Attached files

| file | filename |

|---|---|

| 8-K - 8-K - American Homes 4 Rent | a6418nareitpresentation8-k.htm |

InvestorInvestor Highlights Highlights June 2018

Legal Disclosures Forward-Looking Statements Various statements contained in this presentation, including those that express a belief, expectation or intention, as well as those that are not statements of historical fact, are forward-looking statements. These forward-looking statements may include projections and estimates concerning the timing and success of our strategies, plans or intentions. Forward-looking statements are generally accompanied by words such as “estimate,” “project,” “predict,” “believe,” “expect,” “intend,” “anticipate,” “potential,” “plan,” “goal” or other words that convey the uncertainty of future events or outcomes. We have based these forward-looking statements on our current expectations and assumptions about future events. These assumptions include, among others, our projections and expectations regarding: market trends in the single-family home rental industry and in the local markets where we operate, our ability to institutionalize a historically fragmented business model, our business strengths, our ideal tenant profile, the quality and location of our properties in attractive neighborhoods, the scale advantage of our national platform and the superiority of our operational infrastructure, the effectiveness of our investment philosophy and diversified acquisition strategy, our ability to grow our portfolio and to create a cash flow opportunity with attractive current yields and upside from increasing rents and cost efficiencies and our understanding of our competition and general economic, demographic and real estate conditions that may impact our business. While we consider these expectations and assumptions to be reasonable, they are inherently subject to significant business, economic, competitive, regulatory and other risks, contingencies and uncertainties, most of which are difficult to predict and many of which are beyond our control and could cause actual results to differ materially from any future results, performance or achievements expressed or implied by these forward- looking statements. Investors should not place undue reliance on these forward-looking statements, which speak only as of the date of this presentation, June 4, 2018. We undertake no obligation to update any forward-looking statements to conform to actual results or changes in our expectations, unless required by applicable law. For a further description of the risks and uncertainties that could cause actual results to differ from those expressed in these forward-looking statements, as well as risks relating to the business of the Company in general, see the “Risk Factors” disclosed in the Company’s Annual Report on Form 10-K for the year ended December 31, 2017 and in the Company’s subsequent filings with the Securities and Exchange Commission. Non-GAAP Financial Measures This presentation includes certain financial measures that were not prepared in accordance with U.S. generally accepted accounting principles (GAAP) because we believe they help investors understand our performance. Any non-GAAP financial measures presented are not, and should not be viewed as, substitutes for financial measures required by U.S. GAAP and may not be comparable to the calculation of similar measures of other companies. Additional Information American Homes 4 Rent (NYSE: AMH) (“the Company”) has an effective registration statement (including a prospectus) with the SEC relating to offerings of its securities. Before you invest in any offering, you should read the prospectus in that registration statement and other documents the Company has filed with the SEC for more complete information about the Company and any such offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the Company will arrange to send such information if you request it by calling toll-free (855) 794-2447 or email investors@ah4r.com. 2

Table of Contents SFR Sector: Macro Landscape Drives Strong Demand…………… 4 AMH At A Glance ……………………………………………………….................. 5 AMH Strategy …………………………………………………………..................... 6 AMH Operating Approach ……………………………………………………… 7 How & Where We Invest ……………......................................................... 8-9 Operational Update …………………………................................................. 10 Financial Results …………………………......................................................... 11-13 Defined Terms ………………………………………………………………………… 14-22 Atlanta, GA 3

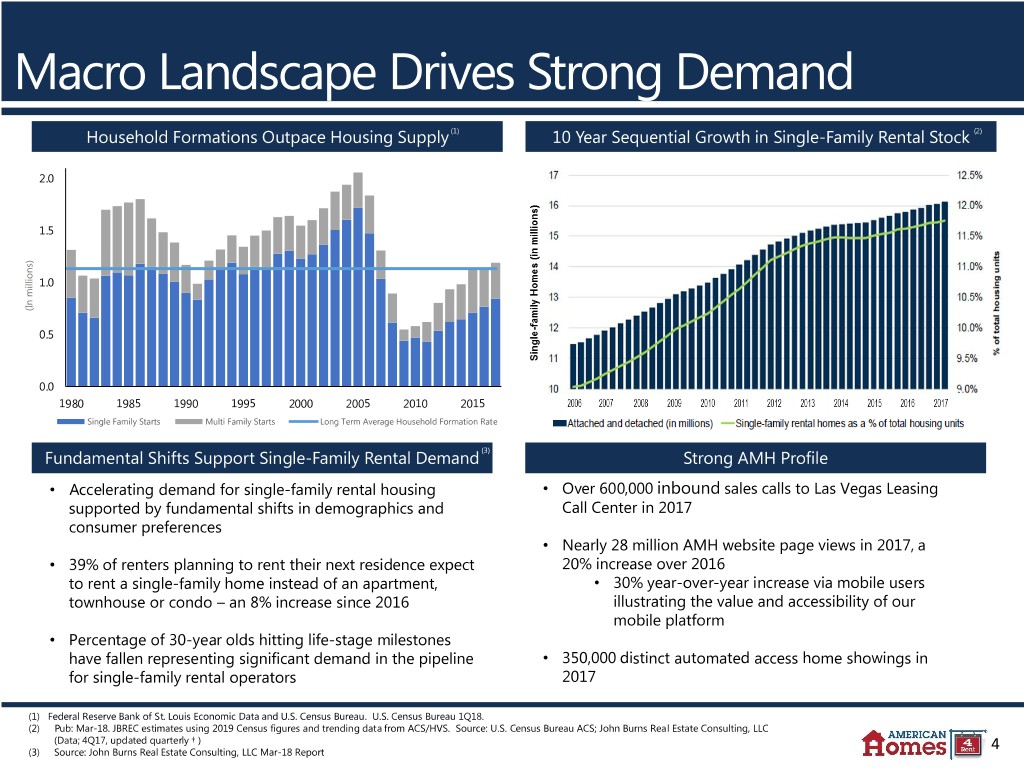

Macro Landscape Drives Strong Demand Household Formations Outpace Housing Supply (1) 10 Year Sequential Growth in Single-Family Rental Stock (2) 2.0 1.5 1.0 (In (In millions) 0.5 0.0 1980 1985 1990 1995 2000 2005 2010 2015 Single Family Starts Multi Family Starts Long Term Average Household Formation Rate Fundamental Shifts Support Single-Family Rental Demand (3) Strong AMH Profile • Accelerating demand for single-family rental housing • Over 600,000 inbound sales calls to Las Vegas Leasing supported by fundamental shifts in demographics and Call Center in 2017 consumer preferences • Nearly 28 million AMH website page views in 2017, a • 39% of renters planning to rent their next residence expect 20% increase over 2016 to rent a single-family home instead of an apartment, • 30% year-over-year increase via mobile users townhouse or condo – an 8% increase since 2016 illustrating the value and accessibility of our mobile platform • Percentage of 30-year olds hitting life-stage milestones have fallen representing significant demand in the pipeline • 350,000 distinct automated access home showings in for single-family rental operators 2017 (1) Federal Reserve Bank of St. Louis Economic Data and U.S. Census Bureau. U.S. Census Bureau 1Q18. (2) Pub: Mar-18. JBREC estimates using 2019 Census figures and trending data from ACS/HVS. Source: U.S. Census Bureau ACS; John Burns Real Estate Consulting, LLC (Data; 4Q17, updated quarterly † ) (3) Source: John Burns Real Estate Consulting, LLC Mar-18 Report 4

AMH At A Glance 51,840 high-quality Only Investment 6.2% Same Home Approx. $250 properties in 22 Grade Rated FY 2017 Core NOI million of annual states (1) balance sheet in after Capex retained cash flow ~ 200,000 residents SFR sector growth ~ 1,200 employees,(1) 95.9% Same-Home Phoenix, AZ of which over 800 1Q 2018 ending are field based or occupancy delivering customer percentage Average property service age of 15 years (1) Best-in-class call center and Boise, ID $10.7 billion total proprietary market technology Net debt to TTM capitalization (1) Adjusted EBITDA of 5.1x (1) (1) As of March 31, 2018 5

The AMH Strategy • Optimize AMH’s differentiated operating platform OPERATIONS • Balance centralized control and oversight, with local office touch STRATEGY • Enhance operating efficiencies with innovative and proprietary technology solutions • Management and execution of all stages of operational lifecycle with AMH internal personnel + • Accretively expand portfolio by investing in AMH’s high growth markets and well diversified portfolio footprint • Focus on high quality properties in desirable neighborhoods and highly rated school districts to attract ideal tenant profile: GROWTH (1) high credit quality, (2) propensity to stay longer and (3) mentality to care for property as their “home” STRATEGY • AMH Development and National Builder Programs add superior quality “built for rental” homes with highly attractive risk adjusted returns • Opportunistic traditional foreclosure auction / MLS acquisition program + • Utilize investment grade cost of capital advantage over SFR peers BALANCE SHEET • Maintain flexible and conservative balance sheet, while optimizing capital stack STRATEGY • Accretively reinvest retained cash flow into external growth initiatives = • Industry leading cash flow margins and long-term operating advantage SHAREHOLDER VALUE • Strong Same-Home Core NOI after Capex growth of 6.2% and 12.1% for FY 2017 and FY 2016, respectively • Alignment of interests with AMH founder and senior management who hold approximately $1.8 billion of equity ownership (1) (1) Based on closing stock price of $20.08 on Friday, March 30, 2018. Common equity includes common shares and operating partnership units that are convertible into common shares. 6

The AMH Operating Approach Centralized approach differentiates AMH operating efficiency Centralized Support Enhanced efficiency • Call centers Superior control • Tenant U/W Ability to make nimble • Lease execution enhancements • Rental pricing Standardized processes • Maintenance oversight Field Efficient management of Management multiple satellite markets • Local district office Local customer service • Regional & district delivery managers Boots on The Ground Exceptional customer service • Leasing agents Accelerated leasing process • Property managers Asset preservation • Maintenance Efficient maintenance delivery technicians 7

How we Invest 2018 Acquisition Outlook • Expect to complete $400 to $600 million of total acquisitions comprised of the following channels: • ~ $200 million in Traditional Foreclosure Auction/MLS purchases • ~ $300 million from National Builder Program & AMH Development • Bulk/Portfolio opportunities would be in addition to above channels Foreclosure Auction/MLS Built for Rental Bulk/Portfolio Opportunities • AMH personnel underwrite and • Consists of: National Builder • Further leverage mature and inspect all homes acquired through Program & AMH Development scalable operating platform foreclosure auction & MLS • Newly built homes expected to • Accretive cost synergy • Create value through discount to have rental premium and lower opportunities replacement cost & renovations expenditure levels • Integration risk mitigated by • Additional scale leverages highly • Minimal development risk successful track record of portfolio efficient operating platform acquisitions • Premium stabilized investment • 5% to 6% economic yields after returns: National Builder Program • Bullish view on consolidation CapEx 50 bps yield premium, AMH opportunities, but timing will be (1) Development 100+ bps yield lumpy and unpredictable premium 8

Where We Invest Diversified footprint, comprised of high growth markets, ideally positioned for long-term sustainable growth and portfolio optimization flexibility Midwest: % of Total Properties: 17.6% 1Q18 SH Avg. Occupied Days: 94.8% 1Q18 Blended Rate Spread: 3.4% Favorable AMH market trends relative to national averages: Employment Growth:(1) - US national average: 1.6% - All AMH markets: 2.1% Single-Family New Lease Rental Rate Growth: West: (2) % of Total Properties: 9.3% - US national average : 3.4% (3) 1Q18 SH Avg. Occupied Days: 96.3% - All AMH Markets : 3.6% 1Q18 Blended Rate Spread: 5.1 % Southeast: % of Total Properties: 47.2% 1Q18 SH Avg. Occupied Days: 94.1% Southwest: 1Q18 Blended Rate Spread: 3.5% % of Total Properties: 25.9% 1Q18 SH Avg. Occupied Days: 95.0% 1Q18 Blended Rate Spread: 3.9% Note: Total properties percentage based on counts as of March 31, 2018. (1) Source: Bureau of Labor Statistics March 2018 (2) Source: JBREC Single Family Rent Index for the twelve months ended March 2018 (3) Actual new lease rental rate spreads as reported by the Company for the three months ended March 2018 9

Operational Update 2018 Same-Home Outlook (1) • Strong demand & AMH initiative to increase Average Occupied Days Percentage 94.5% - 95.5% occupancy drove 1Q18 leasing performance Core revenues growth 3.5% - 4.5% Record High • Highest ever reported Same-Home occupancy of 95.9% at Mar-2018 Occupancy Levels Core property operating expense growth 4.0% - 5.0% • Occupancy remains strong: Same-Home Core NOI after Capital Expenditures occupancy of 96.1% at Apr-2018 and 96.3% at 3.0% - 4.0% May-2018 growth Core NOI margin 64.0% - 65.0% Property tax expense growth 3.5% - 4.5% • High occupancy + spring leasing season = pricing power Average R&M and turnover costs, net, plus Recurring Capital Expenditures per $1,950 - $2,100 • Maintained strong 1Q18 blended rate growth of property 3.7%, while absorbing excess inventory Strong • Rental rate growth accelerating: Pricing Power • Apr-2018 blended spreads of 4.8% and new lease spreads of nearly 7% • May-2018 blended spreads of 5.2% and new lease spreads of nearly 7% • 1Q18 expenditures elevated on non-comparable costs and cosmetic investments to stimulate leasing activity Expenditures On-Track With Guidance • Full year expenditure guidance on track, as cosmetic investments ramp down mid 2Q18, vacant carrying costs decrease and expenditure efficiency initiatives continue (1) Refer to Slide 22 for 2018 Same-Home Outlook disclosure 10

Investment Grade Balance Sheet Capital Structure Debt Maturity Schedule $1,402 (In millions)) (In thousands, exceptFixed share Rate and Debt per share amounts) (Figures in millions,25.0% except per share amounts) 12/31/2016 Common Shares & OP Units $1,004 $956 63.9% Floating Rate Debt 1.9% Preferred Shares $221 9.2% $132 $68 $21 $21 $21 $10 $10 $10 Liquidity Secured Note Payable Exchangeable Senior Notes Asset-backed Securitizations Term Loan Facility Unsecured Senior Notes Principal Amortization Credit Ratings & Ratios Balance Sheet Philosophy Moody’s Investor Service Baa3 / (Stable) Maintain flexible investment grade Continue optimizing capital stack S&P Global Ratings BBB- / (Stable) balance sheet with diverse access to and utilize investment grade rating capital to reduce cost of capital Net debt to Adjusted EBITDA 5.1x Expand sources of available capital Prudent retention of operating cash Debt and preferred shares to Adjusted EBITDA 7.6x as the Company and the SFR sector flow Fixed charge coverage 3.0x evolves and matures Unencumbered Core NOI percentage 63.4% Note: Refer to Defined Terms and Non-GAAP Reconciliations in the Appendix, as well as the 1Q18 Supplemental Information Package, for definitions of metrics and reconciliations to GAAP. 11

Strong Same-Home Performance (Amounts in thousands, except property data) 1Q17 2Q17 3Q17 4Q17 1Q18 Number of Same-Home properties 38,828 38,828 38,828 38,828 38,828 Rents from single-family properties $ 165,728 $ 167,350 $ 167,585 $ 168,910 $ 171,312 Operating Highlights Fees from single-family properties 1,992 2,077 2,222 1,976 1,990 1 Increasing revenues driven Bad debt (1,197) (1,059) (1,863) (1,649) (1,538) by solid rental rate Core revenues 1 $ 166,523 $ 168,368 $ 167,944 $ 169,237 $ 171,764 increases and strong stabilized occupancy levels R&M and turnover costs, net 9,600 12,489 14,331 11,525 13,645 2 Property tax, insurance and HOA fees, net 34,381 34,127 34,153 34,689 34,898 Platform maturation and Property management, net 12,651 12,824 12,582 12,321 13,373 continued expense controls lead to growing Core property operating expenses $ 56,632 $ 59,440 $ 61,066 $ 58,535 $ 61,916 cash flows Core net operating income (“Core NOI”) 2 109,891 108,928 106,878 110,702 109,848 3 Core NOI margin 66.0% 64.7% 63.6% 65.4% 64.0% Strong twelve month Y-o-Y Recurring Capital expenditures 5,336 6,983 8,413 5,941 6,054 growth in Core NOI after capex Core NOI after Capital Expenditures 3 $ 104,555 $ 101,945 $ 98,465 $ 104,761 $ 103,794 Property Enhancing Capex – Resilient flooring $ -- $ 606 $ 1,016 $ 1,524 $ 1,337 4 Long-term sustainable expenditure levels resulting from platform (1) YOY growth in quarterly Core NOI after capex 3 9.0% 7.4% 5.5% 1.5% (0.7%) maturation and operating efficiencies Average R&M, turnover, in-house maintenance $ 384 $ 502 $ 586 $ 449 $ 508 ∑ $ 2,045 and Recurring Capital Expenditures per property 4 Note: Refer to Defined Terms and Non-GAAP Reconciliations in the Appendix for definitions of metrics and reconciliations to GAAP. (1) Year-over-year percentage growth comparisons based on quarterly same-home populations presented in the Company’s supplemental for the respective period. 12

Industry Leading Efficiency Metrics (Dollars in thousands) 1Q17 2Q17 3Q17 4Q17 1Q18 Adjusted EBITDA Margins Total revenues, excluding tenant charge-backs $ 205,381 $ 209,626 $ 210,742 $ 214,569 $ 222,197 Property operating expenses, net ( 56,393) ( 59,715) (63,110) ( 60,929) ( 66,353) Property management expenses, net ( 15,600) ( 15,875) ( 15,770) ( 15,664) ( 17,437) General & administrative expenses, net ( 8,774) ( 8,229) ( 7,826) ( 7,340) (8,633) Other expenses, net ( 629) 199 14 91 (127) Adjusted EBITDA $ 123,985 $ 126,006 $ 124,050 $ 130,727 $ 129,647 Margin 60.4 % 60.1 % 58.9 % 60.9 % 58.3% Recurring Capital Expenditures ( 6,397) ( 8,342) ( 10,316) ( 7,501) ( 7, 386) Leasing costs ( 1,482) ( 1,919) ( 1,960) ( 2,029) ( 2,723) Adjusted EBITDA after Capex & Leasing Costs $ 116,106 $ 115,745 $ 111,774 $ 121,197 $ 119,538 Margin 56.5 % 55.2 % 53.0% 56.5% 53.8% Platform Efficiency Percentage Rents & fees from single-family properties $ 203,711 $ 207,338 $ 210,333 $ 213,368 $ 220,856 Property management expenses, net $ 15,600 $ 15,875 $ 15,770 $ 15,664 $ 17,437 General & administrative expenses, net 8,774 8,229 7,826 7,340 8,633 Leasing costs 1,482 1,919 1,960 2,029 2,723 Total platform costs $ 25,856 $ 26,023 $ 25,556 $ 25,033 $ 28,793 Platform Efficiency Percentage 12.7 % 12.6 % 12.2 % 11.7 % 13.0 % Note: Refer to Defined Terms and Non-GAAP Reconciliations in the Appendix for definitions of metrics and reconciliations to GAAP. 13

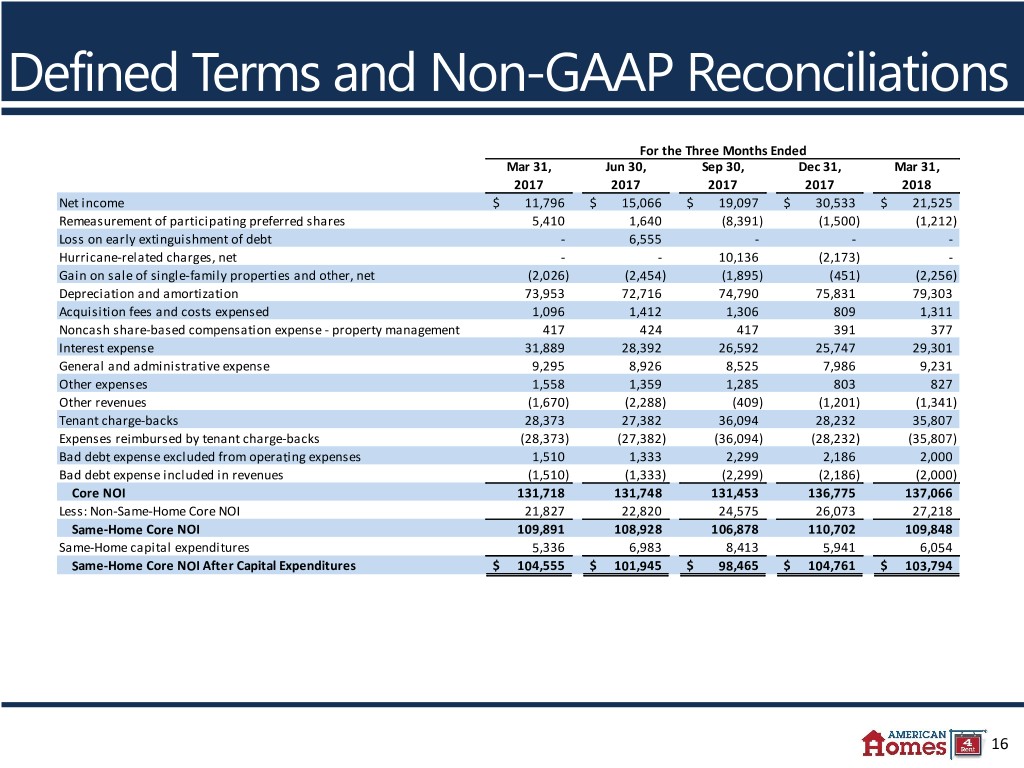

Defined Terms and Non-GAAP Reconciliations Average Occupied Days Percentage Highlights(1) The number of days a property is occupied in the period divided by the total number of days the property is owned during the same period. This calculation excludes properties identified for future sale as part of the Company’s disposition program and properties classified as held for sale. Core Net Operating Income ("Core NOI") and Same-Home Core NOI After Capital Expenditures Core NOI, which we also present separately for our Same-Home portfolio, is a supplemental non-GAAP financial measure that we define as core revenues, which is calculated as rents and fees from single-family properties, net of bad debt expense, less core property operating expenses, which is calculated as property operating and property management expenses, excluding noncash share-based compensation expense, expenses reimbursed by tenant charge- backs and bad debt expense. A property is classified as Same-Home if it has been stabilized longer than 90 days prior to the beginning of the earliest period presented under comparison and if it has not been classified as held for sale, identified for future sale or taken out of service as a result of a casualty loss. Core NOI also excludes (1) noncash fair value adjustments associated with remeasuring our participating preferred shares derivative liability to fair value, (2) noncash gain or loss on conversion of shares or units, (3) gain or loss on early extinguishment of debt, (4) hurricane-related charges, net, (5) gain or loss on sales of single-family properties and other, (6) depreciation and amortization, (7) acquisition fees and costs expensed incurred with business combinations and the acquisition of individual properties, (8) noncash share-based compensation expense, (9) interest expense, (10) general and administrative expense, (11) other expenses and (12) other revenues. We believe Core NOI provides useful information to investors about the operating performance of our single- family properties without the impact of certain operating expenses that are reimbursed through tenant charge-backs. We further adjust Core NOI for our Same-Home portfolio by subtracting recurring capital expenditures to calculate Same-Home Core NOI After Capital Expenditures, which we believe provides useful information to investors because it more fully reflects our operating performance after the impact of all property-level expenditures, regardless of whether they are capitalized or expensed. Core NOI and Same-Home Core NOI After Capital Expenditures should be considered only as supplements to net income or loss as a measure of our performance and should not be used as measures of our liquidity, nor are they indicative of funds available to fund our cash needs, including our ability to pay dividends or make distributions. Additionally, these metrics should not be used as substitutes for net income or loss or net cash flows from operating activities (as computed in accordance with GAAP). 14

Defined Terms and Non-GAAP Reconciliations The following are reconciliations of core revenues, core property operating expenses, Core NOI, Same-Home Core NOI and Same-Home Core NOI After Capital Expenditures to their respective GAAP metrics for the trailing five quarters (amounts in thousands): (1) For the Three Months Ended Mar 31, Jun 30, Sep 30, Dec 31, Mar 31, 2017 2017 2017 2017 2018 Core revenues Total revenues $ 233,754 $ 237,008 $ 246,836 $ 242,801 $ 258,004 Tenant charge-backs (28,373) (27,382) (36,094) (28,232) (35,807) Bad debt expense (1,510) (1,333) (2,299) (2,186) (2,000) Other revenues (1,670) (2,288) (409) (1,201) (1,341) Core revenues 202,201 206,005 208,034 211,182 218,856 Less: Non-Same-Home core revenues 35,678 37,637 40,090 41,945 47,092 Same-Home core revenues $ 166,523 $ 168,368 $ 167,944 $ 169,237 $ 171,764 For the Three Months Ended Mar 31, Jun 30, Sep 30, Dec 31, Mar 31, 2017 2017 2017 2017 2018 Core property operating expenses Property operating expenses $ 83,305 $ 85,954 $ 97,944 $ 87,871 $ 100,987 Property management expenses 17,478 17,442 17,447 17,345 18,987 Noncash share-based compensation - property management (417) (424) (417) (391) (377) Expenses reimbursed by tenant charge-backs (28,373) (27,382) (36,094) (28,232) (35,807) Bad debt expense (1,510) (1,333) (2,299) (2,186) (2,000) Core property operating expenses 70,483 74,257 76,581 74,407 81,790 Less: Non-Same-Home core property operating expenses 13,851 14,817 15,515 15,872 19,874 Same-Home core property operating expenses $ 56,632 $ 59,440 $ 61,066 $ 58,535 $ 61,916 15

Defined Terms and Non-GAAP Reconciliations For the Three Months Ended Highlights(1) Mar 31, Jun 30, Sep 30, Dec 31, Mar 31, 2017 2017 2017 2017 2018 Net income $ 11,796 $ 15,066 $ 19,097 $ 30,533 $ 21,525 Remeasurement of participating preferred shares 5,410 1,640 (8,391) (1,500) (1,212) Loss on early extinguishment of debt - 6,555 - - - Hurricane-related charges, net - - 10,136 (2,173) - Gain on sale of single-family properties and other, net (2,026) (2,454) (1,895) (451) (2,256) Depreciation and amortization 73,953 72,716 74,790 75,831 79,303 Acquisition fees and costs expensed 1,096 1,412 1,306 809 1,311 Noncash share-based compensation expense - property management 417 424 417 391 377 Interest expense 31,889 28,392 26,592 25,747 29,301 General and administrative expense 9,295 8,926 8,525 7,986 9,231 Other expenses 1,558 1,359 1,285 803 827 Other revenues (1,670) (2,288) (409) (1,201) (1,341) Tenant charge-backs 28,373 27,382 36,094 28,232 35,807 Expenses reimbursed by tenant charge-backs (28,373) (27,382) (36,094) (28,232) (35,807) Bad debt expense excluded from operating expenses 1,510 1,333 2,299 2,186 2,000 Bad debt expense included in revenues (1,510) (1,333) (2,299) (2,186) (2,000) Core NOI 131,718 131,748 131,453 136,775 137,066 Less: Non-Same-Home Core NOI 21,827 22,820 24,575 26,073 27,218 Same-Home Core NOI 109,891 108,928 106,878 110,702 109,848 Same-Home capital expenditures 5,336 6,983 8,413 5,941 6,054 Same-Home Core NOI After Capital Expenditures $ 104,555 $ 101,945 $ 98,465 $ 104,761 $ 103,794 16

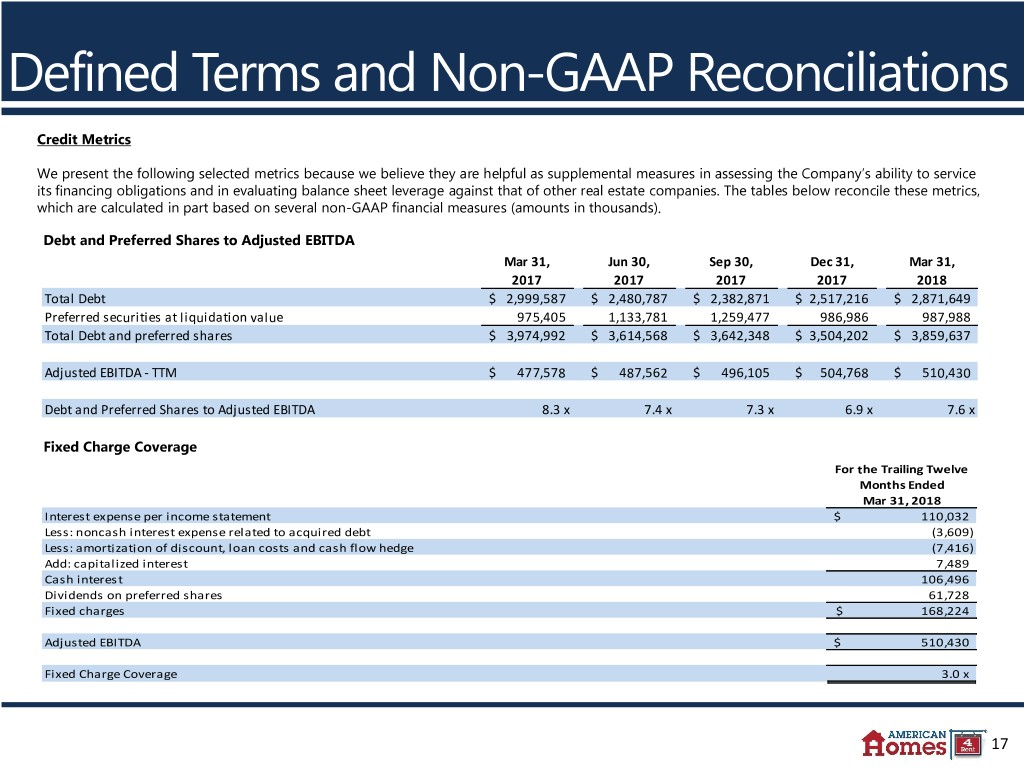

Defined Terms and Non-GAAP Reconciliations Credit Metrics We present the following selected metrics because we believe they are helpful as supplemental measures in assessing the Company’s ability to service its financing obligations and in evaluating balance sheet leverage against that of other real estate companies. The tables below reconcile these metrics, which are calculated in part based on several non-GAAP financial measures (amounts in thousands). Debt and Preferred Shares to Adjusted EBITDA Mar 31, Jun 30, Sep 30, Dec 31, Mar 31, 2017 2017 2017 2017 2018 Total Debt $ 2,999,587 $ 2,480,787 $ 2,382,871 $ 2,517,216 $ 2,871,649 Preferred securities at liquidation value 975,405 1,133,781 1,259,477 986,986 987,988 Total Debt and preferred shares $ 3,974,992 $ 3,614,568 $ 3,642,348 $ 3,504,202 $ 3,859,637 Adjusted EBITDA - TTM $ 477,578 $ 487,562 $ 496,105 $ 504,768 $ 510,430 Debt and Preferred Shares to Adjusted EBITDA 8.3 x 7.4 x 7.3 x 6.9 x 7.6 x Fixed Charge Coverage For the Trailing Twelve Months Ended Mar 31, 2018 Interest expense per income statement $ 110,032 Less: noncash interest expense related to acquired debt (3,609) Less: amortization of discount, loan costs and cash flow hedge (7,416) Add: capitalized interest 7,489 Cash interest 106,496 Dividends on preferred shares 61,728 Fixed charges $ 168,224 Adjusted EBITDA $ 510,430 Fixed Charge Coverage 3.0 x 17

Defined Terms and Non-GAAP Reconciliations Net Debt to Adjusted EBITDA Mar 31, Jun 30, Sep 30, Dec 31, Mar 31, 2017 2017 2017 2017 2018 Total Debt $ 2,999,587 $ 2,480,787 $ 2,382,871 $ 2,517,216 $ 2,871,649 Less: cash and cash equivalents (495,802) (67,325) (243,547) (46,156) (203,883) Less: asset-backed securitization certificates (25,666) (25,666) (25,666) (25,666) (25,666) Less: restricted cash related to securitizations (63,147) (56,058) (46,166) (46,203) (46,384) Net debt $ 2,414,972 $ 2,331,738 $ 2,067,492 $ 2,399,191 $ 2,595,716 Adjusted EBITDA - TTM $ 477,578 $ 487,562 $ 496,105 $ 504,768 $ 510,430 Net Debt to TTM Adjusted EBITDA 5.1 x 4.8 x 4.2 x 4.8 x 5.1 x Unencumbered Core NOI Percentage For the Three Months Ended Mar 31, 2018 Unencumbered Core NOI $ 86,947 Core NOI $ 137,066 Unencumbered Core NOI Percentage 63.4% 18

Defined Terms and Non-GAAP Reconciliations EBITDA / Adjusted EBITDA / Adjusted EBITDA after Capex and Leasing Costs / Adjusted EBITDA Margin / Adjusted EBITDA after Capex and Leasing Costs Margin EBITDA is defined as earnings before interest, taxes, depreciation and amortization. EBITDA is a non-GAAP financial measure and is used by us and others as a supplemental measure of performance. Adjusted EBITDA is a supplemental non-GAAP financial measure calculated by adjusting EBITDA for (1) acquisition fees and costs expensed incurred with business combinations and the acquisition of individual properties, (2) net gain or loss on sales / impairment of single-family properties and other, (3) noncash share-based compensation expense, (4) hurricane-related charges, net, (5) gain or loss on early extinguishment of debt, (6) gain or loss on conversion of shares and units and (7) noncash fair value adjustments associated with remeasuring our participating preferred shares derivative liability to fair value. Adjusted EBITDA after Capex and Leasing Costs is a supplemental non-GAAP financial measure calculated by adjusting Adjusted EBITDA for (1) recurring capital expenditures and (2) leasing costs. Adjusted EBITDA Margin is a supplemental non-GAAP financial measure calculated as Adjusted EBITDA divided by total revenues, net of tenant charge-backs. Adjusted EBITDA after Capex and Leasing Costs Margin is a supplemental non-GAAP financial measure calculated as Adjusted EBITDA after Capex and Leasing costs divided by total revenues, net of tenant charge-backs. We believe these metrics provide useful information to investors because they exclude the impact of various income and expense items that are not indicative of operating performance. 19

Defined Terms and Non-GAAP Reconciliations The following is a reconciliation of net income, determined in accordance with GAAP, to EBITDA, Adjusted EBITDA, Adjusted EBITDA after Capex and Leasing Costs, Adjusted EBITDA Margin and Adjusted EBITDA after Capex and Leasing Costs Margin for the trailing five quarters (amounts in thousands): For the Three Months Ended Mar 31, Jun 30, Sep 30, Dec 31, Mar 31, 2017 2017 2017 2017 2018 Net income $ 11,796 $ 15,066 $ 19,097 $ 30,533 $ 21,525 Interest expense 31,889 28,392 26,592 25,747 29,301 Depreciation and amortization 73,953 72,716 74,790 75,831 79,303 EBITDA 117,638 116,174 120,479 132,111 130,129 Noncash share-based compensation - general and administrative 521 697 699 646 598 Noncash share-based compensation - property management 417 424 417 391 377 Acquisition fees and costs expensed 1,096 1,412 1,306 809 1,311 Net (gain) loss on sale / impairment of single-family properties and other (1,097) (896) (596) 443 (1,556) Hurricane-related charges, net - - 10,136 (2,173) - Loss on early extinguishment of debt - 6,555 - - - Remeasurement of participating preferred shares 5,410 1,640 (8,391) (1,500) (1,212) Adjusted EBITDA $ 123,985 $ 126,006 $ 124,050 $ 130,727 $ 129,647 Recurring capital expenditures (6,397) (8,342) (10,316) (7,501) (7,386) Leasing costs (1,482) (1,919) (1,960) (2,029) (2,723) Adjusted EBITDA after Capex and Leasing Costs $ 116,106 $ 115,745 $ 111,774 $ 121,197 $ 119,538 Total revenues $ 233,754 $ 237,008 $ 246,836 $ 242,801 $ 258,004 Less: tenant charge-backs (28,373) (27,382) (36,094) (28,232) (35,807) Total revenues, net of tenant charge-backs $ 205,381 $ 209,626 $ 210,742 $ 214,569 $ 222,197 Adjusted EBITDA Margin 60.4% 60.1% 58.9% 60.9% 58.3% Adjusted EBITDA after Capex and Leasing Costs Margin 56.5% 55.2% 53.0% 56.5% 53.8% 20

Defined Terms and Non-GAAP Reconciliations Platform Efficiency Percentage Management costs, including (1) property management expenses, net of tenant charge-backs and excluding noncash share-based compensation expense, (2) general and administrative expense, excluding noncash share-based compensation expense and (3) leasing costs, as a percentage of total portfolio rents and fees. For the Three Months Ended Mar 31, Jun 30, Sep 30, Dec 31, Mar 31, (In Thousands) 2017 2017 2017 2017 2018 Property management expenses $ 17,478 $ 17,442 $ 17,447 $ 17,345 $ 18,987 Less: tenant charge-backs (1,461) (1,143) (1,260) (1,290) (1,173) Less: noncash share-based compensation - property management (417) (424) (417) (391) (377) Property management expenses, net 15,600 15,875 15,770 15,664 17,437 General and administrative expense 9,295 8,926 8,525 7,986 9,231 Less: noncash share-based compensation - general and administrative (521) (697) (699) (646) (598) General and administrative expense, net 8,774 8,229 7,826 7,340 8,633 Leasing costs 1,482 1,919 1,960 2,029 2,723 Platform costs $ 25,856 $ 26,023 $ 25,556 $ 25,033 $ 28,793 Rents from single-family properties $ 201,107 $ 204,648 $ 207,490 $ 210,778 $ 218,023 Fees from single-family properties 2,604 2,690 2,843 2,590 2,833 Total portfolio rents and fees $ 203,711 $ 207,338 $ 210,333 $ 213,368 $ 220,856 Platform Efficiency Percentage 12.7% 12.6% 12.2% 11.7% 13.0% 21

Defined Terms and Non-GAAP Reconciliations Property Enhancing Capex Includes elective capital expenditures to enhance the operating profile of a property, such as investments to increase future revenues or reduce maintenance expenditures. Recurring Capital Expenditures For our Same-Home portfolio, includes replacement costs and other capital expenditures recorded during the period that are necessary to help preserve the value and maintain functionality of our properties. For our total portfolio, we calculate recurring capital expenditures by multiplying (a) current period actual recurring capital expenditures per Same-Home property by (b) our total number of properties, excluding non-stabilized properties, properties identified for future sale as part of the Company’s disposition program and properties classified as held for sale. 2018 Same-Home Outlook Disclosure The Company does not provide guidance for the most comparable GAAP financial measures of net income or loss, total revenues and property operating expenses, or a reconciliation of the above-listed forward-looking non-GAAP financial measures to the comparable GAAP financial measures because we are unable to reasonably predict certain items contained in the GAAP measures, including non- recurring and infrequent items that are not indicative of the Company's ongoing operations. Such items include, but are not limited to, net gain or loss on sales and impairment of single-family properties, casualty loss, Non-Same-Home revenues, Non-Same-Home property operating expenses and noncash fair value adjustments associated with remeasuring our participating preferred shares derivative liability to fair value. These items are uncertain, depend on various factors and could have a material impact on our GAAP results for the guidance period. 22