Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Chicken Soup for the Soul Entertainment, Inc. | tv505226_8k.htm |

Exhibit 99.1

INVESTOR PRESENTATION | OCTOBER 2018

FORWARD - LOOKING STATEMENTS This presentation (the “Presentation”) relates to Chicken Soup for the Soul Entertainment, Inc. (“CSS Entertainment” or the “ Com pany”), which completed its initial public offering in August 2017 pursuant to a qualified offering statement (“Offering Statement”) filed under Regulation A as promulg ate d under the Securities Act of 1933, as amended (the “Act”). The Company completed its acquisition of Screen Media Ventures, LLC in November 2017 as further described in the Co mpany’s current report on Form 8 - K, initially filed on November 6, 2017 and amended on January 16, 2018 and January 17, 2018 (the “Screen Media 8 - K”). The Company completed its acquisition of Pivotshare , Inc. in August 2018 as further described in the Company’s current report on Form 8 - K, filed on August 28, 2018 (the “ Pivotshare 8 - K”). Financial information for the year ended December 31, 2017 and the six months ended June 30, 2018 is derived from our Annual Report on Form 10 - K and Quarterly Report on Form 10 - Q, respectively, as filed with the Securities and Exchange Commission. Please see these reports, our Offering Statement, our Current Reports on Form 8 - K (incl uding the Screen Media 8 - K, as amended) and our other filings at www.sec.gov . The purpose of this Presentation is to assist persons in their review of the business and plans of the Company . In addition to the information presented herein, you are advised to read the Offering Circular, which contains additional information, including information regarding the risks faced by the Company in its operations and the risks involved in an investment in the Company . The entire contents of this Presentation is qualified by the Offering Circular . This Presentation includes “forward - looking statements” and projections . CSS Entertainment’s actual results may differ from its expectations, estimates and projections and consequently, you should not rely on these forward looking statements or projections as predictions of future events . Words such as “expect,” “estimate,” “project,” “budget,” “forecast,” “anticipate,” “intend,” “plan,” “may,” “will,” “could,” “should,” “believes,” “predicts,” “potential,” “continue,” and similar expressions are intended to identify such forward - looking statements . These forward - looking statements and projections include, without limitation, estimates and projections of future performance, which are based on numerous assumptions about sales, margins, competitive factors, industry performance and other factors which cannot be predicted . Therefore, the actual results of operations are likely to vary from the projections and the variations may be material and adverse . The projections should not be regarded as a representation or prediction that CSS Entertainment will achieve or is likely to achieve any particular results . CSS Entertainment cautions readers not to place undue reliance upon any forward - looking statements and projections, which speak only as of the date made . CSS Entertainment does not undertake or accept any obligation or undertaking to release publicly any updates or revisions to any forward - looking statements to reflect any change in its expectations or any change in events, conditions or circumstances on which any such statement is based . The Company uses a non - GAAP financial measure to evaluate its results of operations and as a supplemental indicator of our operating performance . The non - GAAP financial measure that the Company uses is Adjusted EBITDA . Adjusted EBITDA is considered a non - GAAP financial measure as defined by Regulation G promulgated by the Act, as amended . Due to the significance of non - cash and non - recurring expenses recognized in the years ended December 31 , 2017 and 2016 , and six months ended June 30 , 2018 and the likelihood of material non - cash and non - recurring expenses to occur in future periods, the Company believes that this non - GAAP financial measure will enhance the understanding of its historical and current financial results . Further, the Company believes that Adjusted EBITDA enables its board of directors and management to analyze and evaluate financial and strategic planning decisions that will directly effect operating decisions and investments . The presentation of Adjusted EBITDA should not be construed as an inference that the Company’s future results will be unaffected by unusual or non - recurring items or by non - cash items . This non - GAAP financial measure should be considered in addition to, rather than as a substitute for, the Company’s actual operating results included in its consolidated financial statements . All registered or unregistered service marks, trademarks and trade names referred to in this Presentation are the property of their respective owners, and CSS Entertainment’s use herein does not imply an affiliation with, or endorsement by, the owners of these service marks, trademarks or trade names . The securities of CSS Entertainment are highly speculative . Investing in shares of CSS Entertainment involves significant risks, including those described in the Offering Circular . 2

RISK FACTORS The following factors, among others, could cause actual results to differ materially from those set forth in this presentatio n: • CSSE does not have a long operating history on which to evaluate the company. • Certain conflicts of interest may arise between CSSE and its affiliated companies and CSSE has waived certain rights with res pec t thereto. • CSSE’s reliance on third parties for production and distribution could limit its control over the quality of the finished vid eo content. • An integral part of CSSE’s strategy is to initially minimize its production and distribution costs by utilizing funding sourc es provided by others, however, such sources may not be readily available. • As CSSE grows the Company may seek to fund and produce more of its video content directly, subjecting the Company to signific ant additional risks. • CSSE has derived revenue to date from limited video content and a limited number of clients, and has funded its projects from a limited number of sources. • CSSE is required to make continuing payments to its affiliates, which may reduce cash flow and profits. • Distributors’ failure to promote CSSE’s video content could adversely affect its revenue and could adversely affect its busin ess results. • CSSE is smaller and less diversified than many of its competitors. • CSSE faces risks from doing business internationally. • Protecting and defending against intellectual property claims may have a material adverse effect on its business. • Piracy of video content may harm CSSE’s business. • CSSE relies upon a number of partners to offer streaming of content to various devices. • Any significant disruption in the computer systems of third parties that CSSE utilizes in its operations could result in a lo ss or degradation of service and could adversely impact its business. • CSSE’s online activities are subject to a variety of laws and regulations relating to privacy, which, if violated, could subj ect CSSE to an increased risk of litigation and regulatory actions. • If government regulations relating to the internet or other areas of CSSE’s business change, CSSE may need to alter the manne r i n which it conducts business or incur greater operating expenses. • If CSSE experiences rapid growth, CSSE may not manage its growth effectively, execute its business plan as proposed or adequa tel y address competitive challenges. • CSSE’s exclusive license to use the Chicken Soup for the Soul brand could be terminated in certain circumstances. • CSSE’s success depends on its management and relationships with affiliated companies. • CSSE is an “emerging growth company” under the JOBS Act of 2012 and cannot be certain if the reduced disclosure requirements applicable to emerging growth companies will make its Class A common stock less attractive to investors. • CSSE’s status as an “emerging growth company” under the JOBS Act of 2012 may make it more difficult to raise capital as and w hen the Company needs it. • Since CSSE’s content is digitally stored and distributed online, and CSSE accepts online payments for various subscription se rvi ces, causing its business to face numerous cybersecurity risks. A more complete description of these risks and uncertainties can be found in the filings of the Company with the U.S. Securit ies and Exchange Commission. 3

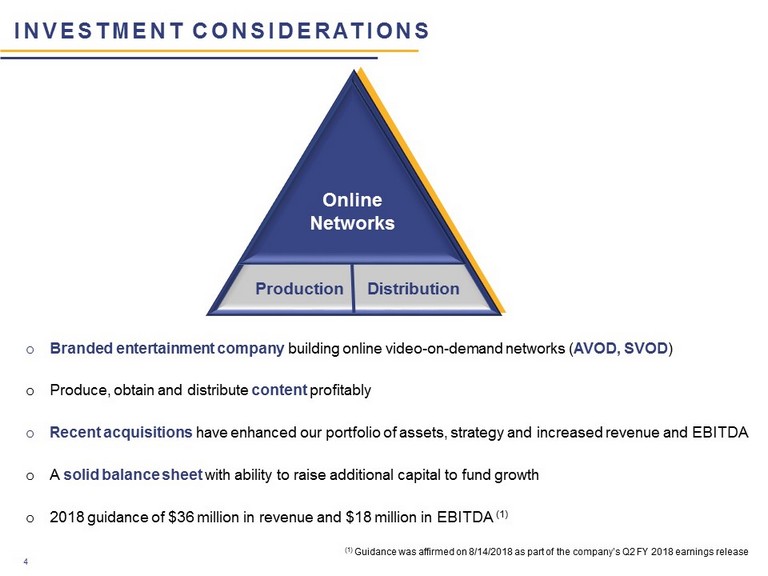

INVESTMENT CONSIDERATIONS 4 o Branded entertainment company building online video - on - demand networks ( AVOD, SVOD ) o Produce, obtain and distribute content profitably o Recent acquisitions have enhanced our portfolio of assets, strategy and increased revenue and EBITDA o A solid balance sheet with ability to raise additional capital to fund growth o 2018 guidance of $36 million in revenue and $18 million in EBITDA (1) (1) Guidance was affirmed on 8/14/2018 as part of the company’s Q2 FY 2018 earnings release Online Networks Production Distribution

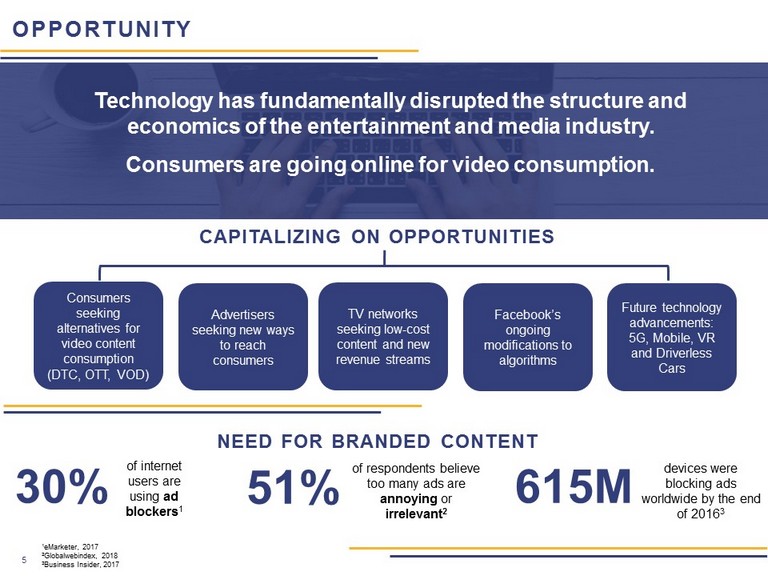

OPPORTUNITY Technology has fundamentally disrupted the structure and economics of the entertainment and media industry. Consumers are going online for video consumption. TV networks seeking low - cost content and new revenue streams Advertisers seeking new ways to reach consumers Facebook’s ongoing modifications to algorithms Future technology advancements: 5G, Mobile, VR and Driverless Cars Consumers seeking alternatives for video content consumption (DTC, OTT, VOD) CAPITALIZING ON OPPORTUNITIES 5 NEED FOR BRANDED CONTENT 30% of internet users are using ad blockers 1 1 eMarketer, 2017 2 Globalwebindex, 2018 3 Business Insider, 2017 51% of respondents believe too many ads are annoying or irrelevant 2 615M devices were blocking ads worldwide by the end of 2016 3

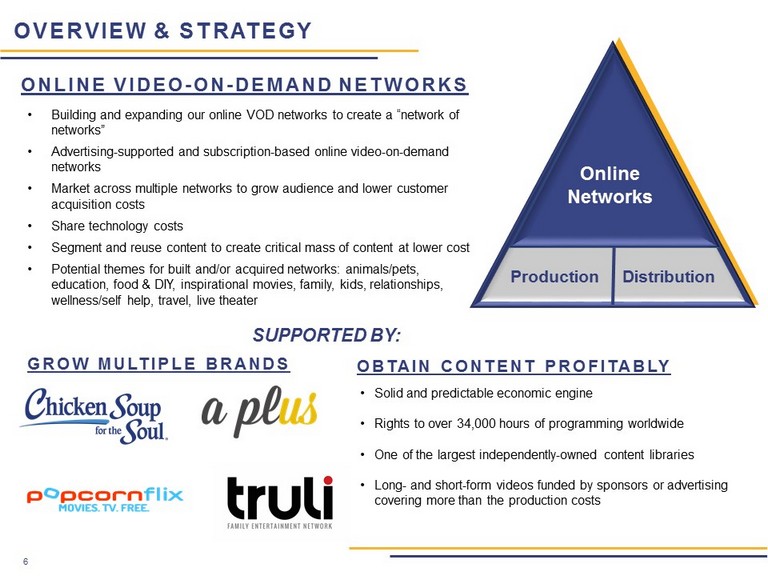

OVERVIEW & STRATEGY 6 • Solid and predictable economic engine • Rights to over 34,000 hours of programming worldwide • One of the largest independently - owned content libraries • Long - and short - form videos funded by sponsors or advertising covering more than the production costs ONLINE VIDEO - ON - DEMAND NETWORKS GROW MULTIPLE BRANDS OBTAIN CONTENT PROFITABLY • Building and expanding our online VOD networks to create a “network of networks” • Advertising - supported and subscription - based online video - on - demand networks • Market across multiple networks to grow audience and lower customer acquisition costs • Share technology costs • Segment and reuse content to create critical mass of content at lower cost • Potential themes for built and/or acquired networks: animals/pets, education, food & DIY, inspirational movies, family, kids, relationships, wellness/self help, travel, live theater SUPPORTED BY: Online Networks Production Distribution

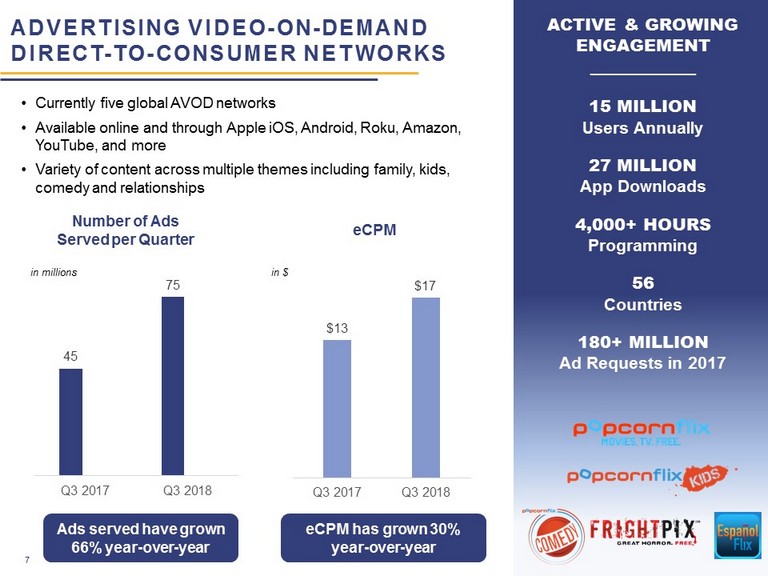

• Currently five global AVOD networks • Available online and through Apple iOS, Android, Roku, Amazon, YouTube, and more • Variety of content across multiple themes including family, kids, comedy and relationships ADVERTISING VIDEO - ON - DEMAND DIRECT - TO - CONSUMER NETWORKS 7 7 ACTIVE & GROWING ENGAGEMENT ___________ 15 MILLION Users Annually 27 MILLION App Downloads 4,000+ HOURS Programming 56 Countries 180+ MILLION Ad Requests in 2017 45 75 Q3 2017 Q3 2018 $13 $17 Q3 2017 Q3 2018 Number of Ads Served per Quarter eCPM in millions Ads served have grown 66% year - over - year eCPM has grown 30% year - over - year in $

ACTIVE & GROWING ENGAGEMENT ___________ 28,000 Hours of Programming 25,000 Paid Monthly Subscriptions 7,000 Content Providers • Global SVOD service offering channels across a variety of categories of content including music, sports, religion, arts and culture, lifestyle and family • Launch branded owned and operated channels • Secure adaptive playback across a multitude of devices • Responsive design, AirPlay and ChromeCast support, iOS, Android and Roku Apps • “Shopify” of online video - on - demand as white label providers SUBSCRIPTION - BASED VIDEO - ON - DEMAND NETWORK 8 8

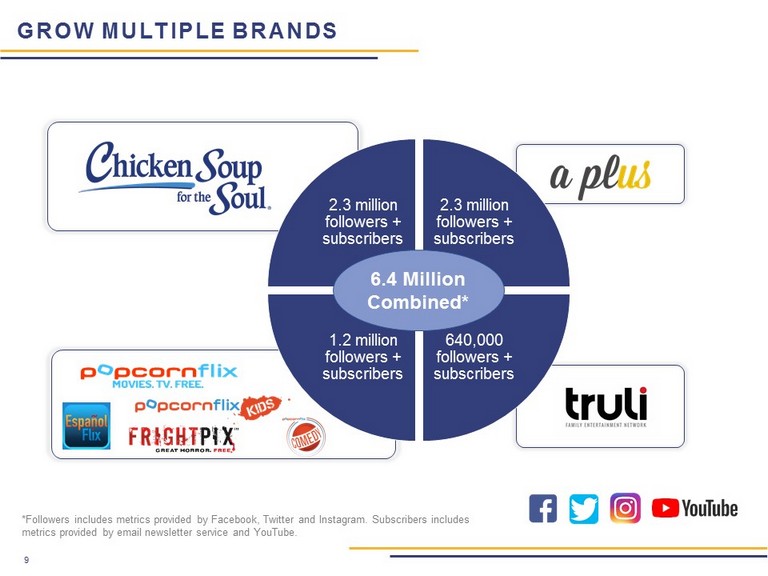

2.3 million followers + subscribers 2.3 million followers + subscribers 640,000 followers + subscribers 1.2 million followers + subscribers GROW MULTIPLE BRANDS 9 6.4 Million Combined* *Followers includes metrics provided by Facebook, Twitter and Instagram. Subscribers includes metrics provided by email newsletter service and YouTube.

COMBINED AUDIENCE (a) Includes impressions, video views, and podcast downloads from 2/1/18 – 9/30/18. Metrics from Facebook, Twitter, Instagram, and Google Analytics. (b) Harris Poll 2008 • 2.652B content views 2/18 – 9/18 (a) • 27 million apps downloaded • 5 million social followers • 550,000 email opt - in newsletter subscribers • 845,000 YouTube subscribers • 25,000 SVOD subscriptions 10 BRAND FACTS 89% Brand Awareness (b) >250 Book Titles Published over 25 years 25,000+ Stories Published 500M Books Sold worldwide 10 - 12 New Titles Published each year

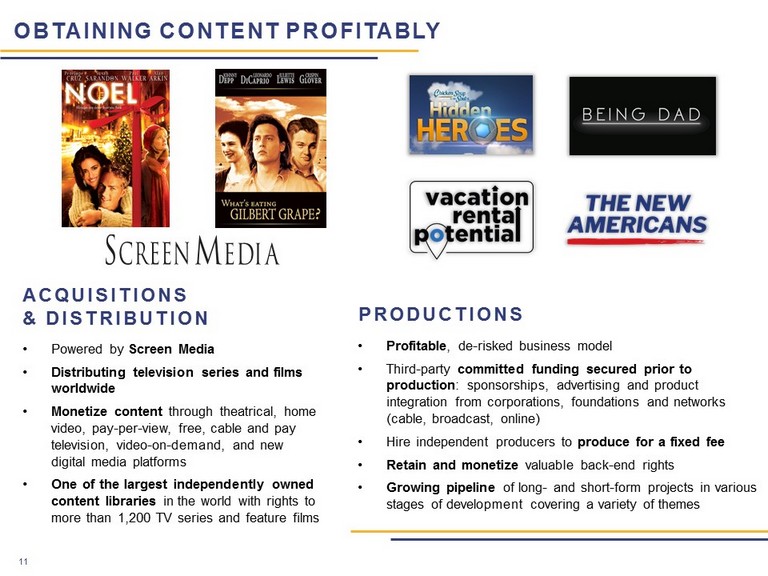

OBTAINING CONTENT PROFITABLY 11 • Profitable , de - risked business model • Third - party committed funding secured prior to production : sponsorships, advertising and product integration from corporations, foundations and networks (cable, broadcast, online) • Hire independent producers to produce for a fixed fee • Retain and monetize valuable back - end rights • Growing pipeline of long - and short - form projects in various stages of development covering a variety of themes • Powered by Screen Media • Distributing television series and films worldwide • Monetize content through theatrical, home video, pay - per - view, free, cable and pay television, video - on - demand, and new digital media platforms • One of the largest independently owned content libraries in the world with rights to more than 1,200 TV series and feature films ACQUISITIONS & DISTRIBUTION PRODUCTIONS

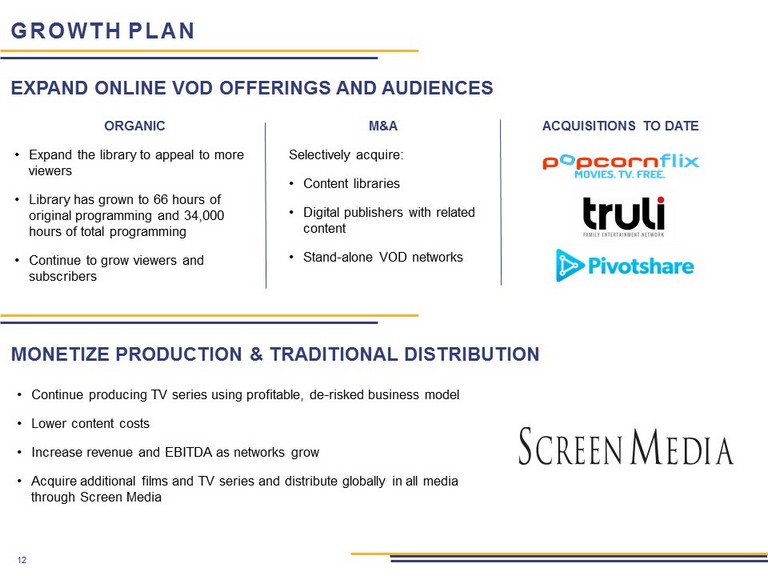

GROWTH PLAN • Continue producing TV series using profitable, de - risked business model • Lower content costs • Increase revenue and EBITDA as networks grow • Acquire additional films and TV series and distribute globally in all media through Screen Media ORGANIC • Expand the library to appeal to more viewers • Library has grown to 66 hours of original programming and 34,000 hours of total programming • Continue to grow viewers and subscribers M&A Selectively acquire: • Content libraries • Digital publishers with related content • Stand - alone VOD networks 12 ACQUISITIONS TO DATE MONETIZE PRODUCTION & TRADITIONAL DISTRIBUTION EXPAND ONLINE VOD OFFERINGS AND AUDIENCES

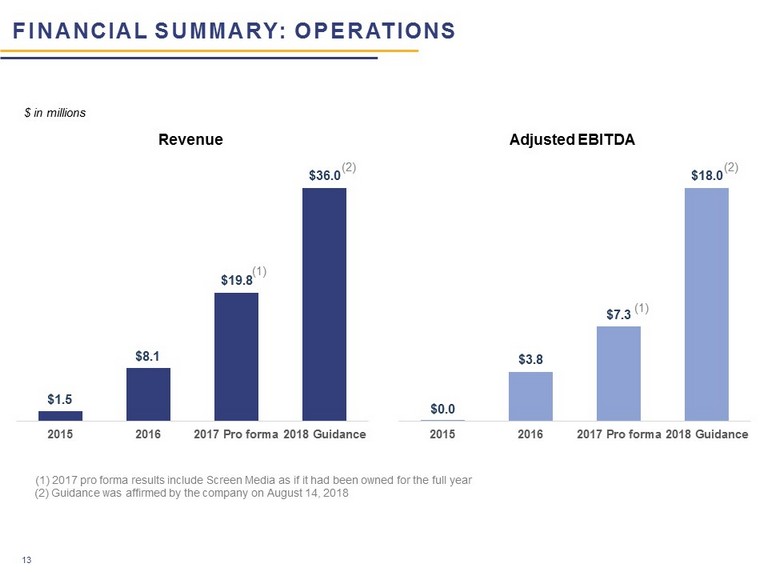

FINANCIAL SUMMARY: OPERATIONS 13 $1.5 $8.1 $19.8 $36.0 2015 2016 2017 Pro forma 2018 Guidance (1) 2017 pro forma results include Screen Media as if it had been owned for the full year (2) Guidance was affirmed by the company on August 14, 2018 $ in millions Revenue (1) (2) $0.0 $3.8 $7.3 $18.0 2015 2016 2017 Pro forma 2018 Guidance (1) (2) Adjusted EBITDA

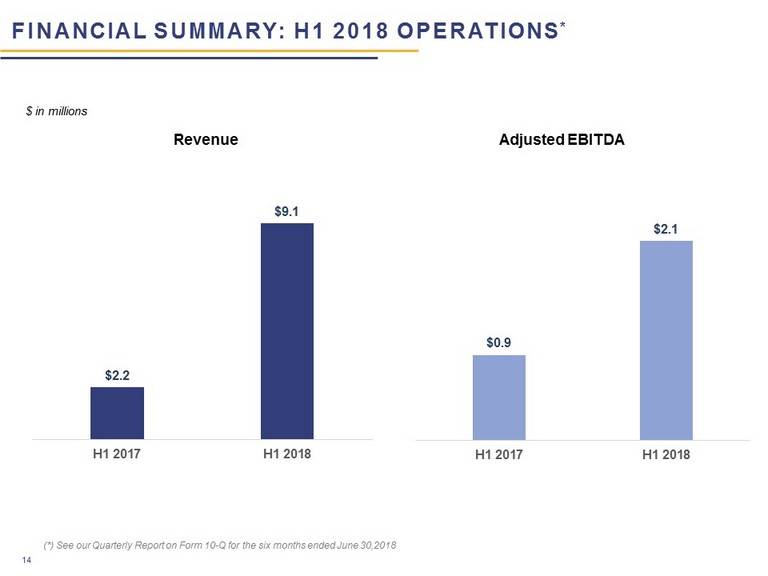

$0.9 $2.1 H1 2017 H1 2018 FINANCIAL SUMMARY: H1 2018 OPERATIONS * 14 $2.2 $9.1 H1 2017 H1 2018 $ in millions (*) See our Quarterly Report on Form 10 - Q for the six months ended June 30,2018 Revenue Adjusted EBITDA

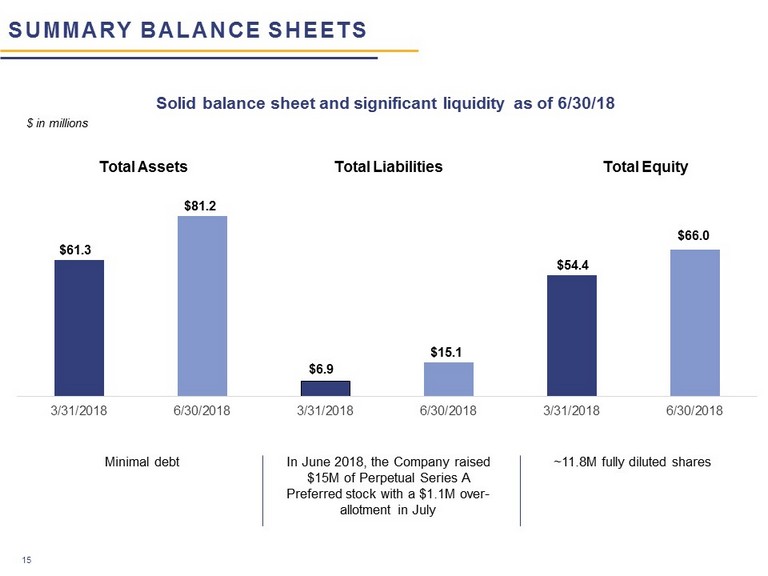

SUMMARY BALANCE SHEETS 15 Total Assets Total Liabilities Total Equity Minimal debt In June 2018, the Company raised $15M of Perpetual Series A Preferred stock with a $1.1M over - allotment in July ~11.8M fully diluted shares $61.3 $81.2 $6.9 $15.1 $54.4 $66.0 3/31/2018 6/30/2018 3/31/2018 6/30/2018 3/31/2018 6/30/2018 $ in millions Solid balance sheet and significant liquidity as of 6/30/18

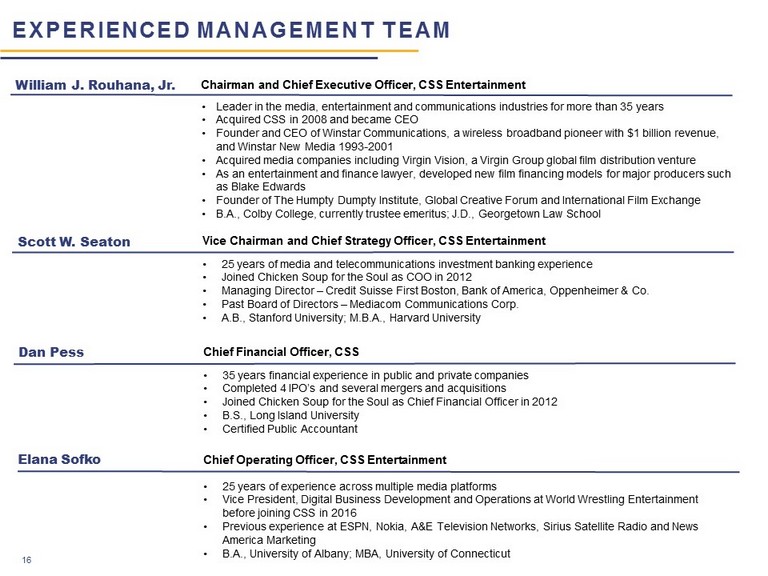

16 EXPERIENCED MANAGEMENT TEAM • Leader in the media, entertainment and communications industries for more than 35 years • Acquired CSS in 2008 and became CEO • Founder and CEO of Winstar Communications, a wireless broadband pioneer with $1 billion revenue, and Winstar New Media 1993 - 2001 • Acquired media companies including Virgin Vision, a Virgin Group global film distribution venture • As an entertainment and finance lawyer, developed new film financing models for major producers such as Blake Edwards • Founder of The Humpty Dumpty Institute, Global Creative Forum and International Film Exchange • B.A., Colby College, currently trustee emeritus; J.D., Georgetown Law School William J. Rouhana, Jr. Chairman and Chief Executive Officer, CSS Entertainment Scott W. Seaton Vice Chairman and Chief Strategy Officer, CSS Entertainment • 25 years of media and telecommunications investment banking experience • Joined Chicken Soup for the Soul as COO in 2012 • Managing Director – Credit Suisse First Boston, Bank of America, Oppenheimer & Co. • Past Board of Directors – Mediacom Communications Corp. • A.B., Stanford University; M.B.A., Harvard University Dan Pess Chief Financial Officer, CSS • 35 years financial experience in public and private companies • Completed 4 IPO’s and several mergers and acquisitions • Joined Chicken Soup for the Soul as Chief Financial Officer in 2012 • B.S., Long Island University • Certified Public Accountant • 25 years of experience across multiple media platforms • Vice President, Digital Business Development and Operations at World Wrestling Entertainment before joining CSS in 2016 • Previous experience at ESPN, Nokia, A&E Television Networks, Sirius Satellite Radio and News America Marketing • B.A., University of Albany; MBA, University of Connecticut Chief Operating Officer, CSS Entertainment Elana Sofko

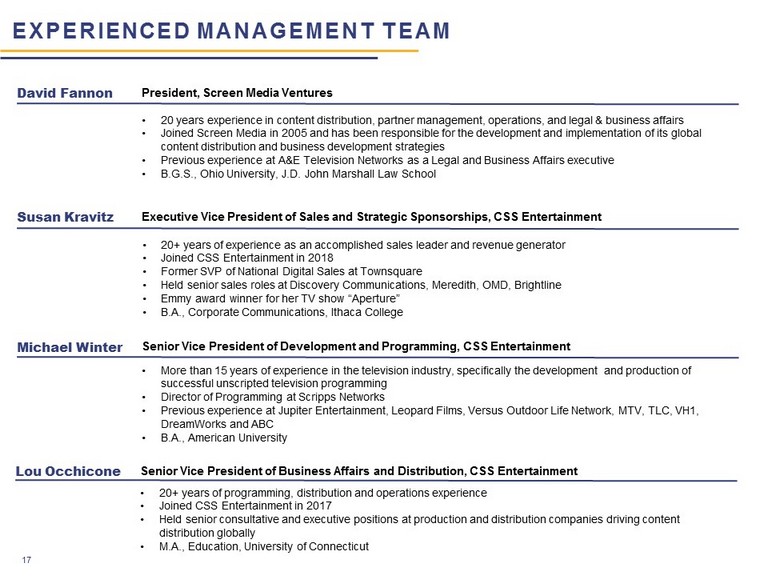

17 EXPERIENCED MANAGEMENT TEAM • 20 years experience in content distribution, partner management, operations, and legal & business affairs • Joined Screen Media in 2005 and has been responsible for the development and implementation of its global content distribution and business development strategies • Previous experience at A&E Television Networks as a Legal and Business Affairs executive • B.G.S., Ohio University, J.D. John Marshall Law School President, Screen Media Ventures David Fannon • 20+ years of experience as an accomplished sales leader and revenue generator • Joined CSS Entertainment in 2018 • Former SVP of National Digital Sales at Townsquare • Held senior sales roles at Discovery Communications, Meredith, OMD, Brightline • Emmy award winner for her TV show “Aperture” • B.A., Corporate Communications, Ithaca College Executive Vice President of Sales and Strategic Sponsorships, CSS Entertainment Susan Kravitz • More than 15 years of experience in the television industry, specifically the development and production of successful unscripted television programming • Director of Programming at Scripps Networks • Previous experience at Jupiter Entertainment, Leopard Films, Versus Outdoor Life Network, MTV, TLC, VH1, DreamWorks and ABC • B.A., American University Senior Vice President of Development and Programming, CSS Entertainment Michael Winter • 20+ years of programming, distribution and operations experience • Joined CSS Entertainment in 2017 • Held senior consultative and executive positions at production and distribution companies driving content distribution globally • M.A., Education, University of Connecticut Senior Vice President of Business Affairs and Distribution, CSS Entertainment Lou Occhicone

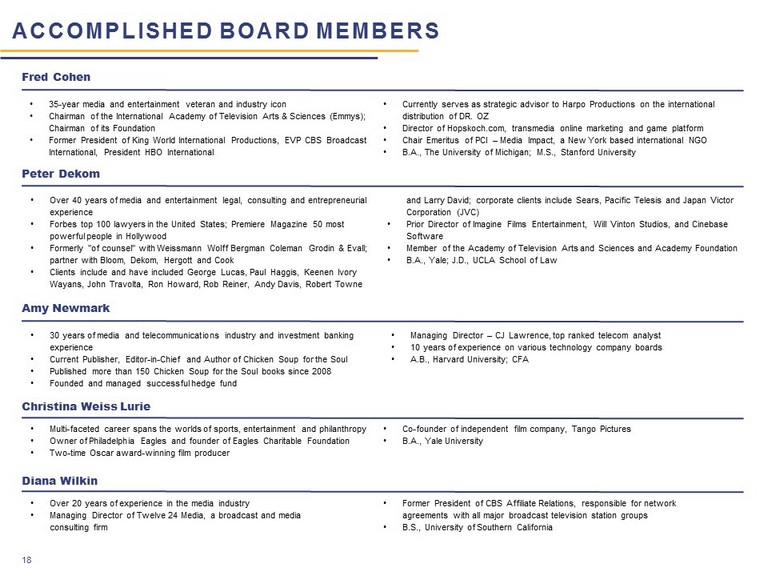

18 ACCOMPLISHED BOARD MEMBERS • 35 - year media and entertainment veteran and industry icon • Chairman of the International Academy of Television Arts & Sciences (Emmys); Chairman of its Foundation • Former President of King World International Productions, EVP CBS Broadcast International, President HBO International • Currently serves as strategic advisor to Harpo Productions on the international distribution of DR. OZ • Director of Hopskoch.com , transmedia online marketing and game platform • Chair Emeritus of PCI – Media Impact, a New York based international NGO • B.A., The University of Michigan; M.S., Stanford University Fred Cohen • Over 40 years of media and entertainment legal, consulting and entrepreneurial experience • Forbes top 100 lawyers in the United States; Premiere Magazine 50 most powerful people in Hollywood • Formerly "of counsel" with Weissmann Wolff Bergman Coleman Grodin & Evall ; partner with Bloom, Dekom , Hergott and Cook • Clients include and have included George Lucas, Paul Haggis, Keenen Ivory Wayans, John Travolta, Ron Howard, Rob Reiner, Andy Davis, Robert Towne and Larry David; corporate clients include Sears, Pacific Telesis and Japan Victor Corporation (JVC) • Prior Director of Imagine Films Entertainment, Will Vinton Studios, and Cinebase Software • Member of the Academy of Television Arts and Sciences and Academy Foundation • B.A., Yale; J.D., UCLA School of Law Peter Dekom • 30 years of media and telecommunications industry and investment banking experience • Current Publisher, Editor - in - Chief and Author of Chicken Soup for the Soul • Published more than 150 Chicken Soup for the Soul books since 2008 • Founded and managed successful hedge fund • Managing Director – CJ Lawrence, top ranked telecom analyst • 10 years of experience on various technology company boards • A.B., Harvard University; CFA Amy Newmark • Multi - faceted career spans the worlds of sports, entertainment and philanthropy • Owner of Philadelphia Eagles and founder of Eagles Charitable Foundation • Two - time Oscar award - winning film producer • Co - founder of independent film company, Tango Pictures • B.A., Yale University Christina Weiss Lurie • Over 20 years of experience in the media industry • Managing Director of Twelve 24 Media, a broadcast and media consulting firm • Former President of CBS Affiliate Relations, responsible for network agreements with all major broadcast television station groups • B.S., University of Southern California Diana Wilkin

Thank you! INVESTOR PRESENTATION OCTOBER 2018

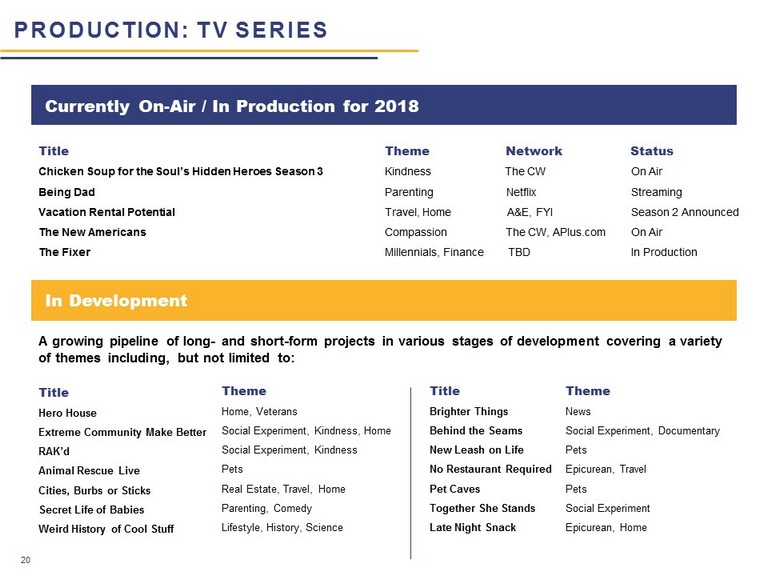

PRODUCTION: TV SERIES Title Theme Network Status Chicken Soup for the Soul’s Hidden Heroes Season 3 Kindness The CW On Air Being Dad Parenting Netflix Streaming Vacation Rental Potential Travel, Home A&E, FYI Season 2 Announced The New Americans Compassion The CW, APlus.com On Air The Fixer Millennials, Finance TBD In Production Currently On - Air / In Production for 2018 Title Hero House Extreme Community Make Better RAK’d Animal Rescue Live Cities, Burbs or Sticks Secret Life of Babies Weird History of Cool Stuff In Development Theme Home, Veterans Social Experiment, Kindness, Home Social Experiment, Kindness Pets Real Estate, Travel, Home Parenting, Comedy Lifestyle, History, Science Title Brighter Things Behind the Seams New Leash on Life No Restaurant Required Pet Caves Together She Stands Late Night Snack Theme News Social Experiment, Documentary Pets Epicurean, Travel Pets Social Experiment Epicurean, Home A growing pipeline of long - and short - form projects in various stages of development covering a variety of themes including, but not limited to: 20

PRODUCTION: SPONSORS Sponsorship from household names is an important source of funding that is secured prior to production of long - form and short - form content. Consumers recognize brands in a positive light when associated with uplifting, authentic content. 21