Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - MYRIAD GENETICS INC | d568140dex991.htm |

| 8-K - 8-K - MYRIAD GENETICS INC | d568140d8k.htm |

Myriad Genetics Acquisition of Counsyl, Inc. 05/29/2018 Exhibit 99.2

Forward Looking Statements Some of the information presented here today may contain projections or other forward-looking statements regarding future events or the future financial performance of the Company. These statements are based on management’s current expectations and the actual events or results may differ materially and adversely from these expectations. We refer you to the documents the Company files from time to time with the Securities and Exchange Commission, specifically, the Company’s annual reports on Form 10-K, its quarterly reports on Form 10-Q, and its current reports on Form 8-K. These documents identify important risk factors that could cause the actual results to differ materially from those contained in the Company’s projections or forward-looking statements. Copyright © 2018 Myriad Genetics, Inc., all rights reserved. www.Myriad.com.

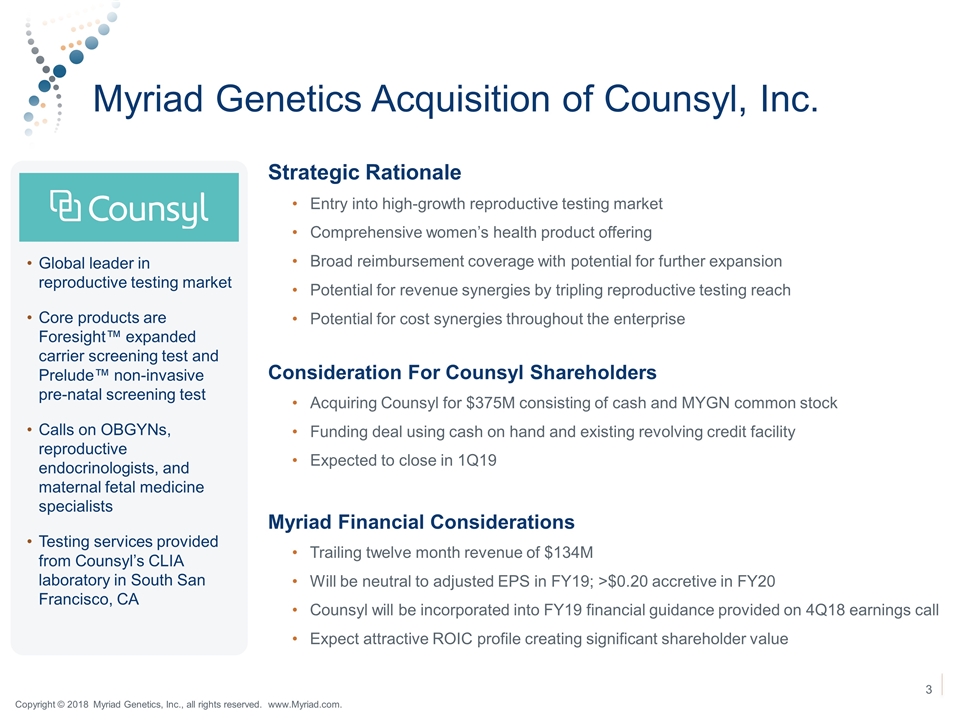

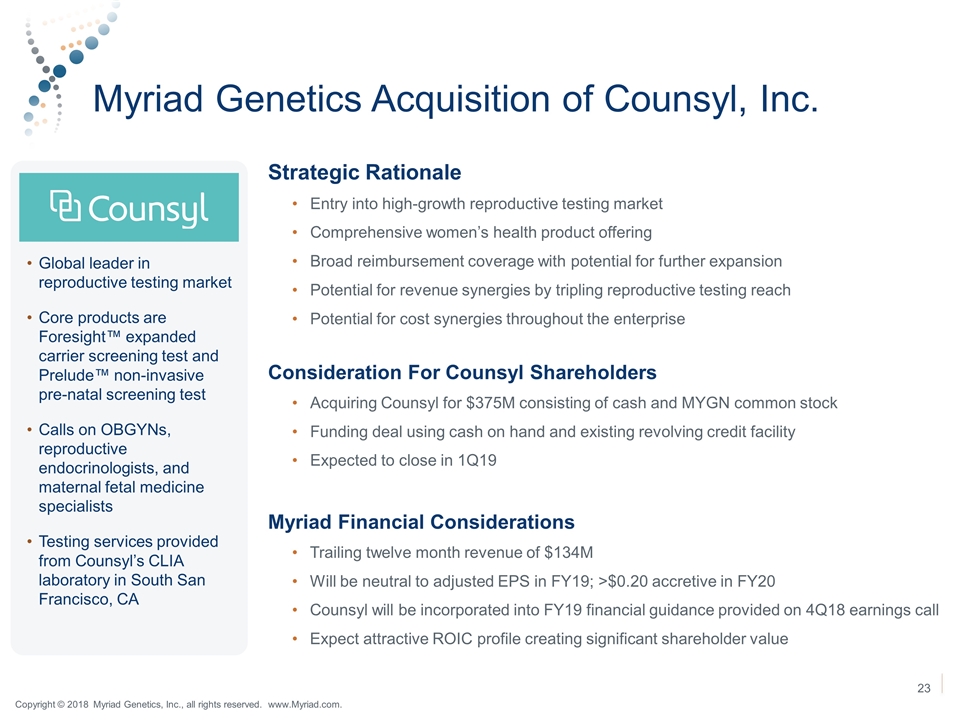

Myriad Genetics Acquisition of Counsyl, Inc. Strategic Rationale Entry into high-growth reproductive testing market Comprehensive women’s health product offering Broad reimbursement coverage with potential for further expansion Potential for revenue synergies by tripling reproductive testing reach Potential for cost synergies throughout the enterprise Consideration For Counsyl Shareholders Acquiring Counsyl for $375M consisting of cash and MYGN common stock Funding deal using cash on hand and existing revolving credit facility Expected to close in 1Q19 Myriad Financial Considerations Trailing twelve month revenue of $134M Will be neutral to adjusted EPS in FY19; >$0.20 accretive in FY20 Counsyl will be incorporated into FY19 financial guidance provided on 4Q18 earnings call Expect attractive ROIC profile creating significant shareholder value Global leader in reproductive testing market Core products are Foresight™ expanded carrier screening test and Prelude™ non-invasive pre-natal screening test Calls on OBGYNs, reproductive endocrinologists, and maternal fetal medicine specialists Testing services provided from Counsyl’s CLIA laboratory in South San Francisco, CA Copyright © 2018 Myriad Genetics, Inc., all rights reserved. www.Myriad.com.

Strategic Rationale 1+1=3 Copyright © 2018 Myriad Genetics, Inc., all rights reserved. www.Myriad.com. Entry into high-growth reproductive testing market Comprehensive women’s health product offering Broad reimbursement with potential for future expansion Potential for revenue synergies by tripling reproductive testing reach Potential for cost synergies and expanded capabilities throughout the enterprise

Counsyl’s Portfolio of Women’s Health Products Allows Entry Into High-Growth Reproductive Testing Market Expanded Carrier Screening Non-Invasive Prenatal Screening Hereditary Cancer Testing Clinical decision support for identifying inheritable disorders Clinical decision support for chromosome conditions Clinical decision support for up to nine cancers Copyright © 2018 Myriad Genetics, Inc., all rights reserved. www.Myriad.com.

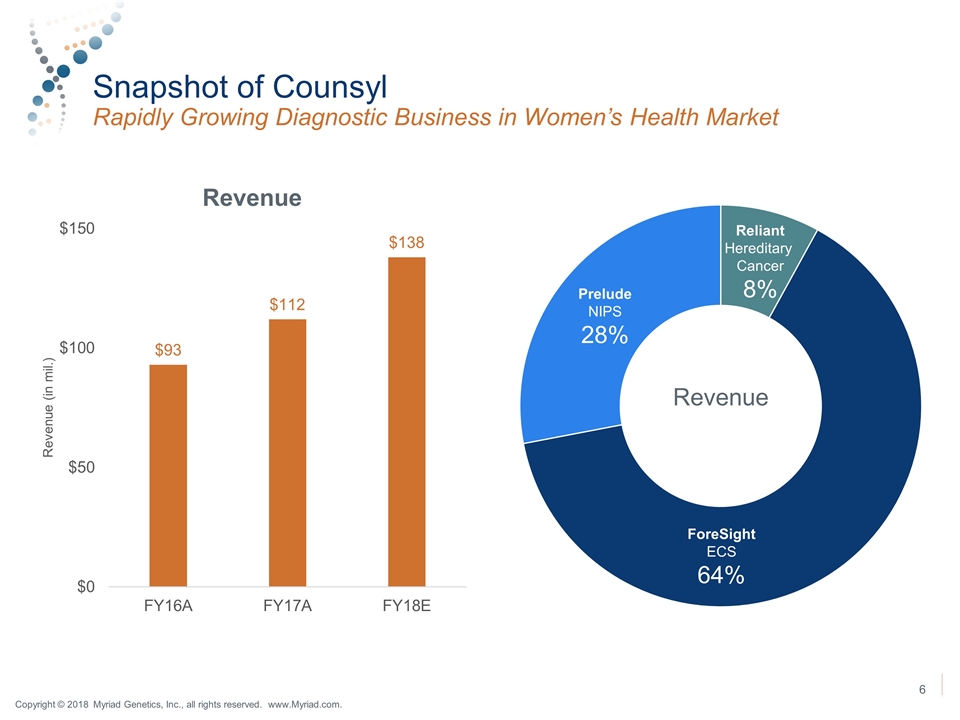

Snapshot of Counsyl Rapidly Growing Diagnostic Business in Women’s Health Market Prelude NIPS 28% Reliant Hereditary Cancer 8% ForeSight ECS 64% Revenue Copyright © 2018 Myriad Genetics, Inc., all rights reserved. www.Myriad.com.

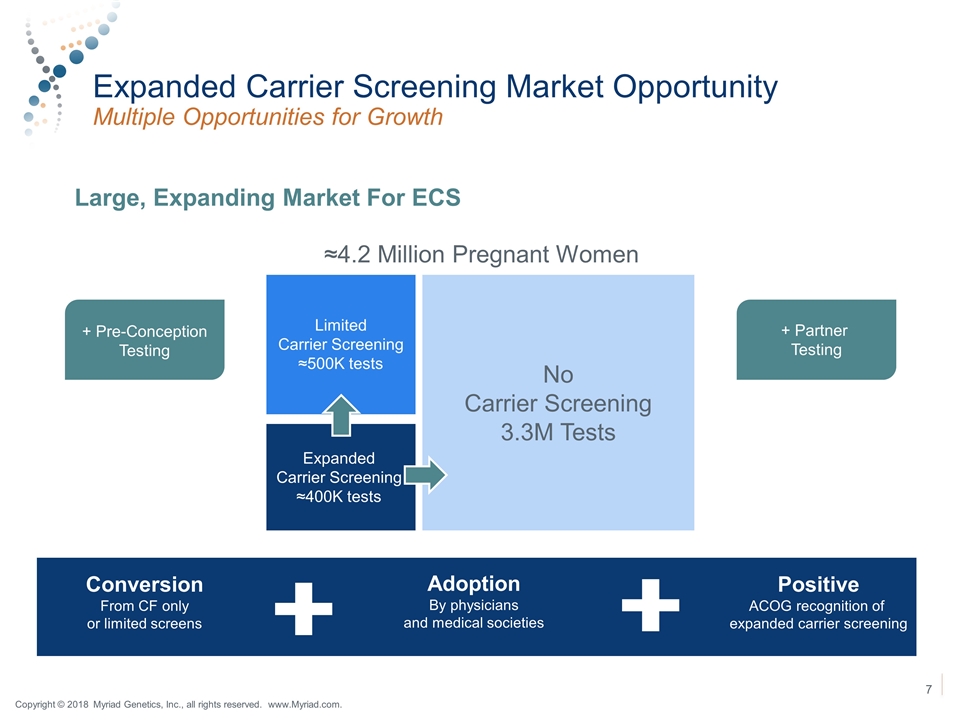

Expanded Carrier Screening Market Opportunity Multiple Opportunities for Growth Large, Expanding Market For ECS Limited Carrier Screening ≈500K tests Expanded Carrier Screening ≈400K tests No Carrier Screening 3.3M Tests + Partner Testing + Pre-Conception Testing ≈4.2 Million Pregnant Women Conversion From CF only or limited screens Positive ACOG recognition of expanded carrier screening Adoption By physicians and medical societies Copyright © 2018 Myriad Genetics, Inc., all rights reserved. www.Myriad.com.

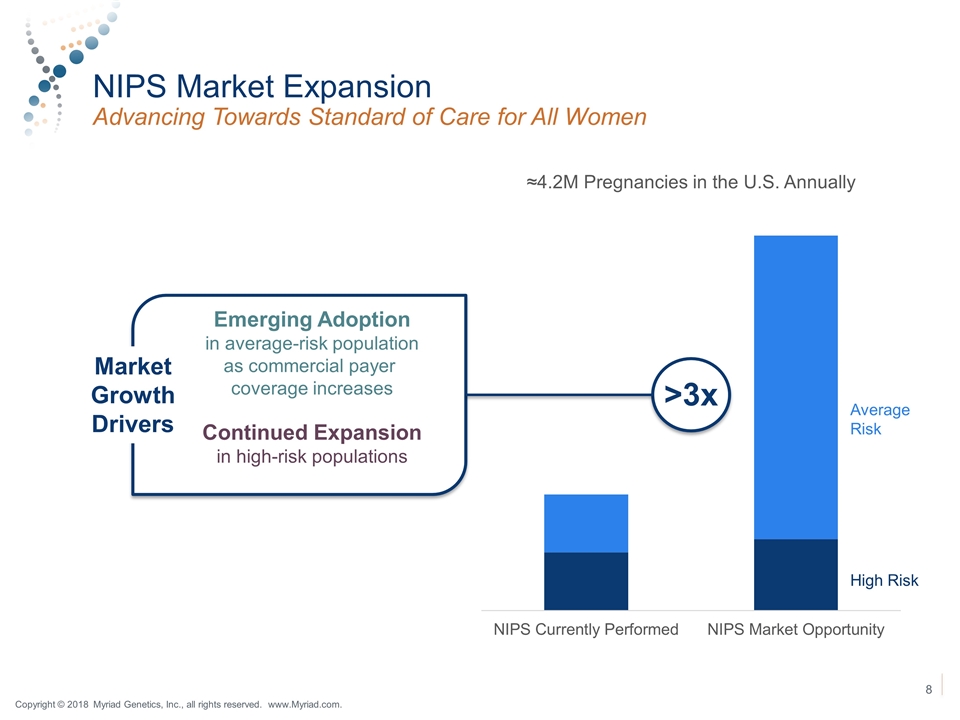

NIPS Market Expansion Advancing Towards Standard of Care for All Women High Risk Average Risk >3x Market Growth Drivers Emerging Adoption in average-risk population as commercial payer coverage increases Continued Expansion in high-risk populations Copyright © 2018 Myriad Genetics, Inc., all rights reserved. www.Myriad.com.

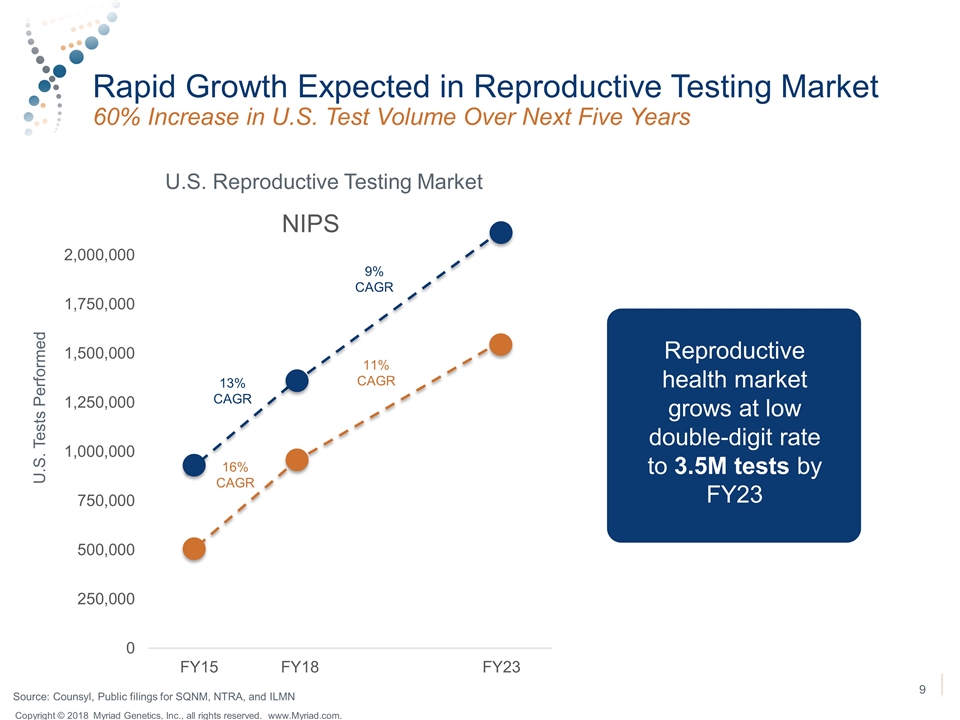

Rapid Growth Expected in Reproductive Testing Market 60% Increase in U.S. Test Volume Over Next Five Years U.S. Reproductive Testing Market 13% CAGR 9% CAGR 11% CAGR 16% CAGR Reproductive health market grows at low double-digit rate to 3.5M tests by FY23 U.S. Tests Performed Source: Counsyl, Public filings for SQNM, NTRA, and ILMN Copyright © 2018 Myriad Genetics, Inc., all rights reserved. www.Myriad.com.

Strategic Rationale 1+1=3 Copyright © 2018 Myriad Genetics, Inc., all rights reserved. www.Myriad.com. Entry into high-growth reproductive testing market Comprehensive women’s health product offering Broad reimbursement with potential for future expansion Potential for revenue synergies by tripling reproductive testing reach Potential for cost synergies and expanded capabilities throughout the enterprise

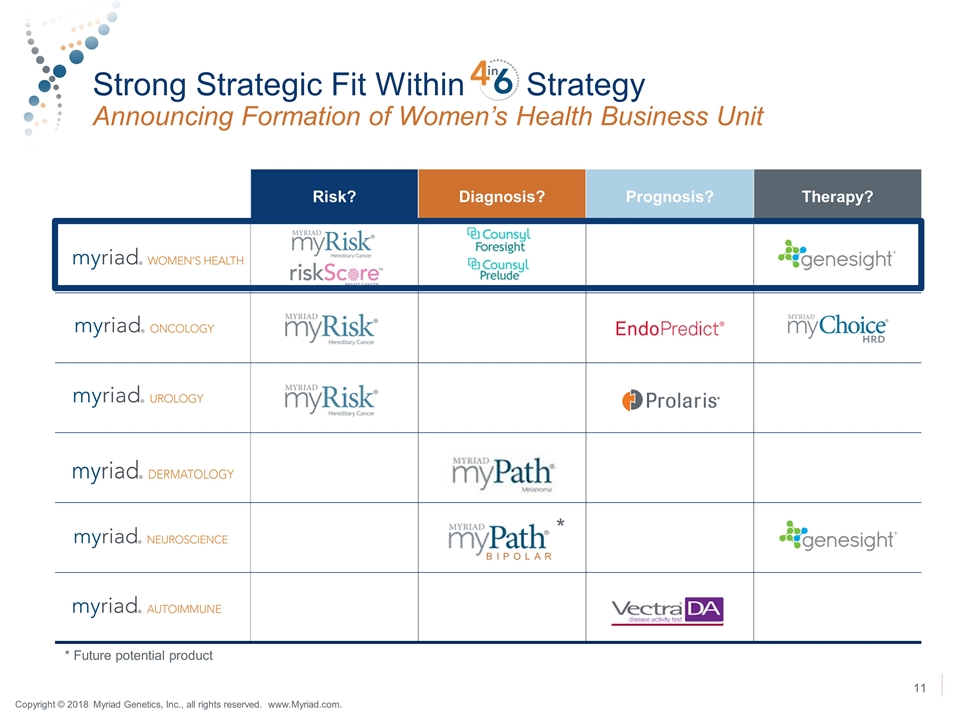

Strong Strategic Fit Within Strategy Announcing Formation of Women’s Health Business Unit Risk? Diagnosis? Prognosis? Therapy? BIPOLAR * * Future potential product Copyright © 2018 Myriad Genetics, Inc., all rights reserved. www.Myriad.com.

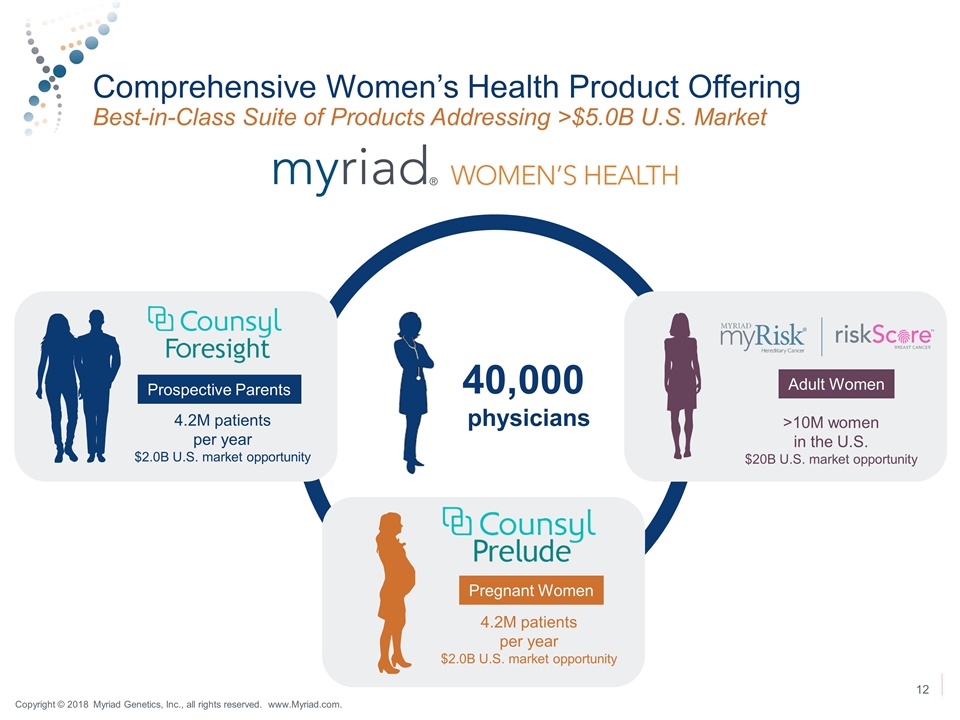

Comprehensive Women’s Health Product Offering Best-in-Class Suite of Products Addressing >$5.0B U.S. Market Prospective Parents 4.2M patients per year $2.0B U.S. market opportunity Pregnant Women 4.2M patients per year $2.0B U.S. market opportunity Prospective Parents Adult Women >10M women in the U.S. $20B U.S. market opportunity 40,000 physicians Copyright © 2018 Myriad Genetics, Inc., all rights reserved. www.Myriad.com.

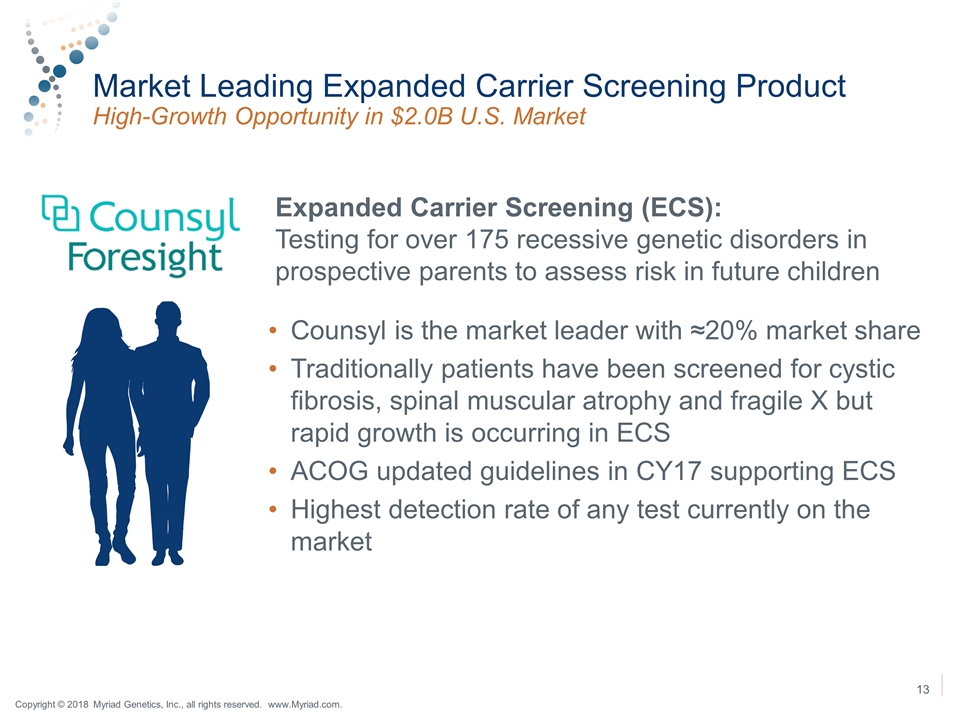

Market Leading Expanded Carrier Screening Product High-Growth Opportunity in $2.0B U.S. Market Expanded Carrier Screening (ECS): Testing for over 175 recessive genetic disorders in prospective parents to assess risk in future children Counsyl is the market leader with ≈20% market share Traditionally patients have been screened for cystic fibrosis, spinal muscular atrophy and fragile X but rapid growth is occurring in ECS ACOG updated guidelines in CY17 supporting ECS Highest detection rate of any test currently on the market 13 Copyright © 2018 Myriad Genetics, Inc., all rights reserved. www.Myriad.com.

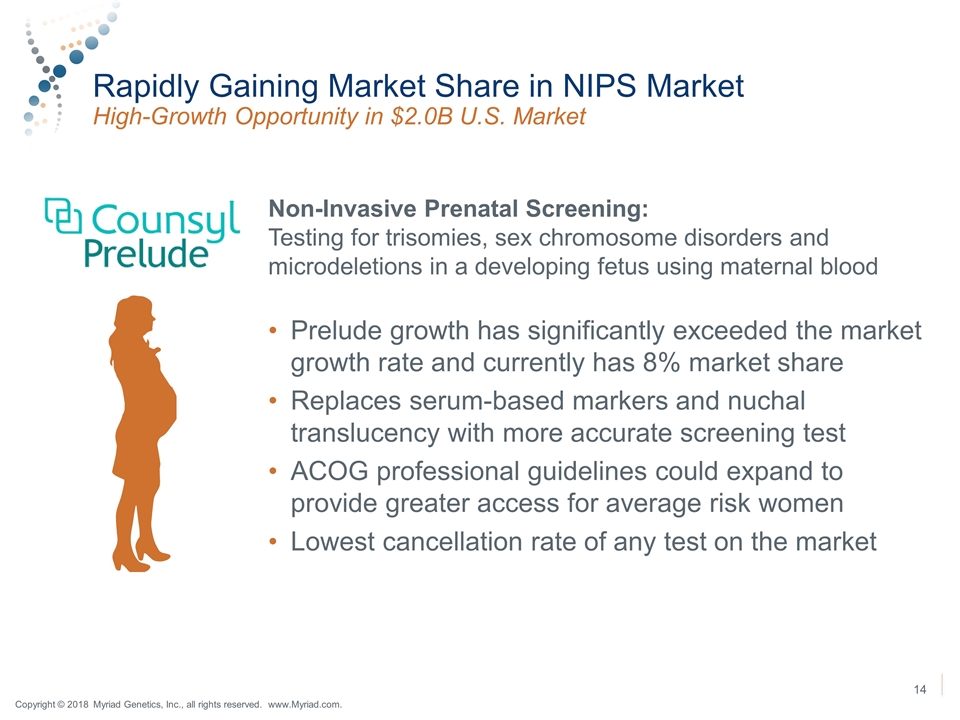

Rapidly Gaining Market Share in NIPS Market High-Growth Opportunity in $2.0B U.S. Market Non-Invasive Prenatal Screening: Testing for trisomies, sex chromosome disorders and microdeletions in a developing fetus using maternal blood Prelude growth has significantly exceeded the market growth rate and currently has 8% market share Replaces serum-based markers and nuchal translucency with more accurate screening test ACOG professional guidelines could expand to provide greater access for average risk women Lowest cancellation rate of any test on the market 14 Copyright © 2018 Myriad Genetics, Inc., all rights reserved. www.Myriad.com.

Strategic Rationale 1+1=3 Copyright © 2018 Myriad Genetics, Inc., all rights reserved. www.Myriad.com. Entry into high-growth reproductive testing market Comprehensive women’s health product offering Broad reimbursement with potential for future expansion Potential for revenue synergies by tripling reproductive testing reach Potential for cost synergies and expanded capabilities throughout the enterprise

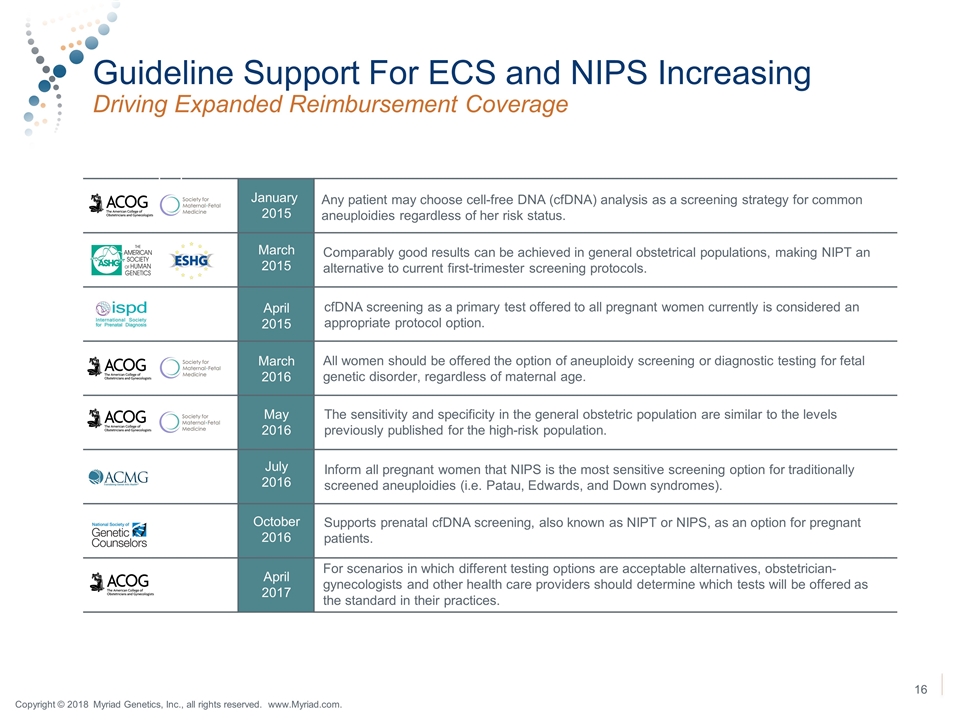

Guideline Support For ECS and NIPS Increasing Driving Expanded Reimbursement Coverage January 2015 March 2015 April 2015 March 2016 May 2016 July 2016 October 2016 April 2017 Any patient may choose cell-free DNA (cfDNA) analysis as a screening strategy for common aneuploidies regardless of her risk status. Comparably good results can be achieved in general obstetrical populations, making NIPT an alternative to current first-trimester screening protocols. cfDNA screening as a primary test offered to all pregnant women currently is considered an appropriate protocol option. All women should be offered the option of aneuploidy screening or diagnostic testing for fetal genetic disorder, regardless of maternal age. The sensitivity and specificity in the general obstetric population are similar to the levels previously published for the high-risk population. Inform all pregnant women that NIPS is the most sensitive screening option for traditionally screened aneuploidies (i.e. Patau, Edwards, and Down syndromes). Supports prenatal cfDNA screening, also known as NIPT or NIPS, as an option for pregnant patients. For scenarios in which different testing options are acceptable alternatives, obstetrician-gynecologists and other health care providers should determine which tests will be offered as the standard in their practices. Copyright © 2018 Myriad Genetics, Inc., all rights reserved. www.Myriad.com.

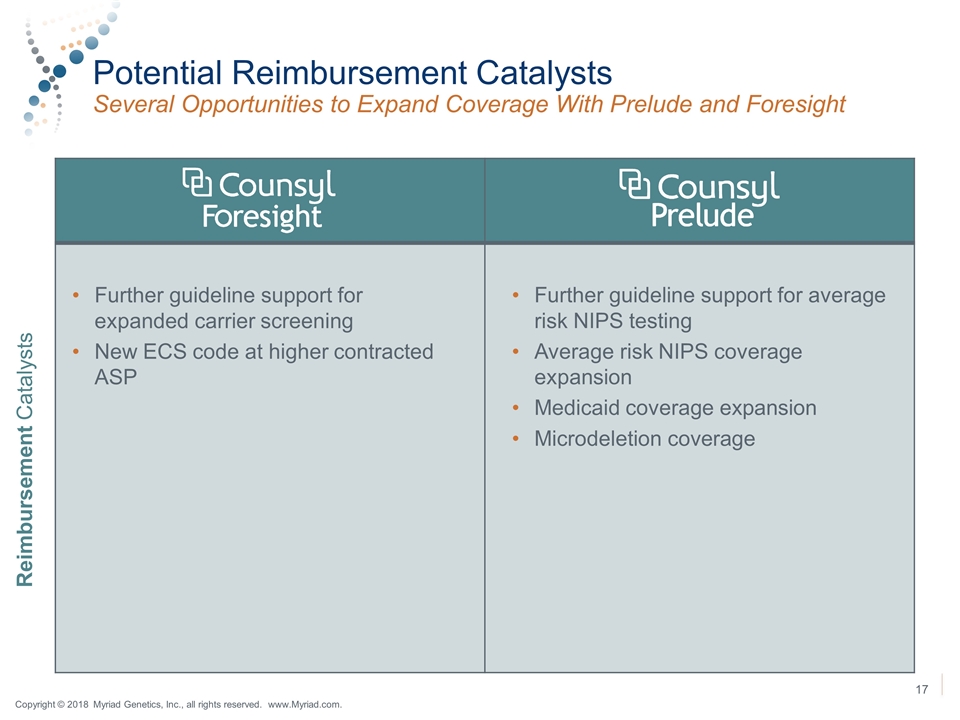

Potential Reimbursement Catalysts Several Opportunities to Expand Coverage With Prelude and Foresight Further guideline support for expanded carrier screening New ECS code at higher contracted ASP Further guideline support for average risk NIPS testing Average risk NIPS coverage expansion Medicaid coverage expansion Microdeletion coverage Reimbursement Catalysts Copyright © 2018 Myriad Genetics, Inc., all rights reserved. www.Myriad.com.

Strategic Rationale 1+1=3 Copyright © 2018 Myriad Genetics, Inc., all rights reserved. www.Myriad.com. Entry into high-growth reproductive testing market Comprehensive women’s health product offering Broad reimbursement with potential for future expansion Potential for revenue synergies by tripling reproductive testing reach Potential for cost synergies and expanded capabilities throughout the enterprise

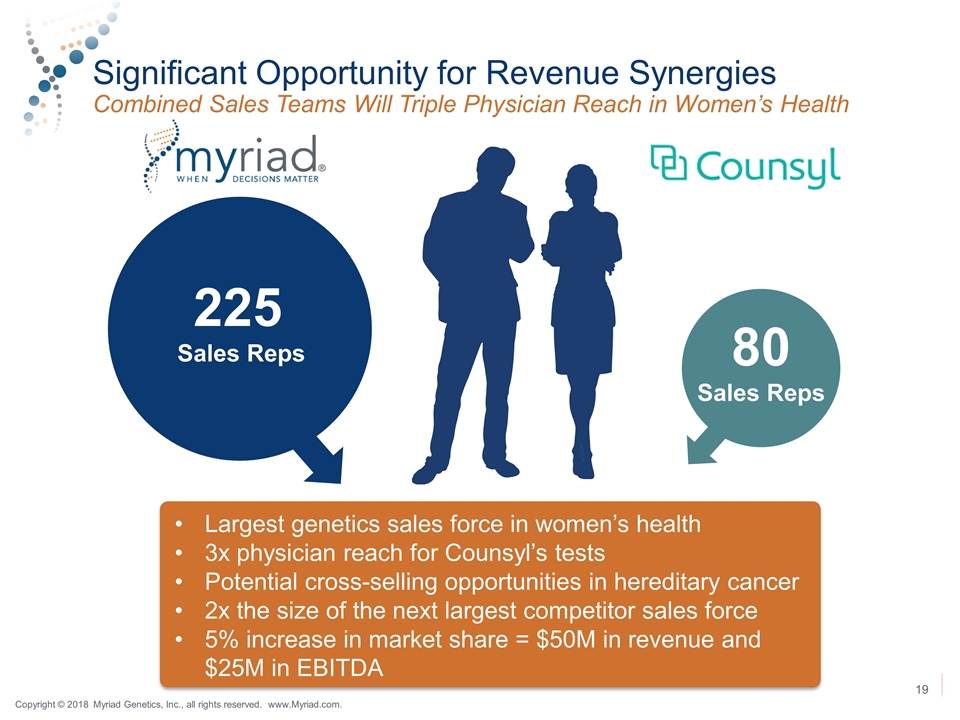

Significant Opportunity for Revenue Synergies Combined Sales Teams Will Triple Physician Reach in Women’s Health 225 Sales Reps 80 Sales Reps Largest genetics sales force in women’s health 3x physician reach for Counsyl’s tests Potential cross-selling opportunities in hereditary cancer 2x the size of the next largest competitor sales force 5% increase in market share = $50M in revenue and $25M in EBITDA Copyright © 2018 Myriad Genetics, Inc., all rights reserved. www.Myriad.com.

Strategic Rationale 1+1=3 Copyright © 2018 Myriad Genetics, Inc., all rights reserved. www.Myriad.com. Entry into high-growth reproductive testing market Comprehensive women’s health product offering Broad reimbursement with potential for future expansion Potential for revenue synergies by tripling reproductive testing reach Potential for cost synergies and expanded capabilities throughout the enterprise

Potential for Cost Synergies Through the Enterprise Experienced Integration Team Managing Project Same integration leadership with similar approach to the Assurex acquisition Leverage enterprise-wide functions such as R&D and Payer Markets Standardize informatics and IT platforms Leverage supplier purchasing power Combine commercial organizations Will look to combine the best functions and processes from both companies Copyright © 2018 Myriad Genetics, Inc., all rights reserved. www.Myriad.com.

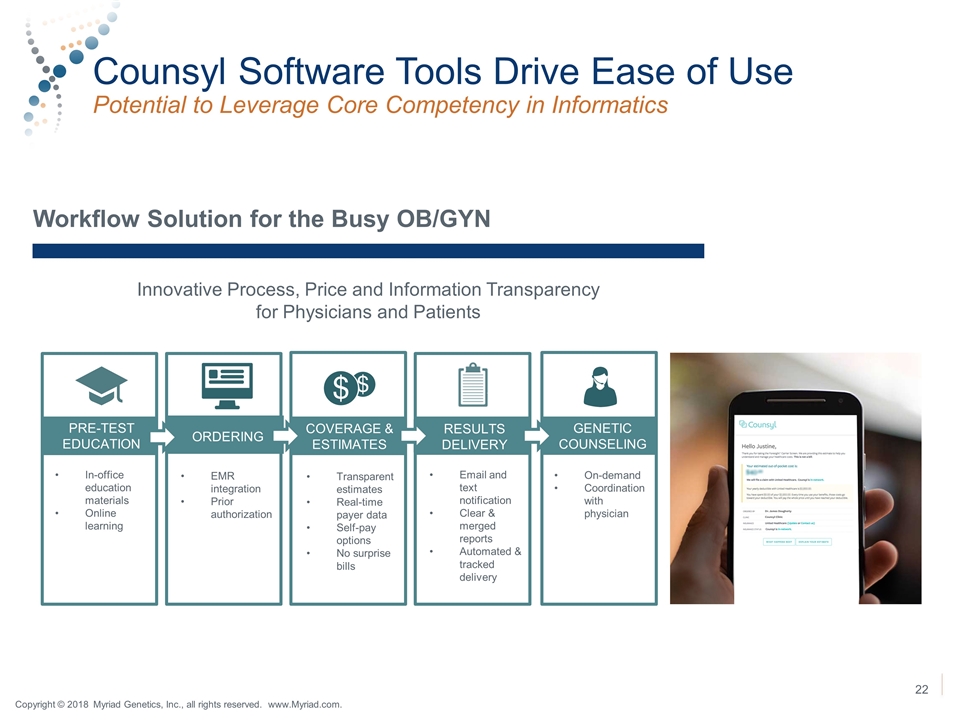

Counsyl Software Tools Drive Ease of Use Potential to Leverage Core Competency in Informatics Workflow Solution for the Busy OB/GYN Innovative Process, Price and Information Transparency for Physicians and Patients PRE-TEST EDUCATION ORDERING COVERAGE & ESTIMATES RESULTS DELIVERY GENETIC COUNSELING In-office education materials Online learning EMR integration Prior authorization Transparent estimates Real-time payer data Self-pay options No surprise bills Email and text notification Clear & merged reports Automated & tracked delivery On-demand Coordination with physician Copyright © 2018 Myriad Genetics, Inc., all rights reserved. www.Myriad.com.

Myriad Genetics Acquisition of Counsyl, Inc. Strategic Rationale Entry into high-growth reproductive testing market Comprehensive women’s health product offering Broad reimbursement coverage with potential for further expansion Potential for revenue synergies by tripling reproductive testing reach Potential for cost synergies throughout the enterprise Consideration For Counsyl Shareholders Acquiring Counsyl for $375M consisting of cash and MYGN common stock Funding deal using cash on hand and existing revolving credit facility Expected to close in 1Q19 Myriad Financial Considerations Trailing twelve month revenue of $134M Will be neutral to adjusted EPS in FY19; >$0.20 accretive in FY20 Counsyl will be incorporated into FY19 financial guidance provided on 4Q18 earnings call Expect attractive ROIC profile creating significant shareholder value Global leader in reproductive testing market Core products are Foresight™ expanded carrier screening test and Prelude™ non-invasive pre-natal screening test Calls on OBGYNs, reproductive endocrinologists, and maternal fetal medicine specialists Testing services provided from Counsyl’s CLIA laboratory in South San Francisco, CA Copyright © 2018 Myriad Genetics, Inc., all rights reserved. www.Myriad.com.