Attached files

| file | filename |

|---|---|

| EX-32.2 - EXHIBIT 32.2 - MISONIX INC | s112490_ex32-2.htm |

| EX-32.1 - EXHIBIT 32.1 - MISONIX INC | s112490_ex32-1.htm |

| EX-31.2 - EXHIBIT 32.2 - MISONIX INC | s112490_ex31-2.htm |

| EX-31.1 - EXHIBIT 31.1 - MISONIX INC | s112490_ex31-1.htm |

| EX-23.2 - EXHIBIT 23.2 - MISONIX INC | s112490_ex23-2.htm |

| EX-23.1 - EXHIBIT 23.1 - MISONIX INC | s112490_ex23-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-K

(Mark One)

| ☑ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended June 30, 2018

OR

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _____ to _____

Commission file number: 1-10986

| MISONIX, INC. |

(Exact name of registrant as specified in its charter)

| New York | 11-2148932 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | |

| 1938 New Highway, Farmingdale, New York | 11735 | |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (631) 694-9555

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Name of each exchange on which registered | |

| Common Stock, $.01 par value | Nasdaq Global Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

☐ Yes ☑ No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

☐ Yes ☑ No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

☑ Yes ☐ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). ☑ Yes ☐ No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☑

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer | ☑ | Non-accelerated filer ☐ | Smaller reporting company ☑ | Emerging growth company ☐ | |||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

☐ Yes ☑ No

The aggregate market value of the voting stock held by non-affiliates of the registrant on December 31, 2017 (computed by reference to the closing price of such stock on such date) was approximately $71,441,583.

There were 9,442,095 shares of Common Stock outstanding at August 29, 2018.

DOCUMENTS INCORPORATED BY REFERENCE

None

USE OF FORWARD-LOOKING STATEMENTS

In this document, we refer to Misonix, Inc. and its subsidiaries (unless the context otherwise requires) as “we,” the “Company” or “Misonix.” With the exception of historical information contained in this Form 10-K, content herein may contain “forward looking statements” that are made pursuant to the Safe Harbor Provisions of the Private Securities Litigation Reform Act of 1995. These statements are based on management’s current expectations and are subject to uncertainty and changes in circumstances. We cannot guarantee that any forward looking statements will be accurate, although we believe that we have been reasonable in our expectations and assumptions. Investors should realize that if underlying assumptions prove inaccurate or unknown risks or uncertainties materialize, actual results could vary materially from our expectations and projections. These factors include general economic conditions, delays and risks associated with the performance of contracts, risks associated with international sales and currency fluctuations, uncertainties as a result of research and development, acceptable results from clinical studies, including publication of results and patient/procedure data with varying levels of statistical relevance, risks involved in introducing and marketing new products, regulatory compliance, potential acquisitions, consumer and industry acceptance, litigation and/or contemplated 510(k) filings, the ability to achieve and maintain profitability in our business lines, and other factors discussed in this Annual Report on Form 10-K, subsequent Quarterly Reports on Form 10-Q and Current Reports on Form 8-K. We disclaim any obligation to update any forward-looking statements.

2

TABLE OF CONTENTS

3

Overview

Misonix, Inc. is a New York corporation based in Farmingdale, New York. We design, manufacture and market minimally invasive therapeutic ultrasonic medical devices. Our products enhance clinical outcomes and provide value to customers and patients. We believe that our current focus products have the ability to become standard of care and provide the Company with a growing revenue stream.

| ● | BoneScalpel® Surgical System (“BoneScalpel”), which is used for surgical procedures involving the precise cutting and sculpting of bone while sparing soft tissue. BoneScapel is now recognized by many surgeons globally as a critical surgical tool enabling improved patient outcomes in the spinal arena. | |

| ● | SonaStar® Surgical Aspirator (“SonaStar”), which is used to emulsify and remove soft and hard tumors, primarily in the neuro and general surgery field. | |

| ● | SonicOne® Wound Cleansing and Debridement System (“SonicOne”), which offers tissue specific debridement and cleansing of wounds and burns for effective removal of devitalized tissue and fibrin deposits while sparing viable cells. |

These devices primarily serve the following clinical specialties: neurosurgery, orthopedic surgery, plastic surgery, wound care and maxillo-facial surgery.

In the United States, our products are marketed primarily through a hybrid sales approach. This includes direct sales representatives, managed by regional sales managers, along with independent distributors.

Outside the United States, we sell our products to specialty distributors who purchase products from us to resell to their clinical customer bases. We sell to all major markets in the Americas, Europe, Middle East, Asia Pacific and Africa.

Products

All Misonix disposables function with proprietary consoles which essentially convert electrical current into ultrasonic energy via piezo electric crystals in order for the relevant device to produce a therapeutic effect.

BoneScalpel

The BoneScalpel is a state of the art, ultrasonic bone cutting and sculpting system capable of making precise cuts with minimal necrosis, minimal burn artifact, minimal inflammation and minimal bone loss. The device is also capable of preserving surrounding soft tissue structures because of its unique ability to differentiate soft tissue from rigid bone. This device can make precise linear or curved cuts, on any plane, with precision not normally associated with powered instrumentation. The BoneScalpel offers the speed and convenience of a powered instrument without the dangers associated with conventional rotary devices. The effect on surrounding soft tissue is minimal due to the elastic and flexible structure of healthy tissue. This is a significant advantage in anatomical regions like the spine where patient safety is of primary concern. In addition, the linear motion of the blunt, tissue-impacting tips avoids accidental ‘trapping’ of soft tissue while largely eliminating the high speed spinning and tearing associated with rotary power instruments. The BoneScalpel allows surgeons to improve on existing surgical techniques by creating new approaches to bone cutting and sculpting and removal, leading to substantial time savings and increased operation efficiencies.

4

The expanded BoneScalpel product platform will allow entry into dynamic market segments like minimally invasive spine surgery and other bone cutting and sculpting needs.

SonaStar

The SonaStar System provides powerful precise aspiration following the ultrasonic ablation of hard or soft tissue. The SonaStar has been used for a wide variety of surgical procedures applying both open and minimally invasive approaches, including neurosurgery and liver surgery. The SonaStar may also be used with OsteoSculpt ® probe tips, which enable the precise shaping or shaving of bony structures that prevent open access to partially or completely hidden soft tissue masses.

SonicOne

The SonicOne Ultrasonic Cleansing and Debridement System is a highly innovative, tissue specific approach for the effective removal of devitalized or necrotic tissue and fibrin deposits while sparing viable, surrounding cellular structures. The tissue specific capability is, in part, due to the fact that healthy and viable tissue structures have a higher elasticity and flexibility than necrotic tissue and are more resistant to destruction from the impact effects of ultrasound. The ultrasonic debridement process separates devitalized tissue from viable tissue layers, allowing for a more defined treatment and, usually, a reduced pain sensation. We believe SonicOne establishes a new standard in wound and burn bed preparation, the essential first step in the healing process, while contributing to a faster patient healing.

License and Other Agreements

On October 19, 2017, the Company entered into a License and Exclusive Manufacturing Agreement (the “Agreement”) with Hunan Xing Hang Rui Kang Bio-technologies Co., Ltd., a Chinese corporation (the “Licensee”) under which Misonix has licensed certain manufacturing and distribution rights to its SonaStar product line in China, Hong Kong and Macau (the “Territory”) in exchange for payments totaling at least $11,000,000.

Pursuant to the Agreement, Licensee is obligated to pay the Company: (i) initial amounts consisting of upfront fees and stocking orders totaling $5,000,000, payable in five (5) equal monthly installments of $1,000,000 each; (ii) royalty payments from the sale of SonaStar products in the Territory, including minimum royalty payments of $2,000,000 per calendar year in each of 2019, 2020, and 2021; and (iii) reimbursement of technology transfer costs in an amount up to $1,000,000. The Agreement also provides that Misonix will supply SonaStar products to Licensee at agreed prices during the transition period prior to Licensee’s commencement of manufacturing.

During the year ended June 30, 2018, the Company delivered the licensed SonaStar technology to the Licensee, and recorded license revenue of $4,010,000. In addition, during the year ended June 30, 2018, the Company had delivered the contractually agreed number of SonaStar units to the Licensee and had recorded product revenue of $990,000. All of the $5 million of initial payments were collected as of March 31, 2018.

In October 1996, we entered into a license agreement with Medtronic Minimally Invasive Therapies (“MMIT”). The MMIT license covered the further development of our medical technology relating to vessel sealing products, which uses high frequency sound waves to coagulate and divide tissue for both open and laparoscopic surgery. We developed the AutoSonix product with MMIT under the agreement. As a result of this joint development, we co-own certain patents with MMIT and MMIT paid us a 5% royalty on end user sales. The MMIT license gives MMIT exclusive worldwide marketing and sales rights for this technology and device. Total royalties from sales of this device worldwide were approximately $525,000, $3,764,000 and $3,903,000 for the fiscal years ended June 30, 2018, 2017 and 2016, respectively. The royalty is recorded as “other income” in our financial statements. Our license agreement with MMIT expired in August 2017 and no further payments are due thereafter.

We sold our rights to the high intensity focused ultrasound technology to SonaCare Medical, LLC (“SonaCare”) in May 2010. We may receive up to approximately $5.8 million in payment for the sale. SonaCare will pay us 7% of the gross revenues received from its sales of the (i) prostate product in Europe and (ii) kidney and liver products worldwide, until we have received payments of $3 million, and thereafter 5% of the gross revenues, up to an aggregate payment of $5.8 million, all subject to a minimum annual royalty of $250,000. Fiscal 2018 payments were $250,000 bringing cumulative payments through June 30, 2018 to $2,542,579.

5

Customers

For the fiscal year ended June 30, 2018, one customer, Hunan Xing Hang Rui Kang Bio-technologies Co., Ltd., accounted for 15.8% of our revenue. During the fiscal years ended June 30, 2017 and 2016, we did not have any customer that accounted for 10% or more of our net sales during such periods.

Research & Development

As of June 30, 2018, our Research and Development (“R&D”) organization consisted of a staff of 10 employees including engineers, technical and support personnel. The in-house technical expertise includes mechanical engineering, acoustics, electrical engineering, software development and product design. The R&D group focuses principally on developing new products and supporting existing products. The Company is currently developing its Nexus next generation surgical platform, resulting in higher research and development expenditures in the current fiscal year.

During the three years ended June 30, 2018, the Company incurred R&D expenses of $4,394,149, $1,837,497, and $1,839,479, or 12.0%, 6.7% and 8.0% of sales, respectively.

Revenue by Region

The Company’s revenues are generated from various regions throughout the world. Sales by the Company outside the United States are made through distributors. Sales made in the United States are made primarily through its direct sales force and some distributors. The following is an analysis of net sales from continuing operations by geographic region:

| For the years ended June 30, | Net Change | ||||||||||||||||||||

| 2018 | 2017 | 2016 | 2018 | 2017 | |||||||||||||||||

| Domestic | $ | 20,044,363 | $ | 16,460,771 | $ | 13,086,806 | 21.8 | % | 25.8 | % | |||||||||||

| International | 16,635,463 | 10,809,192 | 10,026,388 | 53.9 | % | 7.8 | % | ||||||||||||||

| Total | $ | 36,679,826 | $ | 27,269,963 | $ | 23,113,194 | 34.5 | % | 18.0 | % | |||||||||||

Our international sales include a concentration in China, aggregating $6,969,258, $1,335,667, and $1,557,132 for the fiscal years ended June 30, 2018, 2017 and 2016, respectively. Fiscal 2018 international sales include $4,010,000 of license revenue.

Manufacturing and Supply

The Company largely manufactures and assembles its medical device products at its production facility located in Farmingdale, New York. The Company’s products include components manufactured by other companies in the United States. The Company is not dependent upon any single source of supply and has no long-term supply agreements. The Company believes that it will not encounter difficulty in obtaining materials, supplies and components adequate for its anticipated short-term needs.

Competition

Competition in the medical device products industry is rigorous with many companies having significant capital resources, large research laboratories and extensive distribution systems greater than the Company’s. Some of the Company’s major competitors are Medtronic, Anspach, Johnson & Johnson, Integra Life Sciences, Inc., Söering, Stryker Corporation and Smith and Nephew.

Regulatory Requirements

The Company’s medical device products are subject to the regulatory requirements of the U.S. Food and Drug Administration (“FDA”) and other international regulatory authorities. In the United States and other markets where the Company’s products are sold, the Company has the appropriate marketing authorizations and complies with all applicable regulations including, without limitation, 21 USC Chapter 6, 21 CFR Part 807, 93/42 EEC and Health Canada SOR/98-282. In the US, Misonix products have 510(k) clearances.

6

The Company also operates and maintains a Quality Management System which complies with the requirements of International Standards ISO 13485: 2012 + AC:2012, Health Canada CAN/CSA ISO 13485:2003, and US 21 CFR Part 820 Quality System Regulation. This system encompasses the principle of enhancing customer satisfaction through the effective application of the system, including processes for control, monitoring, and continual improvement in order to assure the Company consistently meets or exceeds customer expectations and applicable statutory/regulatory requirements.

The Company is not aware of any regulatory situations, other than those disclosed in Item 3 herein, that would materially impact the Company, nor is the Company aware of any pending legal action or new material breaches of the regulations to which it is subject.

Trademarks, Patents, and Copyrights

The Company holds 55 U.S. patents along with 14 in Europe, 9 in Japan and 15 in Canada, 2 in China and has multiple pending patent applications for its core product lines including ultrasonic and wound technologies, among other things. The Company believes that these patents provide it with a competitive market advantage. The Company also holds 13 trademarks protecting its Company and product names.

The Company will continue to seek patent, trademark, and copyright protections as it deems advisable to protect the markets for its products and its R&D efforts.

Backlog

As of June 30, 2018, the Company’s backlog (firm orders that have not yet been shipped) was $209,648 as compared to $397,660 as of June 30, 2017. The Company does not typically have large recurring orders, but instead ships most of its products on a just in time basis, which results in low levels of backlog.

Employees

As of June 30, 2018, the Company employed a total of 118 full-time employees. The Company considers its relationship with its employees to be good.

Website Access Disclosure

The Company’s Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K are available free of charge on the Company’s website at www.misonix.com as soon as reasonably practicable after such material is electronically filed with or furnished to the SEC. Copies of the Company’s Annual Report will be made available to shareholders, free of charge, upon written request.

In addition to the other information contained in this Annual Report on Form 10-K (the “10-K”) and the exhibits hereto, the following risk factors should be considered carefully in evaluating our business. Our business, financial condition and/or results of operations could be materially adversely affected by any of these risks. This section contains forward-looking statements. You should refer to the explanation of the qualifications and limitations on forward-looking statements set forth immediately prior to the beginning of Item 1 of the 10-K. Additional risks not presently known to us or that we currently deem immaterial may also adversely affect our business, financial condition and/or results of operations. The following list sets forth many, but not all, of the factors that could impact the Company’s ability to achieve results discussed in any forward-looking statement. Investors should understand that it is not possible to predict or identify all such factors and should not consider this list to be a complete statement of all potential risks and uncertainties.

7

Risks Related to Our Business

We are subject to extensive medical device regulation which may impede or hinder the approval process for our products and, in some cases, may not ultimately result in approval or may result in the recall or seizure of previously approved products.

Our products, development activities and manufacturing processes are subject to extensive and rigorous regulation in the United States by the FDA pursuant to the Federal Food, Drug, and Cosmetic Act (the “FDC Act”), by comparable agencies in foreign countries, and by other regulatory agencies and governing bodies. Under the FDC Act, medical devices must receive FDA clearance or approval before they can be commercially marketed in the U.S. In addition, most major markets for medical devices outside the U.S. require clearance, approval or compliance with certain standards before a product can be commercially marketed. The process of obtaining marketing approval or clearance from the FDA for new products, or with respect to enhancements or modifications to existing products, could:

| ● | take a significant amount of time; |

| ● | require the expenditure of substantial resources; |

| ● | involve rigorous pre-clinical and clinical testing; |

| ● | require changes to the products; and |

| ● | result in limitations on the proposed uses of the products. |

Marketing approvals or clearances are not the only risk. The FDA, and other regulatory bodies, also can require the withdrawal of an approved or cleared product from commercial distribution due to failure to comply with regulatory standards or the occurrence of unforeseen problems.

As a medical device manufacturer, we are required to register with the FDA and are subject to periodic inspection by the FDA for compliance with the FDA’s Quality System Regulation requirements, which require manufacturers of medical devices to adhere to certain regulations, including testing, quality control and documentation procedures. In addition, FDA regulations require us to provide information to the FDA whenever there is evidence that reasonably suggests that a medical device may have caused or contributed to a death or serious injury or, if a malfunction were to occur, could cause or contribute to a death or serious injury. Compliance with applicable regulatory requirements is subject to continual review and is rigorously monitored through periodic inspections by the FDA. In the European Union and China, we are required to maintain certain ISO certifications in order to sell our products and must undergo periodic inspections by notified bodies to obtain and maintain these certifications. Failure to meet regulatory quality standards could have a material adverse effect on our business, financial condition or results of operations.

Consequently, there can be no assurance that we will receive the required clearances from the FDA or other regulatory bodies for new products or modifications to existing products on a timely basis or that any FDA approval will not be subsequently withdrawn. Later discovery of previously unknown problems with a product or manufacturer could result in fines, delays or suspensions of regulatory clearances, seizures or recalls of products, operating restrictions and/or criminal prosecution. The failure to receive product approval clearance on a timely basis, suspensions of regulatory clearances, seizures or recalls of products or the withdrawal of product approval by the FDA or other regulatory bodies could have a material adverse effect on our business, financial condition or results of operations.

We may not be able to effectively protect our intellectual property rights.

Patents and other proprietary rights are and will be essential to our business and our ability to compete effectively with other companies. We also rely upon trade secrets, know-how, continuing technological innovations, strategic alliances and licensing opportunities to develop, maintain and strengthen our competitive position. We pursue a policy of generally obtaining patent protection in both the U.S. and abroad for patentable subject matter in our proprietary devices and also attempt to review third-party patents and patent applications to the extent publicly available to develop an effective patent strategy, avoid infringement of third-party patents, identify licensing opportunities and monitor the patent claims of others. We currently own numerous U.S. and foreign patents. We also are party to various license agreements pursuant to which patent rights have been obtained or granted in consideration for cash or royalty payments. No assurance can be made that any pending or future patent applications will result in issued patents, that any current or future patents issued to, or licensed by, us will not be challenged or circumvented by our competitors, or that our patents will not be found invalid.

8

We also operate in an industry that is susceptible to significant intellectual property litigation and it has been common for companies in the medical device field to aggressively challenge the patent rights of other companies in order to prevent the marketing of new devices. Intellectual property litigation is expensive, complex and lengthy and its outcome is difficult to predict. Future patent litigation may result in significant royalty or other payments or injunctions that can prevent the sale of products and may significantly divert the attention of our technical and management personnel.

In addition, we may have to take legal action in the future to protect our patents, trade secrets or know-how or to assert our intellectual property rights against claimed infringement by others. Any legal action of that type could be costly and time consuming to us and no assurances can be made that any lawsuit will be successful.

The invalidation of key patents or proprietary rights that we own, or an unsuccessful outcome in lawsuits to protect our intellectual property, could have a material adverse effect on our business, financial condition or results of operations. In the event that our right to market any of our products is successfully challenged, or if we fail to obtain a required license or are unable to design around a patent, our business, financial condition or results of operations could be materially adversely affected.

Future product liability claims and other litigation may adversely affect our business, reputation and ability to attract and retain customers.

The design, manufacture and marketing of medical device products of the types that we produce entail an inherent risk of product liability claims. A number of factors could result in an unsafe condition or injury to, or death of, a patient with respect to these or other products that we manufacture or sell, including component failures, manufacturing flaws, design defects or inadequate disclosure of product-related risks or product-related information. These factors could result in product liability claims, a recall of one or more of our products or a safety alert relating to one or more of our products. Product liability claims may be brought by individuals or by groups seeking to represent a class.

We have a recent history of net losses.

We have experienced losses from continuing operations during the last three fiscal years. The loss from continuing operations before income taxes was approximately $2.4 million for the 2018 fiscal year, and the accumulated deficit was approximately $15.5 million as of June 30, 2018. There can be no assurance that we will be able to return to operating profitability in the near-term or at all. As of June 30, 2018, we had a cash balance of approximately $11.0 million. Although we believe this amount is sufficient to finance our operations for at least the next 12 months, there can be no assurance that this will provide sufficient liquidity for longer-term operations or initiatives. Our cash flows may be impacted by a number of factors, including changing market conditions, market acceptance of our new and existing products, and the loss of one or more key customers. There can be no assurance that we will be successful in raising additional capital if the need arises. The failure to raise any necessary additional capital on acceptable terms, or at all, may have a material adverse effect on our future business and results of operations.

Anyone or any company can bring an action against Misonix, including private securities litigation and shareholder derivative suits, and adverse litigation results could affect our business.

Our judicial system allows anyone, including shareholders, to bring a claim against the Company and force the Company to defend itself even if the claim is baseless. The defense may or may not be covered by the Company’s insurance, the result of which could ultimately create a burden on the Company dependent upon the outcome.

9

Litigation can be lengthy, expensive and disruptive to our operations, and results cannot be predicted with certainty. An adverse decision could result in monetary damages or injunctive relief that could affect our financial condition or results of operations.

On April 5, 2017, the Company’s former distributor in China, Cicel (Beijing) Science & Technology Co., Ltd., filed a lawsuit against the Company and certain officers and directors of the Company in the United States District Court for the Eastern District of New York, alleging that the Company improperly terminated its contract with the former distributor. The complaint sought various remedies, including compensatory and punitive damages, specific performance and preliminary and post judgment injunctive relief, and asserted various causes of action, including breach of contract, unfair competition, tortious interference with contract, fraudulent inducement, and conversion. On October 7, 2017, the court granted the Company’s motion to dismiss all of the tort claims asserted against it, and also granted the individual defendants’ motion to dismiss all claims asserted against them. The only claim remaining in the case is for breach of contract against the Company. The Company believes it has various legal and factual defenses to the allegations in the complaint, and intends to vigorously defend the action. The case is at its earliest stages; discovery is just beginning and there is no trial date.

On June 6, 2017, Irving Feldbaum, an individual shareholder of Misonix, filed a lawsuit in the U.S. District Court for the Eastern District of New York. The complaint alleges claims against the Company’s board of directors, its former CEO and CFO, certain of its former directors, and the Company as a nominal defendant for alleged violations of Section 14(a) of the Securities Exchange Act of 1934 and state law claims for breach of fiduciary duty, waste of corporate assets, and unjust enrichment. The complaint alleges that the Company incurred damages as a result of alleged false and misleading statements in the Company’s securities filings concerning the Company’s business, operations, and prospects and the Company’s internal control over financial reporting. The complaint also alleges that the Company’s February 4, 2016 Proxy Statement contained false and misleading statements regarding executive compensation. The complaint seeks the recovery of damages on behalf of the Company and the implementation of changes to corporate governance procedures. On June 16, 2017, Michael Rubin, another individual shareholder of Misonix, filed a case alleging similar claims in the same district court. On July 21, 2017, the district court consolidated the two actions for all purposes. On July 16, 2018, the Company and counsel for Mr. Feldbaum and Mr. Rubin informed the District Court that the parties had reached a settlement in principle. There are aspects of the settlement that remain to be negotiated and documented, and the settlement is subject to approval by the District Court after notice to the Company’s shareholders.

Violation of anti-corruption laws could subject the Company to significant penalties which would materially affect our business and liquidity.

We are required to comply with the Foreign Corrupt Practices Act (“FCPA”) and similar anti-corruption laws in other jurisdictions around the world where we do business. Compliance with these laws has been subject to increasing focus and activity by regulatory authorities in recent years. Actions by our employees, or third-party intermediaries acting on our behalf, in violation of such laws, whether carried out in the United States or elsewhere in connection with the conduct of our business may expose us to liability for violations of the FCPA or other anti-corruption laws and accordingly may have a material adverse effect on our reputation and our business, financial condition or results of operations.

With the assistance of outside counsel, the Company conducted a voluntary investigation into the business practices of the independent Chinese entity that previously distributed its products in China and the Company’s knowledge of those business practices, which may have implications under the FCPA, as well as into various internal controls issues identified during the investigation.

On September 27, 2016 and September 28, 2016, the Company voluntarily contacted the SEC and the DOJ, respectively, to advise both agencies of these potential issues. The Company has provided and will continue to provide documents and other information to the SEC and the DOJ, and is cooperating fully with these agencies in their ongoing investigations of these matters.

Although the Company’s investigation is complete, additional issues or facts could arise which may expand the scope or severity of the potential violations. The Company has no current information derived from the investigation or otherwise to suggest that its previously reported financial statements and results are incorrect.

10

At this stage, the Company is unable to predict what, if any, action the DOJ or the SEC may take or what, if any, penalties or remedial measures these agencies may seek. Nor can the Company predict the impact on the Company as a result of these matters, which may include the imposition of fines, civil and criminal penalties, which are not currently estimable, as well as equitable remedies, including disgorgement of any profits earned from improper conduct and injunctive relief, limitations on the Company’s conduct, and the imposition of a compliance monitor. The DOJ and the SEC periodically have based the amount of a penalty or disgorgement in connection with an FCPA action, at least in part, on the amount of profits that a company obtained from the business in which the violations of the FCPA occurred. During its distributorship relationship with the prior Chinese distributor from 2010 through 2016, the Company generated revenues of approximately $8 million.

Further, the Company may suffer other civil penalties or adverse impacts, including lawsuits by private litigants in addition to the lawsuits that already have been filed, or investigations and fines imposed by local authorities. The investigative costs to date are approximately $3.0 million, of which approximately $0.5 million, $2.4 million and $0.1 million was charged to general and administrative expenses during the years ended June 30, 2018, 2017 and 2016 respectively.

Our future growth is dependent upon the development of new products and line extensions, which requires significant research and development, clinical trials and regulatory approvals, all of which are very expensive and time-consuming and may not result in a commercially viable product.

In order to develop new products and improve current product offerings, we focus our research and development programs largely on the development of next-generation and novel technology offerings across multiple programs and opportunities.

As a part of the regulatory process of obtaining marketing clearance from the FDA for new products, we conduct and participate in numerous clinical trials with a variety of study designs, patient populations and trial endpoints. Unfavorable or inconsistent clinical data from existing or future clinical trials conducted by us, by our competitors or by third parties, or the market’s perception of this clinical data, may adversely impact our ability to obtain product approvals from the FDA, our position in, and share of, the markets in which we participate and our business, financial condition, results of operations or future prospects.

New products may not be accepted by customers in the marketplace.

We are now, and will continue to be, developing new products and introducing them into the market. There can be no assurance that any new product will be accepted by the market. New products are sometimes introduced into the market in a prototype format and may need later revisions or design changes before they operate in a manner to be accepted in the market. As a result of the introduction of new products, there is some risk that revenue expectations may not be met and in some cases the product may not achieve market acceptance.

We face intense competition and may not be able to keep pace with the rapid technological changes in the medical device industry.

The medical device product market is highly competitive. We encounter significant competition across our product lines and in each market in which our products are sold from various medical device companies, most of which have greater financial and marketing resources than we do.

Additionally, the medical device product market is characterized by extensive research and development and rapid technological change. Developments by other companies of new or improved products, processes or technology may make our products or proposed products obsolete or less competitive and may negatively impact our revenues. In some cases foreign companies may attempt to copy our designs illegally. We are required to devote continued efforts and financial resources to develop or acquire scientifically advanced technologies and products, apply our technologies cost-effectively across product lines and markets, attract and retain skilled development personnel, obtain patent and other protection for our technology and products, obtain required regulatory and reimbursement approvals and successfully manufacture and market our products. Failure to develop new products or enhance existing products could have a material adverse effect on our business, financial condition or results of operations.

11

Consolidation in the healthcare industry could lead to demands for price concessions or the exclusion of the Company as supplier from certain of our significant market segments.

The cost of healthcare has risen significantly over the past decade and numerous initiatives and reforms initiated by legislators, regulators and third-party payers to curb these costs have resulted in a consolidation trend in the healthcare industry, including hospitals. This in turn has resulted in greater pricing pressures and the exclusion of certain suppliers from important market segments as group purchasing organizations, independent delivery networks and large single accounts continue to consolidate purchasing decisions for some of our hospital customers. We expect that market demand, government regulation, third-party reimbursement policies and societal pressures will continue to change the worldwide healthcare industry, resulting in further business consolidations and alliances among our customers and competitors, which may reduce competition, exert further downward pressure on the prices of our products and may adversely impact our business, financial condition or results of operations.

We may experience disruption in supply due to our dependence on our suppliers to continue to ship product requirements and our inability to obtain suppliers of certain components for our products.

Our suppliers may encounter problems during manufacturing due to a variety of reasons, including poor business practices, failure to follow specific protocols and procedures, failure to comply with applicable regulations, equipment malfunctions, labor shortages or environmental factors. In addition, we purchase both raw materials used in our products and finished goods from various suppliers and may have to rely on a single source supplier for certain components of our products where there are no alternatives are available. Although we anticipate that we have adequate sources of supply and/or inventory of these components to handle our production needs for the foreseeable future, if we are unable to secure on a timely basis sufficient quantities of the materials we depend on to manufacture our products, if we encounter delays or contractual or other difficulties in our relationships with these suppliers, or if we cannot find suppliers at an acceptable cost, then the manufacture of our products may be disrupted, which could increase our costs and have a material adverse effect on our business.

If we fail to manage any expansion or acquisition, our business could be impaired.

We may in the future acquire one or more technologies, products or companies that complement our business. We may not be able to effectively integrate these into our business and any such acquisition could bring additional risks, exposures and challenges to the Company. In addition, acquisitions may dilute our earnings per share, disrupt our ongoing business, distract our management and employees, increase our expenses, subject us to liabilities and increase our risk of litigation, all of which could harm our business. If we use cash to acquire technologies, products, or companies, such use may divert resources otherwise available for other purposes. If we use our common stock to acquire technologies, products, or companies, our shareholders may experience substantial dilution. If we fail to manage any expansions or acquisition, our business could be impaired.

Our agreements and contracts entered into with partners and other third parties may not be successful.

We signed in the past and may pursue in the future agreements and contracts with third parties to assist in our marketing, manufacturing, selling and distribution efforts. We cannot assure you that any agreements or contracts entered into will be successful.

The fluctuation of our quarterly results may adversely affect the trading price of our common stock.

Our revenues and results of operations have in the past and will likely vary in the future from quarter to quarter due to a number of factors, many of which are outside of our control and any of which may cause our stock price to fluctuate. You should not rely on quarter-to-quarter comparisons of our results of operations as an indication of our future performance. It is likely that in some future quarters, our results of operations may be below the expectations of the Company’s public market analysts and investors. In this event, the price of our common stock may fall.

12

We may not be able to attract and retain additional key management, sales and marketing and technical personnel, or we may lose existing key management, sales and marketing or technical personnel, which may delay our development and marketing efforts.

We depend on a number of key management, sales and marketing and technical personnel. The loss of the services of one or more key employees could delay the achievement of our development and marketing objectives. Our success will also depend on our ability to attract and retain additional highly qualified management, sales and marketing and technical personnel to meet our growth goals. We face intense competition for qualified personnel, many of whom are often subject to competing employment offers, and we do not know whether we will be able to attract and retain such personnel.

Future changes in financial accounting standards or practices or existing taxation rules or practices may cause adverse or unexpected revenue fluctuations and affect our reported results of operations.

A change in accounting standards or practices or a change in existing taxation rules or practices can have a significant effect on our reported results and may even affect our reporting of transactions completed before the change is effective. New accounting pronouncements and taxation rules and varying interpretations of accounting pronouncements and taxation practice have occurred and may occur in the future. Changes to existing rules or the questioning of current practices may adversely affect our reported financial results or the way we conduct our business.

The Affordable Healthcare for America Act includes provisions that may adversely affect our business and results of operations, including an excise tax on the sales of most medical devices.

On March 21, 2010, the House of Representatives passed the Affordable Health Care for America Act, which President Obama signed into law on March 23, 2010. With a new administration in place, changes may be made to the Affordable Health Care Act, or it may be repealed and replaced. The potential impact of these events may adversely affect our business and results of operations. The medical device tax has been established, however through an act of Congress, the excise tax was suspended from January 1, 2016 to December 31, 2017. On January 22, 2018, Congress passed another suspension of the tax from January 1, 2018 through December 31, 2020.

We are experiencing greater scrutiny and regulation by governmental authorities, which may lead to greater regulation in the future.

Our medical devices and our business activities are subject to rigorous regulation, including by the FDA, the DOJ and numerous other federal, state and foreign governmental authorities including the imposition of international trade sanctions and tariffs. Certain state governments and the federal government have enacted legislation aimed at increasing transparency of our interactions with health care providers. Any failure to comply with these legal and regulatory requirements could impact our business.

Risk of reprocessing disposables.

In some jurisdictions around the world, culture and practice encourages reuse of disposable products when the product is clearly labeled for single use. Such reuse may expose us to liability in these jurisdictions.

Item 1B. Unresolved Staff Comments.

None.

The Company occupies approximately 34,400 square feet at 1938 New Highway, Farmingdale, New York pursuant to a lease expiring on September 30, 2019. The Company pays rent of approximately $28,000 a month, which includes a pro rata share of real estate taxes, water, sewer and other charges which are assessed on the leased premises or the land upon which the leased premises are situated. The Company believes that the leased facilities are adequate for its present needs.

13

Former Chinese Distributor - FCPA

With the assistance of outside counsel, the Company conducted a voluntary investigation into the business practices of the independent Chinese entity that previously distributed its products in China and the Company’s knowledge of those business practices, which may have implications under the FCPA, as well as into various internal controls issues identified during the investigation (the “Investigation”).

On September 27, 2016 and September 28, 2016, the Company voluntarily contacted the SEC and the DOJ, respectively, to advise both agencies of these potential issues. The Company has provided and will continue to provide documents and other information to the SEC and the DOJ, and is cooperating fully with these agencies in their ongoing investigations of these matters.

Although the Company’s investigation is complete, additional issues or facts could arise which may expand the scope or severity of the potential violations. The Company has no current information derived from the investigation or otherwise to suggest that its previously reported financial statements and results are incorrect.

At this stage, the Company is unable to predict what, if any, action the DOJ or the SEC may take or what, if any, penalties or remedial measures these agencies may seek. Nor can the Company predict the impact on the Company as a result of these matters, which may include the imposition of fines, civil and criminal penalties, which are not currently estimable, as well as equitable remedies, including disgorgement of any profits earned from improper conduct and injunctive relief, limitations on the Company’s conduct, and the imposition of a compliance monitor. The DOJ and the SEC periodically have based the amount of a penalty or disgorgement in connection with an FCPA action, at least in part, on the amount of profits that a company obtained from the business in which the violations of the FCPA occurred. During its distributorship relationship with the prior Chinese distributor from 2010 through 2016, the Company generated revenues of approximately $8 million.

Further, the Company may suffer other civil penalties or adverse impacts, including lawsuits by private litigants in addition to the lawsuits that already have been filed, or investigations and fines imposed by local authorities. The investigative costs to date are approximately $3.0 million, of which approximately $0.5 million, $2.4 million and $0.1 million was charged to general and administrative expenses during the years ended June 30, 2018, 2017 and 2016 respectively.

Former Chinese Distributor – Litigation

On April 5, 2017, the Company’s former distributor in China, Cicel (Beijing) Science & Technology Co., Ltd., filed a lawsuit against the Company and certain officers and directors of the Company in the United States District Court for the Eastern District of New York, alleging that the Company improperly terminated its contract with the former distributor. The complaint sought various remedies, including compensatory and punitive damages, specific performance and preliminary and post judgment injunctive relief, and asserted various causes of action, including breach of contract, unfair competition, tortious interference with contract, fraudulent inducement, and conversion. On October 7, 2017, the court granted the Company’s motion to dismiss all of the tort claims asserted against it, and also granted the individual defendants’ motion to dismiss all claims asserted against them. The only claim remaining in the case is for breach of contract against the Company. The Company believes it has various legal and factual defenses to the allegations in the complaint, and intends to vigorously defend the action. The case is at its earliest stages; discovery is just beginning and there is no trial date.

Stockholder Derivative Litigation

On June 6, 2017, Irving Feldbaum, an individual shareholder of Misonix, filed a lawsuit in the U.S. District Court for the Eastern District of New York. The complaint alleges claims against the Company’s board of directors, its former CEO and CFO, certain of its former directors, and the Company as a nominal defendant for alleged violations of Section 14(a) of the Securities Exchange Act of 1934 and state law claims for breach of fiduciary duty, waste of corporate assets, and unjust enrichment. The complaint alleges that the Company incurred damages as a result of alleged false and misleading statements in the Company’s securities filings concerning the Company’s business, operations, and prospects and the Company’s internal control over financial reporting. The complaint also alleges that the Company’s February 4, 2016 Proxy Statement contained false and misleading statements regarding executive compensation. The complaint seeks the recovery of damages on behalf of the Company and the implementation of changes to corporate governance procedures. On June 16, 2017, Michael Rubin, another individual shareholder of Misonix, filed a case alleging similar claims in the same district court. On July 21, 2017, the district court consolidated the two actions for all purposes. On July 16, 2018, the Company and counsel for Mr. Feldbaum and Mr. Rubin informed the District Court that the parties had reached a settlement in principle. There are aspects of the settlement that remain to be negotiated and documented, and the settlement is subject to approval by the District Court after notice to the Company’s shareholders.

14

Item 4. Mine Safety Disclosures.

Not applicable.

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

The Company’s common stock, $.01 par value (“Common Stock”), is listed on the Nasdaq Global Market under the symbol “MSON”.

The following table sets forth the high and low sales prices for the Common Stock during the periods indicated as reported by the Nasdaq Global Market:

| High | Low | |||||||

| Fiscal 2018: | ||||||||

| First Quarter | $ | 10.90 | $ | 7.05 | ||||

| Second Quarter | 11.00 | 9.06 | ||||||

| Third Quarter | 10.70 | 8.25 | ||||||

| Fourth Quarter | 13.50 | 9.55 | ||||||

| High | Low | |||||||

| Fiscal 2017: | ||||||||

| First Quarter | $ | 7.15 | $ | 4.95 | ||||

| Second Quarter | 11.20 | 4.85 | ||||||

| Third Quarter | 12.00 | 9.05 | ||||||

| Fourth Quarter | 11.80 | 9.35 | ||||||

As of June 30, 2018, the Company had 9,430,466 shares of Common Stock outstanding and 54 shareholders of record. This amount does not take into account shareholders whose shares are held in “street name” by brokerage houses or other intermediaries.

The Company has not paid any cash dividends since its inception. The Company does not intend to pay any cash dividends in the foreseeable future, but intends to retain all earnings, if any, for use in its business operations.

Share Performance Graph

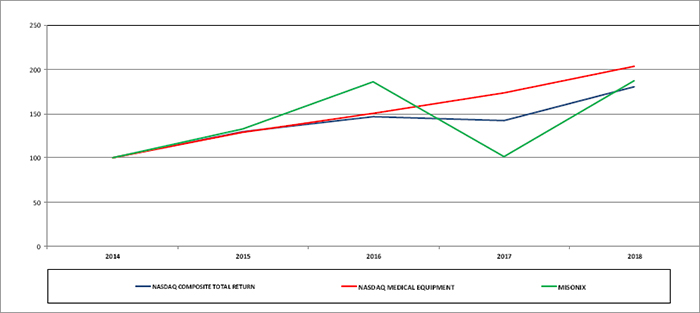

The following graph compares the cumulative total return on the Company’s Common Stock during the last five fiscal years with the NASDAQ Composite Total Return Index and the NASDAQ Medical Equipment Index during the same period. The graph shows the value, at the end of each of the last five fiscal years, of $100 invested in the Common Stock or the indices on June 30, 2013. The graph depicts the change in value of the Company’s Common Stock relative to the noted indices as of the end of each fiscal year and not for any interim period. Historical stock price performance is not necessarily indicative of future stock price performance.

15

| 2014 | 2015 | 2016 | 2017 | 2018 | |||||||||||

| MISONIX, INC. | 100 | 133 | 186 | 101 | 187 | ||||||||||

| NASDAQ Composite Total Return | 100 | 130 | 147 | 142 | 180 | ||||||||||

| NASDAQ Medical Equipment Index | 100 | 129 | 150 | 173 | 204 |

Item 6. Selected Financial Data.

The following selected consolidated financial data should be read in conjunction with Item 7 “Management’s Discussion

and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and the related

notes appearing in Item 8 “Financial Statements and Supplementary Data” of this 10-K.

The consolidated statements of income data for the years ended June 30, 2018, 2017 and 2016 and the consolidated balance sheet data as of June 30, 2018 and 2017 are derived from our audited consolidated financial statements appearing in Item 8 of this 10-K. The consolidated statements of income data for the years ended June 30, 2015 and 2014 and the consolidated balance sheet data as of June 30, 2016, 2015 and 2014 are derived from our audited consolidated financial statements that are not included in the 10-K. The historical results are not necessarily indicative of the results to be expected in any future period.

16

Selected income statement data:

| For the Year Ended June 30, | ||||||||||||||||||||

| 2018 | 2017 | 2016 | 2015 | 2014 | ||||||||||||||||

| Total revenue | $ | 36,679,826 | $ | 27,269,963 | $ | 23,113,194 | $ | 22,204,578 | $ | 17,060,435 | ||||||||||

| Net (loss)/income from continuing operations | (7,803,552 | ) | (1,842,804 | ) | (1,329,077 | ) | 5,304,056 | 1,126,580 | ||||||||||||

| Net (loss)/income per share from continuing operations - Basic | $ | (0.87 | ) | $ | (0.22 | ) | $ | (0.17 | ) | $ | 0.70 | $ | 0.15 | |||||||

| Net (loss)/income per share from continuing operations - Diluted | $ | (0.87 | ) | $ | (0.22 | ) | $ | (0.17 | ) | $ | 0.66 | $ | 0.15 | |||||||

| Selected balance sheet data: | ||||||||||||||||||||

| June 30, | ||||||||||||||||||||

| 2018 | 2017 | 2016 | 2015 | 2014 | ||||||||||||||||

| Total assets | $ | 29,020,751 | $ | 33,369,649 | $ | 27,732,731 | $ | 26,454,248 | $ | 19,527,869 | ||||||||||

| Total long term liabilities | $ | 13,303 | $ | 13,087 | $ | 31,685 | $ | 20,395 | $ | 67,932 | ||||||||||

| Total shareholders’ equity | $ | 24,401,178 | $ | 28,139,842 | $ | 24,401,290 | $ | 23,754,345 | $ | 16,352,364 | ||||||||||

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

Misonix designs, manufactures and markets therapeutic ultrasonic devices. These products are used for precise bone sculpting, removal of soft and hard tumors, and tissue debridement, orthopedic surgery, plastic surgery, and wound and burn care. In the United States, the Company sells its products through a hybrid sales approach which includes direct sales representatives, managed by regional sales managers, along with independent distributors. Outside of the United States, the Company generally sells to distributors who then resell the product to hospitals. The Company operates as one business segment.

In the United States, the Company is taking a more aggressive approach to taking market share, expanding the market and increasing its share of recurring disposable revenue by using a consignment model, whereby the Company will consign the equipment (which is defined as a generator, hand units and accessories) (the “Equipment”) and sell to customers higher margin disposable single use items (the “Consumables”) on a recurring basis. Title remains with the Company with respect to consigned Equipment, which is depreciated and charged to selling expenses over a five year period beginning in fiscal 2017, and a three year period in fiscal 2016. Outside of the United States, the Company has principally not yet adopted a consignment model. The Company’s overall goal is to increase the utilization rate of Equipment which will increase the total number of procedures and maximize the sale of Consumables to our customers, with the goal of becoming the standard of care in the various segments we focus on.

Results of Operations

The following discussion and analysis provides information which the Company’s management believes is relevant to an assessment and understanding of the Company’s results of operations and financial condition. This discussion should be read in conjunction with the consolidated financial statements and notes thereto appearing elsewhere herein. Unless otherwise specified, this discussion relates solely to the Company’s continuing operations.

All of the Company’s sales have been derived from the sale of medical device products, which include manufacture and distribution of ultrasonic medical device products.

17

Fiscal years ended June 30, 2018, 2017 and 2016

Our revenues by category for the three years ended June 30, 2018 are as follows:

| Net Change % | ||||||||||||||||||||

| For the Year Ended June 30, | Year Ended June 30, | |||||||||||||||||||

| 2018 | 2017 | 2016 | 2018 | 2017 | ||||||||||||||||

| Total | ||||||||||||||||||||

| Consumables | $ | 23,596,476 | $ | 20,328,676 | $ | 16,091,651 | 16.1 | % | 26.3 | % | ||||||||||

| Equipment | 9,073,350 | 6,941,287 | 7,021,543 | 30.7 | % | -1.1 | % | |||||||||||||

| License | 4,010,000 | — | — | 100.0 | % | 0.0 | % | |||||||||||||

| Total | $ | 36,679,826 | $ | 27,269,963 | $ | 23,113,194 | 34.5 | % | 18.0 | % | ||||||||||

| Domestic: | ||||||||||||||||||||

| Consumables | $ | 17,735,749 | $ | 14,866,772 | $ | 11,277,449 | 19.3 | % | 31.8 | % | ||||||||||

| Equipment | 2,308,614 | 1,593,999 | 1,809,357 | 44.8 | % | -11.9 | % | |||||||||||||

| Total | $ | 20,044,363 | $ | 16,460,771 | $ | 13,086,806 | 21.8 | % | 25.8 | % | ||||||||||

| International: | ||||||||||||||||||||

| Consumables | $ | 5,860,727 | $ | 5,461,904 | $ | 4,814,202 | 7.3 | % | 13.5 | % | ||||||||||

| Equipment | 6,764,736 | 5,347,288 | 5,212,186 | 26.5 | % | 2.6 | % | |||||||||||||

| Total | $ | 12,625,463 | $ | 10,809,192 | $ | 10,026,388 | 16.8 | % | 7.8 | % | ||||||||||

| License | $ | 4,010,000 | $ | — | $ | — | 100 | % | — | |||||||||||

Fiscal years ended June 30, 2018 and 2017

Net revenue

Revenues increased 34.5% or $9.4 million to $36.7 million in fiscal 2018 from $27.3 million in fiscal 2017 principally due to strong demand for the Company’s products domestically and internationally, and the inclusion of $4.0 million of license revenue relating to the licensing of one of the Company’s products in China.

Product revenue increased 19.8% or $5.4 million to $32.7 million in fiscal 2018, from $27.3 million in fiscal 2017. US product revenue grew 21.8% and international product revenue grew 16.8% for fiscal 2018. Consumables revenue in the United States increased 19.3%, or $2.9 million for the current year, principally due to the strength in the Company’s BoneScalpel product line. International consumables revenue grew 7.3% for the current year.

License revenue was $4.0 million for fiscal 2018, resulting from the Company’s license of SonaStar technology to one of its Chinese distributors. There was no license revenue in fiscal 2017.

Gross profit

The gross profit percentage on product sales was 70.0% in fiscal 2018, compared with 69.9% in fiscal 2017. Including the impact of license revenue in fiscal 2018, which has a 100% gross profit margin, the total gross profit margin for the year was 72.3%.

Selling expenses

Selling expenses increased by $2.2 million, or 15.1% to $16.4 million in fiscal 2018 from $14.2 million in fiscal 2017. The expense increase is related to increased salaries and related costs for the Company’s expanded direct sales force of approximately $1.4 million, higher commission expense of approximately $0.25 million, and increased marketing related expenses of approximately $0.4 million.

18

General and administrative expenses

General and administrative expenses decreased $0.5 million to $9.1 million in fiscal 2018 from $9.6 million in fiscal 2017. The decrease resulted principally from lower professional fees of approximately $2.3 million, reflecting lower professional fees relating to the Investigation. This decrease in expenses was partially offset by an increase in non-cash stock compensation expense of $1.4 million, relating principally to a full year of expense relating to the restricted stock awards granted to the Company’s CEO in December 2016.

Research and development expenses

Research and development expenses increased by $2.6 million, or 139.1% to $4.4 million in fiscal 2018 from $1.8 million in the prior year period. The Company is investing in the design and development of its next generation product, which is expected to be available in fiscal 2019. For fiscal 2018, approximately $2.3 million has been charged to research and development expenses related to this product.

Other income

Other income decreased $3.1 million to $0.6 million in fiscal 2018 from $3.7 million in fiscal 2017. The decrease is related to lower royalty income from MMIT. This royalty agreement expired in August 2017.

Income taxes

For fiscal 2018, the Company recorded an income tax expense of $5.4 million, compared with an income tax benefit of $1.0 million in fiscal 2017.

The income tax expense for fiscal 2018 included a one-time charge of $1.8 million to revalue the Company’s deferred tax asset as of December 31, 2017 to give effect to the reduction in federal corporate tax rate to 21% effective January 1, 2018, as a result of the new tax legislation, enacted on December 22, 2017. Income tax expense also includes a $4.1 million charge to record a full valuation allowance against the Company’s remaining deferred tax assets. In accordance with the guidance of ASC Topic 740, management concluded that in its judgment, the Company’s deferred tax assets at June 30, 2018 are not more likely-than-not realizable. The components of the tax provision are as follows:

| For the years ended June 30, | ||||||||

| 2018 | 2017 | |||||||

| Income tax benefit | $ | (443,746 | ) | $ | (1,022,808 | ) | ||

| Provisional reduction of deferred tax asset relating to Tax Legislation | 1,764,039 | — | ||||||

| Valuation allowance on deferred tax asset | 4,096,353 | — | ||||||

| Net income tax expense (benefit) | $ | 5,416,646 | $ | (1,022,808 | ) | |||

Fiscal years ended June 30, 2017 and 2016

Net revenue

Net sales increased $4,156,769, or 17.98%, to $27,269,963 in fiscal 2017 from $23,113,194 in fiscal 2016 in part due to stronger demand for the Company’s products domestically offset by weaker international Equipment sales. Consumables revenue increased by 26.3% to $20,328,676 for the year ended June 30, 2017 compared with $16,091,651 in the prior year. Equipment sales declined by 1.1% to $6,941,287 compared with $7,021,543 in the prior year. The decline resulted from weaker international sales, principally in China, where the Company ceased shipments in the fourth quarter of fiscal 2016.

Gross profit

Gross profit was 69.9% in fiscal 2017, an increase of 2.8% from 67.1% in fiscal 2016. The increase resulted from a stronger mix of Consumables revenue which carries a higher gross profit margin than Equipment revenue.

19

Selling expenses

Selling expenses increased by $1,587,946, or 15.7% to $14,220,907 in fiscal 2017 from $12,632,961 in fiscal 2016. The expense increase is related to increased commissions of approximately $1.4 million on higher sales of $4.2 million.

General and administrative expenses

General and administrative expenses increased $2,765,690 to $9,565,206 in fiscal 2017 from $6,829,516 in fiscal 2016. The increase resulted principally from increased professional fees of approximately $2.4 million relating to the Investigation, and an additional $442,000 of other professional fees. The Company also paid severance for its former CEO during the fiscal 2017 of approximately $335,000. This increase in expenses was partially offset by a reduction in non-cash stock compensation expense of $805,000, which includes a reversal of stock compensation previously recognized with respect to the Company’s prior CEO relating to unvested stock options which were terminated. The Company also recognized $484,000 of non-cash compensation expense relating to the restricted stock awards granted to the Company’s new CEO in December 2016.

Research and development expenses

Research and development expenses were $1,837,497 for fiscal 2017, approximately the same as fiscal 2016 expenses of $1,839,479.

Other income

Other income decreased $191,486 to $3,735,474 in fiscal 2017 from $3,926,960 in fiscal 2016. The decrease is related to lower royalty income from MMIT. This royalty agreement expired in August 2017.

Income taxes

In fiscal 2017 the income tax benefit for continuing operations had an effective tax rate of 35.7% as compared to an effective rate of 30.1% in fiscal 2016. Prior to June 30, 2014 and through March 31, 2015, the Company had a full valuation allowance recorded against deferred tax assets. The primary factors affecting the fiscal 2017 effective tax rate were non-deductible expenses, stock compensation, tax credits and state income taxes. The primary factors affecting the fiscal 2016 effective tax rate were non-deductible expenses, deferred tax adjustments and state income taxes.

Discontinued operations

The following represents the results of the high intensity focused ultrasound technology sold to SonaCare Medical, LLC in May 2010, which is included in discontinued operations:

| For the years ended June 30, | ||||||||||||

| 2018 | 2017 | 2016 | ||||||||||

| Revenues | $ | — | $ | — | $ | — | ||||||

| Gain on sale of discontinued operations | 250,000 | 250,000 | 250,000 | |||||||||

| Income tax expense | (58,883 | ) | (88,375 | ) | (93,069 | ) | ||||||

| Net income from discontinued operations, net of tax | $ | 191,117 | $ | 161,625 | $ | 156,931 | ||||||

Liquidity and Capital Resources

Working capital at June 30, 2018 was $17.3 million. For fiscal 2018, cash used in operations was $0.6 million, mainly due to the Company’s net loss of $7.6 million and an increase in inventory of $1.4 million, offset by $8.4 million of non-cash expenses.

Cash used in investing activities was $0.3 million, primarily consisting of the purchase of property, plant and equipment along with filing for additional patents, offset by income from discontinued operations.

20

Cash provided by financing activities was $0.3 million for fiscal 2018, resulting from the exercise of stock options.

As of June 30, 2018, the Company had a cash balance of approximately $11.0 and believes it has sufficient cash to finance operations for at least the next 12 months following the issuance date of the financial statements included herein.

Relating to the internal investigation described herein, the Company has incurred approximately $3.0 million in investigative costs and is expected to incur additional costs until the matter is fully resolved. Further, the Company could be subject to fines or penalties related to potential violations of the FCPA.

The Company has been receiving an annual royalty from MMIT which has averaged $3.9 million per year during fiscal 2017 and fiscal 2016. This royalty ended in August 2017.

Commitments

The Company has commitments under operating leases that will be funded from operating sources. At June 30, 2018, the Company’s contractual cash obligations and commitments relating to operating leases and other purchase commitments are as follows:

| Commitment | Less than 1 year | 1-3 years | 4-5 years | After 5 years | Total | |||||||||||||||

| Operating leases | $ | 359,353 | $ | 127,812 | $ | — | $ | — | $ | 487,165 | ||||||||||

| Purchase commitments | 3,841,621 | — | — | — | 3,841,621 | |||||||||||||||

| $ | 4,200,974 | $ | 127,812 | $ | — | $ | — | $ | 4,328,786 | |||||||||||

Off-Balance Sheet Arrangements

The Company has no off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on the Company’s financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that are material to the Company.

Other

In the opinion of management, inflation has not had a material effect on the operations of the Company.

Critical Accounting Policies and Use of Estimates

Our discussion and analysis of financial condition and results of operations is based upon our consolidated financial statements, which have been prepared in accordance with accounting principles generally accepted in the United States of America. The preparation of these financial statements requires us to make estimates and assumptions that affect the reported amounts of assets and liabilities, the disclosure of contingent liabilities, and the reported amounts of revenues and expenses. Significant estimates affecting amounts reported or disclosed in the consolidated financial statements include net realizable value of inventories, valuation of intangible assets including amortization periods for acquired intangible assets, estimates of projected cash flows and discount rates used to value intangible assets and test goodwill and intangible assets for impairment, computation of valuation allowances recorded against deferred tax assets, and valuation of stock-based compensation. These estimates are based on historical experience and on various other assumptions that are believed to be reasonable under the current circumstances. Actual results could differ from these estimates.

We believe that the following accounting policies, which form the basis for developing these estimates, are those that are most critical to the presentation of our consolidated financial statements and require the more difficult subjective and complex judgments.

21

Revenue Recognition

The Company records revenue upon shipment for products shipped F.O.B. shipping point. Products shipped F.O.B. destination points are recorded as revenue when received at the point of destination. Shipments under agreements with distributors are not subject to return, and payment for these shipments is not contingent on sales by the distributor. Accordingly, the Company recognizes revenue on shipments to distributors in the same manner as with other customers. Service contracts and royalty income are recognized when earned. The Company generally warrantees its product for a 12 month period, and accordingly records a related warranty reserve. Historical warranty costs have not been significant.

The Company presents taxes collected from customers and remitted to governmental authorities in the consolidated statements of operations on a net basis.

License revenue is recorded when 1) a contract has been executed, 2) the underlying intellectual property has been transferred, 3) the payment terms are identified and 4) the risk of a reversal of revenue from lack of receipt of consideration or other factors has passed. License revenue for the years ended June 30, 2018, 2017 and 2016 was $4,010,000, $0 and $0, respectively.

Inventories

Inventories, consisting of purchased materials, direct labor and manufacturing overhead, are stated at the lower of cost (determined by the first-in, first-out method) or net realizable value. At each balance sheet date, we evaluate ending inventories for excess quantities and obsolescence. Our evaluation includes an analysis of historical sales levels by product, projections of future demand by product, the risk of technological or competitive obsolescence for our products, general market conditions, and the feasibility of reworking or using excess or obsolete products or components in the production or assembly of other products that are not obsolete or for which we do not have excess quantities in inventory. To the extent that we determine there are excess or obsolete quantities or quantities on hand, we adjust their carrying value to estimated net realizable value. If future demand or market conditions are lower than our projections, or if we are unable to rework excess or obsolete quantities into other products, we may record further adjustments to the carrying value of inventory through a charge to cost of product revenues in the period the revision is made.

Goodwill

The excess of the cost over the fair value of net assets of acquired businesses is recorded as goodwill. Goodwill is not subject to amortization, but is reviewed for impairment at the reporting unit level annually, or more frequently if impairment indicators arise. Our assessment of the recoverability of goodwill is based upon a comparison of the carrying value of goodwill with its estimated fair value and the value of the Company at the measurement date.

Application of these impairment tests requires significant judgments, including estimation of cash flows, which is dependent on internal forecasts, estimation of the long term rate of growth for our business, the useful lives over which cash flows will occur and determination of our weighted average cost of capital. The Company’s market capitalization exceeds the value of the goodwill. Accordingly, the Company concluded that there was no impairment to goodwill at June 30, 2018 and June 30, 2017.

Income Taxes

The Company assesses whether a valuation allowance should be established against its deferred tax assets based on consideration of all available evidence, both positive and negative, using a more likely than not standard. This assessment considers, among other matters, the nature, frequency and severity of recent losses; a forecast of future profitability; the duration of statutory carryback and carryforward periods; the Company’s experience with tax attributes expiring unused; and tax planning alternatives. The likelihood that the deferred tax asset balance will be recovered from future taxable income is assessed at least quarterly, and the valuation allowance, if any, is adjusted accordingly.

Loss Contingencies