Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - CONSOLIDATED EDISON INC | ed-20180630xexx991.htm |

| 8-K - 8-K - CONSOLIDATED EDISON INC | ed-20180630xpr.htm |

2nd Quarter 2018 Earnings Release Presentation August 2, 2018

Available Information On August 2, 2018, Consolidated Edison, Inc. issued a press release reporting its second quarter 2018 earnings and filed with the Securities and Exchange Commission the company’s second quarter 2018 Form 10-Q. This presentation should be read together with, and is qualified in its entirety by reference to, the earnings press release and the Form 10-Q. Copies of the earnings press release and the Form 10-Q are available at: www.conedison.com (select "For Investors" and then select "Press Releases“ and “SEC Filings”, respectively). Forward-Looking Statements This presentation contains forward-looking statements that are intended to qualify for the safe-harbor provisions of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements are statements of future expectations and not facts. Words such as "forecasts," "expects," "estimates," "anticipates," "intends," "believes," "plans," "will" and similar expressions identify forward-looking statements. The forward-looking statements reflect information available and assumptions at the time the statements are made, and speak only as of that time. Actual results or developments may differ materially from those included in the forward-looking statements because of various factors such as those identified in reports the company has filed with the Securities and Exchange Commission, including that the company's subsidiaries are extensively regulated and are subject to penalties; its utility subsidiaries' rate plans may not provide a reasonable return; it may be adversely affected by changes to the utility subsidiaries' rate plans; the intentional misconduct of employees or contractors could adversely affect it; the failure of, or damage to, its subsidiaries' facilities could adversely affect it; a cyber-attack could adversely affect it; it is exposed to risks from the environmental consequences of its subsidiaries' operations; a disruption in the wholesale energy markets or failure by an energy supplier could adversely affect it; it has substantial unfunded pension and other postretirement benefit liabilities; its ability to pay dividends or interest depends on dividends from its subsidiaries; it requires access to capital markets to satisfy funding requirements; changes to tax laws could adversely affect it; its strategies may not be effective to address changes in the external business environment; and it also faces other risks that are beyond its control. Non-GAAP Financial Measure This presentation also contains a financial measure, adjusted earnings, that is not determined in accordance with generally accepted accounting principles in the United States of America (GAAP). This non-GAAP financial measure should not be considered as an alternative to net income, which is an indicator of financial performance determined in accordance with GAAP. Adjusted earnings excludes from net income the net mark-to-market changes in the fair value of the derivative instruments the subsidiaries of Con Edison Clean Energy Businesses, Inc. use to economically hedge market price fluctuations in related underlying physical transactions for the purchase or sale of electricity and gas. Adjusted earnings may also exclude from net income certain other items that the company does not consider indicative of its ongoing financial performance. Management uses this non-GAAP financial measure to facilitate the analysis of the company's financial performance as compared to its internal budgets and previous financial results. Management also uses this non-GAAP financial measure to communicate to investors and others the company's expectations regarding its future earnings and dividends on its common stock. Management believes that this non-GAAP financial measure is also useful and meaningful to investors to facilitate their analysis of the company's financial performance. For more information, contact: Jan Childress, Director, Investor Relations Olivia M. Webb, Manager, Investor Relations Tel.: 212-460-6611, Email: childressj@coned.com Tel.: 212-460-3431, Email: webbo@coned.com www.conEdison.com 2

Table of Contents Page Organizational Structure and Plan 4-5 Dividend and Earnings Announcements 6 2Q 2018 Earnings 7-10 2Q 2018 Developments 11-12 Tax Cuts and Jobs Act of 2017 (TCJA) 13-14 2018 Earnings 15-18 Five-Year Reconciliation of Reported EPS (GAAP) to Adjusted EPS (Non-GAAP) 19 CECONY Operations and Maintenance Expenses 20 Composition of Regulatory Rate Base 21 Average Rate Base Balances 22 Regulated Utility Rates of Return and Equity Ratio 23 Earnings Adjustment Mechanisms and Positive Incentives 24 Capital Expenditures and Utility Capital Expenditures 25-26 2018 Financing Plan and Activity 27 Capital Structure and Liquidity Profile 28-29 Utility Sales and Revenues 30-35 List of Notes to 2018 Form 10-Q Financial Statements 36 3

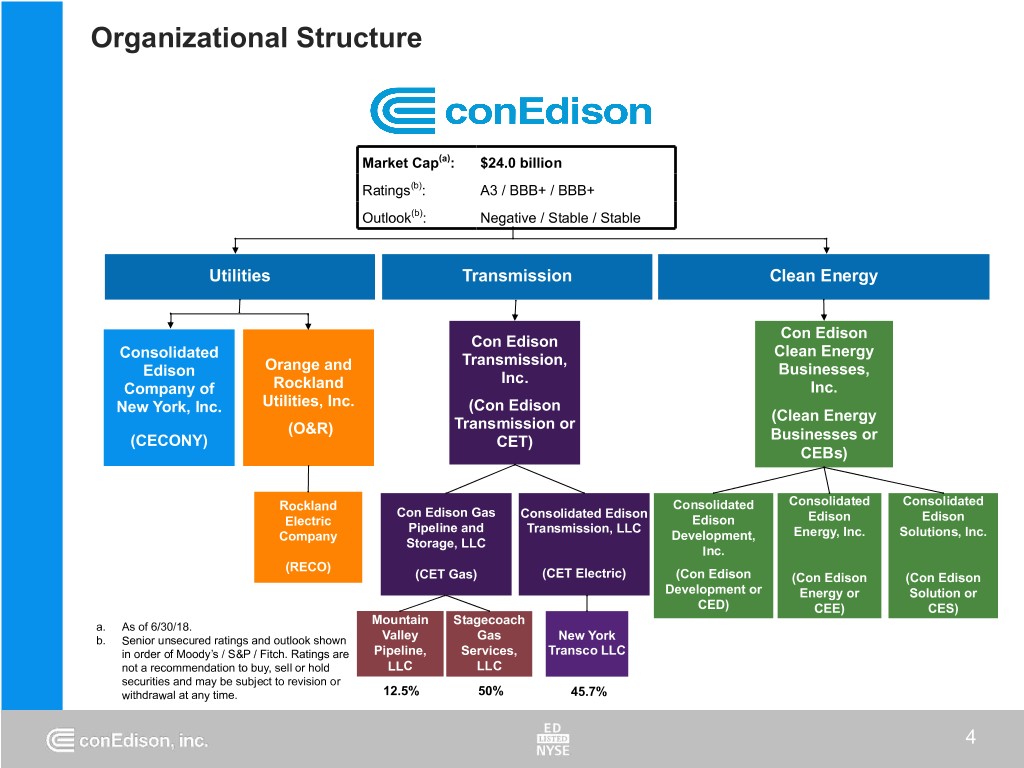

Organizational Structure Market Cap(a): $24.0 billion Ratings(b): A3 / BBB+ / BBB+ Outlook(b): Negative / Stable / Stable Utilities Transmission Clean Energy Con Edison Con Edison Clean Energy Consolidated Transmission, Orange and Businesses, Edison Inc. Company of Rockland Inc. New York, Inc. Utilities, Inc. (Con Edison (Clean Energy (O&R) Transmission or (CECONY) CET) Businesses or CEBs) Rockland Consolidated Consolidated Consolidated Con Edison Gas Consolidated Edison Electric Edison Edison Edison Pipeline and Transmission, LLC Company Development, Energy, Inc. Solutions, Inc. Storage, LLC Inc. (RECO) (CET Gas) (CET Electric) (Con Edison (Con Edison (Con Edison Development or Energy or Solution or CED) CEE) CES) Mountain Stagecoach a. As of 6/30/18. b. Senior unsecured ratings and outlook shown Valley Gas New York in order of Moody’s / S&P / Fitch. Ratings are Pipeline, Services, Transco LLC not a recommendation to buy, sell or hold LLC LLC securities and may be subject to revision or withdrawal at any time. 12.5% 50% 45.7% 4

The Con Edison Plan Customer Focused Strategic Value Oriented Provide safe and Strengthen core Provide steady, reliable service utility delivery predictable business earnings Enhance the Pursue additional Maintain customer regulated growth balance sheet experience opportunities to add stability value in the evolving industry Achieve Grow existing Pay attractive, operational clean energy growing excellence and businesses and dividends cost optimization pursue additional clean energy growth opportunities consistent with our risk appetite 5

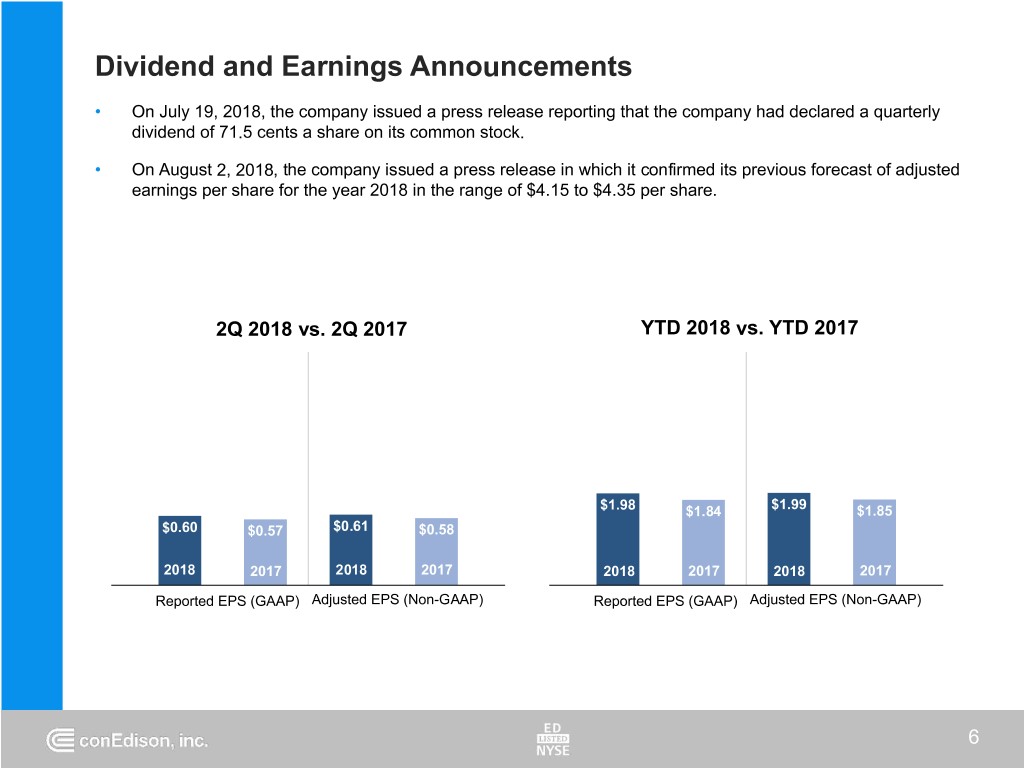

Dividend and Earnings Announcements • On July 19, 2018, the company issued a press release reporting that the company had declared a quarterly dividend of 71.5 cents a share on its common stock. • On August 2, 2018, the company issued a press release in which it confirmed its previous forecast of adjusted earnings per share for the year 2018 in the range of $4.15 to $4.35 per share. 2Q 2018 vs. 2Q 2017 YTD 2018 vs. YTD 2017 $1.98 $1.84 $1.99 $1.85 $0.60 $0.57 $0.61 $0.58 2018 2017 2018 2017 2018 2017 2018 2017 Reported EPS (GAAP) Adjusted EPS (Non-GAAP) Reported EPS (GAAP) Adjusted EPS (Non-GAAP) 6

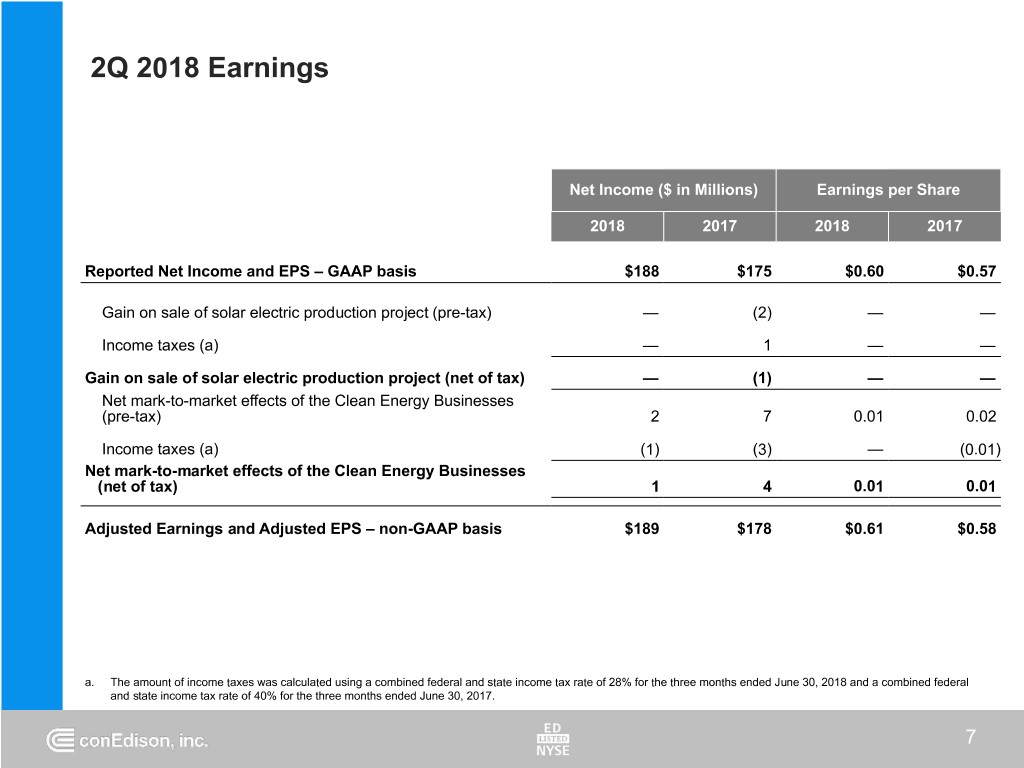

2Q 2018 Earnings Net Income ($ in Millions) Earnings per Share 2018 2017 2018 2017 Reported Net Income and EPS – GAAP basis $188 $175 $0.60 $0.57 Gain on sale of solar electric production project (pre-tax) — (2) — — Income taxes (a) — 1 — — Gain on sale of solar electric production project (net of tax) — (1) — — Net mark-to-market effects of the Clean Energy Businesses (pre-tax) 2 7 0.01 0.02 Income taxes (a) (1) (3) — (0.01) Net mark-to-market effects of the Clean Energy Businesses (net of tax) 1 4 0.01 0.01 Adjusted Earnings and Adjusted EPS – non-GAAP basis $189 $178 $0.61 $0.58 a. The amount of income taxes was calculated using a combined federal and state income tax rate of 28% for the three months ended June 30, 2018 and a combined federal and state income tax rate of 40% for the three months ended June 30, 2017. 7

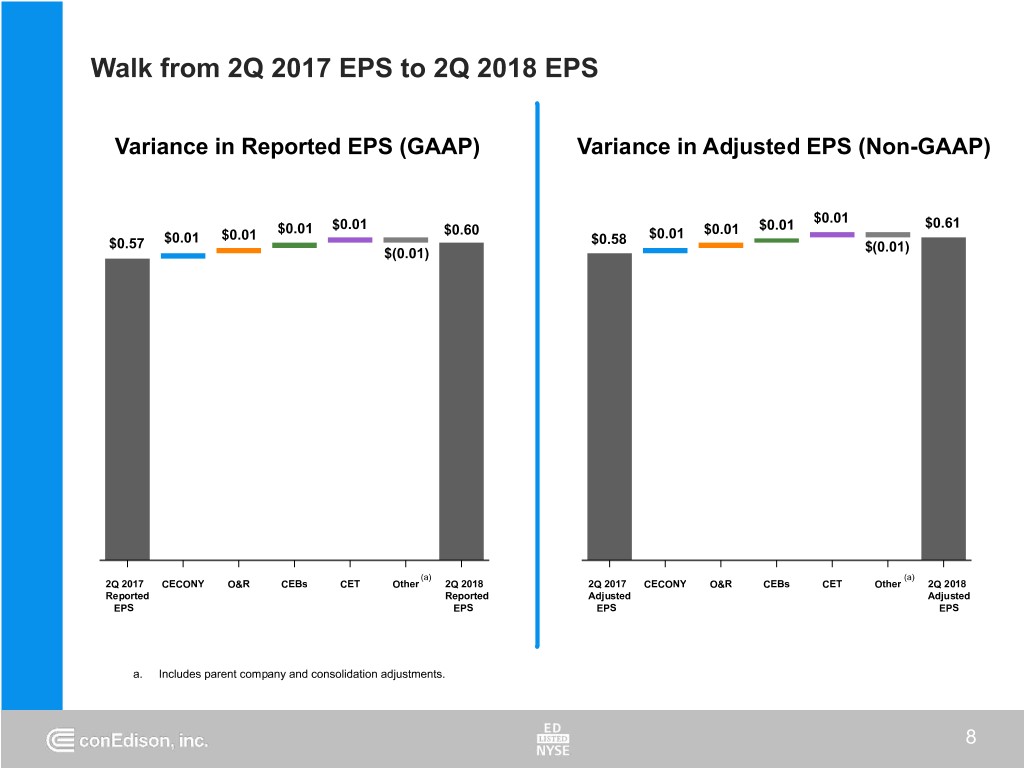

Walk from 2Q 2017 EPS to 2Q 2018 EPS Variance in Reported EPS (GAAP) Variance in Adjusted EPS (Non-GAAP) $0.01 $0.01 $0.01 $0.61 $0.01 $0.01 $0.60 $0.01 $0.01 $0.57 $0.01 $0.58 $(0.01) $(0.01) (a) (a) 2Q 2017 CECONY O&R CEBs CET Other 2Q 2018 2Q 2017 CECONY O&R CEBs CET Other 2Q 2018 Reported Reported Adjusted Adjusted EPS EPS EPS EPS a. Includes parent company and consolidation adjustments. 8

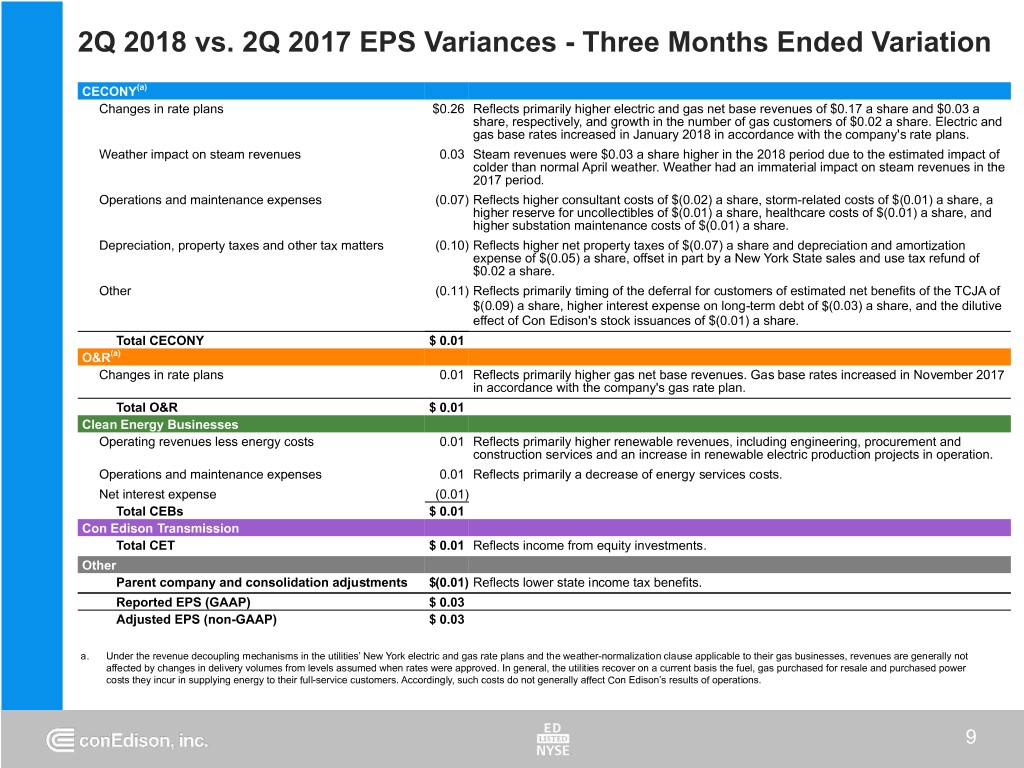

2Q 2018 vs. 2Q 2017 EPS Variances - Three Months Ended Variation CECONY(a) Changes in rate plans $0.26 Reflects primarily higher electric and gas net base revenues of $0.17 a share and $0.03 a share, respectively, and growth in the number of gas customers of $0.02 a share. Electric and gas base rates increased in January 2018 in accordance with the company's rate plans. Weather impact on steam revenues 0.03 Steam revenues were $0.03 a share higher in the 2018 period due to the estimated impact of colder than normal April weather. Weather had an immaterial impact on steam revenues in the 2017 period. Operations and maintenance expenses (0.07) Reflects higher consultant costs of $(0.02) a share, storm-related costs of $(0.01) a share, a higher reserve for uncollectibles of $(0.01) a share, healthcare costs of $(0.01) a share, and higher substation maintenance costs of $(0.01) a share. Depreciation, property taxes and other tax matters (0.10) Reflects higher net property taxes of $(0.07) a share and depreciation and amortization expense of $(0.05) a share, offset in part by a New York State sales and use tax refund of $0.02 a share. Other (0.11) Reflects primarily timing of the deferral for customers of estimated net benefits of the TCJA of $(0.09) a share, higher interest expense on long-term debt of $(0.03) a share, and the dilutive effect of Con Edison's stock issuances of $(0.01) a share. Total CECONY $ 0.01 O&R(a) Changes in rate plans 0.01 Reflects primarily higher gas net base revenues. Gas base rates increased in November 2017 in accordance with the company's gas rate plan. Total O&R $ 0.01 Clean Energy Businesses Operating revenues less energy costs 0.01 Reflects primarily higher renewable revenues, including engineering, procurement and construction services and an increase in renewable electric production projects in operation. Operations and maintenance expenses 0.01 Reflects primarily a decrease of energy services costs. Net interest expense (0.01) Total CEBs $ 0.01 Con Edison Transmission Total CET $ 0.01 Reflects income from equity investments. Other Parent company and consolidation adjustments $(0.01) Reflects lower state income tax benefits. Reported EPS (GAAP) $ 0.03 Adjusted EPS (non-GAAP) $ 0.03 a. Under the revenue decoupling mechanisms in the utilities’ New York electric and gas rate plans and the weather-normalization clause applicable to their gas businesses, revenues are generally not affected by changes in delivery volumes from levels assumed when rates were approved. In general, the utilities recover on a current basis the fuel, gas purchased for resale and purchased power costs they incur in supplying energy to their full-service customers. Accordingly, such costs do not generally affect Con Edison’s results of operations. 9

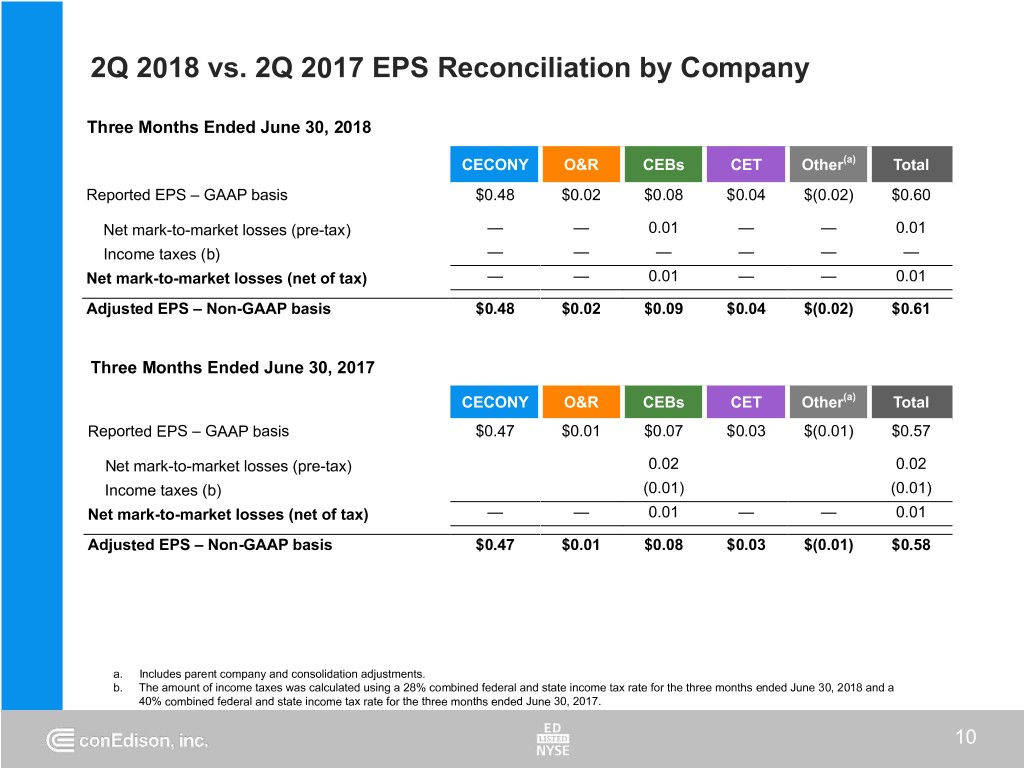

2Q 2018 vs. 2Q 2017 EPS Reconciliation by Company Three Months Ended June 30, 2018 CECONY O&R CEBs CET Other(a) Total Reported EPS – GAAP basis $0.48 $0.02 $0.08 $0.04 $(0.02) $0.60 Net mark-to-market losses (pre-tax) — — 0.01 — — 0.01 Income taxes (b) — — — — — — Net mark-to-market losses (net of tax) — — 0.01 — — 0.01 Adjusted EPS – Non-GAAP basis $0.48 $0.02 $0.09 $0.04 $(0.02) $0.61 Three Months Ended June 30, 2017 CECONY O&R CEBs CET Other(a) Total Reported EPS – GAAP basis $0.47 $0.01 $0.07 $0.03 $(0.01) $0.57 Net mark-to-market losses (pre-tax) 0.02 0.02 Income taxes (b) (0.01) (0.01) Net mark-to-market losses (net of tax) — — 0.01 — — 0.01 Adjusted EPS – Non-GAAP basis $0.47 $0.01 $0.08 $0.03 $(0.01) $0.58 a. Includes parent company and consolidation adjustments. b. The amount of income taxes was calculated using a 28% combined federal and state income tax rate for the three months ended June 30, 2018 and a 40% combined federal and state income tax rate for the three months ended June 30, 2017. 10

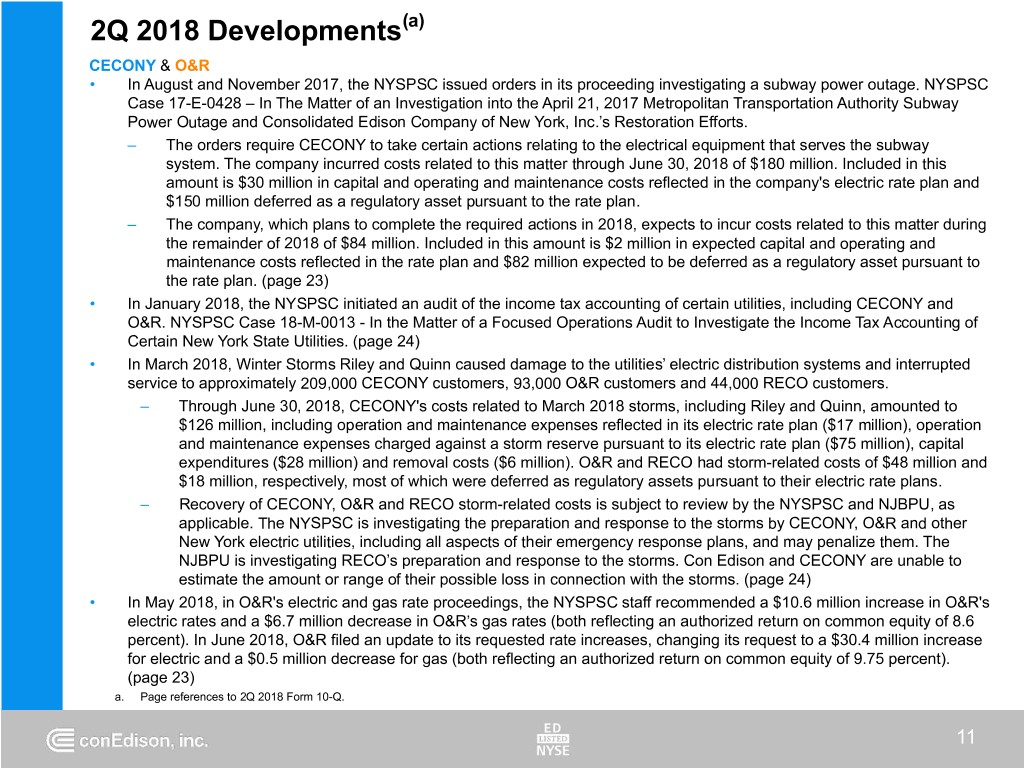

2Q 2018 Developments(a) CECONY & O&R • In August and November 2017, the NYSPSC issued orders in its proceeding investigating a subway power outage. NYSPSC Case 17-E-0428 – In The Matter of an Investigation into the April 21, 2017 Metropolitan Transportation Authority Subway Power Outage and Consolidated Edison Company of New York, Inc.’s Restoration Efforts. – The orders require CECONY to take certain actions relating to the electrical equipment that serves the subway system. The company incurred costs related to this matter through June 30, 2018 of $180 million. Included in this amount is $30 million in capital and operating and maintenance costs reflected in the company's electric rate plan and $150 million deferred as a regulatory asset pursuant to the rate plan. – The company, which plans to complete the required actions in 2018, expects to incur costs related to this matter during the remainder of 2018 of $84 million. Included in this amount is $2 million in expected capital and operating and maintenance costs reflected in the rate plan and $82 million expected to be deferred as a regulatory asset pursuant to the rate plan. (page 23) • In January 2018, the NYSPSC initiated an audit of the income tax accounting of certain utilities, including CECONY and O&R. NYSPSC Case 18-M-0013 - In the Matter of a Focused Operations Audit to Investigate the Income Tax Accounting of Certain New York State Utilities. (page 24) • In March 2018, Winter Storms Riley and Quinn caused damage to the utilities’ electric distribution systems and interrupted service to approximately 209,000 CECONY customers, 93,000 O&R customers and 44,000 RECO customers. – Through June 30, 2018, CECONY's costs related to March 2018 storms, including Riley and Quinn, amounted to $126 million, including operation and maintenance expenses reflected in its electric rate plan ($17 million), operation and maintenance expenses charged against a storm reserve pursuant to its electric rate plan ($75 million), capital expenditures ($28 million) and removal costs ($6 million). O&R and RECO had storm-related costs of $48 million and $18 million, respectively, most of which were deferred as regulatory assets pursuant to their electric rate plans. – Recovery of CECONY, O&R and RECO storm-related costs is subject to review by the NYSPSC and NJBPU, as applicable. The NYSPSC is investigating the preparation and response to the storms by CECONY, O&R and other New York electric utilities, including all aspects of their emergency response plans, and may penalize them. The NJBPU is investigating RECO’s preparation and response to the storms. Con Edison and CECONY are unable to estimate the amount or range of their possible loss in connection with the storms. (page 24) • In May 2018, in O&R's electric and gas rate proceedings, the NYSPSC staff recommended a $10.6 million increase in O&R's electric rates and a $6.7 million decrease in O&R’s gas rates (both reflecting an authorized return on common equity of 8.6 percent). In June 2018, O&R filed an update to its requested rate increases, changing its request to a $30.4 million increase for electric and a $0.5 million decrease for gas (both reflecting an authorized return on common equity of 9.75 percent). (page 23) a. Page references to 2Q 2018 Form 10-Q. 11

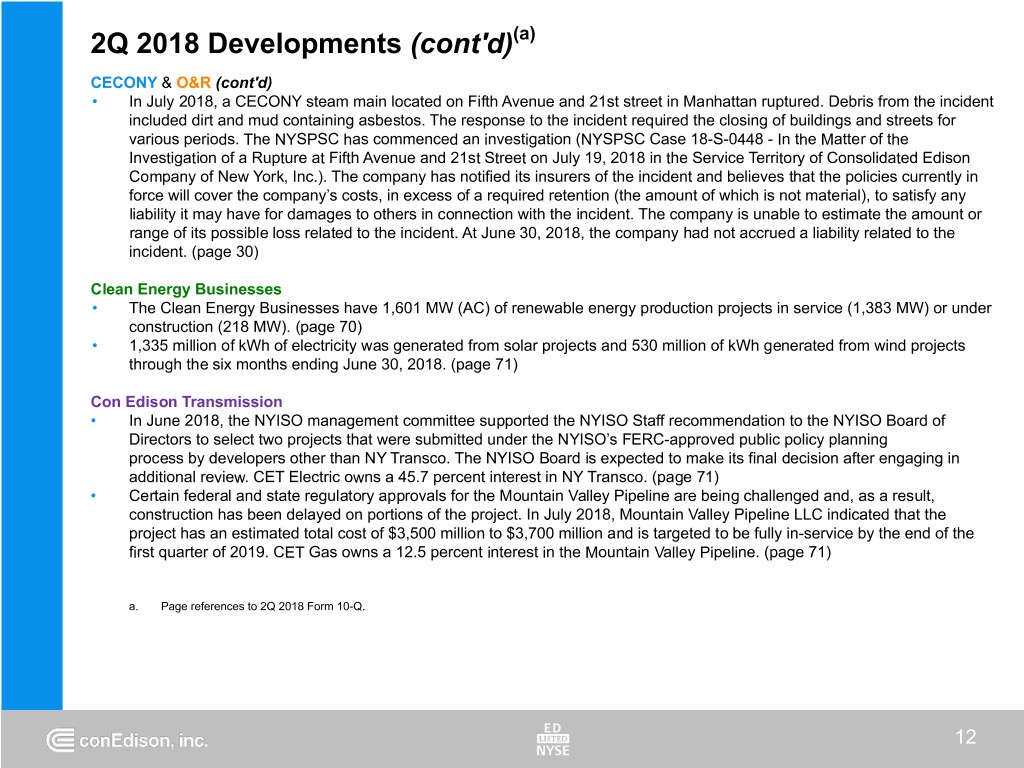

2Q 2018 Developments (cont'd)(a) CECONY & O&R (cont'd) • In July 2018, a CECONY steam main located on Fifth Avenue and 21st street in Manhattan ruptured. Debris from the incident included dirt and mud containing asbestos. The response to the incident required the closing of buildings and streets for various periods. The NYSPSC has commenced an investigation (NYSPSC Case 18-S-0448 - In the Matter of the Investigation of a Rupture at Fifth Avenue and 21st Street on July 19, 2018 in the Service Territory of Consolidated Edison Company of New York, Inc.). The company has notified its insurers of the incident and believes that the policies currently in force will cover the company’s costs, in excess of a required retention (the amount of which is not material), to satisfy any liability it may have for damages to others in connection with the incident. The company is unable to estimate the amount or range of its possible loss related to the incident. At June 30, 2018, the company had not accrued a liability related to the incident. (page 30) Clean Energy Businesses • The Clean Energy Businesses have 1,601 MW (AC) of renewable energy production projects in service (1,383 MW) or under construction (218 MW). (page 70) • 1,335 million of kWh of electricity was generated from solar projects and 530 million of kWh generated from wind projects through the six months ending June 30, 2018. (page 71) Con Edison Transmission • In June 2018, the NYISO management committee supported the NYISO Staff recommendation to the NYISO Board of Directors to select two projects that were submitted under the NYISO’s FERC-approved public policy planning process by developers other than NY Transco. The NYISO Board is expected to make its final decision after engaging in additional review. CET Electric owns a 45.7 percent interest in NY Transco. (page 71) • Certain federal and state regulatory approvals for the Mountain Valley Pipeline are being challenged and, as a result, construction has been delayed on portions of the project. In July 2018, Mountain Valley Pipeline LLC indicated that the project has an estimated total cost of $3,500 million to $3,700 million and is targeted to be fully in-service by the end of the first quarter of 2019. CET Gas owns a 12.5 percent interest in the Mountain Valley Pipeline. (page 71) a. Page references to 2Q 2018 Form 10-Q. 12

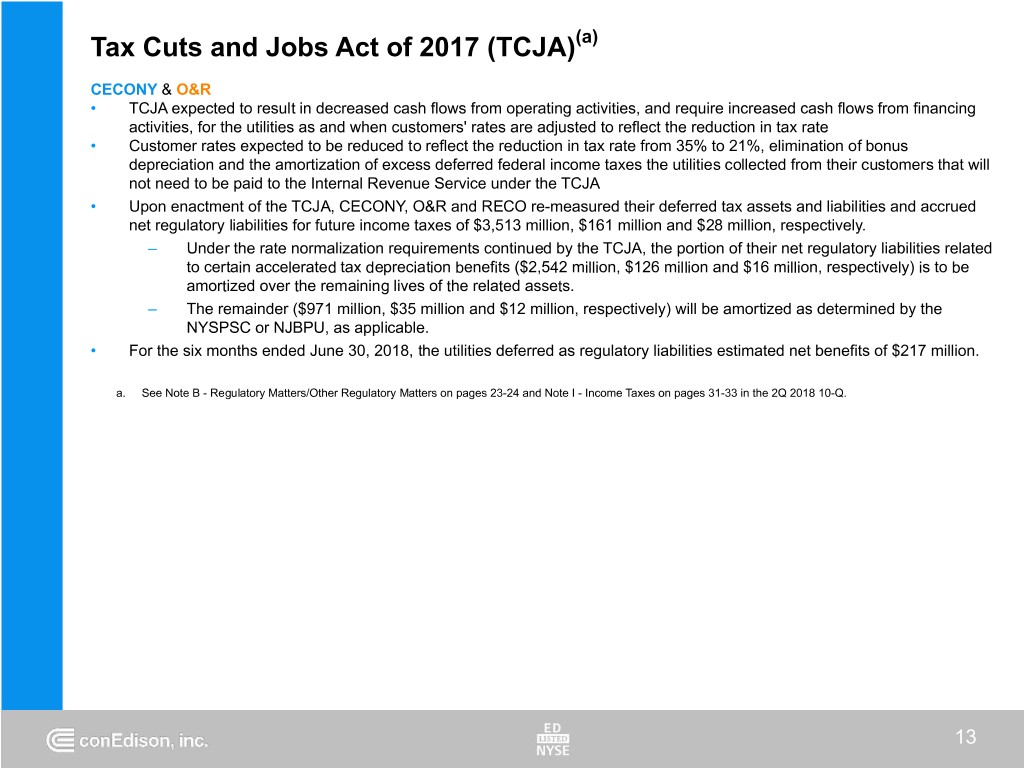

Tax Cuts and Jobs Act of 2017 (TCJA)(a) CECONY & O&R • TCJA expected to result in decreased cash flows from operating activities, and require increased cash flows from financing activities, for the utilities as and when customers' rates are adjusted to reflect the reduction in tax rate • Customer rates expected to be reduced to reflect the reduction in tax rate from 35% to 21%, elimination of bonus depreciation and the amortization of excess deferred federal income taxes the utilities collected from their customers that will not need to be paid to the Internal Revenue Service under the TCJA • Upon enactment of the TCJA, CECONY, O&R and RECO re-measured their deferred tax assets and liabilities and accrued net regulatory liabilities for future income taxes of $3,513 million, $161 million and $28 million, respectively. – Under the rate normalization requirements continued by the TCJA, the portion of their net regulatory liabilities related to certain accelerated tax depreciation benefits ($2,542 million, $126 million and $16 million, respectively) is to be amortized over the remaining lives of the related assets. – The remainder ($971 million, $35 million and $12 million, respectively) will be amortized as determined by the NYSPSC or NJBPU, as applicable. • For the six months ended June 30, 2018, the utilities deferred as regulatory liabilities estimated net benefits of $217 million. a. See Note B - Regulatory Matters/Other Regulatory Matters on pages 23-24 and Note I - Income Taxes on pages 31-33 in the 2Q 2018 10-Q. 13

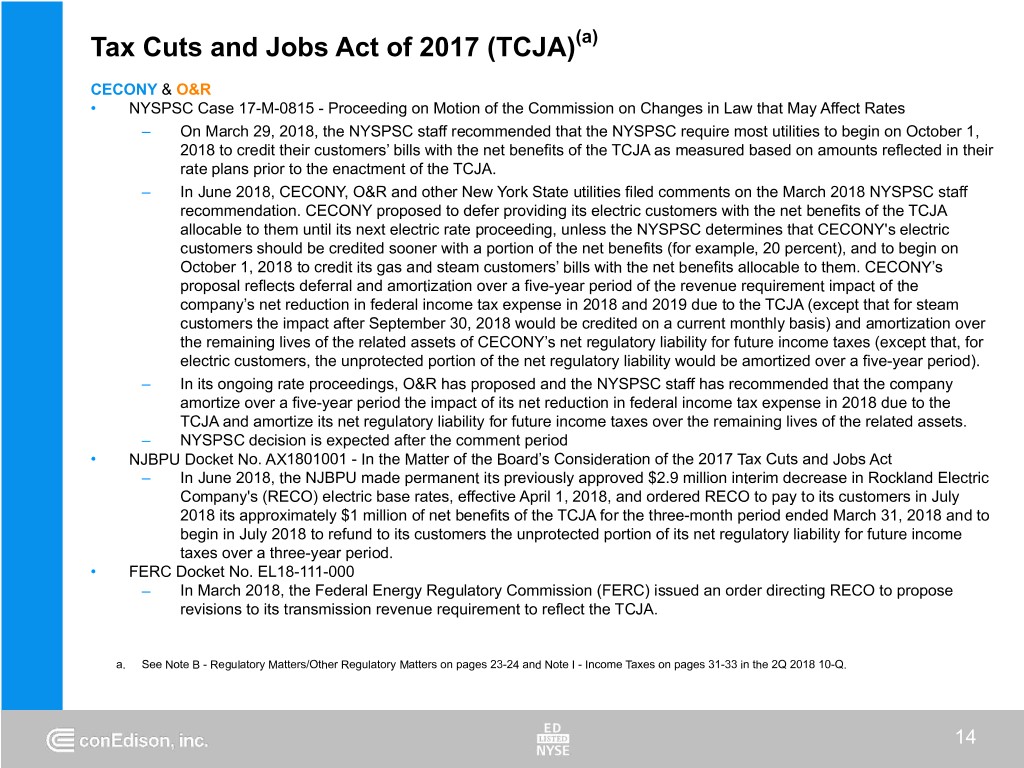

Tax Cuts and Jobs Act of 2017 (TCJA)(a) CECONY & O&R • NYSPSC Case 17-M-0815 - Proceeding on Motion of the Commission on Changes in Law that May Affect Rates – On March 29, 2018, the NYSPSC staff recommended that the NYSPSC require most utilities to begin on October 1, 2018 to credit their customers’ bills with the net benefits of the TCJA as measured based on amounts reflected in their rate plans prior to the enactment of the TCJA. – In June 2018, CECONY, O&R and other New York State utilities filed comments on the March 2018 NYSPSC staff recommendation. CECONY proposed to defer providing its electric customers with the net benefits of the TCJA allocable to them until its next electric rate proceeding, unless the NYSPSC determines that CECONY's electric customers should be credited sooner with a portion of the net benefits (for example, 20 percent), and to begin on October 1, 2018 to credit its gas and steam customers’ bills with the net benefits allocable to them. CECONY’s proposal reflects deferral and amortization over a five-year period of the revenue requirement impact of the company’s net reduction in federal income tax expense in 2018 and 2019 due to the TCJA (except that for steam customers the impact after September 30, 2018 would be credited on a current monthly basis) and amortization over the remaining lives of the related assets of CECONY’s net regulatory liability for future income taxes (except that, for electric customers, the unprotected portion of the net regulatory liability would be amortized over a five-year period). – In its ongoing rate proceedings, O&R has proposed and the NYSPSC staff has recommended that the company amortize over a five-year period the impact of its net reduction in federal income tax expense in 2018 due to the TCJA and amortize its net regulatory liability for future income taxes over the remaining lives of the related assets. – NYSPSC decision is expected after the comment period • NJBPU Docket No. AX1801001 - In the Matter of the Board’s Consideration of the 2017 Tax Cuts and Jobs Act – In June 2018, the NJBPU made permanent its previously approved $2.9 million interim decrease in Rockland Electric Company's (RECO) electric base rates, effective April 1, 2018, and ordered RECO to pay to its customers in July 2018 its approximately $1 million of net benefits of the TCJA for the three-month period ended March 31, 2018 and to begin in July 2018 to refund to its customers the unprotected portion of its net regulatory liability for future income taxes over a three-year period. • FERC Docket No. EL18-111-000 – In March 2018, the Federal Energy Regulatory Commission (FERC) issued an order directing RECO to propose revisions to its transmission revenue requirement to reflect the TCJA. a. See Note B - Regulatory Matters/Other Regulatory Matters on pages 23-24 and Note I - Income Taxes on pages 31-33 in the 2Q 2018 10-Q. 14

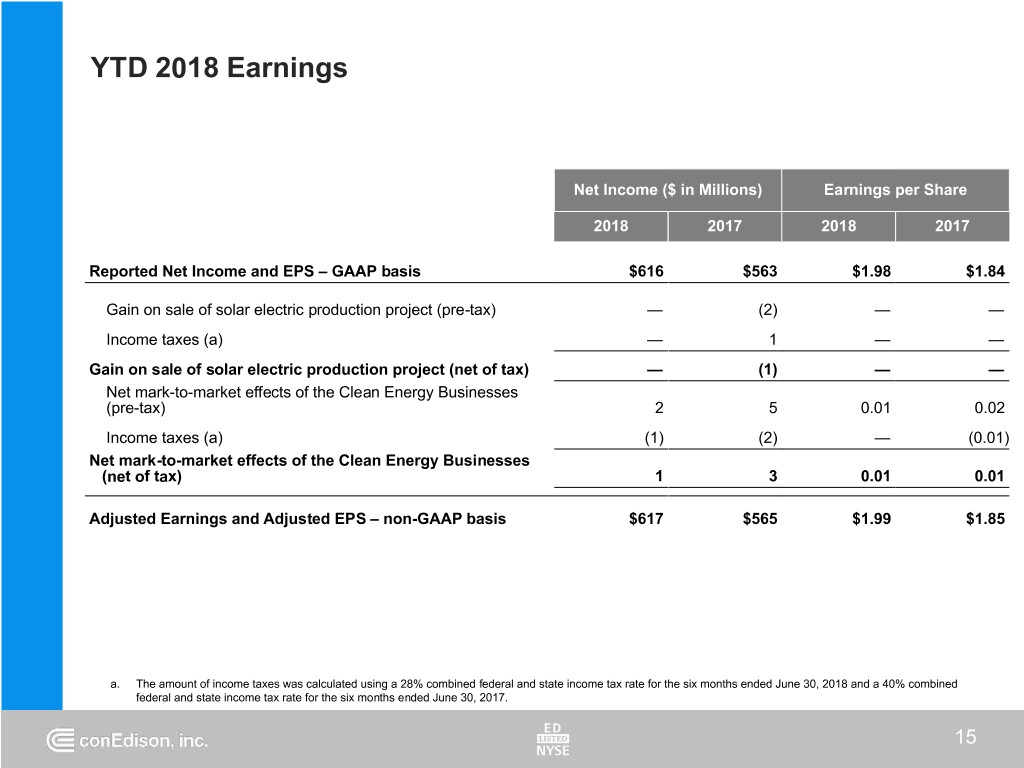

YTD 2018 Earnings Net Income ($ in Millions) Earnings per Share 2018 2017 2018 2017 Reported Net Income and EPS – GAAP basis $616 $563 $1.98 $1.84 Gain on sale of solar electric production project (pre-tax) — (2) — — Income taxes (a) — 1 — — Gain on sale of solar electric production project (net of tax) — (1) — — Net mark-to-market effects of the Clean Energy Businesses (pre-tax) 2 5 0.01 0.02 Income taxes (a) (1) (2) — (0.01) Net mark-to-market effects of the Clean Energy Businesses (net of tax) 1 3 0.01 0.01 Adjusted Earnings and Adjusted EPS – non-GAAP basis $617 $565 $1.99 $1.85 a. The amount of income taxes was calculated using a 28% combined federal and state income tax rate for the six months ended June 30, 2018 and a 40% combined federal and state income tax rate for the six months ended June 30, 2017. 15

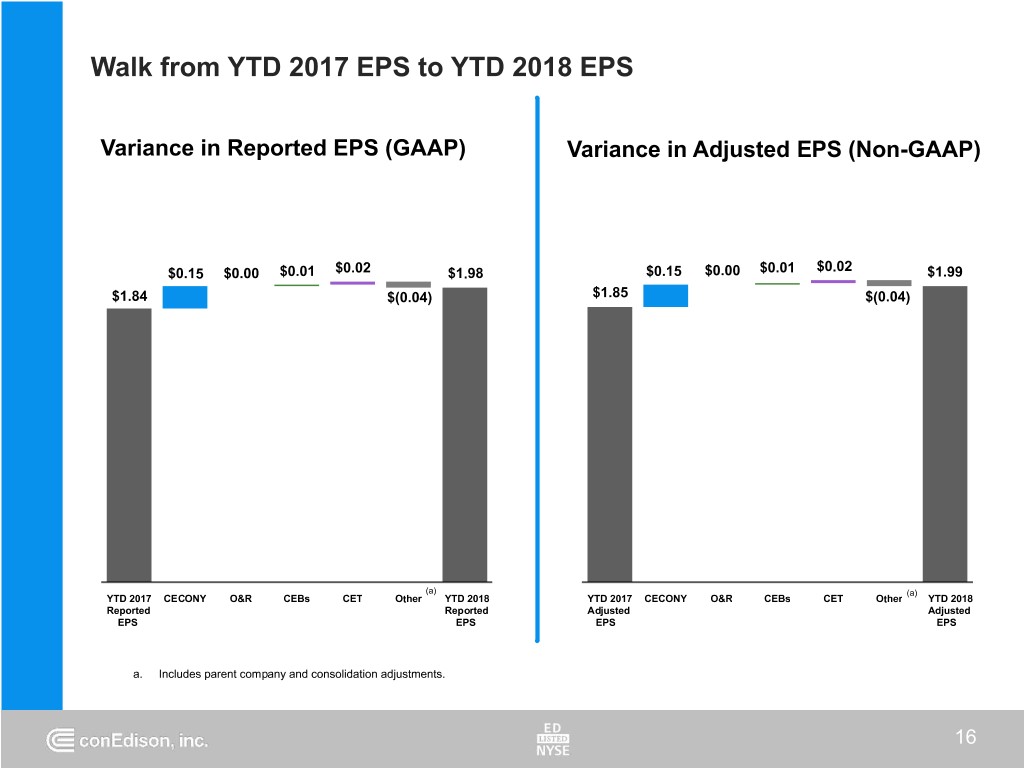

Walk from YTD 2017 EPS to YTD 2018 EPS Variance in Reported EPS (GAAP) Variance in Adjusted EPS (Non-GAAP) $0.02 $0.15 $0.00 $0.01 $0.02 $1.98 $0.15 $0.00 $0.01 $1.99 $1.84 $(0.04) $1.85 $(0.04) (a) (a) YTD 2017 CECONY O&R CEBs CET Other YTD 2018 YTD 2017 CECONY O&R CEBs CET Other YTD 2018 Reported Reported Adjusted Adjusted EPS EPS EPS EPS a. Includes parent company and consolidation adjustments. 16

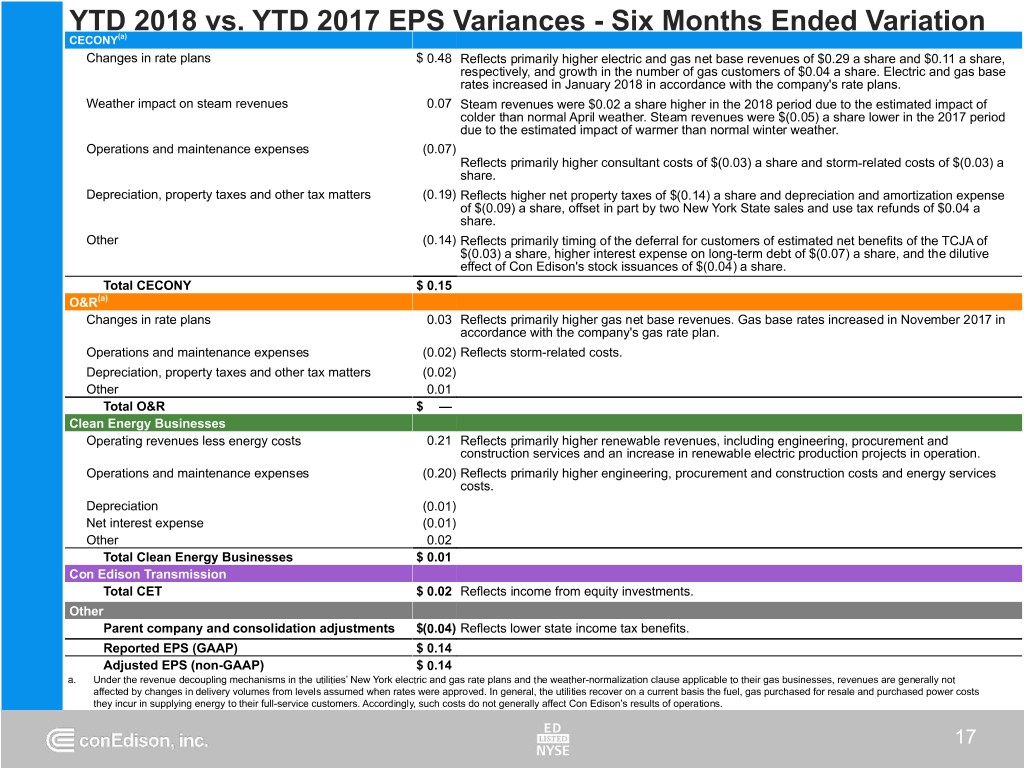

YTD 2018 vs. YTD 2017 EPS Variances - Six Months Ended Variation CECONY(a) Changes in rate plans $ 0.48 Reflects primarily higher electric and gas net base revenues of $0.29 a share and $0.11 a share, respectively, and growth in the number of gas customers of $0.04 a share. Electric and gas base rates increased in January 2018 in accordance with the company's rate plans. Weather impact on steam revenues 0.07 Steam revenues were $0.02 a share higher in the 2018 period due to the estimated impact of colder than normal April weather. Steam revenues were $(0.05) a share lower in the 2017 period due to the estimated impact of warmer than normal winter weather. Operations and maintenance expenses (0.07) Reflects primarily higher consultant costs of $(0.03) a share and storm-related costs of $(0.03) a share. Depreciation, property taxes and other tax matters (0.19) Reflects higher net property taxes of $(0.14) a share and depreciation and amortization expense of $(0.09) a share, offset in part by two New York State sales and use tax refunds of $0.04 a share. Other (0.14) Reflects primarily timing of the deferral for customers of estimated net benefits of the TCJA of $(0.03) a share, higher interest expense on long-term debt of $(0.07) a share, and the dilutive effect of Con Edison's stock issuances of $(0.04) a share. Total CECONY $ 0.15 O&R(a) Changes in rate plans 0.03 Reflects primarily higher gas net base revenues. Gas base rates increased in November 2017 in accordance with the company's gas rate plan. Operations and maintenance expenses (0.02) Reflects storm-related costs. Depreciation, property taxes and other tax matters (0.02) Other 0.01 Total O&R $ — Clean Energy Businesses Operating revenues less energy costs 0.21 Reflects primarily higher renewable revenues, including engineering, procurement and construction services and an increase in renewable electric production projects in operation. Operations and maintenance expenses (0.20) Reflects primarily higher engineering, procurement and construction costs and energy services costs. Depreciation (0.01) Net interest expense (0.01) Other 0.02 Total Clean Energy Businesses $ 0.01 Con Edison Transmission Total CET $ 0.02 Reflects income from equity investments. Other Parent company and consolidation adjustments $(0.04) Reflects lower state income tax benefits. Reported EPS (GAAP) $ 0.14 Adjusted EPS (non-GAAP) $ 0.14 a. Under the revenue decoupling mechanisms in the utilities’ New York electric and gas rate plans and the weather-normalization clause applicable to their gas businesses, revenues are generally not affected by changes in delivery volumes from levels assumed when rates were approved. In general, the utilities recover on a current basis the fuel, gas purchased for resale and purchased power costs they incur in supplying energy to their full-service customers. Accordingly, such costs do not generally affect Con Edison’s results of operations. 17

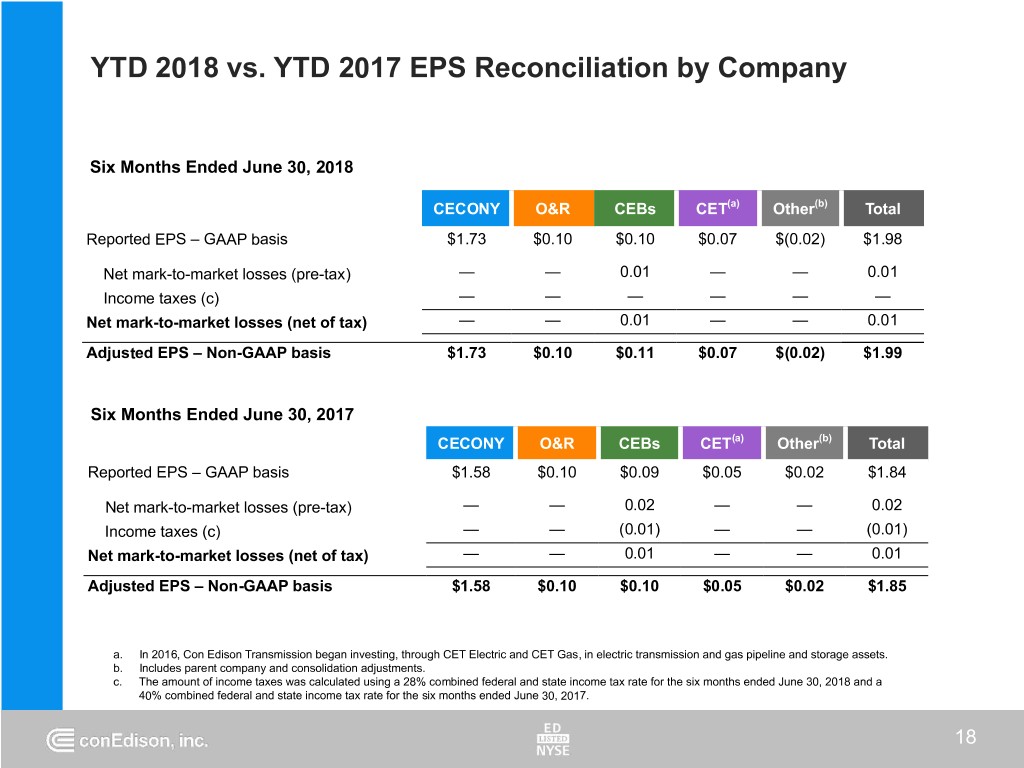

YTD 2018 vs. YTD 2017 EPS Reconciliation by Company Six Months Ended June 30, 2018 CECONY O&R CEBs CET(a) Other(b) Total Reported EPS – GAAP basis $1.73 $0.10 $0.10 $0.07 $(0.02) $1.98 Net mark-to-market losses (pre-tax) — — 0.01 — — 0.01 Income taxes (c) — — — — — — Net mark-to-market losses (net of tax) — — 0.01 — — 0.01 Adjusted EPS – Non-GAAP basis $1.73 $0.10 $0.11 $0.07 $(0.02) $1.99 Six Months Ended June 30, 2017 CECONY O&R CEBs CET(a) Other(b) Total Reported EPS – GAAP basis $1.58 $0.10 $0.09 $0.05 $0.02 $1.84 Net mark-to-market losses (pre-tax) — — 0.02 — — 0.02 Income taxes (c) — — (0.01) — — (0.01) Net mark-to-market losses (net of tax) — — 0.01 — — 0.01 Adjusted EPS – Non-GAAP basis $1.58 $0.10 $0.10 $0.05 $0.02 $1.85 a. In 2016, Con Edison Transmission began investing, through CET Electric and CET Gas, in electric transmission and gas pipeline and storage assets. b. Includes parent company and consolidation adjustments. c. The amount of income taxes was calculated using a 28% combined federal and state income tax rate for the six months ended June 30, 2018 and a 40% combined federal and state income tax rate for the six months ended June 30, 2017. 18

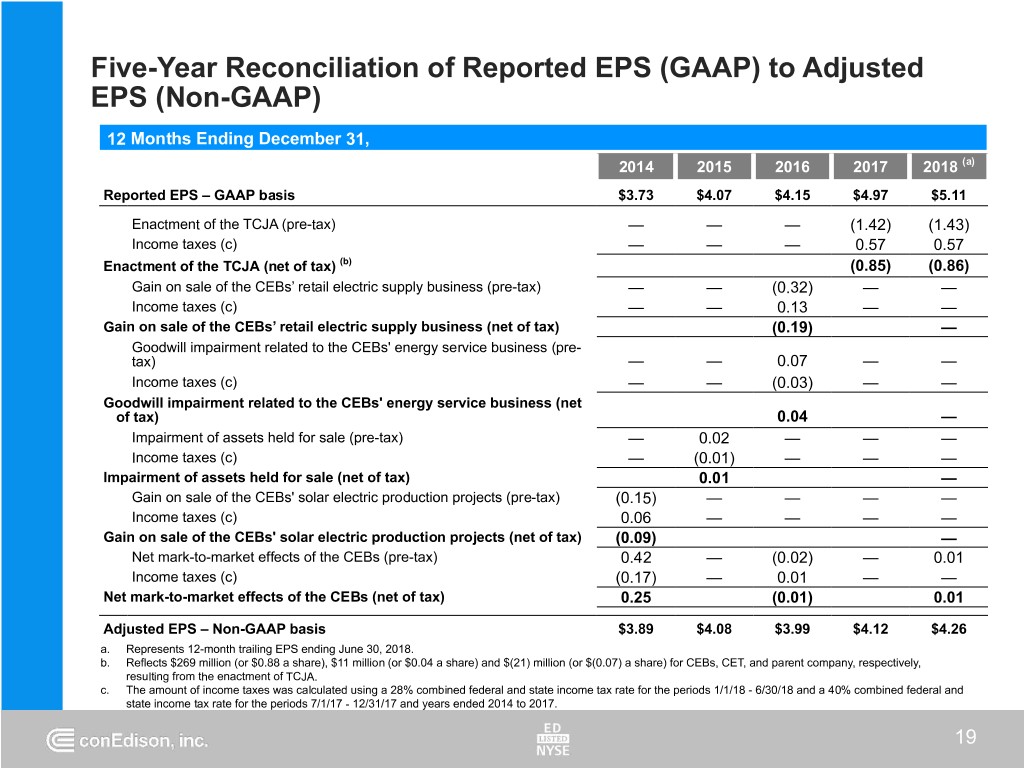

Five-Year Reconciliation of Reported EPS (GAAP) to Adjusted EPS (Non-GAAP) 12 Months Ending December 31, 2014 2015 2016 2017 2018 (a) Reported EPS – GAAP basis $3.73 $4.07 $4.15 $4.97 $5.11 Enactment of the TCJA (pre-tax) — — — (1.42) (1.43) Income taxes (c) — — — 0.57 0.57 Enactment of the TCJA (net of tax) (b) (0.85) (0.86) Gain on sale of the CEBs’ retail electric supply business (pre-tax) — — (0.32) — — Income taxes (c) — — 0.13 — — Gain on sale of the CEBs’ retail electric supply business (net of tax) (0.19) — Goodwill impairment related to the CEBs' energy service business (pre- tax) — — 0.07 — — Income taxes (c) — — (0.03) — — Goodwill impairment related to the CEBs' energy service business (net of tax) 0.04 — Impairment of assets held for sale (pre-tax) — 0.02 — — — Income taxes (c) — (0.01) — — — Impairment of assets held for sale (net of tax) 0.01 — Gain on sale of the CEBs' solar electric production projects (pre-tax) (0.15) — — — — Income taxes (c) 0.06 — — — — Gain on sale of the CEBs' solar electric production projects (net of tax) (0.09) — Net mark-to-market effects of the CEBs (pre-tax) 0.42 — (0.02) — 0.01 Income taxes (c) (0.17) — 0.01 — — Net mark-to-market effects of the CEBs (net of tax) 0.25 (0.01) 0.01 Adjusted EPS – Non-GAAP basis $3.89 $4.08 $3.99 $4.12 $4.26 a. Represents 12-month trailing EPS ending June 30, 2018. b. Reflects $269 million (or $0.88 a share), $11 million (or $0.04 a share) and $(21) million (or $(0.07) a share) for CEBs, CET, and parent company, respectively, resulting from the enactment of TCJA. c. The amount of income taxes was calculated using a 28% combined federal and state income tax rate for the periods 1/1/18 - 6/30/18 and a 40% combined federal and state income tax rate for the periods 7/1/17 - 12/31/17 and years ended 2014 to 2017. 19

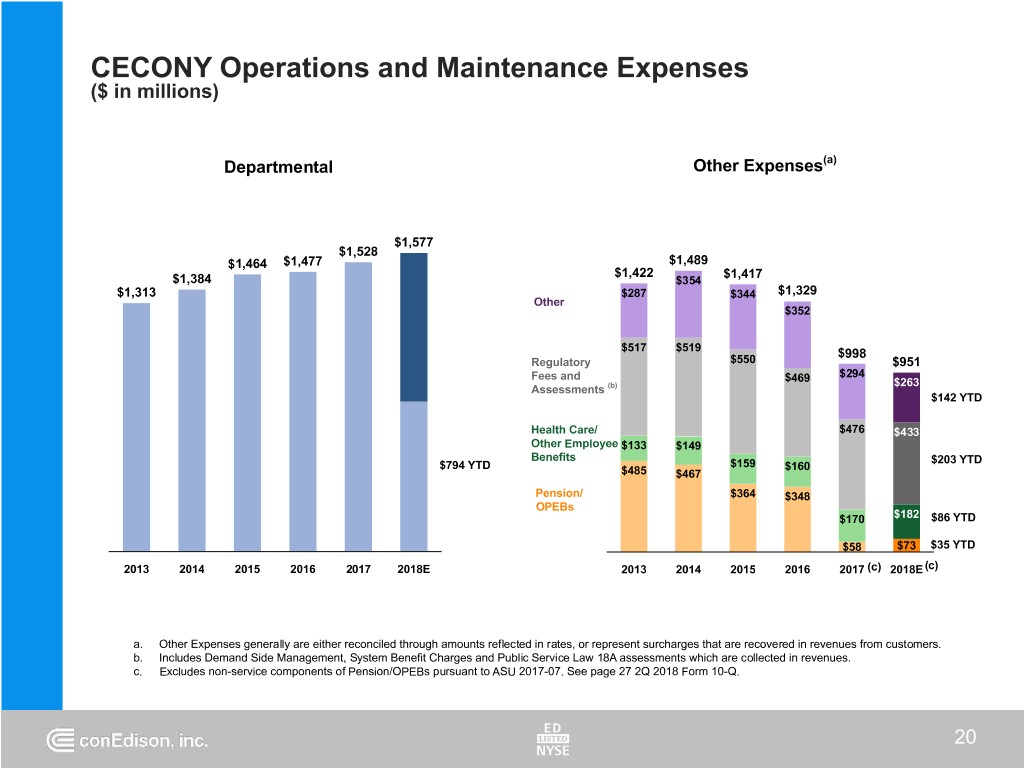

CECONY Operations and Maintenance Expenses ($ in millions) Departmental Other Expenses(a) $1,577 $1,528 $1,464 $1,477 $1,489 $1,422 $1,417 $1,384 $354 $1,313 $287 $344 $1,329 Other $352 $517 $519 $998 Regulatory $550 $951 Fees and $294 $469 $263 Assessments (b) $142 YTD Health Care/ $476 $433 Other Employee $133 $149 Benefits $203 YTD $794 YTD $159 $160 $485 $467 Pension/ $364 $348 OPEBs $170 $182 $86 YTD $58 $73 $35 YTD 2013 2014 2015 2016 2017 2018E 2013 2014 2015 2016 2017 (c) 2018E(c) a. Other Expenses generally are either reconciled through amounts reflected in rates, or represent surcharges that are recovered in revenues from customers. b. Includes Demand Side Management, System Benefit Charges and Public Service Law 18A assessments which are collected in revenues. c. Excludes non-service components of Pension/OPEBs pursuant to ASU 2017-07. See page 27 2Q 2018 Form 10-Q. 20

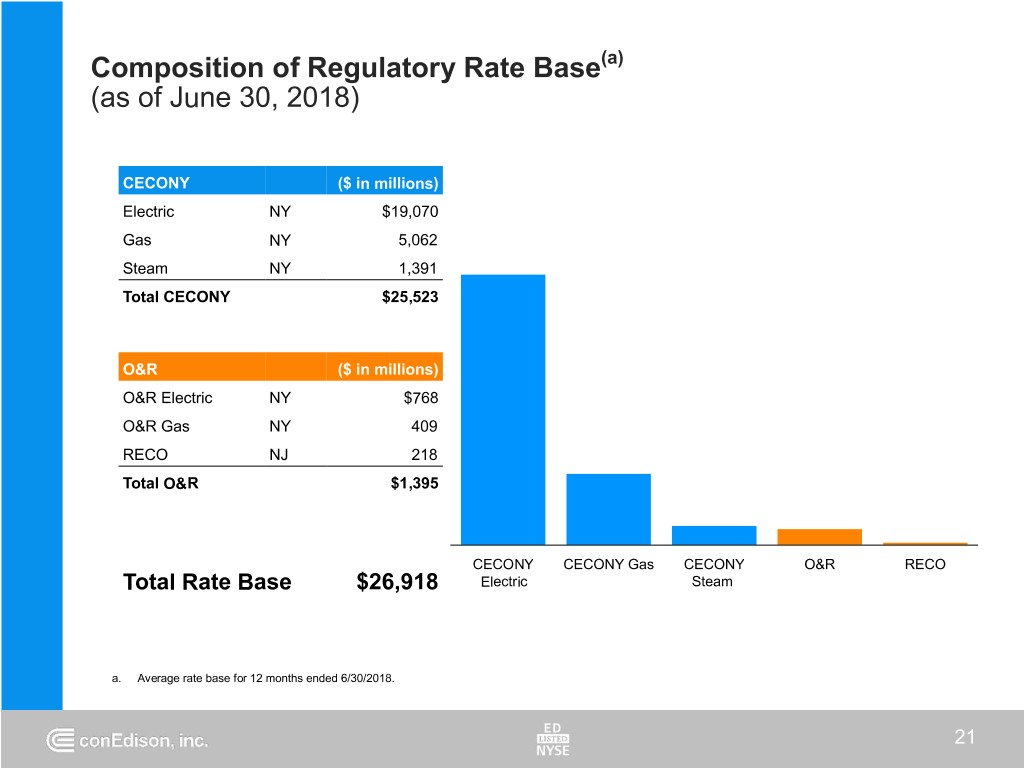

Composition of Regulatory Rate Base(a) (as of June 30, 2018) CECONY ($ in millions) Electric NY $19,070 Gas NY 5,062 Steam NY 1,391 Total CECONY $25,523 O&R ($ in millions) O&R Electric NY $768 O&R Gas NY 409 RECO NJ 218 Total O&R $1,395 CECONY CECONY Gas CECONY O&R RECO Total Rate Base $26,918 Electric Steam a. Average rate base for 12 months ended 6/30/2018. 21

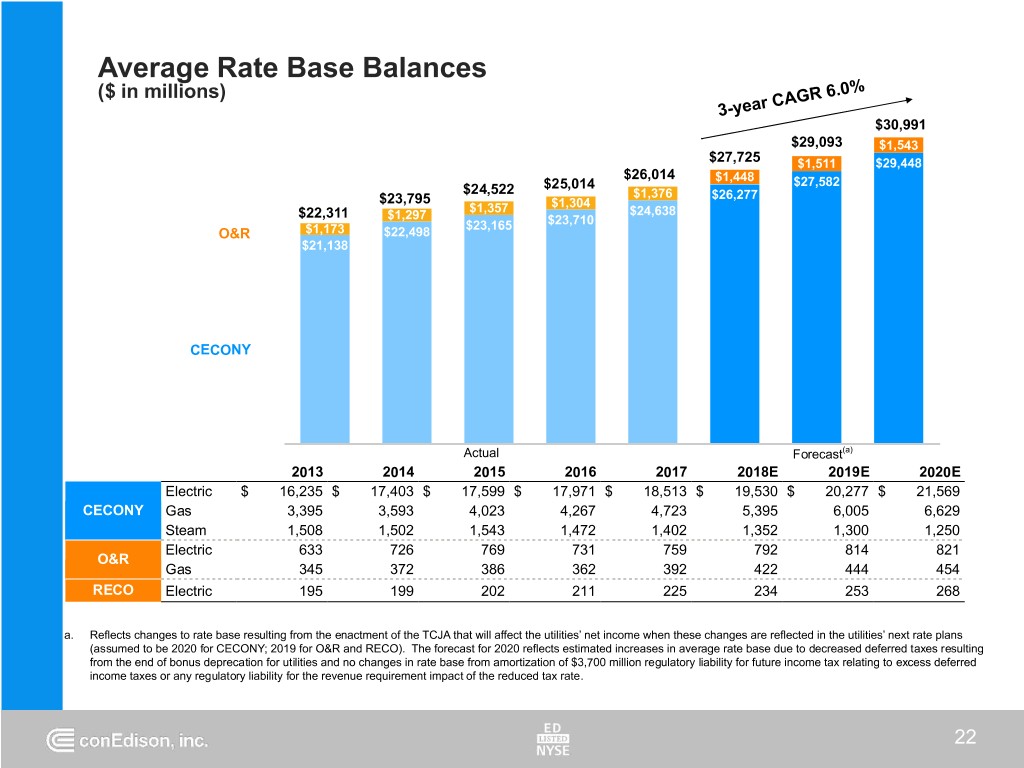

Average Rate Base Balances ($ in millions) 3-year CAGR 6.0% $30,991 $29,093 $1,543 $27,725 $1,511 $29,448 $26,014 $1,448 $27,582 $24,522 $25,014 $23,795 $1,376 $26,277 $1,357 $1,304 $22,311 $1,297 $24,638 $23,165 $23,710 O&R $1,173 $22,498 $21,138 CECONY Actual Forecast(a) 2013 2014 2015 2016 2017 2018E 2019E 2020E Electric $ 16,235 $ 17,403 $ 17,599 $ 17,971 $ 18,513 $ 19,530 $ 20,277 $ 21,569 CECONY Gas 3,395 3,593 4,023 4,267 4,723 5,395 6,005 6,629 Steam 1,508 1,502 1,543 1,472 1,402 1,352 1,300 1,250 Electric 633 726 769 731 759 792 814 821 O&R Gas 345 372 386 362 392 422 444 454 RECO Electric 195 199 202 211 225 234 253 268 a. Reflects changes to rate base resulting from the enactment of the TCJA that will affect the utilities’ net income when these changes are reflected in the utilities’ next rate plans (assumed to be 2020 for CECONY; 2019 for O&R and RECO). The forecast for 2020 reflects estimated increases in average rate base due to decreased deferred taxes resulting from the end of bonus deprecation for utilities and no changes in rate base from amortization of $3,700 million regulatory liability for future income tax relating to excess deferred income taxes or any regulatory liability for the revenue requirement impact of the reduced tax rate. 22

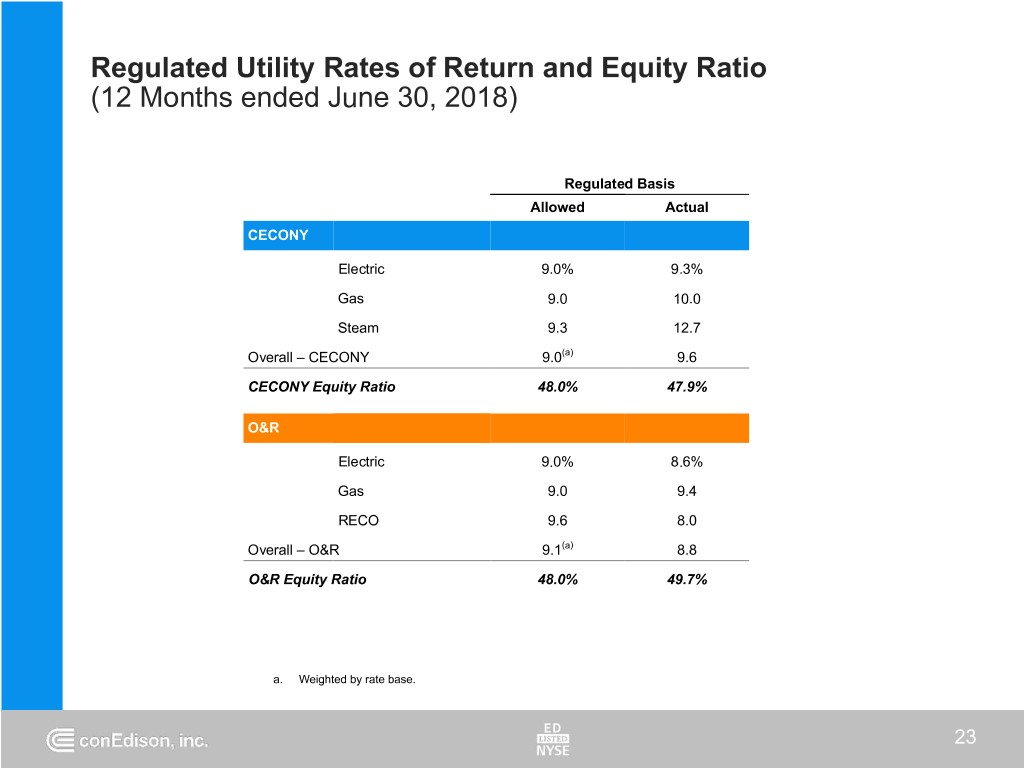

Regulated Utility Rates of Return and Equity Ratio (12 Months ended June 30, 2018) Regulated Basis Allowed Actual CECONY Electric 9.0% 9.3% Gas 9.0 10.0 Steam 9.3 12.7 Overall – CECONY 9.0(a) 9.6 CECONY Equity Ratio 48.0% 47.9% O&R Electric 9.0% 8.6% Gas 9.0 9.4 RECO 9.6 8.0 Overall – O&R 9.1(a) 8.8 O&R Equity Ratio 48.0% 49.7% a. Weighted by rate base. 23

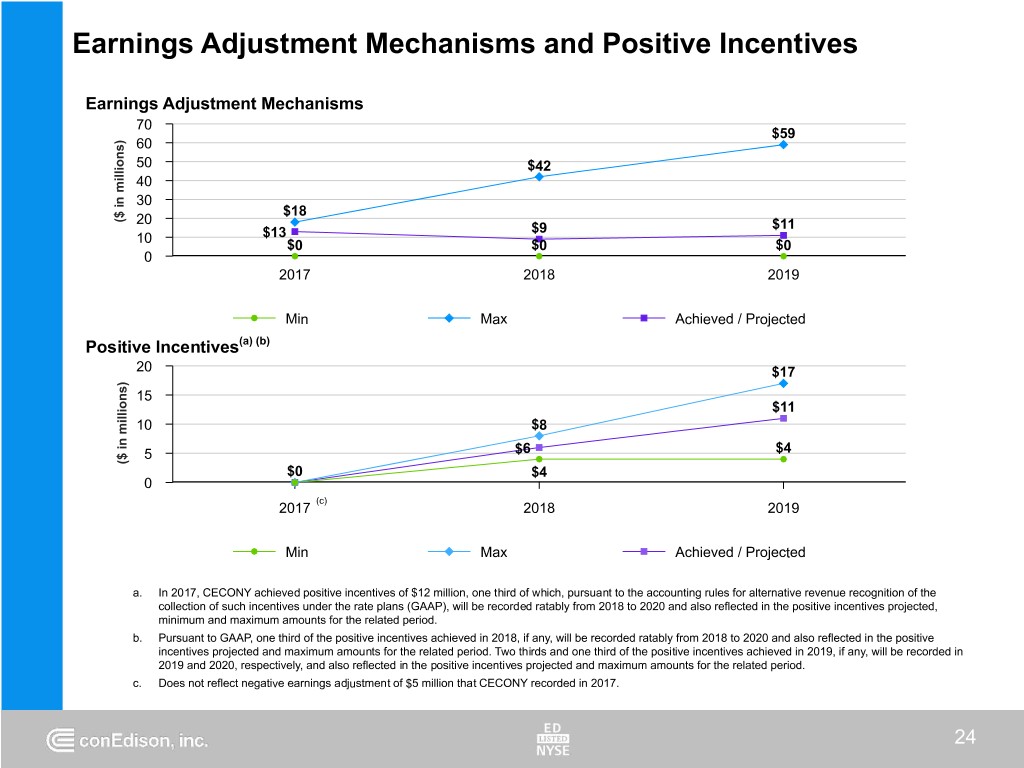

Earnings Adjustment Mechanisms and Positive Incentives Earnings Adjustment Mechanisms 70 $59 60 50 $42 40 30 $18 ($ in millions) 20 $11 $13 $9 10 $0 $0 $0 0 2017 2018 2019 Min Max Achieved / Projected Positive Incentives(a) (b) 20 $17 15 $11 10 $8 5 $6 $4 ($ in millions) $0 $4 0 (c) 2017 2018 2019 Min Max Achieved / Projected a. In 2017, CECONY achieved positive incentives of $12 million, one third of which, pursuant to the accounting rules for alternative revenue recognition of the collection of such incentives under the rate plans (GAAP), will be recorded ratably from 2018 to 2020 and also reflected in the positive incentives projected, minimum and maximum amounts for the related period. b. Pursuant to GAAP, one third of the positive incentives achieved in 2018, if any, will be recorded ratably from 2018 to 2020 and also reflected in the positive incentives projected and maximum amounts for the related period. Two thirds and one third of the positive incentives achieved in 2019, if any, will be recorded in 2019 and 2020, respectively, and also reflected in the positive incentives projected and maximum amounts for the related period. c. Does not reflect negative earnings adjustment of $5 million that CECONY recorded in 2017. 24

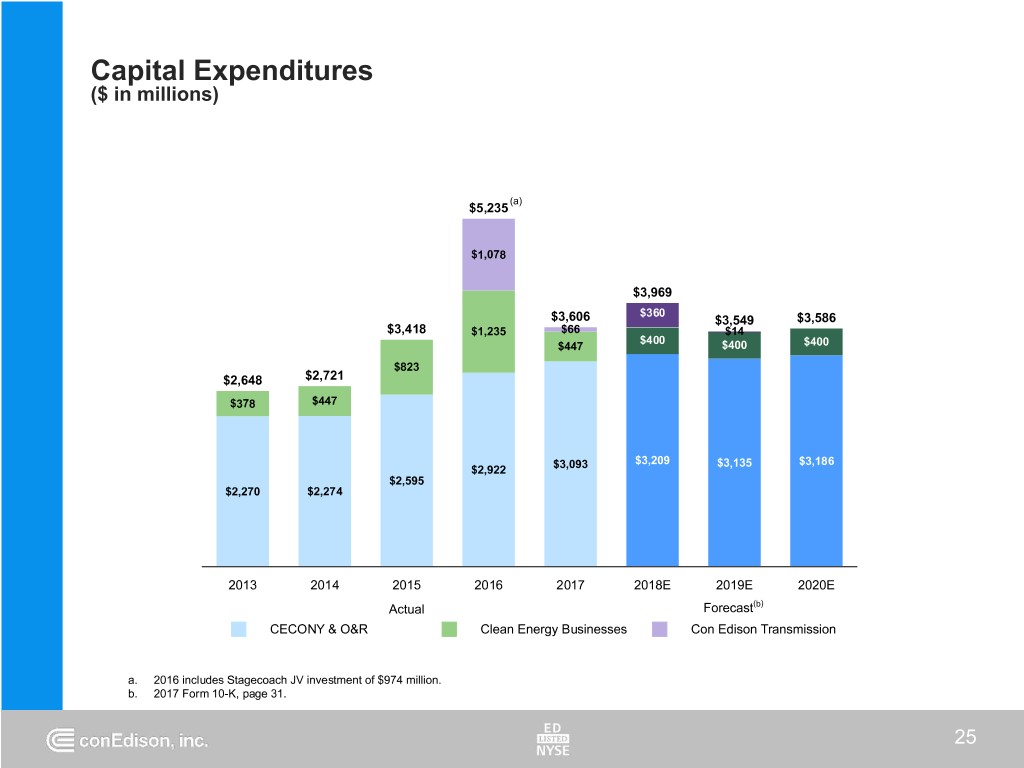

Capital Expenditures ($ in millions) (a) $5,235 $1,078 (1) $3,969 $360 $3,606 $3,549 $3,586 $3,418 $1,235 $66 $14 $400 $447 $400 $400 $823 $2,648 $2,721 $378 $447 $3,093 $3,209 $3,135 $3,186 $2,922 $2,595 $2,270 $2,274 2013 2014 2015 2016 2017 2018E 2019E 2020E Actual Forecast(b) CECONY & O&R Clean Energy Businesses Con Edison Transmission a. 2016 includes Stagecoach JV investment of $974 million. b. 2017 Form 10-K, page 31. 25

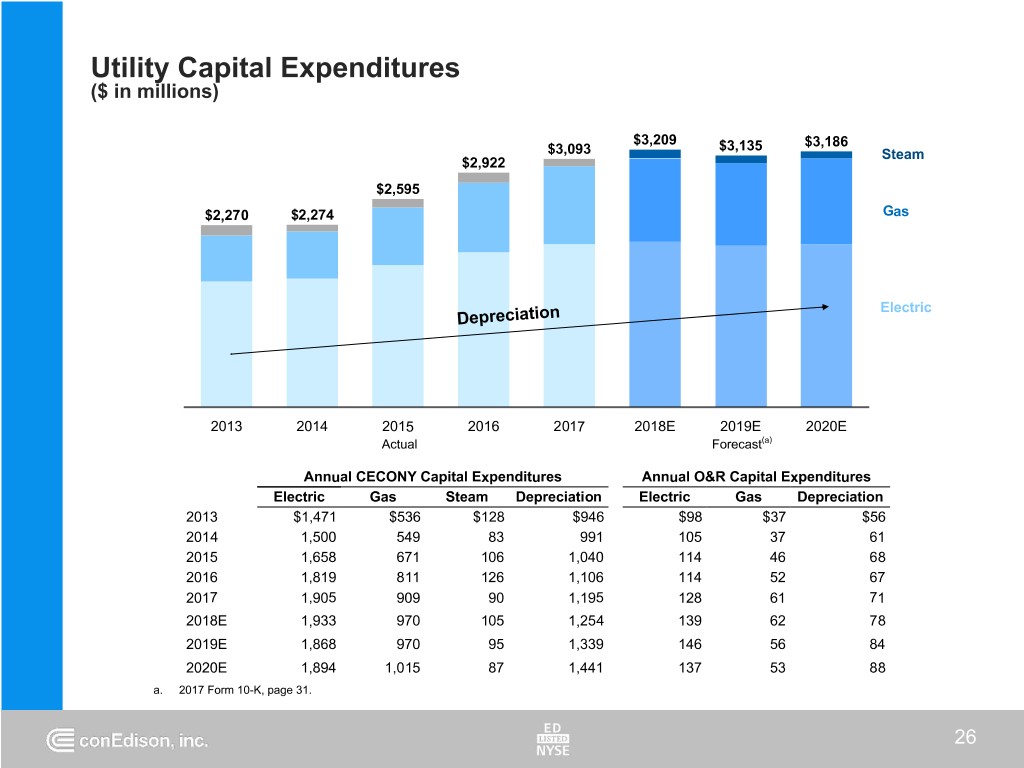

Utility Capital Expenditures ($ in millions) $3,209 $3,135 $3,186 $3,093 Steam $2,922 $2,595 $2,270 $2,274 Gas Electric Depreciation 2013 2014 2015 2016 2017 2018E 2019E 2020E Actual Forecast(a) Annual CECONY Capital Expenditures Annual O&R Capital Expenditures Electric Gas Steam Depreciation Electric Gas Depreciation 2013 $1,471 $536 $128 $946 $98 $37 $56 2014 1,500 549 83 991 105 37 61 2015 1,658 671 106 1,040 114 46 68 2016 1,819 811 126 1,106 114 52 67 2017 1,905 909 90 1,195 128 61 71 2018E 1,933 970 105 1,254 139 62 78 2019E 1,868 970 95 1,339 146 56 84 2020E 1,894 1,015 87 1,441 137 53 88 a. 2017 Form 10-K, page 31. 26

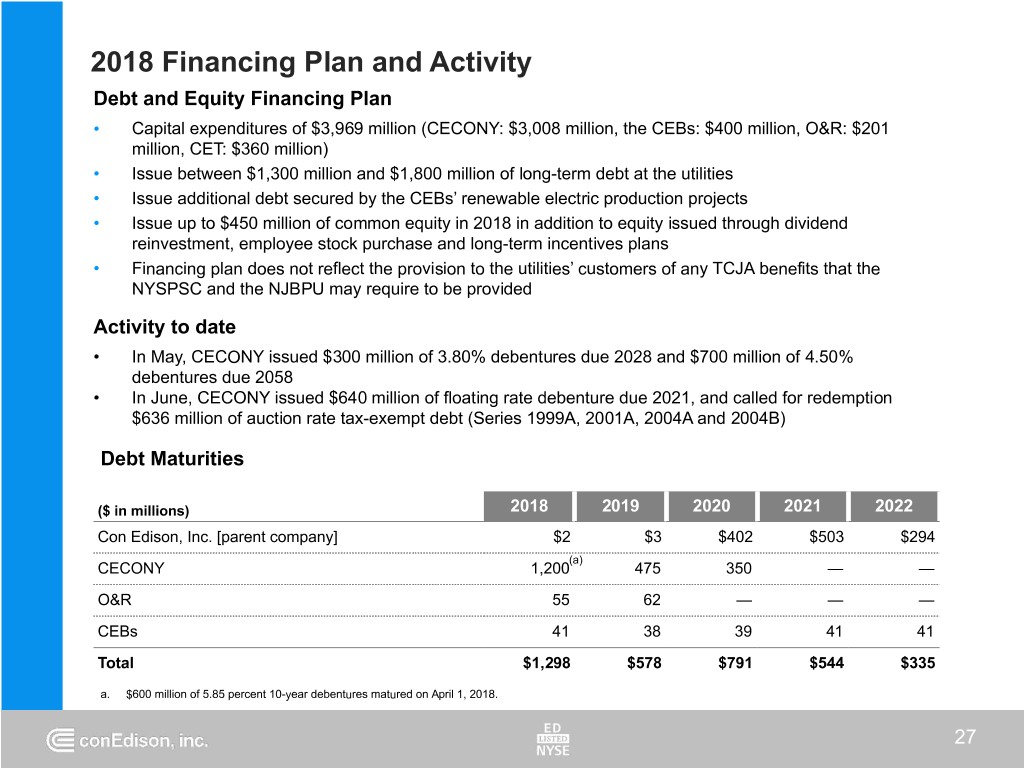

2018 Financing Plan and Activity Debt and Equity Financing Plan • Capital expenditures of $3,969 million (CECONY: $3,008 million, the CEBs: $400 million, O&R: $201 million, CET: $360 million) • Issue between $1,300 million and $1,800 million of long-term debt at the utilities • Issue additional debt secured by the CEBs’ renewable electric production projects • Issue up to $450 million of common equity in 2018 in addition to equity issued through dividend reinvestment, employee stock purchase and long-term incentives plans • Financing plan does not reflect the provision to the utilities’ customers of any TCJA benefits that the NYSPSC and the NJBPU may require to be provided Activity to date • In May, CECONY issued $300 million of 3.80% debentures due 2028 and $700 million of 4.50% debentures due 2058 • In June, CECONY issued $640 million of floating rate debenture due 2021, and called for redemption $636 million of auction rate tax-exempt debt (Series 1999A, 2001A, 2004A and 2004B) Debt Maturities ($ in millions) 2018 2019 2020 2021 2022 Con Edison, Inc. [parent company] $2 $3 $402 $503 $294 (a) CECONY 1,200 475 350 — — O&R 55 62 — — — CEBs 41 38 39 41 41 Total $1,298 $578 $791 $544 $335 a. $600 million of 5.85 percent 10-year debentures matured on April 1, 2018. 27

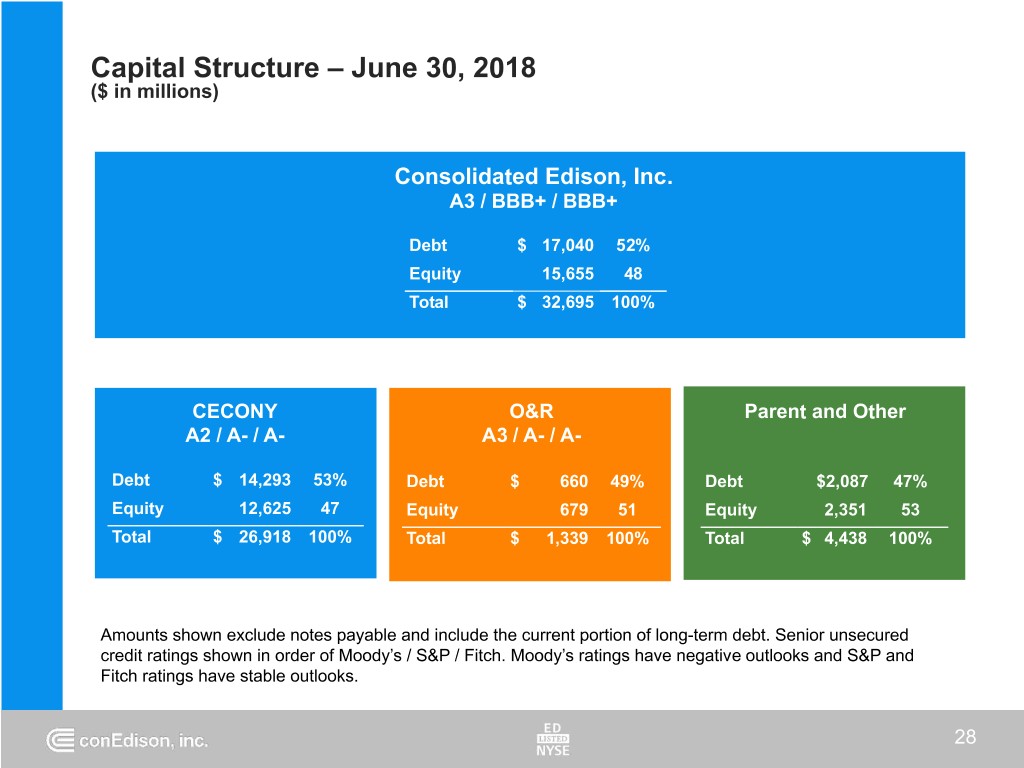

Capital Structure – June 30, 2018 ($ in millions) Consolidated Edison, Inc. A3 / BBB+ / BBB+ Debt $ 17,040 52% Equity 15,655 48 Total $ 32,695 100% CECONY O&R Parent and Other A2 / A- / A- A3 / A- / A- Debt $ 14,293 53% Debt $ 660 49% Debt $2,087 47% Equity 12,625 47 Equity 679 51 Equity 2,351 53 Total $ 26,918 100% Total $ 1,339 100% Total $ 4,438 100% Amounts shown exclude notes payable and include the current portion of long-term debt. Senior unsecured credit ratings shown in order of Moody’s / S&P / Fitch. Moody’s ratings have negative outlooks and S&P and Fitch ratings have stable outlooks. 28

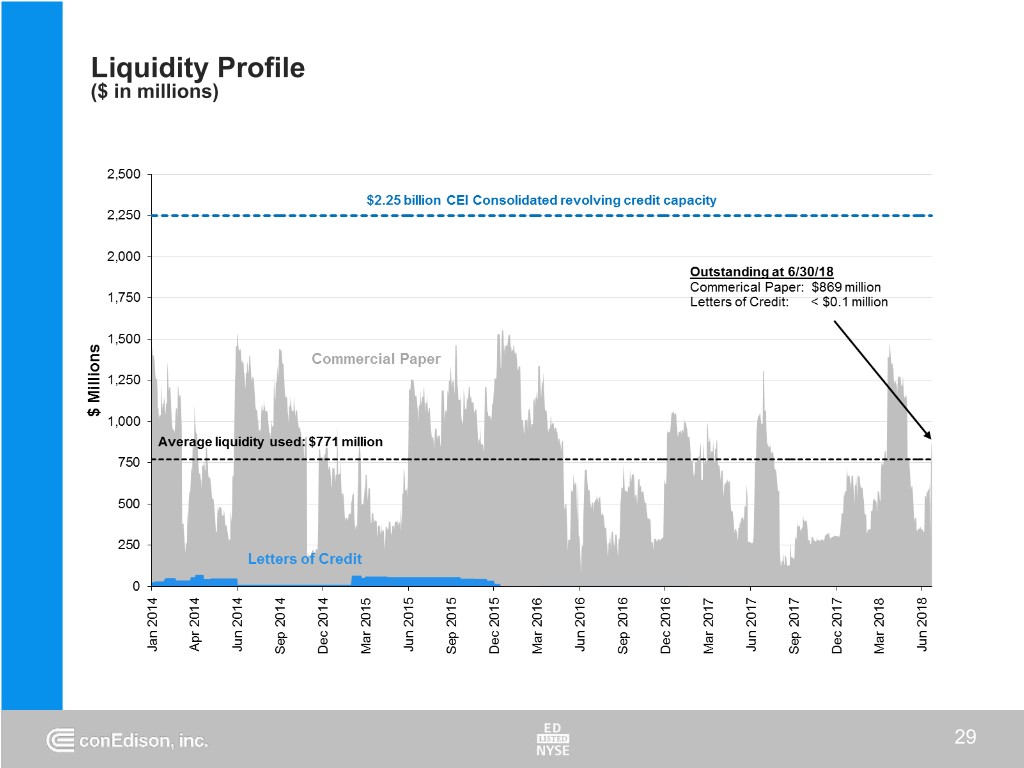

Liquidity Profile ($ in millions) 29

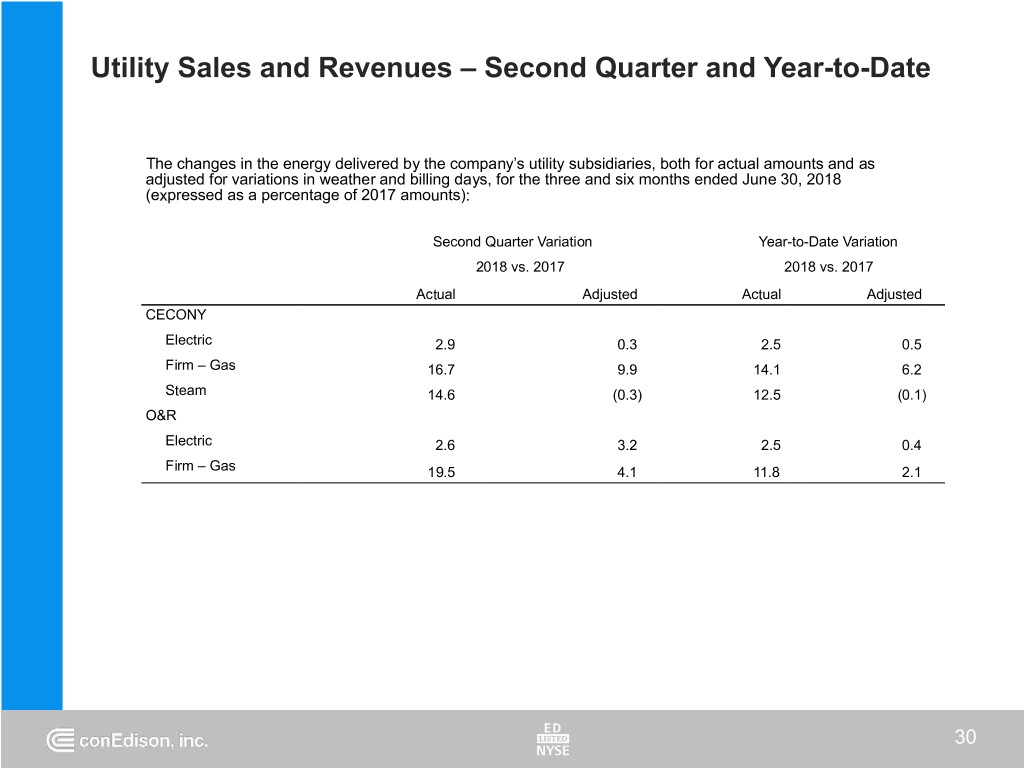

Utility Sales and Revenues – Second Quarter and Year-to-Date The changes in the energy delivered by the company’s utility subsidiaries, both for actual amounts and as adjusted for variations in weather and billing days, for the three and six months ended June 30, 2018 (expressed as a percentage of 2017 amounts): Second Quarter Variation Year-to-Date Variation 2018 vs. 2017 2018 vs. 2017 Actual Adjusted Actual Adjusted CECONY Electric 2.9 0.3 2.5 0.5 Firm – Gas 16.7 9.9 14.1 6.2 Steam 14.6 (0.3) 12.5 (0.1) O&R Electric 2.6 3.2 2.5 0.4 Firm – Gas 19.5 4.1 11.8 2.1 30

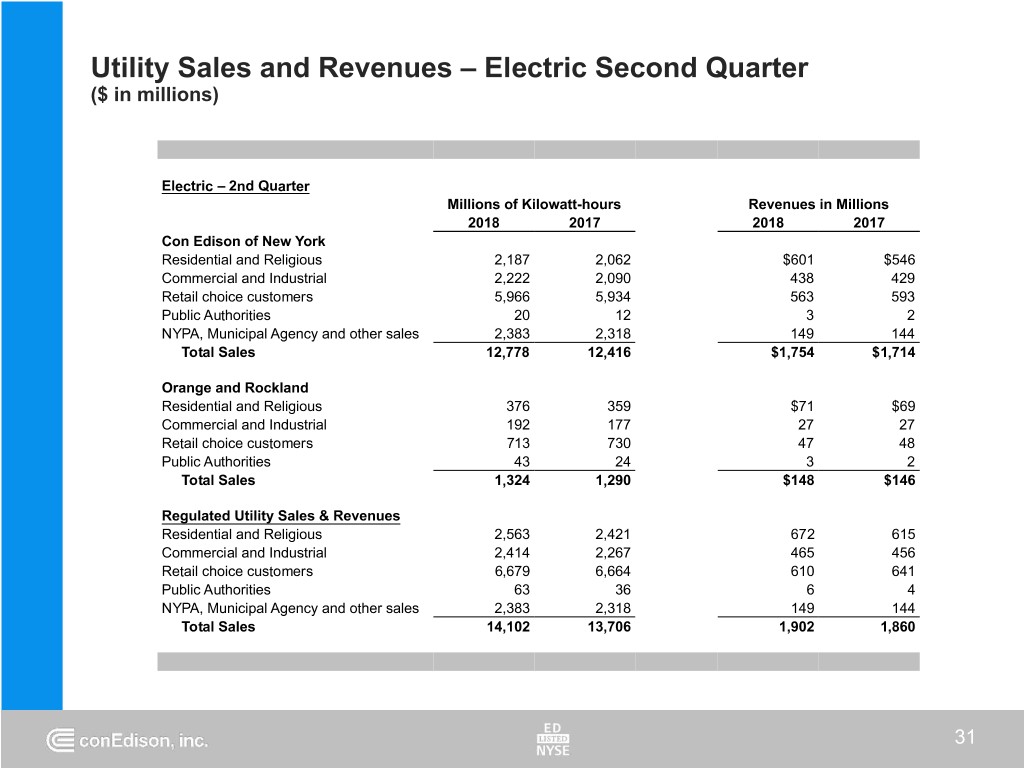

Utility Sales and Revenues – Electric Second Quarter ($ in millions) Electric – 2nd Quarter Millions of Kilowatt-hours Revenues in Millions 2018 2017 2018 2017 Con Edison of New York Residential and Religious 2,187 2,062 $601 $546 Commercial and Industrial 2,222 2,090 438 429 Retail choice customers 5,966 5,934 563 593 Public Authorities 20 12 3 2 NYPA, Municipal Agency and other sales 2,383 2,318 149 144 Total Sales 12,778 12,416 $1,754 $1,714 Orange and Rockland Residential and Religious 376 359 $71 $69 Commercial and Industrial 192 177 27 27 Retail choice customers 713 730 47 48 Public Authorities 43 24 3 2 Total Sales 1,324 1,290 $148 $146 Regulated Utility Sales & Revenues Residential and Religious 2,563 2,421 672 615 Commercial and Industrial 2,414 2,267 465 456 Retail choice customers 6,679 6,664 610 641 Public Authorities 63 36 6 4 NYPA, Municipal Agency and other sales 2,383 2,318 149 144 Total Sales 14,102 13,706 1,902 1,860 31

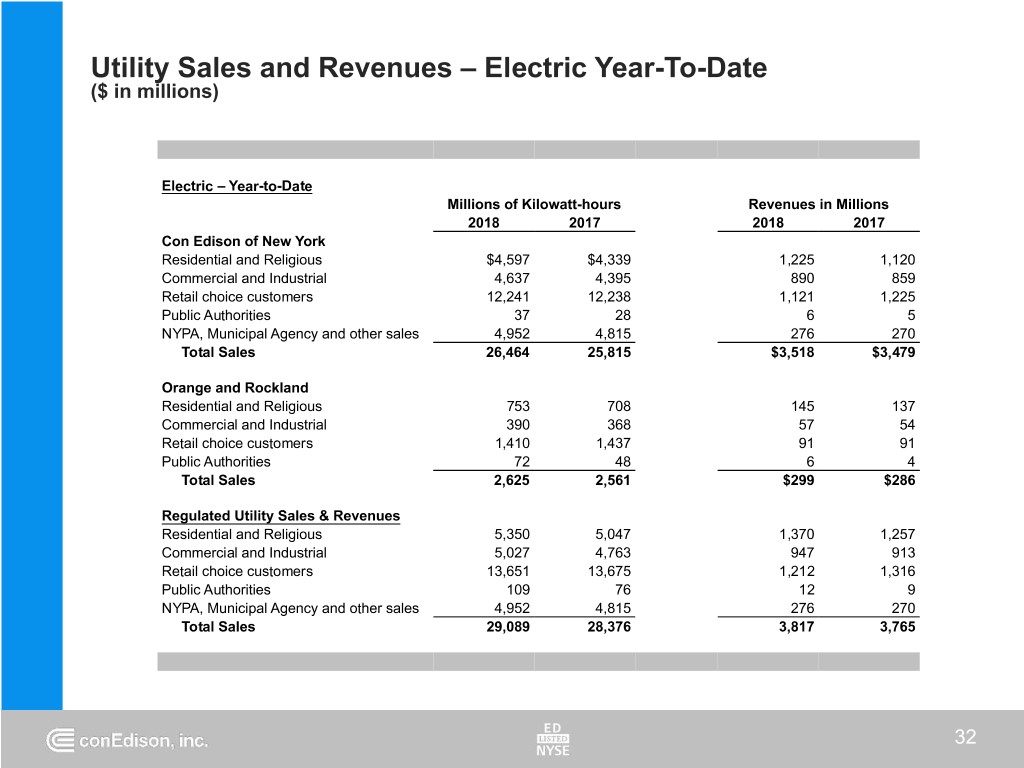

Utility Sales and Revenues – Electric Year-To-Date ($ in millions) Electric – Year-to-Date Millions of Kilowatt-hours Revenues in Millions 2018 2017 2018 2017 Con Edison of New York Residential and Religious $4,597 $4,339 1,225 1,120 Commercial and Industrial 4,637 4,395 890 859 Retail choice customers 12,241 12,238 1,121 1,225 Public Authorities 37 28 6 5 NYPA, Municipal Agency and other sales 4,952 4,815 276 270 Total Sales 26,464 25,815 $3,518 $3,479 Orange and Rockland Residential and Religious 753 708 145 137 Commercial and Industrial 390 368 57 54 Retail choice customers 1,410 1,437 91 91 Public Authorities 72 48 6 4 Total Sales 2,625 2,561 $299 $286 Regulated Utility Sales & Revenues Residential and Religious 5,350 5,047 1,370 1,257 Commercial and Industrial 5,027 4,763 947 913 Retail choice customers 13,651 13,675 1,212 1,316 Public Authorities 109 76 12 9 NYPA, Municipal Agency and other sales 4,952 4,815 276 270 Total Sales 29,089 28,376 3,817 3,765 32

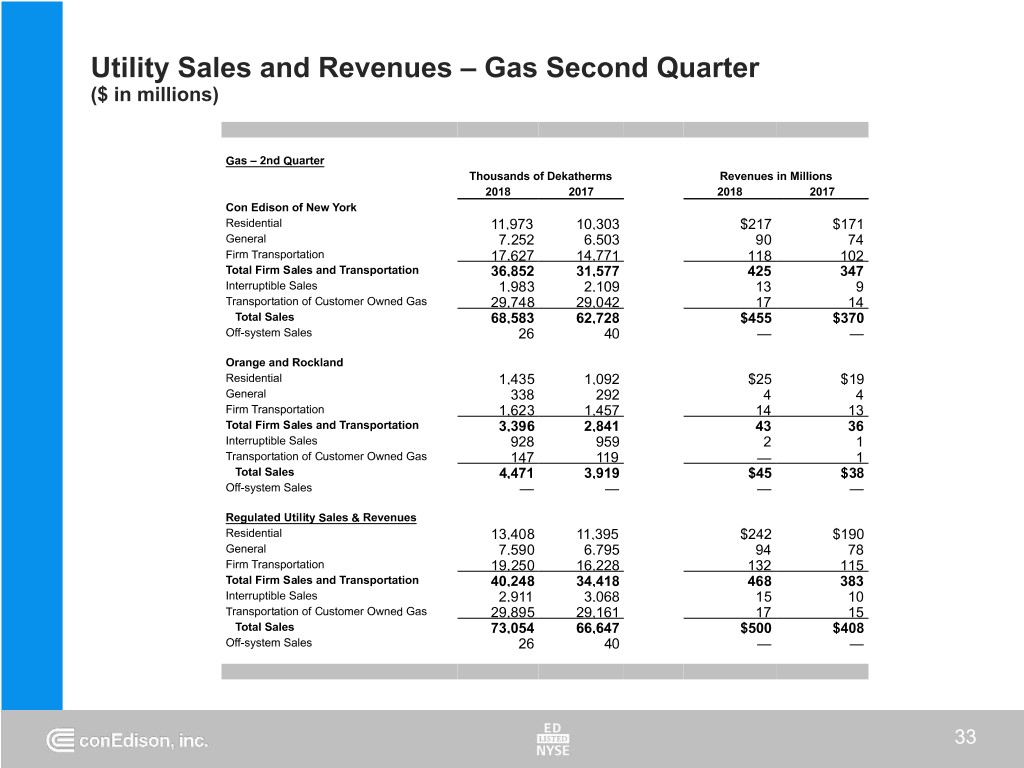

Utility Sales and Revenues – Gas Second Quarter ($ in millions) Gas – 2nd Quarter Thousands of Dekatherms Revenues in Millions 2018 2017 2018 2017 Con Edison of New York Residential 11,973 10,303 $217 $171 General 7,252 6,503 90 74 Firm Transportation 17,627 14,771 118 102 Total Firm Sales and Transportation 36,852 31,577 425 347 Interruptible Sales 1,983 2,109 13 9 Transportation of Customer Owned Gas 29,748 29,042 17 14 Total Sales 68,583 62,728 $455 $370 Off-system Sales 26 40 — — Orange and Rockland Residential 1,435 1,092 $25 $19 General 338 292 4 4 Firm Transportation 1,623 1,457 14 13 Total Firm Sales and Transportation 3,396 2,841 43 36 Interruptible Sales 928 959 2 1 Transportation of Customer Owned Gas 147 119 — 1 Total Sales 4,471 3,919 $45 $38 Off-system Sales — — — — Regulated Utility Sales & Revenues Residential 13,408 11,395 $242 $190 General 7,590 6,795 94 78 Firm Transportation 19,250 16,228 132 115 Total Firm Sales and Transportation 40,248 34,418 468 383 Interruptible Sales 2,911 3,068 15 10 Transportation of Customer Owned Gas 29,895 29,161 17 15 Total Sales 73,054 66,647 $500 $408 Off-system Sales 26 40 — — 33

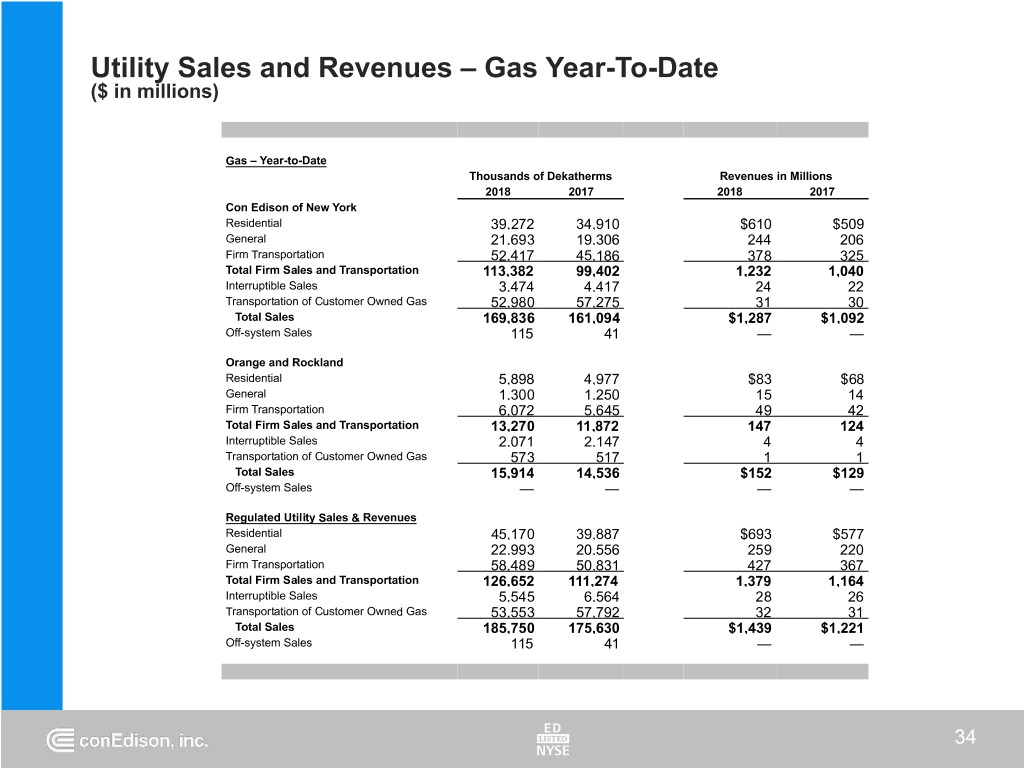

Utility Sales and Revenues – Gas Year-To-Date ($ in millions) Gas – Year-to-Date Thousands of Dekatherms Revenues in Millions 2018 2017 2018 2017 Con Edison of New York Residential 39,272 34,910 $610 $509 General 21,693 19,306 244 206 Firm Transportation 52,417 45,186 378 325 Total Firm Sales and Transportation 113,382 99,402 1,232 1,040 Interruptible Sales 3,474 4,417 24 22 Transportation of Customer Owned Gas 52,980 57,275 31 30 Total Sales 169,836 161,094 $1,287 $1,092 Off-system Sales 115 41 — — Orange and Rockland Residential 5,898 4,977 $83 $68 General 1,300 1,250 15 14 Firm Transportation 6,072 5,645 49 42 Total Firm Sales and Transportation 13,270 11,872 147 124 Interruptible Sales 2,071 2,147 4 4 Transportation of Customer Owned Gas 573 517 1 1 Total Sales 15,914 14,536 $152 $129 Off-system Sales — — — — Regulated Utility Sales & Revenues Residential 45,170 39,887 $693 $577 General 22,993 20,556 259 220 Firm Transportation 58,489 50,831 427 367 Total Firm Sales and Transportation 126,652 111,274 1,379 1,164 Interruptible Sales 5,545 6,564 28 26 Transportation of Customer Owned Gas 53,553 57,792 32 31 Total Sales 185,750 175,630 $1,439 $1,221 Off-system Sales 115 41 — — 34

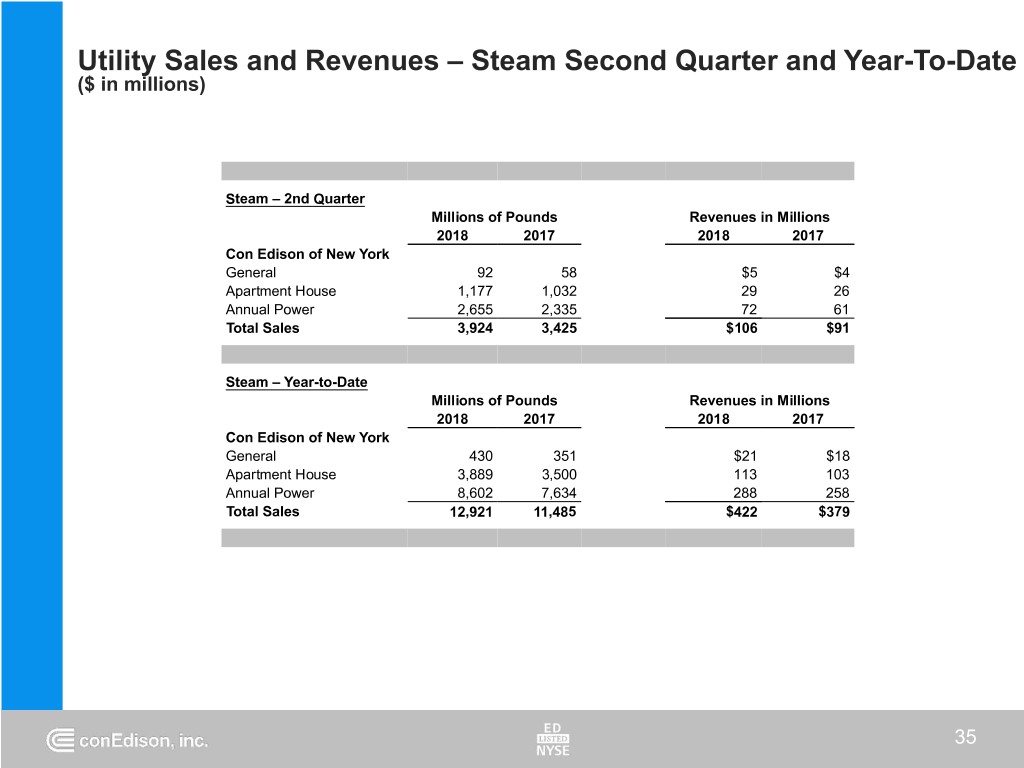

Utility Sales and Revenues – Steam Second Quarter and Year-To-Date ($ in millions) Steam – 2nd Quarter Millions of Pounds Revenues in Millions 2018 2017 2018 2017 Con Edison of New York General 92 58 $5 $4 Apartment House 1,177 1,032 29 26 Annual Power 2,655 2,335 72 61 Total Sales 3,924 3,425 $106 $91 Steam – Year-to-Date Millions of Pounds Revenues in Millions 2018 2017 2018 2017 Con Edison of New York General 430 351 $21 $18 Apartment House 3,889 3,500 113 103 Annual Power 8,602 7,634 288 258 Total Sales 12,921 11,485 $422 $379 35

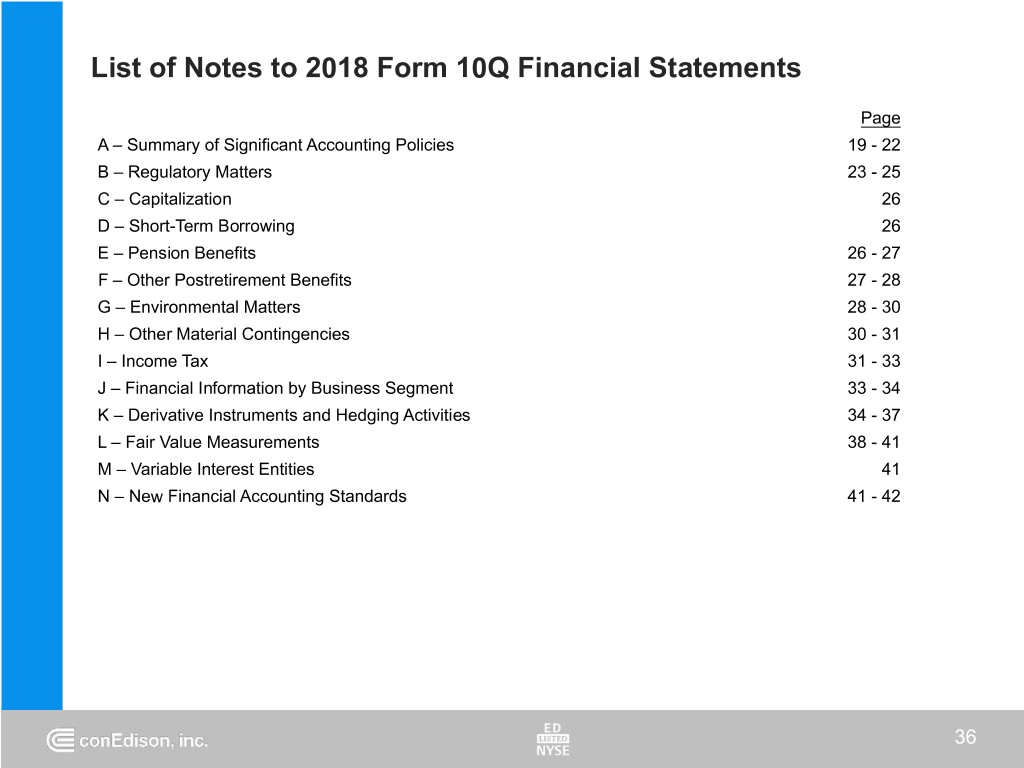

List of Notes to 2018 Form 10Q Financial Statements Page A – Summary of Significant Accounting Policies 19 - 22 B – Regulatory Matters 23 - 25 C – Capitalization 26 D – Short-Term Borrowing 26 E – Pension Benefits 26 - 27 F – Other Postretirement Benefits 27 - 28 G – Environmental Matters 28 - 30 H – Other Material Contingencies 30 - 31 I – Income Tax 31 - 33 J – Financial Information by Business Segment 33 - 34 K – Derivative Instruments and Hedging Activities 34 - 37 L – Fair Value Measurements 38 - 41 M – Variable Interest Entities 41 N – New Financial Accounting Standards 41 - 42 36