Attached files

| file | filename |

|---|---|

| EX-32.2 - EXHIBIT 32.2 - VII Peaks Co-Optivist Income BDC II, Inc. | tv504875_ex32-2.htm |

| EX-32.1 - EXHIBIT 32.1 - VII Peaks Co-Optivist Income BDC II, Inc. | tv504875_ex32-1.htm |

| EX-31.2 - EXHIBIT 31.2 - VII Peaks Co-Optivist Income BDC II, Inc. | tv504875_ex31-2.htm |

| EX-31.1 - EXHIBIT 31.1 - VII Peaks Co-Optivist Income BDC II, Inc. | tv504875_ex31-1.htm |

| EX-21.1 - EXHIBIT 21.1 - VII Peaks Co-Optivist Income BDC II, Inc. | tv504875_ex21-1.htm |

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2017

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File No. 0-54615

VII Peaks Co-Optivist Income BDC II, Inc.

(Exact name of Registrant as specified in its charter)

| Maryland | 45-2918121 | |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification Number) |

4 Orinda Way, Suite 125-A

Orinda, CA 94563

(Address of principal executive offices)

(855) 889-1778

(Registrant’s telephone number, including area code)

Not applicable

(Former Name, Former Address and Former Fiscal Year, if Changed Since Last Report)

Securities registered pursuant to Section 12(b) of the Act:

Common Stock, par value

None

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, par value

$0.001 per share

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act of 1933. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Securities Exchange Act of 1934. Yes ¨ No x

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days: Yes ¨ No x

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer”, “accelerated filer”, “smaller reporting company”, and “emerging growth company” in Rule 12b-2 of the Exchange Act.:

| Large accelerated filer ¨ | Accelerated filer ¨ | Non-accelerated filer x | Smaller reporting company ¨ | Emerging growth company ¨ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

There is no established market for the Registrant's shares of common stock. As of June 30, 2017, the last business day of the registrant's most recently completed second fiscal quarter, the aggregate market value of the registrant's equity held by non-affiliates of the registrant was approximately $43,613,782 based on net asset value per share of the registrant's common stock on such date.

The number of shares of the Registrant’s common stock, par value $0.001 per share, outstanding as of November 5, 2018 was 6,511,714.

Documents Incorporated by Reference

None.

Forward Looking Statements

The following information contains statements that constitute forward-looking statements. These statements generally are characterized by the use of terms such as “may,” “should,” “plan,” “anticipate,” “estimate,” “intend,” “predict,” “believe,” and “expect” or the negative of these terms or other comparable terminology. Although we believe that the expectations reflected in such forward-looking statements are based upon reasonable assumptions, our actual results could differ materially from those set forth in the forward-looking statements.

Forward-looking statements contained in this Annual Report are subject to a number of risks and uncertainties, some of which are beyond our control, including statements as to:

| • | our ability to invest in discounted corporate debt and equity-linked debt securities of our target companies; | |

| • | our ability to successfully employ our Co-Optivist TM approach in executing our investment strategy; | |

| • | a limited pool of prospective target businesses; | |

| • | our ability to pay distributions on our shares of common stock; | |

| • | an economic downturn which could impair our target companies’ abilities to continue to operate, which could lead to the loss of some or all of our assets; | |

| • | changes in general economic or business conditions or economic or demographic trends in the United States; and | |

| • | the risks, uncertainties and other factors we identify in “Risk Factors” and elsewhere in this annual report. |

Our actual results, performance, prospects or opportunities could differ materially from those expressed in or implied by our forward-looking statements. A description of some of the risks that could cause our actual results to differ appears under the section “Risk Factors” and elsewhere in this prospectus. Additional risks of which we are not currently aware or which we currently deem immaterial could also cause our actual results to differ.

In light of these risks, uncertainties and assumptions, you should not place undue reliance on any forward-looking statements. These forward-looking statements are made as of the date of this prospectus. We undertake no obligation to publicly update or revise any forward-looking statements after the date of this prospectus, whether as a result of new information, future events or otherwise, except as required by law.

Forward-looking statements are subject to numerous assumptions, risks and uncertainties, which change over time. Forward-looking statements speak only as of the date they are made, and we assume no duty to and do not undertake to update forward-looking statements. These forward-looking statements contained in this prospectus do not meet the safe harbor for forward-looking statements pursuant to Section 27A of the Securities Act. Actual results could differ materially from those anticipated in forward-looking statements and future results could differ materially from historical performance.

| 2 |

VII PEAKS CO-OPTIVIST INCOME BDC II, INC.

FORM 10-K FOR THE YEAR ENDED DECEMBER 31, 2017

TABLE OF CONTENTS

| 3 |

Except as otherwise specified in this annual report on Form 10-K (“Annual Report”), the terms:

| • | “we”, “us”, “our” and the “Fund” refer to VII Peaks Co-Optivist TM Income BDC II, Inc., a Maryland Corporation. |

General

We are a specialty finance company incorporated in Maryland on August 3, 2011. We are an externally managed, non-diversified closed-end management investment company that has elected to be treated as a business development company (“BDC”) under the Investment Company Act of 1940, as amended, or (the “1940 Act”).

We are managed by VII Peaks Capital, LLC, or (the “Manager”), which is registered as an investment adviser with the Securities and Exchange Commission, or (the “SEC”). We have elected to be treated for federal income tax purposes as a regulated investment company, or (“RIC”) under the Internal Revenue Code of 1986, as amended (the “Code”).

On August 9, 2011, we filed a registration statement on Form N-2 to sell up to 75,000,000 shares of common stock, $0.001 par value per share, at an initial public offering price of $10.00 per share. The registration statement was declared effective by the SEC on March 1, 2012. We achieved the minimum offering requirement on July 10, 2012 and commenced operations on such date. As of December 31, 2017, we issued 6.8 million shares of common stock for gross proceeds of $63.8 million, including $5.9 million under our distribution reinvestment plan (“DRIP”).

We invest in discounted corporate debt, senior secured term loan and equity-linked debt securities of public and private companies that trade on the secondary loan market for institutional investors and provide distributions to investors. The debt is generally high-yield and non-investment grade. At the same time, we actively work with the target company’s management to restructure the underlying securities and improve the liquidity position of the target company’s balance sheet. We employ a proprietary “Co-Optivist” TM approach (“cooperative activism”, Co-Optivist TM is a registered trademark of VII Peaks Capital, LLC, or (“VII Peaks” or the “Manager”), and is being used with their permission) in executing our investment strategy, which entails proactively engaging the target company management on average 24 months prior to a redemption event (typically a put or maturity event) to create an opportunity for growth in the investments. We also make opportunistic debt and preferred equity investments in private companies.

Our investment objectives are to generate current income and capital appreciation. We meet our investment objectives by: (i) realizing income and capital appreciation through the acquisition, management and orderly liquidation of corporate debt securities, (ii) making distributions of available distributable cash to our shareholders, and (iii) preserving the capital investments of our shareholders. There can be no assurance that any of these objectives be achieved.

Capital appreciation on securities is generally not realized evenly over the holding period. In some instances market prices for securities may continue to reflect a discount until a relatively short time period prior to a redemption event. The potential capital gain typically occurs during the end of the holding period of a bond in our portfolio when securities are either called by the company or exchanged to new securities during refinance. We have tendered certain debt securities well above the market-traded deep discount.

Our proprietary “Co-Optivist” TM approach entails investment in the corporate debt and equity-linked debt securities of target companies, or Target Investments, in conjunction with proactively engaging the target company’s management. We acquire Target Investments whose debt securities trade on the over-the-counter market for institutional loans at a discount to their par redemption value and will be subject to a “redemption event” within (on average) 24 months. We also invest directly in debt of private companies. We define a “redemption event” as a maturity event or a put event (where investors in the target company’s debt security can have a redemption right at a pre-determined price). We hold such debt an average of 24 months, during which time we anticipate working actively with the target companies’ management to effect and/or participate in a restructuring or exchange of the invested securities for new securities.

We make investments in target companies that meet our investment criteria. The size of an individual investment will vary based on numerous factors, including the amount of funds raised in our offering. However, assuming we raise the maximum offering amount of $750.0 million, we expect to hold at least 50 investments, and we anticipate that the minimum investment size will be approximately $250,000. We do not anticipate being heavily invested in any one industry, and generally, we do not expect to invest in more than two different classes of debt of the same target company. We invest in debt and equity-linked debt of target companies with a minimum enterprise value of $200.0 million and whose debt and equity-linked debt is actively traded in the secondary loan market. We also make senior secured direct loan investments in companies with a minimum enterprise value of $5.0 million. For such senior secured direct loan investments, we may receive equity securities to boost overall returns. We expect our portfolio to be predominantly composed of senior secured term loans and high-yield corporate debt securities. However, we may also purchase senior secured corporate debt securities, which may have variable interest rates. We currently anticipate that the portion of our portfolio composed of variable rate corporate debt securities, if any, will not exceed 20%, but we may increase that to 33% of our aggregate portfolio at the time of any purchase depending on market opportunities.

| 4 |

We offer our shareholders the ability to receive distributions as well as the potential capital appreciation resulting from the restructuring of the debt of our target companies. To the extent we have distributable income available we anticipate making distributions on a monthly basis to our shareholders.

Between 2001 and 2008, corporate debt levels and the supply of leverage offered by banks and other investors began a steady increase. Since then, corporate debt has continued to increase, with the financing sources less available. We believe a significant amount of this debt will be subject to a redemption event prior to 2021. Many of the companies that have outstanding issues of such debt have not, or been able to proactively refinance, creating a “refinancing wall” that we believe will create a liquidity shortfall for many issuers. The value of the debt securities of these companies as reflected in prices quoted in the secondary loan market, may be at a significant discount to par, and represent a premium yield to maturity reflective of these liquidity concerns, creating the opportunity for us to identify and invest in the debt securities of select companies at attractive current market valuations. We believe that our Co-Optivist TM approach can help our target companies achieve results that are beneficial to the long-term value of their businesses, which will in turn, result in capital gains through capital appreciation, or the exchange of invested securities into a current security or cash at a premium to its acquisition price. Our principals collectively have experience in principal investing, debt securities and general capital markets, and we believe we are well-positioned to capitalize on these opportunities.

Conversion to Closed End Interval Fund

At our adjourned annual meeting of stockholders held on December 28, 2016, our stockholders (i) approved the withdrawal of our election to be treated as a business development company; (ii) approved our reorganization as a Delaware Statutory Trust; (iii) approved the amended and restated investment management agreement with our Manager, and (iv) approved of a fundamental policy whereby we would become an “interval fund”, under which we would make annual repurchase offers of our shares on or about November 1st of each calendar year (collectively, the “Reorganization”). We will complete the Reorganization promptly after approval of an N-2 Registration Statement filed by VII Peaks Co-Optivist Income Fund, a Delaware Statutory Trust, which was formed on January 25, 2017.

Changes to Investment Advisory Agreement

Set forth below is a chart that summarizes the differences between our Manager’s current investment advisory agreement and the amended and restated investment management agreement approved by our shareholders:

| Current Investment Advisory Agreement | Proposed Amended and Restated Investment Advisory Agreement | ||

| Fees-Management | 2.00% if our net assets are below $100 million; 1.75% if our net assets are between $100 million and $250 million; and 1.50% if our net assets are above $250 million. Fee is payable monthly in arrears. | 2.00% if our gross assets are below $100 million; 1.75% if our gross assets are between $100 million and $250 million; and 1.50% if our gross assets are above $250 million. Fee is payable monthly in arrears. | |

| Incentive Fee on Net Investment Income | 20% of our net investment income above a hurdle rate of 8% per annum, paid quarterly. | No change. | |

| Incentive Fee on Capital Gains | 20% of our realized capital gains, less realized and unrealized capital losses. | Eliminated. | |

| Future Offering Expenses | Incurred by our manager and reimbursed at the rate of 1.5% of gross offering proceeds. | Incurred and paid by us. | |

| Past Offering Expenses paid by Manager | Only reimbursable to the extent of 1.5% of our gross offering proceeds. | No change. |

Conversion to Interval Fund

In the event the Reorganization is consummated, our shareholders approved the adoption of a fundamental policy under which we would operate as an “interval fund” that makes periodic repurchase offers for our common stock. Set forth below is the fundamental policy approved by our shareholders:

(a) We will make offers to repurchase our shares at annual intervals pursuant to Rule 23c-3, as amended from time to time. Our Board of Directors may place such conditions and limitations on repurchases as may be permitted.

(b) November 1st of each year, or the next business day if November 1st is not a business day, will be the deadline (the “Repurchase Request Deadline”) by which we must receive repurchase requests submitted by our shareholders in response to the most recent repurchase offer.

| 5 |

(c) The date on which the repurchase price for shares is to be determined shall occur within fourteen (14) days after the Repurchase Request Deadline.

(d) Repurchase requests may be suspended or postponed under certain circumstances, as provided for in Rule 23c-3.

Fundamental Investment Policies and Restrictions

Following our withdrawal of our election to be treated as a business development company, we will no longer be required to invest at least 70% of our assets in eligible portfolio securities. Instead, we are required to adopt fundamental policies and restrictions that govern how we may invest our assets. The stated fundamental policies may only be changed by the affirmative vote of a majority of our outstanding voting securities. As defined by the Investment Company Act of 1940 (the “1940 Act”), the vote of a “majority of the outstanding voting securities of the company” means the vote, at an annual or special meeting of the company’s shareholders duly called, (a) of 66- 2 ⁄ 3% or more of the voting securities present at such meeting, if the holders of more than 50% of the outstanding voting securities of the company are present or represented by proxy; or (b) of more than 50% of the outstanding voting securities of the company, whichever is less.

Set forth below are the fundamental policies and restrictions that we expect to adopt upon consummation of the Reorganization:

| (1) | we may borrow money, except to the extent permitted by the 1940 Act, or any rules, exemptions or interpretations thereunder that may be adopted, granted or issued by the SEC. |

| (2) | we may not act as an underwriter of securities of other issuers, except to the extent we may be deemed to be an underwriter when disposing of our own securities. |

| (3) | we may not make loans if, as a result, more than 33-1/3% of our total assets would be lent to other persons, including other investment companies to the extent permitted by the 1940 Act or any rules, exemptions or interpretations thereunder that may be adopted, granted or issued by the SEC. This limitation does not apply to (1) the lending of portfolio securities, (2) the purchase of debt securities, other debt instruments, loan participations and/or engaging in direct corporate loans in accordance with our investment goals and policies, and (3) repurchase agreements to the extent the entry into a repurchase agreement is deemed to be a loan. |

| (4) | we may not purchase or sell real estate unless acquired as a result of ownership of securities or other instruments and provided that this restriction does not prevent us from (i) purchasing or selling securities or instruments secured by real estate or interests therein, securities or instruments representing interests in real estate or securities or instruments of issuers that invest, deal or otherwise engage in transactions in real estate or interests therein, and (ii) making, purchasing or selling real estate mortgage loans. |

| (5) | we may not purchase or sell physical commodities, unless acquired as a result of ownership of securities or other instruments, provided that this restriction does not prevent us from investing in commodities contracts for the purpose of hedging its investment portfolio, including currency futures, stock index futures, interest rate futures and options thereon. |

| (6) | we may not issue senior securities, except to the extent permitted by the 1940 Act or any rules, exemptions or interpretations thereunder that may be adopted, granted or issued by the SEC. |

| (7) | we may not invest more than 25% of our net assets in securities of issuers in any one industry (other than securities issued or guaranteed by the U.S. government or any of its agencies or instrumentalities or securities of other investment companies). |

| (8) | we will not be limited in the percentage of our assets that may be invested in the securities of any one issuer. |

With respect to these investment restrictions (except our policy on borrowings set forth above), if a percentage restriction is adhered to at the time of our investment or transaction, a later change in percentage resulting from a change in the values of our investments or the value of our total assets, unless otherwise stated, will not constitute a violation of such restriction or policy.

The 1940 Act currently limits borrowing to no more than 33-1/3% of the value of our total net assets. In addition, the 1940 Act currently limits the issuance of a class of senior securities that is indebtedness to no more than 33-1/3% of the value of our total assets or, if the class of senior security is stock, to no more than 50% of the value of our total assets.

Our Manager

Our investment activities are managed by our Manager who is registered as an investment adviser under the Investment Advisers Act of 1940, as amended, or (the “Advisers Act”). Our Manager is responsible for sourcing potential investments, conducting research on prospective investments, analyzing investment opportunities, structuring our investments, and monitoring our investments and portfolio companies on an ongoing basis. Our Manager is led by Gurpreet (Gurprit) S. Chandhoke, who also serves as our Chief Executive Officer of the Fund and Stephen Shea, a managing member of VII Peaks Capital, LLC. They are supported by the Manager’s team of employees, including investment professionals who have extensive experience in underwriting and issuing debt products that include high-yield, bank debt and convertible debt and have acted as financial advisers to private equity funds, venture capital firms and corporations in mergers and acquisitions, recapitalization and corporate finance transactions, and have served as principal investors in private equity and leveraged buyout transactions.

| 6 |

Our Manager has an investment committee that is responsible for reviewing, discussing and approving each investment opportunity we seek to pursue. Our investment committee meets to discuss new and existing opportunities and developments on current investments. Our investment committee currently consists of Mr. Chandhoke, our Chief Executive Officer, and Mr. Milton Balbuena, Co-Chief Investment Officer.

Our Affiliates

Our Manager is owned and managed by Gurpreet (Gurprit) S. Chandhoke, our Chief Executive Officer, and Stephen F. Shea. Founded in April 2009 with principal offices in Orinda, California, our Manager also manages VII Peaks Co-Optivist B Fund I, LLC, VII Peaks Co-Optivist R Fund I, LLC and VII Peaks Co-Optivist B Fund II, LLC, and the VII Peaks Direct Lending Fund, which are private funds that were formed to conduct private placements of securities and which have substantially similar investment objectives as the Fund. As of December 31, 2017, VII Peaks Co-Optivist B Fund I, LLC, VII Peaks Co-Optivist R Fund I, LLC and VII Peaks Co-Optivist B Fund II, LLC had aggregate net assets of $3.3 million.

The investment objective, strategy and fee structure of the private funds are substantially similar to those of VII Peaks Co-Optivist Income BDC II, Inc. However, the performance of the private funds is not necessarily indicative of our future performance.

Market Opportunity

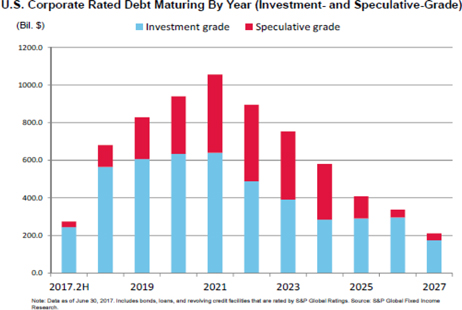

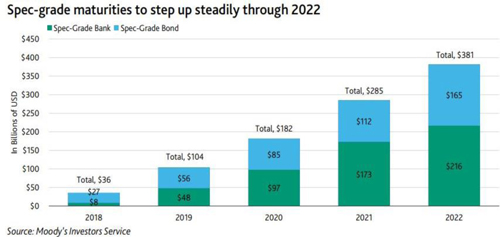

In the upcoming years, we believe many companies will face maturities and redemptions on significant amounts of outstanding debt and will have to find ways to refinance those obligations. See below a chart compiled from S&P for Investment-grade and Speculative-grade USD Bonds maturing from 2017 to 2027. The charts below show over $4.6 trillion of U.S. based investment-grade bonds to mature between 2017 to 2027 and $445 billion in speculative grade bonds to mature between 2018 and 2022.

| 7 |

While companies have recently taken advantage of the low-interest rate environment to amend and extend their debt maturities, we believe this is only a temporary push-out of the debt maturity wall without a meaningful reduction in overall outstanding debt. For the foreseeable future, we expect continued low demand for collateralized debt and soft economic growth to keep credit markets tight. The amount of speculative-grade debt (“BB+” and lower) coming due will continue to be a large share of overall maturing debt. Corporate borrowers whose debt carries lower ratings have had difficulty obtaining refinancing and face what we call a “refinancing wall”. As a result, many companies with speculative-grade debt have chosen to amend-and-extend their maturities rather than fully refinancing their debt.

Our strategy is to invest in debt securities that are issued by companies with solid fundamentals and business prospects but who are facing a liquidity shortfall as they approach the “refinancing wall”. We believe that the expertise and experience of the officers of our Manager provide us with the ability to identify debt securities that we believe are currently mispriced in the secondary loan market and thus provide an opportunity for returns as their values recover and appreciate.

Potential Competitive Strengths

We believe that we have the following potential competitive strengths as compared to investment funds that also invest in discounted corporate debt, senior secured term loan and equity-linked debt securities:

| • | We Are Not a Traditional Distressed Fund. Traditional distressed debt investors typically seek to own the debt and engage in a bankruptcy process with the issuing company and eventually become equity holders. Through equity ownership, traditional distressed debt investors then intend to restructure operations of the Fund. In contrast, we do not invest in debt securities with the intent of undergoing a bankruptcy process. We look to partner with management to pro-actively avoid a default and bankruptcy situation. We are focused on restructuring company balance sheets, not company operations. |

| • | Investment Hold Period. We will not actively trade in and out of positions. Rather, we hold our investments for an average of 24 months. During this hold period we anticipate working co-operatively with target company management and other debt holders on a debt restructuring or exchange. |

| • | Comprehensive Private Equity Due Diligence Approach. We employ a comprehensive private equity approach to our investment due diligence process. This approach involves performing comprehensive business and industry due diligence and in-depth, bottoms-up valuation analyses for each investment, comparable to what a private equity firm with a long-term ownership position would conduct prior to investing in a target company. We believe this disciplined approach serves as an effective risk management tool for our investment process. |

| • | Relevant Capital Markets and Investment Experience. Our investment team consists of individuals who collectively have expertise and experience in principal investing, debt securities and general capital markets. The members of our investment team combined have been involved in the issuance of over $20 billion of debt securities, advised on a number of merger and acquisition transactions and invested in a number of private equity and leveraged buyout transactions. |

Investment Criteria and Strategy

Secondary Market Debt Securities

With respect to corporate debt, senior secured term loan and equity-linked debt securities that we acquire on the secondary market, we invest in discounted corporate debt and equity-linked debt securities of companies that have a perceived risk of near term liquidity issues but have solid business fundamentals and prospects, including historical revenue growth, positive cash flow, significant and sustainable market presence, and sufficient asset coverage. We take a principal position in discounted debt securities with the primary goal of restructuring the terms of the debt to allow the target company to increase its liquidity and strengthen its balance sheet. Our typical target company has a debt redemption event (typically either a put or maturity event) on average within 24 months of our investment and has experienced a significant decline in its equity value reflective of a highly leveraged capital structure or general market conditions. We believe that proactively guiding such companies to restructure their debt will allow them to increase liquidity and free up resources to grow their businesses rather than focusing on managing their debt obligations. We also believe that our involvement can allow the target company more flexibility to explore strategic alternatives, since the terms of the existing debt structure often limits strategic options for the target company.

The following is our primary investment criteria for our target company:

| • | minimum enterprise value of $200 million; |

| • | solid business fundamentals, such as historic revenue growth, profitability and cash flow generation, and favorable prospects for continued improvement in financial performance; |

| • | sufficient asset coverage of at least one and a half times the amount of our potential investment for outstanding liabilities; |

| 8 |

| • | debt or equity-linked debt trading at a discount to par or at a premium yield in secondary loan markets due to a perceived risk of near term liquidity issues; |

| • | balance sheet with debt to total capitalization of at least 50% or high debt to equity ratios; and |

| • | near term redemption (maturity or put) event on its debt creating an upcoming liquidity shortfall. |

The securities that we target include high-yield debt, bank debt, convertible debt, and collateralized loan obligations (“CLO”), which are high-yield loans securitized into pools containing varying degrees of credit rating. Our portfolio is predominantly composed of fixed-rate high-yield and equity-linked corporate debt securities. However, we may also purchase senior secured corporate debt securities which may have variable interest rates. We currently anticipate that the portion of our portfolio composed of variable rate corporate debt securities, if any, will not exceed 20%, but we may increase that to 33% of our aggregate portfolio at the time of any purchase depending on market opportunities. In addition to the investments noted above, we may invest up to 30% of our portfolio in opportunistic investments, including, but not limited to, high-yield bonds, private equity investments, distressed debt investments and securities of public companies that are not thinly traded. We expect that these public companies generally will have debt securities that are non-investment grade. We also may invest in debt securities of middle-market companies located outside of the United States. All investments by us will be subject to oversight by our Board of Directors, a majority of whom will be independent directors with no material interests in such transactions.

In each of our debt investments, we seek to become an influential investor, typically either through the size of our position or cooperation with other debt holders to pursue the shared goal of a beneficial debt restructuring. We actively work with other debt holders and the target company management to potentially restructure and exchange the existing debt for new securities with amended terms. We believe that a debt restructuring can be a positive outcome for not just the issuer but also its other stakeholders.

| • | For such issuers and their equity holders, a debt restructuring is typically viewed favorably by the equity markets and may result in price appreciation in the target company equity securities. |

| • | For investors in the existing debt, a restructuring is often effected through an exchange of securities at a premium to current trading levels to compel security holders to participate. The commencement of a restructuring and its perceived improvement to the Fund’s balance sheet represents an opportunity for investors to participate in capital appreciation that may result from a recovery in the value of the debt securities. |

| • | For the issuer, a debt restructuring can potentially improve liquidity and strengthen its balance sheet by allowing the issuer to retire debt at a discount or obtain more favorable repayment terms. |

We employ our Co-Optivist TM approach in executing our investment strategy, which entails taking an influential position and proactively engaging the target company management on average 24 months prior to a redemption event (typically a put or maturity event). This approach differs from traditional activist debt holders who typically wait until a company is near or at bankruptcy before beginning formal discussions regarding debt restructuring options. In addition, our strategy does not involve taking an operational role in the target company or changing management or members of the target companies’ Board of Directors or actively negotiating the terms of the restructuring. Rather, we look to establish a positive working relationship in assisting our target company to achieve shared goals.

| 9 |

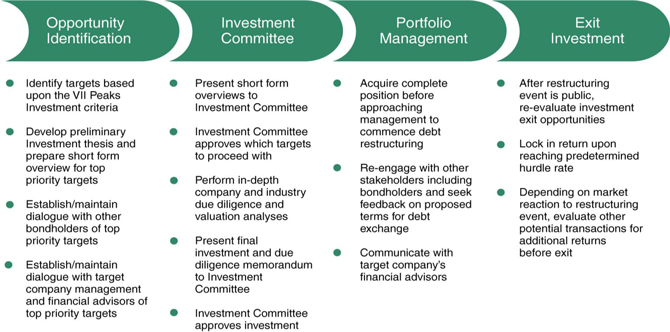

Below is a summary of our investment and approval process:

Originated Investment Positions

We also expect to generate current income through debt and equity investments that we originate, in addition to investments that we acquire on the secondary market. A secondary objective is to generate long-term capital appreciation through such investments. We anticipate that during our offering period we will invest largely in over-the-counter debt securities and customized debt and equity investments in lower middle market companies. We have adopted the following business strategy to achieve our investment objective:

Focus on middle market companies with stable cash flow. We believe that there are relatively few finance companies focused on transactions involving middle market companies, and this is one factor that allows us to negotiate favorable investment terms. Such favorable terms include higher debt yields and lower leverage levels, more significant covenant protection and greater equity participation than typical of transactions involving larger companies. We will generally invest in established companies with positive cash flow. We believe that established companies possess better risk-adjusted return profiles than newer companies that are building management or in early stages of building a revenue base. These middle market companies represent a significant portion of the U.S. economy and often require substantial capital investment to grow their businesses.

Employ disciplined underwriting policies and rigorous portfolio management. We employ an extensive underwriting process that includes a review of the prospects, competitive position, financial performance and industry dynamics of each potential portfolio company. In addition, we perform substantial due diligence on potential investments and seek to invest with management teams and/or private equity sponsors who have proven capabilities in building value. Through our Manager, we offer managerial assistance to our portfolio companies, giving them access to our investment experience, direct industry expertise and contacts, and allowing us to continually monitor their progress. As part of the monitoring process, our Manager analyzes monthly and quarterly financial statements versus the previous periods and year, review financial projections, meet with management, attend board meetings and review all compliance certificates and covenants.

Focus on long-term credit performance and principal protection. We will structure our customized loan investments on a conservative basis with high cash yields, first and/or second lien security interests where possible, cash origination fees, and lower relative leverage levels. Portfolio companies may pay fund manager due diligence fees to cover legal, due diligence, and loan structuring costs. We will seek strong deal protections for our customized debt investments, including default penalties, information rights, board observation rights, and affirmative, negative and financial covenants, such as lien protection and prohibitions against change of control. We believe these protections will reduce our risk of capital loss.

Diversification. We seek to diversify our portfolio broadly among companies in a multitude of different industries and end markets, thereby reducing the concentration of credit risk in any one company or sector of the economy. We cannot guarantee that we will be successful in this effort.

In addition to the investments noted above, we may invest up to 30% of our portfolio in opportunistic investments, including, but not limited to, securities of public companies that are not thinly traded and debt securities of companies located outside of the United States.

| 10 |

Investment Exit Strategy

We employ a strict sell discipline to our investments. As mentioned in our investment selection process, we look for investment opportunities that provide us with the potential to generate income to support sustainable distributions, even if no restructuring of the debt occurs. If a debt restructuring has not occurred upon an investment reaching this return threshold, we will continue our efforts to drive towards a restructuring. If a successful restructuring of the target company debt occurs, we sell a portion of our holdings upon the next pre-determined sell threshold (which we estimate will be approximately twice the average current yield of high yield bonds), usually within one to two quarters after the restructuring event. At that time, depending on the market response to the proposed restructuring, we may choose to exit the entire investment or maintain a small portion to further augment returns.

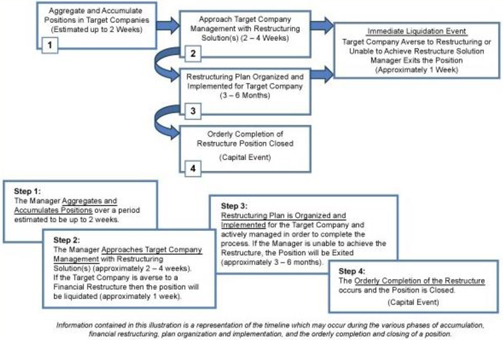

We anticipate that it will take approximately two weeks to accumulate our position in a target company. Following that, we expect that it will take a minimum of an additional two to four weeks to approach management of the target company with a debt restructuring proposal. Assuming the target company wishes to pursue our debt restructuring proposal, we expect that the restructuring itself will take approximately three to six months to implement. At any time during this process, if we feel the target company is unwilling to pursue our debt restructuring proposal, we will seek to dispose of our position in the target company in an orderly manner. We avoid holding the discounted debt if a redemption event is approaching within six months and there is no existing evidence that this debt will be restructured.

The diagram below is illustrative of how we may use our position as an influential debt holder of a target company to restructure its indebtedness.

Portfolio Monitoring

Valuation process. Each quarter, we value investments in our portfolio, and disclose such values in reports filed with the SEC. Investments for which market quotations are readily available are recorded at such market quotations. With respect to investments for which market quotations are not readily available, our Board of Directors, or a committee thereof, determines the fair value of such investments in good faith, utilizing the input of our valuation committee, our Manager and any other professionals or materials that our Board of Directors, or a committee thereof, deems worthy and relevant, including independent third-party valuation firms, if applicable.

Managerial assistance. As a business development company, we must offer, and provide upon request, managerial assistance to certain of our portfolio companies. This assistance could involve, among other things, monitoring the operations of our portfolio companies, participating in board and management meetings, consulting with and advising officers of portfolio companies and providing other organizational and financial guidance. Depending on the nature of the assistance required, our Manager will provide such managerial assistance on our behalf to portfolio companies that request this assistance. To the extent fees are paid for these services, we, rather than our Manager, will retain any fees paid for such assistance.

Determination of Net Asset Value

We determine the net asset value of our investment portfolio each quarter. Securities that are publicly-traded are valued at the reported closing price on the valuation date. Securities that are not publicly-traded are valued at fair value as determined in good faith by our Management and submitted to our Board of Directors, or a committee thereof for review. In connection with that determination, our Manager will prepare portfolio company valuations using relevant inputs, including, but not limited to, indicative dealer quotes, values of like securities, the most recent portfolio company financial statements and forecasts, and valuations prepared by a third-party valuation service annually for certain Level 3 investments.

With respect to investments for which market quotations are not readily available, we undertake a multi-step valuation process each quarter, as described below:

| · | each portfolio company or investment is initially valued by members of the investment committee, with such valuation taking into account information received from an independent valuation firm, if applicable; | |

| · | preliminary valuation conclusions are then documented and discussed with the members of the Board of Directors, or committee thereof including the input and recommendation of members of the investment committee and any third-party valuation firm, if applicable. |

| 11 |

Investments are valued utilizing a market approach, an income approach, or both approaches, as appropriate. The market approach uses prices and other relevant information generated by market transactions involving identical or comparable assets or liabilities (including a business). The income approach uses valuation techniques to convert future amounts (for example, cash flows or earnings) to a single present value amount (discounted) calculated based on an appropriate discount rate. The measurement is based on the net present value indicated by current market expectations about those future amounts. In following these approaches, the types of factors that we may take into account in fair value pricing our investments include, as relevant: available current market data, including relevant and applicable market trading and transaction comparables, applicable market yields and multiples, security covenants, call protection provisions, information rights, the nature and realizable value of any collateral, the portfolio company’s ability to make payments, its earnings and discounted cash flows, the markets in which the portfolio company does business, comparisons of financial ratios of peer companies that are public, M&A comparables, the principal market and enterprise values, among other factors.

We have adopted Financial Accounting Standards Board, or FASB, Accounting Standards Codification, or (“ASC”), Topic 820, Fair Value Measurements and Disclosures, which defines fair value, establishes a framework for measuring fair value in accordance with generally accepted accounting principles and expands disclosures about fair value measurements.

ASC Topic 820 clarifies that the exchange price is the price in an orderly transaction between market participants to sell an asset or transfer a liability in the market in which the reporting entity would transact for the asset or liability, that is, the principal or most advantageous market for the asset or liability. The transaction to sell the asset or transfer the liability is a hypothetical transaction at the measurement date, considered from the perspective of a market participant that holds the asset or owes the liability. ASC Topic 820 provides a consistent definition of fair value which focuses on exit price and prioritizes, within a measurement of fair value, the use of market-based inputs over entity-specific inputs. In addition, ASC Topic 820 provides a framework for measuring fair value and establishes a three-level hierarchy for fair value measurements based upon the transparency of inputs to the valuation of an asset or liability as of the measurement date. The three levels of valuation hierarchy established by ASC Topic 820 are defined as follows:

Level 1: Quoted prices in active markets for identical assets or liabilities, accessible by the Fund at the measurement date.

Level 2: Quoted prices for similar assets or liabilities in active markets, or quoted prices for identical or similar assets or liabilities in markets that are not active, or other observable inputs other than quoted prices.

Level 3: Unobservable inputs for the asset or liability.

In all cases, the level in the fair value hierarchy within which the fair value measurement in its entirety falls has been determined based on the lowest level of input that is significant to the fair value measurement.

Determinations in Connection With Offerings

We last sold our share in our continuous offering at a price of $8.75 per share: however, we have not sold shares in our continuous offering since April 30, 2015. To the extent that our net asset value increases, we will sell at a price necessary to ensure that shares are not sold at a price per share, after deduction of selling commissions and dealer manager fees, that is below the net asset value per share. The closings are typically on a monthly basis. To the extent that the net asset value per share increases subsequent to the last closing, the price per share may increase. Therefore, persons who subscribe for shares of our common stock in our continuous offering must submit subscriptions for a certain dollar amount, rather than a number of shares of common stock and, as a result, may receive fractional shares of our common stock. In connection with each closing on the sale of shares of our common stock offered pursuant to our prospectus on a continuous basis, the Board of Directors or a committee thereof is required within 48 hours of the time that each closing and sale is made to make the determination that we are not selling shares of our common stock at a price which, after deducting selling commissions and dealer manager fees, is below our then current net asset value per share. The Board of Directors or a committee thereof will consider the following factors, among others, in making such determination:

| • | the net asset value of our common stock disclosed in the most recent periodic report we filed with the SEC; |

| • | our management’s assessment of whether any material change in the net asset value has occurred (including through the realization of net gains or losses on the sale of our portfolio investments) from the period beginning on the date of the most recently disclosed net asset value to the period ending two days prior to the date of the closing on and sale of our common stock; and |

| • | the magnitude of the difference between the net asset value disclosed in the most recent periodic report we filed with the SEC and our management’s assessment of any material change in the net asset value since the date of the most recently disclosed net asset value, and the offering price of the shares of our common stock at the date of closing. |

Importantly, this determination does not require that we calculate net asset value in connection with each closing and sale of shares of our common stock, but instead it involves the determination by the Board of Directors or a committee thereof that we are not selling shares of our common stock at a price which, after deducting selling commissions and dealer manager fees, is below the then current net asset value at the time at which the closing and sale is made.

| 12 |

Effective for the February 28, 2013 close and onwards, the Pricing Committee of our Board of Directors increased the share price for new investments from $10.00 to $10.15 per share due to an increase in our NAV generated from successful refinancings of portfolio companies. On August 8, 2014, the Pricing Committee of our Board of Directors decreased the share price for new investments from $10.15 to $10.00 per share, and on November 18, 2014 the Pricing Committee of our Board of Directors decreased the share price for new investments from $10.00 to $9.75 per share. On November 24, 2015, the Board of Directors of the Fund and the Pricing Committee of the Board made a decision to approve a price reduction from $9.75 to $9.25 per share effective for the Funds next closing date and next declared distribution date. On May 23, 2016, the Board of Directors of the Fund and the Pricing Committee of the Board made a final decision to approve a price reduction from $9.25 to $8.75 per share. The decreases in August and November 2014 and November 2015 were made as a result of reductions in the net asset value per share of the Fund’s common stock, which resulted from three factors: overall declines in the market prices of high yield debt instruments; declines in the market value of specific positions that have defaulted or which the market perceives will need to restructure or the ones that have already been restructured into 144A private placement equity positions for which real pricing is not available; and as a result of distributions made to date in excess of net investment income. The Fund has also not been able to raise any additional capital since May 2015 because the N-2 has not been made effective by the SEC. The Pricing Committee of our Board of Directors is required to reassess our offering price when there is a decrease in NAV per share of more than 5% below our current net offering price, and is required to reduce the offering price where the decrease in the NAV per share is the result of a non-temporary movement in the credit markets or in the value of our assets. Our board reviewed market data regarding movements in the credit markets, and the specific circumstances surrounding each of the positions in our portfolio which had experienced the greatest decline in value, including recent earnings announcements, collateral, priority in the capital structure, and current indications as to the terms of any restructuring.

Moreover, to the extent that there is even a remote possibility that we may (i) issue shares of our common stock at a price which, after deducting selling commissions and dealer manager fees, is below the then current net asset value of our common stock at the time at which the closing and sale is made or (ii) trigger the undertaking (which we provided to the SEC in the registration statement to which our prospectus is a part) to suspend the offering of shares of our common stock pursuant to our prospectus if the net asset value fluctuates by certain amounts in certain circumstances until our prospectus is amended, the Board of Directors or a committee thereof will elect, in the case of clause (i) above, either to postpone the closing until such time that there is no longer the possibility of the occurrence of such event or to undertake to determine net asset value within two days prior to any such sale to ensure that such sale will not be at a price which, after deducting selling commissions and dealer manager fees, is below our then current net asset value, and, in the case of clause (ii) above, to comply with such undertaking or to undertake to determine net asset value to ensure that such undertaking has not been triggered.

These processes and procedures are part of our compliance policies and procedures. Records will be made contemporaneously with all determinations described in this section and these records will be maintained with other records we are required to maintain under the 1940 Act. Promptly following any adjustment to the offering price per share of our common stock, we will update our prospectus by filing a prospectus supplement with the SEC. We will also make updated information available via our website.

Taxation and Election of a Regulated Investment Company (“RIC”)

We have elected to be treated as a RIC under Subchapter M of the Code effective for our taxable year ended December 31, 2017, and to annually qualify as a RIC thereafter. As a RIC, we generally will not have to pay corporate-level U.S. federal income taxes on any income that we distribute to our stockholders from our tax earnings and profits. To qualify as a RIC, we must, among other things, meet certain source-of-income and asset diversification requirements (as described below). In addition, in order to obtain RIC tax treatment, we must distribute to our stockholders, for each taxable year, at least 90% of our “investment company taxable income,” which is generally our net ordinary income plus the excess, if any, of realized net short-term capital gain over realized net long-term capital loss, or the Annual Distribution Requirement. Even if we qualify as a RIC, we generally will be subject to corporate-level U.S. federal income tax on our undistributed taxable income and could be subject to U.S. federal excise, state, local and foreign taxes.

In order to qualify as a RIC for U.S. federal income tax purposes, we must, among other things:

| • | elect to be treated as a RIC; |

| • | meet the Annual Distribution Requirement; |

| • | qualify to be treated as a business development company or be registered as a management investment company under the 1940 Act at all times during each taxable year; |

| • | derive in each taxable year at least 90% of our gross income from dividends, interest, payments with respect to certain securities loans, gains from the sale or other disposition of stock or other securities or currencies or other income derived with respect to our business of investing in such stock, securities or currencies and net income derived from an interest in a “qualified publicly traded partnership” (as defined in the Code), or the 90% Income Test; and |

| • | diversify our holdings so that at the end of each quarter of the taxable year (i) at least 50% of the value of our assets consists of cash, cash equivalents, U.S. Government securities, securities of other RICs, and other securities if such other securities of any one issuer do not represent more than 5% of the value of our assets or more than 10% of the outstanding voting securities of the issuer (which for these purposes includes the equity securities of a “qualified publicly traded partnership”); and (ii) no more than 25% of the value of our assets is invested in the securities, other than U.S. Government securities or securities of other RICs, (i) of one issuer (ii) of two or more issuers that are controlled, as determined under applicable tax rules, by us and that are engaged in the same or similar or related trades or businesses or (iii) of one or more “qualified publicly traded partnerships,” or the Diversification Tests. |

| 13 |

Provided that we qualify as a RIC and satisfy the Annual Distribution Requirement, we will not be subject to U.S. federal income tax on the portion of our investment company taxable income and net capital gain (which we define as net long-term capital gain in excess of net short-term capital loss) that we timely distribute to stockholders. We will be subject to U.S. federal income tax at the regular corporate rates on any income or capital gain not distributed (or deemed distributed) to our stockholders.

We will be subject to a 4% nondeductible U.S. Federal excise tax on certain undistributed income of RICs unless we distribute in a timely manner an amount at least equal to the sum of (1) 98% of our ordinary income for each calendar year, (2) 98.2% of our capital gain net income for the one-year period ended October 31st in that calendar year and (3) any income recognized, but not distributed, in preceding years and on which we paid no U.S. federal income tax. We generally will endeavor in each taxable year to avoid any U.S. Federal excise tax on our earnings.

Management Services and Responsibilities

Under the terms of the investment advisory agreement, our Manager:

| • | determines the composition and allocation of our portfolio, the nature and timing of the changes to our portfolio and the manner of implementing such changes; |

| • | determines what securities we will purchase, retain or sell; |

| • | identifies, evaluates, negotiates and structures the investments we make; and |

| • | executes, monitors and services the investments we make. |

Under the investment advisory agreement, our Manager has a fiduciary responsibility for the safeguarding and use of our assets. Our Manager is also subject to liability under both the 1940 Act and the Advisers Act for a breach of these fiduciary duties.

Our Manager’s services under the investment advisory agreement may not be exclusive, and it is free to furnish similar services to other entities so long as its services to us are not impaired. In addition, our Manager performs certain administrative services under the administration agreement. See “Administration Agreement”.

Administration Agreement

Our Manager serves as our administrator. Pursuant to an administration agreement, our Manager furnishes us with office facilities, equipment and clerical, bookkeeping and record keeping services at such facilities. Under the administration agreement, our Manager also performs, or oversees the performance of, our required administrative services, which include, among other things, transfer agency and other service providers supervision and oversight, preparation and supervision of the financial records for which we are required to maintain for SEC reporting, stockholder reporting and other Fund needs, implementation and supervision of a robust compliance program and oversight and administration of the quarterly share repurchase program. In addition, our Manager assists us in activities which include, among other things, performance and supervision of investor relations, the Fund’s Board of Directors communication and reporting, determining and publishing our net asset value, overseeing the preparation and filing of our tax returns, the communication, printing and dissemination of reports to our stockholders, and generally oversees the payment of our expenses and other events such as distributions, and the performance of administrative and professional services rendered to us by others. Under the administration agreement, we are obligated to reimburse our Manager for our allocable portion of our Manager’s overhead in performing its obligations under the administration agreement, including rent, the fees and expenses associated with overseeing and performing the compliance functions and our allocable portion of the compensation of our chief financial officer, chief compliance officer and any administrative support staff; however, to date, cost of the chief financial officer, fund administration accounting and the chief compliance officer are charged directly to the Fund. Under the administration agreement, our Manager will also provide on our behalf managerial assistance to those portfolio companies that request such assistance. The administration agreement also provides the reimbursement to the Fund by the Manager for the Manager’s share of the Directors and Officers insurance, which is paid by the Fund in full. Either party may terminate the administration agreement without penalty upon 60 days’ written notice to the other party.

The administration agreement provides that, absent willful misfeasance, bad faith or negligence in the performance of its duties or by reason of the reckless disregard of its duties and obligations, our Manager and its officers, managers, partners, agents, employees, controlling persons, members and any other person or entity affiliated with it are entitled to indemnification from us for any damages, liabilities, costs and expenses (including reasonable attorneys’ fees and amounts reasonably paid in settlement) arising from the rendering of our Manager’s services under the administration agreement or otherwise as administrator for us.

| 14 |

License Agreements

We have entered into a license agreement with VII Peaks under which VII Peaks has agreed to grant us a non-exclusive, royalty-free license to use the names “VII Peaks” and “Co-Optivist.” Under these agreements, we will have a right to use the “VII Peaks,” and “Co-Optivist” names for so long as our Manager or one of its affiliates remains our investment adviser. Other than with respect to these limited licenses, we will have no legal right to the “VII Peaks,” and “Co-Optivist” names. These license agreements will remain in effect for so long as the investment advisory agreement with our Manager is in effect.

Certain Relationship and Related Party Transactions

Conflicts of interest between the operation of the Fund and other activities of the Manager and its affiliates and principals are expected to occur from time to time. The Manager, in its sole judgment and discretion, will try to mitigate such potential adversity by the exercise of its business judgment in an attempt to fulfill its obligations. However, the Manager has not developed, and does not expect to develop, any formal process for resolving conflicts of interest. Such conflicts may include:

Competing Programs

Conflicts of interest between us and the various roles, activities and duties of the Manager and its affiliates may occur from time to time. The Manager, its officers and other affiliates may act as a manager or general partner of other private or public entities, some of whom may have the same or a similar investment objective as the Fund. As a result, conflicts of interest between us and the other activities of the Manager and its affiliates may occur from time to time. None of the agreements or arrangements, including those relating to compensation, between the Fund, the Manager or their affiliates, is the result of arm’s-length negotiations. As a result, there may be conflicts between us, on the one hand, and our Manager, including members of its management team, on the other, regarding the allocation of resources to the management of our day-to-day activities.

Further, the officers of VII Peaks are involved in other ventures, some of which may compete with us for investment opportunities, including certain affiliated funds or managed accounts, and may be incentivized to offer investment opportunities to such other ventures rather than to us which would make it more difficult to achieve our investment objectives.

As a business development company, we will be subject to certain regulatory restrictions in making our investments. For example, we generally will not be permitted to co-invest with certain entities affiliated with our Manager in transactions originated by our Manager or its affiliates unless we obtain an exemptive order from the SEC or co-invest alongside our Manager or its affiliates in accordance with existing regulatory guidance and our allocation policy. Under existing regulatory guidance, we will be permitted to, and may co-invest in syndicated deals and secondary loan market transactions where price is the only negotiated point.

We may seek exemptive relief from the SEC to engage in co-investment transactions with our Manager and/or its affiliates. However, there can be no assurance that we will obtain such exemptive relief, if requested. Even if we receive exemptive relief, neither our Manager nor its affiliates are obligated to offer us the right to participate in any transactions originated by them. Prior to obtaining exemptive relief, we may co-invest alongside our Manager or its affiliates only in accordance with existing regulatory guidance and our allocation policy.

Compensation Arrangements

The compensation we pay to our Manager was not entered into on an arm’s-length basis with unaffiliated third parties. As a result, the form and amount of such compensation may be less favorable to us than they might have been had they been entered into through arm’s-length transactions with unaffiliated parties. See “Investment Advisory Agreement”.

Regulation

The election as a business development company under the 1940 Act contains prohibitions and restrictions relating to transactions between business development companies and their affiliates (including any investment advisers or sub-advisers), principal underwriters and affiliates of those affiliates or underwriters and requires that a majority of the directors be persons other than “interested persons”, as that term is defined in the 1940 Act. In addition, the 1940 Act provides that we may not change the nature of our business so as to cease to be, or to withdraw our election as, a business development company unless approved by “a majority of our outstanding voting securities” as defined in the 1940 Act.

We may invest up to 100% of our assets in securities acquired directly from issuers in privately negotiated transactions. We do not intend to acquire securities issued by any investment company that exceed the limits imposed by the 1940 Act. Under these limits, except for registered money market funds, we generally cannot acquire more than 3% of the voting stock of any investment company, invest more than 5% of the value of our total assets in the securities of one investment company or invest more than 10% of the value of our total assets in the securities of more than one investment company. With regard to that portion of our portfolio invested in securities issued by investment companies, it should be noted that such investments might subject our stockholders to additional expenses. None of our investment policies are fundamental and any may be changed without stockholder approval.

As a business development company, we may be periodically examined by the SEC for compliance with the 1940 Act. Our Adviser is a registered investment adviser and is also subject to examination by the SEC.

| 15 |

We are required to provide and maintain a bond issued by a reputable fidelity insurance company to protect us against larceny and embezzlement. Furthermore, as a business development company, we are prohibited from protecting any director or officer against any liability to us or our stockholders arising from willful misconduct, bad faith, gross negligence or reckless disregard of the duties involved in the conduct of such person’s office.

Qualifying Assets

Under the 1940 Act, a business development company may not acquire any asset other than assets of the type listed in section 55(a) of the 1940 Act, which are referred to as qualifying assets, unless, at the time the acquisition is made, qualifying assets represent at least 70% of the company’s total assets. The principal categories of qualifying assets relevant to our business are the following:

Securities purchased in transactions not involving any public offering from the issuer of such securities, which issuer (subject to certain limited exceptions) is an eligible portfolio company, or from any person who is, or has been during the preceding 13 months, an affiliated person of an eligible portfolio company, or from any other person, subject to such rules as may be prescribed by the SEC. An eligible portfolio company is defined in the 1940 Act as any issuer which:

| • | is organized under the laws of, and has its principal place of business in, the United States; |

| • | is not an investment company (other than a small business investment company wholly owned by the Fund) or a company that would be an investment company but for certain exclusions under the 1940 Act; and |

| • | satisfies either of the following: |

| • | has a market capitalization of less than $250 million or does not have any class of securities listed on a national securities exchange; or |

| • | is controlled by a business development company or a group of companies including a business development company, the business development company actually exercises a controlling influence over the management or policies of the eligible portfolio company, and, as a result thereof, the business development company has an affiliated person who is a director of the eligible portfolio company. |

| • | Securities of any eligible portfolio company which we control. |

| • | Securities purchased in a private transaction from a U.S. issuer that is not an investment company or from an affiliated person of the issuer, or in transactions incident thereto, if the issuer is in bankruptcy and subject to reorganization or if the issuer, immediately prior to the purchase of its securities was unable to meet its obligations as they came due without material assistance other than conventional lending or financing arrangements. |

| • | Securities of an eligible portfolio company purchased from any person in a private transaction if there is no ready market for such securities and we already own 60% of the outstanding equity of the eligible portfolio company. |

| • | Securities received in exchange for or distributed on or with respect to securities described above, or pursuant to the exercise of warrants or rights relating to such securities. |

| • | Cash, cash equivalents, U.S. Government securities or high-quality debt securities maturing in one year or less from the time of investment. |

Managerial Assistance to Portfolio Companies

A business development company must have been organized and have its principal place of business in the United States and must be operated for the purpose of making investments in the types of securities described in “Regulation – Qualifying Assets” above. However, in order to count portfolio securities as qualifying assets for the purpose of the 70% test, the business development company must either control the issuer of the securities or must offer to make available to the issuer of the securities (other than small and solvent companies described above) significant managerial assistance. Where the business development company purchases such securities in conjunction with one or more other persons acting together, the business development company will satisfy this test if one of the other persons in the group makes available such managerial assistance. Making available managerial assistance means, among other things, any arrangement whereby the business development company, through its directors, officers or employees, offers to provide, and, if accepted, does so provide, significant guidance and counsel concerning the management, operations or business objectives and policies of a portfolio company.

| 16 |

Temporary Investments

Pending investment in other types of “qualifying assets,” as described above, our investments may consist of cash, cash equivalents, U.S. Government securities or high-quality debt securities maturing in one year or less from the time of investment, which we refer to, collectively, as temporary investments, so that 70% of our assets are qualifying assets. Typically, we invest in money market funds which invest in highly rated commercial paper, U.S. Government agency notes, U.S. Treasury bills or in repurchase agreements relating to such securities that are fully collateralized by cash or securities issued by the U.S. Government or its agencies. A repurchase agreement involves the purchase by an investor, such as us, of a specified security and the simultaneous agreement by the seller to repurchase it at an agreed-upon future date and at a price which is greater than the purchase price by an amount that reflects an agreed-upon interest rate. There is no percentage restriction on the proportion of our assets that may be invested in such repurchase agreements. However, certain diversification tests in order to qualify as a RIC for federal income tax purposes will typically require us to limit the amount we invest with any one counterparty. Our Manager will monitor the creditworthiness of the counterparties with which we enter into repurchase agreement transactions.

Senior Securities

We are permitted, under specified conditions, to issue multiple classes of indebtedness and one class of stock senior to our common stock if our asset coverage, as defined in the 1940 Act, is at least equal to 200% immediately after each such issuance. In addition, while any preferred stock or publicly traded debt securities are outstanding, we may be prohibited from making distributions to our stockholders or the repurchasing of such securities or shares unless we meet the applicable asset coverage ratios at the time of the distribution or repurchase. We may also borrow amounts up to 5% of the value of our total assets for temporary or emergency purposes without regard to asset coverage.

Code of Ethics

We and our Manager have each adopted a code of ethics pursuant to Rule 17j-1 under the 1940 Act that establishes procedures for personal investments and restricts certain personal securities transactions. Personnel subject to each code may invest in securities for their personal investment accounts, including securities that may be purchased or held by us, so long as such investments are made in accordance with the code’s requirements. You may read and copy the code of ethics at the SEC’s Public Reference Room in Washington, D.C. You may obtain information on the operation of the Public Reference Room by calling the SEC at (202) 551-8090. In addition, the code of ethics is attached as an exhibit to the registration statement of which the prospectus is a part, and is available on the EDGAR Database on the SEC’s Internet site at http://www.sec.gov. You may also obtain copies of the code of ethics, after paying a duplicating fee, by electronic request at the following e-mail address: publicinfo@sec.gov, or by writing the SEC’s Public Reference Section, 100 F Street, N.E., Washington, D.C. 20549.

Compliance Policies and Procedures

We have adopted and implemented written policies and procedures reasonably designed to prevent violation of the federal securities laws. We are required to review these compliance policies and procedures annually for their adequacy and the effectiveness of their implementation. Our Chief Compliance Officer is responsible for administering these policies and procedures.

Proxy Voting Policies and Procedures

We have delegated our proxy voting responsibility to our Manager. The Proxy Voting Policies and Procedures of our Manager are set forth below. The guidelines are reviewed periodically by our Manager and our independent directors, and, accordingly, are subject to change.

Introduction

Our Manager is registered with the SEC as an investment adviser registered under the Advisers Act. As an investment advisor registered under the Advisers Act, our Manager has fiduciary duties to us. As part of this duty, our Manager recognizes that it must vote client securities in a timely manner free of conflicts of interest and in our best interests and the best interests of our stockholders. Our Manager’s Proxy Voting Policies and Procedures have been formulated to ensure decision-making consistent with these fiduciary duties.

These policies and procedures for voting proxies for our investment advisory clients are intended to comply with Section 206 of, and Rule 206(4)-6 under, the Advisers Act.

Proxy Policies

The Fund primarily invests in debt securities, therefore on a rare occasion would the Manager vote a proxy. If a proxy is received, our Manager evaluates routine proxy matters, such as proxy proposals, amendments or resolutions on a case-by-case basis. Routine matters are typically proposed by management and our Manager will normally support such matters so long as they do not measurably change the structure, management control, or operation of the corporation and are consistent with industry standards as well as the corporate laws of the state of incorporation.

| 17 |