Attached files

| file | filename |

|---|---|

| EX-99.2 - EXHIBIT 99.2 - UNAUDITED PRO FORMA FINANCIALS AS OF JUNE 30, 2018 - CatchMark Timber Trust, Inc. | unauditedproformacondensed.htm |

| 8-K/A - 8-K/A - PRO FORMA WITH TRIPLE T - CatchMark Timber Trust, Inc. | tripletproforma.htm |

CROWN PINE TIMBER 1, L.P. AND AFFILIATED ENTITIES Unaudited Combined Carve-Out Financial Statements For the Three and Six-Month Periods Ended June 30, 2018 and 2017

CROWN PINE TIMBER 1, LP AND AFFILIATED ENTITIES Unaudited Combined Carve-Out Balance Sheets June 30, 2018 and December 31, 2017 (Dollar amounts in thousands) Assets 6/30/2018 12/31/2017 Current assets: Accounts receivable $ 3,300 2,238 Prepaid expenses and other current assets 454 157 Inventory 3,137 3,658 Total current assets 6,891 6,053 Timber and timberlands, net 1,579,643 1,584,753 Buildings and equipment, net 629 680 Total assets $ 1,587,163 1,591,486 Liabilities and Partners’ Capital Current liabilities: Accounts payable and accrued liabilities $ 6,012 8,450 Deferred revenue 9,017 4,081 Total current liabilities 15,029 12,531 Partners’ capital 1,572,134 1,578,955 Total liabilities and partners’ capital $ 1,587,163 1,591,486 1

CROWN PINE TIMBER 1, LP AND AFFILIATED ENTITIES Unaudited Combined Carve-Out Statements of Operations For the Three-Month Periods Ended June 30, 2018 and 2017 (Dollar amounts in thousands) Q2 2018 Q2 2017 Revenues: Log and stumpage sales $ 21,385 19,741 Other revenue 5,482 4,708 Total revenues 26,867 24,449 Operating costs: Cost of logs harvested 15,894 14,564 Depreciation, depletion, and amortization 4,481 4,285 Forest management and engineering expenses 1,151 1,080 Selling, general, and administrative expenses 2,962 2,712 Gain on disposal of timber, timberland, and equipment (1) (10) Net income $ 2,380 1,818 2

CROWN PINE TIMBER 1, LP AND AFFILIATED ENTITIES Unaudited Combined Carve-Out Statements of Operations For the Six-Month Periods Ended June 30, 2018 and 2017 (Dollar amounts in thousands) Q2 2018 Q2 2017 Revenues: Log and stumpage sales $ 40,640 39,821 Other revenue 12,304 7,597 Total revenues 52,944 47,418 Operating costs: Cost of logs harvested 30,218 28,482 Depreciation, depletion, and amortization 8,187 8,677 Forest management and engineering expenses 4,092 4,084 Selling, general, and administrative expenses 6,171 7,035 Gain on disposal of timber, timberland, and equipment (264) (10) Net income $ 4,540 (850) 3

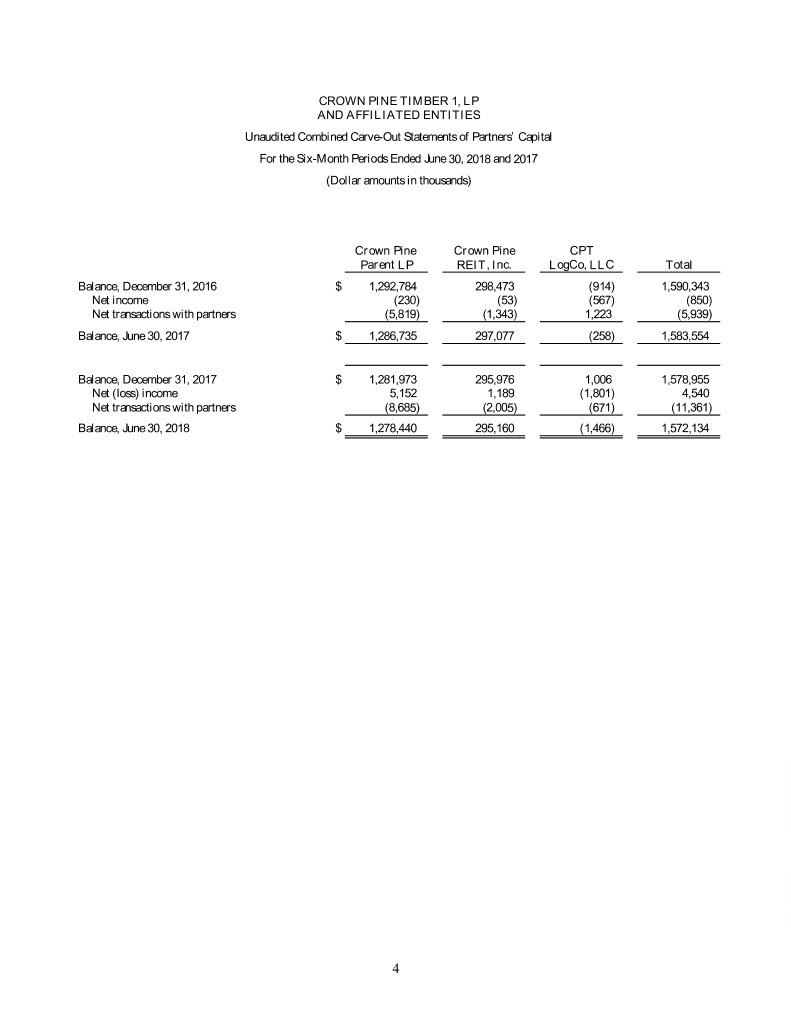

CROWN PINE TIMBER 1, LP AND AFFILIATED ENTITIES Unaudited Combined Carve-Out Statements of Partners’ Capital For the Six-Month Periods Ended June 30, 2018 and 2017 (Dollar amounts in thousands) Crown Pine Crown Pine CPT Parent LP REIT, Inc. LogCo, LLC Total Balance, December 31, 2016 $ 1,292,784 298,473 (914) 1,590,343 Net income (230) (53) (567) (850) Net transactions with partners (5,819) (1,343) 1,223 (5,939) Balance, June 30, 2017 $ 1,286,735 297,077 (258) 1,583,554 Balance, December 31, 2017 $ 1,281,973 295,976 1,006 1,578,955 Net (loss) income 5,152 1,189 (1,801) 4,540 Net transactions with partners (8,685) (2,005) (671) (11,361) Balance, June 30, 2018 $ 1,278,440 295,160 (1,466) 1,572,134 4

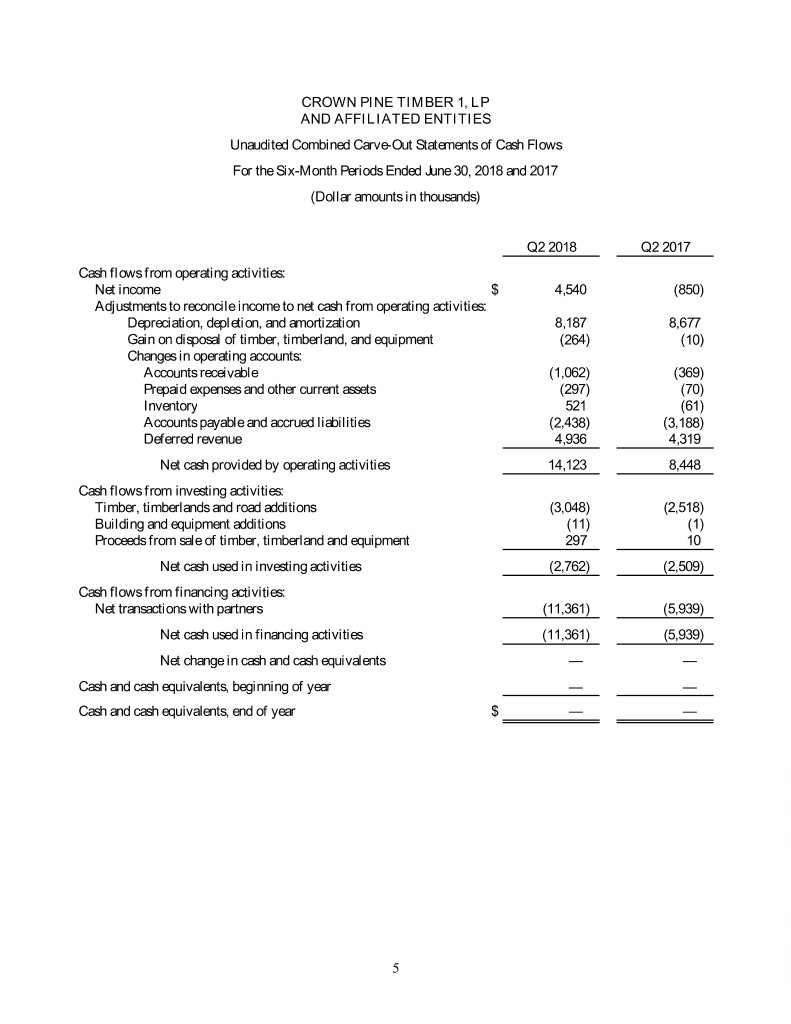

CROWN PINE TIMBER 1, LP AND AFFILIATED ENTITIES Unaudited Combined Carve-Out Statements of Cash Flows For the Six-Month Periods Ended June 30, 2018 and 2017 (Dollar amounts in thousands) Q2 2018 Q2 2017 Cash flows from operating activities: Net income $ 4,540 (850) Adjustments to reconcile income to net cash from operating activities: Depreciation, depletion, and amortization 8,187 8,677 Gain on disposal of timber, timberland, and equipment (264) (10) Changes in operating accounts: Accounts receivable (1,062) (369) Prepaid expenses and other current assets (297) (70) Inventory 521 (61) Accounts payable and accrued liabilities (2,438) (3,188) Deferred revenue 4,936 4,319 Net cash provided by operating activities 14,123 8,448 Cash flows from investing activities: Timber, timberlands and road additions (3,048) (2,518) Building and equipment additions (11) (1) Proceeds from sale of timber, timberland and equipment 297 10 Net cash used in investing activities (2,762) (2,509) Cash flows from financing activities: Net transactions with partners (11,361) (5,939) Net cash used in financing activities (11,361) (5,939) Net change in cash and cash equivalents — — Cash and cash equivalents, beginning of year — — Cash and cash equivalents, end of year $ — — 5

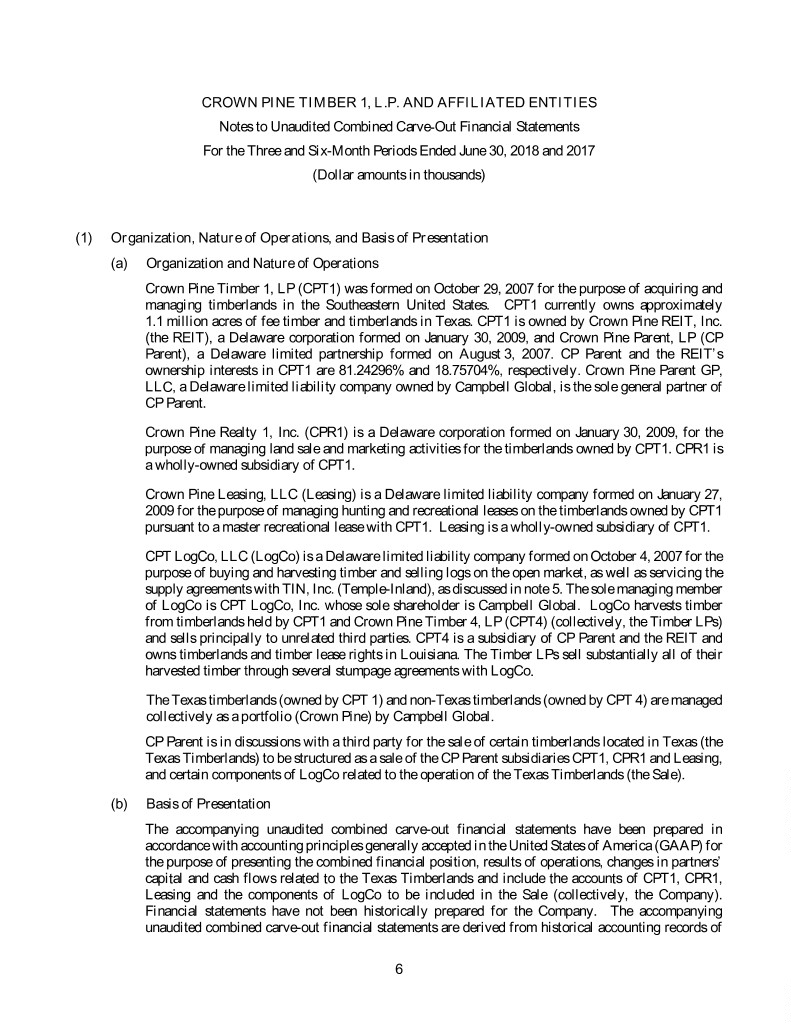

CROWN PINE TIMBER 1, L.P. AND AFFILIATED ENTITIES Notes to Unaudited Combined Carve-Out Financial Statements For the Three and Six-Month Periods Ended June 30, 2018 and 2017 (Dollar amounts in thousands) (1) Organization, Nature of Operations, and Basis of Presentation (a) Organization and Nature of Operations Crown Pine Timber 1, LP (CPT1) was formed on October 29, 2007 for the purpose of acquiring and managing timberlands in the Southeastern United States. CPT1 currently owns approximately 1.1 million acres of fee timber and timberlands in Texas. CPT1 is owned by Crown Pine REIT, Inc. (the REIT), a Delaware corporation formed on January 30, 2009, and Crown Pine Parent, LP (CP Parent), a Delaware limited partnership formed on August 3, 2007. CP Parent and the REIT’s ownership interests in CPT1 are 81.24296% and 18.75704%, respectively. Crown Pine Parent GP, LLC, a Delaware limited liability company owned by Campbell Global, is the sole general partner of CP Parent. Crown Pine Realty 1, Inc. (CPR1) is a Delaware corporation formed on January 30, 2009, for the purpose of managing land sale and marketing activities for the timberlands owned by CPT1. CPR1 is a wholly-owned subsidiary of CPT1. Crown Pine Leasing, LLC (Leasing) is a Delaware limited liability company formed on January 27, 2009 for the purpose of managing hunting and recreational leases on the timberlands owned by CPT1 pursuant to a master recreational lease with CPT1. Leasing is a wholly-owned subsidiary of CPT1. CPT LogCo, LLC (LogCo) is a Delaware limited liability company formed on October 4, 2007 for the purpose of buying and harvesting timber and selling logs on the open market, as well as servicing the supply agreements with TIN, Inc. (Temple-Inland), as discussed in note 5. The sole managing member of LogCo is CPT LogCo, Inc. whose sole shareholder is Campbell Global. LogCo harvests timber from timberlands held by CPT1 and Crown Pine Timber 4, LP (CPT4) (collectively, the Timber LPs) and sells principally to unrelated third parties. CPT4 is a subsidiary of CP Parent and the REIT and owns timberlands and timber lease rights in Louisiana. The Timber LPs sell substantially all of their harvested timber through several stumpage agreements with LogCo. The Texas timberlands (owned by CPT 1) and non-Texas timberlands (owned by CPT 4) are managed collectively as a portfolio (Crown Pine) by Campbell Global. CP Parent is in discussions with a third party for the sale of certain timberlands located in Texas (the Texas Timberlands) to be structured as a sale of the CP Parent subsidiaries CPT1, CPR1 and Leasing, and certain components of LogCo related to the operation of the Texas Timberlands (the Sale). (b) Basis of Presentation The accompanying unaudited combined carve-out financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America (GAAP) for the purpose of presenting the combined financial position, results of operations, changes in partners’ capital and cash flows related to the Texas Timberlands and include the accounts of CPT1, CPR1, Leasing and the components of LogCo to be included in the Sale (collectively, the Company). Financial statements have not been historically prepared for the Company. The accompanying unaudited combined carve-out financial statements are derived from historical accounting records of 6

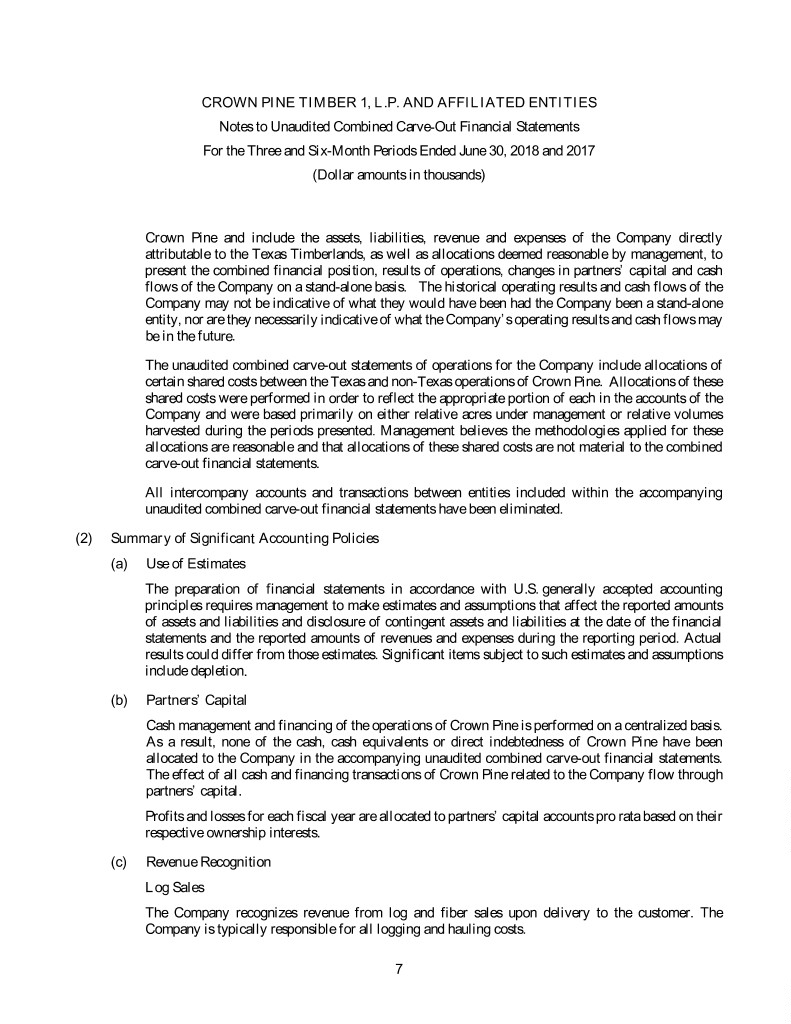

CROWN PINE TIMBER 1, L.P. AND AFFILIATED ENTITIES Notes to Unaudited Combined Carve-Out Financial Statements For the Three and Six-Month Periods Ended June 30, 2018 and 2017 (Dollar amounts in thousands) Crown Pine and include the assets, liabilities, revenue and expenses of the Company directly attributable to the Texas Timberlands, as well as allocations deemed reasonable by management, to present the combined financial position, results of operations, changes in partners’ capital and cash flows of the Company on a stand-alone basis. The historical operating results and cash flows of the Company may not be indicative of what they would have been had the Company been a stand-alone entity, nor are they necessarily indicative of what the Company’s operating results and cash flows may be in the future. The unaudited combined carve-out statements of operations for the Company include allocations of certain shared costs between the Texas and non-Texas operations of Crown Pine. Allocations of these shared costs were performed in order to reflect the appropriate portion of each in the accounts of the Company and were based primarily on either relative acres under management or relative volumes harvested during the periods presented. Management believes the methodologies applied for these allocations are reasonable and that allocations of these shared costs are not material to the combined carve-out financial statements. All intercompany accounts and transactions between entities included within the accompanying unaudited combined carve-out financial statements have been eliminated. (2) Summary of Significant Accounting Policies (a) Use of Estimates The preparation of financial statements in accordance with U.S. generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates. Significant items subject to such estimates and assumptions include depletion. (b) Partners’ Capital Cash management and financing of the operations of Crown Pine is performed on a centralized basis. As a result, none of the cash, cash equivalents or direct indebtedness of Crown Pine have been allocated to the Company in the accompanying unaudited combined carve-out financial statements. The effect of all cash and financing transactions of Crown Pine related to the Company flow through partners’ capital. Profits and losses for each fiscal year are allocated to partners’ capital accounts pro rata based on their respective ownership interests. (c) Revenue Recognition Log Sales The Company recognizes revenue from log and fiber sales upon delivery to the customer. The Company is typically responsible for all logging and hauling costs. 7

CROWN PINE TIMBER 1, L.P. AND AFFILIATED ENTITIES Notes to Unaudited Combined Carve-Out Financial Statements For the Three and Six-Month Periods Ended June 30, 2018 and 2017 (Dollar amounts in thousands) Pay-As-Cut Contracts Under pay-as-cut contracts, title and risk of loss from stumpage sales transfer to the buyer as the trees are cut. Revenue is recognized as timber is harvested. The buyer is typically responsible for all logging and hauling costs. Certain pay-as-cut contracts require an advance payment. The Company deferred a nominal amount of revenue for advance payments received as of December 31, 2017. The Company, in order to maintain capital gain treatment under IRC Section 631(b), and avoid unrelated business taxable income for certain partners, retains economic interest in the timber until it is harvested. Hunting Lease Income The Company receives payment for hunting leases in advance. The revenue is recognized ratably over the term of the hunting leases, which is typically one year. During the unaudited six-month periods ended June 30, 2018 and 2017 the Company recognized $4,010 and $4,060 of hunting lease revenue respectively. During the unaudited quarters ended June 30, 2018 and 2017 the Company recognized $2,014 and $2,034 of hunting lease income respectively. Hunting lease income is included in other revenue in the accompanying unaudited combined carve-out statements of operations. At June 30, 2018 and December 31, 2017 the Company had $9,017 and $4,054 of deferred revenue from hunting leases respectively, which is included in deferred revenue in the accompanying unaudited combined carve-out balance sheets. (d) Stumpage Agreements On October 31, 2007, the Timber LPs entered into a Master Sawtimber Stumpage Agreement (Sawtimber Stumpage Agreement) and a Master Pulpwood Stumpage Agreement (Pulpwood Stumpage Agreement), collectively the Stumpage Agreements, with LogCo. The Stumpage Agreements provide a source of logs and obligate LogCo to purchase all of the planned stumpage of the Timber LPs through the terms of the Supply Agreements. The Sawtimber Stumpage Agreement and the Pulpwood Stumpage Agreement expire upon the termination of the Sawtimber Supply and Pulpwood Supply Agreements. Volumes and prices under the Stumpage Agreements for timber to be purchased are negotiated quarterly with the intention of approximating existing market conditions. CPT1 sold $8,597 and $12,293 (approximately 1,331,999 tons and 1,322,113 tons) of timber to LogCo under the Stumpage Agreements during the unaudited six month periods ended June 30, 2018 and 2017, respectively. CPT1 sold $1,863 and $6,431 (approximately 705,772 tons and 654,867 tons) of timber to LogCo under the Stumpage Agreements during the unaudited quarters ended June 30, 2018 and 2017, respectively. All activity between CPT1 and LogCo has been eliminated in the accompanying unaudited combined carve-out financial statements. (e) Concentration of Credit Risk The Company is subject to credit risk through accounts receivable. For the unaudited six-month period ended June 30, 2018, two customers accounted for 39% and 38% of log and stumpage sales. For the unaudited six-month period ended June 30, 2017, two customers accounted for 40% and 39% of log and stumpage sales. For the unaudited quarter ended June 30, 8

CROWN PINE TIMBER 1, L.P. AND AFFILIATED ENTITIES Notes to Unaudited Combined Carve-Out Financial Statements For the Three and Six-Month Periods Ended June 30, 2018 and 2017 (Dollar amounts in thousands) 2018, two customers accounted for 40% and 39% of log and stumpage sales. For the unaudited quarter ended June 30, 2017, two customers accounted for 40% and 36% of log and stumpage sales. As of June 30, 2018, no single customer accounted for more than 10% of the outstanding accounts receivable balance. As of December 31, 2017, three customers accounted for 26%, 22%, and 14% of outstanding accounts receivable. There was no allowance for doubtful accounts at June 30, 2018 or December 31, 2017. (f) Inventory Inventory consists of rock, seedlings, and tree seed; and is carried at lower of cost or market. (g) Timber and Timberlands Timber and timberlands, including logging roads, are stated at cost less depletion for timber previously harvested and accumulated amortization related to roads. Amortization of logging roads and depletion of timber harvested are determined based on the volume of timber harvested in relation to the amount of estimated recoverable timber. The Company estimates its timber inventory using statistical information and data obtained from physical measurements, site maps, photo-types, and other information-gathering techniques. These estimates are updated annually and may result in adjustments of timber volumes and depletion rates, which are recognized prospectively. Changes in these estimates have no impact on the reported cash flow. (h) Buildings and Equipment Buildings and equipment, including additions and improvements that add to productive capacity or extend useful life, are recorded at cost. Maintenance and repairs are expensed as incurred. Upon retirement or disposal of assets, the cost and related accumulated depreciation are removed from their respective accounts and any gain or loss is reflected in earnings. Depreciation is calculated on buildings and equipment for financial reporting purposes using the straight-line method and is based on estimated useful lives of twenty years and three years, respectively. Depreciation expense for the unaudited six-month periods ended June 30, 2018 and 2017 was $61 and $37 respectively. Depreciation expense for the unaudited quarters ended June 30, 2018 and 2017 was $26 and $12 respectively. Accumulated depreciation on buildings and equipment was $1,139 and $1,090 at June 30, 2018 and December 31, 2017 respectively. (i) Impairment of Long-Lived Assets The Company reviews its long-lived assets, primarily timber and timberlands, for impairment when events or changes in circumstances indicate that the carrying value of such assets may not be recoverable. The Company compares the carrying value of the assets with the asset’s expected future undiscounted cash flows. If the carrying value of the asset exceeds the expected future cash flows, an impairment exists which is measured by the excess of the carrying value over the fair value of the 9

CROWN PINE TIMBER 1, L.P. AND AFFILIATED ENTITIES Notes to Unaudited Combined Carve-Out Financial Statements For the Three and Six-Month Periods Ended June 30, 2018 and 2017 (Dollar amounts in thousands) assets. There were no triggering events, and thus no impairment was recognized during the unaudited six-month periods ended June 30, 2018 and 2017. (j) Fair Value of Financial Instruments Accounting Standards Codification Topic 820, Fair Value Measurement (ASC Topic 820), defines fair value as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. ASC Topic 820 also establishes a fair value hierarchy that prioritizes the inputs to valuation techniques used to measure fair value. The hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurements) and the lowest priority to measurements involving significant unobservable inputs (Level 3 measurements). The three levels of the fair value hierarchy are as follows: Level 1 inputs are quoted prices (unadjusted) in active markets for identical assets or liabilities that the Company has the ability to access at the measurement date. Level 2 inputs are inputs other than quoted prices included within Level 1 that are observable for the asset or liability, either directly or indirectly. Level 3 inputs are unobservable inputs for the asset or liability. The Company does not have any assets or liabilities that are measured at fair value. The unaudited carrying value of all current assets and liabilities at June 30, 2018 and December 31, 2017 approximate their fair values due to their short maturity, less than one year. (k) Income Taxes CPT1, Leasing and LogCo are taxed as partnerships and, accordingly, are generally not liable for federal, state, or local income taxes since income or loss is reported on the separate tax returns of the partners or members. CPR1 is a Taxable REIT Subsidiary (TRS), which is treated as a taxable C-Corporation under the Internal Revenue Code. The Company evaluates the tax positions taken or expected to be taken in the course of preparing the Company’s tax returns to determine whether the tax positions will be sustained by the applicable tax authority. The Company has determined that there is no tax liability resulting from unrecognized tax benefits related to uncertain income tax positions taken or expected to be taken on the tax return for the year ended December 31, 2017. Tax years potentially subject to examination are years 2014 and forward for all entities included within the Company, which is based on the 3 year statute of limitations. The 2011 tax year is also subject to examination for CPR1 but only to the extent of tax attribute carryforwards. 10

CROWN PINE TIMBER 1, L.P. AND AFFILIATED ENTITIES Notes to Unaudited Combined Carve-Out Financial Statements For the Three and Six-Month Periods Ended June 30, 2018 and 2017 (Dollar amounts in thousands) (l) Comprehensive Income Comprehensive income is equal to net income for the unaudited six-month periods and for the unaudited quarters ended June 30, 2018 and 2017. As such, no separate statements of comprehensive income are presented. (3) Related-Party Transactions The Company reimburses Campbell Global for payroll and other administrative costs incurred by Campbell Global on behalf of the Company. Reimbursable costs are billed to the Company by Campbell Global in the normal course of business and are based on proportionate formulas such as time studies, relative acres under management, or relative volumes harvested, depending on the nature of the cost. Reimbursable costs amounted to $2,872 and $2,735 for the unaudited six-month periods ended June 30, 2018 and 2017 respectively. Reimbursable costs amounted to $1,450 and $1,378 for the unaudited quarters ended June 30, 2018 and 2017 respectively. As of June 30, 2018 and December 31, 2017, $1,606 and $1,529 was unpaid respectively. (4) Timber and Timberlands On October 31, 2007, CPT1 purchased approximately 1.13 million acres of fee timber and timberlands in Texas. As of June 30, 2018 and December 31, 2017, the unaudited balance of timber and timberlands consisted of the following: 6/30/18 12/31/17 Timber $ 891,959 889,323 Timberlands 1,039,769 1,039,583 Accumulated depletion (352,085) (344,153) Timber and timberlands, net $ 1,579,643 1,584,753 Depletion expense related to timber for the unaudited six-month periods ended June 30, 2018 and 2017 was $7,932 and $8,509 respectively. Depletion expense related to timber for the unaudited quarters ended June 30, 2018 and 2017 was $4,338 and $4,261 respectively. Depletion expense is included in depreciation, depletion and amortization in the accompanying unaudited combined carve-out statements of operations. (5) Supply Agreements In 2007, the Timber LPs entered into long term supply agreements with Temple-Inland. The supply agreements consist of a Pulpwood Agreement, a Sawtimber Agreement, and a Fiber Agreement, which was terminated in 2012. 11

CROWN PINE TIMBER 1, L.P. AND AFFILIATED ENTITIES Notes to Unaudited Combined Carve-Out Financial Statements For the Three and Six-Month Periods Ended June 30, 2018 and 2017 (Dollar amounts in thousands) The Pulpwood Agreement has a base term of 20 years and commits the Company to produce and deliver annually varying amounts of pulpwood to Temple-Inland on a take or pay basis. The agreement can be extended for an additional five year term at Temple-Inland’s option. The price is updated quarterly and is based (depending on delivery volume) on an industry trade publication or the weighted average price of deliveries from other third parties, which is intended to approximate market. On October 9, 2015, the agreement was amended and restated. The Sawtimber Agreement has a base term of 12 years, and automatically extends for successive one year periods unless terminated by either party. The agreement commits the Company to produce and deliver varying amounts of volume each year on a take or pay basis to Temple-Inland. The price is updated quarterly and is based on the weighted average price of deliveries from other third parties, which is intended to approximate market. The parties agreed to amend the agreement effective as of July 1, 2012 and revised the volume schedule, adjusted certain specifications, and extended the base term an additional 10 years. The parties agreed to amend and restate the agreement effective October 22, 2015. The pricing under the agreement continues to approximate market. Temple-Inland was acquired by International Paper on February 13, 2012 and was being operated as a subsidiary of International Paper. Effective July 19, 2013, International Paper divested the building products business of Temple-Inland to Georgia-Pacific. All rights and obligations under the Sawtimber Agreement transferred to Georgia-Pacific. (6) Subsequent Events The Company has performed a review for subsequent events through August 21, 2018, which is the date the unaudited combined carve-out financial statements were available to be issued. 12