Attached files

| file | filename |

|---|---|

| EX-99.1 - PRESS RELEASE ANNOUNCING THIRD QUARTER 2018 FINANCIAL RESULTS - UMPQUA HOLDINGS CORP | umpq-20180930ex991earnings.htm |

| 8-K - 8-K - UMPQUA HOLDINGS CORP | umpq-201809308k.htm |

UMPQUA HOLDINGS CORPORATION 3rd Quarter 2018 Earnings Conference Call Presentation October 18, 2018

Forward-looking Statements This presentation includes forward-looking statements within the meaning of the “Safe-Harbor” provisions of the Private Securities Litigation Reform Act of 1995, which management believes are a benefit to shareholders. These statements are necessarily subject to risk and uncertainty and actual results could differ materially due to various risk factors, including those set forth from time to time in our filings with the SEC. You should not place undue reliance on forward- looking statements and we undertake no obligation to update any such statements. In this presentation we make forward- looking statements about corporate initiatives and the related savings & restructuring charges, store consolidations and facilities optimization and related costs and savings, and indirect auto wind down. Risks that could cause results to differ from forward-looking statements we make are set forth in our filings with the SEC and include, without limitation, prolonged low interest rate environment; the effect of interest rate increases on the cost of deposits; unanticipated weakness in loan demand or loan pricing; deterioration in the economy; lack of strategic growth opportunities or our failure to execute on those opportunities; our inability to effectively manage problem credits; our inability to successfully implement efficiency and operational excellence initiatives on time and in amounts projected; our ability to successfully develop and market new products and technology; and changes in laws or regulations. 2

Q3 2018 Highlights (compared to Q2 2018) Net earnings available to common shareholders of $91.0 million, or $0.41 per diluted common share $7.0 million increase in interest income on taxable investment securities related to a further refinement of accounting methodology on the interest method for residential mortgage-backed securities and collateralized mortgage obligations. In the second quarter of 2018 the Company took an out of period adjustment related to an initial change in accounting methodology, resulting in a decrease in interest income on taxable investment securities of $7.2 million. For purposes of comparison, interest income on taxable investment securities would have been $17.4 million and $15.7 million in the third and second quarters of 2018, respectively, excluding the impact of these adjustments. Quarterly deposit growth of $398.8 million, offset by $250.6 million of planned run-off from brokered deposits, for net deposit growth of $148.2 million Quarterly loan and lease growth of $214.5 million Net interest income increased by $16.5 million. Excluding the impact of the changes in accounting methodology to the interest method for residential mortgage-backed securities and collateralized mortgage obligations, net interest income increased by $2.3 million. This increase was primarily attributable to a higher average balance of loans and leases Provision for loan and lease losses decreased by $1.6 million, driven primarily by improvement in the loan and lease portfolio, while net charge-offs increased by three basis points to 0.25% of average loans and leases (annualized) Non-interest income increased by $0.7 million, reflecting higher gains on portfolio loans sales and a lower unrealized holding loss on equity securities, partially offset by lower residential mortgage banking revenue Non-interest expense decreased by $16.3 million, driven primarily by lower restructuring charges, lower mortgage banking-related expense, and lower salaries and benefits related to operational excellence initiatives Non-performing assets to total assets of 0.37% Estimated total risk-based capital ratio of 13.7% and estimated Tier 1 common to risk weighted assets ratio of 10.8% Increased quarterly cash dividend by 5% to $0.21 per common share 3

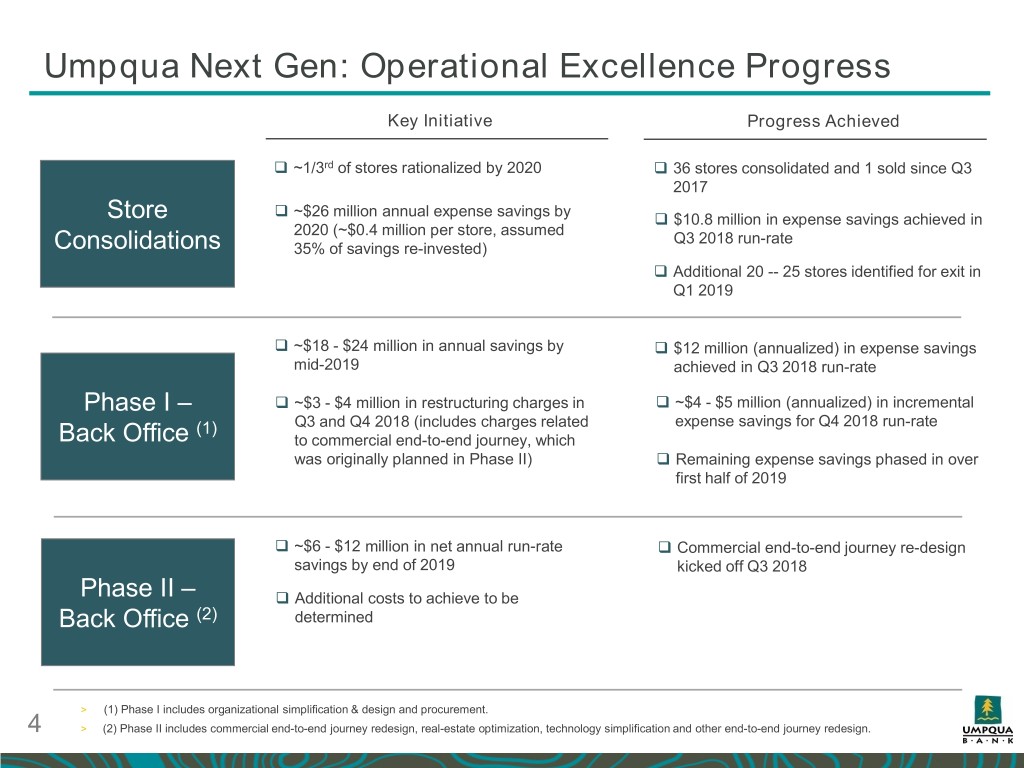

Umpqua Next Gen: Operational Excellence Progress Key Initiative Progress Achieved ~1/3rd of stores rationalized by 2020 36 stores consolidated and 1 sold since Q3 2017 ~$26 million annual expense savings by Store $10.8 million in expense savings achieved in 2020 (~$0.4 million per store, assumed Q3 2018 run-rate Consolidations 35% of savings re-invested) Additional 20 -- 25 stores identified for exit in Q1 2019 ~$18 - $24 million in annual savings by $12 million (annualized) in expense savings mid-2019 achieved in Q3 2018 run-rate Phase I – ~$3 - $4 million in restructuring charges in ~$4 - $5 million (annualized) in incremental (1) Q3 and Q4 2018 (includes charges related expense savings for Q4 2018 run-rate Back Office to commercial end-to-end journey, which was originally planned in Phase II) Remaining expense savings phased in over first half of 2019 ~$6 - $12 million in net annual run-rate Commercial end-to-end journey re-design savings by end of 2019 kicked off Q3 2018 Phase II – Additional costs to achieve to be Back Office (2) determined > (1) Phase I includes organizational simplification & design and procurement. 4 > (2) Phase II includes commercial end-to-end journey redesign, real-estate optimization, technology simplification and other end-to-end journey redesign.

Selected Ratios For the quarter ended Q3 2018 Q2 2018 Q1 2018 Q4 2017 Q3 2017 Return on average assets 1.36% 1.02% 1.25% 1.17% 1.00% Return on average tangible assets 1.46% 1.09% 1.35% 1.26% 1.08% Return on average common equity 9.00% 6.64% 8.06% 7.54% 6.41% Performance Return on average tangible common equity 16.42% 12.18% 14.84% 13.93% 11.90% Efficiency ratio - consolidated 57.06% 65.84% 61.21% 65.46% 62.58% Net interest margin - consolidated 4.09% 3.89% 4.00% 3.93% 4.00% Non-performing loans and leases to loans and leases 0.44% 0.40% 0.37% 0.43% 0.40% Credit Quality Non-performing assets to total assets 0.37% 0.34% 0.33% 0.37% 0.30% Net charge-offs to average loans and leases (annualized) 0.25% 0.22% 0.26% 0.25% 0.20% Tangible common equity to tangible assets (1) 8.83% 8.78% 8.97% 9.02% 8.93% Capital Tier 1 common to risk-weighted asset ratio (2) 10.8% 10.7% 11.0% 11.1% 11.1% Total risk-based capital ratio (2) 13.7% 13.5% 13.9% 14.1% 14.2% > (1) Non-GAAP financial measure. A reconciliation to the comparable GAAP measurement is provided at the end of this slide presentation. 5 > (2) Capital ratio estimated for current quarter, pending completion and filing of regulatory reports.

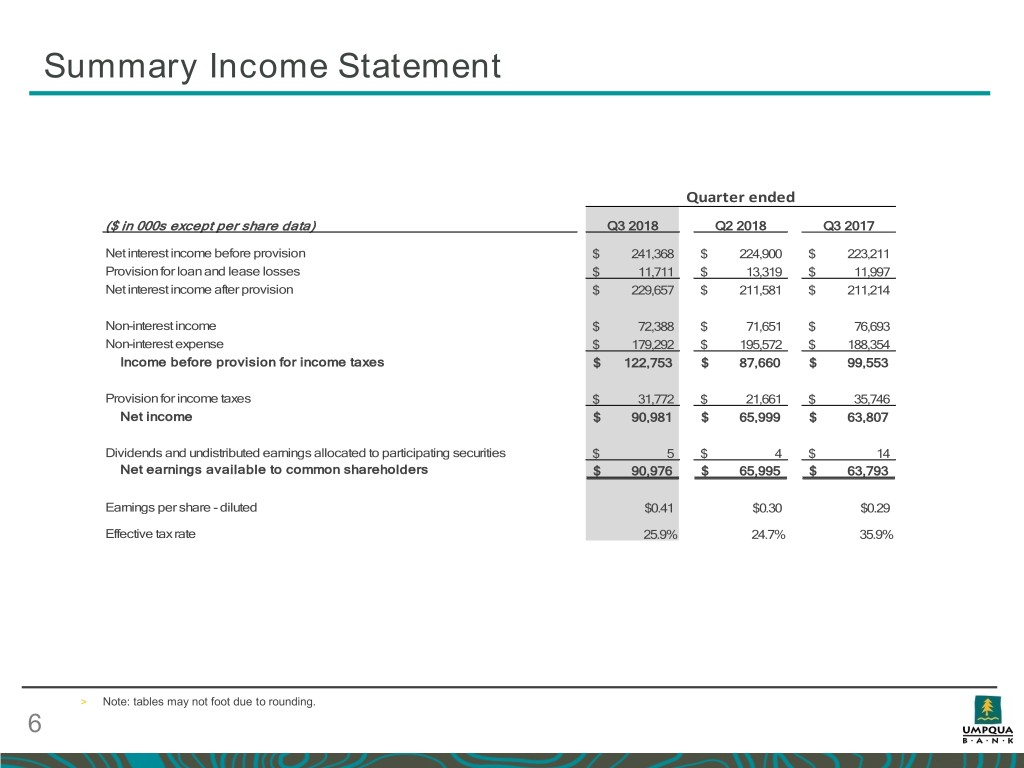

Summary Income Statement Quarter ended ($ in 000s except per share data) Q3 2018 Q2 2018 Q3 2017 Net interest income before provision $ 241,368 $ 224,900 $ 223,211 Provision for loan and lease losses $ 11,711 $ 13,319 $ 11,997 Net interest income after provision $ 229,657 $ 211,581 $ 211,214 Non-interest income $ 72,388 $ 71,651 $ 76,693 Non-interest expense $ 179,292 $ 195,572 $ 188,354 Income before provision for income taxes $ 122,753 $ 87,660 $ 99,553 Provision for income taxes $ 31,772 $ 21,661 $ 35,746 Net income $ 90,981 $ 65,999 $ 63,807 Dividends and undistributed earnings allocated to participating securities $ 5 $ 4 $ 14 Net earnings available to common shareholders $ 90,976 $ 65,995 $ 63,793 Earnings per share - diluted $0.41 $0.30 $0.29 Effective tax rate 25.9% 24.7% 35.9% > Note: tables may not foot due to rounding. 6

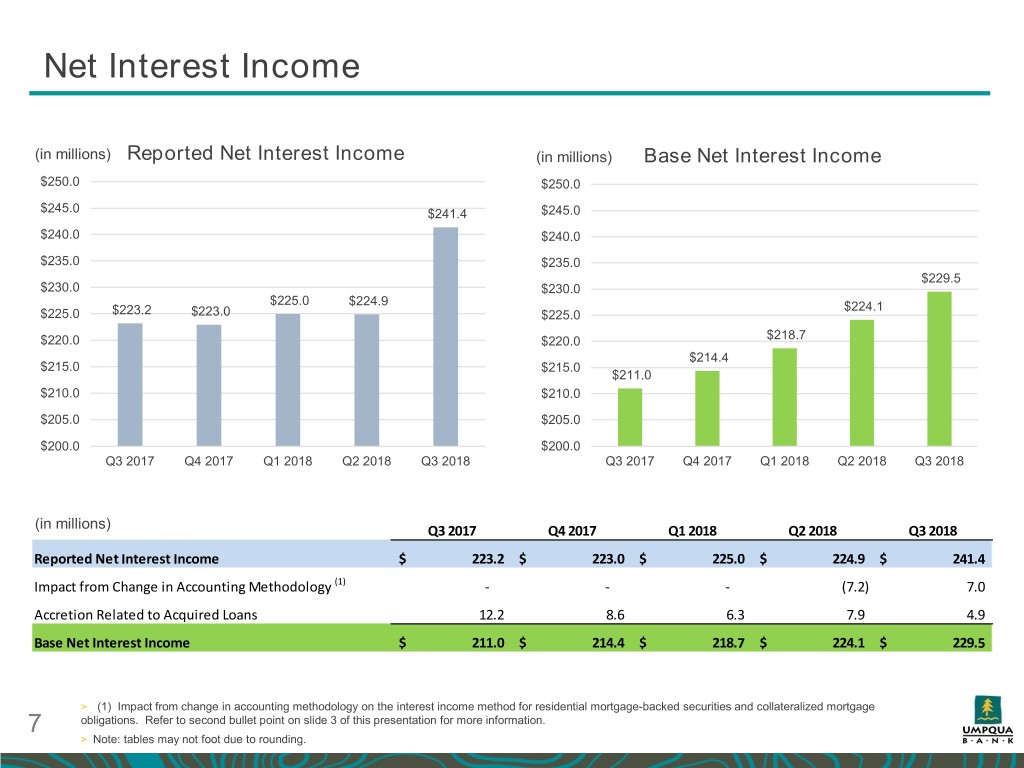

Net Interest Income (in millions) Reported Net Interest Income (in millions) Base Net Interest Income $250.0 $250.0 $245.0 $241.4 $245.0 $240.0 $240.0 $235.0 $235.0 $229.5 $230.0 $230.0 $225.0 $224.9 $224.1 $225.0 $223.2 $223.0 $225.0 $220.0 $220.0 $218.7 $214.4 $215.0 $215.0 $211.0 $210.0 $210.0 $205.0 $205.0 $200.0 $200.0 Q3 2017 Q4 2017 Q1 2018 Q2 2018 Q3 2018 Q3 2017 Q4 2017 Q1 2018 Q2 2018 Q3 2018 (in millions) Q3 2017 Q4 2017 Q1 2018 Q2 2018 Q3 2018 Reported Net Interest Income $ 223.2 $ 223.0 $ 225.0 $ 224.9 $ 241.4 Impact from Change in Accounting Methodology (1) - - - (7.2) 7.0 Accretion Related to Acquired Loans 12.2 8.6 6.3 7.9 4.9 Base Net Interest Income $ 211.0 $ 214.4 $ 218.7 $ 224.1 $ 229.5 > (1) Impact from change in accounting methodology on the interest income method for residential mortgage-backed securities and collateralized mortgage obligations. Refer to second bullet point on slide 3 of this presentation for more information. 7 > Note: tables may not foot due to rounding.

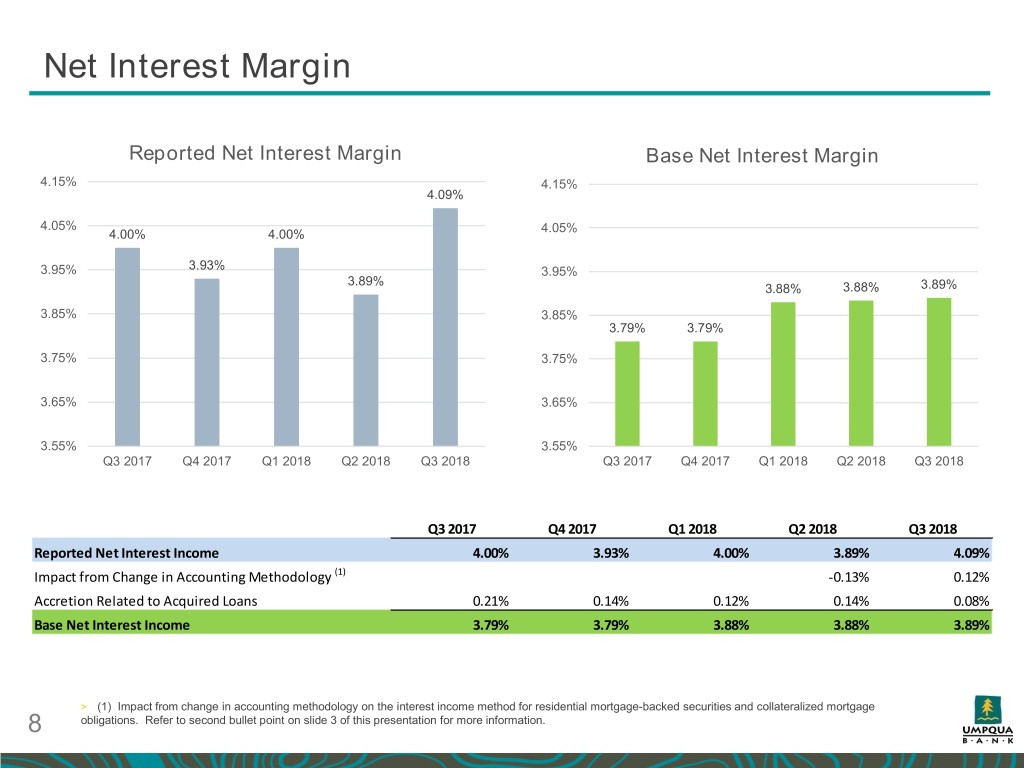

Net Interest Margin Reported Net Interest Margin Base Net Interest Margin 4.15% 4.15% 4.09% 4.05% 4.05% 4.00% 4.00% 3.95% 3.93% 3.95% 3.89% 3.88% 3.88% 3.89% 3.85% 3.85% 3.79% 3.79% 3.75% 3.75% 3.65% 3.65% 3.55% 3.55% Q3 2017 Q4 2017 Q1 2018 Q2 2018 Q3 2018 Q3 2017 Q4 2017 Q1 2018 Q2 2018 Q3 2018 Q3 2017 Q4 2017 Q1 2018 Q2 2018 Q3 2018 Reported Net Interest Income 4.00% 3.93% 4.00% 3.89% 4.09% Impact from Change in Accounting Methodology (1) -0.13% 0.12% Accretion Related to Acquired Loans 0.21% 0.14% 0.12% 0.14% 0.08% Base Net Interest Income 3.79% 3.79% 3.88% 3.88% 3.89% > (1) Impact from change in accounting methodology on the interest income method for residential mortgage-backed securities and collateralized mortgage 8 obligations. Refer to second bullet point on slide 3 of this presentation for more information.

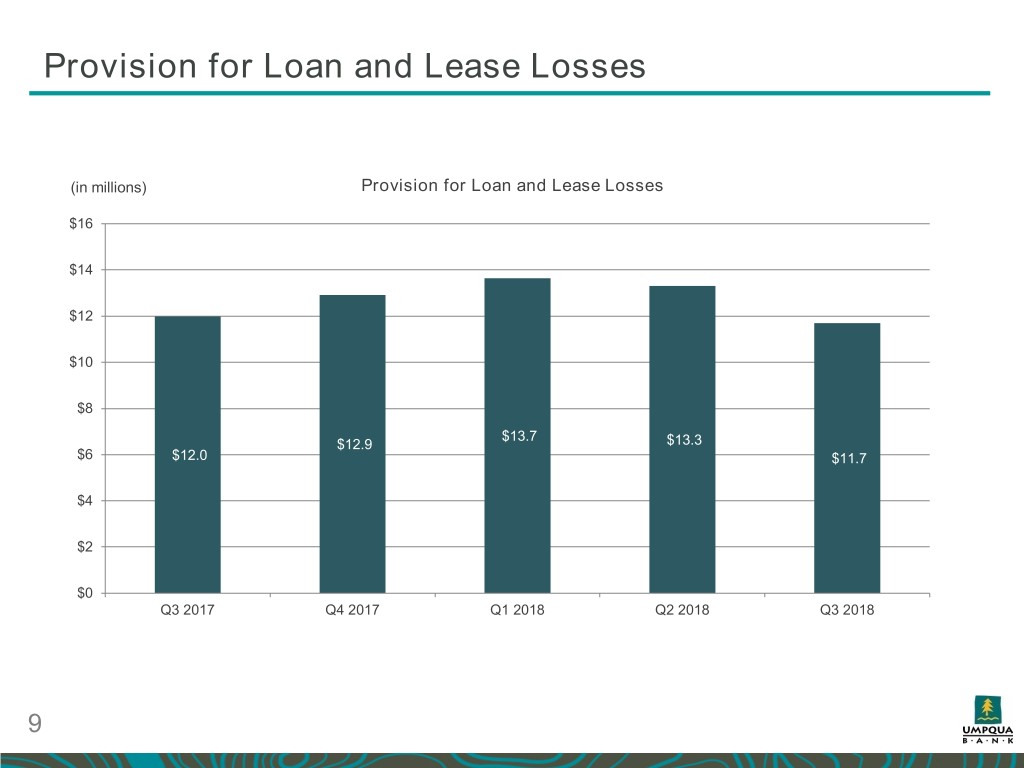

Provision for Loan and Lease Losses (in millions) Provision for Loan and Lease Losses $16 $14 $12 $10 $8 $13.7 $12.9 $13.3 $6 $12.0 $11.7 $4 $2 $0 Q3 2017 Q4 2017 Q1 2018 Q2 2018 Q3 2018 9

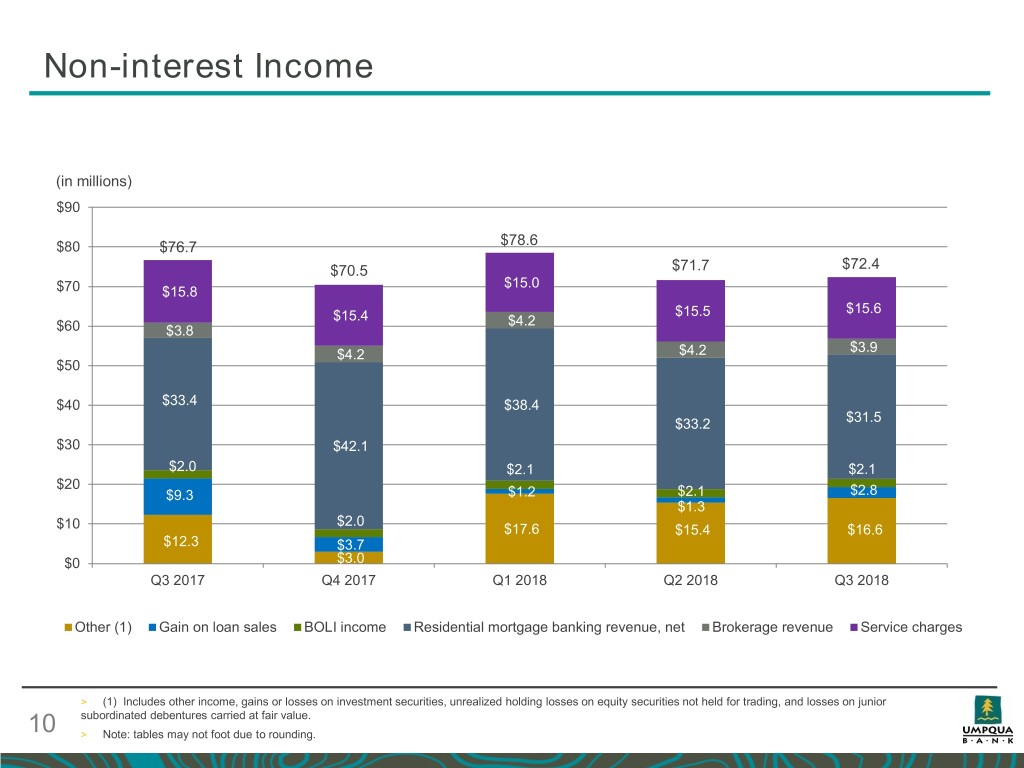

Non-interest Income (in millions) $90 $80 $76.7 $78.6 $70.5 $71.7 $72.4 $15.0 $70 $15.8 $15.5 $15.6 $15.4 $4.2 $60 $3.8 $3.9 $4.2 $4.2 $50 $40 $33.4 $38.4 $33.2 $31.5 $30 $42.1 $2.0 $2.1 $2.1 $20 $9.3 $1.2 $2.1 $2.8 $1.3 $2.0 $10 $17.6 $15.4 $16.6 $12.3 $3.7 $0 $3.0 Q3 2017 Q4 2017 Q1 2018 Q2 2018 Q3 2018 Other (1) Gain on loan sales BOLI income Residential mortgage banking revenue, net Brokerage revenue Service charges > (1) Includes other income, gains or losses on investment securities, unrealized holding losses on equity securities not held for trading, and losses on junior subordinated debentures carried at fair value. 10 > Note: tables may not foot due to rounding.

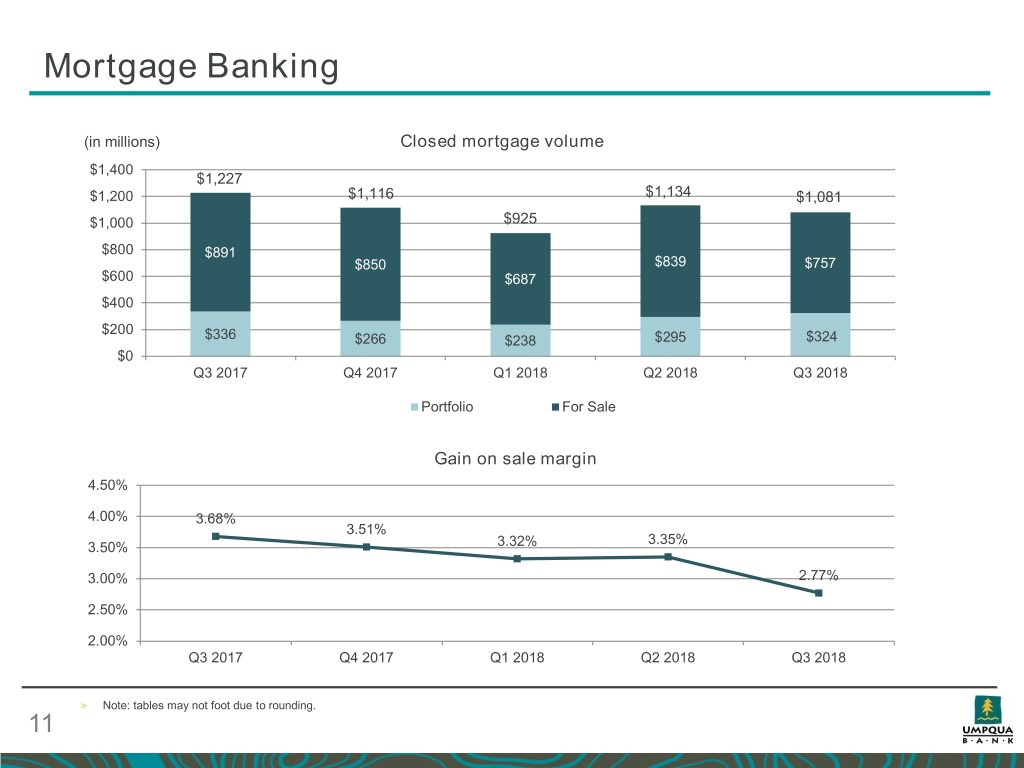

Mortgage Banking (in millions) Closed mortgage volume $1,400 $1,227 $1,200 $1,116 $1,134 $1,081 $1,000 $925 $800 $891 $850 $839 $757 $600 $687 $400 $200 $336 $266 $238 $295 $324 $0 Q3 2017 Q4 2017 Q1 2018 Q2 2018 Q3 2018 Portfolio For Sale Gain on sale margin 4.50% 4.00% 3.68% 3.51% 3.35% 3.50% 3.32% 3.00% 2.77% 2.50% 2.00% Q3 2017 Q4 2017 Q1 2018 Q2 2018 Q3 2018 > Note: tables may not foot due to rounding. 11

Non-interest Expense Non-interest Expense and Efficiency Ratio Non-interest Expense Bridge (in millions) (in millions) $195.6 $4.7 $205.0 130.0% $195.6 $195.0 $192.8 120.0% $3.0 $188.4 $186.1 $185.0 $179.3 110.0% $1.8 $175.0 100.0% $1.6 $165.0 90.0% $1.2 $155.0 80.0% $0.9 65.5% 65.8% $4.0 $145.0 62.6% 61.2% 70.0% 57.1% $(0.9) $179.3 $135.0 60.0% $125.0 50.0% $115.0 40.0% Q3 2017 Q4 2017 Q1 2018 Q2 2018 Q3 2018 Non-interest expense Efficiency ratio 12

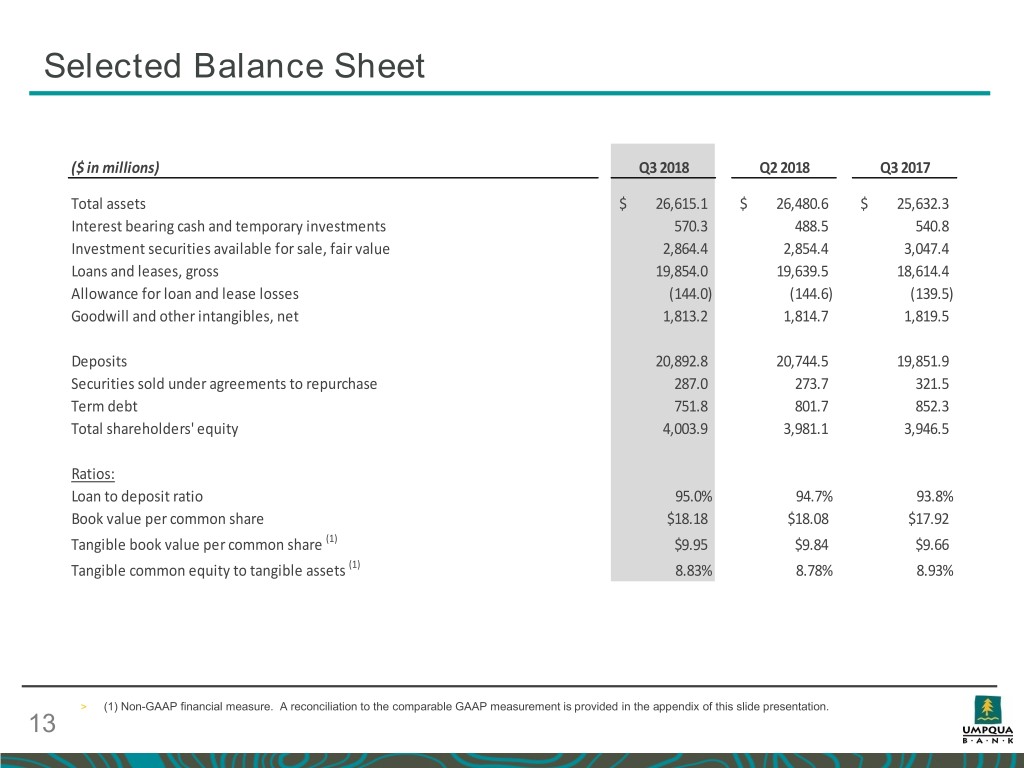

Selected Balance Sheet ($ in millions) Q3 2018 Q2 2018 Q3 2017 Total assets $ 26,615.1 $ 26,480.6 $ 25,632.3 Interest bearing cash and temporary investments 570.3 488.5 540.8 Investment securities available for sale, fair value 2,864.4 2,854.4 3,047.4 Loans and leases, gross 19,854.0 19,639.5 18,614.4 Allowance for loan and lease losses (144.0) (144.6) (139.5) Goodwill and other intangibles, net 1,813.2 1,814.7 1,819.5 Deposits 20,892.8 20,744.5 19,851.9 Securities sold under agreements to repurchase 287.0 273.7 321.5 Term debt 751.8 801.7 852.3 Total shareholders' equity 4,003.9 3,981.1 3,946.5 Ratios: Loan to deposit ratio 95.0% 94.7% 93.8% Book value per common share $18.18 $18.08 $17.92 Tangible book value per common share (1) $9.95 $9.84 $9.66 Tangible common equity to tangible assets (1) 8.83% 8.78% 8.93% > (1) Non-GAAP financial measure. A reconciliation to the comparable GAAP measurement is provided in the appendix of this slide presentation. 13

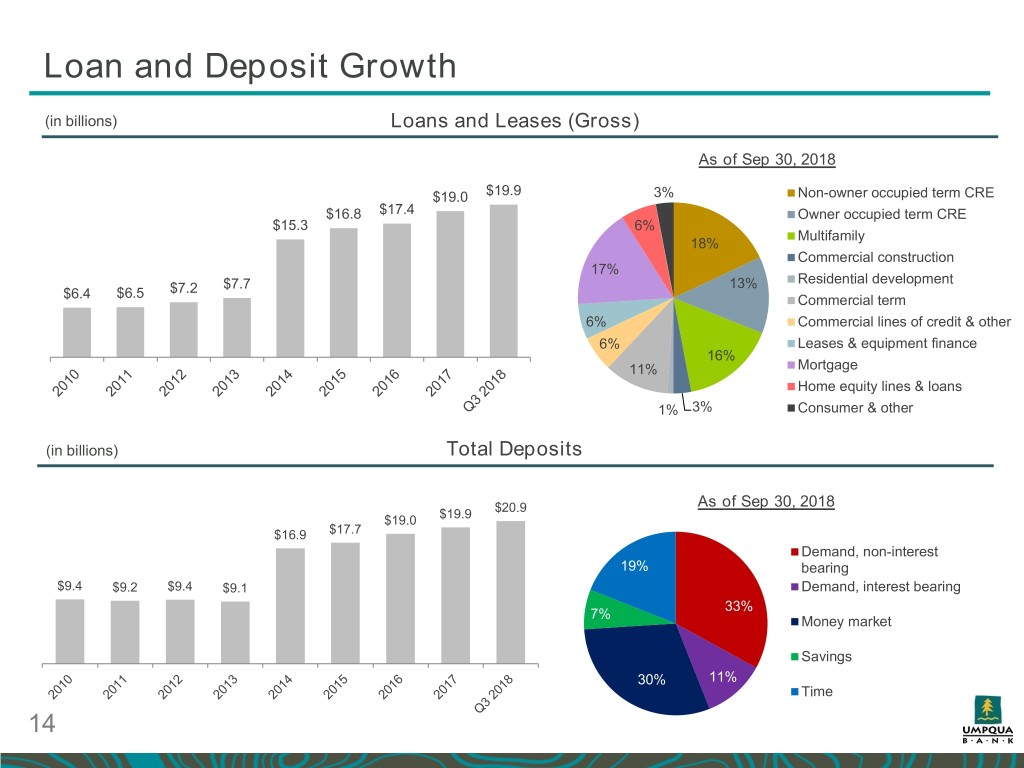

Loan and Deposit Growth (in billions) Loans and Leases (Gross) As of Sep 30, 2018 $19.0 $19.9 3% Non-owner occupied term CRE $16.8 $17.4 Owner occupied term CRE $15.3 6% Multifamily 18% Commercial construction 17% $7.7 13% Residential development $6.5 $7.2 $6.4 Commercial term 6% Commercial lines of credit & other 6% Leases & equipment finance 16% 11% Mortgage Home equity lines & loans 1% 3% Consumer & other (in billions) Total Deposits $20.9 As of Sep 30, 2018 $19.0 $19.9 $16.9 $17.7 Demand, non-interest 19% bearing $9.4 $9.2 $9.4 $9.1 Demand, interest bearing 33% 7% Money market Savings 30% 11% Time 14

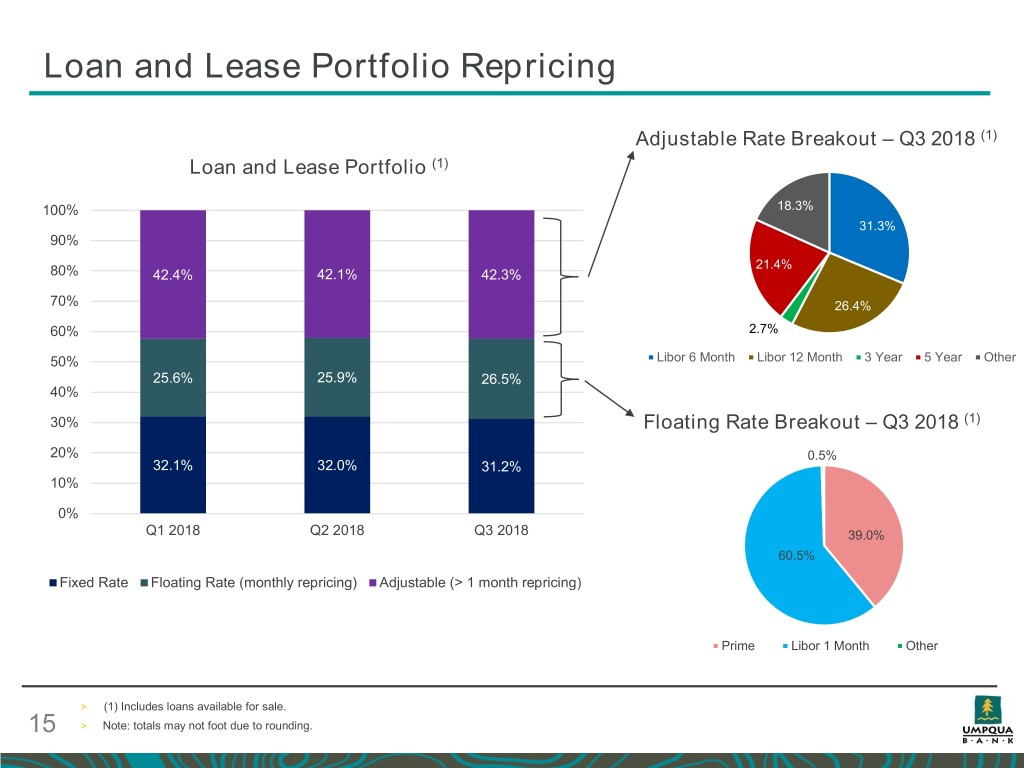

Loan and Lease Portfolio Repricing Adjustable Rate Breakout – Q3 2018 (1) Loan and Lease Portfolio (1) 100% 18.3% 31.3% 90% 21.4% 80% 42.4% 42.1% 42.3% 70% 26.4% 60% 2.7% 50% Libor 6 Month Libor 12 Month 3 Year 5 Year Other 25.6% 25.9% 26.5% 40% 30% Floating Rate Breakout – Q3 2018 (1) 20% 0.5% 32.1% 32.0% 31.2% 10% 0% Q1 2018 Q2 2018 Q3 2018 39.0% 60.5% Fixed Rate Floating Rate (monthly repricing) Adjustable (> 1 month repricing) Prime Libor 1 Month Other > (1) Includes loans available for sale. 15 > Note: totals may not foot due to rounding.

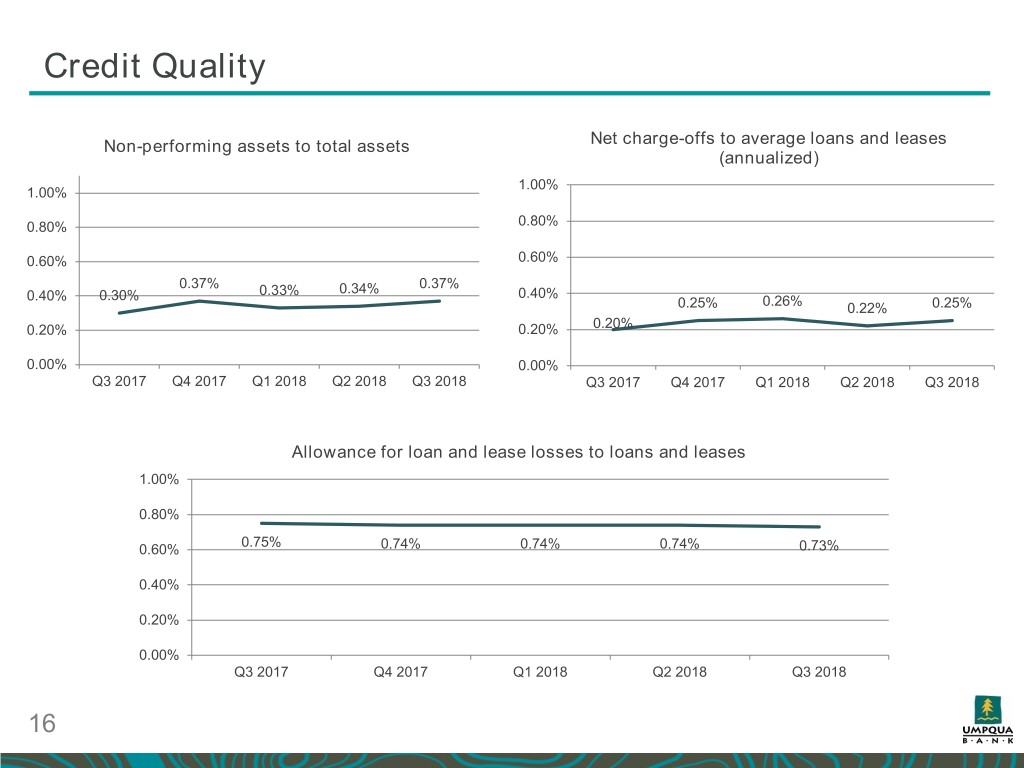

Credit Quality Non-performing assets to total assets Net charge-offs to average loans and leases (annualized) 1.00% 1.00% 0.80% 0.80% 0.60% 0.60% 0.37% 0.37% 0.33% 0.34% 0.40% 0.40% 0.30% 0.26% 0.25% 0.22% 0.25% 0.20% 0.20% 0.20% 0.00% 0.00% Q3 2017 Q4 2017 Q1 2018 Q2 2018 Q3 2018 Q3 2017 Q4 2017 Q1 2018 Q2 2018 Q3 2018 Allowance for loan and lease losses to loans and leases 1.00% 0.80% 0.75% 0.60% 0.74% 0.74% 0.74% 0.73% 0.40% 0.20% 0.00% Q3 2017 Q4 2017 Q1 2018 Q2 2018 Q3 2018 16

Prudent Capital Management > All regulatory capital ratios remained in excess of well-capitalized and internal policy limits > Focused on prudently managing capital • Increased quarterly dividend by 5% to $0.21 per share, ~4.3% current dividend yield • Q3 total payout ratio of 51% Q3 2018 Capital Ratios (1) 13.7% 10.8% 10.8% 8.8% 9.2% Tangible Common Tier 1 Leverage Tier 1 Common Risk Based Tier 1 Risk Based Total Risk Based Equity/Tangible Assets > (1) Regulatory capital ratios are estimates pending completion and filing of the Company’s regulatory reports. 17

Appendix – Non-GAAP Reconciliation

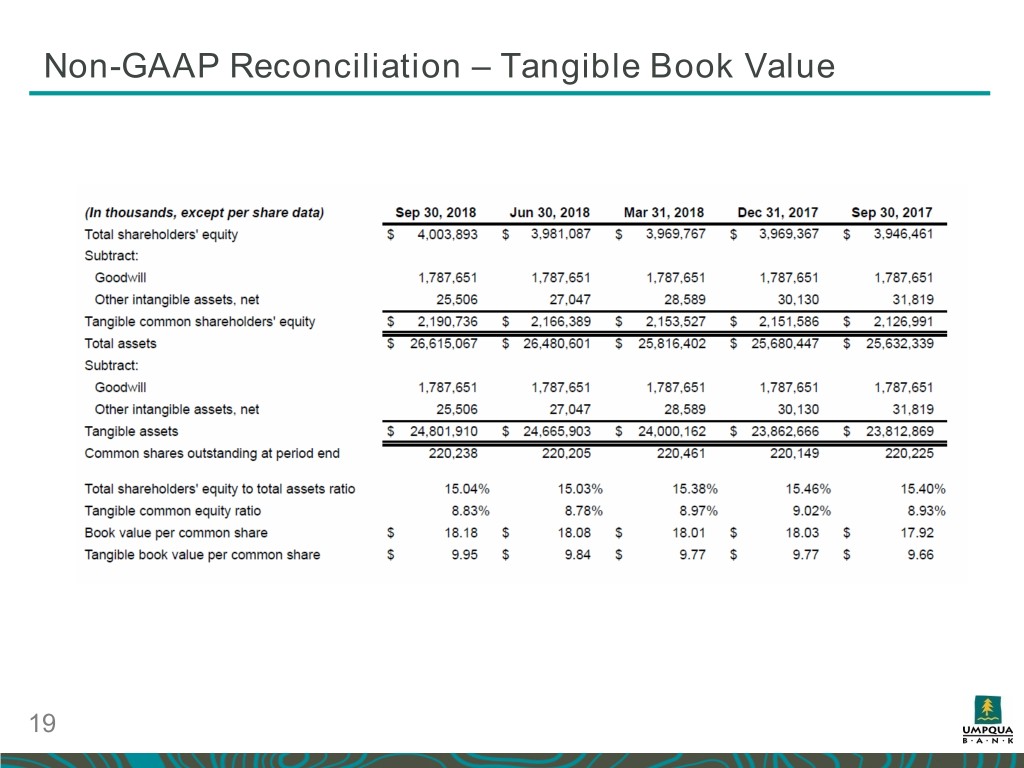

Non-GAAP Reconciliation – Tangible Book Value 19

Thank you