Attached files

| file | filename |

|---|---|

| EX-99.3 - EXHIBIT 99.3 - TRIMBLE INC. | ex-993unauditedproformacom.htm |

| EX-99.1 - EXHIBIT 99.1 - TRIMBLE INC. | a991finalwaterfallholdin.htm |

| EX-23.1 - EXHIBIT 23.1 - TRIMBLE INC. | ex-231consentclean.htm |

| 8-K/A - 8-K/A - TRIMBLE INC. | a8-kaviewpoint.htm |

WATERFALL HOLDINGS, INC AND SUBSIDIARIES Condensed Consolidated Financial Statements March 31, 2018 (Unaudited)

WATERFALL HOLDINGS, INC AND SUBSIDIARIES Table of Contents Page(s) Financial Statements (Unaudited): Condensed Consolidated Balance Sheets 1 Condensed Consolidated Statements of Operations 2 Condensed Consolidated Statements of Comprehensive Loss 3 Condensed Consolidated Statements of Cash Flows 4 Notes to Condensed Consolidated Financial Statements 5–12

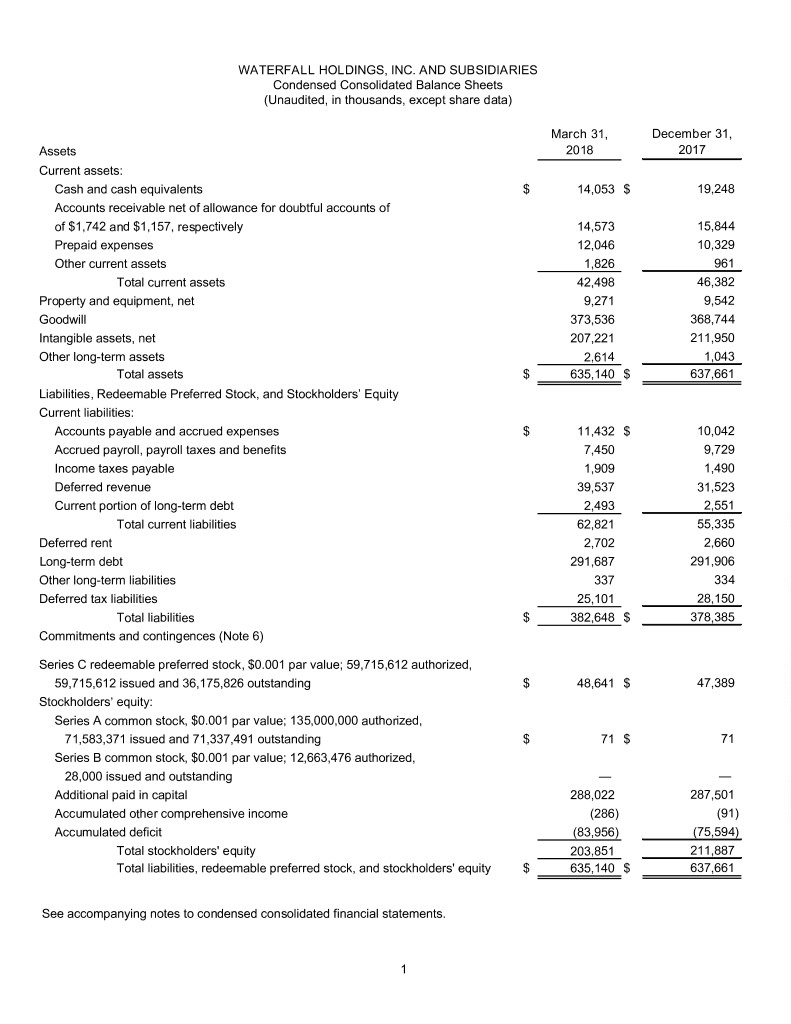

WATERFALL HOLDINGS, INC. AND SUBSIDIARIES Condensed Consolidated Balance Sheets (Unaudited, in thousands, except share data) March 31, December 31, Assets 2018 2017 Current assets: Cash and cash equivalents $ 14,053 $ 19,248 Accounts receivable net of allowance for doubtful accounts of of $1,742 and $1,157, respectively 14,573 15,844 Prepaid expenses 12,046 10,329 Other current assets 1,826 961 Total current assets 42,498 46,382 Property and equipment, net 9,271 9,542 Goodwill 373,536 368,744 Intangible assets, net 207,221 211,950 Other long-term assets 2,614 1,043 Total assets $ 635,140 $ 637,661 Liabilities, Redeemable Preferred Stock, and Stockholders’ Equity Current liabilities: Accounts payable and accrued expenses $ 11,432 $ 10,042 Accrued payroll, payroll taxes and benefits 7,450 9,729 Income taxes payable 1,909 1,490 Deferred revenue 39,537 31,523 Current portion of long-term debt 2,493 2,551 Total current liabilities 62,821 55,335 Deferred rent 2,702 2,660 Long-term debt 291,687 291,906 Other long-term liabilities 337 334 Deferred tax liabilities 25,101 28,150 Total liabilities $ 382,648 $ 378,385 Commitments and contingences (Note 6) Series C redeemable preferred stock, $0.001 par value; 59,715,612 authorized, 59,715,612 issued and 36,175,826 outstanding $ 48,641 $ 47,389 Stockholders’ equity: Series A common stock, $0.001 par value; 135,000,000 authorized, 71,583,371 issued and 71,337,491 outstanding $ 71 $ 71 Series B common stock, $0.001 par value; 12,663,476 authorized, 28,000 issued and outstanding — — Additional paid in capital 288,022 287,501 Accumulated other comprehensive income (286) (91) Accumulated deficit (83,956) (75,594) Total stockholders' equity 203,851 211,887 Total liabilities, redeemable preferred stock, and stockholders' equity $ 635,140 $ 637,661 See accompanying notes to condensed consolidated financial statements. 1

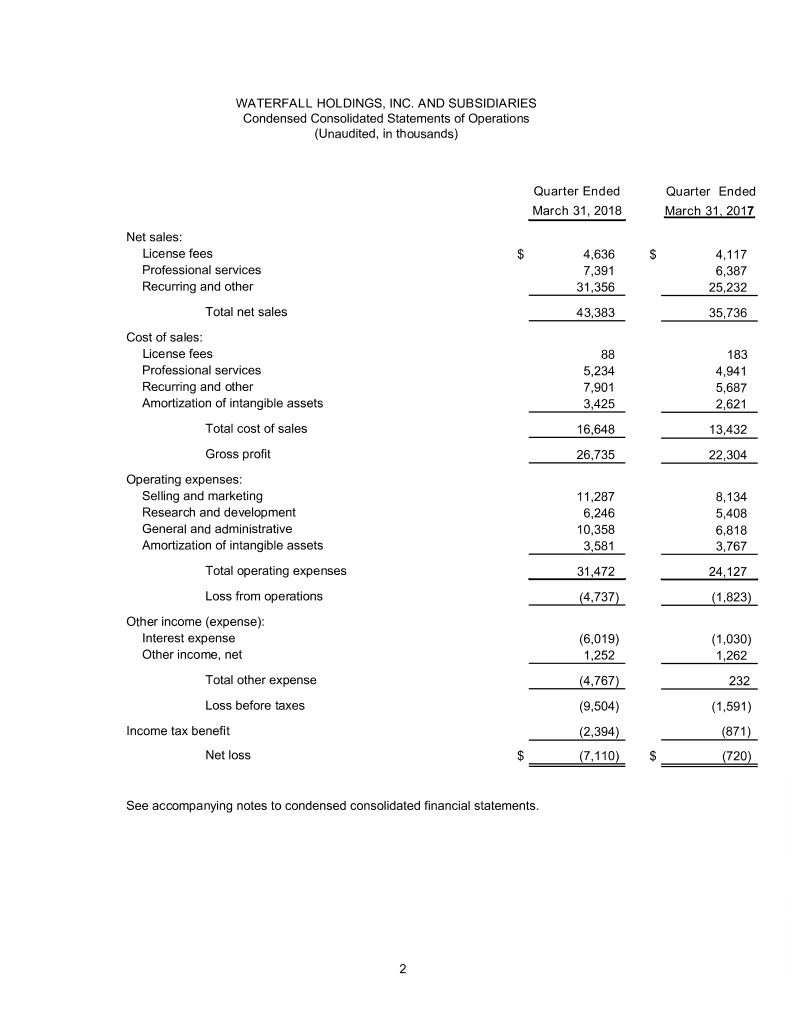

WATERFALL HOLDINGS, INC. AND SUBSIDIARIES Condensed Consolidated Statements of Operations (Unaudited, in thousands) Quarter Ended Quarter Ended March 31, 2018 March 31, 2017 Net sales: License fees $ 4,636 $ 4,117 Professional services 7,391 6,387 Recurring and other 31,356 25,232 Total net sales 43,383 35,736 Cost of sales: License fees 88 183 Professional services 5,234 4,941 Recurring and other 7,901 5,687 Amortization of intangible assets 3,425 2,621 Total cost of sales 16,648 13,432 Gross profit 26,735 22,304 Operating expenses: Selling and marketing 11,287 8,134 Research and development 6,246 5,408 General and administrative 10,358 6,818 Amortization of intangible assets 3,581 3,767 Total operating expenses 31,472 24,127 Loss from operations (4,737) (1,823) Other income (expense): Interest expense (6,019) (1,030) Other income, net 1,252 1,262 Total other expense (4,767) 232 Loss before taxes (9,504) (1,591) Income tax benefit (2,394) (871) Net loss $ (7,110) $ (720) See accompanying notes to condensed consolidated financial statements. 2

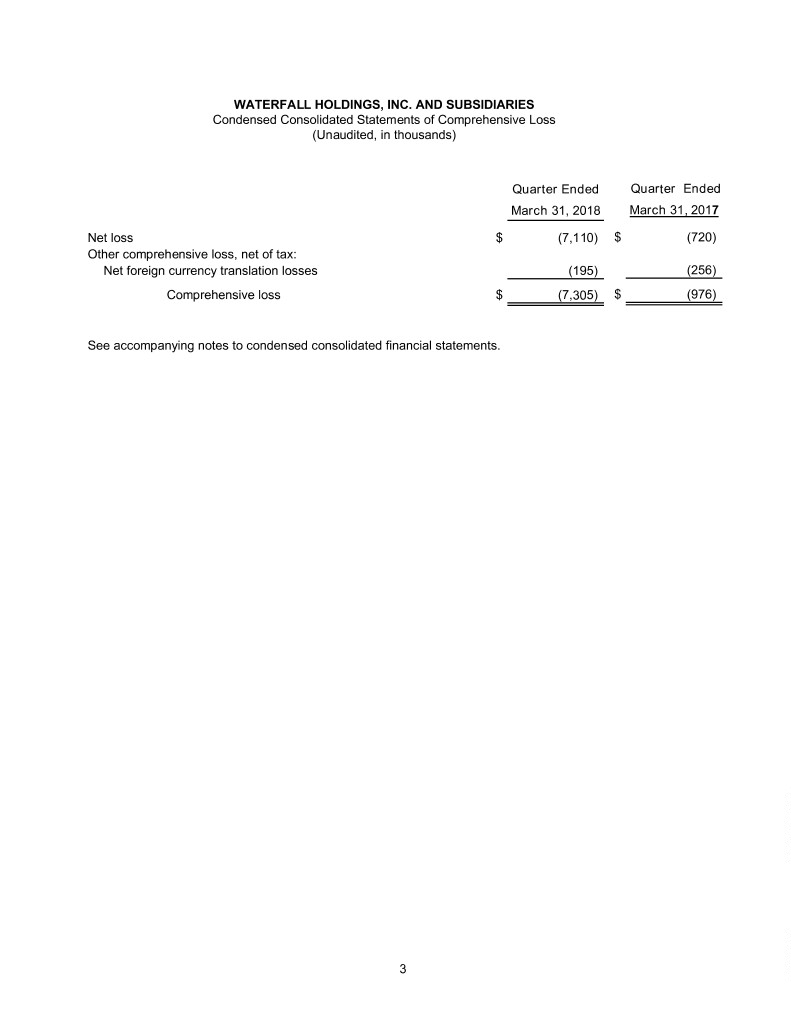

WATERFALL HOLDINGS, INC. AND SUBSIDIARIES Condensed Consolidated Statements of Comprehensive Loss (Unaudited, in thousands) Quarter Ended Quarter Ended March 31, 2018 March 31, 2017 Net loss $ (7,110) $ (720) Other comprehensive loss, net of tax: Net foreign currency translation losses (195) (256) Comprehensive loss $ (7,305) $ (976) See accompanying notes to condensed consolidated financial statements. 3

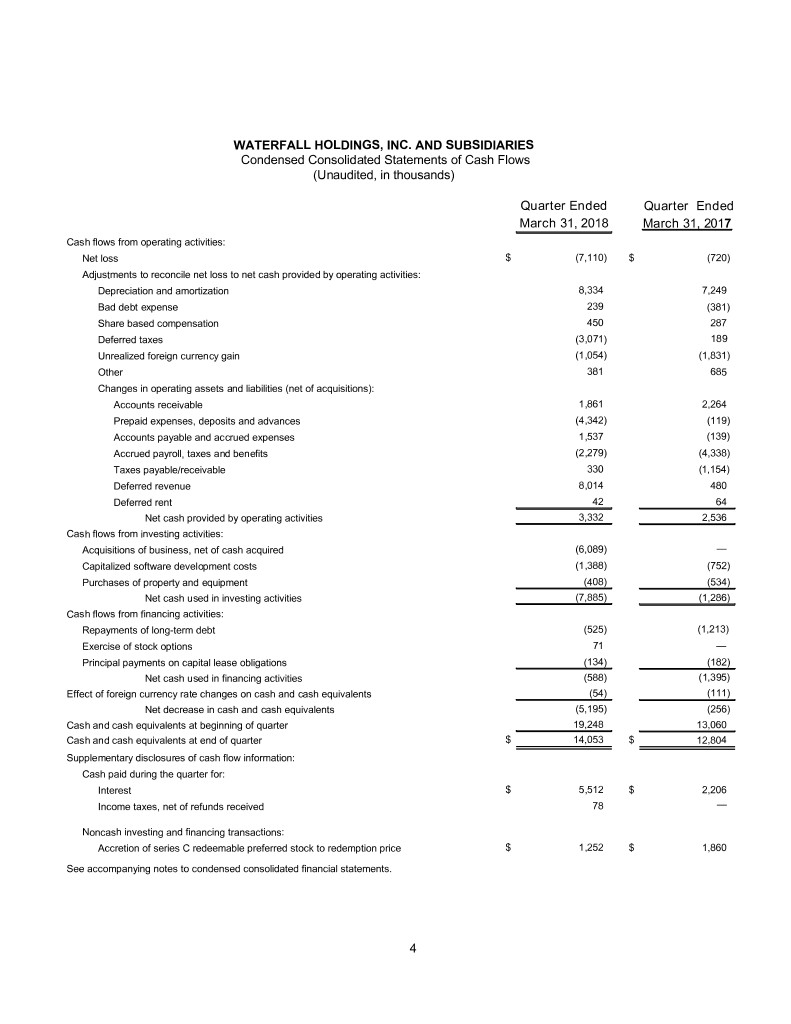

WATERFALL HOLDINGS, INC. AND SUBSIDIARIES Condensed Consolidated Statements of Cash Flows (Unaudited, in thousands) Quarter Ended Quarter Ended March 31, 2018 March 31, 2017 Cash flows from operating activities: Net loss $ (7,110) $ (720) Adjustments to reconcile net loss to net cash provided by operating activities: Depreciation and amortization 8,334 7,249 Bad debt expense 239 (381) Share based compensation 450 287 Deferred taxes (3,071) 189 Unrealized foreign currency gain (1,054) (1,831) Other 381 685 Changes in operating assets and liabilities (net of acquisitions): Accounts receivable 1,861 2,264 Prepaid expenses, deposits and advances (4,342) (119) Accounts payable and accrued expenses 1,537 (139) Accrued payroll, taxes and benefits (2,279) (4,338) Taxes payable/receivable 330 (1,154) Deferred revenue 8,014 480 Deferred rent 42 64 Net cash provided by operating activities 3,332 2,536 Cash flows from investing activities: Acquisitions of business, net of cash acquired (6,089) — Capitalized software development costs (1,388) (752) Purchases of property and equipment (408) (534) Net cash used in investing activities (7,885) (1,286) Cash flows from financing activities: Repayments of long-term debt (525) (1,213) Exercise of stock options 71 — Principal payments on capital lease obligations (134) (182) Net cash used in financing activities (588) (1,395) Effect of foreign currency rate changes on cash and cash equivalents (54) (111) Net decrease in cash and cash equivalents (5,195) (256) Cash and cash equivalents at beginning of quarter 19,248 13,060 Cash and cash equivalents at end of quarter $ 14,053 $ 12,804 Supplementary disclosures of cash flow information: Cash paid during the quarter for: Interest $ 5,512 $ 2,206 Income taxes, net of refunds received 78 — Noncash investing and financing transactions: Accretion of series C redeemable preferred stock to redemption price $ 1,252 $ 1,860 See accompanying notes to condensed consolidated financial statements. 4

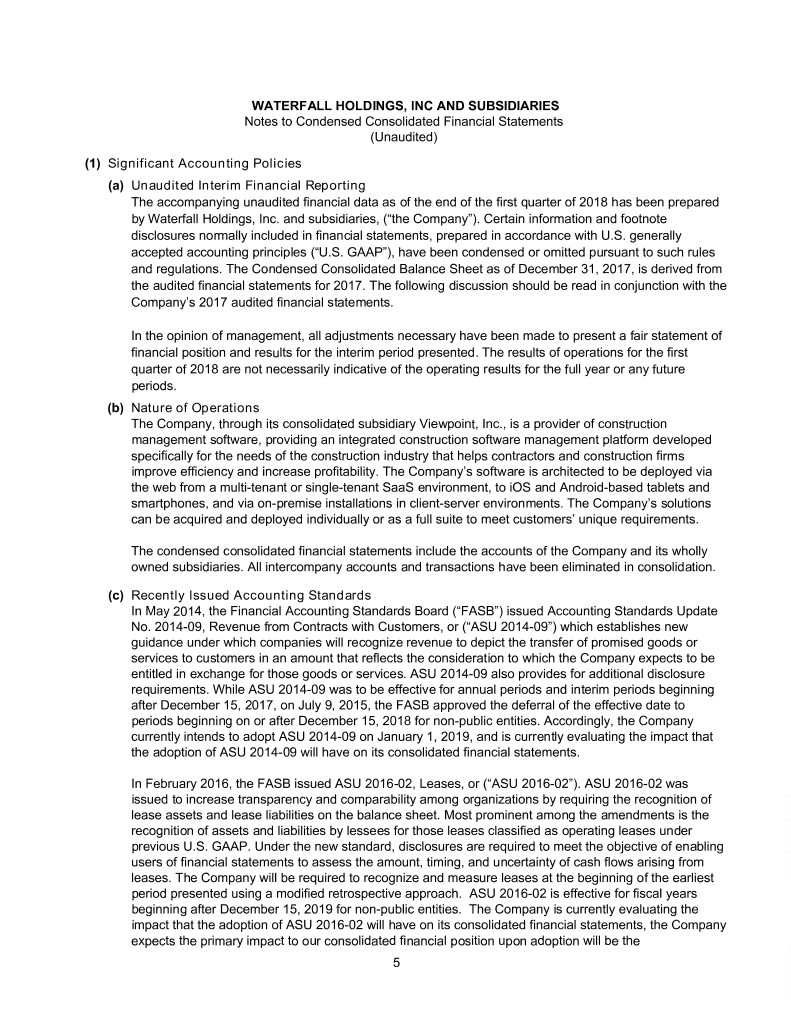

WATERFALL HOLDINGS, INC AND SUBSIDIARIES Notes to Condensed Consolidated Financial Statements (Unaudited) (1) Significant Accounting Policies (a) Unaudited Interim Financial Reporting The accompanying unaudited financial data as of the end of the first quarter of 2018 has been prepared by Waterfall Holdings, Inc. and subsidiaries, (“the Company”). Certain information and footnote disclosures normally included in financial statements, prepared in accordance with U.S. generally accepted accounting principles (“U.S. GAAP”), have been condensed or omitted pursuant to such rules and regulations. The Condensed Consolidated Balance Sheet as of December 31, 2017, is derived from the audited financial statements for 2017. The following discussion should be read in conjunction with the Company’s 2017 audited financial statements. In the opinion of management, all adjustments necessary have been made to present a fair statement of financial position and results for the interim period presented. The results of operations for the first quarter of 2018 are not necessarily indicative of the operating results for the full year or any future periods. (b) Nature of Operations The Company, through its consolidated subsidiary Viewpoint, Inc., is a provider of construction management software, providing an integrated construction software management platform developed specifically for the needs of the construction industry that helps contractors and construction firms improve efficiency and increase profitability. The Company’s software is architected to be deployed via the web from a multi-tenant or single-tenant SaaS environment, to iOS and Android-based tablets and smartphones, and via on-premise installations in client-server environments. The Company’s solutions can be acquired and deployed individually or as a full suite to meet customers’ unique requirements. The condensed consolidated financial statements include the accounts of the Company and its wholly owned subsidiaries. All intercompany accounts and transactions have been eliminated in consolidation. (c) Recently Issued Accounting Standards In May 2014, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update No. 2014-09, Revenue from Contracts with Customers, or (“ASU 2014-09”) which establishes new guidance under which companies will recognize revenue to depict the transfer of promised goods or services to customers in an amount that reflects the consideration to which the Company expects to be entitled in exchange for those goods or services. ASU 2014-09 also provides for additional disclosure requirements. While ASU 2014-09 was to be effective for annual periods and interim periods beginning after December 15, 2017, on July 9, 2015, the FASB approved the deferral of the effective date to periods beginning on or after December 15, 2018 for non-public entities. Accordingly, the Company currently intends to adopt ASU 2014-09 on January 1, 2019, and is currently evaluating the impact that the adoption of ASU 2014-09 will have on its consolidated financial statements. In February 2016, the FASB issued ASU 2016-02, Leases, or (“ASU 2016-02”). ASU 2016-02 was issued to increase transparency and comparability among organizations by requiring the recognition of lease assets and lease liabilities on the balance sheet. Most prominent among the amendments is the recognition of assets and liabilities by lessees for those leases classified as operating leases under previous U.S. GAAP. Under the new standard, disclosures are required to meet the objective of enabling users of financial statements to assess the amount, timing, and uncertainty of cash flows arising from leases. The Company will be required to recognize and measure leases at the beginning of the earliest period presented using a modified retrospective approach. ASU 2016-02 is effective for fiscal years beginning after December 15, 2019 for non-public entities. The Company is currently evaluating the impact that the adoption of ASU 2016-02 will have on its consolidated financial statements, the Company expects the primary impact to our consolidated financial position upon adoption will be the 5

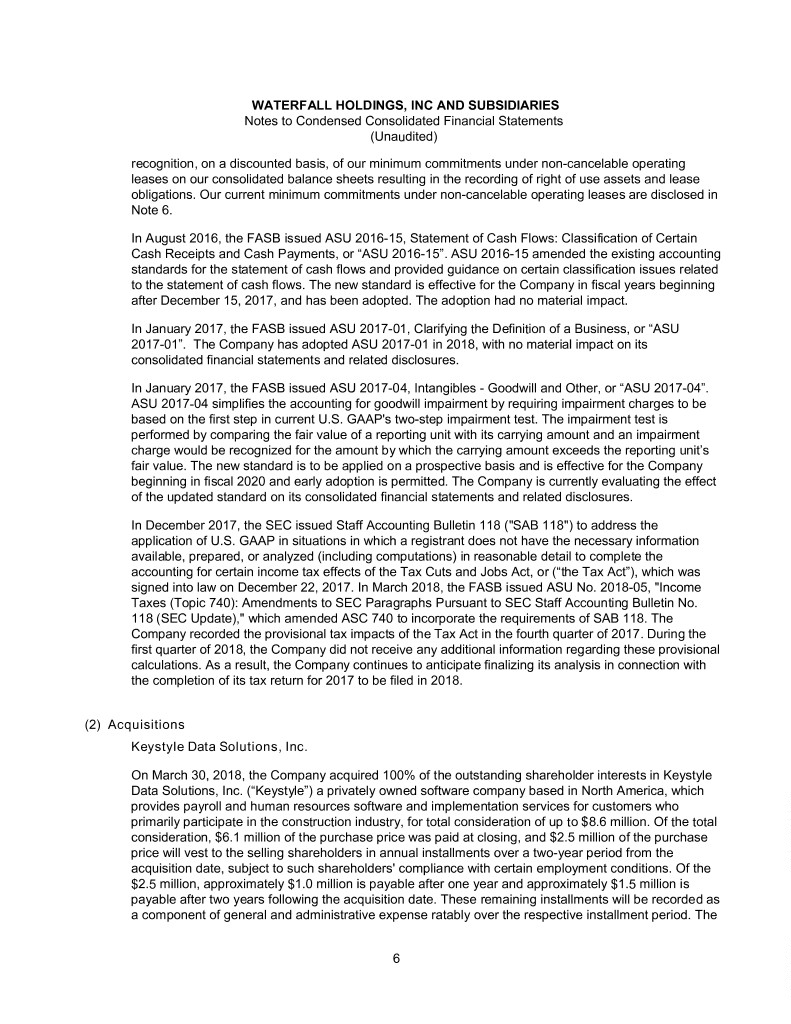

WATERFALL HOLDINGS, INC AND SUBSIDIARIES Notes to Condensed Consolidated Financial Statements (Unaudited) recognition, on a discounted basis, of our minimum commitments under non-cancelable operating leases on our consolidated balance sheets resulting in the recording of right of use assets and lease obligations. Our current minimum commitments under non-cancelable operating leases are disclosed in Note 6. In August 2016, the FASB issued ASU 2016-15, Statement of Cash Flows: Classification of Certain Cash Receipts and Cash Payments, or “ASU 2016-15”. ASU 2016-15 amended the existing accounting standards for the statement of cash flows and provided guidance on certain classification issues related to the statement of cash flows. The new standard is effective for the Company in fiscal years beginning after December 15, 2017, and has been adopted. The adoption had no material impact. In January 2017, the FASB issued ASU 2017-01, Clarifying the Definition of a Business, or “ASU 2017-01”. The Company has adopted ASU 2017-01 in 2018, with no material impact on its consolidated financial statements and related disclosures. In January 2017, the FASB issued ASU 2017-04, Intangibles - Goodwill and Other, or “ASU 2017-04”. ASU 2017-04 simplifies the accounting for goodwill impairment by requiring impairment charges to be based on the first step in current U.S. GAAP's two-step impairment test. The impairment test is performed by comparing the fair value of a reporting unit with its carrying amount and an impairment charge would be recognized for the amount by which the carrying amount exceeds the reporting unit’s fair value. The new standard is to be applied on a prospective basis and is effective for the Company beginning in fiscal 2020 and early adoption is permitted. The Company is currently evaluating the effect of the updated standard on its consolidated financial statements and related disclosures. In December 2017, the SEC issued Staff Accounting Bulletin 118 ("SAB 118") to address the application of U.S. GAAP in situations in which a registrant does not have the necessary information available, prepared, or analyzed (including computations) in reasonable detail to complete the accounting for certain income tax effects of the Tax Cuts and Jobs Act, or (“the Tax Act”), which was signed into law on December 22, 2017. In March 2018, the FASB issued ASU No. 2018-05, "Income Taxes (Topic 740): Amendments to SEC Paragraphs Pursuant to SEC Staff Accounting Bulletin No. 118 (SEC Update)," which amended ASC 740 to incorporate the requirements of SAB 118. The Company recorded the provisional tax impacts of the Tax Act in the fourth quarter of 2017. During the first quarter of 2018, the Company did not receive any additional information regarding these provisional calculations. As a result, the Company continues to anticipate finalizing its analysis in connection with the completion of its tax return for 2017 to be filed in 2018. (2) Acquisitions Keystyle Data Solutions, Inc. On March 30, 2018, the Company acquired 100% of the outstanding shareholder interests in Keystyle Data Solutions, Inc. (“Keystyle”) a privately owned software company based in North America, which provides payroll and human resources software and implementation services for customers who primarily participate in the construction industry, for total consideration of up to $8.6 million. Of the total consideration, $6.1 million of the purchase price was paid at closing, and $2.5 million of the purchase price will vest to the selling shareholders in annual installments over a two-year period from the acquisition date, subject to such shareholders' compliance with certain employment conditions. Of the $2.5 million, approximately $1.0 million is payable after one year and approximately $1.5 million is payable after two years following the acquisition date. These remaining installments will be recorded as a component of general and administrative expense ratably over the respective installment period. The 6

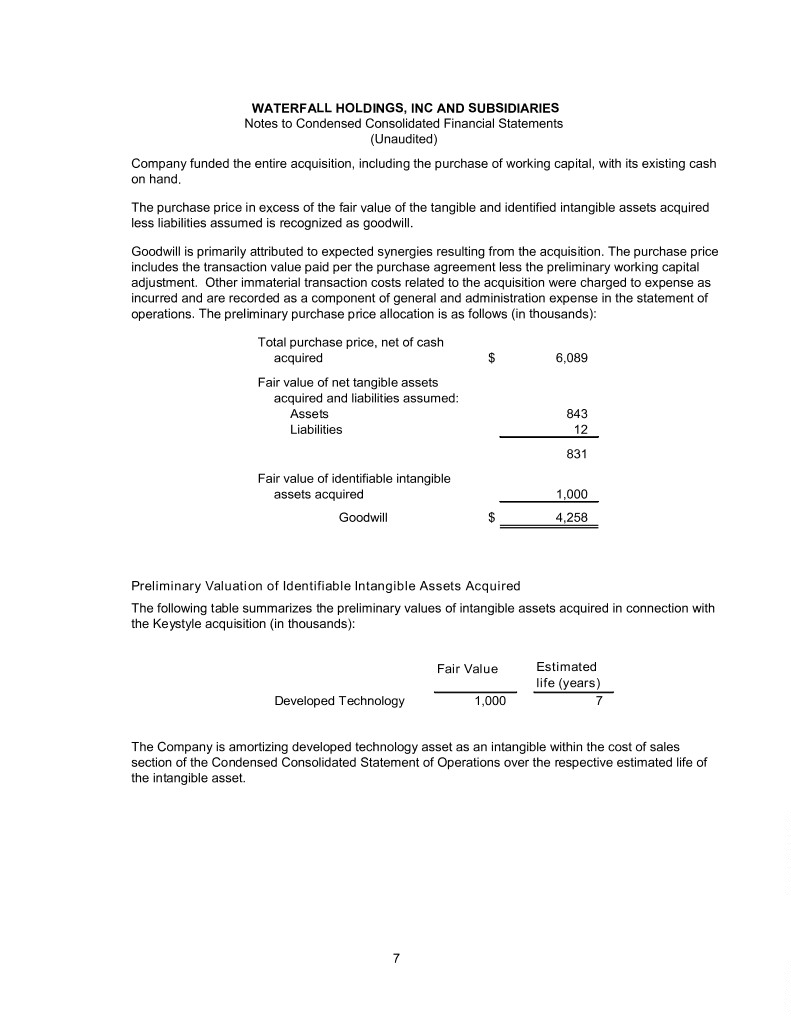

WATERFALL HOLDINGS, INC AND SUBSIDIARIES Notes to Condensed Consolidated Financial Statements (Unaudited) Company funded the entire acquisition, including the purchase of working capital, with its existing cash on hand. The purchase price in excess of the fair value of the tangible and identified intangible assets acquired less liabilities assumed is recognized as goodwill. Goodwill is primarily attributed to expected synergies resulting from the acquisition. The purchase price includes the transaction value paid per the purchase agreement less the preliminary working capital adjustment. Other immaterial transaction costs related to the acquisition were charged to expense as incurred and are recorded as a component of general and administration expense in the statement of operations. The preliminary purchase price allocation is as follows (in thousands): Total purchase price, net of cash acquired $ 6,089 Fair value of net tangible assets acquired and liabilities assumed: Assets 843 Liabilities 12 831 Fair value of identifiable intangible assets acquired 1,000 Goodwill $ 4,258 Preliminary Valuation of Identifiable Intangible Assets Acquired The following table summarizes the preliminary values of intangible assets acquired in connection with the Keystyle acquisition (in thousands): Fair Value Estimated life (years) Developed Technology 1,000 7 The Company is amortizing developed technology asset as an intangible within the cost of sales section of the Condensed Consolidated Statement of Operations over the respective estimated life of the intangible asset. 7

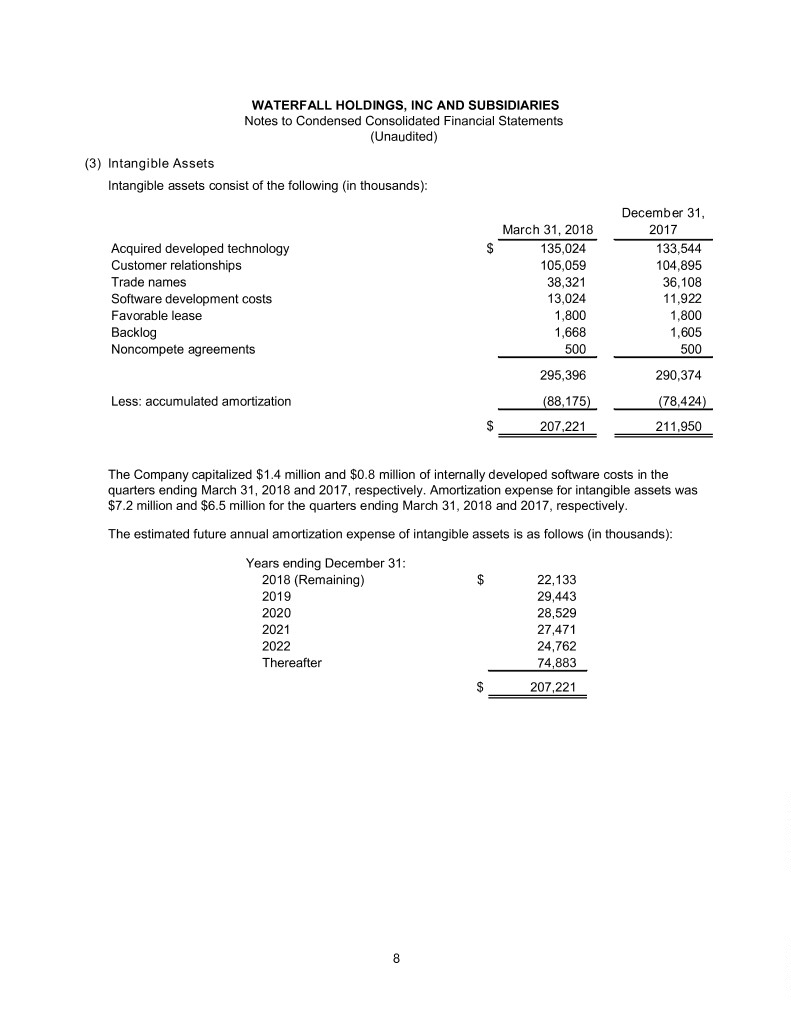

WATERFALL HOLDINGS, INC AND SUBSIDIARIES Notes to Condensed Consolidated Financial Statements (Unaudited) (3) Intangible Assets Intangible assets consist of the following (in thousands): December 31, March 31, 2018 2017 Acquired developed technology $ 135,024 133,544 Customer relationships 105,059 104,895 Trade names 38,321 36,108 Software development costs 13,024 11,922 Favorable lease 1,800 1,800 Backlog 1,668 1,605 Noncompete agreements 500 500 295,396 290,374 Less: accumulated amortization (88,175) (78,424) $ 207,221 211,950 The Company capitalized $1.4 million and $0.8 million of internally developed software costs in the quarters ending March 31, 2018 and 2017, respectively. Amortization expense for intangible assets was $7.2 million and $6.5 million for the quarters ending March 31, 2018 and 2017, respectively. The estimated future annual amortization expense of intangible assets is as follows (in thousands): Years ending December 31: 2018 (Remaining) $ 22,133 2019 29,443 2020 28,529 2021 27,471 2022 24,762 Thereafter 74,883 $ 207,221 8

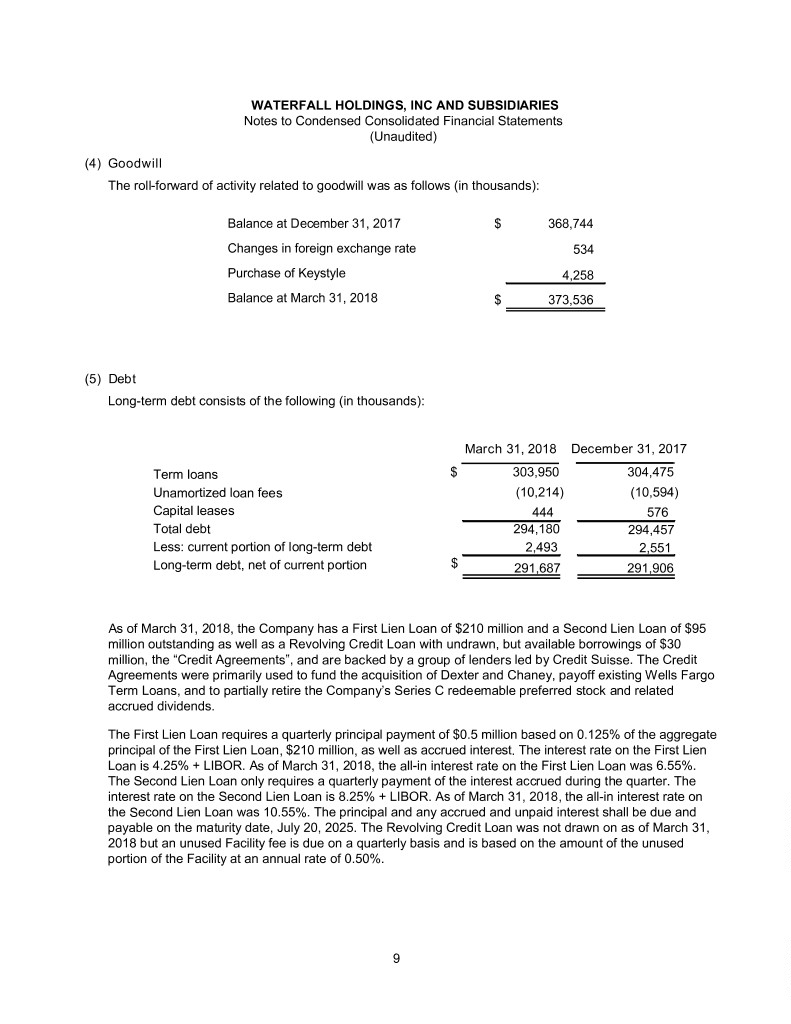

WATERFALL HOLDINGS, INC AND SUBSIDIARIES Notes to Condensed Consolidated Financial Statements (Unaudited) (4) Goodwill The roll-forward of activity related to goodwill was as follows (in thousands): Balance at December 31, 2017 $ 368,744 Changes in foreign exchange rate 534 Purchase of Keystyle 4,258 Balance at March 31, 2018 $ 373,536 (5) Debt Long-term debt consists of the following (in thousands): March 31, 2018 December 31, 2017 Term loans $ 303,950 304,475 Unamortized loan fees (10,214) (10,594) Capital leases 444 576 Total debt 294,180 294,457 Less: current portion of long-term debt 2,493 2,551 Long-term debt, net of current portion $ 291,687 291,906 As of March 31, 2018, the Company has a First Lien Loan of $210 million and a Second Lien Loan of $95 million outstanding as well as a Revolving Credit Loan with undrawn, but available borrowings of $30 million, the “Credit Agreements”, and are backed by a group of lenders led by Credit Suisse. The Credit Agreements were primarily used to fund the acquisition of Dexter and Chaney, payoff existing Wells Fargo Term Loans, and to partially retire the Company’s Series C redeemable preferred stock and related accrued dividends. The First Lien Loan requires a quarterly principal payment of $0.5 million based on 0.125% of the aggregate principal of the First Lien Loan, $210 million, as well as accrued interest. The interest rate on the First Lien Loan is 4.25% + LIBOR. As of March 31, 2018, the all-in interest rate on the First Lien Loan was 6.55%. The Second Lien Loan only requires a quarterly payment of the interest accrued during the quarter. The interest rate on the Second Lien Loan is 8.25% + LIBOR. As of March 31, 2018, the all-in interest rate on the Second Lien Loan was 10.55%. The principal and any accrued and unpaid interest shall be due and payable on the maturity date, July 20, 2025. The Revolving Credit Loan was not drawn on as of March 31, 2018 but an unused Facility fee is due on a quarterly basis and is based on the amount of the unused portion of the Facility at an annual rate of 0.50%. 9

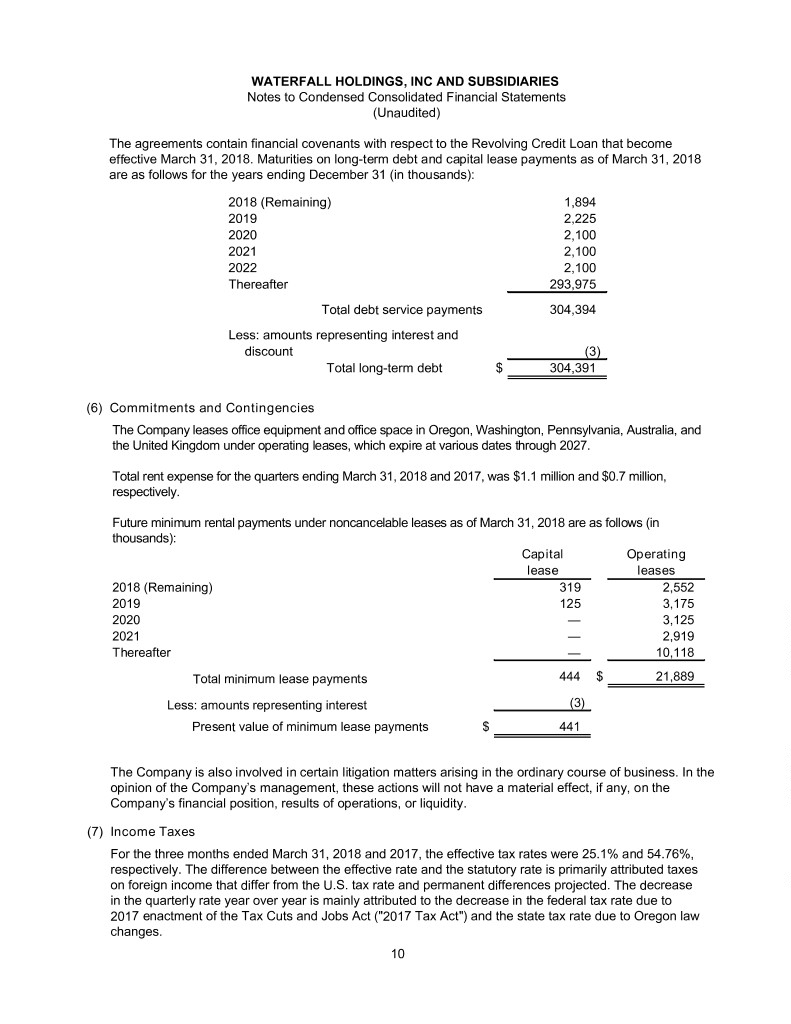

WATERFALL HOLDINGS, INC AND SUBSIDIARIES Notes to Condensed Consolidated Financial Statements (Unaudited) The agreements contain financial covenants with respect to the Revolving Credit Loan that become effective March 31, 2018. Maturities on long-term debt and capital lease payments as of March 31, 2018 are as follows for the years ending December 31 (in thousands): 2018 (Remaining) 1,894 2019 2,225 2020 2,100 2021 2,100 2022 2,100 Thereafter 293,975 Total debt service payments 304,394 Less: amounts representing interest and discount (3) Total long-term debt $ 304,391 (6) Commitments and Contingencies The Company leases office equipment and office space in Oregon, Washington, Pennsylvania, Australia, and the United Kingdom under operating leases, which expire at various dates through 2027. Total rent expense for the quarters ending March 31, 2018 and 2017, was $1.1 million and $0.7 million, respectively. Future minimum rental payments under noncancelable leases as of March 31, 2018 are as follows (in thousands): Capital Operating lease leases 2018 (Remaining) 319 2,552 2019 125 3,175 2020 — 3,125 2021 — 2,919 Thereafter — 10,118 Total minimum lease payments 444 $ 21,889 Less: amounts representing interest (3) Present value of minimum lease payments $ 441 The Company is also involved in certain litigation matters arising in the ordinary course of business. In the opinion of the Company’s management, these actions will not have a material effect, if any, on the Company’s financial position, results of operations, or liquidity. (7) Income Taxes For the three months ended March 31, 2018 and 2017, the effective tax rates were 25.1% and 54.76%, respectively. The difference between the effective rate and the statutory rate is primarily attributed taxes on foreign income that differ from the U.S. tax rate and permanent differences projected. The decrease in the quarterly rate year over year is mainly attributed to the decrease in the federal tax rate due to 2017 enactment of the Tax Cuts and Jobs Act ("2017 Tax Act") and the state tax rate due to Oregon law changes. 10

WATERFALL HOLDINGS, INC AND SUBSIDIARIES Notes to Condensed Consolidated Financial Statements (Unaudited) The Company recognizes the effect of income tax positions only if those positions are “more likely than not” of being sustained. As of March 31, 2018, the Company has $1.6 million, of unrecognized tax benefits. Interest and penalties accrued on unrecognized tax benefits are recorded as tax expense within the condensed consolidated financial statements. The Company does not expect a significant increase or decrease to the total amounts of unrecognized tax benefits within the next twelve months. The Company and its subsidiaries file US federal income tax returns and various state, local and foreign income tax returns. At March 31, 2018, the Company’s statues of limitations are open for all federal and state years filed after the year ended December 31, 2013 and 2012, respectively. Net operating loss and credit carryforwards from all years are subject to examination and adjustments for the three years following the year in which the carryforwards are utilized. The Company is not currently under Internal Revenue Service or state examination. In December 2017, the Tax Act introduced significant changes to U.S. income tax law. Effective 2018, the Tax Act reduced the U.S. statutory tax rate from 35% to 21% and created new taxes on certain foreign- sourced earnings. However, due to the current year loss projected in the US and the full valuation allowance against the loss, the tax law changes have no material impact on the overall effective rate. Due to the timing of the enactment and the complexity involved in applying the provisions of the 2017 Tax Act, the Company made reasonable estimates of the effects and recorded provisional amounts in its financial statements as of December 31, 2017. As the Company collects and prepares necessary data, and interpret the 2017 Tax Act and any additional guidance issued by the U.S. Treasury Department, the Internal Revenue Service, and other standard-setting bodies, the Company may make adjustments to the provisional amounts. Those adjustments may materially affect the Company’s provision for income taxes and effective tax rate in the period in which the adjustments are made. The accounting for the tax effects of the Tax Act will be completed later in 2018. (8) Restructuring In January 2017, the Company decided to better balance its professional services workforce with anticipated demand. The Company announced in March 2017 that in connection with its plan, it would terminate approximately 25 employees and partially shut down one of its satellite offices. The employees were eligible for separation benefits upon their termination. In 2017, the Company recorded $1.0 million of expense associated with the planned employee terminations and office closure. All costs related to this restructuring were included in General and Administrative expenses in the statement of operations in 2017. In September 2017, the Company adopted a plan to integrate the newly acquired Dexter & Chaney business and to continue to drive improvements and efficiencies in the Company’s existing operations. The Company announced in October 2017 that in connection with its plan, it would terminate approximately 80 employees and close an office located in the United Kingdom and an office located in the United States. The employees were eligible for separation benefits upon their termination. In the quarter ending March 31, 2018 and the year ending December 31, 2017, the Company recorded $0.3 and $2.0 million, respectively, of one-time charges, recorded in General and Administrative expenses in the statement of operations, associated with the planned employee terminations. In the quarter ending March 31, 2018, the Company settled $0.3 million of the costs associated with the planned employee terminations. At March 31, 2018, liabilities of $1.7 million related to the 2017 restructuring activities were included in accrued expenses and $0.1 million were included in deferred rent. 11

WATERFALL HOLDINGS, INC AND SUBSIDIARIES Notes to Condensed Consolidated Financial Statements (Unaudited) (9) Related Party Transactions On May 5, 2014, the Company entered into an Advisory Agreement with Bain Capital Partners, LLC, (“Bain”) which will expire in 2024, for which Bain would provide general business advisory services to the Company for an annual fee of $0.5 million and to cover travel and other cost reimbursements. The Advisory Agreement was amended on December 29, 2016, to provide for an annual fee of $1.0 million starting January 1, 2017. The amounts paid to Bain for the quarters ending March 31, 2018 and 2017, were $0.5 million in advisory fees. (10) Subsequent Events The Company has evaluated subsequent events from the balance sheet date through June 15, 2018, the date at which the financial statements were available to be issued. On April 23, 2018, The Company entered into a definitive agreement with Trimble Inc., (“Trimble”) wherein Trimble would acquire the Company in an all-cash transaction valued at $1.2 billion. The transaction closed on July 2, 2018. 12