Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Tesla, Inc. | tsla-8k_20181024.htm |

Exhibit 99.1

|

|

Tesla Third Quarter 2018 Update

• GAAP net income of $312M, non-GAAP net income of $516M • Operating income of $417M and operating margin of 6.1% • Free cash flow of $881M supported by operating cash flow of $1.4B • $3.0B of cash and cash equivalents at Q3-end, increased by $731M in Q3 • Model 3 GAAP and non-GAAP gross margin > 20% in Q3 • Reaffirm expectation of continued GAAP net income and free cash flow in Q4 |

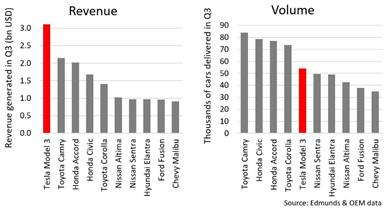

Q3 2018 was a truly historic quarter for Tesla. Model 3 was the best-selling car in the US in terms of revenue and the 5th best-selling car in terms of volume. With average weekly Model 3 production through the quarter (excluding planned shutdowns) of roughly 4,300 units per week, we achieved GAAP net income of $312 million. We also delivered on our internal cost efficiency targets, leading to GAAP Model 3 gross margin of more than 20%, which exceeded our guidance. Finally, our total cash increased by $731 million and we had free cash flow (operating cash flow less capex) of $881 million despite less than 10% of that amount coming from key working capital items (payables, receivables, and inventory).

Model 3 is attracting customers of both premium and non-premium brands, making it a truly mainstream product. We are thankful to our customers for being such strong advocates of our products and mission.

|

AUTOMOTIVE PRODUCTS The Model 3 production system stabilized in Q3. We went from a steep S-curve to more gradual monthly improvements. Among other things, we made the changes necessary to enable production of an All-Wheel Drive (AWD) version of Model 3, and we did this without disrupting our production rate. We started the quarter producing only Rear Wheel Drive (RWD) Model 3s and ended the quarter producing almost entirely AWD cars. Even though AWD cars are significantly more complex to build, we produced 5,300 Model 3s in the last week of Q3.

Labor hours per Model 3 decreased by more than 30% from Q2 to Q3, falling for the first time below the level for Model S and X. In Q4, we will focus even further on cost improvements while continuing to increase our production rate. |

US Passenger Car sales in Q3 |

|

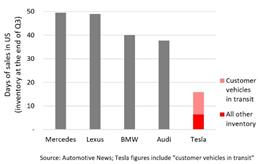

US vehicle inventory – Days of sales |

Vehicle delivery and logistics were our main challenges in Q3 as our delivery system went through a similar “ramp” to what our production system went through in Q2. Fortunately, these challenges are easier to solve than vehicle manufacturing, and we made improvements through the quarter. One of the most significant improvements was the expansion of direct deliveries where our employee delivers the car wherever the customer would like. We believe delivering vehicles to the front door of a customer’s house or office is superior from both a cost and customer satisfaction perspective.

Despite logistical challenges earlier in the quarter, our US inventory at the end of Q3 (including customer vehicles in transit, test drive vehicles, service loaners and engineering fleet – all of which accounted for the vast majority of our inventory) remains the lowest in the industry when measured in terms of days of sales. Even when compared to our own history, our vehicle inventory level at the end of Q3 was the lowest in over two years in terms of days of sales. |

|

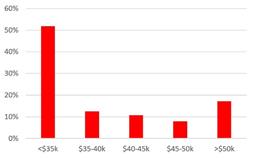

In Q3, we delivered 56,065 Model 3s to customers. Based on trade-ins received from customers since the start of Model 3 production, more than half of those trade-in vehicles were priced below $35,000 when new. It is clear that customers are trading up their relatively cheaper vehicles to buy a Model 3 even though there is not yet a leasing option and the Q3 starting price of a Model 3 was $49,000. This leads us to believe that the total market potential for Model 3 is larger than just the premium sedan market. Additionally, we are working hard to bring down the price of Model 3 to $35,000. We have taken a step forward by recently introducing a medium range version that has a 260-mile EPA estimated range and a starting price of $46,000. Better than expected Model 3 cost reduction is allowing us to bring more affordable options to the market sooner.

We stopped taking Model 3 reservations in North America in early July 2018 when we moved to a direct order system. Of the 455,000 net reservations that we reported in August 2017, less than 20% have cancelled. We are expecting most of the remaining reservations to gradually convert to orders as we launch more versions of Model 3, introduce other financing options, and begin sales outside North America. |

Original purchase price of Model 3 trade-ins |

The mid-sized premium sedan market in Europe is more than twice as big as the same segment in the US. This is why we are excited to bring Model 3 to Europe early next year. The reception at the Paris Auto Show as well as the Goodwood Festival of Speed was very strong. We expect to start taking orders in Europe and China for Model 3 before the end of this year.

Given the growth of Model 3, we delivered almost 70,000 vehicles in the US in Q3. Although we only sell Model 3, Model S and Model X, our total US deliveries in Q3 were on par with total vehicle deliveries made by our long-established premium competitors, each of which has multiple models and a vast network of dealerships.

In order to significantly increase the affordability of Model 3, we have decided to accelerate our manufacturing timeline in China. We are aiming to bring portions of Model 3 production to China during 2019 and to progressively increase the level of localization through local sourcing and manufacturing. Production in China will be designated only for local customers.

|

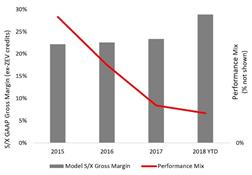

Model S/X gross margin vs. Performance mix |

Model 3 mix was strong in Q3 due to the launch of AWD and Performance variants. While the average selling price will gradually decline as we introduce lower priced variants, we are not expecting this to impact profitability. Model S and X Performance mix declined roughly 4-fold since 2015, yet Model S and X gross margin (excluding ZEV credits) continued to improve by roughly 600 basis points over the same period of time. Margin growth was caused by gradual cost improvements driven by lowering labor hours per vehicle, reduced cost of raw materials, and various other cost efficiencies. We continue to target a 25% gross margin ex-ZEV credits on Model 3.

In Q3, we delivered 27,710 Model S and X vehicles to customers. While demand in China remains challenging due to a 40% import duty for Model S and X, China deliveries still remained a material portion of our Q3 deliveries, and we managed to offset the decline there with growth in North America and Europe. |

Electric vehicles that are designed from the ground up to be electric are structurally safer than equivalent combustion engine vehicles. That is why we were excited to confirm earlier this month that Model 3 received a 5-star rating from NHTSA in every category and sub-category. We continue to improve both the hardware and software on our cars so that our customers immediately get the best of what we have to offer without waiting for a new model year.

Battery pack and powertrain are at the heart of our vehicles. Over the past 15 years, we have worked hard to make the best powertrain anywhere on the market. By 2016, Model X energy efficiency was 3.1 miles of EPA range per kWh. This is an extremely important metric as it allows an EV to reach a long EPA range even when using a relatively small, inexpensive battery pack. With Model 3, energy efficiency improved dramatically to 4.1 EPA miles per kWh, the highest efficiency for any all-wheel drive EV. To put this in context, our current or upcoming AWD (2019) competition is expected to achieve 2.4 to 2.8 miles of EPA range per kWh. Model 3 has far better energy efficiency while also providing the quickest acceleration (0-60 mph in as little as 3.3 seconds) and the highest top speed (155 mph). Additionally, the curb weight of Model 3 long range RWD is only 3% heavier than its gas powered equivalents.

|

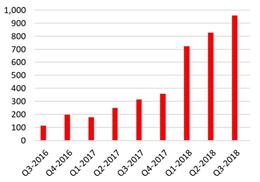

We recently started releasing Version 9.0 of our vehicle software, which marks our biggest software upgrade in the last two years. Our Autopilot software is now much improved, and, as a result, we can start adding new functionality that was not possible in the past. The main functionality we added to our early access users is “Navigate on Autopilot” where on most controlled-access roads such as highways, any Tesla vehicle made from October 2016 with Enhanced Autopilot will be able to automatically change lanes with driver confirmation, transition from one freeway to another, and ultimately exit the freeway when approaching the final destination. We also enabled long-awaited dashboard camera functionality as well as some Atari games when a vehicle is parked. This new software architecture will enable us to accelerate deployment of new Autopilot and Self-Driving features in the future.

During Q3, we opened four new store and service locations, resulting in 351 locations worldwide at the end of the quarter. Our electrified Mobile Service fleet continued to grow further to more than 373 service vehicles on the road at the end of Q3. Since body repairs have been one of the major drawbacks for our customers, we have started to roll out our own body shops in the US. Thus far, we have opened several body shops in the highest density areas and are planning to open dozens more in the next few quarters. |

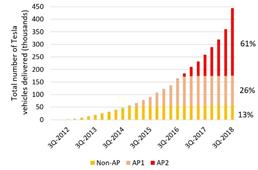

Total Tesla fleet with Autopilot hardware |

In Q3, we opened 44 new Supercharger locations for a total of 1,352 Supercharger stations. To date, we have over 11,000 Supercharging connectors and over 20,000 Destination Charging connectors globally.

ENERGY PRODUCTS

Our energy business is also going through significant changes that led to higher revenues and significantly better profitability.

In Q3, energy storage deployments grew to 239 MWh, an increase of 18% sequentially and 118% compared to Q3 2017. This means that we are well on track to achieve our goal of tripling energy storage deployments in 2018 compared to 2017. We increased Powerwall production so that we can continue to work through our order backlog. We also rolled out new software features for Powerwall, including Time Based Control and Storm Watch (full Powerwall recharge in case of a storm forecast), to continue to bring additional value to our customers.

|

MWh of Energy Storage deployed (12-months rolling) |

We deployed 93 MW of solar energy generation systems in Q3, an 11% increase sequentially. Cash and loan sales made up 80% of residential deployments in the quarter, up from 46% in Q3 2017. Due to the complexity of Solar Roof, we continue to iterate on the design of the product via intensive reliability testing, and we also continue to refine the installation process. Accordingly, we expect to ramp production more quickly during the first half of 2019.

We are prioritizing residential solar installations that are combined with our energy storage products because this combination provides a better customer experience and improves both our revenues and profits. As a result of greater scale, manufacturing efficiencies and improvements in our installation processes, our energy storage gross margin improved materially in Q3.

We have significantly improved the time to install our solar and energy storage products and customers will continue to see faster installation. Though solar energy economics continue to improve every year, one of the remaining gating factors has been customer acquisition costs. Following adjustments to our sales channel strategy earlier this year, a majority of our new solar energy orders now comes from our own website and stores rather than through third-party channels. This has helped us to significantly lower our customer acquisition costs. At the end of Q3, there were almost 450,000 Tesla vehicle owners around the world. Ultimately, we believe this group will become the largest demand generator for our residential solar and Powerwall business.

|

Revenue & Gross Margin

|

|

Three Months Ended |

|

|

Change |

|

|||||||||||||||

|

|

September 30, |

|

|

June 30, |

|

|

|

|

September 30, |

|

|

|

|

|

|

|

|

|||

|

|

2018 |

|

|

2018 |

|

|

|

|

2017 |

|

|

QoQ |

|

YoY |

|

|||||

|

Automotive revenue ($000) |

$ |

6,098,766 |

|

|

$ |

3,357,681 |

|

|

|

|

$ |

2,362,889 |

|

|

|

82 |

% |

|

158 |

% |

|

Automotive gross margin – GAAP |

|

25.8 |

% |

|

|

20.6 |

% |

|

|

|

|

18.3 |

% |

|

|

522 |

bp |

|

752 |

bp |

|

Automotive gross margin excluding SBC and ZEV credit – non-GAAP |

|

25.5 |

% |

|

|

21.0 |

% |

|

|

|

|

18.7 |

% |

|

|

453 |

bp |

|

681 |

bp |

|

• |

Automotive revenue in Q3 increased by 82% sequentially over Q2, mainly due to a sharp increase in Model 3 deliveries. In Q3, we recorded $52M in ZEV credit sales compared to zero in Q2. |

|

• |

With the adoption of the new revenue recognition standard starting January 1, 2018, lease accounting generally applies to vehicles directly leased by us without using bank partners. Only 3% of vehicles delivered in Q3 were subject to lease accounting. |

|

• |

GAAP Automotive gross margin improved significantly to 25.8% in Q3 from 20.6% in Q2, while non-GAAP Automotive gross margin improved to 25.5% in Q3 as compared to 21.0% in Q2. |

|

• |

At an average Model 3 production rate of about 4,300 per week in Q3 (excluding planned shutdowns), Model 3 gross margin grew very significantly to above 20%. The mix of the Model 3 Performance version was only slightly higher than the Performance mix of Model S and X. This strong margin growth was driven by a higher production rate while keeping fixed costs stable, significant reductions in manufacturing costs through lower labor hours per unit, lower scrap rate, lower material costs, and higher average selling price. |

|

• |

Gross margin of Model S and X continued to improve sequentially even though the average selling price per vehicle declined slightly. Model S has been in production for over six years, but we continue to achieve efficiencies in material cost and other manufacturing costs. |

|

|

Three Months Ended |

|

|

Change |

|

|||||||||||||

|

|

September 30, |

|

|

June 30, |

|

|

September 30, |

|

|

|

|

|

|

|

|

|||

|

|

2018 |

|

|

2018 |

|

|

2017 |

|

|

QoQ |

|

YoY |

|

|||||

|

Energy generation and storage revenue ($000) |

$ |

399,317 |

|

|

$ |

374,408 |

|

|

$ |

317,505 |

|

|

|

7 |

% |

|

26 |

% |

|

Energy generation and storage gross margin |

|

17.2 |

% |

|

|

11.8 |

% |

|

|

25.3 |

% |

|

|

543 |

bp |

|

-804 |

bp |

|

• |

Energy generation and storage revenue in Q3 increased by 7% over Q2 and by 26% compared to Q3 2017. This year-over-year increase was mainly driven by a substantial growth in energy storage deployments and higher mix of cash and loan sales for solar deployments. |

|

• |

GAAP gross margin of the Energy business in Q3 improved significantly to 17.2% compared to 11.8% in Q2 mainly due to cost improvements in our solar and storage businesses. |

Other Highlights

|

• |

Service and Other revenue in Q3 increased by 21% compared to Q2. This was mainly due to higher used car sales. |

|

• |

Service and Other gross margin loss in Q3 was less than in Q2. Total gross loss of Service and Other remained relatively stable. This was in line with our expectations. |

|

• |

Our total GAAP operating expenses decreased to $1.11 billion in Q3, which was 11% less than in Q2. Excluding one-time restructuring and other costs, operating expenses decreased by 5% sequentially as we are seeing the benefit of our ongoing cost reduction efforts. |

|

• |

Interest and Other expenses were $145 million in Q3. |

|

• |

There were approximately 171 million basic shares outstanding at the end of Q3. |

Cash Flow and Liquidity

|

• |

Cash flow from operating activities in Q3 was $1.39 billion. This was mainly due to significantly improved volumes and profitability of Model 3. Change in key working capital items (receivables, payables and inventory) during Q3 impacted operating cash flow only slightly. Although our accounts payable increased as expected, our accounts receivables also increased by a similar magnitude since the quarter ended on a Sunday, which limited our ability to collect cash from the banks financing our customer loans. |

|

• |

Customer deposits decreased slightly compared to Q2 to $906 million as we continue to work through our Model 3 backlog. |

|

• |

Our capital expenditures were $510 million, which was below the Q2 2018 level. |

|

• |

Our cash position increased by $731 million in Q3 despite repaying $82.5 million of bonds. |

Model 3 quarterly production and deliveries should continue to increase in Q4 compared to Q3. Our target of delivering 100,000 Model S and X vehicles this year remains unchanged.

We expect gross margin for Model 3 to remain stable in Q4 as manufacturing efficiencies and fixed cost absorption offset a slightly lower trim mix and the negative impact of tariffs from Chinese sourced components. Gross margin for Model S and X will likely decline slightly in Q4, as we expect that the sequential increase in tariffs in Q4 from Chinese sourced components will be only partially offset by increased manufacturing cost efficiencies. For all three vehicles, additional tariffs in Q4 on parts sourced from China will impact our gross profit negatively by roughly $50 million.

Energy generation and storage revenue should decline slightly in Q4 compared to Q3, mainly due to seasonality of the solar business. As a result of lower solar mix and seasonality, gross margin of this segment should also decline slightly in Q4.

We expect our Services and Other business to continue to grow mainly due to used car sales volumes. Gross margin of this segment should see further sequential improvement. We will increase investment in our service infrastructure in North America through deployment of new service locations and additional mobile service vehicles.

Total operating expenses should grow only slightly in Q4 compared to Q3 levels.

We reaffirm our prior guidance that we expect to again achieve positive GAAP net income in Q4. Similarly, in Q4, we continue to expect to generate positive cash from operating cash flows net of capital expenditures, as well as the normal inflow of cash received from non-recourse financing activities on leased vehicles and solar products. Our cash position should remain at least flat in spite of our plan to repay $230 million of convertible notes in cash during Q4.

Our total 2018 capex, the vast majority of which is to grow our capacity, is expected to be slightly below $2.5 billion, consistent with our prior guidance. Our Q4 capex projection includes the purchase of land in China and initial design and other expenditures for Gigafactory 3. Interest expenses in Q4 should be roughly $170 million and losses attributable to noncontrolling interests should decline significantly compared to Q3.

As we have transformed from a 100,000 per year unit carmaker into a ~340,000 unit per year carmaker, our earnings profile has flipped dramatically. Sufficient Model 3 profitability was critical to make our business sustainable – something many argued would be impossible to achieve. Due to the ingenuity and incredible hard work of our team combined with an innovative vehicle design and manufacturing strategy, we have achieved total auto gross margin of ~25%.

We can’t thank you enough for your support. We would not have achieved this historic quarter without it.

|

|

|

|

Elon Musk |

Deepak Ahuja |

Tesla will provide a live webcast of its third quarter 2018 financial results conference call beginning at 3:30 p.m. PT on October 24, 2018, at ir.tesla.com. This webcast will also be available for replay for approximately one year thereafter.

NON-GAAP FINANCIAL INFORMATION

Consolidated financial information has been presented in accordance with GAAP as well as on a non-GAAP basis to supplement our consolidated financial results. Our non-GAAP financial measures include non-GAAP gross margin, non-GAAP net income (loss) attributable to common stockholders, non-GAAP net income (loss) attributable to common stockholders on a per share basis, and operating cash flows plus change in collateralized lease borrowing. Management believes that it is useful to supplement its GAAP financial statements with this non-GAAP information because management uses such information internally for its operating, budgeting and financial planning purposes. These non-GAAP financial measures also facilitate management’s internal comparisons to Tesla’s historical performance as well as comparisons to the operating results of other companies. Management also believes that presentation of the non-GAAP financial measures provides useful information to our investors regarding our financial condition and results of operations because it allows investors greater transparency to the information used by Tesla management in its financial and operational decision-making so that investors can see through the eyes of Tesla management regarding important financial metrics that Tesla management uses to run the business as well as allows investors to better understand Tesla’s performance. Non-GAAP information is not prepared under a comprehensive set of accounting rules and therefore, should only be read in conjunction with financial information reported under U.S. GAAP when understanding Tesla’s operating performance. A reconciliation between GAAP and non-GAAP financial information is provided below.

FORWARD-LOOKING STATEMENTS

Certain statements in this shareholder letter, including statements in the “Outlook” section; statements relating to the progress Tesla is making with respect to product and software development and ramp, such as Model 3, Autopilot and Solar Roof; statements regarding growth in the number of Tesla stores, service centers, body shops, and in other delivery, service, and repair capabilities; statements relating to the production, production rate and delivery timing of products such as Model 3 and Solar Roof and deployment of energy storage capacity; statements regarding growth of our energy business and means to achieve such growth; statements regarding growth in demand and potential customer base, conversion of reservations to orders, cross-selling opportunities and orders for Tesla products and the catalysts for that growth; statements regarding the ability to achieve product demand, volume, production, delivery, leasing, inventory and deployment; statements regarding revenue, cash generation, cash flow, gross margin, spending, capital expenditure and profitability targets; statements regarding productivity improvements and capacity expansion plans, such as for Model 3 manufacturing processes and localization of parts sourcing and manufacturing in China; and statements regarding Gigafactory 1, Gigafactory 2 and Gigafactory 3, including timing and manufacturing plans, including those related to vehicle, battery and photovoltaic cell and other production, are “forward-looking statements” that are subject to risks and uncertainties. These forward-looking statements are based on management’s current expectations, and as a result of certain risks and uncertainties, actual results may differ materially from those projected. The following important factors, without limitation, could cause actual results to differ materially from those in the forward-looking statements: the risk of delays in the manufacture, production, delivery and/or completion of our vehicles and energy products, particularly Model 3, including internationally; the ability to design and achieve and grow simultaneous and separate market acceptance of Model S, Model X, Model 3 and their variants, as well as new vehicle models; the ability of suppliers to meet quality and part delivery expectations at increasing volumes, especially with respect to Model 3 parts; adverse foreign exchange movements; increases in international tariffs, any failures by Tesla products to perform as expected or if product recalls occur; Tesla’s ability to continue to reduce or control manufacturing and other costs; consumers’ willingness to adopt electric vehicles; competition in the automotive and energy product markets generally and the alternative fuel vehicle market and the premium sedan, premium SUV and small to medium-sized sedan markets in particular; Tesla’s ability to establish, maintain and strengthen the Tesla brand; Tesla’s ability to manage future growth effectively as we rapidly grow, especially internationally; the unavailability, reduction or elimination of government and economic incentives for electric vehicles and energy products; Tesla’s ability to establish, maintain and strengthen its relationships with strategic partners such as Panasonic; potential difficulties in finalizing, performing and realizing potential benefits under definitive agreements for Gigafactory 1 and Gigafactory 2 and future manufacturing facilities, such as Gigafactory 3, maintaining Gigafactory 1 and Gigafactory 2 implementation schedules, output and cost estimates; and Tesla’s ability to execute on its strategy for new store, delivery hub, direct delivery, service center, Supercharger and other locations and capabilities. More information on potential factors that could affect our financial results is included from time to time in our Securities and Exchange Commission filings and reports, including the risks identified under the section captioned “Risk Factors” in our quarterly report on Form 10-Q filed with the SEC on August 6, 2018. Tesla disclaims any obligation to update information contained in these forward-looking statements whether as a result of new information, future events, or otherwise.

|

Investor Relations Contact: Martin Viecha Investor Relations ir@tesla.com |

|

|

|

Press Contact: Dave Arnold Communications press@tesla.com

|

Condensed Consolidated Statements of Operations

(Unaudited)

(In thousands, except per share data)

|

|

Three Months Ended |

|

|

Nine Months Ended |

|

||||||||||||||

|

|

September 30, |

|

|

June 30, |

|

|

September 30, |

|

|

September 30, |

|

|

September 30, |

|

|||||

|

|

2018 |

|

|

2018 |

|

|

2017 |

|

|

2018 |

|

|

2017 |

|

|||||

|

Revenues |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Automotive sales |

$ |

5,878,305 |

|

|

$ |

3,117,865 |

|

|

$ |

2,076,731 |

|

|

$ |

11,558,051 |

|

|

$ |

6,125,643 |

|

|

Automotive leasing |

|

220,461 |

|

|

|

239,816 |

|

|

|

286,158 |

|

|

|

633,713 |

|

|

|

813,462 |

|

|

Total automotive revenue |

|

6,098,766 |

|

|

|

3,357,681 |

|

|

|

2,362,889 |

|

|

|

12,191,764 |

|

|

|

6,939,105 |

|

|

Energy generation and storage |

|

399,317 |

|

|

|

374,408 |

|

|

|

317,505 |

|

|

|

1,183,747 |

|

|

|

818,229 |

|

|

Services and other |

|

326,330 |

|

|

|

270,142 |

|

|

|

304,281 |

|

|

|

859,884 |

|

|

|

713,168 |

|

|

Total revenues |

|

6,824,413 |

|

|

|

4,002,231 |

|

|

|

2,984,675 |

|

|

|

14,235,395 |

|

|

|

8,470,502 |

|

|

Cost of revenues |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Automotive sales |

|

4,405,919 |

|

|

|

2,529,739 |

|

|

|

1,755,622 |

|

|

|

9,027,055 |

|

|

|

4,724,849 |

|

|

Automotive leasing |

|

119,283 |

|

|

|

136,915 |

|

|

|

175,224 |

|

|

|

360,694 |

|

|

|

516,683 |

|

|

Total automotive cost of revenues |

|

4,525,202 |

|

|

|

2,666,654 |

|

|

|

1,930,846 |

|

|

|

9,387,749 |

|

|

|

5,241,532 |

|

|

Energy generation and storage |

|

330,554 |

|

|

|

330,273 |

|

|

|

237,288 |

|

|

|

1,036,190 |

|

|

|

592,823 |

|

|

Services and other |

|

444,992 |

|

|

|

386,374 |

|

|

|

367,401 |

|

|

|

1,212,335 |

|

|

|

852,446 |

|

|

Total cost of revenues |

|

5,300,748 |

|

|

|

3,383,301 |

|

|

|

2,535,535 |

|

|

|

11,636,274 |

|

|

|

6,686,801 |

|

|

Gross profit |

|

1,523,665 |

|

|

|

618,930 |

|

|

|

449,140 |

|

|

|

2,599,121 |

|

|

|

1,783,701 |

|

|

Operating expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and development |

|

350,848 |

|

|

|

386,129 |

|

|

|

331,622 |

|

|

|

1,104,073 |

|

|

|

1,023,436 |

|

|

Selling, general and administrative |

|

729,876 |

|

|

|

750,759 |

|

|

|

652,998 |

|

|

|

2,167,039 |

|

|

|

1,794,210 |

|

|

Restructuring and other |

|

26,184 |

|

|

|

103,434 |

|

|

|

— |

|

|

|

129,618 |

|

|

|

— |

|

|

Total operating expenses |

|

1,106,908 |

|

|

|

1,240,322 |

|

|

|

984,620 |

|

|

|

3,400,730 |

|

|

|

2,817,646 |

|

|

Income (loss) from operations |

|

416,757 |

|

|

|

(621,392 |

) |

|

|

(535,480 |

) |

|

|

(801,609 |

) |

|

|

(1,033,945 |

) |

|

Interest income |

|

6,907 |

|

|

|

5,064 |

|

|

|

5,531 |

|

|

|

17,185 |

|

|

|

13,406 |

|

|

Interest expense |

|

(175,220 |

) |

|

|

(163,582 |

) |

|

|

(117,109 |

) |

|

|

(488,348 |

) |

|

|

(324,896 |

) |

|

Other (expense) income, net |

|

22,876 |

|

|

|

50,911 |

|

|

|

(24,390 |

) |

|

|

36,071 |

|

|

|

(83,696 |

) |

|

Income (loss) before income taxes |

|

271,320 |

|

|

|

(728,999 |

) |

|

|

(671,448 |

) |

|

|

(1,236,701 |

) |

|

|

(1,429,131 |

) |

|

Provision (benefit) for income taxes |

|

16,647 |

|

|

|

13,707 |

|

|

|

(285 |

) |

|

|

35,959 |

|

|

|

40,640 |

|

|

Net income (loss) |

|

254,673 |

|

|

|

(742,706 |

) |

|

|

(671,163 |

) |

|

|

(1,272,660 |

) |

|

|

(1,469,771 |

) |

|

Net loss attributable to noncontrolling interests and redeemable noncontrolling interests |

|

(56,843 |

) |

|

|

(25,167 |

) |

|

|

(51,787 |

) |

|

|

(157,086 |

) |

|

|

(183,721 |

) |

|

Net income (loss) attributable to common stockholders |

$ |

311,516 |

|

|

$ |

(717,539 |

) |

|

$ |

(619,376 |

) |

|

$ |

(1,115,574 |

) |

|

$ |

(1,286,050 |

) |

|

Net income (loss) per share of common stock attributable to common stockholders – basic and diluted |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

$ |

1.82 |

|

|

$ |

(4.22 |

) |

|

$ |

(3.70 |

) |

|

$ |

(6.56 |

) |

|

$ |

(7.80 |

) |

|

Diluted |

$ |

1.75 |

|

|

$ |

(4.22 |

) |

|

$ |

(3.70 |

) |

|

$ |

(6.56 |

) |

|

$ |

(7.80 |

) |

|

Weighted average shares used in computing net income (loss) per share of common stock – basic and diluted |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

170,893 |

|

|

|

169,997 |

|

|

|

167,294 |

|

|

|

170,019 |

|

|

|

164,897 |

|

|

Diluted |

|

178,196 |

|

|

|

169,997 |

|

|

|

167,294 |

|

|

|

170,019 |

|

|

|

164,897 |

|

Condensed Consolidated Balance Sheets

(Unaudited)

(In thousands)

|

|

September 30, |

|

|

December 31, |

|

||

|

|

2018 |

|

|

2017 |

|

||

|

Assets |

|

|

|

|

|

|

|

|

Current assets |

|

|

|

|

|

|

|

|

Cash and cash equivalents |

$ |

2,967,504 |

|

|

$ |

3,367,914 |

|

|

Restricted cash |

|

158,627 |

|

|

|

155,323 |

|

|

Accounts receivable, net |

|

1,155,001 |

|

|

|

515,381 |

|

|

Inventory |

|

3,314,127 |

|

|

|

2,263,537 |

|

|

Prepaid expenses and other current assets |

|

325,232 |

|

|

|

268,365 |

|

|

Total current assets |

|

7,920,491 |

|

|

|

6,570,520 |

|

|

Operating lease vehicles, net |

|

2,186,137 |

|

|

|

4,116,604 |

|

|

Solar energy systems, leased and to be leased, net |

|

6,301,537 |

|

|

|

6,347,490 |

|

|

Property, plant and equipment, net |

|

11,246,295 |

|

|

|

10,027,522 |

|

|

Goodwill and intangible assets, net |

|

356,702 |

|

|

|

421,739 |

|

|

MyPower customer notes receivable, net of current portion |

|

422,897 |

|

|

|

456,652 |

|

|

Restricted cash, net of current portion |

|

396,835 |

|

|

|

441,722 |

|

|

Other assets |

|

431,819 |

|

|

|

273,123 |

|

|

Total assets |

$ |

29,262,713 |

|

|

$ |

28,655,372 |

|

|

Liabilities and Equity |

|

|

|

|

|

|

|

|

Current liabilities |

|

|

|

|

|

|

|

|

Accounts payable |

$ |

3,596,984 |

|

|

$ |

2,390,250 |

|

|

Accrued liabilities and other |

|

1,990,095 |

|

|

|

1,731,366 |

|

|

Deferred revenue |

|

570,920 |

|

|

|

1,015,253 |

|

|

Resale value guarantees |

|

604,949 |

|

|

|

787,333 |

|

|

Customer deposits |

|

905,838 |

|

|

|

853,919 |

|

|

Current portion of long-term debt and capital leases (1) |

|

2,106,538 |

|

|

|

896,549 |

|

|

Total current liabilities |

|

9,775,324 |

|

|

|

7,674,670 |

|

|

Long-term debt and capital leases, net of current portion (1) |

|

9,672,613 |

|

|

|

9,418,319 |

|

|

Deferred revenue, net of current portion |

|

950,126 |

|

|

|

1,177,799 |

|

|

Resale value guarantees, net of current portion |

|

455,762 |

|

|

|

2,309,222 |

|

|

Other long-term liabilities |

|

2,555,319 |

|

|

|

2,442,970 |

|

|

Total liabilities |

|

23,409,144 |

|

|

|

23,022,980 |

|

|

Redeemable noncontrolling interests in subsidiaries |

|

551,264 |

|

|

|

397,734 |

|

|

Convertible senior notes (1) |

|

— |

|

|

|

70 |

|

|

Total stockholders' equity |

|

4,508,838 |

|

|

|

4,237,242 |

|

|

Noncontrolling interests in subsidiaries |

|

793,467 |

|

|

|

997,346 |

|

|

Total liabilities and equity |

$ |

29,262,713 |

|

|

$ |

28,655,372 |

|

|

|

|

- |

|

|

|

- |

|

|

(1) Breakdown of our debt is as follows: |

|

|

|

|

|

|

|

|

Recourse debt |

$ |

7,250,617 |

|

|

$ |

6,755,376 |

|

|

Non-recourse debt |

$ |

3,248,021 |

|

|

$ |

2,873,458 |

|

Condensed Consolidated Statement of Cash Flows

(Unaudited)

(In thousands)

Supplemental Consolidated Financial Information

|

|

|

Three Months Ended |

|

|

Nine Months Ended |

|

||||||||||||||

|

|

|

September 30, |

|

|

June 30, |

|

|

September 30, |

|

|

September 30, |

|

|

September 30, |

|

|||||

|

|

|

2018 |

|

|

2018 |

|

|

2017 |

|

|

2018 |

|

|

2017 |

|

|||||

|

Cash Flows from Operating Activities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) |

|

$ |

254,673 |

|

|

$ |

(742,706 |

) |

|

$ |

(671,163 |

) |

|

$ |

(1,272,660 |

) |

|

$ |

(1,469,771 |

) |

|

Adjustments to reconcile net income (loss) to net cash provided by (used in) operating activities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation, amortization and impairment |

|

|

502,825 |

|

|

|

485,255 |

|

|

|

400,624 |

|

|

|

1,404,313 |

|

|

|

1,166,397 |

|

|

Stock-based compensation |

|

|

204,728 |

|

|

|

197,344 |

|

|

|

112,653 |

|

|

|

543,711 |

|

|

|

332,412 |

|

|

Losses related to the SolarCity acquisition |

|

|

— |

|

|

|

— |

|

|

|

18,225 |

|

|

|

— |

|

|

|

29,796 |

|

|

Other |

|

|

77,737 |

|

|

|

97,432 |

|

|

|

88,867 |

|

|

|

328,974 |

|

|

|

364,262 |

|

|

Changes in operating assets and liabilities, net of effect of business combinations |

|

|

351,318 |

|

|

|

(166,989 |

) |

|

|

(249,768 |

) |

|

|

(141,097 |

) |

|

|

(993,641 |

) |

|

Net cash provided by (used in) operating activities |

|

|

1,391,281 |

|

|

|

(129,664 |

) |

|

|

(300,562 |

) |

|

|

863,241 |

|

|

|

(570,545 |

) |

|

Cash Flows from Investing Activities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Capital expenditures |

|

|

(510,271 |

) |

|

|

(609,813 |

) |

|

|

(1,116,434 |

) |

|

|

(1,775,746 |

) |

|

|

(2,628,126 |

) |

|

Payments for the cost of solar energy systems, leased and to be leased |

|

|

(49,494 |

) |

|

|

(67,400 |

) |

|

|

(128,293 |

) |

|

|

(189,869 |

) |

|

|

(547,085 |

) |

|

Business combinations, net of cash acquired |

|

|

(1,200 |

) |

|

|

(5,604 |

) |

|

|

— |

|

|

|

(6,804 |

) |

|

|

(109,147 |

) |

|

Net cash used in investing activities |

|

|

(560,965 |

) |

|

|

(682,817 |

) |

|

|

(1,244,727 |

) |

|

|

(1,972,419 |

) |

|

|

(3,284,358 |

) |

|

Cash Flows from Financing Activities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net cash flows from debt activities |

|

|

(195,760 |

) |

|

|

244,196 |

|

|

|

1,820,399 |

|

|

|

221,301 |

|

|

|

2,386,840 |

|

|

Collateralized lease (repayments) borrowings |

|

|

(142,568 |

) |

|

|

(113,426 |

) |

|

|

80,752 |

|

|

|

(343,086 |

) |

|

|

416,427 |

|

|

Net borrowings under Warehouse Agreements and automotive asset-backed notes |

|

|

114,942 |

|

|

|

114,069 |

|

|

|

78,297 |

|

|

|

403,039 |

|

|

|

166,991 |

|

|

Net cash flows from noncontrolling interests - Auto |

|

|

17,224 |

|

|

|

32,355 |

|

|

|

— |

|

|

|

74,178 |

|

|

|

11,654 |

|

|

Net cash flows from noncontrolling interests - Solar |

|

|

27,070 |

|

|

|

90,375 |

|

|

|

41,643 |

|

|

|

110,687 |

|

|

|

489,549 |

|

|

Proceeds from issuances of common stock in public offerings |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

400,175 |

|

|

Other |

|

|

94,874 |

|

|

|

31,053 |

|

|

|

80,415 |

|

|

|

219,945 |

|

|

|

257,386 |

|

|

Net cash (used in) provided by financing activities |

|

|

(84,218 |

) |

|

|

398,622 |

|

|

|

2,101,506 |

|

|

|

686,064 |

|

|

|

4,129,022 |

|

|

Effect of exchange rate changes on cash and cash equivalents and restricted cash |

|

|

(6,370 |

) |

|

|

(22,611 |

) |

|

|

7,800 |

|

|

|

(18,879 |

) |

|

|

35,736 |

|

|

Net increase (decrease) in cash and cash equivalents and restricted cash |

|

|

739,728 |

|

|

|

(436,470 |

) |

|

|

564,017 |

|

|

|

(441,993 |

) |

|

|

309,855 |

|

|

Cash and cash equivalents and restricted cash at beginning of period |

|

|

2,783,238 |

|

|

|

3,219,708 |

|

|

|

3,512,738 |

|

|

|

3,964,959 |

|

|

|

3,766,900 |

|

|

Cash and cash equivalents and restricted cash at end of period |

|

$ |

3,522,966 |

|

|

$ |

2,783,238 |

|

|

$ |

4,076,755 |

|

|

$ |

3,522,966 |

|

|

$ |

4,076,755 |

|

Reconciliation of GAAP to Non-GAAP Financial Information

(Unaudited)

(In thousands, except per share data)

|

|

|

Three Months Ended |

|

|

Nine Months Ended |

|

||||||||||||||

|

|

|

September 30, |

|

|

June 30, |

|

|

September 30, |

|

|

September 30, |

|

|

September 30, |

|

|||||

|

|

|

2018 |

|

|

2018 |

|

|

2017 |

|

|

2018 |

|

|

2017 |

|

|||||

|

Automotive gross profit – GAAP |

|

$ |

1,573,564 |

|

|

$ |

691,027 |

|

|

$ |

432,043 |

|

|

$ |

2,804,015 |

|

|

$ |

1,697,573 |

|

|

Stock-based compensation expense in automotive cost of revenue |

|

|

20,955 |

|

|

|

13,198 |

|

|

|

10,166 |

|

|

|

49,231 |

|

|

|

27,663 |

|

|

ZEV credit revenue recognized |

|

|

(52,269 |

) |

|

|

— |

|

|

|

(575 |

) |

|

|

(102,583 |

) |

|

|

(100,575 |

) |

|

Automotive gross profit excluding SBC and ZEV credit – non-GAAP |

|

$ |

1,542,250 |

|

|

$ |

704,225 |

|

|

$ |

441,634 |

|

|

$ |

2,750,663 |

|

|

$ |

1,624,661 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Automotive gross margin – GAAP |

|

|

25.8 |

% |

|

|

20.6 |

% |

|

|

18.3 |

% |

|

|

23.0 |

% |

|

|

24.5 |

% |

|

Stock-based compensation expense |

|

|

0.3 |

% |

|

|

0.4 |

% |

|

|

0.4 |

% |

|

|

0.4 |

% |

|

|

0.4 |

% |

|

ZEV credit revenue recognized |

|

|

-0.6 |

% |

|

|

0.0 |

% |

|

|

0.0 |

% |

|

|

-0.6 |

% |

|

|

-1.1 |

% |

|

Automotive gross margin excluding SBC and ZEV credit – non-GAAP |

|

|

25.5 |

% |

|

|

21.0 |

% |

|

|

18.7 |

% |

|

|

22.8 |

% |

|

|

23.8 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) attributable to common stockholders – GAAP |

|

$ |

311,516 |

|

|

$ |

(717,539 |

) |

|

$ |

(619,376 |

) |

|

$ |

(1,115,574 |

) |

|

$ |

(1,286,050 |

) |

|

Stock-based compensation expense |

|

|

204,728 |

|

|

|

197,344 |

|

|

|

112,653 |

|

|

|

543,711 |

|

|

|

332,412 |

|

|

Losses related to the SolarCity acquisition |

|

|

— |

|

|

|

— |

|

|

|

18,225 |

|

|

|

— |

|

|

|

29,796 |

|

|

Net income (loss) attributable to common stockholders – non-GAAP |

|

$ |

516,244 |

|

|

$ |

(520,195 |

) |

|

$ |

(488,498 |

) |

|

$ |

(571,863 |

) |

|

$ |

(923,842 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) per share attributable to common stockholders, basic – GAAP |

|

$ |

1.82 |

|

|

$ |

(4.22 |

) |

|

$ |

(3.70 |

) |

|

$ |

(6.56 |

) |

|

$ |

(7.80 |

) |

|

Stock-based compensation expense |

|

|

1.20 |

|

|

|

1.16 |

|

|

|

0.67 |

|

|

|

3.20 |

|

|

|

2.02 |

|

|

Losses related to the SolarCity acquisition |

|

|

— |

|

|

|

— |

|

|

|

0.11 |

|

|

|

— |

|

|

|

0.18 |

|

|

Net income (loss) per share attributable to common stockholders, basic – non-GAAP |

|

$ |

3.02 |

|

|

$ |

(3.06 |

) |

|

$ |

(2.92 |

) |

|

$ |

(3.36 |

) |

|

$ |

(5.60 |

) |

|

Shares used in per share calculation, basic – GAAP and non-GAAP |

|

|

170,893 |

|

|

|

169,997 |

|

|

|

167,294 |

|

|

|

170,019 |

|

|

|

164,897 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) per share attributable to common stockholders, diluted - GAAP |

|

$ |

1.75 |

|

|

$ |

(4.22 |

) |

|

$ |

(3.70 |

) |

|

$ |

(6.56 |

) |

|

$ |

(7.80 |

) |

|

Stock-based compensation expense |

|

|

1.15 |

|

|

|

1.16 |

|

|

|

0.67 |

|

|

|

3.20 |

|

|

|

2.02 |

|

|

Losses related to the SolarCity acquisition |

|

|

— |

|

|

|

— |

|

|

|

0.11 |

|

|

|

— |

|

|

|

0.18 |

|

|

Net income (loss) per share attributable to common stockholders, diluted - non-GAAP |

|

$ |

2.90 |

|

|

$ |

(3.06 |

) |

|

$ |

(2.92 |

) |

|

$ |

(3.36 |

) |

|

$ |

(5.60 |

) |

|

Shares used in per share calculation, diluted - GAAP and non-GAAP |

|

|

178,196 |

|

|

|

169,997 |

|

|

|

167,294 |

|

|

|

170,019 |

|

|

|

164,897 |

|