Attached files

| file | filename |

|---|---|

| 8-K - 8-K - SPIRIT REALTY CAPITAL, INC. | investorpresentation8k.htm |

Investor Presentation SEPTEMBER 2018

Disclaimer This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 and other federal securities laws. These forward-looking statements can be identified by the use of words such as “expect,” “plan,” "will," “estimate,” “project,” “intend,” “believe,” “guidance,” and other similar expressions that do not relate to historical matters. These forward-looking statements are subject to known and unknown risks and uncertainties that can cause actual results to differ materially from those currently anticipated due to a number of factors, which include, but are not limited to, our continued ability to source new investments, risks associated with using debt and equity financing to fund our business activities (including refinancing and interest rate risks, changes in interest rates and/or credit spreads, changes in the price of our common shares, and conditions of the equity and debt capital markets, generally), unknown liabilities acquired in connection with acquired properties or interests in real-estate related entities, general risks affecting the real estate industry and local real estate markets (including, without limitation, the market value of our properties, the inability to enter into or renew leases at favorable rates, portfolio occupancy varying from our expectations, dependence on tenants’ financial condition and operating performance, and competition from other developers, owners and operators of real estate), the financial performance of our retail tenants and the demand for retail space, particularly with respect to challenges being experienced by general merchandise retailers, potential fluctuations in the consumer price index, risks associated with our failure to maintain our status as a REIT under the Internal Revenue Code of 1986, as amended, and other additional risks discussed in our most recent filings with the Securities and Exchange Commission. We expressly disclaim any responsibility to update or revise forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law. This presentation shall not constitute an offer to sell or the solicitation of an offer to buy securities nor shall there be any sale of any securities in any state in which such solicitation or sale would be unlawful prior to registration or qualification of these securities under the laws of any such state. Certain information contained herein is preliminary and subject to change and may be superseded in its entirety by further updated materials. We do not make any representation as to the accuracy or completeness of the information contained herein. Certain data set forth herein has been obtained from third parties, the accuracy of which we have not independently verified. This information is not intended to provide and should not be relied upon for accounting, legal or tax advice or investment recommendations. You should consult your own counsel, tax, accountant, regulatory and other advisors as to such matters. 2

Snapshot1 Key Market Data Portfolio Overview Operational Metrics EQUITY MARKET CAPITALIZATION2 CONTRACTUAL RENT3 OCCUPIED SQF OCCUPANCY $3.6BN $363M 26.3M 99.6% 2 SAME STORE SALES ENTERPRISE VALUE PROPERTIES NOI MARGIN 1,512 GROWTH $5.6BN 250 TENANTS 1.5% 98% INDUSTRIES DIVIDEND YIELD2 32 5.9% Unencumbered Portfolio 43% 50% OF RENT FROM OF RENT FROM 78.9% PUBLICLY OWNED IG TENANTS OF RENT IS UNENCUMBERED Investment Grade Rated TENANTS S&P BBB- Tenant Concentration $3.9BN Moody’s TOP 10 TOP 20 UNENCUMBERED ASSETS Baa3 Fitch 26% 40% 8.5% BBB- SECURED DEBT TO GROSS ASSETS 1: Snapshot portfolio information is as of June 30, 2018. 2: Based on share price as of September 6, 2018. 3: Annualized contractual rent for the month of June 30, 2018. 3 Please see Appendix at the back of this presentation for Reporting Definitions, Explanations and Non-GAAP Reconciliations.

Strategy 1 2 3 4 5 Operational Continuous Steady Organic rent Conservative excellence portfolio quality and accretive growth balance sheet improvement acquisitions maintenance Improve cost of capital and provide predictable earnings and dividend growth 4

Operational Platform Experience, focus, communication and discipline Finance and Accounting Robust and experienced teams covering each key discipline Asset Acquisitions Management Constant communication and connectivity across departments provides critical information flow Credit and for decision making Research Credit and research focus guides capital allocation decisions Closing Property Management 5

Asset Allocation Tools $600MM C-Stores $500MM Health and Fitness2 $400MM Drug Stores / PharmaciesQSR Industrial Movie Theatres $300MM Casual Dining Grocery2 $200MM Specialty Retail Medical Office Home Improvement 2 Home Furnishings Entertainment Car Washes Wholesale Clubs $100MM Auto Service Sporting Goods Dollar Stores Auto Parts Education General Merchandise2 Auto Dealers2 Office Supplies Data Center Travel Plaza Building Materials Consumer Electronics Professional Services Pet Supplies & Service $0MM Apparel Spirit’s Heat Map Spirit’s Efficient Frontier Spirit’s Property Ranking Model is research driven and is used to actively manage analyzes real estate quality, focuses investments on and balance concentrations, industry strength and tenant internet resistant industries resulting in informed capital credit metrics, providing critical that are positioned to grow allocation decisions insight for all acquisition and over time disposition decision making 1: Porter’s 5 Forces includes competition, substitution, barriers to entry, supplier dynamic and buyer dynamic. Please refer to Michael E. Porter, “Competitive Strategy: Techniques for Analyzing Industries and Competitors. Note: Real Estate Investment as of 2Q. Highlighted industries in green include acquisitions closed and under LOI for the remainder of the year. 6 Please see Appendix at the back of this presentation for Reporting Definitions, Explanations and Non-GAAP Reconciliations.

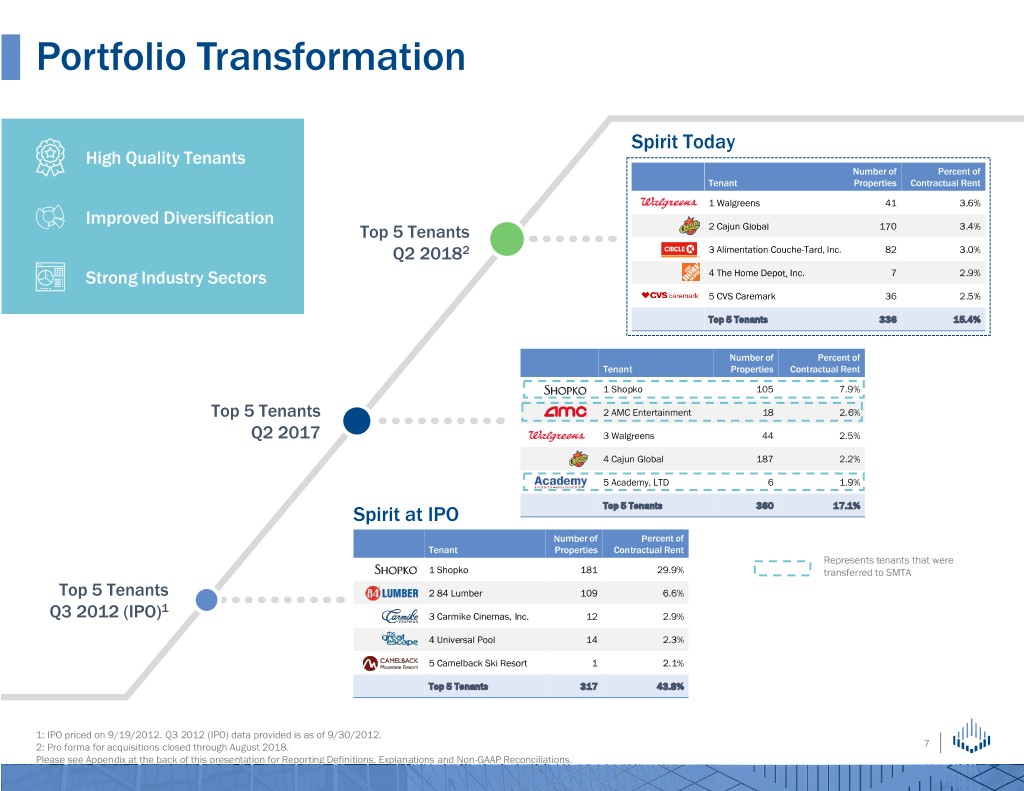

Portfolio Transformation Spirit Today High Quality Tenants Number of Percent of Tenant Properties Contractual Rent 1 Walgreens 41 3.6% Improved Diversification Top 5 Tenants 2 Cajun Global 170 3.4% Q2 20182 3 Alimentation Couche-Tard, Inc. 82 3.0% Strong Industry Sectors 4 The Home Depot, Inc. 7 2.9% 5 CVS Caremark 36 2.5% Top 5 Tenants 336 15.4% Number of Percent of Tenant Properties Contractual Rent 1 Shopko 105 7.9% Top 5 Tenants 2 AMC Entertainment 18 2.6% Q2 2017 3 Walgreens 44 2.5% 4 Cajun Global 187 2.2% 5 Academy, LTD 6 1.9% Spirit at IPO Top 5 Tenants 360 17.1% Number of Percent of Tenant Properties Contractual Rent Represents tenants that were 1 Shopko 181 29.9% transferred to SMTA Top 5 Tenants 2 84 Lumber 109 6.6% 1 Q3 2012 (IPO) 3 Carmike Cinemas, Inc. 12 2.9% 4 Universal Pool 14 2.3% 5 Camelback Ski Resort 1 2.1% Top 5 Tenants 317 43.8% 1: IPO priced on 9/19/2012. Q3 2012 (IPO) data provided is as of 9/30/2012. 2: Pro forma for acquisitions closed through August 2018. 7 Please see Appendix at the back of this presentation for Reporting Definitions, Explanations and Non-GAAP Reconciliations.

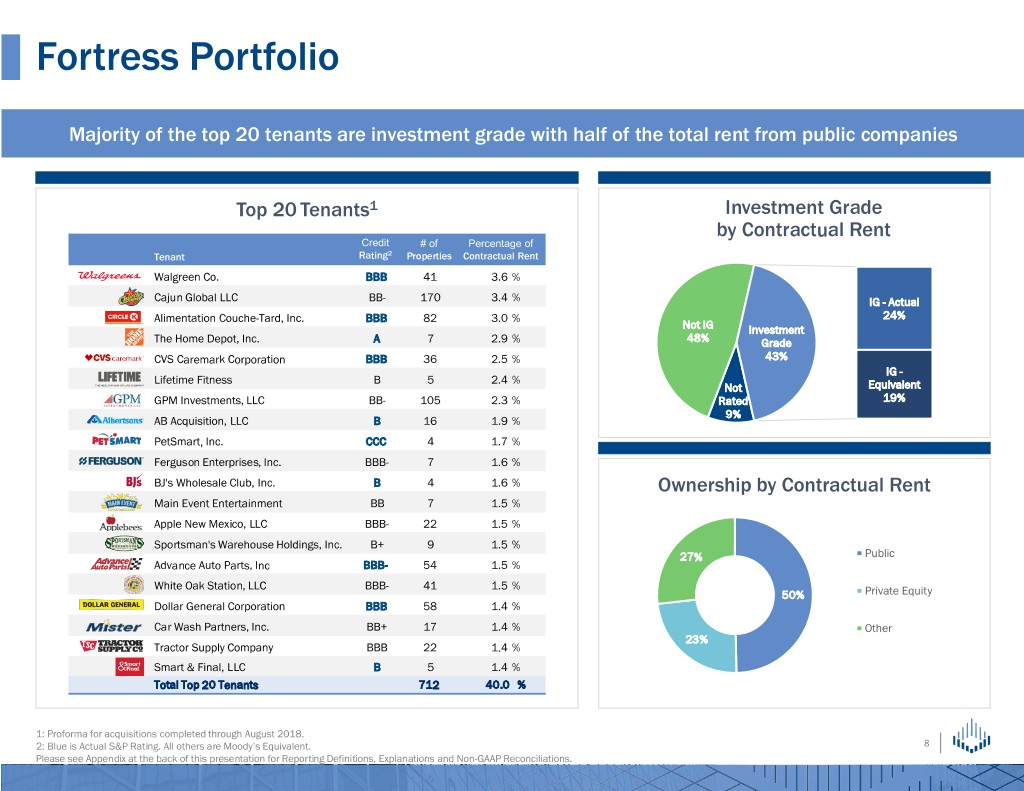

Fortress Portfolio Majority of the top 20 tenants are investment grade with half of the total rent from public companies Top 20 Tenants1 Investment Grade by Contractual Rent Credit # of Percentage of Tenant Rating2 Properties Contractual Rent Walgreen Co. BBB 41 3.6 % Cajun Global LLC BB- 170 3.4 % IG - Actual Alimentation Couche-Tard, Inc. BBB 82 3.0 % 24% Not IG Investment The Home Depot, Inc. A 7 2.9 % 48% Grade CVS Caremark Corporation BBB 36 2.5 % 43% IG - Lifetime Fitness B 5 2.4 % Not Equivalent GPM Investments, LLC BB- 105 2.3 % Rated 19% 9% AB Acquisition, LLC B 16 1.9 % PetSmart, Inc. CCC 4 1.7 % Ferguson Enterprises, Inc. BBB- 7 1.6 % BJ's Wholesale Club, Inc. B 4 1.6 % Ownership by Contractual Rent Main Event Entertainment BB 7 1.5 % Apple New Mexico, LLC BBB- 22 1.5 % Sportsman's Warehouse Holdings, Inc. B+ 9 1.5 % 27% Public Advance Auto Parts, Inc BBB- 54 1.5 % White Oak Station, LLC BBB- 41 1.5 % 50% Private Equity Dollar General Corporation BBB 58 1.4 % Car Wash Partners, Inc. BB+ 17 1.4 % Other 23% Tractor Supply Company BBB 22 1.4 % Smart & Final, LLC B 5 1.4 % Total Top 20 Tenants 712 40.0 % 1: Proforma for acquisitions completed through August 2018. 2: Blue is Actual S&P Rating. All others are Moody’s Equivalent. 8 Please see Appendix at the back of this presentation for Reporting Definitions, Explanations and Non-GAAP Reconciliations.

Diversified Industries Contractual Spirit Contractual Spirit Industry1 Rent % Heat Map Industry1 Rent % Heat Map C-Stores 11.0 % Grocery 5.5 % Health and Fitness 8.6 % Home Improvement 3.5 % QSR 7.7 % Specialty Retail 3.4 % Drug Stores / Pharmacies 7.3 % Home Furnishings 2.7 % Casual Dining 6.2 % Warehouse Clubs / Supercenters 2.2 % Movie Theatres 6.0 % Sporting Goods 2.0 % Medical Office 4.1 % Dollar Stores 1.8 % Entertainment 3.1 % Auto Parts 1.5 % Car Washes 2.5 % Auto Dealers 1.4 % Auto Service 2.2 % General Merchandise 1.2 % Education 1.7 % Office Supplies 1.0 % Travel Plaza 0.9 % Professional Services 0.5 % Building Materials 0.9 % Total Service Industries 61.8 % Consumer Electronics 0.7 % Pet Supplies & Service 0.3 % Industrial 8.2 % Apparel 0.2 % Data Centers and Other 1.7 % Total Traditional Retail 28.3 % 1: Industry categories excludes multi-tenant properties. Industrial and Data Centers are classified by asset type while other industries reflect underlying tenant operations. Contractual Rent is as of June 30, 2018 adjusted for acquisitions completed through August 2018. 9 Please see Appendix at the back of this presentation for Reporting Definitions, Explanations and Non-GAAP Reconciliations.

Comparison Versus Peers Spirit’s portfolio and industry mix is comparable to select peers Spirit Top 10 Tenant Overlap with Peers1 Spirit Top 10 Industry Overlap with Peers1 3.6% 11.0% Walgreen Co. 6.6% C-Stores 10.8% 18.8% 3.0% 8.6% Alimentation Couche-Tard, Inc. 2.4% Health and Fitness 7.5% 3.1% 5.6% 8.2% 2.9% Industrial 12.7% The Home Depot, Inc. 1.2% 7.7% 2.5% QSR 5.5% CVS Caremark Corporation 1.9% 7.9% 7.3% 2.4% Drug Stores / Pharmacies 10.3% Lifetime Fitness 1.9% 1.9% 6.2% Casual Dining 3.5% 2.3% 12.1% GPM Investments, LLC 1.7% 3.7% 6.0% Movie Theaters 5.6% 1.6% 4.8% BJ's Wholesale Club, Inc. 2.1% 2.4% 5.5% Grocery 5.0% 1.4% Dollar General Corporation 3.8% 4.1% Medical Office 2.3% 1.4% Car Wash Partners, Inc. 3.5% 4.1% Home Improvement 3.0% 1.7% SRC O NNN SRC O NNN 1: Proforma for acquisitions completed through August 2018 (SRC). As of June 30, 2018 for O and NNN. 10 Please see Appendix at the back of this presentation for Reporting Definitions, Explanations and Non-GAAP Reconciliations.

Recent Acquisition Activity 2H acquisitions have a weighted average lease term of 17 years and average annual rent bumps of 1.8% Tenant # of Properties Purchase Price ($MM) Cap Rate Cash Economic Lifetime Fitness1 5 $ 141.5 6.4% 7.7% Alaska Club 5 60.6 7.5% 8.7% Kohl’s 1 10.6 8.0% 8.0% CircusTrix 1 5.0 8.0% 8.9% Total Recently Closed 12 $ 217.7 6.8% 8.0% Remaining 2H Pipeline 6 $ 74.7 8.0% 9.0% Total 2H Acquisitions 18 $ 292.4 7.1% 8.3% 1: Lifetime transaction of 6.4% does not include 10% rental escalation in 2020. Pro forma for the rent escalation the cash cap rate increases to 7.0%. 11 Please see Appendix at the back of this presentation for Reporting Definitions, Explanations and Non-GAAP Reconciliations.:

2018 Acquisitions Total acquisitions and development of $354MM at a 7.2% cash cap rate Represents $10MM investment $600MM 2018 Acquisitions: Entertainment: C-Stores $500MM . 1 Shooter’s World2 . 2 CircusTrix2 ) . 1 Topgolf2 1 $400MM Drug Stores / General Merchandise: Pharmacies QSR Industrial Movie Theatres . 1 Kohl’s $300MM Casual Dining Health and Fitness: Real Real Estate Investment Grocery . 5 Alaska Club Gyms Health and Fitness Spirit’s . 5 Lifetime Fitness Gyms $200MM Specialty Medical (Spirit’s $ Investment within categoryeach 2 Home Improvement . Retail Office 1 Vasa Fitness Entertainment Home Furnishings Auto Dealers: Car Washes Wholesale Clubs $100MM Auto Service 2 Sporting Goods Dollar Stores . 1 Insurance Auto Auto Parts Education Auto Dealers Office SuppliesGeneral Merchandise Data Center Travel Plaza Building Materials Grocery: Consumer Electronics Professional Services Pet Supplies & Service 2 $0MM Apparel . 1 Fry’s Risk Adjusted Return Based On Spirit’s Heat Map 1: Industry categories excludes multi-tenant properties. Industrial and Data Centers are classified by asset type while other industries reflect underlying tenant operations. Real Estate Investment is as of June 30, 2018. 2: Represents transactions in pipeline that are expected to close in 2H 2018. 12 Please see Appendix at the back of this presentation for Reporting Definitions, Explanations and Non-GAAP Reconciliations.

2018 YTD Dispositions Pursuing accretive asset recycling in the fourth quarter through targeted asset sales Represents $10MM investment $600MM 2018 YTD Dispositions: C-Stores $500MM C-Store: $7.8MM Industrial: $3.1MM ) QSR: $1.0MM 1 $400MM Drug Stores / PharmaciesQSR Industrial Multi-Tenant: $12.4MM Movie Theatres Vacant: $18.2MM $300MM Casual Dining Real Real Estate Investment Grocery Health and Fitness Spirit’s $200MM Specialty Medical (Spirit’s $ Investment within categoryeach Home Improvement Retail Office Entertainment Home Furnishings Car Washes Wholesale Clubs $100MM Auto Service Sporting Goods Dollar Stores Auto Parts Education General Merchandise Auto Dealers Data Center Office Supplies Travel Plaza Building Materials Consumer Electronics Professional Services Pet Supplies & Service $0MM Apparel Risk Adjusted Return Based On Spirit’s Heat Map 1: Industry categories excludes multi-tenant properties. Industrial and Data Centers are classified by asset type while other industries reflect underlying tenant operations. Real Estate Investment is as of June 30, 2018. 13 Please see Appendix at the back of this presentation for Reporting Definitions, Explanations and Non-GAAP Reconciliations.

Balance Sheet Improvement Credit and Financial Metrics Q3 2012 (IPO)1 Change Q2 2017 Change Q2 2018 Adjusted Debt / 7.3x (0.7x) 6.6x (3.0x) 3.6x Annualized Adjusted EBITDAre2 Fixed Charge Coverage Ratio2 1.8x 1.8x 3.6x (0.3x) 3.3x Unencumbered Assets / <1% 60% 79% Total Real Estate Investments 60% 19% Unsecured Debt Percentage <1% 45% 45% 30% 75% Unencumbered Assets $0.0Bn $4.9Bn $4.9Bn ($1.0Bn) $3.9Bn Weighted Average Stated Interest Rate 5.9% (1.6%) 4.3% (0.4%) 3.9% Credit Ratings (Moody’s/S&P/Fitch)3 Caa1/B/NA Baa3/BBB-/BBB- Baa3/BBB-/BBB- All three rating agencies improved outlook post spin 1: IPO priced on 9/19/2012. Q3 2012 (IPO) data provided is as of 9/30/2012. 2: Adjusted EBITDAre and Fixed Charge Coverage Ratio include two months of SMTA operations. 3: A securities rating is not a recommendation to buy, sell or hold securities and may be subject to revision or withdrawal at any time. 14 Please see Appendix at the back of this presentation for Reporting Definitions, Explanations and Non-GAAP Reconciliations.

Rating Agencies Outlook Updates BBB-, Positive Outlook (June 1, 2018) Baa3, Stable (June 20, 2018) BBB-, Positive Outlook (August 17, 2018) 15

Appendix Spirit Tools and Additional Information

Spirit’s Heat Map Focus on industries that are less vulnerable to competitive forces and technological disruption Worse Technological Disruption Better 100 50 0 0 Wholesale Clubs Better EntertainmentData Centers Building Materials Industrial 1 Pet Supplies Home Improvement Specialty Retail Drug Stores Medical Office Travel Plaza Manufacturing Movie TheatersEducation Home Furnishings Grocery 50 Auto Parts Dollar Stores Auto Service Sporting Goods Auto Dealers C-Stores QSR Casual Dining Professional Services Porter’s Five Forces Five Porter’s General Merchandise (50% Competition, 20% Barriers to Entry, 10% Suppliers,Substitutions) Buyers and Office Supplies Car Washes Health and Fitness Apparel Consumer Electronics 100 Worse 1: Porter’s 5 Forces includes competition, substitution, barriers to entry, supplier dynamic and buyer dynamic. Please refer to Michael E. Porter, “Competitive Strategy: Techniques for Analyzing 17 Industries and Competitors”.

Spirit’s Efficient Frontier1 Recent acquisitions are aligned with Spirit’s Heat Map $600MM C-Stores $500MM Health and Fitness2 $400MM Drug Stores / PharmaciesQSR Industrial Movie Theatres $300MM Casual Dining Grocery2 $200MM Spirit’s Real Estate Real Spirit’s Estate Investment Specialty Retail Medical Office Home Improvement 2 Home Furnishings Entertainment Car Washes (Spirit’seach category) $ Investment within $100MM Auto ServiceWholesale Clubs Sporting Goods Dollar Stores Auto Parts Education General Merchandise2 Auto Dealers2 Office Supplies Data Center Travel Plaza Building Materials Consumer Electronics Professional Services Pet Supplies & Service $0MM Apparel Risk Adjusted Return Based On Spirit’s Heat Map 1: Industry categories excludes multi-tenant properties. Industrial and Data Centers are classified by asset type while other industries reflect underlying tenant operations. Real Estate Investment is as of June 30, 2018 including acquisitions completed through August 2018 and under LOI for the remainder of the year. 2: Industries highlighted in green represent acquisitions closed through August and under LOI for the remainder of the year. 18 Please see Appendix at the back of this presentation for Reporting Definitions, Explanations and Non-GAAP Reconciliations.

Spirit’s Property Ranking Model • Asset level ranking of all properties using twelve criteria • Individual weightings applied to each criteria to arrive at overall ranking 16% • All rankings updated annually • All acquisition candidates ranked; key ingredient in Investment 41% Committee decision process 21% 59% 64% • Weightings favor real estate centric criteria • Heavier weighting on objective criteria • Incorporates Spirit Heat Map via Industry criteria • Ranking is loss given default oriented vs. expected default frequency Real Estate Lease Tenant Objective Subjective • Ranking is not a binary decision making metric Criteria Weighting Formula Pre-OH Unit FCC 5 FCC > 4 = 10; FCC< 1 = 0; FCC between 4 and 1 scaled by 0.4 Pre-OH ML FCC 5 FCC > 4 = 10; FCC< 1 = 0; FCC between 4 and 1 scaled by 0.3 Corp. FCC 5 FCC > 4 = 10; FCC< 1 = 0; FCC between 4 and 1 scaled by 0.3 Lease Term 14 Term > 15 yrs = 10; > 11 yrs = 7; > 5 yrs = 4; < 5 yrs = 0 Lease Type 2 Absolute NNN = 10; NN = 0 Rent bump 5 Annual bump = 10; Other fixed bumps = 7; Flat = 0 5-mile HH Income 10 > $100k = 10; < $100k scaled by $9.3k 5-mile Population 15 > 300k = 10; > 150k = 9; > 100k = 8; > 75k = 7; > 50k = 6; between 40k and 10k scaled by 8k; < 10k = 0 Contract/Dark Rent 20 < -50% = 10; < -20% = 8; < 20% = 5; < 40% = 3; < 100% = 0; < 200% = -3; > 200% = -5 RE Score 15 Subjective; based on trade area, co-tenancy, access, visibility, proximity to demand generators State 5 Historic and projected Population growth, Employment growth, Unemployment rate, GDP growth, CNBC 2017 Business Survey Industry 1 Adjustment based on Spirit Heat Map Total 100 19 Please see Appendix at the back of this presentation for Reporting Definitions, Explanations and Non-GAAP Reconciliations.

Relationship with Spirit MTA REIT Alignment of Interest SRC provides property management, special servicing and asset management services to SMTA for total annual fees of approximately $27.7MM Asset Management Agreement Term Termination Fee Promote . 3-year initial term . 1.75x Property Management and . 10.0% above 10.0% TSR hurdle Asset Management fees for 12 full . 15.0% above 12.5% TSR hurdle calendar months preceding termination date . 20.0% above 15.0% TSR hurdle 20

Appendix Select Industry Views

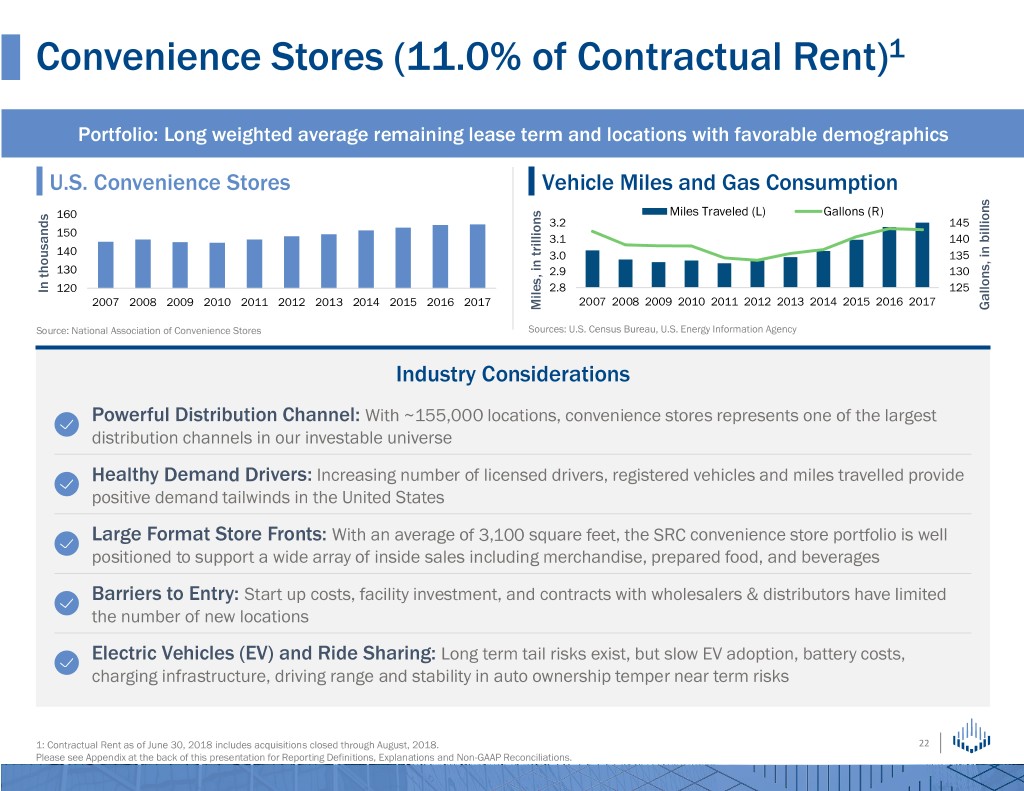

Convenience Stores (11.0% of Contractual Rent)1 Portfolio: Long weighted average remaining lease term and locations with favorable demographics U.S. Convenience Stores Vehicle Miles and Gas Consumption 160 Miles Traveled (L) Gallons (R) 3.2 145 150 3.1 140 140 3.0 135 130 2.9 130 In thousands 120 2.8 125 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 Miles, in in Miles, trillions billions in Gallons, Source: National Association of Convenience Stores Sources: U.S. Census Bureau, U.S. Energy Information Agency Industry Considerations Powerful Distribution Channel: With ~155,000 locations, convenience stores represents one of the largest distribution channels in our investable universe Healthy Demand Drivers: Increasing number of licensed drivers, registered vehicles and miles travelled provide positive demand tailwinds in the United States Large Format Store Fronts: With an average of 3,100 square feet, the SRC convenience store portfolio is well positioned to support a wide array of inside sales including merchandise, prepared food, and beverages Barriers to Entry: Start up costs, facility investment, and contracts with wholesalers & distributors have limited the number of new locations Electric Vehicles (EV) and Ride Sharing: Long term tail risks exist, but slow EV adoption, battery costs, charging infrastructure, driving range and stability in auto ownership temper near term risks 1: Contractual Rent as of June 30, 2018 includes acquisitions closed through August, 2018. 22 Please see Appendix at the back of this presentation for Reporting Definitions, Explanations and Non-GAAP Reconciliations.

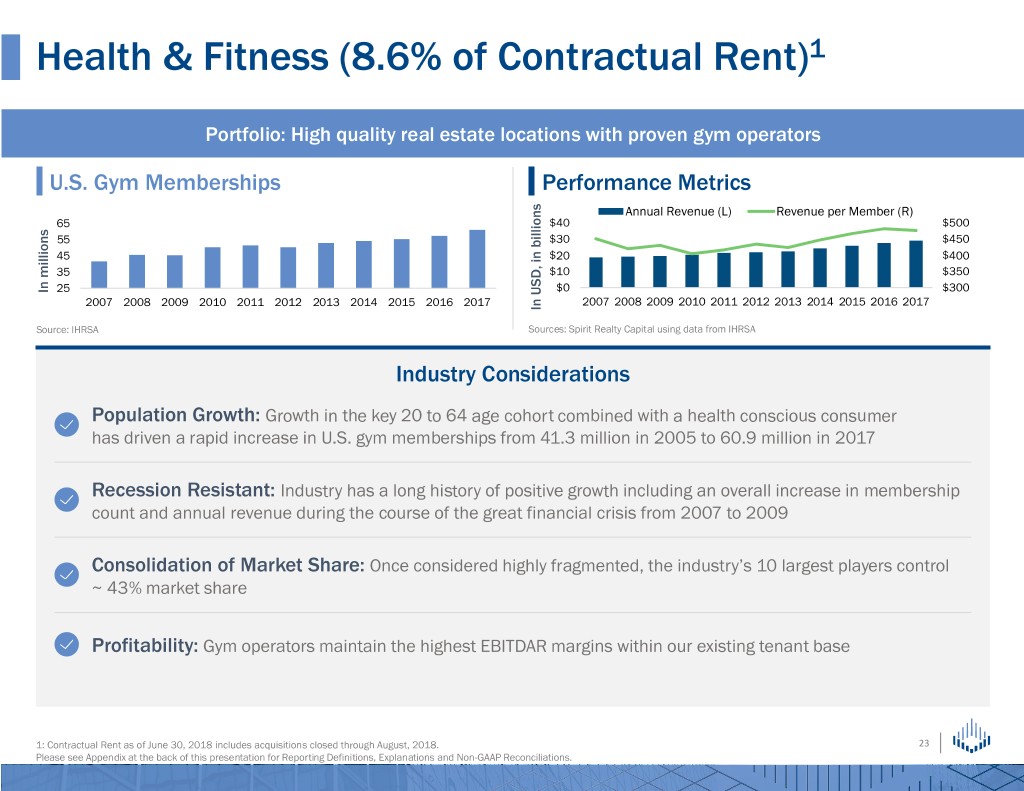

Health & Fitness (8.6% of Contractual Rent)1 Portfolio: High quality real estate locations with proven gym operators U.S. Gym Memberships Performance Metrics Annual Revenue (L) Revenue per Member (R) 65 $40 $500 55 $30 $450 45 $20 $400 35 $10 $350 In millions In 25 $0 $300 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 In USD, in in In USD, billions Source: IHRSA Sources: Spirit Realty Capital using data from IHRSA Industry Considerations Population Growth: Growth in the key 20 to 64 age cohort combined with a health conscious consumer has driven a rapid increase in U.S. gym memberships from 41.3 million in 2005 to 60.9 million in 2017 Recession Resistant: Industry has a long history of positive growth including an overall increase in membership count and annual revenue during the course of the great financial crisis from 2007 to 2009 Consolidation of Market Share: Once considered highly fragmented, the industry’s 10 largest players control ~ 43% market share Profitability: Gym operators maintain the highest EBITDAR margins within our existing tenant base 1: Contractual Rent as of June 30, 2018 includes acquisitions closed through August, 2018. 23 Please see Appendix at the back of this presentation for Reporting Definitions, Explanations and Non-GAAP Reconciliations.

Quick Service Restaurants (7.7% of Contractual Rent)1 Portfolio: Concentration of regional and national brands combined with healthy unit level financial performance QSR Revenue Grocery V. QSR Sales Index (2007 = 100) $300 160 Grocery QSR $250 145 $200 130 $150 115 In billions In $100 100 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 Source: U.S. Census Bureau Source: Spirit Realty Capital using data from the U.S. Census Bureau Industry Considerations Convenience and Price: Rising housing and health care costs make quick serve restaurants a compelling value choice for consumers’ food options resulting in consistent demand across various economic cycles Size and Growth: Quick service restaurants is a ~$300 billion industry and is one of the fastest growing sectors with top line revenue increasing by a compounded average growth rate of 4.7% from 2007 to 2017 Food Away From Home: Lifestyle shifts and busy schedules has resulted in a secular trend of food away from home E-commerce Resistant: Low risk of internet disintermediation and the future of delivery should benefit the QSR industry as most food is eaten away from the restaurant 1: Contractual Rent as of June 30, 2018 includes acquisitions closed through August, 2018. 24 Please see Appendix at the back of this presentation for Reporting Definitions, Explanations and Non-GAAP Reconciliations.

Drug Stores/Pharmacies (7.3% of Contractual Rent)1 Portfolio: Heavy concentration of investment grade tenants U.S. Population: Aged 65 and over Prescription Market Share Mail Service 60 16% 50 12% 40 8% 30 4% In millions In 20 0% 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2020F 2010 2011 2012 2013 2014 2015 2016 2017 Source: American Fact Finder Source: IQVIA Industry Considerations Aging Population: The aging of America provides a powerful industry tailwind as the number of prescriptions and age are highly correlated Size and Scale: Prescription drug business is estimated to be a $400 billion total addressable market and is dominated by three large incumbents Significant Barriers to Entry: 1) Regulatory 2) Long-standing relationships with customers, drug manufactures, wholesale distributors and pharmacy benefit managers 3) Mergers & strategic partnerships have created an interwoven supply chain and preferred pharmacy networks Mail Order: Lacking economic incentive and face-to-face interaction, it has proven difficult to change consumer behavior leading to steady declines in mail order market share: from 14.7% in 2010 to 7.8% in 2017 1: Contractual Rent as of June 30, 2018 includes acquisitions closed through August, 2018. 25 Please see Appendix at the back of this presentation for Reporting Definitions, Explanations and Non-GAAP Reconciliations.

Casual Dining Restaurants (6.2% of Contractual Rent)1 Portfolio: High quality real estate combined with healthy unit level financial performance Casual Dining Revenue Grocery V. Casual Dining Sales Index (2007 = 100) $300 Grocery Casual Dining 160 $250 140 $200 120 $150 100 In billions In $100 80 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 Source: U.S. Census Bureau Sources: Spirit Realty Capital using data from the U.S. Census Bureau Industry Considerations Income and Employment: Since the beginning of 2009, the U.S. economy has added more than 12.6 million jobs pushing the national unemployment rate to below 4.0% leading to expectations for higher wage growth Size and Growth: Casual dining restaurants is a ~$300 billion industry and is one of the fastest growing sectors with top line revenue increasing by a compounded average growth rate of 4.3% from 2007 to 2017 Food Away From Home: Lifestyle shifts and busy schedules has resulted in a secular trend of food away from home Experiential and Social: Atmosphere, connectivity and service provide an experiential retail landscape 1: Contractual Rent as of June 30, 2018 includes acquisitions closed through August, 2018. 26 Please see Appendix at the back of this presentation for Reporting Definitions, Explanations and Non-GAAP Reconciliations.

Movie Theaters (6.0% of Contractual Rent)1 Portfolio: High quality real estate and favorable demographics Box Office Receipts Average Ticket Price and Concession Revenue2 U.S & Canada $12 $10 Ticket Price Concession Revenue $9 $8 $6 $6 $4 $3 $2 In billions In $0 $0 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 Source: Motion Picture Association of America Source: Motion Picture Association of America, Bloomberg Industry Considerations Stability: 31 consecutive years of more than one billion tickets sold Pricing Power: 23 consecutive years of higher average ticket price and expanded food and beverage options are driving steady concession revenue growth Flexible Business Model: In response to increasing digital home entertainment options, theater owners have added luxury seating, enhanced food & beverage menus, subscription pricing models, and exploring new verticals (bowling, laser tag, virtual reality arcades, e-gaming, merchandise sales and dine-in) Content: Quality content from studios (Black Panther, Avengers, Incredibles 2) has driven traffic leading to a 4.6% increase in box office receipts in 1H18 verse 1H2017 Brick & Mortar: Recent acquisition discussion between digital streaming services (NFLX, AMZN) and independent movie theater circuit illustrates the need for physical real estate 1: Contractual Rent as of June 30, 2018 includes acquisitions closed through August, 2018. 2: Concession revenue is per person and calculated as an average of AMC, CNK, Regal 27 Please see Appendix at the back of this presentation for Reporting Definitions, Explanations and Non-GAAP Reconciliations.

Appendix Non-GAAP Reconciliation and Reporting Definitions

Reporting Definitions Adjusted Debt represents interest bearing debt (reported in Adjusted Debt to Annualized Adjusted EBITDAre is a impairment write-downs of depreciated property and accordance with GAAP) adjusted to exclude unamortized debt supplemental non-GAAP financial measure we use to evaluate investments in unconsolidated real estate ventures, plus discount/premium, deferred financing costs, cash and cash the level of borrowed capital being used to increase the adjustments to reflect the Company’s share of EBITDAre of equivalents and cash reserves on deposit with lenders as potential return of our real estate investments and a proxy for unconsolidated real estate ventures, additional security. By excluding these amounts, the result a measure we believe is used by many lenders and ratings Economic Yield is calculated by dividing the contractual cash provides an estimate of the contractual amount of borrowed agencies to evaluate our ability to repay and service our debt rent, including fixed rent escalations and/or cash increases capital to be repaid, net of cash available to repay it. We obligations over time. We believe this ratio is a beneficial determined by CPI (increases calculated using a month to believe this calculation constitutes a beneficial supplemental disclosure to investors as a supplemental means of month historical CPI index) by the initial lease term, expressed non-GAAP financial disclosure to investors in understanding evaluating our ability to meet obligations senior to those of as a percentage of the Gross Investment. our financial condition. A reconciliation of interest bearing our equity holders. Our computation of this ratio may differ debt (reported in accordance with GAAP) to Adjusted Debt is from the methodology used by other equity REITs and, Enterprise Value represents Total Market Capitalization less included in the Appendix found at the end of this presentation therefore, may not be comparable to such other REITs. cash and cash equivalents and reserves on deposit with lenders as of the date indicated. Adjusted EBITDAre represents EBITDAre, or earnings before Capitalization Rate represents the Annualized Cash Rents on interest, taxes, depreciation and amortization for real estate, the date of a property disposition divided by the gross sales Equity Market Capitalization is calculated by multiplying the modified to include other adjustments to GAAP net income price. For Multi-Tenant properties, non-reimbursable property number of shares outstanding by the closing share price of (loss) for transaction costs, severance charges, real estate costs are deducted from the Annualized Cash Rents prior to the Company’s common stock as of the date indicated. acquisition costs, and debt transactions and other items that computing the disposition Capitalization Rate. we do not consider to be indicative of our on-going operating Fixed Charge Coverage Ratio (FCCR) is the ratio of Annualized Contractual Rent represents monthly contractual cash rent performance. We focus our business plans to enable us to Adjusted EBITDA to Annualized Fixed Charges, a ratio derived and earned income from direct financing leases, excluding sustain increasing shareholder value. Accordingly, we believe from non-GAAP measures that we use to evaluate our liquidity percentage rents, from our Owned Properties recognized that excluding these items, which are not key drivers of our and ability to obtain financing. Fixed charges consist of during the final month of the reporting period, adjusted to investment decisions and may cause short-term fluctuations interest expense, reported in accordance with GAAP, less non- exclude amounts received from properties sold during that in net income, provides a useful supplemental measure to cash interest expense. Annualized Fixed Charges is calculated period and adjusted to include a full month of contractual rent investors and analysts in assessing the net earnings by multiplying fixed charges for the quarter by four. for properties acquired during that period. We use Contractual contribution of our real estate portfolio. Because these Rent when calculating certain metrics that are useful to measures do not represent net income (loss) that is computed evaluate portfolio credit, asset type, industry and geographic in accordance with GAAP, they should not be considered diversity and to manage risk. alternatives to net income (loss) or as an indicator of financial performance. A reconciliation of net income (loss) attributable Convertible Notes are the $402.5 million convertible notes of to common stockholders (computed in accordance with GAAP) the Company due in 2019 and the $345.0 million convertible to EBITDAre and Adjusted EBITDAre is included in the notes of the Company due in 2021, together. These liabilities Appendix found at the end of this presentation. are discussed in greater detail in our financial statements and the notes thereto included in our periodic reports filed with Annualized Adjusted EBITDAre is calculated by multiplying the SEC. Adjusted EBITDAre of a quarter by four. Our computation of Adjusted EBITDAre and Annualized Adjusted EBITDAre may EBITDAre is a non-GAAP financial measure and is computed in differ from the methodology used by other equity REITs to accordance with standards established by NAREIT. EBITDAre calculate these measures and, therefore, may not be is defined as net income (loss) (computed in accordance with comparable to such other REITs. GAAP), plus interest expense, plus income tax expense (if any), plus depreciation and amortization, plus (minus) losses and gains on the disposition of depreciated property, plus 29

Reporting Definitions Funds from Operations (FFO) and Adjusted Funds from Operations considered as an alternative to net income (determined in at any point during the measurement period, construction in progress, (AFFO) We calculate FFO in accordance with the standards accordance with GAAP) as a performance measure. and properties where contractual rent was fully or partially reserved in established by the National Association of Real Estate Investment either the current or prior measurement period. Trusts (NAREIT). FFO represents net income (loss) attributable to GAAP Generally Accepted Accounting Principles in the United States. common stockholders (computed in accordance with GAAP), Senior Unsecured Notes refers to the $300 million aggregate Gross Assets is defined as Total Assets plus Accumulated principal amount of 4.450% senior unsecured notes due 2026. excluding real estate-related depreciation and amortization, Depreciation and Amortization. impairment charges and net (gains) losses from property dispositions. Spirit Heat Map is an analysis of potential tenant industries across FFO is a supplemental non-GAAP financial measure. We use FFO as a Gross Investment represents the gross acquisition cost including the Porter’s Five Forces and technological disruption to identify tenant supplemental performance measure because we believe that FFO is contracted purchase price and related capitalized transaction costs. industries which have good fundamentals for future performance. beneficial to investors as a starting point in measuring our operational performance. Specifically, in excluding real estate-related Leakage is calculated by subtracting tenant reimbursement income Spirit Property Ranking Model A proprietary model used annually to depreciation and amortization, gains and losses from property from property costs. rank properties across twelve factors and weightings consisting of dispositions and impairment charges, which do not relate to or are Net Asset Value (NAV) We believe disclosing information frequently both real estate quality scores and credit underwriting criteria, in not indicative of operating performance, FFO provides a performance used in the calculation of NAV is useful to investors and because it order to benchmark property quality, identify asset recycling measure that, when compared year over year, captures trends in enables and facilitates calculation of a metric frequently used by our opportunities and to enhance acquisition or disposition decisions. occupancy rates, rental rates and operating costs. We also believe management as one method to estimate the fair value of our Tenant represents the legal entity ultimately responsible for that, as a widely recognized measure of the performance of equity business. The assessment of the fair value of our business is REITs, FFO will be used by investors as a basis to compare our obligations under the lease agreement or an affiliated entity. Other subjective in that it involves estimates and assumptions and can be tenants may operate the same or similar business concept or brand. operating performance with that of other equity REITs. However, calculated using various methods. Therefore, we have presented because FFO excludes depreciation and amortization and does not certain information regarding our financial and operating results, as Term Loan refers to a $420.0 million unsecured term facility which capture the changes in the value of our properties that result from well as our assets and liabilities that we believe are important in includes an accordion feature which allows the facility to be increased use or market conditions, all of which have real economic effects and calculating our NAV, but have not presented any specific methodology to up to $600.0 million, subject to obtaining additional lender could materially impact our results from operations, the utility of FFO nor provided any guidance on the assumptions or estimates that commitments. Borrowings may be repaid without premium or penalty, as a measure of our performance is limited. In addition, other equity should be used in the calculation of NAV. The components of NAV do and may be re-borrowed within 30 days up to the then available REITs may not calculate FFO as we do, and, accordingly, our FFO may not consider the potential changes in the value of assets, the loan commitment. not be comparable to such other equity REITs’ FFO. Accordingly, collectability of rents or other receivable obligations, or the value FFO should be considered only as a supplement to net income associated with our operating platform. Total Debt represents the sum of the principal balances outstanding (loss) attributable to common stockholders as a measure of on interest-bearing debt on the Company’s balance sheet as of the our performance. NOI Margin represents annualized Contractual Rent less annualized date indicated. Leakage divided by annualized Contractual Rent. AFFO is a non-GAAP financial measure of operating performance used Total Market Capitalization represents Equity Market Capitalization by many companies in the REIT industry. We adjust FFO to eliminate Net Book Value represents the Real Estate Investment value net of plus Total Debt as of the date indicated. the impact of certain items that we believe are not indicative of our accumulated depreciation. core operating performance, including restructuring and divestiture Unencumbered Assets represents the assets in our portfolio that are costs, other G&A costs associated with relocation of the Company's Occupancy is calculated by dividing the number of economically not subject to mortgage indebtedness, which we use to evaluate our headquarters, transactions costs associated with our spin-off, default yielding Owned Properties in the portfolio as of the measurement date potential access to capital and in our management of financial risk. interest and fees on non-recourse mortgage indebtedness, debt by the number of total Owned Properties on said date. The asset value attributed to these assets is the Real Estate Investment. extinguishment gains (losses), transaction costs incurred in Owned Properties refers to properties owned fee-simple or ground connection with the acquisition of real estate investments subject to leased by Company subsidiaries as lessee. Unsecured Debt represents components of Total Debt that are not existing leases and certain non-cash items. These certain non-cash secured by liens, mortgages or deeds of trust on Company assets. items include non-cash revenues (comprised of straight-line rents, Real Estate Investment represents the Gross Investment plus amortization of above and below market rent on our leases, improvements less impairment charges. Weighted Average Remaining Lease Term is calculated by dividing the amortization of lease incentives, amortization of net premium sum product of (a) a stated revenue or sales price component and (b) (discount) on loans receivable, provision for bad debts and Revolving Credit Facility refers to the $800 million unsecured credit the lease term for each lease by (c) the sum of the total revenue or amortization of capitalized lease transaction costs), non-cash interest facility which matures on March 31, 2019. The Revolving Credit sale price components for all leases within the sample. expense (comprised of amortization of deferred financing costs and Facility includes sublimits for swingline loans and letter of credit amortization of net debt discount/premium) and non-cash issuances. Swingline loans and letters of credit reduce availability Weighted Average Stated Interest Rate is calculated by dividing the compensation expense (stock-based compensation expense). In under the Revolving Credit Facility. The ability to borrow under the sum product of (a) coupon interest rate of each note and (b) the addition, other equity REITs may not calculate AFFO as we do, and, Revolving Credit Facility is subject to the ongoing compliance with principal balance outstanding of each note by (c) the sum of the total accordingly, our AFFO may not be comparable to such other equity customary financial covenants. principal balances outstanding for all notes in the sample. REITs’ AFFO. AFFO does not represent cash generated from operating Same Store Pool is defined as all properties owned throughout the activities determined in accordance with GAAP, is not necessarily measurement period in both the current and prior year and exclude: indicative of cash available to fund cash needs and should not be multi-tenant properties, properties that were vacant, renewed or relet 30

Non-GAAP Reconciliation Adjusted Debt, Adjusted EBITDAre, Annualized Adjusted EBITDAre Q2 2018 Fixed Charge Coverage Ratio (FCCR) Q2 2018 Revolving Credit Facility $ 346,500 Annualized Adjusted EBITDAre $ 505, 848 Team Loan, net — Interest expense 42,056 Senior Unsecured Notes, net 295,542 Less: Non-cash interest (6,262) Mortgages and notes payable, net 467,334 Preferred Stock dividends 2,588 Convertible Notes, net 722,756 Fixed charges $ 38,382 Total debt, net 1,832,132 Annualized fixed charges $ 153,528 Add / (less): Fixed Charge Coverage Ratio 3.3x Unamortized debt discount, net 20,042 Unamortized deferred financing costs 17,472 Adjusted Debt to Enterprise Value Q2 2018 Cash and cash equivalents (9,289) Adjusted Debt $ 1,841,988 Restricted cash balances held for the benefit of lenders (18,369) Enterprise value 5,440,516 Total adjustments 9,856 Adjusted Debt / Enterprise Value 33.9% Adjusted Debt $ 1,841,988 Preferred Stock at liquidation value 172,500 Unencumbered Assets to Unsecured Debt Q2 2018 Adjusted Debt + Preferred Stock $ 2,014,488 Unsecured debt: Net Income $ 17,164 Revolving Credit Facility $ 346,500 Add / (less): Term Loan — Interest 42,056 Senior Unsecured Notes 300,000 Depreciation and amortization 53,980 Convertible Notes 747,500 Income tax expense 203 Total Unsecured Debt $ 1,394,000 Realized (gains) on sales of real estate assets (722) Unencumbered Assets $ 3,869,229 Impairments on real estate assets 1,349 Unencumbered Assets / Unsecured Debt 3.5x Total adjustments 96,866 EBITDAre $ 114,030 Add / (less): Other costs in G&A associated with Spin-off 1,392 Notice Regarding Non-GAAP Financial Measures Transaction costs 16,033 In addition to U.S. GAAP financial measures, this presentation contains and may refer Real estate acquisition costs 408 to certain non-GAAP financial measures. These non-GAAP financial measures are in addition to, not a substitute for or superior to, measures of financial performance Gain on debt extinguishment (5,401) prepared in accordance with GAAP. These non-GAAP financial measures should not be Total adjustments 12,432 considered replacements for, and should be read together with, the most comparable Adjusted EBITDAre $ 126,462 GAAP financial measures. Reconciliations to the most directly comparable GAAP Annualized Adjusted EBITDAre $505,848 financial measures and statements of why management believes these measures are Adjusted Debt / Annualized Adjusted EBITDAre 3.6x useful to investors are included in this Appendix if the reconciliation is not presented on the page in which the measure is published. Adjusted Debt + Preferred / Annualized EBITDAre 4.0x 31