Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - Enphase Energy, Inc. | ex991pressrelease.htm |

| EX-2.1 - EXHIBIT 2.1 - Enphase Energy, Inc. | enph-assetpurchaseagreemen.htm |

| 8-K - 8-K - Enphase Energy, Inc. | enph-form8xk06122018agreem.htm |

Enphase To Acquire SunPower’s Microinverter Business 5-Year Agreement Expected To Accelerate Global Adoption Of AC Modules As The De-facto Residential Solution June 12, 2018 Investor Presentation

Safe Harbor Use of forward-looking statements • This presentation (and the conference call or meeting at which this information will be presented) contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, as amended, including statements related to Enphase Energy Inc.’s (the “Company”) worldwide product offerings; the anticipated impact of the transaction on future results including revenues, gross margins, operating expense, operating income, and earnings per share; market share growth; the closing date of strategic transaction; progress toward achieving its 30-20-10 operating model targets; and other measures and market trends. • These forward-looking statements include statements in the future tense and statements including “advance,” “accelerate,” “anticipate,” “believe,” “enable,” “enhance,” “expect,” “improve,” “increase” and similar terms and concepts; all discussions of future periods which are not yet completed; the Company’s expected incremental annualized revenue, gross margin, operating expenses and operating income as a result of the SunPower transaction; the Company’s future financial performance, market demand and expected availability dates for its products, expected performance; the advantages of the Company’s technology; and market trends. • These forward-looking statements are based on the Company’s current expectations and are inherently subject to risks and uncertainties. They should not be considered guarantees of future results, which could differ materially from the results set forth in, contemplated by, or underlying this presentation. “Appendix A – Use of Projections; and Non-GAAP Financial Measures” includes a further summary of the financial measures, metrics and assumptions used in this presentation, as well as risks related thereto that could cause the forward-looking statements contained in this presentation to materially differ from actual results. Additionally, the following factors could materially impact the anticipated financial and business benefits of the transaction summarized in this presentation: the risk that the SunPower asset purchase agreement is terminated prior to closing or that the related transaction (including the transactions under the master supply agreement with SunPower) do not otherwise close (or close on terms different than what has been agreed as of the date hereof); the risk that the acquired assets and the master supply agreement with SunPower do not result in the revenues or margins currently anticipated by the Company; risks relating to supplier delays, changes, cancellations or forecast inaccuracies for products to be delivered to the Company and to SunPower; risks relating to interruptions in supply; risks relating to the parties’ failure or inability to perform their respective obligations under the SunPower master supply agreement, SunPower asset purchase agreement and related agreements; risks relating to the impact of the Company’s anticipated purchase accounting, employee stock-based compensation expenses and acquisition-related charges on the financial results anticipated to be achieved by the transactions with SunPower. • Further factors that could cause actual results to differ materially from the Company’s expectations are described in the reports filed by the Company with the Securities and Exchange Commission pursuant to the Securities Exchange Act of 1934, and we encourage you to review our filings carefully, especially the section entitled “Risk Factors” detailed in the Company’s Annual Report on Form 10-K for the year ended December 31, 2017 and the Company’s Quarterly Report on Form 10-Q for the quarter ended March 31, 2018. • Enphase Energy undertakes no duty or obligation to update any forward-looking statements contained in this presentation as a result of new information, future events or changes in its expectations. • The transactions summarized in this presentation are subject to the completion of the transactions under the Asset Purchase Agreement, dated June 12, 2018, between SunPower Corporation and the Company. Accordingly, the forward looking statements contained herein (or presented on the conference call or meeting at which this information will be presented) are subject to risks and uncertainties associated with the transactions under the SunPower asset purchase agreement including the occurrence of any event, change or circumstance that could give rise to the termination of the SunPower asset purchase agreement, the inability to complete the transactions under the Purchase Agreement due to the failure to satisfy the conditions to completion of the transaction, and the failure to obtain, delays in obtaining or adverse conditions contained in any approvals or consents for the transactions under the SunPower asset purchase agreement. Further information relating to the SunPower asset purchase agreement and the transactions discussed in this presentation, and a copy of the SunPower asset purchase agreement, are included in the Current Report on Form 8-K filed by the Company with the SEC on June 12, 2018. 2 | © 2018 Enphase Energy, Inc. | CONFIDENTIAL

Today’s Announcement Enphase Has Signed A Definitive Agreement on June 12, 2018 To Acquire SunPower’s Microinverter Business • Advances AC Modules As The Future Of Residential Solar • Enhances SunPower’s Home Solar System With Enphase’s IQ Microinverters • Enphase To Be Exclusive1 MLPE2 Supplier for SunPower’s Residential Business in US • Enphase Expects To Add $60-$70M3 Annualized Revenue In Second Half of 2019 at 33%-35% GM4 • Adds Over 140 Patents To Enphase’s Strong IP Portfolio • Expects To Close By End Of The Third Quarter Of 2018 With Initial IQ Shipments In The Fourth Quarter 1Five Year Agreement 2Module Level Power Electronics 3All Estimates represent Annualized Run Rates, currently anticipated to be achieved in second half of 2019. Range of annualized revenue ramp is provided to indicate anticipated incremental financial benefits of the transaction and is not guidance for Enphase’s actual financial results for FY 2019 or other periods. 4Subject to Impacts of Tariffs, Trade Wars, SunPower Sales in North America, as well as other factors detailed in Appendix. Estimates represent Annualized Run Rates, anticipated to be achieved in second half of 2019. Information is provided to indicate anticipated incremental financial benefits of the transaction and is not guidance for Enphase’s actual financial results for FY 2019 or other periods. 3 | © 2018 Enphase Energy, Inc. | CONFIDENTIAL

Transaction Overview For Enphase $25M Cash To SunPower Consideration 7.5M Shares of Enphase Common Stock To SunPower At Close From Enphase’s Balance Sheet Financing $15M Paid At Close, $10M Paid By 12/28/18 Conditions Subject To Qualification Of IQ 7XS & Other Closing Conditions Anticipated End Of Q3 2018 Close Anticipated Accelerates Revenue And GM Improvements Financial Increases Economies Of Scale Impact Improves Non-GAAP EPS 4 | © 2018 Enphase Energy, Inc. | CONFIDENTIAL

Equinox Platform: A Complete Home Solar Solution Specifically engineered IQ 7XS for use with SunPower platform Equinox Home Solar System Offers Great Value To Homeowners, Dealers and Builders

AC Modules Are Key To Equinox Success Equinox Ramp • AC Modules Have Risen To >80% Of SunPower’s Residential Sales • Built To Drive Installation And Commissioning Simplicity And Deliver Installation Time Savings • Factory-Integrated Microinverters MW DC MW Eliminate Need To Assemble Inverters On-site • Access To Challenging Or Constrained Roofs • Enable Easier Installer Training Q4'15 Q1'16 Q2'16 Q3'16 Q4'16 Q1'17 Q2'17 Q3'17 Q4'17 Q1'18

AC Module Powered By Enphase IQ Enhances Equinox Enphase Value Proposition Residential Microinverter Leader Strong Alignment On ACM Strategy Custom 55nm ASIC For Computation And Control 97.5% CEC Efficiency, 2-Wire AC Cable Ideal For Long Tail Installers IQ7 Platform Compatible To SunPower Roadmap Software Architecture Accelerates Geo Expansion High Performance, High Quality, Easy-To-Use Solutions 7 | © 2018 Enphase Energy, Inc. | CONFIDENTIAL

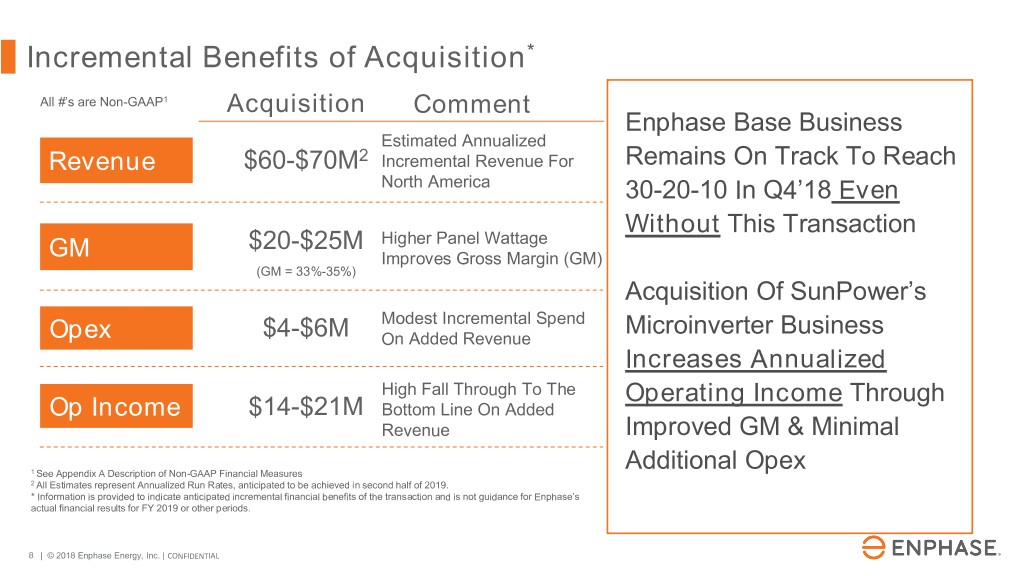

Incremental Benefits of Acquisition* All #’s are Non-GAAP1 Acquisition Comment Enphase Base Business Estimated Annualized Revenue $60-$70M2 Incremental Revenue For Remains On Track To Reach North America 30-20-10 In Q4’18 Even Without This Transaction $20-$25M Higher Panel Wattage GM Improves Gross Margin (GM) (GM = 33%-35%) Acquisition Of SunPower’s Modest Incremental Spend Microinverter Business Opex $4-$6M On Added Revenue Increases Annualized High Fall Through To The Operating Income Through Op Income $14-$21M Bottom Line On Added Revenue Improved GM & Minimal 1 See Appendix A Description of Non-GAAP Financial Measures Additional Opex 2 All Estimates represent Annualized Run Rates, anticipated to be achieved in second half of 2019. * Information is provided to indicate anticipated incremental financial benefits of the transaction and is not guidance for Enphase’s actual financial results for FY 2019 or other periods. 8 | © 2018 Enphase Energy, Inc. | CONFIDENTIAL

Acquisition Summary Five-Year Partnership Between SunPower And Enphase Expected to Create High Performance, High Quality, Easy-To-Use Home Solar Systems Offering Exceptional Experience To Homeowners, Dealers And Builders • Helps Both Companies Focus On Their Core Strengths • Expects To Add $60-70M1 Annualized US Revenue For Enphase In Second Half Of 2019 • Positions Both Companies To Expand Into International Markets • Enphase To Support SunPower’s Module Roadmap With a Series Of New Microinverters • Expect To Accelerate GM Improvement And Long Term Earnings Growth For Enphase • Expect To Create Significant Shareholder Value From Strong EPS Accretion For Enphase 1All Estimates represent Annualized Run Rates, anticipated to be achieved in second half of 2019. Information is provided to indicate anticipated incremental financial benefits of the transaction and is not guidance for Enphase’s actual financial results for FY 2019 or other periods. . 9 | © 2018 Enphase Energy, Inc. | CONFIDENTIAL

Q&A

Appendix A

Appendix A – Use of Projections and Non-GAAP Financial Measures Use of projections This presentation contains projections of future financial performance relating to Annualized Revenue, Gross Margin, Operating Expense and Operating Income that are anticipated to be achieved by Enphase during the second half of fiscal year 2019 as a result of the transactions with SunPower described in this presentation. Enphase’s independent public auditors have not audited, reviewed, compiled, or performed any procedures with respect to the projected financial information included in this presentation. Enphase and its management team do not give any assurance that the projected financial information contained in this presentation accurately represent Enphase’s results of operations or financial condition for the applicable periods. The assumptions and estimates underlying the projected financial information used in this presentation are inherently uncertain and subject to a wide variety of significant business, economic and competitive risks and uncertainties, including those set forth under “Use of forward-looking statements” and below under “Use of non-GAAP financial measures” that could cause actual results to materially differ from those contained in the prospective financial information included in this presentation. Accordingly, there can be no assurance that the projected results are or will be indicative of the future performance of Enphase, indicative of the financial benefits of the transactions with SunPower, or that actual results will not materially differ from those presented in the projections used in this presentation. Inclusion of projections and prospective financial information in this presentation should not be regarded as a representation by any person that the results contained in the projections or prospective financial information are indicative of future results or that they will be achieved. Use of non-GAAP financial measures This presentation and the financial measures included in this presentation have not been prepared in accordance with generally accepted accounting principles (GAAP). In particular, this presentation includes the following forward-looking non-GAAP financial measures: • Annualized Revenue - reflects annualized incremental run-rate revenue anticipated to be earned by Enphase solely from sales of products under the master supply agreement, based on currently anticipated supply levels and pricing in accordance with the master supply agreement, • Gross Margin - reflects run-rate gross margins relating solely to the products sold under the master supply agreement and anticipated incremental costs of goods sold solely relating to products sold under the master supply agreement, • Operating Expense - reflects Enphase’s assumptions and projections soley relating to incremental operating expenses to be incurred by Enphase following the implementation of the SunPower transaction, but excluding any impact of purchase accounting, employee-stock based compensation expense and transaction-related charges, and • Operating Income - presented solely with respect to the incremental revenues anticipated to be realized from the master supply agreement and excluding the impact of purchase accounting, employee-stock based compensation expense and transaction-related charges. 12 | © 2018 Enphase Energy, Inc. | CONFIDENTIAL

Appendix A – Use of Projections and Non-GAAP Financial Measures (Cont.) The non-GAAP financial measures used in this presentation were derived using Enphase’s current estimates of the incremental volumes and selling prices, future costs of products and incremental operating expenses required to support its operations following the integration of the acquired business and the effectiveness of the master supply agreement with SunPower. In addition to these uncertainties and risks, actual results could differ from the forward-looking non-GAAP financial measures included in the presentation as a result of the following factors. • Purchase accounting - Enphase expects the transaction with SunPower to be accounted for as a business combination. Accordingly, the purchase consideration will be allocated to the assets acquired, including goodwill. The net purchase consideration is partially dependent upon the value of Enphase’s stock on the date the transaction closes (which is currently anticipated to be in September 2018), and, as such, is subject to volatility and other market factors. An increase in Enphase’s stock price before the transaction closes would result in an increase in the purchase consideration, which could be material and impact the valuation of the assets acquired. The forward-looking non-GAAP financial measures used in this presentation do not include the impact of purchase accounting, which could materially impact the incremental Operating Expense and other amounts included in the presentation. • Employee Stock-based compensation expense - Enphase excludes employee stock-based compensation expense from its non-GAAP measures primarily because they are non- cash in nature. Moreover, the impact of this expense is significantly affected by Enphase’s stock price at the time of an award over which management has limited to no control. The forward-looking non-GAAP financial measures used in this presentation do not include the impact of employee stock-based compensation expenses, which could materially impact the incremental Operating Expense amounts included in the presentation. • Acquisition-related charges - These items are expected to primarily include the amortization of acquired intangibles, which are expected to consist primarily of intellectual property to be acquired and intangibles related to customer relationships. These items relate specifically to the SunPower acquisition and are not reflective of Enphase’s ongoing financial performance. The valuation of these assets has not been completed at this time, and the purchase accounting methodology is being reviewed. Thus, the impact, which is expected to be material, and the resulting accounting has not been determined. A full valuation of the assets acquired will be performed as of the closing date of the transaction. Enphase is in the process of reviewing the transaction and determining the appropriate accounting methodology for the purchase. The final valuation and determination of purchase accounting could cause the GAAP and non-GAAP incremental impact of the transaction to materially differ from any and all of the non-GAAP financial measures included in this presentation. As a result of the uncertainties and other factors described above, and elsewhere in this “use of Projections and Non-GAAP Financial Measures” Enphase is unable to present a quantitative reconciliation of the forward-looking non-GAAP financial measures included in this presentation to the most directly comparable GAAP financial measure because Enphase management cannot reliably predict all necessary components for the reconciliations. For the same reasons, Enphase is unable to address the probable significance of the unavailable information, which could be material to Enphase’s future financial results. The forward-looking non-GAAP estimates used in this presentation do not reflect a comprehensive system of accounting, differ from GAAP measures with the same captions and may differ from non-GAAP financial measures with the same or similar captions that are used by Enphase or other companies. In addition, these non-GAAP measures do not reflect all of the amounts associated with Enphase’s results of operations or expected results as determined in accordance with GAAP. As such, these non-GAAP measures should be considered as a supplement to, and not as a substitute for, or superior to, financial measures calculated in accordance with GAAP. Enphase uses these non-GAAP financial measures to analyze the estimated incremental impact of the transaction with SunPower, its operating performance and future prospects and to develop internal budgets and financial goals. Enphase believes that these non-GAAP financial measures reflect an additional way of viewing aspects of its operations that, when viewed with its GAAP results, will provide a more complete understanding of factors and trends affecting its business. 13 | © 2018 Enphase Energy, Inc. | CONFIDENTIAL