Attached files

| file | filename |

|---|---|

| EX-99.4 - EX-99.4 - WALT DISNEY CO/ | d606180dex994.htm |

| EX-99.2 - EX-99.2 - WALT DISNEY CO/ | d606180dex992.htm |

| EX-99.1 - EX-99.1 - WALT DISNEY CO/ | d606180dex991.htm |

| 8-K - 8-K - WALT DISNEY CO/ | d606180d8k.htm |

Exhibit 99.3

Structure

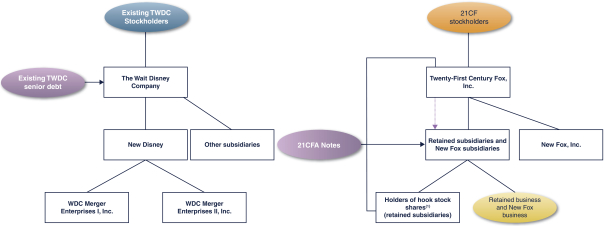

The structure of the Company, New Disney and 21CF (i) as of the date of this offering memorandum and consent solicitation statement and (ii) upon completion of the Exchange Offers and Consent Solicitations, immediately following the Acquisition, is illustrated below:

Existing Structure

|

Indicates a full and unconditional guarantee of the debt obligations of such entity |

| (1) | The hook stock shares are shares held by subsidiaries of 21CF, which will not receive shares of New Fox in the Distribution. The hook stock shares are held by the following wholly owned subsidiaries of 21CF (each of which will become a wholly owned subsidiary of New Disney as a result of the Acquisition): Karlholt US Sub Inc., Carlholt Investment US Sub Inc., TI US Sub Inc., Karlholt Australia Pty Ltd., Telegraph Investment Australia Pty Ltd. and Carlholt Investments Australia Pty Ltd. See “Questions and Answers about the Transactions and the Special Meeting” in the New Disney S-4 (as defined below). |

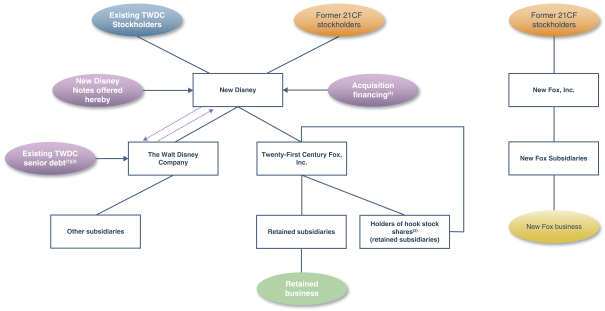

Structure Immediately Following the Acquisition and Settlement of the Exchange Offers and Consent Solicitations(5)(6)

|

Indicates a full and unconditional guarantee of the debt obligations of such entity |

| (1) | As of June 30, 2018, Disney had approximately $23.7 billion of borrowings outstanding, including the current portion thereof. |

| (2) | The hook stock shares are shares held by subsidiaries of 21CF, which will not receive shares of New Fox in the Distribution. The hook stock shares are held by the following wholly owned subsidiaries of 21CF (each of which will become a wholly owned subsidiary of New Disney as a result of the Acquisition): Karlholt US Sub Inc., Carlholt Investment US Sub Inc., TI US Sub Inc., Karlholt Australia Pty Ltd., Telegraph Investment Australia Pty Ltd. and Carlholt Investments Australia Pty Ltd. See “Questions and Answers about the Transactions and the Special Meeting” in the New Disney S-4. |

| (3) | Upon consummation of the Acquisition, New Disney expects to provide full and unconditional guarantees of TWDC’s U.S. and European medium-term notes and TWDC’s Canadian dollar-denominated 2.758% notes due 2024 and to become an additional guarantor and/or borrower under TWDC’s revolving credit facilities. |

| (4) | On September 26, 2018, TWDC announced that it expected the net proceeds from 21CF’s sale of its Sky shares, along with the net proceeds from the RSN Divestiture, to reduce the overall cost of the Acquisition. Any financing in connection with the Acquisition could take any of several forms or any combination thereof. Sources of debt financing may include funds drawn by New Disney under a committed bridge facility term loan of up to $35.7 billion or other bridge facilities and/or debt securities such as senior notes and/or commercial paper. This offering memorandum and consent solicitation statement is not an offer to sell or solicitation of an offer to buy such senior notes, commercial paper or other indebtedness. Such offering will be made, if at all, pursuant to a separate offering document and is not part of the offering of New Disney Notes to which this offering memorandum and consent solicitation statement relates. |

| (5) | This illustration assumes 100% participation in the Exchange Offers and receipt of the requisite consents necessary to effect the Proposed Amendments, as described elsewhere in this offering memorandum and consent solicitation statement. See “The Proposed Amendments.” |

| (6) | In anticipation of, or upon or after consummation of the Acquisition, New Disney may conduct internal reorganization steps to optimize its corporate structure, which may involve transfers of intercompany obligations and equity interests in subsidiaries. |