Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - TherapeuticsMD, Inc. | txmd-8k_081018.htm |

| EX-99.1 - PRESS RELEASE - TherapeuticsMD, Inc. | ex99-1.htm |

Exhibit 99.2

Annovera™ FDA Approval Conference Call August 13 , 2018

2 Forward - Looking Statements This presentation by TherapeuticsMD, Inc. (referred to as “we” and “our”) may contain forward - looking statements. Forward - lookin g statements may include, but are not limited to, statements relating to our objectives, plans and strategies, as well as state men ts, other than historical facts, that address activities, events or developments that we intend, expect, project, believe or anti cip ate will or may occur in the future. These statements are often characterized by terminology such as “believe,” “hope,” “may,” “anticipat e,” “should,” “intend,” “plan,” “will,” “expect,” “estimate,” “project,” “positioned,” “strategy” and similar expressions and are ba sed on assumptions and assessments made in light of our managerial experience and perception of historical trends, current condition s, expected future developments and other factors we believe to be appropriate. Forward - looking statements in this presentation are made as of the date of this presentation, and we undertake no duty to update or revise any such statements, whether as a result of new information, future events or otherwise. Forward - looking statements are n ot guarantees of future performance and are subject to risks and uncertainties, many of which may be outside of our control. Imp ort ant factors that could cause actual results, developments and business decisions to differ materially from forward - looking statement s are described in the sections titled “Risk Factors” in our filings with the Securities and Exchange Commission, including our mos t r ecent Annual Report on Form 10 - K and Quarterly Reports on Form 10 - Q, as well as our current reports on Form 8 - K, and include the following: whether the FDA will approve the NDA for our TX - 001HR product candidate and whether such approval will occur by the PDUFA target action date; our ability to maintain or increase sales of our products; our ability to develop and commercialize ou r hormone therapy drug candidates and one - year contraceptive vaginal system licensed product and obtain additional financing necessary therefor; whether we will be able to comply with the covenants and conditions under our term loan agreement; the length, cost and uncertain results of our clinical trials; potential of adverse side effects or other safety risks that could pr eclude the approval of our hormone therapy drug candidates or adversely affect the commercialization of our current or future approved products; the ability of our licensees to commercialize and distribute our product and product candidates; our reliance on th ird parties to conduct our clinical trials, research and development and manufacturing; the availability of reimbursement from government authorities and health insurance companies for our products; the impact of product liability lawsuits; the influen ce of extensive and costly government regulation; the volatility of the trading price of our common stock; and the concentration of po wer in our stock ownership. TX - 001HR, TX - 005HR, and TX - 006HR are investigational drugs and are not approved by the FDA. This non - promotional presentation i s intended for investor audiences only.

3 First and only patient - controlled , procedure - free , long - acting , reversible birth control ▪ Product fits into existing TXMD infrastructure • Approved: August 10, 2018 • Segesterone acetate component of Annovera expected to be classified as NCE with 5 year exclusivity ▪ Developed by the Population Council – developer of multi - billion dollar products • ParaGard® and Mirena® IUDs; Norplant® and Jadelle ® implants; and Progering ® • Funded by several organizations, including: Bill & Melinda Gates Foundation, US National Institutes of Health, USAID and The Population Council ▪ The ring system is composed of a “squishy” silicone elastomer • 21/7 days cyclical dosing regimen • 89% overall patient satisfaction in clinical trials 1 ▪ Average daily release over one year of use: • 0.15 mg/day segesterone acetate • 0.013 mg/day ethinyl estradiol ▪ Nestorone: progesterone derived unique progestin 2 • High progestational potency and antiovulatory activity • No androgenic, estrogenic or glucocorticoid effects at contraceptive doses Annovera - 1 - Year Vaginal System Segesterone Acetate [ Nestorone ® (NES)]/Ethinyl Estradiol (EE) 1 Merkatz , Ruth B., Marlena Plagianos , Elena Hoskin, Michael Cooney, Paul C. Hewett, and Barbara S. Mensch. 2014. “Acceptability of the Nestorone ®/ethinyl estradiol contraceptive vaginal ring: Development of a model; implications for introduction,” Contraception 90(5): 514 – 521. 2 Narender Kumar, Samuel S. Koide, Yun - Yen Tsong , and Kalyan Sundaram. 2000. “ Nestorone : a Progestin with a Unique Pharmacological Profile,” Steroids 65: 629 - 636

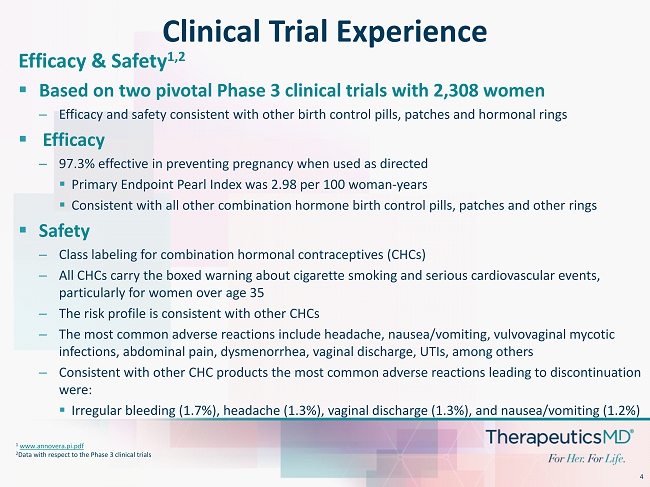

4 Clinical Trial Experience Efficacy & Safety 1,2 ▪ Based on two pivotal Phase 3 clinical trials with 2,308 women – Efficacy and safety consistent with other birth control pills, patches and hormonal rings ▪ Efficacy – 97.3% effective in preventing pregnancy when used as directed ▪ Primary Endpoint Pearl Index was 2.98 per 100 woman - years ▪ Consistent with all other combination hormone birth control pills, patches and other rings ▪ Safety – Class labeling for combination hormonal contraceptives (CHCs) – All CHCs carry the boxed warning about cigarette smoking and serious cardiovascular events, particularly for women over age 35 – The risk profile is consistent with other CHCs – The most common adverse reactions include headache, nausea/vomiting, vulvovaginal mycotic infections, abdominal pain, dysmenorrhea, vaginal discharge, UTIs, among others – Consistent with other CHC products the most common adverse reactions leading to discontinuation were: ▪ Irregular bleeding (1.7%), headache (1.3%), vaginal discharge (1.3%), and nausea/vomiting (1.2%) 1 www.annovera.pi.pdf 2 Data with respect to the Phase 3 clinical trials

5 Acceptability Data 1 ▪ Phase 3 acceptability study (n=905 subjects) ▪ Overall satisfaction 89% related to ease of use, side effects, expulsions/feeling the product, and physical effect during sexual activity ▪ High rates of adherence and continuation 1 Merkatz, Ruth B., Marlena Plagianos , Elena Hoskin, Michael Cooney, Paul C. Hewett, and Barbara S. Mensch. 2014. “Acceptability of the Nestorone ®/ethinyl estradiol contraceptive vaginal ring: Development of a model; implications for introduction,” Contraception 90(5): 514 – 521. 3 http://www.merck.com/product/usa/pi_circulars/n/nuvaring/nuvaring_ppi.pdf Ease of inserting (N=905) Ease of removing (N=905) Ease of remembering CVR insertion (N=905) Ease of remembering CVR removal (N=905) No side effects reported on questionnaire (N=905) 90.8% (n=823) 88.2% (n=798) 87.6% (n=793) 85.2% (n=771) 81.8% (n=740) Phase 3 Acceptability Study Demonstrated 1 - Year Contraceptive Vaginal System High User Satisfaction

6 Annovera Deal Terms ▪ Upon FDA approval: $20mm ▪ First commercial batch release: $20mm ▪ $200mm in cumulative net sales: $40mm ▪ $400mm in cumulative net sales: $40mm ▪ $1b in cumulative net sales: $40mm Milestone Payments Royalty % Step structure: ▪ Annual net sales < $50mm: 5% ▪ Annual net sales > $50mm and < $150mm: 10% ▪ Annual net sales > $150mm: 15% ▪ TXMD and Population Council jointly responsible for one observational PMR study * Additional Cost Considerations *Costs exceeding $20mm to be shared with Population Council

7 NuvaRing – Large Established Ring Market ▪ NuvaRing Owner: Merck ▪ $500mm+ net sales in US ring market with no other branded products in the space * ▪ NuvaRing monthly contraceptive ring (vs. Annovera 1 - year ring) ▪ Annual WAC Price of $2,013 (vs. $1,400) ▪ Semi - rigid ring body (vs. pliable/squishy) ▪ Monthly visit to pharmacy (vs. one annual visit) ▪ 2 NuvaRing generics expected in 2019 *Symphony Health Solutions PHAST Data powered by IDV. Net sales as reported in company filings. (Dollars in Millions) Year End December 31, 2013A 2014A 2015A 2016A 2017A NuvaRing Net Revenue $426 $461 $515 $576 $564 market growth 8.2% 11.7% 11.8% -2.1% NuvaRing Scripts 4.7 4.6 4.4 4.5 4.3 script gowth -1.4% -4.8% 1.1% -3.6% * *

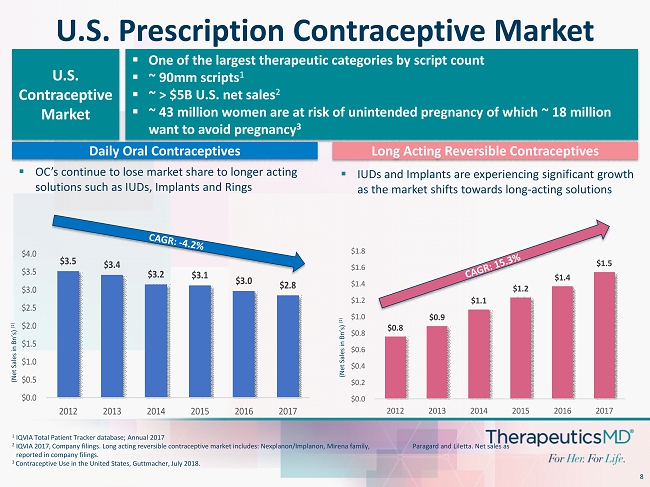

8 U.S. Prescription Contraceptive Market ▪ One of the largest therapeutic categories by script count ▪ ~ 90mm scripts 1 ▪ ~ > $5B U.S. net sales 2 ▪ ~ 43 million women are at risk of unintended pregnancy of which ~ 18 million want to avoid pregnancy 3 U.S. Contraceptive Market $3.5 $3.4 $3.2 $3.1 $3.0 $2.8 $0.0 $0.5 $1.0 $1.5 $2.0 $2.5 $3.0 $3.5 $4.0 2012 2013 2014 2015 2016 2017 Daily Oral Contraceptives Long Acting Reversible Contraceptives ▪ OC’s continue to lose market share to longer acting solutions such as IUDs, Implants and Rings ▪ IUDs and Implants are experiencing significant growth as the market shifts towards long - acting solutions $0.8 $0.9 $1.1 $1.2 $1.4 $1.5 $0.0 $0.2 $0.4 $0.6 $0.8 $1.0 $1.2 $1.4 $1.6 $1.8 2012 2013 2014 2015 2016 2017 (Net Sales in Bn ’s) (1) (Net Sales in Bn ’s) (1) 1 IQVIA Total Patient Tracker database; Annual 2017 2 IQVIA 2017, Company filings. Long acting reversible contraceptive market includes: Nexplanon/ Implanon , Mirena family, Paragard and Liletta . Net sales as reported in company filings. 3 Contraceptive Use in the United States, Guttmacher, July 2018.

9 Expected Benefits of 1 - Year Vaginal Contraceptive System • Long - acting reversible birth control that doesn’t require a procedure or repeat doctor’s visit • Softer and more pliable than NuvaRing and doesn’t require refrigeration • “Vaginal System” - a new class of contraception with potential for $ 0 co - pay • Acceptable for all indicated women including nulliparous women and women who are not in a monogamous relationship * • Empowers women to be in complete control of their fertility and menstruation • Available with a single annual pharmacy visit Patients • A long - acting reversible birth control option that doesn’t require a procedure • No requirement to buy, hold and manage inventory • Acceptable for nulliparous women and women not in a monogamous relationship * • Satisfies patients’ desire to be in control of their fertility and menstruation Healthcare Providers * Lohr , et al. Use of intrauterine devices in nulliparous women. Contraception 95 (2017); 529 - 537

10 Unique Product Characteristics Should Lead to Good Payor Coverage ▪ Anticipate parity or discount pricing level ~$1400 annual WAC cost ▪ 40% decrease to annual WAC of NuvaRing, reflects TXMD’s responsible brand pricing ▪ Allows for improved patient adherence and a potential decrease in unplanned pregnancies ▪ Only one pharmacy fill fee per year (estimated savings of $33 annually) ▪ No repeat office visit or procedure fees (several hundred dollars) ▪ Contains ethinyl estradiol and Nestorone ®, a new and unique progestin ▪ “Vaginal System” - a new class of contraception with potential for $0 co - pay The Affordable Care Act (ACA) mandates that private health plans provide coverage for one treatment per class of contraception used by women with no patient out - of - pocket costs

11 NuvaRing Prescribers Overlap with TXMD Sales Force 1 ▪ 81% of total prescribers within current 150 TXMD territories ▪ No additional sales representatives needed =TXMD territories 150 Reps 1. IQUVIA Data TXMD Sales Force Has Strong Overlap With NuvaRing Prescribers

12 Commercialization Strategy & Timing Commercialization & Launch Timing ▪ Estimated to be commercially available as early as Q3’19 with commercial launch as early as Q4’19 to Q1’20 ▪ Additional marketing team exclusively focused on Annovera anticipated ▪ TXMD to be responsible for all aspects of promotion, product positioning, pricing, education programs, publications, sales messages, and any additional desired clinical studies (subject to oversight by the Joint Product Committee) 1. Lohr , et al. Use of intrauterine devices in nulliparous women. Contraception 95 (2017); 529 - 537 Focused Launch Strategy - Base Case Market Opportunity ▪ NuvaRing customers – monthly ring replaced by annual ring ▪ ~60K annual v itaMedMD prenatal customers who may proceed to contraception ▪ Patients who prefer long acting reversible contraception but fear procedures ▪ Healthcare providers who prefer long acting reversible contraception but forgo due to procedures and cost of procurement ▪ Nulliparous women and those who are not in a monogamous relationship who desire long acting reversible contraception but discouraged from IUDs 1

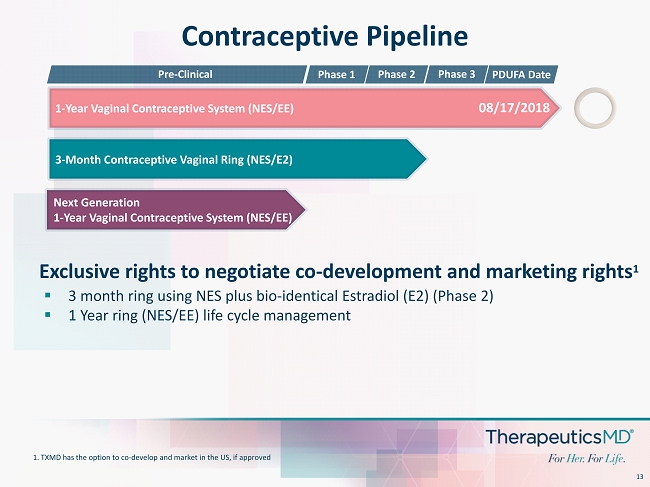

13 Next Generation 1 - Year Vaginal Contraceptive System (NES/EE) Contraceptive Pipeline 3 - Month Contraceptive Vaginal Ring (NES/E2) 1 - Year Vaginal Contraceptive System ( NES/EE) Phase 1 08/17/2018 Pre - Clinical Phase 3 Phase 2 PDUFA Date ▪ 3 month ring using NES plus bio - identical Estradiol (E2) (Phase 2) ▪ 1 Year ring (NES/EE) life cycle management Exclusive rights to negotiate co - development and marketing rights 1 1. TXMD has the option to co - develop and market in the US, if approved

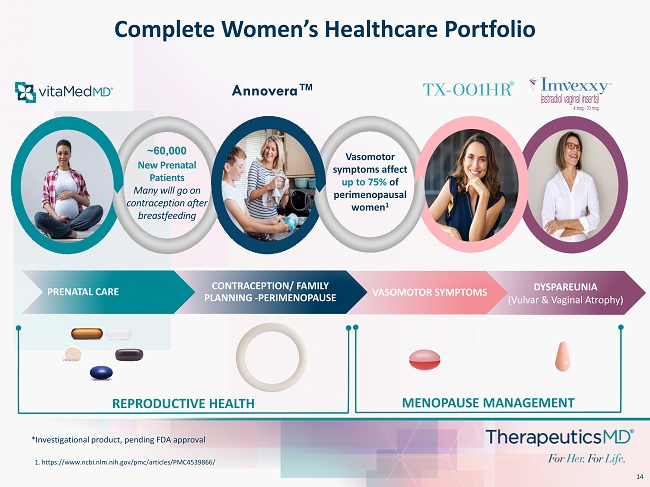

14 Annovera™ VASOMOTOR SYMPTOMS Complete Women’s Healthcare Portfolio Vasomotor symptoms affect up to 75% of perimenopausal women 1 1. https:// www.ncbi.nlm.nih.gov / pmc /articles/PMC4539866/ *Investigational product, pending FDA approval * DYSPAREUNIA (Vulvar & Vaginal Atrophy) PRENATAL CARE CONTRACEPTION/ FAMILY PLANNING - PERIMENOPAUSE ~60,000 New Prenatal Patients Many will go on contraception after breastfeeding REPRODUCTIVE HEALTH MENOPAUSE MANAGEMENT

15 Q&A