Attached files

| file | filename |

|---|---|

| 8-K - 8-K Q3 2018 EARNINGS RELEASE - Green Bancorp, Inc. | a8-kwrapperq32018.htm |

| EX-99.1 - EXHIBIT 99.1 - Green Bancorp, Inc. | ex991earningsreleaseq32018.htm |

Third Quarter 2018 Financial Results Presentation NASDAQ: GNBC October 23, 2018

Safe Harbor Important Additional Information will be Filed with the SEC This presentation does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval with respect to the proposed transaction between Veritex and Green. No offer of securities shall be made except by means of a prospectus meeting the requirements of the Securities Act of 1933, as amended, and no offer to sell or solicitation of an offer to buy shall be made in any jurisdiction in which such offer, solicitation or sale would be unlawful. In connection with the proposed transaction, on October 10, 2018, Veritex filed with the U.S. Securities and Exchange Commission (the “SEC”) a definitive Registration Statement on Form S-4 (File No. 333-227161) containing a joint proxy statement of Veritex and Green and a prospectus of Veritex (the “Joint Proxy/Prospectus”), and each of Veritex and Green may file with the SEC other documents regarding the proposed transaction, including amendments to the Joint Proxy/Prospectus. Veritex and Green began mailing the definitive Joint Proxy/Prospectus to their respective shareholders on October 15, 2018. SHAREHOLDERS ARE URGED TO READ THE REGISTRATION STATEMENT AND THE JOINT PROXY/PROSPECTUS REGARDING THE PROPOSED TRANSACTION CAREFULLY AND IN THEIR ENTIRETY AND ANY OTHER DOCUMENTS FILED WITH THE SEC BY VERITEX AND/OR GREEN, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, BECAUSE THEY CONTAIN (OR WILL CONTAIN) IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. Investors may obtain free copies of the Registration Statement and the Joint Proxy/Prospectus and other documents filed with the SEC by Veritex and/or Green (when available) through the website maintained by the SEC at www.sec.gov. Free copies of the Registration Statement and the Joint Proxy/Prospectus and other documents filed with the SEC by Veritex and/or Green (when available) can also be obtained by directing a request to Veritex Holdings, Inc., 8214 Westchester Drive, Suite 400, Dallas, Texas 75225, or by directing a request to Green Bancorp, Inc., 4000 Greenbriar Street, Houston, Texas 77098. Participants in the Solicitation Veritex, Green and their respective directors and certain of their respective executive officers and employees may be deemed to be participants in the solicitation of proxies from the shareholders of Green or Veritex in respect of the proposed transaction. Information regarding (i) Veritex’s directors and executive officers is available in (x) its proxy statement for its 2018 annual meeting of shareholders, which was filed with the SEC on April 3, 2018, and (y) the Joint Proxy/Prospectus in the Form S-4, which was filed with the SEC by Veritex on October 10, 2018, and (ii) Green’s directors and executive officers is available in (x) its proxy statement for its 2018 annual meeting of shareholders, which was filed with the SEC on April 13, 2018, and (ii) the Joint Proxy/Prospectus in the Form S-4, which was filed with the SEC by Veritex on October 10, 2018. Free copies of these documents may be obtained as described in the preceding paragraph. 2

Safe Harbor Forward-looking Statements This presentation includes “forward-looking statements,” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements are based on various facts and derived utilizing important assumptions, current expectations, estimates and projections and are subject to known and unknown risks, uncertainties and other factors that may cause actual results, performance, outcomes or achievements to be materially different from any future results, performance, outcomes or achievements expressed or implied by such forward-looking statements. Forward-looking statements include, without limitation, statements relating to the impact Green or Veritex expect the proposed transaction to have on the combined entity’s operations, financial condition, and financial results, and Green’s or Veritex’s expectations about the ability to successfully integrate the combined businesses and the amount of cost savings and overall operational efficiencies expected to be realized as a result of the proposed transaction. The forward-looking statements may also include statements about Green’s, Veritex’s or the combined company’s future financial performance, business and growth strategy, projected plans and objectives, as well as other projections based on macroeconomic and industry trends, which are inherently unreliable due to the multiple factors that impact economic trends, and any such variations may be material. Statements preceded by, followed by or that otherwise include the words “believes,” “expects,” “anticipates,” “intends,” “projects,” “estimates,” “plans” and similar expressions or future or conditional verbs such as “will,” “should,” “would,” “may” and “could” are generally forward-looking in nature and not historical facts, although not all forward-looking statements include the foregoing. Further, certain factors that could affect future results and cause actual results to differ materially from those expressed in the forward-looking statements include, but are not limited to, the possibility that the proposed transaction does not close when expected or at all because required regulatory, shareholder or other approvals or other conditions to closing are not received or satisfied on a timely basis or at all, the failure to close for any other reason, changes in Veritex’s share price before closing, that the businesses of Veritex and Green will not be integrated successfully, that the cost savings and any synergies from the proposed transaction may not be fully realized or may take longer to realize than expected, disruption from the proposed transaction making it more difficult to maintain relationships with employees, customers or other parties with whom Veritex and/or Green have business relationships, diversion of management time on transaction-related issues, risks relating to the potential dilutive effect of shares of Veritex common stock to be issued in the proposed transaction, the reaction to the transaction of the companies’ customers, employees and counterparties and other factors, many of which are beyond the control of Veritex and Green. We refer you to the “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections of Veritex’s Annual Report on Form 10-K for the year ended December 31, 2017, the Annual Report on Form 10-K filed by Green for the year ended December 31, 2017, the Joint Proxy/Prospectus in the Form S-4 filed by Veritex on October 10, 2018 and any updates to those risk factors set forth in Veritex’s and Green’s Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and other filings, which have been filed with the SEC and are available on the SEC’s website at www.sec.gov. If one or more events related to these or other risks or uncertainties materialize, or if Green’s or Veritex’s underlying assumptions prove to be incorrect, actual results may differ materially from what Veritex or Green anticipates. Accordingly, you should not place undue reliance on any such forward-looking statements. Any forward-looking statement speaks only as of the date on which it is made. Neither Veritex nor Green undertakes any obligation, and specifically declines any obligation, to update or revise any forward-looking statements, whether as a result of new information, future developments or otherwise. All forward-looking statements, expressed or implied, included in this presentation are expressly qualified in their entirety by the cautionary statements contained or referred to herein. In addition to factors previously disclosed in Green Bancorp’s reports filed with the SEC and those identified elsewhere in this communication, the following factors among others, could cause actual results to differ materially from forward-looking statements: changes in asset quality and credit risk; the inability to sustain revenue and earnings growth; changes in interest rates and capital markets; inflation; customer borrowing, repayment, investment and deposit practices; customer disintermediation; the introduction, withdrawal, success and timing of business initiatives; competitive conditions; the inability to realize cost savings or revenues or to implement integration plans and other consequences associated with mergers, acquisitions and divestitures; economic conditions; and the impact, extent and timing of technological changes, capital management activities, and other actions of the Federal Reserve Board and legislative and regulatory actions and reforms. Unlisted factors may present significant additional obstacles to the realization of forward-looking statements. Annualized, pro forma, projected and estimated numbers are used for illustrative purpose only, are not forecasts and may not reflect actual results. 3

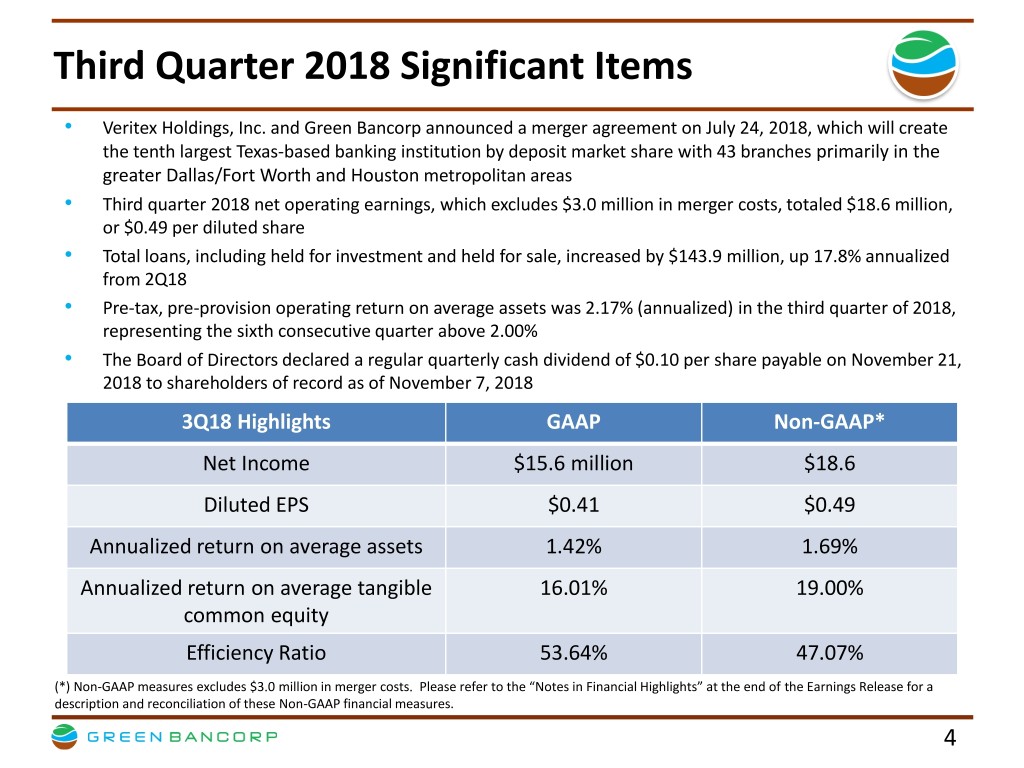

Third Quarter 2018 Significant Items • Veritex Holdings, Inc. and Green Bancorp announced a merger agreement on July 24, 2018, which will create the tenth largest Texas-based banking institution by deposit market share with 43 branches primarily in the greater Dallas/Fort Worth and Houston metropolitan areas • Third quarter 2018 net operating earnings, which excludes $3.0 million in merger costs, totaled $18.6 million, or $0.49 per diluted share • Total loans, including held for investment and held for sale, increased by $143.9 million, up 17.8% annualized from 2Q18 • Pre-tax, pre-provision operating return on average assets was 2.17% (annualized) in the third quarter of 2018, representing the sixth consecutive quarter above 2.00% • The Board of Directors declared a regular quarterly cash dividend of $0.10 per share payable on November 21, 2018 to shareholders of record as of November 7, 2018 3Q18 Highlights GAAP Non-GAAP* Net Income $15.6 million $18.6 Diluted EPS $0.41 $0.49 Annualized return on average assets 1.42% 1.69% Annualized return on average tangible 16.01% 19.00% common equity Efficiency Ratio 53.64% 47.07% (*) Non-GAAP measures excludes $3.0 million in merger costs. Please refer to the “Notes in Financial Highlights” at the end of the Earnings Release for a description and reconciliation of these Non-GAAP financial measures. 4

Fully Diluted EPS and TBVPS Earnings Per Share $0.60 $0.49 $0.50 $0.44 $0.44 $0.41 $0.40 $0.31 $0.33 $0.30 $0.25 $0.26 $0.20 $0.14 $0.10 $0.07 $0.00 3Q17 4Q17 1Q18 2Q18 3Q18 Reported Operating Tangible Book Value Per Share $11.00 $10.75 $10.63 $10.50 $10.36 $10.25 $10.10 $9.97 $10.00 $9.93 $9.75 $9.50 $9.25 $9.00 3Q17 4Q17 1Q18 2Q18 3Q18 5

Performance Metrics ROAA Net Interest Margin 2.5% 4.00% 3.87% 3.94% 2.15% 2.04% 2.01% 2.10% 2.17% 2.0% 1.69% 3.78% 1.56% 3.75% 1.5% 1.20% 1.54% 3.65% 3.64% 0.93% 1.0% 1.42% 1.10% 0.50% 3.50% 0.5% 0.90% 0.25% 0.0% 3.25% 3Q17 4Q17 1Q18 2Q18 3Q18 3Q17 4Q17 1Q18 2Q18 3Q18 Reported Operating PTPP Operating * Reported Efficiency Ratio ROATCE 19.00% 65% 20% 17.88% 57.87% 60% 13.89% 17.65% 53.64% 15% 55% 50.81% 10.81% 16.01% 50.59% 50.05% 50% 10% 12.74% 5.90% 10.47% 45% 49.90% 49.45% 46.49% 47.69% 47.07% 5% 40% 3.02% 35% 0% 3Q17 4Q17 1Q18 2Q18 3Q18 3Q17 4Q17 1Q18 2Q18 3Q18 Reported Operating Reported Operating (*) Pre-tax, pre-provision operating return on average assets is a non-GAAP measure used by management to evaluate the Company’s financial performance 6

Loan Portfolio Overview Highlights Loan Portfolio Composition • Q318 loan growth of $144 mm or 17.8% annualized; with 50% of the growth was in C&I and 45% in CRE • Annualized 2018 YTD loan production up 45% over 2017 • Commercial-focused loan portfolio with 99% of the loan portfolio focused on non-energy loans • In-footprint focus with portfolio primarily distributed across Houston 52% and Dallas 23% • Diversified loan portfolio with no concentration to any single industry in excess of 10% of total loans Loan Portfolio Production Commitments Regulatory CRE/Total Risk Based Capital $1,500 400% 400,000 367,178 $1,289 348,057 $1,252 $1,224 $1,209 $1,222 $1,250 375% 285,404 300,000 254,109 $1,000 350% 195,483 200,000 $750 325% $500 288% 300% 100,000 276% $494 $465 $477 $250 $435 256% 261% 275% - $444 260% 3Q17 4Q17 1Q18 2Q18 3Q18 $0 250% 3Q17 4Q17 1Q18 2Q18 3Q18 Loan Commitments Total RBC CRE Ratio $ in millions, loan balance and corresponding percentages exclude HFS loans, (*) Central TX denotes Austin, San Antonio and San Marcos 7

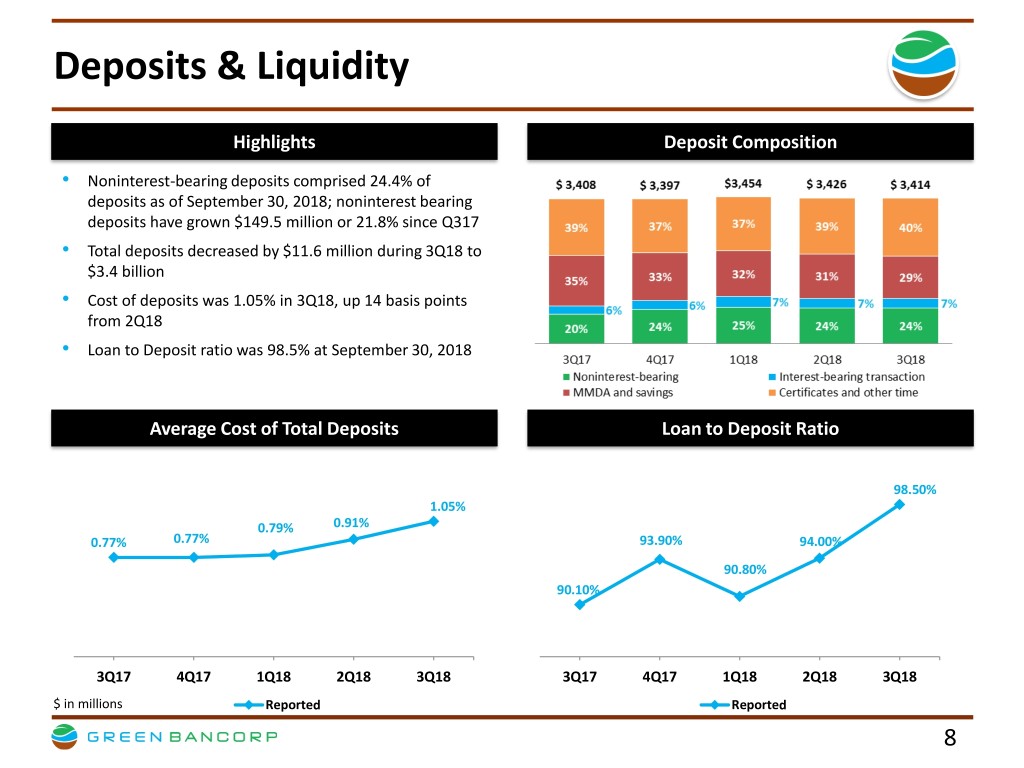

Deposits & Liquidity Highlights Deposit Composition • Noninterest-bearing deposits comprised 24.4% of deposits as of September 30, 2018; noninterest bearing deposits have grown $149.5 million or 21.8% since Q317 • Total deposits decreased by $11.6 million during 3Q18 to $3.4 billion • Cost of deposits was 1.05% in 3Q18, up 14 basis points from 2Q18 • Loan to Deposit ratio was 98.5% at September 30, 2018 Average Cost of Total Deposits Loan to Deposit Ratio 98.50% 1.05% 0.79% 0.91% 0.77% 0.77% 93.90% 94.00% 90.80% 90.10% 3Q17 4Q17 1Q18 2Q18 3Q18 3Q17 4Q17 1Q18 2Q18 3Q18 $ in millions Reported Reported 8

Net Interest Income & Net Interest Margin $45 6.00% Highlights $39.8 $39.5 • NIM declined to 3.78% in Q318 with the $40 $38.2 5.50% primary drivers as follows: 5.65% 5.62% $36.8 $36.3 5.42% • Accretion on purchased credit 5.32% $35 impaired loans declined by $1.1; 5.12% 5.11% 5.13% 5.00% note there is $1.3 mm remaining in 4.94% rate and credit marks on the $30 4.74% 4.69% acquired portfolios 4.50% • Securities yields decline due to a $25 single agency CMBS security in the Net Interest Margin Interest Net portfolio that was bought at a Net Interest Income Interest Net 4.00% premium and paid off at par before $20 3.94% 3.87% maturity 3.78% 3.65% 3.64% 3.50% • Q318 loan portfolio yield excluding fees $15 increased 20 bps to 5.32% and new funded production during the quarter had a $10 3.00% contractual interest rate of 5.50% 3Q17 4Q17 1Q18 2Q18 3Q18 • Cost of deposits including noninterest- NII (L) NIM (R) Loan Yield (R) Loan Yield excl. Fees (R) bearing was 1.05%, up 14 basis points $ in millions from the prior quarter 9

Noninterest Income Customer Service Fees Loan Fees Gain on sale of guaranteed portion of loans, net Other $6 $5.4 $5.5 $5.2 $5.0 $5.0 $5 13.5% 17.4% 8.0% 9.5% 19.2% 20.5% 12.9% $4 26.0% 32.8% 18.2% 17.2% $3 18.4% 17.4% 16.2% 14.0% $2 52.5% 47.1% 46.4% 47.6% $1 45.2% $0 3Q17 * 4Q17 * 1Q18 2Q18 * 3Q18 (*) Excluding net loss on held-for-sale loans of $1.3 million and net loss on the sale of available-for-sale securities of $0.3 million in 3Q17, net loss on held- for-sale loans of $1.1 million in 4Q17 and net gain of $0.1 mm in 2Q18 $ in millions 10

Asset Quality • Nonperforming assets (NPAs) totaled $72.5 million or 1.64% of period end total assets at September 30, 2018, compared to $59.6 million or 1.36% of period end total assets at June 30, 2018, primarily due to two real estate secured loans that were previously classified substandard that moved into non-accrual status. Currently there is no loss expected on either loan. Additionally, note that classified loans were essentially flat from June 30, 2018 to September 30, 2018 • Allowance for loan losses was 1.05% of total loans held for investment at September 30, 2018, and the allowance for loan losses plus acquired loan net discount to total loans held for investment adjusted for acquired loan net discount was 1.08% • Provision expense for the third quarter of 2018 was $320,000, primarily related to general reserves associated with third quarter loan growth, offset by a decrease in specific reserves Asset Quality Allowance for Loan Losses Ratio * 1.22% 1.09% 1.09% 0.98% 1.05% 3Q17 4Q17 1Q18 2Q18 3Q18 Reported (*) Based on percentage of total gross loans held for investment 11

Capital Position Holding Company Bank Capital Adequacy Level * 14.0% 13.1% 12.9% 12.0% 12.0% 12.0% 11.2% 10.9% 10.7% 10.1% 10.0% 8.0% 8.0% 6.0% 6.0% 4.0% 4.5% 4.0% 2.0% 0.0% CET1 Tier 1 RBC Total RBC T1 Leverage Capital $417.1 $458.1 $430.8 $458.1 $500.6 $494.1 $430.8 $458.1 (*) denotes fully phased-in capital adequacy to take effect on January 1, 2019, the Basel III Capital Rules will require GNBC to maintain an additional capital conservation buffer of 2.5% CET1, effectively resulting in minimum ratios of 7.0% CET1, 8.5% Tier 1, 10.5% Total RBC and 4.0% minimum leverage ratio $ in millions 12