Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - Safehold Inc. | safereportsq218results.htm |

| 8-K - 8-K - Safehold Inc. | safe-06302018xpr8xk.htm |

Q2 ‘18 Earnings Results July 26, 2018 (NYSE: SAFE)

Forward-Looking Statements and Other Matters This release may contain forward-looking statements. All statements other than statements of historical fact are forward-looking statements. These forward-looking statements can be identified by the use of words such as “illustrative”, “representative”, “expect”, “plan”, “will”, “estimate”, “project”, “intend”, “believe”, and other similar expressions that do not relate to historical matters. These forward-looking statements reflect the Company’s current views about future events, and are subject to numerous known and unknown risks, uncertainties, assumptions and changes in circumstances that may cause Company’s actual results to differ significantly from those expressed in any forward-looking statement. The Company does not guarantee that the transactions and events described will happen as described (or that they will happen at all). The following factors, among others, could cause actual results and future events to differ materially from those set forth or contemplated in the forward-looking statements: market demand for ground lease capital; the Company’s ability to source new ground lease investments; risks that the rent adjustment clauses in the Company's leases will not adequately keep up with changes in market value and inflation; risks associated with certain tenant and industry concentrations in our initial portfolio; conflicts of interest and other risks associated with the Company's external management structure and its relationships with iStar and other significant investors; risks associated with using debt to fund the Company’s business activities (including changes in interest rates and/or credit spreads, and refinancing and interest rate risks); general risks affecting the real estate industry and local real estate markets (including, without limitation, the potential inability to enter into or renew ground leases at favorable rates, including with respect to contractual rate increases or participating rent); dependence on the creditworthiness of our tenants and their financial condition and operating performance; competition from other developers, owners and operators of real estate (including life insurance companies, pension funds, high net worth investors, sovereign wealth funds, mortgage REITs, private equity funds and separate accounts); unknown liabilities acquired in connection with real estate; and risks associated with our failure to qualify for taxation as a REIT under the Internal Revenue Code of 1986, as amended. Please refer to the section entitled “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2017 and any subsequent reports filed with the Securities and Exchange Commission (SEC) for further discussion of these and other investment considerations. The Company expressly disclaims any responsibility to update or revise forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law. Investor Relations Contact Jason Fooks (212) 930-9400 investors@safetyincomegrowth.com Safety, Income & Growth Inc. The Ground Lease Company 1

I. Earnings Safety, Income & Growth Inc. The Ground Lease Company 2

Section 1 – Earnings Q2 ‘18 Results $ in Thousands Per Share Net Income $1,703 $0.09 Earnings FFO(1) $3,978 $0.22 AFFO(1) $3,022 $0.17 $44M in ground lease investments added from four new leases Investment $631M Cost Basis of portfolio at June 30, 2018 Activity $1.5M termination fee received in Q2 after third-party exercised right of first refusal to purchase 635 Madison ground lease Active Seven deals aggregating $141M currently under LOI Pipeline SAFE continues to expand into new markets with new customers while continuing to see repeat client business Note: Refer to the Glossary for definitions of capitalized terms used in this presentation. (1) Please refer to the Non-GAAP financial metrics in the “FFO/AFFO” slide for reconciliations of these measures to GAAP net income. Safety, Income & Growth Inc. The Ground Lease Company 3

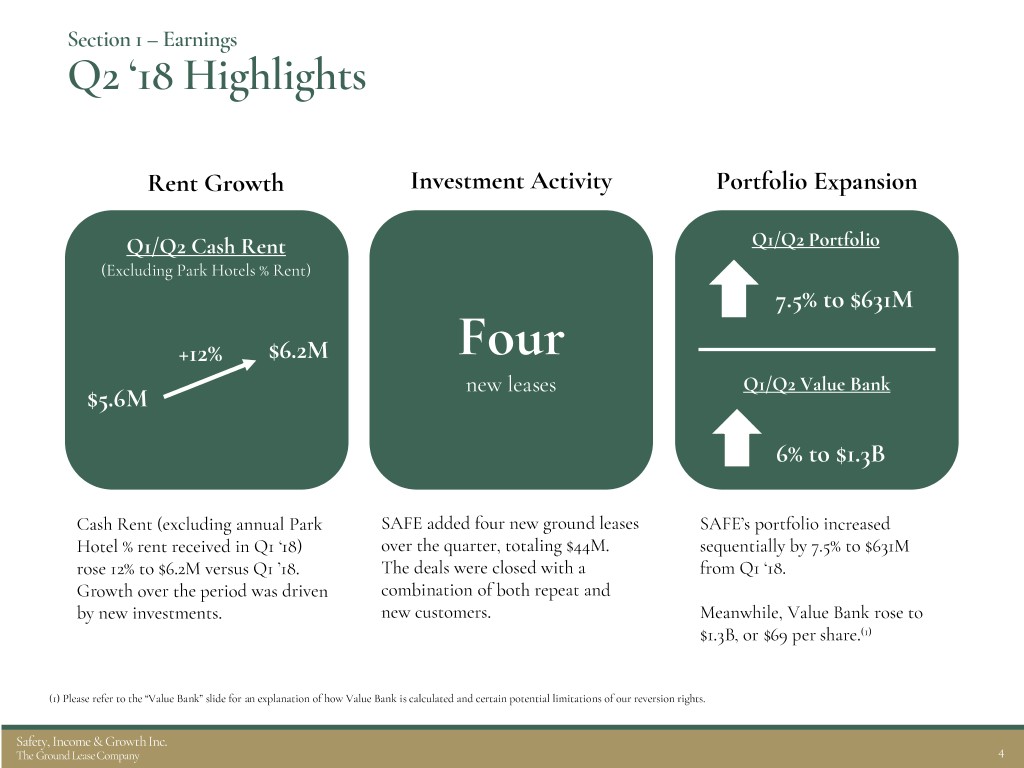

Section 1 – Earnings Q2 ‘18 Highlights Rent Growth Investment Activity Portfolio Expansion Q1/Q2 Cash Rent Q1/Q2 Portfolio (Excluding Park Hotels % Rent) 7.5% to $631M +12% $6.2M Four new leases Q1/Q2 Value Bank $5.6M 6% to $1.3B Cash Rent (excluding annual Park SAFE added four new ground leases SAFE’s portfolio increased Hotel % rent received in Q1 ‘18) over the quarter, totaling $44M. sequentially by 7.5% to $631M rose 12% to $6.2M versus Q1 ’18. The deals were closed with a from Q1 ‘18. Growth over the period was driven combination of both repeat and by new investments. new customers. Meanwhile, Value Bank rose to $1.3B, or $69 per share.(1) (1) Please refer to the “Value Bank” slide for an explanation of how Value Bank is calculated and certain potential limitations of our reversion rights. Safety, Income & Growth Inc. The Ground Lease Company 4

Section 1 – Earnings First Year Highlights Since its IPO in June of 2017, SAFE has: Closed $291M of additional transactions, increasing the size of its portfolio by 86% to $631M Annualized Cash Rent rose from $17.4M to $29.4M, driven by a combination of new ground lease originations and the rent escalations built into the ground lease contracts Value Bank grew 188% to $1.3B(1) Note: Please refer to the “Glossary” slide for an explanation of Annualized Cash Rent calculation. (1) Please refer to the “Value Bank” slide for an explanation on how we calculate Value Bank and certain potential limitations of our reversion rights. Safety, Income & Growth Inc. The Ground Lease Company 5

Section 1 – Earnings Income Statement For the Three Months Ended For the Six Months Ended June 30, 2018 June 30, 2018 Revenues: Ground lease and other lease income $9,861 $21,141 Other income 1,713 2,126 Total revenues $11,574 $23,267 Costs and expenses: Interest expense $3,376 $6,631 Real estate expense 398 752 Depreciation and amortization 2,275 4,546 General and administrative(1) 2,527 4,559 Stock-based compensation(1) 765 765 Other expense 471 510 Total costs and expenses $9,812 $17,763 Net income $1,762 $5,504 Net (income) attributable to non-controlling interests (59) (82) Net income attributable to Safety, Income & Growth Inc. and allocable to common shareholders $1,703 $5,422 Weighted avg. share count 18,191 18,191 Earnings per share $0.09 $0.30 Note: $ in thousands except for per share amounts. (1) Management fee and iStar reimbursables were waived by our manager through June 30, 2018. Please refer to the “General & Administrative” slide for additional details on these expenses. Safety, Income & Growth Inc. The Ground Lease Company 6

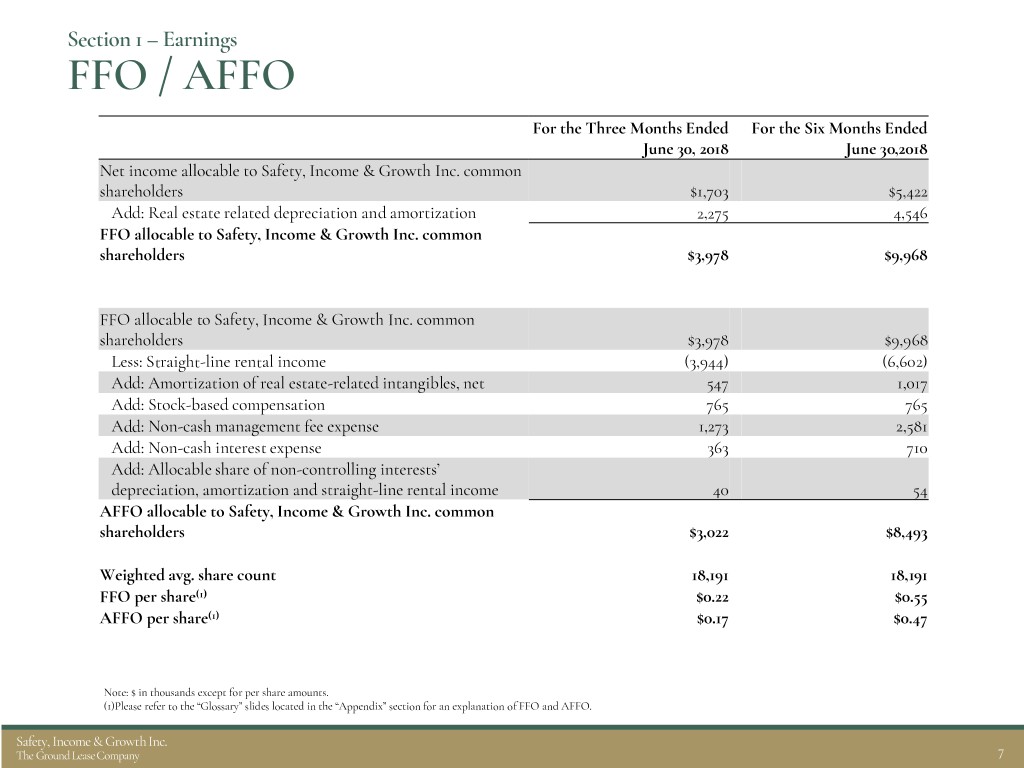

Section 1 – Earnings FFO / AFFO For the Three Months Ended For the Six Months Ended June 30, 2018 June 30,2018 Net income allocable to Safety, Income & Growth Inc. common shareholders $1,703 $5,422 Add: Real estate related depreciation and amortization 2,275 4,546 FFO allocable to Safety, Income & Growth Inc. common shareholders $3,978 $9,968 FFO allocable to Safety, Income & Growth Inc. common shareholders $3,978 $9,968 Less: Straight-line rental income (3,944) (6,602) Add: Amortization of real estate-related intangibles, net 547 1,017 Add: Stock-based compensation 765 765 Add: Non-cash management fee expense 1,273 2,581 Add: Non-cash interest expense 363 710 Add: Allocable share of non-controlling interests’ depreciation, amortization and straight-line rental income 40 54 AFFO allocable to Safety, Income & Growth Inc. common shareholders $3,022 $8,493 Weighted avg. share count 18,191 18,191 FFO per share(1) $0.22 $0.55 AFFO per share(1) $0.17 $0.47 Note: $ in thousands except for per share amounts. (1)Please refer to the “Glossary” slides located in the “Appendix” section for an explanation of FFO and AFFO. Safety, Income & Growth Inc. The Ground Lease Company 7

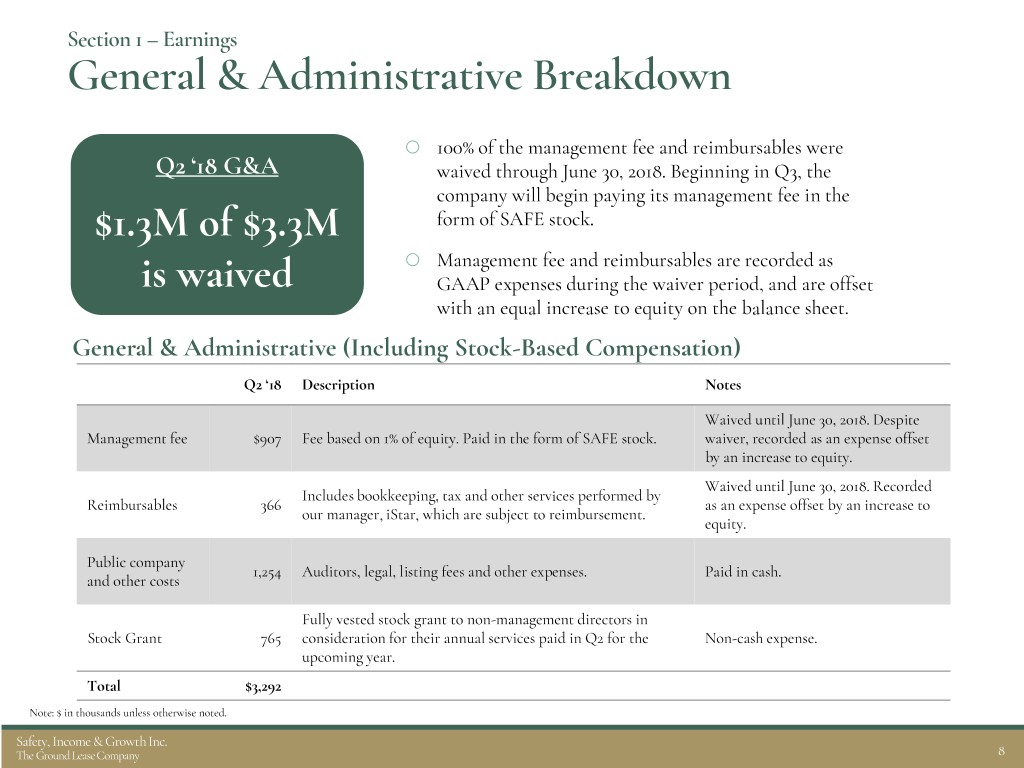

Section 1 – Earnings General & Administrative Breakdown 100% of the management fee and reimbursables were Q2 ‘18 G&A waived through June 30, 2018. Beginning in Q3, the company will begin paying its management fee in the $1.3M of $3.3M form of SAFE stock. Management fee and reimbursables are recorded as is waived GAAP expenses during the waiver period, and are offset with an equal increase to equity on the balance sheet. General & Administrative (Including Stock-Based Compensation) Q2 ‘18 Description Notes Waived until June 30, 2018. Despite Management fee $907 Fee based on 1% of equity. Paid in the form of SAFE stock. waiver, recorded as an expense offset by an increase to equity. Waived until June 30, 2018. Recorded Includes bookkeeping, tax and other services performed by Reimbursables 366 as an expense offset by an increase to our manager, iStar, which are subject to reimbursement. equity. Public company 1,254 Auditors, legal, listing fees and other expenses. Paid in cash. and other costs Fully vested stock grant to non-management directors in Stock Grant 765 consideration for their annual services paid in Q2 for the Non-cash expense. upcoming year. Total $3,292 Note: $ in thousands unless otherwise noted. Safety, Income & Growth Inc. The Ground Lease Company 8

Section 1 – Earnings Dividend Coverage $0.15 dividend was declared in the second quarter representing an annualized rate of $0.60 per share. $0.80 $0.70 $0.60 $0.50 $0.40 $0.68 $0.30 $0.64 $0.60 $0.20 $0.18 $0.10 $0.00 TTM EPS TTM FFO TTM AFFO Annualized Dividend Note: $ amounts are given per share. Please refer to the “EPS, FFO & AFFO Reconciliation” slide in the Appendix for additional details. Safety, Income & Growth Inc. The Ground Lease Company 9

II. Portfolio Safety, Income & Growth Inc. The Ground Lease Company 10

Section 2 – Portfolio Q2 ‘18 Investment Metrics Q1 ‘18 Q2 ‘18 +7.5% $588M $631M Cost Basis +$44M Cost Basis 18 From 4 new ground leases 22 Ground Leases Ground Leases Q2 ‘18 Deals W.A. Cap Rate W.A. Rent Escalators W.A. Ground Rent Coverage W.A. Cost Basis as a % of CPV 2.0% annualized fixed increases over the lease term and all deals 4.25% include CPI-based 4.1x 35.2% adjustments Safety, Income & Growth Inc. The Ground Lease Company 11

Section 2 – Portfolio New Investments Glenridge Point Promenade Crossing Miami Airport 1 & 2 Atlanta, GA Orlando, FL Miami, FL A SAFE Ground Lease™ on two Two SAFE Ground Leases™ on five-story office buildings in the A SAFE Ground Lease™ on a Central Perimeter submarket of adjoining industrial properties in Class A multifamily in the high- Miami. The buildings are fully Atlanta. This marks the third end Baldwin Park submarket of successful ground lease with this occupied by LSG Sky Chefs and Orlando. The property is a 212- adjacent to the Miami Airport client. The buildings are well- unit community with amenities located at the intersection of GA- Intermodal. SAFE purchased the and close access to shopping 400 and I-285, near three MARTA ground leases and its client centers, office parks, and the transit stations and multiple purchased the leaseholds on the Orlando Executive Airport. corporate headquarters. iStar properties from iStar. provided the leasehold financing to the client. Safety, Income & Growth Inc. The Ground Lease Company 12

Section 2 – Portfolio Geographic Diversification by MSA Seattle 14.5% Detroit Minneapolis 0.3% 11.5% Salt Lake City 1.2% San Francisco Milwaukee 3.4% 8.9% Washington, D.C. 7.8% 3.3% 3.2% 22.5% San Diego Durango Raleigh-Durham 5.1% 11.8% 2.2% Los Angeles Atlanta Dallas 2.1% Orlando 2.2% Miami Safety, Income & Growth Inc. The Ground Lease Company 13

Section 2 - Portfolio Portfolio Stratification 20-60 yrs 0.1% Multifamily Office 32% 28% <20 yrs 39% Fixed w/ CPI- Lease Term Property Type Based Adjustments Percentage Rent Remaining(1) >60 yrs 34% 36% 61% Industrial Hotel 3% 37% Rent Escalator 30-40% Type 22% 40-55% 5.0x+ 23% 53% Fixed 7% Ground Rent CPI Cost Basis as % Coverage 23% 3.0-4.0x of CPV 39% <30% 36% 4.0-5.0x 55-60% 8% 19% (1) Weighted based on in-place base rent; assumes leases are fully extended based on in-place rent. Safety, Income & Growth Inc. The Ground Lease Company 14

Section 2 - Portfolio Portfolio Metrics Portfolio Rent Statistics Annualized base rent $26.1M TTM Park Hotels percentage rent $3.3M Total Annualized Cash Rent $29.4M Total GAAP rent (including TTM % rent) $46.4M Total Annualized Cash Rent as % of Cost Basis 4.7% W.A. annualized contractual fixed rent escalations 1.8%(1) Portfolio Ground Lease Statistics Cost Basis as % of CPV 33.4% Ground Rent Coverage 4.7x W.A. lease term remaining 59 years W.A. lease term remaining including extensions 74 years Total Cost Basis of Portfolio $631M (1) Represents the weighted-average annualized escalation of leases that have contractual fixed bumps. Does not include leases with solely inflation-based or percentage rent escalations, which represent 23% and 36%, respectively, of the total portfolio cost basis. Safety, Income & Growth Inc. The Ground Lease Company 15

Section 2 – Portfolio (as of July 17) Pipeline Office 14% Multifamily 50% Property Hotel $620M Near-Term Pipeline (19 Deals) 21% Type In Discussion $480M Entertainment 15% 12 Deals Chicago San 15% Diego 7% Indianapolis Under LOI 6% New York Stamford 18% $141M 6% 7 Deals Location (MSA) Washington D.C. Various 19% 18% Los Angeles 11% The pipeline includes a strong mix of new customers and repeat client business SAFE is targeting new MSA markets to expand and diversify its ground lease business Note: There can be no assurance that SAFE will acquire or originate any of the investments currently being pursued on favorable terms or at all. Percentages are based on estimated ground lease value. Safety, Income & Growth Inc. The Ground Lease Company 16

Section 2 – Portfolio Value Bank of $1.3B or $69 per Share Value Bank is calculated as today’s estimated Combined Property Value (CPV) less the Cost Basis of SAFE’s portfolio SAFE uses Value Bank to track the capital appreciation potential $1,259M at lease expiration from our rights to acquire the buildings on Value Bank our land.(1) (CPV – Cost Basis) $1.9B 67% Total Combined Property Value CPV $1,890M CBRE conducts independent $631M Cost Basis appraisals of the $631M CPV of each asset(2) $1,259M Value Bank Cost Basis 33% (1) Our ability to recognize value through reversion rights may be limited by the rights of our tenants under some of our ground leases, including tenant rights to purchase the properties or level properties under certain circumstances. Please refer to our Current Report on Form 8-K filed with the SEC on July 26, 2018 and “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2017, as updated from time to time in our subsequent periodic reports, filed with the SEC, for a further discussion of such tenants rights. (2) SAFE relies in part on CBRE’s appraisals in calculating Value Bank. SAFE may utilize management’s estimate of CPV for ground lease investments recently acquired that CBRE has not yet appraised. Please refer to our 8-K filed July 26, 2018 with the SEC for additional detail on CBRE’s valuation and our calculation of Value Bank. Safety, Income & Growth Inc. The Ground Lease Company 17

III. Capital Structure Safety, Income & Growth Inc. The Ground Lease Company 18

Section 3 – Capital Structure Debt Overview As of June 30, 2018 Debt Maturity Profile Debt Profile (Effective Rate) 2022 W.A. Extended Maturity is 7.6 years $300(1) Jun.(1) $10 L+135 $227(3) 2023 Undrawn Jan.(2) $71 3.04% Revolver $290 2027 $71(2) Drawn Apr.(3) $227 3.77% Revolver $10 Total $308 2018 2019 2020 2021 2022 2023 2024 2025 2026 2027 Target Leverage Current Leverage Book Debt $308 (i) <2.0x Debt to Equity Book Equity $367 (ii) 25% Debt as a % of CPV Leverage (Debt to Equity) 0.8x Combined Property Value (CPV) $1,890 Debt as a % of CPV 16.3% Note: $ in millions. For additional information on our debt please refer to the 10-Q. (1) Initial maturity is June 2020 with two 1-year extensions. (2) Callable without pre-payment penalty beginning January 2021. (3) April 2027 represents Anticipated Repayment Date. Final maturity is April 2028. Safety, Income & Growth Inc. The Ground Lease Company 19

Section 3 – Capital Structure Interest Rate Protection As of June 30, 2018 The Company seeks to mitigate the impact of interest rate fluctuations by entering into hedges associated with each ground lease prior to taking on long-term debt $440M In addition to $227M of long-term fixed-rate debt, the Company has entered into $213M of aggregate $213M notional value of long-term rate lock hedges for $631M Long-Term Cost Basis Rate Lock Hedges prospective long-term financings on unlevered of Portfolio ground leases Hedges sufficient to allow Company to leverage up to debt/equity target of 2x with interest rate protection $227M Weighted average of more than 10 years of interest Long-Term rate protection on existing portfolio Fixed-Rate Debt Safety, Income & Growth Inc. The Ground Lease Company 20

Section 3 – Capital Structure Balance Sheets As of As of June 30, 2018 March 31, 2018 Assets Real estate Real estate, gross $484,458 $456,476 Accumulated depreciation (7,255) (5,754) Real estate, net 477,203 450,722 Real estate-related intangibles, net(1) 140,016 125,802 Ground lease assets, net 617,219 576,524 Cash and cash equivalents 35,805 83,177 Other assets 30,025 18,719 Total assets $683,049 $678,420 Liabilities and Equity Liabilities: Debt obligations, net $307,276 $307,178 Accounts payable and other liabilities 7,401 7,585 Total liabilities $314,677 $314,763 Equity: Common stock $182 $182 Additional paid-in capital 369,612 366,227 Retained earnings (deficit) (9,328) (8,295) AOCI 6,101 3,770 Total shareholders’ equity $366,567 $361,884 Non-controlling interests 1,805 1,773 Total equity $368,372 $363,657 Total liabilities and equity $683,049 $678,420 Note: $ in thousands. (1) “Real estate-related intangibles, net” represents real estate-related intangible assets of $198M and $184M as of June 30, 2018 and March 31, 2018, respectively, less real estate-related intangible liabilities of $58M as of June 30, 2018 and March 31, 2018, respectively. Safety, Income & Growth Inc. The Ground Lease Company 21

Appendix Safety, Income & Growth Inc. The Ground Lease Company 22

Appendix Cost Basis Reconciliation As of June 30, 2018 Real estate, net $ 477,203 Add: Accumulated depreciation 7,255 Real estate, gross $ 484,458 Add: In-place lease intangibles, net 38,512 Add: Above market intangibles, net 158,406 Add: Lease inducement intangibles, net 747 Add: Leasing commissions, net 221 Less: Below market intangibles, net (57,649) Add: Accumulated amortization 5,891 Cost Basis $ 630,586 Note: $ in thousands. Safety, Income & Growth Inc. The Ground Lease Company 23

Appendix EPS, FFO, & AFFO Reconciliation Trailing Twelve Months Ended June 30, 2018 Net income allocable to Safety, Income & Growth Inc. common shareholders $3,360 Add: Real estate related depreciation and amortization 9,078 FFO allocable to Safety, Income & Growth Inc. common shareholders $12,438 FFO allocable to Safety, Income & Growth Inc. common shareholders $12,438 Less: Straight-line rental income (9,655) Add: Amortization of real estate-related intangibles, net 1,847 Add: Stock-based compensation 765 Add: Non-cash management fee expense 5,034 Add: Non-cash interest expense 1,174 Add: Allocable share of non-controlling interests’ depreciation, amortization and straight-line rental income 55 AFFO allocable to Safety, Income & Growth Inc. common shareholders $11,658 Weighted avg. share count 18,190 Earnings per share $0.18 FFO per share(1) $0.68 AFFO per share(1) $0.64 Note: $ in thousands except for per share amounts. (1) Please refer to the “Glossary” slides located in the “Appendix” section for an explanation of FFO and AFFO. Safety, Income & Growth Inc. The Ground Lease Company 24

Appendix Asset Summary by Property Type Location Lease Expiration / Rent Escalation Property (MSA) Property Type As Extended Structure 6201 Hollywood (North) Los Angeles, CA Multi-Family 2104 / 2104 % of CPI 6200 Hollywood (South) Los Angeles, CA Multi-Family 2104 / 2104 % of CPI Onyx on First Washington, D.C. Multi-Family 2117 /2117 Fixed w/ CPI-Based Adjustments The Buckler Apartments Milwaukee, WI Multi-Family 2112 / 2112 Fixed Promenade Crossing Orlando, FL Multi-Family 2117 / 2117 Fixed w/ CPI-Based Adjustments One Ally Center Detroit, MI Office 2114 / 2174 Fixed w/ CPI-Based Adjustments LifeHope Medical Campus Atlanta, GA Office 2116 / 2176 Fixed Northside Forsyth Hospital Medical Center Atlanta, GA Office 2115 / 2175 Fixed w/ CPI-Based Adjustments NASA/JPSS Headquarters Washington, D.C. Office 2075 / 2105 Fixed Pershing Point Atlanta, GA Office 2117 /2124 Fixed w/ CPI-Based Adjustments Regency Lakeview Raleigh-Durham, NC Office 2117 /2122 Fixed w/ CPI-Based Adjustments Glenridge Point Atlanta, GA Office 2117 /2117 Fixed w/ CPI-Based Adjustments Doubletree Seattle Airport(1)† Seattle, WA Hospitality 2025 /2035 % Rent Hilton Salt Lake† Salt Lake City, UT Hospitality 2025 / 2035 % Rent Doubletree Mission Valley† San Diego, CA Hospitality 2025 / 2035 % Rent Doubletree Durango† Durango, CO Hospitality 2025 /2035 % Rent Doubletree Sonoma† San Francisco, CA Hospitality 2025 / 2035 % Rent Dallas Market Center: Sheraton Suites Dallas, TX Hospitality 2114 / 2114 Fixed Dallas Market Center: Marriott Courtyard Dallas, TX Hospitality 2026 / 2066 % Rent Lock Up Self Storage Facility Minneapolis, MN Industrial 2037 / 2037 Fixed Miami Airport 1 (3500 N.W. 24th Street) Miami, FL Industrial 2117 / 2117 Fixed w/ CPI-Based Adjustments Miami Airport 2 (3630 N.W. 25th Street) Miami, FL Industrial 2117 / 2117 Fixed w/ CPI-Based Adjustments Weighted Avg. 59 / 74 yrs Note: Refer to the “Glossary” for definitions. †Park Hotels Portfolio Asset which is on a single master lease. (1) A majority of the land underlying this property is owned by a third party and is ground leased to us through 2044 with rents that are subject to changes in the CPI; however, our tenant pays this cost directly to the third party. Safety, Income & Growth Inc. The Ground Lease Company 25

Appendix Glossary Calculated by adding (or subtracting) to FFO the following items: straight-line rental income, the amortization of real Adjusted Funds from Operations (AFFO) estate-related intangibles, stock-based compensation, acquisition costs, non-cash management fees, and expense reimbursements, the amortization of deferred financing costs and other expenses related to debt obligations. Calculated as the annualized in-place Cash Rent at quarter-end plus the trailing 12-month percentage rent received from Annualized Cash Rent Park Hotels. Cash Rent Represents ground lease income excluding straight-line rent and amortization of lease intangibles. Cost Basis Cost of real estate and real estate related intangibles. Calculated as Cost Basis divided by CPV. The Company believes the metric is an indicative measure of the safety of its Cost Basis as % of CPV position in a real estate property’s capital structure and represents its last-dollar economic exposure to the underlying property values. The current combined value of the land, buildings and improvements relating to a commercial property, as if there was no ground lease on the land at the property. CPV is based on independent appraisals by CBRE. The Company will use Combined Property Value (CPV) management estimates for recently acquired and originated ground leases for which appraisals from CBRE are not yet available. Management utilizes (i) estimated underlying property net operating income (NOI) in situations where actual underlying property NOI is unavailable and (ii) projected stabilized property NOI when a project is under development. These figures Estimated Underlying Property NOI are based on leasing activity at the property and may include other available market information, such as comparable properties or third party valuations. FFO is calculated in accordance with the National Association of Real Estate Investment Trusts (NAREIT) which defines Funds from Operations (FFO) FFO as net income (determined in accordance with GAAP), excluding gains or losses from sales of depreciable operating property, plus real estate-related depreciation and amortization. Safety, Income & Growth Inc. The Ground Lease Company 26

Appendix Glossary – (cont’d) The ratio of Underlying Property NOI or Estimated Underlying Property NOI to the annualized base rental payment due to SAFE. The Company believes the metric is indicative of its seniority in a property’s cash flow waterfall. Underlying Ground Rent Coverage Property NOI is based on information reported to the Company by its tenants without any independent investigation or verification by SAFE. Leverage The ratio of book debt to book equity. With respect to a property, the net operating income of the commercial real estate being operated at the property without giving effect to any rent paid or payable under the ground lease. Net operating income is calculated as property-level revenues less property-level operating expenses as reported to the Company by the tenant, or as otherwise publicly Underlying Property NOI available. The Company relies on net operating income as reported to it by its tenants without any independent investigation by SAFE, or as otherwise publicly available. Note that figures denoted by Underlying Property NOI include One Ally using the source: Prospectus, dated December 14, 2017, of the Wells Fargo Commercial Mortgage Trust 2017-C42. Calculated as the difference between CPV and Cost Basis. The Company believes Value Bank represents additional Value Bank potential value to SAFE stockholders through the reversion rights embedded in standard ground leases. Safety, Income & Growth Inc. The Ground Lease Company 27