0.02 | ) | $ | (0.06 | ) | |||||

Loss per share: | ||||||||||||||||||||

Basic | $ | (1.12 | ) | $ | (0.79 | ) | $ | (0.35 | ) | $ | (0.07 | ) | $ | (0.12 | ) | |||||

Assuming dilution | $ | (1.12 | ) | $ | (0.79 | ) | $ | (0.35 | ) | $ | (0.07 | ) | $ | (0.12 | ) | |||||

Weighted-average shares outstanding: | ||||||||||||||||||||

Basic | 29,901 | 29,476 | 29,226 | 28,974 | 28,812 | |||||||||||||||

Assuming dilution | 29,901 | 29,476 | 29,226 | 28,974 | 28,812 | |||||||||||||||

Total assets | $ | 199,989 | $ | 226,457 | $ | 252,225 | $ | 264,258 | $ | 275,435 | ||||||||||

Total debt | $ | 39,506 | $ | 30,985 | $ | 37,000 | $ | 37,500 | $ | 42,000 | ||||||||||

Number of restaurants at fiscal year end | 146 | 167 | 175 | 177 | 174 | |||||||||||||||

Number of franchised restaurants at fiscal year end | 105 | 113 | 113 | 106 | 110 | |||||||||||||||

Number of Culinary Contract Services contracts at fiscal year end | 28 | 25 | 24 | 23 | 25 | |||||||||||||||

Costs and Expenses | ||||||||||||||||||||

(As a percentage of restaurant sales) | ||||||||||||||||||||

Cost of food | 28.3 | % | 28.1 | % | 28.3 | % | 28.9 | % | 28.9 | % | ||||||||||

Payroll and related costs | 37.4 | % | 35.9 | % | 35.2 | % | 34.5 | % | 34.3 | % | ||||||||||

Other operating expenses | 18.7 | % | 17.7 | % | 16.1 | % | 17.1 | % | 16.8 | % | ||||||||||

Occupancy costs | 6.1 | % | 6.2 | % | 5.9 | % | 5.7 | % | 6.0 | % | ||||||||||

21

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

Management’s discussion and analysis of the financial condition and results of operations should be read in conjunction with the consolidated financial statements and footnotes for the fiscal years ended August 29, 2018 (“fiscal 2018”), August 30, 2017, (“fiscal 2017”), and August 31, 2016 (“fiscal 2016”) included in Part II, Item 8 of this Form 10-K.

The table on the following page sets forth selected operating data as a percentage of total revenues (unless otherwise noted) for the periods indicated. All information is derived from the accompanying Consolidated Statements of Operations. Percentages may not add due to rounding.

22

Fiscal Year Ended | |||||||||

August 29, 2018 | August 30, 2017 | August 31, 2016 | |||||||

(52 weeks) | (52 weeks) | (53 weeks) | |||||||

Restaurant sales | 91.1 | % | 93.3 | % | 93.9 | % | |||

Culinary contract services | 7.1 | % | 4.8 | % | 4.1 | % | |||

Franchise revenue | 1.7 | % | 1.8 | % | 1.8 | % | |||

Vending revenue | 0.1 | % | 0.1 | % | 0.1 | % | |||

TOTAL SALES | 100.0 | % | 100.0 | % | 100.0 | % | |||

STORE COSTS AND EXPENSES: | |||||||||

(As a percentage of restaurant sales) | |||||||||

Cost of food | 28.3 | % | 28.1 | % | 28.3 | % | |||

Payroll and related costs | 37.4 | % | 35.9 | % | 35.2 | % | |||

Other operating expenses | 18.7 | % | 17.7 | % | 16.1 | % | |||

Occupancy costs | 6.1 | % | 6.2 | % | 5.9 | % | |||

Vending revenue | (0.2 | )% | (0.2 | )% | (0.2 | )% | |||

Store level profit | 9.5 | % | 12.2 | % | 14.7 | % | |||

COMPANY COSTS AND EXPENSES (as a percentage of total sales) | |||||||||

Opening costs | 0.2 | % | 0.1 | % | 0.2 | % | |||

Depreciation and amortization | 4.8 | % | 5.4 | % | 5.4 | % | |||

Selling, general and administrative expenses | 10.6 | % | 10.1 | % | 10.5 | % | |||

Provision for asset impairments and restaurant closings | 2.7 | % | 3.0 | % | 0.4 | % | |||

Net Gain on disposition of property and equipment | (1.6 | )% | (0.5 | )% | (0.2 | )% | |||

Culinary Contract Services Costs (as a percentage of Culinary contract services sales) | |||||||||

Cost of culinary contract services | 93.7 | % | 87.9 | % | 89.6 | % | |||

Culinary income | 6.3 | % | 12.1 | % | 10.4 | % | |||

Franchise Operations Costs (as a percentage of Franchise revenue) | |||||||||

Cost of franchise operations | 24.0 | % | 25.8 | % | 25.9 | % | |||

Franchise income | 76.0 | % | 74.2 | % | 74.1 | % | |||

(As a percentage of total sales) | |||||||||

LOSS FROM OPERATIONS | (6.1 | )% | (4.6 | )% | (0.8 | )% | |||

Interest income | 0.0 | % | 0.0 | % | 0.0 | % | |||

Interest expense | (0.9 | )% | (0.6 | )% | (0.6 | )% | |||

Other income (expense), net | 0.1 | % | (0.1 | )% | 0.0 | % | |||

Loss before income taxes and discontinued operations | (6.9 | )% | (5.3 | )% | (1.4 | )% | |||

Provision for income taxes | 2.1 | % | 0.6 | % | 1.2 | % | |||

Loss from continuing operations | (9.0 | )% | (5.9 | )% | (2.6 | )% | |||

Loss from discontinued operations, net of income taxes | (0.2 | )% | (0.1 | )% | 0.0 | % | |||

NET LOSS | (9.2 | )% | (6.0 | )% | (2.6 | )% | |||

23

Although store level profit, defined as restaurant sales plus vending revenue less cost of food, payroll and related costs, other operating expenses, and occupancy costs is a non-GAAP measure, we believe its presentation is useful because it explicitly shows the results of our most significant reportable segment. The following table reconciles between store level profit, a non-GAAP measure to loss from continuing operations, a GAAP measure:

Fiscal Year Ended | ||||||||||||

August 29, 2018 | August 30, 2017 | August 31, 2016 | ||||||||||

(52 weeks) | (52 weeks) | (53 weeks) | ||||||||||

(In thousands) | ||||||||||||

Store level profit | $ | 31,648 | $ | 42,943 | $ | 55,419 | ||||||

Plus: | ||||||||||||

Sales from culinary contract services | 25,782 | 17,943 | 16,695 | |||||||||

Sales from franchise operations | 6,365 | 6,723 | 7,250 | |||||||||

Less: | ||||||||||||

Opening costs | 554 | 492 | 787 | |||||||||

Cost of culinary contract services | 24,161 | 15,774 | 14,955 | |||||||||

Cost of franchise operations | 1,528 | 1,733 | 1,877 | |||||||||

Depreciation and amortization | 17,453 | 20,438 | 21,889 | |||||||||

Selling, general and administrative expenses(1) | 38,725 | 37,878 | 42,422 | |||||||||

Provision for asset impairments and restaurant closings | 8,917 | 10,567 | 1,442 | |||||||||

Net Gain on disposition of property and equipment | (5,357 | ) | (1,804 | ) | (684 | ) | ||||||

Interest income | (12 | ) | (8 | ) | (4 | ) | ||||||

Interest expense | 3,348 | 2,443 | 2,247 | |||||||||

Other income (expense), net | (298 | ) | 454 | (186 | ) | |||||||

Provision for income taxes | 7,730 | 2,438 | 4,875 | |||||||||

Loss from continuing operations | $ | (32,954 | ) | $ | (22,796 | ) | $ | (10,256 | ) | |||

(1) Marketing and advertising expense included in Selling, general and administrative expenses was $3.5 million, $5.1 million, and $5.6 million in fiscal 2018, 2017, and 2016, respectively.

The following table shows our restaurant unit count as of August 29, 2018 and August 30, 2017.

Restaurant Counts:

Fiscal 2018 Year Begin | Fiscal 2018 Openings | Fiscal 2018 Closings | Fiscal 2018 Year End | |||||||||

Luby’s Cafeterias(1) | 88 | — | (4 | ) | 84 | |||||||

Fuddruckers Restaurants(1) | 71 | — | (11 | ) | 60 | |||||||

Cheeseburger in Paradise | 8 | — | (6 | ) | 2 | |||||||

Total | 167 | — | (21 | ) | 146 | |||||||

(1) Includes 6 restaurants that are part of Combo locations

24

Overview

Description of the business

We generate revenues primarily by providing quality food to customers at our 84 Luby’s branded restaurants located mostly in Texas, 60 Fuddruckers restaurants located throughout the United States, 2 Cheeseburger in Paradise restaurants located in New Jersey and Nebraska, and 105 Fuddruckers franchises located primarily in the United States. In addition to our restaurant business model, we also provide culinary contract services for organizations that offer on-site food service, such as healthcare facilities, colleges and universities, sports stadiums, businesses and institutions, as well as sales through retail grocery outlets.

Business Strategy

In fiscal 2018, we continued our focus on enhancing the guest experience at each of our restaurant brands, executing our growth plan for our Culinary Contract Services segment, and supporting our Fuddruckers franchise network for future growth. In the latter part of the fiscal year, in light of continued sales weakness at our Fuddruckers brand and further profitability declines at each restaurant brand, it became necessary to address short-term liquidity. Management's short-term action plan included accelerating the closure of underperforming restaurant locations, selling owned property at certain locations, and taking other steps in order to re-finance our debt load and provide financial liquidity. All steps taken in accordance with the short-term action plan are with the aim of re-establishing a solid foundation with a portfolio of restaurants and business segments that can successfully restore future profitability.

At our Company-owned restaurants, we focused on menu innovation and variety across the weeks and the seasons. We furthered our efforts in attracting and retaining the most talented individuals to serve and engage with our guests in both restaurant management roles and front-line hourly restaurant team member roles. We have an experienced culinary team that vigorously pursues culinary innovation enhancements. Our marketing initiatives centered around developing a more personal and direct connection with our guests, deploying technology where it makes most sense. Over the last year, we have transitioned much of our advertising and messaging away from traditional medium such as television advertising toward digital media as we transition to the next phase of our loyalty and recognition programs. We continue to make these investments as part of our long-term strategy to increase our brand awareness and motivate new and more frequent guest visits. As we continued to evaluate our portfolio of restaurant locations, we closed 21 restaurants so that resources could be focused on the locations that exhibit the most promise for enhanced profitability. Over the long term, our strategy is to continue to refine our restaurant protoype design and build new restaurants in markets where we believe we can achieve superior restaurant cash flows.