Attached files

| file | filename |

|---|---|

| 8-K - 8-K - CITY HOLDING CO | a8-kchcokbwconf82018.htm |

City Holding Company KBW Conference New York City August 1, 2018

Forward looking statements • This presentation contains certain forward-looking statements that are included pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Such information involves risks and uncertainties that could result in the Company's actual results differing from those projected in the forward-looking statements. Important factors that could cause actual results to differ materially from those discussed in such forward-looking statements include, but are not limited to, (1) the Company may incur additional loan loss provision due to negative credit quality trends in the future that may lead to a deterioration of asset quality; (2) the Company may incur increased charge-offs in the future; (3) the Company could have adverse legal actions of a material nature; (4) the Company may face competitive loss of customers; (5) the Company may be unable to manage its expense levels; (6) the Company may have difficulty retaining key employees; (7) changes in the interest rate environment may have results on the Company’s operations materially different from those anticipated by the Company’s market risk management functions; (8) changes in general economic conditions and increased competition could adversely affect the Company’s operating results; (9) changes in regulations and government policies affecting bank holding companies and their subsidiaries, including changes in monetary policies, could negatively impact the Company’s operating results; (10) the Company may experience difficulties growing loan and deposit balances; (11) deterioration in the financial condition of the U.S. banking system may impact the valuations of investments the Company has made in the securities of other financial institutions resulting in either actual losses or other than temporary impairments on such investments; (12) the effects of the Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”) and the regulations promulgated and to be promulgated thereunder, which may subject the Company and its subsidiaries to a variety of new and more stringent legal and regulatory requirements which adversely affect their respective businesses; (13) the impact of new minimum capital thresholds established as a part of the implementation of Basel III; and (14) other risk factors relating to the banking industry or the Company as detailed from time to time in the Company’s reports filed with the Securities and Exchange Commission, including those risk factors included in the disclosures under the heading “ITEM 1A Risk Factors” of the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2017. Forward-looking statements made herein reflect management's expectations as of the date such statements are made. Such information is provided to assist stockholders and potential investors in understanding current and anticipated financial operations of the Company and is included pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. The Company undertakes no obligation to update any forward- looking statement to reflect events or circumstances that arise after the date such statements are made. 2

Snapshot • Total Assets $4.4 bil • Branches 86 • FTE 849 • Market Cap $1.3 bil • Markets: Stable, Slow growing, and less competitive • Business Lines: Retail, Commercial, Investment Mgmt • Asset Quality: Demonstrated strong track record • Performance: Long record as a high performer • Growth: Succeeding in slow-growth markets and expanding into new markets Date: July 27, 2018 3

Snapshot: City National Markets 2nd Branch Share & 7% Deposit Share in Winchester VA & WV Panhandle $5.7 Billion Major Competitors: BBT, UBSI, WFC 1st Branch Share & 3rd Deposit Share (11%) In Charleston MSA/Huntington MSA; $10.6 Billion Major Competitors: BBT, JPM, HBAN, UBSI st 1 Branch Share & 31% nd Deposit Share 2nd Branch Share & 2 Deposit $2.5 Billion Share (14%) in Staunton MSA Major Competitors: JPM, $1.5 Billion UBSI, BBT Major Competitors: UBSH, BBT 4

CHCO EPS $5.00 EPS $4.75 $4.50 $4.25 $4.00 $3.75 $3.50 $3.25 $3.00 $2.75 $2.50 $2.25 $2.00 2010 2011 2012 2013 2014 2015 2016 2017 2018 Proj CHCO CHCO excl Recovery Impact Peer Data as of December 31, 2017 5 Projection based on KBW estimate of $4.94

CHCO: A perennial high-performing bank 2.25% ROA 2.00% 1.75% 1.50% 1.25% 1.00% 0.75% 0.50% 0.25% 0.00% 2010 2011 2012 2013 2014 2015 2016 2017 Jun 2018 -0.25% -0.50% CHCO CHCO excl Recovery Impact $1B - $5B Peer Data as of December 31, 2017 6

City’s strong deposit franchise provides NIM strength in higher rate environments March 2008 thru June 4.75% 2011: NIM supported by Interest Rate Floors 2013 -2015: NIM supported 4.50% by Accretion from acquisitions 4.25% 4.00% 3.75% 3.50% 3.25% 3.00% 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 Jun 2018 CHCO CHCO excluding PSLs, floors & accretion $1 to $5B Peer Peer Data as of December 31, 2017 7

Non-interest income is branch driven: June 2011 2012 2013 2014 2015 2016 2017 2018 Bankcard Revenues $11.1 $12.4 $13.5 $15.1 $15.9 $16.5 $17.1 $8.9 (+3.7%) (+4.2%) Service Charges $27.0 $26.3 $27.6 $26.6 $26.3 $26.7 $28.6 $14.2 (+7.0%) (+2.8%) Investment Management $3.1 $3.8 $4.0 $4.6 $5.1 $5.6 $6.3 $3.2 (+12.5%) (+7.2%) NOTE: June 2018 percentage change reflect the percentage change from 6/30/17 YTD to 6/30/18 YTD 8

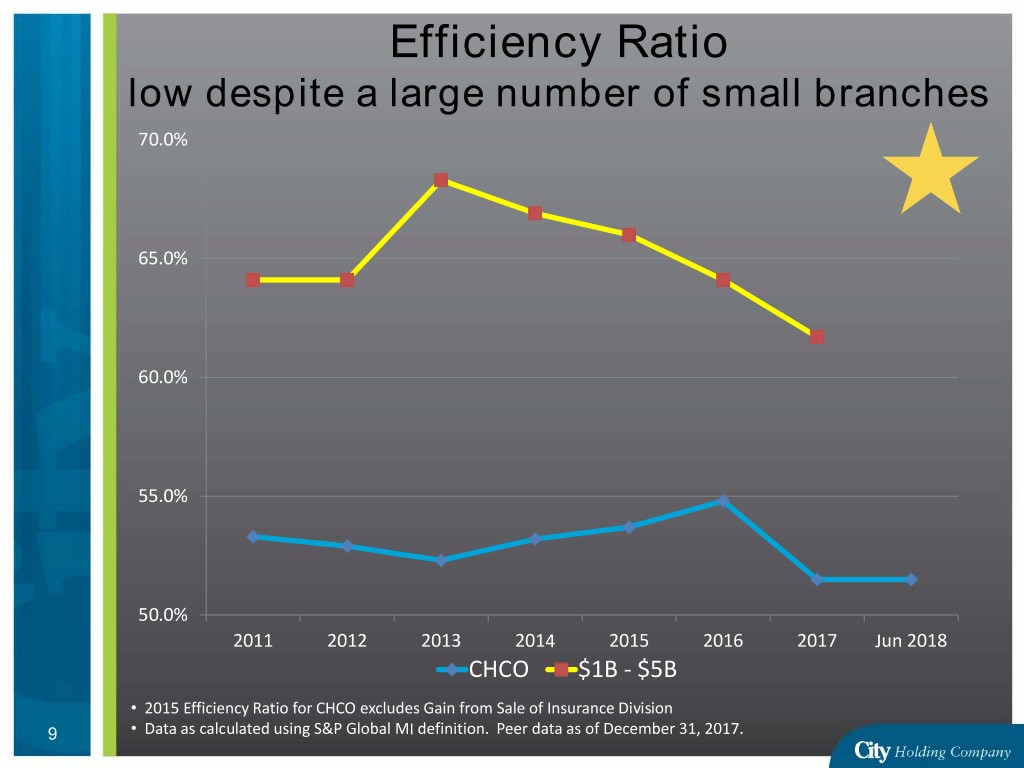

Efficiency Ratio low despite a large number of small branches 70.0% 65.0% 60.0% 55.0% 50.0% 2011 2012 2013 2014 2015 2016 2017 Jun 2018 CHCO $1B - $5B • 2015 Efficiency Ratio for CHCO excludes Gain from Sale of Insurance Division 9 • Data as calculated using S&P Global MI definition. Peer data as of December 31, 2017.

Charge-off trends: 3.00% CHCO Industry 2.50% 2.00% 1.50% 1.00% 0.50% 0.00% 2010 2011 2012 2013 2014 2015 2016 2017 Jun 2018 -0.50% Source: FDIC, All Insured Depository Institutions Peer data as of December 31, 2017 10

A long history of strong asset quality at CHCO 3.50% CHCO NPA/Assets Industry 3.00% 2.50% 2.00% 1.50% 1.00% 0.50% 0.00% 2010 2011 2012 2013 2014 2015 2016 2017 Jun 2018 Source: FDIC, All Insured Depository Institutions Peer data as of December 31, 2017 11

Acquisitions of Poage Bankshares, Inc. & Farmers Deposit Bancorp, Inc. July 11, 2018

Overview of Pro Forma Company Pro Forma Highlights (1) CHCO PBSK Total Assets $4.8 billion PBSK LPO Total Loans $3.5 billion Farmers Deposit Total Deposits $3.9 billion Branch Locations 98 • Creates a $4.8 billion in assets bank with presence across West Virginia, Kentucky, Virginia, and Ohio • Opportunity to leverage scale in existing footprint and expand into adjacent markets • Builds upon solid core funding base Source: S&P Global 13 Data as of 3/31/18 (1) Excludes purchase accounting adjustments

Overview of Poage Bankshares, Inc. Franchise Highlights Branch Footprint • Founded as a savings and loan association in 1889 • Long-standing ties to local communities • Strong market share in counties of operation • 4 PBSK branches within 1 mile of an existing CHCO branch; 5 within 2 miles • No estimated HHI divestitures PBSK Branch (9) PBSKUpdate LPO (1) Headquarters Ashland, KY Markets of Operation Standalone Deposits ($mm) Pro Forma Branch Locations 9 Total KY County Market PBSK CHCO Deposits Share Rank Total Assets $450 million Boyd $844 $183 $66 $249 29.5 % 1 Greenup 390 77 30 107 27.4 2 Total Loans $333 million Jessamine 590 57 -- 57 9.7 6 Lawrence 147 37 -- 37 25.4 2 Montgomery 588 18 -- 18 3.1 5 Total Deposits $375 million TCE / TA 13.05% 14 Source: S&P Global Financial data as of 3/31/18; deposit market share data as of 6/30/17

Overview of Farmers Deposit Bancorp, Inc. Franchise Highlights Branch Footprint • Founded in 1866 as a full service bank Update • Operates 3 branches around the Lexington, KY market • Solid core funding base – MRQ cost of deposits: 0.25% Farmers UpdateDeposit Branch (3) Headquarters Cynthiana, KY Markets of Operation Deposits Deposits Market Branch Locations 3 KY County Rank ($mm) ($mm) Share Total Assets $122 million Harrison 2 $58 $262 22.2 % Nicholas 1 45 45 100.0 Total Loans $60 million Total Deposits $98 million Source: S&P Global TCEFinancial / dataTA as of 3/31/18 14.43% 15 Source: S&P Global Financial data bank level as of 3/31/18; deposit market share data as of 6/30/17

Combined Financial Impact Pro Forma Impact • Immediate mid single digit EPS accretion • Minimal tangible book dilution, earned back in less than 3 years • IRR in excess of 20% Capital Ratios Standalone Today Pro Forma at Close TCE/ TA 10.0% 9.7% Leverage Ratio 10.9% 10.5% Total Risk-Based Ratio 16.3% 15.7% 16 Source: S&P Global Standalone financial data as of 3/31/18

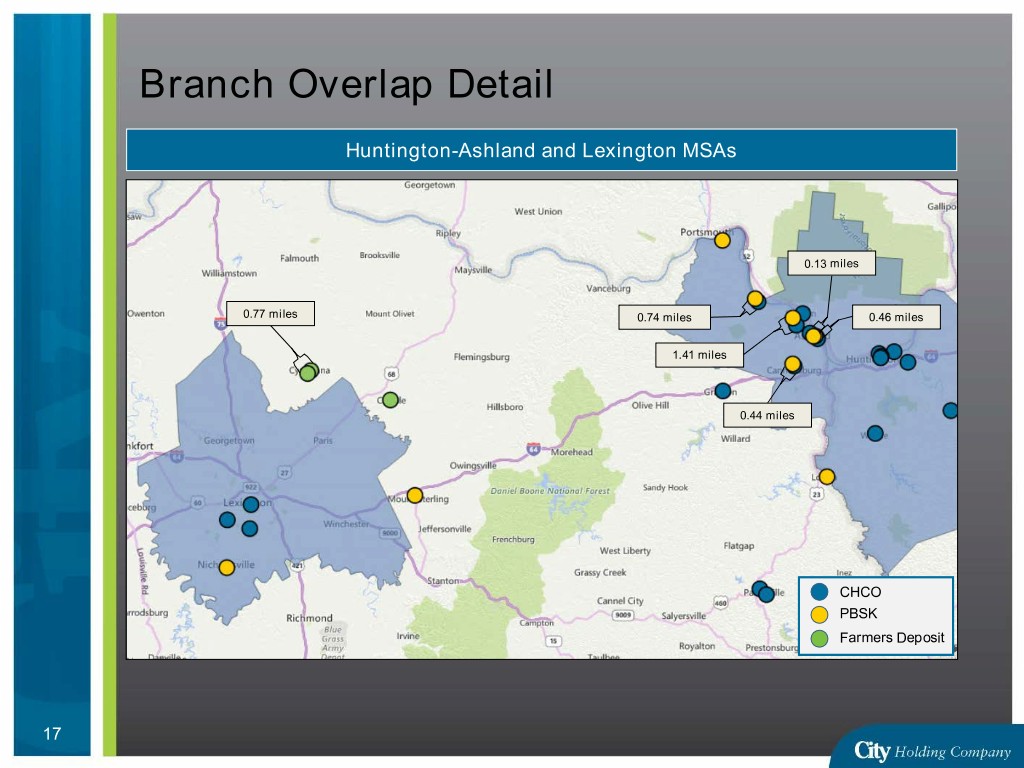

Branch Overlap Detail Huntington-Ashland and Lexington MSAs 0.13 miles 0.77 miles 0.74 miles 0.46 miles 1.41 miles 0.44 miles CHCO PBSK Farmers Deposit 17

Market Position City’s biggest markets have strong distribution, large share, and high profitability Deposits Deposit Branch Branch Market Population ($mm) Share Branches Share Rank Charleston/Huntington/ 583,000 $1,469 13% 33-35 18% 1 Ashland MSA Beckley/Lewisburg WV 175,000 771 31% 16 25% 1 Winchester/Martinsburg 351,000 372 7% 12 10% 2 Valley Region 205,000 244 11% 8 14% 3 Lexington KY Region 500,000 307 2% 7 3% 13 Note: Green highlight indicates market expansion as a result of acquisitions. Data: S&P Global MI – regions modified slightly to fit City’s branch distribution 18

Market Demographics Newer markets have high growth and higher incomes Projected Projected Change in Population Median HHLD Market Population Change 2016- Household Income 2021 Income 2016-2021 Charleston/Huntington/ Ashland 583,000 (0.8%) $45,700 8.0% MSA Beckley 122,000 (1.4%) $40,000 6.3% Winchester/Martinsburg 134,000 4.2% $56,000 7.5% Staunton-Waynesboro 121,000 2.7% $51,000 7.3% Lexington Ky Region 500,000 4.3% $52,000 8.2% National Averages 4.4% $56,000 7.8% Note: Green highlight indicates market expansion as a result of acquisitions. Data: S&P Global MI 19

Deposits mostly in WV and E. KY Key Deposit Markets Deposits West Virginia & E. Kentucky – dating to 1870 79% New Markets 21% 20

Diversified Commercial Loan Portfolio Key Loan Markets Percent of Commercial Portfolio West Virginia & Eastern Kentucky – dating to 1870 47% Virginia/Eastern Panhandle Markets – acquired 19% 2012/13 Charlotte LPO – de novo 2006 12% Lexington, KY – acquired 2015 9% Columbus, OH & Pittsburgh PA 13% 21

Tangible Common Equity Ratio: strong following acquisitions in 2012, 2013 & 2015 11.00% 10.50% 10.00% 9.50% 9.00% Prior to ATM offering, TCE Ratio 9.4% @ 9/30/16 8.50% 8.00% 7.50% 7.00% 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 Jun Proj 2018 2018 22

Share Count: strong capital and high profitability allow aggressive share repurchases Average Shares Outstanding 18,000,000 17,500,000 Proj 2018: Reflects Poage 17,000,000 Acq. 16,500,000 2013: Reflects 2017: Reflects Comm. Acq. 16,000,000 ATM offering 15,500,000 15,000,000 14,500,000 14,000,000 13,500,000 13,000,000 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 Jun Proj 2018 2018 23

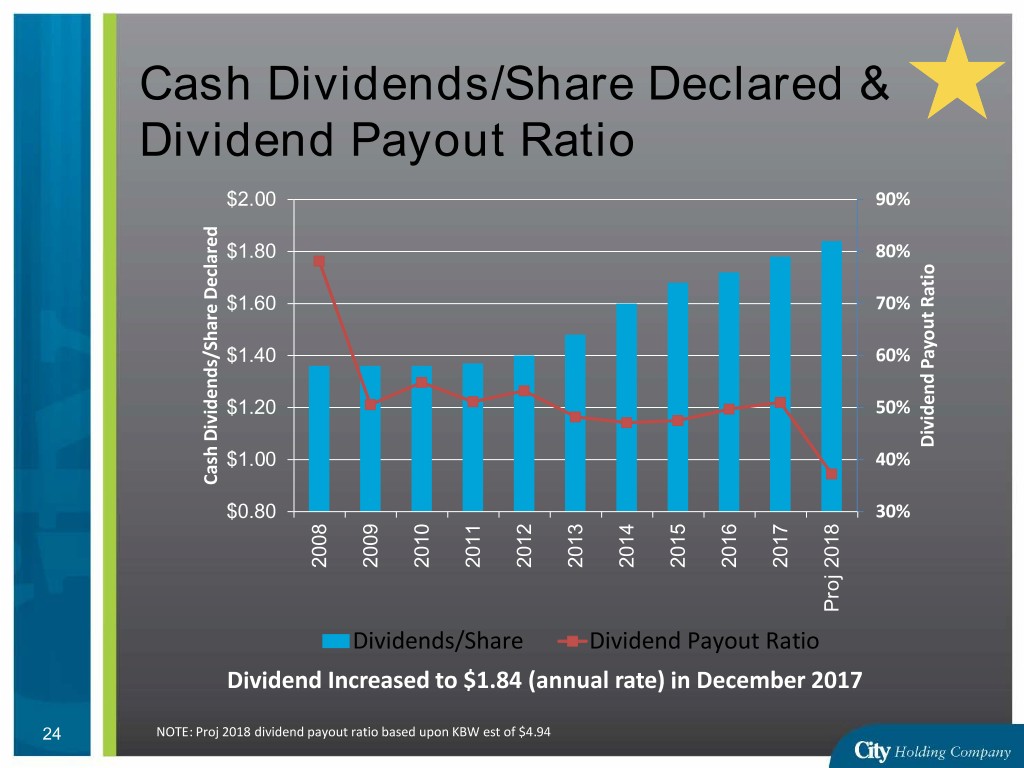

Cash Dividends/Share Declared & Dividend Payout Ratio $2.00 90% $1.80 80% $1.60 70% $1.40 60% $1.20 50% Dividend Payout Ratio Payout Dividend $1.00 40% Cash Dividends/Share Declared Cash Dividends/Share $0.80 30% 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 Proj 2018 Proj Dividends/Share Dividend Payout Ratio Dividend Increased to $1.84 (annual rate) in December 2017 24 NOTE: Proj 2018 dividend payout ratio based upon KBW est of $4.94

Capital Management: A Long-term Core Competency • CHCO is more profitable than average • CHCO generates more capital than average • Projected Earnings of $76.5MM • CHCO pays a good dividend – Based upon earnings estimates – current dividend is 37% of projected 2018 earnings – Historically target 50%+ of earnings in dividends • TCE – 9.7% projected at close of acquisitions • Repurchased 214,000+ shares (2018 YTD) • 40% Target Dividend Payout -> Share Repurchase of up to 600,000 shares annually (3.8% of shares) – represents approx. 4% EPS accretion Per KBW 25

CHCO’s sensitivity to interest rate risk Immediate Basis Point Estimated Increase or Change in Interest Decrease in Net Income Rates between 1-12 months +400 Bp +4.8% +300 Bp +5.6% +200 Bp +5.5% +100 Bp +3.8% -50 Bp -6.1% -100 Bp -14.4% Data: Internal Model as of March 31, 2018. Model assumes that deposit mix will change as rates rise 26

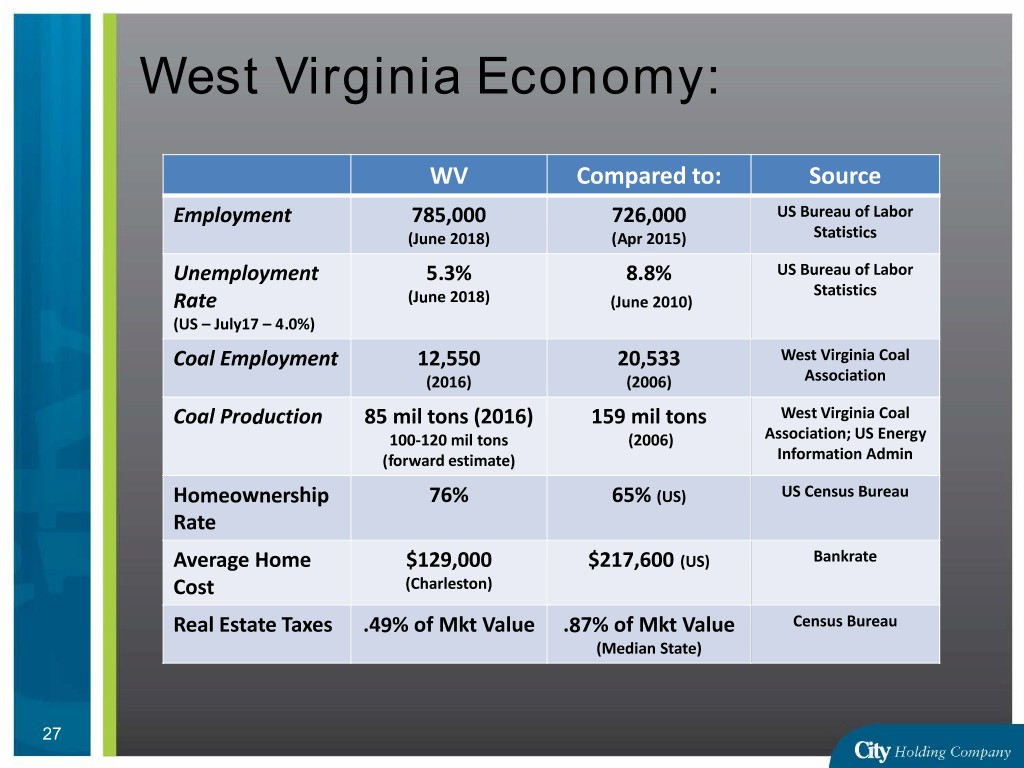

West Virginia Economy: WV Compared to: Source Employment 785,000 726,000 US Bureau of Labor (June 2018) (Apr 2015) Statistics Unemployment 5.3% 8.8% US Bureau of Labor Statistics Rate (June 2018) (June 2010) (US – July17 – 4.0%) Coal Employment 12,550 20,533 West Virginia Coal (2016) (2006) Association Coal Production 85 mil tons (2016) 159 mil tons West Virginia Coal 100-120 mil tons (2006) Association; US Energy (forward estimate) Information Admin Homeownership 76% 65% (US) US Census Bureau Rate Average Home $129,000 $217,600 (US) Bankrate Cost (Charleston) Real Estate Taxes .49% of Mkt Value .87% of Mkt Value Census Bureau (Median State) 27

Commercial loan growth: Success achieved due to community bank orientation, strong team, strong underwriting, and exposure to new higher growth markets. 12.00% 10.00% 8.00% 6.00% 4.00% 2.00% 0.00% 2018: 3.0% CAGR over -2.00% 12/31/17 -4.00% 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 Jun 2018 Jun Growth percentages exclude acquisitions; Loan Decreases in 2014 reflect reduction in acquired problem loans 28

Retail loans Primarily residential related – demonstrates long-term steady and predictable growth; Recent challenges due to flat yield curve $1,750 $1,500 $1,250 Loans$MM $1,000 $750 $500 2010 2011 2012 2013 2014 2015 2016 2017 Jun 2018 Residential Real Estate Home Equity Consumer 29

Deposit growth opportunity: CHCO has many small deposit transaction relationships; Peers tend to have larger commercial & public deposits; So liquidity is readily available as needed. Branches Deposits Deposits/Branch CHCO 86 $ 3.3 B $39 million BBT 66 $ 5.5 B $83 million UBSI 29 $ 2.3 B $79 million JPM 30 $ 2.8 B $93 million HBAN 11 $ 0.9 B $78 million Includes branches within 5 miles of City branch Source: S&P Global MI 30

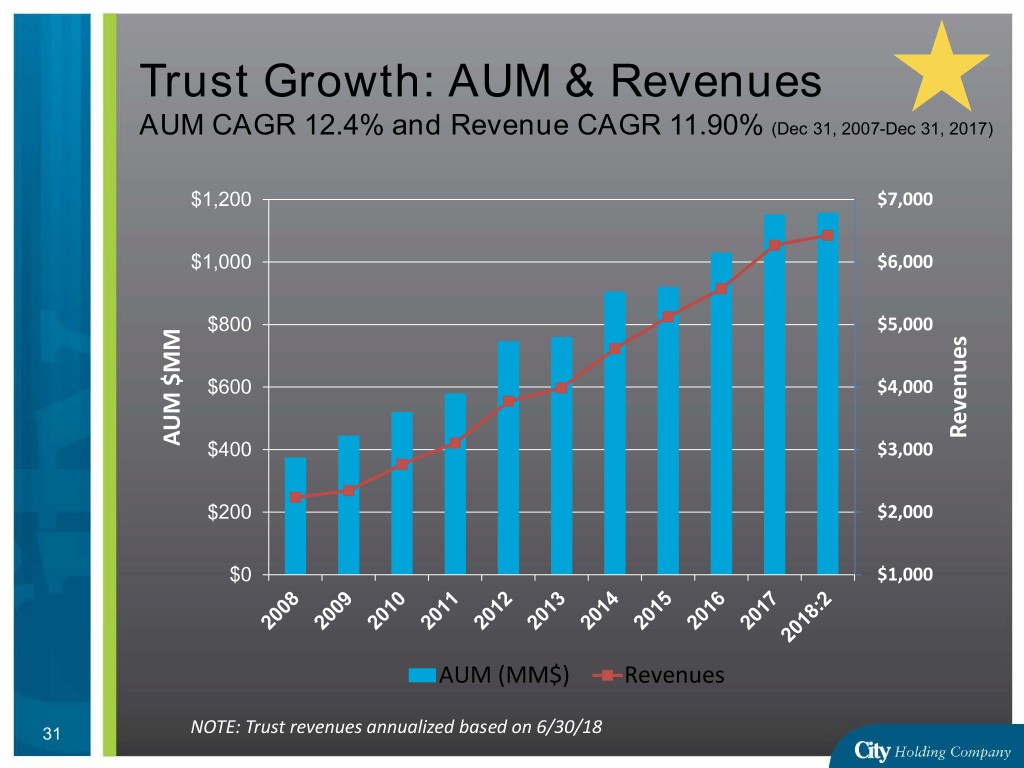

Trust Growth: AUM & Revenues AUM CAGR 12.4% and Revenue CAGR 11.90% (Dec 31, 2007-Dec 31, 2017) $1,200 $7,000 $1,000 $6,000 $800 $5,000 $600 $4,000 Revenues AUM $MM AUM $400 $3,000 $200 $2,000 $0 $1,000 AUM (MM$) Revenues 31 NOTE: Trust revenues annualized based on 6/30/18

City’s Deposit Franchise provides access to low cost and stable funding 1.3% 0.4% 1% 12% 5% 11% 16% Equity Non Interest DDA Interest DDA 15% Savings MMS CDs 19% Jumbos 10% Customer Repos FHLB 9% Other Trust Preferred Data: December 31, 2017 32

DEPOSIT FRANCHISE One key to City’s enviable success • Branches 86 • Average Deposits per Branch $39 MM • Average Households per Branch 1,900 • Average Deposit Share 13.7% • Average Household Share* 25% * - Excludes Coastal & Lexington-Fayette Regions 33

Impact of Acquisitions: The Acquisition of Poage and Farmers will strengthen City’s already strong franchise City Town Square Farmers Households 176,000 Est. 14,000 Est. 6,000 Core Deposits/Assets 77% 78% 74% Consumer Loans/Ttl Loans 53% 60% 29% Demographics Slow Growth Slow Growth Slow Growth Mkt Share 25%+ 21.7% (Boyd) 22.2% (Harrison) 34

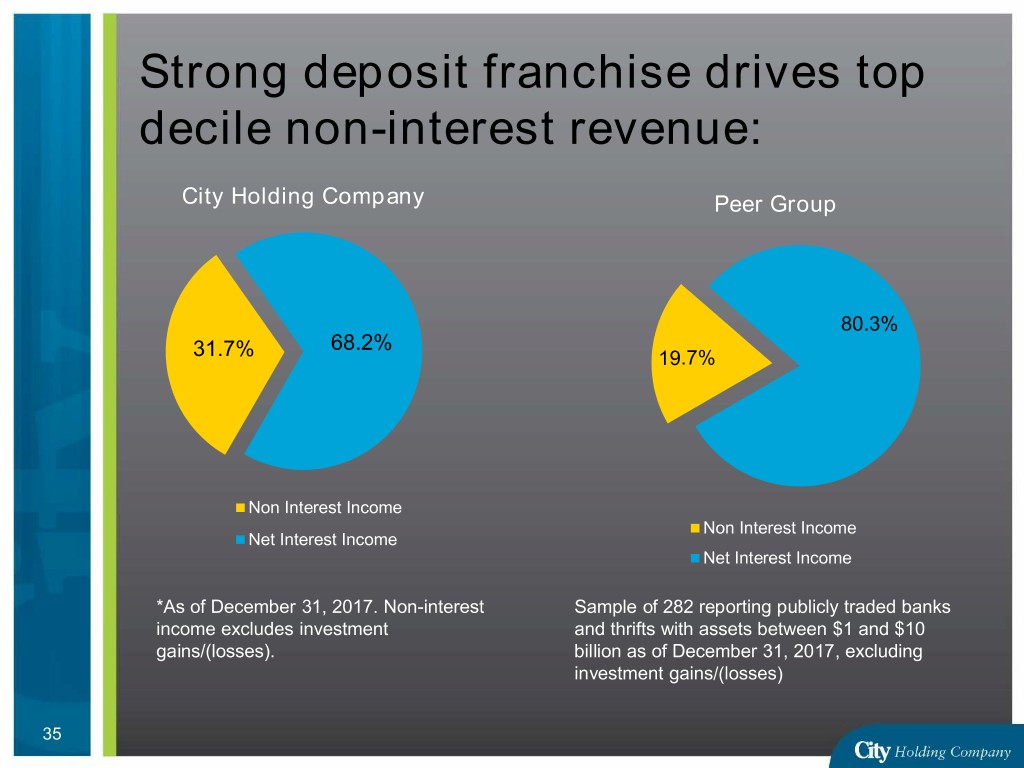

Strong deposit franchise drives top decile non-interest revenue: City Holding Company Peer Group 80.3% 68.2% 31.7% 19.7% Non Interest Income Non Interest Income Net Interest Income Net Interest Income *As of December 31, 2017. Non-interest Sample of 282 reporting publicly traded banks income excludes investment and thrifts with assets between $1 and $10 gains/(losses). billion as of December 31, 2017, excluding investment gains/(losses) 35

Industry & CHCO are Optimistic in 2018: – Lower Tax rates driving earnings and creating capital for deployment in acquisitions, dividends or share repurchases – Higher interest rates increase NIM’s – Less Regulatory Burden • allows more focus on customer needs • City Benefits from stable regulation – Asset quality continues to improve with economy – West Virginia’s economy seems stabilized and has potential to experience growth – City demonstrated that we can grow in slow growth markets • Big banks don’t care about these markets • STI shuttered all WV branches 36

Acquisition philosophy: • Opportunities have increased • Actively looking, but for the best partners • Size: Generally $100MM to $1B • Historically less acquisitive than peers because City’s strategy is driven by creating shareholder value not by size • Acquisitions must truly be strategic or meaningfully accretive • Taking into consideration Geography, Households, Fees, Market Share, Loans, and Talent 37

Tortoise vs. Hare • Tortoise Markets – Slow Growth Markets – Less Competitive – More Profitable – Better Dividends & Share Repurchase – No reason that Tortoise Markets can’t have at least the same Total Shareholder Return • Hare Markets – Faster Growth – More Competitive – Requires Capital to Feed Growth 38

Acquisition territory: But – Requires Willing Sellers…See slides which follow! 39

CHCO represents excellent value and stability • Pricing Metrics*: • Price to Book: 250% • Price to Tangible Book: 297% • Price to 2018 Projected Earnings** 16.5x • Dividend Yield 2.2% • Div Payout Ratio** 37% • Tangible Capital/Tangible Assets*** 9.9% • Institutional Ownership 67% • Average Daily Volume $5.1 mil * Based on Price of $81.78(7/27/18) ** Based on analyst KBW estimate of $4.94 for 2018 40 *** June 30, 2018

Appendix: Non-GAAP Reconciliation Projected 2018 EPS KBW Analyst EPS Estimate (“GAAP”) $4.94 Impact of Kentucky Fuels Corporation recovery (0.14) KBW Analyst EPS Estimate excluding Recovery Impact $4.80 6/30/18 Return on Assets (“GAAP”) 1.85% Impact of Kentucky Fuels Corporation recovery (0.11) Return on Assets excluding Recovery Impact 1.74% 41