Attached files

| file | filename |

|---|---|

| 8-K - 8-K - JETBLUE AIRWAYS CORP | form8-kxinvestorday2018.htm |

1

SAFE HARBOR This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act, which represent our management's beliefs and assumptions concerning future events. When used in this presentation document and in documents incorporated herein by reference, the words “expects,” “plans,” “anticipates,” “indicates,” “believes,” “forecast,” “guidance,” “outlook,” “may,” “will,” “should,” “seeks,” “targets” and similar expressions are intended to identify forward-looking statements. Forward-looking statements involve risks, uncertainties and assumptions, and are based on information currently available to us. Actual results may differ materially from those expressed in the forward-looking statements due to many factors, including, without limitation, our extremely competitive industry; volatility in financial and credit markets which could affect our ability to obtain debt and/or lease financing or to raise funds through debt or equity issuances; our significant fixed obligations and substantial indebtedness; volatility in fuel prices, maintenance costs and interest rates; our reliance on a high daily aircraft utilization; our ability to implement our growth strategy; our limited number of suppliers; our ability to attract and retain qualified personnel and maintain our culture as we grow; our reliance on a limited number of suppliers; our dependence on the New York and Boston metropolitan markets and the effect of increased congestion in these markets; our reliance on automated systems and technology; our being subject to potential unionization, work stoppages, slowdowns or increased labor costs; our presence in some international emerging markets that may experience political or economic instability or may subject us to legal risk; reputational and business risk from information security breaches or cyber-attacks; changes in or additional domestic or foreign government regulation; changes in our industry due to other airlines' financial condition; acts of war or terrorism; global economic conditions or an economic downturn leading to a continuing or accelerated decrease in demand for air travel; the spread of infectious diseases; adverse weather conditions or natural disasters; and external geopolitical events and conditions. It is routine for our internal projections and expectations to change as the year or each quarter in the year progresses, and therefore it should be clearly understood that the internal projections, beliefs and assumptions upon which we base our expectations may change prior to the end of each quarter or year. Further information concerning these and other factors is contained in the Company's Securities and Exchange Commission filings, including but not limited to, the Company's 2017 Annual Report on Form 10-K and its Quarterly Reports on Form 10-Q. In light of these risks and uncertainties, the forward-looking events discussed in this presentation might not occur. We undertake no obligation to update any forward-looking statements to reflect events or circumstances that may arise after the date of this presentation. The following presentation also includes certain “non-GAAP financial measures” as defined in Regulation G under the Securities Exchange Act of 1934. We refer you to the reconciliations made available in our Quarterly Reports on Form 10-Q and Annual Reports on Form 10-K (available on our website at jetblue.com and at sec.gov) and in our second quarter earnings call (furnished on July 24th, 2018), which reconcile the non-GAAP financial measures included in the following presentation to the most directly comparable financial measures calculated and presented in accordance with U.S. GAAP. 32

AGENDA: 2018 INVESTOR DAY 8:30 am – 9:20 am Robin Hayes, Chief Executive Officer • Introduction Marty St. George, EVP Commercial and Planning Andres Barry, President, JetBlue Travel Products • Our Competitive Advantage • Building Blocks: Network & Product Offering 9:20 am – 9:40 am Question & Answer Session 9:40 am – 9:50 am Break 9:50 am – 10:40 am Bonny Simi, President, JetBlue Technology Ventures Joanna Geraghty, President and Chief Operating Officer Steve Priest, EVP Chief Financial Officer • Introducing JetBlue Technology Ventures • Building Blocks: Fleet, Cost & Capital Allocation • Path to EPS Growth through 2020 and Beyond 10:40 am – 11:00 am Question & Answer Session 3

ROBIN HAYES CEO

KEY TAKEAWAYS FROM TODAY 1. JetBlue’s differentiated business model and culture creates opportunities for accretive growth. 2. Since 2014 we’ve continued our journey to improve absolute and relative margins. 3. We believe our ‘Building Blocks’ will improve our margins and returns, and power meaningful EPS growth through 2020 and beyond. 5

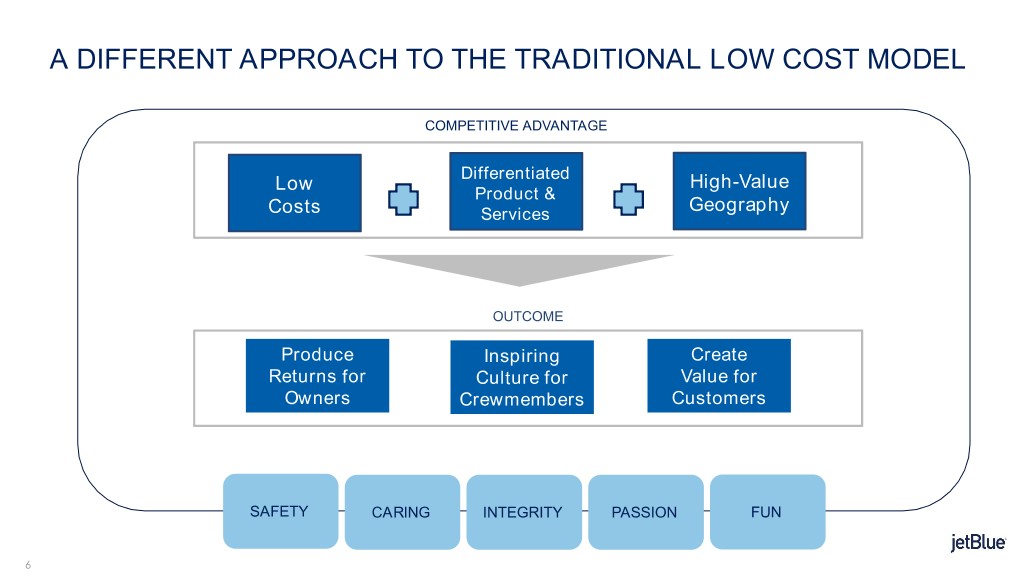

A DIFFERENT APPROACH TO THE TRADITIONAL LOW COST MODEL COMPETITIVE ADVANTAGE Differentiated Low High-Value Product & Costs Services Geography OUTCOME Produce Inspiring Create Returns for Culture for Value for Owners Crewmembers Customers SAFETY CARING INTEGRITY PASSION FUN 6

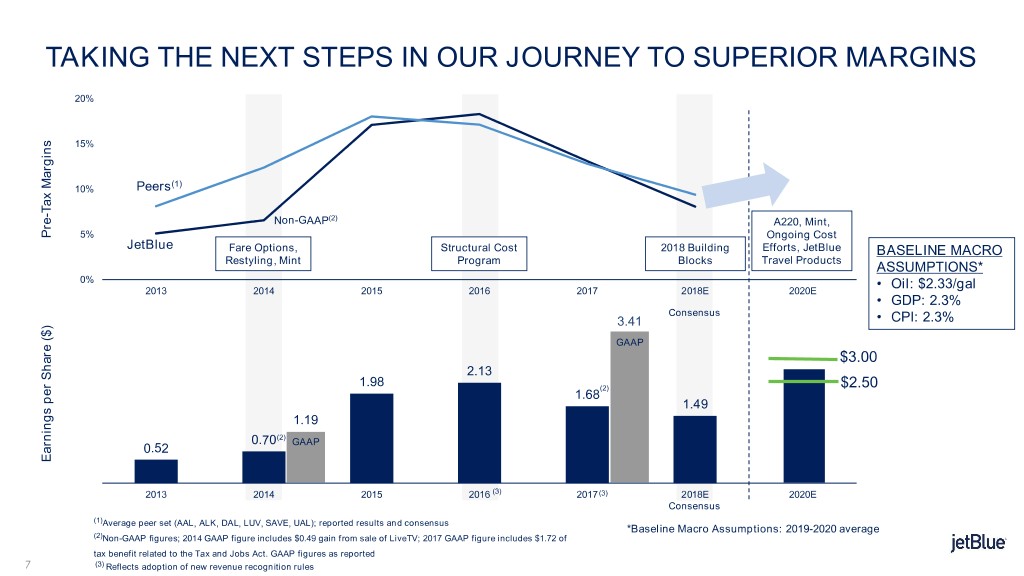

TAKING THE NEXT STEPS IN OUR JOURNEY TO SUPERIOR MARGINS 20% 15% (1) 10% Peers Tax Margins Tax - Non-GAAP(2) A220, Mint, Pre 5% Ongoing Cost JetBlue Fare Options, Structural Cost 2018 Building Efforts, JetBlue BASELINE MACRO Restyling, Mint Program Blocks Travel Products ASSUMPTIONS* 0% • Oil: $2.33/gal 2013 2014 2015 2016 2017 2018E 2020E • GDP: 2.3% Consensus 3.41 • CPI: 2.3% GAAP $3.00 2.13 1.98 (2) $2.50 1.68 1.49 1.19 Non- GAAP 0.70(2) 0.52 GAAP Earnings per Share ($) EarningsperShare Non- GAAP 2013 2014 2015 2016 (3) 2017(3) 2018E 2020E Consensus (1)Average peer set (AAL, ALK, DAL, LUV, SAVE, UAL); reported results and consensus *Baseline Macro Assumptions: 2019-2020 average (2)Non-GAAP figures; 2014 GAAP figure includes $0.49 gain from sale of LiveTV; 2017 GAAP figure includes $1.72 of tax benefit related to the Tax and Jobs Act. GAAP figures as reported 7 (3) Reflects adoption of new revenue recognition rules

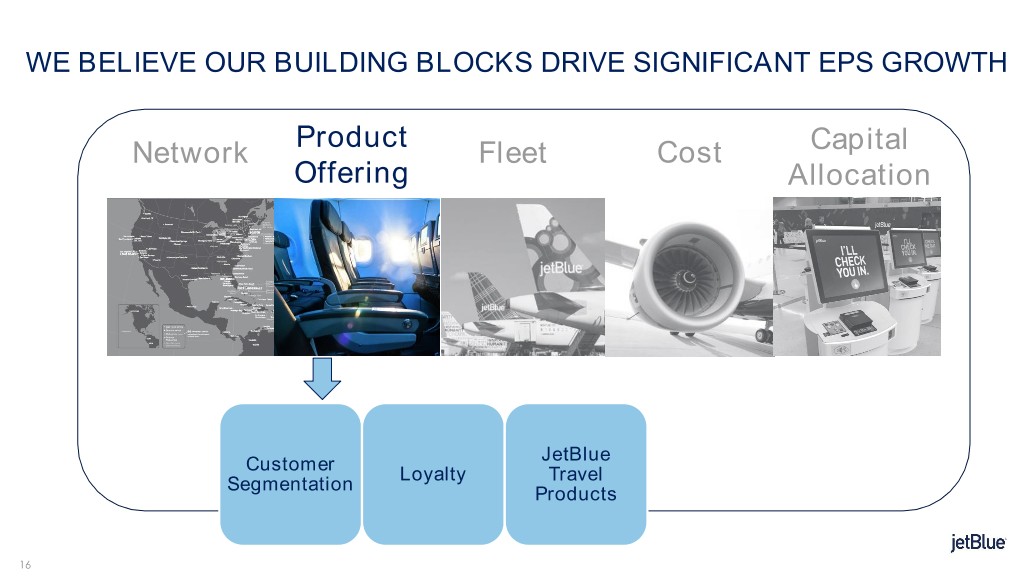

WE BELIEVE OUR BUILDING BLOCKS DRIVE SIGNIFICANT EPS GROWTH Product Network Fleet Cost Capital Offering Allocation 8

MARTY ST. GEORGE EVP COMMERCIAL AND PLANNING ANDRES BARRY PRESIDENT, JETBLUE TRAVEL PRODUCTS

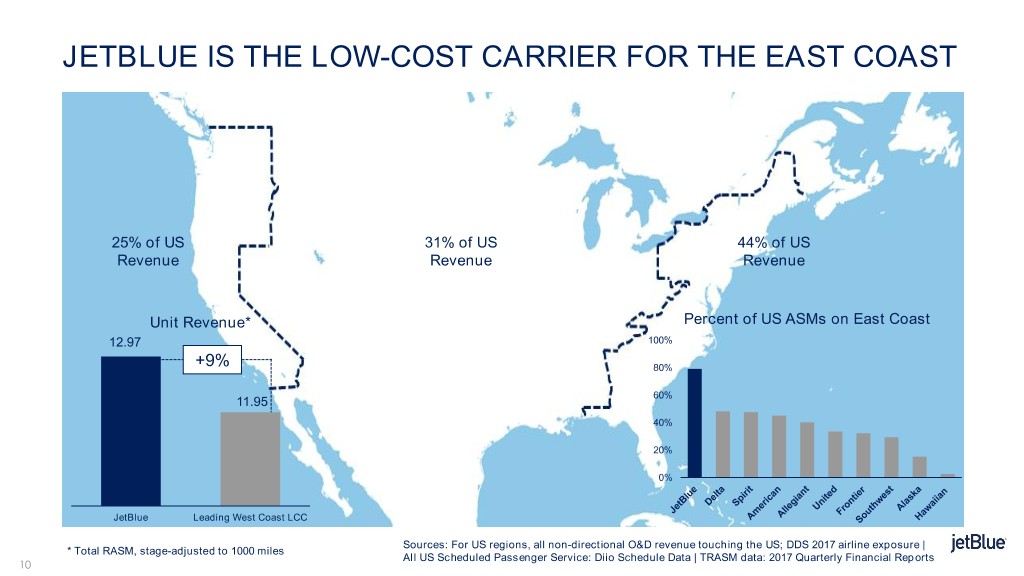

JETBLUE IS THE LOW-COST CARRIER FOR THE EAST COAST 25% of US 31% of US 44% of US Revenue Revenue Revenue Unit Revenue* Percent of US ASMs on East Coast 12.97 100% +9% 80% 60% 11.95 40% 20% 0% JetBlue Leading West Coast LCC Sources: For US regions, all non-directional O&D revenue touching the US; DDS 2017 airline exposure | * Total RASM, stage-adjusted to 1000 miles All US Scheduled Passenger Service: Diio Schedule Data | TRASM data: 2017 Quarterly Financial Reports 10

WE BELIEVE NETWORK AND PRODUCT OFFERING ADD 65 - 95 CENTS IN 2020 EPS $ EPS Focused Growth Network Maturation 30 – 40 cents NETWORK Network Reallocation Customer Segmentation 35 – 55 cents Loyalty PRODUCT PRODUCT OFFERING JetBlue Travel Products 11

WE BELIEVE OUR BUILDING BLOCKS DRIVE SIGNIFICANT EPS GROWTH Product Network Fleet Cost Capital Offering Allocation Focused Network Network Growth Maturation Reallocation 12

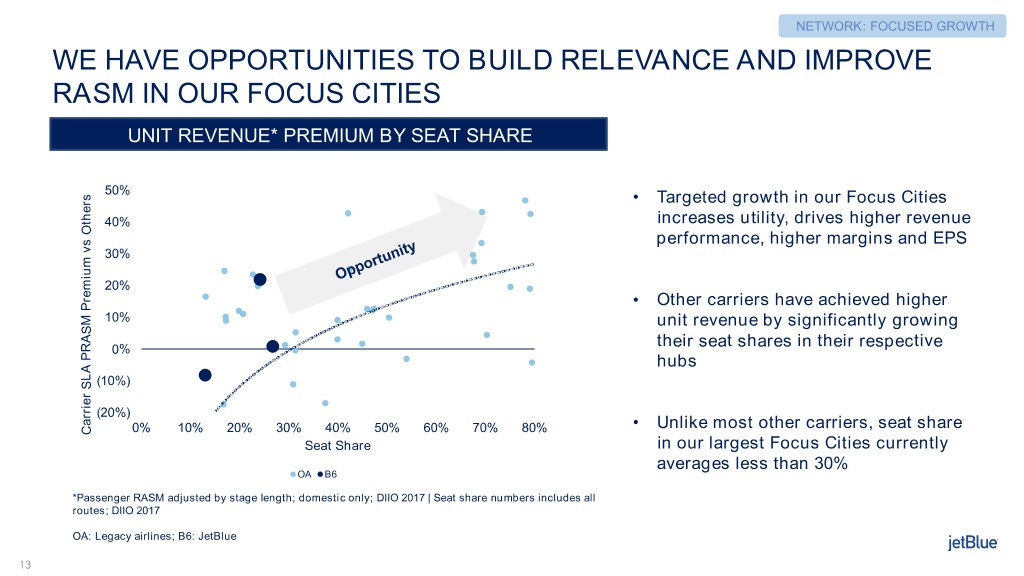

NETWORK: FOCUSED GROWTH WE HAVE OPPORTUNITIES TO BUILD RELEVANCE AND IMPROVE RASM IN OUR FOCUS CITIES UNIT REVENUE* PREMIUM BY SEAT SHARE 50% • Targeted growth in our Focus Cities 40% increases utility, drives higher revenue performance, higher margins and EPS 30% 20% • Other carriers have achieved higher 10% unit revenue by significantly growing 0% their seat shares in their respective hubs (10%) (20%) 0% 10% 20% 30% 40% 50% 60% 70% 80% • Unlike most other carriers, seat share Carrier SLA PRASM OthersPremiumvs PRASM CarrierSLA Seat Share in our largest Focus Cities currently averages less than 30% OA B6 *Passenger RASM adjusted by stage length; domestic only; DIIO 2017 | Seat share numbers includes all routes; DIIO 2017 OA: Legacy airlines; B6: JetBlue 13

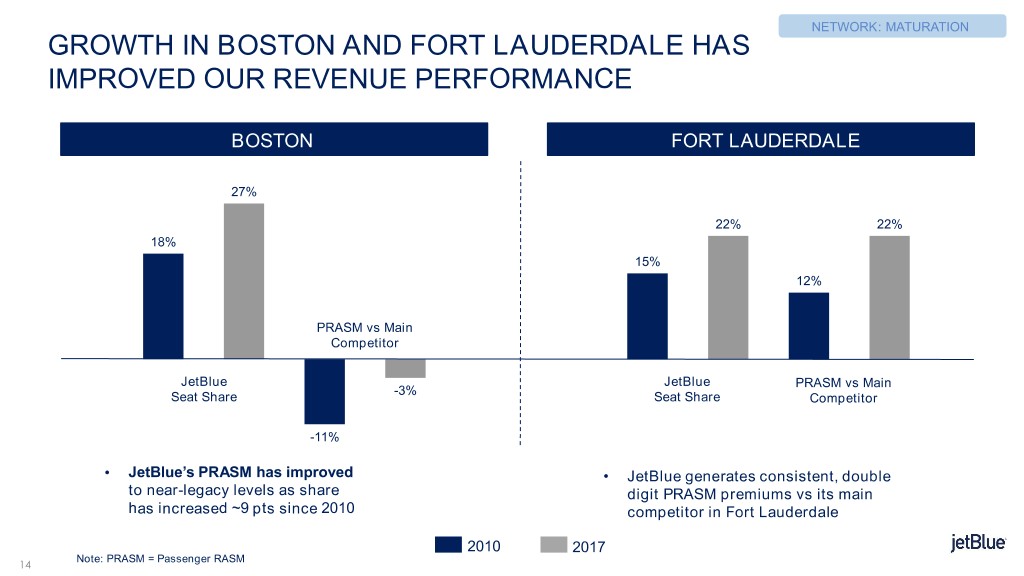

NETWORK: MATURATION GROWTH IN BOSTON AND FORT LAUDERDALE HAS IMPROVED OUR REVENUE PERFORMANCE BOSTON FORT LAUDERDALE 27% 22% 22% 18% 15% 12% PRASM vs Main Competitor JetBlue JetBlue PRASM vs Main -3% Seat Share Seat Share Competitor -11% • JetBlue’s PRASM has improved • JetBlue generates consistent, double to near-legacy levels as share digit PRASM premiums vs its main has increased ~9 pts since 2010 competitor in Fort Lauderdale 2010 2017 Note: PRASM = Passenger RASM 14

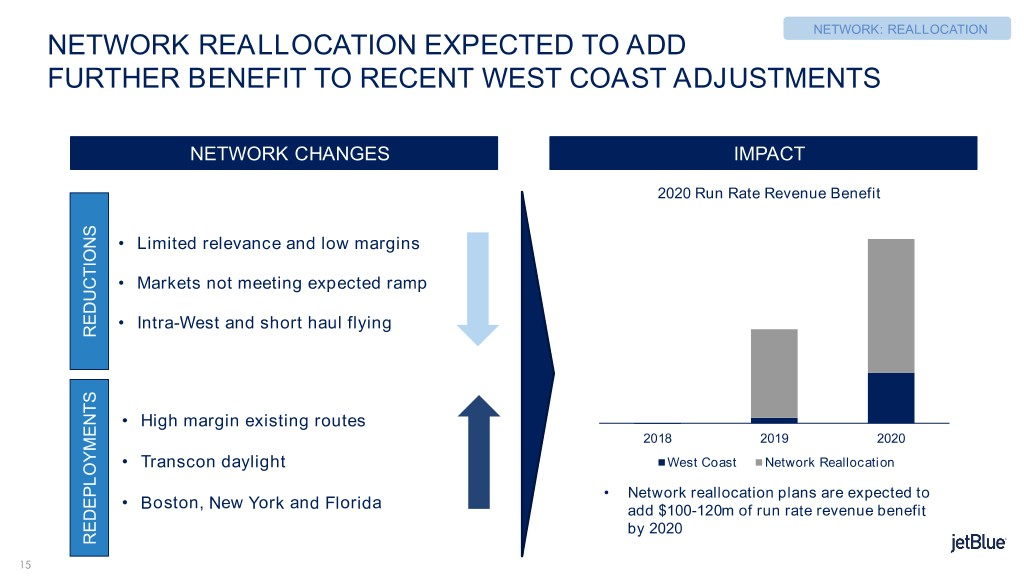

NETWORK: REALLOCATION NETWORK REALLOCATION EXPECTED TO ADD FURTHER BENEFIT TO RECENT WEST COAST ADJUSTMENTS NETWORK CHANGES IMPACT 2020 Run Rate Revenue Benefit • Limited relevance and low margins • Markets not meeting expected ramp • Intra-West and short haul flying REDUCTIONS • High margin existing routes 2018 2019 2020 • Transcon daylight West Coast Network Reallocation • Network reallocation plans are expected to • Boston, New York and Florida add $100-120m of run rate revenue benefit by 2020 REDEPLOYMENTS 15

WE BELIEVE OUR BUILDING BLOCKS DRIVE SIGNIFICANT EPS GROWTH Product Network Fleet Cost Capital Offering Allocation JetBlue Customer Loyalty Travel Segmentation Products 16

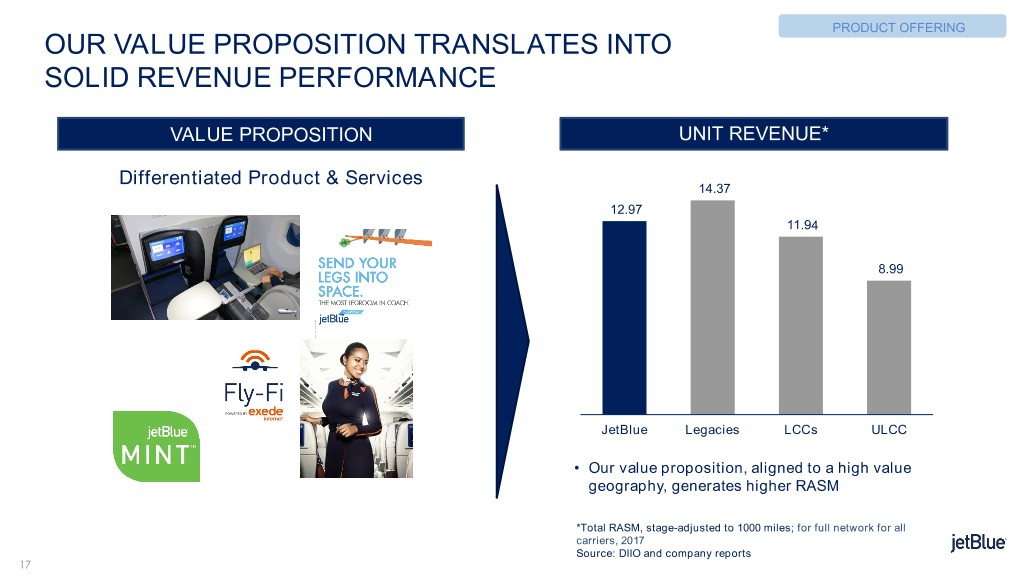

PRODUCT OFFERING OUR VALUE PROPOSITION TRANSLATES INTO SOLID REVENUE PERFORMANCE VALUE PROPOSITION UNIT REVENUE* Differentiated Product & Services 14.37 12.97 11.94 8.99 JetBlue Legacies LCCs ULCC • Our value proposition, aligned to a high value geography, generates higher RASM *Total RASM, stage-adjusted to 1000 miles; for full network for all carriers, 2017 Source: DIIO and company reports 17

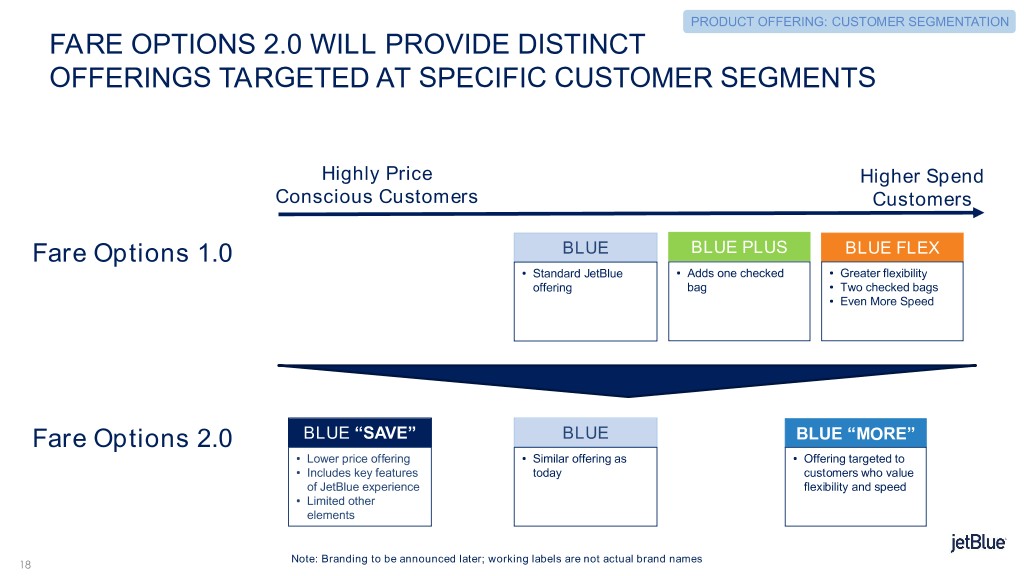

PRODUCT OFFERING: CUSTOMER SEGMENTATION FARE OPTIONS 2.0 WILL PROVIDE DISTINCT OFFERINGS TARGETED AT SPECIFIC CUSTOMER SEGMENTS Highly Price Higher Spend Conscious Customers Customers Fare Options 1.0 BLUE BLUE PLUS BLUE FLEX • Standard JetBlue • Adds one checked • Greater flexibility offering bag • Two checked bags • Even More Speed Fare Options 2.0 BLUE “SAVE” BLUE BLUE “MORE” • Lower price offering • Similar offering as • Offering targeted to • Includes key features today customers who value of JetBlue experience flexibility and speed • Limited other elements Note: Branding to be announced later; working labels are not actual brand names 18

PRODUCT OFFERING: CUSTOMER SEGMENTATION GETTING THE RIGHT PRODUCT, AT THE RIGHT PRICE, TO THE RIGHT CUSTOMER, AT THE RIGHT TIME Improved Revenue • Developing better inventory and pricing tools Management • Improving forecasts of customer demand and willingness-to-pay Tools Dynamic Offer • Laying foundation for dynamic merchandising based on customer preferences Management • Enhancing customer data • Increasing focus and share for direct distribution Distribution • Developing NDC* for direct connects to third parties Enhanced Digital • Continually enhancing functionality of website, mobile, and app Offering • Improving customer experience and adding payment options *NDC: New Distribution Capability 19

PRODUCT OFFERING: LOYALTY WE ARE FURTHER DEVELOPING OUR LOYALTY BUSINESS AS OUR NETWORK MATURES LOYALTY REVENUE GROWTH US$ million ~ $125m 2016 2017 2018E Original Forecast Incremental • Co-brand: continued strength in US acquisition, Caribbean growth • Optimized no fee/fee card mix • Points transfer growth, TrueBlue enhancements 20

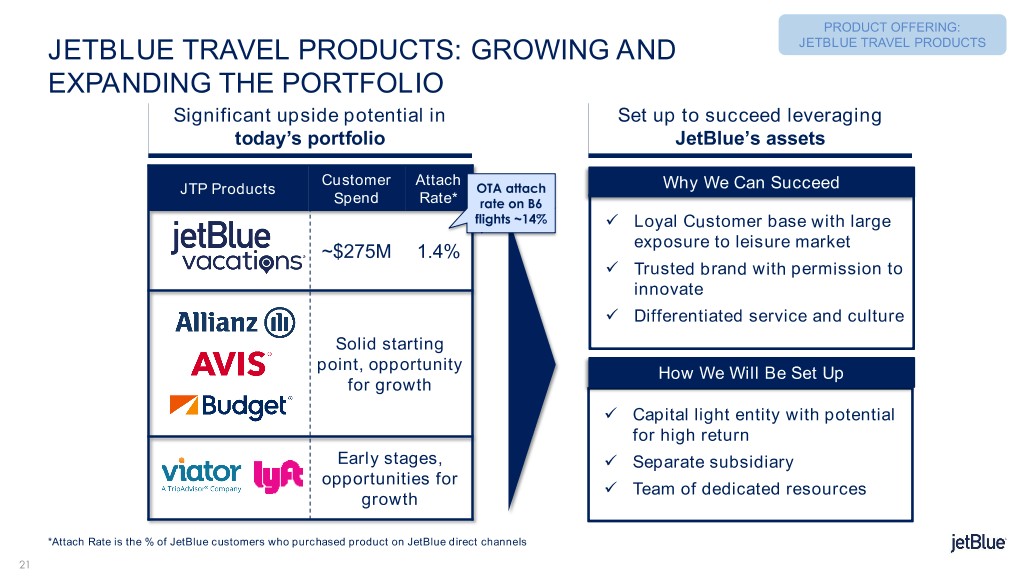

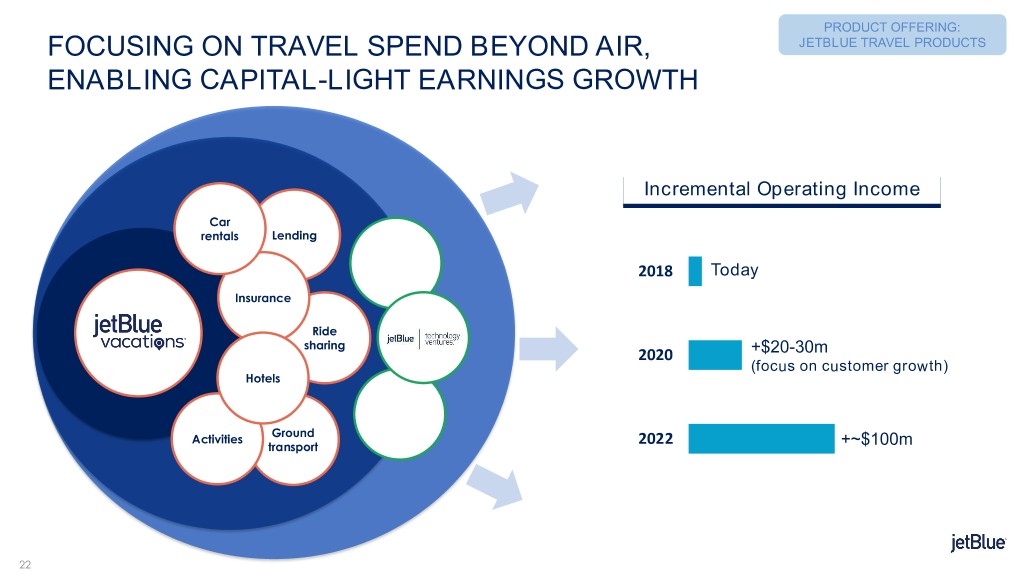

PRODUCT OFFERING: JETBLUE TRAVEL PRODUCTS: GROWING AND JETBLUE TRAVEL PRODUCTS EXPANDING THE PORTFOLIO Significant upside potential in Set up to succeed leveraging today’s portfolio JetBlue’s assets Customer Attach JTP Products OTA attach Why We Can Succeed Spend Rate* rate on B6 flights ~14% Loyal Customer base with large exposure to leisure market ~$275M 1.4% Trusted brand with permission to innovate Differentiated service and culture Solid starting point, opportunity How We Will Be Set Up for growth Capital light entity with potential for high return Early stages, Separate subsidiary opportunities for Team of dedicated resources growth *Attach Rate is the % of JetBlue customers who purchased product on JetBlue direct channels 21

PRODUCT OFFERING: FOCUSING ON TRAVEL SPEND BEYOND AIR, JETBLUE TRAVEL PRODUCTS ENABLING CAPITAL-LIGHT EARNINGS GROWTH Incremental Operating Income Car rentals Lending 2018 Today Insurance Ride sharing 2020 +$20-30m (focus on customer growth) Hotels Ground Activities transport 2022 +~$100m 22

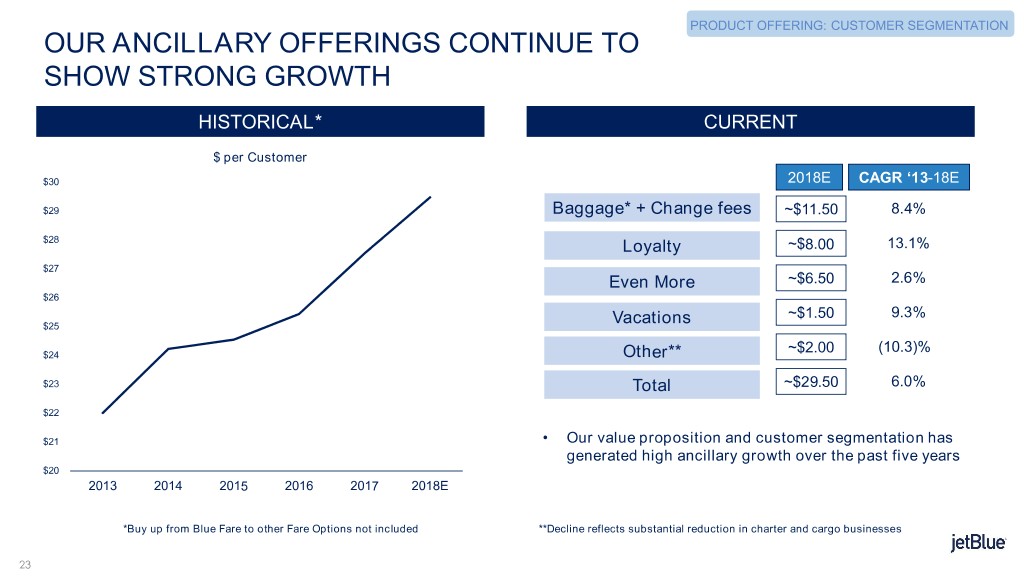

PRODUCT OFFERING: CUSTOMER SEGMENTATION OUR ANCILLARY OFFERINGS CONTINUE TO SHOW STRONG GROWTH HISTORICAL* CURRENT $ per Customer $30 2018E CAGR ‘13-18E $29 Baggage* + Change fees ~$11.50 8.4% $28 Loyalty ~$8.00 13.1% $27 Even More ~$6.50 2.6% $26 ~$1.50 9.3% $25 Vacations ~$2.00 (10.3)% $24 Other** $23 Total ~$29.50 6.0% $22 $21 • Our value proposition and customer segmentation has generated high ancillary growth over the past five years $20 2013 2014 2015 2016 2017 2018E *Buy up from Blue Fare to other Fare Options not included **Decline reflects substantial reduction in charter and cargo businesses 23

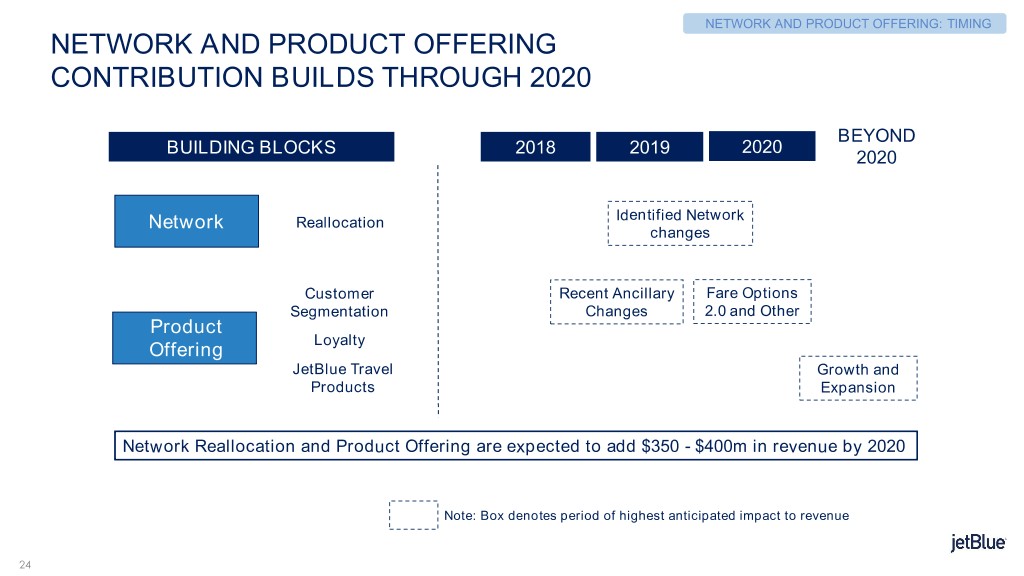

NETWORK AND PRODUCT OFFERING: TIMING NETWORK AND PRODUCT OFFERING CONTRIBUTION BUILDS THROUGH 2020 BEYOND BUILDING BLOCKS 2018 2019 2020 2020 Identified Network Network Reallocation changes Customer Recent Ancillary Fare Options Segmentation Changes 2.0 and Other Product Loyalty Offering JetBlue Travel Growth and Products Expansion Network Reallocation and Product Offering are expected to add $350 - $400m in revenue by 2020 Note: Box denotes period of highest anticipated impact to revenue 24

QUESTION & ANSWER SESSION

BONNY SIMI PRESIDENT, JETBLUE TECHNOLOGY VENTURES

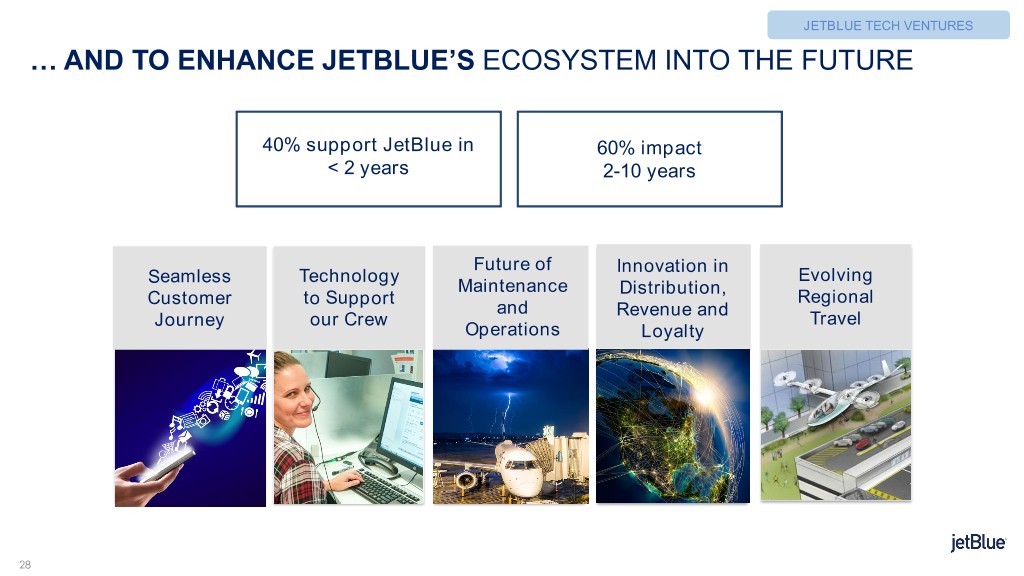

JETBLUE TECH VENTURES WE ARE INVESTING IN TOMORROW’S TECHNOLOGY TO ENHANCE JETBLUE TODAY Silicon Valley 27

JETBLUE TECH VENTURES … AND TO ENHANCE JETBLUE’S ECOSYSTEM INTO THE FUTURE 40% support JetBlue in 60% impact Increase < 2 years 2-10 years Revenue Technology- FutureFuture of of InnovationInnovation in Seamless Technology Evolving Powered MaintenanceMaintenance Distribution,Distribution, Customer to Support Regional Magnificent and Operationsand Revenue andand JourneyJourney our Crew TravelTravel Service Operations LoyaltyLoyalty 28

JOANNA GERAGHTY PRESIDENT AND CHIEF OPERATING OFFICER STEVE PRIEST EVP CHIEF FINANCIAL OFFICER

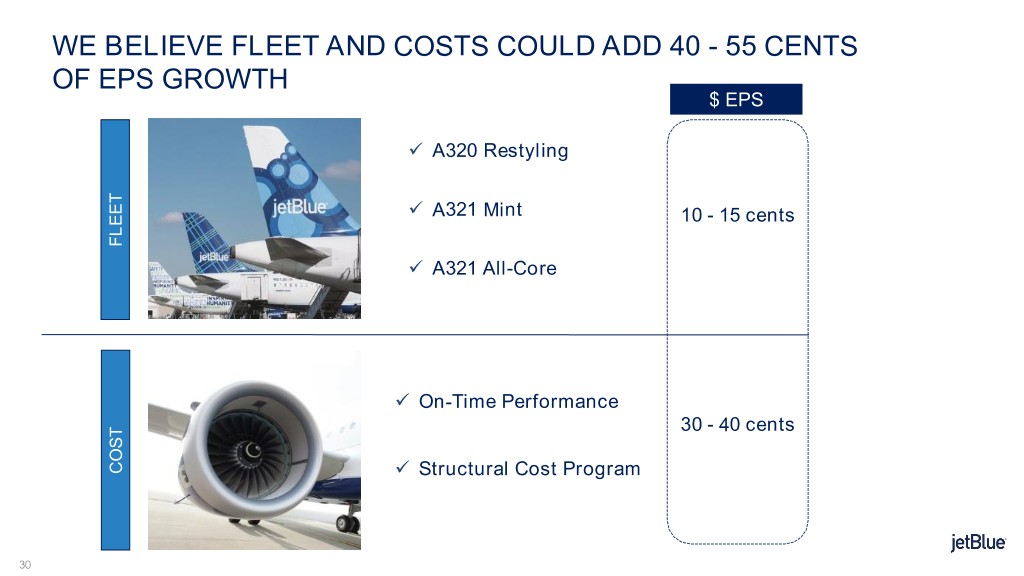

WE BELIEVE FLEET AND COSTS COULD ADD 40 - 55 CENTS OF EPS GROWTH $ EPS A320 Restyling A321 Mint 10 - 15 cents FLEET A321 All-Core On-Time Performance 30 - 40 cents COST Structural Cost Program 30

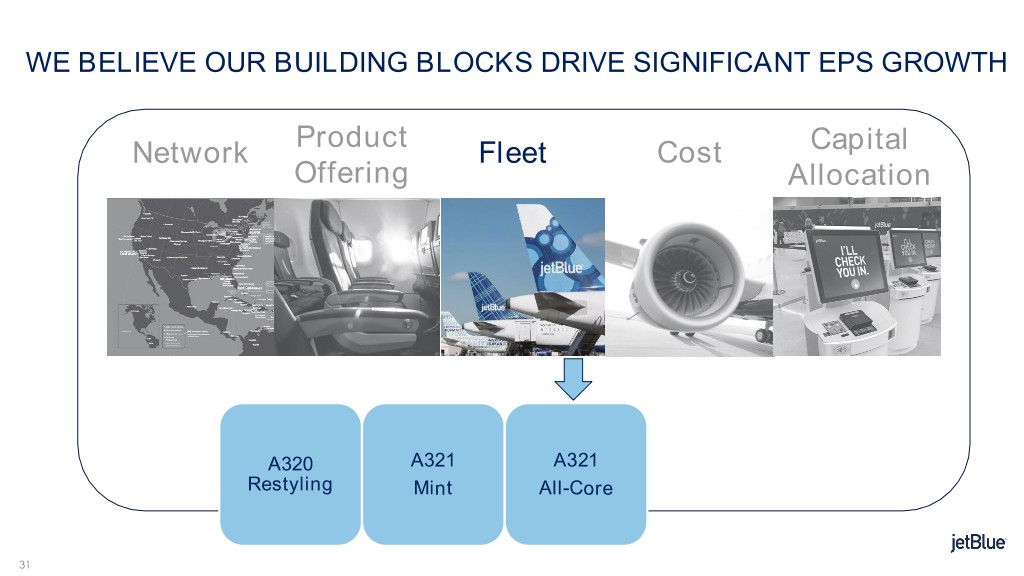

WE BELIEVE OUR BUILDING BLOCKS DRIVE SIGNIFICANT EPS GROWTH Product Network Fleet Cost Capital Offering Allocation A320 A321 A321 Restyling Mint All-Core 31

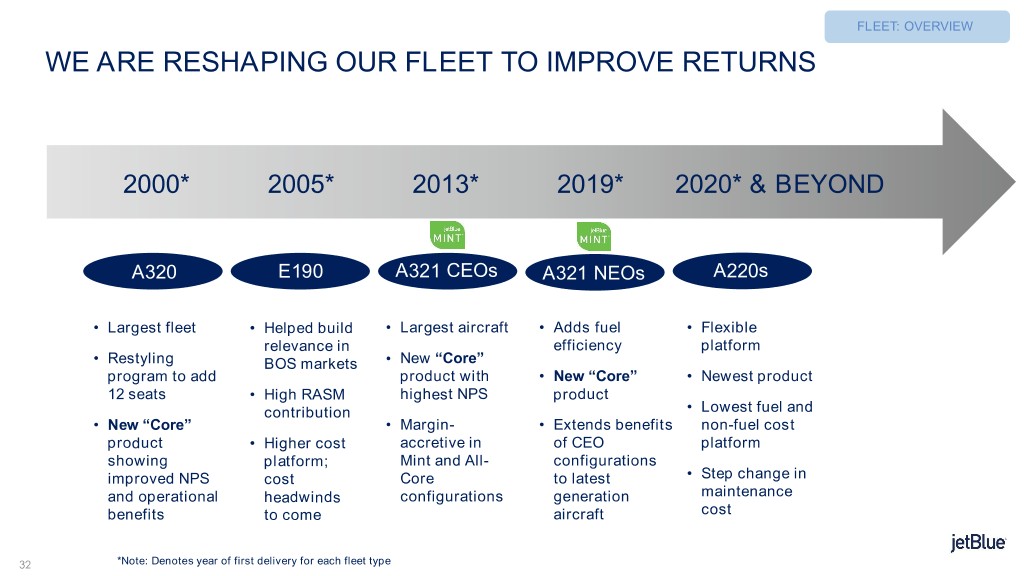

FLEET: OVERVIEW WE ARE RESHAPING OUR FLEET TO IMPROVE RETURNS 2000* 2005* 2013* 2019* 2020* & BEYOND A320 E190 A321 CEOs A321 NEOs A220s • Largest fleet • Helped build • Largest aircraft • Adds fuel • Flexible relevance in efficiency platform • Restyling BOS markets • New “Core” program to add product with • New “Core” • Newest product 12 seats • High RASM highest NPS product contribution • Lowest fuel and • New “Core” • Margin- • Extends benefits non-fuel cost product • Higher cost accretive in of CEO platform showing platform; Mint and All- configurations improved NPS cost Core to latest • Step change in and operational headwinds configurations generation maintenance benefits to come aircraft cost 32 *Note: Denotes year of first delivery for each fleet type

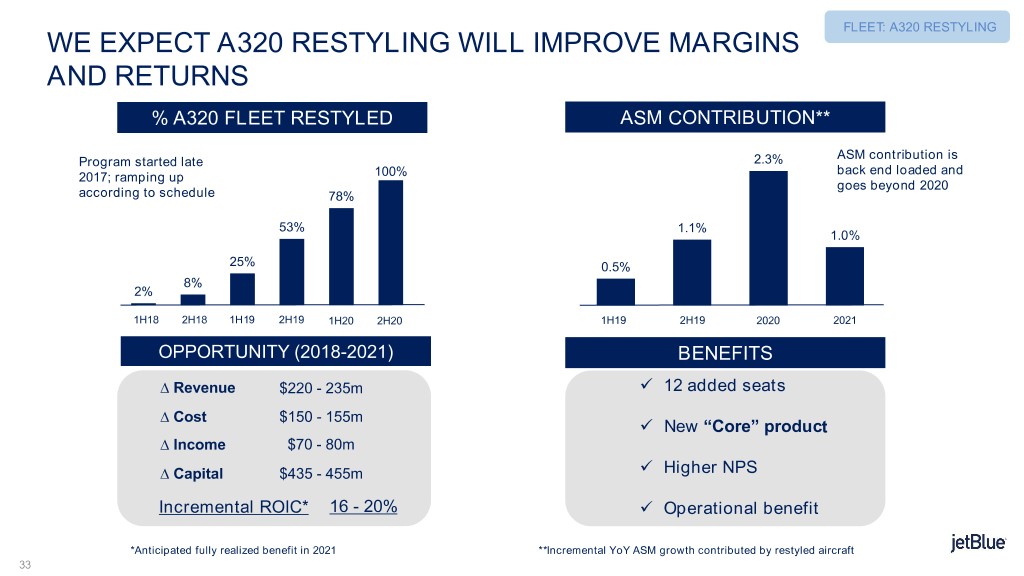

FLEET: A320 RESTYLING WE EXPECT A320 RESTYLING WILL IMPROVE MARGINS AND RETURNS % A320 FLEET RESTYLED ASM CONTRIBUTION** ASM contribution is Program started late 2.3% back end loaded and 2017; ramping up 100% goes beyond 2020 according to schedule 78% 53% 1.1% 1.0% 25% 0.5% 8% 2% 1H18 2H18 1H19 2H19 1H20 2H20 1H19 2H19 2020 2021 OPPORTUNITY (2018-2021) BENEFITS ∆ Revenue $220 - 235m 12 added seats ∆ Cost $150 - 155m New “Core” product ∆ Income $70 - 80m ∆ Capital $435 - 455m Higher NPS Incremental ROIC* 16 - 20% Operational benefit *Anticipated fully realized benefit in 2021 **Incremental YoY ASM growth contributed by restyled aircraft 33

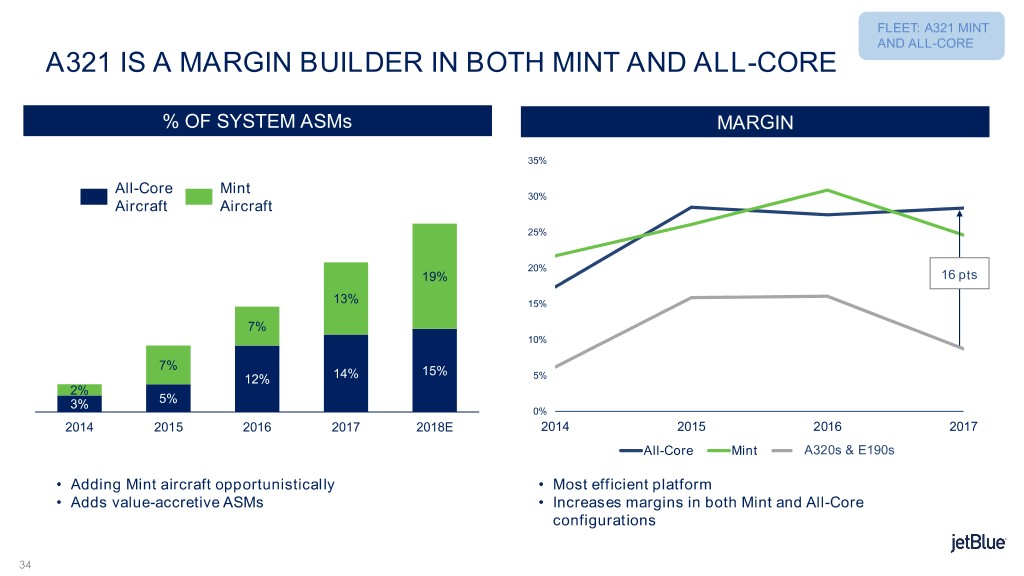

FLEET: A321 MINT AND ALL-CORE A321 IS A MARGIN BUILDER IN BOTH MINT AND ALL-CORE % OF SYSTEM ASMs MARGIN 35% All-Core Mint 30% Aircraft Aircraft 25% 20% 19% 16 pts 13% 15% 7% 10% 7% 15% 12% 14% 5% 2% 3% 5% 0% 2014 2015 2016 2017 2018E 2014 2015 2016 2017 All-Core Mint SystemA320s (ex-321)& E190s • Adding Mint aircraft opportunistically • Most efficient platform • Adds value-accretive ASMs • Increases margins in both Mint and All-Core configurations 34

WE BELIEVE OUR BUILDING BLOCKS DRIVE SIGNIFICANT EPS GROWTH Product Network Fleet Cost Capital Offering Allocation On-Time Structural Performance Cost Program 35

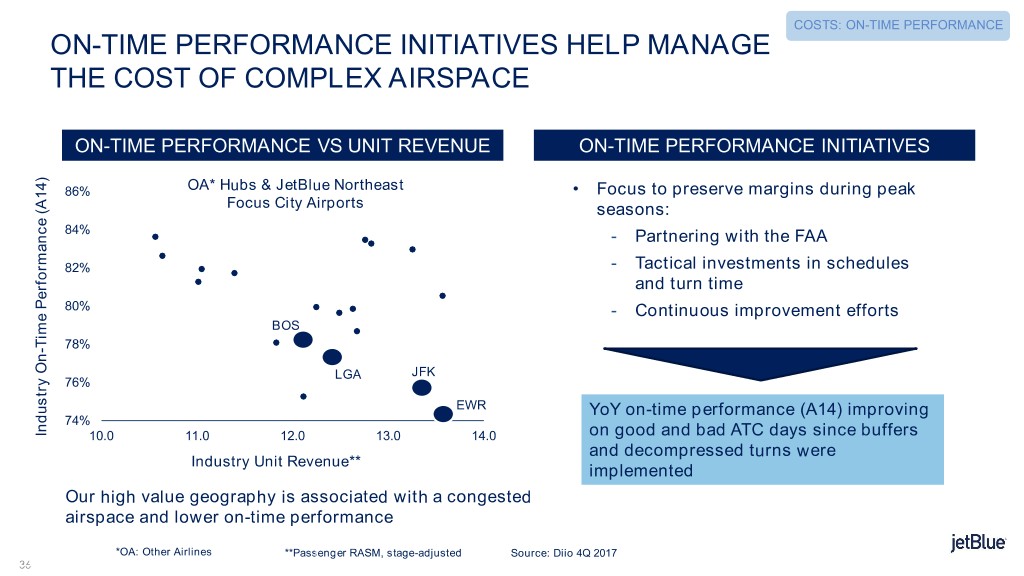

COSTS: ON-TIME PERFORMANCE ON-TIME PERFORMANCE INITIATIVES HELP MANAGE THE COST OF COMPLEX AIRSPACE ON-TIME PERFORMANCE VS UNIT REVENUE ON-TIME PERFORMANCE INITIATIVES 86% OA* Hubs & JetBlue Northeast • Focus to preserve margins during peak Focus City Airports seasons: 84% - Partnering with the FAA 82% - Tactical investments in schedules and turn time 80% - Continuous improvement efforts BOS Time Performance (A14) Performance Time 78% - LGA JFK 76% EWR YoY on-time performance (A14) improving 74% Industry On Industry 10.0 11.0 12.0 13.0 14.0 on good and bad ATC days since buffers and decompressed turns were Industry Unit Revenue** implemented Our high value geography is associated with a congested airspace and lower on-time performance *OA: Other Airlines **Passenger RASM, stage-adjusted Source: Diio 4Q 2017 36

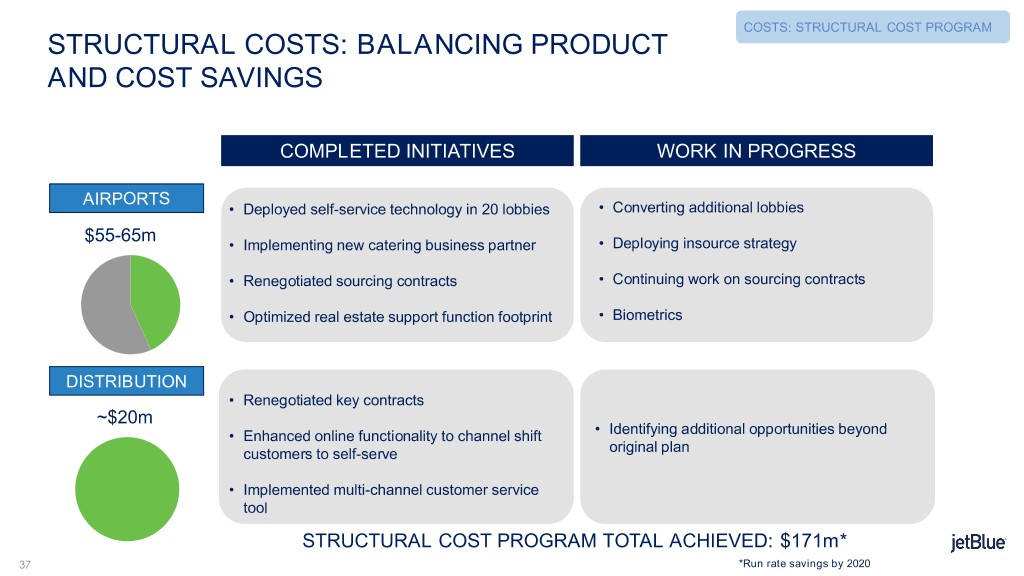

COSTS: STRUCTURAL COST PROGRAM STRUCTURAL COSTS: BALANCING PRODUCT AND COST SAVINGS COMPLETED INITIATIVES WORK IN PROGRESS AIRPORTS • Deployed self-service technology in 20 lobbies • Converting additional lobbies $55-65m • Implementing new catering business partner • Deploying insource strategy • Renegotiated sourcing contracts • Continuing work on sourcing contracts • Optimized real estate support function footprint • Biometrics DISTRIBUTION • Renegotiated key contracts ~$20m • Enhanced online functionality to channel shift • Identifying additional opportunities beyond customers to self-serve original plan • Implemented multi-channel customer service tool STRUCTURAL COST PROGRAM TOTAL ACHIEVED: $171m* 37 *Run rate savings by 2020

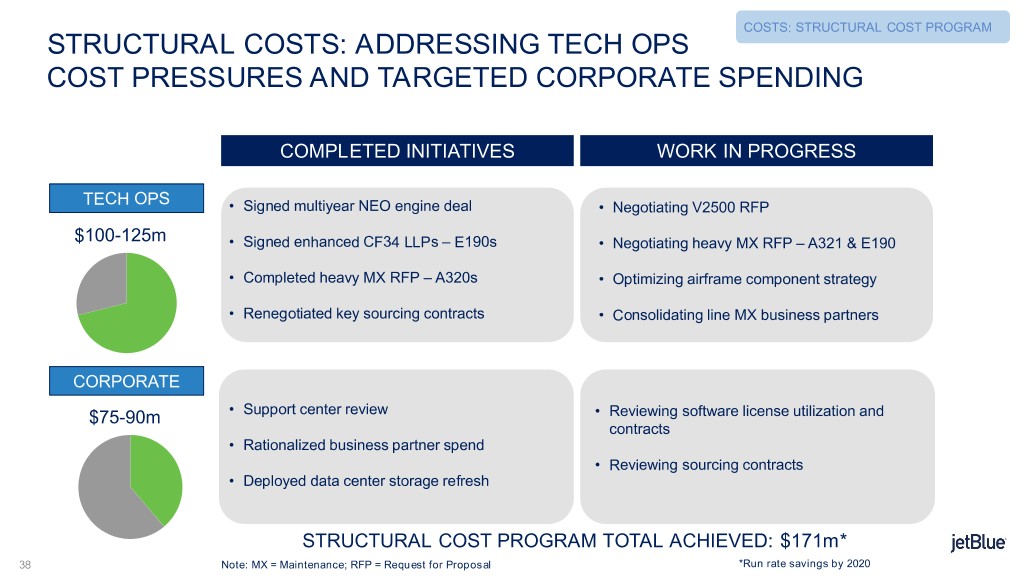

COSTS: STRUCTURAL COST PROGRAM STRUCTURAL COSTS: ADDRESSING TECH OPS COST PRESSURES AND TARGETED CORPORATE SPENDING COMPLETED INITIATIVES WORK IN PROGRESS TECH OPS • Signed multiyear NEO engine deal • Negotiating V2500 RFP $100-125m • Signed enhanced CF34 LLPs – E190s • Negotiating heavy MX RFP – A321 & E190 • Completed heavy MX RFP – A320s • Optimizing airframe component strategy • Renegotiated key sourcing contracts • Consolidating line MX business partners CORPORATE $75-90m • Support center review • Reviewing software license utilization and contracts • Rationalized business partner spend • Reviewing sourcing contracts • Deployed data center storage refresh STRUCTURAL COST PROGRAM TOTAL ACHIEVED: $171m* 38 Note: MX = Maintenance; RFP = Request for Proposal *Run rate savings by 2020

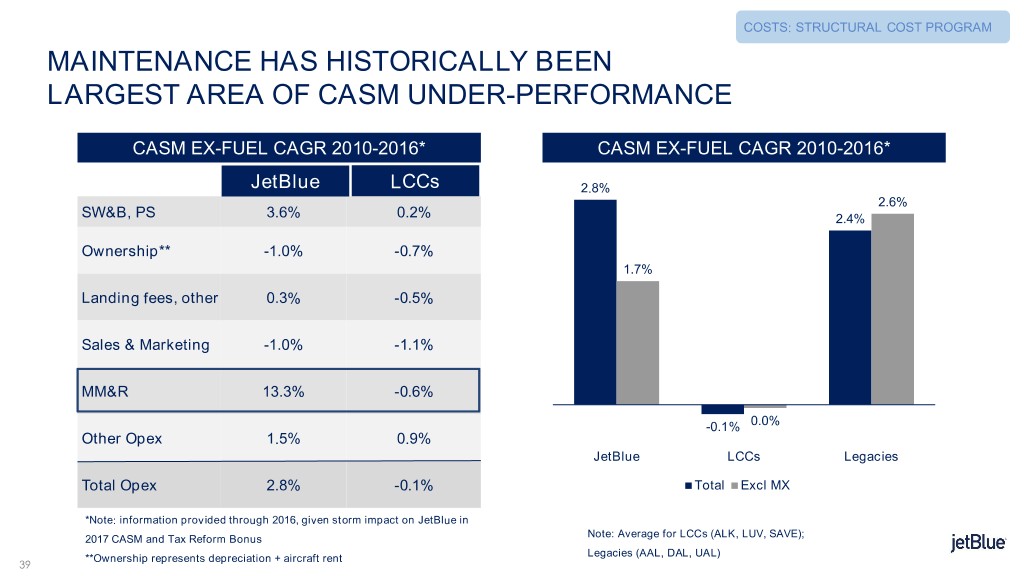

COSTS: STRUCTURAL COST PROGRAM MAINTENANCE HAS HISTORICALLY BEEN LARGEST AREA OF CASM UNDER-PERFORMANCE CASM EX-FUEL CAGR 2010-2016* CASM EX-FUEL CAGR 2010-2016* JetBlue LCCs 2.8% 2.6% SW&B, PS 3.6% 0.2% 2.4% Ownership** -1.0% -0.7% 1.7% Landing fees, other 0.3% -0.5% Sales & Marketing -1.0% -1.1% MM&R 13.3% -0.6% -0.1% 0.0% Other Opex 1.5% 0.9% JetBlue LCCs Legacies Total Opex 2.8% -0.1% Total Excl MX *Note: information provided through 2016, given storm impact on JetBlue in Note: Average for LCCs (ALK, LUV, SAVE); 2017 CASM and Tax Reform Bonus Legacies (AAL, DAL, UAL) **Ownership represents depreciation + aircraft rent 39

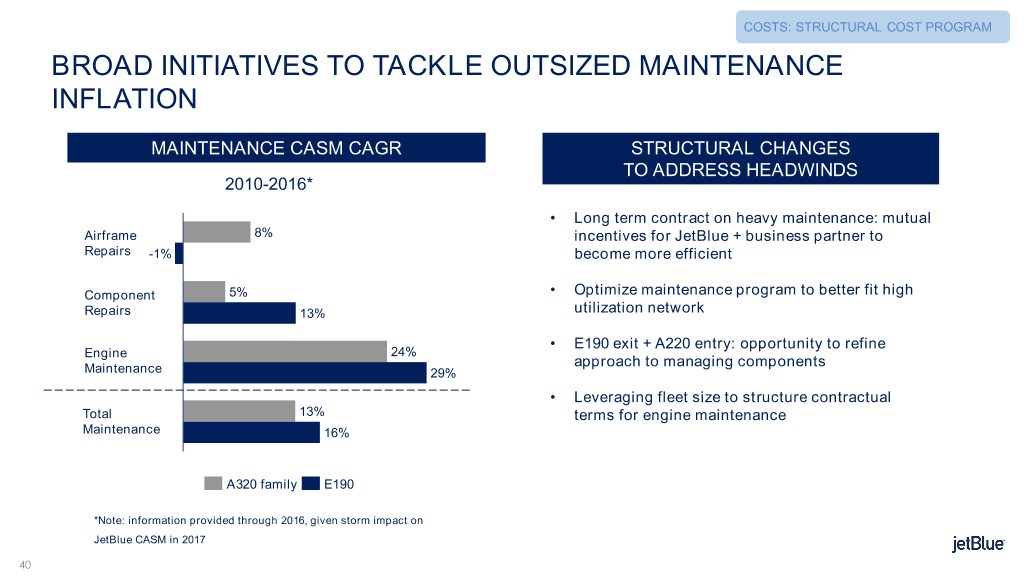

COSTS: STRUCTURAL COST PROGRAM BROAD INITIATIVES TO TACKLE OUTSIZED MAINTENANCE INFLATION MAINTENANCE CASM CAGR STRUCTURAL CHANGES TO ADDRESS HEADWINDS 2010-2016* • Long term contract on heavy maintenance: mutual Airframe 8% incentives for JetBlue + business partner to Repairs -1% become more efficient Component 5% • Optimize maintenance program to better fit high Repairs 13% utilization network • E190 exit + A220 entry: opportunity to refine Engine 24% approach to managing components Maintenance 29% • Leveraging fleet size to structure contractual Total 13% terms for engine maintenance Maintenance 16% A320 family E190 *Note: information provided through 2016, given storm impact on JetBlue CASM in 2017 40

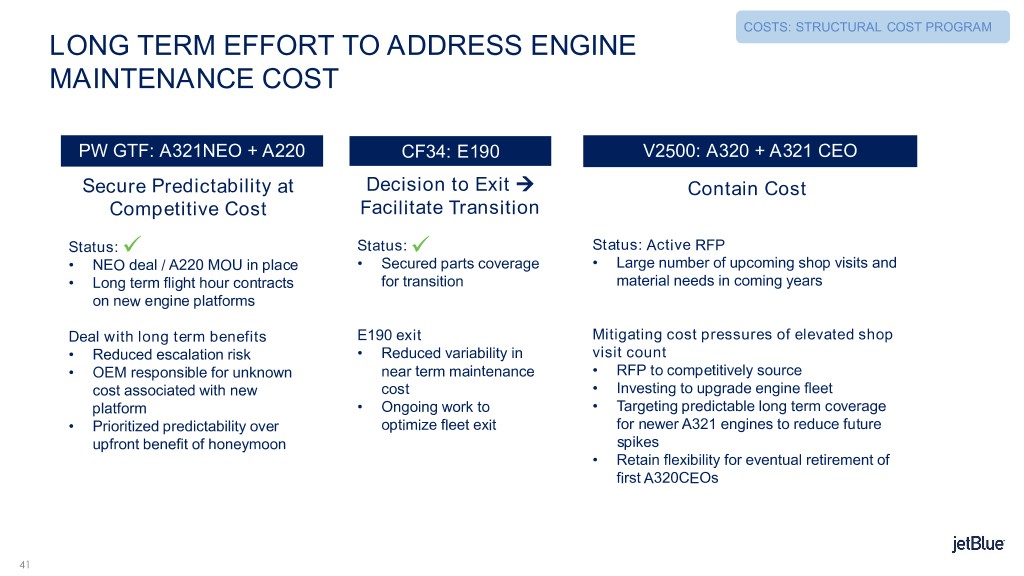

COSTS: STRUCTURAL COST PROGRAM LONG TERM EFFORT TO ADDRESS ENGINE MAINTENANCE COST PW GTF: A321NEO + A220 CF34: E190 V2500: A320 + A321 CEO Secure Predictability at Decision to Exit Contain Cost Competitive Cost Facilitate Transition Status: Status: Status: Active RFP • NEO deal / A220 MOU in place • Secured parts coverage • Large number of upcoming shop visits and • Long term flight hour contracts for transition material needs in coming years on new engine platforms Deal with long term benefits E190 exit Mitigating cost pressures of elevated shop • Reduced escalation risk • Reduced variability in visit count • OEM responsible for unknown near term maintenance • RFP to competitively source cost associated with new cost • Investing to upgrade engine fleet platform • Ongoing work to • Targeting predictable long term coverage • Prioritized predictability over optimize fleet exit for newer A321 engines to reduce future upfront benefit of honeymoon spikes • Retain flexibility for eventual retirement of first A320CEOs 41

COSTS: SUMMARY WE EXPECT TO BE ON TARGET TO HIT OUR 0-1% CASM CAGR GOAL 0.5% - 2.0% 0.0% - 2.0% Structural Cost Structural Cost Program Program ASM Additional ASM Growth (lower) Growth (restyle) 0.0% - 1.0% ALPA A220 (2.5)% - (0.5)% 2018E 2019E 2020E 2018-2020 CAGR TARGET KEY ASSUMPTIONS • JetBlue ASM: 5-7% • JetBlue ASM: Top half of mid-high Note: 2018 excludes special items: • One-time expenses related to ALPA contract single digit range • Impairment of E190 fleet • 2020E includes A220 0-1% CASM CAGR target excludes cost impact A220 impact of 0.25 bps 42

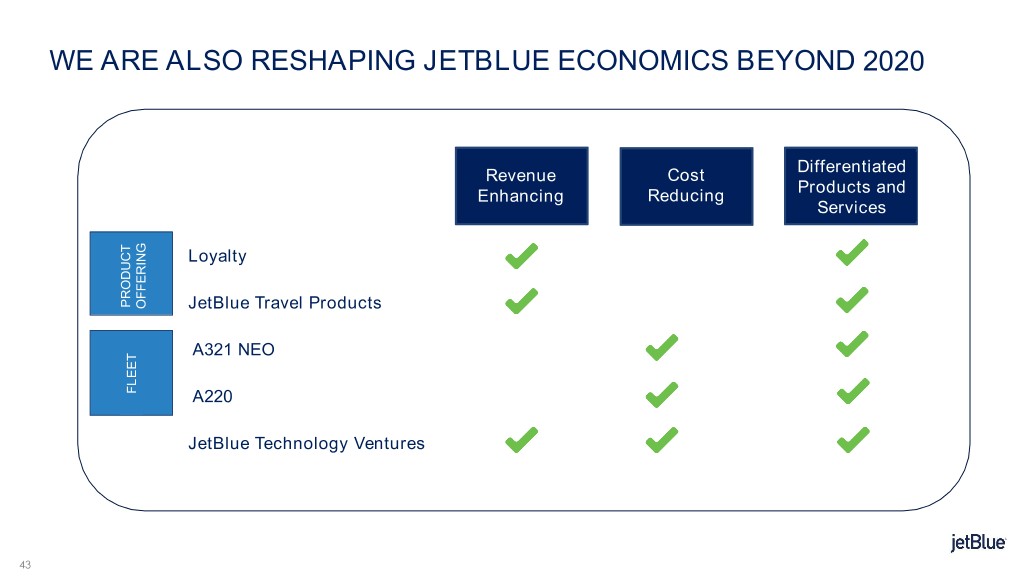

WE ARE ALSO RESHAPING JETBLUE ECONOMICS BEYOND 2020 Differentiated Revenue Cost Products and Enhancing Reducing Services Loyalty PRODUCT PRODUCT OFFERING JetBlue Travel Products A321 NEO FLEET A220 JetBlue Technology Ventures 43

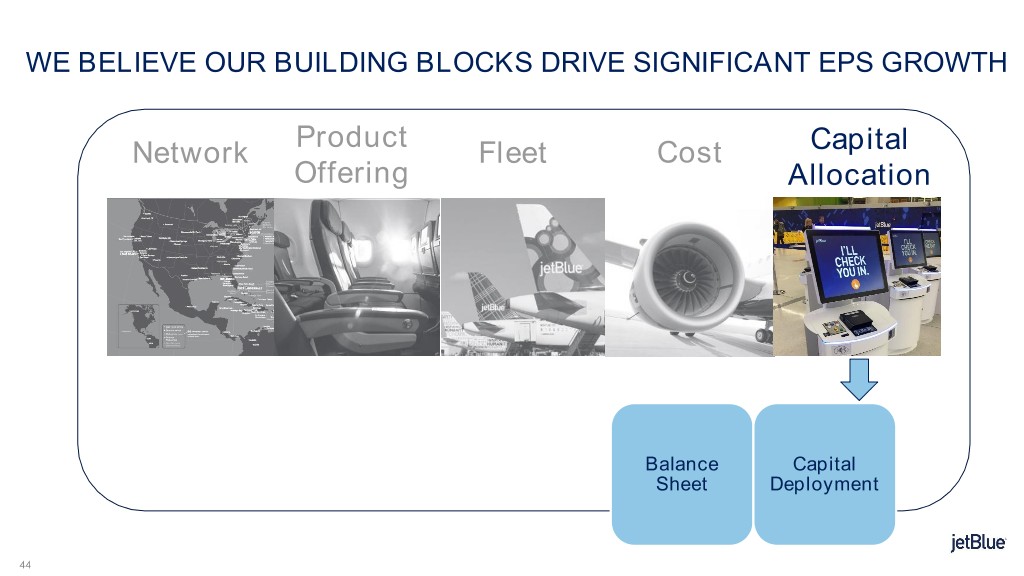

WE BELIEVE OUR BUILDING BLOCKS DRIVE SIGNIFICANT EPS GROWTH Product Network Fleet Cost Capital Offering Allocation Balance Capital Sheet Deployment 44

CAPITAL ALLOCATION: WE HAVE ONE OF THE STRONGEST BALANCE SHEETS BALANCE SHEET IN THE AIRLINE INDUSTRY ADJ. DEBT/CAP; DEBT REPAYMENT BALANCE SHEET METRICS Trailing 12 months, as of 06/30/2018 Trailing 12 months, as of 06/30/2018 800 60% 55% 700 1.94x 50% 46% 600 40% 500 35% 29% 30% 400 30% US$ millionUS$ 300 0.80x 20% 60% 200 10% 30% 100 0 0% 2014 2015 2016 2017 TTM Adj Debt / Cap Net Debt / EBITDAR Adj. Debt/Cap Debt Repayment JetBlue Peers (excludes pension) 45 Note: TTM: excludes E190 impairment

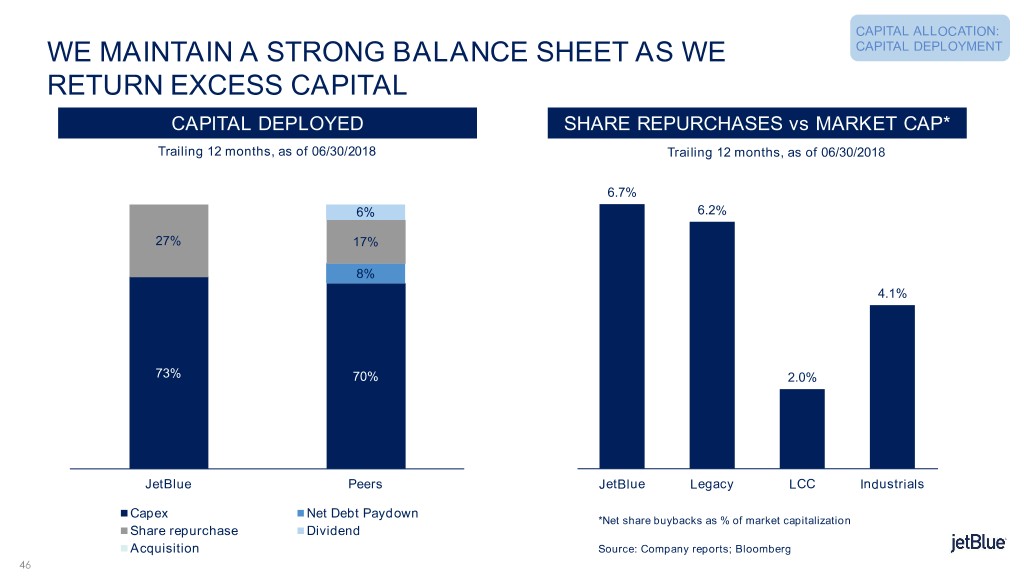

CAPITAL ALLOCATION: WE MAINTAIN A STRONG BALANCE SHEET AS WE CAPITAL DEPLOYMENT RETURN EXCESS CAPITAL CAPITAL DEPLOYED SHARE REPURCHASES vs MARKET CAP* Trailing 12 months, as of 06/30/2018 Trailing 12 months, as of 06/30/2018 6.7% 6% 6.2% 27% 17% 8% 4.1% 73% 70% 2.0% JetBlue Peers JetBlue Legacy LCC Industrials Capex Net Debt Paydown *Net share buybacks as % of market capitalization Share repurchase Dividend Acquisition Source: Company reports; Bloomberg 46

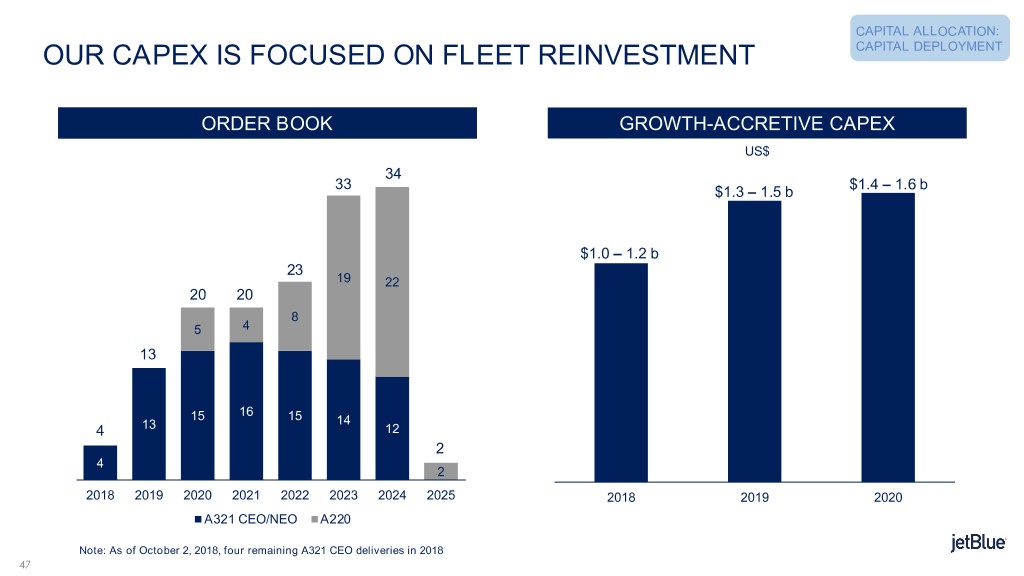

CAPITAL ALLOCATION: OUR CAPEX IS FOCUSED ON FLEET REINVESTMENT CAPITAL DEPLOYMENT CAPITALORDER DEPLOYED BOOK GROWTH-ACCRETIVE CAPEX US$ 34 33 $1.4 – 1.6 b $1.3 – 1.5 b $1.0 – 1.2 b 23 19 22 20 20 8 5 4 13 16 15 15 14 4 13 12 2 4 2 2018 2019 2020 2021 2022 2023 2024 2025 2018 2019 2020 A321 CEO/NEO A220 Note: As of October 2, 2018, four remaining A321 CEO deliveries in 2018 47

OUR BUILDING BLOCKS TOUCH NEARLY EVERY ASPECT OF JETBLUE Product Network Fleet Cost Capital Offering Allocation Focused Customer A320 On-Time Balance Capital Maturation Loyalty Growth Segment Restyling Performance Sheet Deployment JetBlue Structural A321 A321 Re- Travel Cost Allocation Products Mint All-Core Program 48

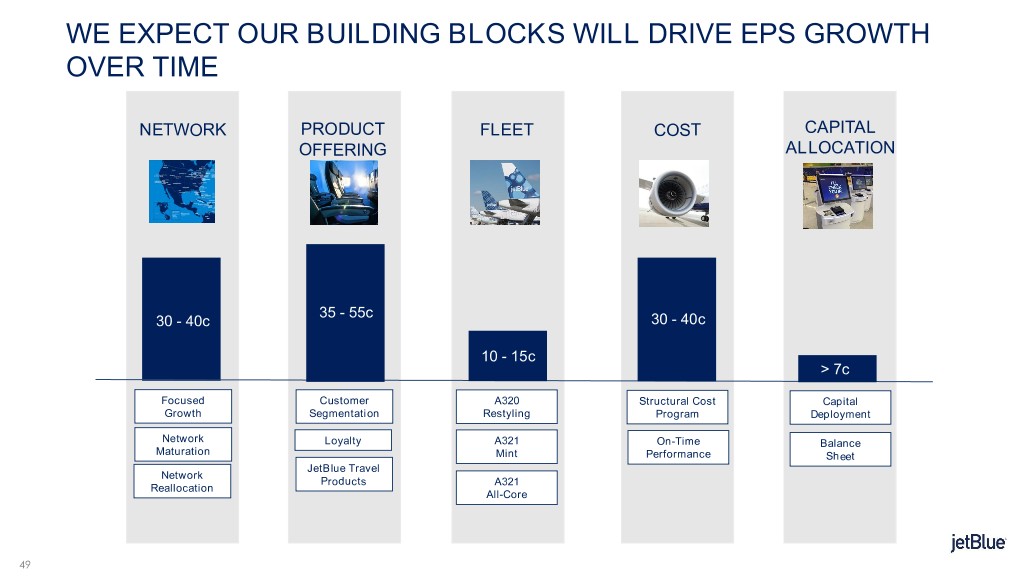

WE EXPECT OUR BUILDING BLOCKS WILL DRIVE EPS GROWTH OVER TIME NETWORK PRODUCT FLEET COST CAPITAL OFFERING ALLOCATION 35 - 55c 30 - 40c 30 - 40c 10 - 15c > 7c Focused Customer A320 Structural Cost Capital Growth Segmentation Restyling Program Deployment Network Loyalty A321 On-Time Balance Maturation Mint Performance Sheet JetBlue Travel Network Products A321 Reallocation All-Core 49

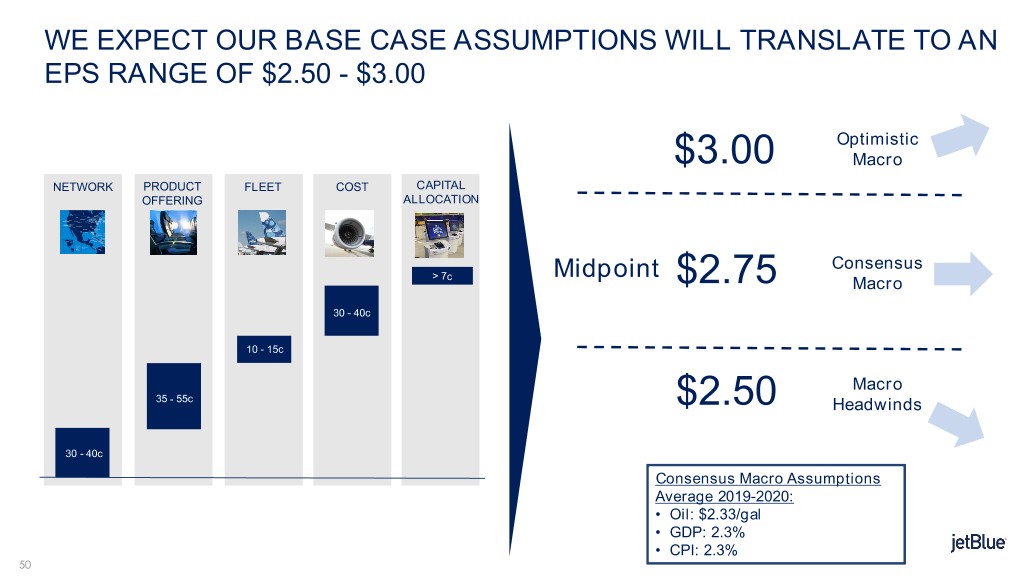

WE EXPECT OUR BASE CASE ASSUMPTIONS WILL TRANSLATE TO AN EPS RANGE OF $2.50 - $3.00 Optimistic $3.00 Macro NETWORK PRODUCT FLEET COST CAPITAL OFFERING ALLOCATION Consensus > 7c Midpoint $2.75 Macro 30 - 40c 10 - 15c Macro 35 - 55c $2.50 Headwinds 30 - 40c Consensus Macro Assumptions Average 2019-2020: • Oil: $2.33/gal • GDP: 2.3% • CPI: 2.3% 50

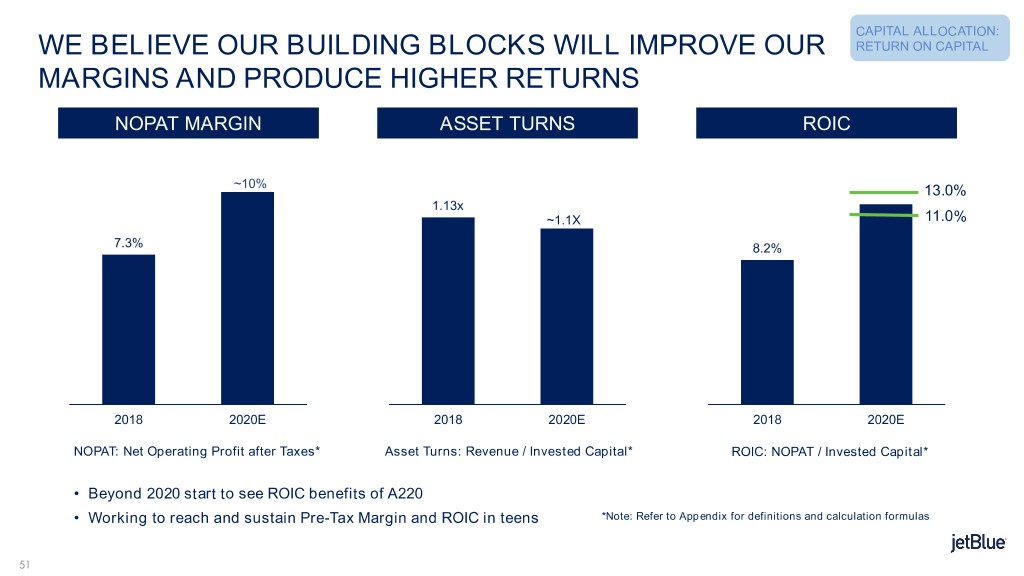

CAPITAL ALLOCATION: WE BELIEVE OUR BUILDING BLOCKS WILL IMPROVE OUR RETURN ON CAPITAL MARGINS AND PRODUCE HIGHER RETURNS NOPAT MARGIN ASSET TURNS ROIC ~10% 13.0% 1.13x ~1.1X 11.0% 7.3% 8.2% 2018 2020E 2018 2020E 2018 2020E NOPAT: Net Operating Profit after Taxes* Asset Turns: Revenue / Invested Capital* ROIC: NOPAT / Invested Capital* • Beyond 2020 start to see ROIC benefits of A220 • Working to reach and sustain Pre-Tax Margin and ROIC in teens *Note: Refer to Appendix for definitions and calculation formulas 51

RECAP OF OUR INVESTOR DAY 1. JetBlue’s differentiated business model and culture creates opportunities for accretive growth. 2. Since 2014 we’ve continued our journey to improve absolute and relative margins. 3. We believe our ‘Building Blocks’ will improve our margins and returns, and power meaningful EPS growth through 2020 and beyond. 52

QUESTION & ANSWER SESSION

APPENDIX: NOTE ON NON-GAAP FINANCIAL MEASURES JetBlue sometimes uses non-GAAP measures that are derived from the Consolidated Financial Statements, but that are not presented in accordance with generally accepted accounting principles ("GAAP"). JetBlue believes these non-GAAP measures provide a meaningful comparison of our results to others in the airline industry and our prior year results. Investors should consider these non-GAAP financial measures in addition to, and not as a substitute for, our financial performance measures prepared in accordance with GAAP. We believe our special items distort our overall trends and that our metrics and results are enhanced with the presentation of our results excluding the impact of special items. For 2014, our special item includes the $241 million gain on the sale of LiveTV, a wholly-owned subsidiary of JetBlue. For 2017, our special item includes a $570 million tax benefit from the measurement of our deferred taxes to reflect the impact of the enactment of the Tax Cut and Jobs Act of 2017. Please refer to our 2014 Annual Report Form 10-K filed with the SEC on February 12, 2015, and our 2017 Annual Report Form 10-K filed with the SEC on February 16, 2018 for a reconciliation of these non-GAAP financial measures. 54

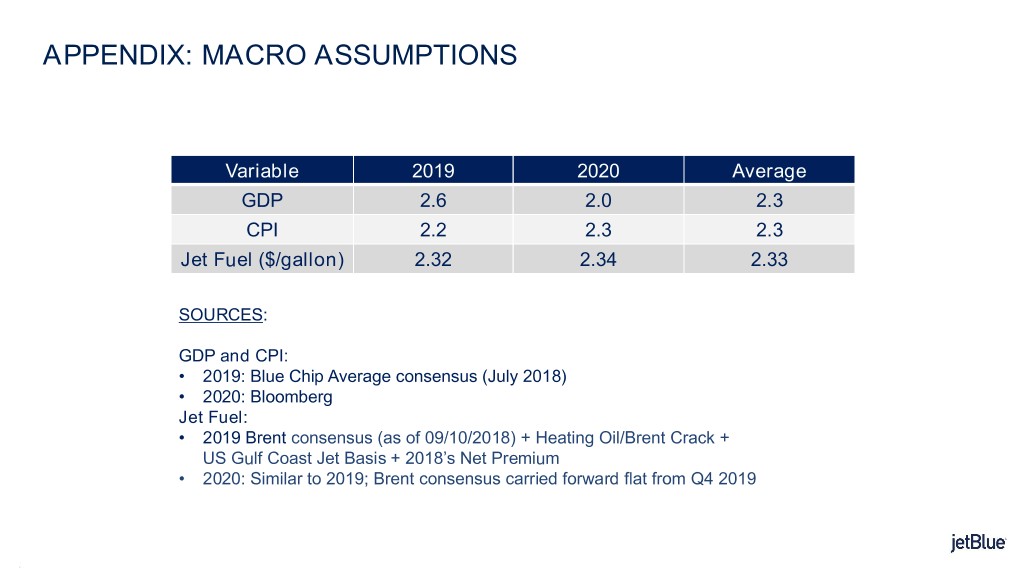

APPENDIX: MACRO ASSUMPTIONS Variable 2019 2020 Average GDP 2.6 2.0 2.3 CPI 2.2 2.3 2.3 Jet Fuel ($/gallon) 2.32 2.34 2.33 SOURCES: GDP and CPI: • 2019: Blue Chip Average consensus (July 2018) • 2020: Bloomberg Jet Fuel: • 2019 Brent consensus (as of 09/10/2018) + Heating Oil/Brent Crack + US Gulf Coast Jet Basis + 2018’s Net Premium • 2020: Similar to 2019; Brent consensus carried forward flat from Q4 2019 55

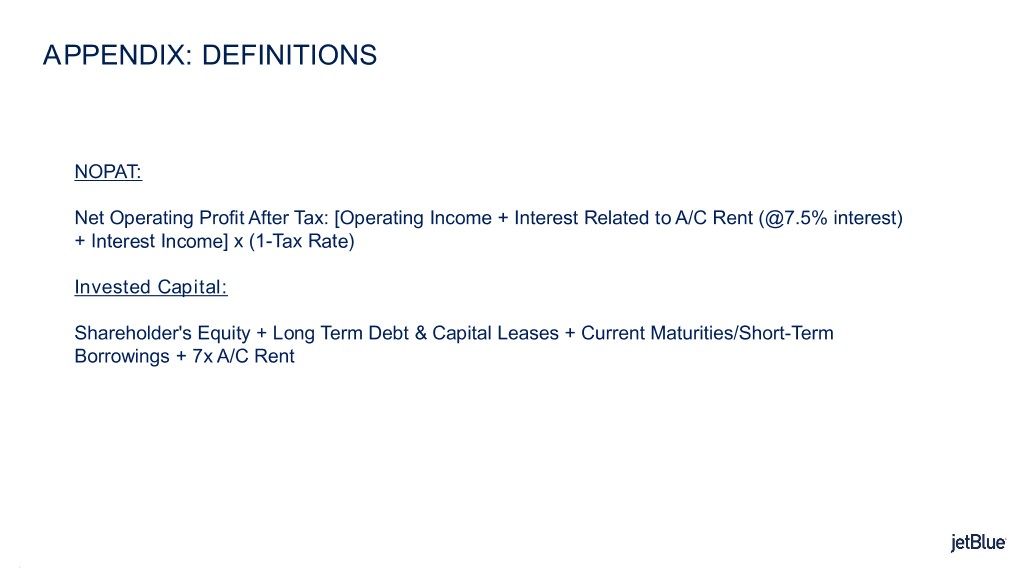

APPENDIX: DEFINITIONS NOPAT: Net Operating Profit After Tax: [Operating Income + Interest Related to A/C Rent (@7.5% interest) + Interest Income] x (1-Tax Rate) Invested Capital: Shareholder's Equity + Long Term Debt & Capital Leases + Current Maturities/Short-Term Borrowings + 7x A/C Rent 56

5757