Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - Paramount Group, Inc. | d543963dex991.htm |

| 8-K - FORM 8-K - Paramount Group, Inc. | d543963d8k.htm |

Exhibit 99.2

SUPPLEMENTAL OPERATING AND FINANCIAL DATA

FOR THE QUARTER ENDED JUNE 30, 2018

|

FORWARD-LOOKING STATEMENTS |

This supplemental information contains forward-looking statements within the meaning of the federal securities laws. You can identify these statements by our use of the words “assumes,” “believes,” “estimates,” “expects,” “guidance,” “intends,” “plans,” “projects” and similar expressions that do not relate to historical matters. You should exercise caution in interpreting and relying on forward-looking statements because they involve known and unknown risks, uncertainties and other factors which are, in some cases, beyond our control and could materially affect actual results, performance or achievements. These factors include, without limitation, the ability to enter into new leases or renew leases on favorable terms, dependence on tenants’ financial condition, the uncertainties of real estate development, acquisition and disposition activity, the ability to effectively integrate acquisitions, the costs and availability of financing, the ability of our joint venture partners to satisfy their obligations, the effects of local, national and international economic and market conditions, the effects of acquisitions, dispositions and possible impairment charges on our operating results, regulatory changes, including changes to tax laws and regulations, and other risks and uncertainties detailed from time to time in our filings with the Securities and Exchange Commission. We do not undertake a duty to update or revise any forward-looking statement, whether as a result of new information, future events or otherwise.

- 2 -

|

TABLE OF CONTENTS |

| Page | ||||

| Company Profile |

4 | |||

| Research Coverage |

5 | |||

| Selected Financial Information |

||||

| Guidance |

6 | |||

| Financial Highlights |

7 | |||

| Consolidated Balance Sheets |

8 | |||

| Consolidated Statements of Income |

9 | |||

| Select Income Statement Data |

10 | |||

| Funds From Operations (“FFO”) |

11 | |||

| Funds Available for Distribution (“FAD”) |

12 | |||

| Earnings Before Interest, Taxes, Depreciation and Amortization for Real Estate (“EBITDAre”) |

13 | |||

| Net Operating Income (“NOI”) |

14 - 16 | |||

| Same Store Results |

17 - 20 | |||

| Consolidated Joint Ventures and Fund |

21 - 23 | |||

| Unconsolidated Joint Ventures |

24 - 26 | |||

| Unconsolidated Funds Summary |

27 | |||

| Capital Structure |

28 | |||

| Debt Analysis |

29 | |||

| Debt Maturities |

30 | |||

| Selected Property Data |

||||

| Portfolio Summary |

31 | |||

| Same Store Leased Occupancy |

32 - 33 | |||

| Top Tenants and Industry Diversification |

34 | |||

| Leasing Activity |

35 - 36 | |||

| Lease Expirations |

37 - 40 | |||

| Cash Basis Capital Expenditures |

41 - 42 | |||

| Definitions |

43 - 44 | |||

- 3 -

|

COMPANY PROFILE |

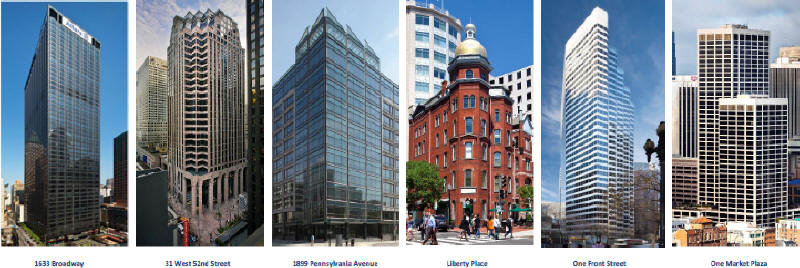

Paramount Group, Inc. (“Paramount”) is a fully-integrated real estate investment trust that owns, operates, manages, acquires and redevelops high-quality, Class A office properties located in select central business district submarkets of New York, Washington, D.C. and San Francisco. Paramount is focused on maximizing the value of its portfolio by leveraging the sought-after locations of its assets and its proven property management capabilities to attract and retain high-quality tenants.

EXECUTIVE MANAGEMENT

| Albert Behler | Chairman, Chief Executive Officer and President | |

| Wilbur Paes | Executive Vice President, Chief Financial Officer and Treasurer | |

| Peter Brindley | Executive Vice President, Leasing | |

| David Zobel | Executive Vice President, Head of Acquisitions |

BOARD OF DIRECTORS

| Albert Behler | Director, Chairman of the Board | |

| Thomas Armbrust | Director | |

| Martin Bussmann | Director | |

| Dan Emmett | Director, Chair of Nominating and Corporate Governance Committee; Lead Independent Director | |

| Lizanne Galbreath | Director, Chair of Compensation Committee | |

| Karin Klein | Director | |

| Peter Linneman | Director, Chair of Audit Committee | |

| Katharina Otto-Bernstein | Director | |

| Mark Patterson | Director |

COMPANY INFORMATION

| Corporate Headquarters | Investor Relations | Stock Exchange Listing | Trading Symbol | |||

| 1633 Broadway, Suite 1801 | IR@paramount-group.com | New York Stock Exchange | PGRE | |||

| New York, NY 10019 | (212) 492-2298 | |||||

| (212) 237-3100 |

- 4 -

|

RESEARCH COVERAGE (1) |

| James Feldman |

Thomas Catherwood |

Derek Johnston / Mike Husseini |

Steve Sakwa | |||

| Bank of America Merrill Lynch | BTIG | Deutsche Bank | Evercore ISI | |||

| (646) 855-5808 |

(212) 738-6140 |

(904) 520-4973 / (212) 250-7703 |

(212) 446-9462 | |||

| james.feldman@baml.com |

tcatherwood@btig.com |

derek.johnston@db.com / |

steve.sakwa@evercoreisi.com | |||

| mike.husseini@db.com |

||||||

| Andrew Rosivach |

Daniel Ismail |

Richard Anderson |

Vikram Malhotra | |||

| Goldman Sachs | Green Street Advisors | Mizuho Securities USA Inc. | Morgan Stanley | |||

| (212) 902-2796 |

(949) 640-8780 |

(212) 205-8445 |

(212) 761-7064 | |||

| andrew.rosivach@gs.com |

dismail@greenst.com |

richard.anderson@us.mizuho-sc.com |

vikram.malhotra@morganstanley.com | |||

| Frank Lee |

Blaine Heck |

|||||

| UBS | Wells Fargo | |||||

| (415) 352-5679 |

(443) 263-6529 |

|||||

| frank-a.lee@ubs.com |

blaine.heck@wellsfargo.com |

|||||

| (1) | With the exception of Green Street Advisors, an independent research firm, the equity analysts listed above are those analysts that, according to First Call Corporation, have published research material on the Company and are listed as covering the Company. Please note that any opinions, estimates or forecasts regarding the Company’s performance made by such analysts do not represent the opinions, estimates or forecasts of the Company or its management. The Company does not by its reference above, imply its endorsement of or concurrence with any information, conclusions or recommendations made by any such analysts. |

- 5 -

|

GUIDANCE |

(unaudited and in thousands, except square feet, % and per share amounts)

| Full Year 2018 |

Compared to Prior Guidance | |||||||||

| Low | High | |||||||||

| Estimated net loss attributable to common stockholders |

$ | (0.14 | ) | $ | (0.10 | ) | ||||

| Real estate impairment loss |

0.17 | 0.17 | ||||||||

| Our share of depreciation and amortization |

0.90 | 0.90 | ||||||||

|

|

|

|

|

|||||||

| Estimated Core FFO (1) |

$ | 0.93 | $ | 0.97 | Increased | |||||

|

|

|

|

|

|||||||

| Assumptions |

||||||||||

| Leasing Activity (square feet) |

700,000 | 900,000 | Increased | |||||||

| PGRE’s share of Same Store Leased % (2) at year end |

96.0 | % | 97.5 | % | Increased | |||||

| Increase in PGRE’s share of Same Store Cash NOI (2) |

7.0 | % | 10.0 | % | Unchanged | |||||

| Increase in PGRE’s share of Same Store NOI (2) |

7.0 | % | 10.0 | % | Increased | |||||

| PGRE’s share of Cash NOI (2) |

351,000 | 355,000 | Increased | |||||||

| PGRE’s share of NOI (2) |

415,000 | 421,000 | Increased | |||||||

| PGRE’s share of straight-line rent and above and below-market lease revenue, net |

64,000 | 66,000 | Increased | |||||||

| Fee income, net of income taxes |

17,000 | 18,000 | Unchanged | |||||||

| PGRE’s share of interest and debt expense, including amortization of deferred financing costs |

(130,000 | ) | (128,000 | ) | Unchanged | |||||

| General and administrative expenses |

(58,000 | ) | (56,000 | ) | Unchanged | |||||

| (1) | We are increasing our Estimated Core FFO Guidance for the full year of 2018, which is reconciled above to estimated net loss attributable to common stockholders per diluted share in accordance with GAAP. The estimated net loss attributable to common stockholders per diluted share is not a projection and is being provided solely to satisfy the disclosure requirements of the U.S. Securities and Exchange Commission. Except as described above, these estimates reflect management’s view of current and future market conditions, including assumptions with respect to rental rates, occupancy levels and the earnings impact of the events referenced in our earnings release issued on August 1, 2018 and otherwise referenced during our conference call scheduled for August 2, 2018. These estimates do not include the impact on operating results from possible future property acquisitions or dispositions, capital markets activity or unrealized gains or losses on real estate fund investments. The estimates set forth above may be subject to fluctuations as a result of several factors, including the straight-lining of rental income and the amortization of above and below-market leases. There can be no assurance that our actual results will not differ materially from the estimates set forth above. |

| (2) | See page 43 for our definition of this measure. |

- 6 -

|

FINANCIAL HIGHLIGHTS |

(unaudited and in thousands, except per share amounts)

| Three Months Ended | Six Months Ended | |||||||||||||||||||

| SELECTED FINANCIAL DATA | June 30, 2018 | June 30, 2017 | March 31, 2018 | June 30, 2018 | June 30, 2017 | |||||||||||||||

| Net (loss) income attributable to common stockholders |

$ | (34,816 | ) | $ | 103,016 | $ | 1,114 | $ | (33,702 | ) | $ | 103,388 | ||||||||

| Per share - basic and diluted |

$ | (0.14 | ) | $ | 0.44 | $ | 0.00 | $ | (0.14 | ) | $ | 0.44 | ||||||||

| Core FFO attributable to common stockholders (1) |

$ | 57,899 | $ | 54,565 | $ | 54,963 | $ | 112,862 | $ | 106,070 | ||||||||||

| Per share - diluted |

$ | 0.24 | $ | 0.23 | $ | 0.23 | $ | 0.47 | $ | 0.45 | ||||||||||

| PGRE’s share of Cash NOI (1) |

$ | 88,488 | $ | 85,436 | $ | 85,947 | $ | 174,435 | $ | 164,553 | ||||||||||

| PGRE’s share of NOI (1) |

$ | 106,246 | $ | 102,208 | $ | 100,580 | $ | 206,826 | $ | 200,570 | ||||||||||

PORTFOLIO STATISTICS

| As of | ||||||||||||||||||||

| June 30, 2018 | March 31, 2018 | December 31, 2017 | September 30, 2017 | June 30, 2017 | ||||||||||||||||

| Leased % (1) |

96.4 | % | 94.0 | % | 93.5 | % | 92.3 | % | 90.9 | % | ||||||||||

COMMON SHARE DATA

| Three Months Ended | ||||||||||||||||||||

| June 30, 2018 | March 31, 2018 | December 31, 2017 | September 30, 2017 | June 30, 2017 | ||||||||||||||||

| Share Price: |

||||||||||||||||||||

| High |

$ | 15.63 | $ | 15.89 | $ | 16.61 | $ | 16.79 | $ | 17.25 | ||||||||||

| Low |

$ | 13.85 | $ | 13.70 | $ | 15.49 | $ | 15.14 | $ | 15.32 | ||||||||||

| Closing (end of period) |

$ | 15.40 | $ | 14.24 | $ | 15.85 | $ | 16.00 | $ | 16.00 | ||||||||||

| Dividends per common share |

$ | 0.100 | $ | 0.100 | $ | 0.095 | $ | 0.095 | $ | 0.095 | ||||||||||

| Annualized dividends per common share |

$ | 0.400 | $ | 0.400 | $ | 0.380 | $ | 0.380 | $ | 0.380 | ||||||||||

| Dividend yield (on closing share price) |

2.6 | % | 2.8 | % | 2.4 | % | 2.4 | % | 2.4 | % | ||||||||||

| (1) | See page 43 for our definition of this measure. |

- 7 -

|

CONSOLIDATED BALANCE SHEETS |

(unaudited and in thousands)

| June 30, 2018 | December 31, 2017 | |||||||

| ASSETS: |

||||||||

| Real estate, at cost |

||||||||

| Land |

$ | 2,186,006 | $ | 2,209,506 | ||||

| Buildings and improvements |

6,132,725 | 6,119,969 | ||||||

|

|

|

|

|

|||||

| 8,318,731 | 8,329,475 | |||||||

| Accumulated depreciation and amortization |

(566,164 | ) | (487,945 | ) | ||||

|

|

|

|

|

|||||

| Real estate, net |

7,752,567 | 7,841,530 | ||||||

| Cash and cash equivalents |

233,530 | 219,381 | ||||||

| Restricted cash |

32,755 | 31,044 | ||||||

| Investments in unconsolidated joint ventures |

67,823 | 44,762 | ||||||

| Investments in unconsolidated real estate funds |

9,292 | 7,253 | ||||||

| Preferred equity investments, net |

35,925 | 35,817 | ||||||

| Marketable securities |

25,913 | 29,039 | ||||||

| Accounts and other receivables, net |

15,549 | 17,082 | ||||||

| Deferred rent receivable |

252,140 | 220,826 | ||||||

| Deferred charges, net |

116,147 | 98,645 | ||||||

| Intangible assets, net |

316,451 | 352,206 | ||||||

| Other assets |

57,821 | 20,076 | ||||||

|

|

|

|

|

|||||

| Total Assets |

$ | 8,915,913 | $ | 8,917,661 | ||||

|

|

|

|

|

|||||

| LIABILITIES: |

||||||||

| Notes and mortgages payable, net |

$ | 3,562,459 | $ | 3,541,300 | ||||

| Revolving credit facility |

— | — | ||||||

| Due to affiliates |

27,299 | 27,299 | ||||||

| Accounts payable and accrued expenses |

123,720 | 117,630 | ||||||

| Dividends and distributions payable |

26,621 | 25,211 | ||||||

| Intangible liabilities, net |

115,559 | 130,028 | ||||||

| Other liabilities |

54,507 | 54,109 | ||||||

|

|

|

|

|

|||||

| Total Liabilities |

3,910,165 | 3,895,577 | ||||||

|

|

|

|

|

|||||

| EQUITY: |

||||||||

| Paramount Group, Inc. equity |

4,113,520 | 4,176,741 | ||||||

| Noncontrolling interests in: |

||||||||

| Consolidated joint ventures |

403,686 | 404,997 | ||||||

| Consolidated real estate fund |

57,816 | 14,549 | ||||||

| Operating Partnership |

430,726 | 425,797 | ||||||

|

|

|

|

|

|||||

| Total Equity |

5,005,748 | 5,022,084 | ||||||

|

|

|

|

|

|||||

| Total Liabilities and Equity |

$ | 8,915,913 | $ | 8,917,661 | ||||

|

|

|

|

|

|||||

- 8 -

|

CONSOLIDATED STATEMENTS OF INCOME |

(unaudited and in thousands, except share and per share amounts)

| Three Months Ended | Six Months Ended | |||||||||||||||||||

| June 30, 2018 | June 30, 2017 | March 31, 2018 | June 30, 2018 | June 30, 2017 | ||||||||||||||||

| REVENUES: |

||||||||||||||||||||

| Property rentals |

$ | 148,486 | $ | 138,232 | $ | 145,741 | $ | 294,227 | $ | 270,467 | ||||||||||

| Straight-line rent adjustments |

16,739 | 11,974 | 13,244 | 29,983 | 32,121 | |||||||||||||||

| Amortization of above and below-market leases, net |

4,304 | 7,981 | 4,420 | 8,724 | 10,989 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Rental income |

169,529 | 158,187 | 163,405 | 332,934 | 313,577 | |||||||||||||||

| Tenant reimbursement income |

13,164 | 11,856 | 14,246 | 27,410 | 24,708 | |||||||||||||||

| Fee income (see details on page 10) |

5,409 | 4,448 | 3,465 | 8,874 | 14,004 | |||||||||||||||

| Other income (see details on page 10) |

3,317 | 3,213 | 3,155 | 6,472 | 6,651 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total revenues |

191,419 | 177,704 | 184,271 | 375,690 | 358,940 | |||||||||||||||

| EXPENSES: |

||||||||||||||||||||

| Operating |

67,646 | 63,461 | 68,978 | 136,624 | 129,432 | |||||||||||||||

| Depreciation and amortization |

64,775 | 68,636 | 65,156 | 129,931 | 131,628 | |||||||||||||||

| General and administrative (see details on page 10) |

17,195 | 16,573 | 12,631 | 29,826 | 30,154 | |||||||||||||||

| Transaction related costs |

293 | 502 | 120 | 413 | 777 | |||||||||||||||

| Real estate impairment loss |

46,000 | — | — | 46,000 | — | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total expenses |

195,909 | 149,172 | 146,885 | 342,794 | 291,991 | |||||||||||||||

| Operating (loss) income |

(4,490 | ) | 28,532 | 37,386 | 32,896 | 66,949 | ||||||||||||||

| Income (loss) from unconsolidated joint ventures |

2,521 | 16,535 | (62 | ) | 2,459 | 18,472 | ||||||||||||||

| Loss from unconsolidated real estate funds |

(14 | ) | (2,411 | ) | (66 | ) | (80 | ) | (2,123 | ) | ||||||||||

| Interest and other income, net (see details on page 10) |

2,094 | 2,486 | 2,016 | 4,110 | 5,686 | |||||||||||||||

| Interest and debt expense (see details on page 10) |

(36,809 | ) | (34,817 | ) | (36,082 | ) | (72,891 | ) | (71,835 | ) | ||||||||||

| Loss on early extinguishment of debt |

— | (5,162 | ) | — | — | (7,877 | ) | |||||||||||||

| Gain on sale of real estate |

— | 133,989 | — | — | 133,989 | |||||||||||||||

| Unrealized gain on interest rate swaps |

— | — | — | — | 1,802 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net (loss) income before income taxes |

(36,698 | ) | 139,152 | 3,192 | (33,506 | ) | 145,063 | |||||||||||||

| Income tax benefit (expense) |

120 | (970 | ) | (477 | ) | (357 | ) | (5,252 | ) | |||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net (loss) income |

(36,578 | ) | 138,182 | 2,715 | (33,863 | ) | 139,811 | |||||||||||||

| Less net (income) loss attributable to noncontrolling interests in: |

||||||||||||||||||||

| Consolidated joint ventures |

(1,752 | ) | (1,897 | ) | (1,055 | ) | (2,807 | ) | (3,188 | ) | ||||||||||

| Consolidated real estate fund |

(152 | ) | (20,169 | ) | (430 | ) | (582 | ) | (20,081 | ) | ||||||||||

| Operating Partnership |

3,666 | (13,100 | ) | (116 | ) | 3,550 | (13,154 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net (loss) income attributable to common stockholders |

$ | (34,816 | ) | $ | 103,016 | $ | 1,114 | $ | (33,702 | ) | $ | 103,388 | ||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Weighted average common shares outstanding: |

||||||||||||||||||||

| Basic |

240,336,485 | 234,990,468 | 240,311,744 | 240,324,183 | 232,968,602 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Diluted |

240,336,485 | 235,010,830 | 240,338,698 | 240,324,183 | 232,995,822 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| (Loss) income per common share: |

||||||||||||||||||||

| Basic |

$ | (0.14 | ) | $ | 0.44 | $ | 0.00 | $ | (0.14 | ) | $ | 0.44 | ||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Diluted |

$ | (0.14 | ) | $ | 0.44 | $ | 0.00 | $ | (0.14 | ) | $ | 0.44 | ||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

- 9 -

|

SELECT INCOME STATEMENT DATA |

(unaudited and in thousands)

| Three Months Ended | Six Months Ended | |||||||||||||||||||

| June 30, 2018 | June 30, 2017 | March 31, 2018 | June 30, 2018 | June 30, 2017 | ||||||||||||||||

| Fee Income: |

||||||||||||||||||||

| Property management |

$ | 1,490 | $ | 1,532 | $ | 1,502 | $ | 2,992 | $ | 3,142 | ||||||||||

| Asset management |

1,823 | 2,359 | 1,610 | 3,433 | 4,625 | |||||||||||||||

| Acquisition and disposition |

1,750 | 250 | — | 1,750 | 5,570 | |||||||||||||||

| Other |

346 | 307 | 353 | 699 | 667 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total fee income |

$ | 5,409 | $ | 4,448 | $ | 3,465 | $ | 8,874 | $ | 14,004 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Three Months Ended | Six Months Ended | |||||||||||||||||||

| June 30, 2018 | June 30, 2017 | March 31, 2018 | June 30, 2018 | June 30, 2017 | ||||||||||||||||

| Other Income: |

||||||||||||||||||||

| Lease termination income |

$ | 29 | $ | 895 | $ | 28 | $ | 57 | $ | 961 | ||||||||||

| Other (primarily parking income and tenant requested services, including overtime heating and cooling) |

3,288 | 2,318 | 3,127 | 6,415 | 5,690 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total other income |

$ | 3,317 | $ | 3,213 | $ | 3,155 | $ | 6,472 | $ | 6,651 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Three Months Ended | Six Months Ended | |||||||||||||||||||

| June 30, 2018 | June 30, 2017 | March 31, 2018 | June 30, 2018 | June 30, 2017 | ||||||||||||||||

| General and Administrative: |

||||||||||||||||||||

| Cash general and administrative |

$ | 12,346 | $ | 11,113 | $ | 6,275 | $ | 18,621 | $ | 19,563 | ||||||||||

| Non-cash general and administrative - stock based compensation expense |

4,650 | 4,438 | 6,265 | 10,915 | 7,867 | |||||||||||||||

| Mark-to-market of deferred compensation plan liabilities (offset by an increase in the mark-to-market of plan assets, which is included in “interest and other income”) |

199 | 1,022 | 91 | 290 | 2,724 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total general and administrative |

$ | 17,195 | $ | 16,573 | $ | 12,631 | $ | 29,826 | $ | 30,154 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Three Months Ended | Six Months Ended | |||||||||||||||||||

| June 30, 2018 | June 30, 2017 | March 31, 2018 | June 30, 2018 | June 30, 2017 | ||||||||||||||||

| Interest and Other Income: |

||||||||||||||||||||

| Preferred equity investment income (1) |

$ | 917 | $ | 953 | $ | 899 | 1,816 | 2,366 | ||||||||||||

| Interest income |

978 | 511 | 1,026 | 2,004 | 596 | |||||||||||||||

| Mark-to-market of deferred compensation plan assets (offset by an increase in the mark-to-market of plan liabilities, which is included in “general and administrative” expenses) |

199 | 1,022 | 91 | 290 | 2,724 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total interest and other income, net |

$ | 2,094 | $ | 2,486 | $ | 2,016 | $ | 4,110 | $ | 5,686 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| (1) | Represents 100% of the investment income from PGRESS Equity Holdings, L.P., of which our 24.4% share is $223, $232 and $219 for the three months ended June 30, 2018 and 2017, and March 31, 2018, respectively and $442 and $576 for the six months ended June 30, 2018 and 2017, respectively. |

| Three Months Ended | Six Months Ended | |||||||||||||||||||

| June 30, 2018 | June 30, 2017 | March 31, 2018 | June 30, 2018 | June 30, 2017 | ||||||||||||||||

| Interest and Debt Expense: |

||||||||||||||||||||

| Interest expense |

$ | 34,055 | $ | 31,999 | $ | 33,321 | $ | 67,376 | $ | 66,287 | ||||||||||

| Amortization of deferred financing costs |

2,754 | 2,818 | 2,761 | 5,515 | 5,548 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total interest and debt expense |

$ | 36,809 | $ | 34,817 | $ | 36,082 | $ | 72,891 | $ | 71,835 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

- 10 -

|

FFO |

(unaudited and in thousands, except share and per share amounts)

| Three Months Ended | Six Months Ended | |||||||||||||||||||

| June 30, 2018 | June 30, 2017 | March 31, 2018 | June 30, 2018 | June 30, 2017 | ||||||||||||||||

| Reconciliation of net (loss) income to FFO and Core FFO: |

||||||||||||||||||||

| Net (loss) income |

$ | (36,578 | ) | $ | 138,182 | $ | 2,715 | $ | (33,863 | ) | $ | 139,811 | ||||||||

| Real estate depreciation and amortization (including our share of unconsolidated joint ventures) |

66,711 | 70,660 | 67,160 | 133,871 | 135,500 | |||||||||||||||

| Real estate impairment loss |

46,000 | — | — | 46,000 | — | |||||||||||||||

| Gain on sale of depreciable real estate |

— | (110,583 | ) | — | — | (110,583 | ) | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| FFO (1) |

76,133 | 98,259 | 69,875 | 146,008 | 164,728 | |||||||||||||||

| Less FFO attributable to noncontrolling interests in: |

||||||||||||||||||||

| Consolidated joint ventures |

(10,840 | ) | (7,740 | ) | (10,207 | ) | (21,047 | ) | (14,935 | ) | ||||||||||

| Consolidated real estate fund |

(152 | ) | (20,276 | ) | (430 | ) | (582 | ) | (20,416 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| FFO attributable to Paramount Group Operating Partnership |

65,141 | 70,243 | 59,238 | 124,379 | 129,377 | |||||||||||||||

| Less FFO attributable to noncontrolling interests in Operating Partnership |

(6,206 | ) | (7,925 | ) | (5,585 | ) | (11,791 | ) | (15,470 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| FFO attributable to common stockholders (1) |

$ | 58,935 | $ | 62,318 | $ | 53,653 | $ | 112,588 | $ | 113,907 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Per diluted share |

$ | 0.25 | $ | 0.27 | $ | 0.22 | $ | 0.47 | $ | 0.49 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| FFO |

$ | 76,133 | $ | 98,259 | $ | 69,875 | $ | 146,008 | $ | 164,728 | ||||||||||

| Non-core items: |

||||||||||||||||||||

| Our share of (distributions from 712 Fifth Avenue in excess of earnings) and earnings in excess of distributions |

(1,512 | ) | (15,072 | ) | 1,195 | (317 | ) | (15,072 | ) | |||||||||||

| Transaction related costs |

293 | 502 | 120 | 413 | 777 | |||||||||||||||

| Realized and unrealized loss from unconsolidated real estate funds |

74 | 2,482 | 131 | 205 | 2,247 | |||||||||||||||

| After-tax net gain on sale of residential condominium land parcel |

— | (21,568 | ) | — | — | (21,568 | ) | |||||||||||||

| Loss on early extinguishment of debt |

— | 5,162 | — | — | 7,877 | |||||||||||||||

| Unrealized gain on interest rate swaps (including our share of unconsolidated joint ventures) |

— | (364 | ) | — | — | (2,750 | ) | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Core FFO (1) |

74,988 | 69,401 | 71,321 | 146,309 | 136,239 | |||||||||||||||

| Less Core FFO attributable to noncontrolling interests in: |

||||||||||||||||||||

| Consolidated joint ventures |

(10,840 | ) | (7,740 | ) | (10,207 | ) | (21,047 | ) | (15,401 | ) | ||||||||||

| Consolidated real estate fund |

(152 | ) | 12 | (430 | ) | (582 | ) | (128 | ) | |||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Core FFO attributable to Paramount Group Operating Partnership |

63,996 | 61,673 | 60,684 | 124,680 | 120,710 | |||||||||||||||

| Less Core FFO attributable to noncontrolling interests in Operating Partnership |

(6,097 | ) | (7,108 | ) | (5,721 | ) | (11,818 | ) | (14,640 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Core FFO attributable to common stockholders (1) |

$ | 57,899 | $ | 54,565 | $ | 54,963 | $ | 112,862 | $ | 106,070 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Per diluted share |

$ | 0.24 | $ | 0.23 | $ | 0.23 | $ | 0.47 | $ | 0.45 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Reconciliation of weighted average shares outstanding: |

||||||||||||||||||||

| Weighted average shares outstanding |

240,336,485 | 234,990,468 | 240,311,744 | 240,324,183 | 232,968,602 | |||||||||||||||

| Effect of dilutive securities |

17,229 | 20,362 | 26,954 | 20,525 | 27,220 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Denominator for FFO and Core FFO per diluted share |

240,353,714 | 235,010,830 | 240,338,698 | 240,344,708 | 232,995,822 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| (1) | See page 43 for our definition of this measure. |

- 11 -

|

FAD |

(unaudited and in thousands)

| Three Months Ended | Six Months Ended | |||||||||||||||||||

| June 30, 2018 | June 30, 2017 | March 31, 2018 | June 30, 2018 | June 30, 2017 | ||||||||||||||||

| Reconciliation of Core FFO to FAD: |

||||||||||||||||||||

| Core FFO |

$ | 74,988 | $ | 69,401 | $ | 71,321 | $ | 146,309 | $ | 136,239 | ||||||||||

| Add (subtract) adjustments to arrive at FAD: |

||||||||||||||||||||

| Amortization of stock-based compensation expense |

4,650 | 4,438 | 6,265 | 10,915 | 7,867 | |||||||||||||||

| Amortization of deferred financing costs (including our share of unconsolidated joint ventures) |

2,827 | 3,061 | 2,835 | 5,662 | 5,859 | |||||||||||||||

| Amortization of above and below-market leases, net (including our share of unconsolidated joint ventures) |

(4,141 | ) | (7,818 | ) | (4,257 | ) | (8,398 | ) | (10,699 | ) | ||||||||||

| Expenditures to maintain assets |

(2,496 | ) | (1,999 | ) | (3,702 | ) | (6,198 | ) | (7,554 | ) | ||||||||||

| Second generation tenant improvements and leasing commissions |

(20,392 | ) | (9,867 | ) | (14,983 | ) | (35,375 | ) | (17,275 | ) | ||||||||||

| Straight-line rent adjustments (including our share of unconsolidated joint ventures) |

(16,853 | ) | (12,208 | ) | (13,197 | ) | (30,050 | ) | (32,719 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| FAD (1) |

38,583 | 45,008 | 44,282 | 82,865 | 81,718 | |||||||||||||||

| Less FAD attributable to noncontrolling interests in: |

||||||||||||||||||||

| Consolidated joint ventures |

(6,277 | ) | (3,123 | ) | (6,850 | ) | (13,127 | ) | (4,983 | ) | ||||||||||

| Consolidated real estate fund |

(152 | ) | 12 | (430 | ) | (582 | ) | (128 | ) | |||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| FAD attributable to Paramount Group Operating Partnership |

32,154 | 41,897 | 37,002 | 69,156 | 76,607 | |||||||||||||||

| Less FAD attributable to noncontrolling interests in Operating Partnership |

(3,063 | ) | (4,727 | ) | (3,488 | ) | (6,551 | ) | (9,156 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| FAD attributable to common stockholders (1) (2) |

$ | 29,091 | $ | 37,170 | $ | 33,514 | $ | 62,605 | $ | 67,451 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Dividends declared on common stock |

$ | 24,053 | $ | 22,637 | $ | 24,051 | $ | 48,104 | $ | 44,618 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| (1) | See page 43 for our definition of this measure. |

| (2) | FAD attributable to common stockholders is not necessarily indicative of future FAD amounts due to fluctuations in the timing of payments for tenant improvements and leasing commissions versus rents received from leases for which such costs are incurred. |

- 12 -

|

EBITDAre |

(unaudited and in thousands)

| Three Months Ended | Six Months Ended | |||||||||||||||||||

| June 30, 2018 | June 30, 2017 | March 31, 2018 | June 30, 2018 | June 30, 2017 | ||||||||||||||||

| Reconciliation of net (loss) income to EBITDAre and Adjusted EBITDAre: |

||||||||||||||||||||

| Net (loss) income |

$ | (36,578 | ) | $ | 138,182 | $ | 2,715 | $ | (33,863 | ) | $ | 139,811 | ||||||||

| Add (subtract) adjustments to arrive at EBITDAre and Adjusted EBITDAre: |

||||||||||||||||||||

| Depreciation and amortization (including our share of unconsolidated joint ventures) |

66,711 | 70,660 | 67,160 | 133,871 | 135,500 | |||||||||||||||

| Interest and debt expense (including our share of unconsolidated joint ventures) |

38,513 | 36,679 | 37,744 | 76,257 | 75,332 | |||||||||||||||

| Income tax (benefit) expense (including our share of unconsolidated joint ventures) |

(120 | ) | 970 | 478 | 358 | 5,252 | ||||||||||||||

| Real estate impairment loss |

46,000 | — | — | 46,000 | — | |||||||||||||||

| Gain on sale of depreciable real estate |

— | (110,583 | ) | — | — | (110,583 | ) | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| EBITDAre (1) |

114,526 | 135,908 | 108,097 | 222,623 | 245,312 | |||||||||||||||

| Less EBITDAre attributable to noncontrolling interests in: |

||||||||||||||||||||

| Consolidated joint ventures |

(17,469 | ) | (12,941 | ) | (16,786 | ) | (34,255 | ) | (25,586 | ) | ||||||||||

| Consolidated real estate fund |

(122 | ) | (20,276 | ) | (432 | ) | (554 | ) | (20,417 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| PGRE’s share of EBITDAre (1) |

$ | 96,935 | $ | 102,691 | $ | 90,879 | $ | 187,814 | $ | 199,309 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| EBITDAre |

$ | 114,526 | $ | 135,908 | $ | 108,097 | $ | 222,623 | $ | 245,312 | ||||||||||

| Add (subtract) adjustments to arrive at Adjusted EBITDAre: |

||||||||||||||||||||

| Our share of (distributions from 712 Fifth Avenue in excess of earnings) and earnings in excess of distributions |

(1,512 | ) | (15,072 | ) | 1,195 | (317 | ) | (15,072 | ) | |||||||||||

| Transaction related costs |

293 | 502 | 120 | 413 | 777 | |||||||||||||||

| EBITDAre from real estate funds |

(122 | ) | 2,021 | (414 | ) | (536 | ) | 1,571 | ||||||||||||

| Pre-tax net gain on sale of residential condominium land parcel |

— | (23,406 | ) | — | — | (23,406 | ) | |||||||||||||

| Loss on early extinguishment of debt |

— | 5,162 | — | — | 7,877 | |||||||||||||||

| Unrealized gain on interest rate swaps (including our share of unconsolidated joint ventures) |

— | (364 | ) | — | — | (2,750 | ) | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Adjusted EBITDAre (1) |

113,185 | 104,751 | 108,998 | 222,183 | 214,309 | |||||||||||||||

| Less Adjusted EBITDAre attributable to noncontrolling interests in: |

||||||||||||||||||||

| Consolidated joint ventures |

(17,469 | ) | (12,941 | ) | (16,786 | ) | (34,255 | ) | (26,052 | ) | ||||||||||

| Consolidated real estate fund |

— | 381 | — | — | 381 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| PGRE’s share of Adjusted EBITDAre (1) |

$ | 95,716 | $ | 92,191 | $ | 92,212 | $ | 187,928 | $ | 188,638 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| (1) | See page 43 for our definition of this measure. |

- 13 -

|

NOI |

(unaudited and in thousands)

| Three Months Ended | Six Months Ended | |||||||||||||||||||

| June 30, 2018 | June 30, 2017 | March 31, 2018 | June 30, 2018 | June 30, 2017 | ||||||||||||||||

| Reconciliation of net (loss) income to NOI and Cash NOI: |

||||||||||||||||||||

| Net (loss) income |

$ | (36,578 | ) | $ | 138,182 | $ | 2,715 | $ | (33,863 | ) | $ | 139,811 | ||||||||

| Add (subtract) adjustments to arrive at NOI and Cash NOI: |

||||||||||||||||||||

| Depreciation and amortization |

64,775 | 68,636 | 65,156 | 129,931 | 131,628 | |||||||||||||||

| General and administrative |

17,195 | 16,573 | 12,631 | 29,826 | 30,154 | |||||||||||||||

| Interest and debt expense |

36,809 | 34,817 | 36,082 | 72,891 | 71,835 | |||||||||||||||

| Loss on early extinguishment of debt |

— | 5,162 | — | — | 7,877 | |||||||||||||||

| Transaction related costs |

293 | 502 | 120 | 413 | 777 | |||||||||||||||

| Income tax (benefit) expense |

(120 | ) | 970 | 477 | 357 | 5,252 | ||||||||||||||

| NOI from unconsolidated joint ventures |

4,569 | 4,958 | 4,740 | 9,309 | 9,781 | |||||||||||||||

| (Income) loss from unconsolidated joint ventures |

(2,521 | ) | (16,535 | ) | 62 | (2,459 | ) | (18,472 | ) | |||||||||||

| Loss from unconsolidated real estate funds |

14 | 2,411 | 66 | 80 | 2,123 | |||||||||||||||

| Fee income |

(5,409 | ) | (4,448 | ) | (3,465 | ) | (8,874 | ) | (14,004 | ) | ||||||||||

| Interest and other income, net |

(2,094 | ) | (2,486 | ) | (2,016 | ) | (4,110 | ) | (5,686 | ) | ||||||||||

| Real estate impairment loss |

46,000 | — | — | 46,000 | — | |||||||||||||||

| Gain on sale of real estate |

— | (133,989 | ) | — | — | (133,989 | ) | |||||||||||||

| Unrealized gain on interest rate swaps |

— | — | — | — | (1,802 | ) | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| NOI (1) |

122,933 | 114,753 | 116,568 | 239,501 | 225,285 | |||||||||||||||

| Less NOI attributable to noncontrolling interests in: |

||||||||||||||||||||

| Consolidated joint ventures |

(16,674 | ) | (12,200 | ) | (16,014 | ) | (32,688 | ) | (24,229 | ) | ||||||||||

| Consolidated real estate fund |

(13 | ) | (345 | ) | 26 | 13 | (486 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| PGRE’s share of NOI (1) |

$ | 106,246 | $ | 102,208 | $ | 100,580 | $ | 206,826 | $ | 200,570 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| NOI (1) |

$ | 122,933 | $ | 114,753 | $ | 116,568 | $ | 239,501 | $ | 225,285 | ||||||||||

| Less: |

||||||||||||||||||||

| Straight-line rent adjustments (including our share of unconsolidated joint ventures) |

(16,853 | ) | (12,208 | ) | (13,197 | ) | (30,050 | ) | (32,719 | ) | ||||||||||

| Amortization of above and below-market leases, net (including our share of unconsolidated joint ventures) |

(4,141 | ) | (7,818 | ) | (4,257 | ) | (8,398 | ) | (10,699 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Cash NOI (1) |

101,939 | 94,727 | 99,114 | 201,053 | 181,867 | |||||||||||||||

| Less Cash NOI attributable to noncontrolling interests in: |

||||||||||||||||||||

| Consolidated joint ventures |

(13,438 | ) | (8,946 | ) | (13,193 | ) | (26,631 | ) | (16,828 | ) | ||||||||||

| Consolidated real estate fund |

(13 | ) | (345 | ) | 26 | 13 | (486 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| PGRE’s share of Cash NOI (1) |

$ | 88,488 | $ | 85,436 | $ | 85,947 | $ | 174,435 | $ | 164,553 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| (1) | See page 43 for our definition of this measure. |

- 14 -

|

NOI |

(unaudited and in thousands)

| Three Months Ended June 30, 2018 | ||||||||||||||||||||

| Total | New York | Washington, D.C. | San Francisco | Other | ||||||||||||||||

| Reconciliation of net (loss) income to NOI and Cash NOI: |

||||||||||||||||||||

| Net (loss) income |

$ | (36,578 | ) | $ | 11,115 | $ | (41,841 | ) | $ | 7,998 | $ | (13,850 | ) | |||||||

| Add (subtract) adjustments to arrive at NOI and Cash NOI: |

||||||||||||||||||||

| Depreciation and amortization |

64,775 | 38,369 | 5,540 | 20,206 | 660 | |||||||||||||||

| General and administrative |

17,195 | — | — | — | 17,195 | |||||||||||||||

| Interest and debt expense |

36,809 | 23,266 | — | 12,273 | 1,270 | |||||||||||||||

| Transaction related costs |

293 | — | — | — | 293 | |||||||||||||||

| Income tax (benefit) expense |

(120 | ) | — | — | 5 | (125 | ) | |||||||||||||

| NOI from unconsolidated joint ventures |

4,569 | 4,493 | — | — | 76 | |||||||||||||||

| Income from unconsolidated joint ventures |

(2,521 | ) | (2,506 | ) | — | — | (15 | ) | ||||||||||||

| Loss from unconsolidated real estate funds |

14 | — | — | — | 14 | |||||||||||||||

| Fee income |

(5,409 | ) | — | — | — | (5,409 | ) | |||||||||||||

| Interest and other income, net |

(2,094 | ) | — | — | (186 | ) | (1,908 | ) | ||||||||||||

| Real estate impairment loss |

46,000 | — | 46,000 | — | — | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| NOI (1) |

122,933 | 74,737 | 9,699 | 40,296 | (1,799 | ) | ||||||||||||||

| Less NOI attributable to noncontrolling interests in: |

||||||||||||||||||||

| Consolidated joint ventures |

(16,674 | ) | — | — | (16,674 | ) | — | |||||||||||||

| Consolidated real estate fund |

(13 | ) | — | — | — | (13 | ) | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| PGRE’s share of NOI for the three months ended June 30, 2018 |

$ | 106,246 | $ | 74,737 | $ | 9,699 | $ | 23,622 | $ | (1,812 | ) | |||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| PGRE’s share of NOI for the three months ended June 30, 2017 |

$ | 102,208 | $ | 68,151 | $ | 11,573 | $ | 24,881 | $ | (2,397 | ) | |||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| NOI (1) |

$ | 122,933 | $ | 74,737 | $ | 9,699 | $ | 40,296 | $ | (1,799 | ) | |||||||||

| Add (subtract) adjustments to arrive at Cash NOI: |

||||||||||||||||||||

| Straight-line rent adjustments (including our share of unconsolidated joint ventures) |

(16,853 | ) | (11,497 | ) | 204 | (5,536 | ) | (24 | ) | |||||||||||

| Amortization of above and below-market leases, net (including our share of unconsolidated joint ventures) |

(4,141 | ) | 533 | (550 | ) | (4,124 | ) | — | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Cash NOI (1) |

101,939 | 63,773 | 9,353 | 30,636 | (1,823 | ) | ||||||||||||||

| Less Cash NOI attributable to noncontrolling interests in: |

||||||||||||||||||||

| Consolidated joint ventures |

(13,438 | ) | — | — | (13,438 | ) | — | |||||||||||||

| Consolidated real estate fund |

(13 | ) | — | — | — | (13 | ) | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| PGRE’s share of Cash NOI for the three months ended June 30, 2018 |

$ | 88,488 | $ | 63,773 | $ | 9,353 | $ | 17,198 | $ | (1,836 | ) | |||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| PGRE’s share of Cash NOI for the three months ended June 30, 2017 |

$ | 85,436 | $ | 61,423 | $ | 10,690 | $ | 15,748 | $ | (2,425 | ) | |||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| (1) | See page 43 for our definition of this measure. |

- 15 -

|

NOI |

(unaudited and in thousands)

| Six Months Ended June 30, 2018 | ||||||||||||||||||||

| Total | New York | Washington, D.C. | San Francisco | Other | ||||||||||||||||

| Reconciliation of net (loss) income to NOI and Cash NOI: |

||||||||||||||||||||

| Net (loss) income |

$ | (33,863 | ) | $ | 16,594 | $ | (37,749 | ) | $ | 12,907 | $ | (25,615 | ) | |||||||

| Add (subtract) adjustments to arrive at NOI and Cash NOI: |

||||||||||||||||||||

| Depreciation and amortization |

129,931 | 76,555 | 11,052 | 41,069 | 1,255 | |||||||||||||||

| General and administrative |

29,826 | — | — | — | 29,826 | |||||||||||||||

| Interest and debt expense |

72,891 | 46,012 | — | 24,440 | 2,439 | |||||||||||||||

| Transaction related costs |

413 | — | — | — | 413 | |||||||||||||||

| Income tax expense |

357 | — | — | 8 | 349 | |||||||||||||||

| NOI from unconsolidated joint ventures |

9,309 | 9,158 | — | — | 151 | |||||||||||||||

| Income from unconsolidated joint ventures |

(2,459 | ) | (2,433 | ) | — | — | (26 | ) | ||||||||||||

| Loss from unconsolidated real estate funds |

80 | — | — | — | 80 | |||||||||||||||

| Fee income |

(8,874 | ) | — | — | — | (8,874 | ) | |||||||||||||

| Interest and other income, net |

(4,110 | ) | — | — | (345 | ) | (3,765 | ) | ||||||||||||

| Real estate impairment loss |

46,000 | — | 46,000 | — | — | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| NOI (1) |

239,501 | 145,886 | 19,303 | 78,079 | (3,767 | ) | ||||||||||||||

| Less NOI attributable to noncontrolling interests in: |

||||||||||||||||||||

| Consolidated joint ventures |

(32,688 | ) | — | — | (32,688 | ) | — | |||||||||||||

| Consolidated real estate funds |

13 | — | — | — | 13 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| PGRE’s share of NOI for the six months ended June 30, 2018 |

$ | 206,826 | $ | 145,886 | $ | 19,303 | $ | 45,391 | $ | (3,754 | ) | |||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| PGRE’s share of NOI for the six months ended June 30, 2017 |

$ | 200,570 | $ | 133,469 | $ | 26,436 | $ | 44,186 | $ | (3,521 | ) | |||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| NOI (1) |

$ | 239,501 | $ | 145,886 | $ | 19,303 | $ | 78,079 | $ | (3,767 | ) | |||||||||

| Add (subtract) adjustments to arrive at Cash NOI: |

||||||||||||||||||||

| Straight-line rent adjustments (including our share of unconsolidated joint ventures) |

(30,050 | ) | (21,005 | ) | 362 | (9,444 | ) | 37 | ||||||||||||

| Amortization of above and below-market leases, net |

(8,398 | ) | 1,090 | (1,097 | ) | (8,391 | ) | — | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Cash NOI (1) |

201,053 | 125,971 | 18,568 | 60,244 | (3,730 | ) | ||||||||||||||

| Less Cash NOI attributable to noncontrolling interests in: |

||||||||||||||||||||

| Consolidated joint ventures |

(26,631 | ) | — | — | (26,631 | ) | — | |||||||||||||

| Consolidated real estate funds |

13 | — | — | — | 13 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| PGRE’s share of Cash NOI for the six months ended June 30, 2018 |

$ | 174,435 | $ | 125,971 | $ | 18,568 | $ | 33,613 | $ | (3,717 | ) | |||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| PGRE’s share of Cash NOI for the six months ended June 30, 2017 |

$ | 164,553 | $ | 114,913 | $ | 23,943 | $ | 29,185 | $ | (3,488 | ) | |||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| (1) | See page 43 for our definition of this measure. |

- 16 -

|

SAME STORE RESULTS |

(unaudited and in thousands)

| Three Months Ended June 30, 2018 | ||||||||||||||||||||

| SAME STORE CASH NOI (1) | Total | New York | Washington, D.C. | San Francisco | Other | |||||||||||||||

| PGRE’s share of Cash NOI for the three months ended June 30, 2018 |

$ | 88,488 | $ | 63,773 | $ | 9,353 | $ | 17,198 | $ | (1,836 | ) | |||||||||

| Acquisitions (2) |

(1,766 | ) | — | — | (1,766 | ) | — | |||||||||||||

| Dispositions |

— | — | — | — | — | |||||||||||||||

| Lease termination income (including our share of unconsolidated joint ventures) |

(54 | ) | (54 | ) | — | — | — | |||||||||||||

| Other, net |

174 | 174 | — | — | — | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| PGRE’s share of Same Store Cash NOI (1) for the three months ended June 30, 2018 |

$ | 86,842 | $ | 63,893 | $ | 9,353 | $ | 15,432 | $ | (1,836 | ) | |||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Three Months Ended June 30, 2017 | ||||||||||||||||||||

| Total | New York | Washington, D.C. | San Francisco | Other | ||||||||||||||||

| PGRE’s share of Cash NOI for the three months ended June 30, 2017 |

$ | 85,436 | $ | 61,423 | $ | 10,690 | $ | 15,748 | $ | (2,425 | ) | |||||||||

| Acquisitions |

— | — | — | — | — | |||||||||||||||

| Dispositions (3) |

(2,332 | ) | — | (2,332 | ) | — | — | |||||||||||||

| Lease termination income (including our share of unconsolidated joint ventures) |

(1,041 | ) | (175 | ) | — | (866 | ) | — | ||||||||||||

| Other, net |

(87 | ) | 30 | — | — | (117 | ) | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| PGRE’s share of Same Store Cash NOI (1) for the three months ended June 30, 2017 |

$ | 81,976 | $ | 61,278 | $ | 8,358 | $ | 14,882 | $ | (2,542 | ) | |||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Increase in PGRE’s share of Same Store Cash NOI |

$ | 4,866 | $ | 2,615 | $ | 995 | $ | 550 | $ | 706 | ||||||||||

| % Increase |

5.9 | % | 4.3 | % | 11.9 | % | 3.7 | % | ||||||||||||

| (1) | See page 43 for our definition of this measure. |

| (2) | Represents our share of Cash NOI attributable to acquired properties (50 Beale Street in San Francisco) for the months in which they were not owned by us in both reporting periods. |

| (3) | Represents our share of Cash NOI attributable to sold properties (Waterview in Washington, D.C.) for the months in which they were not owned by us in both reporting periods. |

- 17 -

|

SAME STORE RESULTS |

(unaudited and in thousands)

| Three Months Ended June 30, 2018 | ||||||||||||||||||||

| SAME STORE NOI (1) | Total | New York | Washington, D.C. | San Francisco | Other | |||||||||||||||

| PGRE’s share of NOI for the three months ended June 30, 2018 |

$ | 106,246 | $ | 74,737 | $ | 9,699 | $ | 23,622 | $ | (1,812 | ) | |||||||||

| Acquisitions (2) |

(2,361 | ) | — | — | (2,361 | ) | — | |||||||||||||

| Dispositions |

— | — | — | — | — | |||||||||||||||

| Lease termination income (including our share of unconsolidated joint ventures) |

(54 | ) | (54 | ) | — | — | — | |||||||||||||

| Other, net |

174 | 174 | — | — | — | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| PGRE’s share of Same Store NOI (1) for the three months ended June 30, 2018 |

$ | 104,005 | $ | 74,857 | $ | 9,699 | $ | 21,261 | $ | (1,812 | ) | |||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Three Months Ended June 30, 2017 | ||||||||||||||||||||

| Total | New York | Washington, D.C. | San Francisco | Other | ||||||||||||||||

| PGRE’s share of NOI for the three months ended June 30, 2017 |

$ | 102,208 | $ | 68,151 | $ | 11,573 | $ | 24,881 | $ | (2,397 | ) | |||||||||

| Acquisitions |

— | — | — | — | — | |||||||||||||||

| Dispositions (3) |

(2,332 | ) | — | (2,332 | ) | — | — | |||||||||||||

| Lease termination income (including our share of unconsolidated joint ventures) |

(1,041 | ) | (175 | ) | — | (866 | ) | — | ||||||||||||

| Other, net |

(785 | ) | 30 | — | (698 | ) | (117 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| PGRE’s share of Same Store NOI (1) for the three months ended June 30, 2017 |

$ | 98,050 | $ | 68,006 | $ | 9,241 | $ | 23,317 | $ | (2,514 | ) | |||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Increase (decrease) in PGRE’s share of Same Store NOI |

$ | 5,955 | (4) | $ | 6,851 | $ | 458 | $ | (2,056 | )(4) | $ | 702 | ||||||||

| % Increase (decrease) |

6.1 | %(4) | 10.1 | % | 5.0 | % | (8.8 | %)(4) | ||||||||||||

| (1) | See page 43 for our definition of this measure. |

| (2) | Represents our share of NOI attributable to acquired properties (50 Beale Street in San Francisco) for the months in which they were not owned by us in both reporting periods. |

| (3) | Represents our share of NOI attributable to sold properties (Waterview in Washington, D.C.) for the months in which they were not owned by us in both reporting periods. |

| (4) | This decrease resulted from income of $3,028 in the prior year from the accelerated amortization of certain below-market lease liabilities in connection with such tenants’ lease modifications. Excluding this income, Same Store NOI increased by 9.5% for the total portfolio and 4.8% for our San Francisco portfolio. |

- 18 -

|

SAME STORE RESULTS - BY SEGMENT |

(unaudited and in thousands)

| Six Months Ended June 30, 2018 | ||||||||||||||||||||

| SAME STORE CASH NOI (1) | Total | New York | Washington, D.C. | San Francisco | Other | |||||||||||||||

| PGRE’s share of Cash NOI for the six months ended June 30, 2018 |

$ | 174,435 | $ | 125,971 | $ | 18,568 | $ | 33,613 | $ | (3,717 | ) | |||||||||

| Acquisitions (2) |

(3,730 | ) | (215 | ) | — | (3,515 | ) | — | ||||||||||||

| Dispositions |

— | — | — | — | — | |||||||||||||||

| Lease termination income (including our share of unconsolidated joint ventures) |

(244 | ) | (244 | ) | — | — | — | |||||||||||||

| Other, net |

174 | 174 | — | — | — | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| PGRE’s share of Same Store Cash NOI (1) for the six months ended June 30, 2018 |

$ | 170,635 | $ | 125,686 | $ | 18,568 | $ | 30,098 | $ | (3,717 | ) | |||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Six Months Ended June 30, 2017 | ||||||||||||||||||||

| Total | New York | Washington, D.C. | San Francisco | Other | ||||||||||||||||

| PGRE’s share of Cash NOI for the six months ended June 30, 2017 |

$ | 164,553 | $ | 114,913 | $ | 23,943 | $ | 29,185 | $ | (3,488 | ) | |||||||||

| Acquisitions |

— | — | — | — | — | |||||||||||||||

| Dispositions (3) |

(8,632 | ) | — | (8,632 | ) | — | — | |||||||||||||

| Lease termination income (including our share of unconsolidated joint ventures) |

(1,107 | ) | (241 | ) | — | (866 | ) | — | ||||||||||||

| Other, net |

(87 | ) | 30 | — | — | (117 | ) | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| PGRE’s share of Same Store Cash NOI (1) for the six months ended June 30, 2017 |

$ | 154,727 | $ | 114,702 | $ | 15,311 | $ | 28,319 | $ | (3,605 | ) | |||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Increase (decrease) in PGRE’s share of Same Store Cash NOI |

$ | 15,908 | $ | 10,984 | $ | 3,257 | $ | 1,779 | $ | (112 | ) | |||||||||

|

% Increase |

10.3 | % | 9.6 | % | 21.3 | % | 6.3 | % | ||||||||||||

| (1) | See page 43 for our definition of this measure. |

| (2) | Represents our share of Cash NOI attributable to acquired properties (60 Wall Street in New York and 50 Beale Street in San Francisco) for the months in which they were not owned by us in both reporting periods. |

| (3) | Represents our share of Cash NOI attributable to sold properties (Waterview in Washington, D.C.) for the months in which they were not owned by us in both reporting periods. |

- 19 -

|

SAME STORE RESULTS - BY SEGMENT |

(unaudited and in thousands)

| Six Months Ended June 30, 2018 | ||||||||||||||||||||

| SAME STORE NOI (1) | Total | New York | Washington, D.C. | San Francisco | Other | |||||||||||||||

| PGRE’s share of NOI for the six months ended June 30, 2018 |

$ | 206,826 | $ | 145,886 | $ | 19,303 | $ | 45,391 | $ | (3,754 | ) | |||||||||

| Acquisitions (2) |

(4,667 | ) | (173 | ) | — | (4,494 | ) | — | ||||||||||||

| Dispositions |

— | — | — | — | — | |||||||||||||||

| Lease termination income (including our share of unconsolidated joint ventures) |

(244 | ) | (244 | ) | — | — | — | |||||||||||||

| Other, net |

174 | 174 | — | — | — | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| PGRE’s share of Same Store NOI (1) for the six months ended June 30, 2018 |

$ | 202,089 | $ | 145,643 | $ | 19,303 | $ | 40,897 | $ | (3,754 | ) | |||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Six Months Ended June 30, 2017 | ||||||||||||||||||||

| Total | New York | Washington, D.C. | San Francisco | Other | ||||||||||||||||

| PGRE’s share of NOI for the six months ended June 30, 2017 |

$ | 200,570 | $ | 133,469 | $ | 26,436 | $ | 44,186 | $ | (3,521 | ) | |||||||||

| Acquisitions |

— | — | — | — | — | |||||||||||||||

| Dispositions (3) |

(8,632 | ) | — | (8,632 | ) | — | — | |||||||||||||

| Lease termination income (including our share of unconsolidated joint ventures) |

(1,107 | ) | (241 | ) | — | (866 | ) | — | ||||||||||||

| Other, net |

(785 | ) | 30 | — | (698 | ) | (117 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| PGRE’s share of Same Store NOI (1) for the six months ended June 30, 2017 |

$ | 190,046 | $ | 133,258 | $ | 17,804 | $ | 42,622 | $ | (3,638 | ) | |||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Increase (decrease) in PGRE’s share of Same Store NOI |

$ | 12,043 | (4) | $ | 12,385 | $ | 1,499 | $ | (1,725 | )(4) | $ | (116 | ) | |||||||

| % Increase (decrease) |

6.3 | %(4) | 9.3 | % | 8.4 | % | (4.0 | %)(4) | ||||||||||||

| (1) | See page 43 for our definition of this measure. |

| (2) | Represents our share of NOI attributable to acquired properties (60 Wall Street in New York and 50 Beale Street in San Francisco) for the months in which they were not owned by us in both reporting periods. |

| (3) | Represents our share of NOI attributable to sold properties (Waterview in Washington, D.C.) for the months in which they were not owned by us in both reporting periods. |

| (4) | This decrease resulted from income of $3,028 in the prior year from the accelerated amortization of certain below-market lease liabilities in connection with such tenants’ lease modifications. Excluding this income, Same Store NOI increased by 8.1% for the total portfolio and 3.3% for our San Francisco portfolio. |

- 20 -

|

CONSOLIDATED JOINT VENTURES AND FUND - BALANCE SHEETS |

(unaudited and in thousands)

| As of June 30, 2018 | As of December 31, 2017 | |||||||||||||||||||||||||||||||||||||||

| Consolidated | Consolidated | |||||||||||||||||||||||||||||||||||||||

| Consolidated Joint Ventures | Fund | Consolidated Joint Ventures | Fund | |||||||||||||||||||||||||||||||||||||

| Total | One | 50 | PGRESS | Residential | Total | One | 50 | PGRESS | Residential | |||||||||||||||||||||||||||||||

| Consolidated | Market | Beale | Equity | Development | Consolidated | Market | Beale | Equity | Development | |||||||||||||||||||||||||||||||

| Joint Ventures | Plaza | Street | Holdings L.P. | Fund | Joint Ventures | Plaza | Street | Holdings L.P. | Fund | |||||||||||||||||||||||||||||||

| PGRE Ownership | 49.0% | 31.1% | 24.4% | 7.4% | 49.0% | 31.1% | 24.4% | 7.4% | ||||||||||||||||||||||||||||||||

| ASSETS: |

||||||||||||||||||||||||||||||||||||||||

| Real estate, net |

$ | 1,711,766 | $ | 1,233,804 | $ | 477,962 | $ | — | $ | — | $ | 1,726,800 | $ | 1,246,427 | $ | 480,373 | $ | — | $ | — | ||||||||||||||||||||

| Cash and cash equivalents |

67,211 | 42,248 | 24,586 | 377 | 6,873 | 46,839 | 24,658 | 21,792 | 389 | 656 | ||||||||||||||||||||||||||||||

| Restricted cash |

5,538 | 5,538 | — | — | — | 8,163 | 8,163 | — | — | — | ||||||||||||||||||||||||||||||

| Preferred equity investments, net |

35,925 | — | — | 35,925 | — | 35,817 | — | — | 35,817 | — | ||||||||||||||||||||||||||||||

| Investments in unconsolidated joint ventures |

— | — | — | — | 40,236 | — | — | — | — | 16,031 | ||||||||||||||||||||||||||||||

| Accounts and other receivables, net |

1,559 | 671 | 888 | — | 67 | 2,548 | 1,423 | 1,125 | — | 2 | ||||||||||||||||||||||||||||||

| Deferred rent receivable |

47,663 | 45,621 | 2,042 | — | — | 44,000 | 43,332 | 668 | — | — | ||||||||||||||||||||||||||||||

| Deferred charges, net |

10,777 | 7,649 | 3,128 | — | — | 8,123 | 7,508 | 615 | — | — | ||||||||||||||||||||||||||||||

| Intangible assets, net |

56,230 | 34,146 | 22,084 | — | — | 66,112 | 39,421 | 26,691 | — | — | ||||||||||||||||||||||||||||||

| Other assets |

2,300 | 1,794 | 506 | — | 15,735 | 908 | 747 | 161 | — | 10 | ||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| Total Assets |

$ | 1,938,969 | $ | 1,371,471 | $ | 531,196 | $ | 36,302 | $ | 62,911 | $ | 1,939,310 | $ | 1,371,679 | $ | 531,425 | $ | 36,206 | $ | 16,699 | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| LIABILITIES: |

||||||||||||||||||||||||||||||||||||||||

| Notes and mortgages payable, net |

$ | 1,197,126 | $ | 969,126 | $ | 228,000 | $ | — | $ | — | $ | 1,196,607 | $ | 968,607 | $ | 228,000 | $ | — | $ | — | ||||||||||||||||||||

| Accounts payable and accrued expenses |

29,317 | 18,181 | 11,073 | 63 | 75 | 21,134 | 14,876 | 6,205 | 53 | 62 | ||||||||||||||||||||||||||||||

| Intangible liabilities, net |

38,754 | 31,255 | 7,499 | — | — | 46,365 | 36,793 | 9,572 | — | — | ||||||||||||||||||||||||||||||

| Other liabilities |

151 | 148 | 3 | — | — | 156 | 149 | 7 | — | — | ||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| Total Liabilities |

1,265,348 | 1,018,710 | 246,575 | 63 | 75 | 1,264,262 | 1,020,425 | 243,784 | 53 | 62 | ||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| EQUITY: |

||||||||||||||||||||||||||||||||||||||||

| Paramount Group, Inc. equity |

269,935 | 172,918 | 87,746 | 9,271 | 5,020 | 270,051 | 172,182 | 88,695 | 9,174 | 2,088 | ||||||||||||||||||||||||||||||

| Noncontrolling interests |

403,686 | 179,843 | 196,875 | 26,968 | 57,816 | 404,997 | 179,072 | 198,946 | 26,979 | 14,549 | ||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| Total Equity |

673,621 | 352,761 | 284,621 | 36,239 | 62,836 | 675,048 | 351,254 | 287,641 | 36,153 | 16,637 | ||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| Total Liabilities and Equity |

$ | 1,938,969 | $ | 1,371,471 | $ | 531,196 | $ | 36,302 | $ | 62,911 | $ | 1,939,310 | $ | 1,371,679 | $ | 531,425 | $ | 36,206 | $ | 16,699 | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

- 21 -

|

CONSOLIDATED JOINT VENTURES AND FUND - OPERATING RESULTS |

(unaudited and in thousands)

| Three Months Ended June 30, 2018 | Three Months Ended June 30, 2017 | |||||||||||||||||||||||||||||||||||

| Consolidated | Consolidated | |||||||||||||||||||||||||||||||||||

| Consolidated Joint Ventures | Fund | Consolidated Joint Ventures | Fund | |||||||||||||||||||||||||||||||||

| Total | One | Residential | Total | One | Residential | |||||||||||||||||||||||||||||||

| Consolidated | Market | 50 Beale | PGRESS Equity | Development | Consolidated | Market | PGRESS Equity | Development | ||||||||||||||||||||||||||||

| Joint Ventures | Plaza | Street (1) | Holdings L.P. | Fund | Joint Ventures | Plaza | Holdings L.P. | Fund | ||||||||||||||||||||||||||||

| Total revenues |

$ | 42,611 | $ | 32,790 | $ | 9,821 | $ | — | $ | 7 | $ | 31,893 | $ | 31,893 | $ | — | $ | 552 | ||||||||||||||||||

| Total operating expenses |

11,325 | 8,097 | 3,228 | — | — | 7,708 | 7,708 | — | 101 | |||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Net operating income |

31,286 | 24,693 | 6,593 | — | 7 | 24,185 | 24,185 | — | 451 | |||||||||||||||||||||||||||

| Depreciation and amortization |

(16,058 | ) | (11,037 | ) | (5,021 | ) | — | — | (11,467 | ) | (11,467 | ) | — | (100 | ) | |||||||||||||||||||||

| Interest and other income, net |

1,103 | 124 | 62 | 917 | 121 | 990 | 37 | 953 | 25 | |||||||||||||||||||||||||||

| Interest and debt expense |

(12,273 | ) | (10,193 | ) | (2,080 | ) | — | — | (10,194 | ) | (10,194 | ) | — | — | ||||||||||||||||||||||

| Gain on sale of real estate |

— | — | — | — | — | — | — | — | 23,406 | (2) | ||||||||||||||||||||||||||

| Income from unconsolidated joint ventures |

— | — | — | — | (16 | ) | — | — | — | 33 | ||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Net income (loss) before income taxes |

4,058 | 3,587 | (446 | ) | 917 | 112 | 3,514 | 2,561 | 953 | 23,815 | ||||||||||||||||||||||||||

| Income tax (expense) benefit |

(5 | ) | 1 | (6 | ) | — | 3 | (3 | ) | (3 | ) | — | — | |||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Net income (loss) |

$ | 4,053 | $ | 3,588 | $ | (452 | ) | $ | 917 | $ | 115 | $ | 3,511 | $ | 2,558 | $ | 953 | $ | 23,815 | |||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| PGRE’s share Ownership |

Total | 49.0% | 31.1% | 24.4% | 7.4% | Total | 49.0% | 24.4% | 7.4% | |||||||||||||||||||||||||||

| Net income (loss) |

$ | 1,816 | $ | 1,752 | $ | (159 | ) | $ | 223 | $ | (15 | ) | $ | 1,479 | $ | 1,247 | $ | 232 | $ | 3,544 | ||||||||||||||||

| Add: Management fee income |

485 | 157 | 328 | — | (22 | ) | 135 | 135 | — | 86 | ||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| PGRE’s share of net income (loss) |

2,301 | 1,909 | 169 | 223 | (37 | ) | 1,614 | 1,382 | 232 | 3,630 | ||||||||||||||||||||||||||

| Add: Real estate depreciation and amortization |

6,970 | 5,408 | 1,562 | — | — | 5,624 | 5,624 | — | 9 | |||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| FFO (3) |

9,271 | 7,317 | 1,731 | 223 | (37 | ) | 7,238 | 7,006 | 232 | 3,639 | ||||||||||||||||||||||||||

| Less: Gain on sale of land parcel |

— | — | — | — | — | — | — | — | (3,118 | ) | ||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Core FFO (3) |

$ | 9,271 | $ | 7,317 | $ | 1,731 | $ | 223 | $ | (37 | ) | $ | 7,238 | $ | 7,006 | $ | 232 | $ | 521 | |||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Noncontrolling interests’ share Ownership |

Total | 51.0% | 68.9% | 75.6% | 92.6% | Total | 51.0% | 75.6% | 92.6% | |||||||||||||||||||||||||||

| Net income (loss) |

$ | 2,237 | $ | 1,836 | $ | (293 | ) | $ | 694 | $ | 130 | $ | 2,032 | $ | 1,311 | $ | 721 | $ | 20,271 | |||||||||||||||||

| Less: Management fee expense |

(485 | ) | (157 | ) | (328 | ) | — | 22 | (135 | ) | (135 | ) | — | (86 | ) | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Net income (loss) attributable to noncontrolling interests |

1,752 | 1,679 | (621 | ) | 694 | 152 | 1,897 | 1,176 | 721 | 20,185 | ||||||||||||||||||||||||||

| Add: Real estate depreciation and amortization |

9,088 | 5,629 | 3,459 | — | — | 5,843 | 5,843 | — | 91 | |||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| FFO (3) |

10,840 | 7,308 | 2,838 | 694 | 152 | 7,740 | 7,019 | 721 | 20,276 | |||||||||||||||||||||||||||

| Less: Gain on sale of real estate |

— | — | — | — | — | — | — | — | (20,288 | ) | ||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Core FFO (3) |

$ | 10,840 | $ | 7,308 | $ | 2,838 | $ | 694 | $ | 152 | $ | 7,740 | $ | 7,019 | $ | 721 | $ | (12 | ) | |||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| (1) | Acquired on July 17, 2017. |

| (2) | Represents the gain on sale of One Steuart Lane (formerly 75 Howard), of which our share, net of income taxes, was $1,661. |

| (3) | See page 43 for our definition of this measure. |

- 22 -

|

CONSOLIDATED JOINT VENTURES AND FUND - OPERATING RESULTS |

(unaudited and in thousands)

| Six Months Ended June 30, 2018 | Six Months Ended June 30, 2017 | |||||||||||||||||||||||||||||||||||

| Consolidated | Consolidated | |||||||||||||||||||||||||||||||||||

| Consolidated Joint Ventures | Fund | Consolidated Joint Ventures | Fund | |||||||||||||||||||||||||||||||||

| Total | One | Residential | Total | One | Residential | |||||||||||||||||||||||||||||||

| Consolidated | Market | 50 Beale | PGRESS Equity | Development | Consolidated | Market | PGRESS Equity | Development | ||||||||||||||||||||||||||||

| Joint Ventures | Plaza | Street (1) | Holdings L.P. | Fund | Joint Ventures | Plaza | Holdings L.P. | Fund | ||||||||||||||||||||||||||||

| Total revenues |

$ | 83,456 | $ | 64,720 | $ | 18,736 | $ | — | $ | 9 | $ | 63,012 | $ | 63,012 | $ | — | $ | 1,420 | ||||||||||||||||||

| Total operating expenses |

21,897 | 15,619 | 6,278 | — | 1 | 14,986 | 14,986 | — | 515 | |||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Net operating income |

61,559 | 49,101 | 12,458 | — | 8 | 48,026 | 48,026 | — | 905 | |||||||||||||||||||||||||||

| Depreciation and amortization |

(32,264 | ) | (22,286 | ) | (9,978 | ) | — | — | (23,040 | ) | (23,040 | ) | — | (359 | ) | |||||||||||||||||||||

| Interest and other income, net |