Attached files

| file | filename |

|---|---|

| EX-32.1 - Arias Intel Corp. | ex32-1.htm |

| EX-31.2 - Arias Intel Corp. | ex31-2.htm |

| EX-31.1 - Arias Intel Corp. | ex31-1.htm |

| EX-21.1 - Arias Intel Corp. | ex21-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

[X] ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended March 31, 2018

[ ] TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ________________ to ________________

Commission file number: 000-55120

Arias Intel Corp.

(Exact name of registrant as specified in its charter)

| Nevada | 46-2143018 | |

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | |

442 W. Kennedy Blvd., Suite 200 |

||

| Tampa, Florida | 33606 | |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code (877) 749-5909

First Harvest Corp.

(Former name or former address, if changed since last report)

Securities registered under Section 12(b) of the Act:

| None | N/A | |

| Title of each class | Name of each exchange on which registered |

Securities registered under Section 12(g) of the Act:

None

Shares of common stock, par value $0.001 per share

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes [ ] No [X]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act.

Yes [ ] No [X]

Indicate by check mark whether the registrant has (1) filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes [X] No [ ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | [ ] | (Do not check if a smaller reporting company) | Accelerated filer | [ ] |

| Non-accelerated filer | [ ] | Smaller reporting company | [X] |

Emerging growth company [ ]

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

Yes [ ] No [X]

The aggregate market value of the voting and non-voting shares of common stock held by non-affiliates as of September 29, 2017 based on the closing sales price of the common stock as reported by the OTC Markets was $94,363,285.

As of July 12, 2018, 50,707,248 shares of the registrant’s common stock were issued and outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Not Applicable

| -2- |

Forward Looking Statements.

This Annual Report on Form 10-K contains certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”) and Section 21E of the Security Exchange Act of 1934 (the “Exchange Act”). Any statements in Annual Report on Form 10-K about our expectations, beliefs, plans, objectives, assumptions or future events or performance are not historical facts and are forward-looking statements. These statements are often, but not always, made through the use of words or phrases such as “believe,” “will,” “expect,” “anticipate,” “estimate,” “intend,” “plan” and “would.” For example, statements concerning financial condition, possible or assumed future results of operations, growth opportunities, industry ranking, plans and objectives of management, markets for our common stock and future management and organizational structure are all forward-looking statements. These statements are based on current expectations, estimates and projections about our business based, in part, on assumptions made by management. These statements are not guarantees of future performance and involve risks, uncertainties and assumptions that are difficult to predict. Therefore, actual outcomes and results may, and are likely to, differ materially from what is expressed or forecasted in the forward-looking statements due to numerous factors, including those described below and additional risks discussed herein, including the risks described under “Risk Factors,” in this Annual Report and in other documents which we file with the Securities and Exchange Commission.

Any forward-looking statements are qualified in their entirety by reference to the risk factors discussed throughout this Annual Report on Form 10-K. Some of the risks, uncertainties and assumptions that could cause actual results to differ materially from estimates or projections contained in the forward-looking statements include, but are not limited to:

| ● | our ability to raise funds for general corporate purposes and operations; | |

| ● | the commercial feasibility and success of our technology and products; | |

| ● | our ability to recruit qualified management and technical personnel; and | |

| ● | government or quasi-government actions with respect to the cannabis industry; |

The foregoing list sets forth some, but not all, of the factors that could affect our ability to achieve results described in any forward-looking statements. You should read this Annual Report on Form 10-K and the documents that we reference herein and have filed as exhibits to the Annual Report on Form 10-K, completely and with the understanding that our actual future results may be materially different from what we expect. You should assume that the information appearing in this Annual Report on Form 10-K is accurate as of the date hereof. Because the risk factors referred to on page 13 of Annual Report on Form 10-K, could cause actual results or outcomes to differ materially from those expressed in any forward-looking statements made by us or on our behalf, you should not place undue reliance on any forward-looking statements. Further, any forward-looking statement speaks only as of the date on which it is made, and we undertake no obligation to update any forward-looking statement to reflect events or circumstances after the date on which the statement is made or to reflect the occurrence of unanticipated events. New factors emerge from time to time, and it is not possible for us to predict which factors will arise. In addition, we cannot assess the impact of each factor on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. We qualify all of the information presented in this Annual Report on Form 10-K, and particularly our forward-looking statements, by these cautionary statements.

Unless the context requires otherwise, the words “Arias,” “the Company,” “we,” “us,” refer to Arias Intel Corp. and, where appropriate, our subsidiaries. We have proprietary rights, including the right to use, trademarks used in this Annual Report on Form 10-K which are important to our business, including SportXction. Solely for convenience, the trademarks and trade names in this Annual Report on Form 10-K are referred to without the ® and TM symbols, but such references should not be construed as any indicator that their respective owners will not assert, to the fullest extent under applicable law, their rights thereto. All other trademarks, trade names and service marks appearing in this Annual Report on Form 10-K are the property of their respective owners.

Overview

Arias Intel Corp. (the “Company”) is a digital media platform for technology, media and gaming, which includes mobile gaming, on-demand delivery, digital media, and e-commerce, with a focus on the cannabis industry and emerging growth sectors. The Company is an early-stage company and has not generated any revenue as of March 31, 2018. The Company plans to generate revenue primarily through in-app purchases, service fees, and cross-channel advertising.

The Company is developing its platform as a way for niche cannabis-related companies, as well as mainstream advertisers to reach a pro-cannabis audience. We believe our platform solves the communication challenge between pro-legalization supporters of medical and therapeutic cannabis and advertisers that want to reach this growing demographic.

| -3- |

To reach the pro-cannabis and gaming target audience, our digital media platform (the “Platform”) currently consists of the following three elements:

| (1) | Hemp Inc – Hemp Inc (the “Game”) is a business strategy, role playing, mobile gaming app similar to FarmVille or Clash Royale and allows mobile gamers to develop, grow and dispense virtual cannabis and interact with celebrities and advertisers’ “brands” within the game. It is a strategy-based game that mimics the real-life cannabis culture, and we intend for it to serve as a platform for advertising and e-commerce sales. |

| The development team for the Game is led by Daniel Hammett, the former Executive Vice President of Activision (Nasdaq: ATVI). Mr. Hammett was responsible for Activision’s intellectual property development and product launches, including the development of iconic games such as Call of Duty, Big Game Hunter, Tony Hawk, Spiderman and Toy Story. Mr. Hammett has put together a team of developers with experience at gaming and technology companies such as Activision, Sega, MiniClip and DropBox. | |

Mr. Hammett serves on our board of directors, and he is also the president of HKA Digital Ltd. (“HKA”), the Game developer. The Game is currently available for download on the iTunes App Store. We intend to launch an updated version of the Game for iPhones, and we anticipate that such updated version of the Game may be available on the Google Play Store for Android phones by the end of 2018, subject to available funding. We intend that the Game will be a sales platform that uses a viral marketing strategy to take advantage of the social media reach of the celebrities in the Game and the popularity of the cannabis legalization movement. We believe this will allow the Game to build its user base with a low acquisition cost. HKA has been able to demonstrate that users can initiate in-app purchases which we believe will serve as a revenue stream for the Company. To date, we have not recognized any revenue from the Game. | |

The objective of the Game is to set up and grow a legal cannabis business in a virtual world, using various business strategies to create a prosperous and sustainable environment which allows for growth. Users are able to establish a grow operation and dispensary, hire staff, purchase strains of cannabis to grow, tools, ancillary products and real estate for the cultivation and sale of cannabis and related products and engage in various business strategies to expand their operations. The Game also promotes social awareness of the benefits of medical cannabis and legalization thereof. The Game also has celebrity avatars, which allows the celebrities to receive a revenue share for referring players to the Game which we believe will assist us in deriving revenue by driving additional traffic to the Game. Celebrities include recognized names such as Jimi Hendrix, Cypress Hill and Melisa Etheridge, as well as organizations such as the National Organization of the Reform of Marijuana Laws, Freedom Leaf and High Times Magazine. The Company hopes that these celebrities will promote the Game through their social media channels, including Twitter, Facebook, YouTube and Instagram. The Company anticipates that celebrity relationships will create tie-ins to sell merchandise, concert tickets and other celebrity endorsed products through an e-commerce channel through the Game. | |

The Game’s primary target audience is enthusiasts of action-adventure and business strategy oriented mobile games, with an affinity toward the legalization of medical and recreational/therapeutic cannabis which intends to be males between the ages of 17 and 35. According to a March 2016 report from digital commerce analyst, Slice Intelligence, in the U.S., people who spent money on mobile games in 2015 paid an average of $87 for in-app purchases in free-to-play mobile games. This information is based upon more than 4 million purchasers of digital products in the U.S. The report also states that 10% of mobile users account for 90% of revenue from in-app purchases. We believe this signifies a highly engaged audience that may provide the Company with revenue opportunities from the Game. |

| -4- |

| Both the mobile gaming market and the cannabis market are expected to experience double-digit compound annual growth rates over the next several years. According to Newzoo Global Games Market Report, in 2018 mobile games are expected to generate $70.3 billion in revenues and $100 billion by 2021. According to a September 2016 article published by Bloomberg, the legal cannabis industry is expected to be valued at $50 billion by 2026, growing to more than eight times its current size, as lawful cannabis purveyors gain new customers and users from the illicit cannabis market. | |

| (2) | Ufly – Ufly is an on-demand delivery service which is similar to an UberEATS-style delivery app model, providing on-demand legal medical cannabis to qualified patients and recreational users in states where cannabis is legal. We intend for the logistics-based app to connect an authorized user to a selection of local, legal cannabis dispensaries in designated cities using their smartphone to select and place orders and have such orders delivered to their door. Ufly is available for download on the iTunes App Store. We have not recognized any revenue from Ufly to date. |

| (3) | SportXction® – SportXction was originally developed as a real-time interactive software system which allowed a user to make play-by-play wagers on a sporting event while the event was in progress. SportXction is not currently available for download and requires additional development for mobile applications. We intend for the SportXction to allow wagering to be conducted online while viewing a live sporting event and accept wagers not only on the outcome of the sporting event, but also on discrete parts of the event and on specific in-game situations for sports including, but not limited to, soccer, football, baseball, basketball, golf, tennis, rugby and cricket. |

We anticipate wagers offered through SportXction to be primarily oriented to short-term action, for example, is the penalty kick successful, is the next play a run or a pass, is the next pitch a ball or a strike, does the shooter make two foul shots, points scored in a quarter and additional short-term actions. The wagers have odds associated with them, which relate to the probable outcome of the proposition being wagered upon, and the odds are adjusted in real-time to balance the betting using algorithms and artificial intelligence software to reflect user sentiment, as derived from their betting patterns. |

Our primary target audience is socially-active Millennials between the ages of 18 and 33 and Generation X’ers between the ages 34 of 50 who own a smartphone and use cannabis legally, either medically or recreationally. This demographic tends to be a regular consumer of games, apps, music, movies and online content and is comfortable with making purchases online and through mobile applications. According to the 2010 U.S. Census Bureau and the 2014 Pew Research Study, it is estimated that approximately 68%, or 56.4 million of the 83 million Millennials and 52%, or 32.7 million of the 63 million Generation X’ers favor cannabis legalization. Our digital media platforms are focused on bridging the gap between brand conscious advertisers and the approximately 89 million cannabis legalization supporters in this target audience.

We believe that by combining three of the fastest growing business sectors – cannabis, mobile gaming and the on-demand economy, together with our world-class development team led by the former Executive Vice President of Activision and our promotional activities, our Platform may become a premiere advertising medium in the cannabis industry.

According to the results of a February 2017 Quinnipiac Poll, 93% of Americans supported regulating the medicinal use of cannabis, 59% supported regulating the adult-use of cannabis and 71% of Americans were opposed to federal government interference with state marijuana programs.

From an app user or gamer perspective, we believe the Platform eliminates the stigma of cannabis as an illicit drug and provides an affinity driven ecosystem that attracts, engages and inspires members through mobile gaming, digital media and e-commerce, while advancing a cause such gamers already support.

| -5- |

From an advertiser perspective, we believe the Platform provides a brand-safe environment which is able to reach a large, self-identified, socially active, web-savvy, niche audience with targeted advertisements uniquely matched to their social engagement habits.

Popular social media platforms such as Facebook, LinkedIn, Twitter, Instagram, YouTube and Google+ do not provide advertisers the ability to tap into this segmented market due to restrictive protocols found within their terms of service. By leveraging the Platform, we believe advertisers may have the ability to gain crucial behavioral analytics across several media platforms in order to dramatically increase their marketing thereby increase their brand’s reach and operational outcomes.

We anticipate that the Platform will create cross-advertising opportunities. In addition to attracting new users and gamers, different elements of the Platform may provide unique user insights and highly actionable intelligence that can better align an advertiser’s products and solutions directly with a more inclined prospect. Whether to expand a user’s knowledge, enjoy an entertaining mobile game or the convenience of on-demand delivery and ecommerce, we believe that the Platform may empower users and advertisers alike to connect in the biggest social movement since the repeal of prohibition.

Revenue Model

Our apps that are available are a “freemium” download and have a three-pronged model to generate revenue:

| (1) | In-app micro-transactions, for example, gamers offered in-game characters, accessories and dead-drops for enhanced game play for a small payment, typically $0.99 to $9.99; | |

| (2) | Branding and ad-placement within the game; and | |

| (3) | Technologies fees and in-app e-commerce purchases. |

The Game is currently available for download on the iTune App Store, and although the Game has generated limited revenue to date while in development, we have not recognized any revenue and will not recognize any such revenue until HKA, the developer, completes and is funded for the buildout and upgrades to specifications agreed to by the parties. As of March 31, 2018, we have paid HKA a total of $1,394,400 in development fees. The total value of the development agreement is $2,000,000 based upon certain development parameters and ongoing scope of work. Although our cash flow has limited further development, subject to receiving funding, we intend to continue development of the Game during the 2019 fiscal year, subject to available funding, including publishing the Game on the Google Play platform for Android phones and full functionality of the Game which includes, among other things, additional Game levels and accessories for purchase in the Game.

The Ufly on-demand delivery app is available for download on iTunes and we have been able demonstrate that users can search and select products, select delivery locations and initiate in-app purchases. To date, we have not recognized any revenue from Ufly; however, we anticipate revenues by the -end of 2018, subject to available funding. We may consider licensing or selling the Ufly technology.

SportXction is not currently available for download and requires additional development for mobile applications, subject to available funding. In July 2016, we acquired intellectual property rights and gaming software technology from Interactive Systems Worldwide, Inc. (“ISWI”), including rights to its SportXction (the “IP Assets”). According to ISWI, the technology has been used in the U.S., as well as licensed in Europe, Asia and South America and has supported wagers on over 2,800 annual sporting events worldwide. We believe this technology has multiple mobile applications. We estimate the IP Assets may hold value for sale in-part or in-whole to a third party, as well as pursuing opportunities for development or licensing. To date, we have not recognized any revenue from SportXction. We may consider licensing or selling the SportXction technology.

We are exploring opportunities to expand a suite of mobile games and apps that may or may not be cannabis-related, but target similar audience demographics as the app in our Platform. We may explore these opportunities through the acquisition of operating companies, asset purchases, joint ventures or internal development.

| -6- |

Advertising

We estimate our advertising services may offer creative ways for marketers and advertisers to reach and engage with our audience. The goal of the engagement-based advertising is to enhance the user or gamer experience while delivering real value to advertisers, including:

| ● | Branded goods and celebrity sponsorships that integrate relevant advertising and messaging within the game-play and social media platforms; | |

| ● | Engagement ads, product placement and offers in which game players and app users engage with advertisers or sign up for third-party promotions; and | |

| ● | Display ads on the Platform with online content, including banner advertisements. |

Management anticipates reaching a large base of medical and recreational cannabis users in cannabis-legal markets through its integrated Platform. Much like Facebook’s model, management believes that it will be easier to on-board advertisers and charge higher fees once the Platform has reached a large enough user base and has the metrics to show user analytics of a targeted audience.

Research and Development

Management believes that continued investment in enhancing existing game-play and digital media with upgrades and developing new digital offerings, software development tools and code modification will be crucial to the Company’s success. We currently have access to a team of contract software developers that can manage our existing offerings and research future enhancements.

Intellectual Property

We have entered into a licensing agreement with HKA for the mobile gaming software of “Hemp Inc.” Our business is significantly based upon the creation, acquisition, use and protection of our intellectual property rights. Some of this intellectual property is in the form of software code, development tools and trade secrets that we use to develop our digital content and games and enable them to run properly on multiple platforms. Other intellectual property we utilize includes product and celebrity names and audio-visual elements, including graphics, music, story lines and interface design.

Some of our intellectual property has been developed by us while other intellectual property rights such as the IP Assets have been acquired by us. In addition, we license some of our intellectual property rights through agreements with third-parties. Our licenses typically limit our use of such intellectual property to specific uses for a specific duration.

We protect our intellectual property rights by relying upon federal, state and common law protections, as well as contractual restrictions. We seek intellectual property protection and trademark protection as appropriate to cover our inventions. We restrict access to proprietary technology by entering into confidentiality agreements with certain of our independent contractors, consultants and developers. In addition, we also rely on a combination of trade secret, copyright, trademark, trade dress and domain names to protect our intellectual property.

Competition

We face significant competition in all aspects of our business. Specifically, we compete for the leisure time, attention and discretionary spending of our users and gamers within our Platform with other social game and digital media developers on the basis of a number of factors, including, but not limited to, user appeal, quality of experience, brand awareness and reputation, access to distribution channels and pricing of our products.

The mobile game and app sector is characterized by frequent product introductions, rapidly emerging mobile platforms, new technologies and new mobile application storefronts.

Our competitors include mobiles games and apps including, but not limited to, mobile games such as Hempire, Wiz Khalida’s Weed Farm, CannaFarm and Ganja Farm, delivery and dispensary apps such as Eaze, WeedMaps and Leafly, as well as casino and gaming apps, such as Royal Panda, Jackpot City, Vegas Paradise, DraftKings and FanDuel. In addition, our users may play games or use apps on personal computers and consoles rather than mobile games and apps, some of which include social features that compete with our games and apps. We believe our Game and apps will have a competitive advantage based on the ease of use and analytical data that we intend to capture to create a better user experience based on user preferences.

Although we believe there currently is no significant player in the cannabis digital media market, the industry is evolving rapidly and is becoming increasingly competitive. Other developers of digital media and social games could develop more compelling content that competes with our social games and adversely affects our ability to attract and retain gamers. These competitors may have access to a larger affinity user base and may have significantly greater financial, marketing, technical personnel and other resources than we do.

| -7- |

Government Regulation

The Company is subject to a number of foreign and domestic laws and regulations that affect companies conducting business on the Internet, many of which are still evolving and could be interpreted in ways that could harm our business. In the United States and internationally, laws relating to the liability of providers of online services for activities of their users and other third parties are currently being tested by a number of claims, including actions based on invasion of privacy and other torts, unfair competition, copyright and trademark infringement, and other theories based on the nature and content of the materials searched, the ads posted, or the content provided by users. Any court ruling or other governmental action that imposes liability on providers of online services for the activities of their users and other third parties could harm our business. We are potentially subject to a number of foreign and domestic laws and regulations that affect the offering of certain types of content, such as that which depicts violence or mature content, many of which are ill defined, still evolving and could be interpreted in ways that could harm our business or expose us to liability.

In addition, rising concern about the use of social networking technologies for illegal conduct, such as the unauthorized dissemination of national security information, money laundering or supporting terrorist activities may in the future produce legislation or other governmental action that could require changes to our games or restrict or impose additional costs upon the conduct of our business.

We may also offer our users and gamers the opportunity to participate in various types of sweepstakes, giveaways and other promotional opportunities. We are subject to laws in a number of jurisdictions concerning the operation and offering of such activities, many of which are still evolving and could be interpreted in ways that could harm our business. Any court ruling or other governmental action that imposes liability on providers of online services could result in criminal or civil liability and could harm our business.

In the area of information security and data protection, many states have passed laws requiring notification to users when there is a security breach for personal data, such as the 2002 amendment to California’s Information Practices Act, or requiring the adoption of minimum information security standards that are often vaguely defined and difficult to implement. The costs of compliance with these laws may increase in the future as a result of changes in interpretation. Furthermore, any failure on our part to comply with these laws may subject us to significant liabilities.

We are also subject to federal, state and foreign laws regarding privacy and protection of player data, including the collection of data from minors. Our Privacy Policy and Terms of Service are posted in our app, and describe our practices concerning the use, transmission and disclosure of player data. Any failure by us to comply with our posted privacy policy or privacy related laws and regulations could result in proceedings against us by governmental authorities or others, which could harm our business. In addition, the interpretation of many data protection laws, and their application to the Internet is unclear and in a state of flux.

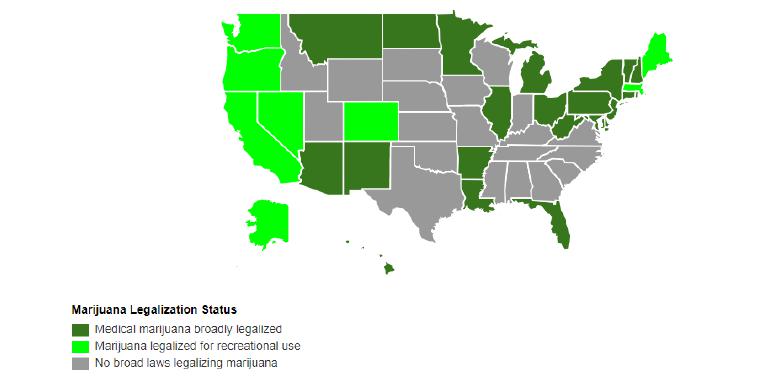

Marijuana is a categorized as a Schedule I controlled substance by the Drug Enforcement Agency and the United States Department of Justice and is illegal to grow, possess and consume under Federal law. However, 30 states have passed state laws that permit doctors to recommend cannabis for medical-use and eight of those states and the District of Columbia have enacted laws that regulate the adult-use of cannabis for any reason. Because doctors are prohibited from prescribing a Schedule I controlled substance, the passage of a state medical marijuana does not necessarily guarantee the implementation of a regulated, commercial system through which patients can purchase cannabis products. This has created an unpredictable business-environment for dispensaries and collectives that operate under certain state laws but in violation of Federal law.

| -8- |

Cole Memo

On August 29, 2013, United States Deputy Attorney General James Cole issued the Cole Memo to United States attorneys guiding them to prioritize enforcement of Federal law away from the cannabis industry operating as permitted under certain state laws, so long as:

| ● | cannabis is not being distributed to minors and dispensaries are not located around schools and public buildings; | |

| ● | the proceeds from sales are not going to gangs, cartels or criminal enterprises; | |

| ● | cannabis grown in states where it is legal is not being diverted to other states; | |

| ● | cannabis-related businesses are not being used as a cover for sales of other illegal drugs or illegal activity; | |

| ● | there is not any violence or use of firearms in the cultivation and sale of marijuana; | |

| ● | there is strict enforcement of drugged-driving laws and adequate prevention of adverse health consequences; and | |

| ● | cannabis is not grown, used, or possessed on Federal properties. |

The Cole Memo was a guide for United States attorneys and did not alter in any way the Department of Justice’s authority to enforce Federal law, including Federal laws relating to cannabis, regardless of state law. As described below, as a result of the issuance of the Sessions Memo by the Department of Justice on January 4, 2018, the Cole memo was rescinded. We cannot provide assurance that our actions were, are or will be in compliance with the Cole Memo, the Sessions Memo or any other laws or regulations that currently exist or may be amended or adopted in the future.

Rohrabacher-Farr Amendment

On December 16, 2014, H.R. 83 - Consolidated and Further Continuing Appropriations Act, 2015 was enacted and included a provision known as the “Rohrabacher-Farr Amendment” which states:

None of the funds made available in this Act to the Department of Justice may be used, with respect to the States of Alaska, Arizona, California, Colorado, Connecticut, Delaware, District of Columbia, Florida, Hawaii, Illinois, Iowa, Kentucky, Maine, Maryland, Massachusetts, Michigan, Minnesota, Mississippi, Missouri, Montana, Nevada, New Hampshire, New Jersey, New Mexico, Oregon, Rhode Island, South Carolina, Tennessee, Utah, Vermont, Washington, and Wisconsin, to prevent such States from implementing their own State laws that authorize the use, distribution, possession, or cultivation of medical marijuana.

The Rohrabacher-Farr Amendment would appear to protect the right of the states to determine their own laws on medical cannabis use; however, the actual effects of the amendment are still unclear. The Rohrabacher-Farr Amendment did not remove the federal ban on medical cannabis and cannabis remains regulated as a Schedule I controlled substance. Further, the United States Department of Justice has interpreted the Rohrabacher-Farr Amendment as only preventing federal action that prevents states from creating and implementing cannabis laws - not against the individuals or businesses that actually carry out cannabis laws – and has continued to sporadically initiate enforcement actions against individuals or businesses participating in the cannabis industry despite such participation being regulated under state law. Whether this interpretation is appropriate is still being litigated, and, while an initial district court decision has not supported the Department of Justice’s interpretation, such decision is currently under appellate review. In addition, no matter what the interpretation is adopted by the courts, there is no question that the Rohrabacher-Farr Amendment does not protect any party not in full compliance with state medicinal cannabis laws.

The Rohrabacher-Farr Amendment represents one of the first times in recent history that Congress has taken action indicating support of medical cannabis. The Rohrabacher-Farr Amendment was renewed by Congress in 2015, 2016, 2017 and 2018 and is in effect until September 30, 2018.

Sessions Memo

On January 4, 2018, Attorney General Jefferson B. Sessions, III issued a memo on federal marijuana enforcement policy announcing a return to the rule of law and the rescission of previous nationwide guidance by the Department of Justice (including, but not limited to, the Cole Memo). In the memorandum, Attorney General Jefferson Sessions directs all U.S. attorneys to enforce the laws enacted by Congress and to follow well established principles when pursuing prosecutions related to marijuana activities. These principles include weighing all relevant considerations, including federal law enforcement priorities set by the Attorney General, the seriousness of the crime, the deterrent effect of criminal prosecution, and the cumulative impact of particular crimes on the community. The effect of this memo is to shift federal policy from a hands-off approach adopted by the Obama administration to permitting federal prosecutors across the country to determine how to prioritize resources to regulate marijuana possession, distribution and cultivation in states where marijuana use is legal.

While we do not directly harvest or distribute cannabis today, we still may be deemed to be violating federal law, or aiding and abetting the violation of Federal law and may be irreparably harmed by a change in enforcement by the federal or state governments.

Additional Government Regulations

We are subject to general business regulations and laws as well as Federal and state regulations and laws specifically governing the Internet and e-commerce. These regulations and laws cover among others, sweepstakes, taxation, tariffs, user privacy, data protection, pricing, content, copyrights, distribution, electronic contracts and other communications, consumer protection, broadband residential Internet access and the characteristics and quality of services. Any noncompliance with the foregoing laws and regulations may harm our business and results of operations.

| -9- |

Market

The legal cannabis industry has evolved considerably over the past three to five years. According to an April 2015 Pew Research Center report, 49% of Americans say they have tried cannabis, and 12% have tried it within the past year. According to the results of a February 2017 Quinnipiac Poll, 93% of Americans supported regulating the medicinal use of cannabis, 59% supported regulating the adult-use of cannabis and 71% of Americans were opposed to federal government interference with state marijuana programs. Opinions have changed drastically since 1969, when Gallup reported that only 12% of the U.S. population favored legalizing cannabis use compared to 64% in 2017.

As people continue to support the legalization movement, legal cannabis markets in the United States continue to expand. There are now thirty states, together with Guam, Puerto Rico and Washington, D.C., with medical cannabis programs and eight of these states (Alaska, California, Colorado, Maine, Massachusetts, Nevada, Oregon and Washington) together with Washington, D.C. have also legalized cannabis for recreational use.

We believe the market will continue to rapidly expand as states broaden the definition of the approved uses for cannabis (i.e. from medicinal to recreational/therapeutic use) and additional states legalize cannabis for at least some purposes. Despite the fact that the Federal Controlled Substances Act makes the use and possession of cannabis illegal on a national level, recent guidance from the federal government suggests that it will continue to tolerate legalization at the state level, especially when backed by strong and effective regulation. We believe it is significant that the current Congressional Spending Bill specifically prevents the Justice Department from spending money to enforce the federal ban on growing or selling cannabis in states where cannabis has been approved.

According to an IBISWorld report, the cannabis industry is expected to achieve rapid growth over the next five years. We believe the industry will continue to benefit from increasingly favorable attitudes towards medical cannabis-based treatments and applications as acceptance and legitimacy of cannabis continues to grow.

Medical Cannabis Market

The last five years have seen a dramatic shift in public opinion on medical cannabis, which is reflected in the direction of individual states toward legalization. The February 2017 Quinnipiac Poll reported 93% of Americans favor the use of legalized cannabis for medical purposes. Thirty states together with Guam, Puerto Rico and Washington, D.C., have enacted medical cannabis laws. According to ProCon there are approximately 3.5 million registered patients within these states, and the five states with the largest known current registered medical cannabis patient populations are: California, Michigan, Florida, Colorado and Washington. An additional 17 states now recognize cannabis or cannabidiol derived products for medical reasons in limited situations or as a legal defense; however, these programs are not deemed comprehensive medical cannabis programs as adopted by the other 30 states.

| -10- |

Cannabis has been used for medicinal purposes for thousands of years and based upon several studies has been deemed to be an effective treatment for pain relief, inflammation and a number of other medical disorders. According to an IBISWorld report, new medical research and changing public opinion have boosted industry growth.

Doctors may prescribe medical cannabis in approved states where patients can receive a “recommendation” from a state-approved, licensed physician for the treatment of certain conditions specified by the state. Medical cannabis is being used to treat severe or chronic pain, inflammation, nausea and vomiting, neurologic symptoms (including muscle spasticity), glaucoma, cancer, multiple sclerosis, post-traumatic stress disorder, anorexia, arthritis, Alzheimer’s, Crohn’s disease, fibromyalgia, attention-deficit disorder, attention-deficit hyperactivity disorder, Tourette’s syndrome, spinal cord injury and numerous other conditions. Cannabis oil has also been deemed effective in treating epileptic seizures in children.

Recreational Cannabis Market

Eight states (Alaska, California, Colorado, Maine, Massachusetts, Nevada, Oregon, Washington) together with Washington, D.C. have legalized recreational cannabis. In November 2012, Colorado voters legalized recreational cannabis use. This history-changing legislation created a window of opportunity for the commercialization and state taxation of a plant group that has, until recently, been virtually untouchable and has set the wheels in motion for other states to follow. In July of 2014, Washington state launched its recreational program and in November 2014 Oregon, Alaska and the Washington, D.C. voted to introduce recreational programs commencing in 2015. In addition, in November 2016, California, Maine, Massachusetts, and Nevada all passed ballot initiatives for the legalization of recreational cannabis. An October 2017 Gallup Poll survey indicated that that 64% of Americans are in favor of legalizing cannabis.

The U.S. Cannabis Market

In a December 2015 cannabis industry research report published by Bank of America / Merrill Lynch, estimates of the total market size for cannabis sales in the U.S. ranged from $33 billion to $100 billion. In addition, according to the report total legal (medical and recreational) cannabis sales could reach $35 billion by 2020.

| -11- |

Another recent cannabis industry research report from Ackrell Capital forecasts the potential growth of the overall legal cannabis consumer market size to $100 billion by 2029 with over 50 million estimated users.

According to an industry research and investment forum, the ArcView Group (“ArcView”), legal U.S. cannabis sales increased from approximately $5.4 billion in 2015 to $6.7 billion in 2016 and were estimated to be $9.7 billion for 2017. This annual gain was largely fueled by the growth in consumer sales, as additional states approved adult recreational cannabis use. ArcView projects that legal cannabis sales will grow at an average rate of 28% per year and that by 2021 legal cannabis sales could be $24.5 billion, which is over a fourfold increase compared to the 2015 sales.

According to a September 2016 Cowen & Co. (“Cowen”) cannabis industry research report titled The Cannabis Compendium: Cross-Sector Views on A Budding Industry, “Cannabis prohibition has been in place for 80+ years, but the tides are clearly turning. Potential product applications range from recreational, to health & wellness, to therapeutic, to pharmaceutical. A lack of robust science has proven problematic, given the plant’s many active ingredients (including THC, the only psychotropic compound of 60+). Proponents point to cannabis’ wide use over thousands of years, skeptics advocate for science, and opponents voice concern.” The Cowen report anticipates that the recreational cannabis market will increase nine fold over the next ten years, assuming federal legalization. The report estimates that there are over 32 million yearly cannabis users in the U.S. and close to 9 million daily users. With approximately $6 billion in legal cannabis sales in 2016 (recreational and medial), the report anticipates the transitioning of the informal market and capitalizing on growing incidence, higher per caps, and premiumization should drive this increase. The reports project a 24% ten-year revenue compound annual growth rate, which the report states is hard to find in consumer staples, in particular with a $50+ billion end-point.

According to the government sponsored National Survey on Drug Use and Health (“NSDUH”), there were 19.8 million “current” cannabis users in the U.S. in 2013, up from 14.5 million in 2007. These self-reported results may be conservative based on the reluctance of respondents to admit to the use of an illegal substance in a government-sponsored survey. For example, an international review found general population surveys underestimate alcohol consumption, sometimes by more than 50%. These studies suggest that it may be appropriate to inflate the NSDUH-only consumption estimates by a factor of two. According to NSDUH, the low and high industry sales are estimated to range from $36 billion to $72 billion. By comparison, U.S. beer market sales last year were estimated at $102 billion, the U.S. cigarette market at $66 billion and the U.S. coffee market at $30 billion.

According to a June 2015 article published by Forbes, it is estimated that for every $1 of legally sold cannabis an additional $2.60 of economic value enters the American economy through ancillary businesses. The cannabis market differs from other emerging markets in that businesses typically expend considerable resources to stimulate demand, while in the cannabis industry significant demand already exists. The demand continues to outpace legal supply due to limitations in state regulations, federal drug, tax and banking laws, and lack of interstate trade.

Employees

We do not have any employees and utilize independent contractors and consultants as needed. We believe we have favorable relations with our independent contractors and consultants.

Corporate History

The Company was incorporated under the laws of the State of Nevada on February 27, 2013 as “American Riding Tours, Inc.” Effective July 22, 2016, the Company changed its name from “American Riding Tours, Inc.” to “First Harvest Corp.” Effective December 1, 2017, the Company changed its name from “First Harvest Corp.” to “Arias Intel Corp.” Prior to the reverse acquisition described below, the Company did not have any significant assets or operations.

| -12- |

On February 10, 2017 (the “Closing Date”), the Company entered into and closed an agreement and plan of merger and reorganization (the “Merger Agreement”), with CV Acquisition Corp., a wholly-owned subsidiary of the Company (“Acquisition Corp.”), and Cannavoices, Inc. (“Cannavoices”). Pursuant to the Merger Agreement, on the Closing Date (i) Acquisition Corp. merged with and into Cannavoices, such that Cannavoices, the surviving corporation, became a wholly-owned subsidiary of the Company, and (ii) the Company issued an aggregate of 23,267,231 shares of common stock to the shareholders of Cannavoices, representing approximately 97.7% of the Company’s then outstanding shares of common stock, following the Closing Date, in consideration for the cancellation of all of the issued and outstanding shares of common stock of Cannavoices.

The sole officer, one of the directors and, prior to closing of the Merger Agreement, the largest stockholder of Cannavoices was Kevin Gillespie, the Chief Executive Officer, President, Chairman of the Board and largest stockholder of the Company.

Cannavoices was incorporated on June 5, 2015 as a Florida corporation. On the Closing Date, pursuant to the Merger Agreement, Cannavoices became a wholly-owned subsidiary of the Company. The acquisition of Cannavoices is treated as a reverse acquisition, and the business of Cannavoices became the business of the Company. At the time of the reverse recapitalization, the Company was not engaged in any active business.

The consolidated financial statements of the Company are those of Arias Intel Corp. and of the consolidated entities from the Closing Date and subsequent periods.

Effective September 23, 2016, we effected a one-for-ten reverse stock split of our issued and outstanding common stock. All the relevant information relating to number of shares and per share information contained in this Annual Report on Form 10-K and consolidated financial statements has been retrospectively adjusted to reflect the reverse stock split for all periods presented.

An investment in the Company’s securities involves a high degree of risk. This Annual Report on Form 10-K contains the risks applicable to an investment in our securities. The risks and uncertainties we have described are not the only ones we face. Additional risks and uncertainties not presently known to us or that we currently deem immaterial may also affect our operations. The occurrence of any of these known or unknown risks might cause you to lose all or part of your investment in the offered securities. In determining whether to purchase the Company’s securities, you should carefully consider all of the material risks described below, together with the other information contained in this Annual Report on Form 10-K.

We have a limited operating history and a history of operating losses and face many of the risks and difficulties frequently encountered by an early stage company.

We were formed in June 2015 and have a limited operating and performance history. Therefore, there is limited historical financial information upon which to base an evaluation of our performance. Our prospects must be considered in light of the uncertainties, risks, expenses, and difficulties frequently encountered by companies in their early stages of operations. We have generated net losses since we began operations, including $10,219,920 and $4,535,060 for the years ended March 31, 2018 and 2017. The amount of future losses and when, if ever, we will achieve profitability are uncertain. To date, our efforts have been focused primarily on the development and marketing of our platforms, development of relationships with advertisers, creation of intellectual property and acquisition of licensed properties.

Our future success will depend on our ability to compete for the leisure time, attention and discretionary spending of our players and customers and to maintain our relationships with advertisers in our target industry. This will require a sustained marketing effort and acceptance of our Platform, the development of relationships with advertisers in our target industry and our ability to maintain and protect our intellectual property rights.

| -13- |

We will need to secure additional financing.

We anticipate that we will require additional funds for our operations. If we are not successful in securing additional financing, we may be unable to execute our business strategy, which could result in curtailment of our operations. We may have to pursue selling or licensing our intellectual technology in-part or in-whole to pay for ongoing operations.

Our ability to raise additional capital is uncertain and dependent on numerous factors beyond our control including, but not limited to, economic conditions and availability or lack of availability of capital. We may also be restricted by the terms of the EMA and Auctus settlement agreements and/or Geneva Roth Series A Preferred Stock financing.

If we cannot raise capital as needed and on acceptable terms, we may not be able to, among other things:

| ● | develop or enhance our Game or Ufly mobile applications; | |

| ● | continue to expand our development, sales and marketing teams; | |

| ● | acquire complementary technologies, products or businesses; | |

| ● | expand our global operations; | |

| ● | hire, train and retain employees; and | |

| ● | respond to competitive pressures or unanticipated working capital requirements. |

To the extent that we raise additional capital through the sale of equity or convertible debt securities, our existing stockholders’ interests may be materially diluted, and the terms of such securities could include liquidation or other preferences that adversely affect their rights as common stockholders. Debt financing and preferred equity financing, if available, may involve restrictive covenants that limit our ability to take specified actions, such as incurring additional debt, making capital expenditures or declaring dividends.

We received a report from our independent registered public accounting firm with an explanatory paragraph for the year ended March 31, 2018 with respect to our ability to continue as a going concern. The existence of such a report may adversely affect our stock price and our ability to raise capital.

In their report dated July 13, 2018, our independent registered public accounting firm expressed substantial doubt about our ability to continue as a going concern as we have not generated revenue and incurred a net loss of $10,219,920 as of March 31, 2018. At March 31, 2018, we had an accumulated deficit of $17,299,170 and expect to continue incurring net losses for the near future. Furthermore, if we were forced to liquidate our assets, the amount realized could be substantially lower than the carrying value of these assets. Our ability to continue as a going concern is subject to our ability to obtain necessary funding from outside sources, including obtaining additional funding from the sale of our securities or obtaining loans from various financial institutions or lenders where possible. Our continued net operating losses increase the difficulty in meeting such goals and there can be no assurances that such methods will prove successful.

If the Platform fails to gain market acceptance, we may not have sufficient capital to pay our expenses and to continue to operate.

Our ultimate success depends on generating revenues from the Platform. We may not achieve and sustain sufficient market acceptance of the Platform to generate sufficient revenues, if at all, to cover our costs and allow us to become profitable or even continue to operate.

We may be unable to successfully develop our business.

There can be no assurance that our business strategies will lead to profits. We face risks and uncertainties relating to our ability to successfully implement our strategies of creating and maintaining relationships with advertisers in our target industry, and capturing the leisure time, attention and discretionary spending of our players and customers. Despite our early entry into the cannabis digital media market, we do not know how successfully we will be able to compete with other mobile game developers and platforms or whether we will be successful in the long or short term with engaging our target customers. We have an unproven business model and operate in a competitive and evolving market. In particular, our business model is based on an expectation that we will be able to be a profitable part of the community of those who support cannabis legalization, and that demand for our role as a link between socially active supporters of cannabis legalization and brand-conscious advertisers will sustain itself or increase.

| -14- |

If we are unable to maintain a good relationship with advertising partners, our business will suffer.

We plan to generate substantially all of our revenue through advertising partnerships and expect to continue to do so for the foreseeable future. Any deterioration in relationships with advertising partners would harm our business.

If we are unable to maintain relationships with celebrity players, our business will suffer.

We plan to have a number of celebrities involved with the Platform, and we believe their involvement will help publicize our Company and will be a source of attraction for new users. To the extent celebrity involvement with the Platform declines, it will affect our ability to attract or retain registered users for our Platform which would harm our business and results of operations.

We may need to make greater investments than we originally planned in advertising and promotional activity in new markets to build brand awareness.

We may need to make greater investments than originally planned in advertising and promotional activity in order to build brand awareness. Such additional investments may cause a strain on our operation and management, which may adversely affect our business.

We operate in a new and rapidly changing niche in the online gaming and advertising industry, which makes it difficult to evaluate our business.

The cannabis digital media niche, on which our business model is founded, is a new and rapidly evolving niche. The growth of the niche and the level of demand and market acceptance of the Platform are subject to a high degree of uncertainty. Our future operating results will depend on numerous factors affecting the cannabis digital media niche, many of which are beyond our control, including, but not limited to:

| ● | Continued worldwide growth of a community of cannabis legalization supporters, which may be affected in ways we cannot predict by changes in or discussions surrounding government regulation of cannabis; | |

| ● | Changes in consumer demographics and public tastes and preferences; | |

| ● | The availability and popularity of other forms of entertainment; | |

| ● | The worldwide growth of personal computer, broadband Internet and mobile device users, and the rate of any such growth; and | |

| ● | General economic conditions, particularly economic conditions affecting discretionary consumer spending. |

Our ability to plan for development of our Platform, including our approach to marketing and promotional activities, will be significantly affected by our ability to anticipate and adapt to rapid changes in the consumer preferences. New and different types of entertainment and delivery channels may increase in popularity at the expense of our Platform. A decline in the popularity of the cannabis legalization movement, or of mobile gaming as a form of entertainment and community building, would have a material adverse effect upon our business and prospects.

The mobile game and application development industry is intensely competitive. We face competition from a number of companies, some of which may have greater financial, marketing, technical, personnel and other resources than us.

Competition among web and mobile game developers is intense. We compete on the basis of user appeal, quality of experience, brand awareness and reputation, access to distribution channels and pricing of our products. There are a number of established, well-financed companies producing game content that will potentially compete with our Platform. In addition, some of our competitors may have access to greater financial, marketing, technical, personnel and other resources than we do and as a result may be better positioned to compete in the marketplace.

| -15- |

New Platform features or changes to existing Platform features could fail to attract new users, retain existing users or generate revenue.

Our business strategy is dependent on our ability to develop our Platform features to attract new users, while retaining existing ones. Changes in user behavior or development of competing platforms may cause our users to switch to alternative platforms or decrease their use of our Platform which may have a material adverse effect on our business. Additionally, any of the following events may cause decreased use of our Platform:

| ● | Emergence of competing platforms and applications; | |

| ● | Inability to convince potential users to join our platform; | |

| ● | Inability to convince celebrities to endorse our products; | |

| ● | Technical issues of our Platform or in the cross-compatibility of multiple platforms; | |

| ● | Potential securities breaches around our data; | |

| ● | A rise in safety or privacy concerns; and | |

| ● | An increase in the level of spam or undesired content on the network. |

Government or quasi-government actions with respect to the cannabis industry could result in our products and services being unavailable in certain geographic regions which may harm our future growth.

Due to our connections to the cannabis industry, governments and quasi-government agencies may ban or cause our network or apps to become unavailable in certain regions and jurisdictions. This could greatly impair or prevent us from registering new users in affected areas and prevent current users from accessing our network. In addition, government or quasi-government action taken against our service providers or partners could cause our network to become unavailable for extended periods of time which could have a material adverse effect upon our business.

Changes in Amazon App Store, Apple App Store or Google Play Store policies could result in our mobile applications being de-listed. In addition, our third party service providers may decline to provide services due to their policies, or cease to provide services previously provided to us due to a change of policy.

Digital distribution platforms may change their review policies and app enforcement guidelines to prohibit all social cannabis-related applications. There can be no assurance that game and applications may not be removed from digital distribution networks for circumstances outside of our control. For example, the Apple App Store is one of the largest content distribution channels in the world and the gateway to effectively distribute our iOS applications to users who own iPhones and iPads. The Apple App Store review team effectively operates as our iOS App’s regulator; they decide what guidelines iOS apps must operate under and how to enforce such guidelines. The Apple guidelines related to cannabis-related apps are not published, enforcement of such guidelines is difficult to predict, and the review and appeal processes are conducted without public oversight.

| -16- |

We may not be able to adequately safeguard our intellectual property rights from unauthorized use, and we may become subject to claims that we infringe on others’ intellectual property rights.

Our business is significantly based on the creation, acquisition, use and protection of intellectual property. We protect our intellectual property rights by relying on federal, state and common law protections, as well as contractual restrictions. We seek intellectual property protection and trademark protection as appropriate covering development and inventions originating from us. We control access to proprietary technology by entering into confidentiality agreements with certain of our independent contractors and consultants. In addition to these arrangements, we also rely on a combination of trade secret, copyright, trademark, trade dress and domain names to protect our intellectual property. These measures afford only limited protection and may not preclude competitors from developing products or services similar or superior to ours. Moreover, the laws of certain foreign countries do not protect intellectual property rights to the same extent as the laws of the United States.

Although we implement protective measures and intend to defend our proprietary rights, our efforts may not be successful. From time to time, we may be subject to litigation within the United States or abroad to enforce our issued or licensed patents, to protect our trade secrets and know-how or to determine the enforceability, scope and validity of our proprietary rights and the proprietary rights of others. Enforcing or defending our proprietary rights can involve complex factual and legal questions and can be expensive, would require management’s attention and might not bring us timely or effective relief.

Furthermore, third parties may assert that our products or processes infringe upon their intellectual property rights. Although there are no pending or threatened intellectual property lawsuits against us, we may face litigation or infringement claims in the future. Infringement claims could result in substantial judgments, and could result in substantial costs and diversion of our resources even if we ultimately prevail. A third party claiming infringement may also obtain an injunction or other equitable relief which could effectively block our use of allegedly infringing intellectual property. Although we may seek licenses from third parties covering intellectual property that we are allegedly infringing, we may not be able to obtain any such licenses on acceptable terms and conditions, if at all.

If we do not effectively manage changes in our business, these changes could place a significant strain on our management and operations.

Our ability to grow successfully requires that we have an effective planning and management process. The expansion and growth of our business could place a significant strain on our management systems, infrastructure and other resources. To manage our growth successfully, we must continue to improve and expand our systems and infrastructure in a timely and efficient manner. Our controls, systems, procedures and resources may not be adequate to support a changing and growing company. If our management fails to respond effectively to changes and growth in our business, including acquisitions, this could have a material adverse effect on the Company’s business, financial condition, results of operations and future prospects.

Damage to our reputation or lack of acceptance of our brand in existing and new markets could negatively impact our business, financial condition and results of operations.

We intend to build a strong reputation for the quality of our technology, and we must protect and grow the value of our brand to be successful. Any incident that erodes consumer affinity for our brand including, but not limited to, software malfunctions, could significantly reduce our brand value and damage our business. If consumers perceive or experience a reduction in quality, or in any way believe we fail to deliver a consistently positive experience, our brand value could suffer and our business may be adversely affected.

Information technology system failures or breaches of our network security could interrupt our operations and adversely affect our business.

We will rely on our computer systems and network infrastructure across our operations. Our operations depend upon our ability to protect our computer equipment and systems against damage from physical theft, fire, power loss, telecommunications failure or other catastrophic events, as well as from internal and external security breaches, viruses, worms and other disruptive problems. Any damage or failure of our computer systems or network infrastructure that causes an interruption in our operations could have a material adverse effect on our business and subject us to litigation or actions by regulatory authorities.

| -17- |

A material breach in security relating to our information systems and regulation related to such breaches could adversely affect us.

Information security risks have generally increased in recent years, in part because of the proliferation of new technologies and the use of the Internet, and the increased sophistication and activity of organized crime, hackers, terrorists, activists, cybercriminals and other external parties, some of which may be linked to terrorist organizations or hostile foreign governments. For example, a cybercriminal could use cybersecurity threats to gain access to sensitive information about another company or to alter or disrupt news or information to be distributed by PR Newswire. Cybersecurity attacks are becoming more sophisticated and include malicious software, ransomware, attempts to gain unauthorized access to data and other electronic security breaches that could lead to disruptions in critical systems, unauthorized release of confidential or otherwise protected information and corruption of data, substantially damaging our reputation. Any person who circumvents our security measures could steal proprietary or confidential customer information or cause interruptions in our operations. We incur costs with respect to protecting against security breaches, and may incur significant additional costs to alleviate problems caused by any breaches. Our failure to prevent security breaches, or well-publicized security breaches affecting the Internet in general, could significantly harm our reputation and business and financial results.

Any new or changes made to laws, regulations, rules or other industry standards affecting our business may have an adverse impact on our financial results.

We are subject to a number of foreign and domestic laws and regulations that affect companies conducting business on the Internet, many of which are still evolving and could be interpreted in ways that could harm our business. In the United States and internationally, laws relating to the liability of providers of online services for activities of their users and other third parties are currently being tested by a number of claims, including actions based on invasion of privacy and other torts, unfair competition, copyright and trademark infringement, and other theories based on the nature and content of the materials searched, the ads posted, or the content provided by users. Any court ruling or other governmental action that imposes liability on providers of online services for the activities of their users and other third parties could harm our business. We are potentially subject to a number of foreign and domestic laws and regulations that affect the offering of certain types of content, such as that which depicts violence, many of which are ill defined, still evolving and could be interpreted in ways that could harm our business or expose us to liability.

In addition, rising concern about the use of social networking technologies for illegal conduct, such as the unauthorized dissemination of national security information, money laundering or supporting terrorist activities may in the future produce legislation or other governmental action that could require changes to our games or restrict or impose additional costs upon the conduct of our business.

We also offer our players the opportunity to participate in various types of sweepstakes, giveaways and other promotional opportunities. We are subject to laws in a number of jurisdictions concerning the operation and offering of such activities, many of which are still evolving and could be interpreted in ways that could harm our business. Any court ruling or other governmental action that imposes liability on providers of online services could result in criminal or civil liability and could harm our business.

In the area of information security and data protection, many states have passed laws requiring notification to users when there is a security breach for personal data, such as the 2002 amendment to California’s Information Practices Act, or requiring the adoption of minimum information security standards that are often vaguely defined and difficult to implement. The costs of compliance with these laws may increase in the future as a result of changes in interpretation. Furthermore, any failure on our part to comply with these laws may subject us to significant liabilities.

We are also subject to federal, state and foreign laws regarding privacy and protection of player data, including the collection of data from minors. Our Privacy Policy and Terms of Service are posted in our apps and describe our practices concerning the use, transmission and disclosure of player data. Any failure by us to comply with our posted privacy policy or privacy related laws and regulations could result in proceedings against us by governmental authorities or others, which could harm our business. In addition, the interpretation of many data protection laws, and their application to the Internet is unclear and in a state of flux.

Our success will be dependent on our ability to attract and retain key personnel.

We believe our success depends on the continued service of our key technical and management personnel, particularly our Chief Executive Officer, Kevin Gillespie, and upon our ability to attract and retain qualified employees, independent contractors and consultants, particularly highly skilled game designers, product managers and engineers. The competition for technical personnel is intense, and the loss of key personnel or the inability to hire such personnel when needed could have a material adverse impact on our results of operation and financial condition. We also do not maintain any key man life insurance policies for any of our employees.

Laws and regulations affecting the cannabis industry are constantly changing, and this may affect our consumer base in ways that we are unable to predict.

Local, state and federal medical cannabis laws and regulations are broad in scope and subject to evolving interpretations. We cannot predict the nature of any future laws, regulations, interpretations or applications that may affect us, nor can we determine what effect additional governmental regulations or administrative policies and procedures, when and if promulgated, could have on the vitality of the cannabis legalization movement or the unification or popularity of the community in favor of legalization, the members of which community form our anticipated consumer base and underpin our business model.

| -18- |

Cannabis remains illegal under Federal law.

Despite the development of a legal cannabis industry under the laws of certain states, these state laws legalizing medical and adult cannabis use are in conflict with the Federal Controlled Substances Act, which classifies cannabis as a Schedule I controlled substance and makes cannabis use and possession illegal on a national level. The United States Supreme Court has ruled that the Federal government has the right to regulate and criminalize cannabis, even for medical purposes, and thus Federal law criminalizing the use of cannabis preempts state laws that legalize its use. Although the prior administration determined that it was not an efficient use of resources to direct Federal law enforcement agencies to prosecute those lawfully abiding by state laws allowing the use and distribution of medical and recreational cannabis, on January 4, 2018, the current administration issued the Sessions Memo announcing a return to the rule of law and the rescission of previous guidance documents. The Sessions Memo rescinds the Cole Memo which was adopted by the Obama administration as a policy of non-interference with marijuana-friendly state laws. The Sessions Memo shifts federal policy from a hands-off approach adopted by the Obama administration to permitting federal prosecutors across the country to decide how to prioritize resources to regulate marijuana possession, distribution and cultivation in states where marijuana use is legal. There can be no assurance that federal prosecutors will not prosecute and dedicate resources to regulate marijuana possession, distribution and cultivation in states where marijuana use is legal which may cause states to reconsider their legalization of marijuana which would have a detrimental effect on the marijuana industry. Any such change in state laws based upon the Sessions Memo and the Federal government’s enforcement of Federal laws could cause significant financial damage to us and our stockholders.

As the possession and use of cannabis is illegal under the Federal Controlled Substances Act, we may be deemed to be aiding and abetting illegal activities through the services and data that we provide to government regulators, dispensaries, cultivators and consumers. As a result, we may be subject to enforcement actions by law enforcement authorities, which would materially and adversely affect our business.

Under Federal law, and more specifically the Federal Controlled Substances Act, the possession, use, cultivation, and transfer of cannabis is illegal. Our business, including our UFly app, provides services to cannabis consumers and business of possession, use, cultivation, and/or transfer of cannabis. As a result, law enforcement authorities, in their attempt to regulate the illegal use of cannabis, may seek to bring an action or actions against us, including, but not limited, to a claim of aiding and abetting another’s criminal activities. The Federal aiding and abetting statute provides that anyone who “commits an offense against the United States or aids, abets, counsels, commands, induces or procures its commission, is punishable as a principal.” 18 U.S.C. §2(a). As a result of such an action, we may be forced to cease operations and our investors could lose their entire investment. Such an action would have a material negative effect on our business and operations.

Federal enforcement practices could change with respect to services provided to participants in the cannabis industry, which could adversely impact us. If the Federal government were to expend its resources on enforcement actions against service providers in the cannabis industry under guidance provided by the Sessions Memo, such actions could have a material adverse effect on our operations, our customers, or the sales of our products.