Attached files

| file | filename |

|---|---|

| EX-32.2 - CERTIFICATION - Future FinTech Group Inc. | f10q0618ex32-2_futurefintech.htm |

| EX-32.1 - CERTIFICATION - Future FinTech Group Inc. | f10q0618ex32-1_futurefintech.htm |

| EX-31.2 - CERTIFICATION - Future FinTech Group Inc. | f10q0618ex31-2_futurefintech.htm |

| EX-31.1 - CERTIFICATION - Future FinTech Group Inc. | f10q0618ex31-1_futurefintech.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

☒ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended June 30, 2018

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ____ to ____

Commission file number: 001-34502

| FUTURE FINTECH GROUP INC. |

| (Exact name of registrant as specified in its charter) |

| Florida | 98-0222013 | |

| (State or other jurisdiction

of incorporation or organization) |

(I.R.S. Employer Identification No.) |

23F, China Development Bank

Tower, No. 2, Gaoxin 1st Road,

Xi’an, PRC

710075

(Address of principal executive offices including zip code)

86-29-81878277

(Registrant’s telephone number, including area code)

N/A

(Former name, former address and former fiscal year, if changed since last report)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ☒ Yes ☐ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). ☒ Yes ☐ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See definitions of “large accelerated filer,” “accelerated filer” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act:

| Large accelerated filer ☐ | Accelerated filer ☐ |

| Non-accelerated filer ☐ | Smaller reporting company ☒ |

| Emerging growth company ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ☐ Yes ☒ No

| Class | Outstanding at August 16, 2018 | |

| Common Stock, $0.001 par value per share | 26,017,083 |

TABLE OF CONTENTS

| PART I. | FINANCIAL INFORMATION | 1 |

| Item 1. | Financial Statements | 1 |

| Item 2. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 20 |

| Item 3. | Quantitative and Qualitative Disclosures about Market Risk | 31 |

| Item 4. | Controls and Procedures | 31 |

| PART II. | OTHER INFORMATION | 32 |

| Item 1. | Legal Proceedings | 32 |

| Item 1A. | Risk Factors | 33 |

| Item 2. | Unregistered Sales of Equity Securities and Use of Proceeds | 33 |

| Item 3. | Defaults upon Senior Securities | 33 |

| Item 4. | Mine Safety Disclosure | 33 |

| Item 5. | Other Information | 33 |

| Item 6. | Exhibits | 33 |

| SIGNATURES | 34 | |

i

PART I. FINANCIAL INFORMATION

| Item 1. | Financial Statements |

FUTURE FINTECH GROUP INC.

CONSOLIDATED BALANCE SHEETS

| June 30, | December 31, | |||||||

| 2018 | 2017 | |||||||

| (Unaudited) | (Audited) | |||||||

| CURRENT ASSETS | ||||||||

| Cash and cash equivalents | $ | 394,108 | $ | 4,586,757 | ||||

| Accounts receivable, net of allowance of $3,081,437 as of June 30, 2018 and December 31, 2017, respectively | 10,731,008 | 17,156,130 | ||||||

| Other receivables | 38,310,134 | 36,781,068 | ||||||

| Inventories | 2,141,749 | 2,097,307 | ||||||

| Deferred tax assets | - | - | ||||||

| Advances to suppliers and other current assets | 4,377,524 | 1,437,657 | ||||||

| TOTAL CURRENT ASSETS | 55,954,523 | 62,058,919 | ||||||

| PROPERTY, PLANT AND EQUIPMENT, NET | 26,110,600 | 28,065,460 | ||||||

| LAND USE RIGHT, NET | 32,436,847 | 33,118,454 | ||||||

| OTHER LONG TERM ASSETS | 64,737,384 | 67,509,002 | ||||||

| TOTAL ASSETS | $ | 179,239,354 | $ | 190,751,835 | ||||

| LIABILITIES | ||||||||

| CURRENT LIABILITIES | ||||||||

| Accounts payable | $ | 3,520,601 | $ | 11,349,288 | ||||

| Accrued expenses | 100,191,182 | 99,910,577 | ||||||

| Income tax payable | 1,577 | - | ||||||

| Advances from customers | 4,278,489 | 655,938 | ||||||

| Short-term bank loans | 6,045,401 | 6,121,637 | ||||||

| TOTAL CURRENT LIABILITIES | 114,037,250 | 118,037,440 | ||||||

| NON-CURRENT LIABILITIES | ||||||||

| Long-term debt | 21,975,032 | 22,252,150 | ||||||

| Obligations under capital leases | 17,294,311 | 17,512,402 | ||||||

| TOTAL NON-CURRENT LIABILITIES | 39,269,343 | 39,764,552 | ||||||

| TOTAL LIABILITIES | 153,306,593 | 157,801,992 | ||||||

| EQUITY | ||||||||

| Future Fintech Group Inc., Stockholders’ equity | ||||||||

| Series B Preferred stock, $0.001 par value; 10,000,000 shares authorized; None issued and outstanding as of June 30, 2018 and December 31, 2017, respectively | - | - | ||||||

| Common stock, $0.001 par value; 60,000,000 shares authorized and 26,071,083 shares issued and outstanding as of June 30, 2018 and 8,333,333 shares authorized and 5,370,245 shares issued and outstanding as of December 31, 2017, respectively | 26,071 | 5,173 | ||||||

| Additional paid-in capital | 109,246,500 | 109,090,782 | ||||||

| Retained earnings | (8,586,590 | (2,346,689 | ||||||

| Accumulated other comprehensive loss | (93,941,687 | ) | (94,142,481 | ) | ||||

| Total Future FinTech Group Inc. stockholders’ equity | 6,744,294 | 12,606,785 | ||||||

| Non-controlling interests | 19,188,467 | 20,343,058 | ||||||

| TOTAL EQUITY | 25,932,761 | 32,949,843 | ||||||

| TOTAL LIABILITIES AND EQUITY | $ | 179,239,354 | $ | 190,751,835 | ||||

The accompanying notes are an integral part of these condensed consolidated financial statements.

| 1 |

FUTURE FINTECH GROUP INC.

CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE INCOME (LOSS)

(Unaudited)

| Three Months Ended June 30, | Six Months Ended June 30, | |||||||||||||||

| 2018 | 2017 | 2018 | 2017 | |||||||||||||

| Revenue | $ | 788,074 | $ | 2,776,872 | $ | 1,350,220 | $ | 5,735,706 | ||||||||

| Cost of goods sold | 615,390 | 1,484,129 | 1,114,950 | 3,908,349 | ||||||||||||

| Gross profit | 172,684 | 1,292,743 | 235,270 | 1,827,357 | ||||||||||||

| Operating Expenses | ||||||||||||||||

| General and administrative expenses | 3,635,465 | 3,077,013 | 6,385,310 | 5,932,342 | ||||||||||||

| Selling expenses | 13,061 | 311,078 | 106,544 | 505,957 | ||||||||||||

| Total operating expenses | 3,648,526 | 3,388,091 | 6,491,854 | 6,438,299 | ||||||||||||

| Loss from operations | (3,475,842 | ) | (2,095,348 | ) | (6,256,584 | ) | (4,610,942 | ) | ||||||||

| Other income (expense) | ||||||||||||||||

| Interest income | (1,039 | ) | 1,139 | (1,028 | ) | 2,179 | ||||||||||

| Subsidy income | - | 342,124 | - | 342,124 | ||||||||||||

| Interest expenses | (415,785 | ) | (595,313 | ) | (861,379 | ) | (626,109 | ) | ||||||||

| Other expenses | (362 | ) | (312,356 | ) | (7,377 | ) | (140,209 | ) | ||||||||

| Total other expenses | (417,186 | ) | (564,406 | ) | (869,784 | ) | (422,015 | ) | ||||||||

| Loss before income tax | (3,893,028 | ) | (2,659,754 | ) | (7,126,368 | ) | (5,032,957 | ) | ||||||||

| Income tax provision | - | 198,663 | - | 260,085 | ||||||||||||

| Net loss | (3,893,028 | ) | (2,858,417 | ) | (7,126,368 | ) | (5,293,042 | ) | ||||||||

| - | ||||||||||||||||

| Less: Net loss attributable to non-controlling interests | (444,992 | ) | (370,419 | ) | (935,977 | ) | (203,821 | ) | ||||||||

| NET LOSS ATTRIBUTABLE TO FUTURE FINTECH GROUP, INC. | (3,448,036 | ) | (2,487,998 | ) | (6,190,391 | ) | (5,089,221 | ) | ||||||||

| Discontinued Operations (Note 11) | ||||||||||||||||

| Income (loss) from discontinued operations | 61 | (48,023 | ) | (49,510 | ) | (96,708 | ) | |||||||||

| NET LOSS ATTRIBUTABLE TO FUTURE FINTECH GROUP, INC. | (3,447,975 | ) | (2,536,021 | ) | (6,239,901 | ) | (5,185,929 | ) | ||||||||

| Other comprehensive income (loss) | ||||||||||||||||

| Foreign currency translation adjustment | (2,814,865 | ) | 1,612,180 | (513,533 | ) | 2,238,236 | ||||||||||

| Comprehensive income (loss) | (6,707,832 | ) | (1,246,237 | ) | (7,689,411 | ) | (3,054,806 | ) | ||||||||

| Comprehensive income (loss) attributable to non-controlling interests | 945,046 | (618,546 | ) | 750,484 | (743,443 | ) | ||||||||||

| COMPREHENSIVE LOSS ATTRIBUTABLE TO FUTURE FINTECH GROUP, INC. | $ | (5,762,786 | ) | $ | (1,864,783 | ) | $ | (6,938,927 | ) | $ | (3,798,249 | ) | ||||

| Loss per share: | ||||||||||||||||

| Basic loss per share from continued operations | (0.23 | ) | (0.49 | ) | (0.41 | ) | (0.35 | ) | ||||||||

| Basic loss per share from discontinued operations | - | (0.01 | ) | - | - | |||||||||||

| Basic loss per share from net loss | (0.23 | ) | (0.50 | ) | (0.41 | ) | (0.35 | ) | ||||||||

| Diluted loss per share: | ||||||||||||||||

| Diluted loss per share from continued operations | (0.23 | ) | (0.49 | ) | (0.41 | ) | (0.35 | ) | ||||||||

| Diluted loss per share from discontinued operations | - | (0.01 | ) | - | - | |||||||||||

| Diluted loss per share from net income | (0.23 | ) | (0.50 | ) | (0.41 | ) | (0.35 | ) | ||||||||

| Weighted average number of shares outstanding | ||||||||||||||||

| Basic | 15,097,512 | 4,537,240 | 15,097,512 | 4,537,240 | ||||||||||||

| Diluted | 15,324,570 | 4,599,740 | 15,324,570 | 4,599,740 | ||||||||||||

The accompanying notes are an integral part of these condensed consolidated financial statements.

| 2 |

FUTURE FINTECH GROUP INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

| For the six months ended June 30, | ||||||||

| 2018 | 2017 | |||||||

| CASH FLOWS FROM OPERATING ACTIVITIES | ||||||||

| Net loss | $ | (6,239,901 | ) | $ | (5,185,929 | ) | ||

| Adjustments to reconcile net loss to net cash provided by operating activities | ||||||||

| Minority interest | 935,977 | (203,821 | ) | |||||

| Depreciation and amortization | 2,085,857 | 1,581,819 | ||||||

| Changes in operating assets and liabilities | ||||||||

| Accounts receivable | 6,425,122 | 6,954,731 | ||||||

| Other receivable | (1,600,648 | ) | (1,176,722 | ) | ||||

| Advances to suppliers and other current assets | (2,939,867 | ) | 2,946,991 | ) | ||||

| Inventories | (44,442 | ) | (606,137 | ) | ||||

| Accounts payable | (7,757,105 | ) | (4,706,261 | ) | ||||

| Accrued expenses | 301,269 | 1,254,603 | ||||||

| Income tax payable | 1,577 | (796,119 | ) | |||||

| Advances from customers | 3,622,551 | 23,322 | ||||||

Net cash (used in) provided by operating activities | (5,209,610 | ) | 86,477 | |||||

| CASH FLOWS FROM INVESTING ACTIVITIES | ||||||||

| Additions to property, plant and equipment | (1,902 | ) | (990,799 | ) | ||||

| Prepayment for other assets | - | (197,956 | ) | |||||

| Net cash used in investing activities | (1,902 | ) | (1,188,755 | ) | ||||

| CASH FLOWS FROM FINANCING ACTIVITIES | ||||||||

| Issue of common stock | 155,952 | 2,679,779 | ||||||

| Proceed of related party loans | - | 263,020 | ||||||

| Proceed of long term debt | - | 2,021,142 | ||||||

| Net cash provided by financing activities | 155,952 | 4,963,941 | ||||||

| Effect of change in exchange rate | 862,911 | (587,459 | ) | |||||

| NET (DECREASE) INCREASE IN CASH AND CASH EQUIVALENTS | (4,192,649 | ) | 3,274,204 | |||||

| Cash and cash equivalents, beginning of period | 4,586,757 | 1,143,585 | ||||||

| Cash and cash equivalents, end of period | $ | 394,108 | $ | 4,417,789 | ||||

| SUPPLEMENTAL DISCLOSURES OF CASH FLOW INFORMATION | ||||||||

| Cash paid for interest | $ | - | $ | 562,761 | ||||

| Cash paid for income taxes | $ | - | $ | 260,085 | ||||

| SUPPLEMENTARY DISCLOSURE OF SIGNIFICANT NON-CASH TRANSACTION | ||||||||

| Transferred from other assets to property, plant and equipment and construction in process | $ | - | $ | 197,956 | ||||

| Equipment acquired by capital lease | $ | - | $ | - | ||||

The accompanying notes are an integral part of these condensed consolidated financial statements.

| 3 |

FUTURE FINTECH GROUP INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

| 1. | Basis of Presentation |

The unaudited condensed consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States for interim financial information and the rules and regulations of the Securities and Exchange Commission. In the opinion of management, the unaudited financial statements have been prepared on the same basis as the annual financial statements and reflect all adjustments, which include only normal recurring adjustments, necessary to present fairly the financial position as of June 30, 2018 and the results of operations and cash flows for the periods ended June 30, 2018 and 2017. The financial data and other information disclosed in these notes to the interim financial statements related to these periods are unaudited. The results for the three months and six months ended June 30, 2018 are not necessarily indicative of the results to be expected for any subsequent periods or for the entire year ending December 31, 2018. The balance sheet at December 31, 2017 has been derived from the audited financial statements at that date.

Certain information and footnote disclosures normally included in financial statements prepared in accordance with accounting principles generally accepted in the United States have been condensed or omitted pursuant to the Securities and Exchange Commission’s rules and regulations. These unaudited financial statements should be read in conjunction with our audited financial statements and notes thereto for the year ended December 31, 2017 as included in our Annual Report on Form 10-K.

| 2. | Business Description and Significant Accounting Policies |

The principal activities of Future FinTech Group Inc. (together with our direct or indirect subsidiaries, “we,” “us,” “our” or “the Company”) consist of production and sales of fruit juice concentrates, fruit juice beverages and other fruit-related products in the People’s Republic of China (“PRC”, or “China”), and overseas markets. We are also currently in the process of transitioning our business into the following, most of which are still in the developmental stage: the design, development, testing, deployment and maintenance of a blockchain-based Globally Shared Shopping Mall and other related software systems; the operation of a supply chain, logistics and trading business for fruit juice products, foods and other consumer and agricultural products; bulk agricultural products spot trading business and financial technology businesses, including software development and information services for the financial leasing and project finance industries through intelligent investment advisory and blockchain technology; related asset and equity investment management; and the development and operation of a blockchain platform for cryptocurrency conversion, payment and other services (“DCON”).

The Company’s activities are principally conducted by subsidiaries operating in the PRC.

| 4 |

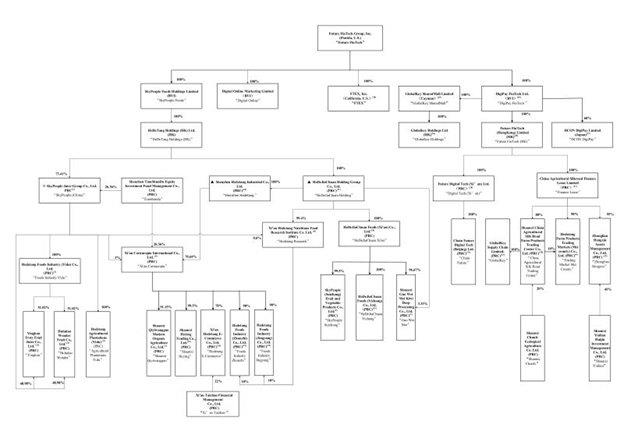

Organizational Structure

Our current organizational structure is set forth in the diagram below:

(1) Xi’an Qinmei Food Co., Ltd., an entity not affiliated with the Company, owns the remaining 8.85% of the equity interest in Shaanxi Qiyiwangguo.

(2) Formerly known as Shaanxi Tianren Organic Food Co. Ltd.

(3) Hedetang Foods Industry (Yidu) Co., Ltd. (“Foods Industry Yidu”), formerly known as SkyPeople Juice Group Yidu Orange Products Co., Ltd., was established on March 13, 2012. Its scope of business includes deep processing and sales of oranges.

(4) Hedetang Agricultural Plantations (Yidu) Co., Ltd., formerly known as Hedetang Fruit Juice Beverages (Yidu) Co., Ltd., was established on March 13, 2012. Its scope of business includes the planting, acquisition and sales of vegetables, fruits, flowers, farm products; fresh fruit picking; research, training and promotion of planting and breeding technology.

(5) SkyPeople (Suizhong) Fruit and Vegetable Products Co., Ltd. was established on April 26, 2012. Its scope of business includes the initial processing, quick-freezing and sales of agricultural products and related by-products.

(6) Hedetang Farm Products Trading Market (Mei County) Co., Ltd., formerly known as SkyPeople Juice Group (Mei County) Kiwi Fruit and Farm Products Trading Market Co., Ltd. (“Kiwi Fruit & Farm Products”) was established on April 19, 2013. Its scope of business includes preliminary processing of agricultural and subsidiary products, establishment of trading markets for agriculture products, and similar activities.

(7) Shaanxi Guo Wei Mei Kiwi Deep Processing Co., Ltd. was established on April 19, 2013. Its scope of business includes producing kiwi fruit juice, kiwi puree, cider beverages, and similar products.

| 5 |

(8) Xi’an Hedetang Fruit Juice Beverages Co., Ltd. (“Xi’an Hedetang”) was established on March 31, 2014. Its scope of business includes the production and sales of fruit juice beverages. On August 10, 2017, it changed its name to Xi’an Hedetang Nutritious Food Research Institute Co., Ltd.

(9) Xi’an Cornucopia International Co., Ltd. (“Cornucopia”) was established on July 2, 2014. Its scope of business includes the retail and wholesale of pre-packaged food.

(10) Shaanxi Fruitee Fun Co., Ltd. (“Fruitee Fun”) was established on July 3, 2014. Its scope of business includes retail and wholesale of pre-packaged food. Shaanxi Fruitee Fun Co., Ltd. (also known as Shaanxi Guoweiduomei Beverage Co., Limited) changed its name to Hedetang Foods Industry (Xi’an) Co., Ltd. (“Foods Industry Xi’an”) on July 5, 2016. On June 6, 2017, it again changed its name to HedeJiachuan Foods (Xi’an) Co. Ltd.

(11) Hedetang Holding Group Co., Ltd., formerly known as Hedetang Holding Co., Ltd., (“Hedetang Holding”) was established on July 21, 2014. Its scope of business includes corporate investment consulting, corporate management consulting, corporate image design and corporate marketing planning. On June 14, 2017, it changed its name to HedeJiachuan Holding Group Co. Ltd.

(12) The Company acquired Huludao Wonder Co. Ltd. (“Huludao”) on September 10, 2008. Its scope of business mainly includes the manufacture and sale of concentrated fruit juice and fruit juice beverages.

(13) The Company acquired Yingkou Trusty Fruits Co., Ltd. (“Yingkou”) on November 25, 2009. Its scope of business mainly includes the manufacture of concentrated fruit juice.

(14) Hedetang Foods Industry (Jingyang) Co., Ltd. (“Foods Industry Jingyang”) was established on September 7, 2016. Its scope of business includes processing, storage and sales of farm products, fruits, tea and snacks; as well as research and promotion of processing technology of organic agriculture, fruit industry and agricultural products.

(15) HedeJiachuan Foods (Yichang) Co. Ltd (“Hedejiachuan Yichang”), formerly known as Hedetang Farm Products Trading Market (Yidu) Co., Ltd., and Hedetang Foods Industry (Yichang) Co., Ltd, was established on March 23, 2016. Its scope of business includes construction, operation, and property management of a farm products trading market; e-commerce services for farm products; and construction and operation management of an e-commerce information platform.

(16) Xi’an Hedetang E-Commerce Co., Ltd. was established on April 21, 2016. Its scope of business includes online sales of pre-packaged foods and bulk foods.

(17) The Company acquired Hedetang Foods (China) Co., Ltd. (“Hedetang Foods China”) on May 18, 2016 through the acquisition of DigiPay FinTech Limited (formerly known as Belking Foods Holdings Group Co., Ltd.), the 100% indirect shareholder of Hedetang Foods China, on the same date. It changed its name to China Agricultural Silkroad Finance Lease Ltd. on May 24, 2018. The scope of business of China Agricultural Silkroad Finance Lease Ltd. includes finance leasing; purchasing leased property domestically and abroad; commercial factoring related to its main businesses; residual value processing related to the leasing business and similar activities.

(18) Hedetang Agricultural Plantations (Mei County) Co., Ltd. was established on September 2, 2016. Its scope of business includes the planting, acquisition and sales of vegetables, fruits, flowers, Chinese herbal medicine, and farm products; fresh fruit picking; research, training and promotion of planting and breeding technology, development and training for E-commerce and online sales of agricultural and sideline products. On September 6, 2017, it changed its name to Shaanxi China Agricultural Silk Road Farm Products Trading Center Co., Ltd.

(19) Hedetang Foods Industry (Zhouzhi) Co., Ltd. (“Foods Industry Zhouzhi”) was established on November 29, 2016. Its scope of business includes production, processing and sales of kiwifruit wine, juice, puree and beverages; storage and sales of fresh fruits; and import and export of a variety of products and technology.

| 6 |

(20) Future FinTech (HongKong) Limited (“FintTech HK”), formerly known as Future World Trading (Hong Kong) and SkyPeople International Trading (HK) Limited, was first established on July 27, 2016. It mainly engages in the import and export of food products.

(21) GlobalKey Supply Chain Limited, formerly known as Shaanxi Quangoutong E-commerce Inc., was acquired on May 27, 2017. Its main business scope includes computer hardware and software development and sales, electronic products and communication equipment, computer network engineering design, business information consultation, online sales and online marketing, and investment management.

(22) Shaanxi Heying Trading Co. Ltd was established on December 17, 2009. Its main business scope includes the sales of pre-packaged food and bulk food; import and export of goods and technology; food technology research and development; business management and consulting, and corporate planning services.

(23) Zhonglian Hengxin Assets Management Co., Ltd. (“Zhonglian Hengxin”) was established in Xi’an in 2017. Its main business scope includes asset management (except for financial, securities, futures and other restricted items); asset acquisition, asset disposal and asset operation (except for financial, securities, futures and other restricted items); planning and advisory for corporate restructure and merger and acquisition; equity and real estate investment (no public offerings, restricted to investment through assets of the company itself ); financial business process outsourcing entrusted by financial institutions; financial information technology outsourcing entrusted by financial institutions; financial knowledge process outsourcing. Businesses that require approval by government agencies shall only operate within the scope of such approval.

(24) Shenzhen Hedetang Industrial Co., Ltd. (“Shenzhen Hedetang”) was established on September 29, 2017. Its main business scope includes industrial projects (specific items to be declared separately); domestic trade; import and export businesses.

(25) DigiPay FinTech Limited (“DigiPay FinTech”), formerly known as Belking Foods Holdings Group Co., Ltd., was established on May 3, 2016.

(26) GlobalKey Holdings Limited (“GlobalKey Holdings”), formerly known as Hedejiachuan (HK) Holdings Limited, and SkyPeople Foods International Holdings (HK) Limited and later Hedetang Holdings (Asia-Pacific) Limited, was established on January 13, 2012. It was established mainly to engage in the import and export of food products.

(27) DCON DigiPay Limited (“DCON DigiPay”) was established on February 5, 2018 in Tokyo, Japan. Its main business scope includes the development and marketing of computer software, asset management consulting, and business consulting.

(28) Future Digital FinTech (Xi’an) Ltd. (“FinTech (Xi’an)”) was established on February 9, 2018 in Xi’an. Its main business scope includes software development and marketing, information consulting services, and financial information technology development. This company will focus its business on acting as an accelerator for blockchain projects and it plans to provide basic support including technical support, whitepaper editing, solution design and financial management services for its clients. Its business will also include training and cultivating technicians for blockchain projects, providing consultation services regarding cryptocurrency exchanges and tokens listing matters, as well as marketing-related services. Its named was changed to Future Digital Tech (Xi’an) Ltd. on May 24, 2018.

(29) GlobalKey SharedMall Limited (“GlobalKey SharedMall”) was established on March 6, 2018 in the Cayman Islands. Its main business scope includes online trading platform for fresh fruits and juices by using blockchain technology.

(30) FTEX, Inc. (“FTEX”) was established on March 15, 2018 in the State of California. It currently does not have business operations.

(31) Chain Future Digital Tech (Beijing) Ltd, (“Chain Future”) was established on July 10, 2018. Its main business scope includes technical services and technology transfer, development, promotion and consultation; wholesale of computer, software and auxiliary equipment, electronic products, and other related products.

| 7 |

Principles of Consolidation

Our consolidated financial statements include the accounts of the Company and its subsidiaries. All material intercompany accounts and transactions have been eliminated in consolidation.

The condensed consolidated financial statements are prepared in accordance with U.S. GAAP. This basis differs from that used in the statutory accounts of SkyPeople (China), Hedetang Food (China), Hedetang Holding, Huludao Wonder, Xi’an Cornucopia, Xi’an Hedetang Juice Beverages, Yingkou, Shaanxi Qiyiwangguo, Hedetang E-commerce, SkyPeople Suizhong, Agricultural Plantation Mei Counting, Food Industry Yidu, Food Industry Jingyang, Guo Wei Mei, Agriculture Plantation Yidu, Trading Market Yidu, Trading Market Mei County and Hedetang Plantations, which were prepared in accordance with the accounting principles and relevant financial regulations applicable to enterprises in the PRC. All necessary adjustments have been made to present the financial statements in accordance with U.S. GAAP.

Uses of estimates in the preparation of financial statements

The Company’s condensed consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America and this requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the condensed consolidated financial statements and reported amounts of revenue and expenses during the reporting period. The significant areas requiring the use of management estimates include, but not limited to, the allowance for doubtful accounts receivable, estimated useful life and residual value of property, plant and equipment, provision for staff benefit, recognition and measurement of deferred income taxes and valuation allowance for deferred tax assets. Although these estimates are based on management’s knowledge of current events and actions management may undertake in the future, actual results may ultimately differ from those estimates.

Shipping and Handling Costs

Shipping and handling amounts billed to customers in related sales transactions are included in sales revenues and shipping expenses incurred by the Company are reported as a component of selling expenses. The shipping and handling expenses of $202,156 and $193,871 for the three months ended June 30, 2018 and 2017, respectively; and $334,136 and $325,851 for the six months ended June 30, 2018 and 2017, respectively; are reported in the Consolidated Statements of Income and Comprehensive Income (Loss) as a component of selling expenses.

Leases

Leases are reviewed and classified as capital or operating at their inception in accordance with ASC Topic 840, Accounting for Leases. For leases that contain rent escalations, the Company records monthly rent expense equal to the total amount of the payments due in the reporting period over the lease term. The difference between rent expense recorded and the amount paid is credited or charged to deferred rent account.

Earnings per share

The Company adopted ASC Topic 215, Statement of Shareholder Equity. Basic EPS are computed by dividing net income available to common shareholders (numerator) by the weighted average number of common shares outstanding (denominator) during the period. Diluted EPS give effect to all dilutive potential common shares outstanding during a period. In computing diluted EPS, the average price for the period is used in determining the number of shares assumed to be purchased from the exercise of stock options and warrants.

| 8 |

Recent Accounting Pronouncements

In June 2018, the FASB issued Accounting Standards Update “ASU No. 2018-07 – Compensation – Stock Compensation”. The ASU expands the scope of current guidance to include all share-based payment arrangements related to the acquisition of goods and services from both non-employees and employees. The guidance in the ASU is effective for the Company in all fiscal years beginning after December 15, 2018. Adoption of ASU 2018-07 did not have any other material effect on the results of operations, financial position or cash flows of the Company.

February 2018, the FASB issued ASU 2018-02, Income Statement-Reporting Comprehensive Income (Topic 220), “Reclassification of Certain Tax Effects from Accumulated Other Comprehensive Income”. ASU 2018-02 was issued to allow the reclassification from accumulated other comprehensive income to retained earnings for the stranded tax effect resulting from the Tax Cuts and Jobs Act enacted on December 22, 2017. The Tax Cuts and Jobs Act, among other things, reduced the corporate tax rate from 35% to 21%, which required the re-evaluation of any deferred tax assets or liabilities at the lowered tax rate which potentially could leave disproportionate tax effects in accumulated other comprehensive income. ASU 2018-02 allows for the election to reclassify these stranded tax effects to retained earnings. ASU 2018-02 is effective for all entities for fiscal years beginning after December 15, 2018, and interim periods within those fiscal years. Early adoption is permitted, including adoption in any interim period for public business entities for reporting periods for which financial statements have not yet been issued. Adoption of ASU 2018--2 did not have any other material effect on the results of operations, financial position or cash flows of the Company.

There were no other recent accounting pronouncements or changes in accounting pronouncements during the three months ended June 30, 2018 compared to the recent accounting pronouncements described in our Annual Report on Form 10-K for the fiscal year ended December 31, 2017 that are of significance or potential significance to us.

| 3. | Inventories |

Inventories by major categories are summarized as follows:

| June

30, 2018 (Unaudited) |

December 31,

2017 (Audited) |

|||||||

| Raw materials and packaging | $ | 273,477 | $ | 837,613 | ||||

| Finished goods | 1,868,272 | 1,259,694 | ||||||

| Inventories | $ | 2,141,749 | $ | 2,097,307 | ||||

| 4. | Related Party Transaction |

Sales to related party

The Company’s subsidiary sold fruit beverages to a related entity, Shaanxi Fullmart Convenient Chain Supermarket Co., Ltd. (“Fullmart”) for approximately $0 and $58,972 for the six months ended June 30, 2018 and 2017, respectively. The accounts receivable balances were approximately $0 as of June 30, 2018 and December 31, 2017, respectively. Fullmart is a company indirectly owned by our Chairman and Chief Executive Officer, Mr. Yongke Xue.

Long-term loan – related party

There were no short-term loans to a related party as of each of June 30, 2018 and 2017.

| 9 |

| 5. | Concentrations |

| (1) | Concentration of customers |

Sales to our five largest customers accounted for approximately 100% and 20% of our net sales during the six months ended June 30, 2018 and 2017, respectively. There was one customer representing over 10% of total sales for the six months ended June 30, 2018. There was no single customer representing over 10% of total sales for the six months ended June 30, 2017.

Sales to our five largest customers accounted for approximately 100% and 20% of our net sales during the three months ended June 30, 2018 and 2017, respectively. There was two customers each representing over 10% of total sales for the six months ended June 30, 2018. There was no single customer representing over 10% of total sales for the three months ended June 30, 2018 and 2017, respectively.

| (2) | Concentration of suppliers |

Four suppliers accounted for 45%, 20%, 16% and 10% of our purchases, respectively, for the six months ended June 30, 2018 and ended June 30, 2017, respectively.

During the three months ended June 30, 2018, four suppliers accounted for 32%, 27%, 22% and 12% our purchases, respectively. During the three months ended June 30, 2017, four suppliers accounted for 33%, 19%, 14% and 12% of our purchases, respectively.

| 6. | Issuance of common stock and warrants |

On November 2, 2017 (the “Agreement Date”), a wholly-owned indirect subsidiary of the Company, Hedetang Foods (China) Co., Ltd. (“Hedetang”), entered into a series of Creditor’s Rights Transfer Agreements (collectively, the “Acquisition Agreements”) with each of Shaanxi Chunlv Ecological Agriculture Co. Ltd., Shaanxi Boai Medical Technology Development Co., Ltd., and Shaanxi Fu Chen Venture Capital Management Co. Ltd. (collectively, the “Sellers”). Pursuant to the Acquisition Agreements, Hedetang agreed to purchase certain creditor’s rights of associated with companies located in the PRC for an aggregate purchase price of RMB 181,006,980 (approximately $27,344,096), of which RMB 108,604,188 (approximately $16,437,248.50) were paid in cash and RMB 72,402,792 (approximately $10,937,638.50) were paid in shares of common stock of the Company based on the average of the closing prices of Future FinTech’s common stock over the five trading days preceding the date of the Acquisition Agreements.

A summary of the Acquisition Agreements is as follows:

1) Shaanxi Chunlv Ecological Agriculture Co. Ltd. agreed to transfer all its credit rights of principal and interest owed by Xi’an Tongji Department Store Co., Ltd. to Hedetang. As of the Agreement Date, the book balance of the principal was RMB 23,625,000, the interest was RMB 38,281,900, and the total credit balance, including the principal and the interest was RMB 61,906,900, of which the RMB 19,757,800 credit was guaranteed by a third party company.

2) Shaanxi Chunlv Ecological Agriculture Co. Ltd. agreed to transfer all its credit rights of principal and interest owed by Shaanxi Youyi Co., Ltd. to Hedetang. As of the Agreement Date, the book balance for the principal was RMB 45,345,000, the interest was RMB 71,224,300, and the total credit balance including the principal and the interest was RMB 116,569,300, all of which was guaranteed by a third party company.

3) Shaanxi Fu Chen Venture Capital Management Co., Ltd. agreed to transfer all its credit rights of principal and interest owed by State Owned Shaanxi No. 8 Cotton and Textile Mill to Hedetang. As of the Agreement Date, the book balance for the principal was RMB 72,370,000, the interest was RMB 138,037,700, and the total of credit including the principal and the interest was RMB 210,407,700, and there was no effective guarantee or pledged assets to secure this debt.

4) Shaanxi Boai Medical Technology Development Co., Ltd. agreed to transfer all its credit rights of principal and interest owed by Xi’an Yanliang Economic Development Co., Ltd. to Hedetang. As of the Agreement Date, the book balance for the principal was RMB 6,350,000, the interest was RMB 9,834,300, and the total of credit including the principal and the interest was RMB 16,184,300, which is secured by certain land use rights.

In connection with the Acquisition Agreements and to provide funding for their consummation, on November 3, 2017, the Company entered into a Share Purchase Agreement (the “Share Purchase Agreement”) with Mr. Zeyao Xue (“Xue”) pursuant to which Future FinTech agreed to sell 11,362,159 shares of its common stock (the “Shares”) to Xue for an aggregate purchase price of $16,437,248.50. The per share price for the Shares was determined using the average closing price quoted on the NASDAQ Global Market for the common stock of the Company over the three (3) trading days prior to the date of the Share Purchase Agreement (the “Purchase Price”), subject to potential upward adjustment. The consummation of the Share Purchase Agreement was contingent on Future FinTech receiving shareholder approval at a Special Shareholders Meeting for the an amendment to its articles of incorporation and the approval of Shares issuance under the Share Purchase Agreement by the shareholders of the Company.

On April 6, 2018, the Company issued an aggregate 7,111,599 shares of the Company’s common stock to three individuals designated by the Sellers in the respective amounts of 378,908; 3,323,225; and 3,409,466 shares, pursuant to the Acquisition Agreements, and 11,362,159 shares of the Company’s common stock pursuant to the Share Purchase Agreement, which such issuances were approved by the Company’s shareholders at a special meeting held on March 13, 2018.

On January 23, 2018, DigiPay FinTech Limited (“DigiPay”), a limited liability company incorporated in British Virgin Islands and a wholly-owned subsidiary of the Company, and Peng Youwang (“Peng”), a Chinese citizen, entered into a DCON Digital Assets Transfer Agreement (the “Agreement”).

| 10 |

Under the terms of the Agreement, Peng transferred to DigiPay a 60% ownership interest in certain digital assets of DCON, a blockchain platform for cryptocurrency conversion, payment and other services (“DCON”), including but not limited to its business plan and white papers, business models, software, codes, architectures, codes, software, applications, technologies, patents, copyrights, trade secrets, customer lists, business points, trading platforms, digital rights, authentication systems, agreements and contracts, intellectual property, token and the DCON communities established on Nova Realm City (the “Transfer Assets”) for an aggregate purchase price of $9,600,000 (the “Purchase Price”). The Company paid the Purchase Price by issuing to Peng 1,200,000 shares of the Company’s common stock, par value $0.001 per share (the “Common Stock”), equaling a per share sale price of $8.00 (the “Share Payment”). Half of the shares of Common Stock subject to the Share Payment were issued within 30 days of the date of the Agreement, and the remaining Shares Payment shares were issued within 90 days of the date of the Agreement. On May 3, 2018, the Company issued the remaining 600,000 shares of its common stock to Mr. Peng and his designee according to the Agreement.

The Agreement also contains customary representations and warranties regarding the Transfer Assets and the ownership thereof, and covenants regarding the parties’ cooperation. DigiPay and Peng further agreed to establish a Japanese operating company for the Transfer Assets, of which DigiPay will hold a 60% ownership interest and Peng’s designee will hold a 40% ownership interest.

On January 5, 2018, the Company issued 880,580 shares of its common stock to Reits (Beijing) Technology Co. Ltd., a limited liability company incorporated in China (“Reits”) pursuant to the Technology Development Service Contract (the “Service Agreement”) signed on December 18, 2017, by Reits and GlobalKey Supply Chain Ltd. (“GlobalKey”), a limited liability company incorporated in China and a wholly owned subsidiary of the Company.

Under the Service Agreement, Reits shall provide services to GlobalKey relating to the design, development, testing, deployment and maintenance of a blockchain-based Globally Shared Shopping Mall and other software systems (the “System”). Following the completion and delivery of the System by Reits, (i) GlobalKey shall provide the hardware and network requirements for the trial deployment of the System, (ii) Reits shall provide training of GlobalKey’s staff in the use and operation of the System, and (iii) for a period of one year from the System delivery date and for no additional charge, Reits shall provide ongoing System maintenance and technical support (the “Free Maintenance Period”). Following the completion of the Free Maintenance Period, GlobalKey may elect to engage Reits for ongoing maintenance and technical support. Under the Service Agreement, GlobalKey shall pay Reits aggregate consideration of RMB 13,000,000 ($2,067,397), of which RMB 9,100,000 ($1,447,178) may be paid in shares of the Company’s common stock, par value $0.001 per share (the “Common Stock”), at a per share price equal to the average of the Common Stock’s closing prices over the 5 trading days prior to the date of the Agreement, or $1.554 per share (the “Share Payment”). The exchange rate between US$ and RMB for the payment is 1:6.65. The Share Payment was made within 15 business days of the date of the Service Agreement, and the remaining Service Agreement consideration shall be paid by GlobalKey in accordance with the schedule described in the Service Agreement. The Company has paid RMB 876,663 ($139,416) and RMB 788,353 ($115,459) in cash to Reits in the first and second quarter of 2018, respectively.

On April 12, 2017, the Company entered into the Purchase Agreement with certain purchasers (the “Purchasers”), pursuant to which the Company offered and sold to the Purchasers, in a registered direct offering, an aggregate of 862,097 shares (the “Shares”) of common stock, par value $0.001 per share (“Common Stock”). The Shares were sold to the Purchasers at a negotiated purchase price of $3.10 per share, for aggregate gross proceeds to the Company of $2,672,500, before deducting fees to the placement agent and other offering expenses payable by the Company. In a concurrent private placement, the Company also agreed to issue to the each of the Purchasers a warrant to purchase one (1) share of the Company’s Common Stock for each share purchased under the Purchase Agreement, pursuant to that certain Common Stock Purchase Warrant, by and between the Company and each Purchaser (each, a “Warrant”, and collectively, the “Warrants”). The Warrants are exercisable beginning on the six month anniversary of the date of issuance at an initial exercise price of $5.20 per share and will expire on the five and a half year anniversary of the date of issuance.

On January 5, 2018, the Company issued 30,000 shares of the Company’s common stock to a certain warrant holder for the exercise of Warrants.

On February 28, 2017, the Company issued options to purchase 62,500 shares of the Company’s common stock with an exercise price equal to the fair market value of the Company’s Common Stock (as defined under the 2011 Stock Incentive Plan in conformity with Regulation 409A of the Internal Revenue Code of 1986, as amended) at the date of grant to three of the Company’s employees pursuant to the 2011 Stock Incentive Plan, which was approved by the Company’s shareholders at annual stockholders meeting on August 18, 2011. These options vested immediately on the grant date with a fair market value of $223,375 based on the fair value of $3.57 per share, which was determined by using the Black Scholes option pricing model. The Company recognized stock-based compensation expense of $223,375 in the first quarter of fiscal 2017 under the 2011 Stock Incentive Plan. On January 5, 2018, the Company issued 62,500 shares of the Company’s common stock to three of its employees for the exercise of such stock options.

As of June 30, 2018, there were no shares of stock available for awards under the 2011 Stock Incentive Plan. As of June 30, 2018, there were 1,300,000 shares of stock available for awards under the 2017 Omnibus Equity Plan

On March 29, 2017, the Company issued 250,000 shares of the Company’s unrestricted common stock to six of the Company’s employees pursuant to our 2015 Omnibus Equity Plan, which was approved by the Company’s shareholders at the annual stockholders meeting on November 19, 2015. The Company recorded an expense of $250 in the first quarter of fiscal 2017 under the 2015 Omnibus Equity Plan, reflecting a par value of $0.001 per share of the Company’s common stock.

The Company’s the 2015 Omnibus Equity Plan permits the grant of incentive stock options (“ISOs”), nonqualified stock options (“NQSOs”), stock appreciation rights (“SARs”), restricted stock, unrestricted stock and restricted stock units (“RSUs”) to its employees of up to 250,000 shares of Common Stock. As of June 30, 2018, there were no shares of stock available for awards under the 2015 Stock Incentive Plan.

| 11 |

| 7. | Other Receivables |

As of June 30, 2018, the balance of other receivables was $38,300,700, which mainly consisted of a deposit of approximately $31.81 million for the purchase of a kiwi orchard in Mei County.

In April 2016, the Company signed a letter of intent with Mei County Kiwifruits Investment and Development Corporation to purchase 833.5 mu (approximately 137.3 acres) of kiwifruits orchard in Mei County. The purchase price will be determined by a third-party valuation company appointed by both parties. As of the date of this report, the valuation has not been completed. The Company paid RMB 200 million (approximately $31.81 million) as a deposit (the “Deposit”) in the second quarter of 2016. The purchase is subject to government approval, approval by the Company’s Board of Directors and a definitive agreement negotiated and signed by the parties. As Mei County is in the process of governmental personnel change, the approval was delayed. Pursuant to the letter of intent, the Deposit shall be returned to the Company within 10 working days upon the request of the Company if the kiwifruits orchard cannot be transferred to the Company according to the schedule. The Company expects to complete the purchase process in the fourth quarter of 2018. As the transaction is not completed, the Company recorded this deposit as other receivables in its balance sheet.

| 8. | Deposits |

As of June 30, 2018, the balance of deposits was $295.720 million, which mainly consisted of a balance of approximately $27.34 million for the leasing fee for the kiwifruits orchard in Mei County and a balance of approximately $17.50 million for the leasing fee for the orange orchard in Yidu city.

On August 3, 2016, Shaanxi Guoweimei Kiwi Deep Processing Company, an indirectly wholly-owned subsidiary of the Company, signed a lease agreement for 20,000 mu (approximately 3,292 acres) of a kiwifruits orchard located in Mei County, Shaanxi Province, with the Di’ErPo Committee of Jinqu Village, Mei County, Shaanxi for a term of 30 years, from August 5, 2016 to August 4, 2046. The annual leasing fee is RMB 1,250 (approximately $199) per mu, and payment of 10 years’ of leasing fees shall be made on each of September 25, 2016, 2026 and 2036. The Company made a payment of RMB 250 million (approximately $39.76 million) for the first 10 years’ leasing fees on August 15, 2016, which is recorded as deposit in the Company’s balance sheet. The Company has amortized $1,889,188 as expenses during the six months ended June 30, 2018.

On August 15, 2016, Hedetang Agricultural Plantations (Yidu) Co., Ltd., an indirectly wholly-owned subsidiary of the Company, signed a lease agreement for 8,000 mu (approximately 1,317 acres) of an orange orchard located in the city of Yidu, Hubei Province, with the Yidu Sichang Farmers Association, Hubei Province, for a term of 20 years, from September 22, 2016 to September 21, 2036. The annual leasing fee is RMB 2,000 (approximately $318) per mu, and payment of 10 years’ of leasing fees shall be made on each of September 25, 2016 and 2026. The Company made a payment of RMB 160 million (approximately $25.44 million) for the first 10 years’ of leasing fees on September 20, 2016, which is recorded as deposits in the Company’s balance sheet. The Company has amortized $1,109,080 as expenses during the six months ended June 30, 2018.

| 9. | Discontinued Operation |

The Company’s Huludao Wonder operation, a subsidiary which produced concentrated apple juice, suffered continued operating losses in the three fiscal years prior to 2016 and its cash flow was minimal for these three years. In December 2016, the Company established a winding-down plan to close this operation. Based on the restructuring plan and in accordance with EITF 03-13, the Company presented the operating results from Huludao Wonder as a discontinued operation, as the Company believed that no continued cash flow would be generated by the disposed component (Huludao Wonder) and that the Company would have no significant continuing involvement in the operation of the discontinued component. Management of the Company initiated a plan to sell the property located in Huludao in December 2016, and ceased the depreciation of the property in accordance with SFAS No. 144. In fiscal year 2017 and 2016, the Company recorded an impairment loss of $11.3 million and $2.4 million, respectively with respect to the concentrated fruit juice production equipment in Huludao Wonder. In accordance with the restructuring plan, the Company intends to transfer the concentrated fruit juice production equipment in Huludao Wonder to another subsidiary and to sell the land and facilities upon favorable circumstances. As the Company does not expect to sell the assets of Huludao Wonder in the near future, the assets were not recorded as assets held for sale as of June 30, 2018. The Company believes that the assets’ book value was lower than its fair value at such time, less the anticipated cost to sell such assets. The book value of the land usage right was $4,463,889 and the book value of the building was $851,666.

| 12 |

As of June 30, 2018, there was an outstanding bank loan of $6.12 million owed by Huludao Wonder to a lending bank. Huludao Wonder has disputed the interest rate on this loan with the bank, and stopped payment of interest on this loan during 2016. The bank sued Huludao Wonder and asked Huludao Wonder to pay back the loan principal and the outstanding interest. As of the date of this report, the Company has not yet reached an agreement with the bank. The Company expects to pay back the outstanding principal and interest of this loan after the Huludao Wonder assets are sold.

During the process of winding down the Company’s operation in Huludao Wonder, the Company incurred general and administrative expenses of approximately $49,510 and $96,708 during the six months ended June 30, 2018 and 2017, respectively.

Loss from discontinued operations for the three and six months ended June 30, 2018 and 2017 was as follows:

| For the Three Months | For the Six Months | |||||||||||||||

| Ended June 30, | Ended June 30, | |||||||||||||||

| 2017 (Unaudited) | 2016 (Unaudited) | 2017 (Unaudited) | 2016 (Unaudited) | |||||||||||||

| REVENUES | $ | - | $ | - | $ | - | $ | - | ||||||||

| COST OF SALES | - | - | - | - | ||||||||||||

| GROSS PROFIT | - | - | - | - | ||||||||||||

| OPERATING EXPENSES: | ||||||||||||||||

| General and administrative | - | (48,023 | ) | (49,510 | ) | (96,708 | ) | |||||||||

| Selling expenses | - | - | - | - | ||||||||||||

| Total | - | (48,023 | ) | (49,510 | ) | (96,708 | ) | |||||||||

| OTHER INCOME (EXPENSE) | ||||||||||||||||

| Interest expense | - | - | - | - | ||||||||||||

| Other income (expenses) | 61 | - | - | - | ||||||||||||

| Total | - | - | - | - | ||||||||||||

| Income (loss) from discontinued operations before income tax | 61 | (48,023 | ) | (49,510 | ) | (96,708 | ) | |||||||||

| Income tax provision | - | - | - | - | ||||||||||||

| INCOME (LOSS) FROM DISCONTINUED OPERATIONS | $ | 61 | $ | (48,023 | ) | (49,510 | ) | (96,708 | ) | |||||||

The loss from discontinued operations was $49,510 and $96,708 for the six months ended June 30, 2018 and 2017, respectively. The Company does not provide a separate cash flow statement for the discontinued operation. The loss from discontinued operations was deemed as cash outflow from operating activities of the discontinued operation. The Company believes there will not be any future significant cash flows from the discontinued operation, as the outstanding accounts receivable and accounts payable are immaterial to the Company’s financial position and liquidity.

| 10. | Segment Reporting |

The Company operates in five segments: concentrated apple juice and apple aroma, concentrated kiwifruit juice and kiwifruit puree, concentrated pear juice, fruit juice beverages, and others. Our concentrated apple juice and apple aroma is primarily produced by the Company’s Jingyang factory and concentrated pear juice is primarily produced by the Company’s Jingyang factory. The Company uses the same production line to manufacture concentrated apple juice and concentrated pear juice. In addition, both Shaanxi Province, where the factory of Jingyang factory is located, and Liaoning Province, where the factory of Huludao Wonder is located, are rich in fresh apple and pear supplies. Concentrated kiwifruit juice and kiwifruit puree is primarily produced by the Company’s Qiyiwangguo factory, and fruit juice beverages are primarily produced by the Company’s Qiyiwangguo factory. The Company’s other products include fructose, concentrated turnjujube juice, and other by products, such as kiwifruit seeds.

| 13 |

Concentrated fruit juice is used as a basic ingredient for manufacturing juice drinks and as an additive to fruit wine and fruit jam, cosmetics and medicines. The Company sells its concentrated fruit juice to domestic customers and exported directly or via distributors. The Company believes that its main export markets are the North America, Europe, Russia, South Korea and the Middle East. The Company sells its Hedetang branded bottled fruit beverages domestically primarily to supermarkets in the PRC. The Company sells its fresh fruit and vegetables to supermarkets and whole sellers in the PRC.

Some of these product segments might never individually meet the quantitative thresholds for determining reportable segments and we determine the reportable segments based on the discrete financial information provided to the chief operating decision maker. The chief operating decision maker evaluates the results of each segment in assessing performance and allocating resources among the segments. Since there is an overlap of services provided and products manufactured between different subsidiaries of the Company, the Company does not allocate operating expenses and assets based on the product segments. Therefore, operating expenses and assets information by segment are not presented. Segment profit represents the gross profit of each reportable segment.

For the three months ended June 30, 2018 (in thousands)

| Concentrated apple juice and apple aroma | Concentrated kiwifruit juice and kiwifruit puree | Concentrated pear juice | Fruit juice beverages | Others | Total | |||||||||||||||||||

| Reportable segment revenue | $ | 185 | $ | 345 | $ | 31 | $ | 521 | $ | 32 | $ | 1,085 | ||||||||||||

| Inter-segment loss | (28 | ) | (143 | ) | (31 | ) | (122 | ) | (2 | ) | (297 | ) | ||||||||||||

| Revenue from external customers | 157 | 202 | - | 399 | 30 | 788 | ||||||||||||||||||

| Segment gross profit | $ | 47 | $ | 13 | $ | - | $ | 96 | $ | 17 | $ | 173 | ||||||||||||

For the three months ended June 30, 2017 (in thousands)

| Concentrated apple juice and apple aroma | Concentrated kiwifruit juice and kiwifruit puree | Concentrated pear juice | Fruit juice beverages | Others | Total | |||||||||||||||||||

| Reportable segment revenue | $ | 277 | $ | 178 | $ | 278 | $ | 4,280 | $ | 13 | $ | 5,026 | ||||||||||||

| Inter-segment loss | (246 | ) | (61 | ) | (165 | ) | (1,776 | (1 | ) | (2,248 | ) | |||||||||||||

| Revenue from external customers | 31 | 117 | 113 | 2,504 | 12 | 2,777 | ||||||||||||||||||

| Segment gross profit | $ | 3 | $ | 36 | $ | 21 | $ | 1,226 | $ | 6 | $ | 1,292 | ||||||||||||

| 14 |

For the six months ended June 30, 2018 (in thousands)

| Concentrated apple juice and apple aroma | Concentrated kiwifruit juice and kiwifruit puree | Concentrated pear juice | Fruit juice beverages | Others | Total | |||||||||||||||||||

| Reportable segment revenue | $ | 231 | $ | 456 | $ | 48 | $ | 956 | $ | 93 | $ | 1,755 | ||||||||||||

| Inter-segment loss | (28 | ) | (143 | ) | (31 | ) | (230 | ) | (2 | ) | (405 | ) | ||||||||||||

| Revenue from external customers | 203 | 313 | 17 | 726 | 91 | 1,350 | ||||||||||||||||||

| Segment gross profit | $ | 52 | $ | 23 | $ | 1 | $ | 126 | $ | 33 | $ | 235 | ||||||||||||

For the six months ended June 30, 2017 (in thousands)

| Concentrated apple juice and apple aroma | Concentrated kiwifruit juice and kiwifruit puree | Concentrated pear juice | Fruit juice beverages | Others | Total | |||||||||||||||||||

| Reportable segment revenue | $ | 1,515 | $ | 383 | $ | 1,771 | $ | 5,652 | 14 | $ | 9,335 | |||||||||||||

| Inter-segment loss | (465 | ) | (72 | ) | (735 | ) | (2,326 | (1 | ) | (3,599 | ) | |||||||||||||

| Revenue from external customers | 1,050 | 311 | 1,036 | 3,326 | 13 | 5,736 | ||||||||||||||||||

| Segment gross profit | $ | 32 | $ | 81 | $ | 147 | $ | 1,561 | 6 | $ | 1,827 | |||||||||||||

The following table reconciles reportable segment profit to the Company’s condensed consolidated income before income tax provision for the three months ended June 30, 2018 and 2017:

| 2018 | 2017 | |||||||

| Segment profit | $ | 235,270 | $ | 1,827,357 | ||||

| Unallocated amounts: | ||||||||

| Operating expenses | (5,327,588 | ) | (4,610,942 | ) | ||||

| Other expenses | (870,831 | ) | (422,015 | ) | ||||

| Loss before tax provision | $ | (6,198,419 | ) | $ | (5,032,957 | ) | ||

| 15 |

| 11. | Entry into a Material Definitive Agreement. |

On June 22, 2018, Digipay Fintech Limited (“Digipay”), a limited liability company incorporated in a British Virgin Islands and a wholly-owned subsidiary of Future FinTech Group Inc. (the “Company”), Lake Chenliu, an individual resident of Costa Rica, and InUnion Chain Ltd. (“InUnion”), a British Virgin Islands company wholly owned by Mr. Chenliu, entered into an InUnion Chain Ltd. Shares Transfer and IUN Digital Assets Investment Agreement (the “Agreement”).

Under the terms of the Agreement, Mr. Chenliu shall transfer to Digipay a 10% ownership interest in InUnion (the “InUnion Shares”) for an aggregate purchase price of $15,000,000 (the “Purchase Price”). The Company will pay the Purchase Price by issuing to Mr. Chenliu shares of the Company’s common stock, par value $0.001 per share (the “Common Stock”), equaling a per share sale price of $3.00 (the “Share Payment”). The shares of Common Stock subject to the Share Payment shall be issued upon the consent of the Company’s board of directors and approval by the The Nasdaq Global Market.

Upon acquiring the InUnion Shares, Digipay will have access to, and use of, certain software, technology and related intellectual property of InUnion without further payment. Digipay will also have the right to designate a director nominee to the board of directors of InUnion.

In addition to the InUnion Shares, Digipay shall also purchase 20,000,000 of the INU tokens issued by InUnion (the “INU Tokens”) for an aggregate purchase price of $1,000,000, which such amount shall be paid in immediately available funds within 180 days of the date of the Agreement. Digipay may be issued additional INU Tokens and shares of InUnion’s capital stock in the event that, after being listed on a global digital assets exchange, the INU Tokens fail to maintain certain minimum trading price requirements.

| 12. | Commitments And Contingencies |

Litigation

In April 2015, China Cinda Asset Management Co., Ltd. Shaanxi Branch (“Cinda Shaanxi Branch”) filed two enforcement proceedings with Xi’an Intermediate People’s Court (the “Court”) against the Company for alleged defaults pursuant to guarantees by the Company to its suppliers for a total amount of RMB 39,596,250 or approximately $6.0 million.

In September 2014, two long term suppliers of pear, mulberry, and kiwi fruits to the Company requested that the Company provide guarantees for their loans with Cinda Shaanxi Branch. Considering the long term business relationship and to ensure the timely supply of raw materials, the Company agreed to provide guarantees upon the value of the raw materials supplied to the Company. Because Cinda Shaanxi Branch is not a bank authorized to provide loans, it eventually provided financing to the two suppliers through the purchase of accounts receivables of the two suppliers with the Company. In July, 2014, the parties entered into two agreements – an Accounts Receivables Purchase and Debt Restructure Agreement, and Guarantee Agreements for Accounts Receivables Purchase and Debt Restructure. Pursuant to the agreements, Cinda Shaanxi Branch agreed to provide a RMB 100 million credit line on a rolling basis to the two suppliers and the Company agreed to pay its accounts payables to the two suppliers directly to Cinda Shaanxi Branch and provided guarantees for the two suppliers. In April 2015, Cinda Shaanxi Branch stopped providing financing to the two suppliers and the two suppliers were unable to continue the supply of raw materials to the Company. Consequently, the Company stopped making any payment to Cinda Shaanxi Branch.

The Company has responded to the Court and taken the position that the financings under the agreements are essentially the loans from Cinda Shaanxi Branch to the two suppliers, and because Cinda Shaanxi Branch does not have permits to make loans in China, the agreements are invalid, void and had no legal effect from the beginning. Therefore, the Company has no obligation to repay the debts owed by the two suppliers to Cinda Shaanxi Branch.

Upon the Court’s suggestion, parties agreed to a settlement discussion in April 2017. As a part of the settlement discussion, on April 18, 2017, the Company withdrew its non-enforcement request with the Court without prejudice. Both parties are still in the process of settlement negotiations. If the parties cannot reach a settlement agreement, the Company has the right to refile the non-enforcement request with the Court. As the Company may still be liable for this loan, the Company recorded expenses and liability of $6.0 million as the result of these two enforcement proceedings in the second quarter of 2018.

Between October, 2013 and January, 2014, Xuzhou Jinkaifeng Glass Co. Ltd. (“JKF”) supplied glass bottles to SkyPeople China. SkyPeople China believed that the glass bottles supplied by JKF had quality issues and did not pay for the bottles delivered. In November, 2016, JKF filed a lawsuit against SkyPeople China with Xuzhou Tongshan District People’s Court. On July 27, 2017, SkyPeople China received judgment from Xuzhou Tongshan District People’s Court that SkyPeople China must pay JKF RMB 365,292 (approximately $55,040) for the glass bottles. SkyPeople China currently is in discussions with JKF on the payment terms and final amount in connection with the enforcement of the judgment.

| 16 |

In April 2015, SkyPeople China entered into a loan agreement with Shaanxi Fangtian Decoration Co. Ltd. (“Fangtian”). Pursuant to the loan agreement, SkyPeople China borrowed RMB 3.5 million (approximately $527,355) from Fangtian. SkyPeople China has not repaid the loan and Fangtian filed a lawsuit with Xi’an Yanta District People’s Court (“Yanta District Court”). On August 10, 2017, Yanta District Court ruled against SkyPeople China and determined that SkyPeople China must repay the loan of RMB 3.5 million plus interest RMB of 402,500 (approximately $588,000). SkyPeople China currently is in discussions with Fangtian on the payment terms and the final amount.

Shaanxi Hengtong Development Co. Ltd. (“Hengtong”) is a coal supplier to SkyPeople China’s Jingyang Branch (“SkyPeople Jingyang”). In November, 2016, Hengtong filed a lawsuit against SkyPeople Jingyang for unpaid coal deliveries and interest for a total amount of RMB 3,133,916 (approximately $482,141). On March 13, 2017, SkyPeople Jingyang received judgment from Jingyang County People’s Court ordering SkyPeople Jingyang to repay RMB 1.78 million (approximately $268,788) to Hengtong. SkyPeople Jingyang appealed the judgement to Xianyang Intermediate People’s Court, and on August 29, 2017, Xiangyang Intermediate Court affirmed the lower court’s decision. SkyPeople Jingyang currently is in discussions with Hengtong on payment terms and the final amount.

In September 2016, the Suizhong Branch of Huludao Banking Co. Ltd. (“Suizhong Branch”) filed a lawsuit with Huludao Intermediate People’s Court (the “Huludao Court”) against the Company’s indirectly wholly-owned subsidiary Huludao Wonder Fruit Co., Ltd. (“Wonder Fruit”) and requested that Wonder Fruit repay a RMB 40 million (approximately $6.35 million) bank loan, plus interest. The loan became due on its maturity date of December 9, 2016. On December 19, 2016, the Huludao Court accepted the case. The Company has been disputing the interest rate of the loan with Suizhong Branch, and has not repaid the loan to date. Wonder Fruit believes that the interest charged by Suizhong Branch is 100% higher than the base rate set by People’s Bank of China and is not in consistent with the China People’s Bank’s base interest and floating rate. The Huludao Court has seized land use rights, buildings and equipment of Wonder Fruit that were pledged as guarantee for the loan and has organized two auction sales for these assets in January and February of 2018, but both auction sales have been unsuccessful in finding a buyer. Wonder Fruit is currently in discussions with the Suizhong Branch on repayment of the bank loan and a reduction of the interest due thereon.

On June 29, 2015, SkyPeople China entered into a loan agreement with Beijing Bank. Pursuant to the loan agreement, SkyPeople China borrowed RMB 30 million (approximately $4.59 million) from Beijing Bank. Hongke Xue, Yongke Xue and Xiujun Wang provided guarantees for the loan and Shaanxi Boai Medical Technology Development Co., Ltd. (“Shaanxi Boai”) provided certain real estate property as a pledge for the loan. SkyPeople China did not repay the loan on time and Beijing Bank filed an enforcement request with Xi’an Intermediate People's Court in June 2017. The Xi’an Intermediate People’s Court has seized real estate properties pledged by Shaanxi Boai and Xiujun Wang. The Court has made inquiries to the Beijing Bank as to whether it is willing to accept the pledged real estate property of Shaanxi Boai as the repayment of the outstanding loan for the amount RMB 27,932,300 (approximately $4.12 million). The real estate property pledged by Xiujun Wang is her only residential property and Ms. Wang has raised objections to the enforcement action against her property with the Court. The Court is in the process of reviewing her objections.

On March 8, 2016, SkyPeople China entered into a loan agreement with Ningxia Bank. Pursuant to the loan agreement, SkyPeople China borrowed RMB 25 million (approximately $3.83 million) from Ningxia Bank. Hongke Xue, Yongke Xue, Lake Chen, Shaanxi Boai Medical Technology Development Co., Ltd. and Shaanxi Qiyiwangguo provided guarantees for the loan. SkyPeople China also pledged 37 equipment and its trademarks to Ningxia Bank for the loan. SkyPeople China has not repaid the loan and Ningxia Bank filed enforcement action with Xi’an Intermediate people's court in August 2017. The Court has frozen the assets of SkyPeople China that were pledged as guarantee for the loan from being transferred to any third-party, but the freeze does not limit or affect the use of these properties by SkyPeople China for its business. In July, 2018, Shaanxi Qiyiwangguo filed petition to the Court and requested the termination of the enforcement action on the basis that its guarantee of the loan was not valid because the seal used on the guarantee agreement was not authentic and the guarantee was not approved by the shareholders of Shaanxi Qiyiwangguo. The Court is in the process of reviewing the petition and the enforcement action has been suspended.

| 17 |

On December 23, 2015, SkyPeople China entered into two loan agreements with China Construction Bank. Pursuant to the loan agreements, SkyPeople China borrowed RMB 13.90 million (approximately $2.13 million), and RMB 30 million (approximately $4.59 million) from China Construction Bank, respectively. Shaanxi Boai Medical Technology Development Co., Ltd. (“Boai”), Mr. Hongke Xue, Mr. Yongke Xue, Mrs. Xiujun Wang and Yingkou Trusty Fruits Co., Ltd. (“Yingkou”) provided pledges for the loans. SkyPeople China has not repaid the loans and China Construction Bank filed an enforcement action with Xi’an Intermediate People's Court in March 2017. The Court has seized and sold by auction certain park space and land use rights pledged by Xiujun Wang and Boai for approximately RMB 25,000,000. The Court also seized certain land use rights pledged by Yingkou Trusty Fruits Co., Ltd., but the auction sale for those rights was not successful. SkyPeople China currently is in discussions with China Construction Bank on the payment terms and the final amount.

On May 9, 2016, SkyPeople China entered into loan agreements with China Construction Bank. Pursuant to the loan agreements, SkyPeople China borrowed RMB 22.9 million (approximately $3.50 million) from China Construction Bank. Shaanxi Province Credit Reassurance Company (“Credit Reassurance Company”) provided a guarantee to China Construction Bank for the loan, Mr. Hongke Xue and Mr. Yongke Xue provided their guarantees, and SkyPeople China provided an office space that it owned to Credit Reassurance Company as a pledge. SkyPeople China has not repaid the loan and Credit Reassurance Company repaid the loan for SkyPeople China. In June 2017, Credit Reassurance filed an enforcement action request with Xi’an Intermediate People’s Court in June 2017. In December 2017, the Xi’an Intermediate People’s Court seized the office space of SkyPeople China and put it up for auction sales in February and April 2018, but neither auction sale was successful. In June, 2018, the Court issued a verdict that the pledged office space shall be used as repayment of the debt in amount of RMB 12,214,800 (approximately $1.8 million) to Credit Reassurance Company. SkyPeople China shall repay the remaining debt of RMB 22,809,236 to Credit Reassurance Company.

In August 2017, Cinda Capital Financing Co. Ltd. (“Cinda”) filed a lawsuit with Beijing 2nd Intermediate People’s Court (the “Beijing Intermediate Court”) against the Company’s indirectly wholly-owned subsidiaries Shaanxi Guoweimei Kiwi Deep Processing Company, Ltd. (“Guoweimei”) and Hedetang Farm Products Trading Market (Mei County) Co., Ltd. (“Trading Market Mei County Co”, and together with Guoweimei, “Leasees”) requested that Leasees repay RMB 50 million (approximately $7.65 million) in capital lease fees, plus interest. Cinda has purchased or paid for refrigerant warehouse and trading hall to the suppliers and vendors and agreed to lease them to the Leasees for a leasing fee of RMB 50 million in December, 2016. The capital leasing fee became due on its maturity date of June 2017, with certain land use rights of Leasees in Mei County and equity of Guoweimei as a pledge. The Company has disputed that the land use rights for the refrigerant warehouse and trading hall were never sold to or transferred to Cinda, therefore it is loan agreement and not capital lease agreement among the parties. Leasees have taken the position that Cinda is not a bank and does not have government permits required to make loans in China, and the agreements including pledge agreement were invalid, void and without legal effect from the beginning. Therefore, the Company only has the obligations to repay principal but not the interest. In November 2017, Beijing Intermediate Court ruled in favor of Cinda and the Leasees appealed the case to Beijing Supreme Court. Beijing Supreme Court held a hearing at the end of July 2018 but has not made a ruling yet. As the Company may still be liable for this loan, the Company recorded expenses and liability of $7.66 million as the result of the enforcement proceeding in the third quarter of 2017.

In August, 2017, Cinda Capital Financing Co. Ltd. (“Cinda”) filed another lawsuit at Beijing Intermediate Court against the Company’s indirectly wholly-owned subsidiaries Guoweimei and SkyPeople China for repayment of leasing fee of RMB 84,970,959 (approximately $13 million) plus interest. In January 2014, Guoweimei and SkyPeople China (the “Equipment Leasees”) signed an Equipment Financial Lease Purchase Agreement with Cinda and an equipment supplier pursuant to which Cinda would provide funds to purchase equipment and the Equipment Leasees would lease the equipment from Cinda. Guoweimei pledged certain land use rights in Mei County to Cinda and Xi’an Hedetang and Hedetang Holding pledged their equities in Guoweimei to Cinda to secure the repayment. Mr. Hongke Xue also provided a personal guarantee for the payment of the leasing fee. Beijing Intermediate Court had two hearings of the case and on March 21, 2018, and it ruled in favor of Cinda to the effect that SkyPople China and Guoweimei shall pay leasing fees due in the amount of RMB 20,994,048 (approximately $3.3 million), as well as leasing fees not yet due in the amount of RMB 63,975,910 (approximately $10 million), plus attorney’s fee and expenses. Beijing Intermediate Court also ruled that Mr. Hongke Xue is jointly liable for the debt as the guarantor, and that Cinda has priority rights to the pledged land use rights in Mei County and the pledged equities of Guoweimei as well as the ownership of the leasing properties until the leasing fees are paid. SkyPeople China has appealed the decision to the Beijing Supreme Court. Beijing Supreme Court held a hearing at the end of July 2018 but has not made a ruling yet.

| 18 |

On October 31, 2017, Xi’an Shanmei Food Co. Ltd. filed a lawsuit against Shaanxi Qiyiwangguo, a majority-owned subsidiary of the Company, with Zhouzhi County People’s Court in connection with a Land Lease Agreement entered into by the parties on October 1, 2013. On March 2, 2018, Zhouzhi County People’s Court issued verdict that: (i) the Land Lease Agreement was thereby terminated; (ii) Shaanxi Qiyiwangguo shall pay Xi’an Shanmei the outstanding leasing fee RMB 211,621 (approximately $32,557) and (iii) Shaanxi Qiyiwangguo shall return the 29.3 mu industrial use land to Xi’an Shanmei. Shaanxi Qiyiwangguo has appealed the decision to the Xi’an Intermediate People’s Court on the basis that: (x) the land use right was a capital contribution by Xi’an Shanmei for a shareholder of Shaanxi Qiyiwangguo who is also the sole shareholder of Xi’an Shamei and Land Lease Agreement was invalid and has no legal effect; (y) Zhouzhi Court did not schedule the hearing for the count claims filed by Shaanxi Qiyiwangguo; and (z) Zhouzhi Court violated certain civil procedures during the trial of the case. Xi’an Intermediate People’s Court has not yet schedule a hearing for the appeal.

In September, 2017, Andrew Chien, a former consultant of SkyPeople China, brought a lawsuit against the Company and Mr. Hongke Xue in the District Court of Connecticut. The complaint was not properly served and the Company learned of the litigation in December 2017. In the complaint, Mr. Chien has made several claims, most of which attempt to hold the Company liable under novel legal theories that relate back to an alleged breach of a consulting agreement between SkyPeople China and Chien from August, 2006. Mr. Chien claimed for approximately $257,000 damages and interest plus 2% of the Company’s then-outstanding shares. Mr. Chien has unsuccessfully attempted to sue the Company on the breach of the same consulting agreement several times in the courts of Connecticut and New York and these cases have been dismissed in the past. The Company has filed a motion to dismiss (“MTD”) and all proceedings are stayed pending determination of the MTD. The Company will vigorously defend this lawsuit and expects to obtain early dismissal of Mr. Chien’s claims.