Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Federal Home Loan Bank of New York | d557544d8k.htm |

Exhibit 99.1

TABLE OF CONTENTS

| STRONG STRATEGY |

2 | |||

| A MESSAGE TO OUR MEMBERS |

2 | |||

| FINANCIAL HIGHLIGHTS |

4 | |||

| STRONG BUSINESS |

6 | |||

| GROWING OUR COOPERATIVE |

6 | |||

| 2017 BUSINESS UPDATE |

7 | |||

| STRONG MISSION |

13 | |||

| EXPANDING HOUSING OPPORTUNITIES |

13 | |||

| WORKING WITH MEMBERS TO STRENGTHEN THE CARIBBEAN |

14 | |||

| STRONG COMMITMENT |

15 | |||

| EXECUTIVE LEADERSHIP |

15 | |||

| BOARD OF DIRECTORS |

16 | |||

| AFFORDABLE HOUSING ADVISORY COUNCIL |

17 | |||

| FHLBNY OFFICERS |

18 | |||

| FHLBNY CULTURE & COMMUNITY FOCUS |

20 |

The information provided by the Federal Home Loan Bank of New York (FHLBNY) in this communication is set forth for informational purposes only. The information should not be construed as an opinion, recommendation, or solicitation regarding the use of any financial strategy and/or the purchase or sale of any financial instrument. All customers are advised to conduct their own independent due diligence before making any financial decisions. Please note that the past performance of any FHLBNY service or product should not be viewed as a guarantee of future results. Also, the information presented here and/or the services or products provided by the FHLBNY may change at any time without notice.

Safe Harbor Statement Under the Private Securities Litigation Reform Act of 1995: This report may contain forward-looking statements within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. These statements are based upon our current expectations and speak only as of the date hereof. These statements may use forward-looking terms, such as “projected,” “expects,” “may,” or their negatives or other variations on these terms. The FHLBNY cautions that, by their nature, forward-looking statements involve risk or uncertainty and that actual results could differ materially from those expressed or implied in these forward-looking statements or could affect the extent to which a particular objective, projection, estimate, or prediction is realized. These forward-looking statements involve risks and uncertainties including, but not limited to, regulatory and accounting rule adjustments or requirements, changes in interest rates, changes in projected business volumes, changes in prepayment speeds on mortgage assets, the cost of our funding, changes in our membership profile, the withdrawal of one or more large members, competitive pressures, shifts in demand for our products, and general economic conditions. We undertake no obligation to revise or update publicly any forward-looking statements for any reason.

STRONG STRATEGY

A MESSAGE TO OUR MEMBERS

At the Federal Home Loan Bank of New York, we recognize the strength in partnership. The 11 Federal Home Loan Banks partner to ensure that the Federal Home Loan Bank System provides a stable source of liquidity for our nation’s local lenders. The FHLBNY takes pride in being a reliable funding partner for each of our 339 members. And each of these members is a trusted partner to the communities it serves. Our ability to develop, grow and support the various partnerships that drive economic growth throughout our District is at the focal point of our business model. We are a cooperative, after all, and in 2017, our focus on building and strengthening these partnerships resulted in a record year for our franchise.

2

STRONG STRATEGY

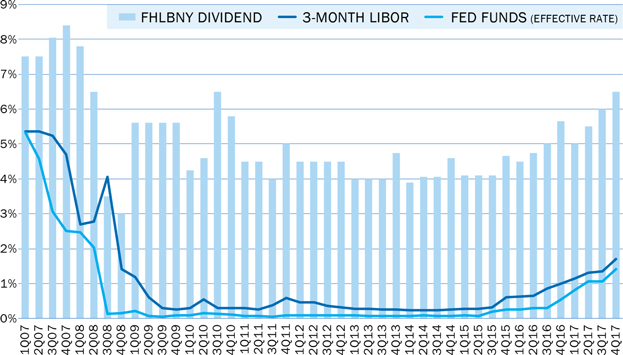

FHLBNY DIVIDEND HISTORY

Our dividends have continued to remain strong, exceeding market reference rates.

Please note: Dividends as shown for each quarter were paid out in the following quarter. Although FHLBNY capital stock has been high-performing and has had a very competitive dividend rate for an extended period of time, the dividend rate is not guaranteed, and as such, it may fluctuate in the future.

3

STRONG STRATEGY

FINANCIAL HIGHLIGHTS

| (DOLLARS IN MILLIONS) |

2017 | 2016 | 2015 | 2014 | 2013 | |||||||||||||||

| SELECTED BALANCES AT YEAR-END |

||||||||||||||||||||

| Total Assets |

$ | 158,918 | $ | 143,606 | $ | 123,239 | $ | 132,825 | $ | 128,333 | ||||||||||

| Advances |

122,448 | 109,257 | 93,874 | 98,797 | 90,765 | |||||||||||||||

| Investments |

33,069 | 30,939 | 26,167 | 25,201 | 20,084 | |||||||||||||||

| Mortgage Loans |

2,897 | 2,747 | 2,524 | 2,129 | 1,928 | |||||||||||||||

| Capital Stock |

6,750 | 6,308 | 5,585 | 5,580 | 5,571 | |||||||||||||||

| Retained Earnings |

1,546 | 1,412 | 1,270 | 1,083 | 999 | |||||||||||||||

| ANNUAL OPERATING RESULTS |

||||||||||||||||||||

| Net Income |

$ | 479 | $ | 401 | $ | 415 | $ | 315 | $ | 305 | ||||||||||

| Dividends Paid |

345 | 259 | 228 | 231 | 200 | |||||||||||||||

| Dividend Rate |

5.54 | % | 4.73 | % | 4.22 | % | 4.19 | % | 4.12 | % | ||||||||||

| PERFORMANCE RATIOS |

||||||||||||||||||||

| Return on Average Equity |

6.30 | % | 5.86 | % | 6.61 | % | 4.88 | % | 5.22 | % | ||||||||||

| Return on Average Assets |

0.32 | % | 0.31 | % | 0.34 | % | 0.25 | % | 0.27 | % | ||||||||||

| Equity to Average Asset |

5.19 | % | 5.31 | % | 5.45 | % | 4.91 | % | 5.05 | % | ||||||||||

| Net Interest Margin |

0.48 | % | 0.43 | % | 0.46 | % | 0.36 | % | 0.38 | % | ||||||||||

Financial results are presented on a GAAP basis for each calendar year. Dividend results shown here are the payments the FHLBNY made during each calendar year, rather than the dividends paid from each calendar year’s income. The Federal Home Loan Bank of New York’s 2017 annual report on Form 10-K, as filed with the Securities and Exchange Commission, contains additional information about the FHLBNY’s financial performance. The report is available on the FHLBNY’s public website, www.fhlbny.com, under the “About Us” tab; select “Investor Relations,” and look under the right-hand column labeled “Financial Reports.” For a copy of the FHLBNY’s Form 10-K, please send a request to fhlbny@fhlbny.com.

4

STRONG STRATEGY

5

STRONG BUSINESS

GROWING OUR COOPERATIVE

6

STRONG BUSINESS

2017 BUSINESS UPDATE

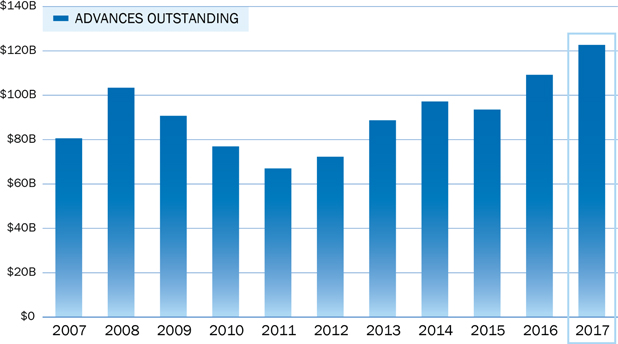

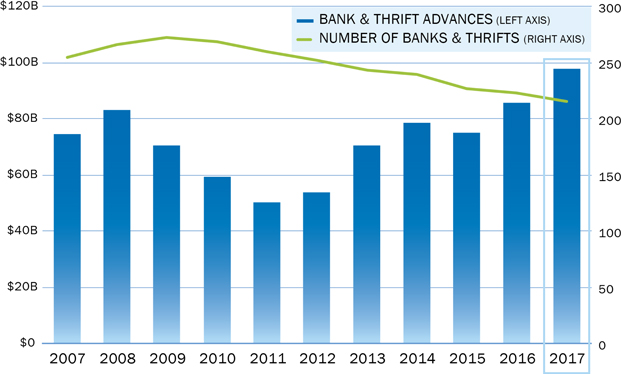

GROWTH IN ADVANCE BUSINESS

Members took advantage of FHLBNY liquidity to mark 2017 as a banner year for advance growth on balance sheet.

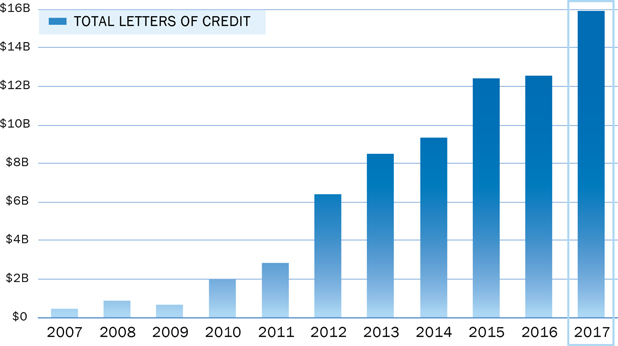

GROWTH IN LETTER OF CREDIT (L/C) BUSINESS

Our widely-accepted L/C product continues to offer members a valuable alternate way to secure deposits, gain a competitive advantage and grow asset balances off-balance sheet. L/C activity increased by approximately $4 billion in 2017.

7

STRONG BUSINESS

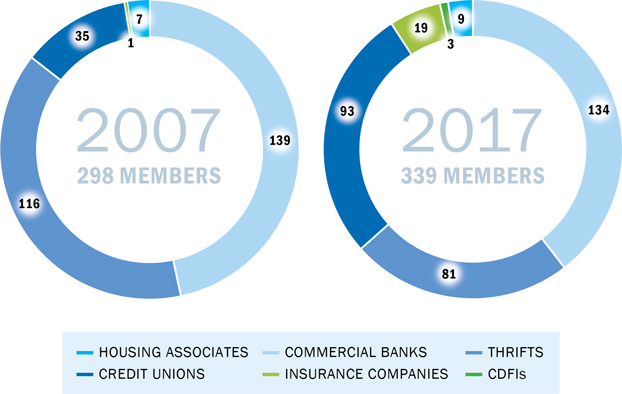

GROWTH & DIVERSITY IN MEMBERSHIP

Over the past decade our membership has grown and diversified considerably. A diverse composition of members

strengthens the cooperative and helps expand funding across our District.

2017 NEW MEMBERS

We welcomed 12 new members to our cooperative in 2017: eight insurance companies and four credit unions.

8

STRONG BUSINESS

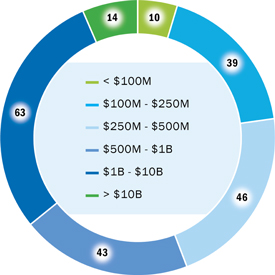

COMMERCIAL BANK & THRIFT MEMBERS

Our banking sector represents over 63% of our cooperative, comprised of 215 commercial banks,

savings banks and thrifts in a diverse mix of asset sizes.

Collectively banks hold the largest percentage of our advance business, representing 80% of the 2017 advance book,

totaling $97.8 billion. The number of members has decreased in recent years, predominantly due to the increase in

merger and acquisition activity and lack of de novos, but this sector is healthy and business is strong.

9

STRONG BUSINESS

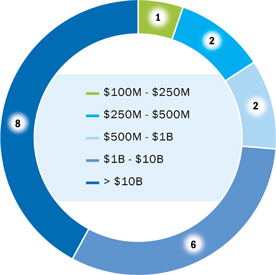

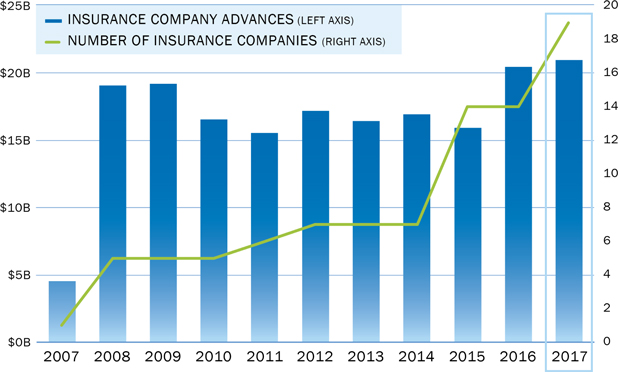

INSURANCE COMPANY MEMBERS

Our insurance company sector has significantly grown in recent years to now represent 19 institutions across

the life, property and casualty and health insurance industries. This sector brings a robust asset base to our cooperative.

Business is poised for continued growth considering their interest in liquidity for strategic and contingent

funding needs. Their tendency to borrow for tenure lengthens our advances book – a partnership that benefits

both the member insurance company and our cooperative.

10

STRONG BUSINESS

CREDIT UNION MEMBERS

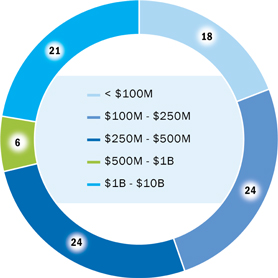

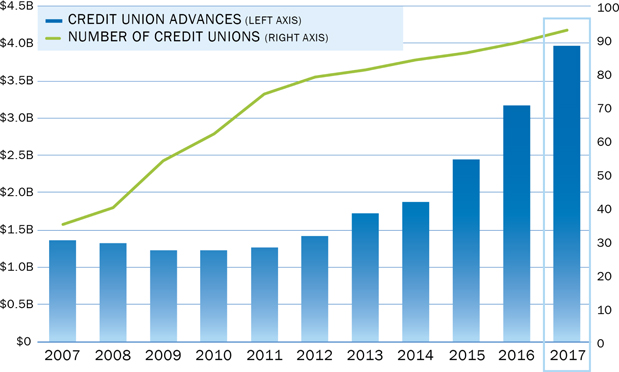

Our credit union sector has steadily grown to now represent over 27% of our cooperative — 93 institutions

with both a diverse and balanced mix of asset sizes.

Over the past decade borrowing activity has also steadily increased as more credit unions realize ways to

maximize our partnership to help manage and grow their asset bases. Since year-end 2016, borrowings increased

by 54.5%, reaching a daily average balance of $4.1 billion for 2017.

11

STRONG BUSINESS

HOUSING ASSOCIATES & CDFI MEMBERS

Our Housing Associate and CDFI sectors play a vital role in meeting the diverse housing and economic needs throughout our District of New Jersey, New York, Puerto Rico and the U.S. Virgin Islands. The following table lists the 12 housing associates and non-depository loan fund CDFIs in our cooperative, along with the focus area and communities they serve — a reference tool so you can see how you can partner with these institutions to further strengthen our District.

Several bank and credit union members are also certified to serve as CDFIs and are federally insured.

| INSTITUTION |

STATE | FOCUS & COMMUNITIES SERVED | ||

| HOUSING ASSOCIATES |

||||

| Dormitory Authority of the State of New York | NY | Integrated services for infrastructure projects including financing, design, procurement and construction to benefit public healthcare, higher education and local and state government entities in the State of New York | ||

| Municipal Housing Authority for the City of Yonkers | NY | Expands affordable/sustainable housing opportunities by leveraging partnerships with private affordable housing developers and administers the Housing Choice Voucher Program to benefit low-income families, the elderly and persons with disabilities in the City of Yonkers | ||

| New Jersey Economic Development Authority | NJ | Administers tax incentives to retain and grow jobs and supports entrepreneurial and community redevelopment initiatives that benefit small and mid-size businesses and not-for-profit organizations in the State of New Jersey | ||

| New Jersey Housing and Mortgage Finance Agency | NJ | Increases the availability of and accessibility to safe, decent and affordable housing to families in New Jersey, including working with first-time homebuyers, senior citizens, and the disabled in our special needs communities | ||

| New York City Housing Development Corporation | NY | Increases the supply of multi-family housing, stimulates economic growth and revitalizes neighborhoods by financing the creation and preservation of affordable housing for low- and moderate-income New Yorkers | ||

| New York State Housing Finance Agency | NY | Creates and preserves high quality affordable multifamily rental housing serving communities across the State of New York | ||

| Puerto Rico Housing Finance Authority | PR | Issues tax-exempt securities and offers programs for mortgage loans, insurance, housing subsidies and section 8 projects to benefit low- and moderate-income families in the Commonwealth of Puerto Rico | ||

| State of New York Mortgage Agency | NY | Large issuer of single family housing bonds to provide low interest mortgage loans for low- and moderate-income first-time home buyers in New York State | ||

| Virgin Islands Housing Finance Authority | VI | Issues tax-exempt Mortgage Revenue bonds, low-income housing tax credits, community development block grants and local subsidies and funding to help the development of affordable housing and community development via programs to benefit low- and moderate-income families in the U.S. Virgin Islands | ||

| NON-DEPOSITORY LOAN FUND CDFIs | ||||

| AAFE Community Development Fund, Inc. | NY | Dedicated to providing opportunities for New York City’s Asian American and other diverse immigrant communities by preserving affordable housing, developing buildings to create housing, securing financing for homebuyers and disbursing loans to small businesses, while providing multilingual counseling services, education, financial assistance and training | ||

| The Community Development Trust, Inc. | NY | Affordable housing investor that works with local, regional, and national partners to make long-term equity investments to originate and purchase long-term mortgages | ||

| National Federation of Community Development Credit Unions, Inc. | NY | Promotes financial inclusion by organizing, supporting, and investing in community development credit unions that specialize in serving populations with limited access to affordable financial services, including low- and moderate-income wage earners, families, new immigrants, young people and the growing number of Americans seeking financial independence | ||

12

STRONG MISSION

EXPANDING HOUSING OPPORTUNITIES

13

STRONG MISSION

WORKING WITH MEMBERS TO STRENGTHEN THE CARIBBEAN

| AFFORDABLE HOUSING FOR SENIORS STANDS TALL

|

In 1990, the FHLBNY announced our first AHP grant in Puerto Rico, and since the Program’s inception, we have awarded more than $18.6 million through 31 grants in Puerto Rico and the U.S. Virgin Islands. These grants have supported projects that have built, renovated or preserved more than 2,600 affordable homes.

Fortunately, most of these projects were not significantly damaged in the September 2017 hurricanes. Projects like Parque Platino – which received a $146,200 AHP grant in 2003, and today provides 14 affordable homes for low- and very low-income seniors in Lares, Puerto Rico – still stand tall, providing much-needed stability before, during and after the storms. The availability and creation of high-quality affordable housing will be even more important as the Caribbean continues to recover, and we look forward to working with our members to put the FHLBNY’s housing programs to work assisting in these efforts. |

14

STRONG COMMITMENT

EXECUTIVE LEADERSHIP

|

José R. González President and Chief Executive Officer |

“The FHLBNY maintains a strong focus on our strategic vision – to be a balanced provider of liquidity to members in all operating environments.” |

15

STRONG COMMITMENT

BOARD OF DIRECTORS

|

CHAIRMAN John R. Buran + Director, President and Chief Executive Officer Flushing Bank Uniondale, New York |

|

VICE CHAIRMAN Larry E. Thompson * Vice Chairman The Depository Trust & Clearing Corporation New York, New York |

|

Kevin Cummings + President and Chief Executive Officer Investors Bank Short Hills, New Jersey |

|

Thomas L. Hoy + Chairman Glens Falls National Bank & Trust Company Glens Falls, New York | |||

|

Anne Evans Estabrook * # Chairman Elberon Development Group Elizabeth, New Jersey |

|

Gerald H. Lipkin + Chairman Valley National Bank Wayne, New Jersey | |||

|

Joseph R. Ficalora + President, Chief Executive Officer and Director New York Community Bank New York Commercial Bank Westbury, New York |

|

Kenneth J. Mahon + President and Chief Executive Officer, and Director Dime Community Bank Brooklyn, New York | |||

|

Jay M. Ford + Director Crest Savings Bank Wildwood, New Jersey |

|

Christopher P. Martin + Chairman, President and Chief Executive Officer The Provident Bank Iselin, New Jersey | |||

|

Michael M. Horn * Partner McCarter & English, LLP Newark, New Jersey |

|

Richard S. Mroz * President New Jersey Board of Public Utilities Trenton, New Jersey | |||

16

STRONG COMMITMENT

17

STRONG COMMITMENT

FHLBNY OFFICERS

| VICE PRESIDENTS | Scott Kay | |

| Deputy Controller | ||

| Jessey Abraham | Eugene Khesin | |

| Senior Manager, Compliance | Senior Trader/Portfolio Officer | |

| Backer Ali | Claudia Kim | |

| Controller | Director, Management Reporting | |

| Dennis Bennett | Phillip Mack | |

| Director, Model Risk | Manager, Credit & Collateral Risk Analytics | |

| Sean Borde | Gregory Marposon | |

| Director, Project Management Office | Financial Risk Officer | |

| James Boyle | Alfred O’Connell | |

| Director, Operational Risk Management | Relationship Manager | |

| John Brandon | Deborah Palladino | |

| Director, Membership & Research | Director, Collateral & Affordable Housing Services | |

| Kenneth Brothers | Shatayu Pandya | |

| Director, Information Security Office | Director, Financial Risk Management | |

| Muriel Brunken | Diahann Rothstein | |

| Director, Mortgage Asset Programs | Director, Investment & Portfolio Management | |

| Judy Chiu | Edward Samson | |

| Derivatives Accounting & Operations Officer | Senior Manager, Reporting | |

| Mark Dankenbrink | Thomas Settino | |

| Director, Financial Audits | Director, Member Relations | |

| Bernard DeSiena | Rei Shinozuka | |

| Director, Business Technology | Director, Asset Liability Modeling & Strategy | |

| Michael Desiderio | Candice Soldano | |

| Director, Member Services & Sales | Director, Marketing & Corporate Events | |

| Vikram Dongre | Louis Solimine | |

| Director, Trading | Director, Funding & Derivatives/Treasurer | |

| Brian Finnegan | Alexies Sornoza | |

| Corporate Secretary | Relationship Manager | |

| Paul Friend | Catherine Sze | |

| General Counsel | Senior Manager, Management Reporting | |

| Bryan Gallagher | Mildred Tse-González | |

| Director, Collateral Analytical Services | Director, Human Resources | |

| Rodger Hicks | Michael Volpe | |

| Director, Technical Services | Director, Member Services Operations | |

| Susan Isquith | Kimberly Whitenack | |

| Director, Credit Risk Management | Senior Manager, Financial Risk Management | |

| Maureen Kalena | Chaohui Yang | |

| Relationship Manager | Senior Enterprise Risk Manager | |

Note: This list reflects FHLBNY officers as of December 31, 2017.

18

STRONG COMMITMENT

ASSISTANT VICE PRESIDENTS

| Mary Alvarez | Anthony Merli | |

| Residential Loan Review Officer | Credit/Capital Markets Audit Manager | |

| Devika Bharrat | Peter Mullany | |

| Financial Audit Officer | Member Services Desk Officer | |

| Erika Buglione | Cassandra Ngai | |

| Senior Manager, Quality Assurance | Manager, Financial Reporting | |

| Christine Campbell | Celena Núñez | |

| Manager, Electronic Payments | Senior Manager, Affordable Housing Programs | |

| Kelvin DePena | Naveen Pahilwani | |

| Senior Manager, Development Operations | Senior Manager, Business Intelligence | |

| Christine Foggia | Bruce Petersel | |

| Risk Control & Governance Officer | Accounting Policy Officer | |

| Huei-Yen Fung | Frederick Puorro | |

| Trader/Analyst | Senior Credit Risk Officer | |

| Joseph Garofalo | Robert Rieb, Jr. | |

| Risk Management Audit Manager | Member Services Desk Officer | |

| Sekar Gopinathan | Carmen Rodriguez | |

| Senior Manager, Systems Development | Electronic Payments Officer | |

| John Gurrieri | Angel Santos | |

| Senior Manager, Collateral, Custody & Pledging Services | Relationship Manager | |

| Mimi Hur | Anthony Scalzo | |

| Financial/Operational Audit Manager | Custody & Pledging Services Officer | |

| Leo Ip | Michael Schoffelen | |

| Lead Network & Storage Engineer Officer | Mortgage Partnership Finance Business Manager | |

| Brian Jones | Eric Shumsky | |

| Financial Economist | Senior Manager, Systems & Support Services | |

| Jason Kannenberg | Alberto Suarez | |

| Senior Manager, Network Storage & Services | Risk Analytics & Reporting Officer | |

| Nick Kargi | Eric Suber | |

| Senior Manager, Systems & Operations Services | Senior Manager, Database Services | |

| Kenneth Knight | Tisa Surat | |

| Commercial Loan Review Officer | Manager, Collateral Initiatives and Support | |

| John Kuo | Benjamin Tan | |

| Senior Systems Engineer Officer | Assistant Treasurer | |

| Kristen Lalama | Priya Udeshi | |

| Senior Credit Risk Officer | Senior Manager, Analyst Services | |

| Julianna Lee | Brian Wiedl | |

| Strategic Planning Senior Analyst | Senior Manager, Records & Continuity Services | |

| Christina Levatino | ||

| Senior Manager, Information Technology Audit | ||

Note: This list reflects FHLBNY officers as of December 31, 2017.

19

STRONG COMMITMENT

STRONG CULTURE & COMMUNITY FOCUS

20

FEDERAL HOME LOAN BANK OF NEW YORK

101 PARK AVENUE, NEW YORK, NY 10178-0601

212.681.6000 • WWW.FHLBNY.COM