Attached files

| file | filename |

|---|---|

| EX-32.1 - EXHIBIT 32.1 - SusGlobal Energy Corp. | exhibit32.htm |

| EX-31.2 - EXHIBIT 31.2 - SusGlobal Energy Corp. | exhibit31-2.htm |

| EX-31.1 - EXHIBIT 31.1 - SusGlobal Energy Corp. | exhibit31-1.htm |

| EX-10.49 - EXHIBIT 10.49 - SusGlobal Energy Corp. | exhibit10-49.htm |

| EX-10.48 - EXHIBIT 10.48 - SusGlobal Energy Corp. | exhibit10-48.htm |

| EX-10.47 - EXHIBIT 10.47 - SusGlobal Energy Corp. | exhibit10-47.htm |

| EX-10.46 - EXHIBIT 10.46 - SusGlobal Energy Corp. | exhibit10-46.htm |

| EX-10.45 - EXHIBIT 10.45 - SusGlobal Energy Corp. | exhibit10-45.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C.

20549

FORM 10-Q

(Mark One)

[X] QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended September 30, 2018

or

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ______________to ________________

Commission file number 333-209143

SUSGLOBAL ENERGY

CORP.

(Exact name of registrant as specified in its

charter)

| Delaware | 38-4039116 |

| (State or other jurisdiction of incorporation or | (I. R. S. Employer Identification No.) |

| organization) |

| 200 Davenport Road | M5R 1J2 |

| Toronto, ON | |

| (Address of principal executive offices) | (Zip Code) |

416-223-8500

(Registrant’s telephone

number, including area code)

Not applicable

(Former name, former

address and former fiscal year, if changed since last report)

Indicate by check mark whether the registrant (1) has filed all

reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the

registrant was required to file such reports), and (2) has been subject to such

filing requirements for the past 90 days.

Yes [ ] No [X] *

Indicate by check mark whether the registrant has submitted

electronically every Interactive

Data File required to be submitted and posted pursuant to Rule 405 of Regulation

S-T (§232.405 of this chapter) during the preceding 12 months (or for such

shorter period that the registrant was required to submit and post such

files).

Yes [X] No [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| pg. 1 |

| Large accelerated filer [ ] | Accelerated filer [ ] |

| Non-accelerated filer [X] | Smaller reporting company [X] |

| (Do not check if a smaller reporting company) | |

| Emerging growth company [X] |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided to Section 7(a)(2)(B) of the Securities Act. [X]

Indicate by check mark whether the registrant is a shell

company (as defined in rule 12b-2 of the Exchange Act).

Yes [

] No [X]

The number of shares of the registrant’s common stock outstanding as of November 13, 2018 was 40,247,531 shares.

*Explanatory Note: The Company is not required to file reports under Section 13 or 15(d) of the Securities Exchange Act of 1934.

| pg. 2 |

| SusGlobal Energy Corp. |

| INDEX TO FORM 10-Q |

| For the Three and Nine-Month Periods Ended September 30, 2018 and 2017 |

| pg. 3 |

| SUSGLOBAL ENERGY CORP. |

| CONSOLIDATED FINANCIAL STATEMENTS |

| September 30, 2018 and 2017 |

| (Expressed in United States Dollars) |

| CONTENTS |

| pg. 4 |

| SusGlobal Energy Corp. |

| Interim Condensed Consolidated Balance Sheets |

| As at September 30, 2018 and December 31, 2017 |

| (Expressed in United States Dollars) |

| (unaudited) |

| September 30, 2018 | December 31, 2017 | |||||

| (refer to note 16) | ||||||

| ASSETS | ||||||

| Current Assets | ||||||

| Cash and cash equivalents | $ | - | $ | 126,117 | ||

| Trade receivables | 137,544 | 183,254 | ||||

| Government remittances receivable | - | 3,671 | ||||

| Inventory | 73,795 | 53,964 | ||||

| Prepaid expenses and deposits | 15,442 | 53,719 | ||||

| Total Current Assets | 226,781 | 420,725 | ||||

| Intangible Assets (note 6) | 142,456 | 147,100 | ||||

| Long-lived Assets, net (note 7) | 3,642,408 | 3,864,588 | ||||

| Long-Term Assets | 3,784,864 | 4,011,688 | ||||

| Total Assets | $ | 4,011,645 | $ | 4,432,413 | ||

| LIABILITIES AND STOCKHOLDERS’ DEFICIENCY | ||||||

| Current Liabilities | ||||||

| Bank indebtedness | $ | 820 | $ | - | ||

| Accounts payable (note 8) | 396,753 | 408,173 | ||||

| Government remittances payable | 22,343 | - | ||||

| Accrued liabilities (notes 8 and 11) | 531,860 | 347,417 | ||||

| Current portion of long-term debt (note 9) | 3,949,053 | 1,828,900 | ||||

| Current portion of obligations under capital lease (note 10) | 91,967 | 59,204 | ||||

| Loans payable to related parties (note 11) | 212,438 | 15,942 | ||||

| Total Current Liabilities | 5,205,234 | 2,659,636 | ||||

| Long-Term Liabilities | ||||||

| Long-term debt (note 9) | - | 2,332,535 | ||||

| Obligations under capital lease (note 10) | 240,627 | 160,580 | ||||

| Total Long-term Liabilities | 240,627 | 2,493,115 | ||||

| Total Liabilities | 5,445,861 | 5,152,751 | ||||

| Stockholders’ Deficiency | ||||||

| Preferred stock, $.0001 par value, 10,000,000 authorized, none issued and outstanding | ||||||

| Common stock, $.0001 par value, 150,000,000 authorized, 40,050,031 (2017- 37,393,031) shares issued and outstanding (note 12) | 4,006 | 3,740 | ||||

| Additional paid-in capital | 5,520,585 | 3,576,111 | ||||

| Subscriptions payable | - | 178,200 | ||||

| Stock compensation reserve | 997,500 | 330,000 | ||||

| Accumulated deficit | (7,802,121 | ) | (4,660,296 | ) | ||

| Accumulated other comprehensive loss | (154,186 | ) | (148,093 | ) | ||

| Stockholders’ deficiency | (1,434,216 | ) | (720,338 | ) | ||

| Total Liabilities and Stockholders’ Deficiency | $ | 4,011,645 | $ | 4,432,413 | ||

| Going concern (note 2) | ||||||

| Commitments (note 13) |

The accompanying notes are an integral part of these interim condensed consolidated financial statements.

| pg. 5 |

| SusGlobal Energy Corp. |

| Interim Condensed Consolidated Statements of Operations and Comprehensive Loss |

| For the three and nine-month periods ended September 30, 2018 and 2017 |

| (Expressed in United States Dollars) |

| (unaudited) |

| For the three-month periods ended | For the nine-month periods ended | |||||||||||

| September 30, 2018 | September 30, 2017 | September 30, 2018 | September 30, 2017 | |||||||||

| (refer to note 16) | (refer to note 16) | |||||||||||

| Revenue | $ | 279,394 | $ | 25,608 | $ | 639,538 | $ | 25,608 | ||||

| Cost of Sales | ||||||||||||

| Opening inventory | 115,733 | - | 53,964 | - | ||||||||

| Depreciation | 98,823 | 14,415 | 291,134 | 14,415 | ||||||||

| Direct wages and benefits | 41,526 | 15,380 | 125,634 | 15,380 | ||||||||

| Equipment rental, delivery and | ||||||||||||

| repairs and maintenance | 41,354 | 10,304 | 102,552 | 10,304 | ||||||||

| Utilities | 22,755 | 3,826 | 54,643 | 3,826 | ||||||||

| Outside contractors | (27 | ) | - | 16,654 | - | |||||||

| 320,164 | 43,925 | 644,581 | 43,925 | |||||||||

| Less: closing inventory | (73,795 | ) | - | (73,795 | ) | - | ||||||

| Total cost of sales | 246,369 | 43,925 | 570,786 | 43,925 | ||||||||

| Gross profit (loss) | 33,025 | (18,317 | ) | 68,752 | (18,317 | ) | ||||||

| Operating expenses | ||||||||||||

| Management compensation-stock- based compensation (note 8) | 332,500 | 82,500 | 1,997,500 | 247,500 | ||||||||

| Management compensation-fees (note 8) | 82,619 | 43,016 | 256,377 | 123,962 | ||||||||

| Professional fees | 246,245 | 92,434 | 383,287 | 180,793 | ||||||||

| Interest expense (note 8) | 90,939 | 40,363 | 267,958 | 83,049 | ||||||||

| Rent and occupancy (note 8) | 54,925 | 25,170 | 123,842 | 50,348 | ||||||||

| Insurance | 14,172 | 16,717 | 44,757 | 53,666 | ||||||||

| Office and administration (note 13(c)) | 39,182 | 21,751 | 102,767 | 54,693 | ||||||||

| Filing fees | 1,479 | 5,499 | 11,518 | 14,855 | ||||||||

| Repairs and maintenance | 1,471 | - | 20,240 | - | ||||||||

| Directors compensation | 766 | - | 2,331 | 24,800 | ||||||||

| Financing costs | - | - | - | 882,153 | ||||||||

| AWT Program | - | - | - | 71,017 | ||||||||

| Total operating expenses | 864,298 | 327,450 | 3,210,577 | 1,786,836 | ||||||||

| Net loss before other income | (831,273 | ) | (345,767 | ) | (3,141,825 | ) | (1,805,153 | ) | ||||

| Other income-insurance proceeds | - | 48,208 | - | 48,208 | ||||||||

| Net loss after other income Other comprehensive (loss) income | (831,273 | ) | (297,559 | ) | (3,141,825 | ) | (1,756,945 | ) | ||||

| Foreign exchange translation | (27,107 | ) | 86,420 | (6,093 | ) | 38,693 | ||||||

| Comprehensive loss | $ | (858,380 | ) | $ | (211,139 | ) | $ | (3,147,918 | ) | $ | (1,718,252 | ) |

| Net loss per share-basic and diluted | $ | (0.02 | ) | $ | (0.01 | ) | $ | (0.08 | ) | $ | (0.05 | ) |

| Weighted average number of common shares outstanding- basic and diluted | 40,003,672 | 36,658,490 | 39,222,148 | 36,185,790 | ||||||||

The accompanying notes are an integral part of these interim condensed consolidated financial statements.

| pg. 6 |

| SusGlobal Energy Corp. |

| Interim Condensed Consolidated Statements of Changes in Stockholders’ Deficiency |

| For the nine-month periods ended September 30, 2018 and year ended December 31, 2017 |

| (Expressed in United States Dollars) |

| (unaudited) |

| Number of | Common | Additional Paid- | Share | Stock | Accumulated | Accumulated Other | Stockholders’ | |||||||||||||||||

| Shares | Shares | in Capital | Subscriptions | Compensation | Deficit | Comprehensive | Deficiency | |||||||||||||||||

| Payable | Reserve | Loss | ||||||||||||||||||||||

| Balance – December 31, 2016 | 34,128,910 | $ | 2,004,407 | $ | - | $ | - | $ | - | $ | (2,447,815 | ) | $ | (41,745 | ) | $ | (485,153 | ) | ||||||

| Shares issued to directors | 40,000 | 11,600 | - | - | - | - | - | 11,600 | ||||||||||||||||

| Shares issued to employee | 5,000 | 1,450 | - | - | - | - | - | 1,450 | ||||||||||||||||

| Shares issued for consulting services | 15,000 | 4,950 | - | - | - | - | - | 4,950 | ||||||||||||||||

| Shares issued on exercise of offer to acquire shares | 115,000 | 11,500 | - | - | - | - | - | 11,500 | ||||||||||||||||

| Shares issued to agents on financing | 1,620,000 | 469,800 | - | - | - | - | - | 469,800 | ||||||||||||||||

| Shares issued on private placement, net of share issue costs | 329,176 | 98,048 | - | - | - | - | - | 98,048 | ||||||||||||||||

| Reallocation between common shares and additional paid-in capital | - | (2,598,130 | ) | 2,598,130 | - | - | - | - | - | |||||||||||||||

| Shares issued to directors | 40,000 | 4 | 13,196 | - | - | - | - | 13,200 | ||||||||||||||||

| Shares issued as compensation for director nomination | 20,000 | 2 | 6,598 | - | - | - | - | 6,600 | ||||||||||||||||

| Shares issued to employee | 4,000 | 1 | 3,999 | - | - | - | - | 4,000 | ||||||||||||||||

| Shares issued for consulting services | 20,000 | 2 | 19,998 | - | - | - | - | 20,000 | ||||||||||||||||

| Shares issued for private placement compensation | 5,000 | 1 | 4,999 | - | - | - | - | 5,000 | ||||||||||||||||

| Shares issued on acquisition of assets | 529,970 | 53 | 529,917 | - | - | - | - | 529,970 | ||||||||||||||||

| Shares issued on private placement, net of share issue costs | 520,975 | 52 | 399,274 | - | - | - | - | 399,326 | ||||||||||||||||

| Stock compensation expensed on vesting of stock award | - | - | - | - | 330,000 | - | - | 330,000 | ||||||||||||||||

| Proceeds received on shares yet to be issued | - | - | - | 178,200 | - | - | - | 178,200 | ||||||||||||||||

| Other comprehensive loss | - | - | - | - | - | - | (106,348 | ) | (106,348 | ) | ||||||||||||||

| Net loss | - | - | - | - | - | (2,212,481 | ) | - | (2,212,481 | ) | ||||||||||||||

| Balance – December 31, 2017 | 37,393,031 | 3,740 | 3,576,111 | 178,200 | 330,000 | (4,660,296 | ) | (148,093 | ) | (720,338 | ) | |||||||||||||

| Shares issued for proceeds previously received | 190,000 | 19 | 178,181 | (178,200 | ) | - | - | - | - | |||||||||||||||

| Shares issued on vesting of 2017 stock award | 2,000,000 | 200 | 1,329,800 | - | (330,000 | ) | - | - | 1,000,000 | |||||||||||||||

| Shares issued for private placement, net of share issue costs | 467,000 | 47 | 436,493 | - | - | - | - | 436,540 | ||||||||||||||||

| Stock compensation expensed on vesting of stock award | - | - | - | - | 997,500 | - | - | 997,500 | ||||||||||||||||

| Other comprehensive loss | - | - | - | - | - | - | (6,093 | ) | (6,093 | ) | ||||||||||||||

| Net loss | - | - | - | - | - | (3,141,825 | ) | - | (3,141,825 | ) | ||||||||||||||

| Balance-September 30, 2018 | 40,050,031 | $ | 4,006 | $ | 5,520,585 | $ | - | $ | 997,500 | $ | (7,802,121 | ) | $ | (154,186 | ) | $ | (1,434,216 | ) |

The accompanying notes are an integral part of these interim condensed consolidated financial statements.

| pg. 7 |

| SusGlobal Energy Corp. |

| Interim Condensed Consolidated Statements of Cash Flows |

| For the nine-month periods ended September 30, 2018 and 2017 |

| (Expressed in United States Dollars) |

| (unaudited) |

| For the nine-month | For the nine-month | |||||

| period ended | period ended | |||||

| September 30, 2018 | September 30, 2017 | |||||

| (refer to note 16) | ||||||

| Cash flows from operating activities | ||||||

| Net loss | $ | (3,141,825 | ) | $ | (1,756,945 | ) |

| Adjustments for: | ||||||

| Depreciation | 297,294 | 15,108 | ||||

| Amortization of intangible asset | 150 | 150 | ||||

| Non-cash financing fees costs and professional fees | - | 501,350 | ||||

| Stock-based compensation | 1,997,500 | 277,750 | ||||

| Interest capitalized | 53,873 | - | ||||

| Changes in non-cash working capital: | - | - | ||||

| Trade receivables | 40,282 | 6,812 | ||||

| Government remittances receivable | 3,578 | |||||

| Other receivable-insurance proceeds | - | (48,208 | ) | |||

| Inventory | (21,620 | ) | - | |||

| Prepaid expenses and deposits | 36,829 | (12,273 | ) | |||

| Accounts payable | 1,186 | (88,742 | ) | |||

| Government remittances payable | 22,470 | - | ||||

| Accrued liabilities | 196,276 | 16,797 | ||||

| Net cash used in operating activities | (514,007 | ) | (1,088,201 | ) | ||

| Cash flows from investing activities | ||||||

| Disposal of term deposit | - | 152,400 | ||||

| Purchase of trade receivables | - | (132,701 | ) | |||

| Purchase of deposit | - | (38,100 | ) | |||

| Purchase of long-lived assets | (1,553 | ) | (3,019,281 | ) | ||

| Purchase of intangible assets | - | (140,625 | ) | |||

| Net cash used in investing activities | (1,553 | ) | (3,178,307 | ) | ||

| Cash flows from financing activities | ||||||

| Bank indebtedness | 820 | - | ||||

| Advances of long-term debt | - | 4,584,564 | ||||

| Repayment of long-term debt | (138,303 | ) | (459,120 | ) | ||

| Repayments of obligations under capital lease | (71,970 | ) | - | |||

| Advances of loans payable to related parties | 213,648 | - | ||||

| Repayments of loans payable to related parties | (15,538 | ) | (169,874 | ) | ||

| Private placement proceeds (net of share issue costs) | 436,540 | 386,874 | ||||

| Subscription payable proceeds | - | 23,000 | ||||

| Net cash provided by financing activities | 425,197 | 4,365,444 | ||||

| Effect of exchange rate on cash | (35,754 | ) | (63,313 | ) | ||

| (Decrease) increase in cash | (126,117 | ) | 35,623 | |||

| Cash and cash equivalents-beginning of period | 126,117 | 1,774 | ||||

| Cash and cash equivalents-end of period | $ | - | $ | 37,397 | ||

| Supplemental Cash Flow Disclosures: | ||||||

| Interest paid | $ | 279,320 | $ | 64,156 | ||

| Income taxes paid | - | - |

| (i) | Refer to notes 9 and 10, long-term debts and obligations under capital lease, for details on the non-cash purchase of certain long-lived assets. |

| (ii) | Refer to note 12, capital stock, for details on the issuance of capital stock for the purchase of long-lived certain assets. |

The accompanying notes are an integral part of these interim condensed consolidated financial statements.

| pg. 8 |

| SusGlobal Energy Corp. |

| Notes to the Interim Condensed Consolidated Financial Statements |

| September 30, 2018 and 2017 |

| (Expressed in United States Dollars) |

| (unaudited) |

1. Nature of Business and Basis of Presentation

SusGlobal Energy Corp. (“SusGlobal”) was formed by articles of amalgamation on December 3, 2014, in the Province of Ontario, Canada and its executive office is in Toronto, Ontario, Canada. SusGlobal, a company in the start-up stages and Commandcredit Corp. (“Commandcredit”), an inactive Canadian public company, amalgamated to continue business under the name of SusGlobal Energy Corp.

On May 23, 2017, SusGlobal filed an Application for Authorization to continue in another Jurisdiction with the Ministry of Government Services in Ontario and a certificate of corporate domestication and certificate of incorporation with the Secretary of State of the State of Delaware under which it changed its jurisdiction of incorporation from Ontario to the State of Delaware (the “Domestication”). In connection with the Domestication each of the currently issued and outstanding common shares were automatically converted on a one-for-one basis into common shares compliant with the laws of the state of Delaware (the “Shares”). As a result of the Domestication, pursuant to Section 388 of the General Corporation Law of the State of Delaware (the “DGCL”), SusGlobal continued its existence under the DGCL as a corporation incorporated in the State of Delaware. The business, assets and liabilities of SusGlobal and its subsidiaries on a consolidated basis, as well as its principal location and fiscal year, were the same immediately after the Domestication as they were immediately prior to the Domestication. SusGlobal filed a Registration Statement on Form S-4 to register the Shares and this registration statement was declared effective by the Securities and Exchange Commission on May, 23, 2017.

SusGlobal is a renewable energy company focused on acquiring, developing and monetizing a global portfolio of proprietary technologies in the waste to energy application.

These interim condensed consolidated financial statements of SusGlobal and its wholly-owned subsidiaries, SusGlobal Energy Canada Corp., SusGlobal Energy Canada I Ltd. (“SGECI”) and SusGlobal Energy Belleville Ltd. (together, the “Company”), have been prepared following generally accepted accounting principles in the United States (“US GAAP”) for interim financial information and the Securities Exchange Commission (“SEC”) instructions to Form 10-Q and Article 8 of SEC Regulation S-X, and are expressed in United States Dollars. The Company’s functional currency is the Canadian Dollar (“CAD”). In the opinion of management, all adjustments necessary for a fair presentation have been included.

2. Going Concern

The interim condensed consolidated financial statements have been prepared in accordance with US GAAP, which assumes that the Company will be able to meet its obligations and continue its operations for the next twelve months.

As at September 30, 2018, the Company had a working capital deficit of $4,978,453 (December 31, 2017-$2,238,911), incurred a net loss of $3,141,825 (2017-$1,756,945) for the nine months ended September 30, 2018 and had an accumulated deficit of $7,802,121 (December 31, 2017-$4,660,296) and expects to incur further losses in the development of its business. These factors cast substantial doubt as to the Company’s ability to continue as a going concern, which is dependent upon its ability to obtain the necessary financing to further the development of its business, satisfy its obligations to PACE Savings & Credit Union Limited (“PACE”) and upon achieving profitable operations. There is no assurance of funding being available or available on acceptable terms. Realization values may be substantially different from carrying values as shown.

These interim condensed consolidated financial statements do not include any adjustments to reflect the future effects on the recoverability and classification of assets or the amounts and classification of liabilities that may result if the Company was unable to continue as a going concern.

| pg. 9 |

| SusGlobal Energy Corp. |

| Notes to the Interim Condensed Consolidated Financial Statements |

| September 30, 2018 and 2017 |

| (Expressed in United States Dollars) |

| (unaudited) |

3. Significant Accounting Policies

These interim condensed consolidated financial statements do not include all of the information and footnotes required by US GAAP for complete financial statements and should be read in conjunction with the consolidated financial statements of the Company for the years ended December 31, 2017 and 2016 and their accompanying notes.

Recently Adopted Accounting Pronouncements:

On January 1, 2018, the Company adopted accounting standards (“ASU”) update No. 2016-18, “Statement of Cash Flows (Topic 230): Restricted Cash”. The Company now includes restricted cash as part of cash and cash equivalents. The Company has adopted this policy on a retrospective basis. The reference to restricted cash included in the interim condensed consolidated statements of cash flow for the three-month period ended March 31, 2017, has been reclassified to cash and cash equivalents at the end of this prior period.

On January 1 2018, the Company adopted ASU No. 2014-09, Revenue from Contracts with Customers, which outlines a single comprehensive model for entities to use in accounting for revenue arising from contracts with customers that supersedes most current revenue recognition guidance. The updated guidance, and subsequent clarifications, collectively referred to as accounting standards codification (“ASC”) 606, require an entity to recognize revenue when it transfers control of promised goods or services to customers in an amount that reflects the consideration to which the entity expects to be entitled to in exchange for those goods or services. In addition, the guidance requires the disclosure of the nature, amount, timing and uncertainty of revenue and cash flows arising from contracts with customers. The Company adopted this standard, utilizing the modified retrospective approach, with the cumulative effect of initially applying the new standard recognized in deficit. Accordingly, comparative prior period information has not been restated and continues to be reported under that accounting standard. The adoption of ASC 606 had no impact on the Company’s interim condensed consolidated balance sheets as of January 1, 2018.

On January 1, 2018, the Company adopted ASU No. 2017, Compensation-Stock Compensation: Topic 718: Scope of Modification Accounting (ASU 2017-09) to provide clarity and reduce both the (1) diversity in practice and (2) cost and complexity when changing the terms or conditions of share-based payment awards. Under ASU 2017-09, modification accounting is required to be applied unless all of the following are the same immediately before and after the change:

| 1. |

The award’s fair value (or calculated value or intrinsic value if those measurement methods are used). |

| 2. |

The award’s vesting conditions. |

| 3. |

The award’s classification as an equity or liability instrument. |

The adoption of this pronouncement had no impact on the Company’s interim condensed consolidated balance sheets as of January 1, 2018.

4. Recent Accounting Pronouncements

From time to time, new accounting pronouncements are issued by the FASB or other standard setting bodies and adopted by the Company as of the specified effective date or possibly early adopted, where permitted. Unless otherwise discussed, the impact of recently issued standards that are not yet effective will not have a material impact on the Company’s financial position, results of operations or cash flows.

| pg. 10 |

| SusGlobal Energy Corp. |

| Notes to the Interim Condensed Consolidated Financial Statements |

| September 30, 2018 and 2017 |

| (Expressed in United States Dollars) |

| (unaudited) |

4. Recent Accounting Pronouncements, (continued)

In February 2016, the FASB issued ASU No. 2016-02, “Leases” (Topic 842). The standard requires lessees to recognize the assets and liabilities that arise from leases on the balance sheet. ASU 2016-02 requires the recognition on the balance sheet of a lease liability to make lease payments by lessees and a right-of-use asset representing its right to use the underlying asset for the lease term. The new guidance will also require significant additional disclosure about the amount, timing and uncertainty of cash flows from leases. The new guidance is effective for annual and interim reporting periods beginning after December 15, 2018 (January 1, 2019 for the Company). The amendments should be applied at the beginning of the earliest period presented using a modified retrospective approach with earlier application permitted as of the beginning of an interim or annual reporting period. In March 2018, the FASB approved a new, optional transition method that will give companies the option to use the effective date as the date of initial application on transition. The Company plans to elect this transition method, and as a result, the Company will not adjust the comparative financial information or make the new required lease disclosures for periods before the effective date. The Company anticipates the adoption of this new standard will result in a significant increase in lease-related assets and liabilities in the consolidated balance sheet. As the impact of this standard is non-cash in nature, the Company does not anticipate its adoption having an impact on the Company’s consolidated statement of cash flows. The Company is currently evaluating the impact of adopting ASU No. 2016-02 on the consolidated statement of income.

In January 2017, the FASB issued ASU No. 2017-04, “Intangibles-Goodwill and Other (Topic 350) - Simplifying the Test for Goodwill Impairment”. The new standard simplifies the accounting for goodwill impairments by eliminating step 2 from the goodwill quantitative impairment test. Instead, if the carrying amount of a reporting unit exceeds its fair value, an impairment loss is to be recognized in an amount equal to that excess, limited to the total amount of goodwill allocated to that reporting unit. The standard is to be effective for interim and annual periods beginning after December 15, 2019 and early adoption is permitted. The Company is currently evaluating the impact of adopting ASU No. 2017-04.

5. Financial Instruments

The carrying value of cash and cash equivalents, trade receivables, certain deposits under prepaid expenses and deposits, bank indebtedness, accounts payable and accrued liabilities approximated their fair values as of September 30, 2018 and December 31, 2017 due to their short-term nature. The carrying value of the long-term debt, obligations under capital lease and loans payable to related parties approximated their fair values due to their market interest rates.

Interest, Credit and Concentration Risk

In the opinion of management, the Company is exposed to significant interest rate risk on its long-term debt of $3,949,053 ($5,112,043 CAD) (December 31, 2017-$4,161,435; $5,220,719 CAD). As at September 30, 2018, the Company is exposed to concentration risk as it had four customers (December 31, 2017-four customers) each representing greater than 5% of total trade receivables that add to 88% (December 31, 2017-91%) in total. The Company had certain customers whose revenue individually represented 10% or more of the Company’s total revenue. These customers accounted for 67% (10%, 26% and 31%) (September 30, 2017-78%) of total revenue.

Liquidity Risk

Liquidity risk is the risk that the Company is unable to meet its obligations as they fall due. The Company takes steps to ensure it has sufficient working capital and available sources of financing to meet future cash requirements for capital programs and operations.

| pg. 11 |

| SusGlobal Energy Corp. |

| Notes to the Interim Condensed Consolidated Financial Statements |

| September 30, 2018 and 2017 |

| (Expressed in United States Dollars) |

| (unaudited) |

5. Financial Instruments, (continued)

The Company actively monitors its liquidity to ensure that its cash flows and working capital are adequate to support its financial obligations and the Company’s capital programs. In order to continue operations, the Company will need to raise capital. There is no assurance of funding being available or available on acceptable terms. Realization values may be substantially different from carrying values as shown.

Currency Risk

Although the Company’s functional currency is the CAD, the Company realizes a portion of its expenses in USD. Consequently, certain assets and liabilities are exposed to foreign currency fluctuations. As at September 30, 2018, $35,034 (2017-$6,057) of the Company’s net monetary liabilities were denominated in USD. The Company has not entered into any hedging transactions to reduce the exposure to currency risk.

6. Intangible Assets

| September 30, 2018 | December 31, 2017 | |||||

| Technology license (net of accumulated amortization of $681 (2017- $531)) | $ | 1,320 | $ | 1,470 | ||

| Environmental compliance approvals-indefinite life- $182,700 CAD | 141,136 | 145,630 | ||||

| $ | 142,456 | $ | 147,100 |

On May 6, 2015, the Company acquired an exclusive license from Syngas SDN BHD (“Syngas”), a Malaysian company to use Syngas intellectual property within North America for a period of five years for $1 consideration, renewable every five years upon written request. Syngas manufactures equipment that produces liquid transportation fuel from plastic waste material. The Company issued 20,000 common shares of the Company to an introducing party, determined to be valued at $2,000.

On September 15, 2017, the Company acquired the environmental approvals on the purchase of certain assets of Astoria from BDO Canada Limited (‘BDO”) under an asset purchase agreement (the “APA”).

7. Long-lived Assets, net

| September 30, 2018 | December 31, 2017 | |||||||||||

| Cost | Accumulated | Net book value | Net book value | |||||||||

| depreciation | ||||||||||||

| Composting buildings | $ | 2,271,732 | $ | 143,382 | $ | 2,128,350 | $ | 2,302,651 | ||||

| Gore cover system | 905,370 | 94,309 | 811,061 | 906,953 | ||||||||

| Driveway and paving | 358,054 | 29,838 | 328,216 | 360,835 | ||||||||

| Machinery and equipment | 47,123 | 14,436 | 32,687 | 44,667 | ||||||||

| Equipment under capital lease | 425,864 | 98,494 | 327,370 | 229,561 | ||||||||

| Office trailer | 6,566 | 2,052 | 4,514 | 6,182 | ||||||||

| Computer equipment | 6,827 | 3,261 | 3,566 | 3,368 | ||||||||

| Computer software | 7,107 | 3,702 | 3,405 | 6,264 | ||||||||

| Automotive equipment | 1,545 | 425 | 1,120 | 1,514 | ||||||||

| Signage | 2,622 | 503 | 2,119 | 2,593 | ||||||||

| $ | 4,032,810 | $ | 390,402 | $ | 3,642,408 | $ | 3,864,588 | |||||

| pg. 12 |

| SusGlobal Energy Corp. |

| Notes to the Interim Condensed Consolidated Financial Statements |

| September 30, 2018 and 2017 |

| (Expressed in United States Dollars) |

| (unaudited) |

7. Long-lived Assets, net, continued

Included above are certain assets of Astoria acquired from BDO under the APA, which closed on September 15, 2017. The purchase price for the purchased assets, described as an organic composting facility, including composting buildings, gore cover system, driveway and paving, certain machinery and equipment, an office trailer, certain computer equipment and computer software consisted of cash of $3,026,114 ($3,917,300 CAD) and 529,970 restricted common shares of the Company, determined to be valued at $529,970 ($700,000 CAD), based on recent private placement pricing. In addition, legal costs in connection with acquiring the assets of $22,598 ($29,253 CAD), are included in the cost of the composting buildings. The purchase price was allocated to the assets acquired based on their estimated relative fair value as at the date the assets were acquired.

8. Related Party Transactions

During the nine-month period ended September 30, 2018, the Company incurred $104,881 ($135,000 CAD) (2017-$34,434; $45,000 CAD) in management fees expense with Travellers International Inc. (“Travellers”), an Ontario company controlled by a director and president of the Company (the “President”); $104,881 ($135,000 CAD) (2017-$34,434; $45,000 CAD) in management fees expense with Landfill Gas Canada Ltd. (“LFGC”), an Ontario company controlled by a director and chief executive officer of the Company (the “CEO”); $37,291 ($48,000 CAD) (2017-$27,547; $36,000 CAD) in management fees expense with the Company’s chief financial officer (the “CFO”); and $9,324 ($12,000 CAD) (2017-$27,547; $36,000 CAD) in management fees expense with the Company’s vice-president of corporate development (the “VPCD”). As at September 30, 2018, unpaid remuneration and unpaid expenses in the amount of $109,075 ($141,198 CAD) (December 31, 2017-$111,426; $139,789 CAD) is included in accounts payable and $166,860 ($216,000 CAD) (December 31, 2017-$102,935; $129,137 CAD) is included in accrued liabilities.

In addition, during the nine-month period ended September 30, 2018, the Company incurred interest expense of $9,482 ($12,205 CAD) (2017-$14,052; $18,363 CAD) on the outstanding loans from Travellers and $3,295 ($4,241 CAD) (2017-$nil; $nil CAD) on the outstanding loans from the directors. As at September 30, 2018, interest of $12,419 ($16,077 CAD) (December 31, 2017-$22,120; $27,750 CAD) on these loans is included in accrued liabilities.

During the nine-month period ended September 30, 2018, the Company incurred $53,565 ($68,947 CAD) (2017-$50,348; $65,797 CAD) in rent paid under a rental agreement to Haute Inc. (“Haute”), an Ontario company controlled by the President.

During the nine-month period ended September 30, 2018, the Company sold $15,612 ($20,095 CAD) of compost product to LFGC.

Furthermore, the Company granted the CEO 3,000,000 restricted stock units (“RSU”), under a consulting agreement effective January 1, 2017, determined to be valued at $990,000 based on recent private placement. On January 1, 2018, 1,000,000 RSUs were exchanged into 1,000,000 common stock. The RSUs for the remaining two installments are to vest annually on January 1, 2019 and 2020. On May 17, 2018, the board of directors (the “Board”) approved an amendment to the President’s consulting agreement to include the granting of 3,000,000 RSUs on the same terms and conditions as those granted to the CEO. This grant was valued at $3,000,000 based on recent private placement pricing. Effective May 17, 2018, 1,000,000 RSUs vested immediately and were exchanged into 1,000,000 common stock. The cost of both RSU grants is presented as management compensation expense.

For the nine-month period ended September 30, 2018, the Company recognized management compensation expense of $997,500 (2017-$247,500) on these awards, representing one quarter of the total value of the awards of $3,990,000.

| pg. 13 |

| SusGlobal Energy Corp. |

| Notes to the Interim Condensed Consolidated Financial Statements |

| September 30, 2018 and 2017 |

| (Expressed in United States Dollars) |

| (unaudited) |

9. Long-Term Debt

| September | December | |||||||||||||||||

| Credit | Credit | Credit | Corporate | 30, 2018 | 31, 2017 | |||||||||||||

| Facility | Facility | Facility | Term | Total | Total | |||||||||||||

| Loan | ||||||||||||||||||

| (a) | (b) | (c) | (d) | |||||||||||||||

| Long-Term Debt | $ | 790,151 | $ | 441,891 | $ | 38,502 | $ | 2,678,509 | $ | 3,949,053 | $ | 4,161,435 | ||||||

| Current portion | (790,151 | ) | (441,891 | ) | (38,502 | ) | (2,678,509 | ) | (3,949,053 | ) | (1,828,900 | ) | ||||||

| Long-term Debt | $ | - | $ | - | $ | - | $ | - | $ | - | $ | 2,332,535 |

| (a) |

The credit facility bears interest at the PACE base rate of 7.00% plus 1.25% per annum, currently 8.25%. The credit facility is due on demand, but until a demand is made, is payable in monthly blended installments of principal and interest of $6,770 ($8,764 CAD), and matures on September 2, 2022. The first and only advance on the credit facility on February 2, 2017, in the amount of $1,236,000 ($1,600,000 CAD), is secured by a business loan general security agreement, a $1,236,000 ($1,600,000 CAD) personal guarantee from the President and a charge against the Company’s premises lease. Also pledged as security are the shares of the wholly-owned subsidiaries, a pledge of 3,300,000 of the Company’s shares held by LFGC, 500,000 of the Company’s shares held by the CFO, 2,000,000 of the Company’s shares held by a director’s company and a limited recourse guarantee by each of these parties. The credit facility is fully open for prepayment at any time without notice or bonus. |

| (b) |

The credit facility advanced on June 15, 2017, in the amount of $463,500 ($600,000 CAD), bears interest at the PACE base rate of 7.00% plus 1.25% per annum, currently 8.25%. The credit facility is due on demand, but until a demand is made, is payable in monthly blended installments of principal and interest of $3,786 ($4,901 CAD), and matures on September 2, 2022. The credit facility is secured by a variable rate business loan agreement on the same terms, conditions and security as noted above. |

| (c) |

The credit facility advanced on August 4, 2017, in the amount of $38,625 ($50,000 CAD), bears interest at the PACE base rate of 7.00% plus 1.25% per annum, currently 8.25%. The credit facility is due on demand, but until a demand is made, is payable in monthly blended installments of principal and interest of $330 ($427 CAD), and matures on September 4, 2022. The credit facility is secured by a variable rate business loan agreement on the same terms, conditions and security as noted above. |

| (d) |

The corporate term loan advanced on September 13, 2017, in the amount of $2,876,904 ($3,724,147 CAD), bears interest at the PACE base rate of 7.00% plus 1.25% per annum, currently 8.25%. The corporate term loan is due on demand, but until a demand is made, is payable in monthly blended installments of principal and interest of $22,952 ($29,711 CAD), and matures on September 13, 2022. The corporate term loan is secured by a business loan general security agreement representing a floating charge over the assets and undertakings of the Company, a first priority charge under a registered debenture and a lien registered under the Personal Property Security Act in the amount of $3,090,756 ($4,000,978 CAD) against the assets including inventory, accounts receivable and equipment. The corporate term loan also included an assignment of existing contracts included in the APA. |

| The shares of the wholly-owned subsidiaries and those shares held by the companies and the CFO noted under (a) above, also represent security for the corporate term loan. |

Repayments are as follows:

| For the three months ending December 31, 2018 | $ | 20,428 | |

| For the year ending December 31, 2019 | 85,136 | ||

| For the year ending December 31, 2020 | 91,511 | ||

| For the year ending December 31, 2021 | 100,273 | ||

| For the year ending December 31, 2022 | 3,651,705 | ||

| Total | $ | 3,949,053 |

For the nine-month period ended September 30, 2018, $241,153 ($310,403 CAD) (2017-$68,997; $90,169 CAD) in interest was charged.

| pg. 14 |

| SusGlobal Energy Corp. |

| Notes to the Interim Condensed Consolidated Financial Statements |

| September 30, 2018 and 2017 |

| (Expressed in United States Dollars) |

| (unaudited) |

10. Obligations under Capital Lease

| September 30, | December 31, | ||||||||||||||

| 2018 | 2017 | ||||||||||||||

| (a) | (b) | (c) | Total | Total | |||||||||||

| Obligations under Capital Lease | $ | 980 | $ | 170,384 | $ | 161,230 | $ | 332,594 | $ | 219,784 | |||||

| Less: current portion | (980 | ) | (49,058 | ) | (41,929 | ) | (91,967 | ) | (59,204 | ) | |||||

| Obligations under Capital Lease | $ | - | $ | 121,326 | $ | 119,301 | $ | 240,627 | $ | 160,580 |

| (a) |

The lease agreement for certain equipment for the Company’s organic composting facility at a cost of $13,272 ($17,180 CAD), is payable in monthly blended installments of principal and interest of $980 ($1,268 CAD) at a monthly interest rate of 5.95%, due November 10, 2018. |

| (b) |

The lease agreement for certain equipment for the Company’s organic composting facility at a cost of $221,437 ($286,650 CAD), is payable in monthly blended installments of principal and interest of $4,511 ($5,840 CAD), plus applicable harmonized sales taxes and an option to purchase the equipment for a final payment of $22,094 ($28,600 CAD), plus applicable harmonized sales taxes on October 31, 2021. The lease agreement bears interest at the rate of 5.982% annually, compounded monthly, due September 30, 2021. |

| (c) |

The lease for certain equipment for the Company’s organic composting facility at a cost of $191,155 ($247,450 CAD), is payable in monthly blended installments of principal and interest of $3,954 ($5,118 CAD), plus applicable harmonized sales taxes for a period of forty-six months plus the first two monthly blended installments of $7,725 ($10,000 CAD) plus applicable harmonized sales taxes and an option to purchase the equipment for a final payment of $ 19,065 ($24,680 CAD) plus applicable harmonized sales taxes on February 27, 2022. The leasing agreement bears interest at the rate of 6.15% annually, compounded monthly, due January 27, 2022. |

The lease liabilities are secured by the equipment under capital lease as described in note 7.

Minimum lease payments are as follows:

| For the three-month period ending December 31, 2018 | $ | 34,840 | |

| For the year ending December 31, 2019 | 101,582 | ||

| For the year ending December 31, 2020 | 101,582 | ||

| For the year ending December 31, 2021 | 110,141 | ||

| For the year ending December 31, 2022 | 23,019 | ||

| 371,164 | |||

| Less: imputed interest | (38,570 | ) | |

| Total | $ | 332,594 |

For the nine-month period ended September 30, 2018, $14,028 ($18,056 CAD) (2017-$nil; ($nil CAD)) in interest was charged.

11. Loans Payable to Related Parties

| September 30, 2018 | December 31, 2017 | |||||

| Travellers International Inc. | $ | 154,500 | $ | 15,942 | ||

| Directors | 57,938 | - | ||||

| $ | 212,438 | $ | 15,942 |

Loan payable in the amount of $154,500 ($200,000 CAD) (December 31, 2017-$15,942; $20,000 CAD), owing to Travellers and bears interest at the rate of 12% per annum, is due on demand and is unsecured. As at September 30, 2018, $9,143 ($11,836 CAD) (December 31, 2017-$22,120; $27,750 CAD) in interest is included in accrued liabilities.

| pg. 15 |

| SusGlobal Energy Corp. |

| Notes to the Interim Condensed Consolidated Financial Statements |

| September 30, 2018 and 2017 |

| (Expressed in United States Dollars) |

| (unaudited) |

11. Loans Payable to Related Parties, continued

During the nine-month period ended September 30, 2018, three directors each loaned the Company $19,313 ($25,000 CAD). The loans bear interest at the rate of 12% per annum, are due on demand and unsecured. As at September 30, 2018, $3,276 ($4,241 CAD) (December 31, 2017-$nil; $nil CAD) in interest is included in accrued liabilities.

During the nine-month period ended September 30, 2018, $12,777 ($16,446 CAD) (2017-$10,154; $13,548 CAD) in interest was charged on the loans payable to related parties.

12. Capital Stock

At September 30, 2018, the Company had 150,000,000 of common shares authorized with a par value of $.0001 per share and 40,050,031 (2017-37,393,031) common shares issued and outstanding.

During the nine-month period ended September 30, 2018, the Company raised $436,540 (December 31, 2017-$497,374) cash on a private placement, net of share issue costs of $30,460 (2017-$48,100), on the issuance of 467,000 (December 31, 2017-850,151) common shares of the Company. In addition, during the nine-month period ended September 30, 2018, the Company issued 190,000 common shares of the Company, in regard to $178,200 cash received on a private placement received prior to December 31, 2017, net of share issue costs of $11,800.

During the prior year, on January 5, 2017 and January 30, 2017, the Company issued, in total, 1,620,000 common shares of the Company, determined to be valued at $469,800, based on recent private placement pricing, to agents for their services in assisting in establishing the first credit facility with PACE. On each of January 30, 2017 and June 8, 2017, the Company issued a total of 40,000 common shares to two new directors, determined to be valued at $11,600 and $13,200 respectively, based on recent private placement pricing. For the nine-month period ended September 30, 2018, the services provided by the directors was disclosed under directors’ compensation in the interim condensed consolidated statements of operations and comprehensive loss.

On February 6, 2017, the Company issued 5,000 common shares and on August 23, 2017, the Company issued 4,000 common shares to a current employee for services and a new employee as an incentive to join the Company, respectively, determined to be valued at $1,450 and $4,000, respectively, based on recent private placement pricing and disclosed under office and administration in the interim condensed consolidated statements of operations and comprehensive loss. On May 9, 2017, the Company issued 15,000 common shares, on June 8, 2017, another 20,000 common shares and then on August 23, 2017, a further 20,000 common shares to consultants for their services, determined to be valued at $4,950, $6,600 and $20,000 respectively, based on recent private placement pricing. These services were disclosed under professional fees in the interim condensed consolidated statements of operations and comprehensive loss. On May 9, 2017, the Company issued 115,000 common shares on the exercise of the offer to acquire common shares at a price of $0.10 per common share by the VPCD. On September 5, 2017, the Company issued 5,000 common shares as compensation for a private placement, determined to be valued at $5,000. In addition, on September 11, 2017, the Company issued 529,970 common shares on the acquisition of assets, determined to be valued at $529,970 ($700,000 CAD), based on recent private placement pricing (see note 7).

All non-cash transactions were valued based on the proceeds of a recent private placement.

Furthermore, the Company granted the CEO 3,000,000 restricted stock units (“RSU”), under a consulting agreement effective January 1, 2017, determined to be valued at $990,000 based on recent private placement. On January 1, 2018, 1,000,000 RSUs were exchanged into 1,000,000 common stock. The RSUs for the remaining two installments are to vest annually on January 1, 2019 and 2020. On May 17, 2018, the Board approved an amendment to the President’s consulting agreement to include the granting of 3,000,000 RSUs on the same terms and conditions as those granted to the CEO. This grant was valued at $3,000,000 based on recent private placement pricing. Effective May 17, 2018, 1,000,000 RSUs vested immediately and were exchanged into 1,000,000 common stock. The cost of both RSU grants is presented as management compensation expense.

| pg. 16 |

| SusGlobal Energy Corp. |

| Notes to the Interim Condensed Consolidated Financial Statements |

| September 30, 2018 and 2017 |

| (Expressed in United States Dollars) |

| (unaudited) |

13. Commitments

| a) |

Effective January 1, 2017, new consulting agreements were finalized for the services of the President and for the CEO. The consulting agreements are for a period of three years, commencing January 1, 2017. For each of these two executive officers, the monthly fees are as follows: $3,863 ($5,000 CAD) for 2017 and $11,588 ($15,000 CAD) for 2018 and 2019. In addition, the CEO was granted 3,000,000 RSUs on January 1, 2017. On January 1, 2018, 1,000,000 RSUs were exchanged into 1,000,000 common stock. The RSUs of the remaining two installments are to vest annually on January 1, 2019 and 2020, respectively. On May 17, 2018, the President’s consulting agreement was amended by the Board to add the granting of 3,000,000 RSUs, on the same terms and conditions as those of the CEO. On this date, the President was issued 1,000,000 common stock on the exchange of 1,000,000 RSUs. The future minimum commitment under these consulting agreements, is as follows: |

| For the three-month period ending December 31, 2018 | $ | 69,525 | ||

| For the year ending December 31, 2019 | 278,100 | |||

| $ | 347,625 |

| b) |

Effective January 1, 2017, the Company entered into a new three-year premises lease agreement with Haute at a monthly amount of $3,090 ($4,000 CAD) for 2017, $ 3,863 ($5,000 CAD) for 2018 and $4,635 ($6,000 CAD) for 2019. The Company is also responsible for all expenses and outlays in connection with its occupancy of the leased premises, including, but not limited to utilities, realty taxes and maintenance. The future minimum commitment under this premises lease agreement is as follows: |

| For the three-month period ending December 31, 2018 | $ | 11,588 | ||

| For the year ending December 31, 2019 | 55,620 | |||

| $ | 67,208 |

| c) |

The Company was assigned the land lease on the purchase of certain assets of Astoria. The land lease, which comprises 13.88 acres in Roslin, Ontario, Canada, has a term expiring March 31, 2034. The basic monthly rent on the net lease is $2,318 ($3,000 CAD) and is subject to adjustment based on the consumer price index as published by Statistics Canada (“CPI”). To date, no adjustment for CPI has been charged by the landlord. The Company is also responsible for any property taxes, maintenance, insurance and utilities. In addition, the Company has the right to extend the lease for five further terms of five years each and one further term of five years less one day. The future minimum commitment under this land lease (excluding any CPI adjustment) is as follows: |

| For the three-month period ending December 31, 2018 | $ | 6,953 | ||

| For the year ending December 31, 2019 | 27,810 | |||

| For the year ending December 31, 2020 | 27,810 | |||

| For the year ending December 31, 2021 | 27,810 | |||

| For the year ending December 31, 2022 | 27,810 | |||

| For the year ending December 31, 2023 | 27,810 | |||

| Thereafter | 285,053 | |||

| $ | 431,056 |

In addition, the Company was recently informed that, through a special provision of the site plan agreement with the City of Belleville (the “City”), Ontario, the Company is required to fund certain road maintenance required by the City for the years 2017 through to 2025 at an annual rate of $7,725 ($10,000 CAD). The payments are due each September 30th. The Company’s portion for the year ended September 30, 2017, would be equal to the 15 days, as the Company owned the organic composting facility since September 15, 2017. Included in accrued liabilities, is the balance owing to September 30, 2018, totaling $8,043 ($10,411).

| d) |

On April 9, 2018, a new one-year consulting agreement was finalized for the services of the Company’s CFO, effective April 1, 2018, at a monthly rate of $4,635 ($6,000 CAD). The future minimum commitment under this agreement is as follows: |

| pg. 17 |

| SusGlobal Energy Corp. |

| Notes to the Interim Condensed Consolidated Financial Statements |

| September 30, 2018 and 2017 |

| (Expressed in United States Dollars) |

| (unaudited) |

13. Commitments, (continued)

| For the three-month period ending December 31, 2018 | $ | 13,905 | ||

| For the year ending December 31, 2019 | 13,905 | |||

| $ | 27,810 |

| e) |

PACE has provided the Company a letter of credit in favor of the Ministry of the Environment and Climate Change (“MOECC”) in the amount of $213,852 ($276,831 CAD) and, as a security, has registered a charge of lease over the premises, located at 704 Phillipston Road, Roslin, Ontario, Canada. The Company is required to provide for environmental remediation and clean-up costs for its organic composting facility. The letter of credit is a requirement of the MOECC and is in connection with the financial assurance provided by the Company for it to be in compliance with the MOECCs environmental objectives. The MOECC regularly evaluates the Company’s organic composting facility to ensure compliance is adhered to and the letter of credit is subject to change by the MOECC. Since the fair value of the environmental remediation costs cannot be determined at this time, no estimate of such costs has been recorded in the accounts. As of September 30, 2018, the MOECC has not drawn on the letter of credit. During the nine-month period ended September 30, 2018, the Company renewed the letter of credit for a further twelve months. |

14. Economic Dependence

The Company generated 67% of its revenue from three customers. The Company’s ability to continue operations is dependent on continuing to generate a similar amount of revenue from these customers.

15. Subsequent Events

The Company’s management has evaluated subsequent events up to the date the interim condensed consolidated financial statements were issued, pursuant to the requirements of ASC 855 and has determined the following to be material subsequent events:

| (a) |

Subsequent to September 30, 2018, the Company raised $181,700 on a private placement, net of share issue costs of $15,800, on the issuance of 197,500 common shares. | |

|

| ||

| (b) |

On November 2, 2018, the Company received clearance from the Financial Industry Regulatory Authority. | |

|

| ||

| (c) |

On December 15, 2017, the Company filed a motion record in the Ontario Superior Court of Justice (the “Court”) against the Business Development Bank of Canada, the applicant and Astoria Organic Matters Ltd. and Astoria Organic Matters Canada LP, together, the respondents, in the amount of $583,647 ($755,400 CAD) in connection with the Company’s purchase of certain assets from the court appointed receiver for Astoria, BDO, on September 15, 2017. The basis for the claim is to cover the Company’s costs to process biosolids stored onsite at the time of purchase that amounted to approximately more than ten times the amount permitted to be stored by conditions in the environmental compliance approval for the site. The tipping fees for these biosolids had already been charged when the biosolids had been received onsite. The Court’s judgment ruled against the Company’s motion and the Company subsequently, on unanimous approval by the Board on June 12, 2018, filed an appeal. The motion on the appeal was heard on September 21, 2018 and the decision of the Court was made on November 8, 2018. The Court dismissed the motion and awarded BDO its costs in the amount of $154,350. This amount has been accrued in the accounts, as at September 30, 2018. |

16. Comparative Figures

Certain of the prior period’s comparative figures have been reclassified to conform to the current period’s presentation.

| pg. 18 |

Item 2. Management's Discussion and Analysis of Financial Condition and Results of Operations.

Certain statements in this Management's Discussion and Analysis ("MD&A"), other than purely historical information, including estimates, projections, statements relating to our business plans, objectives and expected operating results, and the assumptions upon which those statements are based, are "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Forward-looking statements generally can be identified by the use of forward-looking terminology such as "may," "would," "expect," "intend," "could," "estimate," "should," "anticipate," or "believe," and similar expressions. Forward-looking statements are based on current expectations and assumptions that are subject to risks and uncertainties which may cause actual results to differ materially from the forward-looking statements. We undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events, or otherwise. Readers should carefully review the risk factors in our Annual Report on Form 10-K for the fiscal year ended December 31, 2017 filed with the Securities and Exchange Commission on April 16, 2018.

The following MD&A is intended to help readers understand the results of our operation and financial condition, and is provided as a supplement to, and should be read in conjunction with, our Interim Unaudited Financial Statements and the accompanying Notes to Interim Unaudited Financial Statements under Part 1, Item 1 of this Quarterly Report on Form 10-Q.

Growth and percentage comparisons made herein generally refer to the nine-month period ended September 30, 2018 compared with the nine-month period ended September 30, 2017 unless otherwise noted. Unless otherwise indicated or unless the context otherwise requires, all references in this document to "we, "us, "our," the "Company," and similar expressions refer to SusGlobal Energy Corp., and depending on the context, its subsidiaries.

SPECIAL NOTICE ABOUT GOING CONCERN AUDIT OPINION

OUR AUDITOR ISSUED AN OPINION EXPRESSING SUBSTANTIAL DOUBT AS TO OUR ABILITY TO CONTINUE IN BUSINESS AS A GOING CONCERN FOR THE CONSOLIDATED FINANCIAL STATEMENTS FOR THE YEARS ENDED DECEMBER 31, 2017 AND 2016. YOU SHOULD READ THIS QUARTERLY REPORT ON FORM 10-Q WITH THE “GOING CONCERN” ISSUES IN MIND.

This Management’s Discussion and Analysis should be read in conjunction with the unaudited interim condensed consolidated financial statements included in this Quarterly Report on Form 10-Q (the “Financial Statements”). The financial statements have been prepared in accordance with generally accepted accounting policies in the United States (“GAAP”). Except as otherwise disclosed, all dollar figures included therein and in the following management discussion and analysis are quoted in United States dollars.

| pg. 19 |

OVERVIEW

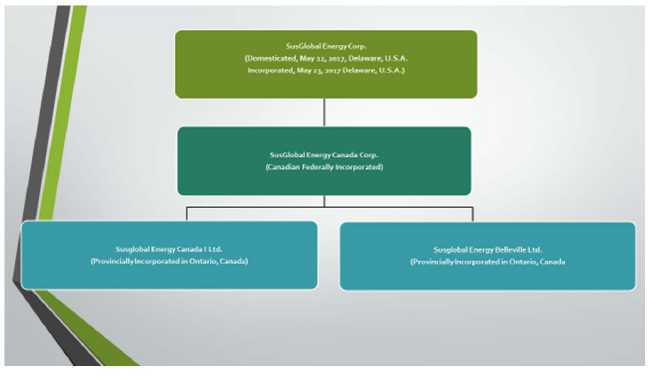

The following organization chart sets forth our wholly-owned subsidiaries:

SusGlobal Energy Corp. (“SusGlobal”) was formed by articles of amalgamation on December 3, 2014, in the Province of Ontario, Canada and its executive office is in Toronto, Ontario, Canada. SusGlobal, a company in the start-up stages and Commandcredit Corp. (“Commandcredit”), an inactive Canadian public company, amalgamated to continue business under the name of SusGlobal Energy Corp.

On May 23, 2017, SusGlobal filed an Application for Authorization to continue in another Jurisdiction with the Ministry of Government Services in Ontario and a certificate of corporate domestication and certificate of incorporation with the Secretary of State of the State of Delaware under which it changed its jurisdiction of incorporation from Ontario to the State of Delaware (the “Domestication”). In connection with the Domestication each of the currently issued and outstanding common shares were automatically converted on a one-for-one basis into common shares compliant with the laws of the state of Delaware (the “Shares”). As a result of the Domestication, pursuant to Section 388 of the General Corporation Law of the State of Delaware (the “DGCL”), SusGlobal continued its existence under the DGCL as a corporation incorporated in the State of Delaware. The business, assets and liabilities of SusGlobal and its subsidiaries on a consolidated basis, as well as its principal location and fiscal year, were the same immediately after the Domestication as they were immediately prior to the Domestication. SusGlobal filed a Registration Statement on Form S-4 to register the Shares and this registration statement was declared effective by the Securities and Exchange Commission on May, 23, 2017.

When the terms “the Company,” “we,” “us” or “our” are used in this document, those terms refer to SusGlobal Energy Corp., and its wholly-owned subsidiaries, SusGlobal Energy Canada Corp., SusGlobal Energy Canada I Ltd. and SusGlobal Energy Belleville Ltd.

SusGlobal is a renewable energy company focused on acquiring, developing and monetizing a global portfolio of proprietary technologies in the waste to energy application.

With the growing amount of organic wastes being produced by society as a whole, a solution for sustainable global management of these wastes must be achieved. SusGlobal through its proprietary technology and processes is equipped and confident to deliver this objective.

| pg. 20 |

Management believes renewable energy is the energy of the future. Sources of this type of energy are more evenly distributed over the earth’s surface than finite energy sources, making it an attractive alternative to petroleum-based energy. Biomass, one of the renewable resources, is derived from organic material such as forestry, food, plant and animal residuals. SusGlobal can therefore help you turn what many consider waste into precious energy. The portfolio will be comprised of four distinct types of technologies: (a) Process Source Separated Organics (“SSO”) in anaerobic digesters to divert from landfills and recover biogas. This biogas can be converted to gaseous fuel for industrial processes, electricity to the grid or cleaned for compressed renewable gas. (b) Increasing the capacity of existing infrastructure (anaerobic digesters) to allow processing of SSO to increase biogas yield. (c) Utilize recycled plastics to produce liquid fuels and (d) process digestate to produce a pathogen free organic fertilizer.

The convertibility of organic material into valuable end products such as biogas, liquid biofuels, organic fertilizers and compost shows the utility of renewable energy. These products can be converted into electricity, fuels and marketed to agricultural operations that are looking for an increase in crop yields, soil amendment and environmentally-sound practices. This practice also diverts these materials from landfills and reduces greenhouse gas emissions that result from landfilling organic wastes. The Company can provide peace of mind that the full lifecycle of organic material is achieved, global benefits are realized and stewardship for total sustainability is upheld.

The project and services offered can benefit the public and private markets. The following includes some of our work managing organic waste streams: Anaerobic Digestion, Dry Digestion, Biogas Production, Wastewater Treatment, In- Vessel Composting, SSO Treatment, Biosolids Heat Treatment and Composting.

The Company can provide a full range of services for handling organic residuals in a period where innovation and sustainability are paramount. From start to finish we offer in-depth knowledge, a wealth of experience and cutting-edge technology for handling organic waste.

The primary focus of the services SusGlobal provides includes identifying idle or underutilized anaerobic digesters and integrating our technologies with capital investment to optimizing the operation of the existing digesters to reach their full capacity for processing SSO. Our processes not only divert significant organic waste from landfills, but also result in methane avoidance, with significant Greenhouse Gas (“GHG”) reductions from waste disposal. The processes also produce renewable energy through the conversion of wastewater biosolids and organic wastes in the same equipment (co-digestion) and valuable end products such as biogas, electricity and organic fertilizer, considered Class AA organic fertilizer.

Currently, the primary customers are municipalities in both rural and urban centers throughout southern and central Ontario, Canada. Much of the research and development that has been carried out has been completed by our CEO through multiple projects carried out on projects prior to the formation of SusGlobal. Where necessary, to be in compliance with provincial and local environmental laws and regulations, SusGlobal submits applications to the respective authorities for approval prior to any necessary engineering being carried out.

RECENT BUSINESS DEVELOPMENTS

Asset Purchase

On September 15, 2017, the Company closed the purchase of certain assets from Astoria Organic Matters Ltd., and Astoria Organic Matters Canada LP (“Astoria”), under the asset purchase agreement (the “APA”) from the court appointed receiver of Astoria, BDO Canada Limited (“BDO”). The purchase price for the composting buildings, Gore cover system, driveway and paving, office trailer, certain machinery and equipment, computer equipment, computer software and intangible assets consisted of cash of $3,167,250 ($4,100,000 CAD), funded by PACE Savings and Credit Union Limited (“PACE”) and 529,970 restricted common shares of the Company, determined to be valued at $529,970 ($700,000 CAD) based on recent private placement pricing. In addition, legal costs in connection with acquiring the assets of $22,598 ($29,253 CAD) are included in the cost of the organic composting facility. In addition, the Company purchased certain accounts receivable which it was required to collect, totaling $134,529 ($174,147 CAD) and a deposit with a local municipality in the amount of $38,625 ($50,000 CAD).

| pg. 21 |

Financing Agreement with PACE

Effective January 1, 2017, the Company obtained a Line of Credit of up to $4,248,750 ($5,500,000 CAD) with PACE. On February 2, 2017, the company received the first and only advance in the amount of $1,236,000 ($1,600,000 CAD). The Line of Credit was due February 2, 2019 and is now one of multiple credit facilities with PACE, as noted below.

The funds advanced on this Line of Credit of $1,236,000 ($1,600,000 CAD) bore interest at the PACE base rate of 6.75%% plus 1.25% per annum, at the time 8%, and was payable on a monthly basis, interest only, until refinanced, as noted below. The Line of Credit is secured by a business loan general security agreement, a $1,236,000 ($1,600,000 CAD) personal guarantee from the president of the Company (the “President”) and a charge against the Company’s premises lease. Also pledged as security are the shares of the wholly-owned subsidiaries and a pledge of 3,300,000 shares of the Company held by Landfill Gas Canada Ltd. (“LFGC”), an Ontario company controlled by a director and chief executive officer of the Company (the “CEO”), 500,000 shares of the Company held by the chief financial officer (the “CFO”) and 2,000,000 shares of the Company held by a director’s company, and a limited recourse guarantee by each. The Line of Credit is fully open for prepayment at any time without notice or bonus. A total commitment fee of $84,975 ($110,000 CAD) was paid to PACE. In addition, the agents who assisted in establishing the Line of Credit received 1,620,000 common shares of the Company determined to be valued at $469,800, based on recent private placement pricing and cash of $300,000, on closing, for their services. Other closing costs in connection with the Line of Credit included legal fees of $29,906 ($38,713 CAD). As at September 30, 2018, $790,151 ($1,022,849 CAD) remains outstanding (December 31, 2017-$817,932; $1,026,135 CAD). During the nine months ended September 30, 2018, the Company incurred interest charges of $48,043 ($61,840 CAD) (2017-$47,463; $62,027 CAD) on this Line of Credit.

On July 27, 2018, the Company refinanced this credit facility at the PACE base rate of 7% plus 1.25% per annum, currently 8.25%. The credit facility is due on demand, but until a demand is made, is payable in monthly blended installments of principal and interest of $6,770 ($8,764 CAD), commencing August 2, 2018, amortized over a twenty-year period and matures on September 2, 2022.

On June 15, 2017, PACE loaned the Company $463,500 ($600,000 CAD) under a variable rate business loan agreement, for its bid for the purchase of certain assets of Astoria on the same terms and conditions to the Line of Credit above. As at September 30, 2018, $441,891 ($572,027 CAD) (December 31, 2017-$457,428; $573,865 CAD) remains outstanding. During the nine months ended September 30, 2018, the Company incurred interest charges of $26,883 ($34,602 CAD) (2017-$10,438; $13,641 CAD) on this credit facility.

On July 27, 2018, the Company refinanced this credit facility at the PACE base rate of 7% plus 1.25% per annum, currently 8.25%. The credit facility is due on demand, but until a demand is made, is payable in monthly blended installments of principal and interest of $3,786 ($4,901 CAD), commencing August 2, 2018, amortized over a twenty-year period and matures on September 2, 2022.

On August 4, 2017, PACE loaned the Company $38,625 ($50,000 CAD) under a variable business loan agreement, to satisfy an outstanding liability on the same terms and conditions to the Line of Credit above, except that the loan was due February 4, 2019. As at September 30, 2018, $38,502 ($49,841 CAD) (December 31, 2017-$39,855; $50,000 CAD) remains outstanding. During the nine months ended September 30, 2018, the Company incurred interest charges of $2,342 ($3,015 CAD) (2017-$478; $625 CAD) on this credit facility.

On July 27, 2018, the Company refinanced this credit facility at the PACE base rate of 7% plus 1.25% per annum, currently 8.25%. The credit facility is payable on demand, but until a demand is made, is payable in monthly blended installments of principal and interest of $330 ($427 CAD), commencing August 4, 2018, amortized over a twenty-year period and matures on September 4, 2022.

On September 13, 2017, PACE loaned the Company $2,876,904 ($3,724,147 CAD) under a corporate term loan. The funds were used for the purpose of acquiring certain assets of Astoria from the court appointed receiver on September 15, 2017. The corporate term loan bore interest at the PACE base rate of 6.75% plus 1.25% per annum, 8% at the time, payable in monthly blended installments of principal and interest of $58,373 ($75,564 CAD), and matures on September 13, 2022. The corporate term loan is secured by a business loan general security agreement representing a floating charge over the assets and undertakings of the Company, a first priority charge under a registered debenture and a lien registered under the Personal Property Securities Act in the amount of $3,090,756 ($4,000,978 CAD) against the assets, including accounts receivable, inventory and equipment. PACE has also provided the Company with a letter of credit in the favor of the Ministry of the Environment and Climate Change (“MOECC”) in the amount of $213,852 ($276,831 CAD) and, as security, has registered a charge of lease over the premises, located at 704 Phillipston Road, Roslin, Ontario, Canada. As of September 30, 2018, and the date of this filing, the MOECC has not drawn on the letter of credit. The corporate term loan also includes an assignment of existing contracts included in the APA. On June 13, 2018, the unpaid and previously deferred interest on the corporate term loan for the period from March 13, 2018 to June 13, 2018, in the amount of $53,873 ($69,343 CAD), was capitalized and included in the principal balance of the corporate term loan. As at September 30, 2018, $2,678,509 ($3,467,326 CAD) remains outstanding. During the nine months ended September 30, 2018, the Company incurred interest charges of $163,884 ($210,946 CAD) (2017-$10,618; $13,876 CAD) on this corporate term loan. The shares pledged as security for the Line of Credit and the other credit facilities also pertain to this corporate term loan.

| pg. 22 |

On July 26, 2018, the Company refinanced this corporate term loan. The first and only blended installment of principal and interest of $22,529 ($29,164 CAD) was due August 1, 2018 at the rate of 8% per annum, and amortized over a twenty-year period. The corporate term loan is due on demand, but until a demand is made, is payable in monthly blended installments of principal and interest of $22,952 ($29,711 CAD), commencing August 13, 2018, at the PACE base rate of 7% plus 1.25% per annum, currently 8.25%. The corporate term loan continues to be amortized over a twenty-year period and matures on September 13, 2022.

Other

On April 11, 2018, three directors each loaned the Company $19,313 ($25,000 CAD) for working capital purposes. The loans bear interest at the rate of 12% per annum, are due on demand and unsecured. There are no written agreements evidencing these loans. During the nine-month period ended September 30, 2018, $3,295 ($4,241 CAD) of interest was charged on these loans. As at September 30, 2018, $3,276 ($4,241 CAD) (December 31, 2017-$nil; $nil CAD) in interest is included in accrued liabilities and the loans remain outstanding.

On April 3, 2018, a new loan was provided by Travellers International Inc. (“Travellers”), an Ontario company controlled by the Executive Chairman and President (the “President”), who is also a director of the Company, in the amount of $154,500 ($200,000 CAD). A portion of the funds, $116,746 ($151,128 CAD), was used to pay two overdue monthly principal and interest instalments on the Company’s corporate term loan with PACE. This new loan is due on demand, unsecured and bears interest at the rate of 12% per annum. There is no written agreement evidencing this loan. During the nine-month period ended September 30, 2018, $9,482 ($12,205 CAD) of interest was charged on this loan and other loans repaid to Travellers during the nine-months ended September 30, 2018. As at September 30, 2018, $9,143 ($11,836 CAD) (December 31, 2017-$nil; $nil CAD) in interest is included in accrued liabilities and the loan remains outstanding.

On February 16, 2018, the Company finalized a lease agreement for certain equipment for its organic composting facility, which was previously on monthly rental, in the amount of $191,155 ($247,450 CAD). The lease is for a period of forty-eight months, with two initial monthly installments of $7,725 ($10,000 CAD) each, plus the applicable harmonized sales taxes, followed by forty-six monthly blended installments of principal and interest of $3,954 ($5,118 CAD), plus the applicable harmonized sales taxes. The Company has the option to purchase the equipment on the forty ninth month for an amount of $19,065 ($24,680 CAD), plus the applicable harmonized sales taxes. The leasing agreement bears interest at the rate of 6.15% annually, compounded monthly, due January 27, 2022.

On October 30, 2017, the Company finalized a lease agreement for certain equipment for its organic composting facility, which commenced on October 30, 2017, in the amount of $221,437 ($286,650 CAD). The lease agreement requires monthly blended installments of principal and interest of $4,511 ($5,840 CAD), plus applicable harmonized sales taxes and a final balloon payment of $22,094 ($28,600 CAD), plus applicable harmonized sales taxes on October 31, 2021. The lease agreement bears interest at the rate of 5.982% annually, compounded monthly, due September 30, 2021.

On September 21, 2017, the company finalized a lease agreement for the lease of certain equipment for its organic composting facility, in the amount of $13,272 ($17,180 CAD). The lease agreement requires monthly blended installments of principal and interest of $980 ($1,268 CAD) at a monthly interest rate of 5.95%, due November 10, 2018.

During the nine months ended September 30, 2018, the Company incurred interest charges of $14,028 ($18,056 CAD) (2017-$nil; $nil CAD) on these leases.

On May 11, 2017, the Company signed a posting agreement with CrowdVest, a Tennessee limited liability company to act as the Company’s online intermediary technology platform in connection with the Company’s offering of common stock under Rule 506 of Regulation D under the Securities Act of 1933. As compensation, CrowdVest received 20,000 restricted common shares of the Company, based on an issue price of $5 per share, once the 506(c)-general solicitation offering commenced. The offering terminated on October 27, 2017 and was not extended.