Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - RYDER SYSTEM INC | exhibit9918-kq32018.htm |

| 8-K - 8-K - RYDER SYSTEM INC | form8-kq32018.htm |

Third Quarter 2018 Earnings Conference Call October 26, 2018 Proprietary and Confidential

Safe Harbor and Non-GAAP Financial Measures Note Regarding Forward-Looking Statements: Certain statements and information included in this presentation are “forward-looking statements” under the Federal Private Securities Litigation Reform Act of 1995, including our financial projections, our expectations regarding market trends and economic conditions, manufacturer production and delivery schedules, fleet growth, performance in our product lines and segments, the strength of our sales pipeline, demand, utilization and pricing trends in commercial rental, volumes and pricing trends in used vehicle sales, used vehicle inventory levels, residual values, return on capital spread, operating cash flow, free cash flow, capital expenditures, our ability to make investments in sales, marketing, IT and new product initiatives, benefits of our sales and marketing initiatives, ability to achieve expected acquisition-related financial benefits, the impact from tax reform on our earnings, the impact of the new lease accounting standard, and the impact and adequacy of steps we have taken to address our cost structure. Accordingly, these forward-looking statements should be evaluated with consideration given to the many risks and uncertainties inherent in our business that could cause actual results and events to differ materially from those in the forward-looking statements. Important factors that could cause such differences include, among others, our ability to adapt to changing market conditions, lower than expected contractual sales, decreases in commercial rental demand or poor acceptance of rental pricing, availability of rental vehicles to meet demand and availability of labor to maintain our fleet at normalized levels, worsening of market demand for used vehicles impacting current pricing and our anticipated proportion of retail versus wholesale sales, lack of customer demand for our services, higher than expected maintenance costs due to, among other things, lower than expected benefits from maintenance initiatives and a newer fleet, setbacks or uncertainty in the economic market, implementation or enforcement of regulations, decreases in freight demand or volumes, poor operational execution particularly with new accounts and product launches, our ability to obtain adequate profit margins for our services, our inability to maintain current pricing levels due to soft economic conditions, business interruptions or expenditures due to severe weather or natural occurrences, competition from other service providers and new entrants, customer retention levels, loss of key customers, driver and technician shortages resulting in higher procurement costs and turnover rates, unexpected bad debt reserves or write-offs, changes in customers’ business environments that will limit their ability to commit to long-term vehicle leases, a decrease in credit ratings, increased debt costs, adequacy of accounting estimates, reserves and accruals particularly with respect to pension, taxes, depreciation, insurance and revenue, sudden or unusual changes in fuel prices, unanticipated currency exchange rate fluctuations, our ability to manage our cost structure, the impact of the adoption of the new lease accounting standard and the risks described in our filings with the Securities and Exchange Commission. The risks included here are not exhaustive. New risks emerge from time to time and it is not possible for management to predict all such risk factors or to assess the impact of such risks on our business. Accordingly, we undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise. Note Regarding Non-GAAP Financial Measures: This presentation includes certain non-GAAP financial measures as defined under SEC rules, including: Comparable Earnings Measures, which consist of comparable earnings from continuing operations, comparable earnings per share from continuing operations (as well as forecasts), comparable earnings before income tax and comparable effective income tax rate, and comparable earnings before interest, taxes, depreciation and amortization. Additionally, our adjusted return on average capital (ROC) and adjusted return on capital spread (ROC spread) measures are calculated based on comparable earnings items. Operating Revenue Measures, which consist of operating revenue for Ryder and its business segments, and segment EBT as a percentage of operating revenue. Cash Flow Measures, which consist of total cash generated and free cash flow. Debt Measures, including total obligations and total obligations to equity. Refer to Appendix - Non-GAAP Financial Measures, beginning on slide 40, for reconciliations of the non-GAAP financial measures contained in this presentation to the nearest GAAP measure. Additional information regarding non-GAAP financial measures as required by Regulation G and Item 10(e) of Regulation S-K can be found in our most recent Form 10-K, Form 10-Q and our Form 8-K filed with the SEC as of the date of this presentation, which are available at http://investors.ryder.com. @ 2018 Ryder System, Inc. 2 All Rights Reserved

Contents • Third Quarter 2018 Results Overview • Used Vehicle Sales Update • EPS Forecast & Strategic Highlights • Lease Accounting Changes • Q & A @ 2018 Ryder System, Inc. 3 All Rights Reserved

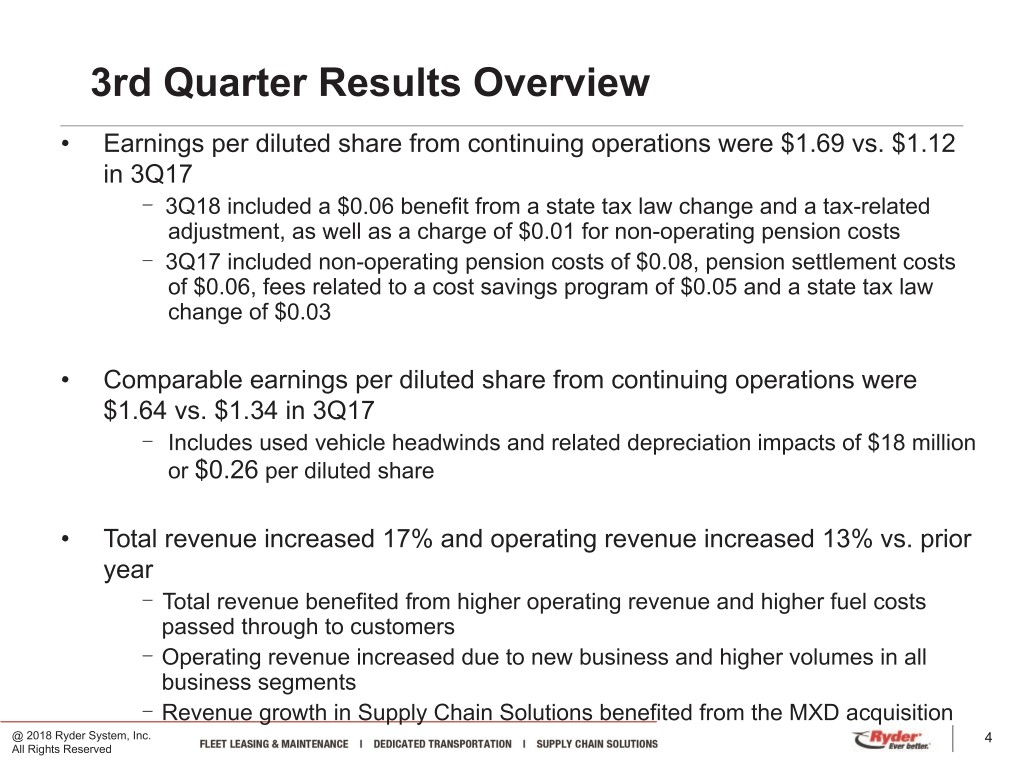

3rd Quarter Results Overview • Earnings per diluted share from continuing operations were $1.69 vs. $1.12 in 3Q17 — 3Q18 included a $0.06 benefit from a state tax law change and a tax-related adjustment, as well as a charge of $0.01 for non-operating pension costs — 3Q17 included non-operating pension costs of $0.08, pension settlement costs of $0.06, fees related to a cost savings program of $0.05 and a state tax law change of $0.03 • Comparable earnings per diluted share from continuing operations were $1.64 vs. $1.34 in 3Q17 — Includes used vehicle headwinds and related depreciation impacts of $18 million or $0.26 per diluted share • Total revenue increased 17% and operating revenue increased 13% vs. prior year — Total revenue benefited from higher operating revenue and higher fuel costs passed through to customers — Operating revenue increased due to new business and higher volumes in all business segments — Revenue growth in Supply Chain Solutions benefited from the MXD acquisition @ 2018 Ryder System, Inc. 4 All Rights Reserved

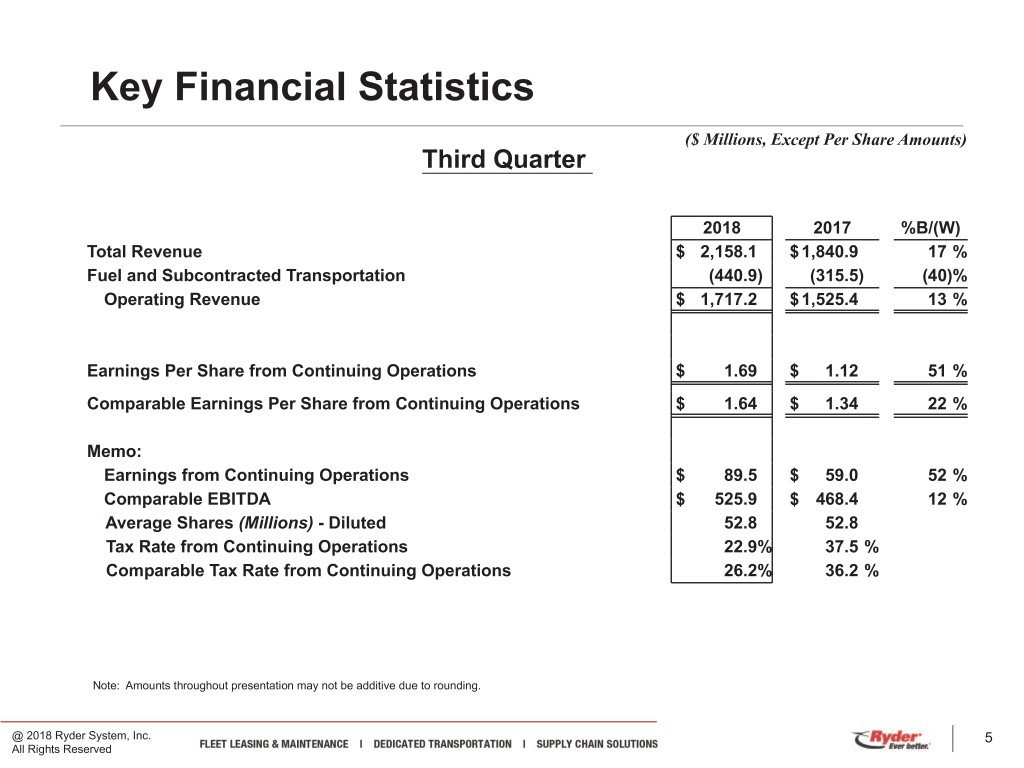

Key Financial Statistics ($ Millions, Except Per Share Amounts) Third Quarter 2018 2017 %B/(W) Total Revenue $ 2,158.1 $ 1,840.9 17 % Fuel and Subcontracted Transportation (440.9) (315.5) (40)% Operating Revenue $ 1,717.2 $ 1,525.4 13 % Earnings Per Share from Continuing Operations $ 1.69 $ 1.12 51 % Comparable Earnings Per Share from Continuing Operations $ 1.64 $ 1.34 22 % Memo: Earnings from Continuing Operations $ 89.5 $ 59.0 52 % Comparable EBITDA $ 525.9 $ 468.4 12 % Average Shares (Millions) - Diluted 52.8 52.8 Tax Rate from Continuing Operations 22.9% 37.5 % Comparable Tax Rate from Continuing Operations 26.2% 36.2 % Note: Amounts throughout presentation may not be additive due to rounding. @ 2018 Ryder System, Inc. 5 All Rights Reserved

Key Financial Statistics Year-To-Date 2018 2017 %B/(W) Total Revenue $ 6,150.9 $ 5,365.9 15% Fuel and Subcontracted Transportation (1,251.6) (912.1) 37% Operating Revenue $ 4,899.2 $ 4,453.8 10% Earnings Per Share from Continuing Operations $ 3.15 $ 2.80 13% Comparable Earnings Per Share from Continuing Operations $ 3.97 $ 3.17 25% Memo: Earnings from Continuing Operations $ 167.0 $ 149.0 12% Comparable EBITDA $ 1,486.2 $ 1,354.3 10% Adjusted Return on Capital vs. Cost of Capital (Trailing 12 Months) 0.0% (0.3)% Average Shares (Millions) - Diluted 52.7 53.0 Tax Rate from Continuing Operations 36.4% 36.9 % Comparable Tax Rate from Continuing Operations 26.5% 36.7 % @ 2018 Ryder System, Inc. 6 All Rights Reserved

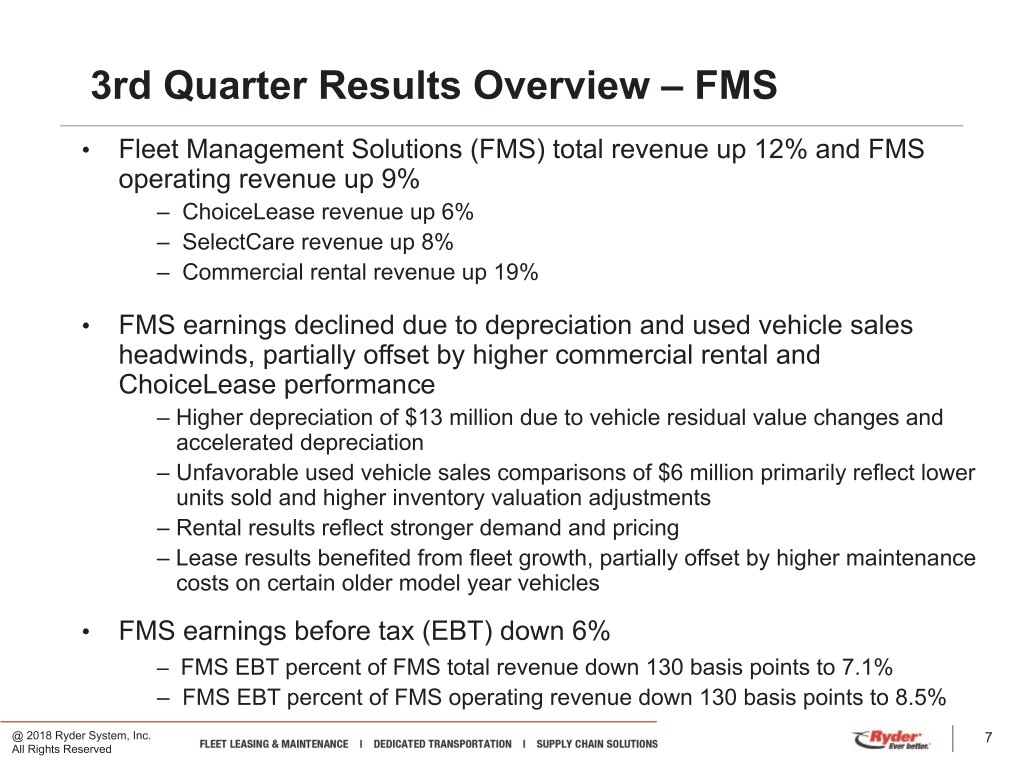

3rd Quarter Results Overview – FMS • Fleet Management Solutions (FMS) total revenue up 12% and FMS operating revenue up 9% – ChoiceLease revenue up 6% – SelectCare revenue up 8% – Commercial rental revenue up 19% • FMS earnings declined due to depreciation and used vehicle sales headwinds, partially offset by higher commercial rental and ChoiceLease performance – Higher depreciation of $13 million due to vehicle residual value changes and accelerated depreciation – Unfavorable used vehicle sales comparisons of $6 million primarily reflect lower units sold and higher inventory valuation adjustments – Rental results reflect stronger demand and pricing – Lease results benefited from fleet growth, partially offset by higher maintenance costs on certain older model year vehicles • FMS earnings before tax (EBT) down 6% – FMS EBT percent of FMS total revenue down 130 basis points to 7.1% – FMS EBT percent of FMS operating revenue down 130 basis points to 8.5% @ 2018 Ryder System, Inc. 7 All Rights Reserved

3rd Quarter Results Overview – DTS • Dedicated Transportation Solutions (DTS) total revenue up 25% and DTS operating revenue up 12% – DTS total and operating revenue increased due to new business and higher volumes • DTS earnings increased slightly due to revenue growth, largely offset by start-up costs on a new customer account • DTS earnings before tax (EBT) up 1% – DTS EBT percent of DTS total revenue down 90 basis points to 4.1% – DTS EBT percent of DTS operating revenue down 60 basis points to 6.3% @ 2018 Ryder System, Inc. 8 All Rights Reserved

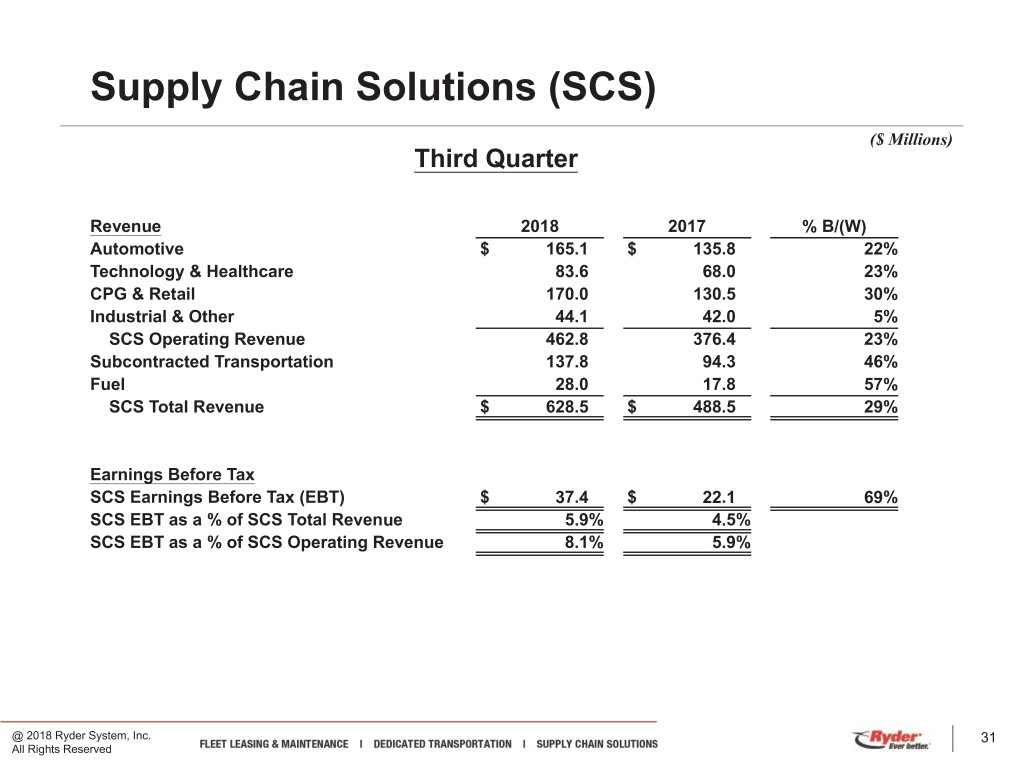

3rd Quarter Results Overview – SCS • Supply Chain Solutions (SCS) total revenue up 29% and SCS operating revenue up 23% – SCS total and operating revenue increased due to increased volumes, new business and the MXD acquisition – Excluding MXD, SCS total revenue and SCS operating grew 18% and 17%, respectively • SCS earnings increased primarily due to revenue growth and improved operating performance • SCS earnings before tax (EBT) up 69% – SCS EBT percent of SCS total revenue up 140 basis points to 5.9% – SCS EBT percent of SCS operating revenue up 220 basis points to 8.1% @ 2018 Ryder System, Inc. 9 All Rights Reserved

Capital Expenditures ($ Millions) Year-To-Date 2018 $ 2018 2017 O/(U) 2017 ChoiceLease $ 1,419 $ 986 $ 433 Commercial Rental 758 296 462 Operating Property and Equipment 120 95 25 Gross Capital Expenditures 2,296 1,376 920 Less: Proceeds from Sales (Primarily Revenue Earning Equipment) (292) (302) (10) Net Capital Expenditures $ 2,005 $ 1,074 $ 931 Memo: Acquisitions $ 167 $ — $ 167 Full year 2018 forecast for gross capital expenditures and net capital expenditures is unchanged at $3.1 billion and $2.7 billion, respectively @ 2018 Ryder System, Inc. 10 All Rights Reserved

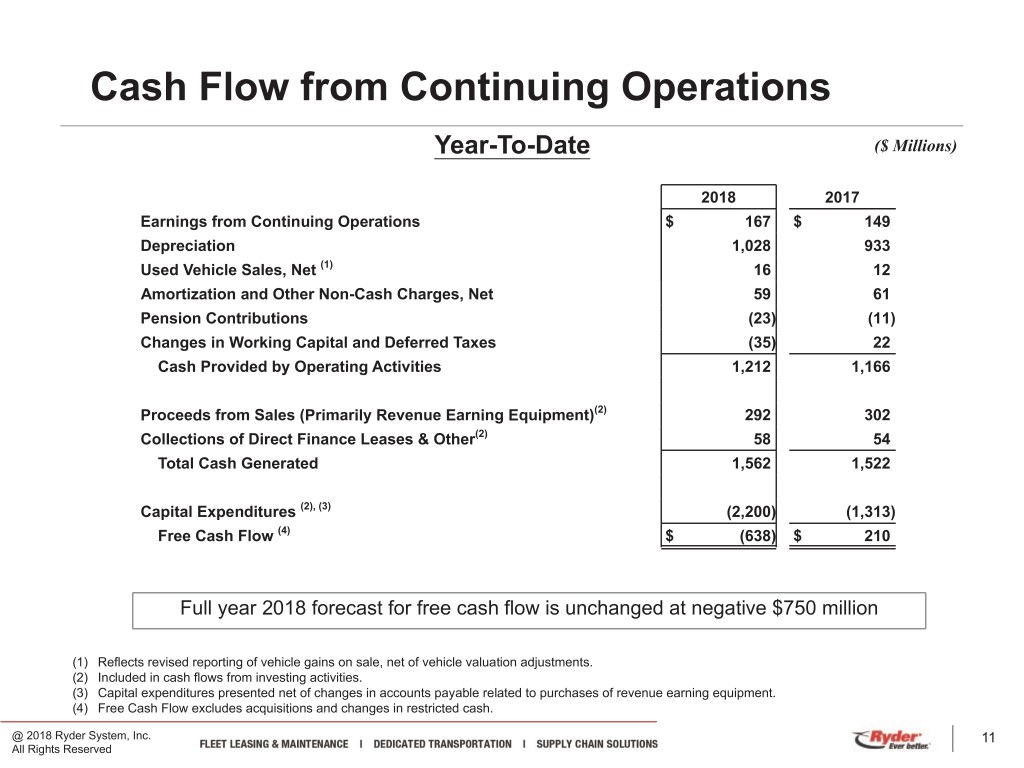

Cash Flow from Continuing Operations Year-To-Date ($ Millions) 2018 2017 Earnings from Continuing Operations $ 167 $ 149 Depreciation 1,028 933 Used Vehicle Sales, Net (1) 16 12 Amortization and Other Non-Cash Charges, Net 59 61 Pension Contributions (23) (11) Changes in Working Capital and Deferred Taxes (35) 22 Cash Provided by Operating Activities 1,212 1,166 Proceeds from Sales (Primarily Revenue Earning Equipment)(2) 292 302 Collections of Direct Finance Leases & Other(2) 58 54 Total Cash Generated 1,562 1,522 Capital Expenditures (2), (3) (2,200) (1,313) Free Cash Flow (4) $ (638) $ 210 Full year 2018 forecast for free cash flow is unchanged at negative $750 million (1) Reflects revised reporting of vehicle gains on sale, net of vehicle valuation adjustments. (2) Included in cash flows from investing activities. (3) Capital expenditures presented net of changes in accounts payable related to purchases of revenue earning equipment. (4) Free Cash Flow excludes acquisitions and changes in restricted cash. @ 2018 Ryder System, Inc. 11 All Rights Reserved

Debt to Equity Ratio 300 277% 263% 250 62% 61% 215% 225% 191% 200 39% 32% 150 100 50 0 12/31/15 12/31/16 12/31/17 09/30/18 Target (1) Midpoint (2) Debt to Equity excl. Pension Pension Impact (2) ($ Millions) 9/30/2018 12/31/2017 9/30/2017 Total Debt 6,283 5,410 5,349 Total Equity (3) 2,918 2,842 2,175 Debt to Equity (4) 215% 191% 246% Year-end 2018 forecast for debt to equity is unchanged at 210% (1) Represents debt to equity target of 200% to 250% while maintaining a solid investment grade rating. (2) Illustrates impact of accumulated net pension related equity charge on leverage. (3) Total Equity includes impact of accumulated net pension related equity charge of $653 million as of 9/30/2018, $567 million as of 12/31/2017 and $611 million as of 9/30/2017. (4) Beginning 12/31/17, Debt to Equity ratio declined due to the revaluation of the net deferred income tax liability related to Tax Reform. @ 2018 Ryder System, Inc. 12 All Rights Reserved

Contents • Third Quarter 2018 Results Overview • Used Vehicle Sales Update • EPS Forecast & Strategic Highlights • Lease Accounting Changes • Q & A @ 2018 Ryder System, Inc. 13 All Rights Reserved

Global Used Vehicle Sales Update • Units held for sale, as reported, were 6,200 at quarter end, down from 6,300 units in the prior year – Units held for sale are down 500 units when adjusted for an elevated number of lease vehicles being prepared for sale in the prior year – Units held for sale increased by 600 vehicles sequentially • Sold 4,100 used vehicles during the third quarter, down by 13% from the prior year and sequentially • Proceeds per unit were up 22% for tractors and up 15% for trucks in the third quarter compared with prior year (excluding the FX impact) – Higher proceeds primarily reflect increased sales through retail sales channel and age of vehicles sold – Retail proceeds per unit were up 11% for tractors and 6% for trucks, year over year – Proceeds per unit were up 11% for tractors and up 7% for trucks, sequentially @ 2018 Ryder System, Inc. 14 All Rights Reserved

Contents • Third Quarter 2018 Results Overview • Used Vehicle Sales Update • EPS Forecast & Strategic Highlights • Lease Accounting Changes • Q & A @ 2018 Ryder System, Inc. 15 All Rights Reserved

EPS Forecast – Continuing Operations ($ Earnings Per Share) • Revising our full year GAAP EPS forecast to $4.88 to $4.98 from $4.71 to $4.91 • Narrowing our full year Comparable EPS forecast to $5.72 to $5.82 from $5.62 to $5.82 • Revised forecast is as follows: Fourth Quarter 2018 Full Year 2018 EPS Forecast $1.73 to $1.83 $4.88 to $4.98 Comparable EPS Forecast $1.75 to $1.85 $5.72 to $5.82 Fourth Quarter 2017 Full Year 2017 EPS $12.08 $14.90 Comparable EPS $1.36 $4.53 @ 2018 Ryder System, Inc. 16 All Rights Reserved

Strategic Highlights • On track for another record sales year in 2018, driven by ChoiceLease and Dedicated • On track for record organic ChoiceLease fleet growth of 8,500 vehicles in 2018 – due to strong sales activity and extended OEM lead times, new leases being signed are for vehicle deliveries well into 2019 • Achieved better than expected results for Ryder Last Mile, our recently acquired last mile platform for big and bulky goods, and recently expanded network in 11 markets • Our second release of RyderGyde,TM a mobile fleet management app, already has 4,000 users and now allows customers to rent vehicles from their mobile devices, as well as browse Ryder's used vehicle inventory • On track for significant 2018 cost savings driven by Zero Based Budgeting process with additional savings anticipated in future years @ 2018 Ryder System, Inc. 17 All Rights Reserved

Progress Toward Three-Year Financial Targets 2018 3-Yr Target Forecast Operating Revenue Growth Fleet Management 6 - 7% l Dedicated Transportation 9 - 10% l Supply Chain 7 - 8% l EBT as % of Operating Revenue lï Reflects Fleet Management 10 - 12% negative impact l from used Dedicated Transportation 8 - 9% vehicle sales and Supply Chain 8 - 9% l maintenance costs on certain older model ROC Spread 100 - 150 bps lï year vehicles l Leverage (Debt-to-Equity) 200 - 250% • FMS targets assume stable rental environment and do not reflect any impact from the new Lease Accounting standard @ 2018 Ryder System, Inc. 18 All Rights Reserved

Contents • Third Quarter 2018 Results Overview • Used Vehicle Sales Update • EPS Forecast & Strategic Highlights • Lease Accounting Changes • Q & A @ 2018 Ryder System, Inc. 19 All Rights Reserved

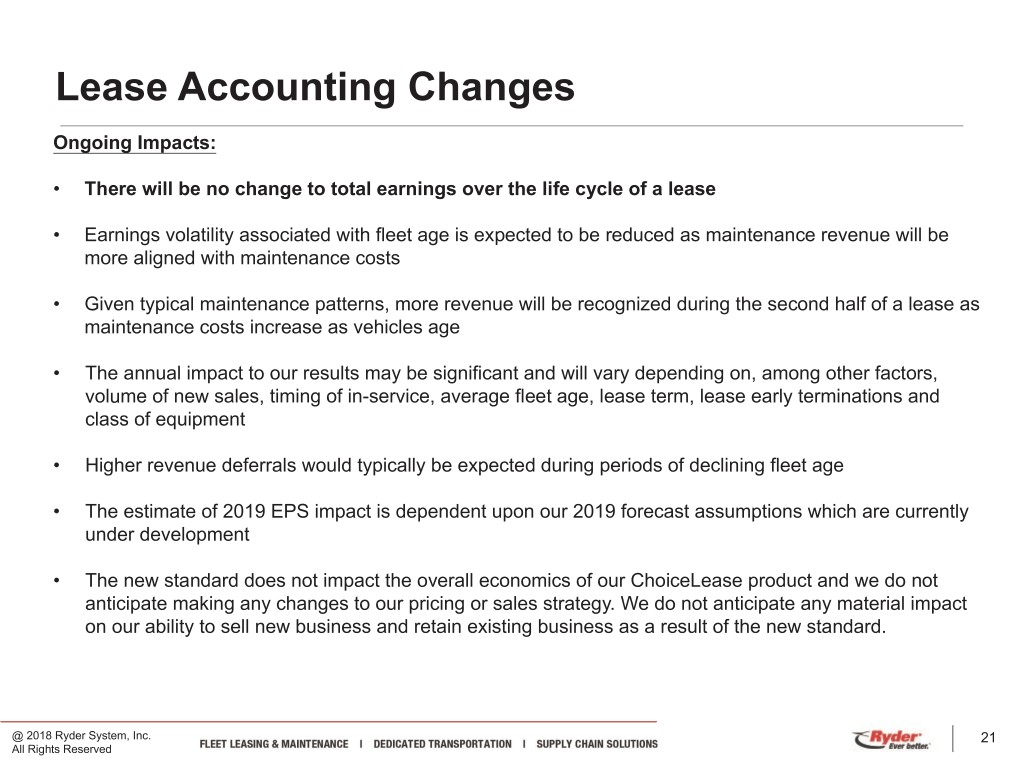

Lease Accounting Changes • The FASB has issued new lease accounting guidance which Ryder is required to adopt effective January 1, 2019 • Ryder must separate lease (i.e. financial ) and non-lease (i.e. maintenance) components and recognize non-lease obligations as the services are provided One-Time Impacts: • Revenue from Ryder's bundled ChoiceLease product must be allocated between lease and maintenance – Maintenance costs increase as vehicles age, but customer payments are largely constant over contract duration – Accordingly, maintenance revenue will be recognized as the costs are estimated to be incurred, resulting in deferred maintenance revenue • A Deferred Revenue balance will be established to reflect the adjusted recognition pattern of our maintenance related revenue for Ryder's ChoiceLease product • We expect the one-time cumulative effect adjustment to recognize deferred revenue to have a significant impact on our consolidated balance sheet by reducing shareholders' equity Balance Sheet Leverage and Cash Flow Impacts: • The one-time adjustment to equity will increase leverage – No capital allocation changes are anticipated as there is no change in cash flow expected – We expect to revise upward our debt to equity target from the current target of 200 - 250% • No impact to current or future free cash flow is expected as a result of the adoption of the new accounting standard @ 2018 Ryder System, Inc. 20 All Rights Reserved

Lease Accounting Changes Ongoing Impacts: • There will be no change to total earnings over the life cycle of a lease • Earnings volatility associated with fleet age is expected to be reduced as maintenance revenue will be more aligned with maintenance costs • Given typical maintenance patterns, more revenue will be recognized during the second half of a lease as maintenance costs increase as vehicles age • The annual impact to our results may be significant and will vary depending on, among other factors, volume of new sales, timing of in-service, average fleet age, lease term, lease early terminations and class of equipment • Higher revenue deferrals would typically be expected during periods of declining fleet age • The estimate of 2019 EPS impact is dependent upon our 2019 forecast assumptions which are currently under development • The new standard does not impact the overall economics of our ChoiceLease product and we do not anticipate making any changes to our pricing or sales strategy. We do not anticipate any material impact on our ability to sell new business and retain existing business as a result of the new standard. @ 2018 Ryder System, Inc. 21 All Rights Reserved

Q&A @ 2018 Ryder System, Inc. 22 All Rights Reserved

Appendix ChoiceLease Vehicle Count Business Segment Detail Central Support Services Balance Sheet Capital Expenditures, Cash Flow and Leverage Return on Capital Spread Asset Management Non-GAAP Financial Measures & Reconciliations @ 2018 Ryder System, Inc. 23 All Rights Reserved

ChoiceLease Vehicle Count (1) 3Q18 3Q18 3Q17 4Q17 1Q18 2Q18 3Q18 O/(U) 3Q17 O/(U) 4Q17 End of Period ChoiceLease Vehicles (as reported) 137,300 139,100 140,800 143,000 145,400 8,100 6,300 Vehicles being prepared for sale (2) 400 — — — — (400) — Adjusted ChoiceLease Vehicles 136,900 139,100 140,800 143,000 145,400 8,500 6,300 Acquisition — — — 800 700 700 700 Adjusted ChoiceLease Vehicles (ex-acquisition) 136,900 139,100 140,800 142,200 144,700 7,800 5,600 (1) Beginning in 2018, ChoiceLease fleet count shown on this schedule will no longer be adjusted to exclude the impact from UK trailers, as the impact is expected to be minimal (2) Represents an elevated number of vehicles being prepared for sale during 2017 Note: Represents end of period vehicle count. Amounts may not recalculate due to rounding. @ 2018 Ryder System, Inc. 24 All Rights Reserved

Business Segments ($ Millions) Third Quarter Memo: Operating Revenue 2018 2017 % B/(W) 2018 2017 % B/(W) Total Revenue: Fleet Management Solutions $ 1,336.5 $ 1,195.8 12 % $ 1,122.0 $ 1,026.0 9 % Dedicated Transportation Solutions 340.6 272.2 25 % 222.2 197.9 12 % Supply Chain Solutions 628.5 488.5 29 % 462.8 376.4 23 % Eliminations (147.6) (115.6) (28)% (89.9) (74.9) (20)% Total $ 2,158.1 $ 1,840.9 17 % $ 1,717.2 $ 1,525.4 13 % Segment Earnings Before Tax: (1) Fleet Management Solutions $ 95.2 $ 100.8 (6)% Dedicated Transportation Solutions 13.9 13.7 1 % Supply Chain Solutions 37.4 22.1 69 % Eliminations (16.1) (14.5) (11)% 130.4 122.2 7 % Central Support Services (Unallocated Share) (12.8) (11.0) (16)% Non-operating Pension Costs (1.2) (7.0) NM Restructuring and Other Items, net (0.3) (9.7) NM Earnings Before Income Taxes $ 116.1 $ 94.5 23 % Provision for Income Taxes 26.6 35.5 25 % Earnings from Continuing Operations $ 89.5 $ 59.0 52 % Comparable Earnings from Continuing Operations $ 86.8 $ 70.9 22 % (1) Our primary measure of segment financial performance excludes unallocated CSS, non-operating pension costs and restructuring and other items, net. @ 2018 Ryder System, Inc. 25 All Rights Reserved

Business Segments Year-To-Date Memo: Operating Revenue 2018 2017 % B/(W) 2018 2017 % B/(W) Total Revenue: Fleet Management Solutions $ 3,874.6 $ 3,491.8 11 % $ 3,241.0 $ 2,986.8 9% Dedicated Transportation Solutions 970.2 811.3 20 % 637.5 591.0 8% Supply Chain Solutions 1,727.8 1,405.8 23 % 1,275.7 1,096.9 16% Eliminations (421.7) (343.0) (23)% (255.0) (221.0) 15% Total $ 6,150.9 $ 5,365.9 15 % $ 4,899.2 $ 4,453.8 10% Segment Earnings Before Tax: (1) Fleet Management Solutions $ 217.9 221.2 (2)% Dedicated Transportation Solutions 45.4 39.8 14 % Supply Chain Solutions 101.3 76.2 33 % Eliminations (44.6) (38.1) (17)% 319.9 299.2 7 % Central Support Services (Unallocated Share) (34.4) (33.0) (4)% Non-operating Pension Costs (3.2) (20.9) NM Restructuring and Other Items, net (19.7) (9.3) NM Earnings Before Income Taxes $ 262.5 $ 236.0 11 % Provision for Income Taxes 95.6 87.0 (10)% Earnings from Continuing Operations $ 167.0 $ 149.0 12 % Comparable Earnings from Continuing Operations $ 210.0 $ 168.5 25 % (1) Our primary measure of segment financial performance excludes unallocated CSS, non-operating pension costs and restructuring and other items, net. @ 2018 Ryder System, Inc. 26 All Rights Reserved

Fleet Management Solutions (FMS) ($ Millions) Third Quarter Revenue 2018 2017 % B/(W) ChoiceLease $ 716.7 $ 673.9 6 % SelectCare 125.9 117.0 8 % Commercial Rental 257.9 216.0 19 % Other 21.5 19.1 13 % FMS Operating Revenue 1,122.0 1,026.0 9 % Fuel Services Revenue 214.5 169.8 26 % FMS Total Revenue $ 1,336.5 $ 1,195.8 12 % FMS Earnings Before Tax FMS Earnings Before Tax (EBT) $ 95.2 $ 100.8 (6)% FMS EBT as a % of FMS Total Revenue 7.1% 8.4% FMS EBT as a % of FMS Operating Revenue 8.5% 9.8% @ 2018 Ryder System, Inc. 27 All Rights Reserved

Fleet Management Solutions (FMS) Year-To-Date Revenue 2018 2017 % B/(W) ChoiceLease $ 2,107.9 $ 1,992.7 6 % SelectCare 373.0 348.0 7 % Commercial Rental 694.9 589.4 18 % Other 65.2 56.8 15 % FMS Operating Revenue 3,241.0 2,986.8 9 % Fuel Services Revenue 633.6 505.1 25 % FMS Total Revenue $ 3,874.6 $ 3,491.8 11 % FMS Earnings Before Tax FMS Earnings Before Tax (EBT) $ 217.9 $ 221.2 (2)% FMS EBT as a % of FMS Total Revenue 5.6% 6.3% FMS EBT as a % of FMS Operating Revenue 6.7% 7.4% @ 2018 Ryder System, Inc. 28 All Rights Reserved

Dedicated Transportation Solutions (DTS) ($ Millions) Third Quarter Revenue 2018 2017 % B/(W) DTS Operating Revenue $ 222.2 $ 197.9 12% Subcontracted Transportation 80.8 46.1 75% Fuel 37.6 28.2 33% DTS Total Revenue $ 340.6 $ 272.2 25% Earnings Before Tax DTS Earnings Before Tax (EBT) $ 13.9 $ 13.7 1% DTS EBT as a % of DTS Total Revenue 4.1% 5.0% DTS EBT as a % of DTS Operating Revenue 6.3% 6.9% @ 2018 Ryder System, Inc. 29 All Rights Reserved

Dedicated Transportation Solutions (DTS) ($ Millions) Year-To-Date Revenue 2018 2017 % B/(W) DTS Operating Revenue $ 637.5 $ 591.0 8% Subcontracted Transportation 224.8 136.5 65% Fuel 107.9 83.7 29% DTS Total Revenue $ 970.2 $ 811.3 20% Earnings Before Tax DTS Earnings Before Tax (EBT) $ 45.4 $ 39.8 14% DTS EBT as a % of DTS Total Revenue 4.7% 4.9% DTS EBT as a % of DTS Operating Revenue 7.1% 6.7% @ 2018 Ryder System, Inc. 30 All Rights Reserved

Supply Chain Solutions (SCS) ($ Millions) Third Quarter Revenue 2018 2017 % B/(W) Automotive $ 165.1 $ 135.8 22% Technology & Healthcare 83.6 68.0 23% CPG & Retail 170.0 130.5 30% Industrial & Other 44.1 42.0 5% SCS Operating Revenue 462.8 376.4 23% Subcontracted Transportation 137.8 94.3 46% Fuel 28.0 17.8 57% SCS Total Revenue $ 628.5 $ 488.5 29% Earnings Before Tax SCS Earnings Before Tax (EBT) $ 37.4 $ 22.1 69% SCS EBT as a % of SCS Total Revenue 5.9% 4.5% SCS EBT as a % of SCS Operating Revenue 8.1% 5.9% @ 2018 Ryder System, Inc. 31 All Rights Reserved

Supply Chain Solutions (SCS) ($ Millions) Year-To-Date Revenue 2018 2017 % B/(W) Automotive $ 458.8 $ 420.1 9% Technology & Healthcare 230.3 194.6 18% CPG & Retail 460.0 365.2 26% Industrial & Other 126.6 117.0 8% SCS Operating Revenue 1,275.7 1,096.9 16% Subcontracted Transportation 371.6 255.7 45% Fuel 80.5 53.3 51% SCS Total Revenue $ 1,727.8 $ 1,405.8 23% Earnings Before Tax SCS Earnings Before Tax (EBT) $ 101.3 $ 76.2 33% SCS EBT as a % of SCS Total Revenue 5.9% 5.4% SCS EBT as a % of SCS Operating Revenue 7.9% 6.9% @ 2018 Ryder System, Inc. 32 All Rights Reserved

Central Support Services (CSS) ($ Millions) Third Quarter 2018 2017 % B/(W) Allocated CSS Costs $ 56.6 $ 54.0 (5)% Unallocated CSS Costs 12.8 11.0 (16)% Total CSS Costs $ 69.4 $ 65.0 (7)% @ 2018 Ryder System, Inc. 33 All Rights Reserved

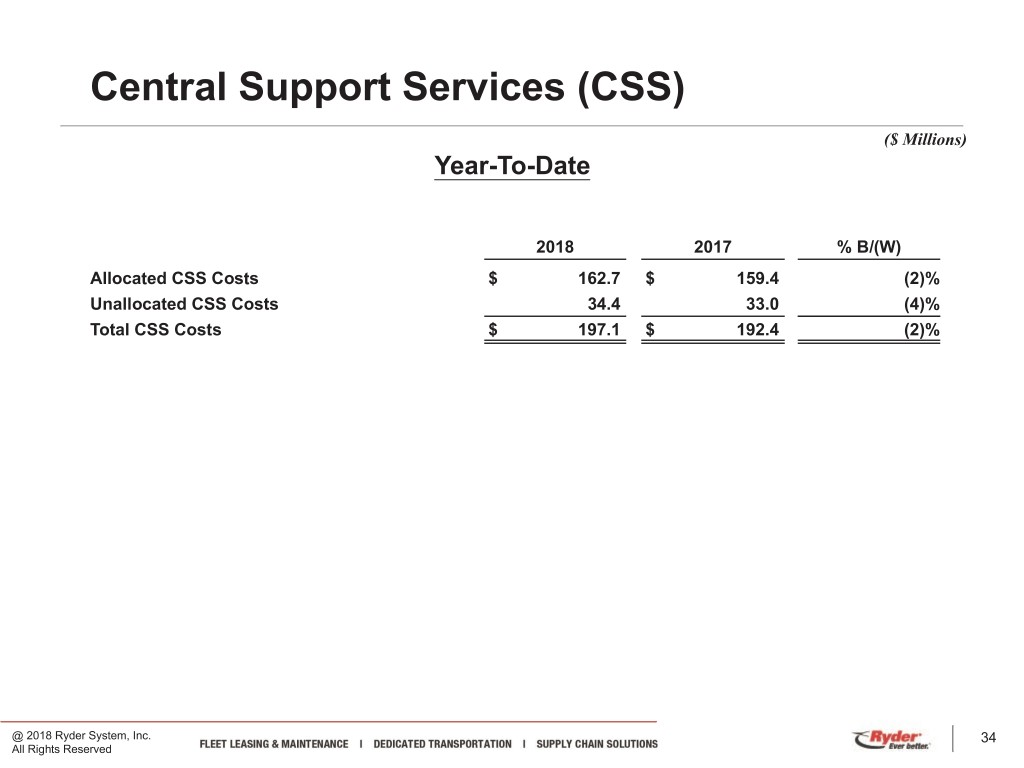

Central Support Services (CSS) ($ Millions) Year-To-Date 2018 2017 % B/(W) Allocated CSS Costs $ 162.7 $ 159.4 (2)% Unallocated CSS Costs 34.4 33.0 (4)% Total CSS Costs $ 197.1 $ 192.4 (2)% @ 2018 Ryder System, Inc. 34 All Rights Reserved

Balance Sheet ($ Millions) September 30, 2018 December 31, 2017 Current Assets $ 1,465 $ 1,323 Revenue Earning Equipment, Net 9,187 8,355 Operating Property and Equipment, Net 826 777 Other Assets 1,207 1,009 Total Assets $ 12,684 $ 11,464 Current Liabilities $ 1,323 $ 1,189 Total Debt 6,283 5,410 Other Non-Current Liabilities (including Deferred Income Taxes) 2,160 2,024 Shareholders' Equity 2,918 2,842 Total Liabilities and Shareholders' Equity $ 12,684 $ 11,464 @ 2018 Ryder System, Inc. 35 All Rights Reserved

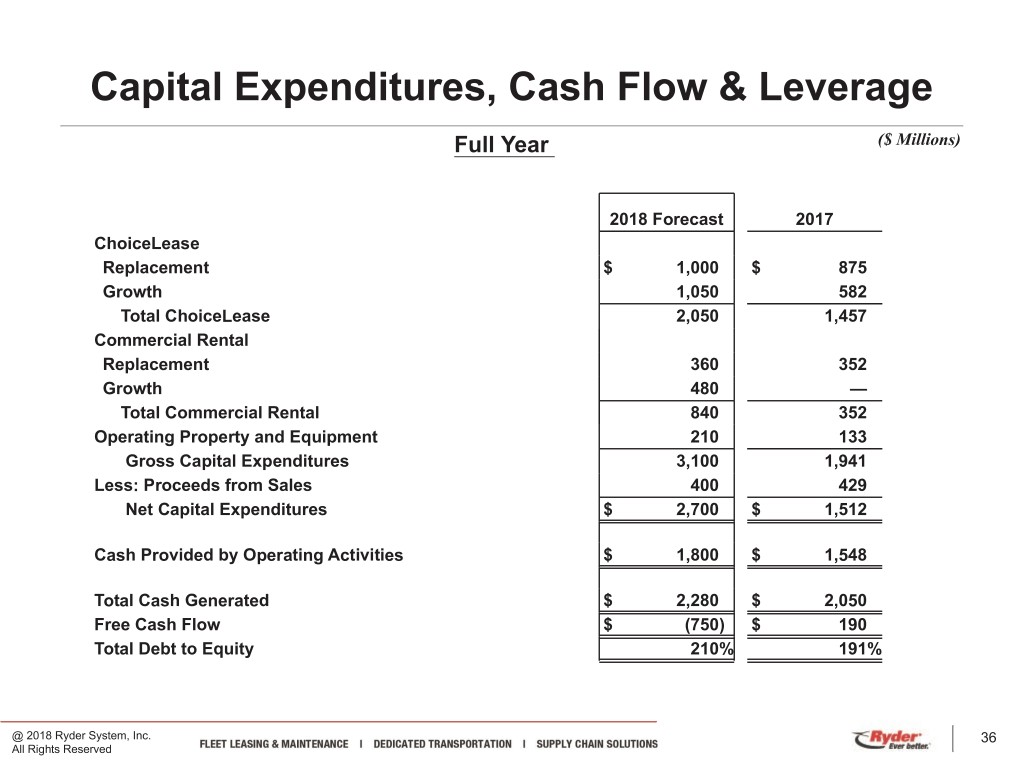

Capital Expenditures, Cash Flow & Leverage Full Year ($ Millions) 2018 Forecast 2017 ChoiceLease Replacement $ 1,000 $ 875 Growth 1,050 582 Total ChoiceLease 2,050 1,457 Commercial Rental Replacement 360 352 Growth 480 — Total Commercial Rental 840 352 Operating Property and Equipment 210 133 Gross Capital Expenditures 3,100 1,941 Less: Proceeds from Sales 400 429 Net Capital Expenditures $ 2,700 $ 1,512 Cash Provided by Operating Activities $ 1,800 $ 1,548 Total Cash Generated $ 2,280 $ 2,050 Free Cash Flow $ (750) $ 190 Total Debt to Equity 210% 191% @ 2018 Ryder System, Inc. 36 All Rights Reserved

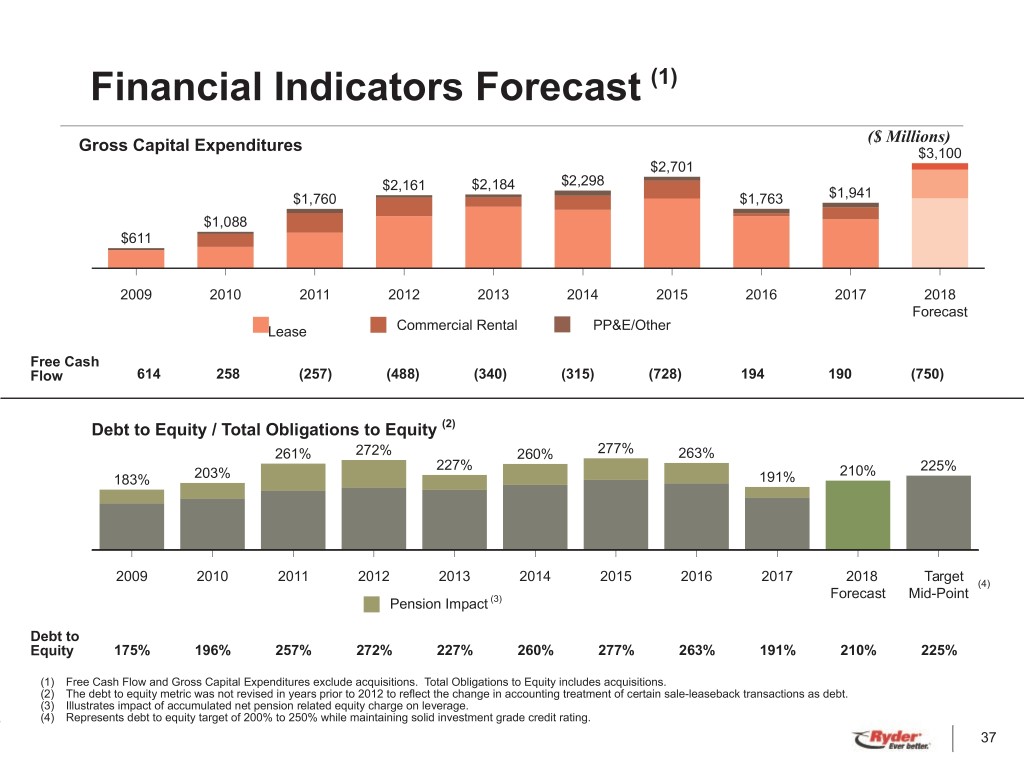

Financial Indicators Forecast (1) ($ Millions) Gross Capital Expenditures $3,100 $2,701 $2,161 $2,184 $2,298 $1,760 $1,763 $1,941 $1,088 $611 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 Forecast Lease Commercial Rental PP&E/Other Free Cash Flow 614 258 (257) (488) (340) (315) (728) 194 190 (750) Debt to Equity / Total Obligations to Equity (2) 261% 272% 260% 277% 263% 227% 210% 225% 183% 203% 191% 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 Target (4) Forecast Mid-Point Pension Impact (3) Debt to Equity 175% 196% 257% 272% 227% 260% 277% 263% 191% 210% 225% (1) Free Cash Flow and Gross Capital Expenditures exclude acquisitions. Total Obligations to Equity includes acquisitions. (2) The debt to equity metric was not revised in years prior to 2012 to reflect the change in accounting treatment of certain sale-leaseback transactions as debt. (3) Illustrates impact of accumulated net pension related equity charge on leverage. (4) Represents debt to equity target of 200% to 250% while maintaining solid investment grade credit rating. @ 2018 Ryder System, Inc. 37 All Rights Reserved

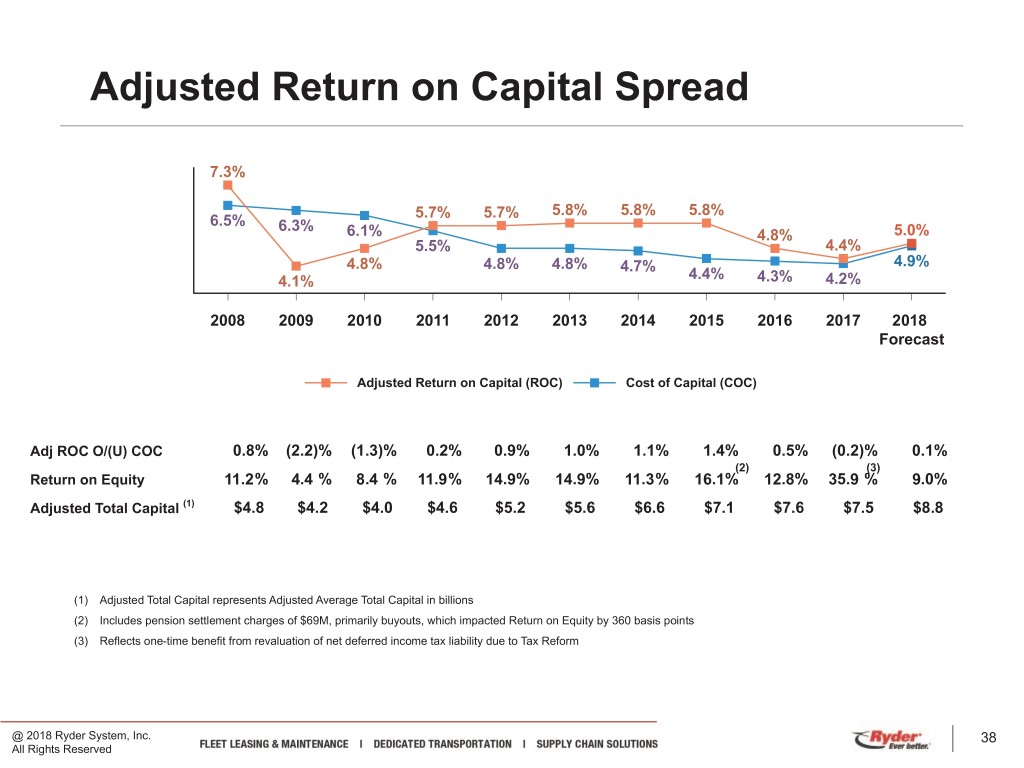

Adjusted Return on Capital Spread 7.3% 5.7% 5.7% 5.8% 5.8% 5.8% 6.5% 6.3% 6.1% 4.8% 5.0% 5.5% 4.4% 4.8% 4.8% 4.8% 4.7% 4.9% 4.1% 4.4% 4.3% 4.2% 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 Forecast Adjusted Return on Capital (ROC) Cost of Capital (COC) Adj ROC O/(U) COC 0.8% (2.2)% (1.3)% 0.2% 0.9% 1.0% 1.1% 1.4% 0.5% (0.2)% 0.1% (2) (3) Return on Equity 11.2% 4.4 % 8.4 % 11.9% 14.9% 14.9% 11.3% 16.1% 12.8% 35.9 % 9.0% Adjusted Total Capital (1) $4.8 $4.2 $4.0 $4.6 $5.2 $5.6 $6.6 $7.1 $7.6 $7.5 $8.8 (1) Adjusted Total Capital represents Adjusted Average Total Capital in billions (2) Includes pension settlement charges of $69M, primarily buyouts, which impacted Return on Equity by 360 basis points (3) Reflects one-time benefit from revaluation of net deferred income tax liability due to Tax Reform @ 2018 Ryder System, Inc. 38 All Rights Reserved

Asset Management YTD Update (US Only) Redeployments – Vehicles coming off-lease or in Rental with useful life remaining are redeployed in the Ryder fleet (SCS, or with another Lease customer). Redeployments exclude units transferred into the Rental product line. Extensions – Ryder re-prices lease contract and extends maturity date. Early terminations – Customer elects to terminate lease prior to maturity. Depending on the remaining useful life, the vehicle may be redeployed in the Ryder fleet (Commercial Rental, SCS, other Lease customer) or sold by Ryder. (a)(b) (a) Current year statistics may exclude some units due to a lag in reporting (b) Excludes early terminations where customer purchases vehicle (c) 2018 YTD activity excludes internal assignments. Historical periods not restated to exclude assignments (represents ~30% of volume) @ 2018 Ryder System, Inc. 39 All Rights Reserved

Non-GAAP Financial Measures This presentation includes “non-GAAP financial measures” as defined by SEC rules. As required by SEC rules, we provide a reconciliation of each non-GAAP financial measure to the most comparable GAAP measure. Non-GAAP financial measures should be considered in addition to, but not as a substitute for or superior to, other measures of financial performance prepared in accordance with GAAP. Specifically, the following non-GAAP financial measures are included in this presentation: Reconciliation & Additional Information Non-GAAP Financial Measure Comparable GAAP Measure Presented on Slide Titled Page Operating Revenue Measures: Operating Revenue Total Revenue Key Financial Statistics 5-6 FMS Operating Revenue, DTS Operating Revenue FMS Total Revenue, DTS Total Revenue and SCS Total Fleet Management Solutions (FMS), Dedicated 27-32 and SCS Operating Revenue Revenue Transportation Solutions (DTS) and Supply Chain Solutions (SCS) FMS EBT as a % of FMS Operating Revenue, DTS FMS EBT as a % of FMS Total Revenue, DTS EBT as a Fleet Management Solutions (FMS), Dedicated 27-32 EBT as a % of DTS Operating Revenue and SCS EBT % of DTS Total Revenue and SCS EBT as a % of SCS Transportation Solutions (DTS) and Supply Chain as a % of SCS Operating Revenue Total Revenue Solutions (SCS) Comparable Earnings Measures: Comparable Earnings and Comparable EPS Earnings and EPS from Continuing Operations Earnings and EPS from Continuing Operations 41 Reconciliation Comparable EPS Forecast EPS Forecast from Continuing Operations EPS Forecast – Continuing Operations 42 Comparable Earnings Before Income Tax and Earnings Before Income Tax and Tax Rate Earnings and Tax Rate from Continuing Operations 43 Comparable Tax Rate Reconciliation Adjusted Return on Capital (ROC) and Adjusted ROC Not Applicable. However, non-GAAP elements of the Adjusted Return on Capital Reconciliation 44-45 Spread calculation have been reconciled to the corresponding GAAP measures. A numerical reconciliation of net earnings to adjusted net earnings and average total debt and average shareholders' equity to adjusted average total capital is provided. Comparable Earnings Before Interest, Taxes, Earnings from Continuing Operations Comparable EBITDA Reconciliation 46 Depreciation and Amortization Cash Flow Measures: Total Cash Generated and Free Cash Flow Cash Provided by Operating Activities Cash Flow Reconciliation 47-48 Debt Measures: Total Obligations and Total Obligations to Equity Balance Sheet Debt and Debt to Equity Debt to Equity Reconciliation 49 @ 2018 Ryder System, Inc. 40 All Rights Reserved

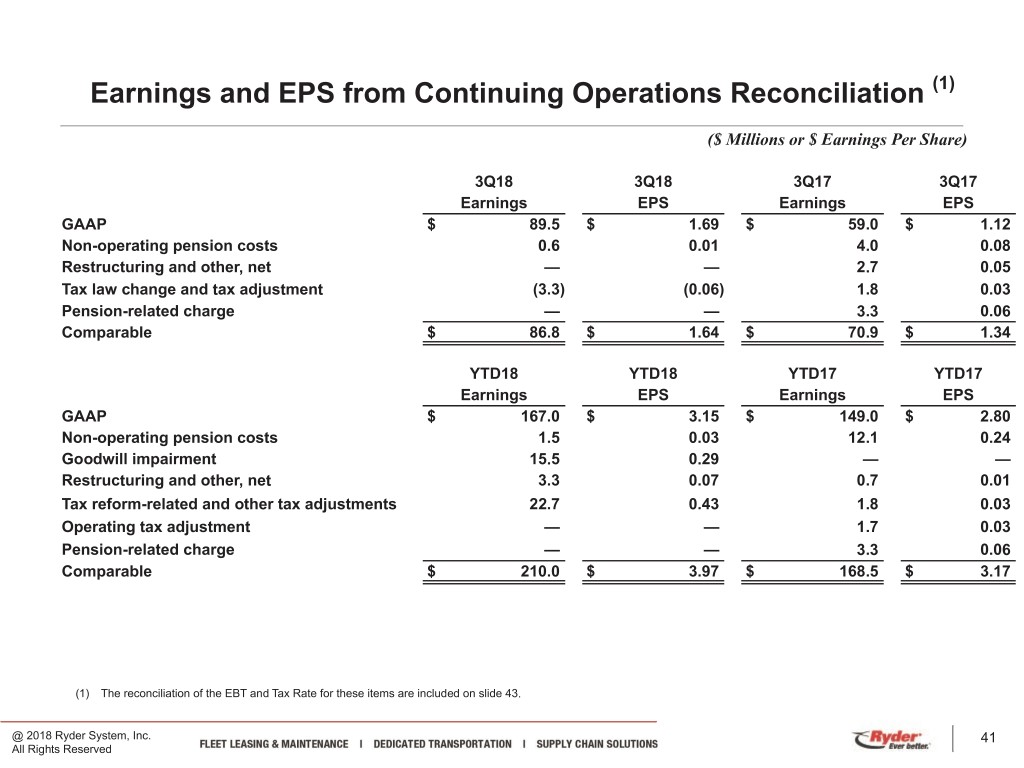

Earnings and EPS from Continuing Operations Reconciliation (1) ($ Millions or $ Earnings Per Share) 3Q18 3Q18 3Q17 3Q17 Earnings EPS Earnings EPS GAAP $ 89.5 $ 1.69 $ 59.0 $ 1.12 Non-operating pension costs 0.6 0.01 4.0 0.08 Restructuring and other, net — — 2.7 0.05 Tax law change and tax adjustment (3.3) (0.06) 1.8 0.03 Pension-related charge — — 3.3 0.06 Comparable $ 86.8 $ 1.64 $ 70.9 $ 1.34 YTD18 YTD18 YTD17 YTD17 Earnings EPS Earnings EPS GAAP $ 167.0 $ 3.15 $ 149.0 $ 2.80 Non-operating pension costs 1.5 0.03 12.1 0.24 Goodwill impairment 15.5 0.29 — — Restructuring and other, net 3.3 0.07 0.7 0.01 Tax reform-related and other tax adjustments 22.7 0.43 1.8 0.03 Operating tax adjustment — — 1.7 0.03 Pension-related charge — — 3.3 0.06 Comparable $ 210.0 $ 3.97 $ 168.5 $ 3.17 (1) The reconciliation of the EBT and Tax Rate for these items are included on slide 43. @ 2018 Ryder System, Inc. 41 All Rights Reserved

EPS Forecast - Continuing Operations ($ Millions or $ Earnings Per Share) Fourth Quarter 2018 Full Year 2018 EPS forecast $1.73 to $1.83 $4.88 to $4.98 Non-operating pension costs, net of tax 0.01 0.04 Goodwill Impairment — 0.29 Restructuring and Other 0.01 0.08 Tax reform-related and other tax adjustments — 0.43 Comparable EPS forecast $1.75 to $1.85 $5.72 to $5.82 Fourth Quarter 2017 Full Year 2017 EPS $12.08 $14.90 Non-operating pension costs 0.07 0.31 Gain on sale of property (0.27) (0.27) Restructuring charges and fees 0.24 0.25 Pension-related adjustments — 0.06 Tax reform-related and other tax adjustments (10.76) (10.75) Operating tax adjustment — 0.03 Comparable EPS $1.36 $4.53 @ 2018 Ryder System, Inc. 42 All Rights Reserved

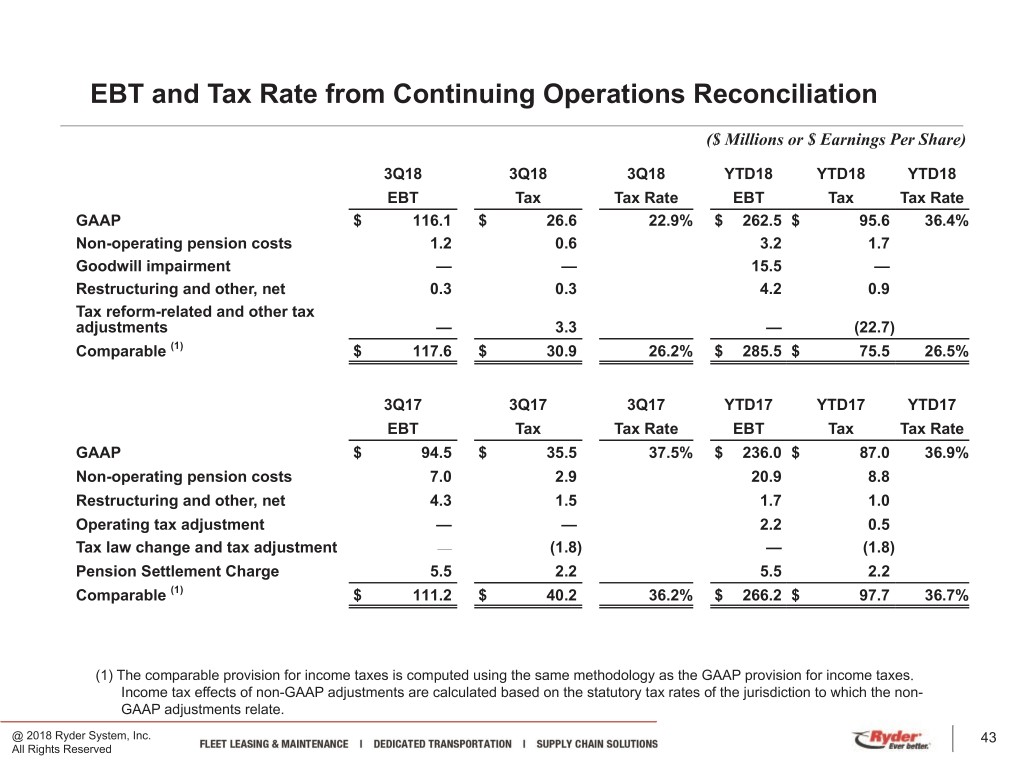

EBT and Tax Rate from Continuing Operations Reconciliation ($ Millions or $ Earnings Per Share) 3Q18 3Q18 3Q18 YTD18 YTD18 YTD18 EBT Tax Tax Rate EBT Tax Tax Rate GAAP $ 116.1 $ 26.6 22.9% $ 262.5 $ 95.6 36.4% Non-operating pension costs 1.2 0.6 3.2 1.7 Goodwill impairment — — 15.5 — Restructuring and other, net 0.3 0.3 4.2 0.9 Tax reform-related and other tax adjustments — 3.3 — (22.7) Comparable (1) $ 117.6 $ 30.9 26.2% $ 285.5 $ 75.5 26.5% 3Q17 3Q17 3Q17 YTD17 YTD17 YTD17 EBT Tax Tax Rate EBT Tax Tax Rate GAAP $ 94.5 $ 35.5 37.5% $ 236.0 $ 87.0 36.9% Non-operating pension costs 7.0 2.9 20.9 8.8 Restructuring and other, net 4.3 1.5 1.7 1.0 Operating tax adjustment — — 2.2 0.5 Tax law change and tax adjustment — (1.8) — (1.8) Pension Settlement Charge 5.5 2.2 5.5 2.2 Comparable (1) $ 111.2 $ 40.2 36.2% $ 266.2 $ 97.7 36.7% (1) The comparable provision for income taxes is computed using the same methodology as the GAAP provision for income taxes. Income tax effects of non-GAAP adjustments are calculated based on the statutory tax rates of the jurisdiction to which the non- GAAP adjustments relate. @ 2018 Ryder System, Inc. 43 All Rights Reserved

Adjusted Return on Capital Reconciliation(1) ($ Millions) 2008 2009 2010 2011 2012 2013 Net earnings (2) $ 200 $ 62 $ 118 $ 170 $ 210 $ 238 Restructuring and other charges, net and other items 70 30 6 6 17 - Income taxes 150 54 61 108 91 126 Adjusted earnings before income taxes 420 146 185 284 317 363 Adjusted interest expense (3) 165 150 133 135 144 141 Adjusted income taxes (4) (230) (122) (124) (157) (167) (177) Adjusted net earnings [A] $ 355 $ 174 $ 194 $ 262 $ 294 $ 327 Average total debt(5) $ 2,882 $ 2,692 $ 2,512 $ 3,079 $ 3,778 $ 4,015 Average off-balance sheet debt(5) 171 142 114 78 2 1 Average total shareholders' equity(5) 1,778 1,396 1,402 1,428 1,406 1,594 Average adjustments to shareholders' equity (6) 10 16 2 4 (3) (2) Adjusted average total capital [B] $ 4,841 $ 4,245 $ 4,030 $ 4,588 $ 5,182 $ 5,608 Adjusted return on capital [A]/[B] 7.3% 4.1 % 4.8 % 5.7% 5.7% 5.8% Weighted average cost of capital 6.5% 6.3 % 6.1 % 5.5% 4.8% 4.8% Adjusted return on capital spread 0.8% (2.2)% (1.3)% 0.2% 0.9% 1.0% (1) Non-GAAP elements of this calculation have been reconciled to the corresponding GAAP measures. A numerical reconciliation of net earnings to adjusted net earnings and average total debt and average shareholders' equity to adjusted average total capital is provided on this slide. (2) Earnings calculated based on a 12-month rolling period. (3) Interest expense includes interest on off-balance sheet vehicle obligations. (4) Income taxes were calculated by excluding taxes related to comparable earnings items and interest expense. (5) The average is calculated based on the average GAAP balances. (6) Represents comparable earnings items for those periods. @ 2018 Ryder System, Inc. 44 All Rights Reserved

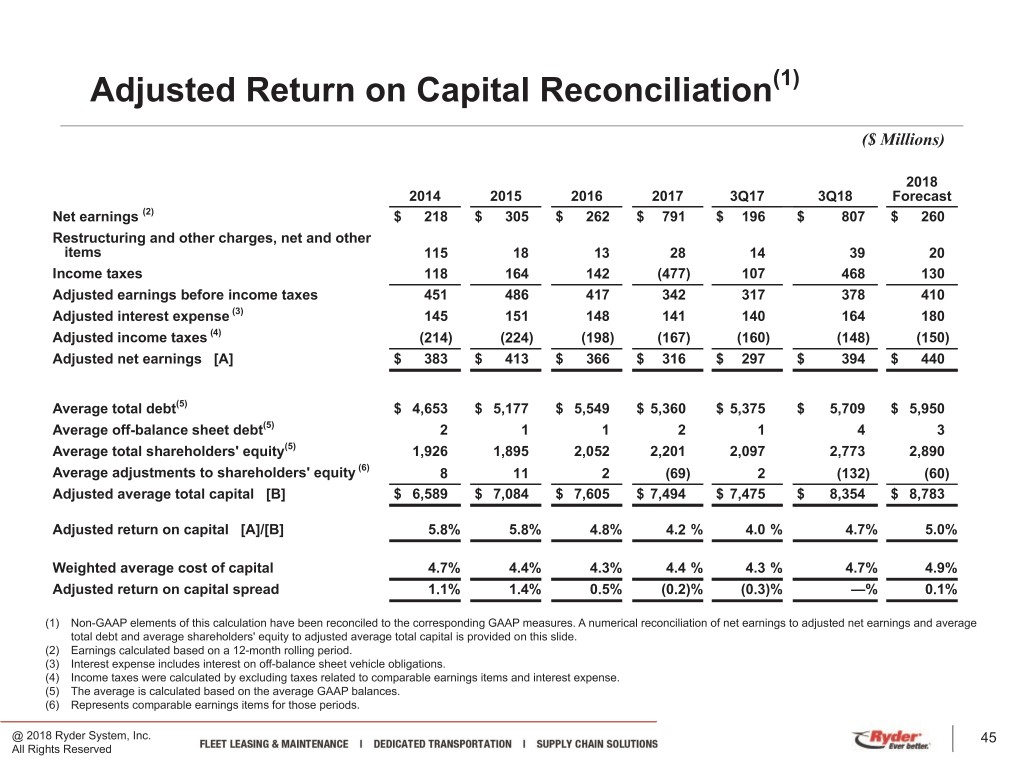

Adjusted Return on Capital Reconciliation(1) ($ Millions) 2018 2014 2015 2016 2017 3Q17 3Q18 Forecast Net earnings (2) $ 218 $ 305 $ 262 $ 791 $ 196 $ 807 $ 260 Restructuring and other charges, net and other items 115 18 13 28 14 39 20 Income taxes 118 164 142 (477) 107 468 130 Adjusted earnings before income taxes 451 486 417 342 317 378 410 Adjusted interest expense (3) 145 151 148 141 140 164 180 Adjusted income taxes (4) (214) (224) (198) (167) (160) (148) (150) Adjusted net earnings [A] $ 383 $ 413 $ 366 $ 316 $ 297 $ 394 $ 440 Average total debt(5) $ 4,653 $ 5,177 $ 5,549 $ 5,360 $ 5,375 $ 5,709 $ 5,950 Average off-balance sheet debt(5) 2 1 1 2 1 4 3 Average total shareholders' equity(5) 1,926 1,895 2,052 2,201 2,097 2,773 2,890 Average adjustments to shareholders' equity (6) 8 11 2 (69) 2 (132) (60) Adjusted average total capital [B] $ 6,589 $ 7,084 $ 7,605 $ 7,494 $ 7,475 $ 8,354 $ 8,783 Adjusted return on capital [A]/[B] 5.8% 5.8% 4.8% 4.2 % 4.0 % 4.7% 5.0% Weighted average cost of capital 4.7% 4.4% 4.3% 4.4 % 4.3 % 4.7% 4.9% Adjusted return on capital spread 1.1% 1.4% 0.5% (0.2)% (0.3)% —% 0.1% (1) Non-GAAP elements of this calculation have been reconciled to the corresponding GAAP measures. A numerical reconciliation of net earnings to adjusted net earnings and average total debt and average shareholders' equity to adjusted average total capital is provided on this slide. (2) Earnings calculated based on a 12-month rolling period. (3) Interest expense includes interest on off-balance sheet vehicle obligations. (4) Income taxes were calculated by excluding taxes related to comparable earnings items and interest expense. (5) The average is calculated based on the average GAAP balances. (6) Represents comparable earnings items for those periods. @ 2018 Ryder System, Inc. 45 All Rights Reserved

Comparable EBITDA Reconciliation(1) ($ Millions) Three months ended September 30, Nine months ended September 30, 2018 2017 2018 2017 Earnings from continuing operations $ 89.5 $ 59.0 $ 167.0 $ 149.0 Provision for income taxes 26.6 35.5 95.6 87.0 Earnings before income taxes from continuing operations 116.1 94.5 262.5 236.0 Non-operating pension costs 1.2 7.0 3.2 20.9 Restructuring and other, net 0.3 4.3 4.2 1.7 Goodwill impairment — — 15.5 — Pension-related charge — 5.5 — 5.5 Operating tax adjustment — — — 2.2 Comparable earnings before income taxes 117.6 111.2 285.5 266.2 Interest expense 47.4 34.9 127.5 104.6 Depreciation 347.2 311.8 1,028.5 932.8 Losses from used vehicle fair value adjustments 11.5 9.2 39.1 46.4 Amortization 2.2 1.5 5.6 4.4 Comparable EBITDA $ 525.9 $ 468.4 $ 1,486.2 $ 1,354.3 (1) Non-GAAP elements of this calculation have been reconciled to the corresponding GAAP measures. A numerical reconciliation of earnings before income taxes from continuing operations to comparable earnings before income taxes from continuing operations is provided on this slide. @ 2018 Ryder System, Inc. 46 All Rights Reserved

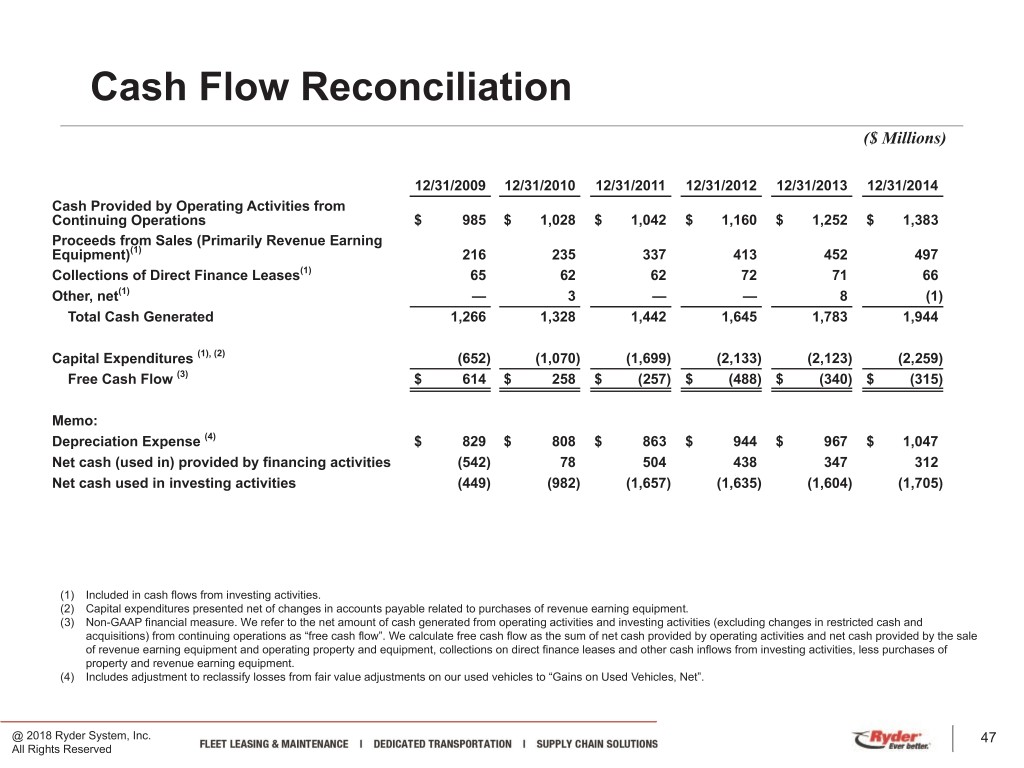

Cash Flow Reconciliation ($ Millions) 12/31/2009 12/31/2010 12/31/2011 12/31/2012 12/31/2013 12/31/2014 Cash Provided by Operating Activities from Continuing Operations $ 985 $ 1,028 $ 1,042 $ 1,160 $ 1,252 $ 1,383 Proceeds from Sales (Primarily Revenue Earning Equipment)(1) 216 235 337 413 452 497 Collections of Direct Finance Leases(1) 65 62 62 72 71 66 Other, net(1) — 3 — — 8 (1) Total Cash Generated 1,266 1,328 1,442 1,645 1,783 1,944 Capital Expenditures (1), (2) (652) (1,070) (1,699) (2,133) (2,123) (2,259) Free Cash Flow (3) $ 614 $ 258 $ (257) $ (488) $ (340) $ (315) Memo: Depreciation Expense (4) $ 829 $ 808 $ 863 $ 944 $ 967 $ 1,047 Net cash (used in) provided by financing activities (542) 78 504 438 347 312 Net cash used in investing activities (449) (982) (1,657) (1,635) (1,604) (1,705) (1) Included in cash flows from investing activities. (2) Capital expenditures presented net of changes in accounts payable related to purchases of revenue earning equipment. (3) Non-GAAP financial measure. We refer to the net amount of cash generated from operating activities and investing activities (excluding changes in restricted cash and acquisitions) from continuing operations as “free cash flow”. We calculate free cash flow as the sum of net cash provided by operating activities and net cash provided by the sale of revenue earning equipment and operating property and equipment, collections on direct finance leases and other cash inflows from investing activities, less purchases of property and revenue earning equipment. (4) Includes adjustment to reclassify losses from fair value adjustments on our used vehicles to “Gains on Used Vehicles, Net”. @ 2018 Ryder System, Inc. 47 All Rights Reserved

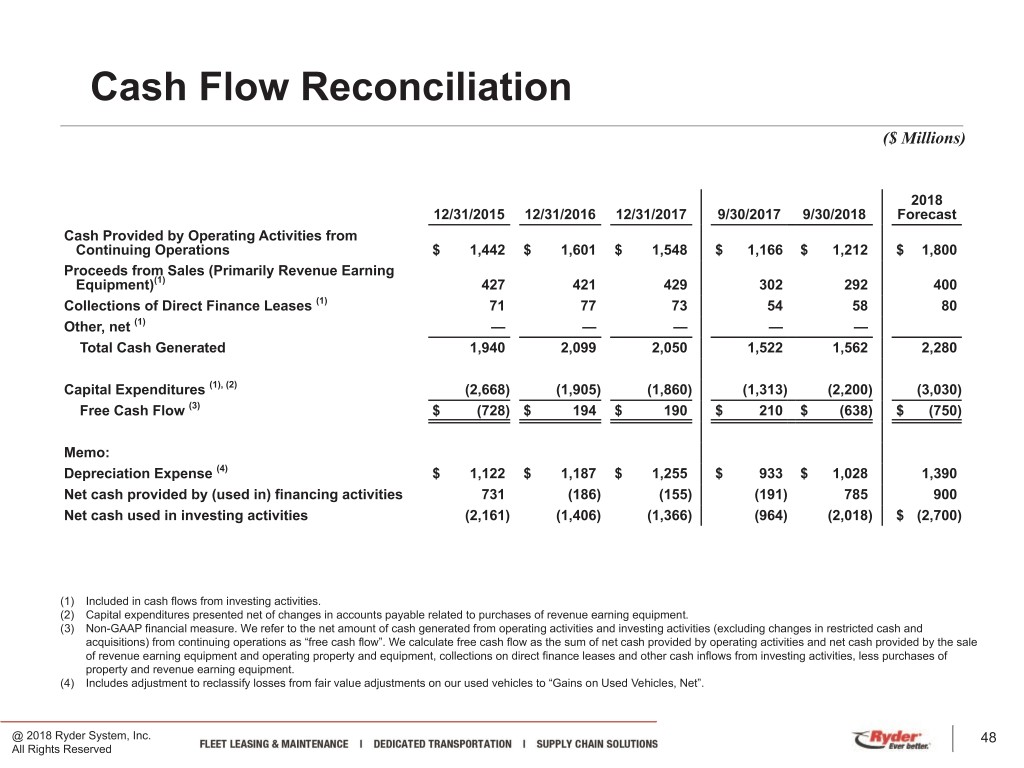

Cash Flow Reconciliation ($ Millions) 2018 12/31/2015 12/31/2016 12/31/2017 9/30/2017 9/30/2018 Forecast Cash Provided by Operating Activities from Continuing Operations $ 1,442 $ 1,601 $ 1,548 $ 1,166 $ 1,212 $ 1,800 Proceeds from Sales (Primarily Revenue Earning Equipment)(1) 427 421 429 302 292 400 Collections of Direct Finance Leases (1) 71 77 73 54 58 80 Other, net (1) — — — — — Total Cash Generated 1,940 2,099 2,050 1,522 1,562 2,280 Capital Expenditures (1), (2) (2,668) (1,905) (1,860) (1,313) (2,200) (3,030) Free Cash Flow (3) $ (728) $ 194 $ 190 $ 210 $ (638) $ (750) Memo: Depreciation Expense (4) $ 1,122 $ 1,187 $ 1,255 $ 933 $ 1,028 1,390 Net cash provided by (used in) financing activities 731 (186) (155) (191) 785 900 Net cash used in investing activities (2,161) (1,406) (1,366) (964) (2,018) $ (2,700) (1) Included in cash flows from investing activities. (2) Capital expenditures presented net of changes in accounts payable related to purchases of revenue earning equipment. (3) Non-GAAP financial measure. We refer to the net amount of cash generated from operating activities and investing activities (excluding changes in restricted cash and acquisitions) from continuing operations as “free cash flow”. We calculate free cash flow as the sum of net cash provided by operating activities and net cash provided by the sale of revenue earning equipment and operating property and equipment, collections on direct finance leases and other cash inflows from investing activities, less purchases of property and revenue earning equipment. (4) Includes adjustment to reclassify losses from fair value adjustments on our used vehicles to “Gains on Used Vehicles, Net”. @ 2018 Ryder System, Inc. 48 All Rights Reserved

Debt to Equity Reconciliation(1) ($ Millions) % to % to % to 12/31/2009 Equity 12/31/2010 Equity 12/31/2011 Equity Debt $ 2,498 175% $ 2,747 196% $ 3,382 257% PV of minimum lease payments and guaranteed residual values under operating leases for vehicles 119 100 64 Total Obligations (2) $ 2,617 183% $ 2,847 230% $ 3,446 261% (1) The debt to equity metric was not revised in years prior to 2012 to reflect the change in accounting treatment of certain sale-leaseback transactions as debt. (2) For years beginning in 2012, sale-leaseback transactions that were previously accounted for as off-balance sheet are now included in GAAP balance sheet debt. The Company does not reconcile total obligations to equity for these years as this metric is the same as the debt to equity metric. Note: Amounts may not recalculate due to rounding. @ 2018 Ryder System, Inc. 49 All Rights Reserved

@ 2018 Ryder System, Inc. 50 All Rights Reserved