Attached files

| file | filename |

|---|---|

| 8-K - 8-K INVESTOR PRESENTATION JUNE 2018 - Infrastructure & Energy Alternatives, Inc. | a8-kinvestorpresentationju.htm |

INVESTOR PRESENTATION • June 5, 2018 •

DISCLAIMER This presentation includes “forward looking statements” within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995. Forward-looking statements may be identified by the use of words such as “forecast,” “intend,” “seek,” “target,” “anticipate,” “believe,” “expect,” “estimate,” “plan,” “outlook,” and “project” and other similar expressions that predict or indicate future events or trends or that are not statements of historical matters. Such forward looking statements include projected financial information. Such forward looking statements with respect to projections, revenues, earnings, performance, strategies, prospects and other aspects of the businesses of Infrastructure and Energy Alternatives, Inc. (the “Company” or “IEA”) are based on current expectations that are subject to risks and uncertainties. A number of factors could cause actual results or outcomes to differ materially from those indicated by such forward looking statements. These factors include, but are not limited to: (1) the reduction in value of production tax credits and investment tax credits due to the enactment of the Tax Cuts and Jobs Act in December 2017; (2) the adverse effect on our business and financial condition if we fail to comply with the regulations of The Occupational Safety and Health Act of 1970, as amended, and other state and local agencies that oversee transportation and safety compliance; (3) substantial liabilities that could result from physical hazards; (4) the inability to operate efficiently if we are unable to attract and retain qualified managers and skilled employees; (5) an inability to realize financial and strategic goals from acquisition and investment activity; (6) significant changes in tax and other economic incentives and political and governmental policies which could materially and adversely affect the U.S. wind and solar industries and (7) other risks and uncertainties indicated in the Company’s definitive proxy statement filed with the Securities and Exchange Commission (the “SEC”) on February 9, 2018 (as supplemented, the “Proxy Statement”), including those under “Risk Factors” therein, and other documents filed or to be filed with the SEC by the Company. You are cautioned not to place undue reliance upon any forward-looking statements, which speak only as of the date made. The Company does not undertake to update or revise the forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law. This presentation includes information based on independent industry publications and other sources. You should not construe the contents of this presentation as legal, accounting, business or tax advice and you should consult your own professional advisors as to the legal, accounting, business, tax, financial or other matters contained herein. The estimates, forecasts and projections contained herein involve significant elements of subjective judgment and analysis and reflect numerous judgments, estimates and assumptions that are inherently uncertain in prospective financial information of any kind. As such, no representation can be made as to the attainability of such estimates, forecasts and projections. Investors are cautioned that such estimates, forecasts or projections have not been audited and have not been prepared in conformance with generally accepted accounting principles. For a listing of risks and other factors that could impact the combined company’s ability to attain its projected results, please refer to the “forward looking statements” above and the “Risk Factors” section of the Proxy Statement. This presentations includes projections that are forward-looking and based on growth assumptions that are inherently subject to significant uncertainties and contingencies, many of which are beyond IEA’s control. While all projections are necessarily speculative, IEA believes that projections relating to periods beyond 12 months from their date of preparation carry increasingly higher levels of uncertainty and should be read in that context. There will be differences between actual and projected results, and actual results may be materially greater or materially less than those contained in the projections. This presentation includes non-GAAP financial measures. Definitions of these non-GAAP financial measures and reconciliations of these non-GAAP financial measures to the most directly comparable GAAP financial measures are included elsewhere in this presentation. IEA believes that these non-GAAP financial measures provide useful information to management and investors regarding certain financial and business trends relating to IEA’s financial condition and results of operations. A more fulsome description of the nature of the adjustments from GAAP is provided elsewhere in this presentation. These non-GAAP financial measures may exclude items that are significant in understanding and assessing financial results. Therefore, these financial measures should not be considered in isolation or as an alternative to net income or other measures of profitability or performance under GAAP. Because these non-GAAP financial measures are not in conformity with GAAP, we urge you to review IEA’s audited financial statements, which have been filed with the SEC. 2

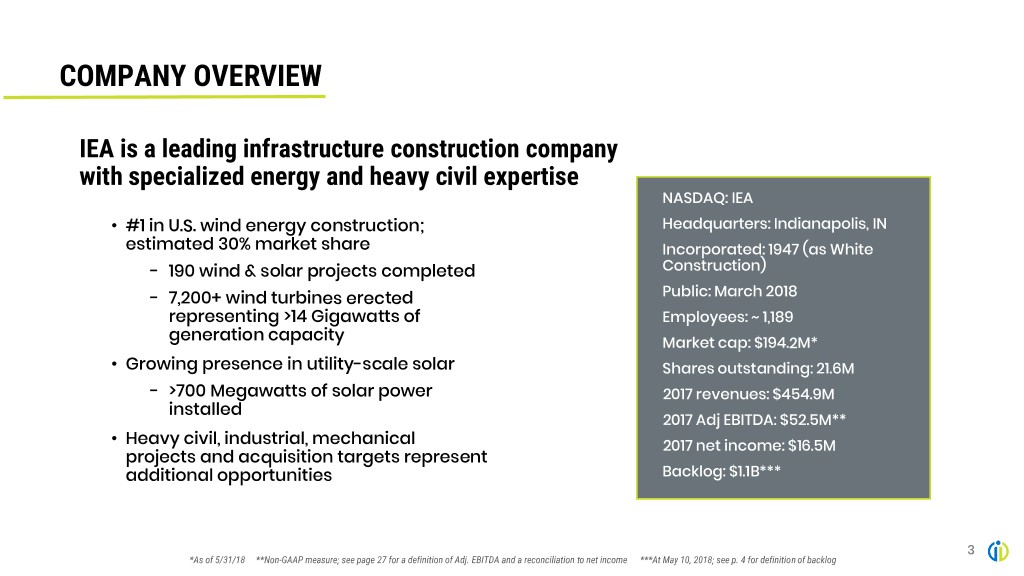

COMPANY OVERVIEW IEA is a leading infrastructure construction company with specialized energy and heavy civil expertise NASDAQ: IEA • #1 in U.S. wind energy construction; Headquarters: Indianapolis, IN estimated 30% market share Incorporated: 1947 (as White − 190 wind & solar projects completed Construction) − 7,200+ wind turbines erected Public: March 2018 representing >14 Gigawatts of Employees: ~ 1,189 generation capacity Market cap: $194.2M* • Growing presence in utility-scale solar Shares outstanding: 21.6M − >700 Megawatts of solar power 2017 revenues: $454.9M installed 2017 Adj EBITDA: $52.5M** • Heavy civil, industrial, mechanical 2017 net income: $16.5M projects and acquisition targets represent additional opportunities Backlog: $1.1B*** *As of 5/31/18 **Non-GAAP measure; see page 27 for a definition of Adj. EBITDA and a reconciliation to net income ***At May 10, 2018; see p. 4 for definition of backlog 3

INVESTMENT THESIS • Pure-play, publicly traded renewable energy engineering, procurement and construction (EPC) company • Leading share of wind market with strong project controls, quality assurance, engineering management and self-perform capabilities • High barriers to entry resulting from specialized capabilities • Renewables power generation is projected to grow ~139% by 2050 (1) • Strong relationships with established, recurring base of blue-chip, investment grade customers and OEMs • Record total backlog(2) of approximately $1.1 billion as of 5/10/18 points to significant revenue growth in 2018 and 2019 • Opportunity to capture incremental annual EBITDA through self- performance of previously subcontracted high voltage electrical work • Strong adjusted free cash flow (3) supports investment in organic growth and M&A • Proven management team with extensive industry knowledge, and #1 safety record versus other Tier I renewable EPCs(4) (1) Source: U.S. Energy Information Administration (January 2018). (2) Backlog means the amount of revenue expected to be realized from the uncompleted portions of existing awards and contracts, including any contracts under which work has not begun and any awarded contracts for which the definitive project documentation is being prepared, as well as expected revenue from change orders and renewal options. Backlog data as of May 10, 2018. (3) Adjusted free cash flow is defined as Adj. EBITDA less capital expenditures and payments under capital leases. 4 (4) Based on 2017 Experience Modification Rate (“EMR”) and Total Recordable Incident Rate (“TRIR”) which are released by the US Department of Labor.

SUMMARY FINANCIAL PERFORMANCE Revenue(1) ($ in millions) Adjusted EBITDA & Margin(1) ($ in millions) $120 25.0% $100 $8 20.0% $64 $80 5 $53 15.0% $775 $60 $75 10.0% $40 $20 5.0% $0 0.0% (3) '16 '17 '18E ‘ (3) Adj. EBITDA Margin • Record results in 2016 driven by new management refocus on U.S. operations, strong project controls and execution • Total new wind construction declined from 8.7 GW in 2016 to 7.0 GW in 2017 (2) – Build-up in 2016 due to PTC extension uncertainty; slow-down in 2017 due to uncertainty over the 2017 Tax Act – Projected to return to 8.4 GW of new capacity in 2018E and to continue to grow to 11.0 GW in 2019E and 13.0 GW in 2020E • Backlog and estimated market share increased in 2017 pointing to strong 2018/2019 growth (1) See page 27 for a definition of Adjusted EBITDA and Adjusted EBITDA Margin and a reconciliation to Adj. EBITDA to net income. (2) Source: American Wind Energy Association (Jan. 2018). 5 (3) Represents 2018 revenue outlook of 775 M (blue bar) to 835 M (green bar) and adjusted EBITDA of 75 M (blue bar) to 85 M (green bar) (see slide 26)

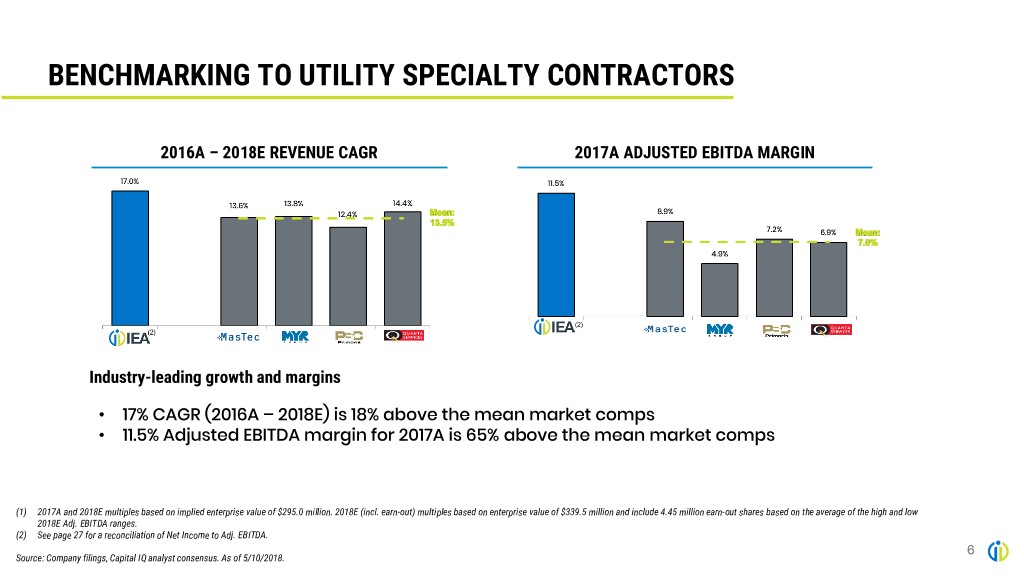

BENCHMARKING TO UTILITY SPECIALTY CONTRACTORS 2016A – 2018E REVENUE CAGR 2017A ADJUSTED EBITDA MARGIN (2) Industry-leading growth and margins • 17% CAGR (2016A – 2018E) is 18% above the mean market comps • 11.5% Adjusted EBITDA margin for 2017A is 65% above the mean market comps (1) 2017A and 2018E multiples based on implied enterprise value of $295.0 million. 2018E (incl. earn-out) multiples based on enterprise value of $339.5 million and include 4.45 million earn-out shares based on the average of the high and low 2018E Adj. EBITDA ranges. (2) See page 27 for a reconciliation of Net Income to Adj. EBITDA. Source: Company filings, Capital IQ analyst consensus. As of 5/10/2018. 6

BENCHMARKING TO UTILITY SPECIALTY CONTRACTORS ENTERPRISE VALUE / EBIT ENTERPRISE VALUE / EBITDA 2017A Adj. 2017A Adj. 2018E 2018E 2018E (incl. earn-out) 2018 Mean: 7.7x 2018 4.2x Mean: 12.3x (1)(2) (1) Current valuations are significantly below market comps • 3.9x Enterprise Value/2018E Adjusted EBIT vs. 12.3x for market comps • 4.2x Enterprise Value/2018E Adjusted EBITDA vs 7.7x for market comps (1) 2017A and 2018E multiples based on implied enterprise value of $295.0 million. 2018E (incl. earn-out) multiples based on enterprise value of $339.5 million and include 4.45 million earn-out shares based on the average of the high and low 2018E Adj. EBITDA ranges. (2) See page 27 for a reconciliation of Net Income to Adj. EBITDA. Source: Company filings, Capital IQ analyst consensus. As of 5/10/2018. 7

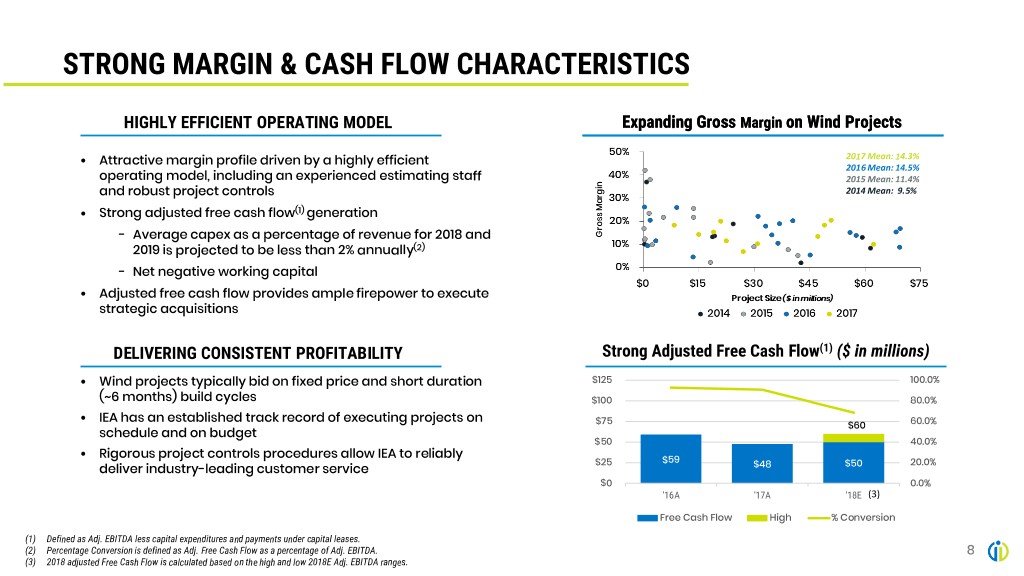

STRONG MARGIN & CASH FLOW CHARACTERISTICS HIGHLY EFFICIENT OPERATING MODEL Expanding Gross Margin on Wind Projects • 2017 Mean: 14.3% Attractive margin profile driven by a highly efficient 2016 Mean: 14.5% operating model, including an experienced estimating staff 2015 Mean: 11.4% and robust project controls 2014 Mean: 9.5% • Strong adjusted free cash flow(1) generation − Average capex as a percentage of revenue for 2018 and 2019 is projected to be less than 2% annually(2) − Net negative working capital • Adjusted free cash flow provides ample firepower to execute strategic acquisitions DELIVERING CONSISTENT PROFITABILITY Strong Adjusted Free Cash Flow(1) ($ in millions) • Wind projects typically bid on fixed price and short duration $125 100.0% (~6 months) build cycles $100 80.0% • IEA has an established track record of executing projects on $75 $60 60.0% schedule and on budget $50 40.0% • Rigorous project controls procedures allow IEA to reliably $25 $59 $50 20.0% deliver industry-leading customer service $48 $0 0.0% '16A '17A '18E (3) Free Cash Flow High % Conversion (1) Defined as Adj. EBITDA less capital expenditures and payments under capital leases. (2) Percentage Conversion is defined as Adj. Free Cash Flow as a percentage of Adj. EBITDA. 8 (3) 2018 adjusted Free Cash Flow is calculated based on the high and low 2018E Adj. EBITDA ranges.

MARCH 2018 TRANSACTION OVERVIEW • On March 26, 2018, (“Closing Date”) the Company completed its merger with M III Acquisition Corp. • The Company entered into a new credit facility which provides for aggregate revolving borrowings of up to $50 million and a $50 million (plus, subject to certain conditions, an additional $25 million accordion capacity) delayed-draw term loan facility, each maturing in March 2021. EQUITY HIGHLIGHTS POST-TRANSACTION OWNERSHIP • 21.6 million shares outstanding at Closing Date At Close Fully Distributed (1) • Up to 9.0 million shares of common stock issuable as earn-out based upon 2018 EBITDA target and/or 2019 EBITDA target (see slide 26) Stockholders • 3.4 million shares of preferred stock convertible into prior to Stockholders business common stock after third anniversary of the Closing Oaktree/ prior to combination Management business 32.7% Date 48.3% combination Oaktree/ 51.7% Management • Approximately 16.9 million warrants outstanding, 67.3% exercisable for approximately 8.4 million shares of common stock at a price of $11.50 (1) Assumes common shares outstanding, plus the 9.0 million of earnout shares and the conversion of preferred stock, with assumed conversion of $10 per common share for 3.4 million shares of common stock. Warrants were excluded as they are not currently in the money. 9

AMPLE LIQUIDITY TO SUPPORT GROWTH STRATEGY As of March 31, 2018: • ~$20 million of cash and cash equivalents • ~$34 million of availability on credit facility (excluding the $25 million accordion feature) • Targeting 2018 Free Cash Flow* of ~$50-$60 million • $25 million Accordion feature on credit facility, and in the future, publicly traded shares, when appropriate, can facilitate M&A opportunities *Free Cash Flow is defined as adjusted EBITDA less Capex, Capital Lease Payments Interest, and Taxes. 10

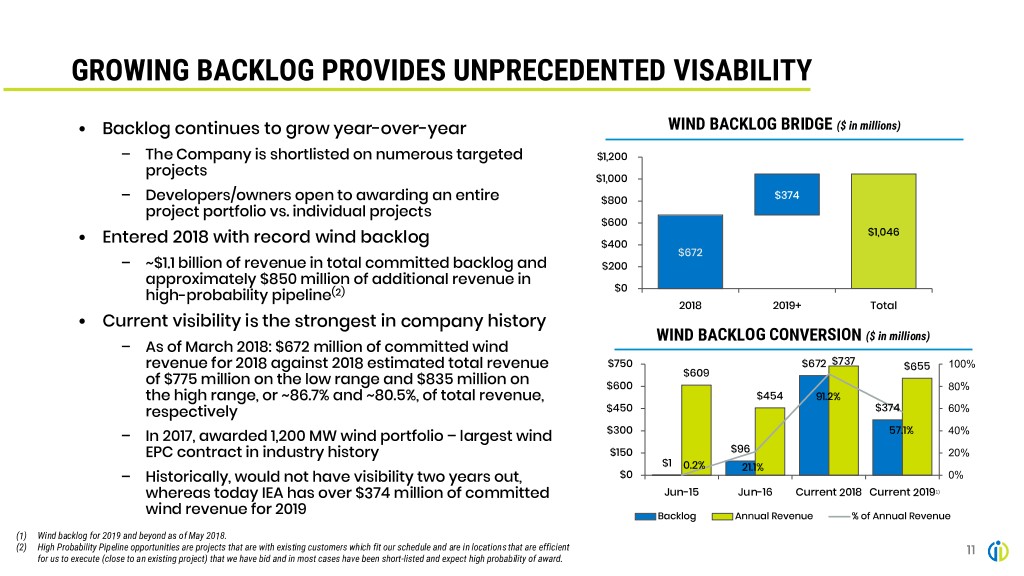

GROWING BACKLOG PROVIDES UNPRECEDENTED VISABILITY WIND BACKLOG BRIDGE ($ in millions) • Backlog continues to grow year-over-year – The Company is shortlisted on numerous targeted $1,200 projects $1,000 – Developers/owners open to awarding an entire $800 $374 project portfolio vs. individual projects $600 • $1,046 Entered 2018 with record wind backlog $400 $672 – ~$1.1 billion of revenue in total committed backlog and $200 approximately $850 million of additional revenue in $0 high-probability pipeline(2) 2018 2019+ Total • Current visibility is the strongest in company history WIND BACKLOG CONVERSION ($ in millions) – As of March 2018: $672 million of committed wind revenue for 2018 against 2018 estimated total revenue $750 $672 $737 $655 100% $609 of $775 million on the low range and $835 million on $600 80% the high range, or ~86.7% and ~80.5%, of total revenue, $454 91.2% 60% respectively $450 $374 $300 40% – In 2017, awarded 1,200 MW wind portfolio – largest wind 57.1% EPC contract in industry history $150 $96 20% $1 0.2% 21.1% – Historically, would not have visibility two years out, $0 0% whereas today IEA has over $374 million of committed Jun-15 Jun-16 Current 2018 Current 2019(1) wind revenue for 2019 Backlog Annual Revenue % of Annual Revenue (1) Wind backlog for 2019 and beyond as of May 2018. (2) High Probability Pipeline opportunities are projects that are with existing customers which fit our schedule and are in locations that are efficient for us to execute (close to an existing project) that we have bid and in most cases have been short-listed and expect high probability of award. 11

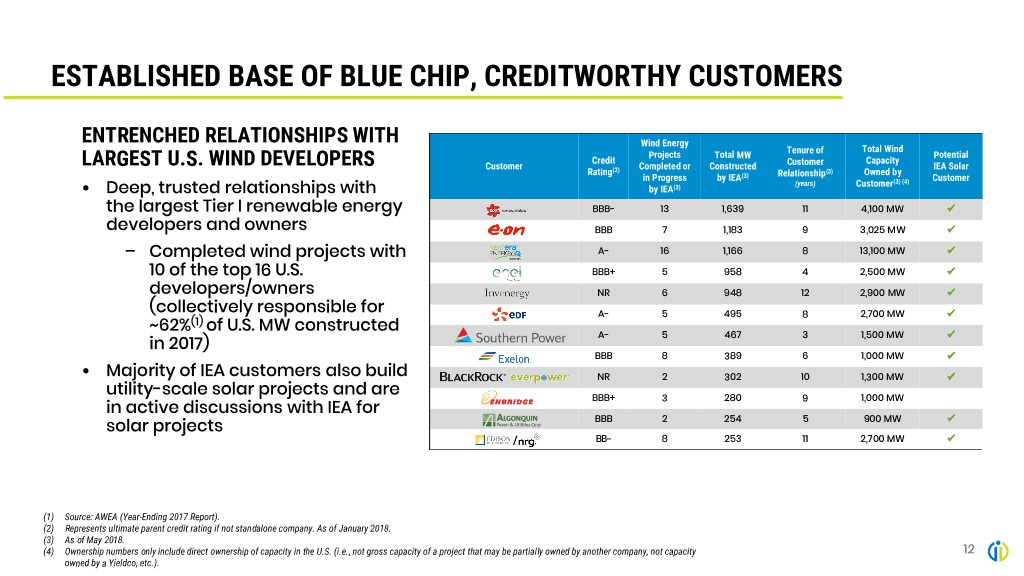

ESTABLISHED BASE OF BLUE CHIP, CREDITWORTHY CUSTOMERS ENTRENCHED RELATIONSHIPS WITH Wind Energy Total Wind Projects Total MW Tenure of Potential Credit Capacity LARGEST U.S. WIND DEVELOPERS Customer Completed or Constructed Customer IEA Solar Rating(2) (3) Owned by in Progress by IEA(3) Relationship Customer (years) Customer(3) (4) • Deep, trusted relationships with by IEA(3) the largest Tier I renewable energy BBB- 13 1,639 11 4,100 MW developers and owners BBB 7 1,183 9 3,025 MW – Completed wind projects with A- 16 1,166 8 13,100 MW 10 of the top 16 U.S. BBB+ 5 958 4 2,500 MW developers/owners NR 6 948 12 2,900 MW (collectively responsible for A- 5 495 8 2,700 MW (1) ~62% of U.S. MW constructed A- 5 467 3 1,500 MW in 2017) BBB 8 389 6 1,000 MW • Majority of IEA customers also build NR 2 302 10 1,300 MW utility-scale solar projects and are BBB+ 3 280 9 1,000 MW in active discussions with IEA for BBB 2 254 5 900 MW solar projects / BB- 8 253 11 2,700 MW (1) Source: AWEA (Year-Ending 2017 Report). (2) Represents ultimate parent credit rating if not standalone company. As of January 2018. (3) As of May 2018. (4) Ownership numbers only include direct ownership of capacity in the U.S. (i.e., not gross capacity of a project that may be partially owned by another company, not capacity 12 owned by a Yieldco, etc.).

RENEWABLE ENERGY INFRASTRUCTURE CONSTRUCTION IS HIGHLY SPECIALIZED Competitive EPC Landscape WA:WA: 15%15% byby 2020* Tier I Double- Engineering Self-Perform Solar 2017E Wind Competitor Provider Breasted(1) Management Electrical Capabilities Installation(2) (3) 1,617 MW 1,5001,500 MW MW 600 MW 1,100 MW 500 MW Market Overview Self-Perform Is Critical • IEA is one of only three Tier I providers for wind construction and is • Construction is ~20%-25% of total cost, but is largest risk to the entire project shortlisted on major targeted projects − Owners demand self-performing services and experienced • IEA believes reliability is more important to customers than price contractors • • Owners and project financiers limit acceptable EPCs Self-perform capabilities allow IEA to retain margin, while better controlling safety and scheduling of projects • Consolidated market share with few EPCs of scale − Turbine erection − Significant competitive barriers limit new market entrants − Service road design and installation • Labor constrained market − Concrete and foundation − Electrical (high voltage being implemented) − Mechanical (1) “Double-breasted” workforce is defined as capability to offer union and non-union labor forces. (2) Source: IEA management actual and MAKE Consulting (May 2017). (3) Executing strategy to self-perform high-voltage electrical work. 13

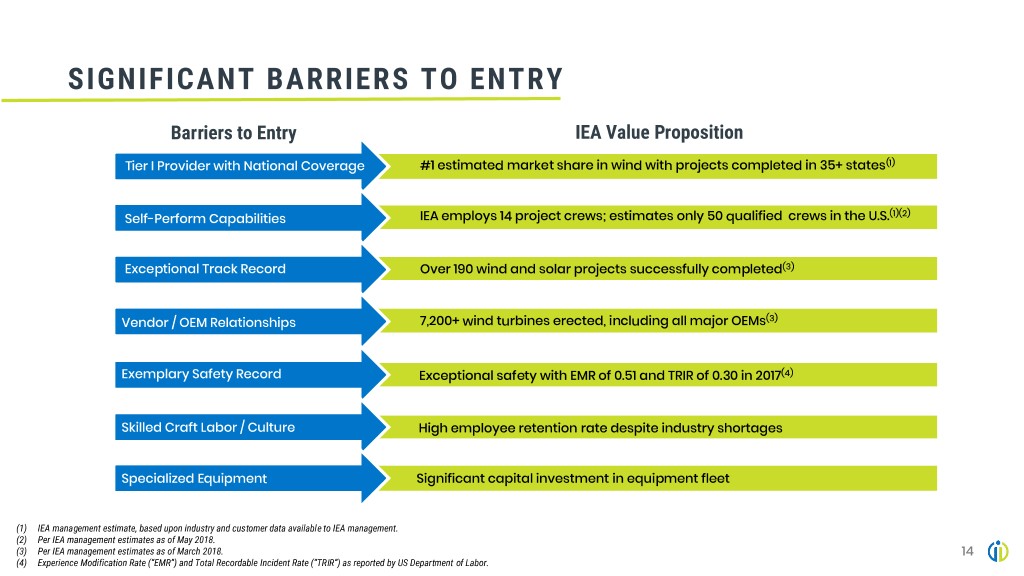

SIGNIFICANT BARRIERS TO ENTRY Barriers to Entry IEA Value Proposition Tier I Provider with National Coverage #1 estimated market share in wind with projects completed in 35+ states(1) (1)(2) Self-Perform Capabilities IEA employs 14 project crews; estimates only 50 qualified crews in the U.S. Exceptional Track Record Over 190 wind and solar projects successfully completed(3) Vendor / OEM Relationships 7,200+ wind turbines erected, including all major OEMs(3) Exemplary Safety Record Exceptional safety with EMR of 0.51 and TRIR of 0.30 in 2017(4) Skilled Craft Labor / Culture High employee retention rate despite industry shortages Specialized Equipment Significant capital investment in equipment fleet (1) IEA management estimate, based upon industry and customer data available to IEA management. (2) Per IEA management estimates as of May 2018. (3) Per IEA management estimates as of March 2018. 14 (4) Experience Modification Rate (“EMR”) and Total Recordable Incident Rate (“TRIR”) as reported by US Department of Labor.

NATIONAL COVERAGE NATIONAL COVERAGE WITH PROJECTS COMPLETED IN 35+ STATES • IEA’s “double-breasted” (union & non-union) workforce enables the Company to work anywhere in the U.S. • Scalable workforce with 2,000+ peak employees • IEA has in place a National Wind Agreement that essentially serves as a Project Labor Agreement for wind turbine construction projects nationwide Hawaii Puerto Rico Headquarters Completed Projects 15

RENEWABLE ENERGY RESHAPING THE POWER INDUSTRY • Renewable energy projects are leading capacity additions in the U.S.; wind and solar accounted for ~59% of all new capacity in 2017 (1) • U.S. Energy Information Administration estimated in January 2018 that renewables will account for >30% of all U.S. capacity by 2030: – Lower, unsubsidized levelized cost of energy(2) – Shut-down of fossil / nuclear power plants – Corporate sustainability practices – corporations and non- utilities – represented ~39% of the MW contracted through Power Purchase Agreements (“PPA”) from renewable generation in 2016(3) • The enactment of the Tax Cuts and Jobs Act in December 2017 preserved the existing production tax credit (“PTC”) and investment tax credit (“ITC”) incentive structures: – A base erosion and anti-abuse tax provision included in the Act could reduce the value of the PTC and ITC for certain participants in the wind and solar energy industry – IEA anticipates that the Act will not have a material negative impact on its business (1) Source: American Wind Energy Association (AWEA) (2017 Year End Report). (2) The “levelized cost of energy” is the net present value of the unit-cost of electricity over the lifetime of a generating asset. (3) Source: American Wind Energy Association (Jan. 2017). 16

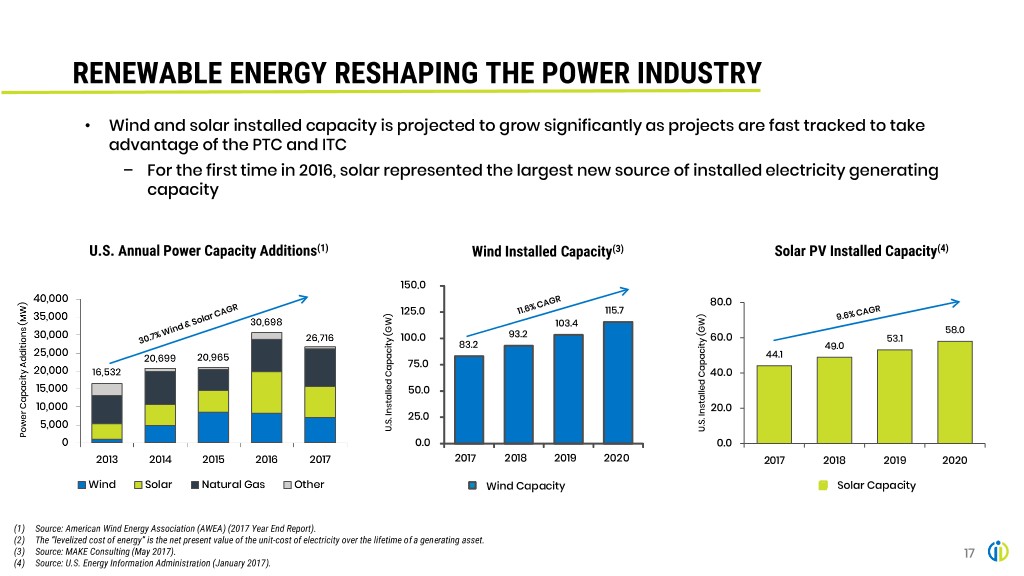

RENEWABLE ENERGY RESHAPING THE POWER INDUSTRY • Wind and solar installed capacity is projected to grow significantly as projects are fast tracked to take advantage of the PTC and ITC – For the first time in 2016, solar represented the largest new source of installed electricity generating capacity U.S. Annual Power Capacity Additions(1) Wind Installed Capacity(3) Solar PV Installed Capacity(4) 150.0 80.0 125.0 115.7 103.4 58.0 100.0 93.2 60.0 53.1 83.2 49.0 44.1 75.0 40.0 50.0 20.0 25.0 U.S. Installed Capacity (GW) U.S. Installed Capacity (GW) 0.0 0.0 2017 2018 2019 2020 2017 2018 2019 2020 Wind Capacity Solar Capacity (1) Source: American Wind Energy Association (AWEA) (2017 Year End Report). (2) The “levelized cost of energy” is the net present value of the unit-cost of electricity over the lifetime of a generating asset. (3) Source: MAKE Consulting (May 2017). (4) Source: U.S. Energy Information Administration (January 2017). 17

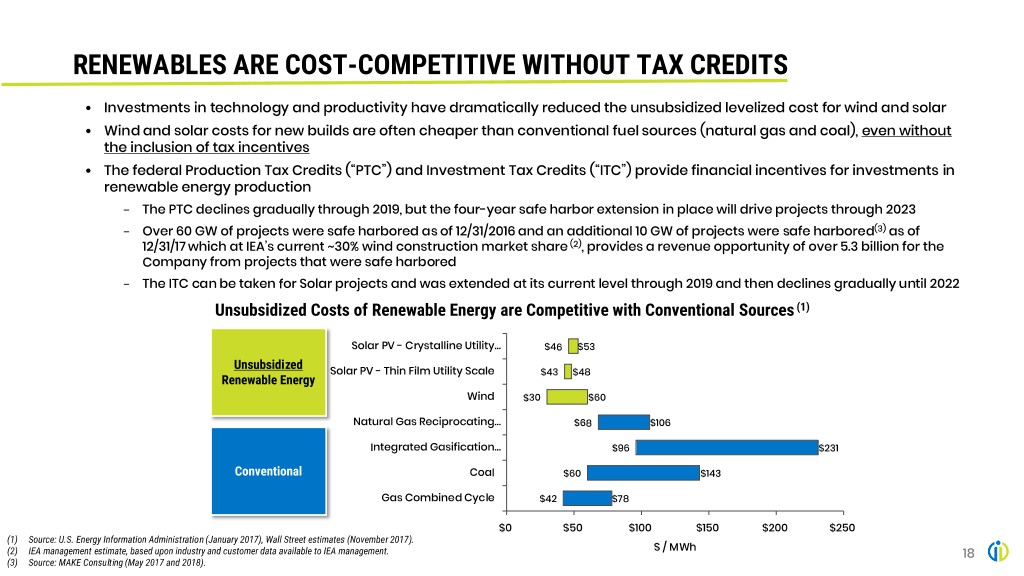

RENEWABLES ARE COST-COMPETITIVE WITHOUT TAX CREDITS • Investments in technology and productivity have dramatically reduced the unsubsidized levelized cost for wind and solar • Wind and solar costs for new builds are often cheaper than conventional fuel sources (natural gas and coal), even without the inclusion of tax incentives • The federal Production Tax Credits (“PTC”) and Investment Tax Credits (“ITC”) provide financial incentives for investments in renewable energy production − The PTC declines gradually through 2019, but the four-year safe harbor extension in place will drive projects through 2023 − Over 60 GW of projects were safe harbored as of 12/31/2016 and an additional 10 GW of projects were safe harbored(3) as of 12/31/17 which at IEA’s current ~30% wind construction market share (2), provides a revenue opportunity of over 5.3 billion for the Company from projects that were safe harbored − The ITC can be taken for Solar projects and was extended at its current level through 2019 and then declines gradually until 2022 Unsubsidized Costs of Renewable Energy are Competitive with Conventional Sources (1) Solar PV - Crystalline Utility… $46 $53 Unsubsidized Renewable Energy Solar PV - Thin Film Utility Scale $43 $48 Wind $30 $60 Natural Gas Reciprocating… $68 $106 Integrated Gasification… $96 $231 Conventional Coal $60 $143 Gas Combined Cycle $42 $78 $0 $50 $100 $150 $200 $250 (1) Source: U.S. Energy Information Administration (January 2017), Wall Street estimates (November 2017). (2) IEA management estimate, based upon industry and customer data available to IEA management. $ / MWh (3) Source: MAKE Consulting (May 2017 and 2018). 18

STATE-WIDE INCENTIVES FOR RENEWABLE ENERGY MN: Xcel: 31.5% by 2020 IOU: 26.5% by 2025 • Strong state-wide Other: 25% by 2025 VT: 75% by NH: 24.8% ME: 10% by WA:WA: 2032 by 2025 2017 Renewable Portfolio 15%15% by 2020*2020 Standards (RPS) set hard targets for MA: 15% by 2020 (new resources) + 1% each year after renewable energy in NY: MI: 50% by 2030 the near and long- 15% by RI: 38.5% by 2019 2021 PA: CT: 27% by 2020 term to diversify 18% by 2021 NV: OH: 25% by 2025 IL: NJ: 20.38% by 2021 + 4.1% solar by 2027 electricity supply and CO: 12.5% by 25% by 2026 reduce IOU: 30% 2026 OR: Large Coop: 20% DE: 25% by 2026 CA: Large IOU: 50% by 2040 Small Coop / Muni: MO: environmental Large COU: 25% by 2025 50% 10% all by 2020 15% by 2021 MD: 25% by 2020 Small Utility: 10% by 2025 by 2030 pollution and Smallest Utility 5% by 2025 DC: 50% by 2032 NM: emissions AZ: IOU: 20% NC: IOU 12.5% by 2021 / Coup & Muni: 15% by 2025 Coop: 10% 10% by 2018 • RPS requires utilities all by 2020 to sell a specified percentage or amount of renewable 26 States electricity by a set + Washington DC date(1) have a Renewable HI: 100% by 2045 Portfolio Standard Renewable Portfolio Standard - ONGOING Renewable Portfolio Goal - MET (1) In most states, standards are measured by percentages of kilowatt hours of retail electric sales. Iowa and Texas require specific amounts of renewable energy capacity rather than percentages and Kansas requires a percentage of peak demand. Source: AWEA 2017. 19 Note: IOUs refer to Investor-Owned Utilities

MULTIPLE LEVERS TO DRIVE GROWTH Multiple Growth Opportunities Beyond Executing ~$1.1 Billion Current Wind Backlog Projects External Growth Organic Growth Robust platform for M&A growth Opportunities to grow presence across attractive markets with long-term growth potential Mergers & Acquisitions Grow Foothold in Civil, Build Solar Presence Industrial & Power Expand Self- Perform Capabilities • Active pursuit list of highly • Leverage 60+ years of strategic and actionable experience across targets • Large addressable market with petrochemical, pharmaceutical • Increase electrical self-perform secular growth drivers through and other heavy industrial • Potential to increase capabilities at least 2050 (1) facilities project diversification • Medium and high voltage • Cross-selling opportunity with • Positive tailwinds exist for through work with • Potential for over 300 bps EBITDA captive, existing wind customer traditional U.S. civil and industrial conventional power, margin increase(2) over the medium- base markets downstream oil and gas- term • Ability to capture incremental ‒ The Fast Act and IDOT and related and other • Initial self-perform projects will share of the expanding utility- INDOT budgets provide for industrial customers commence in 2018 scale solar construction market billions of dollars of funding for civil/infrastructure • Accelerate share of ‒ 2018 EBITDA impact projected to be • Solar PV installed capacity (2) projects currently outsourced high up to $8 million expected to grow at a ~10% CAGR ‒ 2019 EBITDA impact projected to be from 2017 – 2020(1) • IEA maintains a distinctive voltage scope, including up to an incremental $15 million(2) resume and excellent reputation T-line interconnect across these diverse markets (1) Source: U.S. Energy Information Administration (January 2018). (2) IEA management estimates, based upon industry and customer data available to IEA management and included in 20 our guidance range for 2018 on slide 27.

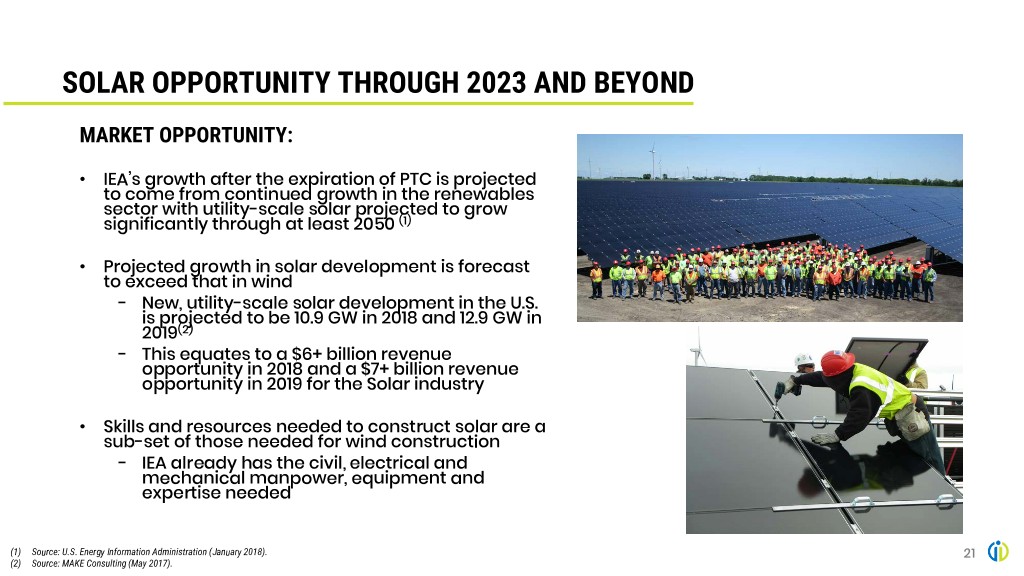

SOLAR OPPORTUNITY THROUGH 2023 AND BEYOND MARKET OPPORTUNITY: • IEA’s growth after the expiration of PTC is projected to come from continued growth in the renewables sector with utility-scale solar projected to grow significantly through at least 2050 (1) • Projected growth in solar development is forecast to exceed that in wind − New, utility-scale solar development in the U.S. is projected to be 10.9 GW in 2018 and 12.9 GW in 2019(2) − This equates to a $6+ billion revenue opportunity in 2018 and a $7+ billion revenue opportunity in 2019 for the Solar industry • Skills and resources needed to construct solar are a sub-set of those needed for wind construction − IEA already has the civil, electrical and mechanical manpower, equipment and expertise needed (1) Source: U.S. Energy Information Administration (January 2018). (2) Source: MAKE Consulting (May 2017). 21

SOLAR OPPORTUNITIES THROUGH 2023 AND BEYOND SOLAR REVENUE MOMENTUM: • Existing wind customers also leading developers of solar − 11 of current top 15 customers also develop solar facilities • Since 2010, IEA has completed 67 solar projects, representing over 700 installed MW − Built out a new commercial team in 2017 to expand its market share in solar • IEA has a growing pipeline of solar projects under its new solar commercial team − Currently, $254 million of high-probability solar revenue in IEA’s pipeline − Additional targeted solar pipeline of $916 million (14 projects)(1) PROJECTED UTILITY-SCALE SOLAR GENERATION(3) SOLAR PROJECTED TO GROW AS A % OF IEA REVENUES(4) 2018 2022 250 200 150 100 50 0 Utility-Scale (1) IEA management estimate as of September 2017. (2) Source: U.S. Energy Information Administration (January 2017). 22 (3) IEA management estimate, based upon industry and customer data available to IEA management.

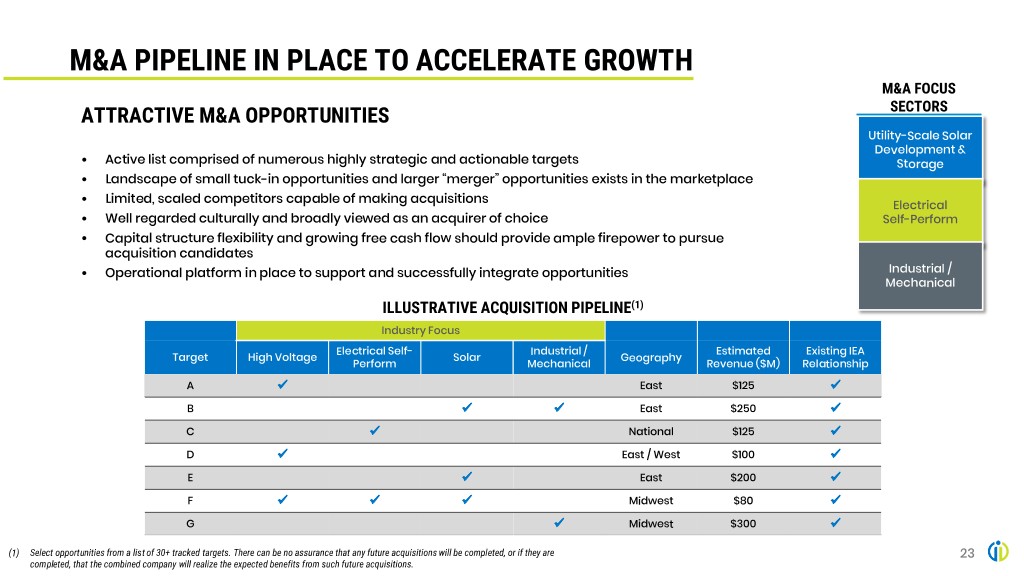

M&A PIPELINE IN PLACE TO ACCELERATE GROWTH M&A FOCUS ATTRACTIVE M&A OPPORTUNITIES SECTORS Utility-Scale Solar Development & • Active list comprised of numerous highly strategic and actionable targets Storage • Landscape of small tuck-in opportunities and larger “merger” opportunities exists in the marketplace • Limited, scaled competitors capable of making acquisitions Electrical • Well regarded culturally and broadly viewed as an acquirer of choice Self-Perform • Capital structure flexibility and growing free cash flow should provide ample firepower to pursue acquisition candidates • Operational platform in place to support and successfully integrate opportunities Industrial / Mechanical ILLUSTRATIVE ACQUISITION PIPELINE(1) Industry Focus Electrical Self- Industrial / Estimated Existing IEA Target High Voltage Solar Geography Perform Mechanical Revenue ($M) Relationship A East $125 B East $250 C National $125 D East / West $100 E East $200 F Midwest $80 G Midwest $300 (1) Select opportunities from a list of 30+ tracked targets. There can be no assurance that any future acquisitions will be completed, or if they are 23 completed, that the combined company will realize the expected benefits from such future acquisitions.

APPENDIX

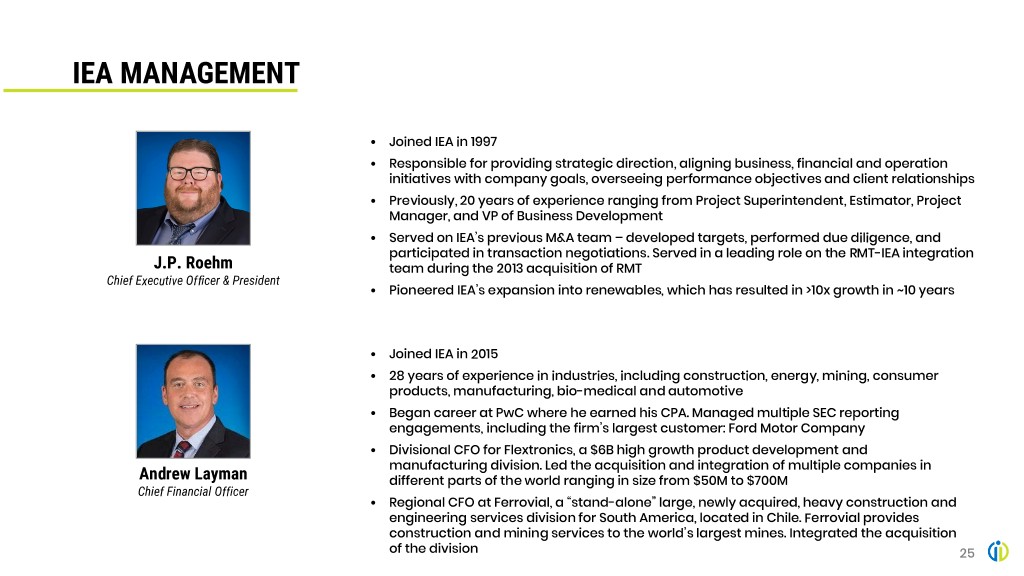

IEA MANAGEMENT • Joined IEA in 1997 • Responsible for providing strategic direction, aligning business, financial and operation initiatives with company goals, overseeing performance objectives and client relationships • Previously, 20 years of experience ranging from Project Superintendent, Estimator, Project Manager, and VP of Business Development • Served on IEA’s previous M&A team – developed targets, performed due diligence, and J.P. Roehm participated in transaction negotiations. Served in a leading role on the RMT-IEA integration team during the 2013 acquisition of RMT Chief Executive Officer & President • Pioneered IEA’s expansion into renewables, which has resulted in >10x growth in ~10 years • Joined IEA in 2015 • 28 years of experience in industries, including construction, energy, mining, consumer products, manufacturing, bio-medical and automotive • Began career at PwC where he earned his CPA. Managed multiple SEC reporting engagements, including the firm’s largest customer: Ford Motor Company • Divisional CFO for Flextronics, a $6B high growth product development and Andrew Layman manufacturing division. Led the acquisition and integration of multiple companies in different parts of the world ranging in size from $50M to $700M Chief Financial Officer • Regional CFO at Ferrovial, a “stand-alone” large, newly acquired, heavy construction and engineering services division for South America, located in Chile. Ferrovial provides construction and mining services to the world’s largest mines. Integrated the acquisition of the division 25

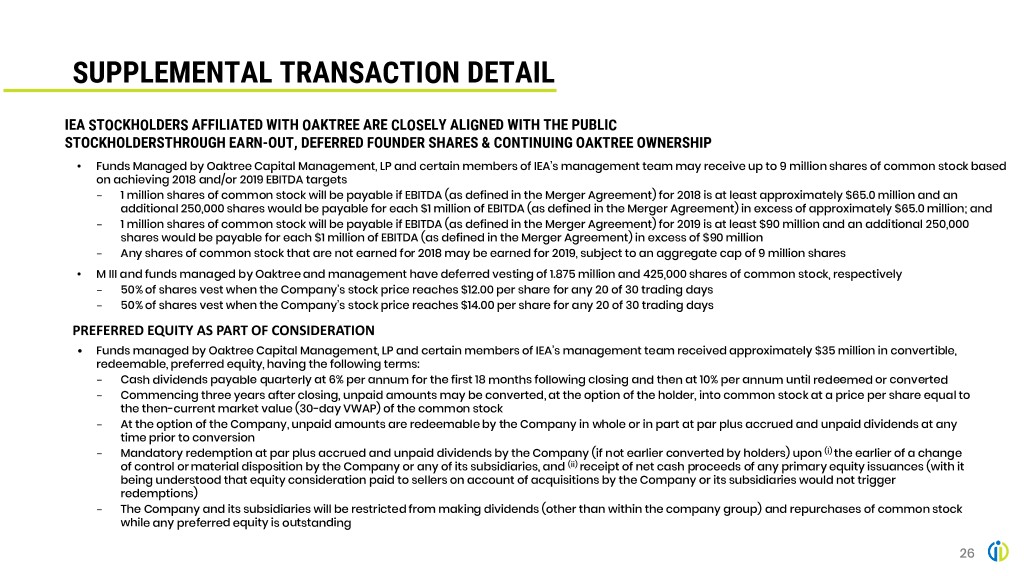

SUPPLEMENTAL TRANSACTION DETAIL IEA STOCKHOLDERS AFFILIATED WITH OAKTREE ARE CLOSELY ALIGNED WITH THE PUBLIC STOCKHOLDERSTHROUGH EARN-OUT, DEFERRED FOUNDER SHARES & CONTINUING OAKTREE OWNERSHIP • Funds Managed by Oaktree Capital Management, LP and certain members of IEA’s management team may receive up to 9 million shares of common stock based on achieving 2018 and/or 2019 EBITDA targets − 1 million shares of common stock will be payable if EBITDA (as defined in the Merger Agreement) for 2018 is at least approximately $65.0 million and an additional 250,000 shares would be payable for each $1 million of EBITDA (as defined in the Merger Agreement) in excess of approximately $65.0 million; and − 1 million shares of common stock will be payable if EBITDA (as defined in the Merger Agreement) for 2019 is at least $90 million and an additional 250,000 shares would be payable for each $1 million of EBITDA (as defined in the Merger Agreement) in excess of $90 million − Any shares of common stock that are not earned for 2018 may be earned for 2019, subject to an aggregate cap of 9 million shares • M III and funds managed by Oaktree and management have deferred vesting of 1.875 million and 425,000 shares of common stock, respectively − 50% of shares vest when the Company’s stock price reaches $12.00 per share for any 20 of 30 trading days − 50% of shares vest when the Company’s stock price reaches $14.00 per share for any 20 of 30 trading days PREFERRED EQUITY AS PART OF CONSIDERATION • Funds managed by Oaktree Capital Management, LP and certain members of IEA’s management team received approximately $35 million in convertible, redeemable, preferred equity, having the following terms: − Cash dividends payable quarterly at 6% per annum for the first 18 months following closing and then at 10% per annum until redeemed or converted − Commencing three years after closing, unpaid amounts may be converted, at the option of the holder, into common stock at a price per share equal to the then-current market value (30-day VWAP) of the common stock − At the option of the Company, unpaid amounts are redeemable by the Company in whole or in part at par plus accrued and unpaid dividends at any time prior to conversion − Mandatory redemption at par plus accrued and unpaid dividends by the Company (if not earlier converted by holders) upon (i) the earlier of a change of control or material disposition by the Company or any of its subsidiaries, and (ii) receipt of net cash proceeds of any primary equity issuances (with it being understood that equity consideration paid to sellers on account of acquisitions by the Company or its subsidiaries would not trigger redemptions) − The Company and its subsidiaries will be restricted from making dividends (other than within the company group) and repurchases of common stock while any preferred equity is outstanding 26

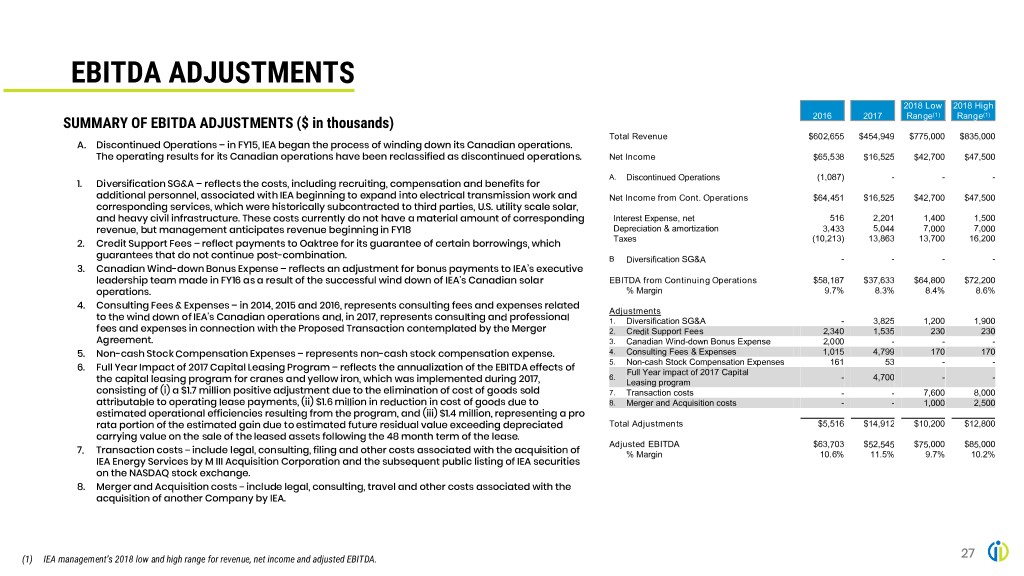

EBITDA ADJUSTMENTS 2018 Low 2018 High (1) (1) SUMMARY OF EBITDA ADJUSTMENTS ($ in thousands) 2016 2017 Range Range Total Revenue $602,655 $454,949 $775,000 $835,000 A. Discontinued Operations – in FY15, IEA began the process of winding down its Canadian operations. The operating results for its Canadian operations have been reclassified as discontinued operations. Net Income $65,538 $16,525 $42,700 $47,500 A. Discontinued Operations (1,087) - - - 1. Diversification SG&A – reflects the costs, including recruiting, compensation and benefits for additional personnel, associated with IEA beginning to expand into electrical transmission work and Net Income from Cont. Operations $64,451 $16,525 $42,700 $47,500 corresponding services, which were historically subcontracted to third parties, U.S. utility scale solar, and heavy civil infrastructure. These costs currently do not have a material amount of corresponding Interest Expense, net 516 2,201 1,400 1,500 revenue, but management anticipates revenue beginning in FY18 Depreciation & amortization 3,433 5,044 7,000 7,000 Taxes (10,213) 13,863 13,700 16,200 2. Credit Support Fees – reflect payments to Oaktree for its guarantee of certain borrowings, which guarantees that do not continue post-combination. B Diversification SG&A - - - - 3. Canadian Wind-down Bonus Expense – reflects an adjustment for bonus payments to IEA’s executive leadership team made in FY16 as a result of the successful wind down of IEA's Canadian solar EBITDA from Continuing Operations $58,187 $37,633 $64,800 $72,200 operations. % Margin 9.7% 8.3% 8.4% 8.6% 4. Consulting Fees & Expenses – in 2014, 2015 and 2016, represents consulting fees and expenses related Adjustments to the wind down of IEA's Canadian operations and, in 2017, represents consulting and professional 1. Diversification SG&A - 3,825 1,200 1,900 fees and expenses in connection with the Proposed Transaction contemplated by the Merger 2. Credit Support Fees 2,340 1,535 230 230 Agreement. 3. Canadian Wind-down Bonus Expense 2,000 - - - 5. Non-cash Stock Compensation Expenses – represents non-cash stock compensation expense. 4. Consulting Fees & Expenses 1,015 4,799 170 170 5. Non-cash Stock Compensation Expenses 161 53 - - 6. Full Year Impact of 2017 Capital Leasing Program – reflects the annualization of the EBITDA effects of Full Year impact of 2017 Capital 6. - 4,700 - - the capital leasing program for cranes and yellow iron, which was implemented during 2017, Leasing program consisting of (i) a $1.7 million positive adjustment due to the elimination of cost of goods sold 7. Transaction costs - - 7,600 8,000 attributable to operating lease payments, (ii) $1.6 million in reduction in cost of goods due to 8. Merger and Acquisition costs - - 1,000 2,500 estimated operational efficiencies resulting from the program, and (iii) $1.4 million, representing a pro rata portion of the estimated gain due to estimated future residual value exceeding depreciated Total Adjustments $5,516 $14,912 $10,200 $12,800 carrying value on the sale of the leased assets following the 48 month term of the lease. Adjusted EBITDA $63,703 $52,545 $75,000 $85,000 7. Transaction costs – include legal, consulting, filing and other costs associated with the acquisition of % Margin 10.6% 11.5% 9.7% 10.2% IEA Energy Services by M III Acquisition Corporation and the subsequent public listing of IEA securities on the NASDAQ stock exchange. 8. Merger and Acquisition costs – include legal, consulting, travel and other costs associated with the acquisition of another Company by IEA. (1) IEA management’s 2018 low and high range for revenue, net income and adjusted EBITDA. 27

THANK YOU Infrastructure and Energy Alternatives, Inc. Andrew Layman, Chief Financial Officer 765.828.2580 The Equity Group, Inc. Fred Buonocore, CFA fbuonocore@equityny.com 212.836.9607 The Equity Group, Inc. Kevin Towle ktowle@equityny.com 212.836.9620 1