Attached files

| file | filename |

|---|---|

| EX-99.7 - EXHIBIT 99.7 - Cloudera, Inc. | cldr8-k10318ex997.htm |

| EX-99.6 - EXHIBIT 99.6 - Cloudera, Inc. | cldr8-k10318ex996.htm |

| EX-99.5 - EXHIBIT 99.5 - Cloudera, Inc. | cldr8-k10318ex995.htm |

| EX-99.4 - EXHIBIT 99.4 - Cloudera, Inc. | cldr8-k10318ex994.htm |

| EX-99.3 - EXHIBIT 99.3 - Cloudera, Inc. | cldr8-k10318ex993.htm |

| EX-99.1 - EXHIBIT 99.1 - Cloudera, Inc. | cldr8-k10318ex991.htm |

| EX-10.2 - EXHIBIT 10.2 - Cloudera, Inc. | cldr8-k10318ex102.htm |

| EX-10.1 - EXHIBIT 10.1 - Cloudera, Inc. | cldr8-k10318ex101.htm |

| EX-2.1 - EXHIBIT 2.1 - Cloudera, Inc. | cldr8-k10318ex21.htm |

| 8-K - 8-K - Cloudera, Inc. | cldr8-k10318.htm |

CLOUDERA AND HORTONWORKS From the Edge to AI October 3, 2018

SAFE HARBOR STATEMENT Statements in this presentation that are not historical in nature are forward-looking statements that, within the meaning of the federal securities laws including the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, involve known and unknown risks and uncertainties. Words such as "may", "will", "expect", "intend", "plan", "believe", "seek", "could", "estimate", "judgment", "targeting", "should", "anticipate", "goal" and variations of these words and similar expressions, are also intended to identify forward-looking statements. The forward-looking statements in this presentation address a variety of subjects, including our belief that the enterprise machine learning and analytics market will quickly emerge and that we will continue to lead its direction through technology and product innovation, our expectation that we will continue our momentum in machine learning, analytics and the cloud, achieve synergies, and achieve our long term model. Readers are cautioned that actual results could differ materially from those implied by such forward-looking statements due to a variety of factors, including global economic conditions, competitive pressures and pricing declines, intellectual property infringement claims, and other risks or uncertainties that are described under the caption “Risk Factors” in our Quarterly Report filed with the Securities and Exchange Commission, or the SEC, on September 6, 2018, and in our other SEC filings. Although we believe the expectations reflected in such forward-looking statements are based upon reasonable assumptions, we can give no assurances that our expectations will be attained. Except to the extent required by applicable law, Cloudera and Hortonworks are under no obligation (and expressly disclaim any such obligation) to update or revise their forward-looking statements whether as a result of new information, future events, or otherwise. We report all financial information required in accordance with U.S. generally accepted accounting principles (GAAP). To supplement our unaudited condensed consolidated financial statements presented in accordance with GAAP, we use certain non-GAAP measures of financial performance. The presentation of these non-GAAP financial measures is not intended to be considered in isolation from, as a substitute for, or superior to, the financial information prepared and presented in accordance with GAAP, and may be different from non-GAAP financial measures used by other companies. In addition, these non-GAAP measures have limitations in that they do not reflect all of the amounts associated with the results of our operations as determined in accordance with GAAP. We believe that these non-GAAP financial measures, when taken together with the corresponding GAAP financial measures, provide meaningful supplemental information regarding our performance by excluding certain items that may not be indicative of our core business, operating results or future outlook. Management uses, and believes that investors benefit from referring to, these non-GAAP financial measures in assessing our operating results, as well as when planning, forecasting and analyzing future periods. We use these non-GAAP financial measures in conjunction with traditional GAAP measures to communicate with our board of directors concerning our financial performance. These non-GAAP financial measures also facilitate comparisons of our performance to prior periods. Please see the slides entitled GAAP to Non-GAAP Reconciliation at the end of this presentation for a reconciliation of each of these measures to the most directly comparable GAAP financial measure. Unless otherwise noted, the information in this presentation is as of July 31, 2018. Cloudera and associated marks are trademarks or registered trademarks of Cloudera, Inc. All other company and product names may be trademarks of their respective owners. 2 © Cloudera, Inc. All rights reserved.

SAFE HARBOR STATEMENT (CONT’D) No Offer or Solicitation This presentation does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval with respect to the proposed merger or otherwise. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended. Additional Information and Where to Find It In connection with the proposed merger between Cloudera and Hortonworks, Cloudera intends to file a registration statement on Form S-4 containing a joint proxy statement/prospectus of Cloudera and Hortonworks and other documents concerning the proposed merger with the SEC. The definitive proxy statement will be mailed to the stockholders of Cloudera and Hortonworks in advance of the special meeting. BEFORE MAKING ANY VOTING DECISION, CLOUDERA’S AND HORTONWORKS’ RESPECTIVE STOCKHOLDERS ARE URGED TO READ THE JOINT PROXY STATEMENT/PROSPECTUS IN ITS ENTIRETY WHEN IT BECOMES AVAILABLE AND ANY OTHER DOCUMENTS FILED BY EACH OF CLOUDERA AND HORTONWORKS WITH THE SEC IN CONNECTION WITH THE PROPOSED MERGER OR INCORPORATED BY REFERENCE THEREIN BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION AND THE PARTIES TO THE PROPOSED TRANSACTION. Investors and security holders will be able to obtain a free copy of the joint proxy statement/prospectus and other documents containing important information about Cloudera and Hortonworks, once such documents are filed with the SEC, through the website maintained by the SEC at www.sec.gov. Cloudera and Hortonworks make available free of charge at www.cloudera.com and www.hortonworks.com, respectively (in the “Investor Relations” section), copies of materials they file with, or furnish to, the SEC. The contents of the websites referenced above are not deemed to be incorporated by reference into the registration statement or the joint proxy statement/prospectus. Participants in the Solicitation This document does not constitute a solicitation of proxy, an offer to purchase or a solicitation of an offer to sell any securities. Cloudera, Hortonworks and their respective directors, executive officers and certain employees may be deemed to be participants in the solicitation of proxies from the stockholders of Cloudera and Hortonworks in connection with the proposed merger. Information regarding the special interests of these directors and executive officers in the proposed merger will be included in the joint proxy statement/prospectus referred to above. Security holders may also obtain information regarding the names, affiliations and interests of Cloudera’s directors and executive officers in Cloudera’s Annual Report on Form 10-K for the fiscal year ended January 31, 2018, which was filed with the SEC on April 4, 2018, and its definitive proxy statement for the 2018 annual meeting of stockholders, which was filed with the SEC on May 16, 2018. Security holders may obtain information regarding the names, affiliations and interests of Hortonworks’ directors and executive officers in Hortonworks’ Annual Report on Form 10-K for the fiscal year ended December 31, 2017, which was filed with the SEC on March 15, 2018, and its definitive proxy statement for the 2018 annual meeting of stockholders, which was filed with the SEC on April 24, 2018. To the extent the holdings of Cloudera securities by Cloudera’s directors and executive officers or the holdings of Hortonworks securities by Hortonworks’ directors and executive officers have changed since the amounts set forth in Cloudera’s or Hortonworks’ respective proxy statement for its 2018 annual meeting of stockholders, such changes have been or will be reflected on Statements of Change in Ownership on Form 4 filed with the SEC. Additional information regarding the interests of such individuals in the proposed merger will be included in the joint proxy statement/prospectus relating to the proposed merger when it is filed with the SEC. These documents (when available) may be obtained free of charge from the SEC’s website at www.sec.gov, Cloudera’s website at www.cloudera.com and Hortonworks’ website at www.hortonworks.com. The contents of the websites referenced above are not deemed to be incorporated by reference into the registration statement or the joint proxy statement/prospectus. 3 © Cloudera, Inc. All rights reserved.

EXECUTIVES ON TODAY’S CALL Tom Reilly Rob Bearden Jim Frankola Scott Davidson CEO CEO CFO COO/CFO 4 © Cloudera, Inc. All rights reserved.

SNAPSHOT OF NEXT-GEN DATA MANAGEMENT LEADERS $411M $309M TTM Revenue(1) TTM Revenue(2) 33% 42% TTM Revenue Growth(1) TTM Revenue Growth(2) 87% 87% Subscription Software Gross Subscription Support Gross (3) + (4) Margin Margin 568 259 Customers with $100K+ Customers with $100K+ Software ARR(3) Subscription ARR(4) >1,300 >1,400 Note: Total Customers Total Customers 1. As of Q2 FY2019 2. As of Q2 FY2018 3. As of Q2 FY2019, Non-GAAP 4. As of Q2 FY2018, Non-GAAP 5. See appendix for GAAP reconciliation 5 © Cloudera, Inc. All rights reserved.

COMPELLING STRATEGIC RATIONALE Category leader Fuel innovation Superior platform Cloud everywhere Unlock synergies Creates clear category Accelerate market Unified platform with Delivers the industry’s leader and industry development and fuel highly complementary first enterprise data cloud Cost synergies and standard, substantially innovation for IoT, cloud, offerings for cross-sell – Edge, private, public, business model benefits benefitting customers and data warehouse, ML and hybrid accelerate achievement of the community AI long-term target model Enhanced Shareholder Value 6 © Cloudera, Inc. All rights reserved.

TRANSACTION OVERVIEW Transaction Terms Each Hortonworks share will be exchanged for 1.305 Cloudera shares Consideration Tax-free, stock-for-stock transaction Pro-forma Ownership Approximately 60% Cloudera shareholders / 40% Hortonworks shareholders Company Name Cloudera Leadership Tom Reilly, CEO Jim Frankola, CFO Scott Davidson, COO Arun Murthy, CPO Board of Directors Five designated by Cloudera, including Martin Cole (Chairman) Four members designated by Hortonworks, including Rob Bearden A tenth director will be selected by the combined board Anticipated Close Calendar Q1 (2019) Certain Conditions Approval by Cloudera and Hortonworks shareholders and regulatory agencies 7 © Cloudera, Inc. All rights reserved.

IMMENSE MARKET OPPORTUNITY $83B $51B $32B $14B + Relational / Non- = TAM 21% Cognitive / AI relational DBMSs $13B CAGR and $5B Data Warehouse Advanced analytics $13B Dynamic data mgmt 2017 2022 Source: IDC. Note: Transformative markets represented $12.7B in 2017 and $32.3B in 2022, approximately broken down into $14.3B for Cognitive/AI Systems and Content Analytics Software, $13.2B for Dynamic Data Management Systems, $4.9B for Advanced and Predictive Analytics Software 8 © Cloudera, Inc. All rights reserved.

FROM THE EDGE TO AI… The industry’s first “enterprise data cloud” IoT, Ingest & Data Data AI, ML & Streaming Engineering Warehouse Data Science Edge | Private | Public | Hybrid 9 © Cloudera, Inc. All rights reserved.

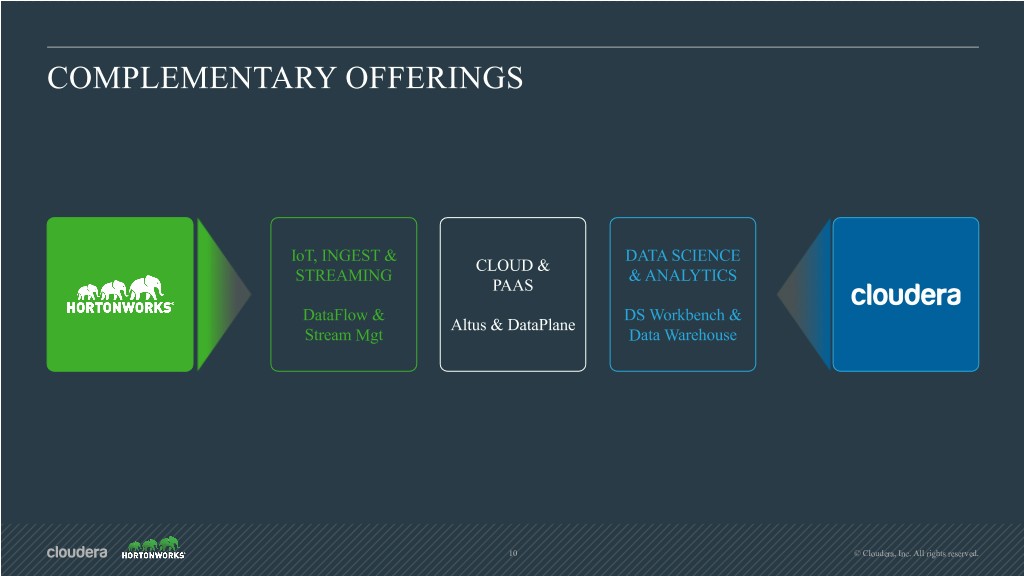

COMPLEMENTARY OFFERINGS IoT, INGEST & DATA SCIENCE CLOUD & STREAMING & ANALYTICS PAAS DataFlow & DS Workbench & Altus & DataPlane Stream Mgt Data Warehouse 10 © Cloudera, Inc. All rights reserved.

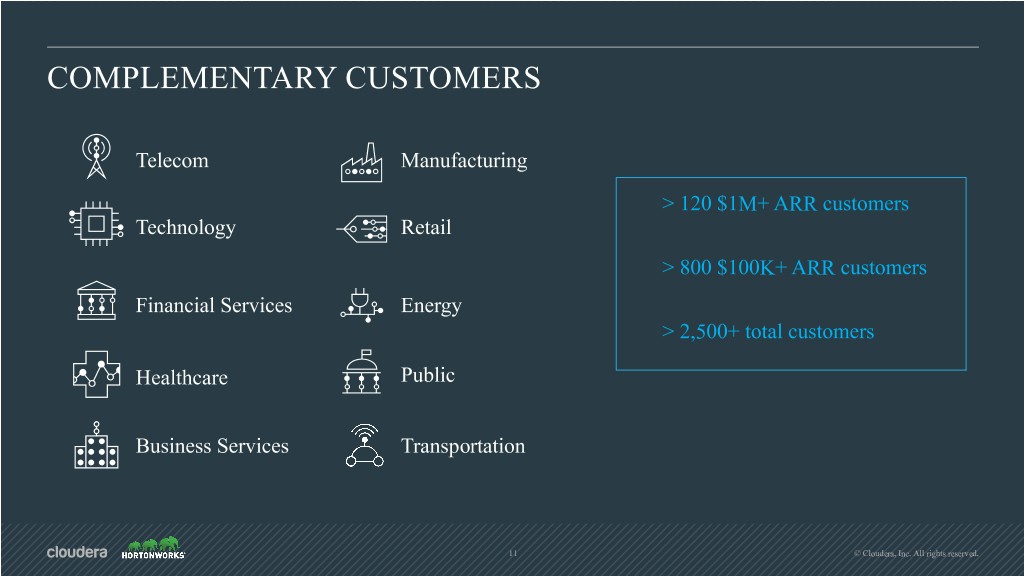

COMPLEMENTARY CUSTOMERS Telecom Manufacturing > 120 $1M+ ARR customers Technology Retail > 800 $100K+ ARR customers Financial Services Energy > 2,500+ total customers Healthcare Public Business Services Transportation 11 © Cloudera, Inc. All rights reserved.

COMPLEMENTARY PARTNERSHIPS Cloud OEMs SIs 12 © Cloudera, Inc. All rights reserved.

SCALE AND GROWTH DAY ONE (TTM through Q2) + Pro-Forma (pre-synergies) Revenue $411M $309M $720M Gross Margin (%) (1) 74% 74% 74% Operating Margin (%) (1) (19%) (18%) (19%) Operating Cash Flow Margin (6%) (1%) (4%) (%) Note: 1. See appendix for GAAP to non-GAAP reconciliation 13 © Cloudera, Inc. All rights reserved.

POWERFUL SYNERGIES • Differentiated and complementary products increase cross-sell opportunities Revenue • Complementary vertical strengths enlarge addressable market • Expanded buyer universe through line of business and IT • R&D optimization Net of reinvestment in • Sales enhancements and optimization growth initiatives Costs • Corporate functions efficiencies >$125M Annualized Savings • Implement best practices in support and services 14 © Cloudera, Inc. All rights reserved.

WELL POSITIONED TO ACHIEVE SYNERGIES Europe North America Budapest, Hungary HQ: Silicon Valley • Common code base • Strong participation in open source community • Similar sales motions • Geographic footprint allows easier collaboration and integration Asia India 15 © Cloudera, Inc. All rights reserved.

ACCELERATE PATH TO LONG-TERM MODEL (TTM through Q2) Day 1 Profile CY2020E(1) (FY2021E) Long-Term Model Revenue $720M >$1B Revenue Growth (%) 37% >20% > $125M of Gross Margin (%) (3) 74% Annualized >75% 82% - 84% Savings(1) Operating Margin (%) (3) (19%) >10%(2) 30% Operating Cash Flow (4%) >15% Margin (%) Note: 1. Based on management’s current expectations and beliefs, and subject to a number of factors and uncertainties that could cause actual results to differ materially from those described here. There is no assurance that the actual results anticipated by us will be realized or that, even if substantially realized, will have the expected consequences to, or effects on, our business or operations 2. Excludes impact of purchase price accounting 3. See appendix for GAAP to non-GAAP reconciliation 16 © Cloudera, Inc. All rights reserved.

COMPELLING STRATEGIC RATIONALE Creates clear category leader and industry standard, substantially benefitting customers and Category leader the community Accelerate market development and fuel innovation for IoT, cloud, data warehouse, ML, and Fuel innovation AI Superior platform Unified platform with highly complementary offerings for cross-sell Cloud everywhere Enables the industry’s first enterprise data cloud – Edge, private, public, hybrid Cost synergies and business model benefits accelerate achievement of long-term target Unlock synergies model Enhanced Shareholder Value 17 © Cloudera, Inc. All rights reserved.

Q&A

APPENDIX

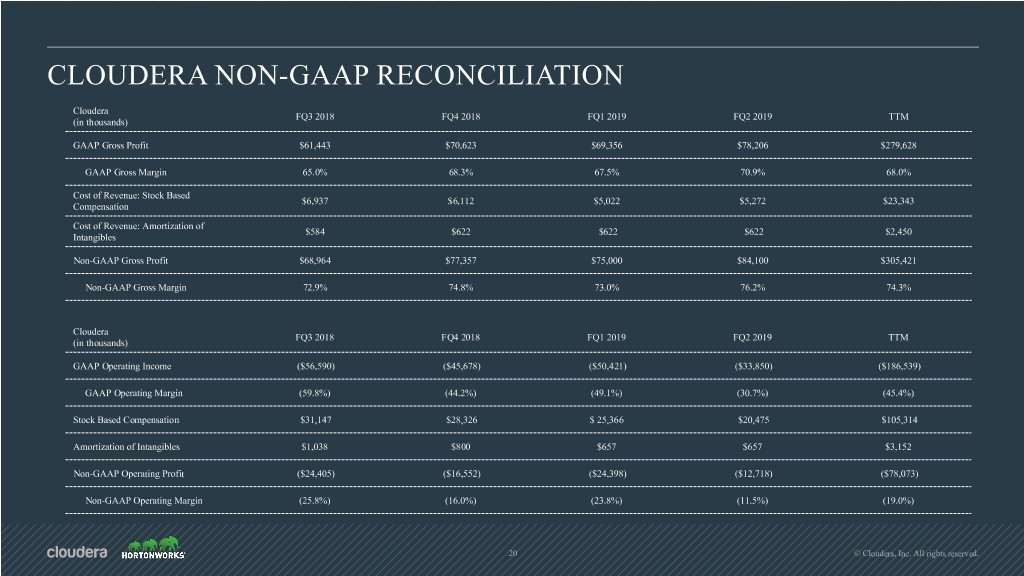

CLOUDERA NON-GAAP RECONCILIATION Cloudera FQ3 2018 FQ4 2018 FQ1 2019 FQ2 2019 TTM (in thousands) GAAP Gross Profit $61,443 $70,623 $69,356 $78,206 $279,628 GAAP Gross Margin 65.0% 68.3% 67.5% 70.9% 68.0% Cost of Revenue: Stock Based $6,937 $6,112 $5,022 $5,272 $23,343 Compensation Cost of Revenue: Amortization of $584 $622 $622 $622 $2,450 Intangibles Non-GAAP Gross Profit $68,964 $77,357 $75,000 $84,100 $305,421 Non-GAAP Gross Margin 72.9% 74.8% 73.0% 76.2% 74.3% Cloudera FQ3 2018 FQ4 2018 FQ1 2019 FQ2 2019 TTM (in thousands) GAAP Operating Income ($56,590) ($45,678) ($50,421) ($33,850) ($186,539) GAAP Operating Margin (59.8%) (44.2%) (49.1%) (30.7%) (45.4%) Stock Based Compensation $31,147 $28,326 $ 25,366 $20,475 $105,314 Amortization of Intangibles $1,038 $800 $657 $657 $3,152 Non-GAAP Operating Profit ($24,405) ($16,552) ($24,398) ($12,718) ($78,073) Non-GAAP Operating Margin (25.8%) (16.0%) (23.8%) (11.5%) (19.0%) 20 © Cloudera, Inc. All rights reserved.

HORTONWORKS NON-GAAP RECONCILIATION Hortonworks Q3 2017 Q4 2017 Q1 2018 Q2 2018 TTM (in thousands) GAAP Gross Profit $47,658 $53,576 $56,801 $62,426 $220,461 GAAP Gross Margin 69% 71% 72% 72% 71% Cost of Revenue: Stock Based $2,090 $2,187 $2,027 $2,949 $9,253 Compensation Cost of Revenue: Amortization of $0 $0 $0 $0 $0 Intangibles Non-GAAP Gross Profit $49,748 $55,763 $58,828 $65,375 $229,714 Non-GAAP Gross Margin 72% 74% 74% 76% 74% Hortonworks Q3 2017 Q4 2017 Q1 2018 Q2 2018 TTM (in thousands) GAAP Operating Income ($44,176) ($45,805) ($40,828) ($42,014) ($172,823) GAAP Operating Margin (64%) (61%) (52%) (49%) (56%) Stock Based Compensation $28,533 $30,881 $ 26,290 $31,440 $117,144 Amortization of Intangibles and advisory $221 $322 $217 $219 $979 fees Non-GAAP Operating Profit ($15,422) ($14,602) ($14,321) ($10,355) ($54,700) Non-GAAP Operating Margin (22%) (19%) (18%) (12%) (18%) 21 © Cloudera, Inc. All rights reserved.