Attached files

| file | filename |

|---|---|

| EX-32.1 - EXHIBIT 32.1 - Synthetic Biologics, Inc. | tv505582_ex32-1.htm |

| EX-31.1 - EXHIBIT 31.1 - Synthetic Biologics, Inc. | tv505582_ex31-1.htm |

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-Q

(Mark One)

| x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended September 30, 2018

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES ACT OF 1934 |

For the transition period from ____________ to ____________

Commission File Number: 001-12584

SYNTHETIC BIOLOGICS, INC.

(Exact name of Registrant as Specified in Its Charter)

| Nevada | 13-3808303 |

| (State or Other Jurisdiction of Incorporation or Organization) | (I.R.S. Employer Identification No.) |

| 9605 Medical Center Drive, Suite 270 | |

| Rockville, MD | 20850 |

| (Address of Principal Executive Offices) | (Zip Code) |

(301) 417-4364

(Registrant’s Telephone Number, Including Area Code)

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ¨ |

| Accelerated filer | x |

| Non-Accelerated filer | ¨ |

| Smaller reporting company | ¨ |

| Emerging growth company | ¨ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

As of November 7, 2018, the registrant had 13,483,976 shares of common stock, $0.001 par value per share, outstanding.

SYNTHETIC BIOLOGICS, INC.

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Quarterly Report on Form 10-Q contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). In particular, statements contained in this Quarterly Report on Form 10-Q, including but not limited to, statements regarding the timing of our clinical trials, the development and commercialization of our pipeline products, the sufficiency of our cash, our ability to finance our operations and business initiatives and obtain funding for such activities and the timing of any such financing, our future results of operations and financial position, business strategy and plan prospects, or costs and objectives of management for future research, development or operations, are forward-looking statements. These forward-looking statements relate to our future plans, objectives, expectations and intentions and may be identified by words such as “may,” “will,” “should,” “expects,” “plans,” “anticipates,” “intends,” “targets,” “projects,” “contemplates,” “believes,” “seeks,” “goals,” “estimates,” “predicts,” “potential” and “continue” or similar words. Readers are cautioned that these forward-looking statements are based on our current beliefs, expectations and assumptions and are subject to risks, uncertainties, and assumptions that are difficult to predict, including those identified below, under Part II, Item 1A. “Risk Factors” and elsewhere in this Quarterly Report on Form 10-Q, and those identified under Part I, Item 1A of our Annual Report on Form 10-K for the year ended December 31, 2017 filed with the Securities and Exchange Commission (the “SEC”) on February 22, 2018 (“2017 Form 10-K”). Therefore, actual results may differ materially and adversely from those expressed, projected or implied in any forward-looking statements. We undertake no obligation to revise or update any forward-looking statements for any reason.

NOTE REGARDING COMPANY REFERENCES

Throughout this Quarterly Report on Form 10-Q, “Synthetic Biologics,” the “Company,” “we,” “us” and “our” refer to Synthetic Biologics, Inc.

NOTE REGARDING TRADEMARKS

All trademarks, trade names and service marks appearing in this Quarterly Report on Form 10-Q are the property of their respective owners.

| 2 |

SYNTHETIC BIOLOGICS, INC.

FORM 10-Q

TABLE OF CONTENTS

| 3 |

ITEM 1. FINANCIAL STATEMENTS (UNAUDITED)

Synthetic Biologics, Inc. and Subsidiaries

Condensed Consolidated Balance Sheets

(In thousands except share and per share amounts)

| September 30, 2018 | December 31, 2017 | |||||||

| Assets | ||||||||

| Current Assets | ||||||||

| Cash and cash equivalents | $ | 9,549 | $ | 17,116 | ||||

| Prepaid expenses and other current assets | 559 | 827 | ||||||

| Total Current Assets | 10,108 | 17,943 | ||||||

| Property and equipment, net | 665 | 872 | ||||||

| Deposits and other assets | 23 | 23 | ||||||

| Total Assets | $ | 10,796 | $ | 18,838 | ||||

| Liabilities and Stockholders' Deficit | ||||||||

| Current Liabilities: | ||||||||

| Accounts payable | $ | 879 | $ | 2,020 | ||||

| Accrued expenses | 1,485 | 1,526 | ||||||

| Warrant liabilities | 19 | 4,083 | ||||||

| Accrued employee benefits | 1,434 | 2,074 | ||||||

| Deferred rent | 97 | 90 | ||||||

| Total Current Liabilities | 3,914 | 9,793 | ||||||

| Long term deferred rent | 329 | 402 | ||||||

| Total Liabilities | 4,243 | 10,195 | ||||||

| Series A convertible preferred stock, $0.001 par value; 10,000,000 and zero shares authorized; 120,000 issued and outstanding | 12,234 | 12,053 | ||||||

| Stockholders' Deficit: | ||||||||

| Common stock, $0.001 par value; 200,000,000 and 10,000,000 shares authorized, 5,346,674 and 3,675,668 issued and 5,344,346 and 3,673,340 outstanding | 5 | 4 | ||||||

| Additional paid-in capital | 200,807 | 192,670 | ||||||

| Accumulated deficit | (204,545 | ) | (194,170 | ) | ||||

| Total Synthetic Biologics, Inc. and Subsidiaries Deficit | (3,733 | ) | (1,496 | ) | ||||

| Non-controlling interest | (1,948 | ) | (1,914 | ) | ||||

| Total Stockholders' Deficit | (5,681 | ) | (3,410 | ) | ||||

| Total Liabilities and Stockholders' Deficit | $ | 10,796 | $ | 18,838 | ||||

See accompanying notes to unaudited condensed consolidated financial statements.

| 4 |

Synthetic Biologics, Inc. and Subsidiaries

Condensed Consolidated Statements of Operations

(In thousands except share and per share amounts)

(Unaudited)

| For the three months ended September 30, | For the nine months ended September 30, | |||||||||||||||

| 2018 | 2017 | 2018 | 2017 | |||||||||||||

| Operating Costs and Expenses: | ||||||||||||||||

| General and administrative | $ | 1,474 | $ | 1,705 | $ | 4,525 | $ | 5,440 | ||||||||

| Research and development | 2,846 | 4,137 | 9,788 | 15,028 | ||||||||||||

| Total Operating Costs and Expenses | 4,320 | 5,842 | 14,313 | 20,468 | ||||||||||||

| Loss from Operations | (4,320 | ) | (5,842 | ) | (14,313 | ) | (20,468 | ) | ||||||||

| Other Income (Expense): | ||||||||||||||||

| Change in fair value of warrant liability | 626 | (5,092 | ) | 4,064 | 2,157 | |||||||||||

| Interest income | 5 | 4 | 20 | 7 | ||||||||||||

| Total Other Income (Expense) | 631 | (5,088 | ) | 4,084 | 2,164 | |||||||||||

| Net Loss | (3,689 | ) | (10,930 | ) | (10,229 | ) | (18,304 | ) | ||||||||

| Net Loss Attributable to Non-controlling Interest | (9 | ) | (8 | ) | (35 | ) | (280 | ) | ||||||||

| Net Loss Attributable to Synthetic Biologics, Inc. and Subsidiaries | $ | (3,680 | ) | $ | (10,922 | ) | (10,194 | ) | (18,024 | ) | ||||||

| Series A Preferred Stock Dividends | (61 | ) | (6,901 | ) | (181 | ) | (6,901 | ) | ||||||||

| Net Loss Attributable to Common Stock Holders | $ | (3,741 | ) | $ | (17,823 | ) | $ | (10,375 | ) | $ | (24,925 | ) | ||||

| Net Loss Per Share - Basic and Dilutive | $ | (0.93 | ) | $ | (4.90 | ) | $ | (2.73 | ) | $ | (7.00 | ) | ||||

| Weighted average number of shares outstanding during the period - Basic and Dilutive | 4,028,304 | 3,665,134 | 3,802,812 | 3,512,868 | ||||||||||||

See accompanying notes to unaudited condensed consolidated financial statements.

| 5 |

Synthetic Biologics, Inc. and Subsidiaries

Condensed Consolidated Statements of Cash Flows

(In thousands)

(Unaudited)

| For the nine months ended September 30, | ||||||||

| 2018 | 2017 | |||||||

| Cash Flows From Operating Activities: | ||||||||

| Net Loss | $ | (10,229 | ) | $ | (18,304 | ) | ||

| Adjustments to reconcile net loss to net cash used in operating activities: | ||||||||

| Stock-based compensation | 1,708 | 2,906 | ||||||

| Warrant issued to consultant | 9 | - | ||||||

| Change in fair value of warrant liabilities | (4,064 | ) | (2,157 | ) | ||||

| Depreciation | 207 | 172 | ||||||

| Changes in operating assets and liabilities: | ||||||||

| Prepaid expenses and other current assets | 268 | 1,251 | ||||||

| Accounts payable | (1,141 | ) | (895 | ) | ||||

| Accrued expenses | (41 | ) | (557 | ) | ||||

| Accrued employee benefits | (640 | ) | 1,293 | |||||

| Deferred rent | (66 | ) | 19 | |||||

| Net Cash Used In Operating Activities | (13,989 | ) | (16,272 | ) | ||||

| Cash Flows From Investing Activities: | ||||||||

| Purchases of property and equipment | - | (209 | ) | |||||

| Net Cash Used In Investing Activities | - | (209 | ) | |||||

| Cash Flows From Financing Activities: | ||||||||

| Proceeds from sale of Series A Preferred Stock, net of issuance cost | - | 11,952 | ||||||

| Proceeds from issuance of common stock for stock option exercises | - | 166 | ||||||

| Proceeds from "at the market" stock issuance | 6,422 | 6,358 | ||||||

| Net Cash Provided By Financing Activities | 6,422 | 18,476 | ||||||

| Net (decrease) increase in cash | (7,567 | ) | 1,995 | |||||

| Cash at beginning of period | 17,116 | 19,055 | ||||||

| Cash at end of period | $ | 9,549 | $ | 21,050 | ||||

| NONCASH FINANCING ACTIVITY: | ||||||||

| Dividends on redeemable convertible preferred stock | $ | 181 | - | |||||

See accompanying notes to unaudited condensed consolidated financial statements.

| 6 |

Synthetic Biologics, Inc. and Subsidiaries

Notes to Condensed Consolidated Financial Statements

(Unaudited)

1. Organization, Nature of Operations and Basis of Presentation

Description of Business

Synthetic Biologics, Inc. (the “Company” or “Synthetic Biologics”) is a late-stage clinical company focused on developing therapeutics designed to preserve the microbiome to protect and restore the health of patients. The Company’s lead candidates poised for Phase 3 development are: (1) SYN-004 (ribaxamase) which is designed to protect the gut microbiome (gastrointestinal (GI) microflora) from the effects of certain commonly used intravenous (IV) beta-lactam antibiotics for the prevention of C. difficile infection (CDI), overgrowth of pathogenic organisms and the emergence of antimicrobial resistance (AMR), and (2) SYN-010 which is intended to reduce the impact of methane-producing organisms in the gut microbiome to treat an underlying cause of irritable bowel syndrome with constipation (IBS-C). The Company’s preclinical pursuits include an oral formulation of the enzyme intestinal alkaline phosphatase (IAP) to treat both local GI and systemic diseases as well as monoclonal antibody therapies for the prevention and treatment of pertussis, and novel discovery stage biotherapeutics for the treatment of phenylketonuria (PKU).

Basis of Presentation

On July 28, 2018, the Board of Directors of the Company approved a reverse stock split of the Company’s authorized, issued and outstanding shares of common stock, par value $0.001 per share, at a ratio of one (1) share of common stock for every thirty-five (35) shares of common stock (the “Reverse Stock Split”). The Company filed a Certificate of Change (the “Certificate of Change”) with the Secretary of State of the State of Nevada on August 8, 2018 to effectuate the Reverse Stock Split. The Reverse Stock Split was effective as of 11:00 p.m. (Eastern Time) on August 10, 2018 (the “Effective Time”) and the Company’s common stock began trading on the NYSE American on a post-split basis when the market opened on August 13, 2018. As a result of the Reverse Stock Split, each thirty-five (35) pre-split shares of common stock outstanding automatically combined into one (1) new share of common stock without any action on the part of the holders, and the number of outstanding shares of common stock was reduced from 132,969,743 shares to 3,799,136 shares (subject to rounding of fractional shares) and the number of authorized shares of common stock was reduced form 350,000,000 share to 10,000,000 shares. Stockholders who otherwise were entitled to receive fractional shares because they held a number of pre-reverse stock split shares of the Company’s common stock not evenly divisible by 35, received, in lieu of a fractional share, that number of shares rounded up to the nearest whole share. The Company issued one whole share of the post-Reverse Stock Split common stock to any stockholder who otherwise would have received a fractional share as a result of the Reverse Stock Split. As a result, no fractional shares were issued in connection with the Reverse Stock Split and no cash or other consideration was paid in connection with any fractional shares that would otherwise have resulted from the Reverse Stock Split. The Reverse Stock Split was effected to meet the per share price requirements of the NYSE American, the Company’s current listing exchange. The Reverse Stock Split did not alter the par value of the Company’s common stock or modify any voting rights or other terms of the common stock. In addition, pursuant to their terms, a proportionate adjustment was made to the per share exercise price and number of shares issuable under all of the Company’s outstanding shares of preferred stock and stock options and warrants to purchase shares of common stock, and the number of shares authorized and reserved for issuance pursuant to the Company’s equity incentive plans was reduced proportionately. After the Reverse Stock Split, the trading symbol for the Company’s common stock continued to be “SYN.”

All share numbers in the condensed consolidated financial statements and footnotes below have been adjusted for the one-for-thirty five reverse stock split effected August 10,2018.

The accompanying condensed consolidated financial statements have been prepared pursuant to the rules and regulations of the Securities and Exchange Commission (“SEC”) for interim financial information. Accordingly, they do not include all of the information and notes required by Accounting Principles Generally Accepted in the United States of America (“U.S. GAAP”) for complete financial statements. The accompanying condensed consolidated financial statements include all adjustments, comprised of normal recurring adjustments, considered necessary by management to fairly state the Company’s results of operations, financial position and cash flows. The operating results for the interim periods are not necessarily indicative of results that may be expected for any other interim period or for the full year. These condensed consolidated financial statements should be read in conjunction with the consolidated financial statements and notes thereto included in the Company’s 2017 Form 10-K. The interim results for the three and nine months ended September 30, 2018 are not necessarily indicative of results for the full year.

The condensed consolidated financial statements are prepared in conformity with U.S. GAAP, which requires the use of estimates, judgments and assumptions that affect the amounts of assets and liabilities at the reporting date and the amounts of revenue and expenses in the periods presented. The Company believes that the accounting estimates employed are appropriate and the resulting balances are reasonable; however, due to the inherent uncertainties in making estimates, actual results may differ from the original estimates, requiring adjustments to these balances in future periods.

| 7 |

Recent Accounting Pronouncements and Developments

In February 2016, the Financial Accounting Standards Board, (“FASB”) issued Accounting Standards Update (“ASU”) 2016-02, Leases (Topic 842), which establishes a new lease accounting model for lessees. The updated guidance requires an entity to recognize assets and liabilities arising from a lease for both financing and operating leases, along with additional qualitative and quantitative disclosures. The amended guidance is effective for fiscal years, and interim periods within those years, beginning after December 15, 2018, with early adoption permitted. The Company is currently evaluating the impact of the adoption of this standard on its consolidated financial statements.

In June 2018, FASB issued ASU 2018-07, Improvements to Nonemployee Share-Based Payment Accounting, which expands the scope of Topic 718 to include share-based payments issued to nonemployees, and generally aligns the accounting for nonemployee awards with the accounting for employee awards. The ASU is effective for fiscal years beginning after December 15, 2018, and interim periods within those fiscal years. Early adoption is permitted. The Company is currently evaluating the impact of the adoption of this standard on its consolidated financial statements.

The Tax Cuts and Jobs Act (the “Tax Act”) was signed into law on December 22, 2017. The Tax Act changed many aspects of U.S. corporate income taxation and included reduction of the corporate income tax rate from 35% to 21%, implementation of a territorial tax system and imposition of a tax on deemed repatriated earnings of foreign subsidiaries. The Company recognized the tax effects of the Tax Act in the year ended December 31, 2017 and recorded $21.6 million in tax expense which relates almost entirely to the remeasurement of deferred tax assets to the 21% tax rate. The Company will continue to assess its provision for income taxes as future guidance is issued but does not currently anticipate significant revisions will be necessary. Accounting Standards Codification (“ASC”) No. 740, Income taxes, requires the Company to record the effects of a tax law change in the period of enactment. However, shortly after the enactment of the Tax Act, the SEC staff issued Staff Accounting Bulletin (“SAB”) 118, which allows the Company to record a provisional amount when it does not have the necessary information available, prepared, or analyzed in reasonable detail to complete its accounting for the change in the tax law. The measurement period ends when the Company has obtained, prepared and analyzed the information necessary to finalize its accounting, but cannot extend beyond one year.

2. Fair Value of Financial Instruments

Fair Value of Financial Instruments

ASC 820, Fair Value Measurement, defines fair value as the amount that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants. As such, fair value is determined based upon assumptions that market participants would use in pricing an asset or liability. Fair value measurements are rated on a three-tier hierarchy as follows:

| · | Level 1 inputs: Quoted prices (unadjusted) for identical assets or liabilities in active markets; |

| · | Level 2 inputs: Inputs, other than quoted prices, included in Level 1 that are observable either directly or indirectly; and |

| 9 |

| · | Level 3 inputs: Unobservable inputs for which there is little or no market data, which require the reporting entity to develop its own assumptions. |

In many cases, a valuation technique used to measure fair value includes inputs from multiple levels of the fair value hierarchy described above. The lowest level of significant input determines the placement of the entire fair value measurement in the hierarchy.

The carrying amounts of the Company’s short-term financial instruments, including cash and cash equivalents, other current assets, accounts payable and accrued liabilities approximate fair value due to the relatively short period to maturity for these instruments.

Cash and cash equivalents include money market accounts of $98,000 as of September 30, 2018 and December 31, 2017 that are measured using Level 1 inputs.

The Company uses Monte Carlo simulations to estimate the fair value of the stock warrants. In using this model, the fair value is determined by applying Level 3 inputs for which there is little or no observable market data, requiring the Company to develop its own assumptions. The assumptions used in calculating the estimated fair value of the warrants represent the Company’s best estimates; however, these estimates involve inherent uncertainties and the application of management judgment. As a result, if factors change and different assumptions are used, the warrant liability and the change in estimated fair value could be materially different.

3. Selected Balance Sheet Information

Prepaid expenses and other current assets (in thousands)

| September 30, 2018 | December 31, 2017 | |||||||

| Prepaid conferences, travel | $ | 230 | $ | 94 | ||||

| Prepaid consulting, subscriptions and other expenses | 184 | 290 | ||||||

| Other receivable | 86 | - | ||||||

| Prepaid insurances | 59 | 351 | ||||||

| Clinical consulting services refund receivable | - | 46 | ||||||

| Prepaid clinical research organizations | - | 46 | ||||||

| Total | $ | 559 | $ | 827 | ||||

Prepaid clinical research organizations expense is classified as a current asset. The Company makes payments to the clinical research organizations based on agreed upon terms that include payments in advance of study services.

| 10 |

Property and equipment, net (in thousands)

| September 30, 2018 | December 31 2017 | |||||||

| Computers and office equipment | $ | 851 | $ | 851 | ||||

| Leasehold improvements | 439 | 439 | ||||||

| Software | 11 | 11 | ||||||

| 1,301 | 1,301 | |||||||

| Less: accumulated depreciation and amortization | (636 | ) | (429 | ) | ||||

| Total | $ | 665 | $ | 872 | ||||

Accrued expenses (in thousands)

| September 30, 2018 | December 31, 2017 | |||||||

| Accrued clinical consulting services | $ | 1,167 | $ | 658 | ||||

| Accrued vendor payments | 243 | 193 | ||||||

| Accrued manufacturing costs | 64 | 661 | ||||||

| Other accrued expenses | 11 | 14 | ||||||

| Total | $ | 1,485 | $ | 1,526 | ||||

Accrued employee benefits (in thousands)

| September 30, 2018 | December 31, 2017 | |||||||

| Accrued bonus expense | $ | 1,007 | $ | 1,283 | ||||

| Accrued vacation expense | 289 | 201 | ||||||

| Accrued severance | 138 | 590 | ||||||

| Total | $ | 1,434 | $ | 2,074 | ||||

| 11 |

4. Stock-Based Compensation

Stock Incentive Plans

On March 20, 2007, the Company’s Board of Directors approved the 2007 Stock Incentive Plan (the “2007 Stock Plan”) for the issuance of up to 71,429 shares of common stock to be granted through incentive stock options, nonqualified stock options, stock appreciation rights, dividend equivalent rights, restricted stock, restricted stock units and other stock-based awards to officers, other employees, directors and consultants of the Company and its subsidiaries. This plan was approved by the stockholders on November 2, 2007. The exercise price of stock options under the 2007 Stock Plan is determined by the compensation committee of the Board of Directors and may be equal to or greater than the fair market value of the Company’s common stock on the date the option is granted. The total number of shares of stock with respect to which stock options and stock appreciation rights may be granted to any one employee of the Company or a subsidiary during any one-year period under the 2007 plan shall not exceed 250,000. Options become exercisable over various periods from the date of grant, and generally expire ten years after the grant date. As of September 30, 2018, there were 19,885 options issued and outstanding under the 2007 Stock Plan.

On November 2, 2010, the Board of Directors and stockholders adopted the 2010 Stock Incentive Plan (the “2010 Stock Plan”) for the issuance of up to 85,714 shares of common stock to be granted through incentive stock options, nonqualified stock options, stock appreciation rights, dividend equivalent rights, restricted stock, restricted stock units and other stock-based awards to officers, other employees, directors and consultants of the Company and its subsidiaries. On October 22, 2013, the stockholders approved and adopted an amendment to the 2010 Stock Plan to increase the number of shares of the Company’s common stock reserved for issuance under the Plan from 85,714 to 171,429. On May 15, 2015, the stockholders approved and adopted an amendment to the 2010 Stock Plan to increase the number of shares of the Company’s common stock reserved for issuance under the Plan from 171,429 to 228,571. On August 25, 2016, the stockholders approved and adopted an amendment to the 2010 Stock Plan to increase the number of shares of the Company’s common stock reserved for issuance under the 2010 Stock Plan from 228,571 to 400,000. On September 7, 2017, the stockholders approved and adopted an amendment to the 2010 Stock Plan to increase the number of shares of the Company’s common stock reserved for issuance under the 2010 Stock Plan from 400,000 to 500,000. On September 24, 2018, the stockholders approved and adopted an amendment to the 2010 Stock Plan to increase the number of shares of the Company’s common stock reserved for issuance under the 2010 Stock Plan from 500,000 to 1,000,000. The exercise price of stock options under the 2010 Stock Plan is determined by the compensation committee of the Board of Directors and may be equal to or greater than the fair market value of the Company’s common stock on the date the option is granted. Options become exercisable over various periods from the date of grant and expire between five and ten years after the grant date. As of September 30, 2018, there were 327,402 options issued and outstanding under the 2010 Stock Plan.

In the event of an employee’s termination, the Company will cease to recognize compensation expense for that employee. There is no deferred compensation recorded upon initial grant date. Instead, the fair value of the stock-based payment is recognized over the stated vesting period.

The Company has applied fair value accounting for all stock-based payment awards since inception. The fair value of each option is estimated on the date of grant using the Black-Scholes option pricing model. There were no options granted during the three and nine months ended September 30, 2018. The assumptions used for the nine months ended September 30, 2017 are as follows:

| Exercise price | $29.05-$30.45 | ||

| Expected dividends | 0% | ||

| Expected volatility | 90%-92% | ||

| Risk free interest rate | 1.67%-1.75% | ||

| Expected life of option | 4.2-4.3 years |

The Company records stock-based compensation based upon the stated vesting provisions in the related agreements. The vesting provisions for these agreements have various terms as follows:

| · | immediate vesting; |

| · | half vesting immediately and remaining over three years; |

| · | in full on one-year anniversary date of grant date; |

| · | quarterly over three years; |

| · | annually over three years; |

| · | one-third immediate vesting and remaining annually over two years; |

| 12 |

| · | one half immediate vesting and remaining over nine months; |

| · | one quarter immediate vesting and remaining over three years; |

| · | one quarter immediate vesting and remaining over 33 months; and |

| · | monthly over three years. |

During the nine months ended September 30, 2018, the Company did not grant options to employees. During the same period in 2017, the Company granted 15,541 options to employees having an approximate fair value of $308,000 based upon the Black-Scholes option pricing model.

A summary of stock option activities for the nine months ended September 30, 2018 is as follows:

| Options | Weighted Average Exercise Price | Weighted Average Remaining Contractual Life | Aggregate Intrinsic Value | |||||||||||

| Balance - December 31, 2016 | 332,561 | $ | 61.87 | 5.49 years | $ | 194,355 | ||||||||

| Granted | 90,286 | $ | 20.12 | |||||||||||

| Exercised | (11,966 | ) | $ | 13.89 | $ | 163,050 | ||||||||

| Expired | (19,091 | ) | $ | 77.46 | ||||||||||

| Forfeited | (32,714 | ) | $ | 42.21 | ||||||||||

| Balance - December 31, 2017 | 359,076 | $ | 53.93 | 4.60 years | $ | 1,800 | ||||||||

| Granted | - | $ | - | |||||||||||

| Exercised | - | $ | - | $ | - | |||||||||

| Expired | (8,124 | ) | $ | 53.27 | ||||||||||

| Forfeited | (3,187 | ) | $ | 27.28 | ||||||||||

| Balance - September 30, 2018 - outstanding | 347,765 | $ | 54.19 | 3.90 years | $ | - | ||||||||

| Balance - September 30, 2018 - exercisable | 257,985 | $ | 64.63 | 3.21 years | $ | - | ||||||||

| Grant date fair value of options granted - September 30, 2018 | $ | - | ||||||||||||

| Weighted average grant date fair value - September 30, 2018 | $ | - | ||||||||||||

Stock-based compensation expense included in operating expenses related to stock options issued to employees and consultants for the three months ended September 30, 2018 and 2017 was $475,000 and $900,000 respectively, and $1.7 million and $2.9 million for the nine months ended September 30, 2018 and 2017, respectively.

As of September 30, 2018, total unrecognized stock-based compensation expense related to stock options was $1,070,000, which is expected to be expensed through January 2020.

| 13 |

5. Stock Purchase Warrants

On November 18, 2016, the Company completed a public offering of 714,286 shares of common stock with accompanying warrants to purchase an aggregate of 1,428,571 million shares of common stock. The stock and warrants were sold in combination, with two warrants for each share of common stock sold, a Series A warrant and a Series B warrant, each representing the right to purchase one share of common stock. The purchase price for each share of common stock and accompanying warrants was $35. The shares of common stock were immediately separable from the warrants and were issued separately. The initial per share exercise price of the Series A warrants was $50.05 and the per share exercise price of the Series B warrants was $60.20, each subject to adjustment as specified in the warrant agreements. The Series A warrants are exercisable until the four year anniversary of the issuance date. The Series B warrants expired on December 31, 2017 and none were exercised prior to expiration. The Series A warrants may be exercised at any time until they expire. The warrants include a provision that if the Company were to enter into a certain transaction, as defined in the agreement, the warrants would be purchased from the holder for cash. Accordingly, the Company recorded the warrants as a liability at their estimated fair value on the issuance date, which was $15.7 million, and changes in estimated fair value will be recorded as non-cash income or expense in the Company’s condensed consolidated statements of operations at each subsequent period. At September 30, 2018, the fair value of the warrant liability was $19,000, which resulted in non-cash income of $605,000 and $3.6 million for the three and nine months ended September 30, 2018, respectively. At September 30, 2017, the fair value of the warrant liability was $10.7 million, which resulted in non-cash expense of $4.1 million for the three months ended September 30, 2017 and non-cash income of $2.0 million for the nine months ended September 30, 2017. In accordance with U.S. GAAP, the warrants were valued on the date of grant using a Monte Carlo simulation.

The assumptions used by the Company are summarized in the following table:

| Series A | ||||||||||||

| September 31, 2018 |

December 31, 2017 |

Issuance Date |

||||||||||

| Closing stock price | $ | 2.60 | $ | 17.85 | $ | 31.15 | ||||||

| Expected dividends | 0 | % | 0 | % | 0 | % | ||||||

| Expected volatility | 80 | % | 80 | % | 85 | % | ||||||

| Risk free interest rate | 2.82 | % | 1.97 | % | 1.58 | % | ||||||

| Expected life of warrant (years) | 2.14 | 2.90 | 4.00 | |||||||||

On October 10, 2014, the Company raised net proceeds of $19.1 million through the sale of 401,703 units at a price of $51.45 per unit to certain institutional investors in a registered direct offering. Each unit consisted of one share of the Company’s common stock and a warrant to purchase 0.5 shares of common stock. The warrants, exercisable for an aggregate of 200,852 shares of common stock, have an exercise price of $61.25 per share and a life of five years. The warrants vested immediately and expire on October 10, 2019.

The warrants issued in conjunction with the registered direct offering in October 2014 include a provision that if the Company were to enter into a certain transaction, as defined in the agreement, the warrants would be purchased from the holder at a premium. Accordingly, the Company recorded the warrants as a liability at their estimated fair value on the issuance date, which was $7.4 million, and changes in estimated fair value are being recorded as non-cash income or expense in the Company’s condensed consolidated statement of operations at each subsequent period. At September 30, 2018, the fair value of the warrant liability was $200.00, which resulted in non-cash income of $21,000 and $415,000 for the three and nine months ended September 30, 2018, respectively. At September 30, 2017, the fair value of the warrant liability was $2.0 million, which resulted in non-cash expense of $1.0 million for the three months ended September 30, 2017 and non-cash income of $0.2 million for the nine months ended September 30, 2017. In accordance with U.S. GAAP, the warrants were valued on the date of grant using the Black-Scholes valuation model which approximates the value derived using a Monte Carlo simulation.

The assumptions used by the Company are summarized in the following table:

| September 30, 2018 |

December 31, 2017 |

Issuance Date |

||||||||||

| Closing stock price | $ | 2.60 | $ | 17.85 | $ | 61.25 | ||||||

| Expected dividends | 0 | % | 0 | % | 0 | % | ||||||

| Expected volatility | 90 | % | 80 | % | 95 | % | ||||||

| Risk free interest rate | 2.60 | % | 1.86 | % | 1.39 | % | ||||||

| Expected life of warrant (years) | 1.04 | 1.79 | 5.00 | |||||||||

The following table summarizes the estimated fair value of the warrant liability (in thousands):

| Balance at December 31, 2017 | $ | 4,083 | ||

| Change in fair value of warrant liability | (4,064 | ) | ||

| Balance at September 30, 2018 | $ | 19 |

On December 26, 2017, the Company entered into a consulting agreement for advisory services for a period of six months. As compensation for such services, the consultant was paid an upfront payment, is paid a monthly fee and on January 24, 2018, was issued a warrant exercisable for 714 shares of the Company’s common stock on the date of issue. The warrant is equity classified and the fair value of the warrant approximated $9,000 and was measured using the Black-Scholes option pricing model. This entire expense was recorded in the quarter ended March 31, 2018. The assumptions used by the Company are summarized in the following table:

| 14 |

| Issuance Date |

||||

| Closing stock price | $ | 18.55 | ||

| Expected dividends | 0 | % | ||

| Expected volatility | 85 | % | ||

| Risk free interest rate | 2.42 | % | ||

| Expected life of warrant (years) | 4.92 | |||

A summary of warrant activity for the Company for the nine months ended September 30, 2018 is as follows:

| Number of Warrants |

Weighted Average Exercise Price |

|||||||

| Balance at December 31, 2017 | 915,138 | $ | 52.50 | |||||

| Granted | 714 | 18.20 | ||||||

| Exercised | - | - | ||||||

| Forfeited | - | - | ||||||

| Balance at September 30, 2018 | 915,852 | $ | 52.48 | |||||

A summary of all outstanding and exercisable warrants as of September 30, 2018 is as follows:

| Exercise Price | Warrants Outstanding |

Warrants Exercisable |

Weighted Average Remaining Contractual Life (years) |

|||||||||||

| $ | 18.20 | 714 | 714 | 4.24 | ||||||||||

| $ | 50.05 | 714,286 | 714,286 | 2.14 | ||||||||||

| $ | 61.25 | 200,852 | 200,852 | 1.03 | ||||||||||

| $ | 52.48 | 915,852 | 915,852 | 1.90 | ||||||||||

6. Net Loss per Share

Basic net loss per share is computed by dividing net loss by the weighted average number of common shares outstanding. Included in net loss is the deemed dividend from preferred shares issuance of $61,000 and $181,000 for the three and nine months ended September 30, 2018, respectively. The deemed dividend relates to the discount provided to preferred stockholders upon conversion of their preferred stock to common shares and is subtracted from net loss (see Note 8). Diluted net loss per share is computed by dividing net loss by the weighted average number of common shares outstanding including the effect of common share equivalents. Diluted net loss per share assumes the issuance of potentially dilutive common shares outstanding for the period and adjusts for any changes in income and the repurchase of common shares that would have occurred from the assumed issuance, unless such effect is anti-dilutive. The number of options and warrants for the purchase of common stock that were excluded from the computations of net loss per common share for the three and nine months ended September 30, 2018 were 347,765 and 915,852, respectively, and for the three and nine months and ended September 30, 2017 were 320,543 and 1,638,333, respectively.

The following tables set forth the computation of diluted net loss per weighted average number of shares outstanding attributable to Synthetic Biologics, Inc. and Subsidiaries for the three and nine months ended September 30, 2018 and 2017 (in thousands except share and per share amounts):

| Three months ended September 30, 2018 | Nine months ended September 30, 2018 | |||||||||||||||||||||||

| Net loss (Numerator) |

Shares (Denominator) |

Per Share Amount |

Net Loss (Numerator) |

Shares (Denominator) |

Per Share Amount |

|||||||||||||||||||

| Net loss - Basic | $ | (3,741 | ) | 4,028,304 | $ | (0.93 | ) | $ | (10,375 | ) | 3,802,812 | $ | (2.73 | ) | ||||||||||

| Dilutive shares related to warrants | - | - | - | - | - | - | ||||||||||||||||||

| Net loss - Dilutive | $ | (4,214 | ) | 4,028,304 | $ | (0.93 | ) | $ | (10,375 | ) | 3,802,812 | $ | (2.73 | ) | ||||||||||

| 15 |

| Three months ended September 30, 2017 | Nine months ended September 30, 2017 | |||||||||||||||||||||||

| Net loss (Numerator) |

Shares (Denominator) |

Per Share Amount |

Net Loss (Numerator) |

Shares (Denominator) |

Per Share Amount |

|||||||||||||||||||

| Net loss - Basic | $ | (17,823 | ) | 3,665,134 | $ | (4.90 | ) | $ | (24,925 | ) | 3,512,868 | $ | (7.00 | ) | ||||||||||

| Dilutive shares related to warrants | - | - | - | - | - | - | ||||||||||||||||||

| Net loss - Dilutive | $ | (17,823 | ) | 3,665,134 | $ | (4.90 | ) | $ | (24,925 | ) | 3,512,868 | $ | (7.00 | ) | ||||||||||

7. Non-controlling Interest

The Company’s non-controlling interest is accounted for under ASC 810, Consolidation, and represents the minority shareholder’s ownership interest related to the Company’s subsidiary, Synthetic Biomics, Inc. (“SYN Biomics”). In accordance with ASC 810, the Company reports its non-controlling interest in subsidiaries as a separate component of equity in the condensed consolidated balance sheets and reports both net loss attributable to the non-controlling interest and net loss attributable to the Company and its subsidiaries on the face of the condensed consolidated statements of operations. The Company’s equity interest in SYN Biomics is 88.5% and the non-controlling stockholder’s interest is 11.5%. For the three and nine months ended September 30, 2018, the accumulated net loss attributable to the non-controlling interest was $9,000 and $35,000, respectively.

8. Common and Preferred Stock

Series A Preferred Stock

On September 11, 2017, the Company entered into a share purchase agreement (the “Purchase Agreement”) with an investor (the “Investor”), pursuant to which the Company offered and sold in a private placement 120,000 shares of its Series A Convertible Preferred Stock, par value $0.001 per share (the “Series A Preferred Stock”) for an aggregate purchase price of $12 million, or $100 per share.

The Series A Preferred Stock ranks senior to the shares of the Company’s common stock, and any other class or series of stock issued by the Company with respect to dividend rights, redemption rights and rights on the distribution of assets upon any voluntary or involuntary liquidation, dissolution or winding up of the affairs of the Company. Holders of Series A Preferred Stock are entitled to a cumulative dividend at the rate of 2.0% per annum, payable quarterly in arrears, as set forth in the Certificate of Designation of Series A Preferred Stock. The Series A Preferred Stock is convertible at the option of the holders at any time into shares of common stock at an initial conversion price of $18.90 per share, subject to certain customary anti-dilution adjustments.

On or at any time after (i) the VWAP (as defined in the Certificate of Designation) for at least 20 trading days in any 30 trading day period is greater than $70.00, subject to adjustment in the case of stock split, stock dividends or the like the Company has the right, after providing notice not less than 6 months prior to the redemption date, to redeem, in whole or in part, on a pro rata basis from all holders thereof based on the number of shares of Series A Preferred Stock then held, the outstanding Series A Preferred Stock, for cash, at a redemption price per share of Series A Preferred Stock of $7,875.00, subject to appropriate adjustment in the event of any stock dividend, stock split, combination or other similar recapitalization with respect to the Series A Convertible Preferred Stock, or (ii) the five year anniversary of the issue date, the Company has the right to redeem, in whole or in part, on a pro rata basis from all holders thereof based on the number of shares of Series A Convertible Preferred Stock then held, the outstanding Series A Preferred Stock, for cash, at a redemption price per share equal to the Liquidation Value (as defined in the Certificate of Designations).

The Series A Preferred Stock is classified as temporary equity due to the shares being (i) redeemable based on contingent events outside of the Company’s control, and (ii) convertible immediately and from time to time. Since the effective conversion price of the Series A Preferred Stock is less than the fair value of the underlying common stock at the date of issuance, there is a beneficial conversion feature (“BCF”) at the issuance date. Because the Series A Preferred Stock has no stated maturity or redemption date and is immediately convertible at the option of the holder, the discount created by the BCF is immediately charged to retained earnings as a “deemed dividend” and impacts earnings per share. During the year ended December 31, 2017, the Company recorded a discount of $6.9 million. Because the Series A Preferred Stock is not currently redeemable, the discount arising from issuance costs was allocated to temporary equity and will not be accreted until such time that redemption becomes probable. The stated dividend rate of 2% per annum is cumulative and the Company accrues the dividend on a quarterly basis (in effect accreting the dividend regardless of declaration because the dividend is cumulative). During the year ended December 31, 2017 and the quarters ended March 31, 2018, June 30, 2018 and September 30, 2018, the Company accrued dividends of $73,000, $59,000, $60,000 and $62,000, respectively. Once the dividend is declared, the Company will reclassify the declared amount from temporary equity to a dividends payable liability. When the redemption of the Series A Preferred Stock becomes probable, the temporary equity will be accreted to redemption value as a deemed dividend.

| 16 |

B. Riley FBR Sales Agreement

On August 5, 2016, the Company entered into the B. Riley FBR Sales Agreement with FBR Capital Markets & Co. (now known as B. Riley FBR, Inc.), which enables the Company to offer and sell shares of the Company’s common stock with an aggregate sales price of up to $40.0 million from time to time through B. Riley FBR Capital Markets & Co. as the Company’s sales agent. Sales of common stock under the B. Riley FBR Sales Agreement are made in sales deemed to be “at-the-market” equity offerings as defined in Rule 415 promulgated under the Securities Act, as amended. B. Riley FBR Capital Markets & Co. is entitled to receive a commission rate of up to 3.0% of gross sales in connection with the sale of the Company’s common stock sold on the Company’s behalf. For the three and nine months ending September 30, 2018, the Company sold through the B. Riley FBR Sales Agreement an aggregate of 1.6 million and 1.7 million shares of the Company’s common stock, and received net proceeds of approximately $6.0 million and $6.4 million, respectively. For the three and nine months ending September 30, 2017, the Company sold through the B. Riley FBR Sales Agreement an aggregate of 0.8 million and 11.0 million shares of the Company’s common stock, and received net proceeds of approximately $0.4 million and $6.4 million, respectively. Subsequent to September 30, 2018, the Company has sold approximately 1.9 million shares of the Company’s common stock, and received net proceeds of approximately $5.8 million.

9. Related Party Transactions

In December 2013, through the Company’s subsidiary, Synthetic Biomics, Inc., the Company entered into a worldwide exclusive license agreement with Cedars-Sinai Medical Center (“CSMC”) and acquired the rights to develop products for therapeutic and prophylactic treatments of acute and chronic diseases, including the development of SYN-010 to target IBS-C. The Company licensed from CSMC a portfolio of intellectual property comprised of several U.S. and foreign patents and pending patent applications for various fields of use, including IBS-C, obesity and diabetes. An investigational team led by Mark Pimentel, M.D. at CSMC discovered that these products may reduce the production of methane gas by certain GI microorganisms. During the nine months ended September 30, 2018 and 2017, the Company did not owe and did not pay Cedars-Sinai Medical Center for milestone payments related this license agreement.

On September 5, 2018, the Company entered into an agreement with CSMC for an investigator-sponsored Phase 2 clinical study of SYN-010 to be co-funded by the Company and CSMC (the “Study”). The Study will provide further evaluation of the efficacy and safety of SYN-010, the Company’s modified-release reformulation of lovastatin lactone, which is exclusively licensed to the Company by CSMC. SYN-010 is designed to reduce methane production by certain microorganisms (M. smithii) in the gut to treat an underlying cause of irritable bowel syndrome with constipation (IBS-C).

In consideration of the support provided by CSMC for the Study, the Company entered into a Stock Purchase Agreement with CSMC pursuant to which the Company has agreed, upon the approval of the Study protocol by the Institutional Review Board, (IRB) to: (i) issue to CSMC fifty thousand (50,000) shares of common stock of the Company; and (ii) transfer to CSMC an additional two million Four hundred twenty thousand (2,420,000) shares of common stock of its subsidiary Synthetic Biomics, Inc. (“Synbiomics”) owned by the Company, such that after such issuance CSMC will own an aggregate of seven million four hundred eighty thousand (7,480,000) shares of common stock of Synbiomics, representing seventeen percent (17%) of the issued and outstanding shares of Synbiomics’ common stock.

The Agreement also provides CSMC with a right, commencing on the six month anniversary of issuance of the stock under certain circumstances in the event that the shares of stock of Synbiomics are not then freely tradeable, and subject to NYSE American, LLC approval, to exchange its Synbiomics shares for unregistered shares of the Company’s common stock, with the rate of exchange based upon the relative contribution of the valuation of Synbiomics to the public market valuation of the Company at the time of each exchange. The Stock Purchase Agreement also provides for tag-along rights in the event of the sale by the Company of its shares of Synbiomics. The study is not yet approved by the IRB.

| 17 |

10. Subsequent Events

On October 15, 2018, the Company closed its underwritten public offering (the “Offering”) pursuant to which it received gross proceeds of approximately $18.6 million before deducting underwriting discounts, commissions and other offering expenses payable by the Company and sold an aggregate of (i) 2,520,000 Class A Units (the “Class A Units”), with each Class A Unit consisting of one share of the Company’s common stock, par value $0.001 per share (the “Common Stock”), and one five-year warrant to purchase one share of Common Stock at an exercise price of $1.38 per share (the “October 2018 Warrants”), with each Class A Unit offered to the public at a public offering price of $1.15, and (ii) 15,723 Class B Units (the “Class B Units”, and together with the Class A Units, the “Units”), with each Class B Unit offered to the public at a public offering price of $1,000 per Class B Unit and consisting of one share of the Company’s Series B Convertible Preferred Stock (the “Series B Preferred Stock”), with a stated value of $1,000 and convertible into shares of Common Stock at the stated value divided by a conversion price of $1.15 per share, with all shares of Series B Preferred Stock convertible into an aggregate of 13,672,173 shares of Common Stock, and issued with an aggregate of 13,672,173 October 2018 Warrants. A.G.P./Alliance Global Partners (the “Underwriters”) acted as sole book-running manager for the Offering.

In addition, pursuant to the Underwriting Agreement that the Company entered into with the Underwriters on October 10, 2018, the Company granted the Underwriters a 45 day option (the “Over-allotment Option”) to purchase up to an additional 2,428,825 shares of Common Stock and/or additional October 2018 warrants to purchase an additional 2,428,825 shares of Common Stock. The Underwriters partially exercised the Over-allotment Option by electing to purchase from the Company additional October 2018 Warrants to purchase 1,807,826 shares of Common Stock.

The Units were offered by the Company pursuant to a registration statement on Form S-1 (File No. 333-227400), as amended, filed with the SEC, which was declared effective by the SEC on October 10, 2018.

The conversion price of the Series B Preferred Stock and exercise price of the October 2018 Warrants is subject to appropriate adjustment in the event of recapitalization events, stock dividends, stock splits, stock combinations, reclassifications, reorganizations or similar events affecting the Common Stock. The exercise price of the October 2018 Warrants is subject to adjustment in the event of certain dilutive issuances.

The October 2018 Warrants are immediately exercisable at a price of $1.38 per share of common stock (which is 120% of the public offering price of the Class A Units) and will expire on October 15, 2023. If at the time of exercise, there is no effective registration statement registering, or no current prospectus available for, the issuance of the shares of common stock to the holder, then the October 2018 warrants may only be exercised through a cashless exercise. No fractional shares of common stock will be issued in connection with the exercise of any October 2018 warrants. In lieu of fractional shares, the holder will receive an amount in cash equal to the fractional amount multiplied by the fair market value of any such fractional shares.

The Company may not effect, and holder will not be entitled to, exercise any October 2018 Warrants or conversion of the Series B Preferred Stock, which, upon giving effect to such exercise, would cause (i) the aggregate number of shares of common stock beneficially owned by the holder (together with its affiliates) to exceed 4.99% (or, at the election of the holder, 9.99%) of the number of shares of common stock outstanding immediately after giving effect to the exercise, or (ii) the combined voting power of the Company’s securities beneficially owned by the holder (together with its affiliates) to exceed 4.99% (or, at the election of the holder, 9.99%) of the combined voting power of all of the Company’s securities then outstanding immediately after giving effect to the exercise or conversion, as such percentage ownership is determined in accordance with the terms of the October 2018 Warrants or Series B Preferred Stock. However, any holder may increase or decrease such percentage to any other percentage not in excess of 9.99% upon at least 61 days’ prior notice from the holder to the Company.

ITEM 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS.

The following discussion should be read in conjunction with our unaudited condensed consolidated financial statements and notes thereto included in this Quarterly Report on Form 10-Q, and our audited consolidated financial statements and notes thereto for the year ended December 31, 2017 included in our Annual Report on Form 10-K filed with the SEC on February 22, 2018. This discussion contains forward-looking statements reflecting our current expectations that involve risks and uncertainties. See “Note Regarding Forward-Looking Statements” for a discussion of the uncertainties, risks and assumptions associated with these statements. Our actual results and the timing of events could differ materially from those expressed or implied by the forward-looking statements due to important factors and risks including, but not limited to, those set forth below under “Risk Factors” and elsewhere herein, and those identified under Part I, Item 1A of our Annual Report on Form 10-K for the year ended December 31, 2017 filed with the SEC on February 22, 2018. All share and per share numbers set forth in this Management’s Discussion and Analysis of Financial Conditions and Results of Operations reflect the the one-for -thirty five reverse stock split effected August 10,2018.

| 18 |

Overview

We are a late-stage clinical company focused on developing therapeutics designed to preserve the microbiome to protect and restore the health of patients. Our lead candidates poised for Phase 3 development are: (1) SYN-004 (ribaxamase) which is designed to protect the gut microbiome from the effects of certain commonly used intravenous (IV) beta-lactam antibiotics for the prevention of C. difficile infection (CDI), overgrowth of pathogenic organisms and the emergence of antimicrobial resistance (AMR), and (2) SYN-010 which is intended to reduce the impact of methane-producing organisms in the gut microbiome to treat an underlying cause of irritable bowel syndrome with constipation (IBS-C). Our preclinical pursuits include an oral formulation of the enzyme intestinal alkaline phosphatase (IAP) to treat both local GI and systemic diseases as well as monoclonal antibody therapies for the prevention and treatment of pertussis, and novel discovery stage biotherapeutics for the treatment of phenylketonuria (PKU).

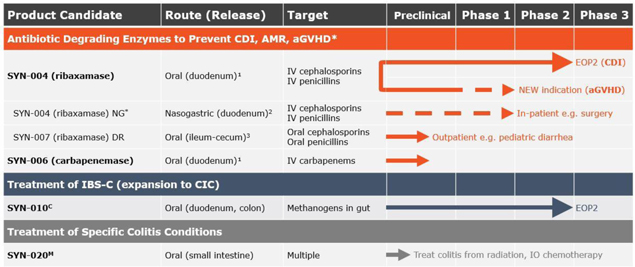

Product Pipeline:

1Designed to degrade excess antibiotics excreted into the GI tract before the antibiotic reached the colon and causes dysbiosis.

2For use in patients who can’t swallow the capsule or its contents.

3Desgned to degrade non-absorbed antibiotic remaining in the GI tract before the antibiotic reaches the colon and causes dysbiosis.

C- Cedars-Sinai Medical Center Collaboration

M- Scientific collaboration with Massachusetts General Hospital

*Development of nasogastric tube (NG) dosing is based on guidance and recommendations by physicians, surgeons, KOLs, our expert steering committee and the U.S. Food & Drug Administration (FDA).

| 19 |

Summary of Clinical and Preclinical Programs

| Therapeutic Area | Product Candidate |

Status | ||

| Prevention of CDI, overgrowth of pathogenic organisms and AMR (Degrade IV beta-lactam antibiotics) | SYN-004 (ribaxamase) (oral enzyme) |

· Reported supportive Phase 1a/1b data (1Q 2015)

· Reported supportive topline data from two Phase 2a clinical trials (4Q 2015 & 2Q 2016)

· Initiated Phase 2b proof-of-concept clinical trial (3Q 2015)

· Received USAN approval of the generic name “ribaxamase” for SYN-004 (July 2016)

· Completed Enrollment of Phase 2b proof-of-concept clinical trial (3Q 2016)

· Awarded contract by the CDC (4Q 2016)

· Announced positive topline data from Phase 2b proof-of-concept clinical trial, including achievement of primary endpoint of significantly reducing CDI (1Q 2017)

· Announced additional results from Phase 2b proof-of-concept clinical trial demonstrating SYN-004 (ribaxamase) protected and maintained the naturally occurring composition of gut microbes from antibiotic-mediated dysbiosis in treated patients (2Q 2017)

· Announced additional results from Phase 2b proof-of-concept clinical trial funded by a contract awarded by the CDC, demonstrating that SYN-004 (ribaxamase) prevented significant change to the presence of certain AMR genes in the gut resistome of patients receiving SYN-004 compared to placebo (3Q 2017)

· Presented additional supportive results regarding several exploratory endpoints from Phase 2b proof-of-concept clinical trial designed to evaluate SYN-004’s (ribaxamase) ability to protect the gut microbiome from opportunistic bacterial infections and prevent the emergence of antimicrobial resistance (AMR) in the gut microbiome (4Q 2017)

· Reached preliminary agreement with the FDA on key elements of a proposed Phase 3 clinical trial program, including de-coupled co-primary endpoints designed to evaluate efficacy separate from safety in a patient population being treated with a representative selection of IV-beta-lactam antibiotics (1H 2018)

· End of Phase 2 meeting with FDA held to solidify remaining elements of planned Phase 3 clinical trial (3Q 2018)

· Expect results from End of Phase 2 meeting with FDA (4Q 2018)

· Clarified market/partner needs and identified potential additional indications for SYN-004 in specialty patient populations such as allogeneic hematopoietic cell transplant patients

· Plan to initiate clinical trial(s) (2H 2019), which may include a broad Phase 3 clinical trial and/or Phase 1/2 clinical trial(s) in a specialty population leading to a subsequent Phase 3 clinical trial |

| 20 |

| Treatment of IBS-C | SYN-010 (oral modified-release lovastatin lactone) |

· Collaboration with Cedars-Sinai Medical Center

· Reported supportive topline data from two Phase 2 clinical trials (4Q 2015 & 1Q 2016)

· Received Type C meeting responses from FDA regarding late-stage aspects of clinical pathway (2Q 2016)

· Presented detailed data supporting previously reported positive topline data from two Phase 2 clinical trials at DDW (May 2016)

· Held End of Phase 2 meeting with FDA (July 2016)

· Confirmed key elements of Pivotal Phase 2b/3 clinical trial design pursuant to consultations with FDA (1Q 2017) | ||

|

· Announced issuance of key U.S. composition of matter patent providing important intellectual property protection in the U.S until at least 2035 (Q2 2018)

· Entered into agreement with CSMC for an investigator-sponsored Phase 2 clinical study of SYN-010 to evaluate SYN-010 dose response and inform Phase 3 clinical development (Q3 2018)

· Anticipate dosing first patient in the Phase 2b investigator sponsored clinical study during Q4 2018

· Anticipate data readout from the Phase 2b investigator sponsored clinical study during 2H 2019 | ||||

| Prevention of CDI, overgrowth of pathogenic organisms and AMR (Degrade IV carbapenem antibiotics) |

SYN-006 (oral enzyme) |

· Identified P2A as a potent carbapenemase that is stable in the GI tract

· Manufactured and formulated research lot for oral delivery (2017)

· Demonstrated microbiome protection in a pig model with ertapenem administration (Q1 2018) | ||

| Prevention of CDI, overgrowth of pathogenic organisms and AMR (Degrade oral beta-lactam antibiotics) | SYN-007 (oral enzyme) |

· Preclinical work ongoing to expand the utility of SYN-004 (ribaxamase) for use with oral beta-lactam antibiotics

· Presented supportive data from canine animal model at the Microbiome World Congress, America (Q4 2017)

· Reported supportive data from a second canine animal model demonstrating that when co-administered with oral amoxicillin and oral Augmentin, oral SYN-007 did not interfere with systemic absorption of antibiotics but did diminish microbiome damage associated with these antibiotics (2Q 2018) |

| 21 |

| Preserve gut barrier, treat local GI inflammation, restore gut microbiome | SYN-020 (oral IAP enzyme) |

· Generated high expressing manufacturing cell lines for intestinal alkaline phosphatase (IAP) (1H 2017) | |||

| · Identified basic DS manufacturing process and potential tablet formulations (2H 2017) | |||||

| · Identified three potential clinical indications in areas of unmet medical need including, enterocolitis associated with radiation therapy, enterocolitis associated with checkpoint inhibitor therapy for cancer, and microscopic colitis (2H 2018) | |||||

| · Ongoing preclinical efficacy studies | |||||

| · Anticipated IND filing (Q4 2019) | |||||

| · Plan to initiate Phase 1 clinical trial (Q1 2020) | |||||

| Prevention and treatment of pertussis | SYN-005 | · Reported supportive preclinical research findings (2014) | |||

| (monoclonal antibody | |||||

| therapies) | · The University of Texas at Austin (“UT Austin”) received a grant from the Bill and Melinda Gates Foundation to support a preclinical study to evaluate the prophylactic capability of SYN-005 (4Q 2015) | ||||

| · Reported supportive preclinical data demonstrating hu1B7, a component of SYN-005, provided protection from pertussis for five weeks in neonatal non-human primate study (Q2 2017) | |||||

| · Reported supportive preclinical data demonstrating that an extended half-life version of hu1B7, a component of SYN-005, provided protection from pertussis for five weeks in a non-human neonatal primate study (Q4 2017) | |||||

| · Collaborations with Intrexon and UT Austin | |||||

Recent Developments

Reverse Stock Split

On August 1, 2018, we announced a reverse stock split (the “Reverse Stock Split”) of our issued and outstanding common stock, par value $0.001 per share (the “Common Stock”), at a ratio of one (1) share of Common Stock for every thirty-five (35) shares of Common Stock, effective August 10, 2018 (the “Effective Date”). Our Common Stock began trading on a split-adjusted basis on the NYSE American when the market opened on August 13, 2018. The Reverse Stock Split was authorized by our Board of Directors on July 31, 2018.

Public Offering

On October 15, 2018, we closed our underwritten public offering (the “Offering”) pursuant to which we received gross proceeds of approximately $18.6 million before deducting underwriting discounts, commissions and other offering expenses payable by us and sold an aggregate of (i) 2,520,000 Class A Units (the “Class A Units”), with each Class A Unit consisting of one share of Common Stock, and one five-year warrant to purchase one share of Common Stock at an exercise price of $1.38 per share (the “October 2018 Warrants”), with each Class A Unit offered to the public at a public offering price of $1.15, and (ii) 15,723 Class B Units (the “Class B Units”, and together with the Class A Units, the “Units”), with each Class B Unit offered to the public at a public offering price of $1,000 per Class B Unit and consisting of one share of the Company’s Series B Convertible Preferred Stock (the “Series B Preferred Stock”), with a stated value of $1,000 and convertible into shares of Common Stock at the stated value divided by a conversion price of $1.15 per share, with all shares of Series B Preferred Stock convertible into an aggregate of 13,672,173 shares of Common Stock, and issued with an aggregate of 13,672,173 October 2018 Warrants. A.G.P./Alliance Global Partners (the “Underwriters”) acted as sole book-running manager for the Offering. In addition, pursuant to the Underwriting Agreement that we entered into with the Underwriters on October 10, 2018, we granted the Underwriters a 45 day option (the “Over-allotment Option”) to purchase up to an additional 2,428,825 shares of Common Stock and/or additional October 2018 Warrants to purchase an additional 2,428,825 shares of Common Stock. The Underwriters partially exercised the Over-allotment Option by electing to purchase from us additional October 2018 Warrants to purchase 1,807,826 shares of Common Stock. The Units were offered by us pursuant to a registration statement on Form S-1 (File No. 333-227400), as amended, filed with the SEC, which was declared effective by the SEC on October 10, 2018.

| 22 |

Our Microbiome-Focused Pipeline

Our SYN-004 (ribaxamase) and SYN-010 programs are focused on protecting the healthy function of the gut microbiome, or gut flora, which is composed of billions of microbial organisms including a natural balance of both “good” beneficial species and potentially “bad” pathogenic species. When the natural balance or normal function of these microbial species is disrupted, a person’s health can be compromised. All of our programs are supported by our growing intellectual property portfolio. We are maintaining and building our patent portfolio through: filing new patent applications; prosecuting existing applications; and licensing and acquiring new patents and patent applications. Our plan remains focused on the advancement of our two late-stage clinical programs. We continue to actively manage resources in preparation for the late-stage clinical advancement of our two late-stage microbiome-focused clinical programs, including our pursuit of opportunities that will allow us to establish the clinical infrastructure and financial resources necessary to successfully initiate and complete this plan.

Clinical and Pre-Clinical Update

SYN-004 (ribaxamase) — Prevention of C. difficile infections (CDI), overgrowth by pathogenic organisms, and the emergence of antimicrobial resistance (AMR)

During the third quarter, we held an End of Phase 2 meeting with the FDA to solidify remaining elements of the proposed Phase 3 clinical program. We anticipate sharing the results from the End of Phase 2 meeting following receipt of the official FDA meeting minutes. In parallel with clinical and regulatory efforts, we have recently completed a Health Economics Outcomes Research study, which was conducted to generate key insights on how we can expect Health Care Practitioners, or HCPs, to evaluate patient access for ribaxamase while also providing a framework for potential reimbursement strategies. After evaluating findings from the study, and after extensive discussions with pharmaceutical companies, physicians, research institutions and clinical development groups worldwide, we believe that there is significant potential value in exploring the development of SYN-004 (ribaxamase) in a more narrow patient population where the incidence of the disease endpoint is high and the clinical development may be less costly. One potential narrow patient population for SYN-004 could be allogeneic hematopoietic cell transplant (HCT) recipients, who have a very high risk of CDI, VRE colonization and potentially fatal bacteremia, and acute-graft-vs-host disease. Published literature has demonstrated a strong association between these adverse outcomes and microbiome damage caused by IV beta-lactam antibiotics in these patients. Further examination and discussions with key opinion leaders (KOLs) are ongoing to evaluate a potential clinical development pathway forward for SYN-004 in such a narrow, specialty patient population.

Contingent on potential interest from prospective partners and/or appropriate funding, we anticipate initiating the Phase 3 clinical trial currently under discussion with the FDA in 2H 2019 which will evaluate SYN-004 (ribaxamase) effects on CDI in a broad and diverse patient population. In parallel, discussions with KOLs are ongoing to determine if further investigation in the form of a potential Phase 1 and/or Phase 2 clinical trial(s) evaluating SYN-004 (ribaxamase) in a specialized patient population may also and/or alternatively be pursued in 2H 2019. We are continuing to pursue potential partnering opportunities for our SYN-004 program both domestically and in China where there has been receptiveness to the idea that a clinical program in a specialized patient population could provide a more viable regulatory pathway towards marketing approval. If it is determined that the clinical advancement of SYN-004 is more favorable and significantly less costly in a specialized patient population, we may elect to prioritize and pursue this strategy in advance of pursuing the broader Phase 3 clinical program currently under discussion with the FDA. If approved by the FDA, SYN-004 (ribaxamase) would be the first available drug designed to prevent primary Clostridium difficile infection by protecting the gut microbiome from antibiotic-mediated dysbiosis.

SYN-010 — Treatment of Irritable Bowel Syndrome with Constipation (IBS-C)

On September 5, 2018, we entered into an agreement with CSMC for an investigator-sponsored Phase 2 clinical study of SYN-010 to be co-funded by us and CSMC (the “Study”).

The Study will provide further evaluation of the efficacy and safety of SYN-010, our modified-release reformulation of lovastatin lactone, which is exclusively licensed to us by CSMC. SYN-010 is designed to reduce methane production by certain microorganisms (M. smithii) in the gut to treat an underlying cause of irritable bowel syndrome with constipation (IBS-C). The data from this study will provide additional insights into potential SYN-010 clinical efficacy, including dose response and microbiome effects, ideally solidifying existing clinical outcomes data, and potentially simplifying Phase 3 clinical development. We believe the successful completion of this study will as allow us to re-engage with prospective partners, both domestically and abroad, who found the results from our previously completed Phase 2a study compelling and have indicated their interest in reviewing a more robust clinical data set.

The Study will be conducted out of the Pimentel Laboratory at CSMC and is expected to be a 12-week, placebo-controlled, double-blind, randomized clinical trial to evaluate two dose strengths of oral SYN-010 (21 mg and 42 mg) in approximately 150 patients diagnosed with IBS-C. The investigator-sponsored Study will be led by the gastrointestinal microbiota researcher Ruchi Mathur, M.D., director of Metabolism, Clinical Research and Administrative Operations at the Medically Associated Science and Technology (MAST) Program at CSMC. The Study is expected to begin enrollment during the fourth quarter of 2018, contingent upon approval of the clinical study protocol by the CSMC Institutional Review Board.

| 23 |

The primary objective for the Study will be to determine the efficacy of SYN-010, measured as an improvement from baseline in the weekly average number of complete spontaneous bowel movements (CSBMs) during the 12-week treatment period for SYN-010 21 mg and 42 mg daily doses relative to placebo. Secondary efficacy endpoints for both dose strengths of SYN-010 are expected to measure changes from baseline in abdominal pain, bloating, stool frequency as well as the use of rescue medication relative to placebo. Exploratory outcomes include Adequate Relief and quality of life measures using the well-validated EQ-5D-5L and PAC-SYM patient questionnaires.

We expect that CSMC will dose the first patient in the investigator-sponsored Phase 2b clinical study in Q4 2018. A data readout from this clinical trial study is anticipated in 2H 2019.

SYN-020 — Oral Intestinal Alkaline Phosphatase

We are currently evaluating and establishing strategies to advance IAP to and through clinical trials for several novel indications, including enterocolitis associated with radiation therapy for cancer and checkpoint inhibitor therapy for cancer and microscopic colitis, all of which have unmet medical needs and span a range of market sizes. Importantly, we believe that with a small capital commitment, we can begin moving SYN-020 towards an IND. We are targeting filing an IND during Q4 2019 and commencing a Phase 1 clinical trial during Q1 2020.

Intellectual Property

All of our programs are supported by growing patent estates that we either own or exclusively license. Each potential product has issued patents that provide protection. In total, we have over 110 U.S. and foreign patents and over 100 U.S. and foreign patents pending. For instance, U.S. Patent Nos. 8,894,994 and 9,587,234, which include claims to compositions of matter and pharmaceutical compositions of beta-lactamases, including SYN-004 (ribaxamase), have patent terms to at least 2031. Further, U.S. Patent 9,301,995 and 9,301,996, both of which will expire in 2031, cover various uses of beta-lactamases, including SYN-004 (ribaxamase), in protecting the microbiome, and U.S. Patent Nos. 9,290,754, 9,376,673, 9,404,103, 9,464,280, and 9,695,409 which will expire in at least 2035, covers further beta-lactamase compositions of matter related to SYN-004 (ribaxamase). Also, U.S. Patent No. 9,192,618, which expires in at least 2023, includes claims that cover use of statins, including SYN-010, for the treatment of IBS-C. U.S. Patent No. 9,289,418, which expires in at least 2033, includes claims that cover the use of a variety of compounds, including the active agent of SYN-010, to treat constipation in certain screened patients. U.S. Patent No. 9,744,208 covers methods of use of the active agent of SYN-010 for the treatment of constipation until at least 2034. U.S Patent No. 9,956,292 includes claims related to composition of matter for the use of anti-methanogenic compositions to treat IBS-C until at least 2035.

Our goal is to (i) obtain, maintain, and enforce patent protection for our products, formulations, processes, methods, and other proprietary technologies, (ii) preserve our trade secrets, and (iii) operate without infringing on the proprietary rights of other parties, worldwide. We seek, where appropriate, the broadest intellectual property protection for product candidates, proprietary information, and proprietary technology through a combination of contractual arrangements and patents.

Critical Accounting Policies

The condensed consolidated financial statements are prepared in conformity with U.S. GAAP, which requires the use of estimates, judgments and assumptions that affect the reported amounts of assets and liabilities, the disclosure of contingent assets and liabilities at the date of the consolidated financial statements, and the reported amounts of revenues and expenses in the periods presented. We believe that the accounting estimates employed are appropriate and resulting balances are reasonable; however, due to inherent uncertainties in making estimates, actual results may differ from the original estimates, requiring adjustments to these balances in future periods. The critical accounting estimates that affect the condensed consolidated financial statements and the judgments and assumptions used are consistent with those described under Part II, Item 7 of our 2017 Form 10-K.

Results of Operations

Three Months Ended September 30, 2018 and 2017

General and Administrative Expenses