Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Ally Financial Inc. | dfast8-k2018.htm |

Ally Financial Inc.

Dodd-Frank Act Stress Test 2018

Estimates in the Severely Adverse Scenario

Forward-Looking Statements

The following disclosure contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements can be identified by the fact that they do not relate strictly to historical or current facts—such as statements that describe the assumptions in the 2018 stress test or its results. Forward-looking statements often use words such as “believe,” “expect,” “anticipate,” “intend,” “pursue,” “seek,” “continue,” “estimate,” “project,” “outlook,” “forecast,” “potential,” “target,” “objective,” “trend,” “plan,” “goal,” “initiative,” “priorities,” or other words of comparable meaning or future-tense or conditional verbs such as “may,” “will,” “should,” “would,” or “could.” Forward-looking statements convey our expectations, intentions, or forecasts about future events, circumstances, or results. All forward-looking statements, by their nature, are subject to assumptions, risks, and uncertainties, which may change over time and many of which are beyond our control. You should not rely on any forward-looking statement as a prediction or guarantee about the future. Actual future objectives, strategies, plans, prospects, performance, conditions, or results may differ materially from those set forth in any forward-looking statement. Some of the factors that may cause actual results or other future events or circumstances to differ from those in forward-looking statements are described in our Annual Report on Form 10-K for the year ended December 31, 2017, our subsequent Quarterly Reports on Form 10-Q or Current Reports on Form 8-K, or other applicable documents that are filed or furnished with the U.S. Securities and Exchange Commission (collectively, our “SEC filings”). Any forward-looking statement made by us or on our behalf speaks only as of the date that it was made. We do not undertake to update any forward-looking statement to reflect the impact of events, circumstances, or results that arise after the date that the statement was made. You, however, should consult further disclosures (including disclosures of a forward-looking nature) that we may make in any subsequent SEC filings.

Our use of the term “loans” describes all of the products associated with our direct and indirect lending activities. The specific products include loans, retail installment sales contracts, lines of credit, leases, and other financing products. The term “lend” or “originate” refers to our direct origination of loans or our purchase or acquisition of loans.

The 2018 Severely Adverse scenario reflects a hypothetical scenario that was designed by the Board of Governors of the Federal Reserve System (“Federal Reserve”) to assess the strength of designated banking organizations, including Ally Financial and Ally Bank, and their resilience to unfavorable economic conditions. Accordingly, the 2018 stress test and its results do not represent or reflect our forecasts or current expectations or plans in connection with future businesses, revenues, expenses, gains, losses, assets, liabilities, or capital ratios. The assumptions in the 2018 stress test, moreover, may not reflect our actions, decisions not to act, or other responses if severely adverse economic conditions were to arise.

- 1 - | ||

Overview

As required under the rules published by the Federal Reserve to address the Dodd-Frank Act Stress Test (“DFAST”) requirements, Ally Financial Inc. (“Ally”) is providing a summary of 2018 company-run stress test results under the Severely Adverse scenario. The stress test results were submitted to the Federal Reserve on April 5, 2018 and cover a nine-quarter planning horizon beginning in the first quarter of 2018 and continuing through the first quarter of 2020. The Severely Adverse scenario is characterized by a severe global recession that is accompanied by a global aversion to long-term fixed-income assets.

As demonstrated through numerous stress tests over the past several years, Ally’s business model is adequately positioned to withstand the effects of a severely stressed macroeconomic environment as well as numerous idiosyncratic events. The following summary of projected impacts to profitability, loss rates, and capital position reflects the assumptions and severity of the 2018 Severely Adverse scenario developed by the Federal Reserve. It is important to note that this scenario is not a forecast by the Federal Reserve or Ally but rather a hypothetical scenario designed to assess the strength of designated banking organizations, including Ally and Ally Bank, and their resilience to severely adverse economic conditions should they occur. The results suggest that Ally’s performance would deteriorate in the Severely Adverse scenario due to increased provision for credit losses, reduced asset levels, net interest margin compression, and market and operational risk related losses. However, Ally would continue to meet all contractual obligations to creditors and counterparties and would exceed all regulatory capital requirements.

Stress Testing Methodologies

Ally’s process for stress testing and assessing capital adequacy leverages a robust enterprise risk management framework that seeks to identify and measure all material risks arising from exposures and business activities. When conducting comprehensive enterprise-wide stress tests, all of Ally’s primary risk types are considered and evaluated. Ally’s primary types of risks in the 2018 stress test were: credit, vehicle residual, insurance/underwriting, market, liquidity, business/strategic, reputation, and operational.

Stress testing is an integral component of Ally’s risk, capital, liquidity, product, and customer management strategies. Stress tests are used to provide insight into how risk exposures and capital sources and uses might be affected by severe, yet plausible, stress scenarios. Stress tests are conducted using a combination of quantitative approaches, internal and external data sources, analytical tools, and management judgment. Models and analytical tools, whether internally- or vendor-developed, are subject to a validation or an annual review by Ally’s model risk management function. Variance and sensitivity analyses, as well as trend reporting and benchmarking techniques, are used to challenge stress test results at various levels of Ally. Throughout the stress testing process, numerous reviews are conducted by working groups, business unit management, senior management, and various councils and committees. In addition, DFAST results are reviewed and approved by Ally’s Board of Directors.

- 2 - | ||

The following provides a brief description of the methodologies used in stress testing to translate Ally’s material risks into financial impacts over the nine-quarter planning horizon.

Balance Sheet

Ally’s current and projected earning asset portfolio is primarily composed of U.S. auto-related assets. The auto portfolio includes consumer lending products (retail loans and leases) and dealer financing products (primarily floorplan financing). Asset balances are projected based on Ally’s expectation of new origination volumes and existing asset amortization under the stress scenario. Given the relatively short duration of Ally’s auto finance products (approximately 2.5 years for retail loans and less than 100 days for floorplan loans), existing assets amortize significantly over the planning horizon. Therefore, the size of Ally’s balance sheet over the nine-quarter planning horizon is largely dependent on the assumptions for new and used auto originations. Key assumptions for originations include new and used industry light vehicle sales, market share of certain manufacturers, and Ally’s financing penetration rates. A statistical modeling approach is used to project industry light vehicle sales while historical experience and management judgment factor into projections for other business assumptions. Similar to the asset portfolio, liability balances are developed using a mix of models, historical experience, and management judgment.

Pre-Provision Net Revenue (“PPNR”)

PPNR measures net revenues from the asset portfolio and is composed of net interest income, non-interest income, and non-interest expense. These components are further segmented and, as a result, various processes and methodologies are used to produce projections over the planning horizon. Since PPNR is a consolidated reporting item, it incorporates stress impacts from many of Ally’s material risks in the 2018 stress test, including vehicle residual, insurance/underwriting, market, liquidity, business/strategic, reputation, and operational.

• | Net Interest Income (“NII”): Net interest income for Ally is significantly influenced by the size, product mix, and credit mix of the earning asset portfolio and the net interest margin on those assets. A quantitative model that utilizes inputs such as balance projections, earning asset yields, interest rates, and credit spreads is used to project NII. The methodology used to develop balance projections was described previously while other key assumptions are developed using a mix of quantitative models, historical experience, and management judgment. While rental income, gains/losses on disposal, and depreciation expense for operating leases are reported within NII in Ally’s financial statements (filed with the SEC), these same items are reported within non-interest income and non-interest expense for the purposes of DFAST, per regulatory PPNR reporting requirements. |

• | Non-Interest Income: Ally’s non-interest income largely consists of insurance premiums, operating lease revenue, servicing fees, gains/losses on the disposal of operating lease assets, |

- 3 - | ||

gains/losses on the sale of mortgages, and wealth management fees. Similar to NII projections, revenues from insurance premiums and operating leases are dependent on portfolio size, and margins. Servicing fees are impacted by the size of the servicing portfolio, SmartAuction activity, and late charges. Ally’s recognized gains/losses on the disposal of operating leases are generally a function of the remaining cost basis (net of accumulated depreciation) of the lease at the time of termination and the sales proceeds received from remarketing the vehicle. Ally models the future expected value of off-lease vehicles (residual value) using key inputs such as U.S. Gross Domestic Product, unemployment rate, gasoline prices, and used vehicle supply and demand forecasts. Gains/losses on the sale of mortgages are primarily impacted by mortgage origination volumes. Wealth management fees are impacted by assets under management balances and trading volumes.

• | Non-Interest Expense: Non-interest expense includes depreciation expense on operating leases, expenses associated with the insurance business, compensation and benefits expense, operational risk expense (e.g., fraud, legal, regulatory compliance, information technology/security), and various other administrative expenses such as expenses associated with deposit operations. Depreciation expense on operating leases is projected using the current depreciation rates on the existing lease portfolio, while depreciation rates for new leases assumed to be originated during the nine-quarter planning horizon are set based on the projection of vehicle residual values, also used in projecting the gain/loss on disposal of operating leases. Expenses associated with the insurance business include sales commissions and provisions for claims losses, which naturally decline as new vehicle sales volumes, and thereby new insurance contracts, decline in the recessionary environment. Projections of compensation and benefits expense, information technology costs, and certain marketing expenses are closely aligned with the projected level of business activity and the severity of the assumed recession. However, other non-interest expense projections generally reflect a conservative bias as no management actions are assumed in the Severely Adverse scenario that would materially reduce expenses to coincide with declining business activity. In addition to routine business driven expenses, consideration is also given to operational risk and other losses that may arise in the stress environment. Given the broad scope of operational risk and limited and varied data, Ally uses a non-modeled approach for estimating a conservative level of operational risk losses in a given scenario. The non-modeled approach includes the use of Ally’s own historical experience (inclusive of losses from discontinued operations), operational risk scenario analysis, and management judgment. |

Losses and Provision for Loan Losses

Credit risk associated with the consumer and commercial loan portfolios manifests itself in the provision for loan losses. The amount of the provision reflects the projected charge-offs for each portfolio under the given scenario while preserving an appropriate allowance for loan losses to ensure adequate coverage at the end of each period.

- 4 - | ||

Ally’s loan loss estimation tools are developed using modeling approaches that incorporate macroeconomic variables and are deemed appropriate for stress testing purposes. Generally, the loan loss models have the following characteristics:

• | Are statistically-driven (e.g., regression-based); |

• | Are product specific; |

• | Incorporate portfolio characteristics as well as macroeconomic factors; and |

• | Follow a frequency and severity framework incorporating quantitative measures of probability of default (“PD”) and loss given default (“LGD”). |

Gains/Losses on Securities Portfolios

Ally’s investment portfolios are subject to market risk. Models are used to project changes in market values due to changes in equity prices, interest rates, credit spreads, and volatility throughout the nine-quarter planning horizon. A credit rating migration analysis is also performed to identify potential other-than-temporary impairments (“OTTI”) in the investment securities portfolio. Different segments of the portfolio are modeled separately while each security in the portfolio is incorporated into the analysis.

Capital

The various balance sheet, revenue, and loss estimates, as outlined above, are combined to generate full balance sheet and income statement projections. These financial statements serve as the basis for the calculations of capital and risk-weighted assets (“RWAs”) that are used to derive pro forma quarterly capital ratios. Ally has calculated capital ratios under the Basel III Standardized Approach, reflective of appropriate transition provisions. The resulting pro forma regulatory capital ratios are evaluated against management’s real-time operating targets and post-stress capital goals (minimums), which are essential inputs into Ally’s continuous capital adequacy assessment and associated governance.

Ally Summary Results

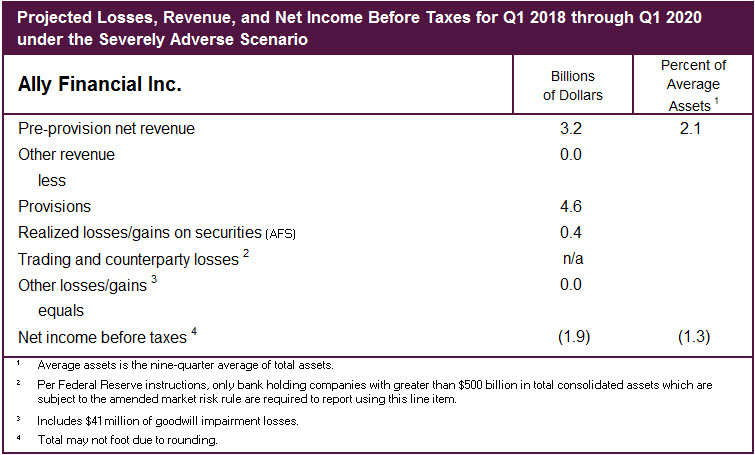

In the Severely Adverse scenario, Ally’s stress results show approximately $1.9 billion in pre-tax net losses over the nine-quarter planning horizon. A decline in NII results primarily from a significant reduction in earning asset balances over the planning horizon. Given the severity of the economic scenario, the expectation is that light vehicle sales would decline, thereby reducing future industry revenue opportunities from retail and lease originations as well as from dealer floorplan financing. A decline in industry light vehicle sales coinciding with reduced consumer demand in a severe macroeconomic recession is supported by historical experience. Consistent with declines in industry light vehicle sales experienced during past recessions, the size of Ally’s balance sheet trends lower in the Severely Adverse scenario as fewer vehicles are sold and, therefore, less financing is needed. This decline in industry sales also negatively impacts revenue from the insurance business. The provision for loan losses and related allowance increase in the Severely Adverse scenario to keep pace with the

- 5 - | ||

expected rise in credit losses, despite a significantly smaller balance sheet over the nine-quarter planning horizon. Realized gains/losses on securities reflect sharp declines in the equity and bond markets.

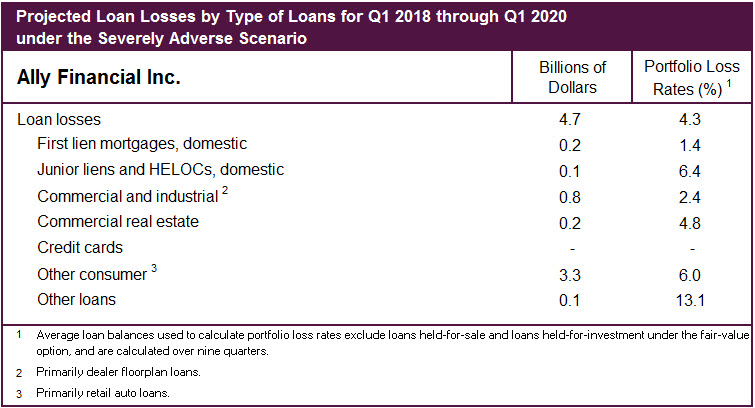

Projected credit losses total $4.7 billion with a cumulative weighted average loss rate of 4.3% for the total loan portfolio over the nine-quarter planning horizon. Ally’s largest loan portfolios, retail auto loans and dealer floorplan financing, have historically experienced low loss rates. Ally’s projected loss rates in the stress test are generally more conservative than those experienced during the most recent economic recession due to the use of conservative modeling assumptions and the relative severity of the Severely Adverse scenario.

Ally’s balance sheet is mainly composed of high-quality, short duration auto assets (approximately 2.5 years for retail loans and less than 100 days for floorplan loans), enabling Ally to withstand severe stress events and exceed regulatory capital requirements throughout the nine-quarter planning horizon. In prior recessions, Ally’s auto loan origination volume and asset balances have declined in line with

- 6 - | ||

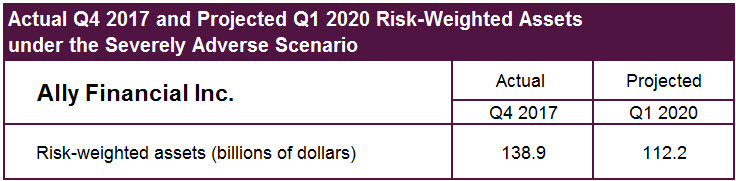

the directional trend of new and used industry light vehicle sales. Consistent with historical experience, Ally projected a decline in industry light vehicle sales that led to reduced loan volume and a smaller balance sheet over time in the Severely Adverse scenario. This is reflected in the reduction in risk-weighted assets from $138.9 billion as of Q4 2017 to $112.2 billion at the end of Q1 2020.

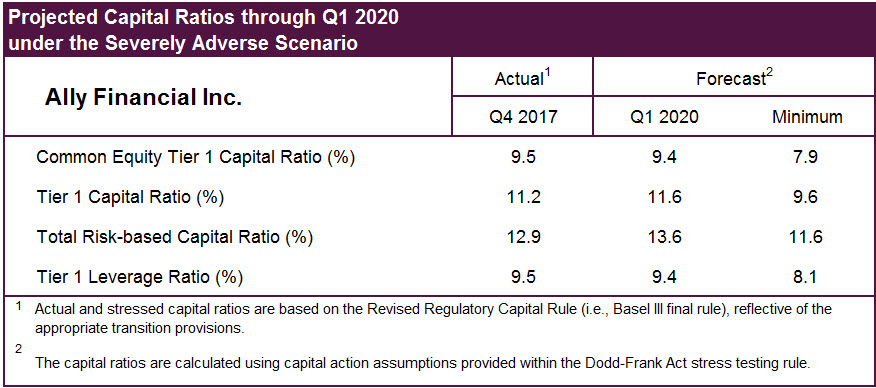

In accordance with DFAST regulatory guidance, capital actions completed in the first quarter of the nine-quarter planning horizon (Q1 2018) are included in the projection of pro forma capital ratios. For the remainder of the horizon, the Federal Reserve prescribes a standardized set of capital actions that, among other things, does not permit the redemption or repurchase of any capital instrument that is eligible for inclusion in the numerator of a regulatory capital ratio (e.g., the repurchase of common stock). Ally has included these assumptions in all capital projections, consistent with regulatory guidance. Ally also assumes all contractual payments are made for existing trust preferred and subordinated debt securities.

Ally’s capital levels are significantly reduced through the nine-quarter planning horizon, primarily driven by the $1.9 billion in pre-tax net losses projected in the Severely Adverse scenario. The impact to Ally’s capital ratios is mostly offset by a meaningful decline in risk-weighted assets, which provides significant conservation of capital. Ally’s Common Equity Tier 1 ratio of 9.5% as of Q4 2017 declines modestly to 9.4% by the end of the nine-quarter planning horizon. All capital ratios exceed regulatory minimums throughout the nine-quarter planning horizon. The following table summarizes Ally’s Q4 2017 actual capital ratios in addition to the low point and end point under the Severely Adverse scenario.

- 7 - | ||

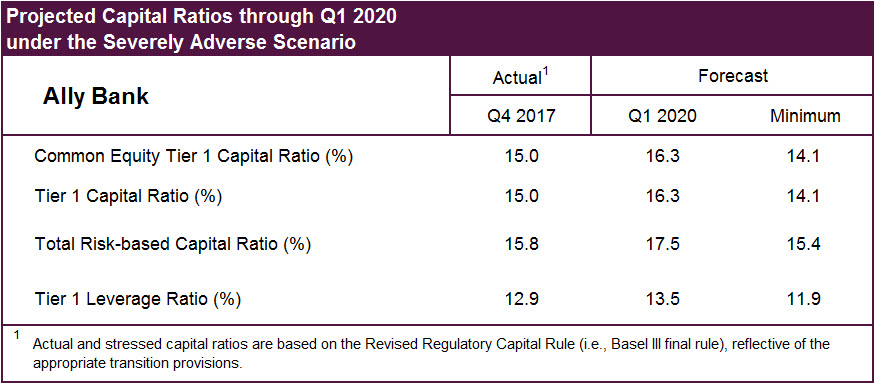

Assets at Ally Bank account for approximately 82% of Ally’s overall assets. Accordingly, Ally Bank’s results in the Severely Adverse scenario reflect many of the same themes that drive Ally’s stress results. Specifically, the forecasted decline in light vehicle sales drives balance sheet contraction, which helps to offset the impact of reduced NII and increased losses. The following table summarizes Ally Bank’s Q4 2017 actual capital ratios in addition to the low point and end point under the Severely Adverse scenario.

- 8 - | ||