Attached files

| file | filename |

|---|---|

| EX-32.1 - CERTIFICATION - China Health Industries Holdings, Inc. | f10k2018ex32-1_chinahealth.htm |

| EX-31.2 - CERTIFICATION - China Health Industries Holdings, Inc. | f10k2018ex31-2_chinahealth.htm |

| EX-31.1 - CERTIFICATION - China Health Industries Holdings, Inc. | f10k2018ex31-1_chinahealth.htm |

| EX-21.1 - LIST OF SUBSIDIARIES - China Health Industries Holdings, Inc. | f10k2018ex21-1_chinahealth.htm |

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended June 30, 2018

or

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ________________ to ________________

Commission file number: 000-51060

CHINA

HEALTH INDUSTRIES HOLDINGS, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 86-0827216 | |

| (State or other jurisdiction of | (I.R.S. Employer | |

| incorporation or organization) | Identification No.) |

| 168 Binbei Street, Songbei District, Harbin City | ||

| Heilongjiang Province | ||

| People’s Republic of China | 150028 | |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: 86-451-88100688

Securities registered pursuant to Section 12(b) of the Act:

None

Securities registered pursuant to Section 12(g) of the Act:

Common

Stock, $0.0001 par value

Title of Class

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ☐ Yes ☒ No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. ☐ Yes ☒ No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ☒ Yes ☐ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). ☒ Yes ☐ No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ☐ | |

| Non-accelerated filer ☐ (Do not check if a smaller reporting company) | Smaller reporting company ☒ | |

| Emerging Growth Company ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). ☐ Yes ☒ No

The aggregate market value of the voting and non-voting common stock of the issuer held by non-affiliates as of December 29, 2017 was approximately $11,258,137 (45,032,549 shares of common stock held by non-affiliates) based upon the closing price of the common stock on such date.

As of September 12, 2018, there were 65,539,737 shares of common stock, par value $0.0001 issued and outstanding.

Table of Contents

| i |

| Item 1. | Business. |

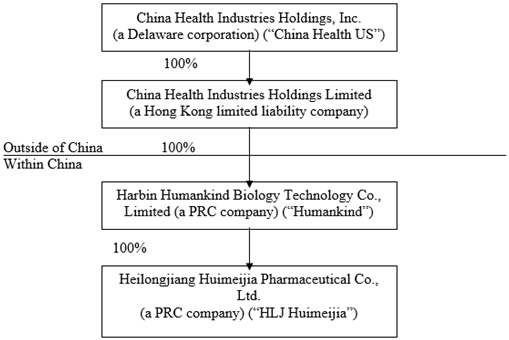

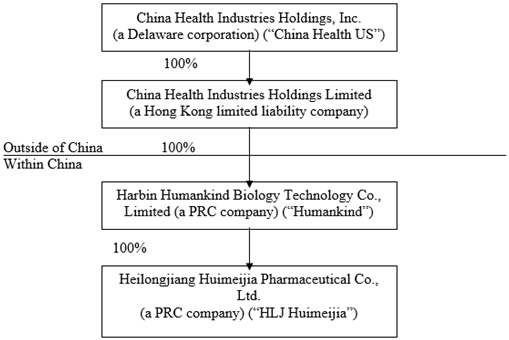

Our History and Corporate Structure

China Health Industries Holdings, Inc. (“China Health US”) was incorporated in the State of Arizona on July 11, 1996 and was the successor of the business known as Arizona Mist, Inc. which began in 1989. On May 9, 2005, it entered into a Stock Purchase Agreement and Share Exchange (effecting a reverse merger) with Edmonds 6, Inc. (“Edmonds 6”), a Delaware corporation, and changed its name to Universal Fog, Inc. Pursuant to this agreement, Universal Fog, Inc. (which has been in continuous operation since 1996) became a wholly-owned subsidiary of Edmonds 6.

China Health Industries Holdings Limited (“China Health HK”) was incorporated on July 20, 2007 in Hong Kong under the Companies Ordinance as a limited liability company. China Health HK was formed for the purpose of seeking and consummating a merger or acquisition with a business entity organized as a private corporation, partnership, or sole proprietorship as defined by FASB ACS Topic 915 (“Development Stage Entities”).

Harbin Humankind Biology Technology Co., Limited (“Humankind”) was incorporated in Harbin City, Heilongjiang Province, the People’s Republic of China (the “PRC”) on December 14, 2003, as a limited liability company under the Company Law of the PRC. Humankind is engaged in the manufacturing and sale of health products.

On August 20, 2007, the sole shareholder of China Health HK entered into a share purchase agreement (the “Share Purchase Agreement”) with the owners of Humankind. Pursuant to the Share Purchase Agreement, China Health HK purchased 100% of the ownership in Humankind for a cash consideration of $60,408 (the “Share Purchase”). Subsequent to the completion of the Share Purchase, Humankind became a wholly-owned subsidiary of China Health HK. The Share Purchase was accounted for as a “reverse merger” since the owner of Humankind owned a majority of the outstanding shares of China Health HK’s common stock immediately following the execution of the Share Purchase Agreement, it was deemed to be the acquirer in the reverse merger. Consequently, the assets and liabilities and the historical operations that have been reflected in the financial statements for periods prior to the Share Purchase are those of Humankind and have been recorded at the historical cost basis. After completion of the Share Purchase, China Health HK’s consolidated financial statements include the assets and liabilities of both China Health HK and Humankind, the historical operations of Humankind, and the operations of China Health HK and its subsidiaries from the closing date of the Share Purchase.

On October 14, 2008, Humankind set up a 99% owned subsidiary, Harbin Huimeijia Medicine Company (“Huimeijia”), with its primary business being manufacturing and distributing medicine. Mr. Xin Sun, the Company’s majority owner, owns 1% of Huimeijia. Huimeijia is consolidated in the consolidated financial statements of China Health HK.

On December 31, 2008, China Health HK entered into a reverse merger with Universal Fog, Inc., a U.S. publicly traded shell company (the “Transaction”). China Health HK is the acquirer in the Transaction, and the Transaction has been treated as a recapitalization of China Health US. After the Transaction and a 20:1 reverse stock split, Mr. Xin Sun owned 61,203,088 shares of common stock, representing 98.3% of the 62,234,737 total outstanding shares of common stock of China Health US. On April 7, 2009, Mr. Sun transferred 28,200,000 shares of common stock to 296 individuals, leaving him with 33,003,088 shares of common stock of China Health US, or approximately 53.03% of the total outstanding shares of common stock. Universal Fog, Inc. changed its name to China Health Industries Holdings, Inc. on February 19, 2009.

On November 22, 2013, Humankind completed the acquisition of Heilongjiang Huimeijia Pharmaceutical Co., Ltd. (“HLJ Huimeijia”) for a total purchase price of $16,339,869 (RMB100,000,000). HLJ Huimeijia was founded on October 30, 2003, and is engaged in the manufacturing and distribution of tincture, ointments, rubber paste (including hormones), topical solution, suppositories, liniment (including traditional Chinese medicine extractions), enemas and oral liquids. HLJ Huimeijia’s predecessor is Heilongjiang Xue Du Pharmaceutical Co., Ltd., which has established its brand name in the market through its supply of high quality medical products. HLJ Huimeijia is categorized as a “high and new technology” enterprise by the Science Technology Department in Heilongjiang Province. HLJ Huimeijia has 21 products which have been approved by, and have received approval numbers issued by, the China Food and Drug Administration (“CFDA”). In addition, HLJ Huimeijia is the holder of one patent for utility models, five patents for external design and three trademarks in China, including the Chinese brand name of “Xue Du” which has an established reputation among customers in northeastern China.

| 1 |

On December 24, 2014, Humankind entered into a stock transfer agreement (the “Original Agreement”) with (i) Xiuzheng Pharmaceutical Group Co., Ltd. a company incorporated under the laws of the PRC and located in Jilin province (“Xiuzheng Pharmacy” or the “Buyer”), (ii) Mr. Xin Sun, the CEO of the Company, and (iii) Huimeijia, a subsidiary of Humankind that is 99% owned by Humankind and 1% owned by Mr. Xin Sun. Pursuant to the Original Agreement, Humankind and Mr. Xin Sun (collectively, the “Equity Holders”), would sell their respective equity interests in Huimeijia to Xiuzheng Pharmacy. On February 9, 2015, the four parties entered into a supplementary agreement (the “Supplementary Agreement”) to modify the terms of the Original Agreement, pursuant to which the Equity Holders and Huimeijia (collectively, the “Asset Transferors”) would only sell 19 drug approval numbers (the “Assets”) to Xiuzheng Pharmacy. The Equity Holders would have retained their equity interests in Huimeijia, but would have pledged such equity interests to Xiuzheng Pharmacy until the Assets were transferred. On October 12, 2016, the four parties agreed to rescind the Supplementary Agreement and entered into a new supplementary agreement pursuant to which the parties agreed to execute the transfer of the equity interests based on the Original Agreement, and the Equity Holders sold their respective equity interests in Huimeijia to Xiuzheng Pharmacy for total cash consideration of RMB 8,000,000 (approximately $1,306,186 USD, the “Purchase Price”) to the Equity Holders. As of October 12, 2016, Huimeijia had completed changes in its business registration, and Xiuzheng Pharmacy had obtained a new business license issued by the local State Administration of Industry and Commerce in Harbin (“Harbin SAIC”) for Huimeijia, in which Huimeijia’s ownership was recorded as held by Xiuzheng Pharmacy, and the legal representative (a person that is authorized to take most corporate actions on behalf of a company under PRC corporate laws) of Huimeijia had been appointed by the Buyer.

China Health US, China Health HK, Humankind and HLJ Huimeijia are collectively referred herein to as the “Company.”

As of June 30, 2018, the Company’s corporate structure was as follows:

| 2 |

Business Overview

Humankind was incorporated in the PRC on December 14, 2003, and completed its Good Manufacturing Practice (“GMP”) certificate on April 24, 2007, which will last until February 14, 2019 and is expected to extend after that. It is in the business of the manufacture and sale of health products.

Huimeijia was incorporated in the PRC on October 14, 2008. Huimeijia received its GMP certificate on July 23, 2009, which expired as of July 22, 2014. On December 24, 2014, Humankind entered into a stock transfer agreement (the “Agreement”) with Xiuzheng Pharmaceutical Group Co., Ltd. a company incorporated under the laws of the People’s Republic of China and located in Jilin province (“Xiuzheng Pharmacy” or the “Buyer”), Mr. Xin Sun, the CEO of the Company, and Huimeijia, pursuant to which, Humankind and Mr. Xin Sun (the “Equity Holders”), shall sell their respective equity interests in Huimeijia to Xiuzheng Pharmacy. The transfer of the 100% equity interests of Huimeijia to the Buyer was for a total cash consideration of RMB 8,000,000 (approximately $1,306,186) to the Equity Holders.

On February 9, 2015, the four parties entered into a supplementary agreement (the “Supplementary Agreement”) to modify the terms of the Agreement, pursuant to which, the Equity Holders and Huimeijia (collectively the “Assets Transferors”) shall only sell the 19 drug approval numbers (including the tablet, capsule, powder, mixture, oral liquid, syrup and oral solution under the 19 approval numbers; licenses including the original copies of Business License, Organization Code Certificate, Tax Registration Certificate, Drug Production Permit and GMP Certificate, and other documents and original copies related to the production and operation of the 19 drugs) (the “Assets”) to Xiuzheng Pharmacy. The Equity Holders will retain the equity interests in Huimeijia, but will have the equity interests pledged to Xiuzheng Pharmacy until the Assets are transferred, at which time all the cash consideration shall be paid by the Buyer. The total cash consideration remains to be the same as under the Agreement, i.e., RMB 8,000,000 (approximately $1,306,186) to the Assets Transferors.

On October 12, 2016, the four parties agreed to rescind the Supplementary Agreement and entered into a new supplementary agreement, pursuant to which the parties agreed to execute the transfer of the equity interests based on the Original Agreement and the Equity Holders sold their respective equity interests in Huimeijia to Xiuzheng Pharmacy for total cash consideration of RMB-8,000,000 (approximately $1,306,186, the “Purchase Price”) to the Equity Holders. Huimeijia has completed changes in its business registration, and Xiuzheng Pharmacy has obtained a new business license issued by the local State Administration of Industry and Commerce in Harbin (“Harbin SAIC”) for Huimeijia, in which Huimeijia’s ownership is recorded as held by Xiuzheng Pharmacy with Harbin SAIC, and the legal representative (a person that is authorized to take most of corporate actions on behalf of a company under PRC corporate laws) of Huimeijia has been appointed by Xiuzheng Pharmacy. The gain on the disposal of Huimeijia was $1,157,590.

HLJ Huimeijia was founded on October 30, 2003, and its latest GMP certificate is effective until April 24, 2023. HLJ Huimeijia engages in the manufacture and distribution of tincture, ointments, rubber paste (including hormones), topical solution, suppositories, liniment (including traditional Chinese medicine extractions), enemas and oral liquids. Its predecessor is Heilongjiang Xue Du Pharmaceutical Co., Ltd., which had established brand recognition in the market through its supply of high-quality drug products. HLJ Huimeijia is a “high and new technology” enterprise that provides the most comprehensive types of topical medical products in Heilongjiang Province, a northeastern province of China.

Our business is conducted through our PRC subsidiaries, Humankind and HLJ Huimeijia. Our products are primarily sold through sales agents. We plan to develop chain-stores to sell our products and to eventually sell our products online.

Products

We have, through Humankind, the license to manufacture and sell 14 health supplement products, each of which have been assigned a Guo Shi Jian Zi number, or China health food approval number (as provided below), an approval number issued by the China Food and Drug Administration (“CFDA”). A product with such a number shall include a description of the nourishment value and health function of the products on product specifications. Consumers can check the official website of CFDA to verify a health supplement product through such a number.

We have, through HLJ Huimeijia, the license to manufacture and sell 21 products. In addition, HLJ Huimeijia holds one patent for utility models, five patents for external design, and three trademarks in China, including the Chinese characters of “Xue Du,” which has a good reputation amongst customers in northeastern China.

We are licensed to sell our products, including our medical drugs, only in the PRC.

| 3 |

| (i) | Hemp Derivative Products |

We have newly developed the following products that are derived from hemp. We began to sell our new products since May 2018. Hemp Oil, Hemp Protein Powder, Hemp Polypeptide and Collagen Peptide are sold through Humankind. Other cosmetics are sold through HLJ Huimeijia.

| Serial No. | Name | |

| 1 | Hemp Oil | |

| 2 | Hemp Protein Powder | |

| 3 | Hemp Polypeptide | |

| 4 | Collagen Peptide | |

| 5 | Natural Hemp Essence Repair Lotion | |

| 6 | Natural Hemp Revitalizing Essence | |

| 7 | Natural Hemp Anit-aging Brightening Eye Cream | |

| 8 | Natural Hemp Frozen Age Nourishing Cream |

| (ii) | Health Supplement |

Our “QunLe” brand Sailuozhi soft capsule, which is made from frog oil, soybean isoflavone, procyanidine (made from grape seeds) and vitamin E, is for freckle removal and skin moisture supplements. The certification number issued by CFDA on September 3, 2013, is 2013B1097, with an expiration date on September 2, 2018.

On May 12, 2010, we received a patent for this product (number 200610010394.4) under the name “Run Chao” (which has since been changed to “QunLe”) with the National Bureau of Intellectual Property.

Pursuant to a technology transfer agreement dated October 12, 2007 (the “2007 Technology Transfer Agreement”), we purchased a health product known as “Kindlink” brand propolis and black ant capsule made from propolis, black ant, acanthopanax and astragalus root from Beijing Jindelikang Bio-Technology Co., Ltd (“Jindelikang”). The change of the ownership has been approved by the CFDA. This product is intended to boost one’s immunity. The certification number issued by the CFDA on August 20, 2004, for the license to manufacture the product is GuoShiJianZi G20040906. We have no continuing obligations under the 2007 Technology Transfer Agreement.

Pursuant to a technology transfer agreement dated January 18, 2013 (the “2013 Technology Transfer Agreement”), we purchased 12 health products from Guangzhou Aoda Biology Beauty Healthy Technology Co., Ltd, a non-affiliated party. These twelve products are the following:

| - | Dr. Xiao Brand Honeysuckle Pearl Capsule (Guo Shi Jian Zi G20100656), which is effective in acne removal, |

| - | Dr. Xiao Brand Multivitamin Tablet (Guo Shi Jian Zi G20080176), which is a multivitamin and mineral supplement, |

| 4 |

| - | Dr. Xiao Brand Zhengdian Capsule (Guo Shi Jian Zi 20070261), which is effective in relieving eyestrain, |

| - | Dr. Xiao Brand Shengui Capsule (Guo Shi Jian Zi G20080297), which is effective in increasing bone density, |

| - | Dr. Xiao Brand Multivitamin Tablet (Woman) (Guo Shi Jian Zi G20070338), which is an iron and multivitamin supplement, |

| - | Dr. Xiao Brand Shikong Soft Capsule (Guo Shi Jian Zi 20080096), which is effective in improving memory, |

| - | Dr. Xiao Brand Huangjingdanggui Tablet (Guo Shi Jian Zi G20080201), which is effective in improving nutritional anemia and chloasma, |

| - | Dr. Xiao Brand Xingxing Soft Capsule (Guo Shi Jian Zi G20080080), which is effective in improving memory, |

| - | Dr. Xiao Brand Vitamin A Fish Oil Soft Capsule (Guo Shi Jian Zi G20080406), which is effective in relieving eyestrain, |

| - | Dr. Xiao Brand Colon Cleanser Granules (Guo Shi Jian Zi G20060061), which is effective in relaxing bowels and promoting the discharge of lead, |

| - | Dr. Xiao Brand Jianli Soft Capsule (Guo Shi Jian Zi G20050710), which is effective in increasing immunity and relieving physical fatigue, and |

| - | LB Brand Xinpin Capsule (Guo Shi Jian Zi G20050770), which is effective in dispelling chloasma. |

The major suppliers of raw materials for our products who exceeded 10% of our total purchases in the fiscal years 2018 and 2017 are the following:

| Purchases | ||||||||||

| (in U.S. | % of | |||||||||

| Name of Supplier | Dollars) | Purchases | ||||||||

| FY2018 | Shukui Wang | 2,312,103 | 65.87 | % | ||||||

| FY2017 | Shukui Wang | 2,622,567 | 78.08 | % | ||||||

| Shantou Yuehui Packing Material Co., Ltd | 349,112 | 10.37 | % | |||||||

For the past two fiscal years, Mr. Shukui Wang has been our biggest supplier of raw materials.

| 5 |

The Company typically signs monthly purchase orders with its suppliers. All purchase orders with Mr. Wang and with our other suppliers are on similar terms. We shall remit payment to a supplier’s account no later than three business days after receiving raw materials. A supplier shall deliver raw materials no later than three business days after receiving a purchase order. The cost of delivery is borne by a supplier.

| (iii) | Medical Drugs |

HLJ Huimeijia has 21 products with approval numbers issued by the CFDA as following:

| English Name | Efficacy | |||

| 1 | Enema Glycerini | Lubricating laxative. Used for constipation. | ||

| 2 | Umguentum Acidi Borici Camphoratum | Dermerethistica. Used for chilblain. | ||

| 3 | Ge Hong Beriberi Water | Dehumidification insecticide. Used for tinea pedis and tinea manuum caused by damp toxin brewing and binding, and other skin diseases caused by enzyme. | ||

| 4 | Pelvic Inflammation Suppository | Heat-clearing and detoxifying; activating blood to promote menstruation disperse swelling and relieve pain. Used for toxin and blood stasis stagnation in the uterus, distending pain in the lower abdomen, irregular menses, algomenorrhea and leukorrhagia, as well as pelvic inflammation and annexitis with the aforementioned symptoms. | ||

| 5 | Injury and Paralysis Tincture | Warm channel and expelling cold, promoting blood circulation to arrest pain. Used to relieve pain caused by traumatic injury and sprain. | ||

| 6 | Indometacin and Furazolidone Suppositories | Anti - inflammatory painkiller. Used to treat acute hemorrhoid, including internal hemorrhoids, external hemorrhoids, mixed hemorrhoids, anal fissure or archosyrinx and relieve pain; Used to ease pain after the operation of anal fissure, archosyrinx or hemorrhoids. | ||

| 7 | Injury and Rheumatism Relieving Paste | Dispelling rheumatism and relieving pain. Used for headache, rheumatalgia, neuralgia, sprain and muscular soreness. | ||

| 8 | Refining GouPi Cream | Relaxing tendon, invigorating the circulation of blood, dissipating cold and relieving pain. Used for arthralgia and myalgia, acute contusion, sprain, rheumatalgia, arthralgia, hypochondriac pain, muscular soreness, etc. | ||

| 9 | Muskiness Pain Relieving Paste | Expelling wind and removing dampness, relaxing the tendons and unblocking collateral. Used for rheumatic arthralgia, low back cold pain, traumatic injury, etc. |

| 6 |

| English Name | Efficacy | |||

| 10 | Muskiness Bone Strengthener Paste | Analgesia and anti-inflammatory. Used for rheumatalgia, arthralgia, backache, neuralgia, muscular soreness, sprain and contusion. | ||

| 11 | Matrine Suppositories | Antibacterial and antiphlogistic drugs. Used for trichomonas and candida vaginitis, chronic cervicitis, pelvic inflammation, etc. | ||

| 12 | Ethacriding Lactate Solution | Disinfectant and preservative drug. Used for disinfection of traumatic and disinfected wounds. | ||

| 13 | Triamcinolone Acetonide and Neomycin Paste | Used for neurodermatitis circumscripta and chronic eczema. Also used for small-scale psoriasis. | ||

| 14 | Double – Coptis Suppository | Course wind and resolving the exterior, heat-clearing and detoxifying. Used for influenza caused by affection of exogenous wind-heat, with symptoms of fever, cough and sore throat. Also used for upper respiratory tract infections and pneumonia, with symptoms of fever, cough and sore throat. | ||

| 15 | Methylrosanilinium Chloride Solution | Disinfectant and preservative drug. | ||

| 16 | Iodine Tincture | Disinfectant and preservative drug. | ||

| 17 | Mercurochrome Solution | Disinfectant and preservative drug. | ||

| 18 | Hydrogen Peroxide Solution | Disinfectant and preservative drug. | ||

| 19 | Halcinonide Cream | Grucocorticoid. External use drug only to be used on the skin. Used for dermatoneuritis and psoriasis. | ||

| 20 | Compound Fluocinonide Tincture | Grucocorticoid. Used for dermatoneuritis and psoriasis. | ||

| 21 | Policresulen Vaginal Suppository | Anti-microbial and hemostasis drug. |

Distribution

We signed a non-exclusive cooperation agreement with the Commercial Bureau of Qing’an County, Heilongjiang on September 17, 2008. Under the agreement, various affiliated companies of the Commercial Bureau provides organic food and green food products to us for distribution and sale throughout the PRC.

| 7 |

We order products from the Commercial Bureau and such products are delivered within 20 days of placing the order. The prices for these products fluctuate within a 3% range from their wholesale price, but we are not restricted in any way in dictating the retail prices for such products. We typically have an average profit margin of approximately 20%.

Most of our products are sold to sales agents. In the fiscal year of 2017, due to the update of GMP certificate which prevents HLJ Huimeijia from selling products during this period, our sales network covered 5 provinces and 2 Municipalities in China and our products were mainly sold in Anhui, Zhejiang, Shanghai, Jiangsu, Beijing, Gansu, and Heilongjiang provinces or cities. In the fiscal year of 2018, due to the update of GMP certificate which prevents HLJ Huimeijia from selling products during this period, our sales network covered 5 provinces and 2 Municipalities in China and our products were mainly sold in Anhui, Zhejiang, Shanghai, Jiangsu, Beijing, Gansu, and Heilongjiang provinces or cities.

E-business

We are in the process of building the infrastructure to conduct our business over the internet. A B2C e-business call and sales center has been established and will become an integral part of our distribution channel in the future. We have employed graduates from Tsinghua University, Harbin Industry University and Harbin Engineering University to develop the ERP, CRM and Office Automation software (“OA Software”) for our e-business. The OA Software has been used in our daily operation. The Company plans to sell its products via internet in the fiscal year of 2018.

Our Customers

We sell most of our products to sales agents, who are our customers. The sales agents sell the products to the end users.

Our customers who contributed more than 10% of our consolidated revenues during the past two fiscal years are as follows:

| Sales | ||||||||||

| (in U.S. | Percent of | |||||||||

| Name | Products Sold | Dollars) | Sales | |||||||

| FY2018 | ||||||||||

| Libin Wang | Hemp Oil, Hemp Protein Powder, Hemp Polypeptide, | 1,170,161 | 17.85 | % | ||||||

| Yufeng Shen | Collagen Peptide, Waterlilies Soft Capsule, | 936,260 | 14.28 | % | ||||||

| Xindong Yang | Propolis and Black Ant Capsule | 842,618 | 12.85 | % | ||||||

| FY2017 | ||||||||||

| Libin Wang |

Waterlilies Soft Capsule, Propolis and Black Ant Capsule

|

991,391 | 15.56 | % | ||||||

| Yufeng Shen | 860,766 | 13.51 | % | |||||||

| Jinhong Xiao | 774,175 | 12.15 | % | |||||||

| Suqin Zhang | 645,838 | 10.14 | % | |||||||

| Hao Liu | 643,504 | 10.10 | % | |||||||

| 8 |

Manufacture

We manufacture our health food products on a plot of land located in Jin Xing Industrial Park, Songbei District, Harbin. On June 7, 2004, the Company entered into a Land Use Purchase Contract with the local government, pursuant to which the Company agreed to purchase the right to use a piece of land, approximately 8 acres (32,000 square meters), located in Harbin City, Heilongjiang Province for commercial purposes for a fifty-year period from June 7, 2004 through June 6, 2054, for $637,261 (RMB5,248,000). The Company fully paid to the government the consideration for the land use right on June 13, 2004. The Department of Housing and Urban Development of Harbin City approved this transaction. The Company is in the process of applying for the title certificate from the local government. The manufacturing facility on the land is 4,000 square meters and there are five production lines which are sufficient for our purposes. We package our products in bottles, plastic containers and aluminum foil bags there.

Since we acquired HLJ Huimeijia on November 22, 2013, we also manufacture our medicines and drugs using HLJ Huimeijia’s land, approximately 43,350 square meters, located in Hai-lin Economic Development Zone, Mudanjiang City. The manufacturing facilities occupy approximately 5,710 square meters. We plan to build new manufacturing facilities on the land. The expected construction cost is approximately $7,520,000 (RMB 50,000,000).

Our Development Strategy

We will continue to focus on combining our products with traditional Chinese medicine, the creation of new products such as our hemp-based products, and developing our B2C e-business and chain-stores. We plan to implement health management projects in our future chain-stores throughout China and establish a database of our clients’ health data obtained from our B2C e-business and call center.

We plan to establish a one-stop shop for our customer’s health needs. From conducting a genetic profile of our customer to determine his/her susceptibility to certain types of diseases and then customizing health supplements and organic/green food to meet his/her needs, we plan to cater to our customer’s needs at all levels. With the distribution network we hope to establish through our chain stores and B2C e-businesses, we plan to eventually branch out into the sale and distribution of beauty products and medical appliances.

We plan to open chain stores of up to 100 stores within the next 24 months; expand our oversea sales to North America, South Asia and European Union; acquire pharmaceuticals to enhance marketing network and production capacity and increase investment in research and development of CBD drugs and hemp-based products.

The Future

Within the next ten years, our goals are to:

| 1. | Increase product coverage in target markets; achieve 20%-30% coverage |

Our target market is the health industry market. Presently, we believe that our product coverage is approximately 0.2%. We plan to open distribution stores in different provinces of China to expand our coverage. We also plan to sell our products through B2C websites to our customers.

| 2. | Enter into the medicine, health product, health industry top 500 companies in the PRC |

Currently, we are not ranked in the top 500 medicine, health product and health industry companies in the PRC. We believe that if our projected increase in revenue is achieved, we will achieve our goal of becoming one of the top 500 medicine, health product, health industry companies in China.

| 3. | Form a diversified management group |

Currently, our management group comprises graduates from the most prestigious universities in the PRC, such as Peking University and Renmin University of China. We plan to further diversify our management group by hiring talent both in the PRC and abroad.

| 4. | Enter into the international market and create an internationally famous brand |

Currently, our products are sold under the brand names “Qunle”, “Kindlink”, “Huimeijia” and “Dr. Xiao” in the PRC. Our goal is eventually to expand our sales abroad to countries such as the United States of America, Russia, and Eastern Europe and South-east Asian countries.

| 9 |

Our Business Plan

The plans designed to meet our manufacturing, marketing and profit targets include:

Manufacturing:

| (a) | improving the manufacturing techniques and staff training; |

| (b) | guaranteeing high quality material supply; |

| (c) | strengthening the working procedure controls; |

| (d) | implementing GMP to ensure a compliance standard in the food and medical industries; |

| (e) | ensuring that all employees have adequate training in health regulations. |

Marketing:

Adopt an effective marketing strategy to:

| (a) | utilize direct distribution of products to chain stores nationwide; |

| (b) | build business alliances with well-known enterprises to create private label brands; |

| (c) | expand the marketing of our products beyond the traditional methods. |

Product Distribution:

| (a) | enlarge our sales and marketing force while developing new markets; |

| (b) | strengthen the distribution channel by developing promotion strategies and participating in trade shows; |

| (c) | Develop 3-5 new products to market each year; |

| (d) | develop new markets through innovation and research. |

Our approach to manufacturing, marketing, cost control and products distribution, which is detailed above, is designed to minimize production costs and increase revenue at the same time. We feel that our procedures will enable us to reach our sales goals with an optimal manufacturing cost. The result should yield profits and a return to our investors.

Good Manufacturing Practice or “GMP” is a term that is recognized worldwide for the control and management of manufacturing and quality control testing of foods and pharmaceutical products. An important part of GMP is documentation of every aspect of the process, activities, and operations involved with drug and medical device manufacture. Additionally, GMP requires that all manufacturing and testing equipment has been qualified as suitable for use, and that all operational methodologies and procedures (such as manufacturing, cleaning, and analytical testing) utilized in the drug manufacturing process have been validated (according to predetermined specifications), to demonstrate that they can perform their purported function(s).

The Market for Healthcare and Beauty Products

The health product industry is one of the mainstream industries in the PRC, since it has a high level of recognition and importance. Recently there have been new policies for health products, which control quality, manufacturing, manufacturing environments and techniques. With the PRC’s large and aging population there will be a steady demand for healthcare products. It is predicted that the healthcare and beauty industry will flourish over the next 50 years.

| 10 |

The Healthcare Product Market in the PRC

With thousands of years of history in health culture and traditional Chinese medicine, the PRC currently utilizes advanced techniques and production capacity to initiate new health care trends, from drugs and medicines to traditional health food and nutritional supplements, and from medical devices to health management and advice. These trends demonstrate huge potential in the PRC’s health products market.

According to a report issued by BCG, the global management consulting firm based in Boston, titled “From Insight to Action: Capturing a Share of China’s Consumer Health Market”, Chinese consumers are increasingly health conscious and China’s growing health and wellness market is expected to reach nearly $70 billion by 2020.

With the rise of the concept of “Great Health”, the per capita expenditure of health products and the consumer group have been significantly improved. Roland Berger, a global strategy consulting firm headquartered in Munich, Germany, recently released a report entitled Successful Strategies for China’s Health Products Industry in the Thirteenth Five-Year Plan Period. This report analyze the opportunities and challenges of China’s health products market, and puts forward relevant enterprise development strategies. Driven by consumption upgrades and favorable policies, the report predicts that the market scale of health products in China will grow from about RMB120 billion in 2015 to about RMB180 billion in 2020, and will surpass the United States as the world’s largest in the foreseeable future.

Driven by the change of consumer treatment to prevention, the promotion of health awareness, the refinement of health needs and the pursuit of high-quality health products, the market scale of health products in China broke through RMB100 billion in 2014 and nearly RMB150 billion in 2017. China Commercial Industry Research Institute predicts that the market scale of health products in China will reach RMB181.6 billion in 2020.

Comparing the consumption habits of Chinese and American health products, we can see that there is still much room for development in China’s market. The penetration rate of health products in the United States is 50%, while that in China is only 20%, and in terms of per capita consumption, China is only one-eighth of that in the United States.

Hemp and its Market and Industry in the PRC

Hemp was originated from the middle and lower reaches of Yellow River with over eight-thousand years’ planting history. The hemp textile technology in our country has matured as early as two thousand years in the Western Han Dynasty. “Plain Color Zen Clothing”, coming up from Han Tombs at Mawangdui and other hemp textile products have become the milestone in the developing history of hemp textile technology.

Hemp, also known as Huoma, Xianma, Kuima, Hanma, Dama. Species that containing less than 0.3% of tetrahydrocannabinol (THC) is considered as Hemp, and more than 0.3% is considered as Marijuana and Hashish internationally. Hemp is a kind of economic plant with special effects and can be grown in large areas in all parts of China. It has low requirements for soil and climate and can grow on relatively barren land. Planting hemp has become a way to get rich and get out of poverty in some poor areas.

Hemp is full of treasures. The skin, stem, seed, root, leaf and flower of hemp have utility value which can be widely applied in the fields of textile, paper-making, food, medicine, construction, transportation, national defense and military industry and so on. As a kind of traditional economic plant, hemp fiber has the functions of moisture absorption and perspiration, natural antimicrobial health care, good quality of adsorption, excellent quality of anti-UV and unique wave adsorption and sound attenuation. The stem of hemp has high degree of lignification and can be used to produce high value biologic additives, viscose fibers, top grade cigarette paper and wooden ceramics and so on. The leaf and flower of hemp can be used to produce various kinds of health products and the seed of hemp can be used to manufacture top grade edible oil, essential oil and hemp protein.

| 11 |

A hemp plant contains over 400 kinds of chemical components and can be divided into cannabinoid and non-cannabinoid compounds. Cannabinol (CBN) in cannabinoid has the functions of anti-inflammatory, analgesia, anti-convulsion and suppressing female hormone secretion. Cannabidiol (CBD) has the functions of anti-inflammatory, sterilization, analgesia, antianxiety, antipsychotic, antioxidation, neural protection, reducing enterocinesia and improving learning and memory ability.

Hemp is the major high-yielding crop of making traditional fiber products in China. It is a kind of high value-added economic crop with a wide range of uses and multi-purpose crop with market prospects that provides fiber, hemp stem and seed. Hemp has many unique natural characteristics, especially its environmental benefits and its natural versatility, which is a valuable kind of crop for ecological economy.

Textiles, clothing, military industry, construction materials, food, medicines, health supplements, cosmetics and skin care products of the downstream of hemp industry in China are relatively well-developed. The bottleneck that restricts the development of downstream industries is that the cultivation of hemp in the upstream has long been the planting mode of scattered peasant households, and has not formed large-scale industrialized cultivation and local initial processing capacity.

After years of development, Chinese consumers have gradually rationalized their attitude and behavior in the consumption of health care products, paying more attention to the safety and efficacy of health care products. At the same time, the government has gradually improved the laws and regulations of the health care industry and tightened its supervision.

The rejuvenation of the modern industry of hemp resulted from the major breakthrough in research and mass production of hemp. Firstly, cultivate new varieties of hemp with low activity of anesthetic in agricultural scientific research. The main component of these varieties of anesthetics is THC and the content of THC is controlled at 0.3% which approximates to non-toxicity. This has led to a renewed understanding and affirmation of the industrial use of hemp, and made the cultivation of hemp mechanize, effectively contributing to the development of hemp industry.

In order to meet the needs of the development of domestic and foreign market, China has successively reactivated the hemp industry projects in Yunnan, Heilongjiang, Shandong, Shanxi, and Anhui and Hubei provinces to set up factories and scientific research institutes to carry out research and development of various products. The natural functional advantages of its related products are favored by consumers at home and abroad. The products are exported to countries such as the United States, Canada, Australia, Japan, and Korea. Currently, related products of hemp have also become an export-oriented pillar industry in China.

At present, on the basis of solving scientific and technological problems of deep degumming of hemp, extraction of fine fiber, extraction of CBD, purification of hemp seed oil, extraction of essential oil of hemp, extraction of hemp protein, biocomposites, fiber reinforced composite materials, carry out pilot plant test and industrialized mass production of related products of hemp, and gradually develop the deep comprehensive utilization of hemp products, demonstrating the strength of deep processing in the hemp industry.

The Hemp Market and Industry in the U. S.

An investigation team of the ArcView Group, which is a hemp industry investment and research company headquartered in Oakland, California, found that the sales of legal hemp in the US market increased by 74% in 2014 and reached 2.7 billion dollars (RMB 16.9 billion). and there was only 1.5 billion dollars (about RMB 9.4 billion) in 2013. The report also predicted that it would be a strong development year of legal hemp in 2015 and would increase by 32% in the market. By 2019, all the legal hemp markets will be combined to form a whole market with huge potential which is worth nearly 11 billion dollars.

It is predicted in the Forbes Magazine that by 2020, CBD in the US market will be increased by 700%. According to the predicted data provided by the Hemp Business Magazine, the scale of CBD in the US market will reach 2.1 billion dollars by 2020, of which 0.45 billion dollars is from the extraction of hemp-based CBD, the figure was 90 million dollars in 2015. The data provided by the consultant of Lyubo Company is more optimistic, which says that the scale of CBD in the US market will reach 3 billion dollars by 2021.

| 12 |

Competition in the Healthcare Products Industry

We believe our competitors are:

Harbin DaZhong Pharmaceutical Co., Ltd.(Located in Harbin, Heilongjiang Province);

Tsinghua Unisplendour Corporation Limited (Located in Weihai City, Shandong Province);

Yeecare Company (Located in Beijing);

Heilongjiang Tianlong Pharmaceuticals Co., Ltd (Located in Heilongjiang Province); and

HPGC Renmintongtai Pharmaceuticals Co., Ltd (Located in Heilongjiang Province).

Yunnan Hansu Biotechnology Co., Ltd. (Located in Yunnan Province)

Our Competitive Advantages and Strategy

We believe that we have the following advantages over our competitors:

| ● | We have more categories of products and a diversified production line; |

| ● | We have a strong and effective research and development team; |

| ● | We are a self-owned enterprise, and have the support of the local government; |

| ● | We have a geographical advantage being located in Heilongjiang Province, the center of the healthcare industry in the PRC. |

Sales and Marketing

We plan to open more chain stores throughout the PRC. Customers of our stores would be able to enjoy discounts on the price of our products and services. After establishing a sufficient number of stores, we plan to develop a 24-hour delivery system for our B2C e-business.

We incurred approximately $20,000 for advertising and promotion for the fiscal year of 2018. We have budgeted approximately $500,000 for advertising and promotion for the fiscal year of 2019.

Intellectual Property

We received a patent (200610010394.4) for our “Qunle” brand Sailuozhi soft capsule from the National Bureau of Intellectual Property. We had initially applied for and used the trade name of “RunChao” soft capsules, but the trade name was changed to “Qunle”, and the change was approved by the National Bureau of Intellectual Property.

Pursuant to a Technology Transfer Agreement dated October 12, 2007 (“Kindlink Technology Transfer Agreement”), we purchased, for a total of RMB350,000, the technology, manufacturing, and trademark rights to the health product known as “Kindlink” brand propolis and black ant capsule made from propolis, black ant, acanthopanax, astragalus root from Jindelikang. The change of the ownership was approved by the CFDA. This product is consumed to boost one’s immunity. The certification number issued by the CFDA on August 20, 2004, to permit the manufacture of the product is GuoShiJianZi G20040906. We have no continuing obligations under the Kindlink Technology Transfer Agreement.

| 13 |

We have the following 14 trademarks(1):

| Certificate | ||||||||

| Trademark | No. | Category | Registrant | Valid Term | ||||

| “Qunle” | 3896026 | No.5 : Food preparations adapted for medical purposes; Albuminous milk; Dietetic beverages adapted for medical purposes; Milk sugar; Diabetic bread; Albuminous foodstuffs for medical purposes; Food for babies; Dietetic substances adapted for medical use; Nutritional additives for medical purposes | Humankind | 7/7/2016 to 7/6/2026 | ||||

| “Wangzu” | 4857905 | No.30: Molasses for food; Honey; pollen healthy grease; tortoise tuchahoe paste; breed columbine extract; helix alga; non-medicial nutrition liquid; non-medicial nutrition powder; non-medicial nutrition capsule; sugar candy bird’s nest | Humankind | 5/14/2008 to 5/13/2028 | ||||

| “Kindlink” | 3236981 | No.5: Food preparations adapted for medical purposes; Dietetic substances adapted for medical use | Humankind | 12/7/2013 to 12/06/2023 | ||||

| “Huimeijia” | 5280303 | No.5 : Medicine for human consumption; Medical nutrition capsule; Fibres (Edible plant) [non-nutritive]; Injection; Raw material drug; Troche; suppository; Food preparations adapted for medical purposes; Dietetic foods adapted for medical purposes; Dietetic substances adapted for medical use | Humankind | 7/21/2009 to 7/20/2019 | ||||

| “Huide” | 5280304 | No.5 : Medicines for human consumption; Medical nutrition capsule; Fibres (Edible plant) [non-nutritive]; Injection; Raw material drug; Troche; suppository; Food preparations adapted for medical purposes; Dietetic foods adapted for medical purposes; Dietetic substances adapted for medical use | Humankind | 7/21/2009 to 7/20/2019 | ||||

| “KDLK” | 3230404 | No.5 : Food preparations adapted for medical purposes; Dietetic foods adapted for medical purposes; Dietetic substances adapted for medical use | Humankind | 9/28/2013 to 9/27/2023 | ||||

| “dr.xiao” | 5176731 | No.5 : Disinfectant; Medicines for veterinary purposes; Insecticide; Sanitary napkin; Medicine health bag; Dental lacquer | Humankind | 8/14/2009 to 8/13/2019 |

| 14 |

| Certificate | ||||||||

| Trademark | No. | Category | Registrant | Valid Term | ||||

| “dr.xiao” | 1610828 | No.30: non-medicial nutrition liquid; non-medicial nutrition cream; non-medicial nutrition powder; Honey; non-medicial nutrition capsule; non-medicial nutrition gum; Candy for food; Spirulina (non-medicial nutrient); Candy; Pollen healthy grease | Humankind | 7/28/2011 to 7/27/2021 | ||||

| “DaLeNing” | 5053772 | No.5 : Medicine for human; Chinese patent drugs; Suppository; Tincture; Water aqua; Paste; Liniment; Medical lotion; Patch; Chemical pharmaceuticals preparations | HLJ Huimeijia | 5/7/2009 to 5/6/2019 | ||||

| “Xuedu” | 5053657 | No.5 : Medicine for human; Chinese patent drugs; Suppository; Tincture; Water aqua; Paste; Liniment; Medical lotion; Patch; Chemical pharmaceuticals preparations | HLJ Huimeijia | 5/7/2009 to 5/6/2019 | ||||

| “Xuedu” with an image | 642099 | No.5 : Paste | HLJ Huimeijia | 5/21/2013 to 5/20/2023 | ||||

| “Tai Yan Li” | 10014001 | No.30: Honey, spirulina (non-medical), non-medical nutrient solution, non-medical nutrient lotion, non-medical nutrient powder, non-medical nutrient capsule, pastry, cereal, flour product. | Humankind | 11/28/2012 to 11/27/2022 | ||||

| “Tai Yan Li” | 10013969 | No. 3: Cleanser lotion, soup, anti -bacterial hand soup, cleanser, cosmetics, conditioning gel, polish, essential oil. | Humankind | 11/28/2012 to 11/27/2022 | ||||

| “Luo Qian’ | 8358643 | No. 3: essential oil, fragrance essential oil, nourishing essential oil, cosmetic mask, cosmetic tools, cosmetics, cosmetic cleanser, perfume, weight-losing cosmetics, banishing essence. | Humankind | 6/14/2011 to 6/13/2021 |

(1) The trademarks listed here have been spelt in Pinyin for the U.S. readers’ convenience. The original trademarks are in Chinese characters.

In addition, the trademark of “LB” and its associated image under the registration number 1738881 was transferred to us on March 19, 2015 from Guangzhou Aoda Biology Beauty Healthy Technology Co., Ltd, from whom we acquired 12 health products in January 2013.

We have the right to use the following patents under the approval of National Bureau of Intellectual Property:

| Patent | ||||||||||

| Categories | Name | Inventor/Designer | Patent No. | Duration | Owner | |||||

| Invention Patent | Runchao Soft Capsule and Its Manufacturing Method | Xin Sun | ZL200610010394.4 | August 10, 2006- August 9, 2026 | Xin Sun* | |||||

| Utility Patent | Heating System in Compression Coaster with Coating Wheels | ZhengJiang Huang | ZL201220485432.2 | September 22, 2012- September 21, 2022 | HLJ Huimeijia | |||||

| Design Patent | Packing Box for Pain- relieving Ointment | Jianjun Wang | ZL201230448116.3 | September 19, 2012- September 18, 2022 | HLJ Huimeijia | |||||

| Design Patent | Packing Box for Nasal Mucus-releiving Ointment | Jianjun Wang | ZL201230448676.9 | September 19, 2012- September 18, 2022 | HLJ Huimeijia | |||||

| Design Patent | Packing Box for Gou Pi Plaster | Jianjun Wang | ZL201230447952.X | September 19, 2012- September 18, 2022 | HLJ Huimeijia | |||||

| Design Patent | Packing Box for Tendons and Bones Strengthening Musk Ointment | Jianjun Wang | ZL201230448670.1 | September 19, 2012- September 18, 2022 | HLJ Huimeijia | |||||

| Design Patent | Packing Box for Pain- relieving Musk Ointment | Jianjun Wang | ZL201230448010.3 | September 19, 2012- September 18, 2022 | HLJ Huimeijia |

*Mr. Sun verbally authorized the Company the right to use the patent.

| 15 |

The following is a list of our patent applications:

The applicants of all the following patens are Humankind, their inventor is Mr. Xin Sun. The result of a patent application in China is typically within two years after the date of the application, which is March 2017 for our patent applications below.

| Serial No. | Name | Application | Technology Field | |||

| 1 | Cannabidiol (CBD) Cataplasmata | Cannabidiol (CBD) is used for relieving muscle pain and its preparation method. | The invention belongs to the research and application field of industrial hemp and relates to a kind of cataplasmata, in particular to Cannabidiol (CBD) which is used for relieving muscle pain and its preparation method. | |||

| 2 | Cannabidiol (CBD) Suspension | Cannabidiol (CBD) Suspension is used for treating arthritis and its preparation method. | The invention relates to the field of pharmaceutical preparations, in particular to a kind of Cannabidiol (CBD) Suspension which is used for treating arthritis and its preparation method. | |||

| 3 | Cannabidiol (CBD) Gel | Cannabidiol (CBD) Gel has the effect of relieving nervous headache and its preparation method. | The invention relates to gel preparations for medicine, in particular to a kind of Cannabidiol (CBD) Gel which has the effect of relieving nervous headache and its preparation method. | |||

| 4 | Cannabidiol (CBD) Paste | Cannabidiol (CBD) Paste has the effect of relieving swelling and pain and its preparation method. | The invention relates to the field of medicine, in particular to a kind of Cannabidiol (CBD) Paste which has the effect of relieving swelling and pain and its preparation method. | |||

| 5 | Cannabidiol (CBD) Soft Capsule | Cannabidiol (CBD) Soft Capsule has the effect of improving diabetes and its preparation method. | The invention relates to the field of soft capsule, in particular to a kind of Cannabidiol (CBD) Soft Capsule which has the effect of improving diabetes and its preparation method. | |||

| 6 | Cannabidiol (CBD) Suppository | Cannabidiol (CBD) Suppository has the effect of heat sterilization and its preparation method. | The invention relates to the field of medicine, in particular to a kind of Cannabidiol (CBD) Suppository which has the effect of heat sterilization and its preparation method. | |||

| 7 | Cannabidiol (CBD) Plaster | Cannabidiol (CBD) Rubber Plaster has the effect of treating old bone disease and its preparation method. | The invention relates to the field of medical plaster, in particular to a kind of Cannabidiol (CBD) Rubber Plaster which has the effect of treating old bone disease and its preparation method. | |||

| 8 | Cannabidiol (CBD) Rubber Plaster | Cannabidiol (CBD) Rubber Plaster has the effect of dispelling wind and eliminating dampness and its preparation method. | The invention relates to the field of medical plaster, in particular to a kind of Cannabidiol (CBD) Rubber Plaster which has the effect of dispelling wind and eliminating dampness and its preparation method. | |||

| 9 | Cannabidiol (CBD) Liquid Pharmaceutical Preparations | Cannabidiol (CBD) Liquid Pharmaceutical Preparations has the anti-anxiety effect and its preparation method. | The invention relates to the field of liquid pharmaceutical preparations, in particular to a kind of Cannabidiol (CBD) Liquid Pharmaceutical Preparations which has the anti-anxiety effect and its preparation method. | |||

| 10 | Moisturizing Cream with Hemp Seed Oil | Moisturizing Cream with Hemp Seed Oil and its preparation method. | The invention relates to the field of cosmetics, in particular to a kind of Moisturizing Cream which contains hemp seed oil and its preparation method. |

| 16 |

The laws governing our business are as follows:

| ● | Pharmaceutical administration law of the PRC enacted January 12, 2001 | |

| ● | Healthcare registration and administration law, enacted January 7, 2005 | |

| ● | Measures for the Administration of Pharmaceutical Trade License, enacted January 4, 2004 | |

| ● | Measures for the Supervision Over and Administration of Pharmaceutical Production, enacted May 8, 2004 | |

| ● | Food Safety Law of the PRC, enacted June 1, 2009 | |

| ● | Regulation on the Implementation of the Food Safety Law of the PRC, enacted July 20, 2009 | |

| ● | Regional regulation: Heilongjiang Regional Medicinal Materials Resource Protection Bylaw, enacted January 8, 2005 | |

| ● | Good Manufacturing Practice (GMP) Amendment, enacted January 17, 2011 | |

| ● | Hemp Industry 3-year Special Action Plan of Heilongjiang Province (2018-2020) and | |

| ● | Hemp Legislation of Heilongjiang Province in May 2017. |

In the PRC, a Good Manufacturing Practice Certification (“GMP Certification”) is required for companies that produce medical drugs and health supplements. It is also required to market our medical drugs and health supplements. According to the Administrative Rules of Drug Manufacturing and Certification issued by the CFDA of the PRC on September 7, 2005, the CFDA is responsible for the review and issuance of GMP Certification. To obtain a GMP Certification, a company shall submit its application; the CFDA will then conduct a technical review of the application materials; if such company passes the technical review, the CFDA will inspect the manufacturing site. The CFDA also conducts follow-up inspections on the manufacturing site. After the issuance of the GMP Certification, the CFDA may inspect the manufacturing site from time to time. The GMP Certifications of our wholly owned subsidiaries, Humankind, HLJ Huimeijia, are valid through February 14, 2019 and December 31, 2015, respectively. For the GMP Certificate of HLJ Huimeijia, the Company applied for a new certificate, which was obtained on April 25, 2018. Since obtaining the GMP Certification, we have been able to manufacture and market our products without further governmental approval.

| 17 |

Employees

As of June 30, 2018, we have 140 employees including 9 officers, 12 administrators, 36 sales persons and 56 workers, 17 scientists, 5 engineers and 5 accountants. We believe that we are in compliance with local prevailing wage, contractor licensing and insurance regulations, and have good relations with our employees.

We also have 19 independent workers for packing.

| Item 1A. | Risk Factors. |

We are a smaller reporting company and therefore this item is not applicable to us.

| Item 1B. | Unresolved Staff Comments. |

Not applicable.

| Item 2. | Properties. |

All land belongs to the state in PRC. Enterprises and individuals can pay the state a fee to obtain a right to use a piece of land for commercial purpose or residential purpose for an initial period of 50 years or 70 years, respectively. The land use right can be sold, purchased, and exchanged in the market. The land use right of a successor owner will be reduced by the amount of time consumed by the predecessor owner.

We manufacture our products on a plot of land located in Jin Xing Industrial Park, Songbei District, Harbin. On June 7, 2004, the Company entered into a Land Use Purchase Contract with the local government, pursuant to which the Company agreed to purchase the right to use a piece of land, approximately 8 acres (32,000 square meters), located in Harbin County, Heilongjiang Province for commercial purposes for a fifty-year period from June 7, 2004 through June 6, 2054, for $637,261 (RMB 5,248,000). The Company fully paid to the government the consideration for the land use right on June 13, 2004. The Department of Housing and Urban Development of Harbin City approved this transaction. The Company is in the process of applying for the title certificate from the local government. Due to certain re-zoning conducted by the local government, the estimate time to receive the title certificate is uncertain. The Company is striving to accelerate the process. The manufacturing facility on the land is 4,000 square meters and there are five production lines which are sufficient for our operation. We package our products in bottles, plastic containers and aluminum foil bags.

Since we acquired HLJ Huimeijia on November 22, 2013, we also manufacture our medicines and drugs using HLJ Huimeijia’s land, approximately 43,350 square meters, located in Hai-lin Economic Development Zone, Mudanjiang City. The manufacturing facilities occupy approximately 5,710 square meters. We plan to build new manufacturing facilities on the land. The expected construction cost is approximately $7,520,000 (RMB 50,000,000).

In addition, the HLJ Huimeijia facility, with a book value of $1,796,166, has been mortgaged for the working capital loan in the principal amount of $1,611,967 (RMB 10,000,000).

| Item 3. | Legal Proceedings. |

We do not know of any material, active, pending or threatened proceeding against us or our subsidiaries, nor are we, or any subsidiary, involved as a plaintiff or defendant in any material proceeding or pending litigation.

| Item 4. | Mine Safety Disclosures. |

This item is not applicable to us.

| 18 |

| Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities. |

Market Information

Our common stock is traded over-the-counter on the OTC Markets QB Tier under the ticker “CHHE” and the market for the stock has been relatively inactive. The range of high and low bid quotations for the quarters of the last two years ended June 30, 2017 and 2018 for which financial statements are included is listed below. The quotations are taken from Yahoo Finance. They reflect inter-dealer prices, without retail mark-up, mark-down or commission, and may not necessarily represent actual transactions.

| Calendar Quarter | High Bid | Low Bid | ||||||

| Fiscal Year ended June 30, 2018 | ||||||||

| First Quarter | $ | 0.13 | $ | 0.12 | ||||

| Second Quarter | $ | 0.29 | $ | 0.12 | ||||

| Third Quarter | $ | 0.46 | $ | 0.33 | ||||

| Fourth Quarter | $ | 0.80 | $ | 0.35 | ||||

| Fiscal Year ended June 30, 2017 | ||||||||

| First Quarter | $ | 0.20 | $ | 0.11 | ||||

| Second Quarter | $ | 0.17 | $ | 0.11 | ||||

| Third Quarter | $ | 0.35 | $ | 0.11 | ||||

| Fourth Quarter | $ | 0.27 | $ | 0.12 | ||||

As of September 12, 2018, we had approximately 495 shareholders of record of our common stock, such number of holders does not include street name holders who hold shares by brokerage firms. The holders of common stock are entitled to one vote for each share held of record on all matters submitted to a vote of stockholders. Holders of the common stock have no preemptive rights and no right to convert their common stock into any other securities. There are no redemption or sinking fund provisions applicable to the common stock.

Dividends

We have not paid dividends on our common stock and do not anticipate paying such dividends in the foreseeable future. We will rely on dividends from Humankind for our funds and PRC regulations may limit the amount of funds distributed to us from Humankind, which will affect our ability to declare any dividends.

| 19 |

Securities Authorized for Issuance Under Equity Compensation Plans

On March 27, 2015 the Board of Directors (the “Board”) adopted the Company’s 2015 Equity Incentive Plan (the “Plan”), which became effective as of such date. The total number of authorized shares under the Plan is 6,000,000 shares of common stock. For the material features of the Plan, please see Note 18.

The following table summarizes the number of shares of our common stock authorized for issuance under our the Plan as of June 30, 2018.

Equity Compensation Plan Information

| Plan category | Number of securities to be issued upon exercise of outstanding options, warrants and rights (a) | Weighted-average exercise price of outstanding options, warrants and rights (b) | Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)) (c) | |||||||||

| Equity compensation plans approved by security holders | - | - | - | |||||||||

| Equity compensation plans not approved by security holders | - | - | 2,700,000 | (1) | ||||||||

| Total | ||||||||||||

(1) The Company granted an aggregate of 3.3 million shares of restricted shares to its CEO and an employee on March 30, 2015.

Registrar and Stock Transfer Agent

Our stock transfer agent is Direct Transfer LLC (f/k/a Interwest Transfer Company, Inc) at 1981 Murray Holladay Road, Suite 100, Salt Lake City, UT 84117. Their telephone number is (801) 272-9294, and their fax number is (801) 277-3147.

Shares Eligible for Future Sale

There is no active trading market for our common stock. Future sales of substantial amounts of our common stock in the trading market could adversely affect market prices.

| 20 |

Penny Stock Regulations

Our shares of common stock are subject to the “penny stock” rules of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) and various rules thereunder. In general terms, “penny stock” is defined as any equity security that has a market price less than $5.00 per share, subject to certain exceptions. The rules provide that any equity security is considered to be a penny stock unless that security is registered and traded on a national securities exchange meeting specified criteria set by the SEC, issued by a registered investment company, and excluded from the definition on the basis of price (at least $5.00 per share), or based on the issuer’s net tangible assets or revenues. In the last case, the issuer’s net tangible assets must exceed $3,000,000 if in continuous operation for at least three years or $5,000,000 if in operation for less than three years or the issuer’s average revenues for each of the past three years must exceed $6,000,000.

Trading in shares of penny stock is subject to additional sales practice requirements for broker-dealers who sell penny stocks to persons other than established customers and accredited investors. Accredited investors, in general, include individuals with assets in excess of $1,000,000 or annual income exceeding $200,000 (or $300,000 together with their spouse), and certain institutional investors. For transactions covered by these rules, broker-dealers must make a special suitability determination for the purchase of the security and must have received the purchaser’s written consent to the transaction prior to the purchase. Additionally, for any transaction involving a penny stock, the rules require the delivery, prior to the first transaction, of a risk disclosure document relating to the penny stock. A broker-dealer also must disclose the commissions payable to both the broker-dealer and the registered representative, and current quotations for the security. Finally, monthly statements must be sent disclosing recent price information for the penny stocks. These rules may restrict the ability of broker-dealers to trade or maintain a market in our common stock, to the extent it is penny stock, and may affect the ability of shareholders to sell their shares.

Recent Sale of Unregistered Securities

None.

Repurchase of Equity Securities

None.

| Item 6. | Selected Financial Data. |

Not Applicable.

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations. |

FORWARD LOOKING STATEMENTS

We make certain forward-looking statements in this report. Statements concerning our future operations, prospects, strategies, financial condition, future economic performance (including growth and earnings), demand for our services, and other statements of our plans, beliefs, or expectations, including the statements contained under the captions “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” as well as captions elsewhere in this document, are forward-looking statements. In some cases, these statements are identifiable through the use of words such as “anticipate,” “believe,” “estimate,” “expect,” “intend,” “plan,” “project,” “target,” “can,” “could,” “may,” “should,” “will,” “would,” and similar expressions. The forward-looking statements we make are not guarantees of future performance and are subject to various assumptions, risks, and other factors that could cause actual results to differ materially from those suggested by these forward-looking statements. These risks and uncertainties, together with the other risks described from time to time in reports and documents that we file with the SEC should be considered in evaluating forward-looking statements. Because such statements are subject to risks and uncertainties, actual results may differ materially from those expressed or implied by the forward-looking statements. Indeed, it is likely that some of our assumptions will prove to be incorrect. Our actual results and financial position will vary from those projected or implied in the forward-looking statements and the variances may be material. You are cautioned not to place undue reliance on such forward-looking statements, which reflect our view only as of the date of this report.

Important factors that could cause actual results to differ from those in the forward-looking statements include, without limitation, the following:

| ● | the effect of political, economic, and market conditions and geopolitical events; | |

| ● | legislative and regulatory changes that affect our business; | |

| ● | the availability of funds and working capital; and | |

| ● | the actions and initiatives of current and potential competitors |

| 21 |

Except as required by applicable laws, regulations or rules, we do not undertake any responsibility to publicly release any revisions to these forward-looking statements to take into account events or circumstances that occur after the date of this report. Additionally, we do not undertake any responsibility to update you on the occurrence of any unanticipated events which may cause actual results to differ from those expressed or implied by any forward-looking statements.

The following discussion and analysis should be read in conjunction with our consolidated financial statements and the related notes thereto as filed with the SEC and other financial information contained elsewhere in this report.

Except as otherwise indicated by the context, references in this report to “we,” “us,” “our,” “the Registrant,” “our Company,” or “the Company” are to China Health Industries Holdings, Inc., a Delaware corporation, China Health Industries Holdings Limited, a corporation incorporated under the laws of Hong Kong, its wholly owned subsidiary in China, Harbin Humankind Biology Technology Co. Limited (“Humankind”) and indirect wholly owned subsidiary, Heilongjiang Huimeijia Pharmaceutical Co., Ltd. (“HLJ Huimeijia”). Unless the context otherwise requires, all references to (i) “PRC” and “China” are to the People’s Republic of China; (ii) “U.S. dollar,” “$” and “US$” are to United States dollars; (iii) “RMB” are to Renminbi Yuan of China; (iv) “Securities Act” are to the Securities Act of 1933, as amended; and (v) “Exchange Act” are to the Securities Exchange Act of 1934, as amended.

Business Overview

Our principal business operations are conducted through our wholly-owned subsidiaries, Humankind and HLJ Huimeijia.

The Company owns a GMP-certified plant and facilities and has the capacity to produce 21 CFDA-approved medicines and 14 CFDA-approved health supplement products in soft capsule, hard capsule, tablet, granule and oral liquid forms. These products address the needs of some key sectors in China, including the feminine, geriatric and children’s markets.

HLJ Huimeijia's previous GMP certificate expired at the end of December 2015, and HLJ Huimeijia was required to cease all production activities, hough HLJ Huimeijia was permitted to sell inventory produced prior to obtaining the new GMP certificate. Management anticipated that there would be no or very little revenue generated by HLJ Huimeijia after the expiration of the previous GMP certificate. On April 25, 2018, HLJ Huimeijia obtained the new GMP certificate and, pursuant to PRC law, was able to resume normal production activities at that time.

On December 24, 2014, Humankind entered into a stock transfer agreement (the “Original Agreement”) with Xiuzheng Pharmaceutical Group Co., Ltd., a company incorporated under the laws of the PRC and located in Jilin province (“Xiuzheng Pharmacy” or the “Buyer”), Mr. Xin Sun, the CEO of the Company, and Huimeijia, a subsidiary 99% owned by Humankind and 1% owned by Mr. Xin Sun. Pursuant to the Original Agreement, Humankind and Mr. Xin Sun (the “Equity Holders”), would sell their respective equity interests in Huimeijia to Xiuzheng Pharmacy. On February 9, 2015, the four parties entered into a supplementary agreement (the “Supplementary Agreement”) to modify the terms of the Original Agreement, pursuant to which, the Equity Holders and Huimeijia (collectively the “Asset Transferors”) would only sell 19 drug approval numbers (the “Assets”) to Xiuzheng Pharmacy. The Equity Holders would have retained their equity interests in Huimeijia, but would have pledged such equity interests to Xiuzheng Pharmacy until the Assets were transferred. On October 12, 2016, the four parties agreed to rescind the Supplementary Agreement and entered into a new supplementary agreement, pursuant to which the parties agreed to execute the transfer of the equity interests based on the Original Agreement, and the Equity Holders sold their respective equity interests in Huimeijia to Xiuzheng Pharmacy for total cash consideration of RMB 8,000,000 (approximately $1,306,186, the “Purchase Price”). As of October 12, 2016, Huimeijia had completed changes in its business registration, and Xiuzheng Pharmacy had obtained a new business license issued by the local State Administration of Industry and Commerce in Harbin (“Harbin SAIC”) to Huimeijia, in which Huimeijia’s ownership was recorded as held by Xiuzheng Pharmacy with Harbin SAIC, and the legal representative (a person that is authorized to take most corporate actions on behalf of a company under PRC corporate laws) of Huimeijia had been appointed by the Buyer.

Our business is conducted through our sales agents and sales personnel. We sell our products directly to end customers by our own sales personnel as well as our sales agents, operating primarily in Jiangsu, Zhejiang, Shanghai, Beijing, Anhui and Gansu, where most of our revenues are generated. Our sales through agents in Anhui, Zhejiang, Shanghai, Jiangsu, Beijing and Gansu provinces accounted for 17%, 14%, 12%, 10%, 9% and 7% of our total sales, respectively, for the year ended June 30, 2018. Although we do not currently sell our products online, we expect to do so in the future.

2019 Outlook

Overall, we anticipate our total revenues for the year ended June 30, 2019 versus the year ended June 30, 2018 to increase by 114% or approximately $7.5 million, with growth in all categories of our product sales, including the anticipated revenue from Humankind for approximately $9.9 million, mainly in the sales growth of hemp-based products, and from HLJ Huimeijia for approximately $4.2 million. The gross profit margin for the year ended June 30, 2019 is expected to be approximately 45%, and we estimate our overall net profit margin for the year ended June 30,2019 to be approximately 12%. There is, however, no assurance that we will reach these projections.

| 22 |

Results of Operations

The following table summarizes the top lines of the results of our operations for the years ended June 30, 2018 and 2017, respectively:

| June 30, 2018 | June 30, 2017 | Variance | % | |||||||||||||

| Revenues | $ | 6,554,939 | $ | 6,371,552 | $ | 183,387 | 3 | % | ||||||||

| Humankind | 6,476,253 | 6,371,390 | 104,863 | 2 | % | |||||||||||

| HLJ Huimeijia | 78,686 | 162 | 78,524 | 48472 | % | |||||||||||

| Cost of Goods Sold | $ | 4,279,635 | $ | 4,068,947 | $ | 210,688 | 5 | %) | ||||||||

| Humankind | 4,012,551 | 4,068,880 | (56,329 | ) | (1 | %) | ||||||||||

| HLJ Huimeijia | 267,084 | 67 | 267,017 | 398533 | % | |||||||||||

| Gross Profit | $ | 2,275,304 | $ | 2,302,605 | $ | (27,301 | ) | (1 | %) | |||||||

| Humankind | 2,463,702 | 2,302,510 | 161,192 | 7 | % | |||||||||||

| HLJ Huimeijia | (188,398 | ) | 95 | (188,493 | ) | (198414 | %) | |||||||||

Revenue

Total revenues from the operations of the Company increased by $183,387, or 3%, for the year ended June 30, 2018 as compared to the same period in 2017. The increase in revenues was primarily due to an increase of $104,863 or 2% in Humankind’s revenues and an increase of $78,524 or 48472% in HLJ Huimeijia’s revenues for the year ended June 30, 2018 as compared to the same period in 2017. The increase of the sales revenue in Humankind was primarily due to our constant market development and new launched products. The increase of the sales revenue in HLJ Huimeijia was primarily due to the completion of review for GMP Certificate. HLJ Huimeijia has gradually manufacture and market our products since June 2018.

Our total cost of sales increased $210,688 or 5% for the year ended June 30, 2018 as compared to the same period in 2017. The increase in the overall cost of sales was attributable to an increase of $267,017 or 398533% in HLJ Huimeijia’s cost of sales, 2018 as compared to the same period in 2017, which was attributed to a disposal of expired stocks with $232,246 in this period.

Our gross profit decreased by $27,301 from $2,302,065 for the year ended June 30, 2017 to $2,275,304 for the year ended June 30, 2018. This decrease was due to the disposal of expired stocks in HLJ Huimeijia as discussed above.

Sales by Product Line

The following table summarizes a breakdown of our sales by major product line for the years ended June 30, 2018 and 2017, respectively:

| June 30, 2018 | June 30, 2018 | |||||||||||||||||||||||

| Quantity | Sales | % | Quantity | Sales | % | |||||||||||||||||||