Attached files

| file | filename |

|---|---|

| EX-32.2 - EX-32.2 - EyePoint Pharmaceuticals, Inc. | d617568dex322.htm |

| EX-32.1 - EX-32.1 - EyePoint Pharmaceuticals, Inc. | d617568dex321.htm |

| EX-31.2 - EX-31.2 - EyePoint Pharmaceuticals, Inc. | d617568dex312.htm |

| EX-31.1 - EX-31.1 - EyePoint Pharmaceuticals, Inc. | d617568dex311.htm |

| EX-23.1 - EX-23.1 - EyePoint Pharmaceuticals, Inc. | d617568dex231.htm |

| EX-21.1 - EX-21.1 - EyePoint Pharmaceuticals, Inc. | d617568dex211.htm |

| EX-10.24 - EX-10.24 - EyePoint Pharmaceuticals, Inc. | d617568dex1024.htm |

| EX-10.20 - EX-10.20 - EyePoint Pharmaceuticals, Inc. | d617568dex1020.htm |

| EX-10.19 - EX-10.19 - EyePoint Pharmaceuticals, Inc. | d617568dex1019.htm |

| EX-10.15 - EX-10.15 - EyePoint Pharmaceuticals, Inc. | d617568dex1015.htm |

| EX-10.12 - EX-10.12 - EyePoint Pharmaceuticals, Inc. | d617568dex1012.htm |

| EX-3.5 - EX-3.5 - EyePoint Pharmaceuticals, Inc. | d617568dex35.htm |

| 10-K - 10-K - EyePoint Pharmaceuticals, Inc. | d617568d10k.htm |

Exhibit 10.25

SECOND AMENDMENT OF LEASE

This Second Amendment of Lease (this “Amendment”) is executed as of May 17, 2018, between WHETSTONE RIVERWORKS HOLDINGS, LLC, a Delaware limited liability company (“Landlord”), and EYEPOINT PHARMACEUTICALS, INC., a Delaware corporation, formerly known as pSivida Corp., as amended pursuant to the Certificate of Amendment of Certificate of Incorporation filed with the Delaware Secretary of State on March 28, 2018 as file number 4515023 (“Tenant”), for the purpose of amending the Lease between Landlord’s predecessor-in-interest with respect to the Lease (defined below) and Tenant dated November 1, 2013 (the “Original Lease”). The Original Lease, as amended by the First Amendment of Lease dated February 6, 2014 (the “First Amendment”) and the Commencement Date Agreement dated March 27, 2014, is referred to herein as the “Lease”. Capitalized terms used but not defined herein shall have the meanings assigned to them in the Original Lease.

RECITALS:

Pursuant to the terms of the Lease, Tenant is currently leasing Suite B300, consisting of 13,650 rentable square feet of space (the “Existing Premises”), and Tenant formerly leased the Storage Space, as defined in the First Amendment, in the Building located at 480 Pleasant Street, Watertown, MA 02472. Tenant desires to extend the Term and lease the space depicted on Exhibit A hereto, containing approximately 6,590 rentable square feet and commonly known as Suite A-210 (the “Suite A-210 Premises”), and Landlord has agreed to extend the Term and lease such space to Tenant on the terms and conditions contained herein.

AGREEMENTS:

For valuable consideration, whose receipt and sufficiency are acknowledged, Landlord and Tenant agree as follows:

1. Extension of Term. The Term is hereby extended such that it expires at 5:00 p.m., local time, on the last day of the 80th full calendar month following the Suite A-210 Effective Date, as defined below (the “Expiration Date”) on the terms and conditions of the Lease, as modified hereby. Except as provided in Exhibit F attached hereto, Tenant shall have no further rights to extend or renew the Term; accordingly, Section 10.23 of the Original Lease is deleted. By way of clarification, Tenant no longer leases the Storage Space. Therefore, all references to the Storage Space in the First Amendment are hereby deleted.

2. Suite A-210 Premises; Tenant’s Percentage; Acceptance. Landlord hereby leases to Tenant, and Tenant hereby leases from Landlord, the Suite A-210 Premises on the terms and conditions of the Lease, as modified hereby; accordingly, from and after the Suite A-210 Effective Date (defined below), the term “Premises” shall refer collectively to the Existing Premises and the Suite A-210 Premises, and, except as otherwise provided herein, Tenant’s Percentage shall be increased to 10.36%, which is the percentage obtained by dividing the number of rentable square feet in the Premises (20,240) by the number of rentable square feet in the Building (195,423). Tenant accepts the Suite A-210 Premises delivered with all the Building’s Systems in good working order and the Premises delivered in a broom clean condition and Landlord shall not be required to perform any demolition work or tenant finish-work therein or to provide any allowances therefor, except as expressly set forth in Section 7 below. Landlord and Tenant stipulate that the number of rentable square feet in the Existing Premises, the Suite A-210 Premises and the Building are correct.

3. Term for Suite A-210 Premises. The Term for the Suite A-210 Premises shall begin on the Suite A-210 Effective Date and shall expire on the Expiration Date, unless sooner terminated as a result of a casualty, condemnation or default by Tenant as provided in the Lease. As used herein, the “Suite A-210 Effective Date” means the earliest of (a) the date on which Tenant occupies any portion of the Suite A-210 Premises and begins conducting business therein, (b) the date on which the Work (as defined in Exhibit C hereto) in the Suite A-210 Premises is Substantially Completed (as defined in Exhibit C hereto), or (c) the date on which the Work in the Suite A-210 Premises would have been Substantially Completed but for the occurrence of any Tenant Delay Days (as defined in Exhibit C hereto). Prior to occupying the Suite A-210 Premises, Tenant shall execute and deliver to Landlord a letter substantially in the form of Exhibit D hereto confirming (1) the Suite A-210 Effective Date, (2) that Tenant has accepted the Suite A-210 Premises, and (3) that Landlord has performed all of its obligations with respect to the Suite A-210 Premises (except for punch-list items specified in such letter); however, the failure of the parties to execute such letter shall not defer the Suite A-210 Effective Date or otherwise invalidate the Lease or this Amendment.

4. Base Rent for the Premises. For clarity, the monthly installments of Base Rent under the Lease for the Existing Premises shall remain as provided in the Original Lease until April 30, 2019. The monthly installments of Base Rent under the Lease for the “Entire Premise” (i.e., both the Existing Premises and the Suite A-2 I0 Premises) shall be the following amounts for the following periods of time:

| Lease Month |

Annual Base Rent Rate Per Rentable Square Foot |

Monthly Installments of Base Rent for the Premises | ||

| Suite A-210 |

$31.50 | $55,601.25 | ||

| Effective Date—04.30.19 |

(for the Existing Premises) $36.00 (for the Suite A-210 Premises) |

|||

| 05.01.19-12 |

$36.00 | $60,720.00 | ||

| 13-24 |

$37.00 | $62,406.67 | ||

| 25-36 |

$38.00 | $64,093.33 | ||

| 37-48 |

$39.00 | $65,780.00 | ||

| 49-60 |

$40.00 | $67,466.67 | ||

| 61-80 |

$41.00 | $69,153.33 |

As used herein, the term “Lease Month” means each calendar month during the Term from and after the Suite A-210 Effective Date (and if the Suite A-210 Effective Date does not occuron the first day ofa calendar month, the period from the Suite A-210 Effective Date to the first day of the next calendar month shall be included in the first Lease Month for purposes of determining the duration of the Term and the monthly Base Rent rate applicable for such partial month}.

Base Rent and additional rent (other than Tenant’s Electricity [defined below]) for the Entire Premises shall be conditionally abated during the first four months following the Suite A-210 Effective Date, e.g., if the Suite A-210 Effective Date is August 25, 2018, Base Rent and additional rent (other than Tenant’s Electricity) for the Entire Premises shall be abated until December 24, 2018. However, if Tenant delivers this Amendment fully signed by Tenant to Landlord after May 14, 2018, the abatement as provided above shall be for three months rather than four months. Beginning on the first day following the expiration of the abatement period, Tenant shall make Base Rent and additional rent payments for the Premises as otherwise provided in the Lease, as amended by this Amendment. Notwithstanding such abatement of Base Rent and additional rent (other than Tenant’s Electricity) for the Premises (a) all other sums due under the Lease, as amended by this Amendment, including Tenant’s Electricity, shall be payable as provided in the Lease, as amended by this Amendment, and (b) any increases in Base Rent for the Premises set forth in the Lease, as amended by this Amendment, shall occur on the dates scheduled therefor.

The abatement of Base Rent for the Entire Premises provided for herein is conditioned upon Tenant’s full and timely performance of all of its obligations under the Lease, as amended by this Amendment. If at any time following the date hereof an Event of Default by Tenant occurs, the abatement of Base Rent for the Entire Premises provided for herein shall immediately become void, and Tenant shall promptly pay to Landlord, in addition to all other amounts due to Landlord under the Lease, as amended by this Amendment, the full amount of all Base Rent for the Entire Premises herein abated multiplied by a fraction, the numerator of which is the number of full calendar months remaining in the Term as of the date of the Event of Default and the denominator of which is the number of months in the Term.

2

5. Operating Expenses; Taxes; Tenant’s Electricity. Tenant shall pay Tenant’s Electricity and increases in Tenant’s Share of Operating Expenses and Taxes with respect to the Entire Premises in the manner provided in the Lease, except that:

5.1 for clarity, through April 30, 2019, the Operating Expense Base and the Real Estate Tax Base for the Existing Premises shall remain 2014;

5.2 from and after May 1, 2019 with respect to the Existing Premises, and from and after the Suite A-210 Effective Date with respect to the Suite A-210 Premises, the Operating Expense Base shall be the calendar year 2019 (as adjusted to reflect 95% occupancy of the Building as provided in the Lease); provided that Operating Expenses for the Operating Expense Base only shall not include costs incurred due to extraordinary circumstances or other non-recurring charges, including market-wide labor rate increases due to boycotts and strikes; utility rate increases due to extraordinary circumstances or other non-recurring charges, including conservation surcharges, boycotts, embargos or other shortages; insurance deductibles; or amortized costs relating to capital improvements;

5.3 from and after May 1, 2019 with respect to the Existing Premises, and from and after the Suite A-210 Effective Date with respect to the Suite A-210 Premises, the Real Estate Tax Base shall be the fiscal year 2020 (i.e., July 1, 2019 through June 30, 2020).

5.4 Tenant shall continue to pay the cost of all submetered electricity for the Premises (“Tenant’s Electricity”) as provided in Section 3.3 of the Original Lease. To the extent not already existing, as part of the Work (as defined in Exhibit C attached hereto) in the Suite A-210 Premises, Landlord shall ensure that all electricity used in the Suite A-210 Premises is separately submetered or otherwise included in Tenant’s existing submeter for the Existing Premises. Tenant’s obligation to commence paying Tenant’s Electricity for the Suite A-210 Premises shall commence on the Suite A-210 Effective Date.

6. Letter of Credit. Within 30 days following the Suite A-210 Effective Date, Tenant shall deliver to Landlord, at Tenant’s expense, a letter of credit in a form reasonably acceptable to Landlord with an expiration date that is 120 days following the Expiration Date. However, the total amount of the Letter of Credit shall remain the same as, not in addition to, the Letter of Credit existing prior to the Suite A-210 Effective Date.

7. Tenant Finish-Work. Landlord shall construct tenant improvements in the Suite A-210 Premises in accordance with Exhibit C hereto. Subject to the terms and conditions of Exhibit C attached hereto, Landlord shall be responsible for the completion of all such work, and all costs, permits and approvals (to the extent such permits and approvals may be obtained by Landlord) associated with said work that may be necessary for the permanent use and occupancy of the Entire Premises by Tenant.

8. Parking. From and after the Suite A-210 Effective Date, Tenant shall have those parking rights set forth on Exhibit E of this Amendment and no further parking rights. Accordingly, Section 2.1(c) of the Original Lease is deleted.

9. Confidentiality. Tenant acknowledges the terms and conditions of the Lease (as amended hereby) are to remain confidential for Landlord’s benefit, and may not be disclosed by Tenant to anyone, by any manner or means, directly or indirectly, without Landlord’s prior written consent; however, Tenant may disclose the terms and conditions of the Lease to its attorneys, accountants, employees and existing or prospective financial partners, or if required by law or court order, provided all parties to whom Tenant is permitted hereunder to disclose such terms and conditions are advised by Tenant of the confidential nature of such terms and conditions and agree to maintain the confidentiality thereof (in each case, prior to disclosure). Tenant shall be liable for any disclosures made in violation of this Section by Tenant or by any entity or individual to whom the terms of and conditions of the Lease were disclosed or made available by Tenant. The consent by Landlord to any disclosures shall not be deemed to be a waiver on the part of Landlord of any prohibition against any future disclosure.

10. Estoppel Certificates. Pursuant to the terms of the Lease, Tenant is obligated to execute and deliver to Landlord from time to time estoppel certificates confirming and containing such factual certifications and representations as to the Lease as Landlord may reasonably request. Unless otherwise required by Landlord’s mortgagee or a prospective purchaser or mortgagee of the Building, the form of estoppel certificate to be signed by Tenant is attached hereto as Exhibit B.

3

11. Financial Statements. If Tenant is an entity that is domiciled in the United States of America, and whose securities are funded through a public securities exchange subject to regulation by the United States of America publicly traded over exchanges based in the United States and whose financial statements are readily available at no cost to Landlord, the terms of this Section 11 shall not apply. Otherwise, within 15 days after Landlord’s request, Tenant will furnish Tenant’s most recent audited financial statements (including any notes to them) to Landlord, or, if no such audited statements have been prepared, such other financial statements (and notes to them) as may have been prepared by an independent certified public accountant or, failing those, Tenant’s internally prepared financial statements. Tenant will discuss its financial statements with Landlord and, following the occurrence of an Event of Default under the Lease, as amended from time to time, will give Landlord access to Tenant’s books and records in order to enable Landlord to verify the financial statements. Landlord will not disclose any aspect of Tenant’s financial statements that Tenant designates to Landlord as confidential except (a) to Landlord’s mortgagee or prospective mortgagees or purchasers of the Building, (b) in litigation between Landlord and Tenant, and/or (c) if required by law or court order. Tenant shall not be required to deliver the financial statements required under this Section 11 more than once in any 12-month period unless requested by Landlord’s mortgagee or a prospective buyer or lender of the Building or an Event of Default occurs.

12. Landlord’s Notice Address. The addresses for Landlord’s notice set forth below shall supersede and replace any addresses for notice to Landlord set forth in the Lease.

| Landlord: | Whetstone Riverworks Holdings, LLC One Market Plaza, Spear Tower, Suite 4125 San Francisco, CA 94105 Attention: Asset Manager – Riverworks

| |

| with a copy to | Whetstone Riverworks Holdings, LLC c/o Spear Street Capital, LLC 450 Lexington Avenue, 39th Floor New York, NY 10017 Attention: Asset Manager – Riverworks |

13. Brokerage. Landlord and Tenant each warrant to the other that it has not dealt with any broker or agent in connection with the negotiation or execution of this Amendment other than Colliers International and Newmark Knight Frank, whose commission shall be paid by Landlord pursuant to a separate written agreement. Tenant and Landlord shall each indemnify the other against all costs, expenses, attorneys’ fees, and other liability for commissions or other compensation claimed by any other broker or agent claiming the same by, through, or under the indemnifying party.

14. UBTI and REIT Qualification. Landlord and Tenant agree that all Rent payable by Tenant to Landlord shall qualify as “rents from real property” within the meaning of both Sections 512(b)(3) and 856(d) of the Internal Revenue Code of 1986, as amended (the “Code”) and the U.S. Department of Treasury Regulations promulgated thereunder (the “Regulations”). In the event that Landlord, in its sole and absolute discretion, determines that there is any risk that all or part of any rent shall not qualify as “rents from real property” for the purposes of Sections 512(b)(3) or 856(d) of the Code and the Regulations promulgated thereunder, Tenant agrees (1) to cooperate with Landlord by entering into such amendment or amendments as Landlord deems necessary to qualify all rents as “rents from real property,” and (2) to permit an assignment of the Lease; provided, however, that any adjustments required pursuant to this Section shall be made so as to produce the equivalent Rent (in economic terms) payable prior to such adjustment.

15. Prohibited Persons and Transactions. Tenant represents and warrants that neither it nor any of Tenant’s respective partners, members, shareholders or other equity owners is, nor will they become, a person or entity with whom U.S. persons or entities are restricted from doing business under regulations of the Office of Foreign Assets Control (“OFAC”) of the Department of the Treasury (including those named on OFAC’s Specially Designated Nationals and Blocked Persons List) or under any statute, executive order (including the September 24, 2001,

4

Executive Order Blocking Property and Prohibiting Transactions with Persons Who Commit, Threaten to Commit, or Support Terrorism), or other governmental action and is not and will not assign or otherwise transfer the Lease to such persons or entities.

16. Waiver of Jury Trial. TO THE MAXIMUM EXTENT PERMITTED BY LAW, TENANT (ON BEHALF OF ITSELF AND ITS RESPECTIVE SUCCESSORS, ASSIGNS AND SUBTENANTS) AND LANDLORD EACH, AFTER CONSULTATION WITH COUNSEL, KNOWINGLY WAIVES ANY RIGHT TO TRIAL BY JURY IN ANY LITIGATION OR TO HAVE A JURY PARTICIPATE IN RESOLVING ANY DISPUTE ARISING OUT OF OR WITH RESPECT TO THE LEASE, AS AMENDED BY THIS AMENDMENT, OR ANY OTHER INSTRUMENT, DOCUMENT OR AGREEMENT EXECUTED OR DELIVERED IN CONNECTION THEREWITH OR THE TRANSACTIONS RELATED THERETO.

17. Ratification. Tenant hereby ratifies and confirms its obligations under the Lease, and represents and warrants to Landlord that it has no defenses thereto. Additionally, Tenant further confirms and ratifies that, as of the date hereof, (a) the Lease is and remains in good standing and in full force and effect, (b) Tenant has no claims, counterclaims, set-offs or defenses against Landlord arising out of the Lease or in any way relating thereto or arising out of any other transaction between Landlord and Tenant, and (c) except as expressly provided for in this Amendment, all allowances provided to Tenant under the Lease, if any, and all construction to be performed by Landlord or its agents under the Lease, if any, have been paid and performed in full by Landlord, and Landlord has no further obligations with respect thereto. Landlord hereby ratifies and confirms its obligations under the Lease and represents and warrants to Tenant that, as of the date hereof, (1) monthly Base Rent is not more than 30 days past due, (2) the Lease is and remains in good standing and in full force and effect and Landlord has no defenses thereto, and (3) to Landlord’s knowledge, Landlord has no non-monetary claims, counterclaims, set-offs or defenses against Tenant arising out of the Lease or in any way relating thereto or arising out of any other transaction between Landlord and Tenant.

18. Binding Effect; Arms’-Length Negotiation; Governing Law; No Reliance. Except as modified hereby, the Lease shall remain in full effect and this Amendment shall be binding upon Landlord and Tenant and their respective successors and assigns. If any inconsistency exists or arises between the terms of the Lease and the terms of this Amendment, the terms of this Amendment shall prevail. This Amendment shall be governed by the laws of the State in which the Premises are located. Except for those set forth in this Amendment, no representations, warranties, or agreements have been made by Landlord or Tenant to the other with respect to this Amendment or the obligations of Landlord or Tenant in connection therewith. Further, Tenant disclaims any reliance upon any and all representations, warranties or agreements not expressly set forth in the Lease, as amended by this Amendment. Landlord and Tenant agree that they have both had the opportunity to retain legal counsel to review, revise, and negotiate this Amendment on their individual behalf. Landlord and Tenant stipulate that this Amendment has been reviewed and revised by both Landlord and Tenant and their respective legal counsel and that the Lease, as amended hereby, is the result of an arms’-length negotiation and compromise. Landlord and Tenant further stipulate that they are both sophisticated individuals or business entities capable of understanding and negotiating the terms of the Lease, as amended hereby.

19. Counterparts. This Amendment may be executed in multiple counterparts, each of which shall be deemed to be an original, and all of such counterparts shall constitute one document. To facilitate execution of this Amendment, the parties hereto may execute and exchange, by telephone facsimile or electronic mail PDF, counterparts of the signature pages. Signature pages may be detached from the counterparts and attached to a single copy of this Amendment to physically form one document.

[THE REMAINDER OF THIS PAGE IS INTENTIONALLY LEFT BLANK]

5

Executed as of the date first written above.

| LANDLORD: | WHETSTONE RIVERWORKS HOLDINGS, LLC, a Delaware limited liability company

| |||||

| By: |

/s/ Rajiv S. Patel | |||||

| Name: | Rajiv S. Patel | |||||

| Title: | President | |||||

| TENANT: | EYEPOINT PHARMACEUTICALS, INC., a Delaware corporation | |||||

| By: | /s/ Nancy Lurker | |||||

| Name: | Nancy Lurker | |||||

| Title: | President & CEO | |||||

| Executed on: May 14, 2018 | ||||||

[Signature Page to Second Amendment of Lease]

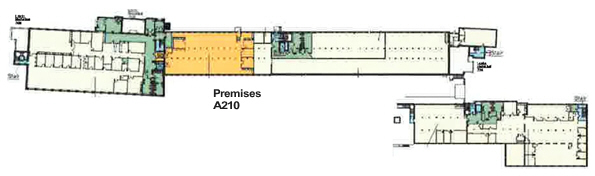

EXHIBIT A

DEPICTION OF SUITE A-210 PREMISES

2nd Floor

A-1

EXHIBIT B

FORM OF TENANT ESTOPPEL CERTIFICATE

The undersigned is the Tenant under the Lease (defined below) between , a as Landlord, and the undersigned as Tenant, for the Premises on the floor(s) of the office building located at and commonly known as and hereby certifies as follows:

1. The Lease consists of the original Lease Agreement dated as of , between Tenant and Landlord[‘s predecessor-in-interest) and the following amendments or modifications thereto (if none, please state “none”):

The documents listed above are herein collectively referred to as the “Lease” and represent the entire agreement between the parties with respect to the Premises. All capitalized terms used herein but not defined shall be given the meaning assigned to them in the Lease.

2. The Lease is in full force and effect and has not been modified, supplemented or amended in any way except as provided in Section 1 above.

3. The Term commenced on and the Term expires, excluding any renewal options, on , 20 , and Tenant has no option to purchase all or any part of the Premises or the Building or, except as expressly set forth in the Lease, any option to terminate or cancel the Lease.

4. Tenant currently occupies the Premises described in the Lease and Tenant has not transferred, assigned, or sublet any portion of the Premises nor entered into any license or concession agreements with respect thereto except as follows (if none, please state “none”):

5. All monthly installments of Base Rent, all additional Rent and all monthly installments of estimated additional Rent have been paid when due through . The current monthly installment of Base Rent is $ .

6. All conditions of the Lease to be performed by Landlord necessary to the enforceability of the Lease have been satisfied and Landlord is not in default thereunder. In addition, Tenant has not delivered any notice to Landlord regarding a default by Landlord thereunder.

7. As of the date hereof, there are no existing defenses or offsets, or, to Tenant’s knowledge, claims or any basis for a claim, that Tenant has against Landlord and no event has occurred and no condition exists, which, with the giving of notice or the passage of time, or both, will constitute a default under the Lease .

8. No rental has been paid more than 30 days in advance and no security deposit has been delivered to Landlord except as provided in the Lease.

9. If Tenant is a corporation, partnership or other business entity, each individual executing this

B-1

Estoppel Certificate on behalf of Tenant hereby represents and warrants that Tenant is a duly formed and existing entity qualified to do business in the state in which the Premises is located and that Tenant has full right and authority to execute and deliver this Estoppel Certificate and that each person signing on behalf of Tenant is authorized to do so.

10. There are no actions pending against Tenant under any bankruptcy or similar laws of the United States or any state.

11. Other than in compliance with all applicable laws and incidental to the ordinary course of the use of the Premises, Tenant has not used or stored any hazardous substances in the Premises.

12. All tenant improvement work to be performed by Landlord under the Lease has been completed in accordance with the Lease and has been accepted by Tenant and all reimbursements and allowances due to Tenant under the Lease in connection with any tenant improvement work have been paid in full.

Tenant acknowledges that this Estoppel Certificate may be delivered to Landlord, Landlord’s mortgagee or to a prospective mortgagee or prospective purchaser, and their respective successors and assigns, and acknowledges that Landlord, Landlord’s mortgagee and/or such prospective mortgagee or prospective purchaser will be relying upon the statements contained herein in disbursing loan advances or making a new loan or acquiring the property of which the Premises are a part and that receipt by it of this certificate is a condition of disbursing loan advances or making such loan or acquiring such property.

Executed as of , 20 .

| TENANT: |

,. a | |||||

| By: |

||||||

| Name: |

||||||

| Title: |

||||||

EXHIBIT C

TENANT FINISH-WORK: ALLOWANCE

(Landlord Performs the Work)

1. Acceptance of Suite A-210 Premises. Except as set forth in this Exhibit, Tenant accepts the Suite A-210 Premises delivered with all the Building’s Systems in good working order and the Premises delivered in a broom clean condition on the date this Amendment is entered into.

2. Space Plans.

2.1 Preparation and Delivery. Within seven business days after Tenant’s execution of this Amendment, Tenant shall meet with a design consultant selected by Landlord (the “Architect”) to discuss the nature and extent of all improvements that Tenant proposes to install in the Premises and, at such meeting, provide the Architect with all necessary data and information needed by the Architect to prepare initial space plans therefor as required by this paragraph. On or before the tenth day following the date that Tenant meets with Architect, Landlord shall deliver to Tenant a space plan prepared by the Architect depicting improvements to be installed in the Premises (the “Space Plans”).

2.2 Approval Process. Tenant shall notify Landlord whether it approves of the submitted Space Plans within five business days after Landlord’s submission thereof. If Tenant disapproves of such Space Plans, then Tenant shall notify Landlord thereof specifying in reasonable detail the reasons for such disapproval, in which case Landlord shall, within three business days after such notice, revise such Space Plans in accordance with Tenant’s objections and submit to Tenant for its review and approval. Tenant shall notify Landlord in writing whether it approves of the resubmitted Space Plans within three business days after its receipt thereof. This process shall be repeated until the Space Plans have been finally approved by Tenant and Landlord. If Tenant fails to notify Landlord that it disapproves of the initial Space Plans within five business days (or, in the case of resubmitted Space Plans, within three business days) after the submission thereof, then Tenant shall be deemed to have approved the Space Plans in question.

3. Working Drawings.

3.1 Preparation and Delivery. On or before the date which is 15 days following the date on which the Space Plans are approved (or deemed approved) by Tenant and Landlord, Landlord shall cause to be prepared final working drawings of all improvements to be installed in the Premises and deliver the same to Tenant for its review and approval (which approval shall not be unreasonably withheld, delayed or conditioned). Such working drawings shall be prepared by a design consultant selected by Landlord (whose fee shall be included in the Total Construction Costs [defined below]).

3.2 Approval Process. Tenant shall notify Landlord whether it approves of the submitted working drawings within five business days after Landlord’s submission thereof. If Tenant disapproves of such working drawings, then Tenant shall notify Landlord thereof specifying in reasonable detail the reasons for such disapproval, in which case Landlord shall, within five business days after such notice, revise such working drawings in accordance with Tenant’s objections and submit the revised working drawings to Tenant for its review and approval. Tenant shall notify Landlord in writing whether it approves of the resubmitted working drawings within three business days after its receipt thereof. This process shall be repeated until the working drawings have been finally approved by Landlord and Tenant. If Tenant fails to notify Landlord that it disapproves of the initial working drawings within five business days (or, in the case of resubmitted working drawings, within three business days) after the submission thereof, then Tenant shall be deemed to have approved the working drawings in question. Any delay caused by Tenant’s unreasonable withholding of its consent or delay in giving its written approval as to such working drawings shall constitute a Tenant Delay Day (defined below). If the working drawings are not fully approved (or deemed approved) by both Landlord and Tenant by the 15th business day after the delivery of the initial draft thereof to Tenant, then each day after such time period that such working drawings are not fully approved (or deemed approved) by both Landlord and Tenant shall constitute a Tenant Delay Day.

C-1

3.3 Landlord’s Approval; Performance of Work. If any of Tenant’s proposed construction work will affect the Building’s Structure or the Building’s Systems, then the working drawings pertaining thereto must be approved by the Building’s engineer of record. Landlord’s approval of such working drawings shall not be unreasonably withheld, provided that (a) they comply with all Laws, (b) the improvements depicted thereon do not (1) adversely affect (in the reasonable discretion of Landlord) the Building’s Structure or the Building’s Systems (including the Building’s restrooms or mechanical rooms), or (2) affect in a negative manner (in the sole discretion of Landlord) (A) the exterior appearance of the Building, (B) the appearance of the Building’s common areas or elevator lobby areas or (C) the provision of services to other occupants of the Building, (c) such working drawings are sufficiently detailed to allow construction of the improvements and associated work in a good and workmanlike manner, and (d) the improvements depicted thereon conform to the rules and regulations promulgated from time to time by Landlord for the construction of tenant improvements (a copy of which has been delivered to Tenant). As used herein, “Working Drawings” means the final working drawings approved by Landlord, as amended from time to time by any approved changes thereto, and “Work” means all improvements to be constructed in accordance with and as indicated on the Working Drawings, together with any work required by governmental authorities to be made to other areas of the Building as a result of the improvements indicated by the Working Drawings. The Work also includes obtaining all necessary permits and approvals for permanent occupancy by Tenant to the extent the same may be obtained by Landlord. Landlord’s approval of the Working Drawings shall not be a representation or warranty of Landlord that such drawings are adequate for any use or comply with any Law, but shall merely be the consent of Landlord thereto. Tenant shall, at Landlord’s request, sign the Working Drawings to evidence its review and approval thereof. After the Working Drawings have been approved, Landlord shall cause the Work to be performed in substantial accordance with the Working Drawings.

4. Bidding of Work. Prior to commencing the Work, Landlord shall competitively bid the Work to three contractors selected by Landlord and reasonably approved by Tenant, which approval shall not be unreasonably withheld, delayed or conditioned. Any value engineering by Tenant within the five business day period provided in the last sentence of this Section 4 will not constitute a Tenant Delay Day. If the estimated Total Construction Costs are expected to exceed the Construction Allowance, Tenant shall be allowed to review the submitted bids from such contractors to value engineer any of Tenant’s requested alterations. In such case, Tenant shall notify Landlord of any items in the Working Drawings that Tenant desires to change within three business days after Landlord’s submission thereof to Tenant. If Tenant fails to notify Landlord of its election within such three business day period, Tenant shall be deemed to have approved the bids. Within five business days following Landlord’s submission of the initial construction bids to Tenant under the foregoing provisions (if applicable), Tenant shall have completed all of the following items: (a) finalized with Landlord’s representative and the proposed contractor, the pricing of any requested revisions to the bids for the Work, and (b) approved in writing any overage in the Total Construction Costs in excess of the Construction Allowance, failing which, each day after such five business day period shall constitute a Tenant Delay Day.

5. Change Orders. Tenant may initiate changes in the Work. Each such change must receive the prior written approval of Landlord, such approval shall be granted or withheld in accordance with the standards set forth in Section 3.1 above; additionally, if any such requested change might (a) delay the Suite A-210 Effective Date beyond three business days or, (b) leave any portion of the Premises not fully finished and ready for occupancy, Landlord may withhold its consent in its sole and absolute discretion. Landlord shall, upon completion of the Work, cause to be prepared accurate architectural, mechanical, electrical and plumbing “as-built” plans of the Work as constructed in both blueprint and electronic CADD format, which plan shall be incorporated into this Exhibit C by this reference for all purposes. If Tenant requests any changes to the Work described in the Space Plans or the Working Drawings, then such increased costs and any additional design costs incurred in connection therewith as the result of any such change shall be added to the Total Construction Costs.

6. Definitions. As used herein, a “Tenant Delay Day” means each day of delay in the performance of the Work that occurs (a) because Tenant fails to timely furnish any information or deliver or approve any required documents such as the Space Plans or Working Drawings (whether preliminary, interim revisions or final), pricing estimates, construction bids, and the like, (b) because of any change by Tenant to the Space Plans or Working Drawings, (c) because Tenant fails to attend any meeting with Landlord, the Architect, any design professional, or any contractor, or their respective employees or representatives, as may be required or scheduled hereunder or otherwise necessary in connection with the preparation or completion of any construction documents, such as the Space Plans or Working Drawings, or in connection with the performance of the Work, (d) because of any

C-2

specification by Tenant of materials or installations in addition to or other than Landlord’s standard finish-out materials or any materials that are not readily available, or (e) because a Tenant Party otherwise delays completion of the Work. As used herein “Substantial Completion,” “Substantially Completed,” and any derivations thereof mean the Work in the Premises is substantially completed (as reasonably determined by Landlord) in substantial accordance with the Working Drawings. Substantial Completion also includes obtaining all necessary permits and approvals for permanent occupancy by Tenant to the extent the same may be obtained by Landlord. Substantial Completion shall have occurred even though minor details of construction, decoration, landscaping and mechanical adjustments remain to be completed by Landlord. “Building’s Structure” means the Building’s exterior walls, roof, elevator shafts, footings, foundations, structural portions of load-bearing walls, structural floors and subfloors, and structural columns and beams; “Building’s Systems” means the Building’s HVAC, life-safety, plumbing, electrical, and mechanical systems; and “Laws” means all federal, state, and local laws, rules and regulations, all court orders, governmental directives, and governmental orders, and all restrictive covenants affecting the Building, and “Law” means any of the foregoing.

7. Walk-Through; Punchlist. When Landlord considers the Work in the Premises to be Substantially Completed, Landlord will notify Tenant and, within five business days thereafter, Landlord’s representative and Tenant’s representative shall conduct a walk-through of the Premises and identify any necessary touch-up work, repairs and minor completion items that are necessary for final completion of the Work. Neither Landlord’s representative nor Tenant’s representative shall unreasonably withhold his or her agreement on punchlist items. Landlord shall use reasonable efforts to cause the contractor performing the Work to complete all punchlist items within 30 days after agreement thereon; however, Landlord shall not be obligated to engage overtime labor in order to complete such items.

8. Existing Premises Rent Obligations. Tenant’s obligation to pay Rent under the Lease with respect to the Existing Premises shall continue at all times during the performance of the Work. Tenant hereby acknowledges that the performance of the Work may occur during normal business hours while Tenant is in occupancy of the Existing Premises and that no interference to Tenant’s business operations in the Existing Premises shall entitle Tenant to any abatement of Rent.

9. Excess Costs. Tenant shall pay the entire amount by which the Total Construction Costs (hereinafter defined) exceed the Construction Allowance (hereinafter defined) (such excess amount being referred to herein as the “Excess Amount”). Upon approval of the Working Drawings and selection of a contractor, Tenant shall promptly (a) execute a work order agreement prepared by Landlord which identifies such drawings and itemizes the Total Construction Costs and sets forth the Construction Allowance, and (b) pay to Landlord 90% of Landlord’s estimate of the Excess Amount. Upon Substantial Completion of the Work and before Tenant occupies the Suite A-210 Premises to conduct business therein, Tenant shall pay to Landlord any remaining unpaid portion of the Excess Amount. In the event of default of payment of any portion of the Excess Amount, Landlord (in addition to all other remedies) shall have the same rights as for an Event of Default under this Lease. As used herein, “Total Construction Costs” means the entire cost of performing the Work, including design of and space planning for the Work and preparation of the Working Drawings and the final “as-built” plan of the Work, costs of construction labor and materials, electrical usage during construction, additional janitorial services, standard building directory and suite tenant signage, related taxes and insurance costs, licenses, permits, certifications, surveys and other approvals required by Law, and the construction supervision fee referenced in Section 11 of this Exhibit.

10. Construction Allowance. Landlord shall provide to Tenant a construction allowance not to exceed $670,750.00 (the “Construction Allowance”) to be applied toward the Total Construction Costs, as adjusted for any changes to the Work. The Construction Allowance shall not be disbursed to Tenant in cash, but shall be applied by Landlord to the payment of the Total Construction Costs, if, as, and when the cost of the Work is actually incurred and paid by Landlord. After Landlord pays the Total Construction Costs and provided no default under the Lease then exists, Tenant may use any excess Construction Allowance for Tenant’s furniture, fixtures or equipment or towards the cost of Base Rent obligations under the Lease by so notifying Landlord in writing of Tenant’s election. Following Landlord’s receipt of Tenant’s election to apply the unused portion of the Construction Allowance towards Tenant’s Base Rent obligations, Landlord shall apply such excess toward Tenant’s Base Rent obligation first accruing after such date until such excess is fully exhausted. The entire Construction Allowance must be used (that is, the Work must be fully complete, any Base Rent credits exhausted) within six months following the Suite A-210 Effective

C-3

Date, or shall be deemed forfeited with no further obligation by Landlord with respect thereto; time being of the essence with respect thereto.

11. Construction Management. Landlord or its affiliate or agent shall supervise the Work, make disbursements required to be made to the contractor, and act as a liaison between the contractor and Tenant and coordinate the relationship between the Work, the Building, and the Building’s Systems. In consideration for Landlord’s construction supervision services, Tenant shall pay to Landlord a construction supervision fee equal to 2.5 percent of the Total Construction Costs (exclusive of the construction supervision fee). In addition, Tenant will reimburse Landlord for Landlord’s reasonable, out-of-pocket costs payable to third parties and incurred by Landlord in reviewing Tenant’s proposed plans, including reasonable engineers’ or architects’ fees within 30 days after Landlord’s delivery to Tenant of a statement of such costs. Tenant will be obligated to make such reimbursement without regard to whether Landlord consents to any such proposed action.

12. Construction Representatives. Landlord’s and Tenant’s representatives for coordination of construction and approval of change orders will be as follows, provided that either party may change its representative upon written notice to the other:

| Landlord’s Representative: |

Jessica Viens | |||

| c/o Newmark Knight Frank | ||||

| 480 Pleasant Street | ||||

| Watertown, MA 02472 | ||||

| Telephone: 617.393.9733 | ||||

| Tenant’s Representative: |

Marty Nazzaro | |||

| c/o Eyepoint Pharmaceuticals 480 Pleasant Street, Suite B300 | ||||

| Telephone: 617-972-6223 | ||||

| Cell: 617-331-1071 | ||||

| Fax: 617-926-5050 | ||||

13. Miscellaneous. To the extent not inconsistent with this Exhibit, Section 4.2 of the Original Lease shall govern the performance of the Work and Landlord’s and Tenant’s respective rights and obligations regarding the improvements installed pursuant thereto.

C-4

EXHIBIT D

CONFIRMATION OF SUITE A-210 EFFECTIVE DATE

, 20

EyePoint Pharmaceuticals, Inc.

480 Pleasant Street, Suite B300

Watertown, MA 02472

| Re: | Second Amendment of Lease (the “Amendment”) dated May 17, 2018, between WHESTONE RIVERWORKS HOLDINGS, LLC, a Delaware limited liability company (“Landlord”), and EYEPOINT PHARMACEUTICALS, INC., a Delaware corporation (“Tenant”), for the lease of approximately 6,590 rentable square feet of additional space (the “Suite A-210 Premises”) pursuant to the Lease (as defined in and amended by the Amendment). Capitalized terms used herein but not defined shall be given the meanings assigned to them in the Amendment unless otherwise indicated. |

Ladies and Gentlemen:

Landlord and Tenant agree as follows:

1. Condition of Suite A-210 Premises. Tenant has accepted possession of the Suite A-210 Premises pursuant to the Amendment. Any improvements required by the terms of the Amendment to be made by Landlord have been completed to the full and complete satisfaction of Tenant in all respects except for the punchlist items described on Exhibit A hereto (the “Punchlist Items”), and except for such Punchlist Items, Landlord has fulfilled all of its duties under the Amendment with respect to such tenant improvements. Furthermore, Tenant acknowledges that the Suite A-210 Premises are suitable for general office and research and development laboratories purposes and uses ancillary and incidental thereto.

2. Suite A-210 Effective Date. The Suite A-210 Effective Date is , 20 .

3. Expiration Date. The Expiration Date is , 20 , which is the last day of the 80th full calendar month following the Suite A-210 Effective Date.

4. Ratification. Tenant hereby ratifies and confirms its obligations under the Lease, and represents and warrants to Landlord that it has no defenses thereto. Additionally, Tenant further confirms and ratifies that, as of the date hereof, (a) the Lease is and remains in good standing and in full force and effect, and (b) Tenant has no claims, counterclaims, set-offs or defenses against Landlord arising out of the Lease or in any way relating thereto or arising out of any other transaction between Landlord and Tenant. Landlord hereby ratifies and confirms its obligations under the Lease.

5. Binding Effect; Governing Law. Except as modified hereby, the Lease shall remain in full effect and this letter shall be binding upon Landlord and Tenant and their respective successors and assigns. If any inconsistency exists or arises between the terms of this letter and the terms of the Lease, the terms of this letter shall prevail. This letter shall be governed by the laws of the State in which the Suite A-210 Premises are located.

D-1

Please indicate your agreement to the above matters by signing this letter in the space indicated below and returning an executed original to us.

| Sincerely, | ||

| WHETSTONE RIVERWORKS HOLDINGS, LLC, a Delaware limited liability company | ||

| By: |

| |

| Name: |

| |

| Title: |

| |

| Agreed and accepted: | ||

| EYEPOINT PHARMACEUTICALS, INC., a Delaware corporation | ||

| By : |

| |

| Name: |

| |

| Title: |

| |

D-2

EXHIBIT A

Please insert any punchlist items that remain to be performed by Landlord. If no items are listed below by Tenant, none shall be deemed to exist.

D-3

EXHIBIT E

PARKING

Tenant shall be provided a total of 70 parking access cards for unreserved parking spaces, of which 15 spaces shall be allocated to the lower lot located on the south side of Pleasant Street (the “Lower Lot”) and 55 spaces allocated to the upper lot located on the north side of Pleasant Street (the “Upper Lol” and with the Lower Lot, the ‘‘Parkine Area”) subject to such terms, conditions and regulations as are from time to time applicable to patrons of the Parking Area.

Tenant shall at all times comply with all laws respecting the use of the Parking Area . Landlord reserves the right to adopt, modify, and enforce reasonable rules and regulations governing the use of the Parking Area from time to time including designation of assigned parking spaces, requiring use of any key-card, sticker, or other identification or entrance systems and charging a fee for replacement of any such key card, sticker or other item used in connection with any such system and hours of operations. Landlord may refuse to permit any person who violates such rules and regulations to park in the Parking Area, and any violation of the rules and regulations shall subject the car to removal from the Parking Area. The Lower Lot shall be operated pursuant to a sticker program. Tenant may elect to have the stickers transferred to rotating employees or visitors of the Building.

Tenant may validate visitor parking by such method or methods as Landlord may approve, at the validation rate from time to time generally applicable to visitor parking. Unless specified to the contrary above, the parking spaces provided hereunder shall be provided on an unreserved, “first-come , first served” basis. Tenant acknowledges that Landlord has arranged or may arrange for the Parking Area to be operated by an independent contractor, not affiliated with Landlord.

All motor vehicles (including all contents thereof) shall be parked in the Parking Area at the sole risk of Tenant and Tenant’s assignees, subtenants, agents, contractors, employees, licensees, guests and invitees, it being expressly agreed and understood Landlord has no duty to insure any of said motor vehicles (including the contents thereof), and Landlord is not responsible for the protection and security of such vehicles. Landlord shall not be responsible for enforcing Tenant’s parking rights against any third parties. NOTWITHSTANDING ANYTHING TO THE CONTRARY CONTAINED IN THE LEASE, LANDLORD SHALL HAVE NO LIABILITY WHATSOEVER FOR ANY PROPERTY DAMAGE OR LOSS WHICH MIGHT OCCUR ON THE PARKING AREA OR AS A RESULT OF OR IN CONNECTION WITH THE PARKING OF MOTOR VEHICLES IN ANY OF THE PARKING SPACES.

E-1

EXHIBIT F

EXTENSION OPTION

Tenant may extend the Term for one additional period of five years, by delivering written notice of the exercise thereof to Landlord not earlier than 12 months or later than 10 months before the expiration of the Term. The Base Rent payable for each month during such extended Term shall be the Prevailing Rental Rate (defined below) at the commencement of such extended Term. As used herein, the “Prevailing Rental Rate” shall mean the prevailing rental rate that a willing tenant would pay, and a willing landlord would accept (both having reasonable knowledge of the relevant factors), for a comparable lease transaction for space that is of equivalent quality, size, utility and location as the space in question and that is located in a comparable building (including the Building) within the submarket of Watertown, Massachusetts, taking into consideration (a) the location, quality and age of the Building; (b) the use and size of the space in question; (c) the location and/or floor level of the space in question; (d) the amount of any tenant improvement allowances, abatement of rental, or other tenant inducements for the space in question, if any; (e) the fact that a lease may be a “triple net”, “base year” or “gross” lease for the space in question; (t) the amount of any brokerage commissions; (g) the expense stop or base year for pass-through expense purposes for the space in question; (h) the credit standing of Tenant; (i) the length of the term for the space in question; U) the amount and frequency of increases in Basic Rent; (k) intentionally omitted; (I) the tenant improvements located in the space in question; and (m) the amount of any parking charges of equivalent quality, size, utility and location.. Within 30 days after receipt of Tenant’s notice to extend, Landlord shall deliver to Tenant written notice of the Prevailing Rental Rate and shall advise Tenant of the required adjustment to Base Rent, if any, and the other terms and conditions offered. Tenant shall, within ten days after receipt of Landlord’s notice, notify Landlord in writing whether Tenant (1) accepts Landlord’s determination of the Prevailing Rental Rate, or (2) rejects Landlord’s determination of the Prevailing Rental Rate and elects to have the Prevailing Rental Rate determined by the arbitration procedure outlined below. If Tenant timely notifies Landlord that Tenant accepts Landlord’s determination of the Prevailing Rental Rate, then, within 30 days following the determination of the Prevailing Rental Rate, Landlord and Tenant shall execute an amendment to this Lease extending the Term on the same terms and conditions provided in this Lease, except as follows:

(a) Base Rent shall be adjusted to the Prevailing Rental Rate, with periodic increases therein as described above;

(b) Tenant shall have no further option to extend the Term unless expressly granted by Landlord in writing; and

(c) Landlord shall lease to Tenant the Premises in their then-current condition, and Landlord shall not provide to Tenant any allowances (e.g., moving allowance, construction allowance, and the like) or other tenant inducements; provided, if Landlord provides any such allowances or other tenant inducements for renewals of space in the Building, and such allowances have been taken into account in determining the Prevailing Rental Rate, then Landlord shall provide such allowances to Tenant.

If Tenant timely delivers written notice to Landlord that Tenant rejects Landlord’s determination of the Prevailing Rental Rate, time being of the essence with respect thereto, Tenant shall, nevertheless, be deemed to have irrevocably renewed the Term, and the determination of the Prevailing Rental Rate shall be made by brokers as provided below. In such event, within ten days thereafter, each party shall select a licensed commercial real estate broker with at least ten years’ experience in leasing office buildings in the city or submarket in which the Premises are located (a “Qualified Broker”). The two brokers shall give their opinion of prevailing rental rates (based upon the same criteria as described in the first paragraph above) within ten days after their retention. If such brokers timely reach agreement, such agreed determination shall be the Prevailing Rental Rate for purposes of this Exhibit and shall be final and binding on Landlord and Tenant. In the event the opinions of the two brokers differ and, after good faith efforts for ten days after the expiration of such initial ten day period, they cannot mutually agree, the brokers shall immediately and jointly appoint a third Qualified Broker. If the brokers are unable to agree upon such third Qualified Broker, then such third Qualified Broker shall be appointed by the American Arbitration Association upon the request of either Landlord or Tenant (and such appointee shall satisfy the requirement of a Qualified Broker and shall be bound by the procedures described in this paragraph). This third broker shall immediately (within five days) choose either the determination of Landlord’s broker or Tenant’s broker and such choice of this third broker shall be the

F-1

Prevailing Rental Rate for purposes of this Exhibit and shall be final and binding on Landlord and Tenant. Each party shall pay its own costs for its real estate broker. Following the determination of the Prevailing Rental Rate by the brokers, the parties shall equally share the costs of any third broker. The parties shall immediately execute an amendment as set forth above. If Tenant fails to timely notify Landlord in writing that Tenant accepts or rejects Landlord’s determination of the Prevailing Rental Rate, time being of the essence with respect thereto, then, at Landlord’s option, (a) Tenant’s rights under this Exhibit shall terminate and Tenant shall have no right to extend the Term; or (b) Tenant shall be deemed to have irrevocably renewed the Term and to have accepted Landlord’s determination of the Prevailing Rental Rate.

Tenant’s rights under this Exhibit are personal to EyePoint Pharmaceuticals, Inc. and shall terminate, at Landlord’s option, if(a) an Event of Default exists as of the date of Tenant’s exercise of its rights under this Exhibit or as of the commencement date of the extended Term, (b) the Lease or Tenant’s right to possession of any of the Premises is terminated, (c) Tenant fails to lease from Landlord or occupy at least 65% of the number of rentable square feet leased to Tenant as of the Suite A-210 Effective Date, (d) Tenant has marketed any of the Premises for sublease or assignment during the one year period prior to the date of Tenant’s extension exercise notice to Landlord or prior to the commencement of the extended Term; or (e) Tenant fails to timely exercise its option under this Exhibit, time being of the essence with respect to Tenant’s exercise thereof.

F-2