Attached files

| file | filename |

|---|---|

| EX-32.2 - CERTIFICATION - AIRBORNE WIRELESS NETWORK | abwn_ex322.htm |

| EX-32.1 - CERTIFICATION - AIRBORNE WIRELESS NETWORK | abwn_ex321.htm |

| EX-31.2 - CERTIFICATION - AIRBORNE WIRELESS NETWORK | abwn_ex312.htm |

| EX-31.1 - CERTIFICATION - AIRBORNE WIRELESS NETWORK | abwn_ex311.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

x ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended: August 31, 2018

OR

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ____________ to ____________

Commission file number: 333-179079

| AIRBORNE WIRELESS NETWORK |

| (Exact name of registrant as specified in its charter) |

| NEVADA | 27-4453740 | |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

4115 Guardian Street, Suite C, Simi Valley, California 93063

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: (805) 583-4302

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined by Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15 (d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes x No o

Indicate by check mark if disclosure of delinquent filers in response to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | o | Accelerated filer | x |

| Non-accelerated filer | o | Smaller reporting company | x |

| Emerging Growth Company | o |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant is a shell company (as defined in rule 12b-2 of the Exchange Act). Yes o No x

The aggregate market value of the voting and non-voting stock held by non-affiliates of the Registrant, as of February 28, 2018, the last business day of the Registrant’s most recently second fiscal quarter, was approximately $154,995,770.

The number of shares of the Registrant's $0.001 par value outstanding common stock as of November 8, 2018 was 1,517,216,617.

AIRBORNE WIRELESS NETWORK

ANNUAL REPORT ON FORM 10-K

| Number |

| Page | ||

|

| ||||

|

| ||||

| 5 | ||||

| 15 | ||||

| 29 | ||||

| 29 | ||||

| 29 | ||||

| 30 | ||||

|

| ||||

| 31 | ||||

| 37 | ||||

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | 37 | |||

| 44 | ||||

| 44 | ||||

| CHANGES AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE | 44 | |||

| 44 | ||||

| 45 | ||||

|

| ||||

| 46 | ||||

| 51 | ||||

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS | 56 | |||

| CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE | 57 | |||

| 57 | ||||

| PART IV | ||||

|

| ||||

| 58 | ||||

| 2 |

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This annual report on Form 10-K contains forward-looking statements. All statements other than statements of historical or current facts contained in this annual report, including statements regarding our future results of operations and financial position, business strategy, proposed new products and services, research and development costs, granting of regulatory approvals, timing and likelihood of success, plans and objectives of management for future operations and future results of anticipated products and services, are forward-looking statements. These statements involve known and unknown risks, uncertainties and other important factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements.

In some cases, forward-looking statements can be identified by terms such as “may,” “will,” “should,” “expect,” “plan,” “anticipate,” “could,” “would,” “intend,” “target,” “project,” “contemplate,” “believe,” “estimate,” “predict,” “potential” or “continue” or the negative of these terms or other similar expressions. The forward-looking statements in this annual report are only predictions. We have based these forward-looking statements largely on our current expectations and projections about future events and financial trends that we believe may affect our business, financial condition and results of operations. These forward-looking statements speak only as of the date of this annual report and are subject to a number of risks, and except as required by applicable law, we do not plan to publicly update or revise any forward-looking statements contained herein, whether as a result of any new information, future events, changed circumstances or otherwise.

Because forward-looking statements are inherently subject to risks and uncertainties, some of which cannot be predicted or quantified and some of which are beyond our control, prospective investors should not rely on these forward-looking statements as predictions of future events. The events and circumstances reflected in our forward-looking statements may not be achieved or occur and actual results could differ materially from those projected in, or implied by, the forward-looking statements due to a variety of factors, including, but not limited to:

|

| · | our financial performance, including our history of operating losses; |

|

| · | our ability to obtain additional funding to continue our operations; |

|

| · | our ability to successfully develop, implement and commercialize the Infinitus Super Highway ("Infinitus"); |

|

| · | our ability to enter into agreements with airlines that permit us to install our equipment on their aircraft; |

|

| · | our ability to enter into agreements with potential customers, vendors and purchasers; |

|

| · | changes in the regulatory environments of the United States and other countries in which we intend to operate; |

|

| · | our ability to attract and retain key management and other personnel; |

|

| · | competition from new market entrants and new technologies; |

|

| · | our ability to identify and pursue development of appropriate products; and |

|

| · | risks, uncertainties and assumptions described under the sections in this annual report titled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and elsewhere in this annual report. |

Forward-looking statements are expressly qualified in their entirety by this cautionary statement. The forward-looking statements included in this document are made as of the date of this document and we do not undertake any obligation to update forward-looking statements to reflect new information, subsequent events or otherwise, except as required by law. Moreover, we operate in an evolving environment. New risk factors and uncertainties may emerge from time to time, and it is not possible for management to predict all risk factors and uncertainties. Prospective investors should read this annual report and the documents we have filed as exhibits to the registration statement of which this annual report forms a part with the understanding that our actual future results may be materially different from what we expect.

| 3 |

| Table of Contents |

INDUSTRY DATA

Unless otherwise indicated, information contained in this annual report concerning our industry and the markets in which we plan to operate, including our general expectations and potential market position, market opportunity and market share, is based on information from our own management estimates and research, as well as from industry and general publications and research, surveys and studies conducted by third parties. Management estimates are derived from publicly available information, our knowledge of our industry and assumptions based on such information and knowledge, which we believe to be reasonable. In addition, assumptions and estimates of our and our industry’s future performance are necessarily subject to a high degree of uncertainty and risk due to a variety of factors, including those described in this annual report under the heading “Risk Factors.” These and other factors could cause our future performance to differ materially from our assumptions and estimates. For additional information, see “Cautionary Statement Regarding Forward-Looking Statements.”

| 4 |

| Table of Contents |

Airborne Wireless Network (the “Company,” “we,” “us,” or “our”) was formed as a Nevada corporation on January 5, 2011 under the name “Ample-Tee” to engage in the business of promoting, marketing, selling and distributing hard to find ergonomic products for the physically disabled.

On October 20, 2015, our current President, Treasurer and Secretary, J. Edwards Daniels, acquired control of the Company by purchasing from Lawrence Chenard, our former president, 2,803 shares of our common stock for a purchase price of $250,000 (2,667 of which shares were delivered by Mr. Daniels to the Company for cancellation without consideration in August 2016).

On May 19, 2016, we changed our name to “Airborne Wireless Network” to better align our name with our intention to develop and deliver next generation global connectivity.

On August 3, 2016, we acquired from Apcentive, Inc. (“Apcentive”) all of Apcentive’s right, title and interest in and to U.S. Patent No. 6,285,878 B1, which expired on September 20, 2018 and all related support materials, continuations, amendments, updates and contemplated updates and amendments and the trademark “Infinitus Super Highway.” In exchange for that patent and trademark, we issued to Apcentive a number of shares of our common stock and agreed to pay Apcentive a future royalty equal to 1.5% of the net cash we receive from the promotion, marketing, sale, licensing, distribution and other exploitation of that patent.

On August 24, 2018, we effected a 30,000-to-1 reverse split of our common stock. As a result of the reverse split, every 30,000 pre-split shares of the Company’s common stock outstanding on the effective date of the reverse split were automatically combined into one new share of common stock without any action on the part of the holders, and the number of outstanding shares of common stock was reduced from approximately 8,888,443 to approximately 296,000 (subject to the rounding up of fractional shares). All historical share balances and share price-related data in this annual report have been adjusted based on the 30,000-to-1 reverse split ratio.

Our principal executive office is located at 4115 Guardian Street, Suite C, in Simi Valley, California 93063 and our telephone number is (805) 583-4302. Our fiscal year end is August 31.

Overview

We are an early-stage company with the principal business strategy of developing, marketing and licensing a fully meshed, high-speed broadband airborne wireless network by linking aircraft in flight. We call this network the “Infinitus Super Highway.” To our knowledge, no fully meshed commercial broadband airborne network exists in the world today.

We expect that Infinitus will provide a broadband wireless communication infrastructure by using and customizing existing, small, lightweight, low-power relay station equipment and antennae that will be installed onboard aircraft. Each equipped aircraft would have a broadband wireless communication link to one or more neighboring aircraft and/or ground stations. These aircraft would form a chain of seamless airborne repeaters or routers providing broadband wireless communication gateways along the entire flight path, essentially creating a digital superhighway in the sky. If a link was interrupted, the signal would be redirected to the next participating aircraft or ground station in the chain -- in other words, there would be multiple, simultaneous data connections and thus the system would not rely on a single link.

We intend to act as a wholesale carrier, licensing our bandwidth to, among others, data service providers (such as major telecommunications companies and other Internet service providers) that provide broadband services to end users, to government agencies and to companies that desire a more robust private broadband network. We do not plan to license or sell Infinitus directly to consumers. We anticipate that Infinitus will enable our future customers to minimize their infrastructure development time and costs, and increase the reliability of their broadband communications systems.

If we can successfully complete the development of Infinitus, Infinitus could provide high-speed broadband Internet service to (i) supplement or replace current broadband networks, (ii) serve currently underserved markets, such as maritime, rural and remote locations, (iii) government agencies, including those that provide emergency or disaster relief services, (iv) companies seeking a more secure, reliable private data network, (v) customers onboard aircraft in flight seeking improved Internet access and connectivity and (vi) owners and operators of private jets and small aircraft owners, which in turn, can provide additional aircraft for the Infinitus network. Infinitus could also provide a wireless broadband network that is not vulnerable or susceptible to single points of failure (as is the case with current networks).

| 5 |

| Table of Contents |

Infinitus was originally based principally on a United States patent that we acquired in August 2016. The patent, which expired on September 20, 2018, gave the holder the right to exclude others in the United States, commensurate with the scope of the patent, from creating a fully meshed, high-speed broadband wireless network by linking commercial aircraft in flight. We also filed a patent application in the United States on July 25, 2017 seeking rights to exclude others from using our method of synchronizing free space optic links between aircraft in flight, which technology we believe will be instrumental in making Infinitus operate successfully. Currently, this patent application is undergoing prioritized examination at the U.S. Patent and Trademark Office and we are continuing to prosecute this patent application in order to get the patent granted as soon as possible. On July 25, 2018, we also filed an application seeking rights to exclude others from using this method under the international Patent Cooperation Treaty (“PCT”).

We are currently in the process of completing the development of Infinitus, and have not licensed Infinitus to anyone or generated any revenue from external customers during the last three fiscal years. During the fiscal years ended August 31, 2018 and 2017, we recorded net losses of ($76,683,224) and ($36,912,959), respectively. Our total assets as of August 31, 2018 and 2017 were valued at $1,210,248 and $528,326, respectively.

We have a three-pronged plan to commercialize Infinitus, which is described more fully below.

Current Limitations on the Current Broadband Wireless Network

As the proliferation of mobile devices and tablets has grown, so too has the dependency on such devices, and the need -- or rather demand -- for more bandwidth. Regardless of application; telecommunications, Internet, airborne, maritime or remote, with current technology, we believe that there is not enough available bandwidth to adequately support that growth.

Limited satellite bandwidth, combined with the inherent air-to-ground connectivity challenges of current solutions, underscores the challenges to meet the current and growing demand. Add the significant limitations of current technology, especially when it involves trans-oceanic journeys, we believe that the need for new, comprehensive solutions becomes apparent.

Much of the air traveling public is familiar with traditional airborne services, as many airlines offer “Wi-Fi” services. The integrity of those services depends on a single link, either accessing a cellular tower, or a satellite. This limits customer usage to non-real time services, as such technology suffers from “single points of failure” and there simply is not enough bandwidth for current demands, let alone for the future. Accordingly, service is often interrupted and slow, due to an infrastructure not designed to handle the demand for data traffic. The reason for slow data-rates is that data is “stored and forwarded,” meaning onboard equipment holds the data until the next link is available.

Our Proposed Solution - Infinitus

Infinitus will use aircraft in flight to create a fully meshed broadband airborne wireless network. Each aircraft equipped with Infinitus would have a broadband wireless communication link to one or more neighboring aircraft and/or ground stations. As such, if a link is ever interrupted, the signal would be redirected to the next participating aircraft or ground station in the chain. In other words, multiple, simultaneous data connections would exist at all times and the system would not rely on a single link, as is the case with existing technology.

Because Infinitus would typically be used at mid-level altitudes (20,000 to 40,000 feet), we believe that it will have inherent advantages over satellites. We believe that such altitudes will provide us with the primary advantage of being able to reuse operating spectrum. Nature limits the range of signals based upon the curvature of the earth, allowing the same frequencies to be reused beyond the horizon.

| 6 |

| Table of Contents |

We believe that our ability to assign operating frequencies dynamically and the ease and cost-effective ways in which we will be able to service and/or upgrade our equipment (unlike high altitude solutions), could provide us a steady, leading role in the expanding broadband wireless industry.

When new and more efficient data-transmission technologies emerge, we believe that upgrading Infinitus would be as easy as replacing a single module. Satellite technology, on the other hand, in most cases, has already been surpassed by the time a satellite is launched, due to the typical two-year period between the design of a satellite and its subsequent launch. Additionally, satellites cannot generally be upgraded or serviced once launched.

Development and Testing

We are currently in the development and testing phase of our plan.

In May 2017, we conducted our first airborne test of the system, using two Boeing 767 aircraft and a temporary mobile mast system to emulate a ground station (“Proof of Concept flight test”). The two Boeing 767 aircraft were provided by Jet Midwest Group, LLC under the terms that company’s agreement with the Company. During the Proof of Concept flight test, FAA and electromagnetic field interference tests were completed successfully. The Proof of Concept flight test also successfully demonstrated, on a micro scale, the ability of aircraft equipped with Infinitus to act as airborne repeaters or routers to send and receive broadband signals from one aircraft to another. The tests also successfully demonstrated aircraft-to-ground communication; ground-to-aircraft communication; and aircraft-to-aircraft-to-ground-and-back communication.

We will need to complete the software development and the design and development of the customized hardware to enable Infinitus and implement our business plan. To do so, we will need to achieve the following three milestones:

· First Milestone: Complete a high-bandwidth demonstration utilizing free space optics and radio frequency synchronization.

We intend to complete this demonstration by conducting a two-plane test utilizing two Cessnas (or equivalent planes) (the “Cessna Proof of Test”) installed with Infinitus technology incorporating the free space optics underlying the Company’s patent application filed on July 25, 2017, which seeks the right to exclude others, commensurate with the scope of the patent application, from using our method of synchronizing free space optic links between aircraft in flight and radio frequency synchronization. The intent of the Cessna proof of test is to establish a radio frequency link between the two aircraft to share position information and then establish a free space optical (laser) link for acquisition and optical transmission of data, to measure, among other things, throughput and data packet-loss rates. The test is being designed to prove that “self-synchronizing” and “self-restoring” airborne free space optic links are feasible and practical. Prior to commencing the Cessna Proof of Test, we intend to complete lab and field tests including static and dynamic testing of the hardware at various distances and conditions.

In this regard, we engaged iNTELLICOM Technologies, Ltd. (“Intellicom”) in February 2017 to help us manage the development and coordination of our Radio Frequency (“RF”) and free space optics equipment, ranging from test-equipment/test protocols, to modem selection/modification, RF and antenna gear. Intellicom, with which we entered into a formal contract in December 2017, is presently working with the Company and its primary software and free space optic developers to prepare for the next milestones. Under our contract with Intellicom, Intellicom agreed to provide such skilled communications engineering services to the Company and we agreed to pay for these services in accordance with Intellicom’s stated hourly rates. The term of the agreement expires upon the completion of all services to be provided thereunder by Intellicom, and also may be terminated by either party without cause upon 30 days’ prior written notice. The agreement also contains standard events of default, which, if experienced by one party, permit the other party to terminate upon written notice.

Also, in this regard, we engaged Thinking Different Technologies B.V. (“TDT”) in June 2017 under a Software Development Agreement to help us complete development of the software for Infinitus. TDT is a Netherlands-based software developer and engineering development company that engages in research, development, prototyping and patenting of numerous cutting-edge technologies, including chaos non-linear telecommunication and radio technology, anti-inertia phenomenon and economy of fuel in automotive and aviation industries, among others. Pursuant to the Software Development Agreement, TDT is to develop, deliver, help integrate, support and maintain custom software for use by the Company in connection with the Company’s development of Infinitus. As compensation for these services pursuant to the Development Agreement, the Company has agreed to pay TDT a development fee which shall not exceed $1,000,000. In November 2018, the Company announced that TDT had completed the custom software necessary for ongoing field and lab tests of the Company’s free space optics units and the contemplated Cessna Proof of Test.

| 7 |

| Table of Contents |

We also engaged Mynaric AG, formerly known as ViaLight Communications GmbH (“Mynaric”), in 2017 pursuant to a Design and Manufacturing Services Agreement to work to integrate Mynaric’s innovative free space optic technology into our patent application which seeks the right to exclude others, commensurate with the scope of the patent, from using our method of synchronizing free space optic links between aircraft in flight to be incorporated into Infinitus. Under the Design and Manufacturing Agreement, the Company and Mynaric collaborate in the development of a custom hybrid frequency-free space optic-based communication system product(s) for use in connection with our development of Infinitus. The specific pricing, payment specifications and delivery requirements of each product and equipment delivery are governed by individual purchase orders placed under the agreement. Among other things, in addition to these specific product terms, the Design and Manufacturing Agreement provides for the system of placing and finalizing product orders, engineering change orders, product delivery parameters, reporting, communication, product quality control, respective intellectual property rights of the parties, non-competition/non-solicitation and cancellation rights. The Design and Manufacturing Services Agreement expires after five (5) years from August 2017, with automatic renewals for additional one (1) year periods (on the same terms). Mynaric delivered two hybrid frequency-free space optic-based communication units to the Company during the summer of 2018. The Company and Mynaric are in the process of integrating the Mynaric two hybrid frequency-free space optic-based communication units into the Company’s hardware and software.

We are also collaborating with GE Aviation, one of the GE Business Units, which we believe could accelerate the development of our proprietary hybrid radio and free-optics communications system. Under our arrangement with GE Aviation, GE Aviation will arrange for tactical-grade inertial reference units with embedded GPS that can be utilized for heading, pointing, attitude and stabilization of the Infinitus system to be provided for our Cessna Proof of Test. We believe these units should help assure a successful result.

In addition, following the Cessna Proof of Test, we plan to engage a highly experienced antenna designer to develop and produce the customized airborne antennae that will need to be installed on all aircraft to enable Infinitus. At that time, we also plan to engage an FAA-certified OEM manufacturer to design, develop and produce the storage module, or line replacement unit, that will be used to house the software and which will be installed on the aircraft. The engagement and retention of these designers and manufacturers, which will be FAA-designated “Designated Engineering Representatives” and “Designated Airworthiness Representatives,” is a precondition to us being able to proceed with further planned testing of Infinitus.

In addition, we have engaged legal and other consultants, including two national law firms and a telecommunications consulting firm, to assist us with development and implementation of domestic and international regulatory changes necessary to support Infinitus; the acquisition of spectrum rights for Infinitus and/or its implementation partners; negotiating and obtaining the referred spectrum band(s) for Infinitus to operate effectively, the minimum amount of spectrum required to support Infinitus, the potential for sharing with other co-frequency services; the potential for operations on a secondary versus primary basis; the potential for partners to secure spectrum rights on behalf of the Company; the potential for staged national/regional roll-out versus global implementation; and the potential for national licensing via spectrum auctions.

We expect to achieve this first milestone in the next six to nine months, and believe we will need to expend approximately $500,000-$1,000,000 in additional funds, which funds we do not currently have on hand.

· Second Milestone: Obtain an initial FAA approval for installation on aircraft

We need to achieve and obtain an initial FAA-issued Supplemental Type Certificate approving the design and installation of our equipment on aircraft. We plan on initially obtaining such a certificate for installation on 737-800 aircraft, which would allow Infinitus hardware to be permanently installed on those aircraft. We may also consider other aircraft for the testing. We also need to obtain an FAA-issued Parts Manufacturing Approval that would allow the Company to be the manufacturer of record and produce equipment for installation on multiple 737 aircraft. We would thereafter seek additional Supplemental Type Certificates for other aircraft outside the 737-800 series types as they are added to the network. As part of this effort, we intend to conduct a larger airborne test involving up to 20 commercial aircraft, which will confirm billable function of data transfer. Subject to obtaining needed capital, we expect to achieve this second milestone in the next 12-24 months, and believe it will cost approximately $60 million to achieve.

| 8 |

| Table of Contents |

· Third Milestone: Set up capability to roll out Infinitus

If the 20-aircraft test is successful, which will require the utilization of our equipment at multiple ground stations, then we will have also determined the equipment requirements for future ground stations. This will be tentatively coordinated with partners such as Zayo and other telecommunication companies or similar companies. These types of companies own many of the physical locations that can interface with our proprietary antennae and associated harnesses to interface with their site equipment. We will then need to establish initial quality control functions including quality control manuals and procedures in support of our FAA-issued Parts Manufacturing Approval. This will support the necessary control functions to facilitate the installation of our equipment on aircraft and on the ground. Lastly, the Company will need to establish a secure facility where we will conduct final assembly of our equipment. This space will also house a laboratory and will need to be 2,000 square feet or larger, in accordance with FAA guidelines. We cannot yet predict when we will achieve this third milestone, but believe achieving this third milestone will ultimately cost approximately $350 million.

Creating the Fully Meshed Broadband Wireless Network--Contracting with Commercial Airlines and Traditional Data Transfer Providers

In order to commercialize Infinitus, our equipment will have to be installed on a sufficient number of aircraft so that a fully meshed broadband airborne wireless network will be available 24 hours a day and 7 days a week in the geographic territories we initially intend to cover. In that regard, we plan to enter into agreements with commercial airlines (passenger and cargo) that will allow us to install our equipment on their aircraft. Although we cannot currently predict what the final terms and conditions of the agreements we plan to negotiate and enter into with commercial airlines will be, we believe commercial airlines will be amenable to such agreements because Infinitus will enhance their overall customer service by providing better Internet access and connectivity to their customers onboard aircraft in-flight. We may simultaneously or subsequently enter into agreements with owners and operators of private jets and small aircraft owners, which in turn, can provide additional aircraft for the Infinitus network.

Our initial market will be the continental United States. For the United States, we currently estimate that we will need to have our equipment installed on approximately 2,000 aircraft. These models and network features are being refined during our development phase and will require additional modeling that will, in turn, be verified and ratified through the testing and development phases.

In addition to installing our equipment on commercial aircraft, we also need to establish the ground-based system infrastructure that will allow users to access the network. In that regard, we plan to enter into agreements with traditional data transfer companies, such as fiber-based network solution providers, with which we can partner to support the ground-based system infrastructure required to fully enable Infinitus. We believe that these providers will be amenable to such agreements because they will enjoy significantly increased data traffic and associated revenues, as well as additional trade recognition, as a part of enabling Infinitus.

In this regard, on December 12, 2016, we entered into a Memorandum of Understanding with Electric Lightwave Holdings, Inc., a fiber-based network services provider in the western United States, pursuant to which the parties agreed to explore the possibility of entering into an agreement whereby Electric Lightwave Holdings would support Infinitus with its 12,500 mile fiber optics cable and data center network, including an undersea cable link to the Hawaiian Islands. The agreement contemplated by the Memorandum of Understanding would also provide us access to strategic real estate within the western United States on which we will construct our ground stations. Since our entry into the Memorandum of Understanding, Zayo Group Holdings, Inc. acquired Electric Lightwave Holdings. The Memorandum of Understanding with Electric Lightwave Holdings, Inc. is non-binding and there is no assurance that we will enter into a definitive agreement.

We ultimately intend to also expand into the international and maritime markets. For the international market, we will build upon the relationships we have fostered to date with our strategic partners to gain access to international commercial airlines. We believe that these airlines will also be amenable to entering into agreements allowing us to install our equipment on their aircraft for the same reason that airlines serving the United States would agree to such installation.

| 9 |

| Table of Contents |

For the maritime market, we will seek to contract with shipping and cruise ship companies, as well as operators of water platform oil drilling rigs. They will install our equipment on their ships and drilling rigs, which would serve as signal boosters that amplify and relay any broadband wireless signal when line of sight may be lost between planes and/or ground stations. We believe that such shipping and cruise ship companies and drilling rig operators would be amenable to entering into agreements allowing us to install our equipment on their ships and/or drilling rigs because it will enable cell phone and Internet service on those ships and drilling rigs, while also enabling real-time tracking functionality.

Licensing Infinitus to Customers

Once Infinitus is in place, we intend to act as a wholesaler of broadband wireless bandwidth.

As noted, our intended customers fall into three broad categories:

|

| · | Data service providers, such as larger telecommunications carriers and ISPs (including those that provide in-cabin connectivity, such as GoGo, rural service providers, maritime access providers, and in the future, possibly, drone network access/safety, drone control beyond the horizon, private business jet network access; |

|

| · | Government agencies such as the FAA, the Department of Defense, the Transportation Security Administration or emergency or disaster relief agencies/providers; and |

|

| · | Large private companies seeking to either establish their own private networks, or improve their existing private networks, by utilizing Infinitus. |

Marketing to the aforementioned customers will be on a direct basis, although we anticipate that many of our customers will be derived from introductions and industry relations. Once Infinitus has been established, we expect to be approached by additional service providers as we would be offering solutions which may not be available with current technologies.

Manufacturing, Equipment and Installation

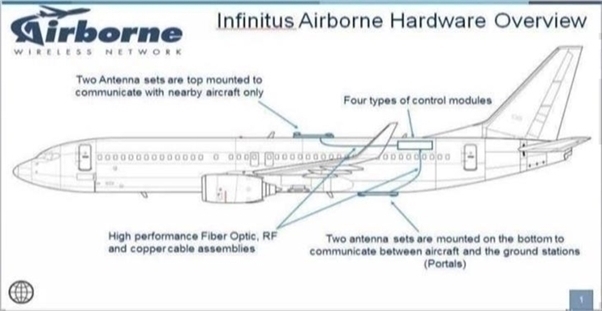

The equipment to be installed on each aircraft includes a radome, customized antennae and several line replaceable units, which will house the Infinitus software.

The airborne portion of the system is made up of radio frequency and free-space optics antennae and control boxes. The control boxes are mounted within the aircraft close to the antennae for efficiency. There are four types of control boxes, all of which are fairly small:

|

| · | the first type controls all data in and out of the aircraft; |

|

| · | the second type processes positional information of all neighboring aircraft; |

|

| · | the third type contains the system’s security features and overall management interfaces and it shares management data with the central (ground-based) control system; and |

|

| · | the fourth type controls the tracking features and dynamic performance of the radio frequency and free space optics antennae. |

The antennae, which are smaller than traditional satellite antennae and are placed in small bubbles, are called radomes. We use optically transparent radomes for the free space optics and opaque radomes for the RF. As described elsewhere in this annual report, this equipment will require FAA certification, both for the near-term types as well as the production roll-out versions. Initially, the Company will use radomes with established STC’s that will be adapted to our system requirements. Two sets are mounted on the bottom to communicate between aircraft and the ground stations (portals), and two sets are top mounted to communicate with nearby aircraft only. The combination of all would provide up to four sets of independent radio frequency and free space optic links between aircraft, creating a global mesh. Each aircraft will have this set of hardware making each aircraft a “node” within the mesh group. Each mesh group will serve a geographic region comprised of multiple mesh groups. The location of where our equipment will be installed on a typical commercial aircraft is depicted below.

| 10 |

| Table of Contents |

We are in the process of finalizing the design of the control boxes and customizing the antennae for use in Infinitus. We currently anticipate that all equipment will be manufactured by third parties pursuant to our STCs and PMA. The completion of the design and initial manufacture of the equipment is a precondition to the conducting of our 20-plane test, which we believe will occur in the next 12-24 months.

For the Proof of Concept flight test that we completed in May 2017, we utilized prototype versions of these components including a ground transceiver, two airborne transceivers and a fixed antenna. The base station on the ground was equipped with an omni-directional antenna.

Although all components will be manufactured by third parties who are experts in their respective fields, such manufacturing would be done on an original equipment manufacturer’s basis, to our specifications. We would be the owner of the design of such components and responsible ultimately for the quality of each component and, except when required by the FAA rules, responsible for compliance with the applicable FAA Parts Manufacturing Authority. See “-Licenses and Regulation.” To ensure that we remain compliant with our Parts Manufacturing Approvals, we will maintain manufacturing oversight; this will include establishing and maintaining a product management facility controlled by us where we will oversee final assembly of the equipment.

We plan to hire a team of employees who will train to become specialists in installing the relevant equipment on aircraft, and who will in turn train employees of one or more third-party service providers with whom we plan to contract. In addition, airlines with which we intend to work may prefer to have their own employees or a third-party service provider of their choice install our equipment directly. We expect to have our team train any such third-party service provider on how to install our equipment correctly.

Competition

We believe that if we are successful, the proprietary nature of Infinitus will enable us to create a unique broadband network which currently is not available in the marketplace.

There are a number of possibly competing systems that rely on launching large numbers of satellites. Potential competitors include, but are not limited to:

|

| · | Inmarsat PLC and its satellites. Inmarsat is a leader in the providing of satellite-based communication services to the maritime industry; |

|

| · | Traditional communications and broadcast satellites. Currently, traditional satellites (despite their many disadvantages and huge environmental impact), are the major solution provider to solving the world’s ever-growing need for communications and connectivity; |

|

| · | Viasat Inc., which offers a satellite-based Internet service; |

|

| · | Facebook, Inc., which is attempting to create a network in the sky utilizing drones with wingspans the size of Boeing 737/757 aircraft; and |

|

| · | Google, Inc., which is attempting to create a network in the sky utilizing drones or balloons. |

| 11 |

| Table of Contents |

To our knowledge, the closest approach to Infinitus is Facebook’s proposed use of drones to provide network coverage. This approach resembles Infinitus, with two major differences. First, we believe that the use of large, unmanned drones (with wingspans the size of a Boeing 737/757 aircraft) flying overhead, solely depending on solar power, may not to be the safest method for providing this service. Second, we began developing Infinitus with a U.S. patent that protected Infinitus from competitors seeking to utilize our technology, although this patent expired on September 20, 2018. However, we also filed an additional patent application on July 25, 2017 seeking the right to exclude others, commensurate with the scope of the patent application, from using our method of synchronizing free space optic links between aircraft in flight, which we believe, if obtained, will be instrumental in making Infinitus operate successfully. Currently, this patent application is undergoing prioritized examination at the U.S. Patent and Trademark Office and we are continuing to prosecute this patent application in order to get the patent granted as soon as possible. We do not believe that our competitors own similar patents nor do they have a license to use the technology covered by our patent application.

Research and Development

Research and development expenses were $1,902,452 and $1,086,599 for the fiscal years ended August 31, 2018 and 2017, respectively. Most of these funds have been spent on the development and testing of Infinitus. We expect to continue to spend substantial amounts of our available cash on the development and testing of Infinitus in the near future.

Employees

As of October 31, 2018, we had eight full-time employees and nine total employees. Additionally, we utilize the services of consultants to assist with the development of our business. We consider our relationship with our employees to be good.

We anticipate that human resource planning will be a part of an ongoing process that will include regular evaluation of our operations. We intend to hire additional employees at such time as we determine it is appropriate.

Licenses and Regulation

Federal Aviation Administration

The FAA prescribes standards and certification requirements for the manufacturing of aircraft and aircraft components, and certifies and rates repair stations to perform aircraft maintenance, and preventive maintenance and alterations, including the installation and maintenance of aircraft components. Each type of aircraft operated in the United States pursuant to an FAA-issued standard airworthiness certificate must possess an FAA Type Certificate, which constitutes approval of the design of the aircraft type based on applicable airworthiness standards. When a party other than the holder of the FAA Type Certificate develops a major modification to an aircraft already type-certificated, that party must obtain an FAA-issued STC approving the design of the modified aircraft type. As our equipment would constitute a major modification, we will need to obtain an STC for each aircraft type operated by each airline on whose aircraft our equipment will be installed. Separate STCs typically are required for different configurations of the same aircraft type, such as when they are configured differently for different airlines.

After obtaining an STC, a manufacturer desiring to manufacture components to be used in the modification covered by the STC must apply to the FAA for a PMA which permits the holder to manufacture and sell components manufactured in conformity with the PMA and its approved design and data package. In general, each initial PMA is an approval of a manufacturing or modification facility’s production quality control system. PMA supplements are obtained to authorize the manufacture of a particular part in accordance with the requirements of the pertinent FAA regulations which are included in its production quality control system. We plan to routinely apply for such PMAs and supplements. We plan to utilize qualified and approved suppliers. We also plan to be the sole owner of the design, and be responsible for the quality, of each component in accordance with the applicable PMA.

| 12 |

| Table of Contents |

Our business will depend on our continuing access to, or use of, applicable FAA certifications, authorizations and other approvals, and our employment of, or access to, FAA-certified individual engineering and other professionals. In this regard, on October 18, 2016, we entered into a Consulting Agreement with Aero Certification and Engineering LLC (“Aero”), pursuant to which we engaged Aero to support us in our development of data and analysis to support FAA Civil Certification of Infinitus.

In accordance with these certifications, authorizations and other approvals, the FAA will require that we maintain, review and document our quality assurance processes. The FAA may also visit our facilities at any time as part of our agreement for certification as a manufacturing facility to ensure that our facilities, procedures and quality control systems meet the requirements for the FAA approvals we hold. In addition, we will be responsible for informing the FAA of significant changes to our organization and operations, product failures or defects, and any changes to our operational facilities or FAA-approved quality control systems. Other FAA requirements include training procedures and drug and alcohol screening for safety-sensitive employees working at our facilities.

Foreign Aviation Regulation

According to our understanding of international aviation convention, we believe that the airworthiness of FAA-certified Infinitus equipment installed on U.S.-registered aircraft should be recognized by civil aviation authorities (“CAAs”) worldwide. As a result, we do not expect to require further airworthiness certification formalities in countries outside of the United States for U.S.-registered aircraft that already have an STC issued by the FAA covering Infinitus equipment. For aircraft registered with a CAA other than the United States, the installation of Infinitus equipment would require airworthiness certification from an airworthiness certification body. Typically, the CAA of the country in which the aircraft is registered is responsible for ensuring the airworthiness of any aircraft modifications under its authority.

The FAA holds bilateral agreements with a number of certification authorities around the globe. Bilateral agreements facilitate the reciprocal airworthiness certification of civil aeronautical products that are imported/exported between two signatory countries. A Bilateral Airworthiness Agreement (“BAA”) or Bilateral Aviation Safety Agreement (“BASA”) with Implementation Procedures for Airworthiness (“IPA”) provides for airworthiness technical cooperation between the FAA and its counterpart civil aviation authorities. Pursuant to a BAA or BASA, the CAA of the aircraft’s country of registration generally validates STCs issued by the FAA and then issues a Validation Supplemental Type Certificate. For countries with which the FAA does not have a BAA or BASA, we must apply for certification approval with the CAA of the country in which the aircraft is registered. In order to obtain the necessary certification approval, Infinitus would be required to comply with the airworthiness regulations of the country in which the aircraft is registered. Failure to comply with all foreign airworthiness and aviation regulatory requirements at the commencement of each airline partner’s service in any country in which such partner registers aircraft when there are no applicable bilateral agreements could lead to significant additional costs related to certification and could impact the timing of our ability to provide our service on our airline partners’ fleets.

Federal Communications Commission

The FCC is responsible for managing and licensing the electromagnetic spectrum for broadband wireless communications in the United States. Currently, only the 849-851 MHz and 894-896 MHz bands have been designated by the FCC for exclusive nationwide licenses to provide radio telecommunications services to persons on aircraft. The FCC has pending before it a rulemaking proceeding proposing to authorize the use of spectrum in the 14.0-14.5 GHz bands for an air-to-ground mobile broadband service on a secondary basis, but has not yet allocated this spectrum for commercial air-to- ground services. Given its business goals and the limited amount of spectrum presently expressly allocated for commercial mobile aeronautical service by the FCC, Infinitus is presently evaluating the appropriate spectrum to provide its services in the continental United States. If the spectrum we identify as appropriate for Infinitus has not been expressly allocated for commercial aeronautical mobile service by the FCC, we will need to petition the FCC to initiate a rulemaking proceeding to designate such spectrum for commercial mobile aeronautical mobile service, and to adopt service rules for use of such spectrum. There can be no assurances if or when the FCC will initiate such a rulemaking proceeding in response to a request by us, or that the outcome any such rulemaking proceeding will be favorable to Infinitus. Even if the FCC allocates the spectrum required for Infinitus, it will be necessary to obtain the FCC Licenses to use a portion of this spectrum for Infinitus. We cannot provide any assurances if and when we will receive such spectrum allocation and/or the FCC Licenses necessary to operate Infinitus on a permanent basis.

| 13 |

| Table of Contents |

We have obtained experimental special temporary authority from the FCC to begin tests of portions of our proposed air-to-air and air-to-ground meshed network system. See “Licenses and Regulation - Regulatory Status.” We may need to obtain additional experimental authorizations and licenses from the FCC to test and develop Infinitus. We anticipate that we will receive such experimental authorizations in the ordinary course, but there can be no assurances that this will be the case. If and when the FCC grants us any required experimental authorizations and other FCC Licenses necessary to operate Infinitus, any breach of the terms of the FCC Licenses us from time to time, or any violation of the Communications Act the FCC’s rules and policies, could result in the revocation, suspension, cancellation, modification or reduction in the term of a license or the imposition of monetary fines. From time to time, the FCC may monitor or audit our compliance with the Communications Act and the FCC’s rules and policies or with the terms or conditions of our FCC Licenses, including in response to a complaint filed by a third party alleging our noncompliance or violation of the Communications Act and the FCC’s rules and policies or with the terms or conditions of our FCC Licenses. In addition, the Communications Act, from which the FCC obtains its authority, or the FCC’s rules and policies, may be amended in the future in a manner that could be adverse to us. The FCC from time to time may initiate a rulemaking proceeding to allocate spectrum for or change its rules and policies governing the aeronautical services proposed by us. It is not possible to predict what changes the FCC may propose or, if adopted, the likely impact of any such changes on our proposed aeronautical service and business.

Regulatory Status

The FAA has issued us a project number, ST16664LA-T, for our initial STC application. Upon approval of our STC application, we will be certified to install our broadband and transceiver system on Boeing 757-200 aircraft. We intend to seek certification for most of the world’s common commercial aircraft types, including the Boeing 737 and Airbus A320/21 series aircraft. Similar certificates would need to be approved for each additional aircraft type. We completed our Proof of Concept flight test on two Boeing 767-300ER aircraft and a temporary mobile mast station that emulated a ground station. This test was successfully completed on May 31, 2017 under a FAA-approved experimental operating certificate and a FCC experimental special temporary authorization number 0378-EX-ST-2017X. Prior to our Proof of Concept flight test, we successfully completed ground demonstrations on two static 757-200 aircraft. We anticipate that this testing will ultimately result in our obtaining a STC, though we do not currently hold one and there can be no assurance that we will be granted one in a timely manner, or at all.

In addition to the STCs, we will need a PMA from the FAA to become an approved manufacturer of our system. All of our outside vendors in our component supply chain will also need to obtain a PMA.

Additionally, we are seeking approval from the FAA for certification on a non-interference basis of Infinitus regarding onboard critical aircraft operating components. We are initially seeking a STC approval on a non-interfering basis and thus we anticipate the FAA issuing this certification; however, there can be no assurance that we are issued this certification in a timely manner, or at all.

In March 2017, we filed with the FCC an application for an experimental special temporary authorization, file number 0378-EX-ST-2017X, to begin air-to-air and air-to-ground meshed network system evaluations. That license was granted in May 2017 and allowed us to complete the Proof of Concept flight test. This certificate has since expired. We are in ongoing discussions with the FCC to obtain final FCC approvals. For additional information regarding FCC licenses and authorizations, see “Risk Factors - Regulation by United States and foreign government agencies, including the FAA, which regulates the civil aviation manufacturing and repair industries in the United States, and the FCC, which is responsible for issuing spectrum licenses in the United States, requires us to obtain certain certifications, and any changes in relevant regulatory schemes may increase our costs of providing Infinitus or require us to change or discontinue Infinitus.”

Patents, Proprietary Rights and Know-How

Our intellectual property consists of (i) a patent application in the United States on July 25, 2017 seeking to exclude others, commensurate with the scope of the patent application, from using our method of synchronizing free space optic links between aircraft in flight, and (ii) an application for the servicemark “Infinitus Super Highway,” which is pending at the U.S. Patent & Trademark Office (U.S. Serial No. 87670983). Currently, the patent application is undergoing prioritized examination at the U.S. Patent and Trademark Office and we are continuing to prosecute this patent application in order to get the patent granted as soon as possible. On July 25, 2018, we also filed an application seeking rights to exclude others from using this method under the international PCT. U.S. patent No. 6,285,878 B1, which we acquired in 2016 but expired on September 20, 2018, previously gave us the right to exclude others in the United States, commensurate with the scope of the patent, from creating a high-speed broadband wireless network by linking commercial aircraft in flight. For more information regarding our intellectual property, please see the IP-related risks in the section titled “Risk Factors” in this annual report.

| 14 |

| Table of Contents |

Geographic Information

We have not generated any revenue from any customers since our inception. The following tables list revenue and property and equipment, net by geographic area:

|

|

| As of August 31, |

| |||||

|

|

| 2018 |

|

| 2017 |

| ||

| Property and equipment, net: |

|

|

|

|

|

| ||

| United States |

| $ | 34,610 |

|

| $ | 25,348 |

|

| Rest of the world |

|

| - |

|

|

| - |

|

| Total property and equipment, net |

| $ | 34,610 |

|

| $ | 25,348 |

|

Securities Exchange Act Reports

Our Internet address is www.airbornewirelessnetwork.com (this uniform resource locator, or URL, is an inactive textual reference only and is not intended to incorporate the Company’s website into this annual report). We make available free of charge on our Internet website our annual reports on Form 10-K, our quarterly reports on Form 10-Q, our current reports on Form 8-K and any amendments to those reports filed or furnished under Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) as soon as reasonably practicable after we file such material with, or furnish it to, the Securities and Exchange Commission (the “SEC”). The SEC maintains an internet site that contains reports, proxy and information statements and other information regarding issuers that file electronically at www.sec.gov.

The following discussion of risk factors contains forward-looking statements. These risk factors may be important to understanding other statements in this Form 10-K. The following information should be read in conjunction with Part II, Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the consolidated financial statements and related notes in Part II, Item 8, “Financial Statements and Supplementary Data” of this Form 10-K.

The business, financial condition and operating results of the Company can be affected by a number of factors, whether currently known or unknown, including but not limited to those described below, any one or more of which could, directly or indirectly, cause the Company’s actual financial condition and operating results to vary materially from past, or from anticipated future, financial condition and operating results.

Because of the following factors, as well as other factors affecting the Company’s financial condition and operating results, past financial performance should not be considered to be a reliable indicator of future performance, and investors should not use historical trends to anticipate results or trends in future periods.

Risks Related to Our Business and Industry

We may be unsuccessful in completing the development of Infinitus.

As Infinitus is currently in the development and testing phase and has yet to be deployed for commercial use, we cannot assure you that we will be able to complete the development of Infinitus so that it performs as expected or that we will complete development on our projected timeline. We have conducted only one airborne test of the system with two aircraft and a temporary mobile mast system to emulate a ground station and certain of the actual, customized equipment that will be used in the commercialized version of Infinitus was not used during this test.

| 15 |

| Table of Contents |

We need to engage third-party vendors to complete development of the software and hardware necessary to operate the airborne mesh network, and to design, develop and manufacture the customized equipment to be installed on the aircraft. Once the design and development of the software and hardware is substantially complete, we will then conduct a larger airborne test of Infinitus, using up to 20 commercial aircraft. There is no guarantee that this larger airborne test will be successful.

The software necessary to enable Infinitus will be complex and could contain material defects or errors, due either to our third party vendors failing to adequately develop the software according to our specifications or simply due to the inherent complexity of the software itself. In particular, such defects or errors may occur when the software is first introduced or when new versions or enhancements are released. Defects or errors that initially go undetected could also occur in the future.

In addition, the hardware required to enable Infinitus is expected to consist of complex systems and components and could contain errors or defects, due either to our third party vendors failing to adequately manufacture the equipment according to our specifications or due to inherent, unforeseen defects in design.

If we cannot complete development of Infinitus, we will have no business. Further, significant delays in completing Infinitus will require us to raise more funds to sustain operations and there is no assurance that we can raise such funds on favorable terms, or at all.

Our business will depend on entering into agreements with airlines that permit us to install our equipment on their aircraft.

Our ability to generate revenue will depend on our ability to have our equipment installed on aircraft in order to create the Infinitus mesh network. A mesh network is a network topology in which each node relays data for the network. All mesh nodes cooperate in the distribution of data in the network. In order to create a mesh network over the continental United States that operates 24 hours a day and 7 days a week, we believe that we will need to have our equipment installed on at least 2,000 aircraft that fly in the continental United States. To expand outside the continental United States, we will need to have our equipment installed on a significantly greater number of aircraft. If we are unable to create the mesh network, we may not be successful in commercializing Infinitus. As an early-stage company with a new product, we anticipate that we may have difficulty getting access to the major airlines to negotiate the installation of our equipment on their aircraft. No assurance can be given that we will be successful in persuading airlines to install our equipment.

As of the date of this annual report, we have no agreements permitting us to install our equipment on any aircraft. In addition, even if an airline permits us to install our equipment on its aircraft, the airline may not renew the contract upon expiration, or may terminate the contract prior to expiration upon the occurrence of certain contractually stipulated events such as material breach of contract or the failure to achieve certain certification, equipment delivery, installation or other milestones within agreed-upon time frames. These contracts might also permit termination prior to the expiration date upon the payment of a termination fee.

Our business will depend upon the entering into of agreements with customers to use Infinitus.

User fees from our customers from the use of Infinitus will provide all or substantially all of our revenues. As of the date of this annual report, we have no agreements with customers. We can give no assurance that our potential customers, including data service providers that provide broadband service to end users, government agencies or entities with private data networks, will license Infinitus or will agree to pay the license fees we will request. The failure to enter into those agreements or realize the anticipated benefits from these agreements on a timely basis, or at all, or to renew any agreements upon expiration or termination would have a material adverse effect on our financial condition and results of operations.

We will need significant additional financing to commercialize Infinitus and we may not be able to obtain such financing on acceptable terms or at all.

To date, we have relied primarily on private and public sales of our common stock, preferred stock and warrants and convertible securities to fund our operations. We will require additional financing in the near and long term to fully execute our business plan, including the completion of our proposed airborne test of the system involving 20 commercial aircraft as well as to cover our operational costs while we obtain all relevant certifications, negotiate relevant agreements and otherwise fully develop and commercialize Infinitus. We estimate that to fully complete development of Infinitus and commence commercialization we will require over $400 million of additional financing, assuming we can progress on our current timetable. Any material delays would result in us requiring additional financing.

| 16 |

| Table of Contents |

In addition, we are currently exploring various options with respect to developing and implementing Infinitus and may actively consider from time to time other significant technological, strategic and operational initiatives. In order to execute on any of these initiatives, we may require additional financing. Our success will depend on our ability to raise such additional financing on reasonable terms and on a timely basis.

The market conditions and the macroeconomic conditions that affect the markets in which we operate could have a material adverse effect on our ability to secure financing on acceptable terms, if at all. We may be unable to secure additional financing on favorable terms, or at all, or our operating cash flow may be insufficient to satisfy our financial obligations. The terms of additional financing may limit our financial and operating flexibility. Our ability to satisfy our financial obligations will depend upon our future operating performance, the availability of credit generally, economic conditions and financial, business and other factors, many of which are beyond our control. Furthermore, if financing is not available when needed, or is not available on acceptable terms, we may be unable to take advantage of business opportunities or respond to regulatory pressures, any of which could have a material adverse effect on our business, financial condition and results of operations.

We have from time to time evaluated, and we continue to evaluate, our potential capital needs. We may utilize one or more types of capital raising in order to fund any initiative in this regard, including the issuance of new equity securities and new debt securities, including debt securities convertible into shares of our common stock. If we raise additional funds through further issuances of equity, convertible debt securities or other securities convertible into shares of our common stock, our existing stockholders could suffer significant dilution in their percentage ownership of our company. As a consequence, in order to prevent the trading price of our common stock from falling precipitously, we may effect one or more additional reverse splits of our common stock. In addition, any new securities we issue could have rights, preferences and privileges senior to those of holders of our common stock, and we may grant holders of such securities rights with respect to the governance and operations of our business. If we are unable to obtain adequate financing or financing on terms satisfactory to us, if and when we require it, our ability to grow or support our business and to respond to business challenges could be significantly limited.

We have incurred operating losses since our inception. We expect to incur operating losses for the foreseeable future and may never achieve or maintain profitability.

We have incurred significant losses since inception and expect to continue to incur losses for the foreseeable future. We incurred net losses of $76,683,224 and $36,912,959, resulting in a total accumulated deficit of $113,812,053 and $37,128,829, during the fiscal years ended August 31, 2018 and 2017, respectively. We have devoted substantially all of our financial resources and efforts toward developing Infinitus. Our net losses may fluctuate significantly from quarter to quarter and from year to year. We anticipate that our expenses will increase as we continue to develop Infinitus. We must succeed in developing and commercializing Infinitus and generate significant revenue to become and remain profitable. There can be no assurance that we complete the development and commercialization of Infinitus, and therefore, we may never generate revenues that are significant enough to achieve profitability.

Our customers and the prospective airlines with which we intend to work are large entities, and it may take a long time and significant effort and expense to negotiate contracts with them, which could require us to raise additional capital to sustain operations until we generate positive cash flow from operations.

The companies with which we will need to negotiate agreements, including telecommunications carriers, ISPs and commercial airlines, are primarily large entities. Negotiations with these large companies are expected to require substantial time, effort and resources. The time required to reach a final agreement with an airline or other large company is unpredictable. The longer it takes to enter into a sufficient number of these contracts to generate positive cash flow, the more financing we will require, and we can give no assurance that we will be able to obtain such financing.

Regulation by United States and foreign government agencies, including the FAA, which regulates the civil aviation manufacturing and repair industries in the United States, and the Federal Communications Commission (the “FCC”), which is responsible for issuing spectrum licenses in the United States, requires us to obtain certain certifications, and any changes in relevant regulatory schemes may increase our costs of providing Infinitus or require us to change or discontinue Infinitus.

| 17 |

| Table of Contents |

We are subject to various regulations, including those regulations promulgated by various federal, state and local regulatory agencies and legislative bodies and comparable agencies outside the United States where we may desire to offer Infinitus. The two U.S. government agencies that will have primary regulatory authority over our operations are the FAA and the FCC.

The commercial and private aviation industries, including civil aviation manufacturing and repair industries, are highly regulated in the United States by the FAA. FAA certification is required for all equipment installed on commercial aircraft and type-certificated business aircraft, and certain of our operating activities will require that we obtain FAA certification as a parts manufacturer. FAA approvals required to operate our business include Supplemental Type Certificates (“STCs”) and Parts Manufacturing Approvals (“PMAs”). Obtaining STCs and PMAs is an expensive and time-consuming process that requires significant focus and resources. Any inability to obtain, delay in obtaining or change in, needed FAA certifications, authorizations or approvals, could have an adverse effect on our ability to meet our installation commitments, manufacture and sell parts for installation on aircraft or expand our business and could, therefore, materially adversely affect our growth prospects, business and operating results. We expect that the FAA will closely regulate many of our operations. If we fail to comply with the FAA’s many regulations and standards that apply to our activities, we could lose the FAA certifications, authorizations or other approvals on which our manufacturing, installation, maintenance, preventive maintenance and alteration capabilities are based. In addition, from time to time, the FAA or comparable foreign agencies adopt new regulations or amend existing regulations. The FAA could also change its policies regarding the delegation of inspection and certification responsibilities to private companies, which could adversely affect our business. To the extent that any such new regulations or amendments to existing regulations or policies apply to our activities, those new regulations or amendments to existing regulations could generally increase our costs of compliance.

The FCC is responsible for managing and licensing the electromagnetic spectrum for broadband wireless communications in the United States. Currently, the 849-851 MHz and 894-896 MHz bands have been designated by the FCC for exclusive nationwide licenses to provide radio telecommunications services to persons on aircraft (the “800 MHz ATG Band”). In addition to the 800 MHz ATG Band, the FCC has allocated certain spectrum for satellite-based services to aircraft, including L-band mobile satellite spectrum and spectrum in the 10.95-11.2 GHz, 11.45-11.7 GHz, 11.7-12.2 GHz, and 14.0-14.5 GHz bands for communications between fixed satellite service geostationary-orbit satellites and earth stations on aircraft. The FCC also has pending before it a rulemaking proceeding proposing to authorize the use of spectrum in the 14.0-14.5 GHz bands for an air-ground mobile broadband service on a secondary basis, but has not yet allocated this spectrum for commercial air-to- ground services. Given its business goals and the limited amount of spectrum presently expressly allocated for commercial mobile aeronautical service by the FCC, we are presently evaluating the appropriate spectrum to provide our Infinitus services in the continental United States. If the spectrum we identify as appropriate for Infinitus has not been expressly allocated for commercial mobile aeronautical service by the FCC, we will need to petition the FCC to initiate a rulemaking proceeding to designate such spectrum for commercial mobile aeronautical service, and to adopt service rules for use of such spectrum. There can be no assurances if or when the FCC will initiate such a rulemaking proceeding in response to a request by us, or that the outcome of any such rulemaking proceeding will be favorable to Infinitus. Even if the FCC allocates the spectrum required for Infinitus, it will be necessary to obtain certain license(s) and other authorizations (collectively, “FCC Licenses”) to use a portion of this spectrum for Infinitus. We cannot provide any assurances if and when we will receive such spectrum allocation and/or the FCC Licenses necessary to operate Infinitus on a permanent basis.

We have obtained experimental special temporary authority from the FCC to begin tests of portions of our proposed air-to-air and air-to-ground meshed network system. See “Licenses and Regulation - Regulatory Status.” We may need to obtain additional experimental authorizations and licenses from the FCC to test and develop Infinitus. We anticipate that we will receive such experimental authorizations in the ordinary course, but there can be no assurances that this will be the case. If and when the FCC grants us any required experimental authorizations and other FCC Licenses necessary to operate Infinitus, any breach of the terms of the FCC Licenses us from time to time, or any violation of the Communications Act of 1934, as amended (the “Communications Act”) or the FCC’s rules and policies, could result in the revocation, suspension, cancellation, modification or reduction in the term of a license or the imposition of monetary fines. From time to time, the FCC may monitor or audit our compliance with the Communications Act and the FCC’s rules and policies or with the terms or conditions of our FCC Licenses, including in response to a complaint filed by a third party alleging our noncompliance or violation of the Communications Act and the FCC’s rules and policies or with the terms or conditions of our FCC Licenses. In addition, the Communications Act, from which the FCC obtains its authority, or the FCC’s rules and policies, may be amended in the future in a manner that could be adverse to us. The FCC from time to time may initiate a rulemaking proceeding to allocate spectrum for or change its rules and policies governing the aeronautical services proposed by us. It is not possible to predict what changes the FCC may propose or, if adopted, the likely impact of any such changes on our proposed aeronautical service and business.

| 18 |

| Table of Contents |

In addition to these U.S. agencies, we may also be subject to regulation by foreign government agencies that choose to assert jurisdiction over us as a result of the service we intend to provide on aircraft that fly in their airspace. Adverse decisions or regulations of these U.S. and foreign regulatory agencies could negatively impact our operations and costs of doing business and could delay the implementation of Infinitus and have other adverse consequences for us. Our ability to obtain certain regulatory approvals to offer Infinitus internationally may also be the responsibility of a third party, and, therefore, may be out of our control. We are unable to predict the scope, pace or financial impact of regulations and other policy changes that could be adopted by the various governmental agencies that oversee portions of our business.