Attached files

| file | filename |

|---|---|

| EX-99.2 - EXHIBIT 99.2 - ULTIMATE SOFTWARE GROUP INC | exhibit992unauditedproform.htm |

| EX-23.1 - EXHIBIT 23.1 - ULTIMATE SOFTWARE GROUP INC | exhibit231pkfconsentletter.htm |

| 8-K/A - 8-K/A - ULTIMATE SOFTWARE GROUP INC | peopledocform8-k.htm |

Exhibit 99.1

CONSOLIDATED FINANCIAL STATEMENTS

PeopleDoc Group

As of December 31, 2017 and for the year ended December 31, 2017

With Independent Auditor's Report

INDEPENDENT AUDITOR'S REPORT

The Directors

Peopledoc SAS

53 rue d'Hauteville

75010 Paris

France

We have audited the accompanying consolidated financial statements of Peopledoc, SAS and its subsidiaries (the Group), which comprise the consolidated statement of financial position as of December 31, 2017 and the related consolidated statements of profit and loss and other comprehensive income, changes in consolidated shareholder’s equity, and cash flows for the year then ended, and the related notes to the consolidated financial statements.

Management’s Responsibility for the Consolidated Financial Statements

Management is responsible for the preparation and fair presentation of these consolidated financial statements in accordance with International Financial Reporting Standards as issued by the International Accounting Standards Board (IASB); this includes the design, implementation, and maintenance of internal control relevant to the preparation and fair presentation of consolidated financial statements that are free from material misstatement, whether due to fraud or error.

Auditors’ Responsibility

Our responsibility is to express an opinion on these consolidated financial statements based on our audit. We conducted our audit in accordance with auditing standards generally accepted in the United States of America. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the consolidated financial statements are free from material misstatement.

An audit involves performing procedures to obtain audit evidence about the amounts and disclosures in the consolidated financial statements. The procedures selected depend on the auditors’ judgment, including the assessment of the risks of material misstatement of the consolidated financial statements, whether due to fraud or error. In making those risk assessments, the auditor considers internal control relevant to the entity’s preparation and fair presentation of the consolidated financial statements in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the entity’s internal control. Accordingly, we express no such opinion. An audit also includes evaluating the appropriateness of accounting policies used and the reasonableness of significant accounting estimates made by management, as well as evaluating the overall presentation of the consolidated financial statements.

We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our opinion.

Basis for Qualified Opinion

As disclosed in Note 1 to the consolidated financial statements, International Financial Reporting Standards as issued by the IASB requires that consolidated financial statements be presented with comparative financial information. The accompanying consolidated financial statements have been prepared as of and for the year ended December 31, 2017 solely for the purpose of meeting the requirements of Rule 3-05 of Regulation S-X of the US Securities and Exchange Commission ("Rule 3.05"). Accordingly, no comparative financial information is presented.

Qualified Opinion

In our opinion, except for the effects of the matter described in the Basis for Qualified Opinion paragraph, the consolidated financial statements referred to above present fairly, in all material respects, the consolidated financial position of Peopledoc, SAS and its subsidiaries as of December 31, 2017, and their consolidated financial performance and their consolidated cash flows for the year then ended in accordance with International Financial Reporting Standards as issued by the IASB.

/s/ Audit Conseil Expertise, SAS

Paris , France

September 28, 2018

1 | CONSOLIDATED STATEMENT OF PROFIT AND LOSS AND OTHER COMPREHENSIVE INCOME |

Year Ended December 31, | |||||||

2017 | |||||||

In thousands of euros | Note | ||||||

Revenue | 18 | 15 386 | |||||

Cost of revenue | <5 221> | ||||||

Gross profit | 10 165 | ||||||

Research and development expenses | 20 | <2 529> | |||||

Sales and marketing expenses | <11 474> | ||||||

General and administrative expenses | <6 859> | ||||||

Customer care and success expenses | <1 920> | ||||||

Loss from operations | <12 617> | ||||||

Income from cash and cash equivalents | 23 | ||||||

Cost of gross financial debt | 23 | <13> | |||||

Finance costs, net | <13> | ||||||

Other financial income and expenses | 24 | <70> | |||||

Financial income | <83> | ||||||

Shared income in equity method's companies | - | ||||||

Income Tax | 25 | ||||||

Net loss | <12 700> | ||||||

Net loss attributable to the owners of the Company | <12 700> | ||||||

Year Ended December 31, | |||||||

In thousands of euros | |||||||

Net loss for the period | <12 700> | ||||||

Other comprehensive income (loss) | 5 | ||||||

Items that may be reclassified to profit or loss | |||||||

Actuarial gains and losses on post-employment benefits | <0> | ||||||

Actuarial gains and losses on net Investment in a Foreign Operation | <1 584> | ||||||

Foreign currency translation differences | 1 589 | ||||||

Total comprehensive loss for the year | <12 695> | ||||||

Attributable to shareholders of Peopledoc SAS | <12 695> | ||||||

2 | Consolidated statement of financial position |

2.1 | Assets |

Year Ended December 31, | ||

2017 | ||

Assets (in thousands of euros) | Note | |

Intangible assets | 2 | 3 790 |

Property, plant and equipment | 3 | 961 |

Other non-current financial assets | 4 | 815 |

Non-current assets | 5 566 | |

Trade receivables | 5 | 7 376 |

Other receivables | 6 | 817 |

Other current financial assets | 71 | |

Current tax assets | 7 | 1 703 |

Cash and cash equivalents | 8 | 4 815 |

Current assets | 14 782 | |

Total assets | 20 348 | |

2.2 | Liabilities and equity |

Year Ended December 31, | ||

2017 | ||

Equity and liabilities (in thousands of euros) | Note | |

Share capital | 9 / 10 | 225 |

Additional paid-in capital | 38 905 | |

Consolidated reserves | <23 734> | |

Foreign currency translation reserve | 965 | |

Retained earnings | <12 700> | |

Equity attributable to equity holders of the parent company | 3 661 | |

Total Equity | 3 661 | |

Financial debt | 12 | 2 220 |

Non-current provisions | 11 | 130 |

Non-current liabilities | 2 350 | |

Financial debt | 12 | 836 |

Current provisions | ||

Trade payables | 13 | 2 298 |

Deferred revenue | 13 | 6 927 |

Other current payables | 13 | 4 276 |

Current liabilities | 14 337 | |

Total equity and liabilities | 20 348 | |

3 | Cash flow statement |

Year Ended December 31, | ||

2017 | ||

In thousands of euros | Note | |

NET LOSS | <12 700> | |

Net allowances depreciation and amortization | 1 048 | |

Share based payment expense | 1 018 | |

Profit on disposal of non-current assets | 2 | |

Gross cash flow | <10 632> | |

Interest paid | 13 | |

Income tax expense recognised in profit or loss | <0> | |

Cash used for operations before cost of borrowing | <10 619> | |

Income taxes paid | 1 864 | |

Changes in working capital | 3 681 | |

CASH USED FOR OPERATING ACTIVITIES | <5 074> | |

Acquisition of tangible and intangible assets | <3 530> | |

Payments for financial investments | <174> | |

Sale of financial assets | 10 | |

CASH USED FOR INVESTING ACTIVITIES | <3 694> | |

Capital increases by owners of the Company | 186 | |

Variation of other financial debts | 12.1.2 | 2 962 |

Repayment of borrowings | 12.1.2 | <299> |

Interest paid | <13> | |

CASH FROM FINANCING ACTIVITIES | 2 836 | |

NET DECREASE (INCREASE) IN CASH AND CASH EQUIVALENTS | <5 933> | |

Effect of exchange-rate changes | <77> | |

CASH AND CASH EQUIVALENTS AT THE BEGINNING OF THE YEAR | 10 821 | |

CASH AND CASH EQUIVALENT AT THE END OF THE YEAR | 0 | 4 815 |

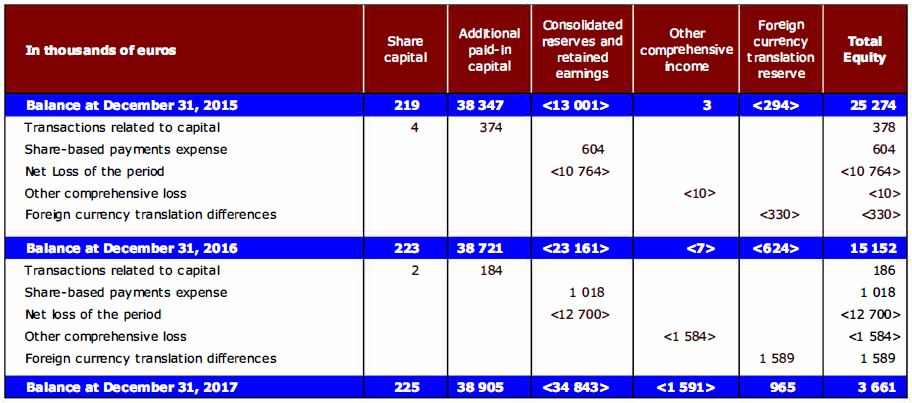

4 | Change in consolidated shareholders' equity |

Notes to the consolidated financial statements

Note: all the amounts presented in the consolidated summary documents are in thousands of euros.

1 | Accounting policies |

Peopledoc SAS (the "Company") is a company incorporated and domiciled in France.

In these financial statements and notes, PeopleDoc SAS is referred to as the Parent, and together with its subsidiaries, collectively as PeopleDoc Group, the Group, the Company or we.

The consolidated financial statements of the PeopleDoc Group (hereafter “the Group”) have been established by the President & CEO of PeopleDoc SAS, Jonathan Benhamou.

The group financial statements are in compliance with International Financial Reporting Standards (“IFRSs”) as issued by the International Accounting Standards Board (the “IASB”) except for the exclusion of comparative figures for the prior year required by IAS 1 "presentation of financial statements".

The purpose of these financial statements is to meet the reporting requirements of Rule 3-05 of Regulation S-X of the Securities and Exchange Commission and as such these are a set of non-statutory statements.

1.1 Adopted IFRS not yet applied

At the date of authorisation of these financial statements, the following Standards and Interpretations which have not been applied in these financial statements were in issue but not yet effective:

IFRS 15 Revenue from Contracts with Customers (effective from 1 January 2018), IFRS 9 Financial Instruments (effective from 1 January 2018); IFRS 16 Leases (effective from 1 January 2019); IFRS 17 Insurance Contracts (effective from 1 January 2021); IFRS 10 and IAS 28 (amendments) Sale or contribution of assets between an investor and its associate or joint venture (effective date to be determined).

The directors do not expect that the adoption of the Standards listed above will have a material impact on the financial statements of the Group in future periods.

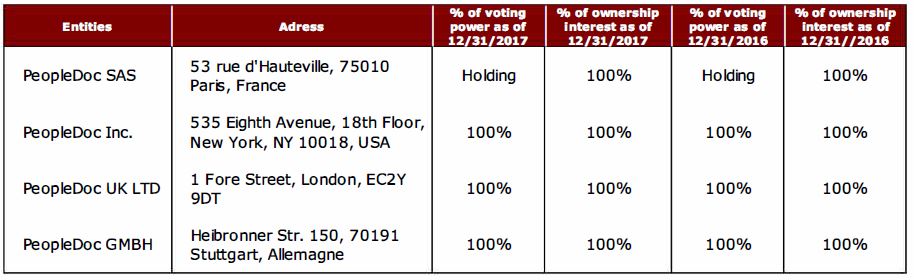

1.2 Basis for consolidation

Overview of the Group and its business

Created in 2007 as Novapost, the PeopleDoc Group is a global technology company that develops cloud-based digital solutions for human resource service delivery, specializing in case management, process automation and employee file management.

In these financial statements and notes, PeopleDoc SAS is referred to as the Parent, and together with its subsidiaries, collectively as PeopleDoc Group, the Group, the Company or we.

List of consolidated entities

No change in scope during the year 2017.

Full consolidation

All the entities over which the Group exercises control, i.e. those in which it is exposed or entitled to variable returns resulting from its involvement with these entities and when it has the capacity to influence these returns through its power over these entities, are fully consolidated.

The financial statements of subsidiaries are included in the consolidated financial statements from the date when control is obtained up until the date when the Group ceases to have control over them.

We have control over all of our subsidiaries, and consequently, all of the Group's subsidiaries are fully consolidated.

Year-end dates

The financial statements for the Group and the various consolidated entities have been prepared with the same year-end date of December 31, 2017.

1.3 Accounting estimates and judgements used when preparing the financial statements

Judgments

In connection with the process to apply accounting methods, the Group has exercised its judgement and taken into consideration the elements with the most significant impact on the amounts recorded in the financial statements.

Use of estimates

The valuation of certain balances for the statements of income and the statements of financial position when preparing the consolidated financial statements involves the use of assumptions, estimates or assessments with an impact on the application of the accounting methods and the amounts reported for assets, liabilities, revenue and expenses. These estimates and assumptions are reviewed on a regular basis. Changes in accounting estimates are recorded in the accounts during the period that they relate to.

Within the Group, estimates primarily concern the assumptions retained for calculating provisions for employee benefits and those retained for valuing the plans for awarding company founder stock warrants (BSPCE) to employees.

1.4 | Functional currency |

The consolidated financial statements are presented in thousands of euros. The euro is the functional currency of PeopleDoc SAS, the parent company, as well as the Group's reporting currency.

The functional currency, which is the currency that best reflects the economic environment in which the Group operates, is determined individually for each Group entity and is used to measure its financial position and operational results.

The assets and liabilities of consolidated companies expressed in foreign currencies are converted into euros based on the exchange rate in force on the closing date, except for the net position, which is recorded at its historical value. Income and expenses for these companies are converted into euros based on the average exchange rate for the period. Any exchange gains or losses resulting from conversions are recognized in other comprehensive income under “foreign currency translation differences”.

Foreign exchange differences on intra-group assets and liabilities are also recorded in the income statement. As an exception, these exchange differences are temporarily recognized in other comprehensive income

when the related monetary asset or liability is an integral part of the net investment in a foreign operation. This is indeed the case for loans and receivables relating to activities in the United States of America which the settlement is neither planned nor likely in the foreseeable future.

1.5 | Intragroup transactions |

Intragroup transactions and statements of financial position balances, as well as profits and losses resulting from transactions between Group companies, are fully eliminated in the consolidated financial statements.

1.6 | Intangible assets |

1.6.1 | Research and development costs |

Development costs, i.e. costs resulting from the application of research findings for a plan or model with a view to producing new or substantially improved products or techniques, are recorded as intangible assets if the Group is able to demonstrate that it simultaneously fulfils the criteria for the technical and commercial feasibility of the product or technique, the availability of sufficient resources to complete the development, the commitment to complete the intangible asset, the capacity to use or sell this intangible asset, the capacity to generate future economic benefits, and the capacity to reliably value the various expenses attributable to the intangible asset during its development.

The expenditure capitalized in this way notably includes development costs to create new products or provide new features for existing products, for which the capitalization criteria defined by IAS 38 are assessed by the marketing and R&D teams when launching these projects.

Capitalized expenditures are measured at their production cost based on the time spent by developers. Product time is valued based on salaries plus payroll taxes, applying a coefficient for costs.

The tax savings relating to the research tax credit (CIR), based on the eligible section of research and development costs, are included in the valuation of the intangible assets recorded in this way.

Amortization of capitalized research and development begins when capitalization stops and is calculated on a straight-line basis over the assets’ useful lives estimated at five years.

1.6.2 | Other intangible assets |

Patents, trademarks, and fully-owned software and user rights are capitalized and amortized over their estimated useful lives, ranging from one to three years.

1.7 | Property, plant and equipment |

Property, plant and equipment are initially recorded at their acquisition cost, plus direct acquisition costs, less the amount of accumulated depreciation and amortization.

Depreciation is calculated on a straight-line basis depending on the estimated useful life of the item of property, plant and equipment concerned. No residual value is associated with these fixed assets. The main depreciation schedules are as follows:

• | General fixtures and fittings: 10 years, |

• | Office equipment and furniture: 5 to 10 years, |

• | IT equipment: 3 years. |

The useful lives and depreciation methods for assets are reviewed and, if applicable, adjusted at each reporting date, and the changes are recorded on a prospective basis as a change of accounting estimate.

1.8 | Impairment of assets |

When an event or a change in the economic environment indicates a risk of impairment for other intangible assets, property, plant and equipment, or work-in-progress, the Group reviews the value of these assets.

This test is carried out to compare an asset's recoverable value with its book value.

An asset's recoverable value, which is used for calculating potential impairments in value, corresponds to the higher of the asset's fair value, after deducting sales costs, and its value-in-use.

The value-in-use of each asset or group of assets is determined based on the present value of future cash flows (discounted cash flow method) using a specific discount rate, after tax, for each asset or group of assets concerned.

The fair value corresponds to the amount obtained from the sale of the asset or group of assets under conditions for normal competition between well-informed, consenting parties, after deducting the sales costs.

An impairment loss is recognized when the book value of the asset or the cash generating unit which it belongs to is greater than its recoverable value. If applicable, impairments are recognized in profit or loss.

Other impairment losses recorded previously may be reversed.

No impairments were recorded at December 31, 2017 or 2016.

1.9 | Financial assets |

▪ | Trade receivables |

Trade receivables are measured at their fair value when initially recorded in the accounts, and then at their net realizable value. Depreciation is performed if the probability of trade receivables collection is lower than their book value.

v | Cash and cash equivalents |

Cash and cash equivalents include liquid assets and short-term investments that have a maturity of less than three months from the acquisition date and satisfy the criteria for IAS 7.

Cash corresponds to the total amount of cash on hand and demand deposits with banks.

Short-term investments are measured at their market value at each reporting date.

v | Non-current and current financial assets |

• | Non-current: investments with a fixed maturity of over one year which the Group has both the intent and the ability to hold to maturity are classified as non-current assets. They are recorded at their amortized cost, determined based on the effective interest rate for investments, less any impairment charges. |

• | Current: marketable securities, other investment securities and other financial instruments held for trading are classified as current assets. They are recognized at fair value. The gains or losses resulting from this measurement are recognized in profit or loss for the period which they relate to. |

v | Financial assets are classified as available for sale and measured at fair value. |

The gains or losses resulting from this measurement are recognized directly in equity until the financial asset is realized. Indeed, when these investments are derecognized, the cumulative gains and losses previously recognized directly in equity are recognized in profit or loss. When these instruments accrue interest, the amount of interest, calculated using the effective interest rate method, is recognized in profit or loss.

When possible, the fair value of assets held for trading and available for sale are defined in relation to their stock market value. In cases when they are not listed, cash flow discounting techniques are used.

1.10 | Finance leases |

Leases are recorded as finance leases when they transfer virtually all the related and inherent risks and benefits to the lessee. The classification as a finance lease is based on the content of these contracts and determined when an agreement is entered into, in accordance with the principles defined by IAS 17.

In 2017, the Group did not have any significant finance leases.

1.11 | Shareholders' equity |

v | Dividends |

The company has never declared a dividend since its inception.

v | Share-based payments expense |

Since being created, the Parent has set up several payment schemes leading to the awarding of equity instruments, based on stock options awarded to the Group's employees.

The Group has applied IFRS 2 for all the equity instruments awarded to employees.

The fair value of the bonus shares and options awarded are recorded under personnel costs as an increase in shareholders' equity. The fair value is measured on the date when bonus shares and options are awarded and spread over the vesting period for employees.

1.12 | Financial liabilities |

Financial liabilities are classified into two categories: financial liabilities recorded at amortized cost and financial liabilities recorded at fair value through profit or loss.

At December 31, 2017, the Group did not have any financial liabilities measured at fair value through profit or loss. Within the Group, financial liabilities measured at amortized cost primarily include trade payables.

1.13 | Other liabilities |

1.13.1 | Provisions |

The Group records provisions on the statement of financial position when it has a current obligation (legal or constructive) resulting from a past event, when it is likely that an outflow of resources will be required to settle the obligation, and when the amount of this obligation can be reliably estimated.

When the impact is significant, provisions are discounted. The method used involves discounting future cash flows, based on a pre-tax rate that reflects the market's expectations for the cost of money, as well as the obligation's specific risks in certain cases.

1.13.2 | Employee benefits |

In accordance with the laws and practices in France, the Group has obligations relating to employee benefits and particularly post-employment benefits.

Retirement benefits and related commitments: in certain countries, the legislation or agreements in place include arrangements for the payment of benefits to employees, either on their retirement date, or at certain moments following their retirement, depending on their seniority and their salary at retirement age

• | These post-employment benefits are offered through defined benefit plans. The amount of future commitments involved with these plans is assessed based on actuarial assumptions in line with the projected unit credit method. |

• | Their calculation takes into account various demographic assumptions (staff turnover, mortality, etc.) and financial assumptions (future pay rises, rate of inflation, etc.) defined at the limits of each entity concerned and is discounted. |

• | The discount rate, defined for each country or region, is determined with reference to the return on high-quality long-term corporate bonds (or government bonds if there is no active market), |

• | The actuarial gains or losses relating to post-employment benefits are recognized in full in other comprehensive income. |

• | The Group's defined benefit plans are not funded. |

The main actuarial assumptions used to calculate the liability are as follows:

The provisions recorded in the Group's financial statements are explained in note 11.

Year Ended December 31, | |

2017 | |

Discount rate | 1,29% |

Salary growth rate | 2,50% |

Social security charges rate | 47,27% |

Turnover assumption | 5,00% |

1.14 | Recognition of revenues |

1.14.1 | Revenue Recognition |

The Company derives its revenues primarily from two sources: (1) subscription revenues, which are comprised of subscription fees from customers accessing the Company’s enterprise cloud computing services and from customers paying for additional support beyond the standard support that is included in the basic subscription fees; and (2) related professional services such as project management, implementation services and other revenue. “Other revenue” consists primarily of training fees.

The Company commences revenue recognition when all of the following conditions are satisfied:

• | there is persuasive evidence of an arrangement; |

• | the service has been or is being provided to the customer; |

• | the collection of the fees is reasonably assured; and |

• | the amount of fees to be paid by the customer is fixed or determinable. The Company’s subscription service arrangements are non-cancelable and do not contain refund-type provisions. |

Subscription and Support Revenues: Subscription and support revenues are recognized ratably over the contract terms beginning on the commencement date of each contract, which is the date the Company’s service is made available to customers. Amounts that have been invoiced are recorded in accounts receivable and in deferred revenue or revenue, depending on whether the revenue recognition criteria have been met.

Professional Services and Other Revenues: The Company’s professional services contracts are either on a time and materials, fixed fee basis or subscription basis. These revenues are recognized as the services are rendered for time and materials contracts, when the milestones are achieved and accepted by the customer, or on a proportional performance basis for fixed price contracts and ratably over the contract term for subscription professional services contracts. The milestone method for revenue recognition is used when there is substantive uncertainty at the date the contract is entered into whether the milestone will be achieved. Training revenues are recognized as the services are performed.

1.14.2 | Deferred Revenue |

The deferred revenue balance does not represent the total contract value of annual or multi-year, non- cancelable subscription agreements. Deferred revenue primarily consists of billings or payments received in advance of revenue recognition from subscription services described above and is recognized as the revenue recognition criteria are met. The Company generally invoices customers in annual installments. The deferred revenue balance is influenced by several factors, including seasonality, the compounding effects of renewals, invoice duration, invoice timing, dollar size and new business linearity within the quarter.

Deferred revenue that will be recognized during the succeeding twelve-month period is recorded as current deferred revenue and the remaining portion is recorded as noncurrent.

1.15 | Corporate income tax |

The tax expense recorded in profit or loss includes current and deferred tax. The tax expense or income relating to current or deferred tax is recognized in profit or loss unless it relates to elements that are recognized directly in equity. In this case, the tax impact is recorded in a shareholders' equity account.

1.15.1 | Current tax |

Current tax is assessed based on the tax rate and tax legislation adopted or about to be adopted on the reporting date, as well as any adjustments relating to tax liabilities from previous years.

The research tax credit (Crédit impôt recherche) and innovation tax credit (Crédit d’impôt innovation) are recorded against research and development costs or capitalized development costs.

The tax credit promoting competitiveness and employment (CICE) is deducted from personnel costs and allocated to the various functions.

1.15.2 | Deferred tax |

Any differences on the reporting date between the tax value of assets and liabilities and their book value on the consolidated statement of financial position result in timing differences. These differences are recognized as:

• | Deferred tax assets, when the tax value is higher than the book value (future tax saving), |

• | Deferred tax liabilities, when the tax value is lower than the book value (future tax expense). |

Deferred taxes are recorded in line with the asset-liability approach for the accrual method. Deferred taxes are valued factoring in known changes in tax rates (and tax regulations) that have been adopted or virtually adopted by the reporting date. The impact of any changes in the tax rate on deferred taxes recognized previously in profit or loss or in equity is recorded respectively in profit or loss or in equity during the year when such rate changes come into force.

Deferred taxes are recognized respectively in profit or loss or other comprehensive income or in equity during the year depending on whether they concern items that are themselves recognized in profit or loss or in equity.

Deferred tax assets are recorded if and only if it is likely that taxable profits will be generated, making it possible for any deferred tax assets to be used. If the probability is not high, such assets are not recorded.

The book value of deferred tax assets is reviewed at each reporting date to determine whether this value needs to be reduced if it is no longer likely that sufficient taxable profits will be available to make it possible to use the benefit of all or part of such deferred tax assets. Conversely, such a reduction will be written back if it becomes likely that sufficient taxable profits will be available.

Deferred tax assets and liabilities are not discounted. Deferred tax assets are recorded in relation to tax losses if and only if it is likely that there will be future taxable profits in the near future which these unused tax credits and tax losses may be allocated against.

In line with the schedule for recovering PeopleDoc's tax-loss carryforwards, the Group has not recorded any deferred tax assets.

The stock of tax-loss carryforwards available represents 37 069 k €.

The corresponding tax value represents 7 278 k€.

1.16 | Financial income and expenses |

Financial income and expenses primarily include:

• | Interest income relating to cash and cash equivalents, |

• | And interest expenses relating to financing for the operating and investment cycle. |

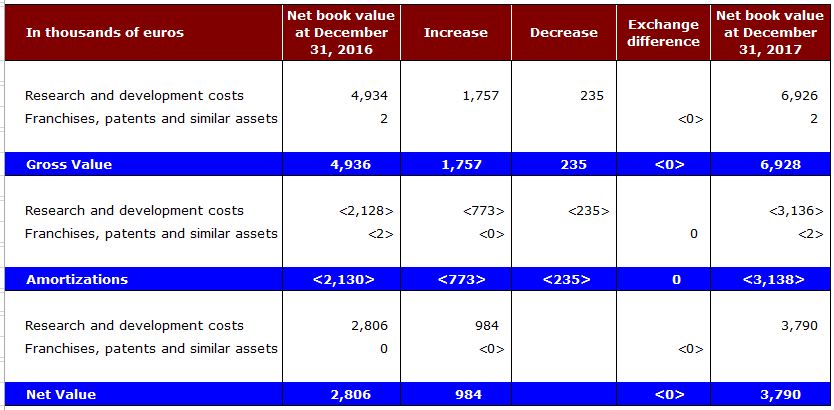

2 | Intangible assets |

R & D expenses consist mainly of staff costs allocated to development minus research tax credits.

The increase in R & D expenses at December 31, 2017 is as follows:

• | Personnel costs : 3 169 k€, |

• | Research tax credit receivables: - 1 412 k€. |

The repayment of the 2017 research tax credit is expected in October 2018.

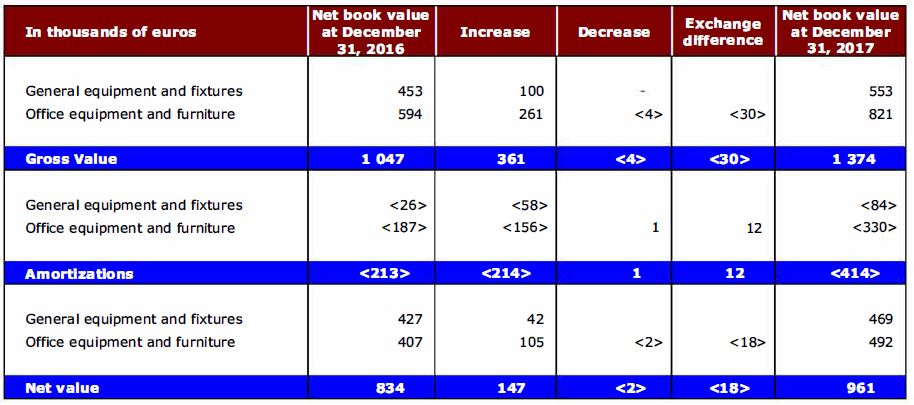

3 | Property, plant and equipment |

4 | Other non-current financial assets |

Year Ended December 31, | |

2017 | |

In thousands of euros | |

Other financial assets | 815 |

Total other financial assets | 815 |

Other financial assets primarily include security deposits relating to the renting of the Group's premises as well as stamps deposits received from customers.

5 | Trade receivables |

Year Ended December 31, | |

2017 | |

In thousands of euros | |

Customer receivables | 7 430 |

Provisions | <54> |

Trade accounts receivables | 7 376 |

6 | Other receivables |

Year Ended December 31, | |

2017 | |

In thousands of euros | |

Social receivables | 20 |

Tax receivables | 139 |

Tax and social receivables | 159 |

Prepaid expenses | 627 |

Other receivables | 31 |

Total other receivables | 817 |

7 | Current tax assets |

The total amount of 1.7 million euros corresponds to tax credit receivables (Credit Impot Recherche, CIR and Crédit d'impôt pour la compétitivité et l'emploi CICE) waiting to be reimbursed.

8 | Cash and cash equivalents |

Year Ended December 31, | |

2017 | |

Detail of cash (in thousands of euros) | |

Cash | 4 815 |

NET CASH | 4 815 |

9 | Share capital |

The share capital comprises 22,452,223 shares with a par value of 0.01 euros.

During the year, the Group carried out three capital increases:

On March 29, 2017, for 12.35 euros, issuing 1,235 new shares with a par value of 0.01 euros, combined with an issue premium of 1.6094 euros per share.

On June 08, 2017, for 1,584.00 euros, issuing 158,400 new shares with a par value of 0.01 euros, combined with an issue premium of 0.8999 euros per share.

On November 11, 2017, for 247.01 euros, issuing 24,701 new shares with a par value of 0.01 euros, combined with an issue premium of 1.6094 euros per share.

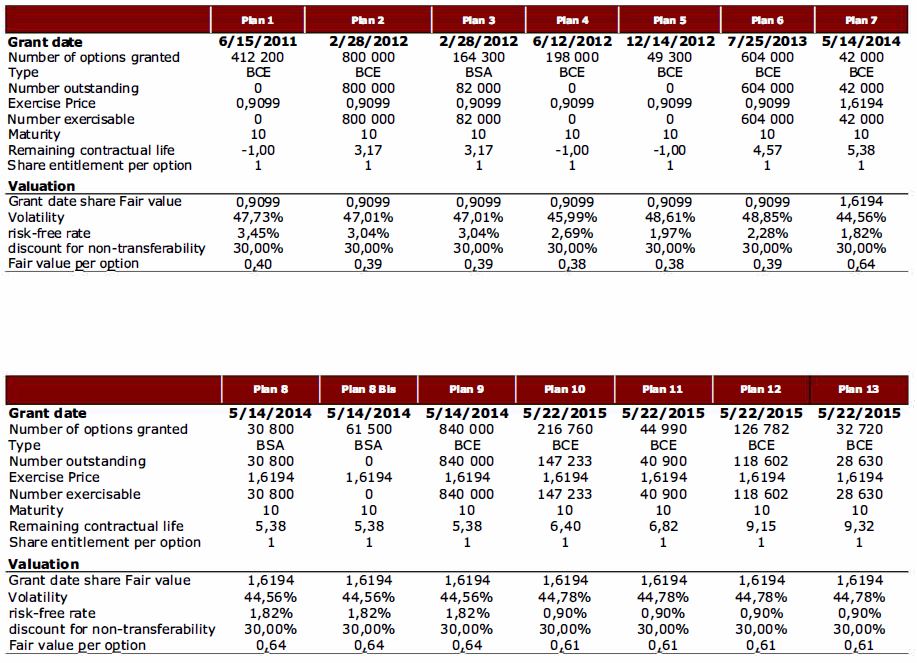

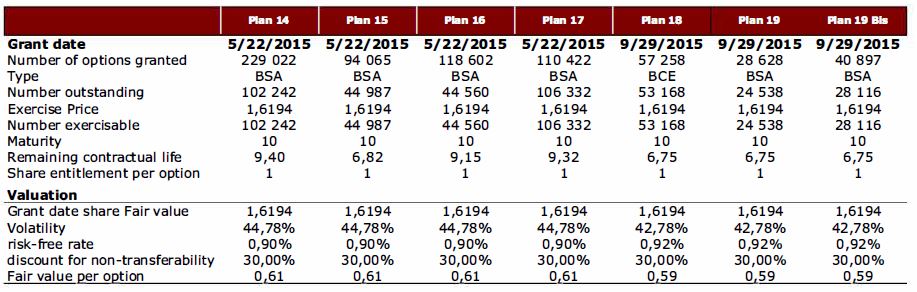

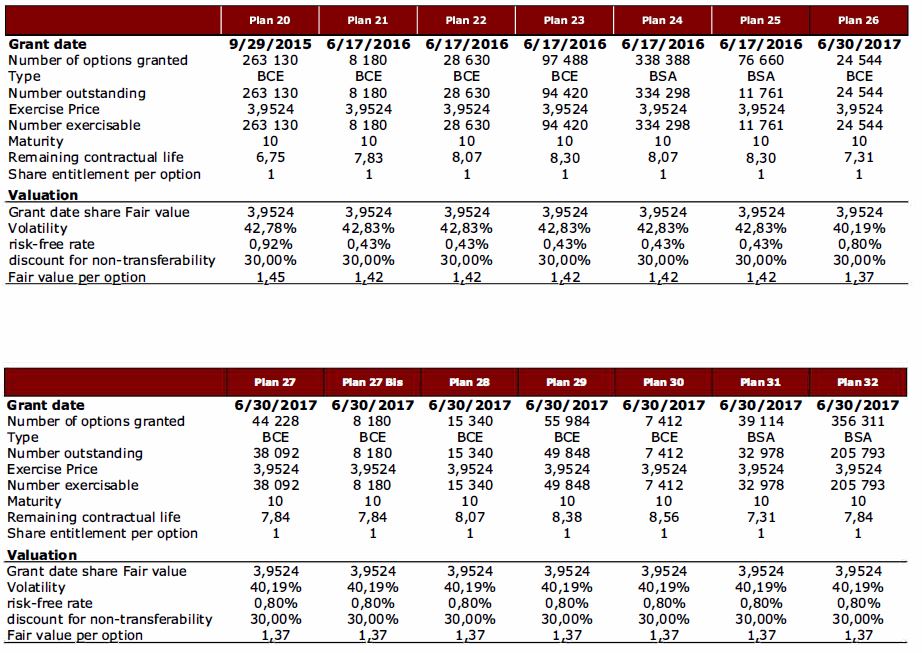

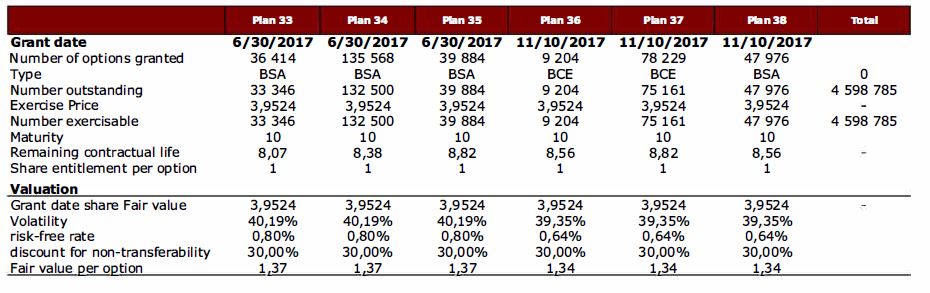

10 | Share-based payments |

The Parent has issued potentially dilutive instruments to key managers. The instruments concerned are stock options (hereafter “BSA stock options”) and company founder stock warrants (hereafter “BSPCE company founder stock warrants”).

These BSA stock options and BSPCE company founder stock warrants are financial instruments that enable beneficiaries to subscribe for PeopleDoc SAS shares at a given price and on a given date, in a fixed proportion.

In line with IFRS 2, these benefits are recorded under personnel costs (contra entry in equity) in the consolidated accounts.

The valuation methods used to estimate the fair value of the plans giving access to the Company's capital are as follows:

• | The share price on the grant date is equal to the strike price; |

• | The risk-free rate used is the 10-year OAT rate on the grant date, with the plans granted over this period; |

• | Volatility was determined on the basis of a comparable companies sample; |

• | The price discount related to the non-transferability of stock options compared to transferable equivalent optional instruments, was chosen on the the SFEV’s work basis (French assessor company); |

• | The Black & Scholes valuation model is used to measure the fair value of the plans giving access to the Company's capital. |

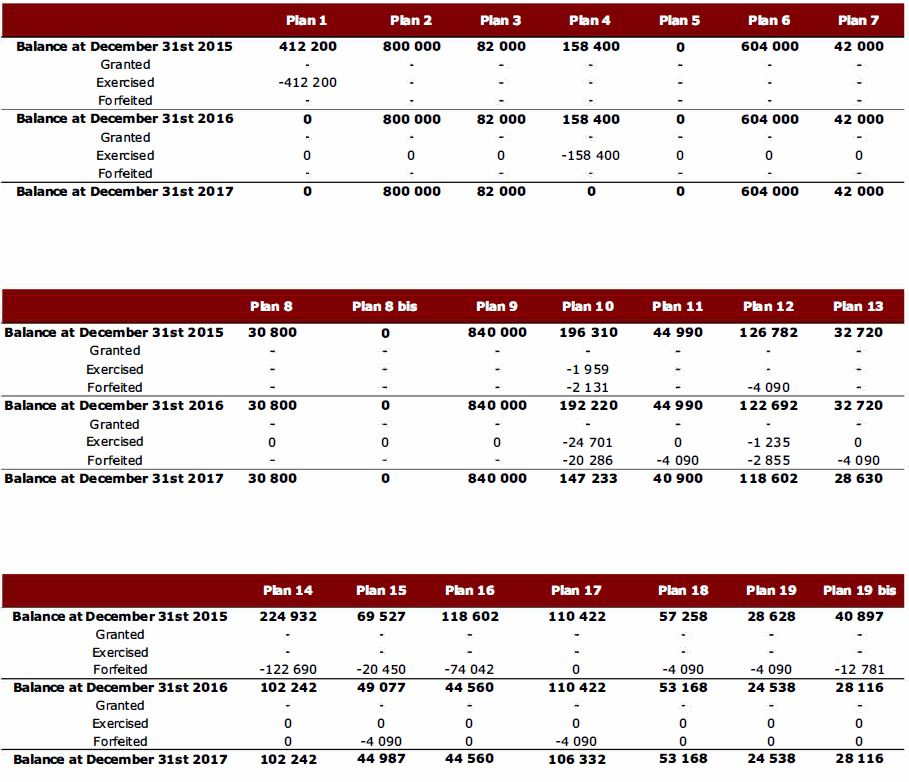

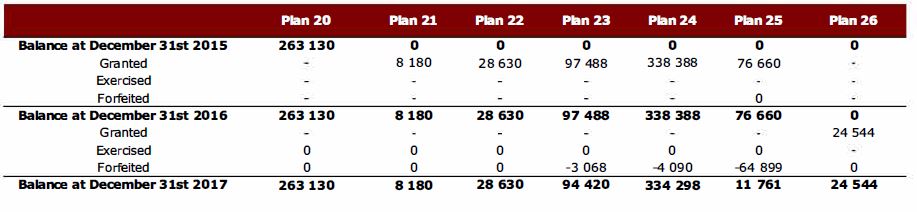

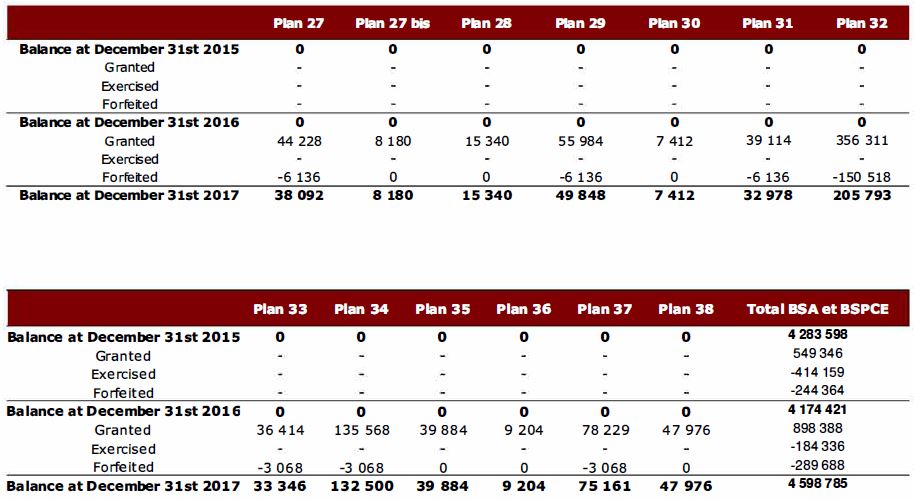

10.1.1 | Details of BSA and BSPCE |

10.1.2 | Change in Number of BSA and BSPCE outstanding |

10.1.3 | Plans characteristics |

Plan 1 | ; |

Plan 2 | The vesting for the intended beneficiaries is as follow: The Beneficiaries may only exercise their BSCPE in the event of a liquidity event consisting in the sale of at least 50% of the Company's shares held by the shareholders of the Company. It being specified, and under penalty of being declared void, that the BSCPE shall be exercised, no later than the day on which the Liquidity Event is completed. |

Plan 3 | The Beneficiary may exercise the warrants as of December 31, 2013 - The Beneficiary must exercise all of its acquired rights in any event before the expiration of ten (10) years from the date of the warrants allocation, ie before February 28, 2022. |

Plan 4 | The BSCPE will be vesting by thirds over three years from June 12, 2013 until the expiry date of June 11, 2017 |

Plan 5 | The BSCPE will be vesting by thirds over three years from December 14, 2013 until the expiry date of December 13, 2017 |

Plan 6 | The Beneficiaries may only exercise their BSCPE in the event of a liquidity event consisting in the sale of at least 50% of the Company's shares held by the shareholders of the Company. It being specified, and under penalty of being declared void, that the BSCPE shall be exercised, no later than the day on which the Liquidity Event is completed. |

Plans 7, 8bis and 9 | The vesting for the intended beneficiaries is as follow: a. 25% acquired as of May 14, 2015 and up to the Expiry Date, provided that no Departure has occurred before then; and b. the balance (75%) being acquired in successive one-month periods, equal percentage, during each of the thirty-six (36) months running from May 15, 2015 to May 13, 2024 |

Plan 8 | The Beneficiary may exercise the warrants as of May 14, 2014 - The Beneficiary must exercise all of its acquired rights in any event before the expiration of ten (10) years from the date of the warrants allocation, ie before May 13, 2024. |

Plans 10 and 14 | The vesting for the intended beneficiaries is as follow: a. 25% acquired as of May 22, 2015 and up to the Expiry Date (as defined in the Plan), provided that no Departure has occurred before then; and b. the balance (75%) being acquired in successive one-month periods, equal percentage, during each of the thirty-six (36) months running from May 22, 2015 to May 21, 2025 |

Plans 11 and 15 | The vesting for the intended beneficiaries is as follow: a. 25% acquired as of October 22, 2015 and up to the Expiry Date (as defined in the Plan), provided that no Departure has occurred before then; and b. the balance (75%) being acquired in successive one-month periods, equal percentage, during each of the thirty-six (36) months running from October 22, 2015 to May 21, 2025 |

Plans 12 and 16 | The vesting for the intended beneficiaries is as follow: a. 25% acquired as of February 22, 2016 and up to the Expiry Date (as defined in the Plan), provided that no Departure has occurred before then; and b. the balance (75%) being acquired in successive one-month periods, equal percentage, during each of the thirty-six (36) months running from February 22, 2016 to May 21, 2025 |

Plans 13 and 17 | The vesting for the intended beneficiaries is as follow: a. 25% acquired as of April 22, 2016 and up to the Expiry Date (as defined in the Plan), provided that no Departure has occurred before then; and b. the balance (75%) being acquired in successive one-month periods, equal percentage, during each of the thirty-six (36) months running from April 22, 2016 to May 21, 2025 |

Plans 18, 19 and 20 | The vesting for beneficiaries whose allocation was approved by the Strategic Committee dated September 29, 2015 is as follows: a. 25% acquired as of September 29, 2016 and up to the Expiry Date (as defined in the Plan), provided that no Departure has occurred before then; and b. the balance (75%) being acquired in successive one-month periods, equal percentage, during each of the thirty-six (36) months running from September 29, 2016 to September 28, 2025 |

Plan 19 bis | The vesting for beneficiaries whose allocation was approved by the Strategic Committee dated September 29, 2015 is as follows: a. 25% acquired as of October 1st, 2015 and up to the Expiry Date (as defined in the Plan), provided that no Departure has occurred before then; and b. the balance (75%) being acquired in successive one-month periods, equal percentage, during each of the thirty-six (36) months running from September 29, 2015 to September 28, 2025 |

Plan 21 | The vesting for the intended beneficiaries is as follow: a. 25% acquired as of October 29, 2016 and up to the Expiry Date (as defined in the Plan), provided that no Departure has occurred before then; and b. the balance (75%) being acquired in successive one-month periods, equal percentage, during each of the thirty-six (36) months running from October 29, 2016 to June 16, 2026 |

Plans 22 and 24 | The vesting for the intended beneficiaries is as follow: a. 25% acquired as of January 26, 2017 and up to the Expiry Date (as defined in the Plan), provided that no Departure has occurred before then; and b. the balance (75%) being acquired in successive one-month periods, equal percentage, during each of the thirty-six (36) months running from January 26, 2018 to June 16, 2026 |

Plans 23 and 25 | The vesting for the intended beneficiaries is as follow: a. 25% acquired as of April 21, 2017 and up to the Expiry Date (as defined in the Plan), provided that no Departure has occurred before then; and b. the balance (75%) being acquired in successive one-month periods, equal percentage, during each of the thirty-six (36) months running from April 21, 2017 to June 16, 2026 |

Plans 26 and 31 | The vesting for the intended beneficiaries is as follow: a. 25% acquired as of July 22, 2017 and up to the Expiry Date (as defined in the Plan), provided that no Departure has occurred before then; and b. the balance (75%) being acquired in successive one-month periods, equal percentage, during each of the thirty-six (36) months running from July 22, 2017 to June 29, 2027 |

Plans 27 and 32 | The vesting for the intended beneficiaries is as follow: a. 25% acquired as of November 4, 2017 and up to the Expiry Date (as defined in the Plan), provided that no Departure has occurred before then; and b. the balance (75%) being acquired in successive one-month periods, equal percentage, during each of the thirty-six (36) months running from November 4, 2017 to June 29, 2027 |

Plan 27 bis | The vesting for the intended beneficiaries is as follow: a. 25% acquired as of January 26, 2017 and up to the Expiry Date (as defined in the Plan), provided that no Departure has occurred before then; and b. the balance (75%) being acquired in successive one-month periods, equal percentage, during each of the thirty-six (36) months running from January 26, 2017 to June 29, 2027 |

Plans 28 and 33 | The vesting for the intended beneficiaries is as follow: a. 25% acquired as of January 27, 2018 and up to the Expiry Date (as defined in the Plan), provided that no Departure has occurred before then; and b. the balance (75%) being acquired in successive one-month periods, equal percentage, during each of the thirty-six (36) months running from January 27, 2018 to June 29, 2027 |

Plans 29 and 34 | The vesting for the intended beneficiaries is as follow: a. 25% acquired as of May 18, 2018 and up to the Expiry Date (as defined in the Plan), provided that no Departure has occurred before then; and b. the balance (75%) being acquired in successive one-month periods, equal percentage, during each of the thirty-six (36) months running from May 18, 2018 to June 29, 2027 |

Plans 30 and 36 | The vesting for the intended beneficiaries is as follow: a. 25% acquired as of July 25, 2018 and up to the Expiry Date (as defined in the Plan), provided that no Departure has occurred before then; and b. the balance (75%) being acquired in successive one-month periods, equal percentage, during each of the thirty-six (36) months running from July 25, 2018 to November 9, 2027 |

Plans 35 and 37 | The vesting for the intended beneficiaries is as follow: a. 25% acquired as of October 26, 2018 and up to the Expiry Date (as defined in the Plan), provided that no Departure has occurred before then; and b. the balance (75%) being acquired in successive one-month periods, equal percentage, during each of the thirty-six (36) months running from October 26, 2018 to November 9, 2027 |

Plans 36 and 38 | The vesting for the intended beneficiaries is as follow: a. 25% acquired as of July 25, 2018 and up to the Expiry Date (as defined in the Plan), provided that no Departure has occurred before then; and b. the balance (75%) being acquired in successive one-month periods, equal percentage, during each of the thirty-six (36) months running from July 25, 2018 to November 9, 2027 |

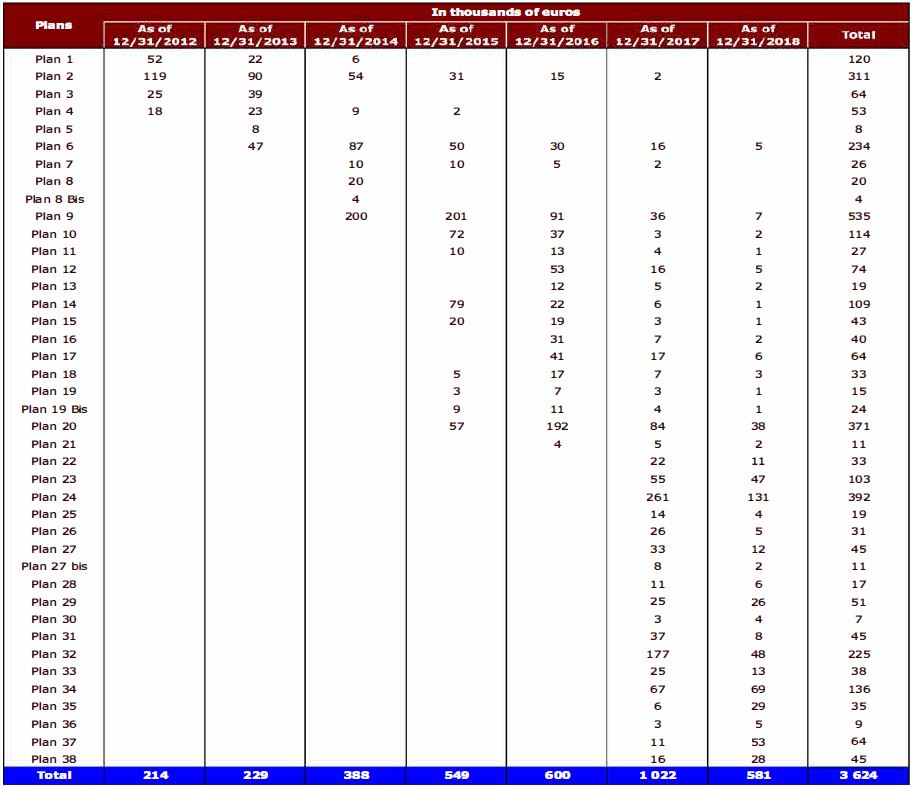

10.1.4 | Spread of Share based Payment Expenses |

Considering the conditions for exercising the BSA stock options and BSPCE company founder stock warrants awarded, the expense relating to each plan is spread over its vesting period.

Spread of expenses

11 | Non-current provisions |

In thousands of euros | As of 12/31/2016 | Dotations | OCI | As of 12/31/2017 |

Provisions for employee benefits | 69 | 61 | 0 | 130 |

Total | 69 | 61 | 0 | 130 |

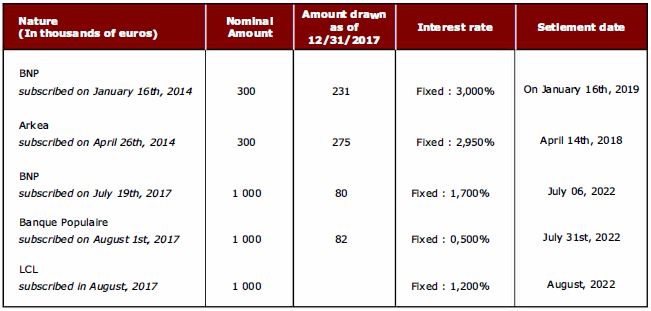

12 | Financial debt |

The Group holds five loans from banks institutions. The characteristics of which are as follows:

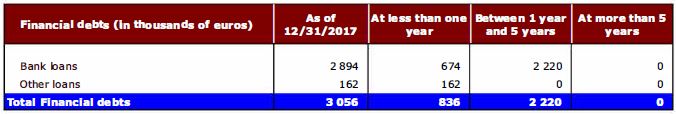

12.1.1 | Breakdown by maturity |

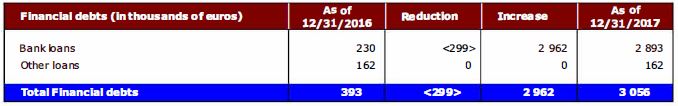

12.1.2 | Changes during the year |

13 | Current liabilities |

Year Ended December 31, | |

2017 | |

In thousands of euros | |

Trade payables | 2 298 |

Down payments received | |

Current accounts – liabilities | 11 |

Paid leave & bonus provisions, Social security payable | 3 054 |

Taxes payable | 1 120 |

Deferred income | 6 926 |

Other trade payables | 92 |

Total | 13 501 |

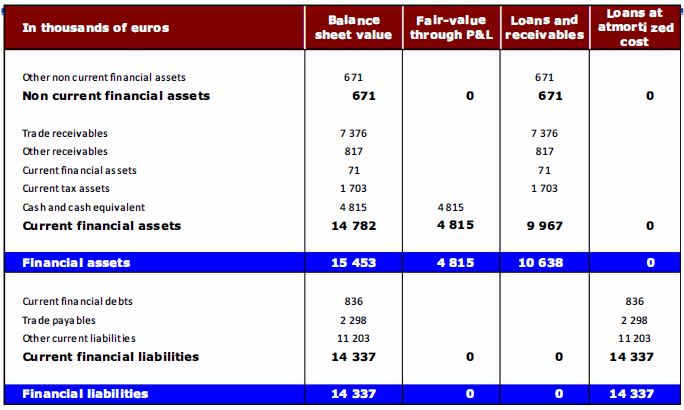

14 | Fair value of financial assets and liabilities |

15 | Financial risk management |

15.1.1 | Credit risk |

The credit risk relating to cash, cash equivalents, current financial instruments and trade receivables is not significant in view of the quality of the financial institutions that the Company and the Group's main customers work with.

15.1.2 | Rate risk |

The PeopleDoc Group is exposed to a non-significant rate risk in view of the outstanding levels of capital and the maturities of its borrowings.

15.1.3 | Foreign exchange risk |

The operational foreign exchange risks on operating or financial flows not denominated in the entities' operating currencies are not significant in terms of transactions in foreign currencies other than the euro.

The Group is therefore primarily exposed to foreign exchange risks linked to the conversion, for preparing the consolidated accounts, of the foreign currency accounts of consolidated subsidiaries with a different functional currency other than the euro.

As of 12/31/2017 | |||

In thousands of euros | USD | GBP | |

Trade receivables | 1 147 | 84 | |

Trade payables | <1 033> | <79> | |

Current accounts | 153 | 3 | |

Currencies appreciation against the euro | |||

Impact on the Income statement | |||

In thousands of euros | As of 12/31/2017 | ||

+10 % | -10 % | ||

Trade receivables | 105 | <105> | |

Trade payables | <95> | 95 | |

Current accounts | 13 | <13> | |

Total | 23 | <23> | |

The exchange risk sensitivity table above presents the impact of a 10% appreciation or depreciation in the euro against the other currencies for the amounts of trade receivables, trade payables and current accounts denominated in currencies other than the euro.

16 | Commitments received & given |

PeopleDoc received a bank guarantee from BNP PARIBAS for its French office lease (situated on 53, Hauteville street, 75010 Paris, France) in the amount of 684 732 euros in 2016. This facility was backed by 352 366 euros of cash collateral deposit provided to BNP PARIBAS bank.

PeopleDoc has received the following financial commitments:

• | financing for the benefit of BNP PARIBAS: 710 000 euros from BPIFRANCE |

• | financing for the benefit of LCL: 500 000 euros from BPIFRANCE |

PeopleDoc has given also the following commitments:

• | Business pledge of de 25 000 euros to Arkea Bank |

• | Business pledge of 1 360 000 euros to bank BNP PARIBAS |

• | Business pledge of 1 150 000 euros to bank LCL |

• | Business pledge of 1 200 000 euros to bank Banque Populaire |

In 2016 PeopleDoc SAS signed an 8-year rent agreement for its French office situated on 53 rue d’Hauteville, Paris 75010, France. Annual rent is of 769 000 euros.

17 | Transactions with related parties |

Intercompany cash management agreements (loan agreements) have been signed between PeopleDoc SAS and its subsidiaries.

18 | Segment reporting |

The Company operates as one operating segment. Operating segments are defined as components of an enterprise for which separate financial information is evaluated regularly by the chief operating decision maker, who is the chief executive officer, in deciding how to allocate resources and assessing performance.

Over the past few years, including 2017, the Company has expanded its platform and services offerings, in various market segments of the enterprise cloud computing market. While the Company has offerings in multiple enterprise cloud computing market segments, the Company’s business operates in one operating segment because the majority of the Company’s offerings operate on a single platform and are deployed in an identical way, and the Company’s chief operating decision maker evaluates the Company’s financial information and resources and assesses the performance of these resources on a consolidated basis. Since the Company operates in one operating segment, all required financial segment information can be found in the consolidated financial statements.

In thousands of euros | Europe | North America | Total |

As of | As of | As of | |

12/31/2017 | 12/31/2017 | 12/31/2017 | |

Revenues | 12 416 | 2 970 | 15 386 |

Operating loss | <7 313> | <5 304> | <12 617> |

Non current assets | 5 451 | 115 | 5 566 |

Revenues per country

Year Ended December 31, | |

2017 | |

In thousands of euros | 31/12/2017 |

Europe | |

France | 11 641 |

Germany | 664 |

UK | 111 |

North America | |

USA | 2 904 |

Canada | 67 |

In 2017, our largest client represented 3% of our consolidated revenue.

19 | Breakdown of operating expenses |

Year Ended December 31, | |

2017 | |

In thousands of euros | |

Used purchases | <1 209> |

Personnel costs or expenses | <16 497> |

Taxes | <392> |

Depreciation, amortization and provision | <1 067> |

Other operating income | 11 |

Other operating expenses | <8 850> |

Operating expenses | <28 004> |

19.1.1 | Other operating expenses |

Year Ended December 31, | |

2017 | |

In thousands of euros | |

Subcontracting | <155> |

Lease payments | <6> |

Rents | <1 277> |

Maintenance and repairs | <209> |

Insurance premiums | <71> |

Miscellaneous | <55> |

External staff | <654> |

Fees | <1 368> |

Advertising | <973> |

Transportation costs | <3> |

Travel expenses | <1 429> |

Postage and telecommunication | <2 496> |

Bank fees | <79> |

Other external charges | <69> |

Other operating expenses | <4> |

Net book value of tangible assets sold | <2> |

Total | <8 850> |

19.1.2 | Depreciation and amortization |

Year Ended December 31, | |

2017 | |

In thousands of euros | |

Non current assets depreciation | <1 006> |

Provisions for pensions | <61> |

Total allowances provisions | <1 067> |

Net allowances provisions | <1 067> |

20 | Research and development costs |

Year Ended December 31, | |

2017 | |

In thousands of euros | |

R&D expenses incurred during the period | <4 925> |

Capitalized development costs | 3 169 |

Depreciation and amortization | <1 350> |

Innovation tax credit | 0 |

Amortization of research tax credit | 577 |

Subsidies | |

Total research and development expenses | <2 529> |

21 | Workforce |

Year Ended December 31, | |

2017 | |

Workforce | |

PeopleDoc SAS | 140 |

PeopleDoc INC. | 45 |

PeopleDoc UK LTD | 7 |

PeopleDoc GMBH | 14 |

Total | 206 |

22 | Statutory auditors’ fees |

Year Ended December 31, | |

2017 | |

In thousands of euros | |

Statutory audit fees, certification, auditing of the legal accounts | 28 |

PeopleDoc SAS | 28 |

Other services rendered | 16 |

PeopleDoc SAS | 16 |

Auditor's fees | 44 |

23 | Cost of financial debt |

Year Ended December 31, | |

2017 | |

In thousands of euros | |

Income from cash and cash equivalents | 0 |

Other financial expenses | <13> |

Total | <13> |

24 | Other financial income and expenses |

Year Ended December 31, | |

2017 | |

In thousands of euros | |

Foreign exchange gains | 1 |

Other financial incomes | 0 |

Financial cost of pension - discounting effects | <1> |

Foreign exchange losses | <55> |

Other financial expenses | <15> |

Total | <70> |

25 | Corporate income tax |

25.1.1 | Tax charges |

Year Ended December 31, | |

2017 | |

In thousands of euros | |

Tax payable | |

Deferred tax | 0 |

TOTAL income tax expenses | 0 |

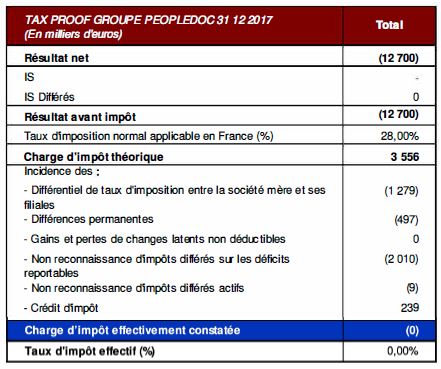

25.1.2 | Tax proof |

The reconciliation between the corporate income tax presented on the income statement and the theoretical tax payable based on the rate in force in France can be broken down as follows:

26 | Events after the reporting period |

PeopleDoc SAS contracted a short term credit line of 1,500,000 euros with BNP Paribas in May 2018.

On July 26, 2018, Ultimate Software and PeopleDoc entered into the Share Purchase Agreement (the “Purchase Agreement”) and on July 27, 2018, the Parties consummated the transactions contemplated by the Purchase Agreement (the "Closing"), and Ultimate Software acquired PeopleDoc. Pursuant to the Purchase Agreement, the Ultimate Software acquired all of the capital stock of PeopleDoc for aggregate consideration valued at approximately $300 million, subject to customary closing and post-closing adjustments. Following the Share Purchase Agreement, there is no more outstanding potential dilutive shares.