Attached files

| file | filename |

|---|---|

| 8-K - 8-K - InPoint Commercial Real Estate Income, Inc. | ck0001690012-8k_20181009.htm |

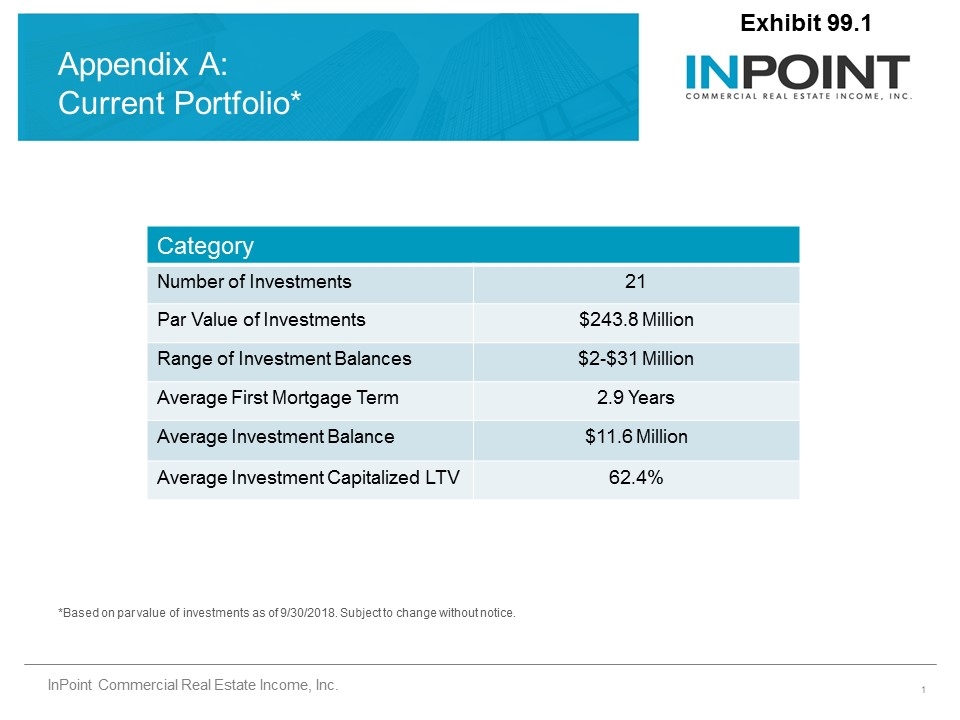

*Based on par value of investments as of 9/30/2018. Subject to change without notice. Category Number of Investments 21 Par Value of Investments $243.8 Million Range of Investment Balances $2-$31 Million Average First Mortgage Term 2.9 Years Average Investment Balance $11.6 Million Average Investment Capitalized LTV 62.4% Appendix A: Current Portfolio* Exhibit 99.1

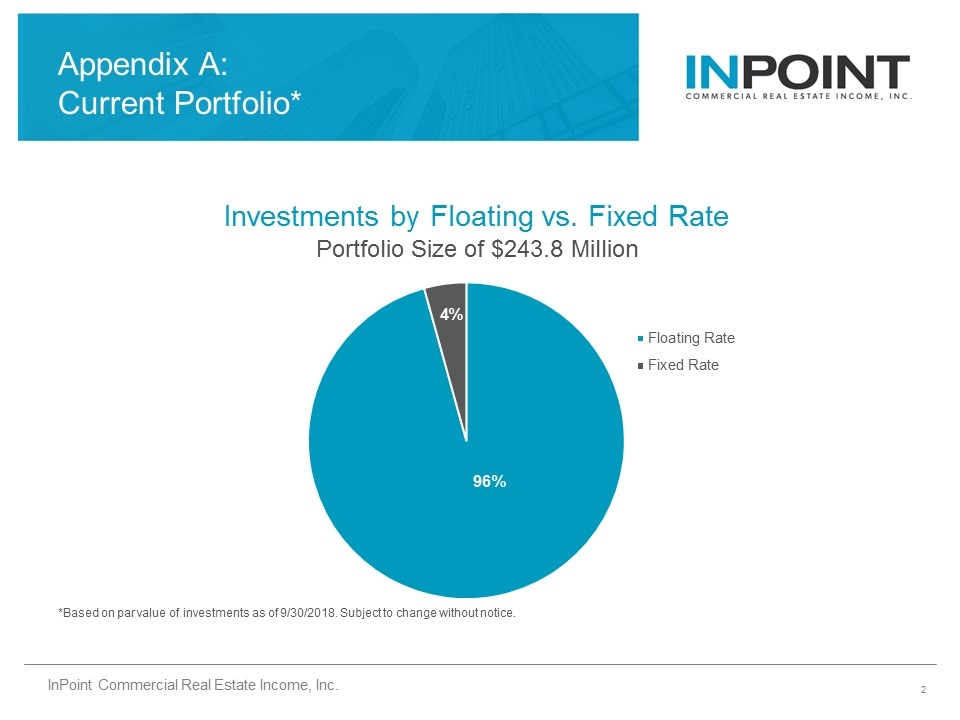

Appendix A: Current Portfolio* Investments by Floating vs. Fixed Rate *Based on par value of investments as of 9/30/2018. Subject to change without notice. Portfolio Size of $243.8 Million

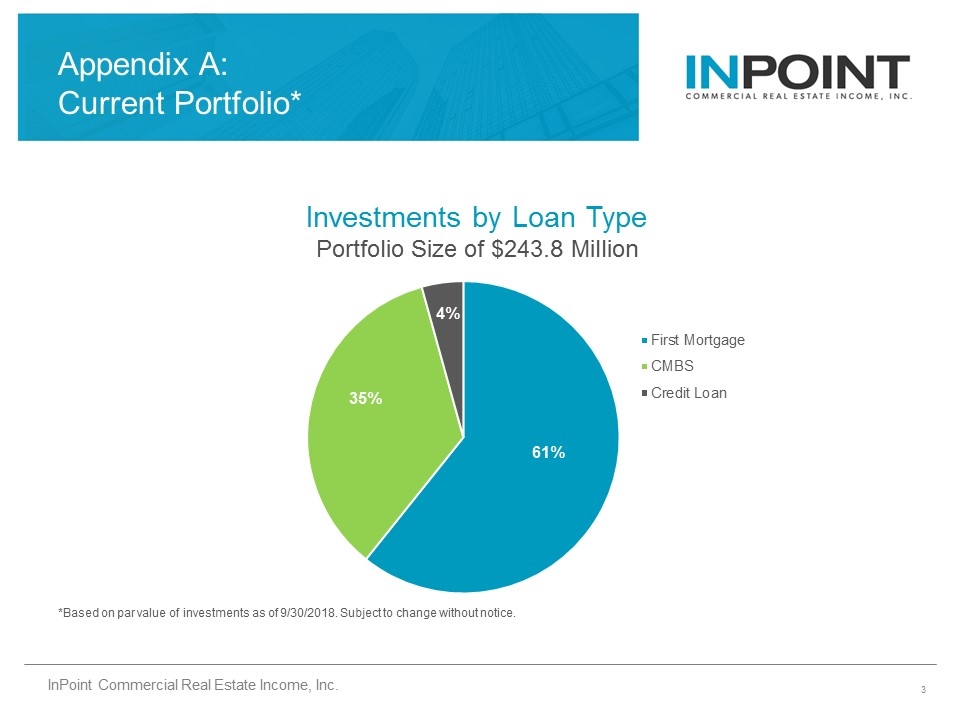

Appendix A: Current Portfolio* Investments by Loan Type Portfolio Size of $243.8 Million *Based on par value of investments as of 9/30/2018. Subject to change without notice.

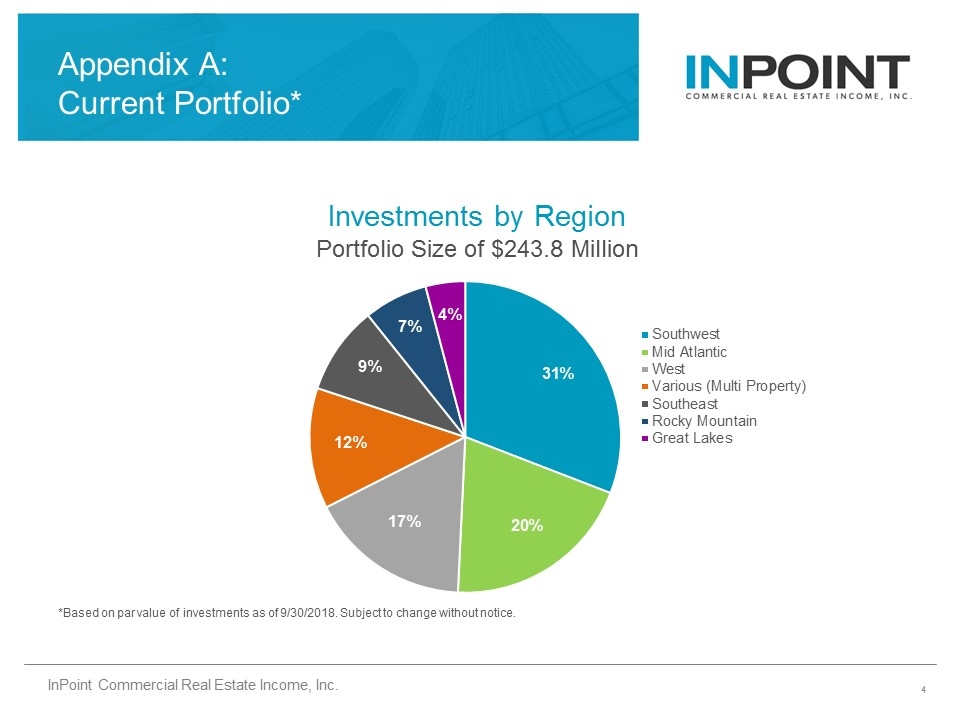

Investments by Region Appendix A: Current Portfolio* Portfolio Size of $243.8 Million *Based on par value of investments as of 9/30/2018. Subject to change without notice.

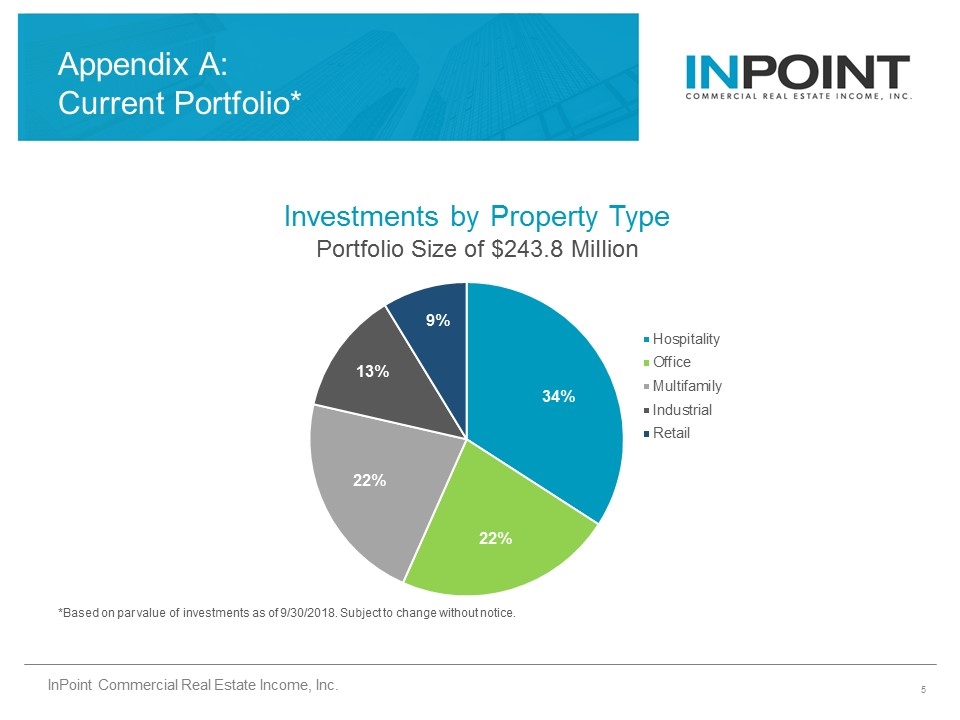

Appendix A: Current Portfolio* Investments by Property Type *Based on par value of investments as of 9/30/2018. Subject to change without notice. Portfolio Size of $243.8 Million

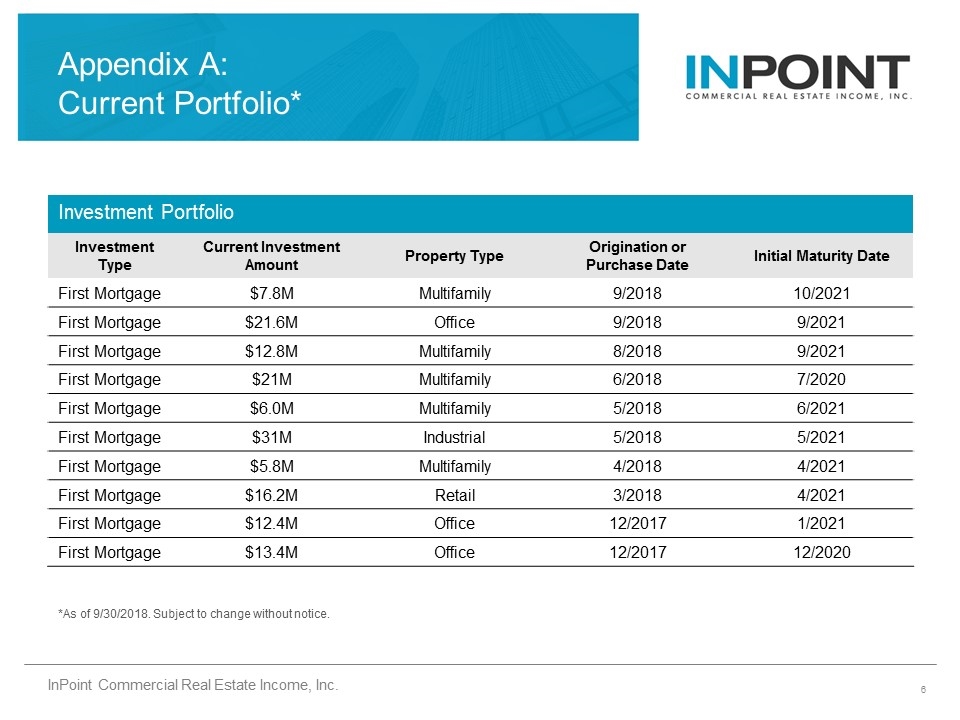

*As of 9/30/2018. Subject to change without notice. Investment Portfolio Investment Type Current Investment Amount Property Type Origination or Purchase Date Initial Maturity Date First Mortgage $7.8M Multifamily 9/2018 10/2021 First Mortgage $21.6M Office 9/2018 9/2021 First Mortgage $12.8M Multifamily 8/2018 9/2021 First Mortgage $21M Multifamily 6/2018 7/2020 First Mortgage $6.0M Multifamily 5/2018 6/2021 First Mortgage $31M Industrial 5/2018 5/2021 First Mortgage $5.8M Multifamily 4/2018 4/2021 First Mortgage $16.2M Retail 3/2018 4/2021 First Mortgage $12.4M Office 12/2017 1/2021 First Mortgage $13.4M Office 12/2017 12/2020 Appendix A: Current Portfolio*

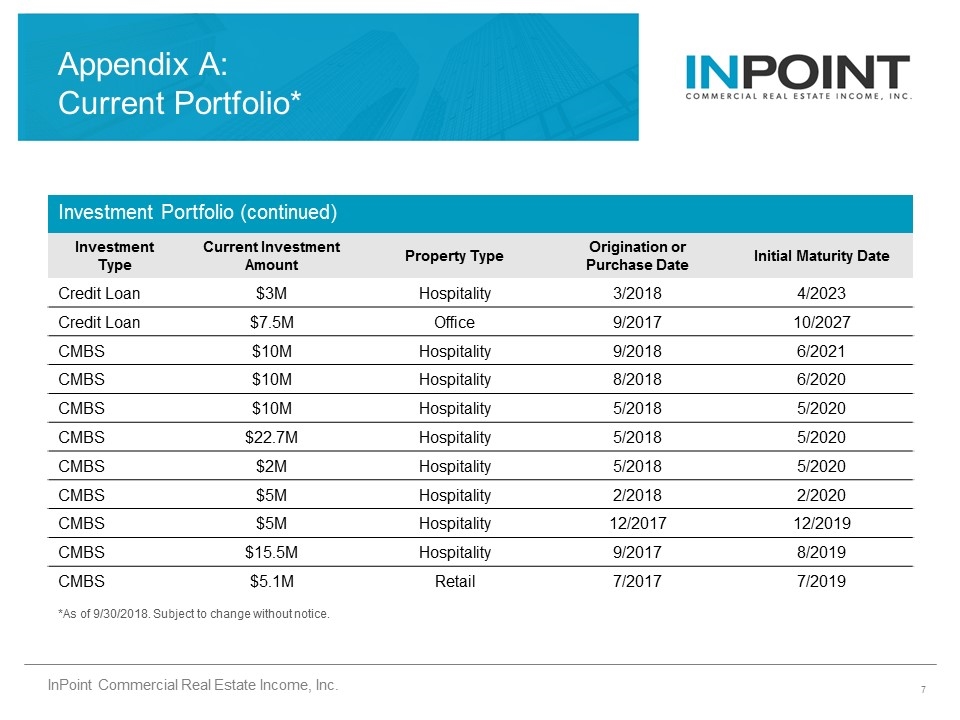

*As of 9/30/2018. Subject to change without notice. Investment Portfolio (continued) Investment Type Current Investment Amount Property Type Origination or Purchase Date Initial Maturity Date Credit Loan $3M Hospitality 3/2018 4/2023 Credit Loan $7.5M Office 9/2017 10/2027 CMBS $10M Hospitality 9/2018 6/2021 CMBS $10M Hospitality 8/2018 6/2020 CMBS $10M Hospitality 5/2018 5/2020 CMBS $22.7M Hospitality 5/2018 5/2020 CMBS $2M Hospitality 5/2018 5/2020 CMBS $5M Hospitality 2/2018 2/2020 CMBS $5M Hospitality 12/2017 12/2019 CMBS $15.5M Hospitality 9/2017 8/2019 CMBS $5.1M Retail 7/2017 7/2019 Appendix A: Current Portfolio*