Attached files

| file | filename |

|---|---|

| EX-32 - EXHIBIT 32 - DECKERS OUTDOOR CORP | deck331201810-kexhibit32.htm |

| EX-31.2 - EXHIBIT 31.2 - DECKERS OUTDOOR CORP | deck331201810-kexhibit312.htm |

| EX-31.1 - EXHIBIT 31.1 - DECKERS OUTDOOR CORP | deck331201810-kexhibit311.htm |

| EX-23.1 - EXHIBIT 23.1 - DECKERS OUTDOOR CORP | deck331201810-kexhibit231.htm |

| EX-21.1 - EXHIBIT 21.1 - DECKERS OUTDOOR CORP | deck331201810-kexhibit211.htm |

| EX-10.10 - EXHIBIT 10.10 - DECKERS OUTDOOR CORP | deck331201810-kexhibit1010.htm |

| EX-10.9 - EXHIBIT 10.9 - DECKERS OUTDOOR CORP | deck331201810-kexhibit109.htm |

| EX-10.6 - EXHIBIT 10.6 - DECKERS OUTDOOR CORP | morenovalleyfirstamendme.htm |

| 10-K - 10-K - DECKERS OUTDOOR CORP | deck331201810-k.htm |

SECOND AMENDMENT TO STANDARD INDUSTRIAL LEASE (NET) THIS SECOND AMENDMENT TO STANDARD INDUSTRIAL LEASE (NET) (this "Amendment"} is made and entered into as of the 17th day of July, 2017 ("Eff~tive Date"), by and between MORENO KNOX, LLC, a Delaware limited liability company ("Landlord"), and DECKERS OUTDOOR CORPORATION, a Delaware corporation ("Tenant"). RECITALS A. Landlord and Tenant are parties to that certain Standard Industrial Lease (Net) dated as of December 5, 2013 (the "Original Lease"), as amended by that certain First Amendment to Standard Industrial Lease (Net) dated as of June 6, 2017 by and between Landlord and Tenant (the "First Amendment"). The Original Lease, as modified by the First Amendment, may be referred to herein as the "Lease." Pursuant to the Lease, as of the Expansion Rent Commencement Date (as defmed in the First Amendment), Landlord will lease to Tenant space containing approximately I ,530,944 square feet (which includes the Original Premises and the Expansion Space, as such terms are defmed in the First Amendment) (the "Premises"), which will consist of the entire building located at 17791 Perris Boulevard, Moreno Valley, CA 92551 (the "Building"), which Building is part of the project consisting of approximately 71.29 acres commonly known as Vantage Pointe Logistics Center (the "Project"). B. Landlord is engaged in discussions to sell the Project, including the Premises (the "Potential Sale"). The closing date of the Potential Sale shall be referred to herein as the "Potential Closing Date". C. The parties hereto desire to amend the Lease, all on the following terms and conditions set forth in this Amendment. NOW, THEREFORE, in consideration of the mutual covenants and agreements herein contained and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, Landlord and Tenant agree as follows: I. Construction/Property Management After the Potential Closing Date. Notwithstanding anything to the contrary contained in the Lease, if the Potential Closing Date occurs before the Delivery Date (as defined in the First Amendment), then commencing on the Potential Closing Date and continuing until the Delivery Date, Landlord shall retain SRG Development, L.P., a Delaware limited partnership ("Development Manager"), as the development manager for the construction of Landlord's Work (as defined in the First Amendment) and any other work required to be completed by Landlord in connection with the Expansion Space as set forth in the First Amendment, pursuant to a separate agreement between Landlord and Development Manager. Further, notwithstanding anything to the contrary contained in the Lease, if the Potential Closing Date occurs before the Delivery Date (as defined in the First Amendment), then commencing on the Potential Closing Date and continuing until the Delivery Date, Landlord shall retain Sares Regis Management Company, L.P., a Delaware limited partnership ("Property Manager"), as the property manager for the Building, pursuant to a separate agreement between Landlord and Property Manager. II. Converted Amount. Pursuant to Section IV of the First Amendment, Tenant hereby elects to convert all of the Abated Amount to a cash payment (such amount being the "Converted Amount"). The Converted Amount is hereby agreed by Landlord and Tenant to be equal to a cash payment of Four Million Three Hundred Twenty-Two Thousand One Hundred Twenty-Six and 04/100 Dollars ($4,322, 126.04). Provided Tenant is not in default under the Lease, as amended hereby, beyond any applicable notice and cure period as of the applicable payment date, then Landlord shall pay to Tenant, within thirty (30) days after the Effective Date of this Amendment, the Converted Amount as set forth above. Upon such payment by Landlord to Tenant, Tenant shall no longer be entitled to any Abated Amount pursuant to Paragraph IV of the First Amendment and such Paragraph shall be deemed deleted in its entirety and of no further force or effect, and Tenant shall thereafter be responsible to pay the applicable monthly Basic Rent and NNN Charges as they become due and payable under the Lease, as amended hereby. II 52618.04/0C 298582·0000117·17·17/bhn/Jdc · I- 4425562v3/ 100550.0 I 22

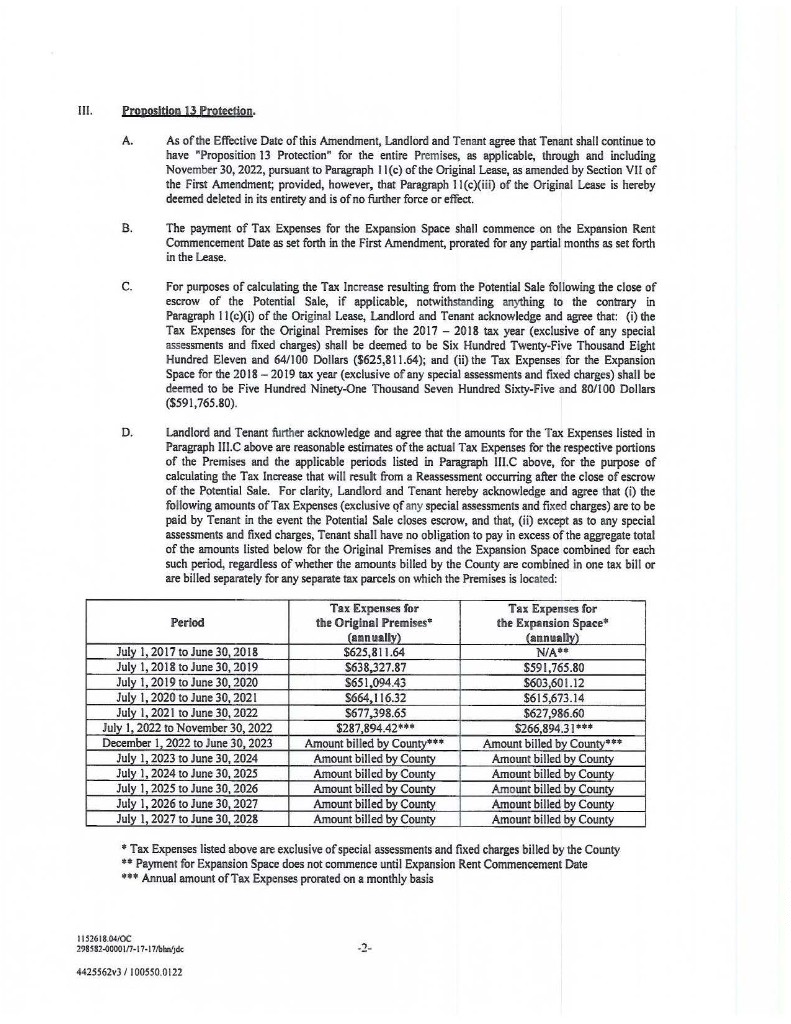

HI. Prooosition 13 Protection. A. As ofthe Effective Date of this Amendment, Landlord and Tenant agree that Tenant shall continue to have "Proposition 13 Protection" for the entire Premises, as applicable, through and including November 30,2022, pursuant to Paragraph ll(c) of the Original Lease, as amended by Section VII of the First Amendment; provided, however, that Paragraph ll(c)(iii) of the Original Lease is hereby deemed deleted in its entirety and is of no further force or effect. B. The payment of Tax Expenses for the Expansion Space shall commence on the Expansion Rent Commencement Date as set forth in the First Amendment, prorated for any partial months as set forth in the Lease. C. For purposes of calculating the Tax Increase resulting from the Potential Sale following the close of escrow of the Potential Sale, if applicable, notwithstanding anything to the contrary in Paragraph ll(c)(i) of the Original Lease, landlord and Tenant acknowledge and agree that: (i) the Tax Expenses for the Original Premises for the 2017 - 2018 tax year (exclusive of any special assessments and fixed charges) shall be deemed to be Six Hundred Twenty-Five Thousand Eight Hundred Eleven and 64/100 Dollars ($625,81 1.64); and (ii)the Tax Expenses for the Expansion Space for the 2018 - 20 19 tax year (exclusive of any special assessments and fixed charges) shall be deemed to be Five Hundred Ninety-One Thousand Seven Hundred Sixty-Five and 80/100 Dollars ($591,765.80). D. Landlord and Tenant further acknowledge and agree that the amounts for the Tax Expenses listed in Paragraph III.C above are reasonable estimates of the actual Tax Expenses for the respective portions of the Premises and the applicable periods listed in Paragraph III.C above, for the purpose of calculating the Tax Increase that will result from a Reassessment occurring after the close of escrow of the Potential Sale. For clarity, Landlord and Tenant hereby acknowledge and agree that (i) the following amounts of Tax Expenses (exclusive qfany special assessments and fixed charges) are to be paid by Tenant in the event the Potential Sale closes escrow, and that, (ii) except as to any special assessments and fixed charges, Tenant shall have no obligation to pay in excess of the aggregate total of the amounts listed below for the Original Premises and the Expansion Space combined for each such period, regardless of whether the amounts billed by the County are combined in one tax bill or are billed separately for any separate tax parcels on which the Premises is located: Tax Expenses for Tax Expenses for Period the Original Premises* the Expansion Space* (annually) (annually) July I, 2017 to June 30,2018 $625,81 1.64 N/Au July I, 2018 to June 30,2019 $638,327.87 $591,765.80 July 1, 20 19 to June 30, 2020 $651,094.43 $603,601.12 July I, 2020 to June 30, 2021 $664 116.32 $615,673.14 July I, 2021 to June 30, 2022 $677,398.65 $627986.60 July 1, 2022 to November 30, 2022 $287,894.42*** $266,894.31 *** December 1, 2022 to June 30, 2023 Amount billed by County*** Amount billed by County* •• July I, 2023 to June 30, 2024 Amount billed by County Amount billed by County July 1, 2024 to June 30,2025 Amount billed by County Amount billed by Cou®'_ July I, 2025 to June 30, 2026 Amount billed by County Amount billed I?Y_ CoW!_ty July 1, 2026 to June 30,2027 Amount billed by County Amount billed by County July 1, 2027 to June 30, 2028 Amount billed by County Amount billed by County *Tax Expenses listed above are exclusive of special assessments and fixed charges billed by the County ** Payment for Expansion Space does not commence until Expansion Rent Commencement Date *** Annual amount of Tax Expenses prorated on a monthly basis 1152618.04/0C 298582.0000117-17-17/bhn/Jdc -2- 4425562v3/100550.0122

IV. Waiver of Right of First Befusa!. Notwithstanding anything contained in the Lease to the contrary, Tenant hereby waives its Right of first Refusal (as set forth in Rider 3 of the Original Lease, as amended by Paragraph XII of the First Amendment) with respect to the Potential Sale only. In accordance with Rider 3 ofthe Original Lease, in the event that the Potential Sale fails to close escrow on or before March 26,2018, Tenant's Right of First Refusal shall be reinstated and shall remain in full force and effect pursuant to Rider 3 of the Original Lease, as amended by Paragraph XII of the First Amendment. V. Miscellaneous. A. This Amendment sets forth the entire agreement between the parties with respect to the matters set forth herein. Except as set forth in this Amendment, there have been no additional oral or written representations or agreements. Tenant acknowledges that it has no tennination or cancellation options, options to extend (except as provided in the Lease), options to expand, rights of first offer or rights of first refusal (except as provided in the Lease as modified by this Amendment). B. Except as herein modified or amended, the provisions, conditions and terms of the Lease shall remain unchanged and in full force and effect. C. In the case of any inconsistency between the provisions of the Lease and this Amendment, the provisions of this Amendment shall govern and control. D. Submission of this Amendment by Landlord is not an offer to enter into this Amendment but rather is a solicitation for such an offer by Tenant. Landlord shall not be bound by this Amendment until both Tenant and Landlord have executed and Landlord has delivered the same to Tenant. E. The capitalized terms used in this Amendment shall have the same definitions as set forth in the Lease to the extent that such capitalized tenns are defined therein and not redefined in this Amendment. F. Except for Cresa ("Tenant's Broker") and Landlord's Broker, as defined below, Tenant hereby represents to Landlord that Tenant has dealt with no other brokers in connection with this Amendment. Tenant agrees to indemni:l)' and hold Landlord, its trustees, members, principals, beneficiaries, partners, officers, directors, employees, mortgagee(s) and agents, and the respective principals and members of any such agents harmless from all claims of any brokers (except for Tenant's Broker and Landlord's Broker) claiming to have represented Tenant in connection with this Amendment. Except for Lee & Associates ("Landlord's Broker") and Tenant's Broker, Landlord hereby represents to Tenant that Landlord has dealt with no other brokers in connection with this Amendment. Landlord agrees to indemnifY and hold Tenant, its trustees, members, principals, beneficiaries, partners, officers, directors, employees, and agents, and the respective principals and members of any such agents harmless from all claims of any brokers (except for Tenant's Broker and Landlord's Broker) claiming to have represented Landlord in connection with this Amendment. Landlord agrees to pay Tenanfs Broker and Landlord's Broker pursuant to a separate agreement. G. This Amendment may be executed in counterparts, each of which shall be deemed an original, but all of which, together, shall constitute one and the same Amendment. H. Landlord and Tenant (and their agents. brokers, vendors, consultants, etc.) agree to keep all information with respect to the transaction contemplated herein strictly confidential between Landlord and Tenant; provided, however, (A) Landlord shall be allowed to disclose the terms of this Amendment to its existing and/or prospective lenders, potential buyers, partners, attorneys, consultants, accountants, agents, employees, real estate and loan brokers and as it might be required by law to disclose, and (B) Tenant shall be allowed to disclose the tenns of this Amendment to Tenant's attorneys, accountants, consultants, agents and as it might be required by law or the SEC to disclose. Landlord and Tenant further expressly agree that there shall be no press releases or other publicity originated by the parties hereto, or any representatives thereof, concerning the subject 1152618.04/0C 298582-00001/7-17 -17/bhn/jdc -3- 4425562v3/100550.0122

Amendment transaction, without the prior written consent of both parties, not to be unreasonably withheld, conditioned or delayed. I. Landlord and Tenant each (i) have agreed to permit the use from time to time, where appropriate, of facsimile or other electronic signatures in order to expedite the transaction contemplated by this Amendment, (ii) intend to be bound by its respective facsimile or other electronic signature, (iii) are aware that the other will rely on the facsimile transmitted or other electronically transmitted signature, and (iv) acknowledge such reliance and waives any defenses to the enforcement of this Amendment and the documents affecting the transaction contemplated by this Amendment based on the fact that a signature was sent by facsimile or electronic transmission only. J. Tenant acknowledges and agrees that notwithstanding anything in this Amendment to the contrary, in no event shall Landlord be obligated to enter into an agreement for, or effectuate, the Potential Sale, and Landlord shall have no liability to Tenant in the event the Potential Sale does not occur. !SIGNATURES ARE ON FOLLOWING PAGEl 1152618.04/0C 298S82·00001n-t7-171bhn/jdC -4- 4425562v3/100550.0122

IN WITNESS WHEREOF, Landlord and Tenant have duly executed this Amendment as of the day and year first above written. LANDLORD: MORENO KNOX, LLC, a Delaware limited liability company By: SRG Moreno Knox, L.P., a California limited partnership Its: Managing Member By: Regis Contractors, Inc., a California corporation Its: General Partner By: /s/ Larry Lukanish____________ Name: Larry Lukanish______________ Title: Vice President_______________ TENANT: DECKERS OUTDOOR CORPORATION, a Delaware corporation By: /s/ Thomas A. George ___________ Name: Thomas A. George______________ Title: Chief Financial Officer___________ 1152618.03/OC 298582-00001/5-15-18/bhn/bjw -5-