Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - CITIZENS FINANCIAL GROUP INC/RI | d605595d8k.htm |

Morgan Stanley Financials Conference June 12, 2018 Brad Conner Vice Chairman, Head of Consumer Banking Exhibit 99.1

Forward-looking statements and use of key performance metrics and non-GAAP financial measures This document contains forward-looking statements within the Private Securities Litigation Reform Act of 1995. Statements regarding potential future share repurchases and future dividends are forward-looking statements. Also, any statement that does not describe historical or current facts is a forward-looking statement. These statements often include the words “believes,” “expects,” “anticipates,” “estimates,” “intends,” “plans,” “goals,” “targets,” “initiatives,” “potentially,” “probably,” “projects,” “outlook” or similar expressions or future conditional verbs such as “may,” “will,” “should,” “would,” and “could.” Forward-looking statements are based upon the current beliefs and expectations of management, and on information currently available to management. Our statements speak as of the date hereof, and we do not assume any obligation to update these statements or to update the reasons why actual results could differ from those contained in such statements in light of new information or future events. We caution you, therefore, against relying on any of these forward-looking statements. They are neither statements of historical fact nor guarantees or assurances of future performance. While there is no assurance that any list of risks and uncertainties or risk factors is complete, important factors that could cause actual results to differ materially from those in the forward-looking statements include the following, without limitation: Negative economic and political conditions that adversely affect the general economy, housing prices, the job market, consumer confidence and spending habits which may affect, among other things, the level of nonperforming assets, charge-offs and provision expense; The rate of growth in the economy and employment levels, as well as general business and economic conditions, and changes in the competitive environment; Our ability to implement our business strategy, including the cost savings and efficiency components, and achieve our financial performance goals; Our ability to meet heightened supervisory requirements and expectations; Liabilities and business restrictions resulting from litigation and regulatory investigations; Our capital and liquidity requirements (including under regulatory capital standards, such as the U.S. Basel III capital rules) and our ability to generate capital internally or raise capital on favorable terms; The effect of changes in interest rates on our net interest income, net interest margin and our mortgage originations, mortgage servicing rights and mortgages held for sale; Changes in interest rates and market liquidity, as well as the magnitude of such changes, which may reduce interest margins, impact funding sources and affect the ability to originate and distribute financial products in the primary and secondary markets; The effect of changes in the level of checking or savings account deposits on our funding costs and net interest margin; Financial services reform and other current, pending or future legislation or regulation that could have a negative effect on our revenue and businesses, including the Dodd-Frank Act and other legislation and regulation relating to bank products and services; A failure in or breach of our operational or security systems or infrastructure, or those of our third party vendors or other service providers, including as a result of cyber-attacks; and Management’s ability to identify and manage these and other risks. In addition to the above factors, we also caution that the amount and timing of any future common stock dividends or share repurchases will depend on our financial condition, earnings, cash needs, regulatory constraints, capital requirements (including requirements of our subsidiaries), and any other factors that our Board of Directors deems relevant in making such a determination. Therefore, there can be no assurance that we will repurchase shares or pay any dividends to holders of our common stock, or as to the amount of any such repurchases or dividends. More information about factors that could cause actual results to differ materially from those described in the forward-looking statements can be found under “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2017, filed with the United States Securities and Exchange Commission on February 22, 2018. Key Performance Metrics and Non-GAAP Financial Measures and Reconciliations Key Performance Metrics: Our management team uses key performance metrics (KPMs) to gauge our performance and progress over time in achieving our strategic and operational goals and also in comparing our performance against our peers. We have established the following financial targets, in addition to others, as KPMs, which are utilized by our management in measuring our progress against financial goals and as a tool in helping assess performance for compensation purposes. These KPMs can largely be found in our periodic reports which are filed with the Securities and Exchange Commission, and are supplemented from time to time with additional information in connection with our quarterly earnings releases. Our key performance metrics include: Return on average tangible common equity (ROTCE); Return on average total tangible assets (ROTA); Efficiency ratio; Operating leverage; and Common equity tier 1 capital ratio. In establishing goals for these KPMs, we determined that they would be measured on a management-reporting basis, or an operating basis, which we refer to externally as “Adjusted” or “Underlying” results. We believe that these “Adjusted” or “Underlying” results provide the best representation of our financial progress toward these goals as they exclude items that our management does not consider indicative of our ongoing financial performance. KPMs that contain “Adjusted” or “Underlying” results are considered non-GAAP financial measures.

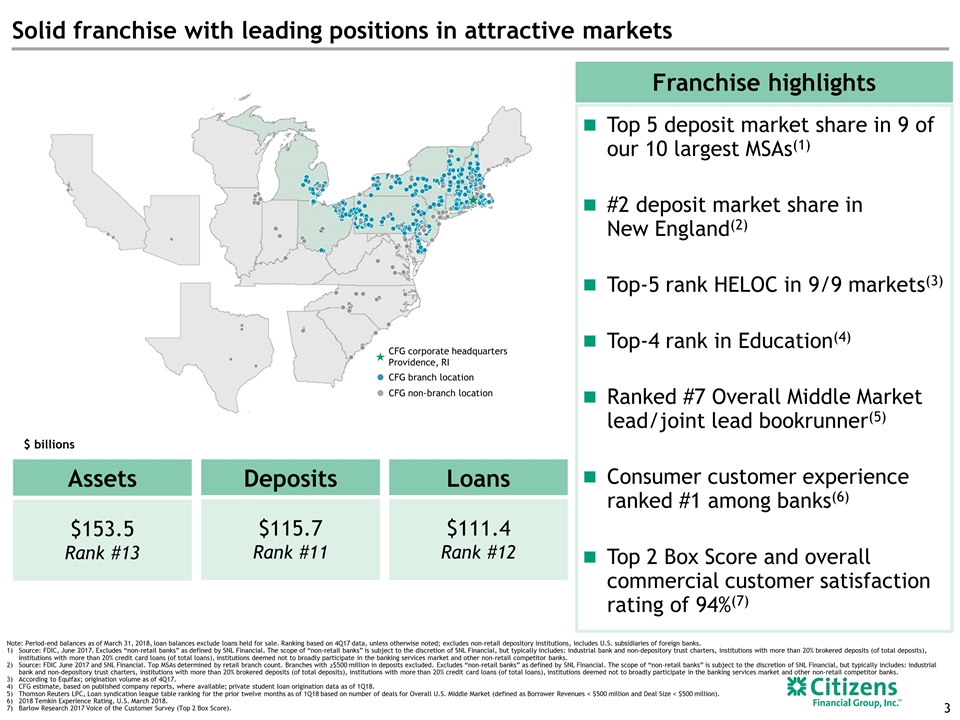

Solid franchise with leading positions in attractive markets CFG corporate headquarters Providence, RI CFG branch location CFG non-branch location Assets $153.5 Rank #13 Loans $111.4 Rank #12 Deposits $115.7 Rank #11 Top 5 deposit market share in 9 of our 10 largest MSAs(1) #2 deposit market share in New England(2) Top-5 rank HELOC in 9/9 markets(3) Top-4 rank in Education(4) Ranked #7 Overall Middle Market lead/joint lead bookrunner(5) Consumer customer experience ranked #1 among banks(6) Top 2 Box Score and overall commercial customer satisfaction rating of 94%(7) Franchise highlights $ billions Note: Period-end balances as of March 31, 2018, loan balances exclude loans held for sale. Ranking based on 4Q17 data, unless otherwise noted; excludes non-retail depository institutions, includes U.S. subsidiaries of foreign banks. Source: FDIC, June 2017. Excludes “non-retail banks” as defined by SNL Financial. The scope of “non-retail banks” is subject to the discretion of SNL Financial, but typically includes: industrial bank and non-depository trust charters, institutions with more than 20% brokered deposits (of total deposits), institutions with more than 20% credit card loans (of total loans), institutions deemed not to broadly participate in the banking services market and other non-retail competitor banks. Source: FDIC June 2017 and SNL Financial. Top MSAs determined by retail branch count. Branches with ≥$500 million in deposits excluded. Excludes “non-retail banks” as defined by SNL Financial. The scope of “non-retail banks” is subject to the discretion of SNL Financial, but typically includes: industrial bank and non-depository trust charters, institutions with more than 20% brokered deposits (of total deposits), institutions with more than 20% credit card loans (of total loans), institutions deemed not to broadly participate in the banking services market and other non-retail competitor banks. According to Equifax; origination volume as of 4Q17. CFG estimate, based on published company reports, where available; private student loan origination data as of 1Q18. Thomson Reuters LPC, Loan syndication league table ranking for the prior twelve months as of 1Q18 based on number of deals for Overall U.S. Middle Market (defined as Borrower Revenues < $500 million and Deal Size < $500 million). 2018 Temkin Experience Rating, U.S. March 2018. Barlow Research 2017 Voice of the Customer Survey (Top 2 Box Score).

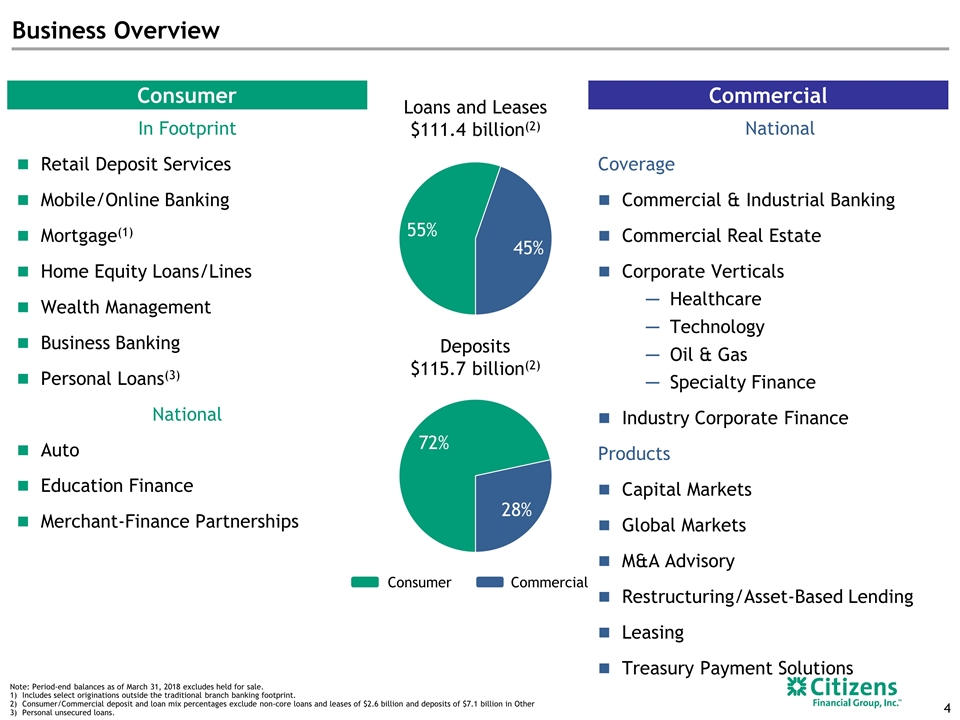

Business Overview Consumer In Footprint Retail Deposit Services Mobile/Online Banking Mortgage(1) Home Equity Loans/Lines Wealth Management Business Banking Personal Loans(3) National Auto Education Finance Merchant-Finance Partnerships Commercial National Coverage Commercial & Industrial Banking Commercial Real Estate Corporate Verticals Healthcare Technology Oil & Gas Specialty Finance Industry Corporate Finance Products Capital Markets Global Markets M&A Advisory Restructuring/Asset-Based Lending Leasing Treasury Payment Solutions Note: Period-end balances as of March 31, 2018 excludes held for sale. Includes select originations outside the traditional branch banking footprint. Consumer/Commercial deposit and loan mix percentages exclude non-core loans and leases of $2.6 billion and deposits of $7.1 billion in Other Personal unsecured loans. Deposits $115.7 billion(2) Loans and Leases $111.4 billion(2) Consumer Commercial

Key Messages – Consumer Banking Using segmentation strategies to drive household growth, deepen & retain customer relationships Leveraging data analytics to understand customer needs Enhancing Mass Affluent & Affluent offerings Improving customer acquisition & deepening through personalized offers & experiences Evolving distribution to better meet changing consumer preferences & create integrated, multi-channel experiences Focused on continued improvement in fee income Significant investments in Wealth & Mortgage capabilities showing results Utilizing Tapping Our Potential (“TOP”) & Balance Sheet Optimization (“BSO”) programs to drive efficiencies & returns Have embedded continuous improvement mindset

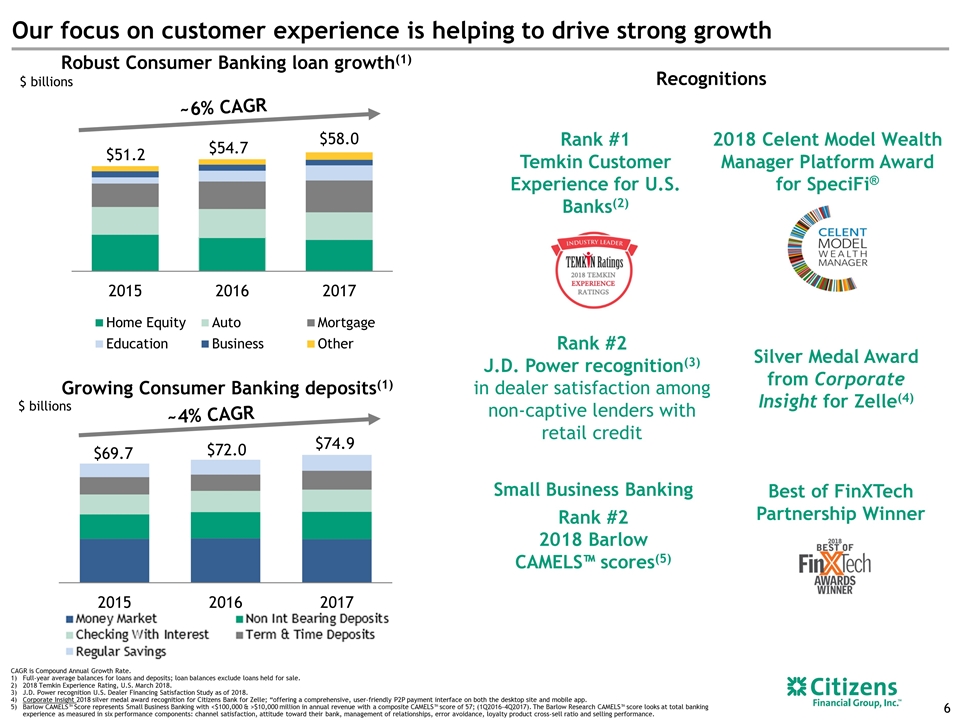

Rank #1 Temkin Customer Experience for U.S. Banks(2) Our focus on customer experience is helping to drive strong growth $ billions Robust Consumer Banking loan growth(1) ~6% CAGR Recognitions Growing Consumer Banking deposits(1) ~4% CAGR $75.2 $75.5 .28% .29% .31%.33% .37% Deposit Costs 2018 Celent Model Wealth Manager Platform Award for SpeciFi® Best of FinXTech Partnership Winner Rank #2 J.D. Power recognition(3) in dealer satisfaction among non-captive lenders with retail credit Small Business Banking Rank #2 2018 Barlow CAMELS™ scores(5) Silver Medal Award from Corporate Insight for Zelle(4) CAGR is Compound Annual Growth Rate. Full-year average balances for loans and deposits; loan balances exclude loans held for sale. 2018 Temkin Experience Rating, U.S. March 2018. J.D. Power recognition U.S. Dealer Financing Satisfaction Study as of 2018. Corporate Insight 2018 silver medal award recognition for Citizens Bank for Zelle; “offering a comprehensive, user-friendly P2P payment interface on both the desktop site and mobile app. Barlow CAMELS™ Score represents Small Business Banking with <$100,000 & >$10,000 million in annual revenue with a composite CAMELS™ score of 57; (1Q2016-4Q2017). The Barlow Research CAMELS™ score looks at total banking experience as measured in six performance components: channel satisfaction, attitude toward their bank, management of relationships, error avoidance, loyalty product cross-sell ratio and selling performance. $69.7 $72.0 $74.9 $51.2 $54.7 $58.0 $ billions

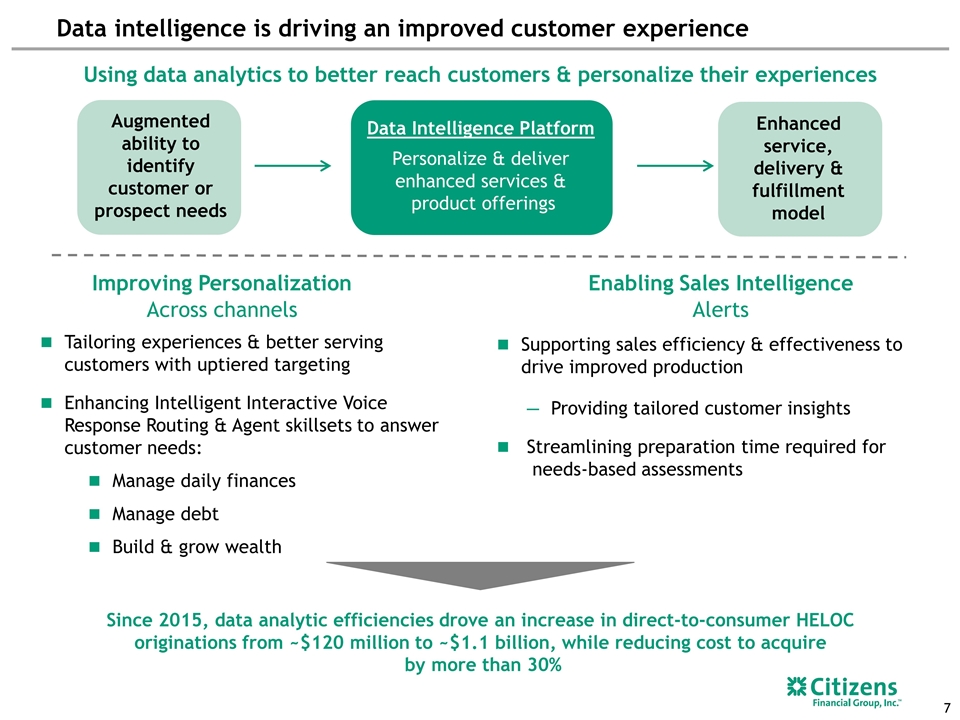

Since 2015, data analytic efficiencies drove an increase in direct-to-consumer HELOC originations from ~$120 million to ~$1.1 billion, while reducing cost to acquire by more than 30% Data intelligence is driving an improved customer experience Improving Personalization Across channels Enabling Sales Intelligence Alerts Tailoring experiences & better serving customers with uptiered targeting Enhancing Intelligent Interactive Voice Response Routing & Agent skillsets to answer customer needs: Manage daily finances Manage debt Build & grow wealth Supporting sales efficiency & effectiveness to drive improved production Providing tailored customer insights Streamlining preparation time required for needs-based assessments Data Intelligence Platform Personalize & deliver enhanced services & product offerings Augmented ability to identify customer or prospect needs Enhanced service, delivery & fulfillment model Using data analytics to better reach customers & personalize their experiences

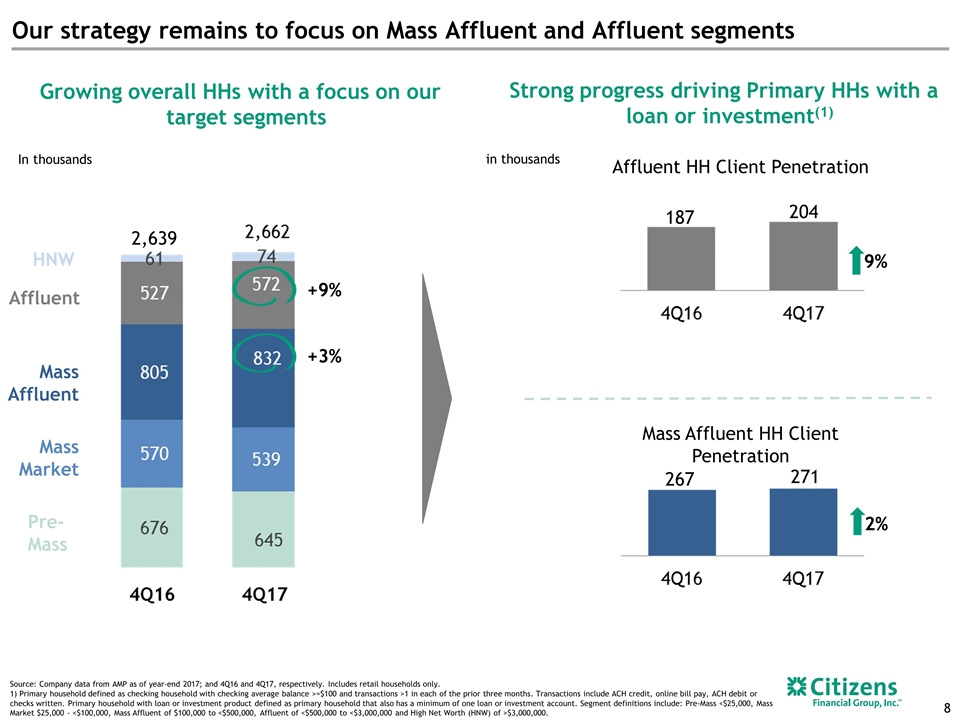

Our strategy remains to focus on Mass Affluent and Affluent segments Affluent Mass Affluent Mass Market Pre- Mass Growing overall HHs with a focus on our target segments HNW $64 48% $216 $245 Strong progress driving Primary HHs with a loan or investment(1) In thousands Source: Company data from AMP as of year-end 2017; and 4Q16 and 4Q17, respectively. Includes retail households only. 1) Primary household defined as checking household with checking average balance >=$100 and transactions >1 in each of the prior three months. Transactions include ACH credit, online bill pay, ACH debit or checks written. Primary household with loan or investment product defined as primary household that also has a minimum of one loan or investment account. Segment definitions include: Pre-Mass <$25,000, Mass Market $25,000 - <$100,000, Mass Affluent of $100,000 to <$500,000, Affluent of <$500,000 to <$3,000,000 and High Net Worth (HNW) of >$3,000,000. Affluent HH Client Penetration Mass Affluent HH Client Penetration 187 204 9% 267 271 2% in thousands +9% +3% 2,639

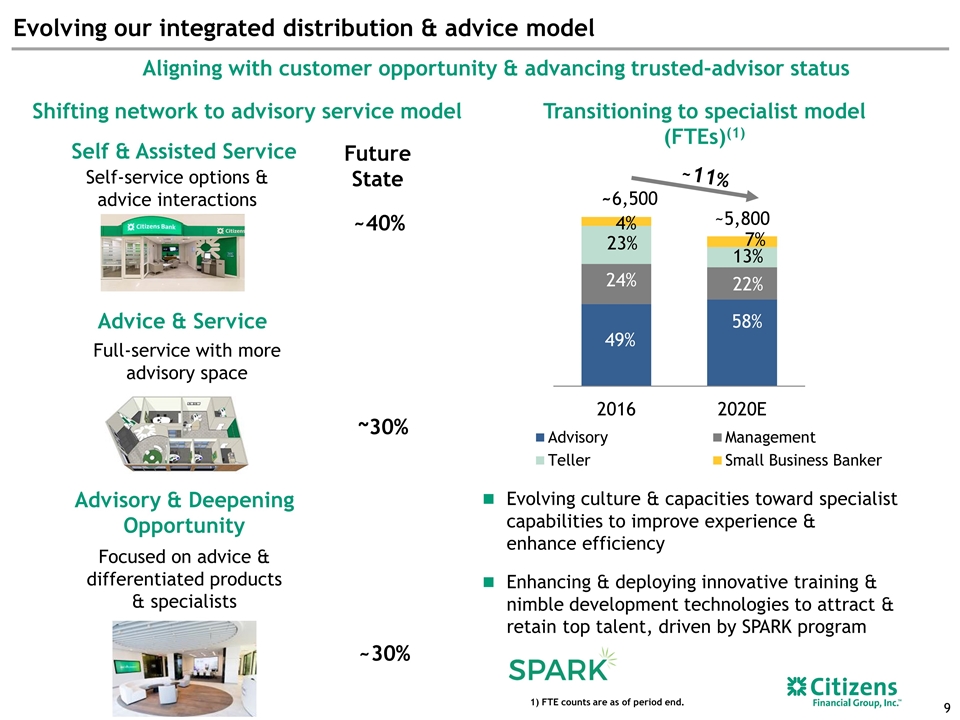

Evolving our integrated distribution & advice model Self & Assisted Service Advice & Service Advisory & Deepening Opportunity Self-service options & advice interactions Full-service with more advisory space Aligning with customer opportunity & advancing trusted-advisor status Focused on advice & differentiated products & specialists Relationship Banker Relationship Banker Specialize with Mass Market customers [HOLD for 2nd bullet] Licensed Banker Specialize with Mass Affluent customers HOLD for 2nd bullet] Future State ~30% ~40% ~30% ~11% ~5,800 Shifting network to advisory service model Evolving culture & capacities toward specialist capabilities to improve experience & enhance efficiency Enhancing & deploying innovative training & nimble development technologies to attract & retain top talent, driven by SPARK program ~6,500 Transitioning to specialist model (FTEs)(1) 49% 58% 1) FTE counts are as of period end.

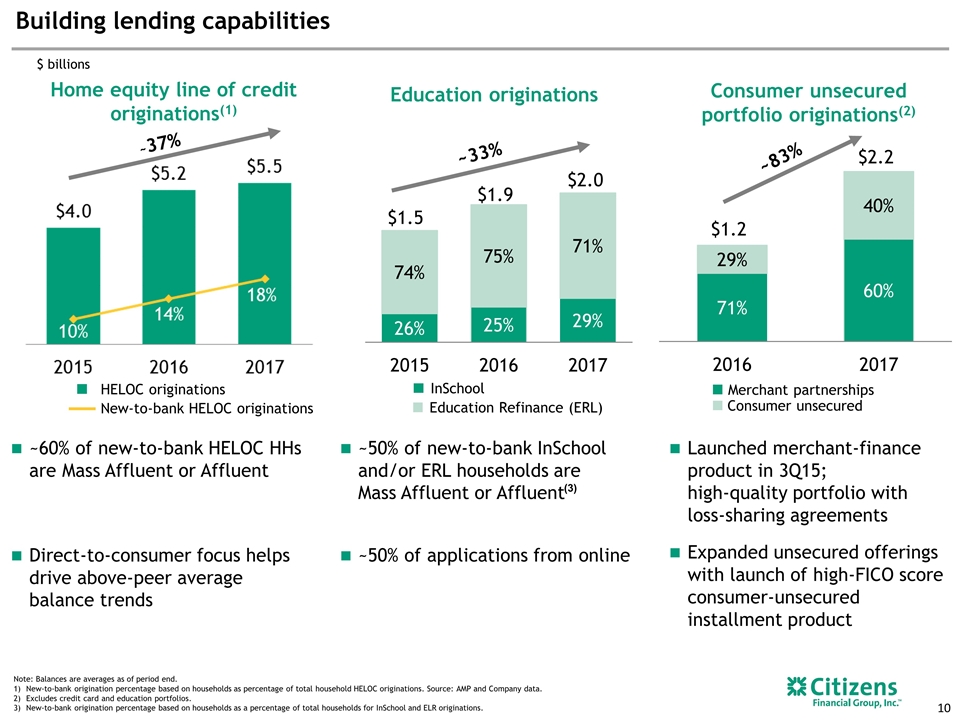

Building lending capabilities Home equity line of credit originations(1) $ billions Education originations Consumer unsecured portfolio originations(2) Note: Balances are averages as of period end. New-to-bank origination percentage based on households as percentage of total household HELOC originations. Source: AMP and Company data. Excludes credit card and education portfolios. New-to-bank origination percentage based on households as a percentage of total households for InSchool and ELR originations. $1.5 $1.9 ~37% ~33% Launched merchant-finance product in 3Q15; high-quality portfolio with loss-sharing agreements Expanded unsecured offerings with launch of high-FICO score consumer-unsecured installment product Merchant partnerships Couple of bullets in Education backup HELOC originations New-to-bank HELOC originations Consumer unsecured Working to obtain more granular HELOC information and to get In School parent/co-signer granular information. $2.0 InSchool Education Refinance (ERL) ~60% of new-to-bank HELOC HHs are Mass Affluent or Affluent Direct-to-consumer focus helps drive above-peer average balance trends ~50% of new-to-bank InSchool and/or ERL households are Mass Affluent or Affluent ~50% of applications from online ~83% (3)

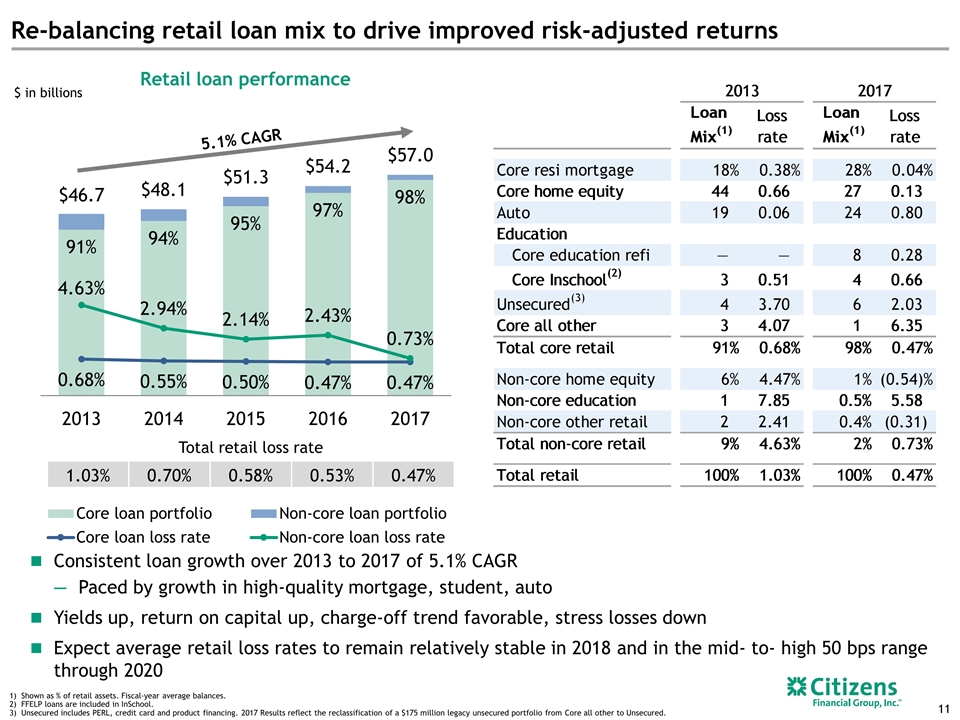

1.03% 0.70% 0.58% 0.53% 0.47% Retail loan performance Total retail loss rate Consistent loan growth over 2013 to 2017 of 5.1% CAGR Paced by growth in high-quality mortgage, student, auto Yields up, return on capital up, charge-off trend favorable, stress losses down Expect average retail loss rates to remain relatively stable in 2018 and in the mid- to- high 50 bps range through 2020 Shown as % of retail assets. Fiscal-year average balances. FFELP loans are included in InSchool. Unsecured includes PERL, credit card and product financing. 2017 Results reflect the reclassification of a $175 million legacy unsecured portfolio from Core all other to Unsecured. Re-balancing retail loan mix to drive improved risk-adjusted returns $ in billions 5.1% CAGR

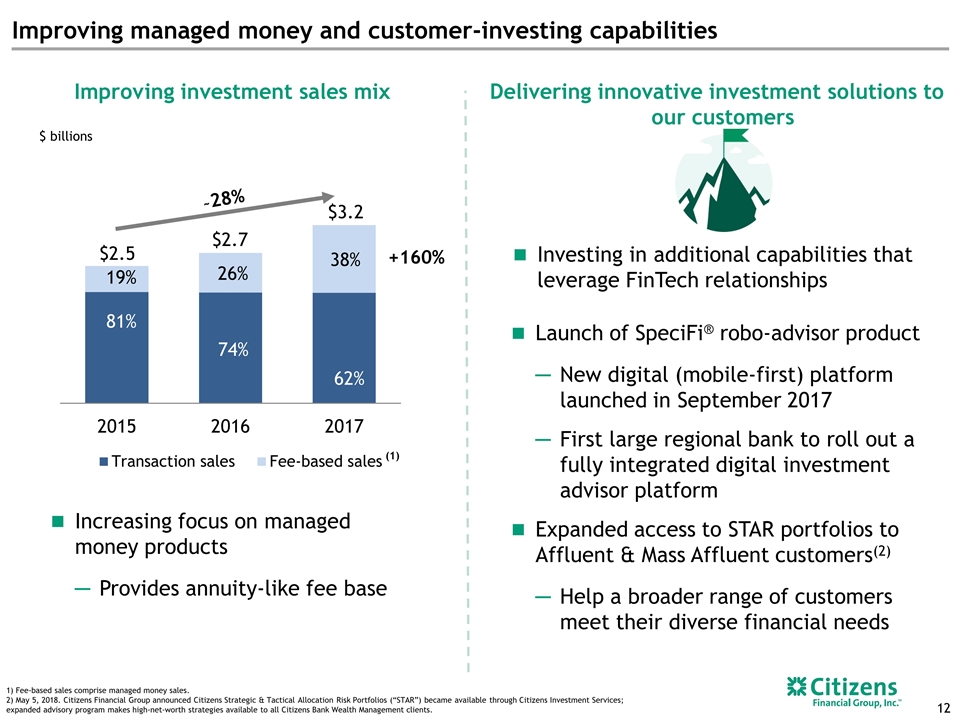

Improving managed money and customer-investing capabilities 1) Fee-based sales comprise managed money sales. 2) May 5, 2018. Citizens Financial Group announced Citizens Strategic & Tactical Allocation Risk Portfolios (“STAR”) became available through Citizens Investment Services; expanded advisory program makes high-net-worth strategies available to all Citizens Bank Wealth Management clients. Improving investment sales mix Delivering innovative investment solutions to our customers 442 538 +160% Launch of SpeciFi® robo-advisor product New digital (mobile-first) platform launched in September 2017 First large regional bank to roll out a fully integrated digital investment advisor platform Expanded access to STAR portfolios to Affluent & Mass Affluent customers(2) Help a broader range of customers meet their diverse financial needs Investing in additional capabilities that leverage FinTech relationships $ billions $2.5 $2.7 $3.2 81% 74% Increasing focus on managed money products Provides annuity-like fee base ~28%

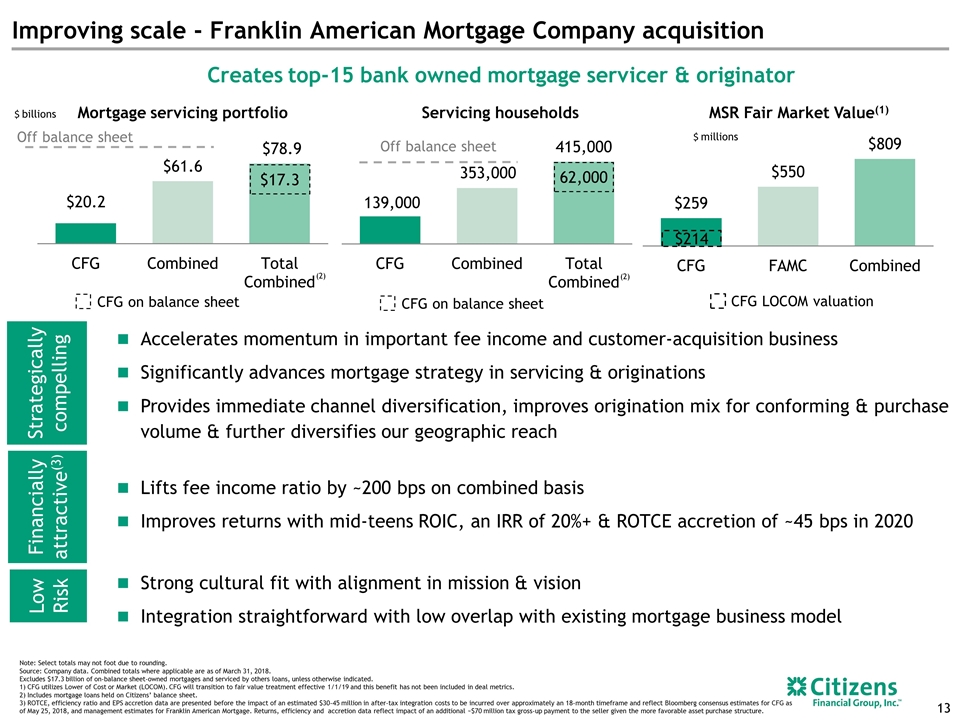

Improving scale - Franklin American Mortgage Company acquisition Accelerates momentum in important fee income and customer-acquisition business Significantly advances mortgage strategy in servicing & originations Provides immediate channel diversification, improves origination mix for conforming & purchase volume & further diversifies our geographic reach Mortgage servicing portfolio Servicing households Off balance sheet Off balance sheet $17.3 62,000 Note: Select totals may not foot due to rounding. Source: Company data. Combined totals where applicable are as of March 31, 2018. Excludes $17.3 billion of on-balance sheet-owned mortgages and serviced by others loans, unless otherwise indicated. 1) CFG utilizes Lower of Cost or Market (LOCOM). CFG will transition to fair value treatment effective 1/1/19 and this benefit has not been included in deal metrics. 2) Includes mortgage loans held on Citizens’ balance sheet. 3) ROTCE, efficiency ratio and EPS accretion data are presented before the impact of an estimated $30-45 million in after-tax integration costs to be incurred over approximately an 18-month timeframe and reflect Bloomberg consensus estimates for CFG as of May 25, 2018, and management estimates for Franklin American Mortgage. Returns, efficiency and accretion data reflect impact of an additional ~$70 million tax gross-up payment to the seller given the more favorable asset purchase structure. MSR Fair Market Value(1) CFG on balance sheet (2) $214 CFG LOCOM valuation $ millions $ billions Creates top-15 bank owned mortgage servicer & originator Strategically compelling Financially attractive(3) Low Risk Strong cultural fit with alignment in mission & vision Integration straightforward with low overlap with existing mortgage business model Lifts fee income ratio by ~200 bps on combined basis Improves returns with mid-teens ROIC, an IRR of 20%+ & ROTCE accretion of ~45 bps in 2020 CFG on balance sheet (2) 139,000 353,000 415,000

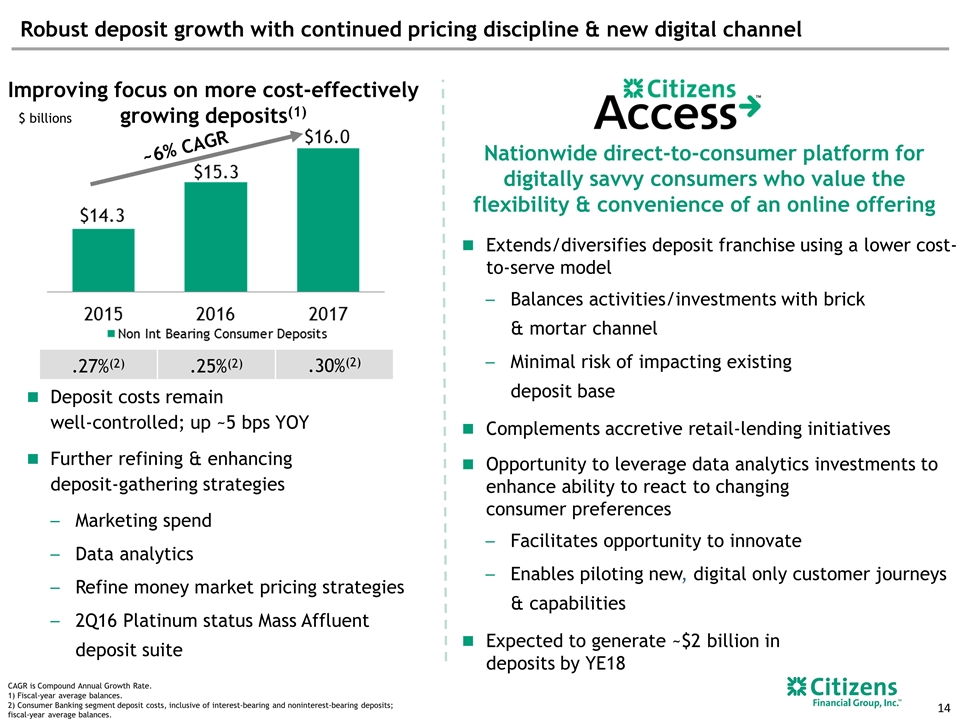

Improving focus on more cost-effectively growing deposits(1) Robust deposit growth with continued pricing discipline & new digital channel Deposits need to go near this slide Deposit costs remain well-controlled; up ~5 bps YOY Further refining & enhancing deposit-gathering strategies Marketing spend Data analytics Refine money market pricing strategies 2Q16 Platinum status Mass Affluent deposit suite Extends/diversifies deposit franchise using a lower cost-to-serve model Balances activities/investments with brick & mortar channel Minimal risk of impacting existing deposit base Complements accretive retail-lending initiatives Opportunity to leverage data analytics investments to enhance ability to react to changing consumer preferences Facilitates opportunity to innovate Enables piloting new, digital only customer journeys & capabilities Expected to generate ~$2 billion in deposits by YE18 .27%(2) .25%(2) .30%(2) Pull in original three bullets from david’s slide Nationwide direct-to-consumer platform for digitally savvy consumers who value the flexibility & convenience of an online offering ~6% CAGR CAGR is Compound Annual Growth Rate. 1) Fiscal-year average balances. 2) Consumer Banking segment deposit costs, inclusive of interest-bearing and noninterest-bearing deposits; fiscal-year average balances. $ billions

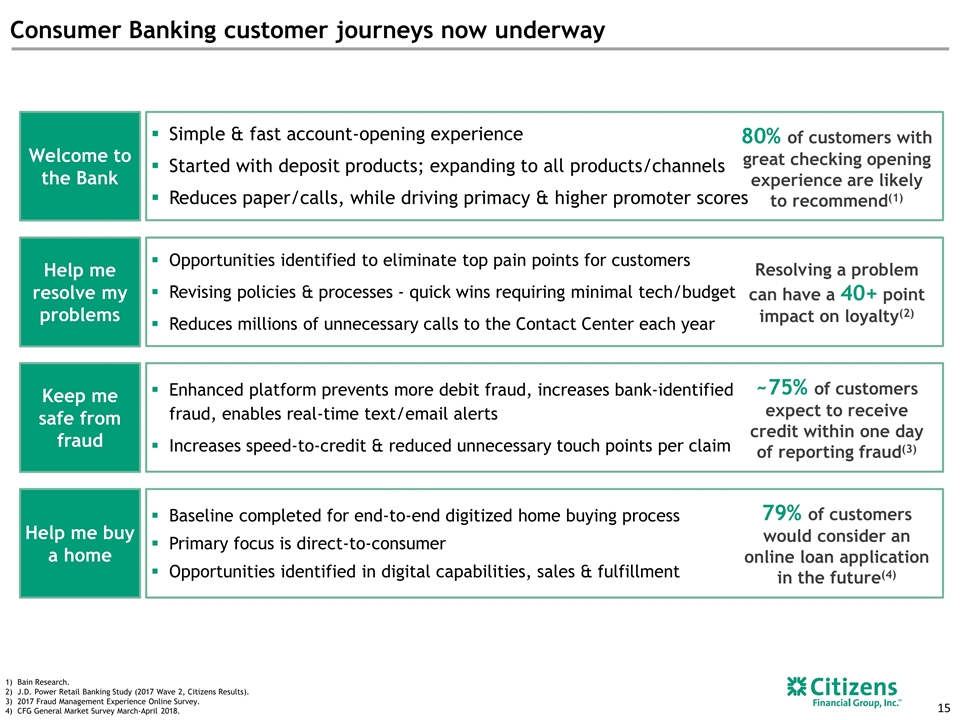

Welcome to the Bank Help me resolve my problems Keep me safe from fraud Help me buy a home Opportunities identified to eliminate top pain points for customers Revising policies & processes - quick wins requiring minimal tech/budget Reduces millions of unnecessary calls to the Contact Center each year Resolving a problem can have a 40+ point impact on loyalty(2) ~75% of customers expect to receive credit within one day of reporting fraud(3) 79% of customers would consider an online loan application in the future(4) 80% of customers with great checking opening experience are likely to recommend(1) Simple & fast account-opening experience Started with deposit products; expanding to all products/channels Reduces paper/calls, while driving primacy & higher promoter scores Enhanced platform prevents more debit fraud, increases bank-identified fraud, enables real-time text/email alerts Increases speed-to-credit & reduced unnecessary touch points per claim Baseline completed for end-to-end digitized home buying process Primary focus is direct-to-consumer Opportunities identified in digital capabilities, sales & fulfillment Bain Research. J.D. Power Retail Banking Study (2017 Wave 2, Citizens Results). 2017 Fraud Management Experience Online Survey. CFG General Market Survey March-April 2018. Consumer Banking customer journeys now underway

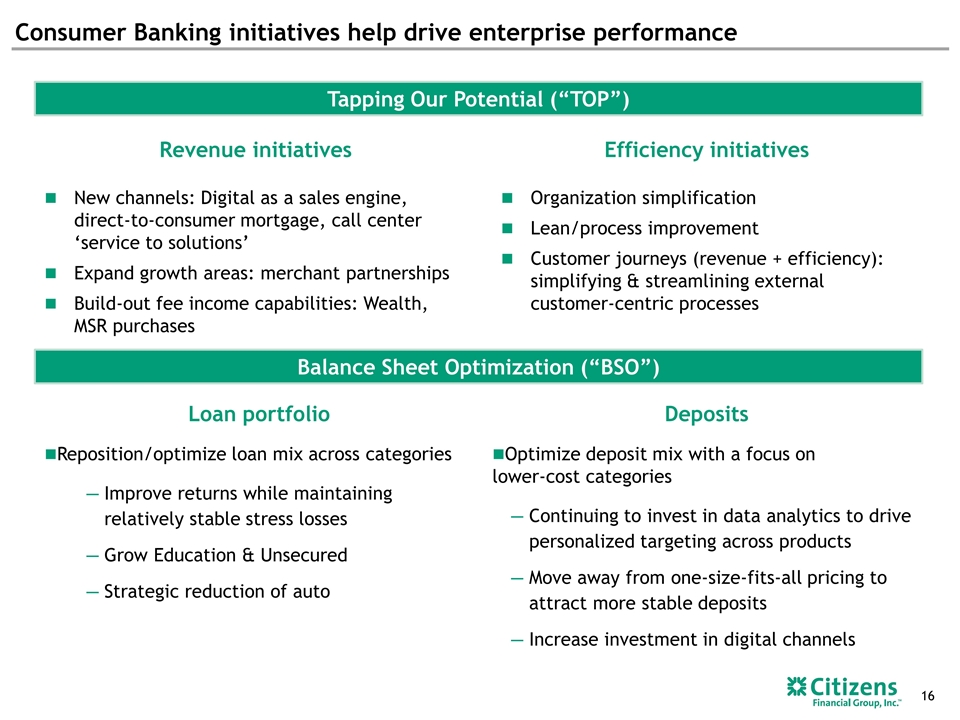

Consumer Banking initiatives help drive enterprise performance Loan portfolio Reposition/optimize loan mix across categories Improve returns while maintaining relatively stable stress losses Grow Education & Unsecured Strategic reduction of auto Deposits Optimize deposit mix with a focus on lower-cost categories Continuing to invest in data analytics to drive personalized targeting across products Move away from one-size-fits-all pricing to attract more stable deposits Increase investment in digital channels Efficiency initiatives Organization simplification Lean/process improvement Customer journeys (revenue + efficiency): simplifying & streamlining external customer-centric processes Revenue initiatives New channels: Digital as a sales engine, direct-to-consumer mortgage, call center ‘service to solutions’ Expand growth areas: merchant partnerships Build-out fee income capabilities: Wealth, MSR purchases Tapping Our Potential (“TOP”) Balance Sheet Optimization (“BSO”)

Key messages – Citizens Bank Consumer Banking’s strategy remains consistent & is helping drive strong overall CFG performance Improving customer acquisition & deepening through personalized offers & experiences Evolving distribution channels to adapt to the changing banking landscape Capturing fee income opportunities Significant investments in Wealth & Mortgage capabilities showing results Continuing to invest to drive improving efficiencies & returns On track to deliver well for all stakeholders in 2018

Appendix

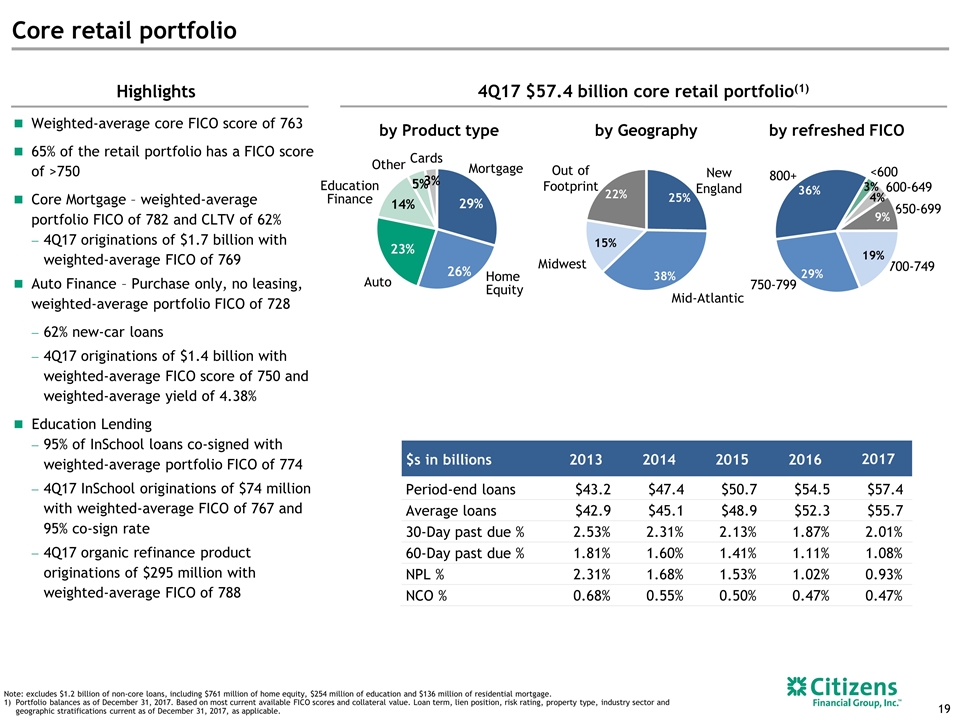

Core retail portfolio Highlights Weighted-average core FICO score of 763 65% of the retail portfolio has a FICO score of >750 Core Mortgage – weighted-average portfolio FICO of 782 and CLTV of 62% 4Q17 originations of $1.7 billion with weighted-average FICO of 769 Auto Finance – Purchase only, no leasing, weighted-average portfolio FICO of 728 62% new-car loans 4Q17 originations of $1.4 billion with weighted-average FICO score of 750 and weighted-average yield of 4.38% Education Lending 95% of InSchool loans co-signed with weighted-average portfolio FICO of 774 4Q17 InSchool originations of $74 million with weighted-average FICO of 767 and 95% co-sign rate 4Q17 organic refinance product originations of $295 million with weighted-average FICO of 788 by Product type by Geography by refreshed FICO $s in billions 2013 2014 2015 2016 2017 Period-end loans $43.2 $47.4 $50.7 $54.5 $57.4 Average loans $42.9 $45.1 $48.9 $52.3 $55.7 30-Day past due % 2.53% 2.31% 2.13% 1.87% 2.01% 60-Day past due % 1.81% 1.60% 1.41% 1.11% 1.08% NPL % 2.31% 1.68% 1.53% 1.02% 0.93% NCO % 0.68% 0.55% 0.50% 0.47% 0.47% Out of Footprint New England Mid-Atlantic Midwest Home Equity Mortgage Auto Cards Education Finance Other 800+ 750-799 700-749 650-699 600-649 <600 4Q17 $57.4 billion core retail portfolio(1) Note: excludes $1.2 billion of non-core loans, including $761 million of home equity, $254 million of education and $136 million of residential mortgage. Portfolio balances as of December 31, 2017. Based on most current available FICO scores and collateral value. Loan term, lien position, risk rating, property type, industry sector and geographic stratifications current as of December 31, 2017, as applicable.

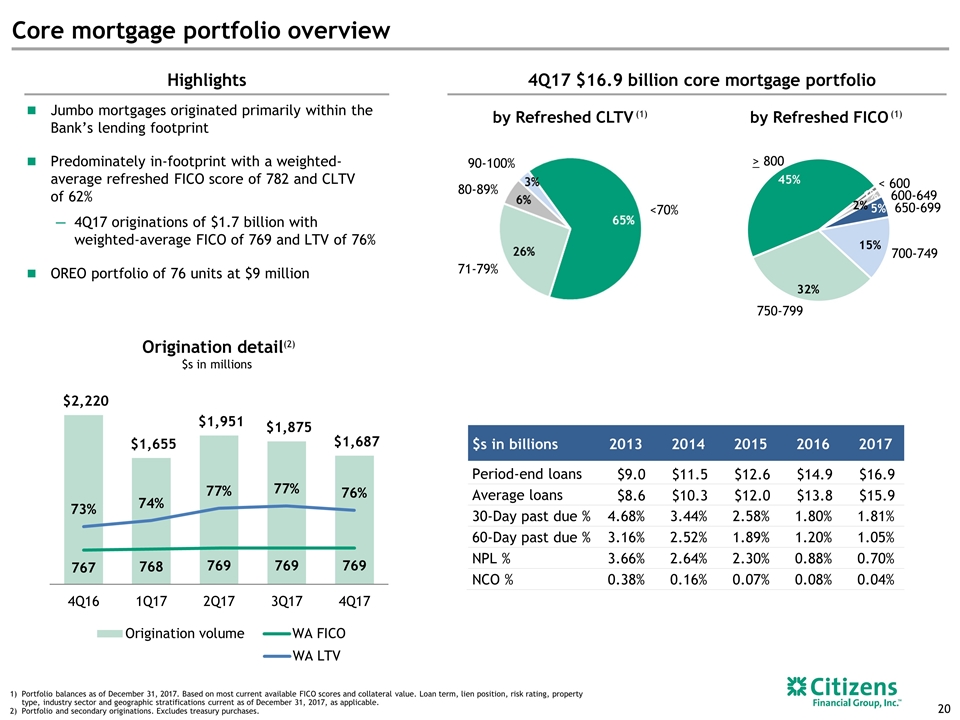

Core mortgage portfolio overview Highlights Jumbo mortgages originated primarily within the Bank’s lending footprint Predominately in-footprint with a weighted-average refreshed FICO score of 782 and CLTV of 62% 4Q17 originations of $1.7 billion with weighted-average FICO of 769 and LTV of 76% OREO portfolio of 76 units at $9 million by Refreshed CLTV by Refreshed FICO $s in billions 2013 2014 2015 2016 2017 Period-end loans $9.0 $11.5 $12.6 $14.9 $16.9 Average loans $8.6 $10.3 $12.0 $13.8 $15.9 30-Day past due % 4.68% 3.44% 2.58% 1.80% 1.81% 60-Day past due % 3.16% 2.52% 1.89% 1.20% 1.05% NPL % 3.66% 2.64% 2.30% 0.88% 0.70% NCO % 0.38% 0.16% 0.07% 0.08% 0.04% 90-100% 71-79% 80-89% Origination detail(2) $s in millions Portfolio balances as of December 31, 2017. Based on most current available FICO scores and collateral value. Loan term, lien position, risk rating, property type, industry sector and geographic stratifications current as of December 31, 2017, as applicable. Portfolio and secondary originations. Excludes treasury purchases. (1) (1) <70% 4Q17 $16.9 billion core mortgage portfolio < 600 600-649 700-749 > 800 650-699 750-799

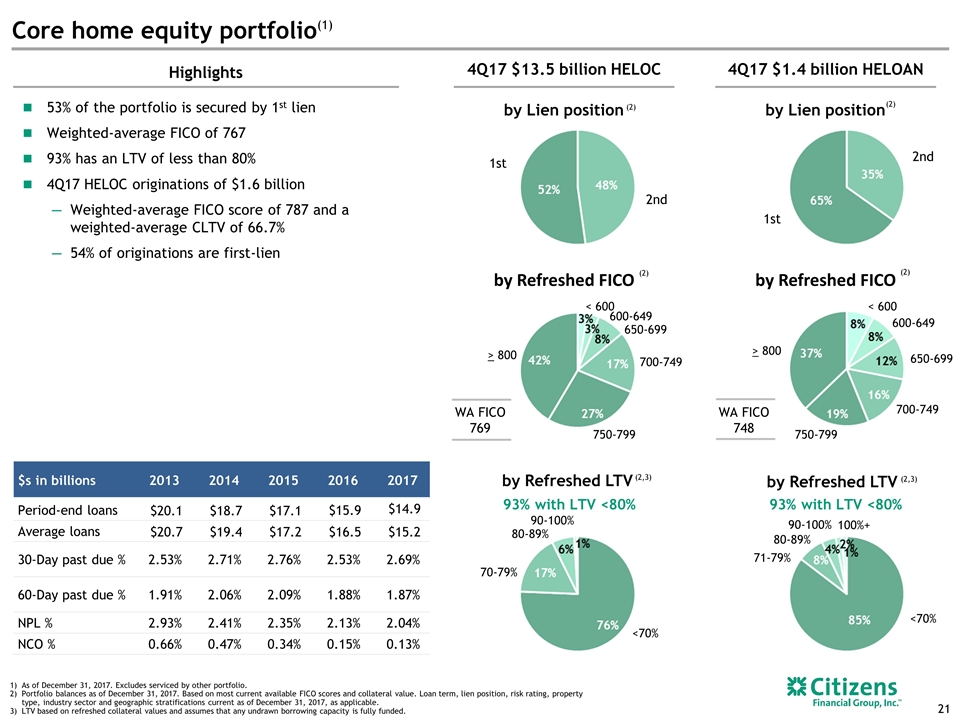

$s in billions 2013 2014 2015 2016 2017 Period-end loans $20.1 $18.7 $17.1 $15.9 $14.9 Average loans $20.7 $19.4 $17.2 $16.5 $15.2 30-Day past due % 2.53% 2.71% 2.76% 2.53% 2.69% 60-Day past due % 1.91% 2.06% 2.09% 1.88% 1.87% NPL % 2.93% 2.41% 2.35% 2.13% 2.04% NCO % 0.66% 0.47% 0.34% 0.15% 0.13% As of December 31, 2017. Excludes serviced by other portfolio. Portfolio balances as of December 31, 2017. Based on most current available FICO scores and collateral value. Loan term, lien position, risk rating, property type, industry sector and geographic stratifications current as of December 31, 2017, as applicable. LTV based on refreshed collateral values and assumes that any undrawn borrowing capacity is fully funded. by Lien position by Lien position 2nd 1st 2nd 1st Highlights (2) (2) 4Q17 $13.5 billion HELOC 4Q17 $1.4 billion HELOAN Core home equity portfolio(1) by Refreshed LTV by Refreshed FICO by Refreshed FICO <70% 90-100% 71-79% <70% 70-79% 80-89% WA FICO 769 WA FICO 748 93% with LTV <80% 93% with LTV <80% (2) (2,3) (2) (2,3) by Refreshed LTV 80-89% 90-100% 100%+ 53% of the portfolio is secured by 1st lien Weighted-average FICO of 767 93% has an LTV of less than 80% 4Q17 HELOC originations of $1.6 billion Weighted-average FICO score of 787 and a weighted-average CLTV of 66.7% 54% of originations are first-lien < 600 600-649 700-749 > 800 650-699 750-799 < 600 600-649 700-749 > 800 650-699 750-799

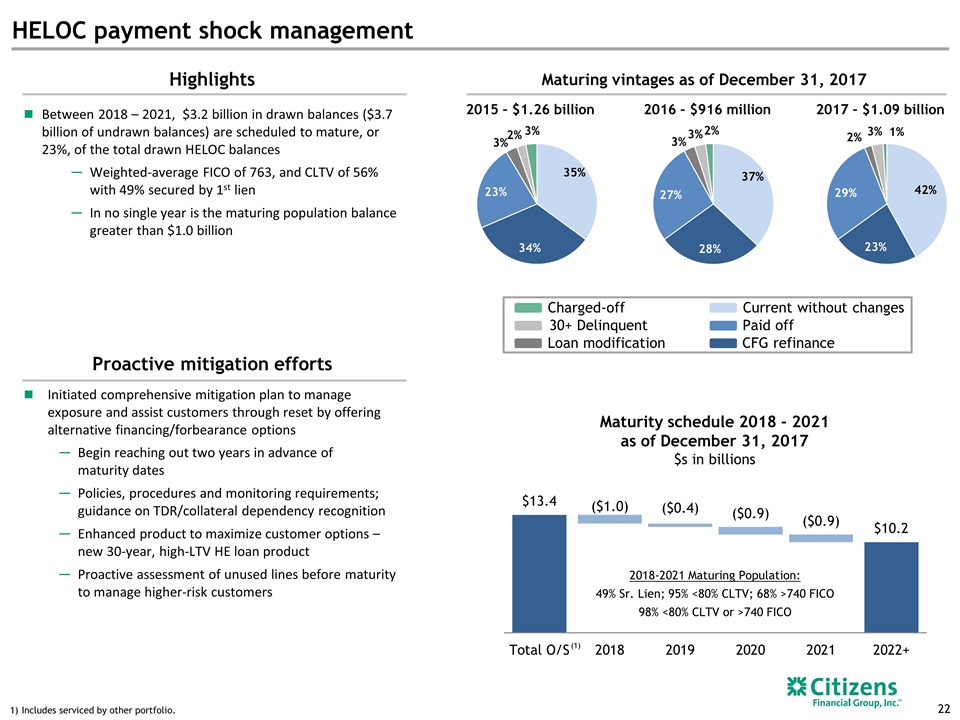

Highlights Between 2018 – 2021, $3.2 billion in drawn balances ($3.7 billion of undrawn balances) are scheduled to mature, or 23%, of the total drawn HELOC balances Weighted-average FICO of 763, and CLTV of 56% with 49% secured by 1st lien In no single year is the maturing population balance greater than $1.0 billion Maturing vintages as of December 31, 2017 HELOC payment shock management 2015 – $1.26 billion 2016 – $916 million 2017 – $1.09 billion Maturity schedule 2018 - 2021 as of December 31, 2017 $s in billions Includes serviced by other portfolio. (1) Proactive mitigation efforts Initiated comprehensive mitigation plan to manage exposure and assist customers through reset by offering alternative financing/forbearance options Begin reaching out two years in advance of maturity dates Policies, procedures and monitoring requirements; guidance on TDR/collateral dependency recognition Enhanced product to maximize customer options – new 30-year, high-LTV HE loan product Proactive assessment of unused lines before maturity to manage higher-risk customers 2018-2021 Maturing Population: 49% Sr. Lien; 95% <80% CLTV; 68% >740 FICO 98% <80% CLTV or >740 FICO Charged-off 30+ Delinquent Loan modification Current without changes Paid off CFG refinance

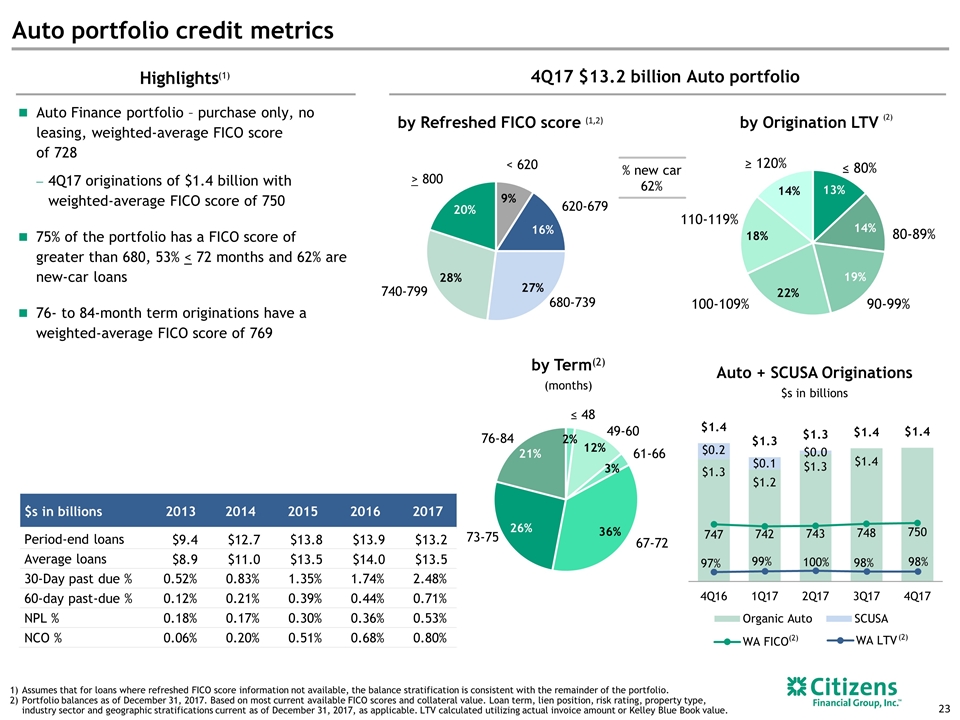

Auto portfolio credit metrics Highlights by Refreshed FICO score ≤ 48 49-60 76-84 61-66 67-72 73-75 by Origination LTV Assumes that for loans where refreshed FICO score information not available, the balance stratification is consistent with the remainder of the portfolio. Portfolio balances as of December 31, 2017. Based on most current available FICO scores and collateral value. Loan term, lien position, risk rating, property type, industry sector and geographic stratifications current as of December 31, 2017, as applicable. LTV calculated utilizing actual invoice amount or Kelley Blue Book value. (1) (1,2) Auto + SCUSA Originations $s in billions (2) $s in billions 2013 2014 2015 2016 2017 Period-end loans $9.4 $12.7 $13.8 $13.9 $13.2 Average loans $8.9 $11.0 $13.5 $14.0 $13.5 30-Day past due % 0.52% 0.83% 1.35% 1.74% 2.48% 60-day past-due % 0.12% 0.21% 0.39% 0.44% 0.71% NPL % 0.18% 0.17% 0.30% 0.36% 0.53% NCO % 0.06% 0.20% 0.51% 0.68% 0.80% (2) (2) by Term(2) (months) Auto Finance portfolio – purchase only, no leasing, weighted-average FICO score of 728 4Q17 originations of $1.4 billion with weighted-average FICO score of 750 75% of the portfolio has a FICO score of greater than 680, 53% < 72 months and 62% are new-car loans 76- to 84-month term originations have a weighted-average FICO score of 769 80-89% 90-99% 100-109% 110-119% ≥ 120% ≤ 80% % new car 62% 620-679 680-739 > 800 < 620 740-799 4Q17 $13.2 billion Auto portfolio

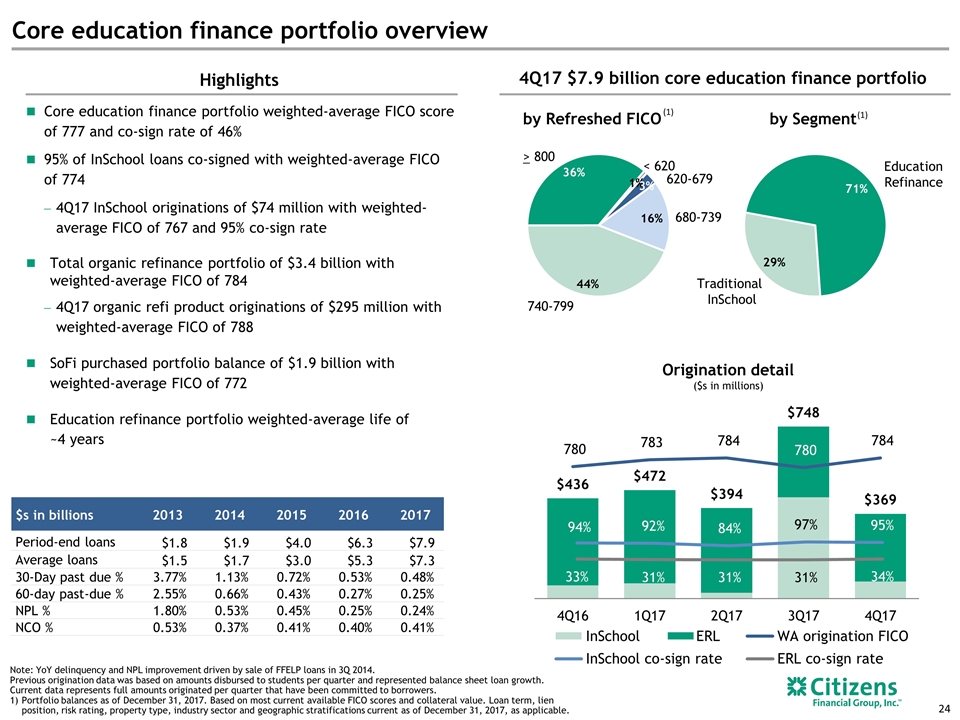

Core education finance portfolio overview Highlights by Refreshed FICO Note: YoY delinquency and NPL improvement driven by sale of FFELP loans in 3Q 2014. Previous origination data was based on amounts disbursed to students per quarter and represented balance sheet loan growth. Current data represents full amounts originated per quarter that have been committed to borrowers. Portfolio balances as of December 31, 2017. Based on most current available FICO scores and collateral value. Loan term, lien position, risk rating, property type, industry sector and geographic stratifications current as of December 31, 2017, as applicable. Core education finance portfolio weighted-average FICO score of 777 and co-sign rate of 46% 95% of InSchool loans co-signed with weighted-average FICO of 774 4Q17 InSchool originations of $74 million with weighted-average FICO of 767 and 95% co-sign rate Total organic refinance portfolio of $3.4 billion with weighted-average FICO of 784 4Q17 organic refi product originations of $295 million with weighted-average FICO of 788 SoFi purchased portfolio balance of $1.9 billion with weighted-average FICO of 772 Education refinance portfolio weighted-average life of ~4 years by Segment Traditional InSchool Education Refinance (1) $s in billions 2013 2014 2015 2016 2017 Period-end loans $1.8 $1.9 $4.0 $6.3 $7.9 Average loans $1.5 $1.7 $3.0 $5.3 $7.3 30-Day past due % 3.77% 1.13% 0.72% 0.53% 0.48% 60-day past-due % 2.55% 0.66% 0.43% 0.27% 0.25% NPL % 1.80% 0.53% 0.45% 0.25% 0.24% NCO % 0.53% 0.37% 0.41% 0.40% 0.41% 4Q17 $7.9 billion core education finance portfolio (1) Origination detail ($s in millions) 620-679 680-739 > 800 < 620 740-799 InSchool co-sign rate ERL co-sign rate InSchool ERL WA origination FICO

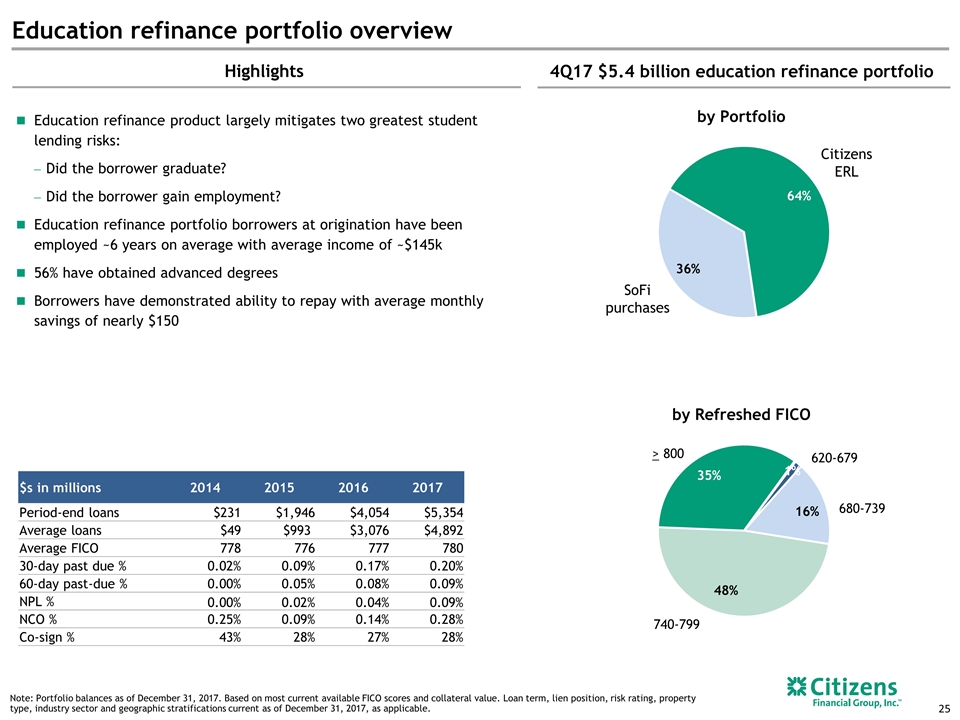

Education refinance portfolio overview Note: Portfolio balances as of December 31, 2017. Based on most current available FICO scores and collateral value. Loan term, lien position, risk rating, property type, industry sector and geographic stratifications current as of December 31, 2017, as applicable. Education refinance product largely mitigates two greatest student lending risks: Did the borrower graduate? Did the borrower gain employment? Education refinance portfolio borrowers at origination have been employed ~6 years on average with average income of ~$145k 56% have obtained advanced degrees Borrowers have demonstrated ability to repay with average monthly savings of nearly $150 Highlights 4Q17 $5.4 billion education refinance portfolio Citizens ERL SoFi purchases 620-679 680-739 > 800 740-799 by Refreshed FICO by Portfolio $s in millions 2014 2015 2016 2017 Period-end loans $231 $1,946 $4,054 $5,354 Average loans $49 $993 $3,076 $4,892 Average FICO 778 776 777 780 30-day past due % 0.02% 0.09% 0.17% 0.20% 60-day past-due % 0.00% 0.05% 0.08% 0.09% NPL % 0.00% 0.02% 0.04% 0.09% NCO % 0.25% 0.09% 0.14% 0.28% Co-sign % 43% 28% 27% 28%

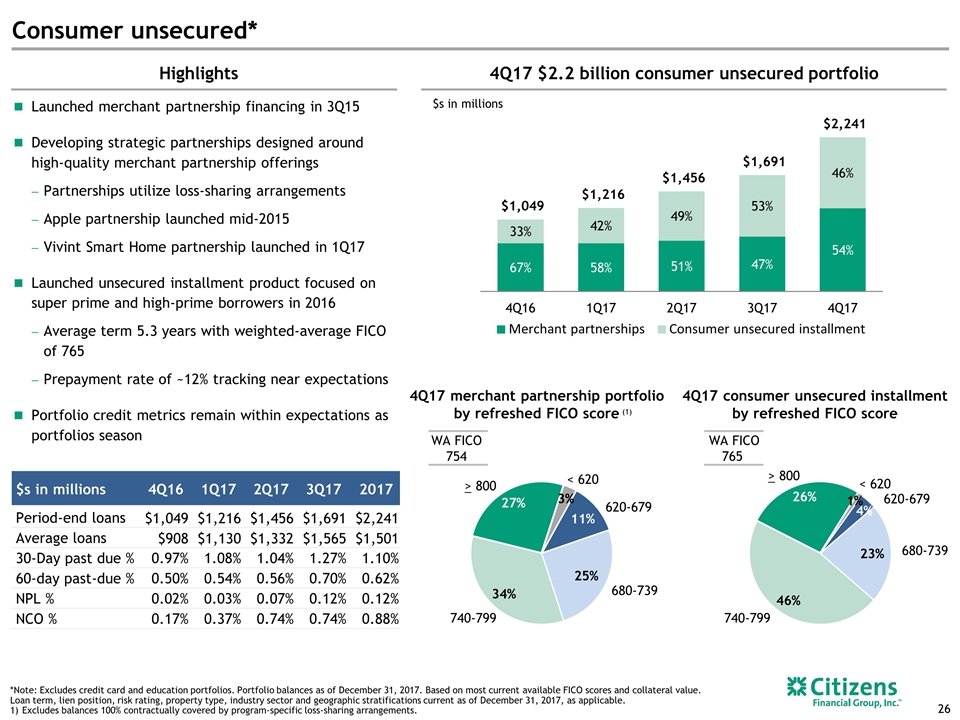

Consumer unsecured* $s in millions 4Q16 1Q17 2Q17 3Q17 2017 Period-end loans $1,049 $1,216 $1,456 $1,691 $2,241 Average loans $908 $1,130 $1,332 $1,565 $1,501 30-Day past due % 0.97% 1.08% 1.04% 1.27% 1.10% 60-day past-due % 0.50% 0.54% 0.56% 0.70% 0.62% NPL % 0.02% 0.03% 0.07% 0.12% 0.12% NCO % 0.17% 0.37% 0.74% 0.74% 0.88% Highlights Launched merchant partnership financing in 3Q15 Developing strategic partnerships designed around high-quality merchant partnership offerings Partnerships utilize loss-sharing arrangements Apple partnership launched mid-2015 Vivint Smart Home partnership launched in 1Q17 Launched unsecured installment product focused on super prime and high-prime borrowers in 2016 Average term 5.3 years with weighted-average FICO of 765 Prepayment rate of ~12% tracking near expectations Portfolio credit metrics remain within expectations as portfolios season 4Q17 $2.2 billion consumer unsecured portfolio $s in millions 4Q17 merchant partnership portfolio by refreshed FICO score 4Q17 consumer unsecured installment by refreshed FICO score WA FICO 765 *Note: Excludes credit card and education portfolios. Portfolio balances as of December 31, 2017. Based on most current available FICO scores and collateral value. Loan term, lien position, risk rating, property type, industry sector and geographic stratifications current as of December 31, 2017, as applicable. Excludes balances 100% contractually covered by program-specific loss-sharing arrangements. (1) WA FICO 754 620-679 680-739 > 800 < 620 740-799 620-679 680-739 > 800 < 620 740-799 Merchant partnerships Consumer unsecured installment