Attached files

| file | filename |

|---|---|

| 8-K - 8-K - ENTERGY CORP /DE/ | a03018.htm |

ENTERGY STATISTICAL REPORT |

AND INVESTOR GUIDE |

2017 |

Our Vision: We Power Life |

Our Mission: We exist to grow a world-class energy business that creates sustainable value for our four stakeholders – customers, employees, communities and owners. |

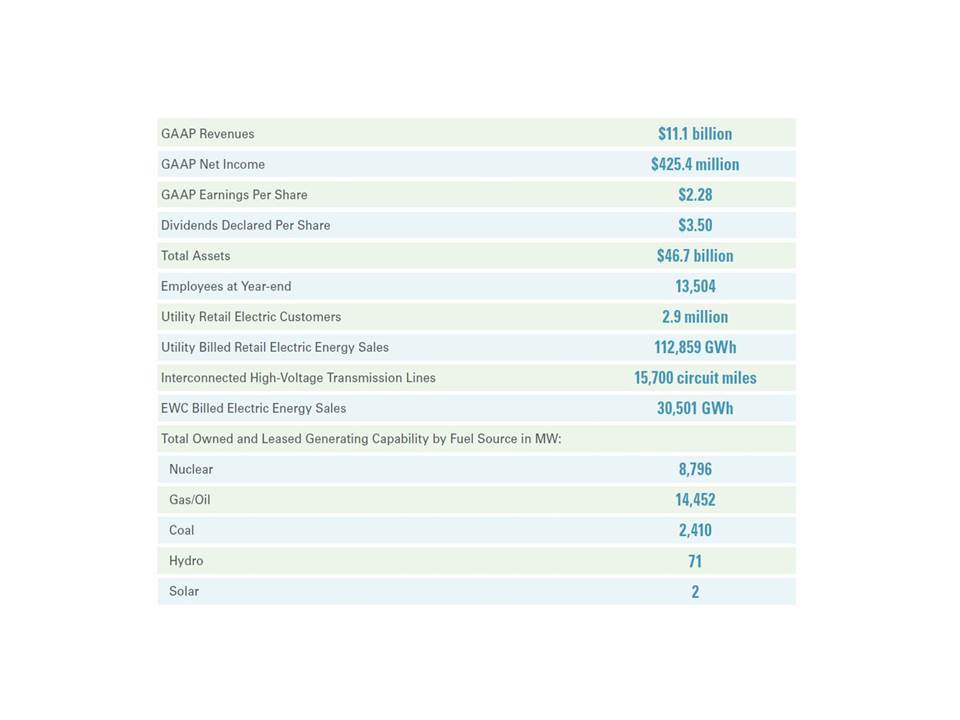

Entergy Corporation (NYSE:ETR) is an integrated energy company engaged primarily in electric power production and retail distribution operations. Entergy owns and operates power plants with approximately 30,000 megawatts of electric generating capacity, including nearly 9,000 megawatts of nuclear power. Entergy delivers electricity to 2.9 million utility customers in Arkansas, Louisiana, Mississippi and Texas. Entergy has annual revenues of approximately $11 billion and more than 13,000 employees. |

We have assembled the statistics and facts in this report to support your review and analysis of Entergy’s results over the last five years. This information is available in two electronic files, Excel and PDF in order to facilitate easier access and analysis. |

Entergy Investor Relations |

TABLE OF CONTENTS | Note: The Excel Tab labels correspond to the page numbers | |||

in the PDF version of the 2017 report. | ||||

Excel Tab | Excel Tab | |||

ABOUT THIS PUBLICATION | Page 2 | Utility Securities Detail | Page 31 | |

FORWARD-LOOKING INFORMATION | Page 2 | Utility Long-Term Debt and Preferred Stock | Page 31 | |

REGULATION G COMPLIANCE | Page 2 | Entergy Arkansas, Inc. | Page 31 | |

ENTERGY AT A GLANCE | Pages 3 – 4 | Entergy Utility Holding Company, LLC | Page 31 | |

Entergy Louisiana, LLC | Page 32 | |||

ENTERGY CORPORATION AND SUBSIDIARIES | Entergy Mississippi, Inc. | Page 33 | ||

Selected Financial and Operating Data | Page 5 | Entergy New Orleans, LLC | Page 33 | |

Selected Financial Data | Page 5 | Entergy Texas, Inc. | Page 34 | |

Utility Electric Operating Data | Page 5 | System Energy Resources, Inc. | Page 34 | |

Entergy Wholesale Commodities Operating Data | Page 5 | Utility Statistical Information | Page 35 | |

Employees | Page 5 | Utility Total Capability | Page 35 | |

Owned and Leased Capability | Page 5 | Utility Selected Operating Data | Page 35 | |

Consolidated Quarterly Financial Metrics | Page 6 | Utility Consolidating Information | Page 36 | |

Consolidated Annual Financial Metrics | Page 6 | Entergy Arkansas, Inc. | Pages 37 – 38 | |

Financial Results | Page 7 | Entergy Louisiana, LLC | Pages 39 – 40 | |

GAAP to Non-GAAP Reconciliations: | Page 7 | Entergy Mississippi, Inc. | Pages 41 – 42 | |

Consolidated Quarterly Results | Page 7 | Entergy New Orleans, Inc. | Pages 43 – 44 | |

GAAP to Non-GAAP Reconciliations: | Pages 8 – 9 | System Energy Resources, Inc. | Page 44 | |

Utility, Parent & Other Quarterly Results | Page 10 | Entergy Texas, Inc. | Pages 45 – 46 | |

Consolidated Quarterly Special Items | Pages 11 – 12 | Utility Nuclear Plant Statistics | Page 47 | |

GAAP to Non-GAAP Reconciliations: | Page 13 | Utility Regulatory Information | Page 48 | |

Consolidated Annual Results | Page 14 | State Regulatory Commissions | Page 48 | |

Consolidated Annual Special Items | Pages 15 – 16 | Commission/Council Members | Page 48 | |

Consolidated Statements of Operations | Pages 17 – 18 | |||

Consolidating Income Statement | Pages 19 – 20 | ENTERGY WHOLESALE COMMODITIES | ||

Consolidated Balance Sheets | Page 20 | EWC Quarterly Financial Metrics | Page 49 | |

Consolidating Balance Sheet | Page 21 | EWC Annual Financial Metrics | Page 49 | |

Consolidated Statements of Cash Flow | Page 22 | EWC Quarterly Operational Metrics | Page 49 | |

Cash Flow Information by Business | EWC Annual Operational Metrics | Page 49 | ||

Consolidated Statements of Changes in Equity | Page 23 | EWC Total Capacity | Page 49 | |

Consolidated Statements of Comprehensive | Page 23 | EWC Nuclear Plant Statistics | Page 50 | |

Income (Loss) | Page 23 | EWC Non-Nuclear Wholesale Assets | Page 50 | |

Consolidated Capital Expenditures | Page 23 | Plant Statistics | ||

Entergy Corporation Securities Detail | Page 23 | EWC Non-Nuclear Wholesale Assets | Page 50 | |

Entergy Corporation Long-Term Debt | Plant Emissions | |||

Securities Ratings (Outlook) | EWC Nuclear Securities Detail | Page 51 | ||

Preferred Member Interests | Page 24 | EWC Non-Nuclear Wholesale Assets | Page 51 | |

Page 24 | Securities Detail | |||

UTILITY | Page 24 | |||

Utility Quarterly Financial Metrics | Page 24 | DEFINITIONS OF OPERATIONAL MEASURES AND | ||

Utility Annual Financial Metrics | Page 25 | GAAP AND NON-GAAP FINANCIAL MEASURES | Page 52 | |

Utility Securities Ratings (Outlook) | Page 25 | |||

Utility Historical Capital Expenditures | Pages 26 – 27 | REG G RECONCILIATIONS | ||

Utility Financial Results | Pages 28 – 30 | Financial Measures | Pages 53 – 66 | |

Utility Consolidating Income Statement | ||||

Utility Consolidating Balance Sheet | INVESTOR INFORMATION | Page 67 | ||

Utility Selected Annual Financial Metrics | ||||

ABOUT THIS PUBLICATION | |

This publication is unaudited and should be used in conjunction with Entergy’s | • uncertainty regarding the establishment of interim or permanent sites for |

2017 Annual Report to Shareholders and Form 10-K filed with the Securities | spent nuclear fuel and nuclear waste storage and disposal and the level of |

and Exchange Commission. It has been prepared for information purposes and | spent fuel and nuclear waste disposal fees charged by the U.S. |

is not intended for use in connection with any sale or purchase of, or any offer | government or other providers related to such sites |

to buy, any securities of Entergy Corporation or its subsidiaries. | • variations in weather and the occurrence of hurricanes and other storms |

and disasters, including uncertainties associated with efforts to remediate | |

FORWARD-LOOKING INFORMATION | the effects of hurricanes, ice storms, or other weather events and the recovery |

In this report and from time to time, Entergy Corporation makes statements concerning | of costs associated with restoration, including accessing funded storm reserves, |

its expectations, beliefs, plans, objectives, goals, strategies, and future | federal and local cost recovery mechanisms, securitization, and insurance |

events or performance. Such statements are “forward-looking statements” | • effects of climate change, including the potential for increases in sea |

within the meaning of the Private Securities Litigation Reform Act of 1995. | levels or coastal land and wetland loss |

Words such as “may,” “will,” “could,” “project,” “believe,” “anticipate,” “intend,” | • changes in the quality and availability of water supplies and the related |

“expect,” “estimate,” “continue,” “potential,” “plan,” “predict,” “forecast,” | regulation of water use and diversion |

and other similar words or expressions are intended to identify forward-looking | • Entergy’s ability to manage its capital projects and operation |

statements but are not the only means to identify these statements. Although Entergy | and maintenance costs |

believes that these forward-looking statements and the underlying assumptions are | • Entergy’s ability to purchase and sell assets at attractive prices |

reasonable, it cannot provide assurance that they will prove correct. Any | and on other attractive terms |

forward-looking statement is based on information current as of the date of this | • the economic climate, and particularly economic conditions in Entergy’s |

report and speaks only as of the date on which such statement is made. | Utility service area and the northern United States and events and |

Except to the extent required by the federal securities laws, Entergy undertakes | circumstances that could influence economic conditions in those areas, |

no obligation to publicly update or revise any forward-looking statements, | including power prices, and the risk that anticipated load growth |

whether as a result of new information, future events, or otherwise. | may not materialize |

Forward-looking statements involve a number of risks and uncertainties. | • federal income tax reform, including the enactment of the Tax Cuts and Jobs |

There are factors that could cause actual results to differ materially from those | Act, and its intended and unintended consequences on financial results and |

expressed or implied in the forward-looking statements, including (a) those | future cash flows, including the potential impact to credit ratings, which |

factors discussed or incorporated by reference in Item 1A. Risk Factors contained | may affect Entergy’s ability to borrow funds or increase the cost of |

in the Form 10-K for the year ended Dec. 31, 2017, (b) those factors discussed or | borrowing in the future |

incorporated by reference in Management’s Financial Discussion and Analysis | • the effects of Entergy’s strategies to reduce tax payments, especially in |

contained in the Form 10-K for the year ended Dec. 31, 2017, and (c) the following | light of federal income tax reform |

factors (in addition to others described elsewhere in this report and in | • changes in the financial markets and regulatory requirements for the |

subsequent securities filings): | issuance of securities, particularly as they affect access to |

• resolution of pending and future rate cases, formula rate proceedings and related | capital and Entergy’s ability to refinance existing securities, execute |

negotiations, including various performance-based rate discussions, | share repurchase programs, and fund investments and acquisitions |

Entergy’s utility supply plan, and recovery of fuel and purchased power costs | • actions of rating agencies, including changes in the ratings of |

• long-term risks and uncertainties associated with the termination of the System | debt and preferred stock, changes in general corporate ratings, |

Agreement in 2016, including the potential absence of federal authority to resolve | and changes in the rating agencies’ ratings criteria |

certain issues among the Utility operating companies and their retail regulators | • changes in inflation and interest rates |

• regulatory and operating challenges and uncertainties and economic risks | • the effect of litigation and government investigations or proceedings |

associated with the Utility operating companies’ participation in MISO, | • changes in technology, including (i) Entergy’s ability to implement new |

including the benefits of continued MISO participation, the effect of current or | technologies, (ii) the impact of changes relating to new, developing, or |

projected MISO market rules and market and system conditions in the MISO | alternative sources of generation such as distributed energy and energy |

markets, the allocation of MISO system transmission upgrade costs, and the effect | storage, energy efficiency, demand side management and other measures |

of planning decisions that MISO makes with respect to future transmission | that reduce load, and competition from other companies offering products |

investments by the Utility operating companies | and services to our customers based on new or emerging technologies |

• changes in utility regulation, including with respect to retail and wholesale | • the effects, including increased security costs, of threatened or actual |

competition, the ability to recover net utility assets and other potential stranded | terrorism, cyber-attacks or data security breaches, natural or man-made |

costs, and the application of more stringent transmission reliability requirements | electromagnetic pulses that affect transmission or generation infrastructure, |

or market power criteria by the FERC or the U.S. Department of Justice | accidents, and war or a catastrophic event such as a nuclear accident or a |

• changes in the regulation or regulatory oversight of Entergy’s nuclear generating | natural gas pipeline explosion |

facilities and nuclear materials and fuel, including with respect to the planned, potential | • Entergy’s ability to attract and retain talented management, directors, |

or actual shutdown of nuclear generating facilities owned or operated by | and employees with specialized skills |

Entergy Wholesale Commodities and the effects of new or existing safety or | • changes in accounting standards and corporate governance |

environmental concerns regarding nuclear power plants and nuclear fuel | • declines in the market prices of marketable securities and resulting funding |

• resolution of pending or future applications, and related regulatory proceedings | requirements and the effects on benefits costs for Entergy’s defined benefit |

and litigation, for license renewals or modifications or other authorizations required | pension and other postretirement benefit plans |

of nuclear generating facilities and the effect of public and political opposition on | • future wage and employee benefit costs, including changes |

these applications, regulatory proceedings and litigation | in discount rates and returns on benefit plan assets |

• the performance of and deliverability of power from Entergy’s generation | • changes in decommissioning trust fund values or earnings or in the |

resources, including the capacity factors at Entergy's nuclear generating facilities | timing of, requirements for, or cost to decommission Entergy's nuclear plant |

• increases in costs and capital expenditures that could result from the commitment | sites and the implementation of decommissioning of such sites |

of substantial human and capital resources required for the operation and maintenance | following shutdown |

of Entergy’s nuclear generating facilities | • the decision to cease merchant power generation at all Entergy |

• Entergy’s ability to develop and execute on a point of view regarding future | Wholesale Commodities nuclear power plants by mid-2022, including |

prices of electricity, natural gas, and other energy-related commodities | the implementation of the planned shutdowns of Pilgrim, Indian Point 2, |

• prices for power generated by Entergy’s merchant generating | Indian Point 3, and Palisades |

facilities and the ability to hedge, meet credit support requirements for hedges, | • the effectiveness of Entergy’s risk management policies and procedures |

sell power forward or otherwise reduce the market price risk associated | and the ability and willingness of its counterparties to satisfy their |

with those facilities, including the Entergy Wholesale Commodities nuclear plants | financial and performance commitments |

especially in light of the planned shutdown or sale of each of these nuclear plants | • factors that could lead to impairment of long-lived assets |

• the prices and availability of fuel and power Entergy must purchase | • the ability to successfully complete strategic transactions Entergy may |

for its Utility customers, and Entergy’s ability to meet credit support | undertake, including mergers, acquisitions, divestitures, or restructurings, |

requirements for fuel and power supply contracts | regulatory or other limitations imposed as a result of any such strategic |

• volatility and changes in markets for electricity, natural gas, | transaction and the success of the business following any such |

uranium, emissions allowances, and other energy-related commodities, | strategic transaction |

and the effect of those changes on Entergy and its customers | |

• changes in law resulting from federal or state energy legislation or | REGULATION G COMPLIANCE |

legislation subjecting energy derivatives used in hedging and risk | Financial performance measures shown in this report include those |

management transactions to governmental regulation | calculated and presented in accordance with generally accepted |

• changes in environmental laws and regulations, agency positions, or associated | accounting principles (GAAP), as well as those that are considered |

litigation, including requirements for reduced emissions of sulfur dioxide, nitrogen | non-GAAP measures. This report includes non-GAAP measures |

oxide, greenhouse gases, mercury, particulate matter, heat, and other regulated air | of operational earnings; operational EPS; adjusted earnings; |

and water emissions, requirements for waste management and disposal and for the | operational adjusted EBITDA; operational ROIC; operational ROE; |

remediation of contaminated sites, wetlands protection and permitting, | operational return on average member's equity; operational non-fuel operation |

and changes in costs of compliance with these environmental laws and regulations | and maintenance expense; operational common dividend payout ratio; |

• changes in laws and regulations, agency positions, or associated litigation related | gross liquidity; total debt, excluding securitization debt; |

to protected species and associated critical habitat designations | net debt to net capital ratio; debt to capital ratio, excluding |

• the effects of changes in federal, state or local laws and regulations, | securitization debt; net debt to net capital ratio, excluding securitization debt; |

and other governmental actions or policies, including changes in | parent debt to total debt ratio, excluding securitization debt; |

monetary, fiscal, tax, environmental, or energy policies | debt to operational adjusted EBITDA, excluding securitization debt; |

operational FFO to debt ratio, excluding securitization debt; operational | |

net revenue when describing Entergy’s results of operations and financial | |

performance. We have prepared reconciliations of these measures to the | |

most directly comparable GAAP measures. Reconciliations can be found | |

on pages 7, 10, and 53 – 66. | |

ENTERGY AT A GLANCE | ||

VISION, MISSION AND STAKEHOLDER OBJECTIVES | ||

We power life. This is our vision. It goes much further than powering the grid. Together, we help improve lives, build businesses and create prosperity. “We power life” is Entergy’s promise to create a better future for us all. | ||

We exist to grow a world-class energy business that creates sustainable value for our four stakeholders – customers, employees, communities and owners. This is our mission. | ||

• For our customers, we create value by delivering top-quartile customer satisfaction through anticipating customer needs and exceeding their expectations while keeping rates reasonable. | ||

• For our employees, we create value by earning top-quartile organizational health scores and top-decile safety performance and by providing a rewarding, engaging, diverse and inclusive work environment with fair compensation and benefits and opportunities for career advancement. | ||

• For our communities, we create value by achieving top-decile corporate social responsibility performance through economic development, philanthropy, volunteerism and advocacy and by operating our business safely and in a socially and environmentally responsible way. | ||

• For our owners, we create value by delivering top-quartile returns through the relentless pursuit of opportunities to optimize our business. | ||

BUSINESS STRATEGY | ||

Our strategy to achieve our stakeholder objectives has two key areas of focus. First, we invest in the utility for the benefit of our customers, which supports steady, predictable growth in earnings and dividends. Second, we manage risk by ensuring our utility investments are customer-centric and supported by progressive regulatory constructs, and by exiting our merchant business. | ||

ENTERGY BY THE NUMBERS | ||

ENTERGY AT A GLANCE | ||

OPERATIONS | ||

UTILITY | ||

Entergy’s utility companies generate, transmit, distribute, and sell | ENTERGY WHOLESALE COMMODITIES (EWC) | |

electric power, and operate a small natural gas distribution business. | Entergy has announced the sale or closure of the EWC nuclear assets, completing | |

• Five electric utilities with 2.9 million customers | its plan to exit the merchant power business and transition to a pure-play utility. | |

• Four states – Arkansas, Louisiana, Mississippi, Texas | ||

• 22,000 MW generating capacity | EWC owns, operates and decommissions nuclear power plants located in the | |

• Two gas utilities with 199,000 customers | northern United States and sells the electric power produced by its operating | |

plants to wholesale customers. EWC also provides operations and management services, | ||

ENTERGY ARKANSAS, INC. (E-AR) | including decommissioning services, to nuclear power plants owned by other utilities | |

Entergy Arkansas generates, transmits, distributes, and sells electric | in the United States. EWC also owns interests in non-nuclear power plants that sell | |

power to 709,000 retail customers in Arkansas. | the electric power produced by those plants to wholesale customers. | |

ENTERGY LOUISIANA, LLC (E-LA) | • 3,568 MW nuclear-owned generating capacity in four units in northern U.S. | |

Entergy Louisiana generates, transmits, distributes, and sells electric | • Pilgrim Nuclear Power Station in Plymouth, Massachusetts | |

power to 1,078,000 retail customers in Louisiana. Entergy | • Indian Point Energy Center Units 2 and 3 in Buchanan, New York | |

Louisiana also provides natural gas utility service to 93,000 customers in | • Palisades Nuclear Plant in Covert, Michigan | |

the Baton Rouge, Louisiana area. | • 394 net owned MW non-nuclear generating capacity | |

• 800 MW under management support services contract | ||

ENTERGY MISSISSIPPI, INC. (E-MS) | • Cooper Nuclear Station located near Brownville, Nebraska | |

Entergy Mississippi generates, transmits, distributes, and sells electric | ||

power to 449,000 retail customers in Mississippi. | James A. FitzPatrick Nuclear Power Plant was sold on March 31, 2017. Entergy plans | |

to close Pilgrim on May 31, 2019, Indian Point 2 on April 30, 2020, Indian Point 3 on | ||

ENTERGY NEW ORLEANS, LLC (E-NO) | April 30, 2021, and Palisades on May 31, 2022. | |

Entergy New Orleans generates, transmits, distributes, and sells | ||

electric power to 200,000 retail customers in the city of New Orleans, | Vermont Yankee Nuclear Power Station was shutdown at the end of 2014. | |

Louisiana. Entergy New Orleans also provides natural gas utility | Entergy has entered into an agreement to sell Vermont Yankee and the transaction | |

service to 106,000 customers in the city of New Orleans. | is expected to close in December 2018. | |

ENTERGY TEXAS, INC. (E-TX) | ||

Entergy Texas generates, transmits, distributes, and sells electric power | ||

to 448,000 retail customers in Texas. | ||

SYSTEM ENERGY RESOURCES, INC. (SERI) | ||

System Energy owns or leases 90% of the Grand Gulf 1 nuclear | ||

generating facility. System Energy sells its power and capacity from | ||

Grand Gulf 1 at wholesale to Entergy Arkansas (36%), Entergy Louisiana (14%), | ||

Entergy Mississippi (33%) and Entergy New Orleans (17%). | ||

UTILITY NUCLEAR PLANTS | ||

Entergy owns and operates five nuclear units at four plant sites to serve | ||

its regulated utility business: Arkansas Nuclear One (ANO) Units 1 and 2 | ||

near Russellville, Arkansas; Grand Gulf Nuclear Station Unit 1 in Port Gibson, | ||

Mississippi; River Bend Station in St. Francisville, Louisiana and | ||

Waterford Steam Electric Station Unit 3 in Killona, Louisiana. | ||

SELECTED FINANCIAL AND OPERATING DATA | |||||||||||||||

SELECTED FINANCIAL DATA | |||||||||||||||

2017 | 2016 | 2015 | 2014 | 2013 | |||||||||||

GAAP MEASURES | |||||||||||||||

Operating Revenues ($ millions) | 11,074 | 10,846 | 11,513 | 12,495 | 11,391 | ||||||||||

As-Reported Net Income (Loss) Attributable to Entergy Corporation ($ millions) | 412 | (584 | ) | (177 | ) | 941 | 712 | ||||||||

As-Reported Earnings Per Share ($) | 2.28 | (3.26 | ) | (0.99 | ) | 5.22 | 3.99 | ||||||||

Common Dividend Paid Per Share ($) | 3.50 | 3.42 | 3.34 | 3.32 | 3.32 | ||||||||||

Common Dividend Payout Ratio – As-Reported (%) | 154 | (104 | ) | (339 | ) | 64 | 83 | ||||||||

NON-GAAP MEASURES | |||||||||||||||

Operational Earnings ($ millions) | 1,300 | 1,272 | 1,076 | 1,050 | 957 | ||||||||||

Operational Earnings Per Share ($) | 7.20 | 7.11 | 6.00 | 5.83 | 5.36 | ||||||||||

Special Items ($ millions) | (889 | ) | (1,855 | ) | (1,252 | ) | (109 | ) | (245 | ) | |||||

Special Items Per Share ($) | (4.92 | ) | (10.37 | ) | (6.99 | ) | (0.61 | ) | (1.37 | ) | |||||

Common Dividend Payout Ratio – Operational (%) | 49 | 48 | 56 | 57 | 62 | ||||||||||

UTILITY ELECTRIC OPERATING DATA | |||||||||||||||

2017 | 2016 | 2015 | 2014 | 2013 | |||||||||||

Retail Kilowatt-Hour Sales (millions) | 112,859 | 112,595 | 112,312 | 110,910 | 107,781 | ||||||||||

Peak Demand (megawatts) | 21,671 | 21,387 | 21,730 | 20,472 | 21,581 | ||||||||||

Retail Customers – Year End (thousands) | 2,884 | 2,868 | 2,845 | 2,818 | 2,800 | ||||||||||

ENTERGY WHOLESALE COMMODITIES OPERATING DATA | |||||||||||||||

2017 | 2016 | 2015 | 2014 | 2013 | |||||||||||

Billed Electric Energy Sales (gigawatt hours) | 30,501 | 35,881 | 39,745 | 44,424 | 45,127 | ||||||||||

EMPLOYEES | |||||||||||||||

2017 | 2016 | 2015 | 2014 | 2013 | |||||||||||

Total Employees – Year End | 13,504 | 13,513 | 13,579 | 13,393 | 13,808 | ||||||||||

OWNED AND LEASED CAPABILITY (MW)(a) | ||||||||||||||||

As of December 31, 2017 | ||||||||||||||||

E-AR | E-LA | E-MS | E-NO | E-TX | SERI | EWC(b)(c) | Total | |||||||||

Gas/Oil | 2,136 | 6,603 | 2,944 | 491 | 2,065 | — | 213 | 14,452 | ||||||||

Coal | 1,189 | 360 | 414 | — | 266 | — | 181 | 2,410 | ||||||||

Total Fossil | 3,325 | 6,963 | 3,358 | 491 | 2,331 | — | 394 | 16,862 | ||||||||

Nuclear | 1,821 | 2,136 | — | — | — | 1,271 | 3,568 | 8,796 | ||||||||

Hydro | 71 | — | — | — | — | — | — | 71 | ||||||||

Solar | — | — | 1 | 1 | — | — | — | 2 | ||||||||

Total | 5,217 | 9,099 | 3,359 | 492 | 2,331 | 1,271 | 3,962 | 25,731 | ||||||||

(a) Owned and Leased Capability is the dependable load carrying capability as demonstrated under actual operating conditions based on the primary fuel (assuming no curtailments) that each station was designed to utilize. | ||||||||||||||||

(b) Nuclear reflects Net MW in Operation. Net MW in Operation is the installed capacity owned and operated. Excludes management services contract for Cooper Nuclear Station. | ||||||||||||||||

(c) Fossil reflects nameplate rating of generating unit and excludes capacity under contract. | ||||||||||||||||

CONSOLIDATED ENTERGY CORPORATION AND SUBSIDIARIES DATA | |||||||||||||||||||||||||||||||||

CONSOLIDATED QUARTERLY FINANCIAL METRICS | |||||||||||||||||||||||||||||||||

2017 | 2016 | FY % | |||||||||||||||||||||||||||||||

1Q | 2Q | 3Q | 4Q | FY | 1Q | 2Q | 3Q | 4Q | FY | CHANGE | |||||||||||||||||||||||

GAAP MEASURES | |||||||||||||||||||||||||||||||||

ROIC – as-reported (%)(a) | (1.3 | ) | (1.9 | ) | (1.8 | ) | 3.4 | 3.4 | 0.7 | 2.4 | 7.0 | (0.7 | ) | (0.7 | ) | 4.1 | |||||||||||||||||

ROE – as-reported (%)(a) | (8.4 | ) | (9.8 | ) | (9.4 | ) | 5.1 | 5.1 | (2.5 | ) | 1.7 | 13.4 | (6.7 | ) | (6.7 | ) | 11.8 | ||||||||||||||||

Book value per share | $44.90 | $46.63 | $48.38 | $44.28 | $44.28 | $52.38 | $54.54 | $56.21 | $45.12 | $45.12 | ($0.84 | ) | |||||||||||||||||||||

End of period shares outstanding (millions) | 179.4 | 179.5 | 179.6 | 180.5 | 180.5 | 178.7 | 178.9 | 179.1 | 179.1 | 179.1 | 1.4 | ||||||||||||||||||||||

Cash and cash equivalents ($ millions) | 1,083 | 934 | 546 | 781 | 781 | 1,092 | 996 | 1,307 | 1,188 | 1,188 | (407 | ) | |||||||||||||||||||||

Revolver capacity ($ millions) | 4,185 | 4,163 | 4,213 | 4,174 | 4,174 | 3,794 | 4,173 | 4,243 | 3,720 | 3,720 | 454 | ||||||||||||||||||||||

Commercial paper ($ millions) | 1,088 | 1,147 | 1,272 | 1,467 | 1,467 | 578 | 853 | 264 | 344 | 344 | 1,123 | ||||||||||||||||||||||

Total debt ($ millions) | 15,611 | 16,285 | 16,224 | 16,677 | 16,677 | 15,092 | 14,837 | 15,073 | 15,275 | 15,275 | 1,402 | ||||||||||||||||||||||

Securitization debt ($ millions) | 637 | 602 | 582 | 545 | 545 | 752 | 716 | 698 | 661 | 661 | (116 | ) | |||||||||||||||||||||

Debt to capital (%) | 65.4 | 65.5 | 64.6 | 67.1 | 67.1 | 60.9 | 59.6 | 59.4 | 64.8 | 64.8 | 2.3 | ||||||||||||||||||||||

Off-balance sheet liabilities ($ millions) | |||||||||||||||||||||||||||||||||

Debt of joint ventures – Entergy’s share | 71 | 70 | 68 | 67 | 67 | 77 | 76 | 74 | 72 | 72 | (5 | ) | |||||||||||||||||||||

Leases – Entergy’s share | 397 | 397 | 397 | 429 | 429 | 359 | 359 | 359 | 397 | 397 | 32 | ||||||||||||||||||||||

Power purchase agreements accounted for as leases(b) | 166 | 166 | 166 | 136 | 136 | 195 | 195 | 195 | 166 | 166 | (30 | ) | |||||||||||||||||||||

Total off-balance sheet liabilities | 634 | 633 | 631 | 632 | 632 | 631 | 630 | 628 | 635 | 635 | ($3 | ) | |||||||||||||||||||||

NON-GAAP MEASURES | |||||||||||||||||||||||||||||||||

ROIC – operational (%)(a) | 6.7 | 6.5 | 6.5 | 7.1 | 7.1 | 5.8 | 7.5 | 7.9 | 7.2 | 7.2 | (0.1 | ) | |||||||||||||||||||||

ROE – operational (%)(a) | 13.9 | 13.3 | 13.0 | 16.2 | 16.2 | 10.4 | 14.3 | 15.6 | 14.7 | 14.7 | 1.5 | ||||||||||||||||||||||

Gross liquidity ($ millions) | 5,268 | 5,097 | 4,759 | 4,955 | 4,955 | 4,886 | 5,169 | 5,550 | 4,908 | 4,908 | 47 | ||||||||||||||||||||||

Debt to capital, excluding securitization debt (%) | 64.4 | 64.7 | 63.8 | 66.3 | 66.3 | 59.7 | 58.4 | 58.3 | 63.8 | 63.8 | 2.5 | ||||||||||||||||||||||

Net debt to net capital, excluding securitization debt (%) | 62.7 | 63.2 | 62.9 | 65.2 | 65.2 | 57.8 | 56.6 | 55.9 | 61.8 | 61.8 | 3.4 | ||||||||||||||||||||||

Parent debt to total debt, excluding securitization debt (%) | 21.1 | 20.5 | 20.9 | 21.9 | 21.9 | 19.5 | 19.1 | 19.4 | 19.8 | 19.8 | 2.1 | ||||||||||||||||||||||

Debt to operational adjusted EBITDA, excluding securitization debt (times) | 4.4 | 4.6 | 4.6 | 4.8 | 4.8 | 4.6 | 4.4 | 4.2 | 4.1 | 4.1 | 0.7 | ||||||||||||||||||||||

Operational FFO to debt, excluding securitization debt (%) | 17.3 | 15.2 | 15.3 | 15.9 | 15.9 | 21.0 | 21.1 | 21.1 | 18.8 | 18.8 | (2.9 | ) | |||||||||||||||||||||

Totals may not foot due to rounding. | |||||||||||||||||||||||||||||||||

(a) Rolling twelve months. | |||||||||||||||||||||||||||||||||

(b) For further detail, see Note 10 on page 156 of the 2017 SEC Form 10-K. | |||||||||||||||||||||||||||||||||

CONSOLIDATED ANNUAL FINANCIAL METRICS | |||||||||||||||||||||

2017 | 2016 | 2015 | 2014 | 2013 | |||||||||||||||||

GAAP MEASURES | |||||||||||||||||||||

ROIC – as-reported (%) | 3.4 | (0.7 | ) | 1.0 | 5.6 | 4.7 | |||||||||||||||

ROE – as-reported (%) | 5.1 | (6.7 | ) | (1.8 | ) | 9.6 | 7.6 | ||||||||||||||

Book value per share | $44.28 | $45.12 | $51.89 | $55.83 | $54.00 | ||||||||||||||||

End of period shares outstanding (millions) | 180.5 | 179.1 | 178.4 | 179.2 | 178.4 | ||||||||||||||||

Cash and cash equivalents ($ millions) | 781 | 1,188 | 1,351 | 1,422 | 739 | ||||||||||||||||

Revolver capacity ($ millions) | 4,174 | 3,720 | 3,582 | 3,592 | 3,977 | ||||||||||||||||

Commercial paper ($ millions) | 1,467 | 344 | 422 | 484 | 1,045 | ||||||||||||||||

Total debt ($ millions) | 16,677 | 15,275 | 13,850 | 13,917 | 13,562 | ||||||||||||||||

Securitization debt ($ millions) | 545 | 661 | 775 | 777 | 883 | ||||||||||||||||

Debt to capital (%) | 67.1 | 64.8 | 59.1 | 57.4 | 57.7 | ||||||||||||||||

Off-balance sheet liabilities ($ millions) | |||||||||||||||||||||

Debt of joint ventures – Entergy’s share | 67 | 72 | 77 | 81 | 86 | ||||||||||||||||

Leases – Entergy’s share | 429 | 397 | 359 | 422 | 456 | ||||||||||||||||

Power purchase agreements accounted for as leases(a) | 136 | 166 | 195 | 224 | 253 | ||||||||||||||||

Total off-balance sheet liabilities | 632 | 635 | 631 | 727 | 795 | ||||||||||||||||

NON-GAAP MEASURES | |||||||||||||||||||||

ROIC – operational (%) | 7.1 | 7.2 | 6.3 | 6.1 | 5.8 | ||||||||||||||||

ROE – operational (%) | 16.2 | 14.7 | 11.2 | 10.7 | 10.2 | ||||||||||||||||

Gross liquidity ($ millions) | 4,955 | 4,908 | 4,933 | 5,014 | 4,716 | ||||||||||||||||

Debt to capital, excluding securitization debt (%) | 66.3 | 63.8 | 57.7 | 56.0 | 56.1 | ||||||||||||||||

Net debt to net capital, excluding securitization debt (%) | 65.2 | 61.8 | 55.0 | 53.2 | 54.6 | ||||||||||||||||

Parent debt to total debt, excluding securitization debt (%) | 21.9 | 19.8 | 21.9 | 20.4 | 21.9 | ||||||||||||||||

Debt to operational adjusted EBITDA, excluding securitization debt (times) | 4.8 | 4.1 | 4.1 | 3.7 | 4.0 | ||||||||||||||||

Operational FFO to debt, excluding securitization debt (%) | 15.9 | 18.8 | 25.7 | 27.8 | 27.0 | ||||||||||||||||

Totals may not foot due to rounding. | |||||||||||||||||||||

(a) For further detail, see Note 10 on page 156 of the 2017 SEC Form 10-K. | |||||||||||||||||||||

FINANCIAL RESULTS | ||||||||||||||||||||||

ENTERGY CORPORATION CONSOLIDATED QUARTERLY RESULTS – GAAP TO NON-GAAP RECONCILIATION | ||||||||||||||||||||||

2017 | 2016 | FY | ||||||||||||||||||||

(After-tax, per share in $) (a) | 1Q | 2Q | 3Q | 4Q | FY | 1Q | 2Q | 3Q | 4Q | FY | CHANGE | |||||||||||

AS-REPORTED | ||||||||||||||||||||||

Utility | 0.92 | 1.35 | 2.22 | (0.26 | ) | 4.22 | 1.09 | 2.09 | 2.47 | 0.67 | 6.34 | (2.12 | ) | |||||||||

Parent & Other | (0.30 | ) | (0.32 | ) | (0.32 | ) | (0.04 | ) | (0.97 | ) | (0.25 | ) | (0.32 | ) | (0.35 | ) | (0.32 | ) | (1.24 | ) | 0.27 | |

Entergy Wholesale Commodities | (0.16 | ) | 1.24 | 0.31 | (2.36 | ) | (0.97 | ) | 0.44 | 1.39 | 0.04 | (10.23 | ) | (8.36 | ) | 7.39 | ||||||

CONSOLIDATED AS-REPORTED EARNINGS (LOSS) | 0.46 | 2.27 | 2.21 | (2.66 | ) | 2.28 | 1.28 | 3.16 | 2.16 | (9.88 | ) | (3.26 | ) | 5.54 | ||||||||

LESS SPECIAL ITEMS | ||||||||||||||||||||||

Utility | — | — | — | (1.00 | ) | (1.00 | ) | — | — | — | — | — | (1.00 | ) | ||||||||

Parent & Other | — | — | — | 0.29 | 0.29 | — | — | — | — | — | 0.29 | |||||||||||

Entergy Wholesale Commodities | (0.53 | ) | (0.84 | ) | (0.14 | ) | (2.71 | ) | (4.21 | ) | (0.07 | ) | 0.05 | (0.15 | ) | (10.19 | ) | (10.37 | ) | 6.16 | ||

TOTAL SPECIAL ITEMS | (0.53 | ) | (0.84 | ) | (0.14 | ) | (3.42 | ) | (4.92 | ) | (0.07 | ) | 0.05 | (0.15 | ) | (10.19 | ) | (10.37 | ) | 5.45 | ||

OPERATIONAL | ||||||||||||||||||||||

Utility | 0.92 | 1.35 | 2.22 | 0.74 | 5.22 | 1.09 | 2.09 | 2.47 | 0.67 | 6.34 | (1.12 | ) | ||||||||||

Parent & Other | (0.30 | ) | (0.32 | ) | (0.32 | ) | (0.33 | ) | (1.26 | ) | (0.25 | ) | (0.32 | ) | (0.35 | ) | (0.32 | ) | (1.24 | ) | (0.02 | ) |

Entergy Wholesale Commodities | 0.37 | 2.08 | 0.45 | 0.35 | 3.24 | 0.51 | 1.34 | 0.19 | (0.04 | ) | 2.01 | 1.23 | ||||||||||

CONSOLIDATED OPERATIONAL EARNINGS (LOSS) | 0.99 | 3.11 | 2.35 | 0.76 | 7.20 | 1.35 | 3.11 | 2.31 | 0.31 | 7.11 | 0.09 | |||||||||||

Weather Impact | (0.16 | ) | (0.09 | ) | (0.25 | ) | 0.06 | (0.44 | ) | (0.14 | ) | (0.09 | ) | 0.18 | 0.11 | 0.06 | (0.50 | ) | ||||

SHARES OF COMMON STOCK OUTSTANDING | ||||||||||||||||||||||

($ millions) | ||||||||||||||||||||||

End of period | 179.4 | 179.5 | 179.6 | 180.5 | 180.5 | 178.7 | 178.9 | 179.1 | 179.1 | 179.1 | 1.4 | |||||||||||

Weighted average - diluted | 179.8 | 180.2 | 180.5 | 180.3 | 180.5 | 179.0 | 179.5 | 180.0 | 179.1 | 178.9 | 1.6 | |||||||||||

Totals may not foot due to rounding. | ||||||||||||||||||||||

(a) Per share amounts are calculated by dividing the corresponding line item in the chart above by the diluted average number of common shares outstanding for the period. | ||||||||||||||||||||||

UTILITY, PARENT & OTHER QUARTERLY RESULTS – GAAP TO NON-GAAP RECONCILIATION | ||||||||||||||||||||||

2017 | 2016 | FY | ||||||||||||||||||||

($ millions) | 1Q | 2Q | 3Q | 4Q | FY | 1Q | 2Q | 3Q | 4Q | FY | CHANGE | |||||||||||

Utility as-reported earnings (loss) | 164.7 | 243.5 | 400.8 | (47.4 | ) | 761.6 | 194.9 | 375.6 | 443.3 | 120.4 | 1,134.2 | (372.6 | ) | |||||||||

Parent & Other as-reported earnings (loss) | (54.4 | ) | (56.9 | ) | (57.9 | ) | (6.3 | ) | (175.5 | ) | (44.0 | ) | (58.6 | ) | (62.8 | ) | (57.1 | ) | (222.5 | ) | 47.1 | |

UP&O AS-REPORTED EARNINGS (LOSS) | 110.3 | 186.6 | 343.0 | (53.8 | ) | 586.1 | 151.0 | 317.0 | 380.5 | 63.3 | 911.7 | (325.6 | ) | |||||||||

LESS: | ||||||||||||||||||||||

Special items | — | — | — | (128.5 | ) | (128.5 | ) | — | — | — | — | — | (128.5 | ) | ||||||||

Weather | (47.5 | ) | (25.9 | ) | (72.7 | ) | 18.3 | (127.8 | ) | (41.3 | ) | (26.6 | ) | 55.0 | 31.0 | 18.1 | (145.9 | ) | ||||

Tax effect of weather (a) | 18.3 | 10.0 | 28.0 | (7.0 | ) | 49.2 | 15.9 | 10.2 | (21.1 | ) | (12.0 | ) | (7.0 | ) | 56.2 | |||||||

Estimated weather impact (after-tax) | (29.2 | ) | (15.9 | ) | (44.7 | ) | 11.3 | (78.6 | ) | (25.4 | ) | (16.3 | ) | 33.8 | 19.1 | 11.1 | (89.7 | ) | ||||

Customer sharing | — | — | — | — | — | — | (16.1 | ) | — | — | (16.1 | ) | 16.1 | |||||||||

Tax effect of customer sharing (a) | — | — | — | — | — | — | 6.2 | — | — | 6.2 | (6.2 | ) | ||||||||||

Other income tax items | (9.4 | ) | 0.5 | 0.2 | (22.3 | ) | (31.0 | ) | 6.0 | 132.4 | (6.6 | ) | (4.9 | ) | 126.9 | (157.9 | ) | |||||

Tax items, net of customer sharing | (9.4 | ) | 0.5 | 0.2 | (22.3 | ) | (31.0 | ) | 6.0 | 122.5 | (6.6 | ) | (4.9 | ) | 117.0 | (147.9 | ) | |||||

UP&O ADJUSTED EARNINGS (LOSS) | 148.9 | 202.0 | 387.5 | 85.7 | 824.2 | 170.3 | 210.9 | 353.2 | 49.2 | 783.6 | 40.6 | |||||||||||

(After-tax, per share in $) (b) | ||||||||||||||||||||||

Utility as-reported earnings (loss) | 0.92 | 1.35 | 2.22 | (0.26 | ) | 4.22 | 1.09 | 2.09 | 2.47 | 0.67 | 6.34 | (2.12 | ) | |||||||||

Parent & Other as-reported earnings (loss) | (0.30 | ) | (0.32 | ) | (0.32 | ) | (0.04 | ) | (0.97 | ) | (0.25 | ) | (0.32 | ) | (0.35 | ) | (0.32 | ) | (1.24 | ) | 0.27 | |

UP&O AS-REPORTED EARNINGS (LOSS) | 0.62 | 1.03 | 1.90 | (0.30 | ) | 3.25 | 0.84 | 1.77 | 2.12 | 0.35 | 5.10 | (1.85 | ) | |||||||||

LESS: | ||||||||||||||||||||||

Special items | — | — | — | (0.71 | ) | (0.71 | ) | — | — | — | — | — | (0.71 | ) | ||||||||

Weather | (0.16 | ) | (0.09 | ) | (0.25 | ) | 0.06 | (0.44 | ) | (0.14 | ) | (0.09 | ) | 0.18 | 0.11 | 0.06 | (0.50 | ) | ||||

Tax items, net of customer sharing | (0.05 | ) | — | — | (0.12 | ) | (0.17 | ) | 0.03 | 0.68 | (0.04 | ) | (0.03 | ) | 0.66 | (0.82 | ) | |||||

UP&O ADJUSTED EARNINGS (LOSS) | 0.83 | 1.12 | 2.15 | 0.48 | 4.57 | 0.95 | 1.18 | 1.98 | 0.27 | 4.38 | 0.18 | |||||||||||

Totals may not foot due to rounding. | ||||||||||||||||||||||

(a) Income tax effect is calculated by multiplying the pre-tax amount by the estimated income tax rates that are expected to apply to those adjustments. | ||||||||||||||||||||||

(b) Per share amounts are calculated by dividing the corresponding line item in the chart above by the diluted average number of common shares outstanding for the period. | ||||||||||||||||||||||

FINANCIAL RESULTS | ||||||||||||||||||||||

ENTERGY CORPORATION CONSOLIDATED QUARTERLY SPECIAL ITEMS - BY ITEM TYPE | ||||||||||||||||||||||

Shown as Positive/(Negative) Impact on Earnings | ||||||||||||||||||||||

2017 | 2016 | FY | ||||||||||||||||||||

(Pre-tax except for income tax effects and total, $ millions) | 1Q | 2Q | 3Q | 4Q | FY | 1Q | 2Q | 3Q | 4Q | FY | CHANGE | |||||||||||

UTILITY | ||||||||||||||||||||||

SPECIAL ITEMS | ||||||||||||||||||||||

Tax reform | — | — | — | (180.7 | ) | (180.7 | ) | — | — | — | — | — | (180.7 | ) | ||||||||

Total | — | — | — | (180.7 | ) | (180.7 | ) | — | — | — | — | — | (180.7 | ) | ||||||||

PARENT & OTHER | ||||||||||||||||||||||

SPECIAL ITEMS | ||||||||||||||||||||||

Tax reform | — | — | — | 52.1 | 52.1 | — | — | — | — | — | 52.1 | |||||||||||

Total | — | — | — | 52.1 | 52.1 | — | — | — | — | — | 52.1 | |||||||||||

ENTERGY WHOLESALE COMMODITIES SPECIAL ITEMS | ||||||||||||||||||||||

Items associated with decisions to close or sell EWC nuclear plants | (230.9 | ) | (232.8 | ) | (39.3 | ) | (140.6 | ) | (643.7 | ) | (19.9 | ) | (19 | ) | (42.4 | ) | (2,828.5 | ) | (2,909.8 | ) | 2,266.2 | |

Gain on the sale of FitzPatrick | 16.3 | — | — | — | 16.3 | — | — | — | — | — | 16.3 | |||||||||||

DOE litigation awards | — | — | — | — | — | — | 33.8 | — | — | 33.8 | (33.8 | ) | ||||||||||

Income tax effect on adjustments above (a) | 75.1 | 81.5 | 13.7 | 49.2 | 219.6 | 7.0 | (5.2 | ) | 15.0 | 1,003.9 | 1,020.7 | (801.1 | ) | |||||||||

Income tax benefit resulting from FitzPatrick transaction | 44.5 | — | — | — | 44.5 | — | — | — | — | — | 44.5 | |||||||||||

Tax reform | — | — | — | (396.7 | ) | (396.7 | ) | — | — | — | — | — | (396.7 | ) | ||||||||

Total | (95.1 | ) | (151.3 | ) | (25.5 | ) | (488.1 | ) | (760.0 | ) | (12.9 | ) | 9.6 | (27.5 | ) | (1,824.6 | ) | (1,855.3 | ) | 1,095.2 | ||

TOTAL SPECIAL ITEMS | (95.1 | ) | (151.3 | ) | (25.5 | ) | (616.7 | ) | (888.6 | ) | (12.9 | ) | 9.6 | (27.5 | ) | (1,824.6 | ) | (1,855.3 | ) | 966.7 | ||

2017 | 2016 | FY | ||||||||||||||||||||

(After-tax, per share in $) (b) | 1Q | 2Q | 3Q | 4Q | FY | 1Q | 2Q | 3Q | 4Q | FY | CHANGE | |||||||||||

UTILITY | ||||||||||||||||||||||

SPECIAL ITEMS | ||||||||||||||||||||||

Tax reform | — | — | — | (1.00 | ) | (1.00 | ) | — | — | — | — | — | (1.00 | ) | ||||||||

Total | — | — | — | (1.00 | ) | (1.00 | ) | — | — | — | — | — | (1.00 | ) | ||||||||

PARENT & OTHER | ||||||||||||||||||||||

SPECIAL ITEMS | ||||||||||||||||||||||

Tax reform | — | — | — | 0.29 | 0.29 | — | — | — | — | — | 0.29 | |||||||||||

Total | — | — | — | 0.29 | 0.29 | — | — | — | — | — | 0.29 | |||||||||||

ENTERGY WHOLESALE COMMODITIES SPECIAL ITEMS | ||||||||||||||||||||||

Items associated with decisions to close or sell EWC nuclear plants | (0.84 | ) | (0.84 | ) | (0.14 | ) | (0.51 | ) | (2.32 | ) | (0.07 | ) | (0.07 | ) | (0.15 | ) | (10.19 | ) | (10.49 | ) | 8.17 | |

Gain on the sale of FitzPatrick | 0.06 | — | — | — | 0.06 | — | — | — | — | — | 0.06 | |||||||||||

DOE litigation awards | — | — | — | — | — | — | 0.12 | — | — | 0.12 | (0.12 | ) | ||||||||||

Income tax benefit resulting from FitzPatrick transaction | 0.25 | — | — | — | 0.25 | — | — | — | — | — | 0.25 | |||||||||||

Tax reform | — | — | — | (2.20 | ) | (2.20 | ) | — | — | — | — | — | (2.20 | ) | ||||||||

Total | (0.53 | ) | (0.84 | ) | (0.14 | ) | (2.71 | ) | (4.21 | ) | (0.07 | ) | 0.05 | (0.15 | ) | (10.19 | ) | (10.37 | ) | 6.16 | ||

TOTAL SPECIAL ITEMS | (0.53 | ) | (0.84 | ) | (0.14 | ) | (3.42 | ) | (4.92 | ) | (0.07 | ) | 0.05 | (0.15 | ) | (10.19 | ) | (10.37 | ) | 5.45 | ||

Totals may not foot due to rounding. | ||||||||||||||||||||||

(a) Income tax effect is calculated by multiplying the pre-tax amount by the estimated income tax rate that is expected to apply. | ||||||||||||||||||||||

(b) EPS effect is calculated by multiplying the pre-tax amount by the estimated income tax rate that is expected to apply to each adjustment and then dividing by the diluted | ||||||||||||||||||||||

average number of common shares outstanding for the period. | ||||||||||||||||||||||

FINANCIAL RESULTS | ||||||||||||||||||||||

ENTERGY CORPORATION CONSOLIDATED QUARTERLY SPECIAL ITEMS - BY INCOME STATEMENT LINE ITEM | ||||||||||||||||||||||

Shown as Positive/(Negative) Impact on Earnings | ||||||||||||||||||||||

2017 | 2016 | FY | ||||||||||||||||||||

(Pre-tax except for Income taxes and Total, $ millions) | 1Q | 2Q | 3Q | 4Q | FY | 1Q | 2Q | 3Q | 4Q | FY | CHANGE | |||||||||||

UTILITY SPECIAL ITEMS | ||||||||||||||||||||||

Net revenue (a) | — | — | — | 55.5 | 55.5 | — | — | — | — | — | 55.5 | |||||||||||

Income taxes (c) | — | — | — | (236.2 | ) | (236.2 | ) | — | — | — | — | — | (236.2 | ) | ||||||||

Total | — | — | — | (180.7 | ) | (180.7 | ) | — | — | — | — | — | (180.7 | ) | ||||||||

PARENT & OTHER SPECIAL ITEMS | ||||||||||||||||||||||

Income taxes (c) | — | — | — | 52.1 | 52.1 | — | — | — | — | — | 52.1 | |||||||||||

Total | — | — | — | 52.1 | 52.1 | — | — | — | — | — | 52.1 | |||||||||||

ENTERGY WHOLESALE COMMODITIES SPECIAL ITEMS | ||||||||||||||||||||||

Net revenue (b) | 90.6 | 0.5 | — | — | 91.0 | — | — | 7.5 | 33.3 | 40.7 | 50.3 | |||||||||||

Non-fuel O&M | (120.3 | ) | (37.1 | ) | (21.6 | ) | (22.3 | ) | (201.3 | ) | (11.5 | ) | 22.7 | (29.3 | ) | (57.5 | ) | (75.6 | ) | (125.7 | ) | |

Asset write-offs and impairments | (211.8 | ) | (193.6 | ) | (16.2 | ) | (116.8 | ) | (538.4 | ) | (7.4 | ) | (7.0 | ) | (18.8 | ) | (2,802.5 | ) | (2,835.6 | ) | 2,297.3 | |

Taxes other than income taxes | (4.1 | ) | (2.5 | ) | (1.5 | ) | (1.6 | ) | (9.6 | ) | (1.0 | ) | (0.9 | ) | (1.8 | ) | (1.8 | ) | (5.5 | ) | (4.1 | ) |

Gain on sale of asset | 16.3 | — | — | — | 16.3 | — | — | — | — | — | 16.3 | |||||||||||

Miscellaneous net (other income) | 14.6 | — | — | — | 14.6 | — | — | — | — | — | 14.6 | |||||||||||

Income taxes (c) | 119.6 | 81.5 | 13.7 | (347.4 | ) | (132.7 | ) | 7.0 | (5.2 | ) | 15.0 | 1,003.9 | 1,020.7 | (1,153.4 | ) | |||||||

Total | (95.1 | ) | (151.3 | ) | (25.5 | ) | (488.1 | ) | (760.0 | ) | (12.9 | ) | 9.6 | (27.4 | ) | (1,824.6 | ) | (1,855.3 | ) | 1,095.2 | ||

TOTAL SPECIAL ITEMS (after-tax) | (95.1 | ) | (151.3 | ) | (25.5 | ) | (616.7 | ) | (888.6 | ) | (12.9 | ) | 9.6 | (27.4 | ) | (1,824.6 | ) | (1,855.3 | ) | 966.7 | ||

Totals may not foot due to rounding. | ||||||||||||||||||||||

(a) Operating revenue less fuel, fuel related expenses and gas purchased for resale, purchased power and other regulatory charges (credits) – net. | ||||||||||||||||||||||

(b) Operating revenue less fuel, fuel related expenses and purchased power. | ||||||||||||||||||||||

(c) Income taxes represents the income tax effect of the special items which were calculated using the estimated income tax rate that is expected to apply to each item, as well as tax adjustments as a result of tax reform. The 2017 period also includes the income tax benefit which resulted from the FitzPatrick transaction. | ||||||||||||||||||||||

FINANCIAL RESULTS | ||||||||||

ENTERGY CORPORATION CONSOLIDATED ANNUAL RESULTS – GAAP TO NON-GAAP RECONCILIATION | ||||||||||

(After-tax, per share in $) (a) | 2017 | 2016 | 2015 | 2014 | 2013 | |||||

AS-REPORTED | ||||||||||

Utility | 4.22 | 6.34 | 6.12 | 4.60 | 4.64 | |||||

Parent & Other | (0.97 | ) | (1.24 | ) | (1.15 | ) | (1.00 | ) | (0.89 | ) |

Entergy Wholesale Commodities | (0.97 | ) | (8.36 | ) | (5.96 | ) | 1.62 | 0.24 | ||

CONSOLIDATED AS-REPORTED EARNINGS | 2.28 | (3.26 | ) | (0.99 | ) | 5.22 | 3.99 | |||

LESS SPECIAL ITEMS | ||||||||||

Utility | (1.00 | ) | — | — | (0.04 | ) | (0.16 | ) | ||

Parent & Other | 0.29 | — | — | — | 0.02 | |||||

Entergy Wholesale Commodities | (4.21 | ) | (10.37 | ) | (6.99 | ) | (0.57 | ) | (1.23 | ) |

TOTAL SPECIAL ITEMS | (4.92 | ) | (10.37 | ) | (6.99 | ) | (0.61 | ) | (1.37 | ) |

OPERATIONAL | ||||||||||

Utility | 5.22 | 6.34 | 6.12 | 4.64 | 4.80 | |||||

Parent & Other | (1.26 | ) | (1.24 | ) | (1.15 | ) | (1.00 | ) | (0.91 | ) |

Entergy Wholesale Commodities | 3.24 | 2.01 | 1.03 | 2.19 | 1.47 | |||||

CONSOLIDATED OPERATIONAL EARNINGS | 7.20 | 7.11 | 6.00 | 5.83 | 5.36 | |||||

Weather Impact | (0.44 | ) | (0.06 | ) | 0.19 | 0.07 | — | |||

Totals may not foot due to rounding. | ||||||||||

(a) Per share amounts are calculated by dividing the corresponding line item in the chart above by the diluted average number of common shares outstanding for the period. | ||||||||||

FINANCIAL RESULTS | ||||||||||

ENTERGY CORPORATION CONSOLIDATED ANNUAL SPECIAL ITEMS - BY ITEM TYPE | ||||||||||

Shown as Positive/(Negative) Impact on Earnings | ||||||||||

(Pre-tax except for income tax effects and total, $ millions) | 2017 | 2016 | 2015 | 2014 | 2013 | |||||

UTILITY SPECIAL ITEMS | ||||||||||

Transmission business spin-merge expenses | — | — | — | — | (35.7 | ) | ||||

HCM implementation expenses | — | — | — | (13.2 | ) | (33.1 | ) | |||

Income tax effect on Utility adjustments above | — | — | — | 5.6 | 39.9 | |||||

Tax reform | (180.7 | ) | — | — | — | — | ||||

Total | (180.7 | ) | — | — | (7.6 | ) | (29.0 | ) | ||

PARENT & OTHER SPECIAL ITEMS | ||||||||||

Transmission business spin-merge expenses | — | — | — | — | 5.5 | |||||

HCM implementation expenses | — | — | — | — | (3.0 | ) | ||||

Income tax effect on Parent & Other adjustments above | — | — | — | — | 1.2 | |||||

Tax reform | 52.1 | — | — | — | — | |||||

Total | 52.1 | — | — | — | 3.6 | |||||

ENTERGY WHOLESALE COMMODITIES SPECIAL ITEMS | ||||||||||

Items associated with decisions to close or sell EWC nuclear plants | (643.7 | ) | (2,909.8 | ) | (2,053.5 | ) | (154.5 | ) | (343.1 | ) |

Top Deer investment impairment | — | — | (36.8 | ) | — | — | ||||

Gain on the sale of RISEC | — | — | 154.0 | — | — | |||||

Gain on the sale of FitzPatrick | 16.3 | — | — | — | — | |||||

DOE litigation awards | — | 33.8 | — | — | — | |||||

HCM implementation expenses | — | — | — | (3.4 | ) | (24.4 | ) | |||

Income tax effect on EWC adjustments above (a) | 219.6 | 1,020.7 | 683.8 | 56.1 | 147.7 | |||||

Income tax benefit resulting from FitzPatrick transaction | 44.5 | — | — | — | — | |||||

Tax reform | (396.7 | ) | — | — | — | — | ||||

Total | (760.0 | ) | (1,855.3 | ) | (1,252.4 | ) | (101.8 | ) | (219.8 | ) |

TOTAL SPECIAL ITEMS | (888.6 | ) | (1,855.3 | ) | (1,252.4 | ) | (109.4 | ) | (245.2 | ) |

(After-tax, per share in $) (b) | 2017 | 2016 | 2015 | 2014 | 2013 | |||||

UTILITY SPECIAL ITEMS | ||||||||||

Transmission business spin-merge expenses | — | — | — | — | (0.05 | ) | ||||

HCM implementation expenses | — | — | — | (0.04 | ) | (0.11 | ) | |||

Tax reform | (1.00 | ) | — | — | — | — | ||||

Total | (1.00 | ) | — | — | (0.04 | ) | (0.16 | ) | ||

PARENT & OTHER SPECIAL ITEMS | ||||||||||

Transmission business spin-merge expenses | — | — | — | — | 0.03 | |||||

HCM implementation expenses | — | — | — | — | (0.01 | ) | ||||

Tax reform | 0.29 | — | — | — | — | |||||

Total | 0.29 | — | — | — | 0.02 | |||||

ENTERGY WHOLESALE COMMODITIES SPECIAL ITEMS | ||||||||||

Items associated with decisions to close or sell EWC nuclear plants | (2.32 | ) | (10.49 | ) | (7.42 | ) | (0.56 | ) | (1.15 | ) |

Top Deer investment impairment | — | — | (0.13 | ) | — | — | ||||

Gain on the sale of RISEC | — | — | 0.56 | — | — | |||||

Gain on the sale of FitzPatrick | 0.06 | |||||||||

DOE litigation awards | — | 0.12 | — | — | — | |||||

HCM implementation expenses | — | — | — | (0.01 | ) | (0.08 | ) | |||

Income tax benefit resulting from FitzPatrick transaction | 0.25 | — | — | — | — | |||||

Tax reform | (2.20 | ) | — | — | — | — | ||||

Total | (4.21 | ) | (10.37 | ) | (6.99 | ) | (0.57 | ) | (1.23 | ) |

TOTAL SPECIAL ITEMS | (4.92 | ) | (10.37 | ) | (6.99 | ) | (0.61 | ) | (1.37 | ) |

Totals may not foot due to rounding. | ||||||||||

(a) Income tax effect is calculated by multiplying the pre-tax amount by the estimated income tax rate that is expected to apply. | ||||||||||

(b) EPS effect is calculated by multiplying the pre-tax amount by the estimated income tax rate that is expected to apply to each adjustment and then dividing by the | ||||||||||

diluted average number of common shares outstanding for the period. | ||||||||||

FINANCIAL RESULTS | ||||||||||

ENTERGY CORPORATION CONSOLIDATED ANNUAL SPECIAL ITEMS - BY INCOME STATEMENT LINE ITEM | ||||||||||

Shown as Positive/(Negative) Impact on Earnings | ||||||||||

(Pre-tax except for Income taxes and Total, $ millions) | 2017 | 2016 | 2015 | 2014 | 2013 | |||||

UTILITY SPECIAL ITEMS | ||||||||||

Net revenue (a) | 55.5 | — | — | — | 5.7 | |||||

Non-fuel O&M | — | — | — | (12.6 | ) | (64.0 | ) | |||

Asset write-offs and impairments | — | — | — | — | (9.4 | ) | ||||

Taxes other than income taxes | — | — | — | (0.6 | ) | (1.0 | ) | |||

Income taxes (c) | (236.2 | ) | — | — | 5.6 | 39.7 | ||||

Total | (180.7 | ) | — | — | (7.6 | ) | (29.0 | ) | ||

PARENT & OTHER SPECIAL ITEMS | ||||||||||

Non-fuel O&M | — | — | — | — | (0.3 | ) | ||||

Asset write-offs and impairments | — | — | — | — | (2.8 | ) | ||||

Income taxes (c) | 52.1 | — | — | — | 6.7 | |||||

Total | 52.1 | — | — | — | 3.6 | |||||

ENTERGY WHOLESALE COMMODITIES SPECIAL ITEMS | ||||||||||

Net revenue (b) | 91.0 | 40.7 | — | — | — | |||||

Non-fuel O&M | (201.3 | ) | (75.6 | ) | (17.0 | ) | (46.8 | ) | (37.1 | ) |

Asset write-offs and impairments | (538.4 | ) | (2,835.6 | ) | (2,036.2 | ) | (107.5 | ) | (329.3 | ) |

Taxes other than income taxes | (9.6 | ) | (5.5 | ) | (0.3 | ) | (3.6 | ) | (1.1 | ) |

Gain on sale of asset | 16.3 | — | 154.0 | — | — | |||||

Miscellaneous net (other income) | 14.6 | — | (36.8 | ) | — | — | ||||

Income taxes (c) | (132.7 | ) | 1,020.7 | 683.8 | 56.1 | 147.7 | ||||

Total | (760.0 | ) | (1,855.3 | ) | (1,252.4 | ) | (101.8 | ) | (219.8 | ) |

TOTAL SPECIAL ITEMS (after-tax) | (888.6 | ) | (1,855.3 | ) | (1,252.4 | ) | (109.4 | ) | (245.2 | ) |

Totals may not foot due to rounding. | ||||||||||

(a) Operating revenue less fuel, fuel related expenses and gas purchased for resale, purchased power and other regulatory charges (credits) – net. | ||||||||||

(b) Operating revenue less fuel, fuel related expenses and purchased power. | ||||||||||

(c) Income taxes represents the income tax effect of the special items which were calculated using the estimated income tax rate that is expected | ||||||||||

to apply to each item, as well as tax adjustments as a result of tax reform. The 2017 period also includes the income tax benefit which resulted | ||||||||||

from the FitzPatrick transaction. | ||||||||||

(Page left blank intentionally) | |||||||||

FINANCIAL RESULTS | |||||||||||||||

CONSOLIDATED STATEMENTS OF OPERATIONS (unaudited) | |||||||||||||||

In thousands, except share data, for the years ended December 31, | 2017 | 2016 | 2015 | 2014 | 2013 | ||||||||||

OPERATING REVENUES: | |||||||||||||||

Electric | $9,278,895 | $8,866,659 | $9,308,678 | $9,591,902 | $8,942,360 | ||||||||||

Natural gas | 138,856 | 129,348 | 142,746 | 181,794 | 154,353 | ||||||||||

Competitive businesses | 1,656,730 | 1,849,638 | 2,061,827 | 2,721,225 | 2,294,234 | ||||||||||

Total | 11,074,481 | 10,845,645 | 11,513,251 | 12,494,921 | 11,390,947 | ||||||||||

OPERATING EXPENSES: | |||||||||||||||

Operation and maintenance: | |||||||||||||||

Fuel, fuel-related expenses, and gas purchased for resale | 1,991,589 | 1,809,200 | 2,452,171 | 2,632,558 | 2,445,818 | ||||||||||

Purchased power | 1,427,950 | 1,220,527 | 1,390,805 | 1,915,414 | 1,554,332 | ||||||||||

Nuclear refueling outage expenses | 168,151 | 208,678 | 251,316 | 267,679 | 256,801 | ||||||||||

Other operation and maintenance | 3,423,689 | 3,296,711 | 3,354,981 | 3,310,536 | 3,331,934 | ||||||||||

Asset write-offs, impairments, and related charges | 538,372 | 2,835,637 | 2,104,906 | 179,752 | 341,537 | ||||||||||

Decommissioning | 405,685 | 327,425 | 280,272 | 272,621 | 242,104 | ||||||||||

Taxes other than income taxes | 617,556 | 592,502 | 619,422 | 604,606 | 600,350 | ||||||||||

Depreciation and amortization | 1,389,978 | 1,347,187 | 1,337,276 | 1,318,638 | 1,261,044 | ||||||||||

Other regulatory charges (credits) – net | (131,901 | ) | 94,243 | 175,304 | (13,772 | ) | 45,597 | ||||||||

Total | 9,831,069 | 11,732,110 | 11,966,453 | 10,488,032 | 10,079,517 | ||||||||||

Gain on sale of asset | 16,270 | — | 154,037 | — | 43,569 | ||||||||||

OPERATING INCOME (LOSS) | 1,259,682 | (886,465 | ) | (299,165 | ) | 2,006,889 | 1,354,999 | ||||||||

OTHER INCOME: | |||||||||||||||

Allowance for equity funds used during construction | 95,088 | 67,563 | 51,908 | 64,802 | 66,053 | ||||||||||

Interest and investment income | 288,197 | 145,127 | 187,062 | 147,686 | 199,300 | ||||||||||

Miscellaneous – net | (12,701 | ) | (41,617 | ) | (95,997 | ) | (42,016 | ) | (59,762 | ) | |||||

Total | 370,584 | 171,073 | 142,973 | 170,472 | 205,591 | ||||||||||

INTEREST EXPENSE: | |||||||||||||||

Interest expense | 707,212 | 700,545 | 670,096 | 661,083 | 629,537 | ||||||||||

Allowance for borrowed funds used during construction | (44,869 | ) | (34,175 | ) | (26,627 | ) | (33,576 | ) | (25,500 | ) | |||||

Total | 662,343 | 666,370 | 643,469 | 627,507 | 604,037 | ||||||||||

INCOME (LOSS) BEFORE INCOME TAXES | 967,923 | (1,381,762 | ) | (799,661 | ) | 1,549,854 | 956,553 | ||||||||

Income taxes | 542,570 | (817,259 | ) | (642,927 | ) | 589,597 | 225,981 | ||||||||

CONSOLIDATED NET INCOME (LOSS) | 425,353 | (564,503 | ) | (156,734 | ) | 960,257 | 730,572 | ||||||||

Preferred dividend requirements of subsidiaries | 13,741 | 19,115 | 19,828 | 19,536 | 18,670 | ||||||||||

NET INCOME (LOSS) ATTRIBUTABLE TO ENTERGY CORPORATION | $411,612 | ($583,618 | ) | ($176,562 | ) | $940,721 | $711,902 | ||||||||

Basic earnings (loss) per average common share | $2.29 | ($3.26 | ) | ($0.99 | ) | $5.24 | $3.99 | ||||||||

Diluted earnings (loss) per average common share | $2.28 | ($3.26 | ) | ($0.99 | ) | $5.22 | $3.99 | ||||||||

Basic average number of common shares outstanding | 179,671,797 | 178,885,660 | 179,176,356 | 179,506,151 | 178,211,192 | ||||||||||

Diluted average number of common shares outstanding | 180,535,893 | 178,885,660 | 179,176,356 | 180,296,885 | 178,570,400 | ||||||||||

FINANCIAL RESULTS | ||||||||||||

2017 CONSOLIDATING INCOME STATEMENT (unaudited) | ||||||||||||

PARENT & | ENTERGY | |||||||||||

In thousands, except share data, for the year ended December 31, 2017. | UTILITY | OTHER | EWC | CONSOLIDATED | ||||||||

OPERATING REVENUES: | ||||||||||||

Electric | $9,279,010 | ($115 | ) | $— | $9,278,895 | |||||||

Natural gas | 138,856 | — | — | 138,856 | ||||||||

Competitive businesses | — | — | 1,656,730 | 1,656,730 | ||||||||

Total | 9,417,866 | (115 | ) | 1,656,730 | 11,074,481 | |||||||

OPERATING EXPENSES: | ||||||||||||

Operation and maintenance: | ||||||||||||

Fuel, fuel-related expenses, and gas purchased for resale | 1,908,576 | (115 | ) | 83,128 | 1,991,589 | |||||||

Purchased power | 1,323,161 | 115 | 104,674 | 1,427,950 | ||||||||

Nuclear refueling outage expenses | 154,010 | — | 14,141 | 168,151 | ||||||||

Other operation and maintenance | 2,467,997 | 27,128 | 928,564 | 3,423,689 | ||||||||

Asset write-offs, impairments, and related charges | — | — | 538,372 | 538,372 | ||||||||

Decommissioning | 150,727 | — | 254,958 | 405,685 | ||||||||

Taxes other than income taxes | 536,407 | 1,532 | 79,617 | 617,556 | ||||||||

Depreciation and amortization | 1,195,179 | 1,678 | 193,121 | 1,389,978 | ||||||||

Other regulatory charges (credits) - net | (131,901 | ) | — | — | (131,901 | ) | ||||||

Total | 7,604,156 | 30,338 | 2,196,575 | 9,831,069 | ||||||||

Gain on sale of asset | — | — | 16,270 | 16,270 | ||||||||

OPERATING INCOME (LOSS) | 1,813,710 | (30,453 | ) | (523,575 | ) | 1,259,682 | ||||||

OTHER INCOME: | ||||||||||||

Allowance for equity funds used during construction | 95,088 | — | — | 95,088 | ||||||||

Interest and investment income | 218,317 | (154,241 | ) | 224,121 | 288,197 | |||||||

Miscellaneous – net | (12,050 | ) | (5,004 | ) | 4,353 | (12,701 | ) | |||||

Total | 301,355 | (159,245 | ) | 228,474 | 370,584 | |||||||

INTEREST EXPENSE: | ||||||||||||

Interest expense | 592,170 | 91,328 | 23,714 | 707,212 | ||||||||

Allowance for borrowed funds used during construction | (44,869 | ) | — | — | (44,869 | ) | ||||||

Total | 547,301 | 91,328 | 23,714 | 662,343 | ||||||||

INCOME (LOSS) BEFORE INCOME TAXES | 1,567,764 | (281,026 | ) | (318,815 | ) | 967,923 | ||||||

Income taxes | 794,616 | (105,566 | ) | (146,480 | ) | 542,570 | ||||||

CONSOLIDATED NET INCOME (LOSS) | 773,148 | (175,460 | ) | (172,335 | ) | 425,353 | ||||||

Preferred dividend requirements of subsidiaries | 11,553 | — | 2,188 | 13,741 | ||||||||

NET INCOME (LOSS) ATTRIBUTABLE TO ENTERGY CORPORATION | $761,595 | ($175,460 | ) | ($174,523 | ) | $411,612 | ||||||

Basic earnings (loss) per average common share | $4.24 | ($0.98 | ) | ($0.97 | ) | $2.29 | ||||||

Diluted earnings (loss) per average common share | $4.22 | ($0.97 | ) | ($0.97 | ) | $2.28 | ||||||

Totals may not foot due to rounding. | ||||||||||||

FINANCIAL RESULTS | |||||||||||||||

CONSOLIDATED BALANCE SHEETS (unaudited) | |||||||||||||||

In thousands, as of December 31, | 2017 | 2016 | 2015 | 2014 | 2013 | ||||||||||

ASSETS | |||||||||||||||

CURRENT ASSETS: | |||||||||||||||

Cash and cash equivalents: | |||||||||||||||

Cash | $56,629 | $129,579 | $63,497 | $131,327 | $129,979 | ||||||||||

Temporary cash investments | 724,644 | 1,058,265 | 1,287,464 | 1,290,699 | 609,147 | ||||||||||

Total cash and cash equivalents | 781,273 | 1,187,844 | 1,350,961 | 1,422,026 | 739,126 | ||||||||||

Accounts receivable: | |||||||||||||||

Customer | 673,347 | 654,995 | 608,491 | 596,917 | 670,641 | ||||||||||

Allowance for doubtful accounts | (13,587 | ) | (11,924 | ) | (39,895 | ) | (35,663 | ) | (34,311 | ) | |||||

Other | 169,377 | 158,419 | 178,364 | 220,342 | 195,028 | ||||||||||

Accrued unbilled revenues | 383,813 | 368,677 | 321,940 | 321,659 | 340,828 | ||||||||||

Total accounts receivable | 1,212,950 | 1,170,167 | 1,068,900 | 1,103,255 | 1,172,186 | ||||||||||

Deferred fuel costs | 95,746 | 108,465 | — | 155,140 | 116,379 | ||||||||||

Accumulated deferred income taxes | — | — | — | 27,783 | 175,073 | ||||||||||

Fuel inventory – at average cost | 182,643 | 179,600 | 217,810 | 205,434 | 208,958 | ||||||||||

Materials and supplies – at average cost | 723,222 | 698,523 | 873,357 | 918,584 | 915,006 | ||||||||||

Deferred nuclear refueling outage costs | 133,164 | 146,221 | 211,512 | 214,188 | 192,474 | ||||||||||

Prepayments and other | 156,333 | 193,448 | 344,872 | 343,223 | 410,489 | ||||||||||

Total | 3,285,331 | 3,684,268 | 4,067,412 | 4,389,633 | 3,929,691 | ||||||||||

OTHER PROPERTY AND INVESTMENTS: | |||||||||||||||

Investment in affiliates – at equity | 198 | 198 | 4,341 | 36,234 | 40,350 | ||||||||||

Decommissioning trust funds | 7,211,993 | 5,723,897 | 5,349,953 | 5,370,932 | 4,903,144 | ||||||||||

Non-utility property – at cost (less accumulated depreciation) | 260,980 | 233,641 | 219,999 | 213,791 | 199,375 | ||||||||||

Other | 441,862 | 469,664 | 468,704 | 405,169 | 210,616 | ||||||||||

Total | 7,915,033 | 6,427,400 | 6,042,997 | 6,026,126 | 5,353,485 | ||||||||||

PROPERTY, PLANT AND EQUIPMENT: | |||||||||||||||

Electric | 47,287,370 | 45,191,216 | 44,467,159 | 44,881,419 | 42,935,712 | ||||||||||

Property under capital lease | 620,544 | 619,527 | 952,465 | 945,784 | 941,299 | ||||||||||

Natural gas | 453,162 | 413,224 | 392,032 | 377,565 | 366,365 | ||||||||||

Construction work in progress | 1,980,508 | 1,378,180 | 1,456,735 | 1,425,981 | 1,514,857 | ||||||||||

Nuclear fuel | 923,200 | 1,037,899 | 1,345,422 | 1,542,055 | 1,566,904 | ||||||||||

Total property, plant and equipment | 51,264,784 | 48,640,046 | 48,613,813 | 49,172,804 | 47,325,137 | ||||||||||

Less – accumulated depreciation and amortization | 21,600,424 | 20,718,639 | 20,789,452 | 20,449,858 | 19,443,493 | ||||||||||

Property, plant and equipment – net | 29,664,360 | 27,921,407 | 27,824,361 | 28,722,946 | 27,881,644 | ||||||||||

DEFERRED DEBITS AND OTHER ASSETS: | |||||||||||||||

Regulatory assets: | |||||||||||||||

Regulatory asset for income taxes - net | — | 761,280 | 775,528 | 836,064 | 849,718 | ||||||||||

Other regulatory assets (includes securitization property of | |||||||||||||||

$485,031 as of December 31, 2017, | |||||||||||||||

$600,996 as of December 31, 2016, $714,044 as | |||||||||||||||

of December 31, 2015, $724,839 as of December 31, 2014, | |||||||||||||||

and $822,218 as of December 31, 2013) | 4,935,689 | 4,769,913 | 4,704,796 | 4,968,553 | 3,893,363 | ||||||||||

Deferred fuel costs | 239,298 | 239,100 | 238,902 | 238,102 | 172,202 | ||||||||||

Goodwill | 377,172 | 377,172 | 377,172 | 377,172 | 377,172 | ||||||||||

Accumulated deferred income taxes | 178,204 | 117,885 | 54,903 | 48,351 | 62,011 | ||||||||||

Other | 112,062 | 1,606,009 | 561,610 | 807,508 | 771,004 | ||||||||||

Total | 5,842,425 | 7,871,359 | 6,712,911 | 7,275,750 | 6,125,470 | ||||||||||

TOTAL ASSETS | $46,707,149 | $45,904,434 | $44,647,681 | $46,414,455 | $43,290,290 | ||||||||||

FINANCIAL RESULTS | |||||||||||||||

CONSOLIDATED BALANCE SHEETS (unaudited) | |||||||||||||||

In thousands, as of December 31, | 2017 | 2016 | 2015 | 2014 | 2013 | ||||||||||

LIABILITIES AND EQUITY | |||||||||||||||

CURRENT LIABILITIES: | |||||||||||||||

Currently maturing long-term debt | $760,007 | $364,900 | $214,374 | $899,375 | $457,095 | ||||||||||

Notes payable and commercial paper | 1,578,308 | 415,011 | 494,348 | 598,407 | 1,046,887 | ||||||||||

Accounts payable | 1,452,216 | 1,285,577 | 1,071,798 | 1,166,431 | 1,173,313 | ||||||||||

Customer deposits | 401,330 | 403,311 | 419,407 | 412,166 | 370,997 | ||||||||||

Taxes accrued | 214,967 | 181,114 | 210,077 | 128,108 | 191,093 | ||||||||||

Accumulated deferred income taxes | — | — | — | 38,039 | 28,307 | ||||||||||

Interest accrued | 187,972 | 187,229 | 194,565 | 206,010 | 180,997 | ||||||||||

Deferred fuel costs | 146,522 | 102,753 | 235,986 | 91,602 | 57,631 | ||||||||||

Obligations under capital leases | 1,502 | 2,423 | 2,709 | 2,508 | 2,323 | ||||||||||

Pension and other postretirement liabilities | 71,612 | 76,942 | 62,513 | 57,994 | 67,419 | ||||||||||

Other | 221,771 | 180,836 | 184,181 | 248,251 | 484,510 | ||||||||||

Total | 5,036,207 | 3,200,096 | 3,089,958 | 3,848,891 | 4,060,572 | ||||||||||

NON-CURRENT LIABILITIES: | |||||||||||||||

Accumulated deferred income taxes and taxes accrued | 4,466,503 | 7,495,290 | 8,306,865 | 9,133,161 | 8,724,635 | ||||||||||

Accumulated deferred investment tax credits | 219,634 | 227,147 | 234,300 | 247,521 | 263,765 | ||||||||||

Obligations under capital leases | 22,015 | 24,582 | 27,001 | 29,710 | 32,218 | ||||||||||

Regulatory liability for income taxes - net | 2,900,204 | — | — | — | — | ||||||||||

Other regulatory liabilities | 1,588,520 | 1,572,929 | 1,414,898 | 1,383,609 | 1,295,955 | ||||||||||

Decommissioning and asset retirement cost liabilities | 6,185,814 | 5,992,476 | 4,790,187 | 4,458,296 | 3,933,416 | ||||||||||

Accumulated provisions | 478,273 | 481,636 | 460,727 | 418,128 | 115,139 | ||||||||||

Pension and other postretirement liabilities | 2,910,654 | 3,036,010 | 3,187,357 | 3,638,295 | 2,320,704 | ||||||||||

Long-term debt (includes securitization bonds | |||||||||||||||

of $544,921 as of December 31, 2017, $661,175 as of | |||||||||||||||

December 31, 2016, $774,696 as of December 31, 2015, | |||||||||||||||

$776,817 as of December 31, 2014, and $883,013 as of | |||||||||||||||

December 31, 2013) | 14,315,259 | 14,467,655 | 13,111,556 | 12,386,710 | 12,022,993 | ||||||||||

Other | 393,748 | 1,121,619 | 449,856 | 557,649 | 583,667 | ||||||||||

Total | 33,480,624 | 34,419,344 | 31,982,747 | 32,253,079 | 29,292,492 | ||||||||||

Commitments and Contingencies | |||||||||||||||

Subsidiaries' preferred stock without sinking fund | 197,803 | 203,185 | 318,185 | 210,760 | 210,760 | ||||||||||

EQUITY: | |||||||||||||||

Common shareholders' equity: | |||||||||||||||

Common stock, $.01 par value, authorized 500,000,000 | |||||||||||||||

shares; issued 254,752,788 shares in 2017, 2016, 2015, | |||||||||||||||

2014, and 2013 | 2,548 | 2,548 | 2,548 | 2,548 | 2,548 | ||||||||||

Paid-in capital | 5,433,433 | 5,417,245 | 5,403,758 | 5,375,353 | 5,368,131 | ||||||||||

Retained earnings | 7,977,702 | 8,195,571 | 9,393,913 | 10,169,657 | 9,825,053 | ||||||||||

Accumulated other comprehensive income (loss) | (23,531 | ) | (34,971 | ) | 8,951 | (42,307 | ) | (29,324 | ) | ||||||

Less – treasury stock, at cost (74,235,135 shares in 2017, | |||||||||||||||

75,623,363 shares in 2016, 76,363,763 shares in 2015, | |||||||||||||||

75,512,079 shares in 2014, and 76,381,936 shares in 2013) | 5,397,637 | 5,498,584 | 5,552,379 | 5,497,526 | 5,533,942 | ||||||||||

Total common shareholders' equity | 7,992,515 | 8,081,809 | 9,256,791 | 10,007,725 | 9,632,466 | ||||||||||

Subsidiaries' preferred stock without sinking fund | — | — | — | 94,000 | 94,000 | ||||||||||

Total | 7,992,515 | 8,081,809 | 9,256,791 | 10,101,725 | 9,726,466 | ||||||||||

TOTAL LIABILITIES AND EQUITY | $46,707,149 | $45,904,434 | $44,647,681 | $46,414,455 | $43,290,290 | ||||||||||

FINANCIAL RESULTS | ||||||||||||

2017 CONSOLIDATING BALANCE SHEET (unaudited) | ||||||||||||

ENTERGY | ||||||||||||

In thousands, as of December 31, 2017. | UTILITY | PARENT & OTHER | EWC | CONSOLIDATED | ||||||||

ASSETS | ||||||||||||

CURRENT ASSETS: | ||||||||||||

Cash and cash equivalents: | ||||||||||||

Cash | $50,270 | $971 | $5,388 | $56,629 | ||||||||

Temporary cash investments | 494,158 | 3,663 | 226,822 | 724,644 | ||||||||

Total cash and cash equivalents | 544,428 | 4,634 | 232,210 | 781,273 | ||||||||

Notes receivable | — | (514,418 | ) | 514,418 | — | |||||||

Accounts receivable: | ||||||||||||

Customer | 561,751 | — | 111,596 | 673,347 | ||||||||

Allowance for doubtful accounts | (13,587 | ) | — | — | (13,587 | ) | ||||||

Associated companies | 43,639 | (55,019 | ) | 11,381 | 1 | |||||||

Other | 159,396 | — | 9,981 | 169,377 | ||||||||

Accrued unbilled revenues | 383,813 | — | — | 383,813 | ||||||||

Total accounts receivable | 1,135,012 | (55,019 | ) | 132,958 | 1,212,950 | |||||||

Deferred fuel costs | 95,746 | — | — | 95,746 | ||||||||

Fuel inventory – at average cost | 178,813 | — | 3,830 | 182,643 | ||||||||

Materials and supplies – at average cost | 672,715 | — | 50,506 | 723,222 | ||||||||

Deferred nuclear refueling outage costs | 130,103 | — | 3,061 | 133,164 | ||||||||

Prepayments and other | 150,568 | (8,677 | ) | 14,442 | 156,333 | |||||||

Total | 2,907,385 | (573,480 | ) | 951,425 | 3,285,331 | |||||||

OTHER PROPERTY AND INVESTMENTS: | ||||||||||||

Investment in affiliates – at equity | 1,390,785 | (1,390,673 | ) | 86 | 198 | |||||||

Decommissioning trust funds | 3,162,649 | — | 4,049,344 | 7,211,993 | ||||||||

Non-utility property – at cost (less accumulated depreciation) | 251,904 | (13 | ) | 9,089 | 260,980 | |||||||

Other | 439,264 | — | 2,598 | 441,862 | ||||||||

Total | 5,244,602 | (1,390,686 | ) | 4,061,117 | 7,915,033 | |||||||

PROPERTY, PLANT AND EQUIPMENT: | ||||||||||||

Electric | 46,332,630 | 4,406 | 950,333 | 47,287,370 | ||||||||

Property under capital lease | 620,544 | — | — | 620,544 | ||||||||

Natural gas | 453,162 | — | — | 453,162 | ||||||||

Construction work in progress | 1,949,769 | 253 | 30,487 | 1,980,508 | ||||||||

Nuclear fuel | 822,260 | — | 100,941 | 923,200 | ||||||||

Total property, plant and equipment | 50,178,365 | 4,659 | 1,081,761 | 51,264,784 | ||||||||

Less – accumulated depreciation and amortization | 21,003,295 | 198 | 596,931 | 21,600,424 | ||||||||

Property, plant and equipment – net | 29,175,070 | 4,461 | 484,830 | 29,664,360 | ||||||||

DEFERRED DEBITS AND OTHER ASSETS: | ||||||||||||

Regulatory assets: | ||||||||||||

Regulatory asset for income taxes - net | — | — | — | — | ||||||||

Other regulatory assets (includes securitization property of | ||||||||||||

$485,031 as of December 31, 2017) | 4,935,689 | — | — | 4,935,689 | ||||||||

Deferred fuel costs | 239,298 | — | — | 239,298 | ||||||||

Goodwill | 374,099 | — | 3,073 | 377,172 | ||||||||

Accumulated deferred income taxes | 32,238 | 40,541 | 105,425 | 178,204 | ||||||||

Other | 70,288 | 9,635 | 32,139 | 112,062 | ||||||||

Total | 5,651,612 | 50,176 | 140,637 | 5,842,425 | ||||||||

TOTAL ASSETS | $42,978,669 | ($1,909,529 | ) | $5,638,009 | $46,707,149 | |||||||

Totals may not foot due to rounding. | ||||||||||||

FINANCIAL RESULTS | ||||||||||||

2017 CONSOLIDATING BALANCE SHEET (unaudited) | ||||||||||||

ENTERGY | ||||||||||||

In thousands, as of December 31, 2017. | UTILITY | PARENT & OTHER | EWC | CONSOLIDATED | ||||||||

LIABILITIES AND EQUITY | ||||||||||||

CURRENT LIABILITIES: | ||||||||||||

Currently maturing long-term debt | $760,007 | $— | $— | $760,007 | ||||||||

Notes payable and commercial paper: | ||||||||||||

Associated companies | — | (6,433 | ) | 6,433 | — | |||||||

Other | 111,345 | 1,466,963 | — | 1,578,308 | ||||||||

Accounts payable: | ||||||||||||

Associated companies | 31,970 | (67,310 | ) | 35,340 | — | |||||||

Other | 1,211,661 | 109 | 240,446 | 1,452,216 | ||||||||

Customer deposits | 401,330 | — | — | 401,330 | ||||||||

Taxes accrued | 241,877 | (12,298 | ) | (14,612 | ) | 214,967 | ||||||

Interest accrued | 161,077 | 26,603 | 292 | 187,972 | ||||||||

Deferred fuel costs | 146,522 | — | — | 146,522 | ||||||||

Obligations under capital leases | 1,502 | — | — | 1,502 | ||||||||

Pension and other postretirement liabilities | 59,378 | — | 12,234 | 71,612 | ||||||||

Other | 129,001 | 1,958 | 90,812 | 221,771 | ||||||||

Total | 3,255,670 | 1,409,592 | 370,945 | 5,036,207 | ||||||||

NON-CURRENT LIABILITIES: | ||||||||||||

Accumulated deferred income taxes and taxes accrued | 5,288,573 | (151,174 | ) | (670,896 | ) | 4,466,503 | ||||||

Accumulated deferred investment tax credits | 219,634 | — | — | 219,634 | ||||||||

Obligations under capital leases | 22,015 | — | — | 22,015 | ||||||||

Regulatory liability for income taxes - net | 2,900,204 | — | — | 2,900,204 | ||||||||

Other regulatory liabilities | 1,588,520 | — | — | 1,588,520 | ||||||||

Decommissioning and retirement cost liabilities | 3,002,469 | — | 3,183,345 | 6,185,814 | ||||||||

Accumulated provisions | 477,742 | — | 531 | 478,273 | ||||||||

Pension and other postretirement liabilities | 2,170,518 | — | 740,136 | 2,910,654 | ||||||||

Long-term debt (includes securitization bonds | ||||||||||||

of $544,921 as of December 31, 2017) | 12,163,671 | 2,048,518 | 103,070 | 14,315,259 | ||||||||

Other | 714,509 | (393,075 | ) | 72,314 | 393,748 | |||||||

Total | 28,547,855 | 1,504,269 | 3,428,500 | 33,480,624 | ||||||||

Subsidiaries' preferred stock without sinking fund | 173,554 | — | 24,249 | 197,803 | ||||||||

COMMON EQUITY: | ||||||||||||

Common shareholders' equity: | ||||||||||||

Common stock, $.01 par value, authorized 500,000,000 shares; | ||||||||||||

issued 254,752,788 shares in 2017 | 2,030,268 | (2,228,823 | ) | 201,103 | 2,548 | |||||||

Paid-in capital | 2,934,943 | 1,006,941 | 1,491,549 | 5,433,433 | ||||||||

Retained earnings | 6,304,977 | 1,676,129 | (3,404 | ) | 7,977,702 | |||||||

Accumulated other comprehensive income (loss) | (148,598 | ) | — | 125,067 | (23,531 | ) | ||||||

Less – treasury stock, at cost (74,235,135 shares in 2017) | 120,000 | 5,277,637 | — | 5,397,637 | ||||||||

Total | 11,001,590 | (4,823,390 | ) | 1,814,315 | 7,992,515 | |||||||

TOTAL LIABILITIES AND EQUITY | $42,978,669 | ($1,909,529 | ) | $5,638,009 | $46,707,149 | |||||||

Totals may not foot due to rounding. | ||||||||||||

FINANCIAL RESULTS | |||||||||||||||

CONSOLIDATED STATEMENTS OF CASH FLOW (unaudited) | |||||||||||||||

In thousands, for the years ended December 31, | 2017 | 2016 | 2015 | 2014 | 2013 | ||||||||||

OPERATING ACTIVITIES: | |||||||||||||||

Consolidated net income (loss) | $ | 425,353 | $ | (564,503 | ) | $ | (156,734 | ) | $ | 960,257 | $ | 730,572 | |||

Adjustments to reconcile consolidated net income (loss) | |||||||||||||||

to net cash flow provided by operating activities: | |||||||||||||||

Depreciation, amortization, and decommissioning, including nuclear fuel amortization | 2,078,578 | 2,123,291 | 2,117,236 | 2,127,892 | 2,012,076 | ||||||||||

Deferred income taxes, investment tax credits, and non-current taxes accrued | 529,053 | (836,257 | ) | (820,350 | ) | 596,935 | 311,789 | ||||||||