Attached files

| file | filename |

|---|---|

| 8-K - 8-K - 1ST CONSTITUTION BANCORP | fccyform8-kinvestorpresent.htm |

Bancorp Investor Presentation November 7, 2018 1

DRAFT Section 1 About 1st Constitution Bancorp Bancorp 22 2

Forward-Looking Statement and Safe Harbor This presentation contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The Private Securities Litigation Reform Act of 1995 provides a “safe harbor” for forward-looking statements. When used in this and in future filings by 1st Constitution Bancorp (the “Company”) with the Securities and Exchange Commission (the “SEC”), in the Company’s press releases and in oral statements made with the approval of an authorized executive officer of the Company, the words or phrases “will,” “will likely result,” “could,” “anticipates,” “believes,” “continues,” “expects,” “plans,” “will continue,” “is anticipated,” “estimated,” “project” or “outlook” or similar expressions (including confirmations by an authorized executive officer of the Company of any such expressions made by a third party with respect to the Company) are intended to identify forward-looking statements. Readers should not place undue reliance on these forward-looking statements, which are based upon the current beliefs and expectations of the management of the Company. These forward-looking statements are subject to risks and uncertainties and actual results might differ materially from those discussed in, or implied by, the forward-looking statements. Factors that may cause actual results to differ from those results expressed or implied, include, but are not limited to, those listed under “Business”, “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in the Company’s Annual Report on Form 10-K for the year ended December 31, 2017 filed with the SEC on March 19, 2018, such as the overall economy and the interest rate environment; the ability of customers to repay their obligations; the adequacyof the allowance for loan losses; competition; significant changes in accounting, tax or regulatory practices and requirements; certain interest rate risks; risks associated with investments in mortgage-backed securities; risks associated with speculative construction lending; and risks associated with safeguarding information technology systems. Although management has taken certain steps to mitigate any negative effect of the aforementioned items, significant unfavorable changes could severely impact the assumptions used and could have an adverse effect on profitability. The Company undertakes no obligation to update, alter, or otherwise revise any forward-looking statements, whether written or oral, that may be made from time to time, whether as the result of new information, future events, or otherwise. Bancorp 3

1st Constitution Highlights Company Profile • New Jersey-chartered bank holding company organized in 1999 • One banking subsidiary, 1st Constitution Bank, founded in 1989 • Growth-oriented community bank headquartered in Cranbury, New Jersey • Operates 20 branches throughout Middlesex, Monmouth, Mercer and Somerset Counties and the Fort Lee area of Bergen County, New Jersey • Seeks to provide customers a high level of personalized banking services, emphasizing quick and flexible responses to customer demands Track Record of Successful Acquisitions/Integration • Completed acquisition of New Jersey Community Bank on April 11, 2018 ($97mm total assets) • Completed acquisition of Rumson-Fair Haven Bank & Trust Co. on February 7, 2014 ($214mm total assets) • Completed acquisition of 3 branches from Amboy Bank in March 2011 ($112mm total deposits) 1st Constitution Bancorp provides financial services to consumers, businesses, and institutions in Central New Jersey in the communities we serve. Our basis of services emphasizes credit products for creditworthy consumers and businesses, and deposit products and services designed to enhance the value or our clients' assets. Our employees are a key element in our success. We will train Mission them appropriately and provide them with the means to deliver a superior level or service to our customers, and reward them accordingly for their overall performance. Our mission is to enhance Statement shareholder value by making each of our operating units a driving force towards providing shareholders with an appropriate rate of return on their investment. Bancorp 4

Markets of Operation and Demographics Franchise Highlights Market Overview 2018 - 2024 Projected Population Growth 4.42% • 11th most populous state in the US, ~$580 billion economy with a population 3.93% of approx. 9 million 3.04% • 2.72% 2.86% New Jersey is the most densely populated state in the U.S. (1,209 people per 2.53% sq. mile) 2.33% • Markets represent 35% of the total New Jersey population • Well situated in some of the top counties in the Mid-Atlantic 0.45% – Highly populated counties with close proximity to New York City, Philadelphia and the New Jersey shore Middlesex Monmouth Somerset Mercer Bergen NJ Nation Projected Population Growth Franchise Weighted 2018 Percent of 2018 - 2024 Projected Median HH Income Growth Number Deposit State of in Market Franchise 30% County Branches ($000) (%) 107,717 25% 96,670 New Jersey 93,543 82,945 Middlesex 6 420,904 43.97 77,984 78,317 Monmouth 7 245,082 25.60 19.4% 20% 61,045 Somerset 2 169,121 17.67 17.8% Mercer 4 94,007 9.82 15.4% 14.0% 14.7% Bergen 1 28,064 2.93 15% 13.4% 12.6% Weighted Average Total 20 957,178 100.00 State of New Jersey 957,178 10% Middlesex Monmouth Somerset Mercer Bergen NJ Nation Median 2018 HHI Projected Change Source: SNL Financial Bancorp 5 5

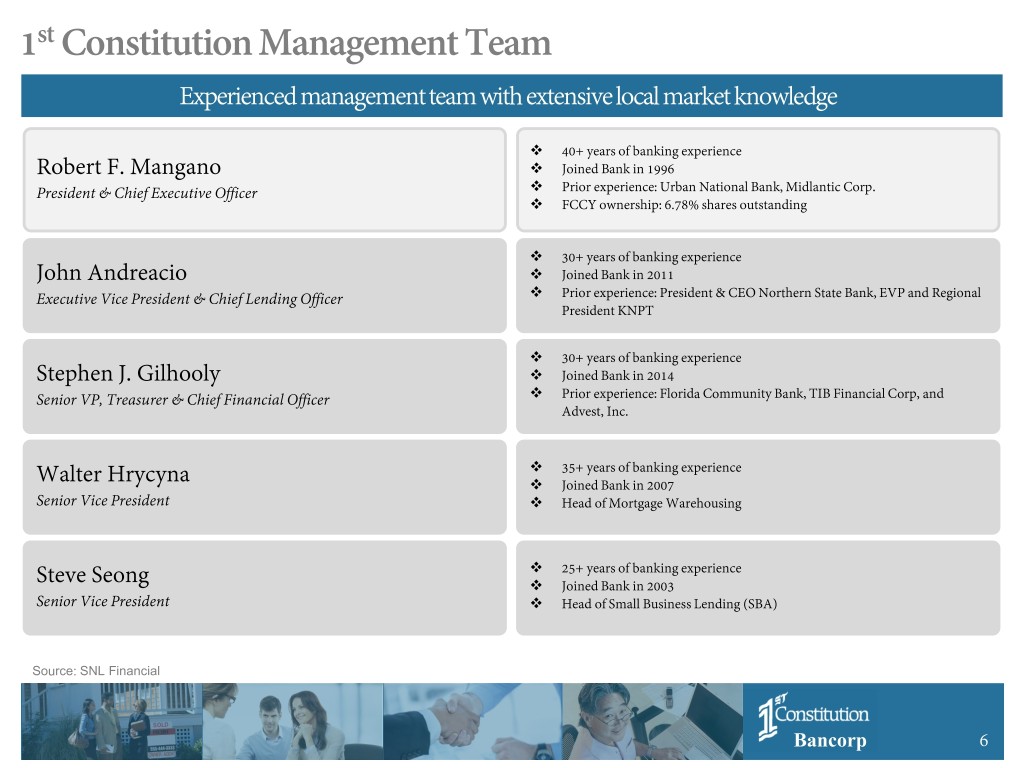

1st Constitution Management Team Experienced management team with extensive local market knowledge 40+ years of banking experience Robert F. Mangano Joined Bank in 1996 President & Chief Executive Officer Prior experience: Urban National Bank, Midlantic Corp. FCCY ownership: 6.78% shares outstanding 30+ years of banking experience John Andreacio Joined Bank in 2011 Executive Vice President & Chief Lending Officer Prior experience: President & CEO Northern State Bank, EVP and Regional President KNPT 30+ years of banking experience Stephen J. Gilhooly Joined Bank in 2014 Senior VP, Treasurer & Chief Financial Officer Prior experience: Florida Community Bank, TIB Financial Corp, and Advest, Inc. 35+ years of banking experience Walter Hrycyna Joined Bank in 2007 Senior Vice President Head of Mortgage Warehousing 25+ years of banking experience Steve Seong Joined Bank in 2003 Senior Vice President Head of Small Business Lending (SBA) Source: SNL Financial Bancorp 6 6

DRAFT Section 2 1st Constitution Financial Summary Bancorp 77 7

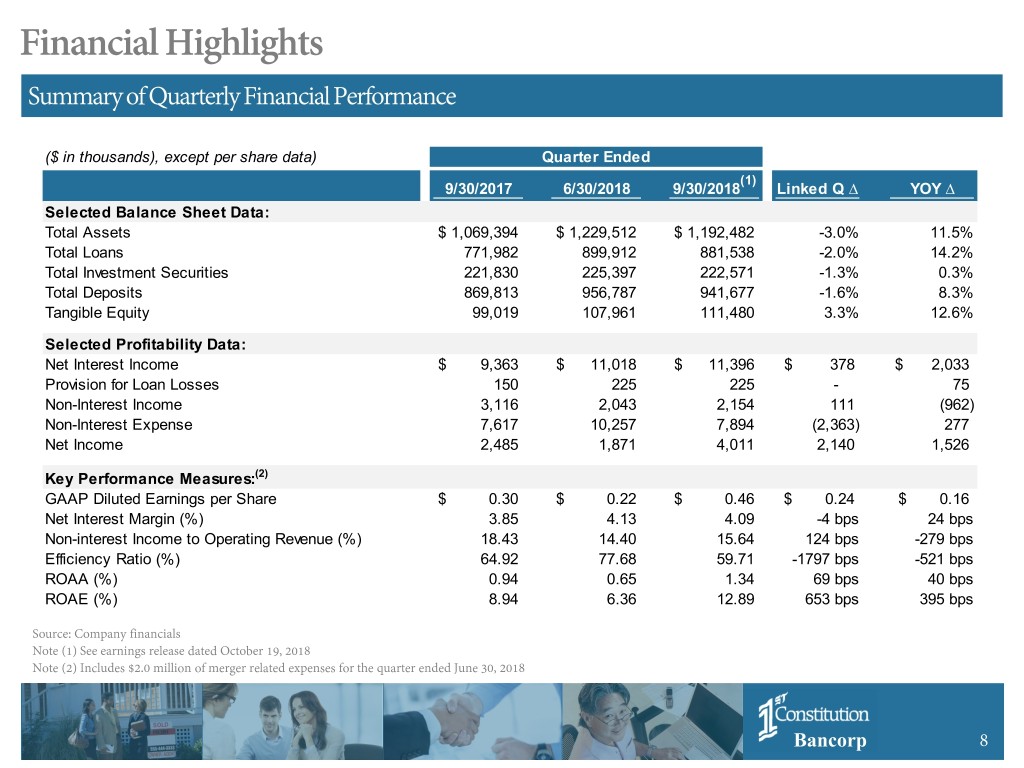

Financial Highlights Summary of Quarterly Financial Performance ($ in thousands), except per share data) Quarter Ended (1) 9/30/2017 6/30/2018 9/30/2018 Linked Q ∆ YOY ∆ Selected Balance Sheet Data: Total Assets $ 1,069,394 $ 1,229,512 $ 1,192,482 -3.0% 11.5% Total Loans 771,982 899,912 881,538 -2.0% 14.2% Total Investment Securities 221,830 225,397 222,571 -1.3% 0.3% Total Deposits 869,813 956,787 941,677 -1.6% 8.3% Tangible Equity 99,019 107,961 111,480 3.3% 12.6% Selected Profitability Data: Net Interest Income $ 9,363 $ 11,018 $ 11,396 $ 378 $ 2,033 Provision for Loan Losses 150 225 225 - 75 Non-Interest Income 3,116 2,043 2,154 111 (962) Non-Interest Expense 7,617 10,257 7,894 (2,363) 277 Net Income 2,485 1,871 4,011 2,140 1,526 Key Performance Measures:(2) GAAP Diluted Earnings per Share $ 0.30 $ 0.22 $ 0.46 $ 0.24 $ 0.16 Net Interest Margin (%) 3.85 4.13 4.09 -4 bps 24 bps Non-interest Income to Operating Revenue (%) 18.43 14.40 15.64 124 bps -279 bps Efficiency Ratio (%) 64.92 77.68 59.71 -1797 bps -521 bps ROAA (%) 0.94 0.65 1.34 69 bps 40 bps ROAE (%) 8.94 6.36 12.89 653 bps 395 bps Source: Company financials Note (1) See earnings release dated October 19, 2018 Note (2) Includes $2.0 million of merger related expenses for the quarter ended June 30, 2018 Bancorp 8 8

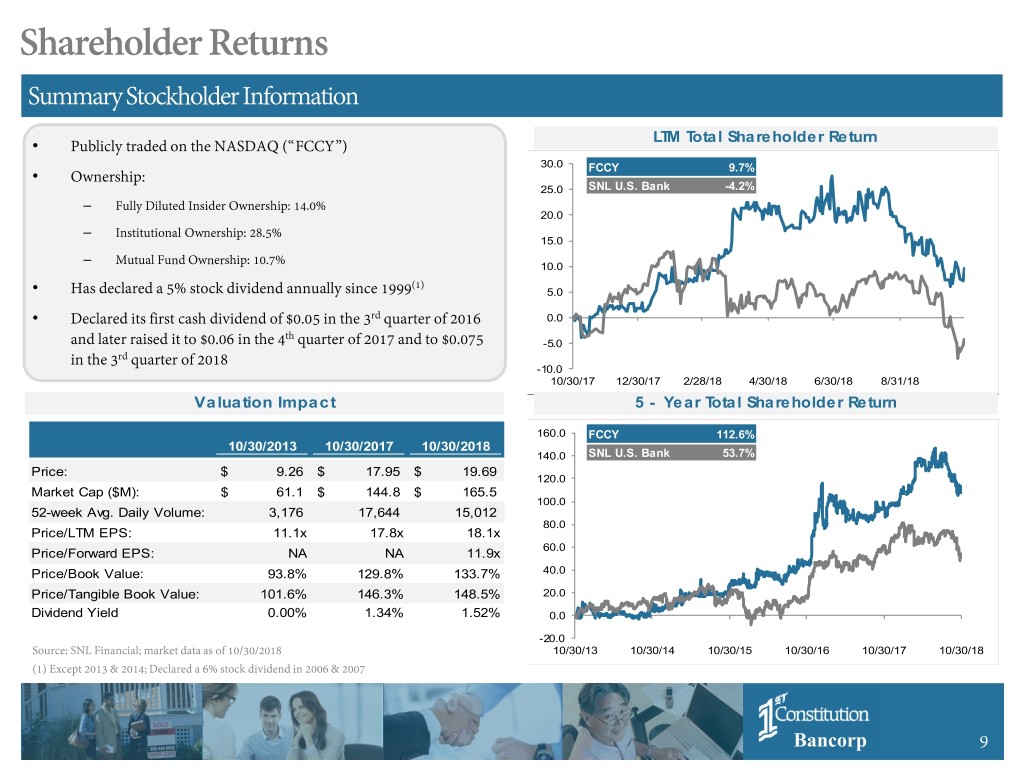

Shareholder Returns Summary Stockholder Information LTM Total Shareholder Return • Publicly traded on the NASDAQ (“FCCY”) 30.0 FCCY 9.7% • Ownership: 25.0 SNL U.S. Bank -4.2% – Fully Diluted Insider Ownership: 14.0% 20.0 – Institutional Ownership: 28.5% 15.0 – Mutual Fund Ownership: 10.7% 10.0 (1) • Has declared a 5% stock dividend annually since 1999 5.0 • Declared its first cash dividend of $0.05 in the 3rd quarter of 2016 0.0 th and later raised it to $0.06 in the 4 quarter of 2017 and to $0.075 - 5.0 rd in the 3 quarter of 2018 - 10.0 10/30/17 12/30/17 2/28/18 4/30/18 6/30/18 8/31/18 Valuation Impact 5 - Year Total Shareholder Return 160.0 FCCY 112.6%0 0% 10/30/2013 10/30/2017 10/30/2018 140.0 SNL U.S. Bank 53.7% Price: $ 9.26 $ 17.95 $ 19.69 120.0 Market Cap ($M): $ 61.1 $ 144.8 $ 165.5 100.0 52-week Avg. Daily Volume: 3,176 17,644 15,012 80.0 Price/LTM EPS: 11.1x 17.8x 18.1x 60.0 Price/Forward EPS: NA NA 11.9x Price/Book Value: 93.8% 129.8% 133.7% 40.0 Price/Tangible Book Value: 101.6% 146.3% 148.5% 20.0 Dividend Yield 0.00% 1.34% 1.52% 0.0 - 20.0 Source: SNL Financial; market data as of 10/30/2018 10/30/13 10/30/14 10/30/15 10/30/16 10/30/17 10/30/18 (1) Except 2013 & 2014; Declared a 6% stock dividend in 2006 & 2007 Bancorp 9 9

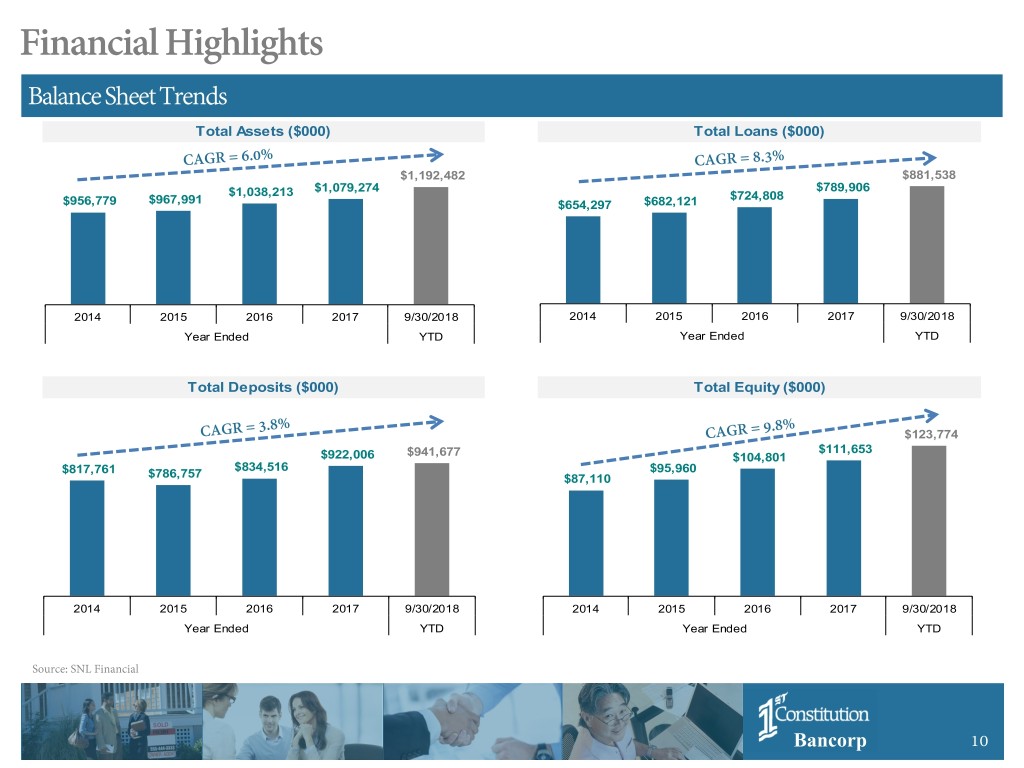

Financial Highlights Balance Sheet Trends Total Assets ($000) Total Loans ($000) $1,192,482 $881,538 $1,079,274 $789,906 $1,038,213 $724,808 $956,779 $967,991 $654,297 $682,121 2014 2015 2016 2017 9/30/2018 2014 2015 2016 2017 9/30/2018 Year Ended YTD Year Ended YTD Total Deposits ($000) Total Equity ($000) $123,774 $111,653 $922,006 $941,677 $104,801 $817,761 $834,516 $95,960 $786,757 $87,110 2014 2015 2016 2017 9/30/2018 2014 2015 2016 2017 9/30/2018 Year Ended YTD Year Ended YTD Source: SNL Financial Bancorp 10 10

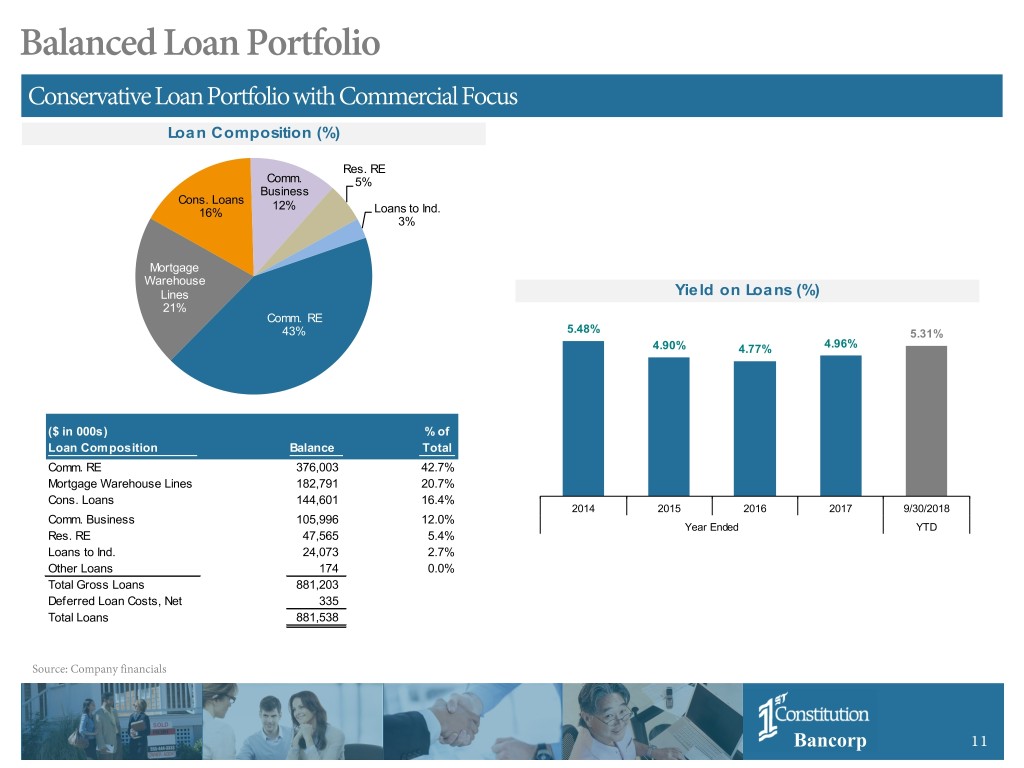

Balanced Loan Portfolio Conservative Loan Portfolio with Commercial Focus Loan Composition (%) Res . RE Comm. 5% Business Cons. Loans 12% 16% Loans to Ind. 3% Mortgage Warehouse Lines Yield on Loans (%) 21% Comm. RE 43% 5.48% 5.31% 4.90% 4.77% 4.96% ($ in 000s) % of Loan Composition Balance Total Comm. RE 376,003 42.7% Mortgage Warehouse Lines 182,791 20.7% Cons. Loans 144,601 16.4% 2014 2015 2016 2017 9/30/2018 Comm. Business 105,996 12.0% Year Ended YTD Res . RE 47,565 5.4% Loans to Ind. 24,073 2.7% Other Loans 174 0.0% Total Gross Loans 881,203 Deferred Loan Costs, Net 335 Total Loans 881,538 Source: Company financials Bancorp 11 11

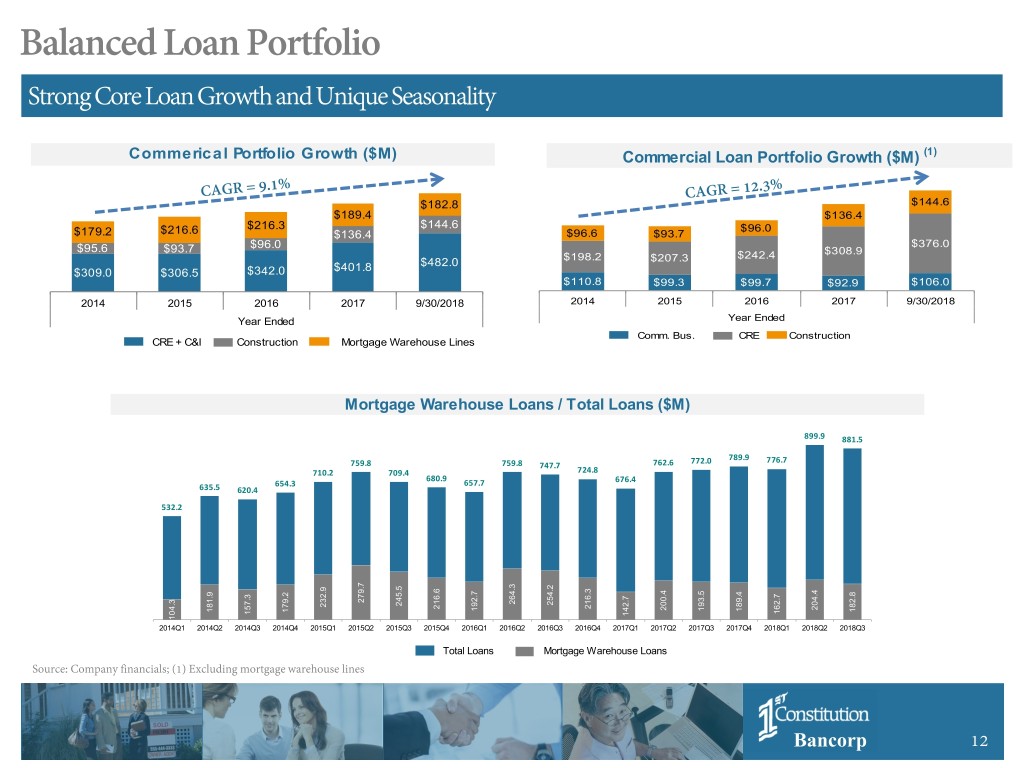

Balanced Loan Portfolio Strong Core Loan Growth and Unique Seasonality Commerical Portfolio Growth ($M) Commercial Loan Portfolio Growth ($M) (1) $182.8 $144.6 $189.4 $136.4 $216.3 $144.6 $96.0 $179.2 $216.6 $136.4 $96.6 $93.7 $96.0 $376.0 $95.6 $93.7 $308.9 $198.2 $207.3 $242.4 $401.8 $482.0 $309.0 $306.5 $342.0 $110.8 $99.3 $99.7 $92.9 $106.0 2014 2015 2016 2017 9/30/2018 2014 2015 2016 2017 9/30/2018 Year Ended Year Ended Comm. Bus . CRE Construction CRE + C&I Construction Mortgage Warehouse Lines Mortgage Warehouse Loans / Total Loans ($M) 899.9 881.5 772.0 789.9 776.7 759.8 759.8 747.7 762.6 710.2 709.4 724.8 680.9 654.3 657.7 676.4 635.5 620.4 532.2 279.7 264.3 254.2 245.5 232.9 216.6 216.3 204.4 200.4 193.5 192.7 189.4 182.8 181.9 179.2 162.7 157.3 142.7 104.3 2014Q1 2014Q2 2014Q3 2014Q4 2015Q1 2015Q2 2015Q3 2015Q4 2016Q1 2016Q2 2016Q3 2016Q4 2017Q1 2017Q2 2017Q3 2017Q4 2018Q1 2018Q2 2018Q3 Total Loans Mortgage Warehouse Loans Source: Company financials; (1) Excluding mortgage warehouse lines Bancorp 12 12

Loan Portfolio Overview Summary of Lending Focus • Mortgage Warehouse – Provides a revolving line of credit that is available to licensed mortgage banking companies – Originates one-to-four family residential mortgage loans that are pre-sold to the secondary mortgage market – On average, loans remain outstanding for a period of less than 30 days, with repayment coming directly from the sale of the loan into the secondary mortgage market • Commercial business and SBA – SBA – preferred lender designation • Construction – Principally residential single family and multi family • Residential mortgage banking – Originate and sell into secondary market • Commercial real estate – Primarily owner occupied and income properties Source: SNL Financial Bancorp 13 13

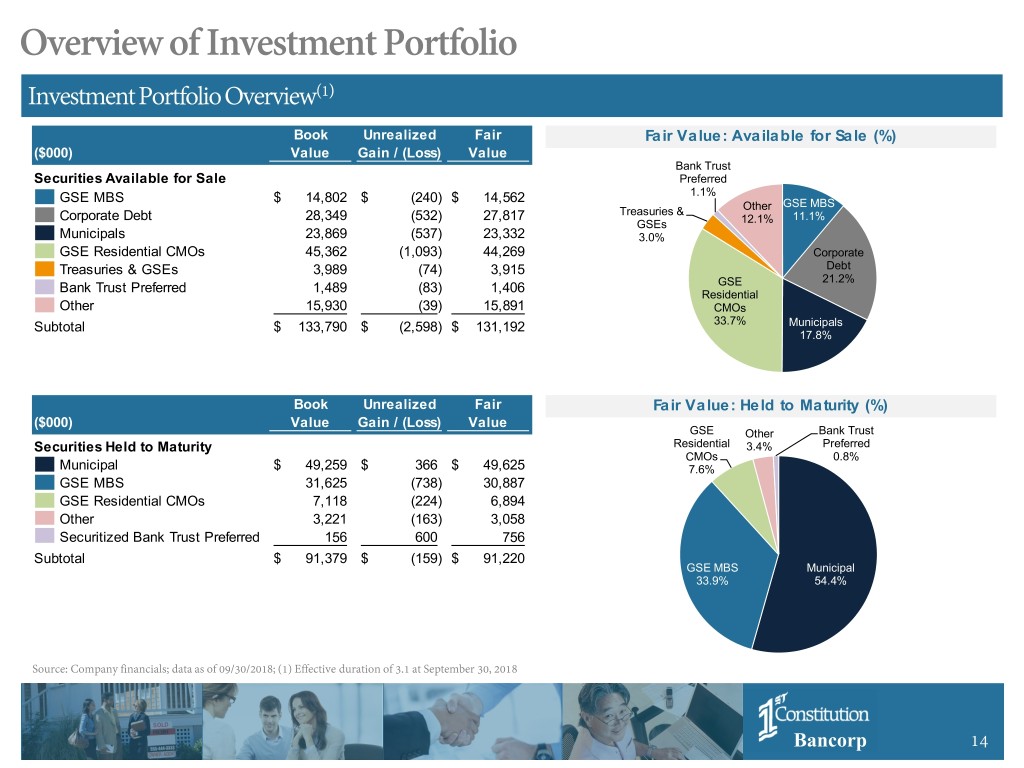

Overview of Investment Portfolio Investment Portfolio Overview(1) Book Unrealized Fair Fair Value: Available for Sale (%) ($000) Value Gain / (Loss) Value Bank Trust Securities Available for Sale Preferred GSE MBS $ 14,802 $ (240) $ 14,562 1.1% Other GSE MBS Corporate Debt 28,349 (532) 27,817 Treasuries & 11.1% GSEs 12.1% Municipals 23,869 (537) 23,332 3.0% GSE Residential CMOs 45,362 (1,093) 44,269 Corporate Treasuries & GSEs 3,989 (74) 3,915 Debt GSE 21.2% Bank Trust Preferred 1,489 (83) 1,406 Residential Other 15,930 (39) 15,891 CMOs Subtotal $ 133,790 $ (2,598) $ 131,192 33.7% Municipals 17.8% Book Unrealized Fair Fair Value: Held to Maturity (%) ($000) Value Gain / (Loss) Value GSE Other Bank Trust Securities Held to Maturity Residential 3.4% Preferred CMOs 0.8% Municipal $ 49,259 $ 366 $ 49,625 7.6% GSE MBS 31,625 (738) 30,887 GSE Residential CMOs 7,118 (224) 6,894 Other 3,221 (163) 3,058 Securitized Bank Trust Preferred 156 600 756 Subtotal $ 91,379 $ (159) $ 91,220 GSE MBS Municipal 33.9% 54.4% Source: Company financials; data as of 09/30/2018; (1) Effective duration of 3.1 at September 30, 2018 Bancorp 14 14

Asset Quality Conservative Credit Culture NPAs by Type ($M) Asset Quality $10.6 $7.0 $5.4 $7.1 $9.3 $2.5 $5.8 $1.0 1.11% (1.04%) $0.2 0.78% 0.72% 0.66% $7.1 $6.8 0.52% $6.0 $4.8 $5.2 (0.07%) 0.03 (0.01%) (0.05%) 2014 2015 2016 2017 9/30/2018 2014 2015 2016 2017 9/30/2018 Year Ended Year Ended Nonaccrual Oreo NCOs / Average Loans (%) NPAs Excl Restructured / Assets (%) Nonaccrual Loans / Total Loans 0.88% 0.90% 0.77% 0.74% 0.72% 2014 2015 2016 2017 9/30/2018 Year Ended Source: SNL Financial Nonaccrual Loans / Total Loans (%) Bancorp 15 15

Attractive Deposit Composition Core Deposit Focus Deposit Composition (%) Noninterest- bearing Deposits / Deposits (%) 22.46% 21.31% 19.84% 20.33% 20.47% Time Savings Deposits Deposits 21.9% 20.1% Non-Interest Interest Bearing bearing 2014 2015 2016 2017 9/30/2018 22.5% 35.5% Year Ended YTD C o st o f Fund s (%) (1) 0.93% 0.75% 0.71% 0.67% 0.62% ($ in 000s) % of Deposit Composition Balance Total Interest bearing $ 334,552 35.5% Non-Interest Bearing 211,492 22.5% Time Deposits 205,886 21.9% Savings Deposits 189,747 20.1% 2014 2015 2016 2017 9/30/2018 Total Deposits $ 941,677 Year Ended YTD Source: Company financials; (1) Cost of funds is interest incurred on liabilities as a percent of average interest-bearing liabilities Bancorp 16 16

Financial Highlights Capital Trends Tier 1 Common Equity Leverage Ratio (%) 10.03% 10.40% 10.19% 10.43% 10.80% 10.93% 11.23% 11.19% 9.53% NA 2014 2015 2016 2017 9/30/2018 2014 2015 2016 2017 9/30/2018 Year Ended YTD Year Ended YTD Tier 1 Ratio (%) Total Risk-Based Capital Ratio (%) 12.41% 13.24% 12.18% 13.08% 12.08% 12.02% 12.84% 12.84% 11.41% 12.28% 2014 2015 2016 2017 9/30/2018 2014 2015 2016 2017 9/30/2018 Year Ended YTD Year Ended YTD Source: SNL Financial Bancorp 17 17

Financial Highlights Income Statement Trends Net Interest Income ($000) Noninterest Expense ($000) 33,854 41,902 31,206 2,406 36,165 265 34,687 33,977 26,865 27,447 27,291 31,230 30,941 31,448 2014 2015 2016 2017 9/30/2018 2014 2015 2016 2017 9/30/2018 Year Ended LTM Year Ended LTM Noninterest Income ($000) Net Income ($000) 8,240 8,012 12,598 184 1,528 * 6,814 6,922 6,586 9,285 1,761 8,664 8,828 1,900 7,828 5,291 935 9,309 6,928 4,356 2014 2015 2016 2017 9/30/2018 2014 2015 2016 2017 9/30/2018 Year Ended LTM Year Ended LTM *Includes a $184,000 gain on bargain purchase Deferred Tax Asset Revaluation Gain on Bargain Purchase Adjusted for Merger Expense Source: SNL Financial Bancorp 18 18

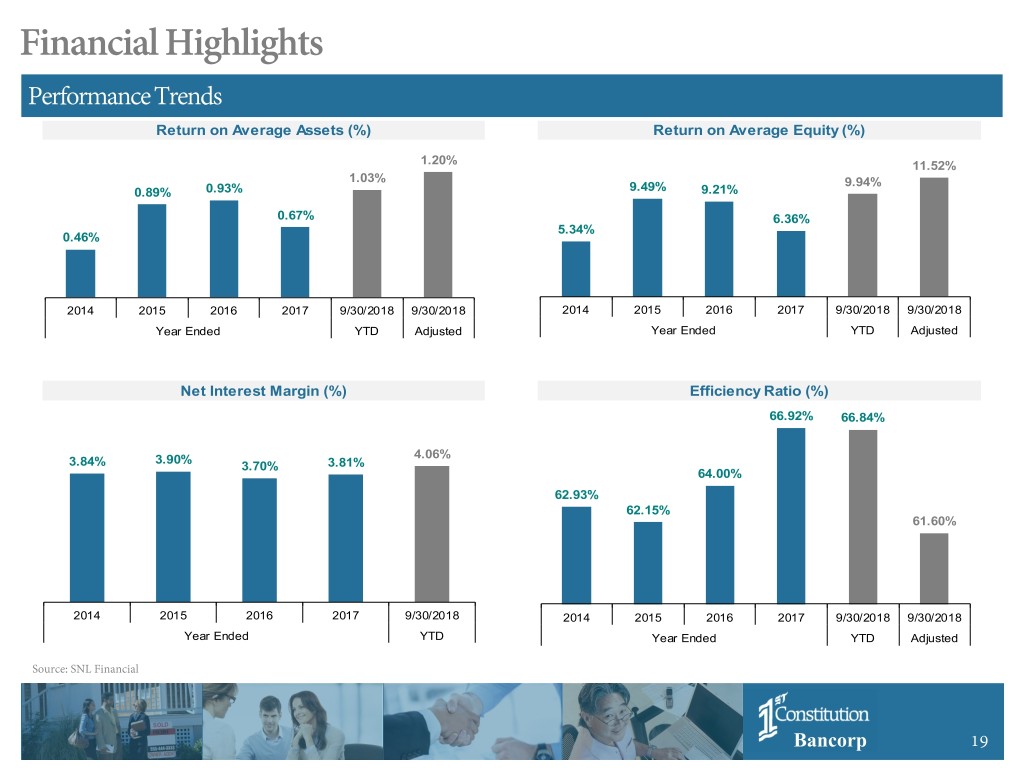

Financial Highlights Performance Trends Return on Average Assets (%) Return on Average Equity (%) 1.20% 11.52% 1.03% 9.94% 0.89% 0.93% 9.49% 9.21% 0.67% 6.36% 5.34% 0.46% 2014 2015 2016 2017 9/30/2018 9/30/2018 2014 2015 2016 2017 9/30/2018 9/30/2018 Year Ended YTD Adjusted Year Ended YTD Adjusted Net Interest Margin (%) Efficiency Ratio (%) 66.92% 66.84% 3.90% 4.06% 3.84% 3.70% 3.81% 64.00% 62.93% 62.15% 61.60% 2014 2015 2016 2017 9/30/2018 2014 2015 2016 2017 9/30/2018 9/30/2018 Year Ended YTD Year Ended YTD Adjusted Source: SNL Financial Bancorp 19 19

Non-GAAP Reconciliation (1) September 30 Adjusted Net Income ($000s, except per share data) Three months ended Nine months ended September 30, September 30, 2018 2017 2018 2017 Adjusted Net Income Net income $ 4,011 $ 2,485 $ 8,735 $ 6,353 Adjustments: Merger-related expenses - - 2,141 - Gain from bargain purchase - - (184) - Income tax effect of adjustments 2 - - (568) - Adjusted Net Income 3 $ 4,011 $ 2,485 $ 10,124 $ 6,353 Adjusted Net Income per diluted share Adjusted Net Income $ 10,124 $ 6,353 Diluted shares outstanding 8,565,401 8,309,363 Adjusted Net Income per diluted share $1.18 $0.76 Adjusted return on average assets Adjusted Net Income $ 10,124 $ 6,353 Average assets 1,132,045 1,021,645 Adjusted return on average assets 1.20% 0.83% Adjusted return on average equity Adjusted Net Income $ 10,124 $ 6,353 Average equity 117,484 107,871 Return on average equity 11.52% 7.87% Book value and tangible book value per share Shareholders' equity 123,774 111,610 Less: goodw ill and intangible assets 12,294 12,591 Tangible shareholders' equity 111,480 99,019 Shares outstanding 8,404,292 8,069,560 Book value per share $14.73 $13.83 Tangible book value per share $13.26 $12.27 1 The Company used the non-GAAP financial measures, Adjusted Net Income, Adjusted Net Income per diluted share, adjusted return on average assets and adjusted return on average equity, because the Company believes that it is helpful to readers in understanding the Company's financial performance and the effect on net income of the merger-related expenses and the gain from the bargain purchase recorded in connection with the NJCB merger. These non-GAAP measures improve the comparability of the current period results with the results of the prior periods. The Company cautions that the non-GAAP financial measures should be considered in addition to, but not as a substitute for, the Company's GAAP financial results. 2 Tax effected at an income tax rate of 30.09%, less the impact of non-deductible merger expenses and the non-taxable gain from the bargain purchase. 3 There were no non-GAAP adjustments for the three months ended September 30, 2018 and the three and nine-month periods ended September 30, 2017. Bancorp 20 20

Non-GAAP Reconciliation (1) December 31 Adjusted Net Income ($000s, except per share data) Three months ended Twelve months ended December 31, December 31, 2017 2016 2017 2016 Adjusted net income Net income $ 574 $ 2,056 $ 6,928 $ 9,285 Adjustments: Revaluation of deferred tax assets 1,712 - 1,712 - Merger-related expenses 265 - 265 - Income tax effect of adjustments (2) (77) - (77) - Adjusted net income $ 2,474 $ 2,056 $ 8,828 $ 9,285 Adjusted net income per diluted share Adjusted net income $ 2,474 $ 2,056 $ 8,828 $ 9,285 Diluted shares outstanding 8,340,318 8,228,741 8,312,784 8,177,439 Adjusted net income per diluted share $0.30 $0.25 $1.06 $1.14 Adjusted average return on average assets Adjusted net income $ 2,474 $ 2,056 $ 8,828 $ 9,285 Average assets 1,062,232 1,028,464 1,031,796 1,001,769 Adjusted return on average assets 0.92% 0.80% 0.86% 0.93% Adjusted average return on average equity Adjusted net income $ 2,474 $ 2,056 $ 8,828 $ 9,285 Average equity 112,054 103,986 108,925 100,807 Return on average equity 8.76% 7.89% 8.10% 9.21% 1 The Company used the non-GAAP financial measures, Adjusted Net Income and Adjusted Net Income per diluted share, because the Company believes that it is useful for the users of the financial information to understand the effect on net income of the revaluation of its deferred tax assets and of the merger-related expenses incurred in connection with the merger with New Jersey Community Bank. These non-GAAP financial measures improve the comparability of the current period results with the results of prior periods. The Company cautions that the non-GAAP financial measures should be considered in addition to, but not as a substitute for, the Company’s GAAP results. 2 Tax effected at an income rate of 39.94%, less the impact of non-deductible merger expenses. Bancorp 21 21

Focus on Technology Full Suite of Online Banking and Mobile Delivery Systems Consumer Online Banking Services Consumer Mobile Banking • Bill payments • Offers full online banking functionality to customers from their • Account alerts mobile devices • E-statements • Transfer funds • Can be accessed by downloading the 1st Constitution mobile • Review account activity app on a mobile device or tablet • Open new account • Deposit checks from mobile device • Popmoney –(person to person payments) • Mobile Wallet – pay with your debit card from mobile device • 1stconstitution.com – main website • 1stconstitutiondirect.com – internet bank • Card Valet – manage your debit card by setting spending limits • momentummortgage.com – residential mortgage or block your card if lost or stolen Business Online Banking Business Mobile Banking • Online Cash Management –Originate wire transfers and ACH, • Offers all of the functionalities of business online banking to place stop payments and view account activity business customers from their mobile devices • EZ Deposit (remote deposit capture) • Can be accessed by downloading the Cash Manager app on a • Bill Payment mobile device or tablet • Positive Pay • Deposit checks from mobile device Bancorp 22 22

Bancorp 23

Summary • Experienced management team with extensive in-market experience • Significant insider ownership by management and directors • Each line of business managed by experienced and trained professionals who have been at the Company for an average of 10 years • Internal audit, compliance, BSA, and loan review functions overseen in-house by trained and experienced, full-time employees • Focus on credit quality • Attractive market demographics and growth opportunities • Low cost, core deposit franchise • Diversified loan portfolio • Strong historical record of profitability • High return to shareholders through increasing dividends • Shareholder and customer focus • Successful acquirer/integrator of banks/branches Bancorp 24 24