Attached files

| file | filename |

|---|---|

| EX-32.2 - EX-32.2 - MCDERMOTT INTERNATIONAL INC | mdr-ex322_7.htm |

| EX-32.1 - EX-32.1 - MCDERMOTT INTERNATIONAL INC | mdr-ex321_9.htm |

| EX-31.2 - EX-31.2 - MCDERMOTT INTERNATIONAL INC | mdr-ex312_10.htm |

| EX-31.1 - EX-31.1 - MCDERMOTT INTERNATIONAL INC | mdr-ex311_8.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

|

☑ |

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended June 30, 2018

OR

|

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File No. 001-08430

McDERMOTT INTERNATIONAL, INC.

(Exact name of registrant as specified in its charter)

|

REPUBLIC OF PANAMA |

|

|

72-0593134 |

|

(State or Other Jurisdiction of Incorporation or Organization) |

|

|

(I.R.S. Employer Identification No.) |

|

|

|

|

|

|

757 N. Eldridge Parkway HOUSTON, TEXAS |

|

|

77079 |

|

(Address of Principal Executive Offices) |

|

|

(Zip Code) |

Registrant’s Telephone Number, Including Area Code: (281) 870-5000

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☑ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer |

☑ |

Accelerated filer |

☐ |

|

|

|

|

|

|

Non-accelerated filer |

☐ (Do not check if a smaller reporting company) |

Smaller reporting company |

☐ |

|

|

|

|

|

|

|

|

Emerging growth company |

☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☑

The number of shares of the registrant’s common stock outstanding at July 27, 2018 was 180,536,768.

TABLE OF CONTENTS

McDERMOTT INTERNATIONAL, INC.

INDEX—FORM 10-Q

|

|

|

PAGE |

|

|

1 |

|

|

Item 1—Condensed Consolidated Financial Statements |

|

|

|

|

1 |

|

|

|

2 |

|

|

|

3 |

|

|

|

4 |

|

|

|

5 |

|

|

|

7 |

|

|

Item 2—Management’s Discussion and Analysis of Financial Condition and Results of Operations |

|

43 |

|

Item 3—Quantitative and Qualitative Disclosures about Market Risk |

|

64 |

|

|

65 |

|

|

|

66 |

|

|

|

66 |

|

|

|

66 |

|

|

|

83 |

|

|

|

85 |

|

|

|

88 |

CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

PART I: Item 1—FINANCIAL INFORMATION

|

McDERMOTT INTERNATIONAL, INC. |

|

|||||||||||||||

|

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS |

|

|||||||||||||||

|

(Unaudited) |

|

|||||||||||||||

|

|

|

Three Months Ended June 30, |

|

|

Six Months Ended June 30, |

|

||||||||||

|

|

|

2018 |

|

|

2017 |

|

|

2018 |

|

|

2017 |

|

||||

|

|

|

(In millions, except per share amounts) |

|

|||||||||||||

|

Revenues |

|

$ |

1,735 |

|

|

$ |

789 |

|

|

$ |

2,343 |

|

|

$ |

1,308 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Costs and Expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of operations |

|

|

1,486 |

|

|

|

650 |

|

|

|

1,962 |

|

|

|

1,079 |

|

|

Project related intangibles amortization |

|

|

12 |

|

|

|

- |

|

|

|

12 |

|

|

|

- |

|

|

Total cost of operations |

|

|

1,498 |

|

|

|

650 |

|

|

|

1,974 |

|

|

|

1,079 |

|

|

Research and development expenses |

|

|

5 |

|

|

|

1 |

|

|

|

5 |

|

|

|

1 |

|

|

Selling, general and administrative expenses |

|

|

75 |

|

|

|

50 |

|

|

|

124 |

|

|

|

87 |

|

|

Other intangibles amortization |

|

|

10 |

|

|

|

- |

|

|

|

10 |

|

|

|

- |

|

|

Transaction costs |

|

|

37 |

|

|

|

- |

|

|

|

40 |

|

|

|

- |

|

|

Restructuring and integration costs |

|

|

63 |

|

|

|

- |

|

|

|

75 |

|

|

|

- |

|

|

Other operating expenses (income), net |

|

|

1 |

|

|

|

- |

|

|

|

1 |

|

|

|

(2 |

) |

|

Total expenses |

|

|

1,689 |

|

|

|

701 |

|

|

|

2,229 |

|

|

|

1,165 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income (loss) from investments in unconsolidated affiliates |

|

|

3 |

|

|

|

(3 |

) |

|

|

(1 |

) |

|

|

(6 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating income |

|

|

49 |

|

|

|

85 |

|

|

|

113 |

|

|

|

137 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other expense: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense, net |

|

|

(72 |

) |

|

|

(22 |

) |

|

|

(83 |

) |

|

|

(39 |

) |

|

Other non-operating expense, net |

|

|

(16 |

) |

|

|

(3 |

) |

|

|

(14 |

) |

|

|

(2 |

) |

|

Total other expense, net |

|

|

(88 |

) |

|

|

(25 |

) |

|

|

(97 |

) |

|

|

(41 |

) |

|

|

|

|

|

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

(Loss) income before provision for income taxes |

|

|

(39 |

) |

|

|

60 |

|

|

|

16 |

|

|

|

96 |

|

|

|

|

|

|

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

Income tax (benefit) expense |

|

|

(84 |

) |

|

|

23 |

|

|

|

(63 |

) |

|

|

34 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-operating loss from investments in unconsolidated affiliates |

|

|

- |

|

|

|

(1 |

) |

|

|

- |

|

|

|

(2 |

) |

|

|

|

|

|

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

Net income |

|

|

45 |

|

|

|

36 |

|

|

|

79 |

|

|

|

60 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Less: Net (loss) income attributable to noncontrolling interests |

|

|

(2 |

) |

|

|

- |

|

|

|

(3 |

) |

|

|

2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income attributable to McDermott |

|

$ |

47 |

|

|

$ |

36 |

|

|

$ |

82 |

|

|

$ |

58 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income per share attributable to McDermott |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

0.33 |

|

|

$ |

0.38 |

|

|

$ |

0.68 |

|

|

$ |

0.67 |

|

|

Diluted |

|

$ |

0.33 |

|

|

$ |

0.38 |

|

|

$ |

0.68 |

|

|

$ |

0.62 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shares used in the computation of net income per share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

144 |

|

|

|

94 |

|

|

|

120 |

|

|

|

87 |

|

|

Diluted |

|

|

144 |

|

|

|

94 |

|

|

|

120 |

|

|

|

94 |

|

See accompanying Notes to these Condensed Consolidated Financial Statements.

|

|

1 |

|

CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

|

McDERMOTT INTERNATIONAL, INC. |

|

|||||||||||||||

|

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME |

|

|||||||||||||||

|

(Unaudited) |

|

|||||||||||||||

|

|

|

Three Months Ended June 30, |

|

|

Six Months Ended June 30, |

|

||||||||||

|

|

|

2018 |

|

|

2017 |

|

|

2018 |

|

|

2017 |

|

||||

|

|

|

(In millions) |

|

|||||||||||||

|

Net income |

|

$ |

45 |

|

|

$ |

36 |

|

|

$ |

79 |

|

|

$ |

60 |

|

|

Other comprehensive (loss) income, net of tax: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Loss) gain on derivatives |

|

|

(12 |

) |

|

|

9 |

|

|

|

(12 |

) |

|

|

11 |

|

|

Foreign currency translation |

|

|

(11 |

) |

|

|

- |

|

|

|

(12 |

) |

|

|

- |

|

|

Total comprehensive income |

|

|

22 |

|

|

|

45 |

|

|

|

55 |

|

|

|

71 |

|

|

Less: Comprehensive (loss) income attributable to noncontrolling interests |

|

|

(2 |

) |

|

|

- |

|

|

|

(3 |

) |

|

|

2 |

|

|

Comprehensive income attributable to McDermott |

|

$ |

24 |

|

|

$ |

45 |

|

|

$ |

58 |

|

|

$ |

69 |

|

See accompanying Notes to these Condensed Consolidated Financial Statements.

|

|

2 |

|

CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

|

McDERMOTT INTERNATIONAL, INC. |

||||

|

|

|

|

||

|

|

|

June 30, 2018 |

|

December 31, 2017 |

|

|

|

(In millions, except per share amounts) |

||

|

Assets |

|

(Unaudited) |

|

|

|

Current assets: |

|

|

|

|

|

Cash and cash equivalents ($140 and $0 related to variable interest entities ("VIEs")) |

|

$814 |

|

$390 |

|

Restricted cash and cash equivalents |

|

324 |

|

18 |

|

Accounts receivable—trade, net ($29 and $0 related to VIEs) |

|

968 |

|

328 |

|

Accounts receivable—other ($52 and $0 related to VIEs) |

|

130 |

|

42 |

|

Contracts in progress ($213 and $0 related to VIEs) |

|

918 |

|

621 |

|

Project related intangible assets, net |

|

129 |

|

- |

|

Inventory |

|

48 |

|

- |

|

Other current assets ($22 and $0 related to VIEs) |

|

190 |

|

36 |

|

Total current assets |

|

3,521 |

|

1,435 |

|

Property, plant and equipment, net |

|

2,090 |

|

1,666 |

|

Accounts receivable—long-term retainages |

|

61 |

|

39 |

|

Investments in unconsolidated affiliates |

|

423 |

|

8 |

|

Goodwill |

|

3,926 |

|

- |

|

Other intangibles, net |

|

1,039 |

|

- |

|

Deferred income taxes |

|

178 |

|

18 |

|

Other non-current assets |

|

190 |

|

57 |

|

Total assets |

|

$11,428 |

|

$3,223 |

|

|

|

|

|

|

|

Liabilities and Equity |

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

Current maturities of long-term debt |

|

$42 |

|

$24 |

|

Accounts payable ($354 and $0 related to VIEs) |

|

906 |

|

279 |

|

Advance billings on contracts ($66 and $0 related to VIEs) |

|

1,227 |

|

32 |

|

Project related intangible liabilities, net |

|

29 |

|

- |

|

Accrued liabilities ($94 and $0 related to VIEs) |

|

1,442 |

|

337 |

|

Income taxes payable |

|

123 |

|

35 |

|

Total current liabilities |

|

3,769 |

|

707 |

|

Long-term debt |

|

3,418 |

|

513 |

|

Non-current other taxes |

|

96 |

|

63 |

|

Other non-current liabilities |

|

579 |

|

151 |

|

Total liabilities |

|

7,862 |

|

1,434 |

|

Commitments and contingencies |

|

|

|

|

|

Stockholders' equity: |

|

|

|

|

|

Common stock, par value $1.00 per share, authorized 255 shares; |

|

|

|

|

|

issued 183 and 98 shares, respectively |

|

183 |

|

98 |

|

Capital in excess of par value |

3,480 |

|

1,858 |

|

|

Retained earnings/ (accumulated deficit) |

|

54 |

|

(48) |

|

Accumulated other comprehensive loss |

|

(75) |

|

(51) |

|

Treasury stock, at cost: 3 and 3 shares, respectively |

|

(96) |

|

(96) |

|

Total McDermott Stockholders' Equity |

|

3,546 |

|

1,761 |

|

Noncontrolling interest |

|

20 |

|

28 |

|

Total stockholders' equity |

|

3,566 |

|

1,789 |

|

Total liabilities and stockholders' equity |

|

$11,428 |

|

$3,223 |

See accompanying Notes to these Condensed Consolidated Financial Statements.

|

|

3 |

|

CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

|

McDERMOTT INTERNATIONAL, INC. |

|

|||||||

|

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS |

|

|||||||

|

(Unaudited) |

|

|||||||

|

|

|

Six Months Ended June 30, |

|

|||||

|

|

|

2018 |

|

|

2017 |

|

||

|

|

|

(In millions) |

|

|||||

|

Cash flows from operating activities: |

|

|

|

|

|

|

|

|

|

Net income |

|

$ |

79 |

|

|

$ |

60 |

|

|

Non-cash items included in net income: |

|

|

|

|

|

|

|

|

|

Depreciation and intangible amortization |

|

|

80 |

|

|

|

50 |

|

|

Debt issuance cost amortization |

|

|

17 |

|

|

|

10 |

|

|

Stock-based compensation charges |

|

|

28 |

|

|

|

12 |

|

|

Deferred taxes |

|

|

(100 |

) |

|

|

4 |

|

|

Other non-cash items |

|

|

- |

|

|

|

(2 |

) |

|

Changes in operating assets and liabilities, net of effects of businesses acquired: |

|

|

|

|

|

|

|

|

|

Accounts receivable |

|

|

278 |

|

|

|

37 |

|

|

Contracts in progress, net of Advance billings on contracts |

|

|

(141 |

) |

|

|

(411 |

) |

|

Inventory |

|

|

14 |

|

|

|

- |

|

|

Accounts payable |

|

|

129 |

|

|

|

260 |

|

|

Other current and non-current assets |

|

|

(2 |

) |

|

|

(13 |

) |

|

Investments in unconsolidated affiliates |

|

|

1 |

|

|

|

8 |

|

|

Other current and non-current liabilities |

|

|

52 |

|

|

|

76 |

|

|

Total cash provided by operating activities |

|

|

435 |

|

|

|

91 |

|

|

|

|

|

|

|

|

|

|

|

|

Cash flows from investing activities: |

|

|

|

|

|

|

|

|

|

CB&I combination consideration, net of cash of $498 acquired |

|

|

(2,374 |

) |

|

|

- |

|

|

Purchases of property, plant and equipment |

|

|

(43 |

) |

|

|

(81 |

) |

|

Advances with third party participants of proportionately consolidated consortiums, net |

|

|

(45 |

) |

|

|

- |

|

|

Proceeds from asset dispositions |

|

|

2 |

|

|

|

55 |

|

|

Investments in unconsolidated affiliates |

|

|

(3 |

) |

|

|

(1 |

) |

|

Other |

|

|

2 |

|

|

|

- |

|

|

Total cash used in investing activities |

|

|

(2,461 |

) |

|

|

(27 |

) |

|

|

|

|

|

|

|

|

|

|

|

Cash flows from financing activities: |

|

|

|

|

|

|

|

|

|

Proceeds from issuance of long-term debt |

|

|

3,560 |

|

|

|

- |

|

|

Repayment of debt |

|

|

(515 |

) |

|

|

(230 |

) |

|

Advances with joint ventures, proportionately consolidated consortiums and third party participants |

|

|

(42 |

) |

|

|

- |

|

|

Debt and letter of credit issuance costs |

|

|

(208 |

) |

|

|

(19 |

) |

|

Debt extinguishment costs |

|

|

(10 |

) |

|

|

- |

|

|

Acquisition of NCI |

|

|

- |

|

|

|

(11 |

) |

|

Repurchase of common stock |

|

|

(14 |

) |

|

|

(7 |

) |

|

Total cash provided by (used in) financing activities |

|

|

2,771 |

|

|

|

(267 |

) |

|

|

|

|

|

|

|

|

|

|

|

Effects of exchange rate changes on cash, cash equivalents and restricted cash |

|

|

(15 |

) |

|

|

- |

|

|

Net increase (decrease) in cash, cash equivalents and restricted cash |

|

|

730 |

|

|

|

(203 |

) |

|

Cash, cash equivalents and restricted cash at beginning of period |

|

|

408 |

|

|

|

612 |

|

|

Cash, cash equivalents and restricted cash at end of period |

|

$ |

1,138 |

|

|

$ |

409 |

|

See accompanying Notes to these Condensed Consolidated Financial Statements.

|

|

4 |

|

CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

|

McDERMOTT INTERNATIONAL, INC. |

|

|||||||||||||||||||||||||||||||

|

CONDENSED CONSOLIDATED STATEMENTS OF EQUITY |

|

|||||||||||||||||||||||||||||||

|

(Unaudited) |

|

|||||||||||||||||||||||||||||||

|

|

|

Common Stock Par Value |

|

|

Capital in Excess of Par Value |

|

|

Retained Earnings/ (Accumulated Deficit) |

|

|

Accumulated Other Comprehensive Loss ("AOCI") |

|

|

Treasury Stock |

|

|

Stockholders' Equity |

|

|

Noncontrolling Interest ("NCI") |

|

|

Total Equity |

|

||||||||

|

|

(In millions) |

|

||||||||||||||||||||||||||||||

|

Balance at December 31, 2017 |

|

$ |

98 |

|

|

$ |

1,858 |

|

|

$ |

(48 |

) |

|

$ |

(51 |

) |

|

$ |

(96 |

) |

|

$ |

1,761 |

|

|

$ |

28 |

|

|

$ |

1,789 |

|

|

Adoption of ASC 606 |

|

|

- |

|

|

|

- |

|

|

|

20 |

|

|

|

- |

|

|

|

- |

|

|

|

20 |

|

|

|

- |

|

|

|

20 |

|

|

Balance at January 1, 2018 |

|

|

98 |

|

|

|

1,858 |

|

|

|

(28 |

) |

|

|

(51 |

) |

|

|

(96 |

) |

|

|

1,781 |

|

|

|

28 |

|

|

|

1,809 |

|

|

Net income |

|

|

- |

|

|

|

- |

|

|

|

82 |

|

|

|

- |

|

|

|

- |

|

|

|

82 |

|

|

|

(3 |

) |

|

|

79 |

|

|

CB&I combination |

|

|

85 |

|

|

|

1,608 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

1,693 |

|

|

|

(5 |

) |

|

|

1,688 |

|

|

Other comprehensive loss, net of tax |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(24 |

) |

|

|

- |

|

|

|

(24 |

) |

|

|

- |

|

|

|

(24 |

) |

|

Common stock issued |

|

|

1 |

|

|

|

(1 |

) |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

Stock-based compensation charges |

|

|

- |

|

|

|

28 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

28 |

|

|

|

- |

|

|

|

28 |

|

|

Purchase of treasury shares |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(14 |

) |

|

|

(14 |

) |

|

|

- |

|

|

|

(14 |

) |

|

Retirement of common stock |

|

|

(1 |

) |

|

|

(13 |

) |

|

|

- |

|

|

|

- |

|

|

|

14 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

Balance at June 30, 2018 |

|

$ |

183 |

|

|

$ |

3,480 |

|

|

$ |

54 |

|

|

$ |

(75 |

) |

|

$ |

(96 |

) |

|

$ |

3,546 |

|

|

$ |

20 |

|

|

$ |

3,566 |

|

See accompanying Notes to these Condensed Consolidated Financial Statements.

|

|

5 |

|

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

|

|

|

|

|

|

|

PAGE |

|

|

7 |

|

|

Note 2—Basis of Presentation and Significant Accounting Policies |

|

7 |

|

|

14 |

|

|

|

18 |

|

|

|

20 |

|

|

|

21 |

|

|

|

21 |

|

|

Note 8—Contracts in Progress and Advance Billings on Contracts |

|

22 |

|

|

22 |

|

|

|

23 |

|

|

|

25 |

|

|

|

26 |

|

|

|

31 |

|

|

|

32 |

|

|

|

32 |

|

|

|

33 |

|

|

|

34 |

|

|

|

35 |

|

|

|

36 |

|

|

|

37 |

|

|

|

40 |

|

|

|

42 |

|

|

6 |

|

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

NOTE 1—NATURE OF OPERATIONS AND ORGANIZATION

Nature of Operations

McDermott International, Inc. (“McDermott,” “MDR,” “we,” “our,” “us” or the “Company”), a corporation incorporated under the laws of the Republic of Panama in 1959, is a fully-integrated provider of engineering, procurement, construction and installation (“EPCI”) and technology solutions to the energy industry. On May 10, 2018, we completed our combination with Chicago Bridge & Iron Company N.V. (“CB&I”) through a series of transactions (the “Combination”) (see Note 3, Business Combination, for further discussion). We design and build end-to-end infrastructure and technology solutions, from the wellhead to the storage tank, to transport and transform oil and gas into a variety of products. Our proprietary technologies, integrated expertise and comprehensive solutions are utilized for offshore, subsea, power, liquefied natural gas (“LNG”) and downstream energy projects around the world. Our customers include national, major integrated and other oil and gas companies as well as producers of petrochemicals and electric power, and we operate in most major energy producing regions throughout the world. We execute our contracts through a variety of methods, principally fixed-price, but also including cost reimbursable, cost-plus, day-rate and unit-rate basis or some combination of those methods.

Organization

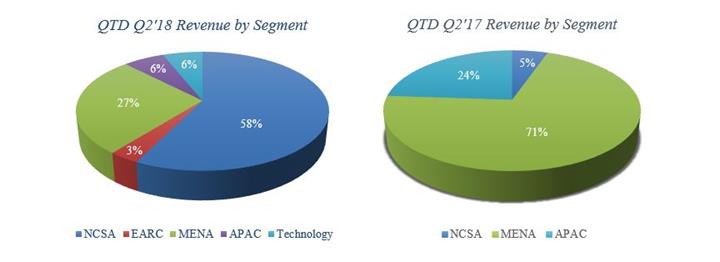

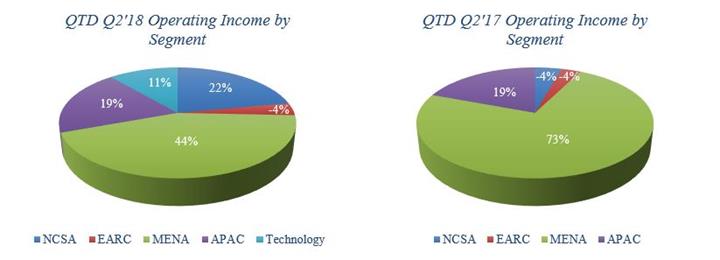

Our business is organized into five operating groups, which represent our reportable segments consisting of: North, Central and South America (“NCSA”); Europe, Africa, Russia and Caspian (“EARC”); the Middle East and North Africa (“MENA”); Asia Pacific (“APAC”); and Technology. See Note 21, Segment Reporting, for further discussion.

NOTE 2—BASIS OF PRESENTATION AND SIGNIFICANT ACCOUNTING POLICIES

Basis of Accounting and Consolidation

The accompanying Condensed Consolidated Financial Statements (the “Financial Statements”) are unaudited and have been prepared from our books and records in accordance with Rule 10-1 of Regulation S-X for interim financial information. Accordingly, they do not include all of the information and notes required by accounting principles generally accepted in the United States (“U.S. GAAP”) for complete financial statements and are not necessarily indicative of results of operations for a full year. Therefore, they should be read in conjunction with the Financial Statements and Notes thereto included in our Current Report on Form 8-K filed with the SEC on July 31, 2018 (the “July 31 Form 8-K”).

These Financial Statements reflect all wholly owned subsidiaries and those entities which we are required to consolidate. See the “Joint Venture and Consortium Arrangements” section of this footnote for further discussion of our consolidation policy for those entities that are not wholly owned. In the opinion of our management, all adjustments, consisting only of normal recurring adjustments, considered necessary for a fair presentation have been included. Intercompany balances and transactions are eliminated in consolidation. Values presented within tables (excluding per share data) are in millions and may not sum due to rounding.

Reclassifications

In the second quarter of 2018, we made certain classification changes, as well as reclassifications to our historical financial statements to align with our current presentation as follows:

|

|

• |

Bidding and Proposal Costs—In conjunction with the Combination, we realigned our commercial personnel within the operating groups for the combined company. As a result of the realignment, beginning in the second quarter of 2018, we included our bid and proposal expenses in Cost of operations in our Condensed Consolidated Statements of Operations (the “Statements of Operations”) to better represent how those costs are managed and controlled. For periods reported prior to the second quarter of 2018, bid and proposal expenses are included in Selling, general and administrative (“SG&A”) expenses. Our Cost of operations for the three months ended June 30, 2018 includes $17 million of bid and proposal expenses. Our SG&A expense for the six months ended June 30, 2018 includes bid and proposal expenses of $10 million incurred in the first quarter of 2018, and the three and six months ended June 30, 2017 includes bid and proposal expenses of $9 million and $16 million, respectively. |

|

|

7 |

|

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

|

|

• |

Reverse Common Stock Split—We amended our Amended and Restated Articles of Incorporation to effect a three-to-one reverse stock split of McDermott common stock, effective May 9, 2018. Common stock, capital in excess of par, share and per share (except par value per share, which was not affected) information for all periods presented has been recast in the Financial Statements and the accompanying Notes to reflect the reverse stock split. |

|

|

• |

Pension and Postretirement Benefit Costs—In conjunction with our adoption of Accounting Standards Update (“ASU”) 2017-07, we reclassified non-service costs relating to our pension and postretirement plans from SG&A to Other non-operating income (expense) for all historical periods presented. The reclassification did not result in a material impact. |

|

|

• |

Restructuring and Integration/Transaction Costs—Approximately $11 million of restructuring and integration costs and $3 million of transaction costs related to the Combination, which were previously recorded within Other operating (income) expenses, net during the three months ended March 31, 2018, were reclassified to (i) Restructuring and integration costs and (ii) Transaction costs, respectively, in our Statements of Operations for the six months ended June 30, 2018. |

Use of Estimates and Judgments

The preparation of financial statements in conformity with U.S. GAAP requires us to make estimates and judgments that affect the reported amounts of assets, liabilities, revenue and expenses and related disclosures of contingent assets and liabilities. We believe the most significant estimates and judgments are associated with: (i) revenue recognition for our contracts, including estimating costs to complete each contract and the recognition of incentive fees and unapproved change orders and claims; (ii) determination of fair value with respect to acquired assets and liabilities; (iii) fair value and recoverability assessments that must be periodically performed with respect to long-lived tangible assets, goodwill and other intangible assets; (iv) valuation of deferred tax assets and financial instruments; (v) the determination of liabilities related to self-insurance programs and income taxes; and (vi) consolidation determinations with respect to our joint venture and consortium arrangements. If the underlying estimates and assumptions upon which the Financial Statements are based change in the future, actual amounts may differ from those included in the Financial Statements.

Significant Accounting Policies

Revenue Recognition—Our revenue is primarily derived from long-term contracts with customers, and we determine the appropriate accounting treatment for each contract at inception in accordance with ASU 2014-09 (Accounting Standards Codification (“ASC”) Topic 606), Revenue from Contracts with Customers. Our contracts primarily relate to: EPCI services; engineering services; construction services; pipe and steel fabrication services; engineered and manufactured products; technology licensing; and catalyst supply. An EPCI contract may also include technology licensing, and our services may be provided between or among our reportable segments.

|

|

8 |

|

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

|

|

predictability regarding the timing of revenue recognition. A contract may include technology licensing services, which may be provided between our reportable segments. |

|

|

• |

Performance Obligations—A performance obligation is a promise in a contract to transfer a distinct good or service to a customer and is the unit of account in ASC Topic 606. The transaction price of a contract is allocated to each distinct performance obligation and recognized as revenue when, or as, the performance obligation is satisfied. Our contract costs and related revenues are generally recognized over time as work progresses due to continuous transfer to the customer. To the extent a contract is deemed to have multiple performance obligations, we allocate the transaction price of the contract to each performance obligation using our best estimate of the standalone selling price of each distinct good or service in the contract. In addition, certain contracts may be combined and deemed to be a single performance obligation. Our EPCI contracts are generally deemed to be single performance obligations and our contracts with multiple performance obligations were not material as of June 30, 2018. |

|

|

• |

Performance Obligations Satisfied Over Time—Revenues for our contracts that satisfy the criteria for over time recognition are recognized as the work progresses. Revenues for contracts recognized over time include revenues for contracts to provide: EPCI services; engineering services; construction services; pipe and steel fabrication services; engineered and manufactured products; technology licensing; and “non-generic” catalyst supply. We measure transfer of control utilizing an input method to measure progress of the performance obligation based upon the cost-to-cost measure of progress, with Cost of operations including direct costs, such as materials and labor, and indirect costs that are attributable to contract activity. Under the cost-to-cost approach, the use of estimated costs to complete each performance obligation is a significant variable in the process of determining recognized revenues and is a significant factor in the accounting for such performance obligations. Significant estimates impacting the cost to complete each performance obligation are: costs of engineering, materials, components, equipment, labor and subcontracts; vessel costs; labor productivity; schedule durations, including subcontractor or supplier progress; contract disputes, including claims; achievement of contractual performance requirements; and contingency, among others. The cumulative impact of revisions in total cost estimates during the progress of work is reflected in the period in which these changes become known, including, to the extent required, the reversal of profit recognized in prior periods and the recognition of losses expected to be incurred on contracts in progress. Additionally, external factors such as weather, customer requirements and other factors outside of our control, may affect the progress and estimated cost of a project’s completion and, therefore, the timing and amount of recognition of revenues and income. Due to the various estimates inherent in our contract accounting, actual results could differ from those estimates, which could result in material changes to our financial statements and related disclosures. See Note 4, Revenue Recognition, for further discussion. |

|

|

• |

Performance Obligation Satisfied at a Point-in-Time Method—Contracts with performance obligations that do not meet the criteria to be recognized over time are required to be recognized at a point-in-time, whereby revenues and gross profit are recognized only when a performance obligation is complete and a customer has obtained control of a promised asset. Revenues for contracts recognized at a point in time include our “generic” catalyst supply and certain manufactured products (which are recognized upon shipment) and certain non-engineering and non-construction oriented services (which are recognized when the services are performed). In determining when a performance obligation is complete for contracts with revenues recognized at a point-in-time, we measure transfer of control considering physical possession of the asset, legal transfer of title, significant risks and awards rewards of ownership, customer acceptance and our rights to payment. See Note 4, Revenue Recognition, for further discussion. |

|

|

• |

Remaining Performance Obligations (“RPOs”)―RPOs represent the amount of revenues we expect to recognize in the future from our contract commitments on projects. RPOs include the entire expected revenue values for joint ventures we consolidate and our proportionate value for consortiums we proportionately consolidate. We do not include expected revenues of contracts related to unconsolidated joint ventures in our RPOs, except to the extent of any subcontract awards we receive from those joint ventures. Currency risks associated with RPOs that are not mitigated within the contracts are generally mitigated with the use of foreign currency derivative (hedging) instruments, when deemed significant. However, these actions may not eliminate all currency risk exposure included within our long-term contracts. RPOs may not be indicative of future operating results, and projects included in RPOs may be cancelled, modified or otherwise altered by customers. See Note 4, Revenue Recognition, for further discussion. |

|

|

9 |

|

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

|

|

modification of the existing contract and performance obligation. We estimate variable consideration for a performance obligation at the most likely amount to which we expect to be entitled (or the most likely amount we expect to incur in the case of liquidated damages), utilizing estimation methods that best predict the amount of consideration to which we will be entitled (or will be incurred in the case of liquidated damages). We include variable consideration in the estimated transaction price to the extent it is probable that a significant reversal of cumulative revenues recognized will not occur or when the uncertainty associated with the variable consideration is resolved. Our estimates of variable consideration and determinations of whether to include estimated amounts in transaction prices are based largely on assessments of our anticipated performance and all information (historical, current and forecasted) reasonably available to us. The effect of variable consideration on the transaction price of a performance obligation is recognized as an adjustment to revenues on a cumulative catch-up basis. To the extent unapproved change orders and claims reflected in transaction price (or excluded from transaction price in the case of liquidated damages) are not resolved in our favor, or to the extent incentives reflected in transaction price are not earned, there could be reductions in, or reversals of, previously recognized revenue. See Note 4, Revenue Recognition, for further discussion. |

|

|

• |

Loss Recognition―A risk associated with our contracts is that revenues from customers may not cover increases in our costs. It is possible that current estimates could materially change for various reasons. For all contracts, if a current estimate of total contract cost indicates a loss, the projected loss is recognized in full immediately and reflected in Cost of operations in the Statements of Operations. It is possible that these estimates could change due to unforeseen events, which could result in adjustments to overall contract revenues and costs. Variations from estimated contract performance could result in material adjustments to operating results for any fiscal quarter or year. In our Condensed Consolidated Balance Sheets (“Balance Sheets”), the provisions for estimated losses on all active uncompleted projects are included in Advance billings on contracts. See Note 4, Revenue Recognition, for further discussion. |

|

|

• |

Accounts Receivable and Contract Balances―The timing of when we bill our customers is generally dependent upon advance billing terms, milestone billings based on the completion of certain phases of the work, or when the services are provided or products are shipped. |

|

|

• |

Accounts Receivable―Any uncollected billed amounts for our performance obligations recognized over time, including contract retainages to be collected within one year, are recorded within Accounts receivable-trade, net. Any uncollected billed amounts and unbilled receivables for our performance obligations recognized at a point in time are also recorded within Accounts receivable-trade, net. Contract retainages to be collected beyond one year are recorded within Accounts receivable-long-term retainages. We establish allowances for doubtful accounts based on our assessments of collectability. See Note 7, Accounts Receivable, for further discussion. |

|

|

• |

Contracts in Progress—Projects with performance obligations recognized over time that have revenues recognized to date in excess of cumulative billings are reported within Contracts in progress on our Balance Sheets. We expect to invoice customers for all unbilled revenues, and our payment terms are generally for less than 12 months upon billing. Our contracts typically do not include a significant financing component. See Note 8, Contracts in Progress and Advances Billings on Contracts, for further discussion. |

|

|

• |

Advance Billings on Contracts—Projects with performance obligations recognized over time that have cumulative billings in excess of revenues are reported within Advance billings on contracts on our Balance Sheets. Our Advance billings on contracts balance also includes our provisions for estimated losses on all active projects. See Note 8, Contracts in Progress and Advances Billings on Contracts for further discussion. |

Bidding and Proposal Costs―Bidding and proposal costs are generally charged to Cost of operations as incurred, but in certain cases their recognition may be deferred if specific probability criteria are met. We had no significant deferred bidding and proposal costs at June 30, 2018.

Goodwill—Goodwill represents the excess of the purchase price over the fair value of net assets acquired in connection with the Combination. Goodwill is not amortized, but instead is reviewed for impairment at least annually at a reporting unit level, absent any indicators of impairment. We will perform our annual impairment assessment during the fourth quarter of each year based on balances as of October 1. We identify a potential impairment by comparing the fair value of the applicable reporting unit to its net book value, including goodwill. If the net book value exceeds the fair value of the reporting unit, we measure the impairment by comparing the carrying value of the reporting unit to its fair value.

To determine the fair value of our reporting units and test for impairment, we utilize an income approach (discounted cash flow method) as we believe this is the most direct approach to incorporate the specific economic attributes and risk profiles of our reporting units into our valuation model. We generally do not utilize a market approach, given the lack of relevant information generated by market transactions involving comparable businesses. However, to the extent market indicators of fair value become available, we

|

|

10 |

|

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

consider such market indicators in our discounted cash flow analysis and determination of fair value. See Note 3, Business Combination, for further discussion.

Intangible and Other Long-Lived Assets—Our finite-lived intangible assets resulted from the Combination and are amortized over their estimated remaining useful economic lives. Our project-related intangible assets are amortized as the applicable projects progress, customer relationships are amortized utilizing an accelerated method based on the pattern of cash flows expected to be realized, taking into consideration expected revenues and customer attrition, and our other intangibles are amortized utilizing a straight-line method. We review tangible assets and finite-lived intangible assets for impairment whenever events or changes in circumstances indicate the carrying value of the asset may not be recoverable. If a recoverability assessment is required, the estimated future cash flow associated with the asset or asset group will be compared to their respective carrying amounts to determine if an impairment exists. See Note 3, Business Combination, and Note 9, Intangible Assets, for further discussion.

Income Taxes—Deferred tax assets and liabilities are recognized for the future tax consequences attributable to differences between the financial statement carrying amounts of existing assets and liabilities and their respective tax bases using currently enacted income tax rates for the years in which the differences are expected to reverse. We provide for income taxes based on the tax laws and rates in the countries in which we conduct our operations. McDermott International, Inc. is a Panamanian corporation that earns all of its income outside of Panama. As a result, we are not subject to income tax in Panama. We operate in numerous taxing jurisdictions around the world. Each of these jurisdictions has a regime of taxation that varies, not only with respect to statutory rates, but also with respect to the basis on which these rates are applied. These variations, along with changes in our mix of income or loss from these jurisdictions, may contribute to shifts, sometimes significant, in our effective tax rate.

A valuation allowance (“VA”) is provided to offset any net deferred tax assets (“DTAs”) if, based on the available evidence, it is more likely than not that some or all of the DTAs will not be realized. The realization of our net DTAs depends upon our ability to generate sufficient future taxable income of the appropriate character and in the appropriate jurisdictions.

On a periodic and ongoing basis, we evaluate our DTAs (including our net operating loss (“NOL”) DTAs) and assess the appropriateness of our VAs. In assessing the need for a VA, we consider both positive and negative evidence related to the likelihood of realization of the DTAs. If, based on the weight of available evidence, our assessment indicates it is more likely than not a DTA will not be realized, we record a VA. Our assessments include, among other things, the amount of taxable temporary differences which will result in future taxable income, the value and quality of our RPOs, evaluations of existing and anticipated market conditions, analysis of recent and historical operating results (including cumulative losses over multiple periods) and projections of future results, strategic plans and alternatives for associated operations, as well as asset expiration dates, where applicable. At June 30, 2018 and December 31, 2017, we had VAs against certain U.S. and non-U.S. DTAs, as we do not believe it is more likely than not that we will utilize those DTAs. See the July 31 Form 8-K for further discussion of our VA assessments.

If the factors upon which we based our assessment of realizability of our DTAs differ materially from our expectations, including future operating results being lower than our current estimates, our future assessments could be impacted and result in an increase in VAs and increase in tax expense.

Income tax and associated interest and penalty reserves, where applicable, are recorded in those instances where we consider it more likely than not that additional tax will be due in excess of amounts reflected in income tax returns filed worldwide, irrespective of whether we have received tax assessments. We continually review our exposure to additional income tax obligations and, as further information becomes known or events occur, changes in our tax, interest and penalty reserves may be recorded within income tax expense. See Note 17, Income Taxes, for further discussion.

Foreign Currency—The nature of our business activities involves the management of various financial and market risks, including those related to changes in foreign currency exchange rates. The effects of translating financial statements of foreign operations into our reporting currency are recognized as a cumulative translation adjustment in accumulated other comprehensive income (loss) (“AOCI”), which is net of tax, where applicable.

Derivative Financial Instruments—We utilize derivative financial instruments in certain circumstances to mitigate the effects of changes in foreign currency exchange rates and interest rates, as described below.

|

|

11 |

|

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

|

|

generally seek hedge accounting treatment for contracts used to hedge operating exposures and designate them as cash flow hedges. Therefore, gains and losses, exclusive of credit risk and forward points (which represent the time value component of the fair value of our derivative positions), are included in AOCI until the associated underlying operating exposure impacts our earnings. Changes in the fair value of (i) credit risk and forward points, (ii) instruments deemed ineffective during the period, and (iii) instruments that we do not designate as cash flow hedges are recognized within Other non-operating income (expense). |

|

|

• |

Interest Rate Derivatives—Our interest rate derivatives are limited to a swap arrangement entered into on May 8, 2018, to hedge against interest rate variability associated with $1.94 billion of our $2.26 billion “Term Facility” described in Note 12, Debt. The swap arrangement has been designated as a cash flow hedge as its critical terms matched those of the Term Facility at inception and through June 30, 2018. Accordingly, changes in the fair value of the swap arrangement are included in AOCI until the associated underlying exposure impacts our interest expense. |

See Note 15, Fair Value Measurements, and Note 16, Derivative Financial Instruments, for further discussion.

Joint Venture and Consortium Arrangements—In the ordinary course of business, we execute specific projects and conduct certain operations through joint venture, consortium and other collaborative arrangements (referred to as “joint ventures” and “consortiums”). We have various ownership interests in these joint ventures and consortiums, with such ownership typically proportionate to our decision making and distribution rights. The joint ventures and consortiums generally contract directly with their third-party customers; however, services may be performed directly by the joint ventures and consortium, us, our co-venturers, or a combination thereof.

Joint ventures and consortium net assets consist primarily of working capital and property and equipment, and assets may be restricted from use for obligations outside of the joint venture or consortiums. These joint ventures and consortiums typically have limited third-party debt or have debt that is non-recourse in nature. They may provide for capital calls to fund operations or require participants in the joint venture or consortiums to provide additional financial support, including advance payment or retention letters of credit.

Each joint venture or consortium is assessed at inception and on an ongoing basis as to whether it qualifies as a Variable Interest Entity (“VIE”) under the consolidations guidance in ASC Topic 810, Consolidations. A venture generally qualifies as a VIE when it (i) meets the definition of a legal entity, (ii) absorbs the operational risk of the projects being executed, creating a variable interest, and (iii) lacks sufficient capital investment from the co-venturers, potentially resulting in the joint venture or consortium requiring additional subordinated financial support to finance its future activities.

If at any time a joint venture or consortium qualifies as a VIE, we perform a qualitative assessment to determine whether we are the primary beneficiary of the VIE and therefore need to consolidate the VIE. We are the primary beneficiary if we have (i) the power to direct the economically significant activities of the VIE and (ii) the right to receive benefits from and obligation to absorb losses of the VIE. If the joint venture or consortium is a VIE and we are the primary beneficiary, or we otherwise have the ability to control the joint venture or consortium, it is consolidated. If we determine we are not the primary beneficiary of the VIE or only have the ability to significantly influence, rather than control the joint venture or consortium, it is not consolidated.

We account for unconsolidated joint ventures and consortiums using either (i) proportionate consolidation for both the Balance Sheet and Statement of Operations when we meet the applicable accounting criteria to do so, or (ii) utilize the equity method. For incorporated unconsolidated joint ventures and consortiums under the equity method, we record our share of the profit or loss of the investments, net of income taxes, in the Statements of Operations. We evaluate our equity method investments for impairment when events or changes in circumstances indicate the carrying value of such investments may have experienced an other-than-temporary decline in value. When evidence of loss in value has occurred, we compare the estimated fair value of our investment to the carrying value of our investment to determine whether an impairment has occurred. If the estimated fair value is less than the carrying value and we consider the decline in value to be other-than-temporary, the excess of the carrying value over the estimated fair value is recognized in the Financial Statements as an impairment. See Note 10, Joint Venture and Consortium Arrangements, for further discussion.

Transaction Costs—Transaction costs primarily related to professional service fees (including audit, legal and advisory services) associated with the Combination. See Note 3, Business Combination, for further discussion.

Restructuring and Integration Costs—Restructuring and integration costs primarily relate to costs to achieve our combination profitability initiative (“CPI”). See Note 11, Restructuring and Integration Costs, for further discussion.

|

|

12 |

|

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

See Note 2, Basis of Presentation and Significant Accounting Policies, included in the July 31 Form 8-K, for additional information relating to our accounting policies.

Recently Adopted Accounting Guidance

Revenue from Contracts with Customers (ASC Topic 606)—In May 2014, the Financial Accounting Standards Board (the “FASB”) issued a new standard related to revenue recognition which supersedes most of the existing revenue recognition requirements in U.S. GAAP and requires entities to recognize revenue at an amount that reflects the consideration to which an entity expects to be entitled in exchange for transferring goods or services to a customer. It also requires significantly expanded disclosures regarding the qualitative and quantitative information of an entity’s nature, amount, timing and uncertainty of revenue and cash flows arising from contracts with customers.

The FASB has issued several amendments to the standard, including clarification on accounting for licenses of intellectual property, identifying performance obligations, reporting gross versus net revenue and narrow-scope revisions and practical expedients.

We adopted the new standard on January 1, 2018 (the “initial application” date):

|

|

• |

using the modified retrospective application, with no restatement of the comparative periods presented and a cumulative effect adjustment to retained earnings as of the date of adoption; |

|

|

• |

applying the new standard only to those contracts that are not substantially complete at the date of initial application; and |

|

|

• |

disclosing the impact of the new standard in our 2018 Financial Statements. |

Significant changes to our accounting policies as a result of adopting of the new standard are discussed below:

|

|

• |

We measure transfer of control utilizing an input method to measure progress for individual contracts or combinations of contracts based on the total costs incurred as applicable to each contract. Previously, under ASC Topic 605-35, Construction-Type and Production-Type Contracts, we generally excluded certain costs from the cost-to-cost method of measuring progress toward completion, such as significant costs for procured materials and third-party subcontractors. |

|

|

• |

Our Balance Sheets no longer reflect assets related to cost incurred in excess of cost recognized due to the inclusion of all costs incurred in our results and associated measurement of progress toward completion under our current policy. |

|

|

• |

Variable consideration, including change orders, claims, bonus, incentive fees and liquidated damages or penalties are now included in the estimated contract revenue at the most likely amount to which we expect to be entitled. We include variable consideration in the estimated transaction price to the extent we conclude that it is probable a significant revenue reversal will not occur or when the uncertainty associated with the variable consideration is resolved. |

For accounting policies and disclosures related to our adoption of ASC 606, see our significant accounting policies within this note, Note 4, Revenue Recognition, and Note 8, Contracts in Progress and Advance Billing on Contracts.

Pension and Postretirement Benefits—In March 2017, the FASB issued ASU 2017-07, Compensation—Retirement Benefits (Topic 715): Improving the Presentation of Net Periodic Pension Cost and Net Periodic Postretirement Benefit. This ASU requires bifurcation of certain components of net pension and postretirement benefit cost in the Statements of Operations. We adopted this ASU effective as of January 1, 2018. As a result, benefit costs, excluding any service cost component, previously included in SG&A, are now included in other non-operating income (expense), net in our Statements of Operations. All comparable periods presented have been retrospectively revised to reflect this change.

Income Taxes—In October 2016, the FASB issued ASU 2016-16, Income Taxes (Topic 740): Intra-Entity Transfers of Assets Other Than Inventory. This ASU requires entities to recognize the income tax consequences of an intra-entity transfer of an asset other than inventory when the transfer occurs. This ASU is effective for interim and annual periods beginning after December 15, 2017. The adoption of ASU 2016-16 during the first quarter 2018 did not have a material impact on the Financial Statements. During the three months ended June 30, 2018, we had an income tax benefit of $117 million resulting from an intra-entity transfer of assets. See Note 17, Income Taxes, for further discussion.

|

|

13 |

|

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

In December 2017, the SEC issued Staff Accounting Bulletin (“SAB”) 118 to address the application of U.S. GAAP in situations in which a registrant does not have the necessary information available, prepared or analyzed (including computations) in reasonable detail to complete the accounting for certain income tax effects of the U.S. Tax Cuts and Jobs Act (the “Tax Reform Act”), signed into law on December 22, 2017. In March 2018, the FASB issued ASU 2018-05, which amended ASC 740 to incorporate the requirements of SAB 118. We recognized the provisional tax impacts of the Tax Reform Act in the fourth quarter of 2017. During the six months ended June 30, 2018, we did not receive any additional information regarding these provisional calculations. As a result, we continue to anticipate finalizing our analysis in connection with the completion of our tax return for 2017 to be filed in 2018.

Goodwill—In January 2017, the FASB issued ASU 2017-04, Intangibles-Goodwill and Other (Topic 350): Simplifying the Test for Goodwill Impairment. This ASU eliminates the second step of the goodwill impairment test that required a hypothetical purchase price allocation. The ASU requires that, if a reporting unit’s carrying value exceeds its fair value, an impairment charge would be recognized for the excess amount, not to exceed the carrying amount of goodwill. We early adopted this ASU during the second quarter 2018. Our adoption of the standard did not have a material impact on the Financial Statements.

Accounting Guidance Issued But Not Adopted as of June 30, 2018

Financial Instruments—In June 2016, the FASB issued ASU 2016-13, Financial Instruments—Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments. This ASU will require a financial asset measured at amortized cost basis to be presented at the net amount expected to be collected. A valuation account, allowance for credit losses, will be deducted from the amortized cost basis of the financial asset to present the net carrying value at the amount expected to be collected on the financial asset. This ASU is effective for interim and annual periods beginning after December 15, 2019. We are currently assessing the impact of this guidance on our future consolidated financial statements and related disclosures.

Leases—In February 2016, the FASB issued ASU 2016-02, Leases (Topic 842). The ASU will require entities that lease assets—referred to as “lessees”—to recognize on the balance sheet the assets and liabilities for the rights and obligations created by leases with lease terms of more than 12 months. Consistent with current U.S. GAAP, the recognition, measurement and presentation of expenses and cash flows arising from a lease by a lessee primarily will depend on its classification as a finance or operating lease. However, unlike current U.S. GAAP—which requires only capital leases to be recognized on the balance sheet—the new ASU will require both types of leases to be recognized on the balance sheet. This ASU is effective for interim and annual periods beginning after December 15, 2018. Early adoption is permitted. We are currently assessing the impact of this ASU on our future Consolidated Financial Statements and related disclosures.

Income Taxes—In January 2018, the FASB issued ASU 2018-02, Reporting Comprehensive Income (Topic 220). This ASU gives entities the option to reclassify to retained earnings the tax effects resulting from the Tax Reform Act related to items in AOCI that the FASB refers to as having been stranded in AOCI. The standard may be applied retrospectively to each period in the year of adoption. This ASU will also require new disclosures regarding our accounting policy for releasing the tax effects in AOCI. This ASU is effective for us in the first quarter of 2019, although early adoption is permitted. We are assessing the timing of adoption of the new standard and its potential impact on our future Consolidated Financial Statements.

General―On December 18, 2017, we entered into an agreement (as amended, the “Business Combination Agreement”) to combine our business with CB&I, an established downstream provider of industry-leading petrochemical, refining, power, gasification and gas processing technologies and solutions. On May 10, 2018 (the “Combination Date”) we completed the Combination.

Transaction Overview―On the Combination Date, we acquired the equity of certain U.S. and non-U.S. CB&I subsidiaries that owned CB&I’s technology business, as well as certain intellectual property rights, for $2.87 billion in cash consideration that was funded using debt financing, as discussed further in Note 12, Debt, and existing cash. Also on the Combination Date, CB&I shareholders received 0.82407 shares of McDermott common stock for each share of CB&I common stock tendered in the exchange offer. Each remaining share of CB&I common stock held by CB&I shareholders not acquired by McDermott in the exchange offer was effectively converted into the right to receive the same 0.82407 shares of McDermott common stock that was paid in the exchange offer, together with cash in lieu of any fractional shares of McDermott common stock, less any applicable withholding taxes. Stock-settled equity based awards relating to shares of CB&I’s common stock were either canceled and converted into the right to receive cash or were converted into comparable McDermott awards on generally the same terms and conditions as prior to the Combination Date. We

|

|

14 |

|

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

issued 84.5 million shares of McDermott common stock to the former CB&I shareholders and converted CB&I stock-settled equity awards into McDermott stock-settled equity-based awards to be settled in approximately 2.2 million shares of McDermott common stock.

Transaction Accounting―The Combination is accounted for using the acquisition method of accounting in accordance with ASC Topic 805, Business Combinations. McDermott is considered the acquirer for accounting purposes based on the following facts at the Combination Date: (i) McDermott’s stockholders owned approximately 53 percent of the combined business on a fully diluted basis; (ii) a group of McDermott’s directors, including the Chairman of the Board, constituted a majority of the Board of Directors; and (iii) McDermott’s President and Chief Executive Officer and Executive Vice President and Chief Financial Officer continue in those roles. The series of transactions resulting in McDermott’s acquisition of CB&I’s entire business is being accounted for as a single accounting transaction, as such transactions were entered into at the same time in contemplation of one another and were collectively designed to achieve an overall commercial effect.

Purchase Consideration―We completed the Combination for a gross purchase price of approximately $4.6 billion ($4.1 billion net of cash acquired), detailed as follows (in millions, except per share amounts):

|

CB&I shares for Combination consideration |

|

103 |

|

Conversion Ratio: 1 CB&I share = 0.82407 McDermott shares |

|

85 |

|

McDermott stock price on May 10, 2018 |

|

$19.92 |

|

Equity Combination consideration transferred |

|

$1,684 |

|

Fair value of converted awards earned prior to the Combination |

|

9 |

|

Total equity Combination consideration transferred |

|

1,693 |

|

Cash consideration transferred |

|

2,872 |

|

Total Combination consideration transferred |

|

4,565 |

|

Less: Cash acquired |

|

(498) |

|

Total Combination consideration transferred, net of cash acquired |

|

$4,067 |

Preliminary Purchase Price Allocation—The aggregate purchase price noted above was allocated to the major categories of assets and liabilities acquired based upon their estimated fair values at the Combination Date, which were based, in part, upon outside preliminary appraisal and valuation of certain assets, including specifically identified intangible assets and property and equipment. The excess of the purchase price over the preliminary estimated fair value of the net tangible and identifiable intangible assets acquired totaling $3.9 billion, was recorded as goodwill.

|

|

15 |

|

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

The following summarizes our preliminary purchase price allocation at the Combination Date (in millions):

|

|

|

May 10, 2018 |

|

|

|

Net tangible assets: |

|

|

|

|

|

Cash |

|

$ |

498 |

|

|

Accounts receivable |

|

|

905 |

|

|

Inventory |

|

|

62 |

|

|

Contracts in progress |

|

|

341 |

|

|

Assets held for sale (1) |

|

|

66 |

|

|

Other current assets |

|

|

153 |

|

|

Deferred tax assets |

|

|

45 |

|

|

Investments in unconsolidated affiliates |

|

|

403 |

|

|

Property, plant and equipment |

|

|

409 |

|

|

Deferred tax liabilities |

|

|

(17 |

) |

|

Other non-current assets |

|

|

145 |

|

|

Accounts payable |

|

|

(498 |

) |

|

Advance billings on contracts (2) |

|

|

(1,400 |

) |

|

Other current liabilities |

|

|

(1,189 |

) |

|

Other non-current liabilities |

|

|

(445 |

) |

|

Total net tangible assets |

|

|

(522 |

) |

|

Project related intangible assets/liabilities, net (3) |

|

|

112 |

|

|

Other intangible assets (4) |

|

|

1,049 |

|

|

Net identifiable assets |

|

|

639 |

|

|

Goodwill (5) |

|

|

3,926 |

|

|

Total Combination consideration transferred |

|

|

4,565 |

|

|

Less: Cash acquired |

|

|

(498 |

) |

|

Total Combination consideration transferred, net of cash acquired |

|

$ |

4,067 |

|

|

(1) |

Assets held for sale includes CB&I’s former administrative headquarters within Corporate and various fabrication facilities within NCSA. |

|

(2) |

Advance billings on contracts includes provisions for estimated losses on projects of $112 million. |

|

(3) |

Project related intangible assets/liabilities, net includes intangible asset and liabilities of $145 million and $33 million, respectively. The balances represent the fair value of acquired RPOs and normalized profit margin fair value associated with acquired long-term contracts that were deemed to be lower than fair value (excluding amounts recorded in Advance billings on contracts and Contracts in progress) as of the Combination Date. The project related intangible assets and liabilities will be amortized as the applicable projects progress over a range of 2 to 4 years within Project intangibles amortization in our Statements of Operations. |

|

(4) |