Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - CHART INDUSTRIES INC | d548141d8k.htm |

Chart Industries Strategic Update October 2, 2018 Exhibit 99.1

Forward-Looking Statements Certain statements made in this presentation are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements include statements concerning Chart Industries’ plans, objectives, future orders, revenues, margins, tax rates and tax planning, earnings or performance, liquidity and cash flow, capital expenditures, business trends, and other information that is not historical in nature. Forward-looking statements may be identified by terminology such as "may," "will," "should," "could," "expects," "anticipates," "believes," "projects," "forecasts," “outlook,” “guidance,” "continue," or the negative of such terms or comparable terminology. Forward-looking statements contained in this presentation or in other statements made by the Company are made based on management's expectations and beliefs concerning future events impacting the Company and are subject to uncertainties and factors relating to the Company's operations and business environment, all of which are difficult to predict and many of which are beyond the Company's control, that could cause the Company's actual results to differ materially from those matters expressed or implied by forward-looking statements. Factors that could cause the Company’s actual results to differ materially from those described in the forward-looking statements include: those found in Item 1A (Risk Factors) in the Company’s most recent Annual Report on Form 10-K filed with the SEC, which should be reviewed carefully; Chart’s ability to close the VRV acquisition, successfully integrate VRV, and achieve anticipated revenue, earnings and accretion; estimated segment revenues, future revenue, earnings, cash flows, and margin targets and run rates; and Chart’s ability to close the sale of its oxygen-related products business within the BioMedical segment. The Company undertakes no obligation to update or revise any forward-looking statement. Chart Industries is a leading diversified global manufacturer of highly engineered equipment for the industrial gas, energy, and biomedical industries. The majority of Chart Industries' products are used throughout the liquid gas supply chain for purification, liquefaction, distribution, storage and end-use applications, a large portion of which are energy-related. Chart Industries has domestic operations located across the United States and an international presence in Asia, Australia, Europe and Latin America. For more information, visit: http://www.chartindustries.com.

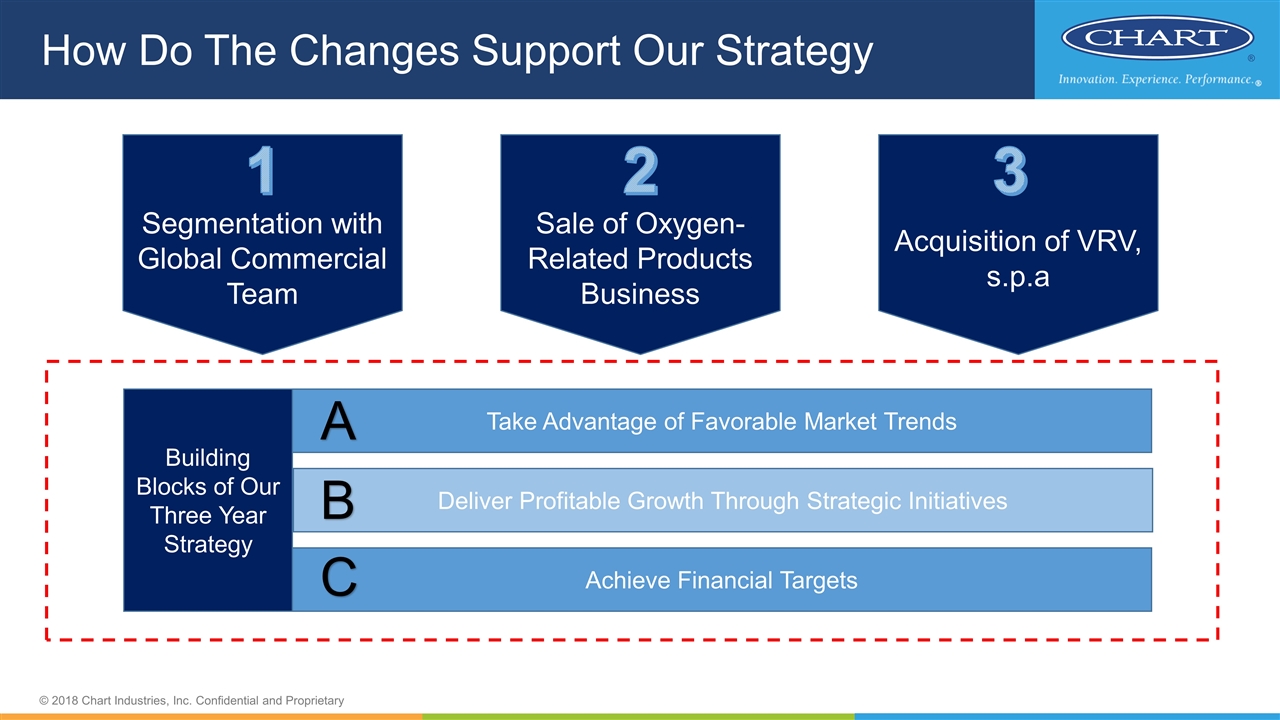

Changes to Support Our Strategy Segmentation with Global Commercial Team Sale of Oxygen-Related Products Business Acquisition of VRV, s.p.a 1 2 3 Predictable, Disciplined and Profitable Growth Take Advantage of Favorable Market Trends Deliver Profitable Growth Through Strategic Initiatives Achieve Financial Targets Building Blocks of Our Three Year Strategy A B C

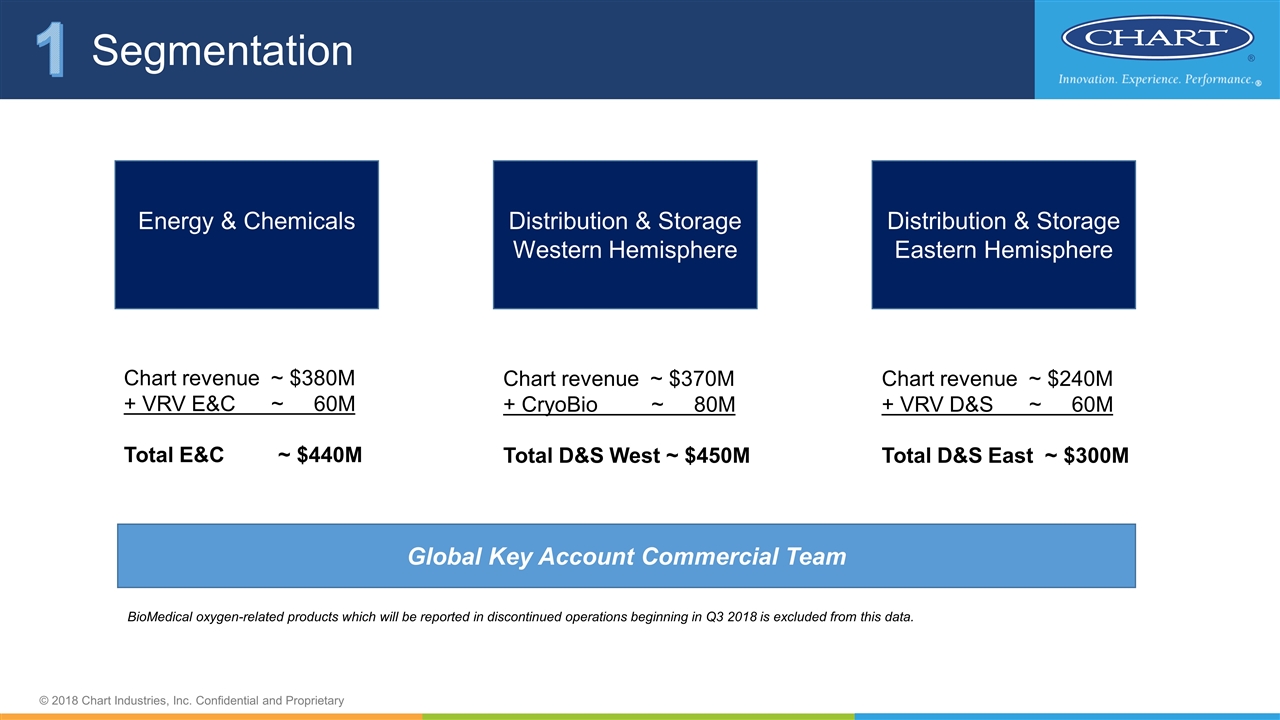

Segmentation Energy & Chemicals Distribution & Storage Western Hemisphere Distribution & Storage Eastern Hemisphere Chart revenue ~ $380M + VRV E&C ~ 60M Total E&C ~ $440M Chart revenue ~ $370M + CryoBio ~ 80M Total D&S West ~ $450M Chart revenue ~ $240M + VRV D&S ~ 60M Total D&S East ~ $300M 1 Global Key Account Commercial Team BioMedical oxygen-related products which will be reported in discontinued operations beginning in Q3 2018 is excluded from this data.

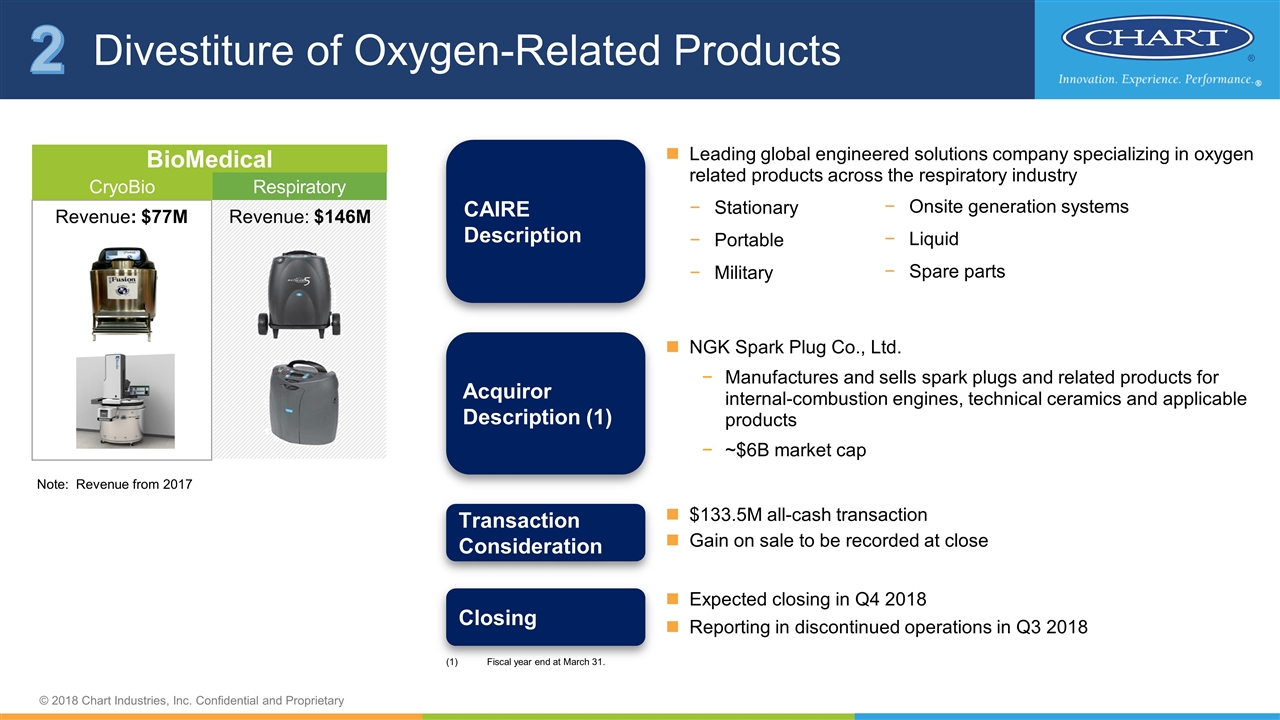

Divestiture of Oxygen-Related Products 2 Respiratory BioMedical Revenue: $77M Revenue: $146M CryoBio Note: Revenue from 2017 CAIRE Description Leading global engineered solutions company specializing in oxygen related products across the respiratory industry Stationary Portable Military Transaction Consideration $133.5M all-cash transaction Gain on sale to be recorded at close Acquiror Description (1) NGK Spark Plug Co., Ltd. Manufactures and sells spark plugs and related products for internal-combustion engines, technical ceramics and applicable products ~$6B market cap Closing Expected closing in Q4 2018 Reporting in discontinued operations in Q3 2018 (1) Fiscal year end at March 31. Onsite generation systems Liquid Spare parts

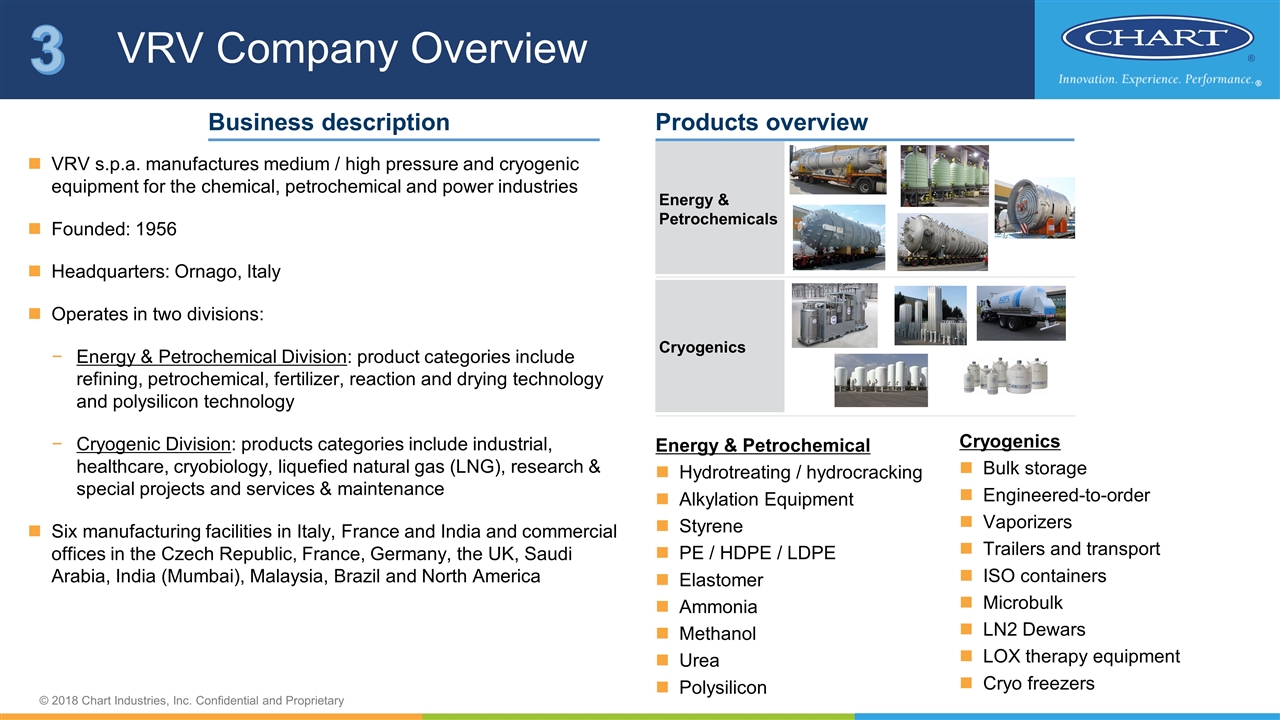

Energy & Petrochemicals VRV s.p.a. manufactures medium / high pressure and cryogenic equipment for the chemical, petrochemical and power industries Founded: 1956 Headquarters: Ornago, Italy Operates in two divisions: Energy & Petrochemical Division: product categories include refining, petrochemical, fertilizer, reaction and drying technology and polysilicon technology Cryogenic Division: products categories include industrial, healthcare, cryobiology, liquefied natural gas (LNG), research & special projects and services & maintenance Six manufacturing facilities in Italy, France and India and commercial offices in the Czech Republic, France, Germany, the UK, Saudi Arabia, India (Mumbai), Malaysia, Brazil and North America Business description Products overview Cryogenics Energy & Petrochemical Hydrotreating / hydrocracking Alkylation Equipment Styrene PE / HDPE / LDPE Elastomer Ammonia Methanol Urea Polysilicon Cryogenics Bulk storage Engineered-to-order Vaporizers Trailers and transport ISO containers Microbulk LN2 Dewars LOX therapy equipment Cryo freezers VRV Company Overview 3

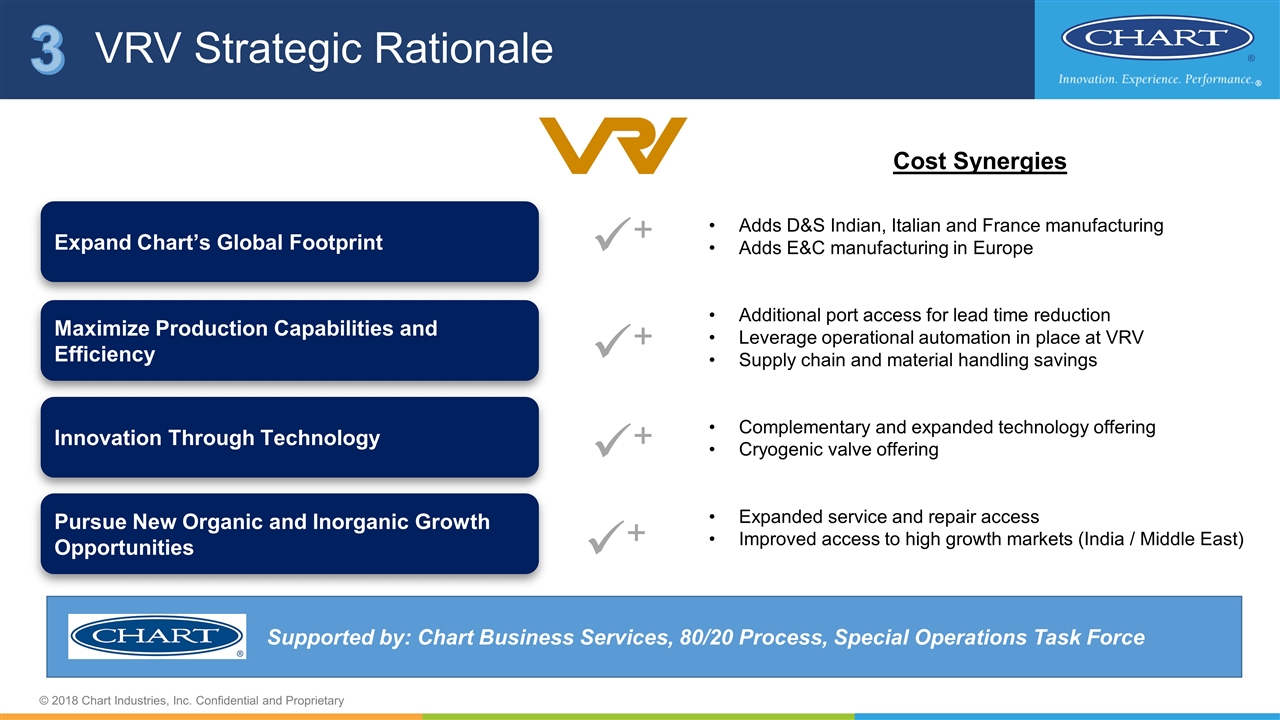

VRV Strategic Rationale 3 ü+ Expand Chart’s Global Footprint Maximize Production Capabilities and Efficiency ü+ Innovation Through Technology ü+ Pursue New Organic and Inorganic Growth Opportunities ü+ Adds D&S Indian, Italian and France manufacturing Adds E&C manufacturing in Europe Additional port access for lead time reduction Leverage operational automation in place at VRV Supply chain and material handling savings Complementary and expanded technology offering Cryogenic valve offering Expanded service and repair access Improved access to high growth markets (India / Middle East) Cost Synergies Supported by: Chart Business Services, 80/20 Process, Special Operations Task Force

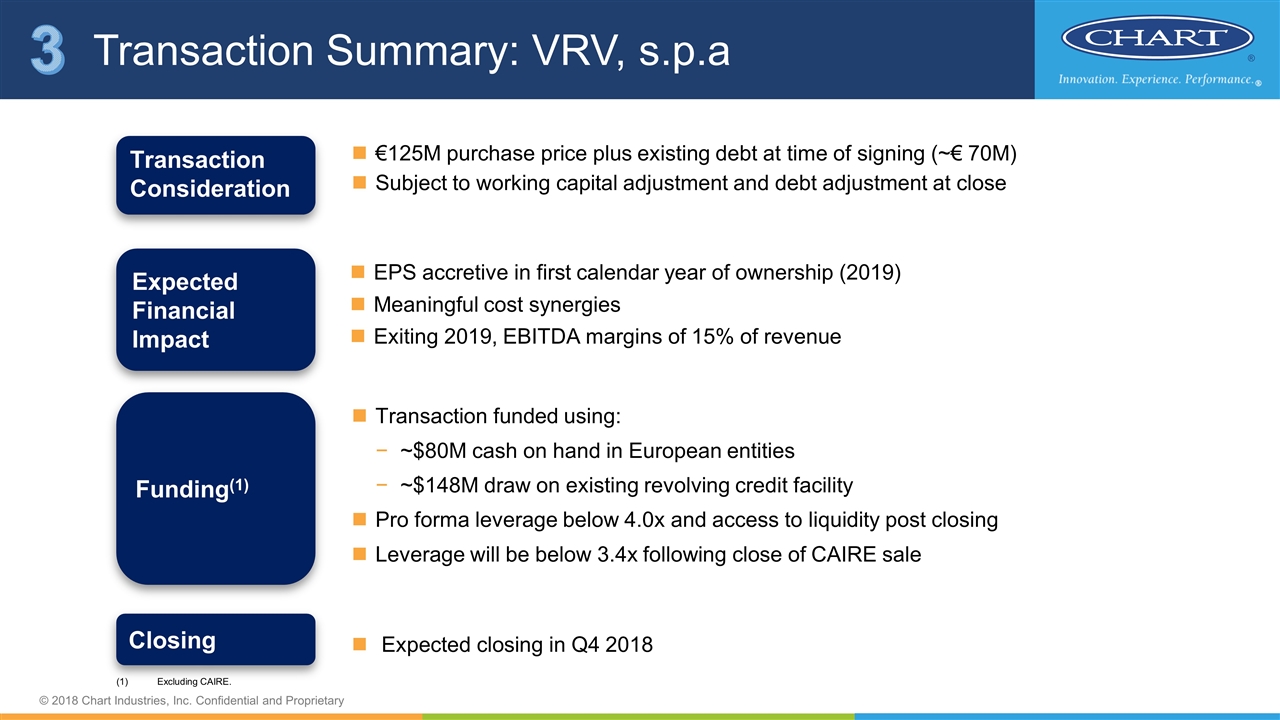

Transaction Summary: VRV, s.p.a 3 Transaction Consideration €125M purchase price plus existing debt at time of signing (~€ 70M) Subject to working capital adjustment and debt adjustment at close Closing Expected closing in Q4 2018 Expected Financial Impact EPS accretive in first calendar year of ownership (2019) Meaningful cost synergies Exiting 2019, EBITDA margins of 15% of revenue Funding(1) Transaction funded using: ~$80M cash on hand in European entities ~$148M draw on existing revolving credit facility Pro forma leverage below 4.0x and access to liquidity post closing Leverage will be below 3.4x following close of CAIRE sale (1) Excluding CAIRE.

How Do The Changes Support Our Strategy Segmentation with Global Commercial Team Sale of Oxygen-Related Products Business Acquisition of VRV, s.p.a 1 2 3 Take Advantage of Favorable Market Trends Deliver Profitable Growth Through Strategic Initiatives Achieve Financial Targets Building Blocks of Our Three Year Strategy A B C

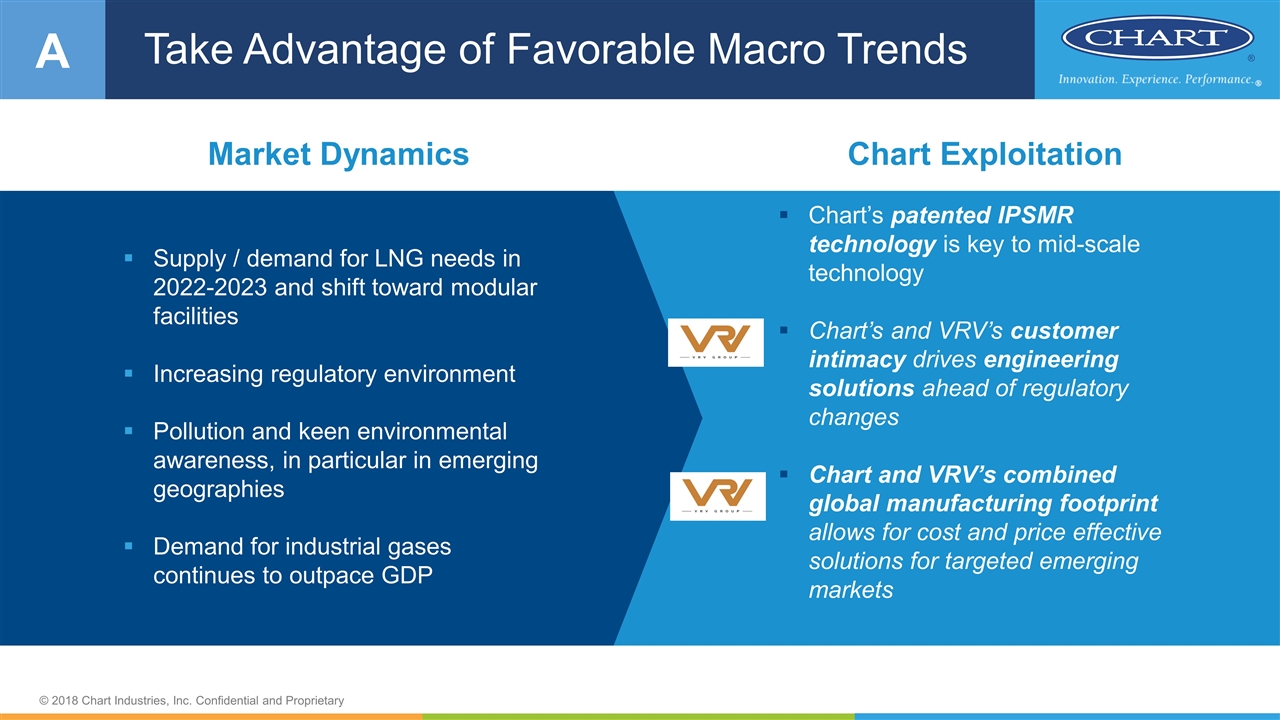

Take Advantage of Favorable Macro Trends Market Dynamics Chart Exploitation Supply / demand for LNG needs in 2022-2023 and shift toward modular facilities Increasing regulatory environment Pollution and keen environmental awareness, in particular in emerging geographies Demand for industrial gases continues to outpace GDP Chart’s patented IPSMR technology is key to mid-scale technology Chart’s and VRV’s customer intimacy drives engineering solutions ahead of regulatory changes Chart and VRV’s combined global manufacturing footprint allows for cost and price effective solutions for targeted emerging markets A

Accelerate Growth through Acquisitions Acquisition Criteria: Strong level of strategic fit High degree of leveragability (specific and attainable synergies) Proven growth and profitability Reasonable price expectations Management bench strength Ownership that’s willing to assist in the transition Prioritize Key Market Opportunities: SERVICE & REPAIR BUILDOUT FANS TEMPERATURE EXPANSION B CRYOGENIC VALVES AND PUMPS

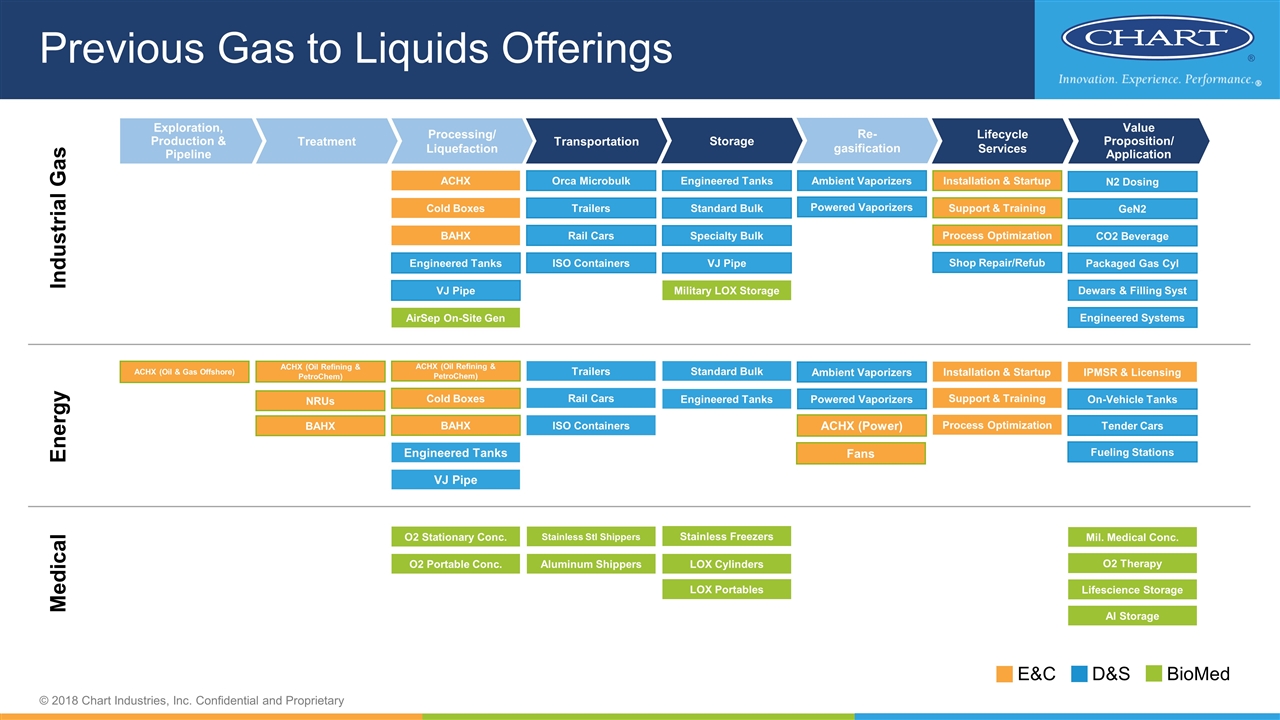

Previous Gas to Liquids Offerings Exploration, Production & Pipeline Processing/ Liquefaction Treatment Transportation Storage Lifecycle Services Value Proposition/ Application Re- gasification Industrial Gas Energy Engineered Tanks Engineered Tanks VJ Pipe Engineered Tanks VJ Pipe Trailers Shop Repair/Refub Rail Cars Standard Bulk Specialty Bulk ISO Containers Trailers Rail Cars ISO Containers Ambient Vaporizers Powered Vaporizers Ambient Vaporizers Powered Vaporizers VJ Pipe Orca Microbulk Standard Bulk Engineered Tanks Fueling Stations On-Vehicle Tanks Tender Cars N2 Dosing GeN2 CO2 Beverage Packaged Gas Cyl Dewars & Filling Syst Engineered Systems Medical ACHX (Oil & Gas Offshore) ACHX (Oil Refining & PetroChem) NRUs BAHX ACHX (Oil Refining & PetroChem) ACHX Cold Boxes BAHX Installation & Startup Support & Training Process Optimization Installation & Startup Support & Training Process Optimization Cold Boxes BAHX IPMSR & Licensing ACHX (Power) Fans E&C D&S BioMed AirSep On-Site Gen Stainless Freezers Mil. Medical Conc. LOX Cylinders Military LOX Storage O2 Stationary Conc. O2 Portable Conc. Stainless Stl Shippers Aluminum Shippers LOX Portables O2 Therapy Lifescience Storage AI Storage

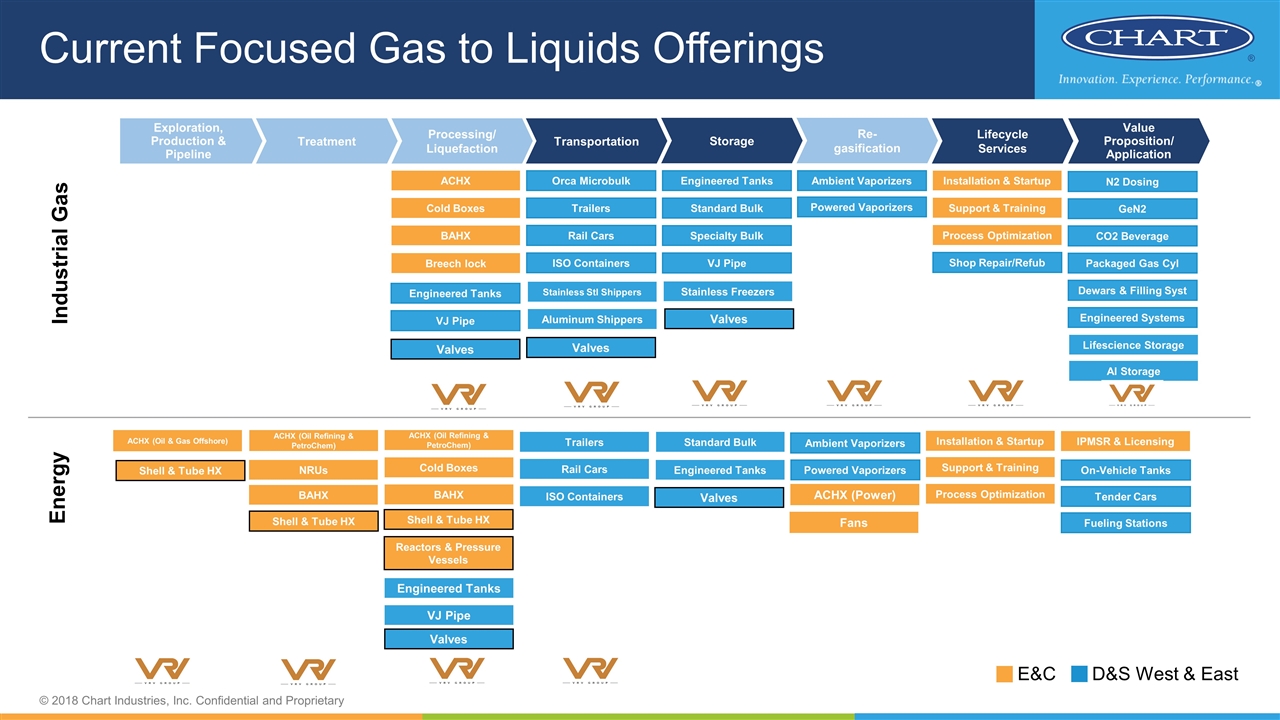

Current Focused Gas to Liquids Offerings Exploration, Production & Pipeline Processing/ Liquefaction Treatment Transportation Storage Lifecycle Services Value Proposition/ Application Re- gasification Industrial Gas Energy Engineered Tanks Engineered Tanks VJ Pipe Engineered Tanks VJ Pipe Trailers Shop Repair/Refub Rail Cars Standard Bulk Specialty Bulk ISO Containers Trailers Rail Cars ISO Containers Ambient Vaporizers Powered Vaporizers Ambient Vaporizers Powered Vaporizers VJ Pipe Orca Microbulk Standard Bulk Engineered Tanks Fueling Stations On-Vehicle Tanks Tender Cars N2 Dosing GeN2 CO2 Beverage Packaged Gas Cyl Dewars & Filling Syst Engineered Systems ACHX (Oil & Gas Offshore) ACHX (Oil Refining & PetroChem) NRUs BAHX ACHX (Oil Refining & PetroChem) ACHX Cold Boxes BAHX Installation & Startup Support & Training Process Optimization Installation & Startup Support & Training Process Optimization Cold Boxes BAHX IPMSR & Licensing ACHX (Power) Fans E&C D&S West & East Stainless Freezers Stainless Stl Shippers Aluminum Shippers Lifescience Storage AI Storage Breech lock Shell & Tube HX Valves Valves Valves Valves Valves Shell & Tube HX Shell & Tube HX Reactors & Pressure Vessels

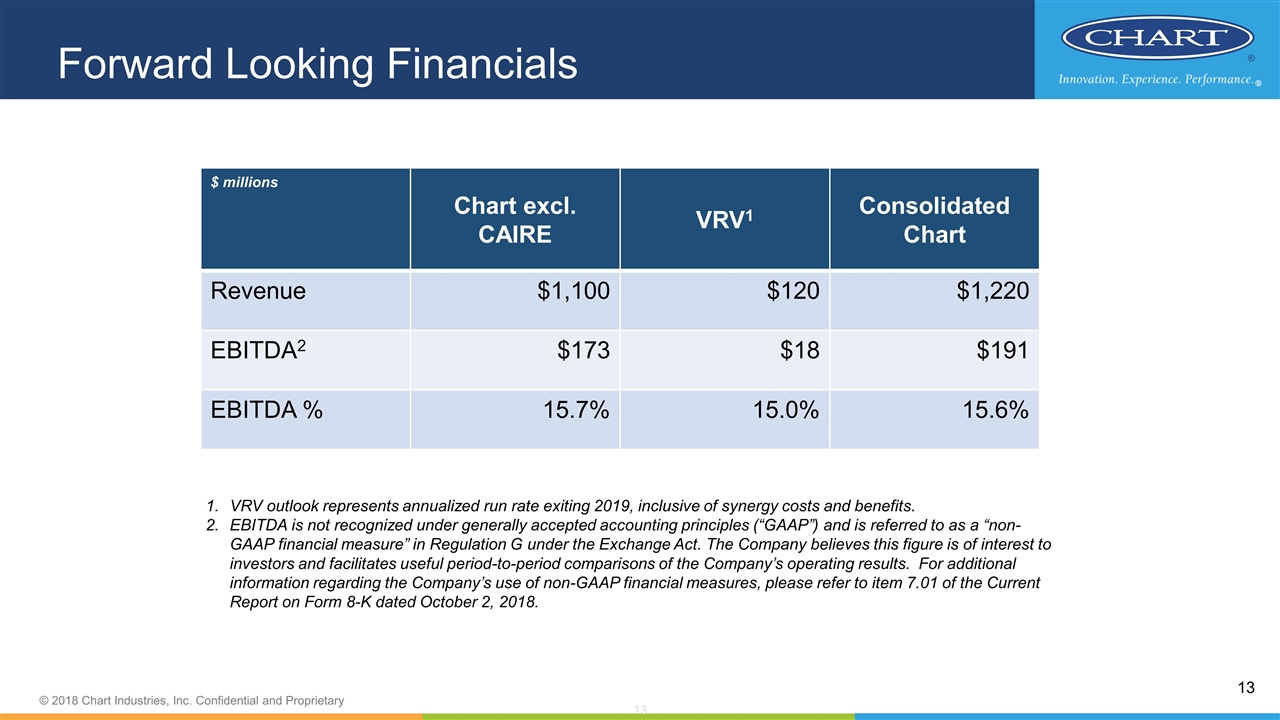

Forward Looking Financials VRV outlook represents annualized run rate exiting 2019, inclusive of synergy costs and benefits. EBITDA is not recognized under generally accepted accounting principles (“GAAP”) and is referred to as a “non-GAAP financial measure” in Regulation G under the Exchange Act. The Company believes this figure is of interest to investors and facilitates useful period-to-period comparisons of the Company’s operating results. For additional information regarding the Company’s use of non-GAAP financial measures, please refer to item 7.01 of the Current Report on Form 8-K dated October 2, 2018. $ millions Chart excl. CAIRE VRV1 Consolidated Chart Revenue $1,100 $120 $1,220 EBITDA2 $173 $18 $191 EBITDA % 15.7% 15.0% 15.6%

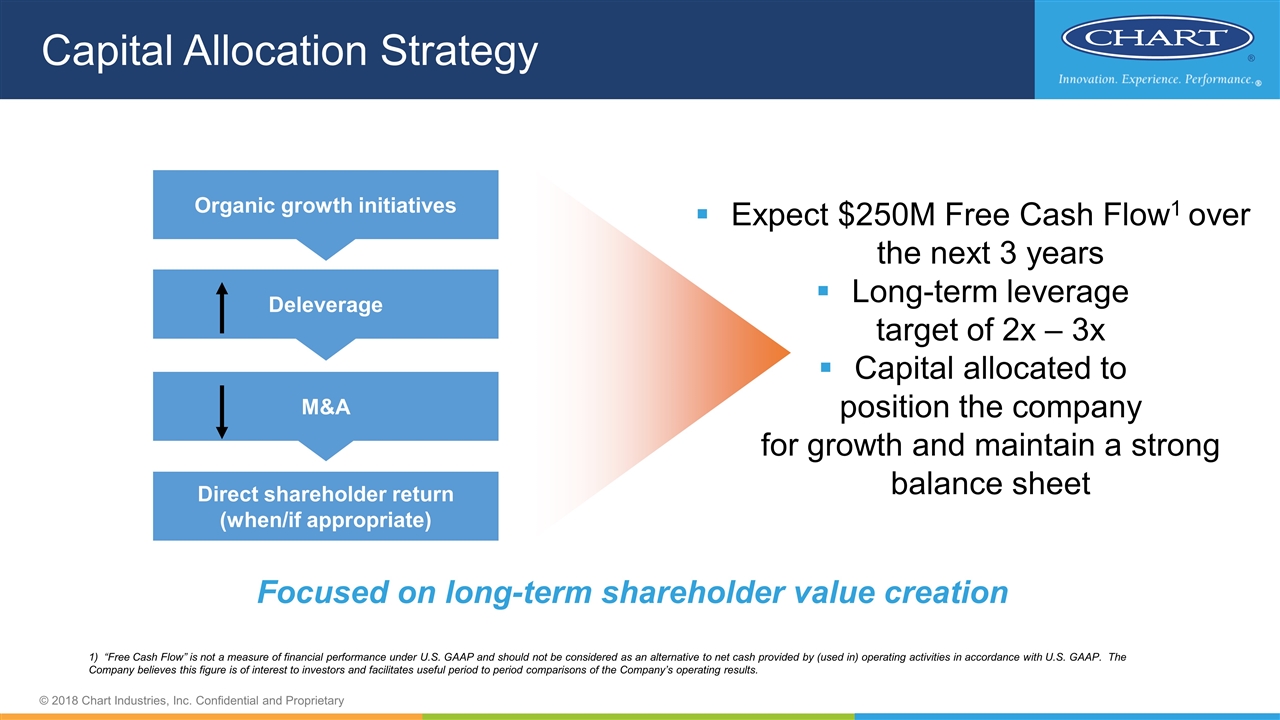

Capital Allocation Strategy Focused on long-term shareholder value creation Organic growth initiatives M&A Deleverage Direct shareholder return (when/if appropriate) Expect $250M Free Cash Flow1 over the next 3 years Long-term leverage target of 2x – 3x Capital allocated to position the company for growth and maintain a strong balance sheet 1) “Free Cash Flow” is not a measure of financial performance under U.S. GAAP and should not be considered as an alternative to net cash provided by (used in) operating activities in accordance with U.S. GAAP. The Company believes this figure is of interest to investors and facilitates useful period to period comparisons of the Company’s operating results.

Strategic Realignment Supports Achieving 2021 Financial Targets Predictable, Disciplined and Profitable Growth 40+% Revenue Growth to $1.7B ~700bps Operating Margin Expansion to ~17% 21% of Sales from Aftermarket from 13% Leading Positions Across the Portfolio Well-Balanced Portfolio of Long-Cycle and Short-Cycle Products Consistent Growth in Operating Income, EPS and FCF

VRV and Chart Advisors VRV Transaction: Credit Suisse served as exclusive financial advisor and Winston & Strawn LLP and NCTM served as legal advisors to Chart, while Shearman & Sterling LLP served VRV as legal advisors. CAIRE Transaction: Credit Suisse served as exclusive financial advisor and Winston & Strawn LLP served as exclusive legal advisor to Chart.