Attached files

| file | filename |

|---|---|

| EX-99.2 - EXHIBIT 99.2 - LUNA INNOVATIONS INC | exhibit992saleofoptoelecto.htm |

| EX-99.1 - EXHIBIT 99.1 - LUNA INNOVATIONS INC | exhibit991earningsrelease.htm |

| 8-K - EARNINGS RELEASE - LUNA INNOVATIONS INC | luna-8xkearningsreleaseand.htm |

Exhibit 99.3 Investor Supplemental materials August 1, 2018

Safe Harbor Safe Harbor Statement Under the Private Securities Litigation Reform Act of 1995 This presentation includes information that constitutes “forward-looking statements” made pursuant to the safe harbor provision of the Private Securities Litigation Reform Act of 1995 that involve risks and uncertainties. These statements include the company's expectations regarding the company’s future financial performance and the potential demand for its products, the company’s growth potential, market growth and trends, its business focus and competitive advantages, its reputation for technological excellence, the execution of its strategy, its ability to leverage its technology to serve customers, its long-term growth, the strength of its balance sheet, approach to capital deployment and acquisitions, the culture and organization of its businesses, the design of its business model and its technical capabilities, valuation of the company and the company continuing to leverage the trends of growth in optical connectivity in high speed networks and data centers, as well as the expanding use of composite materials and the need for improved means of testing their structural integrity. Management cautions the reader that these forward-looking statements are only predictions and are subject to a number of both known and unknown risks and uncertainties, and actual results, performance, and/or achievements of the company may differ materially from the future results, performance, and/or achievements expressed or implied by these forward-looking statements as a result of a number of factors. These factors include, without limitation, failure of demand for the company’s products and services to meet expectations, failure of target market to grow and expand, technological and strategic challenges, market valuation of the company and those risks and uncertainties set forth in the company’s periodic reports and other filings with the Securities and Exchange Commission ("SEC"). Such filings are available on the SEC’s website at www.sec.gov and on the company’s website at www.lunainc.com. The statements made in this presentation are based on information available to Luna as of the date of this presentation and Luna undertakes no obligation to update any of the forward-looking statements after the date of this presentation, except as required by law. Non-GAAP Financial Measures In addition to U.S. GAAP financial information, this presentation includes Adjusted EBITDA, a non-GAAP financial measures. This non-GAAP financial measures is in addition to, and not a substitute for or superior to, measures of financial performance prepared in accordance with U.S. GAAP. A reconciliation of Adjusted EBITDA to Loss from Continuing Operations is included in the appendix to this presentation. NASDAQ: LUNA Luna Innovations Incorporated© 2018

Divestiture of OptoElectronics Solutions business

Divestiture of Opto business allows greater focus on core business capabilities in fiber optic-based test and measurement Luna has closed on the divestiture of its Optoelectronic Solutions business to OSI Systems, Inc. OSI Systems, Inc. is an integrated designer and manufacturer of specialized electronic systems and components for critical applications, including a division dedicated to optoelectronic manufacturing. Sale price is up to $18.5 million ▪ $17.5 million cash ▪ Up to $1.0 million earn-out based on 18-month post-close revenue target NASDAQ: LUNA Luna Innovations Incorporated© 2018

Proceeds add to strong cash position and flexible balance sheet; we will maintain our disciplined capital deployment strategy A disciplined approach to capital deployment, with a focus on working capital and reinvestment in the business to generate long-term sustainable growth Continue to invest in the organic growth of the company ▪ Strategic investments will be made to enhance and expand our core products and access to market ▪ Investments in Lightwave sales and marketing team ▪ Invest in engineering resources to accelerate the product road map Disciplined acquisition strategy ▪ Taking a targeted and deliberate approach ▪ Interesting potential opportunities that allow us to grow test and measurement capabilities through acquisition ▪ Intend to target acquisitions that we can expect to be quickly accretive Additional capital allocation may include share repurchase; dependent on corporate earnings growth and other available opportunities Financial performance NASDAQ: LUNA Luna Innovations Incorporated© 2018

Pro-forma Luna financials:1 Three Months Ended ($ in 000s) 3/31/2017 6/30/2017 9/30/2017 12/31/2017 3/31/2018 6/30/2018 Revenues: Technology development $ 4,236 $ 4,602 $ 4,590 $ 5,148 $ 4,637 $ 5,466 Products and licensing 2,398 3,680 3,713 4,714 4,132 4,457 Total revenues 6,634 8,282 8,303 9,862 8,769 9,923 Cost of revenues: Technology development 3,109 3,444 3,492 3,943 3,354 3,945 Products and licensing 995 1,529 1,470 1,732 1,575 1,748 Total cost of revenues 4,104 4,973 4,962 5,675 4,929 5,693 Gross profit 2,530 3,309 3,341 4,187 3,840 4,230 Operating expense: Selling, general and administrative 3,204 2,947 2,832 3,943 3,334 3,265 Research, development and engineering 700 600 662 692 880 760 Total operating expense 3,904 3,547 3,494 4,635 4,214 4,025 Operating Income (Loss) $ (1,374) $ (238) $ (153) $ (448) $ (374) $ 205 1 Unaudited pro forma financials assumes Optoelectronics business had been sold on January 1, 2017 NASDAQ: LUNA Luna Innovations Incorporated© 2018

Business Strategy

Our business model accelerates the process of bringing new and innovative products to market Structural & Material Test Communications Test & Technology development and Terahertz Deliver high-definition Measurement distributed strain & Design and manufacture, Cutting edge temperature sensing data high performance fiber optic measurement not available using test instruments for technologies & highly conventional measurement communications market leverageable, third party technologies funded research What problem does Luna solve? NASDAQ: LUNA Luna Innovations Incorporated© 2018

Strong growth opportunity through Luna’s fiber optic-based technologies (Lightwave) Luna’s fiber optic technologies are used two ways: SENSING OPTICAL TEST & MEASUREMENT Aerospace and Automotive Communications Measuring strain and temperature in Testing optical components and composites and other advanced networks deployed by the Tele- and materials: far superior to Data-communications market conventional technologies Business opportunities – Lightwave NASDAQ: LUNA Luna Innovations Incorporated© 2018

There are strong drivers of growth for our technology in Automotive and Aerospace Challenges we address Drivers for our products Instrumenting complex parts Testing requirements changing Performing fatigue testing in drastically with introduction of new composites materials and lighter-weight designs New materials have very large changes Strain and temperature measurements in strain over short distances fundamental to performance and safety in aerospace and automotive Identifying small defects, eliminate markets false positives Incumbent technologies (strain gages, Mapping complex strain profiles RTDs, etc.) do not scale well to meet challenges of modern design Business opportunities – Lightwave NASDAQ: LUNA Luna Innovations Incorporated© 2018

There are two distinct growth opportunities for our technology in the Communications market Optical Fiber and short component network test development and manufacturing Silicon photonics is creating demand for Bandwidth demands continue to drive advanced test solutions double-digit connectivity growth We are at the beginning of the era of Luna products deliver unprecedented optical connectivity in silicon visibility into short-haul networks Luna products offer 30x faster device characterization vs competition Increase quality and reduce time to market for new designs Accelerate time to market through reduced iteration of design, fab, test Business opportunities – Lightwave NASDAQ: LUNA Luna Innovations Incorporated© 2018

2Q 2018 Results

Second Quarter 2018 earnings We delivered another strong quarter: ▪ Strong revenue growth across nearly all businesses ▪ More than double the Adjusted EBITDA and positive net income versus a loss in the same year ago period Fifth consecutive quarter of year-over-year top line growth and positive net income from continuing operations Total revenues of $13.8 million for the three months ended June 30, 2018, up 22% compared to the three months ended June 30, 2017 Net income improved to $1.1 million for the three months ended June 30, 2018 compared to a net loss of $(0.2) million for the three months ended June 30, 2017 Adjusted EBITDA1 improved to $1.3 million for the three months ended June 30, 2018 compared to $0.6 million for the three months ended June 30, 2017 1Adj EBITDA is a non-GAAP measure. Reconciliation of comparable GAAP measures to non-GAAP measures is provided in the appendix to NASDAQ: LUNA this presentation Luna Innovations Incorporated© 2018

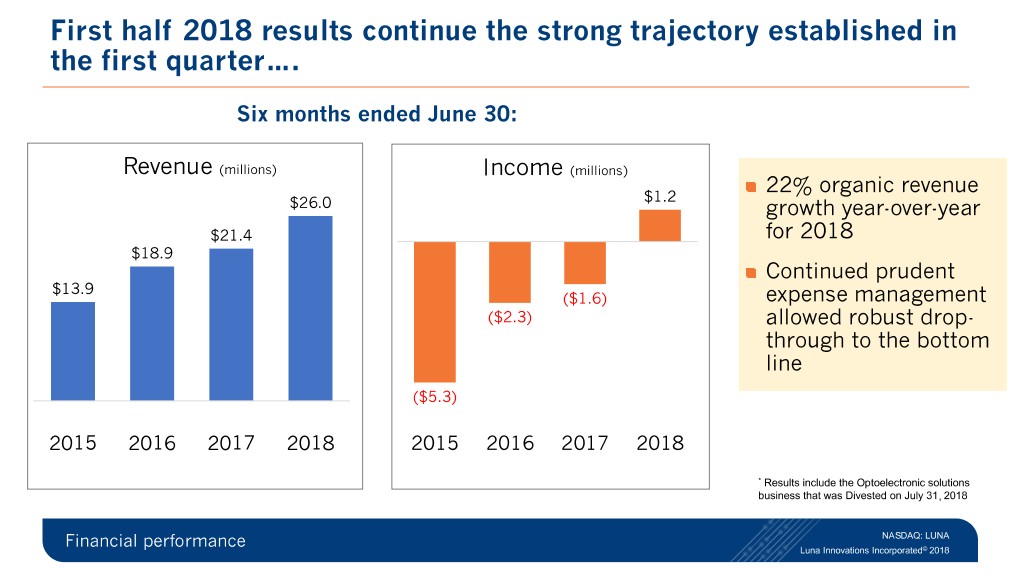

First half 2018 results continue the strong trajectory established in the first quarter…. Six months ended June 30: Revenue (millions) Income (millions) 22% organic revenue $1.2 $26.0 growth year-over-year $21.4 for 2018 $18.9 Continued prudent $13.9 ($1.6) expense management ($2.3) allowed robust drop- through to the bottom line ($5.3) 2015 2016 2017 2018 2015 2016 2017 2018 * Results include the Optoelectronic solutions business that was Divested on July 31, 2018 Financial performance NASDAQ: LUNA Luna Innovations Incorporated© 2018

….And continues the record performance of 2017 and trajectory of the last several years Twelve months ended December 31: Revenue (millions) Income (millions) Double-digit organic $46.2 $0.6 revenue growth year- $41.9 over-year $34.5 Positive income from continuing operations $21.3 in 20171 ($2.7) ($3.4) ($5.2) 1 2017 income from continuing ops normalized for 2014 2015 2016 2017 2014 2015 2016 2017 a one-time pre-tax charge of $0.7 million related to former CEO departure * Results include the Optoelectronic solutions business that was Divested on July 31, 2018 Financial performance NASDAQ: LUNA Luna Innovations Incorporated© 2018

We have a disciplined capital deployment strategy to leverage our flexible balance sheet and strong cash position Pro-forma for the OPTO divestiture, our balance sheet reflects: ▪ $72 Million in total assets • $48 Million in cash and cash equivalents • $60 Million in working capital A disciplined approach to capital deployment, with a focus on working capital and reinvestment in the business to generate long-term sustainable growth Financial performance NASDAQ: LUNA Luna Innovations Incorporated© 2018

Why invest in Luna? Proprietary, measurement technology, offering unprecedented combination of resolution, accuracy and speed Customers in attractive markets: Aerospace, Automotive, Communications, Energy and Defense Positioned to take advantage of trends such as vehicle light-weighting and increasing demands on data centers and broadband capacity Adequately capitalized to fund growth Long-tenured, experienced executive team / board Corporate culture of innovation and integrity Compelling value: currently trading at an attractive multiple Summary NASDAQ: LUNA Luna Innovations Incorporated© 2018

Appendix

Reconciliation of Net Income to Adjusted EBITDA Three Months Ended June 30, 2018 2017 Net income/(loss) $1,067,327 $(221,762) Less loss from discontinued operations, - (298,817) net of income taxes Net income/(loss) from continuing 1,067,327 77,055 operations Interest expense 33,988 60,386 Investment income (100,846) - Income tax (benefit)/expense (98,133) 40,937 Depreciation and amortization 314,725 285,253 EBITDA 1,217,061 463,631 Share-based compensation 117,823 151,672 Adjusted EBITDA $1,334,884 $615,303 NASDAQ: LUNA Additional Financial Info Luna Innovations Incorporated© 2018